QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Under Rule 14a-12 |

MOTHERS WORK, INC.

|

| (Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| /x/ | | No fee required |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(I)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregrate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

/ / |

|

Fee paid previously with preliminary materials. |

/ / |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

MOTHERS WORK, INC.

456 North Fifth Street

Philadelphia, Pennsylvania 19123

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

January 17, 2002

To the Stockholders of Mothers Work, Inc.:

The Annual Meeting of Stockholders of Mothers Work, Inc., a Delaware corporation (the "Company") will be held at 9:00 a.m., local time, on January 17, 2002 at the Company's corporate headquarters, 456 North Fifth Street, Philadelphia, Pennsylvania, for the following purposes:

- 1.

- To elect three directors of the Company;

- 2.

- To ratify the appointment of Arthur Andersen LLP as independent auditors for the Company for the fiscal year ending September 30, 2002; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournments thereof.

Only holders of the Common Stock and Series C Cumulative Preferred Stock at the close of business on December 19, 2001 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Such stockholders may vote in person or by proxy. The stock transfer books of the Company will not be closed. The accompanying form of proxy is solicited by the Board of Directors of the Company.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON, YOU ARE URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE SELF-ADDRESSED ENVELOPE, ENCLOSED FOR YOUR CONVENIENCE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IF YOU DECIDE TO ATTEND THE MEETING AND WISH TO VOTE IN PERSON, YOU MAY REVOKE YOUR PROXY BY WRITTEN NOTICE AT THAT TIME.

December 21, 2001

MOTHERS WORK, INC.

456 North Fifth Street

Philadelphia, Pennsylvania 19123

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

January 17, 2002

This Proxy Statement, which is first being mailed to stockholders on approximately December 21, 2001, is furnished in connection with the solicitation by the Board of Directors of Mothers Work, Inc. (the "Company") of proxies to be used at the Annual Meeting of Stockholders of the Company (the "Annual Meeting"), to be held at 9:00 a.m. on January 17, 2002 at the Company's corporate headquarters, 456 North Fifth Street, Philadelphia, Pennsylvania, and at any adjournments or postponements thereof. If proxies in the accompanying form are properly executed and returned prior to voting at the meeting, the shares of the Company's Common Stock (the "Common Stock") and Series C Cumulative Preferred Stock (the "Series C Preferred Stock") represented thereby will be voted as instructed on the proxy. If no instructions are given on a properly executed and returned proxy, the shares of the Common Stock and Series C Preferred Stock represented thereby will be voted for the election of the nominees for director named below, for the ratification of the appointment of Arthur Andersen LLP as independent auditors, and in support of management on such other business as may properly come before the Annual Meeting or any adjournments thereof. Any proxy may be revoked by a stockholder prior to its exercise upon written notice to the Secretary of the Company, by delivering a duly executed proxy bearing a later date, or by the vote of a stockholder cast in person at the Annual Meeting.

VOTING

Holders of record of the Common Stock and Series C Preferred Stock on December 19, 2001 will be entitled to vote at the Annual Meeting or any adjournments or postponements thereof. As of that date, there were 3,512,274 shares of Common Stock and 302,619 shares of Series C Preferred Stock outstanding and entitled to vote. The presence, in person or by proxy, of holders of Common Stock and Series C Preferred Stock entitled to cast at least a majority of the votes which all holders of the Common Stock and Series C Preferred Stock are entitled to cast will constitute a quorum for purposes of the transaction of business. Each share of Common Stock and Series C Preferred Stock entitles the holder thereof to one vote on the election of the nominee for director and on any other matter that may properly come before the Annual Meeting. Stockholders are not entitled to cumulative voting in the election of directors. Directors are elected by a plurality of the votes cast and votes may be cast in favor of or withheld from each director nominee. Votes that are withheld from a director nominee will be excluded entirely from the vote for such nominee and will have no effect thereon.

Abstentions and broker non-votes (described below) are counted in determining whether a quorum is present. Abstentions with respect to any proposal other than the election of directors will have the same effect as votes against the proposal, because approval requires a vote in favor of the proposal by a majority of the shares entitled to vote, present in person or represented by proxy. A "broker non-vote" occurs when a broker submits a proxy that does not indicate a vote for some of the proposals because the beneficial owners have not instructed the broker on how to vote on such proposals and the broker does not have discretionary authority to vote in the absence of instructions. Broker non-votes are not considered to be shares "entitled to vote" (other than for quorum purposes), and will therefore have no effect on the outcome of any of the matters to be voted upon at the Annual Meeting.

The cost of solicitation of proxies by the Board of Directors will be borne by the Company. Proxies may be solicited by mail, personal interview, telephone or facsimile and, in addition, directors, officers and regular employees of the Company may solicit proxies by such methods without additional remuneration. Banks, brokerage houses and other institutions, nominees or fiduciaries will be requested to forward the proxy materials to beneficial owners in order to solicit authorizations for the execution of proxies. The Company will, upon request, reimburse such banks, brokerage houses and other institutions, nominees and fiduciaries for their expenses in forwarding such proxy materials to the beneficial owners of the Common Stock and Series C Preferred Stock.

2

ELECTION OF DIRECTORS

(PROPOSAL 1)

The Company's Board of Directors is divided into three classes, with staggered three-year terms. Currently, the Board has seven members. Unless otherwise specified in the accompanying proxy, the shares voted pursuant thereto will be cast for Ms. Rebecca C. Matthias, Mr. Joseph A. Goldblum, and Mr. David Schlessinger for terms expiring at the Annual Meeting of Stockholders to be held following fiscal 2004 (the "2005 Annual Meeting"). If, for any reason, at the time of election, any of the nominees named should decline or be unable to accept his or her nomination or election, it is intended that such proxy will be voted for the election, in the nominee's place, of a substituted nominee, who would be recommended by the Board of Directors. The Board of Directors, however, has no reason to believe that any of the nominees will be unable to serve as a director.

The following biographical information is furnished as to each nominee for election as a director and each of the current directors:

Nominees for Election to the Board of Directors for a Three-Year

Term Expiring at the 2005 Annual Meeting

Rebecca C. Matthias, 48, founded the Company in 1982 and has served as a director of the Company and its President since its inception. Since January 1993, Ms. Matthias has served as the Company's Chief Operating Officer. Prior to 1982, she was a construction engineer for the Gilbane Building Company. Ms. Matthias also serves as a member of the Board of Trustees of Drexel University.

Joseph A. Goldblum, 52, has been a director of the Company since 1989. Mr. Goldblum has been President of G-II Equity Investors, Inc. a general partner of G-II Family Partnership L.P. since May 1989. He was also Of Counsel with the law firm of Goldblum & Hess from May 1989 to December 1996.

David Schlessinger, 46, founded Encore Books, a retail bookstore chain, in 1973 and served as its Chairman and Chief Executive Officer until 1986. Mr. Schlessinger founded Zany Brainy, Inc., a retail children's educational products company, in 1991. He served as Zany Brainy's Chief Executive Officer until 1996 and as its Chairman until 1998. Since 1998, he has been engaged in personal investment activities as well as consulting and board services with private companies.

Members of the Board of Directors Continuing in Office

Term Expiring at the 2003 Annual Meeting

Stanley C. Tuttleman, 82, became a director on January 20, 2000. He has been the President and Chief Executive Officer of Tuttson Capital Corp., a financial services corporation, since 1983. Mr. Tuttleman also serves as Chief Executive Officer and Chairman of Telepartners, Inc., a wireless program company.

William A. Schwartz, Jr., 62, became a director of the Company on August 28, 1998. Mr. Schwartz is President and Chief Executive Officer of U.S. Vision, a retailer of optical products and services, a position which he has held since 1995. Mr. Schwartz currently is a director of U.S. Vision and Commerce Bankcorp.

Members of the Board of Directors Continuing in Office

Term Expiring at 2004 Annual Meeting

Dan W. Matthias, 58, joined the Company on a full-time basis in 1982 and has served as Chairman of the Board since its inception. Since January 1993, Mr. Matthias has been the Company's Chief Executive Officer. He had previously been involved in the computer and electronics industry, serving as a director of Zilog, Inc. and serving as the President of a division of a subsidiary of Exxon Corporation.

Elam M. Hitchner, III, 55, became a director of the Company in January 1994. Mr. Hitchner is a partner at the law firm Pepper Hamilton LLP, Philadelphia, Pennsylvania, which provides legal services to

3

the Company. From July 1999 until December 31, 2000, Mr. Hitchner was a general partner of Meridian Venture Partners and Meridian Venture Partners II, venture capital firms located in Radnor, Pennsylvania. From May 1992 until June 1999, Mr. Hitchner was a partner at the law firm of Pepper Hamilton LLP. See "Certain Transactions."

Other than the husband and wife relationship between Dan and Rebecca Matthias, there are no family relationships among any of the other directors of the Company.

Holders of the Series C Preferred Stock have the right to designate one representative to attend as an observer the meetings of the Company's Board of Directors. Currently, the Series C Preferred Stock holders have designated Bruce Pollack of Centre Partners Management LLC to this board observer position.

The Board of Directors recommends a vote For Proposal 1 to elect all Nominees to the Board of Directors for a Three-Year Term Expiring at the 2005 Annual Meeting.

4

Committees and Meetings of

the Board of Directors

During the fiscal year ended September 30, 2001, the Board of Directors held four meetings. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and committees of the Board of Directors on which he or she served.

During the fiscal year ended September 30, 2001, the Audit Committee, which consists of Mr. Hitchner, Chairman, Mr. Schwartz and Mr. Tuttleman held four meetings. Each member of the Audit Committee is considered an "independent director" under NASD's rules. The function of the Audit Committee is to assist the Board of Directors in preserving the integrity of the financial information published by the Company through the review of financial and accounting control and policies, financial reporting requirements, alternative accounting principles that could be applied and the quality and effectiveness of the independent accountants. On June 14, 2000, the Board and the Audit Committee unanimously adopted the Audit Committee Charter outlining the responsibilities and duties of the Audit Committee.

During the fiscal year ended September 30, 2001, the Compensation Committee, which consists of Mr. Goldblum, Chairman, Mr. Matthias and Ms. Verna Gibson, who served as a director during fiscal 2001, held five meetings. The Compensation Committee considers recommendations of the Company's management regarding compensation, bonuses and fringe benefits of the executive officers of the Company, and determines whether the recommendations of management are consistent with general policies, practices, and compensation scales established by the Board of Directors. A subcommittee (Ms. Gibson and Mr. Goldblum) of the Compensation Committee considers management's proposals regarding stock option grants and their consistency with policies established by the Board of Directors, and, in general, administers the Company's Restated 1987 Stock Option Plan.

During the fiscal year ended September 30, 2001, the Nominating Committee, which consists of Mr. Matthias, Chairman, Mr. Goldblum and Mr. Hitchner, held two meetings. The Nominating Committee functions include establishing the criteria for selecting candidates for nomination to the Board of Directors; actively seeking candidates who meet those criteria; and making recommendations to the Board of Directors of nominees to fill vacancies on, or as additions to, the Board of Directors. The Nominating Committee will consider nominees for election to the Board of Directors that are recommended by stockholders provided that a complete description of the nominees' qualifications, experience and background, together with a statement signed by each nominee in which he or she consents to act as such, accompany the recommendations. Such recommendations should be submitted in writing to the attention of the Chairman of the Board of Directors, and should not include self-nominations.

Compensation of Directors

The Company pays each director, other than the Matthiases, a retainer of $3,000 per quarter. In addition, each director is paid $1,500 for each Board meeting, and $500 for each Committee meeting, attended by such director in person. Upon conclusion of each Annual Meeting of Stockholders, the Company grants each director other than the Matthiases options to purchase 2,000 shares of the Common Stock pursuant to the Company's 1994 Director Stock Option Plan.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities (collectively, "Reporting Persons"), to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of the Common Stock and other equity securities of the Company. Reporting Persons are additionally required to furnish the Company with copies of all Section 16(a) forms they file.

David Mangini, the Company's Executive Vice President—Product and Marketing filed a Form 3 late. Other than as specified above, to the Company's knowledge, based solely on review of the copies of such reports furnished to the Company and written representations of Reporting Persons that no other reports were required with respect to fiscal 2001, all Section 16(a) filing requirements applicable to the Reporting Persons were complied with.

5

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors has:

- •

- Reviewed and discussed the audited financial statements with management;

- •

- Discussed with Arthur Andersen LLP, the Company's independent auditor, the matters required to be discussed by Statement on Auditing Standards No. 61;

- •

- Received the written disclosures and the letter from Arthur Andersen LLP required by Independence Standards Board Standard No. 1, and has discussed with Arthur Andersen LLP its independence.

In reliance on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended September 30, 2001.

Audit Fees:

Audit fees billed to the Company by Arthur Andersen LLP during the Company's 2001 fiscal year, including fees in connection with the review of the Company's annual financial statements and those financial statements included in the Company's quarterly reports on Form 10-Q, totaled $133,500.

Financial Information Systems Design and Implementation Fees:

The Company did not engage Arthur Andersen LLP to provide advice to the Company regarding financial information systems design and implementation during the fiscal year ended September 30, 2001.

All Other Fees:

Other audit-related fees billed to the Company by Arthur Andersen LLP during the Company's 2001 fiscal year, which include amounts billed for services traditionally performed by the auditors such as statutory audits, accounting consultation, consultation on Securities and Exchange Commission registration statements and filings and other services, totaled $21,300.

Fees billed to the Company by Arthur Andersen LLP during the Company's 2001 fiscal year for all other non-audit services rendered to the Company, including tax related services, totaled $107,607.

The Audit Committee has considered the non-audit services rendered to the Company by Arthur Andersen LLP and believes the rendering of those services is not incompatible with Arthur Andersen LLP maintaining its independence.

The foregoing Audit Committee Report shall not be deemed to be incorporated by reference into any filing made by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, notwithstanding any general statement contained in any such filing incorporating this proxy statement by reference, except to the extent the Company incorporates such report by specific reference.

6

Compensation Committee Report

on Executive Compensation

The Compensation Committee of the Board of Directors has furnished the following report on executive compensation:

General

The Compensation Committee of the Board of Directors consists of Joseph A. Goldblum, Chairman, Dan W. Matthias(1), and Verna Gibson. Under the supervision of the Compensation Committee, the Company has developed and implemented compensation policies, plans and programs which seek to enhance the profitability of the Company, and thus stockholder value, by aligning the financial interests of the Company's senior management with those of its stockholders. Annual base salary and longer term incentive compensation provide an important incentive in attracting and retaining corporate officers and other key employees and motivating them to perform to the full extent of their abilities in the best long-term interests of the stockholders.

- (1)

- Dan Matthias, Chairman of the Board and Chief Executive Officer, abstains from voting on issues pertaining to his personal compensation and Rebecca Matthias' compensation.

The Company's executive compensation program consists of two key elements: (1) an annual component, i.e., base salary and annual bonus and (2) a long-term component, i.e., stock options. Executive compensation levels are determined in connection with a review of compensation levels at comparable publicly held companies. The Compensation Committee has determined that a compensation package that contains long-term stock based incentives is appropriate for the Company's goals of sustainable growth and enhanced shareholder value.

Based on this philosophy, a meaningful portion of the senior executives' annual bonus and stock options is designed to be linked to the increase of the Company's earnings per share ("EPS") over the prior fiscal year. This will lead to the creation of value for the Company's stockholders in both the short and long term. Under this pay-for-performance orientation:

- •

- executives are motivated to improve the overall performance and profitability of the Company; and

- •

- accountability is further encouraged through the adjustment of salaries and incentive awards on the basis of each executive's individual performance, potential and contribution.

The policies with respect to each element of the compensation package, as well as the basis for determining the compensation of the Chief Executive Officer and the President, Dan and Rebecca Matthias, respectively, are described below.

Base Salary: Base salary represents compensation for discharging job responsibilities and reflects the executive officer's performance over time. Peer salaries for comparable positions are used as reference points in setting salary opportunities for executive officers. The Company's overall goal is to approximate the median salaries paid by the peer group assuming comparability of such factors as position, responsibilities and tenure.

Individual salary adjustments take into account the Company's salary increase guidelines for the year and individual performance contributions for the year, as well as sustained performance contributions over a number of years and significant changes in responsibilities, if any. The assessment of individual performance contributions is subjective and does not reflect the Company's performance.

Annual Bonus: Annual bonuses are generally based on the Company's performance and management's performance against specified goals established by senior management and the

7

Compensation Committee. The annual bonuses for the Chief Executive Officer and the President are based on performance against their goals and the Company's EPS. Notwithstanding the foregoing, the Compensation Committee has the discretion to increase the annual bonus in any given year to take into account what it deems to be extraordinary events.

To align stockholder and executive officer interests, the long-term component of the Company's executive compensation program uses grants whose value is related to the value of the Common Stock. Stock options are granted to reinforce the importance of improving stockholder value over the long-term, and to encourage and facilitate the executive's stock ownership. Under the Restated 1987 Stock Option Plan, options to purchase Common Stock are available for grant to directors, officers and other key employees of the Company. Stock options are granted at 100% of the fair market value of the Common Stock on the date of the grant to ensure that the executives can only be rewarded for appreciation in the price of the Common Stock when the Company's stockholders are similarly benefited. Stock options are exercisable up to ten years from the date granted. The stock options generally vest over a five year period, although some stock options vest immediately. While all executives are eligible to receive stock options, participation in each annual grant, as well as the size of the grant each participating executive receives, is contingent on the increase in the EPS over the prior fiscal year. Notwithstanding the foregoing, the Compensation Committee has the discretion to increase the annual grant of options in any given year to take into account what it deems to be extraordinary events.

8

Chief Executive Officer and President Compensation

In fiscal 2001, the annual base salary for Dan W. Matthias, Chairman of the Board and Chief Executive Officer, and Rebecca C. Matthias, President and Chief Operating Officer, increased from $377,493 to $402,000 and from $376,265 to $401,000, respectively. The fiscal 2001 base salary is comparable with the salaries of senior management of publicly-held companies of comparable size in the retail clothing industry.

The Matthiases' compensation package as set forth in their respective employment agreements consists of two elements: (1) an annual component consisting of base salary and cash bonus and (2) a long-term component consisting of stock options. It is the practice of the Committee to meet with senior management at the beginning of each fiscal year and agree upon priority goals for that year. Management's performance can then be measured against attainment of such goals. The goals for fiscal 2001 contained criteria such as meeting certain financial goals and further development of the senior management team. Based on the financial performance of the Company, each of the Matthiases was entitled to a bonus which was paid in fiscal 2002. The Board ratified the Committee's recommendations regarding the fiscal 2001 compensation of each of the Matthiases at its meeting on November 15, 2001, pending further market competitive review.

9

SUMMARY COMPENSATION TABLE

The following table sets forth, for the fiscal years ended September 30, 2001, 2000 and 1999, certain compensation information with respect to the Company's Chief Executive Officer and the other Company officers named therein.

| |

| | Annual Compensation

| | Long-Term

Compensation

|

|---|

| |

| |

| |

| | Awards

|

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Securities

Underlying

Options/SARs (#)

|

|---|

Dan W. Matthias

Chairman and

Chief Executive Officer | | 2001

2000

1999 | | 402,102

377,493

350,000 | | 40,000

210,000

— | | 60,000

—

25,000 |

Rebecca C. Matthias

President and Chief

Operating Officer |

|

2001

2000

1999 |

|

400,969

376,265

350,000 |

|

40,000

210,000

— |

|

60,000

—

25,000 |

Michael F. Devine, III*

Senior Vice President—

Finance and Chief Financial Officer |

|

2001

2000

1999 |

|

292,973

160,583

— |

|

35,000

130,460

— |

|

10,000

30,000

— |

Vana Longwell

President—Motherhood |

|

2001

2000

1999 |

|

365,669

308,974

266,666 |

|

38,500

210,050

— |

|

—

—

5,000 |

Frank C. Mullay**

Senior Vice President—Stores |

|

2001

2000

1999 |

|

263,987

221,945

— |

|

27,000

115,603

— |

|

—

30,000

— |

Donald W. Ochs***

Senior Vice President—Operations |

|

2001

2000

1999 |

|

230,831

340,806

323,333 |

|

—

212,338

— |

|

—

—

5,000 |

- *

- Mr. Devine joined the Company in February 2000 and resigned as an officer of the Company on November 30, 2001.

- **

- Mr. Mullay joined the Company September 8, 1999.

- ***

- Mr. Ochs resigned from the Company in August 2001. Salary includes amounts paid to Mr. Ochs for consulting services provided from April 16, 2001 until July 20, 2001.

10

STOCK OPTIONS GRANTED TO CERTAIN EXECUTIVE OFFICERS

DURING LAST FISCAL YEAR

The following table sets forth certain information regarding options for the purchase of Common Stock that were awarded to the Company's Chief Executive Officer and the other named Company officers during fiscal 2001.

Option Grants In Fiscal Year Ended September 30, 2001

| |

| |

| |

| |

| | Potential Realizable

Gain at Assumed

Annual Rates of Stock

Appreciation for Option

Terms Compounded

Annually

|

|---|

| |

| | Percent of Total

Options

Granted to

Employees in

Last Fiscal

Year

| |

| |

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| |

| |

|

|---|

Name

| | Exercise or

Base Price

($/Sh)

| |

|

|---|

| | Expiration Date

| | 5%

| | 10%

|

|---|

| Dan W. Matthias | | 60,000 | (1) | 21.0 | % | $ | 9.50 | | October 2, 2010 | | $ | 308,626 | | $ | 829,065 |

Rebecca C. Matthias |

|

60,000 |

(1) |

21.0 |

% |

$ |

9.50 |

|

October 2, 2010 |

|

$ |

308,626 |

|

$ |

829,065 |

Michael F. Devine, III |

|

10,000 |

(2) |

3.5 |

% |

$ |

7.88 |

|

March 16, 2011 |

|

$ |

67,638 |

|

$ |

154,377 |

Vana Longwell |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

Frank C. Mullay |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

Donald W. Ochs |

|

— |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

- (1)

- These options were fully vested as of the grant date and were granted under the Restated 1987 Stock Option Plan.

- (2)

- These options become exercisable as to 20% of the shares on March 16, 2002 and will become exercisable as to an additional 20% of such shares on March 16 of each successive year, with full vesting occurring on March 16, 2006. These options were granted under the Restated 1987 Stock Option Plan and have a term of 10 years, subject to earlier termination in certain circumstances.

11

AGGREGATED OPTION EXERCISES IN FISCAL YEAR

ENDED SEPTEMBER 30, 2001 AND FISCAL YEAR 2001-END OPTION VALUES

The following table sets forth certain information regarding options for the purchase of the Common Stock that were exercised and/or held by the Company's Chief Executive Officer and the other named Company officers during fiscal 2001.

| |

| |

| | Number of Securities Underlying

Unexercised Options at FY-End (#)

| | Value of Unexercised

In-the-Money Options

at FY-End ($)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Dan W. Matthias | | — | | — | | 197,905 | | — | | — | | — |

Rebecca C. Matthias |

|

— |

|

— |

|

197,905 |

|

— |

|

— |

|

— |

Michael F. Devine, III |

|

— |

|

— |

|

6,000 |

|

34,000 |

|

— |

|

11,000 |

Vana Longwell |

|

— |

|

— |

|

38,000 |

|

5,000 |

|

5,194 |

|

1,299 |

Frank C. Mullay |

|

— |

|

— |

|

12,000 |

|

18,000 |

|

— |

|

— |

Donald W. Ochs |

|

— |

|

— |

|

— |

|

|

|

— |

|

— |

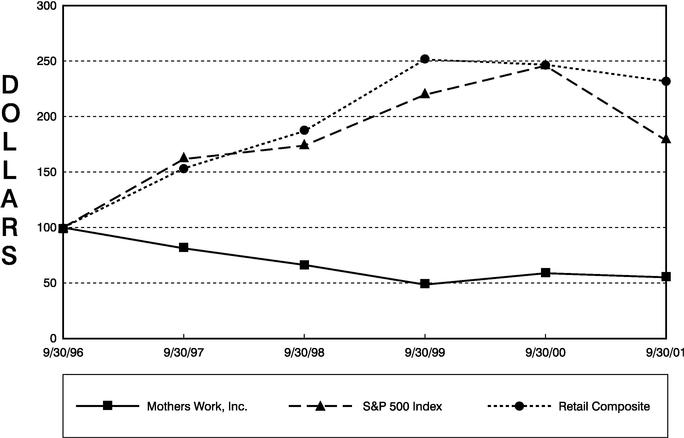

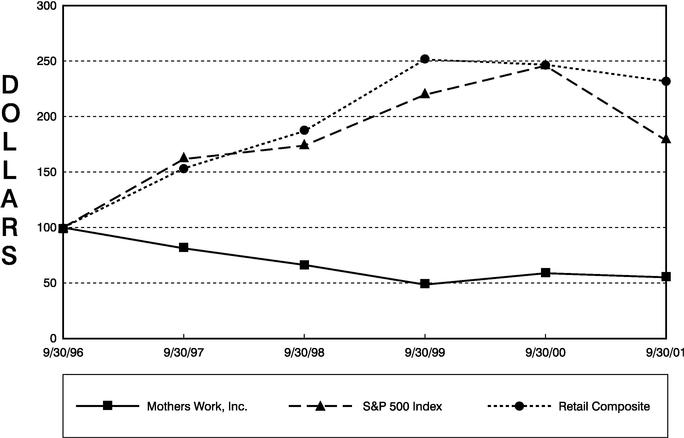

Stock Price Performance Graph

The graph below compares the cumulative total stockholder return on the Company's Common Stock for the period September 30, 1996 to September 30, 2001, with the cumulative total return of the Standard & Poor's 500 Stock Index and the Standard and Poor's Retail Stores Composite Index. The comparison assumes $100 was invested on September 30, 1996 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends.

12

Employment Agreements

The Company is a party to written employment agreements (the "Employment Agreements") with both Dan and Rebecca Matthias which expire on September 30, 2004, unless earlier terminated pursuant to the terms of the Employment Agreements. The term of each Employment Agreement automatically extends for successive one year periods extending the expiration date into the third year after the extension, unless either the Company or the executive gives written notice to the other party that the term will not so extend. Under the Employment Agreements, the Company has agreed to nominate the Matthias' as directors and to use its best efforts to cause them to be elected as directors. The base salary of each executive for fiscal 2002 is expected to be $450,000 per year, and the base salary will increase each year during the term in an amount determined by the Compensation Committee of the Board of Directors, but in any event no less than the rate of inflation. Beginning with a policy established in fiscal 2001, for each year each executive will be entitled to a cash bonus of up to 100% of base salary based on a formula relating to the percentage increase of EPS before extraordinary items for the year over the highest EPS before extraordinary items for any prior year, with the maximum bonus payable at a 50% percentage increase. In addition, following each fiscal year, each executive will be granted up to 60,000 immediately-vested stock options based on a similar formula, with the maximum number of options to be granted at a 35% percentage increase. The Compensation Committee retains the discretion to increase the executives' bonuses and to grant additional options if such Committee deems it to be appropriate.

The Employment Agreements provide that for one year following the termination of employment of either executive (other than for "good reason" or upon a "change of control" of the Company, as such terms are defined in the Employment Agreements) the executive shall not compete with the Company or solicit the Company's suppliers or employees. If the employment of either executive is terminated by the Company without cause or by the executive for good reason or following a change of control, (i) the executive is entitled to receive a lump sum severance payment equal to three years of base salary and the maximum amount of cash and option bonus compensation and fringe benefits which would have been paid or made available to the executive during the three years following such termination, (ii) all stock options held by the terminated executive will become immediately vested, and the executive may require the Company to repurchase all such stock options at a price equal to the excess of the closing price of the Common Stock over the exercise price of the options, and (iii) the executive is entitled to cause the Company to register all shares owned by the executive under the Securities Act of 1933, as amended, to the extent they are not then registered, and the executive may additionally include his or her shares in future registrations filed by the Company. In the event of a termination by the Company for cause or by the executive without good reason, the executive will not be entitled to any further base salary or bonus compensation, and all unvested options then held by the executive will be automatically canceled. In the event of a termination by the Company because of a disability, the executive shall continue to receive base salary and cash bonus and option compensation and fringe benefits during the three years following such termination, at 50% of the levels the executive would have received if the executive's employment had been terminated by the Company without cause, as described above, less any payments received by the executive under any long term disability or life insurance provided by the Company.

The Company entered into an agreement with former officer Donald Ochs as of April 16, 2001 pursuant to which Mr. Ochs provided consulting services to the Company regarding operational matters. He ceased providing consulting services to the Company and the terms of this consulting agreement ended on July 20, 2001. He received a total of $37,152 for services rendered under the consulting agreement.

13

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of December 14, 2001, except as otherwise noted, with respect to the beneficial ownership of shares of the Common Stock and Series C Preferred Stock by each person who is known to the Company to be the beneficial owner of more than five percent of the outstanding Common Stock and Series C Preferred Stock, by each director or nominee for director, by each of the officers named on the Summary Compensation Table, and by all directors and executive officers as a group. Unless otherwise indicated, each person has sole voting power and sole investment power.

| | Common Stock

| | Series C Cumulative Preferred Stock(b)

| |

| |

|---|

Name and Address

of Beneficial Owner(a)

| | Amount and

Nature of

Beneficial

Ownership

| | Percent

of Class

| | Amount and

Nature of

Beneficial

Ownership

| | Percent of

Class

Outstanding

| | Percent of

Voting

Power

| |

|---|

| Dan W. and Rebecca C. Matthias | | 914,730 | (c) | 26.3 | % | — | | — | | 24.2 | % |

Michael F. Devine, III |

|

12,100 |

(d) |

* |

|

— |

|

— |

|

* |

|

Verna K. Gibson |

|

55,945 |

(e) |

1.6 |

% |

— |

|

— |

|

* |

|

Joseph A. Goldblum |

|

169,924 |

(f) |

4.9 |

% |

— |

|

— |

|

4.5 |

% |

Elam M. Hitchner, III |

|

58,500 |

(g) |

1.7 |

% |

— |

|

— |

|

1.5 |

% |

Vana Longwell |

|

39,800 |

(h) |

1.1 |

% |

— |

|

— |

|

1.1 |

% |

Frank C. Mullay |

|

12,000 |

(i) |

* |

|

— |

|

— |

|

* |

|

Donald W. Ochs |

|

13,000 |

|

* |

|

— |

|

— |

|

* |

|

William A. Schwartz, Jr. |

|

8,000 |

(j) |

* |

|

— |

|

— |

|

* |

|

Stanley C. Tuttleman |

|

31,000 |

(k) |

* |

|

— |

|

— |

|

* |

|

Centre Capital Investors III, L.P.

c/o Centre Partners Management LLC

30 Rockefeller Center Suite 1050

New York, NY 10020 |

|

131,128 |

(l) |

3.8 |

% |

127,912 |

|

42.3 |

% |

7.4 |

% |

Centre Capital Tax-Exempt

Investors III, L.P.

c/o Centre Partners Management LLC

30 Rockefeller Center Suite 1050

New York, NY 10020 |

|

18,172 |

(l) |

* |

|

17,726 |

|

5.9 |

% |

* |

|

James R. Kirsch

133 Laurel Avenue

Highland Park, IL 60035 |

|

43,886 |

(l) |

1.3 |

% |

33,080 |

|

10.9 |

% |

2.0 |

% |

William S. Kirsch

c/o Kirkland & Ellis

200 East Randolph Drive

Chicago, IL 60601 |

|

43,886 |

(l) |

1.3 |

% |

33,080 |

|

10.9 |

% |

2.0 |

% |

14

Daniel S. Kirsch, as Trustee

of The Daniel S. Kirsch Trust,

dated October 8, 1996

2225 Tennyson

Highland Park, IL 60035 |

|

83,729 |

(l) |

2.4 |

% |

63,113 |

|

20.9 |

% |

3.9 |

% |

Dimensional Fund Advisors, Inc.

1299 Ocean Avenue 11th Floor

Santa Monica, CA 90401 |

|

278,90 |

(m) |

8.0 |

% |

— |

|

— |

|

7.4 |

% |

Foremark Investments, Ltd.

c/o Madeline Wong

21 South End Avenue Penthouse 1C

New York, NY 10280 |

|

217,365 |

(n) |

6.2 |

% |

— |

|

— |

|

5.7 |

% |

MVP Distribution Partners

259 Radnor-Chester Rd.

Radnor, PA 19087 |

|

374,645 |

(o) |

10.8 |

% |

— |

|

— |

|

9.9 |

% |

Oakmont Capital, Inc.

112 St. Clair Avenue West Suite 504

Ontario, Canada M4V 2Y3 |

|

259,000 |

(p) |

7.4 |

% |

— |

|

— |

|

6.8 |

% |

All directors and officers as a group (10 persons) |

|

1,301,999 |

(q) |

37.4 |

% |

— |

|

— |

|

34.4 |

% |

- *

- Less than 1% of the outstanding Common Stock or less than 1% of the voting power.

- (a)

- Except as otherwise indicated, the address of each person named in the table is: c/o Mothers Work, Inc., 456 North Fifth Street, Philadelphia, Pennsylvania 19123.

- (b)

- Shares of the Series C Cumulative Preferred Stock are entitled to one vote per share and vote with the Common Stock on all matters on which holders of Common Stock are entitled to vote.

- (c)

- Includes 212,905 shares and 212,905 shares, respectively, purchasable upon exercise of stock options by Dan and Rebecca Matthias (or a total of 425,810 shares). Except for the shares purchasable upon exercise of stock options, Dan and Rebecca Matthias are husband and wife and beneficially own the shares indicated jointly.

- (d)

- Includes 12,000 shares purchasable upon the exercise of options.

- (e)

- Includes 27,945 shares purchasable upon the exercise of options.

- (f)

- Includes 53,010 shares owned by G-II Family Partnership L.P. Mr. Goldblum is general partner of G-II Family Partnership L.P. and may be deemed to be a beneficial owner of such shares. Also includes 18,000 shares purchasable upon exercise of stock options (including 2,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the 2002 Annual Meeting, subject to Mr. Goldblum's re-election as a director); 26,700 shares held as custodian or in trust for members of Mr. Goldblum's family; and 26,370 shares held by Mr. Goldblum as custodian for the benefit of three of the Matthias' children.

- (g)

- Includes 18,000 shares purchasable upon exercise of stock options (including 2,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the 2002 Annual Meeting.

15

- (h)

- Includes 39,600 shares purchasable upon exercise of stock options.

- (i)

- Includes 12,000 shares purchasable upon exercise of stock options.

- (j)

- All shares purchasable upon exercise of stock options (includes 2,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the 2002 Annual Meeting).

- (k)

- Includes 6,000 shares purchasable upon exercise of stock options (including 2,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the 2002 Annual Meeting).

- (l)

- Consisting of shares purchasable upon exercise of warrants.

- (m)

- Information is based on the Schedule 13G filed with the Securities and Exchange Commission on February 2, 2001. Dimensional Fund Advisors Inc. ("Dimensional"), an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts. These investment companies' trusts and accounts are the "Funds". In its role as investment advisor and investment manager, Dimensional possesses voting and/or investment power over 278,900 shares of the Company's Common Stock. The Funds own all securities reported in this statement, and Dimensional disclaims beneficial ownership of such securities.

- (n)

- Information is based on the Schedule 13G filed with the Securities and Exchange Commission on December 2, 1998. Foremark Investments Ltd. is the record owner of all of the shares; Madeline Wong is the owner of all of the voting and equity securities of Foremark. Such shares do not include 42,000 shares owned by John Charlton, the husband of Madeline Wong.

- (o)

- Information is based on the Schedule 13G filed with the Securities and Exchange Commission on May 3, 1999.

- (p)

- Based on the Schedule 13D/A filed with the Securities and Exchange Commission on November 19, 1998, all of such shares may be deemed to be beneficially owned by Oakmont Capital Inc. ("Oakmont"). Oakmont is a part of a group (the "Group") which also includes E.J.K. Real Estate Services Limited, Inc. ("EJK") and 1272562 Ontario, Inc. ("1272562"), Gregory P. Hannon and Terence M. Kavanagh. Oakmont has sole voting power and sole dispositive power with respect to 173,800 of such shares. EJK and 127652 each own 50 percent of the voting stock of Oakmont and have shared voting power and shared dispositive power with respect to the shares owned by Oakmont. Mr. Kavanagh owns all of the capital stock in EJK, and Mr. Hannon owns all of the capital stock of 1272562. EJK, 1272562, Mr. Kavanagh, and Mr. Hannon also have sole voting power and sole dispositive power as to shares not directly owned by Oakmont.

- (q)

- Includes the following number of shares owned by affiliates of the following directors, which may be deemed to be beneficially owned by the directors: Joseph A. Goldblum—53,010. Also includes the following number of shares purchasable upon the exercise of stock options owned (or which may be deemed to be owned) by the following persons: Verna K. Gibson—27,945, Joseph A. Goldblum—18,000, Elam M. Hitchner, III—18,000, Dan W. Matthias—212,905, Rebecca C. Matthias—212,905, Michael F. Devine, III—12,000, William A. Schwartz, Jr.—8,000, Stanley C. Tuttleman—6,000, Frank C. Mullay—12,000, and Vana Longwell—39,600.

CERTAIN TRANSACTIONS

Elam M. Hitchner, III is a partner at Pepper Hamilton LLP, which provides legal services to the Company.

16

RATIFICATION OF

APPOINTMENT OF AUDITORS

(PROPOSAL 2)

The Board of Directors has selected Arthur Andersen LLP ("Arthur Andersen"), independent public accountants, to audit the consolidated financial statements of the Company for the fiscal year ending September 30, 2002 and recommends that the stockholders ratify such selection. This appointment will be submitted to the stockholders for ratification at the Annual Meeting.

The submission of the appointment of Arthur Andersen is not required by law or by the By-laws of the Company. The Board of Directors is nevertheless submitting it to the stockholders to ascertain their views. If the stockholders do not ratify the appointment, the selection of other independent public accountants will be considered by the Board of Directors. If Arthur Andersen shall decline to accept or become incapable of accepting its appointment, or if its appointment is otherwise discontinued, the Board of Directors will appoint other independent public accountants.

A representative of Arthur Andersen is expected to be present at the Annual Meeting. The representative will have the opportunity to make a statement and will be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR Proposal 2 to ratify the appointment of Arthur Andersen as independent auditors for the year ending September 30, 2002.

OTHER BUSINESS

Management knows of no other matters that will be presented at the Annual Meeting. However, if any other matter properly comes before the meeting, or any adjournment or postponement thereof, it is intended that proxies in the accompanying form will be voted in accordance with the judgment of the persons named therein.

ANNUAL REPORT

A copy of the Company's Annual Report to Stockholders for the fiscal year ended September 30, 2001 accompanies this Proxy Statement.

17

STOCKHOLDER PROPOSALS

In order for a shareholder proposal to be considered for inclusion in the Company's proxy statement and form of proxy relating to the Annual Meeting of Stockholders to be held in 2003, the proposal must be received by the Company at its principal executive offices not later than August 23, 2002. In addition, in the event that the Company receives notice of a stockholder proposal not intended for inclusion in the Company's proxy statement at the Company's principal executive offices not later than November 6, 2002, then so long as the Company includes in its proxy statement for that Meeting the advice on the nature of the proposal and how the named proxyholders intend to vote the shares for which they have received discretionary authority, such proxyholders may exercise discretionary authority with respect to such proposal, except to the extent limited by the Securities and Exchange Commission's rules governing shareholder proposals.

The company will provide to each person solicited, without charge except for exhibits, upon request in writing, a copy of its Annual Report on Form 10-K, including the financial statements and financial statement schedules, as filed with the securities and exchange commission for the fiscal year ended September 30, 2001. Requests should be directed to Mothers Work, Inc., 456 North Fifth Street, Philadelphia, Pennsylvania 19123.

Date: December 21, 2001

Philadelphia, Pennsylvania

18

MOTHERS WORK, INC.

Proxy Solicited On Behalf Of The Board Of Directors

The undersigned, revoking all previous proxies, hereby appoints Dan W. Matthias and Rebecca C. Matthias, and each of them acting individually, as the attorney and proxy of the undersigned, with full power of substitution, to vote, as indicated below and in their discretion upon such other matters as may properly come before the meeting, all shares which the undersigned would be entitled to vote at the Annual Meeting of the Stockholders of the Company to be held on January 17, 2002, and at any adjournment or postponement thereof.

| 1. | | Election of Directors: |

| | | / / | | FOR the nominees listed below | | / / | | WITHOLD AUTHORITY to vote for the nominees listed below |

| | | Nominees: | | For a three-year term expiring at the 2005 Annual Meeting:

Rebecca C. Matthias, Joseph A. Goldblum and David Schlessinger. |

| (INSTRUCTION: To withhold authority to vote for any nominee(s), write the name(s) of such nominee(s) on the line below.) |

|

|

|

| 2. | | Ratification of appointment of Arthur Andersen LLP as independent auditors for the Company for the fiscal year ending September 30, 2002: |

| | | / / FOR / / AGAINST / / ABSTAIN

|

Please date and sign your Proxy on the reverse side and return it promptly.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. UNLESS OTHERWISE SPECIFIED, THE SHARES WILL BE VOTED "FOR" THE ELECTION OF THE NOMINEES FOR DIRECTOR LISTED ON THE REVERSE SIDE HEREOF AND "FOR" RATIFICATION OF APPOINTMENT OF ARTHUR ANDERSEN LLP AS THE COMPANY'S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2002. THIS PROXY ALSO DELEGATES DISCRETIONARY AUTHORITY WITH RESPECT TO ANY OTHER BUSINESS WHICH MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENT OR POSTPONEMENT THEREOF.

THE UNDERSIGNED HEREBY ACKNOWLEDGES RECEIPT OF THE NOTICE OF ANNUAL MEETING AND PROXY STATEMENT.

| | |

|

| | | Signature of Stockholder |

|

|

|

| | | Signature of Stockholder |

|

|

Date: |

|

|

| | | | |

|

NOTE: PLEASE SIGN THIS PROXY EXACTLY AS NAME(S) APPEAR ON YOUR STOCK CERTIFICATE. WHEN SIGNING AS ATTORNEY-IN-FACT, EXECUTOR, ADMINISTRATOR, TRUSTEE OR GUARDIAN, PLEASE ADD YOUR TITLE AS SUCH, AND IF SIGNER IS A CORPORATION, PLEASE SIGN WITH FULL CORPORATE NAME BY A DULY AUTHORIZED OFFICER OR OFFICERS AND AFFIX THE CORPORATE SEAL. WHERE STOCK IS ISSUED IN THE NAME OF TWO (2) OR MORE PERSONS, ALL SUCH PERSONS SHOULD SIGN.

QuickLinks

ELECTION OF DIRECTORS (PROPOSAL 1)Committees and Meetings of the Board of DirectorsCompensation of DirectorsSection 16(a) Beneficial Ownership Reporting ComplianceAUDIT COMMITTEE REPORTChief Executive Officer and President CompensationSUMMARY COMPENSATION TABLESTOCK OPTIONS GRANTED TO CERTAIN EXECUTIVE OFFICERS DURING LAST FISCAL YEARAGGREGATED OPTION EXERCISES IN FISCAL YEAR ENDED SEPTEMBER 30, 2001 AND FISCAL YEAR 2001-END OPTION VALUESSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTCERTAIN TRANSACTIONSRATIFICATION OF APPOINTMENT OF AUDITORS (PROPOSAL 2)OTHER BUSINESSANNUAL REPORTSTOCKHOLDER PROPOSALSMOTHERS WORK, INC. Proxy Solicited On Behalf Of The Board Of Directors