QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

MOTHERS WORK, INC |

(Name of Registrant as Specified In Its Charter) |

NOT APPLICABLE |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | | | |

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

456 North Fifth Street

Philadelphia, Pennsylvania 19123

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

January 22, 2004

To the Stockholders of Mothers Work, Inc.:

The Annual Meeting of Stockholders of Mothers Work, Inc., a Delaware corporation (the "Company"), will be held at 9:00 a.m. Eastern Standard Time, on January 22, 2004 at the Company's corporate headquarters, 456 North Fifth Street, Philadelphia, Pennsylvania, for the following purposes:

- 1.

- To elect two directors of the Company;

- 2.

- To ratify the action of the Audit Committee of the Board of Directors in appointing KPMG LLP ("KPMG") as independent public accountants to audit the consolidated financial statements of the Company and its subsidiaries for the fiscal year ending September 30, 2004; and

- 3.

- To transact such other business as may properly come before the meeting or any adjournments thereof.

Only holders of the Common Stock at the close of business on December 9, 2003 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements thereof. Such stockholders may vote in person or by proxy. The accompanying form of proxy is solicited by the Board of Directors of the Company.

| | | By Order of the Board of Directors |

|

|

|

| | | Dan W. Matthias

Chairman of the Board and

Chief Executive Officer |

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. YOU ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND IN PERSON, YOU ARE URGED TO COMPLETE, SIGN AND RETURN THE ENCLOSED PROXY CARD IN THE SELF-ADDRESSED ENVELOPE, ENCLOSED FOR YOUR CONVENIENCE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES. IF YOU DECIDE TO ATTEND THE MEETING AND WISH TO VOTE IN PERSON, YOU MAY REVOKE YOUR PROXY BY WRITTEN NOTICE AT THAT TIME.

December 23, 2003

456 North Fifth Street

Philadelphia, Pennsylvania 19123

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON

January 22, 2004

This proxy statement, which is first being mailed to stockholders on approximately December 23, 2003, is furnished in connection with the solicitation by the Board of Directors of Mothers Work, Inc. (the "Company") of proxies to be used at the Annual Meeting of Stockholders of the Company to be held at 9:00 a.m., Eastern Standard Time, on January 22, 2004 (the "Annual Meeting") at the Company's corporate headquarters, 456 North Fifth Street, Philadelphia, Pennsylvania, and at any adjournments or postponements thereof. If proxies in the accompanying form are properly executed and returned prior to voting at the meeting, the shares of the Company's Common Stock (the "Common Stock") represented thereby will be voted as instructed on the proxy. If no instructions are given on a properly executed and returned proxy, the shares of the Common Stock represented thereby will be voted for the election of the nominees for director named below, for the ratification of the appointment of KPMG as independent public accountants, and in support of management on such other business as may properly come before the Annual Meeting or any adjournments thereof. Any proxy may be revoked by a stockholder prior to its exercise upon written notice to the Secretary of the Company, by delivering a duly executed proxy bearing a later date, or by the vote of a stockholder cast in person at the Annual Meeting.

VOTING

Holders of record of the Common Stock on December 9, 2003 will be entitled to vote at the Annual Meeting or any adjournments or postponements thereof. As of that date, there were 5,236,544 shares of Common Stock outstanding and entitled to vote. The presence, in person or by proxy, of holders of Common Stock entitled to cast at least a majority of the votes which all holders of the Common Stock are entitled to cast will constitute a quorum for purposes of the transaction of business. Each share of Common Stock entitles the holder thereof to one vote on the election of the nominee for director and on any other matter that may properly come before the Annual Meeting. Stockholders are not entitled to cumulative voting in the election of directors. Directors are elected by a plurality of the votes cast and votes may be cast in favor of or withheld from each director nominee. Votes that are withheld from a director nominee will be excluded entirely from the vote for such nominee and will have no effect thereon. Ratification of the appointment of KPMG as independent public accountants to audit the consolidated financial statements of the Company and its subsidiaries for the year ending September 30, 2004 requires the affirmative vote of the holders of a majority of the shares entitled to vote, present at the Annual Meeting in person or represented by proxy.

Abstentions and broker non-votes (described below) are counted in determining whether a quorum is present. Abstentions with respect to any proposal other than the election of directors will have the same effect as votes against the proposal. A "broker non-vote" occurs when a broker submits a proxy that does not indicate a vote for some of the proposals because the beneficial owners have not instructed the broker on how to vote on such proposals and the broker does not have discretionary authority to vote in the absence of instructions. Broker non-votes are not considered to be shares

"entitled to vote" (other than for quorum purposes), and will therefore have no effect on the outcome of any of the matters to be voted upon at the Annual Meeting.

The cost of solicitation of proxies by the Board of Directors will be borne by the Company. Proxies may be solicited by mail, personal interview, telephone or facsimile and, in addition, directors, officers and regular employees of the Company may solicit proxies by such methods without additional remuneration. Banks, brokerage houses and other institutions, nominees or fiduciaries will be requested to forward the proxy materials to beneficial owners in order to solicit authorizations for the execution of proxies. The Company will, upon request, reimburse such banks, brokerage houses and other institutions, nominees and fiduciaries for their expenses in forwarding such proxy materials to the beneficial owners of the Common Stock.

ELECTION OF DIRECTORS

(PROPOSAL 1)

The Company's Board of Directors is divided into three classes, with staggered three-year terms. Currently, the Board has seven members. Unless otherwise specified in the accompanying proxy, the shares voted pursuant thereto will be cast for Mr. Dan W. Matthias and Mr. Elam M. Hitchner for terms expiring at the Annual Meeting of Stockholders to be held following fiscal 2006 (the "2007 Annual Meeting"). If, for any reason, at the time of election, any of the nominees named should decline or be unable to accept his or her nomination or election, it is intended that such proxy will be voted for the election, in the nominee's place, of a substituted nominee, who would be recommended by the Board of Directors. The Board of Directors, however, has no reason to believe that any of the nominees will be unable to serve as a director.

The following biographical information is furnished as to each nominee for election as a director and each of the current directors:

Nominees for Election to the Board of Directors for a Three-Year

Term Expiring at the 2007 Annual Meeting

Dan W. Matthias, 60, founded the Company in 1982 and has served as Chairman of the Board since its inception. From 1983 to 1993, he served as the Company's Executive Vice President, and since January 1993, Mr. Matthias has been the Company's Chief Executive Officer. Prior to founding the Company, Mr. Matthias had been involved in the computer and electronics industry, serving as a director of Zilog, Inc. and serving as the President of a division of a subsidiary of Exxon Corporation.

Elam M. Hitchner, III, 57, has served as a director of the Company since January 1994. Mr. Hitchner was a partner in the law firm Pepper Hamilton LLP, which provides legal services to the Company, from May 1992 to June 1999, and returned to the firm in January 2001, where he currently is Of Counsel. Mr. Hitchner does not participate in the provision of legal services to the Company. From July 1999 until December 31, 2000, Mr. Hitchner was a general partner of Meridian Venture Partners and Meridian Venture Partners II, venture capital firms located in Radnor, Pennsylvania.

Members of the Board of Directors Continuing in Office

Term Expiring at the 2005 Annual Meeting

Rebecca C. Matthias, 50, founded the Company in 1982 and has served as a director of the Company and its President since its inception. Since January 1993, Ms. Matthias has also served as the Company's Chief Operating Officer. In 1992, Ms. Matthias was chosen as "Regional Entrepreneur of the Year" by Inc. Magazine and Merrill Lynch Corporation, and in September 2003, Ms. Matthias was recognized as a top woman entrepreneur by the United States Small Business Administration. Prior to 1982, Ms. Matthias was a construction engineer for the Gilbane Building Company. Ms. Matthias also

2

serves as a member of the Board of Trustees of Drexel University and a director on the Board of Directors of CSS Industries, Inc.

Joseph A. Goldblum, 54, has served as a director of the Company since 1989. Mr. Goldblum has been President of G-II Equity Investors, Inc., a general partner of G-II Family Partnership L.P., since May 1989. He was also Of Counsel with the law firm of Goldblum & Hess from May 1989 to December 1996.

David Schlessinger, 48, has served as a director of the Company since January 2002. Mr. Schlessinger is the founder and Chief Executive Officer of Five Below, Inc., an extreme-value retailer in the teen and pre-teen market, a position which he has held since January 2002. He has been engaged in personal investment activities as well as consulting and board services with private companies since 1998. Mr. Schlessinger founded Zany Brainy, a retail children's educational products company, in 1991 and served as Zany Brainy's Chief Executive Officer until 1996 and as its Chairman until 1998. He founded Encore Books, a retail bookstore chain, in 1973 and served as its Chairman and Chief Executive Officer until 1986.

Members of the Board of Directors Continuing in Office

Term Expiring at the 2006 Annual Meeting

William A. Schwartz, Jr., 64, has served as a director of the Company since August 1998. Mr. Schwartz is President and Chief Executive Officer of U.S. Vision, Inc., a retailer of optical products and services, a position which he has held since 1995. Mr. Schwartz currently is a director of U.S. Vision, Inc. and Commerce Bancorp.

Stanley C. Tuttleman, 84, has served as a director of the Company since January 2000. He has been the President and Chief Executive Officer of Tuttson Capital Corp., a financial services corporation, since 1983. Mr. Tuttleman also serves as Chief Executive Officer and Chairman of Telepartners, Inc., a wireless program company.

Other than the husband and wife relationship between Dan and Rebecca Matthias, there are no family relationships among any of the other directors of the Company.

The Board of Directors recommends a vote For Proposal 1 to elect all Nominees to the Board of Directors for a Three-Year Term Expiring at the 2007 Annual Meeting.

Committees and Meetings of

the Board of Directors

During the fiscal year ended September 30, 2003, the Board of Directors held five meetings, of which one was held telephonically as scheduled. Each director attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and committees of the Board of Directors on which he or she served.

The Company expects all of its directors to attend the annual meetings of stockholders. Three directors attended last year's annual meeting.

The Board of Directors has three committees: an Audit Committee, a Compensation Committee and a Nominating Committee.

During the fiscal year ended September 30, 2003, the Audit Committee, which consists of Mr. Hitchner, Chairman, Mr. Schwartz and Mr. Tuttleman, held seven meetings, of which three were held telephonically as scheduled. Each member of the Audit Committee is considered an "independent director" under Nasdaq rules and the rules of the Securities and Exchange Commission ("SEC"). The function of the Audit Committee is to assist the Board of Directors in preserving the integrity of the financial information published by the Company through the review of financial and accounting

3

controls and policies, financial reporting requirements, alternative accounting principles that could be applied and the quality and effectiveness of the independent public accountants. The Audit Committee Charter is attached as Appendix A.

The Board of Directors has determined that the Audit Committee does not have an "audit committee financial expert" as that term is defined in the SEC's rules and regulations. However, the Board of Directors believes that each of the members of the Audit Committee has demonstrated that he is capable of analyzing and evaluating the Company's financial statements and understanding internal controls and procedures for financial reporting. As the Board of Directors believes that the current members of the Audit Committee are qualified to carry out all of the duties and responsibilities of the Company's Audit Committee, the Board does not believe that it is necessary at this time to actively search for an outside person to serve on the Board of Directors who would qualify as an audit committee financial expert.

During the fiscal year ended September 30, 2003, the Compensation Committee, which consists of Mr. Goldblum, Chairman, Mr. Schlessinger and Mr. Schwartz, held three meetings. Each member of the Compensation Committee is considered an "independent director" under Nasdaq rules. The Compensation Committee considers recommendations of the Company's management regarding compensation, bonuses and fringe benefits of the executive officers of the Company, and determines whether the recommendations of management are consistent with general policies, practices, and compensation scales established by the Board of Directors. The Board of Directors has adopted a Compensation Committee Charter, which is attached as Appendix B.

During the fiscal year ended September 30, 2003, the Nominating Committee, which then consisted of Mr. Matthias, Chairman, Mr. Goldblum and Mr. Hitchner, held no meetings. In order for the Nominating Committee to consist solely of "independent directors" under Nasdaq rules, Mr. Matthias resigned from the Nominating Committee in December 2003 and the Board of Directors appointed Mr. Schwartz to the Nominating Committee.

The Nominating Committee's functions include establishing the criteria for selecting candidates for nomination to the Board of Directors; actively seeking candidates who meet those criteria; and making recommendations to the Board of Directors of nominees to fill vacancies on, or as additions to, the Board of Directors. The Nominating Committee will consider director candidates who have relevant business experience, are accomplished in their respective fields, and who possess the skills and expertise to make a significant contribution to the Board of Directors, the Company and its stockholders. Director nominees should have high-leadership business experience, knowledge about issues affecting the Company and the ability and willingness to apply sound and independent business judgment. The Nominating Committee will consider nominees for election to the Board of Directors that are recommended by stockholders, provided that a complete description of the nominees' qualifications, experience and background, together with a statement signed by each nominee in which he or she consents to act as such, accompany the recommendations. Such recommendations should be submitted in writing to the attention of the Nominating Committee, c/o Mothers Work, Inc., 456 North Fifth Street, Philadelphia, Pennsylvania, 19123, and should not include self-nominations. The Nominating Committee applies the same criteria to nominees recommended by stockholders. The Board of Directors has adopted a Nominating Committee Charter, which is attached as Appendix C.

Stockholder Communications

Stockholders may contact the Board of Directors by writing to them c/o Mothers Work, Inc., 456 North Fifth Street, Philadelphia, Pennsylvania, 19123. All communications directed to the Board will be delivered to the Board of Directors.

4

Compensation of Directors

The Company pays each director, other than the Matthiases, a retainer of $4,000 per quarter. In addition, each director is paid $1,500 for each Board meeting scheduled to be held in person and attended by such director, and $500 for each Committee meeting scheduled to be held in person and attended by such director. Directors are not compensated for attendance at Board or Committee meetings scheduled to be held telephonically. Upon conclusion of each Annual Meeting of Stockholders, the Company grants each director, other than the Matthiases, immediately vested options to purchase 3,000 shares of the Common Stock pursuant to the Company's 1994 Director Stock Option Plan.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities (collectively, "Reporting Persons"), to file with the SEC initial reports of ownership (on Form 3) and reports of changes in ownership of the Common Stock and other equity securities of the Company (on Forms 4 and 5). Reporting Persons are additionally required to furnish the Company with copies of all Section 16(a) reports they file.

To the Company's knowledge, based solely upon a review of the copies of such reports furnished to the Company, the following Section 16(a) reports for the fiscal year ended September 30, 2003 were not timely filed: one late report for each of Elam M. Hitchner, Stanley C. Tuttleman, Joseph A. Goldblum, David Schlessinger and William A. Schwartz, relating to one grant of stock options under the Company's 1994 Director Stock Option, and one late report for each of Dan W. Matthias, Rebecca C. Matthias, Edward M. Krell and David Mangini, relating to one grant of stock options under the Company's 1987 Stock Option Plan, as amended and restated (the "Amended and Restated Stock Option Plan").

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors has:

- •

- Reviewed and discussed the audited financial statements for the year ended September 30, 2003 with management;

- •

- Discussed with the Company's independent public accountants regarding matters required to be discussed by Statement on Auditing Standards ("SAS") No. 61, as amended by SAS No. 90, in connection with the audit of the financial statements for the year ended September 30, 2003; and

- •

- Received the written disclosures and the letter from the independent public accountants required by Independence Standards Board Standard No. 1, and has discussed with the independent auditors its independence.

In reliance on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for filing with the SEC for the year ended September 30, 2003.

5

Auditor Fees and Services

The following is a summary of the fees billed to the Company by KPMG for professional services rendered for the fiscal year ended September 30, 2003, and by Arthur Andersen LLP ("Andersen") and KPMG for the fiscal year ended September 30, 2002:

| | Fiscal 2003 Fees ($)

| | Fiscal 2002 Fees ($)

|

|---|

Fee Category

| |

| |

| | Total Fiscal 2002

Fees

|

|---|

| | KPMG

| | KPMG

| | Andersen

|

|---|

| Audit Fees (1) | | 200,000 | | 299,000 | | 40,000 | | 339,000 |

| Audit-Related Fees (2) | | 22,000 | | 214,230 | | 204,240 | | 418,470 |

| Tax Fees (3) | | 80,000 | | 3,500 | | 59,000 | | 62,500 |

| All Other Fees (4) | | — | | — | | — | | — |

| | |

| |

| |

| |

|

| | Total Fees | | 302,000 | | 516,730 | | 303,240 | | 819,970 |

| | |

| |

| |

| |

|

- (1)

- Audit Fees consist of fees billed for professional services rendered for the audit of the Company's financial statements and for reviews of the interim financial statements included in the Company's quarterly reports on Form 10-Q.

- (2)

- Audit-Related Fees consist of fees billed for professional services rendered for audit-related services including consultation on SEC registration statements and filings and the issuance of consents, audit of the business acquired during fiscal 2002, and consultations on other financial accounting and reporting related matters.

- (3)

- Tax Fees consists of fees billed for professional services relating to tax compliance and other tax advice.

- (4)

- All Other Fees consist of fees billed for all other services

The Audit Committee pre-approved all audit and non-audit services described above rendered to the Company by KPMG during fiscal 2003 and has pre-approved similar services to be rendered during fiscal 2004. The Audit Committee believes the rendering of these services is not incompatible with the independent auditors maintaining their independence.

| | | The Audit Committee

Elam M. Hitchner, III, Chairman

William A. Schwartz, Jr.

Stanley C. Tuttleman |

The foregoing Audit Committee Report shall not be deemed to be incorporated by reference into any filing made by the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, notwithstanding any general statement contained in any such filing incorporating this proxy statement by reference, except to the extent the Company incorporates such report by specific reference.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors has furnished the following report on executive compensation:

General

The Compensation Committee of the Board of Directors consists of Joseph A. Goldblum, Chairman, David Schlessinger and William A. Schwartz. Under the supervision of the Compensation

6

Committee, the Company has developed and implemented compensation policies, plans and programs which seek to enhance the profitability of the Company, and thus stockholder value, by aligning the financial interests of the Company's senior management with those of its stockholders. Annual base salary and longer term incentive compensation provide an important incentive in attracting and retaining corporate officers and other key employees and motivating them to perform to the full extent of their abilities and in the long-term interests of the stockholders.

The Company's executive compensation program consists of two key elements: (1) an annual component, i.e., base salary and annual bonus and (2) a long-term component, i.e., stock options. Executive compensation levels are determined in connection with a review of compensation levels at comparable publicly held companies. The Compensation Committee has determined that a compensation package that contains long-term stock based incentives is appropriate for the Company's goals of sustainable growth and enhanced stockholder value.

Based on this philosophy, a meaningful portion of the senior executives' annual bonus and stock options is designed to be linked to the Company's achievement of targeted earnings before interest expense, income tax provision, depreciation and amortization expense ("EBITDA"). Under this pay-for-performance orientation:

- •

- executives are motivated to improve the overall performance and profitability of the Company; and

- •

- accountability is further encouraged through the adjustment of salaries and incentive awards on the basis of each executive's individual performance, potential and contribution.

The policies with respect to each element of the compensation package, as well as the basis for determining the compensation of the Chief Executive Officer and the President, Dan and Rebecca Matthias, respectively, are described below.

1. Annual Component: Base Salary and Annual Bonus

Base Salary: includes compensation for discharging job responsibilities and reflects the executive officer's performance over time. Peer salaries for comparable positions are used as reference points in setting salary opportunities for executive officers. The Company's overall goal is to approximate the median salaries paid by the peer group assuming comparability of such factors as position, responsibilities and tenure.

Individual salary adjustments take into account the Company's salary increase guidelines for the year and individual performance contributions for the year, as well as sustained performance contributions over a number of years and significant changes in responsibilities, if any. The assessment of individual performance contributions is subjective and does not reflect the Company's performance.

Annual Bonus: based on the Company's performance and management's performance against specified goals established by senior management and the Compensation Committee.

The annual bonuses for the Chief Executive Officer and the President are based upon the Company's achievement of targeted EBITDA. Notwithstanding the foregoing, the Compensation Committee has the discretion to increase the annual bonus in any given year to take into account what it deems to be extraordinary events.

2. Long-Term Component: Stock Options

To align stockholder and executive officer interests, the long-term component of the Company's executive compensation program includes the granting of stock options whose value is dependent upon the appreciation in the market price of the underlying Common Stock. Stock options are granted to reinforce the importance of improving stockholder value over the long-term, and to encourage and

7

facilitate the executive's stock ownership. Under the Amended and Restated Stock Option Plan, options to purchase Common Stock are available for grant to officers and other employees and consultants of the Company. Stock options are granted with an exercise price equal to 100% of the fair market value of the Common Stock on the date of grant to ensure that the executives can only be rewarded for appreciation in the price of the Common Stock when the Company's stockholders are similarly benefited. Stock options are exercisable up to ten years from the date granted. The stock options generally vest over a five year period, although some stock options, including those granted to the Chief Executive Officer and the President pursuant to the terms of their employment agreements, vest immediately. While all executives are eligible to receive stock options, participation in each annual grant, as well as the size of the grant each participating executive receives, is based upon Company and individual performance. Notwithstanding the foregoing, the Compensation Committee has the discretion to increase the annual grant of options in any given year to take into account what it deems to be extraordinary events. Certain options for the Company's Chief Executive Officer and the President are governed by the terms of their employment agreements. The entitlement of the Chief Executive Officer and the President to options for services rendered are based upon the Company's EBITDA performance.

Chief Executive Officer and President Compensation

In fiscal 2003, the annual base salaries for each of Dan W. Matthias, Chairman of the Board and Chief Executive Officer, and Rebecca C. Matthias, President and Chief Operating Officer, increased from $450,000 to $463,500, respectively. As of October 1, 2003, the fiscal 2004 salaries for the Chief Executive Officer and President were increased from $463,500 to $477,400, respectively. The fiscal 2003 and 2004 base salaries are commensurate with the salaries of other senior management of publicly-held companies of comparable size in the retail clothing industry.

The Matthiases' compensation package as set forth in their respective employment agreements, as modified by the Compensation Committee, consists of two elements: (1) an annual component consisting of base salary and cash bonus and (2) a long-term component consisting of stock options. See "Employment Agreements" on page 14. Management's performance is measured against the Company's achievement of targeted EBITDA. Based upon the Company's actual fiscal 2003 EBITDA relative to targeted EBITDA, as approved by the Compensation Committee, each of the Matthiases received a cash bonus of 12.8% of his or her base salary, representing a cash bonus equal to $59,096 for each of them, and each received 25.5% of their target option grant of 45,000 stock options for their long-term compensation component, representing a grant of 11,475 stock options each. The Board ratified the Compensation Committee's recommendations regarding the basis of the fiscal 2003 compensation of each of the Matthiases.

| | | The Compensation Committee

Joseph A. Goldblum, Chairman

David Schlessinger

William A. Schwartz, Jr. |

8

SUMMARY COMPENSATION TABLE

The following table sets forth, for the fiscal years ended September 30, 2003, 2002 and 2001, certain compensation information with respect to the Company's Chief Executive Officer and the other Company officers named therein.

| |

| |

| |

| |

| | Long-Term

Compensation

| |

| |

|---|

| |

| | Annual Compensation

| |

| | Awards

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus ($)

| | Other Annual

Compensation

($)(a)

| | Shares

Underlying

Options/SARs (#)

| | All Other

Compensation ($)

| |

|---|

Dan W. Matthias

Chairman and Chief

Executive Officer | | 2003

2002

2001 | | 463,189

449,039

402,102 | | 59,096

450,000

40,000 | | —

—

— | | 11,475

60,000

15,000 | (b)

(b)

(b) | 2,680

—

— | (f)

|

Rebecca C. Matthias

President and Chief

Operating Officer |

|

2003

2002

2001 |

|

463,189

449,039

400,969 |

|

59,096

450,000

40,000 |

|

—

—

— |

|

11,475

60,000

15,000 |

(b)

(b)

(b) |

1,290

—

— |

(f)

|

David Mangini (c)

Executive Vice President–

General Merchandise Manager |

|

2003

2002

2001 |

|

441,865

450,000

60,577 |

|

59,351

154,215

7,500 |

|

—

—

— |

|

5,000

10,000

50,000 |

|

—

—

— |

|

Edward M. Krell (d)

Executive Vice President–

Chief Financial Officer |

|

2003

2002 |

|

309,796

196,154 |

|

39,529

102,810 |

|

34,652

96,888 |

(e)

(e) |

10,000

35,000 |

|

—

— |

|

- (a)

- In accordance with the rules of the Securities and Exchange Commission, other compensation in the form of perquisites and other personal benefits, securities or property, has been omitted in those instances where such perquisites and other personal benefits, securities or property, constituted less than the lesser of $50,000 or ten percent of the total of annual salary and bonus for the named executive officer for such year.

- (b)

- This stock option was granted pursuant to the named officer's employment agreement with respect to services rendered during the applicable fiscal year, notwithstanding the fact that the grant was made after the end of the respective fiscal year.

- (c)

- Mr. Mangini, Executive Vice President – General Merchandise Manager, joined the Company on August 6, 2001.

- (d)

- Mr. Krell, Executive Vice President – Chief Financial Officer, joined the Company on January 28, 2002.

- (e)

- Represents relocation expenses reimbursed to the executive by the Company, together with a gross-up of associated income taxes, with payments made in fiscal years 2002 and 2003.

- (f)

- Represents amount paid by the Company for term life insurance premiums.

9

STOCK OPTIONS GRANTED TO CERTAIN EXECUTIVE OFFICERS DURING LAST FISCAL YEAR

The following table sets forth certain information regarding options for the purchase of Common Stock that were awarded and issued to the Company's Chief Executive Officer and the other named Company officers during fiscal 2003.

Option Grants In Fiscal Year Ended September 30, 2003

| |

| |

| |

| |

| | Potential Realizable Gain

at Assumed Annual Rates

of Stock Appreciation for

Option Terms

Compounded Annually ($)

|

|---|

| |

| | Percent of

Total

Options

Granted to

Employees in

Last

Fiscal Year

| |

| |

|

|---|

| | Number of

Shares

Underlying

Options

Granted (#)

| |

| |

|

|---|

| | Exercise or

Base

Price

($/Sh)

| |

|

|---|

Name

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Dan W. Matthias | | 60,000 | (1) | 23.2 | % | 37.05 | | 11/20/12 | | 1,398,033 | | 3,542,889 |

Rebecca C. Matthias |

|

60,000 |

(1) |

23.2 |

% |

37.05 |

|

11/20/12 |

|

1,398,033 |

|

3,542,889 |

David Mangini |

|

5,000 |

(2) |

1.9 |

% |

37.05 |

|

11/20/12 |

|

116,503 |

|

295,241 |

Edward M. Krell |

|

10,000 |

(2) |

3.9 |

% |

37.05 |

|

11/20/12 |

|

233,005 |

|

590,482 |

- (1)

- These options were fully vested as of the grant date and were granted under the Amended and Restated Stock Option Plan.

- (2)

- These options were granted under the Amended and Restated Stock Option Plan and become exercisable as to 20% of the underlying shares on each of the first five anniversaries of the grant date.

10

AGGREGATED OPTION EXERCISES IN FISCAL YEAR

ENDED SEPTEMBER 30, 2003 AND 2003 FISCAL YEAR-END OPTION VALUES

The following table sets forth certain information regarding options for the purchase of the Common Stock that were exercised and/or held by the Company's Chief Executive Officer and the other named Company officers during fiscal 2003.

| |

| |

| | Number of Shares

Underlying

Unexercised Options at

Fiscal Year End (#)

| |

| |

|

|---|

| |

| |

| | Value of Unexercised

In-the-Money Options

at Fiscal Year End ($)

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

($)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Dan W. Matthias | | — | | — | | 255,905 | | — | | 3,983,051 | | — |

Rebecca C. Matthias |

|

— |

|

— |

|

255,905 |

|

— |

|

3,983,051 |

|

— |

David Mangini |

|

— |

|

— |

|

22,000 |

|

43,000 |

|

452,920 |

|

793,680 |

Edward M. Krell |

|

— |

|

— |

|

7,000 |

|

38,000 |

|

142,450 |

|

569,800 |

SUMMARY OF ALL EXISTING EQUITY COMPENSATION PLANS

The following table sets forth information as of the end of the Company's 2003 fiscal year with respect to compensation plans under which the Company is authorized to issue shares.

Equity Compensation Plan Information

Plan Category

| | Number of Shares to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights (#)

| | Weighted-Average

Exercise Price of

Outstanding

Options,

Warrants and

Rights ($)

| | Number of Shares

Remaining Available

for Future Issuance

under Equity

Compensation Plans

(excluding securities

reflected in 1st

column) (#)

|

|---|

| Equity compensation plans approved by security holders (1) | | 1,093,250 | | 16.36 | | 624,877 |

Equity compensation plans not approved by security holders (2) |

|

— |

|

— |

|

— |

| | |

| |

| |

|

Total |

|

1,093,250 |

|

16.36 |

|

624,877 |

| | |

| |

| |

|

- (1)

- These plans consist of the Amended and Restated Stock Option Plan and 1994 Director Stock Option Plan.

- (2)

- The Company does not maintain any equity compensation plans that have not been approved by the stockholders.

11

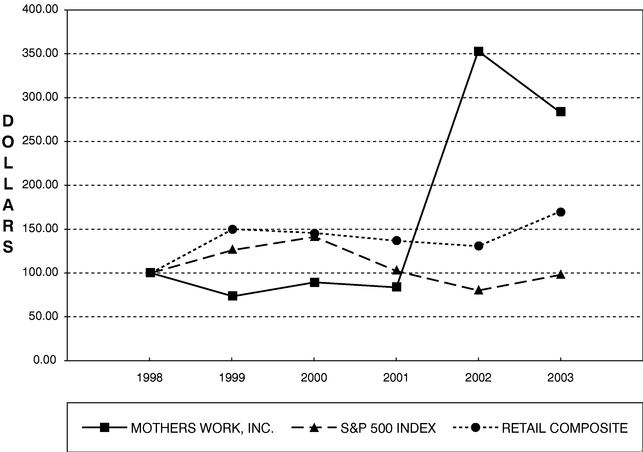

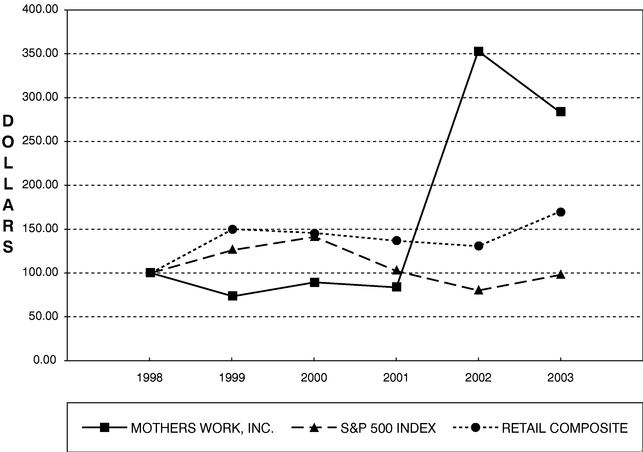

Stock Price Performance Graph

The graph below compares the cumulative total stockholder return on the Company's Common Stock for the period September 30, 1998 to September 30, 2003, with the cumulative total return of the Standard & Poor's 500 Stock Index and the Standard and Poor's Retail Stores Composite Index. The comparison assumes $100 was invested on September 30, 1998 in the Company's Common Stock and in each of the foregoing indices and assumes reinvestment of dividends.

Total Stockholder Returns

12

Employment Agreements

Dan and Rebecca Matthias

The Company is a party to written employment agreements (the "Employment Agreements") with both Dan and Rebecca Matthias which expire on September 30, 2006, unless earlier terminated pursuant to the terms of the Employment Agreements. The term of each Employment Agreement automatically extends for successive one-year periods extending the expiration date into the third year after the extension, unless either the Company or the executive gives written notice to the other party that the term will not so extend. Under the Employment Agreements, as modified based on discussions with the Compensation Committee, the Company has agreed to nominate the Matthiases as directors and to use its best efforts to cause them to be elected as directors. The base salary of each executive for fiscal 2004 is $477,400 per year, and the base salary will increase each year during the term in an amount determined by the Compensation Committee of the Board of Directors, but in any event no less than the rate of inflation.

The Matthiases are each entitled to a cash bonus of up to 100% of his or her base salary and a grant of up to 60,000 immediately-vested stock options based on a formula relating to the Company's achievement of a target EBITDA that has been approved by the Compensation Committee. Under these formulas, achievement of 100% of target EBITDA results in each of the Matthiases earning a cash bonus equal to 50% of his or her base salary and a grant of 45,000 immediately-vested stock options. The Compensation Committee retains the discretion to increase the executives' bonuses and to grant additional options if such Committee deems it to be appropriate.

The Employment Agreements provide that for one year following the termination of employment of either executive (other than for "Good Reason" or upon a "Change of Control" of the Company, as such terms are defined in the Employment Agreements), the executive shall not compete with the Company or solicit the Company's suppliers or employees. If the employment of either executive is terminated by the Company without cause or by the executive for good reason or following a change of control, each term as defined in the Employment Agreements, (i) the executive is entitled to receive a lump sum severance payment equal to three years of base salary and the maximum amount of cash and option bonus compensation and fringe benefits which would have been paid or made available to the executive during the three years following such termination, (ii) all unvested stock options held by the terminated executive will become immediately vested, and (iii) the executive is entitled to cause the Company to register all shares owned by the executive under the Securities Act of 1933, as amended, to the extent they are not then registered, and the executive may additionally include his or her shares in future registrations filed by the Company. In the event of a termination by the Company for cause or by the executive without good reason, the executive will not be entitled to any further base salary or bonus compensation, and all unvested options then held by the executive will be automatically canceled. In the event of a termination by the Company because of a disability, the executive shall continue to receive base salary and cash bonus and option compensation and fringe benefits during the three years following such termination, at 50% of the levels the executive would have received if the executive's employment had been terminated by the Company without cause, as described above, less any payments received by the executive under any long term disability or life insurance provided by the Company.

Edward Krell

The Company is also a party to a written employment agreement with Edward Krell which expires on September 30, 2005, unless earlier terminated pursuant to the terms of his employment agreement. The term of the employment agreement automatically extends for successive one-year periods extending the expiration date into the second year after the extension, unless either the Company or

13

the executive gives written notice to the other party that the term will not so extend. The base salary of Mr. Krell for fiscal 2004 is $360,000 per year.

The employment agreement provides that for two years following the termination of employment, Mr. Krell shall not compete with the Company or solicit the Company's suppliers or employees. Except for a "Change of Control" as defined in the agreement, if the employment of Mr. Krell is terminated by the Company without cause, (i) he is entitled to receive a lump sum severance payment equal to one year of his then current base salary, and (ii) all unvested stock options held by him will become immediately vested and exercisable. If after a Change of Control the employment of Mr. Krell is terminated by the Company or by Mr. Krell, he is entitled to receive a lump sum severance payment equal to (i) two years of his then current base salary or the highest salary paid to him at any time by the Company, (ii) two years of the target amount of cash bonus compensation (currently 50% of base salary) and (iii) two years of fringe benefits, provided, however, that the Company may instead elect to continue providing such benefits, and all stock options held by him will become immediately vested and exercisable. In the event of a termination by the Company for cause, as defined in the employment agreement, he will not be entitled to any further base salary, bonus compensation or fringe benefits.

14

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information, as of November 20, 2003, except as otherwise noted, with respect to the beneficial ownership of shares of the Common Stock by each person who is known to the Company to be the beneficial owner of more than five percent of the outstanding Common Stock, by each director or nominee for director, by each of the officers named on the Summary Compensation Table, and by all directors and executive officers as a group. Unless otherwise indicated, each person has sole voting power and sole investment power.

| | Common Stock

| |

|---|

Name and Address

of Beneficial Owner (a)

| | Amount and Nature of

Beneficial Ownership

| | Percent

of Class

| |

|---|

| Dan W. and Rebecca C. Matthias | | 1,004,680 | (b) | 17.4 | % |

| David Mangini | | 25,000 | (c) | * | |

| Edward M. Krell | | 16,158 | (d) | * | |

| Joseph A. Goldblum | | 148,219 | (e) | 2.8 | % |

| Elam M. Hitchner, III | | 44,500 | (f) | * | |

| David Schlessinger | | 8,000 | (g) | * | |

| William A. Schwartz, Jr. | | 15,000 | (h) | * | |

| Stanley C. Tuttleman | | 44,000 | (i) | * | |

| MVP Distribution Partners | | 374,645 | (j) | 7.2 | % |

| | 259 Radnor-Chester Rd.

Radnor, PA 19087 | | | | | |

| Oakmont Capital, Inc. | | 259,000 | (k) | 5.0 | % |

| | 112 St. Clair Avenue West Suite 504

Ontario, Canada M4V 2Y3 | | | | | |

| All directors and officers as a group (9 persons) | | 1,305,557 | (l) | 22.2 | % |

- *

- Less than 1% of the outstanding Common Stock or less than 1% of the voting power.

- (a)

- Except as otherwise indicated, the address of each person named in the table is: c/o Mothers Work, Inc., 456 North Fifth Street, Philadelphia, Pennsylvania 19123.

- (b)

- Includes 267,380 shares and 267,380 shares, respectively, purchasable upon exercise of stock options by Dan and Rebecca Matthias (or a total of 534,760 shares purchasable upon exercise of stock options). Except for the shares purchasable upon exercise of stock options, Dan and Rebecca Matthias, who are husband and wife, beneficially own the shares indicated jointly.

- (c)

- All shares purchasable upon exercise of stock options.

- (d)

- Includes 16,000 shares purchasable upon exercise of stock options.

- (e)

- Includes 43,010 shares owned by G-II Family Partnership L.P. Mr. Goldblum is general partner of G-II Family Partnership L.P. and may be deemed to be a beneficial owner of such shares. Also includes 24,000 shares purchasable upon exercise of stock options (including options to purchase 3,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the Annual Meeting); 15,200 shares held as custodian or in trust for members of Mr. Goldblum's family; 495 shares owned by his wife; and 29,670 shares held by Mr. Goldblum as custodian for the benefit of the Matthias' children.

- (f)

- Includes 24,000 shares purchasable upon exercise of stock options (including options to purchase 3,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the Annual Meeting, subject to Mr. Hitchner's re-election as a director).

15

- (g)

- All shares purchasable upon exercise of stock options (including options to purchase 3,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the Annual Meeting).

- (h)

- Includes 14,000 shares purchasable upon exercise of stock options (including options to purchase 3,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the Annual Meeting).

- (i)

- Includes 12,000 shares purchasable upon exercise of stock options (including options to purchase 3,000 shares expected to be granted under the Company's 1994 Director Stock Option Plan upon completion of the Annual Meeting).

- (j)

- Information is based on the Schedule 13D filed with the Securities and Exchange Commission on June 10, 2002. According to that filing, Robert Brown, a general partner of MVP Distribution Partners and its affiliates, including Meridian Venture Partners, beneficially owns 127,600 shares of the Company's common stock, which are not included in the above table.

- (k)

- Based on the Schedule 13D/A filed with the Securities and Exchange Commission on November 19, 1998, all of such shares may be deemed to be beneficially owned by Oakmont Capital Inc. ("Oakmont"). Oakmont is part of a group (the "Group") which also includes E.J.K. Real Estate Services Limited, Inc. ("EJK"), 1272562 Ontario, Inc. ("1272562"), Gregory P. Hannon and Terence M. Kavanagh. Oakmont has sole voting power and sole dispositive power with respect to 173,800 of such shares. EJK and 127652 each own 50 percent of the voting stock of Oakmont and have shared voting power and shared dispositive power with respect to the shares owned by Oakmont. Mr. Kavanagh owns all of the capital stock in EJK, and Mr. Hannon owns all of the capital stock of 1272562. EJK, 1272562, Mr. Kavanagh, and Mr. Hannon also have sole voting power and sole dispositive power as to shares not directly owned by Oakmont.

- (l)

- Includes the following number of shares purchasable upon exercise of stock options owned (or which may be deemed to be owned) by the following persons: Joseph A. Goldblum—24,000, Elam M. Hitchner, III—24,000, Edward M. Krell—16,000, David Mangini—25,000, Dan W. Matthias—267,380, Rebecca C. Matthias—267,380, David Schlessinger—8,000, William A. Schwartz, Jr.—14,000 and Stanley C. Tuttleman—12,000.

CERTAIN TRANSACTIONS

One of the Company's directors and the Chairman of the Audit Committee, Elam M. Hitchner, is Of Counsel at the law firm of Pepper Hamilton LLP, which provides legal services to the Company. Mr. Hitchner does not participate in the provision of legal services to the Company.

The Company's Chief Executive Officer and President own an apartment that has been rented, at times, to the Company for its use. During the fiscal years ended September 30, 2002 and 2001, the rent paid by the Company under this arrangement totaled approximately $8,000 and $19,000, respectively. No rent was paid by the Company under this arrangement during the fiscal year ending September 30, 2003.

RATIFICATION OF

APPOINTMENT OF AUDITORS

(PROPOSAL 2)

The Audit Committee of the Board of Directors has appointed the firm of KPMG as independent public accountants to audit and report on the consolidated financial statements of the Company and its subsidiaries for the year ending September 30, 2004, and to perform such other appropriate accounting and related services as may be required by the Audit Committee. KPMG has served as the Company's independent public accountants since June 6, 2002. The Board of Directors recommends that the

16

stockholders ratify such selection. This appointment will be submitted to the stockholders for ratification at the Annual Meeting.

On June 4, 2002, the Company dismissed Arthur Andersen LLP ("Arthur Andersen") as its independent public accountants. On June 6, 2002, the Company engaged KPMG to serve as the Company's independent public accountants for fiscal 2002. The appointment of KPMG was effective immediately. The decision by the Board of Directors to replace Arthur Andersen with KPMG was based on the recommendation of the Company's Audit Committee and approved by the Board of Directors.

Arthur Andersen's reports on the Company's consolidated financial statements for each of fiscal 2000 and fiscal 2001 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During fiscal 2000 and fiscal 2001, and through June 4, 2002, there were no disagreements with Arthur Andersen on any matter of accounting principles or practice, financial statement disclosure, or auditing scope or procedure which, if not resolved to Arthur Andersen's satisfaction, would have caused them to make reference to the subject matter in connection with their report on the Company's consolidated financial statements for such years; and there were no reportable events as defined in Item 304 (a)(1)(v) of Regulation S-K. During fiscal 2002, KPMG audited the Company's consolidated financial statements for fiscal 2001 and fiscal 2000 in connection with the Company's August 2002 debt and equity financings.

During fiscal 2000 and fiscal 2001, and through June 4, 2002, the Company did not consult KPMG with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, or any other matters or reportable events as set forth on Item 304 (a)(2)(i) and (ii) of Regulation S-K.

The Company previously provided Arthur Andersen and KPMG with a copy of the foregoing disclosures.

The submission of the appointment of KPMG to the stockholders is not required by law or by the By-laws of the Company. The Board of Directors is nevertheless submitting it to the stockholders to ascertain their views. If the stockholders do not ratify the appointment, the selection of other independent public accountants will be considered by the Board of Directors. If KPMG shall decline to accept or become incapable of accepting its appointment, or if its appointment is otherwise discontinued, the Board of Directors will appoint other independent public accountants.

A representative of KPMG is expected to be present at the Annual Meeting. The representative will have the opportunity to make a statement and will be available to respond to appropriate questions.

The Board of Directors recommends a vote FOR Proposal 2 to ratify the appointment of KPMG as independent auditors for the fiscal year ending September 30, 2004.

OTHER BUSINESS

Management knows of no other matters that will be presented at the Annual Meeting. However, if any other matter properly comes before the meeting, or any adjournment or postponement thereof, it is intended that proxies in the accompanying form will be voted in accordance with the judgment of the persons named therein.

17

ANNUAL REPORT

A copy of the Company's Annual Report to Stockholders for the fiscal year ended September 30, 2003 accompanies this proxy statement.

STOCKHOLDER PROPOSALS

In order for a stockholder proposal to be considered for inclusion in the Company's proxy statement and form of proxy relating to the Annual Meeting of Stockholders to be held in 2005 (the "2005 Annual Meeting"), the proposal must be received by the Company at its principal executive offices not later than August 25, 2004. In addition, in the event that the Company receives notice of a stockholder proposal intended for presentation at the 2005 Annual Meeting but not intended for inclusion in the Company's proxy statement for such meeting at the Company's principal executive offices not later than November 8, 2004, then so long as the Company includes in its proxy statement for such Meeting the advice on the nature of the proposal and how the named proxyholders intend to vote the shares for which they have received discretionary authority, such proxyholders may exercise discretionary authority with respect to such proposal, except to the extent limited by the Securities and Exchange Commission's rules governing stockholder proposals.

The Company will provide to each person solicited, without charge except for exhibits, upon request in writing, a copy of its Annual Report on Form 10-K, including the financial statements and financial statement schedules, as filed with the Securities and Exchange Commission for the fiscal year ended September 30, 2003. Requests should be directed to Mothers Work, Inc., Attention: Chief Financial Officer, 456 North Fifth Street, Philadelphia, Pennsylvania, 19123.

| | | By Order of the Board of Directors |

|

|

|

| | | Dan W. Matthias

Chairman of the Board and

Chief Executive Officer |

Philadelphia, Pennsylvania

Date: December 23, 2003

18

Appendix A

CHARTER OF THE

AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

OF

MOTHERS WORK, INC.

ARTICLE I

PURPOSE

The primary purpose of the Audit Committee (the "Committee") is to assist the Board of Directors (the "Board") of Mothers Work, Inc. (the "Company") in undertaking and fulfilling its oversight responsibilities in connection with: (a) overseeing the accounting and financial reporting processes, which are designed to ensure the integrity and completeness of financial reports prepared by the Company for submission to any governmental or regulatory body or the public; (b) reviewing the Company's systems of internal controls established for finance, accounting, legal compliance and ethics, and overseeing changes to correct internal control weaknesses, if necessary; (c) assessing the processes relating to the determination and mitigation of financial risks; (d) monitoring compliance with legal regulatory requirements; (e) monitoring the independence of the Company's independent public accountants; (f) overseeing and reviewing the audits of the Company's financial statements, (g) providing effective communication between the Board, senior and financial management and the Company's independent public accountants.

In discharging its oversight role, the Committee is empowered to investigate any matter brought to its attention with full power and all necessary resources to retain special legal, accounting or other consultants to advise the Committee.

ARTICLE II

MEMBERSHIP AND TERM

A. MEMBERSHIP. The Committee shall be comprised of at least three members of the Board. Committee members shall meet the independence requirements of the Nasdaq Stock Market and the rules and regulations of the Securities and Exchange Commission ("SEC"). Accordingly,

- 1.

- Each member of the Committee must be an independent, non-executive director free from any relationship that, in the judgment of the Board, may interfere with the exercise of the member's independence;

- 2.

- Each member of the Committee must not directly or indirectly receive any payments from the Company other than in such member's capacity as a member of the audit committee, the board of directors, or any other board committee;

- 3.

- Each member of the Committee must be able to read and understand fundamental financial statements, including a company's balance sheet, income statement, and cash flow statement; and

- 4.

- At least one member of the Committee must have past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in such individual's financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities.

A-1

- 5.

- Each member of the Committee must, in the judgment of the Board, have sufficient time to devote to service as a member of the Committee, considering the other professional and personal commitments of such member, including other Board duties and obligations.

B. TERM. The members of the Committee shall be appointed for a one year term by the Board at its annual meeting. Any vacancy occurring in the Committee shall be filled by the Board. Any such Committee member so elected shall hold office for a term expiring at the Board's next annual meeting. Unless a Chairman of the Committee is designated by the Board, the members of the Committee will elect a Chairman by formal vote of the Committee's full membership.

ARTICLE III

RELATIONSHIP WITH INDEPENDENT ACCOUNTANTS

The Company's independent public accountants shall directly report to the Committee, and the Committee shall be directly responsible for the appointment, compensation, retention and oversight of the work of the Company's independent public accountants engaged (including resolutions of disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or related work. The Committee will ascertain that the independent public accountants will be available to the full Board at least annually (and more frequently if deemed appropriate by the Committee) to provide the Board with a timely analysis of significant financial reporting issues. The Committee will not engage the independent public accountants to perform any services that are not permitted by the Securities Exchange Act of 1934 ("Exchange Act").

ARTICLE IV

MEETINGS

The Committee shall meet at such times and from time to time as it deems to be appropriate, but not less than quarterly. Meetings of the Committee may be held upon the call of any Committee member by mailing a written notice stating the day, hour and geographic location, if any, of such meeting, to each Committee member at his or her last known post office address, by causing the same to be delivered personally or by transmitting such notice by telephone, facsimile, e-mail, or verbally, to each Committee member, in any case, at least two days before the meeting. Notice may be waived in writing before or after the time of such meeting, and attendance of a Committee member at a meeting shall constitute a waiver of notice thereof. Neither the business to be transacted at, nor the purpose of, any meeting need be specified in the notice of such meeting. Members of the Committee may attend a meeting by telephone conference.

The Committee may request any officer or employee of the Company or the Company's outside counsel or independent public accountants to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee. Minutes of each meeting of the Committee shall be reduced to writing. Except as otherwise provided by statute or this Charter, a majority of the incumbent members of the Committee shall be required to constitute a quorum for the transaction of business at any meeting, and the act of a majority of the Committee members present and voting at any meeting at which a quorum is present shall be the act of the Committee. The Committee shall report to the Board at the first Board meeting following each such Committee meeting. The Committee may also act by unanimous written consent without a meeting. As part of its job to foster open communication, the Committee should meet, whenever deemed appropriate by the Committee, with management and/or the independent public accountants in separate sessions to discuss any matters that the Committee or each of these groups believe should be discussed privately. In addition, the Committee should meet with the independent public accountants and management quarterly to review the Company's financial statements and related materials as described below.

A-2

ARTICLE V

RESPONSIBILITIES

The following guidelines enumerate the duties, responsibilities and authority of the Committee in carrying out its oversight role.

- 1.

- Review and reassess the adequacy of this Committee and its Charter not less than annually and recommend any proposed changes to the Board for consideration and approval.

- 2.

- Hold such regular meetings as may be necessary and such special meetings as may be called by the Chairman of the Committee or at the request of the independent public accountants or management.

- 3.

- Review with management and the independent public accountants the audited financial statements and related footnotes, and the clarity of the disclosures in the financial statements, to be included in the Company's Annual Report on Form 10-K (or the Annual Report to Stockholders if distributed prior to the filing of Form 10-K) prior to the filing of the Form 10-K (and, to the extent practicable, prior to the annual earnings release), including a review of major issues regarding accounting and auditing principles and practices and any related party transactions as well as the adequacy of internal controls that could significantly affect the Company's financial statements, and review and consider with the independent public accountants the matters required to be discussed by Statement on Auditing Standards ("SAS") 61.

- 4.

- Review with management and the independent public accountants their judgments about the quality, not just the acceptability, of accounting principles, the reasonableness of significant judgments, and the clarity and transparency of the disclosures in the financial statements.

- 5.

- Prepare the report required by the rules of the SEC regarding the Committee, to be included in the Company's annual proxy statement. The Committee will include a statement within such report on whether the Committee has recommended that the financial statements be included in the Form 10-K. The Committee should also ensure that a copy of the Committee's Charter is included within the Company's proxy statement at least once every three years.

- 6.

- Discuss with the independent public accountants and management whether the Company's interim accounting policies and practices as well as significant events, transactions and changes in accounting estimates were considered by the independent public accountants (after performing their required quarterly review) to have affected the quality of the Company's financial reporting. Such review will occur prior to the Company's filing of the Form 10-Q for each of the first three fiscal quarters for each such quarter and, to the extent practicable, prior to the quarterly earnings release.

- 7.

- Review the Company's disclosures contained in "Management's Discussion and Analysis of Financial Condition and Results of Operations," in the Company's Annual Report on Form 10-K, Quarterly Report on Form 10-Q or other pertinent form, as applicable.

- 8.

- Review the Company's earnings press releases, including the use of "pro-forma" or "adjusted" non-GAAP information (subject to compliance with law and applicable SEC rules, including Regulation G), as well as financial information and earnings guidance provided to analysts and rating agencies, and discuss any of the foregoing with management to the extent desired by any member of the Committee. Such discussion may be general in nature (consisting of discussing the types of information to be disclosed and the types of presentations to be made).

- 9.

- Meet periodically with management and the independent public accountants to review the Company's major financial risk exposures and the steps taken to monitor and control such exposures.

A-3

- 10.

- Discuss with management and the independent public accountants the effect of regulatory and accounting initiatives, including pronouncements by the Financial Accounting Standards Board, the SEC and other agencies or bodies, on the Company's financial statements.

- 11.

- Review disclosures made to the Committee by the Company's Chief Executive Officer and Chief Financial Officer, or the Company's disclosure committee or any member thereof, during their certification process for the Form 10-K or Form 10-Q, as appropriate, about any significant deficiencies in the design or operation of internal controls or material weaknesses therein and any fraud involving management or other employees who have a significant role in the Company's internal controls.

- 12.

- Review any relevant financial reports or other financial information submitted to any governmental body, or the public, including any certification, report, opinion, or review rendered by the independent public accountants.

- 13.

- Review and discuss, on an annual and quarterly basis with the independent public accountants, the following:

- a.

- all critical accounting policies and practices used;

- b.

- all alternative disclosures and treatments of financial information within generally accepted accounting principles that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent public accountant; and

- c.

- other material written communications between the independent public accountant and management, such as any management letter or schedule of unadjusted differences.

- 14.

- Obtain from the independent public accountants their recommendation regarding internal controls and other matters relating to the accounting procedures and the books and records of the Company and the correction of controls deemed to be deficient. After the completion of the audit, the Committee shall review with the independent public accountants any problems or difficulties the independent public accountants may have encountered.

- 15.

- Receive periodic reports from the independent public accountants regarding relationships between the independent public accountants and the Company consistent with Independence Standards Board Standard Number 1. The Committee shall also discuss with the independent public accountants any such disclosed relationships and their impact on the independent public accountant's independence. The Committee shall take appropriate action to ensure the continuing objectivity and independence of the independent public accountants.

- 16.

- The Committee shall pre-approve all auditing services and permitted non-audit services and approve the fees for such services and terms thereof to be performed for the Company by its independent public accountant in one of two methods. Under the first method, the engagement to render the services would be entered into pursuant to pre-approval policies and procedures established by the Committee, as set forth in the Pre-Approval Policy, provided that (i) the policies and procedures set forth in detail the services to be performed, (ii) the Committee is informed of each service, and (iii) such policies and procedures do not include delegation of the Committee's responsibilities under the Exchange Act to the Company's management. Under the second method, the engagement to render the services would be presented to and pre-approved by the Committee (subject to the de minimus exceptions for non-audit services described in Section 10A(i)(1)(B) of the Exchange Act that are approved by the Committee prior to the completion of the audit). The Chairman of the Committee will have the authority to grant pre-approvals of audit and permissible non-audit services by the independent public accountants, provided that all pre-approvals by the

A-4

Chairman must be presented to the full Committee at its next scheduled meeting. The Company will provide for appropriate funding as determined by the Committee, for payment of compensation to the independent public accountants and to any consultants, experts or advisors engaged by the Committee.

- 17.

- Adopt regular and separate systems of reporting to the Committee by management and the internal auditors regarding controls and operations of the Company's business units with particular emphasis on risk and profitability.

- 18.

- Adopt procedures, as set forth in the Procedures for Investigating Complaints policy, for the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

- 19.

- Review with the independent public accountants and the internal auditor, if any, the coordination of audit efforts to promote a reduction of redundant efforts and the effective use of audit resources.

- 20.

- Ensure the timely rotation of the lead partner and the concurring partner (sometimes described as the reviewing partner), as defined in Rule 2-01 of Regulation S-X.

- 21.

- Recommend to the Board policies for the Company's hiring of current employees of the independent public accountant or former employees who participated in any capacity in the audit of the Company.

- 22.

- Review with the Company's general counsel legal matters that may have a material impact on the financial statements, the Company's compliance policies and any material reports or inquiries received from regulators or governmental agencies.

- 23.

- Establish, review, and update periodically a code of business conduct and ethics that covers, among other things, business ethics, securities law requirements and procedures and policies in connection with transactions between the Company and covered persons, and ensure that management has established a system to enforce this code. Review the procedures established by the Company that monitor the compliance by the Company with its code of business conduct and ethics applicable to directors, officers and employees, and compliance with its loan and indenture covenants and restrictions. Review and evaluate whether Company management is adequately communicating the importance of complying with the code to all covered persons.

- 24.

- Review the report of management of the Company on its assessment of the design and effectiveness of internal controls and financial reporting, and the report of the independent public accountants on management's assertions contained in its report. Review and evaluate whether Company management is adequately communicating the importance of internal controls to all relevant persons.

- 25.

- Establish, review, and update periodically policies and procedures in connection with approving any related party transactions between the Company and directors, officers or employees, and ensure that management has established a system to enforce these policies and procedures. Review the procedures established by the Company to monitor compliance by the Company with these policies and procedures, and whether the Company is complying with these policies and procedures.

- 26.

- Conduct or authorize investigation into any matters within the Committee's scope of responsibilities with full access to all books, records, facilities and personnel of the company and direct access to the independent public accountants.

A-5

- 27.

- Engage independent counsel and other advisors, as the Committee determines necessary, to carry out its duties.

- 28.

- Consider such other matters in relation to the financial affairs of the Company and its accounts, and in relation to the audit of the Company, as the Committee may, in its discretion, determine to be advisable.

While the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and are in accordance with the generally accepted accounting principles. This is the responsibility of management and the independent public accountants.

The Committee recognizes that the Company's management is responsible for preparing the Company's financial statements, and the independent public accountants are responsible for auditing or reviewing those financial statements in compliance with applicable law. The Committee also recognizes that management of the Company and the independent public accountants have more time, knowledge and more detailed information on the Company than do Committee members. Consequently, in carrying out its oversight responsibility, the Committee will not provide any professional certification as to the independent public accountants' work. In addition, it is not the duty of the Committee to assure compliance with laws and regulations.

A-6

Appendix B

MOTHERS WORK, INC.

BOARD OF DIRECTORS

COMPENSATION COMMITTEE CHARTER

I. ORGANIZATION

A. Membership