Filed by Orchestra-Prémaman S.A.

Pursuant to Rule 425 of the Securities Act of 1933,

as amended, deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934, as amended

Subject Company: Destination Maternity Corporation

Commission File No. 000-21196

Orchestra-Prémaman S.A. posted an English and French version of the following presentation on its website on June 30, 2017.

FY 2016/2017 RESULTS PRESENTATION

2 DISCLAIMER This presentation does not constitute an offer to buy or solicitation of any offer to sell securities or a solicitation of any vote or approval . It does not constitute a prospectus or prospectus equivalent document . This presentation is not a substitute for the registration statement, proxy statement/prospectus, Securities Note or other document(s) that Orchestra - Prémaman may file with the SEC or the AMF . This presentation contains forward - looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995 ), including statements regarding the proposed business combination between Destination Maternity and Orchestra - Prémaman (the “Merger”), Destination Maternity’s turnaround plan, and their potential impact on earnings, net sales, comparable sales, other results of operations, liquidity and financial condition, and various business initiatives . Forward - looking statements can be identified by, among other things, the use of forward - looking terms such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “pro forma,” “anticipates,” “intends,” “continues,” “could,” “estimates,” “plans,” “potential,” “predicts,” “goal,” “objective,” or the negative of any of these terms, or comparable terminology, or by discussions of our outlook, plans, goals, strategy or intentions . These forward - looking statements, and others that may be made from time to time by management of Destination Maternity and Orchestra - Prémaman , involve a number of risks and uncertainties related to operating performance and outlook of Destination Maternity and the combined businesses of Destination Maternity and Orchestra - Prémaman following the Merger, as well as other future events and their potential effects on Destination Maternity, Orchestra - Prémaman and the combined company that are subject to risks and uncertainties . The following factors, among others, in the future could cause Destination Maternity’s or Orchestra - Prémaman’s actual results, performance, achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by these forward - looking statements . These factors include, but are not limited to, statements relating to ( i ) the possibility that the Merger does not close when expected or at all, or that Destination Maternity and Orchestra - Prémaman , in order to achieve governmental and regulatory approvals, may be required to modify aspects of the Merger or to accept conditions that could adversely affect the combined company or the expected benefits of the proposed Merger ; (ii) the ability to obtain the requisite Destination Maternity and Orchestra - Prémaman stockholder approvals, on the proposed terms and timeframe ; (iii) the benefits of the Merger, including future financial and operating results of the combined company, Destination Maternity’s and Orchestra - Prémaman’s plans, objectives, expectations and intentions, and the ability to realize the expected synergies or savings from the proposed Merger in the amounts or in the timeframe anticipated ; (iv) the risk that competing offers or acquisition proposals will be made ; (v) the ability to integrate Destination Maternity’s and Orchestra - Prémaman’s businesses in a timely and cost - efficient manner ; (vi) the inherent uncertainty associated with financial projections ; (vii) the potential impact of the announcement or closing of the proposed Merger on customer, supplier, employee and other relationships ; and (viii) other factors referenced in Destination Maternity’s Annual Report on Form 10 - K or Orchestra - Prémaman’s Registration Document (document de référence ), including those set forth under the caption “Risk Factors . ” In addition, these forward - looking statements necessarily depend upon assumptions, estimates and dates that may be incorrect or imprecise and involve known and unknown risks, uncertainties and other factors . Accordingly, any forward - looking statements included in this announcement do not purport to be predictions of future events or circumstances and may not be realized . Forward - looking statements speak only as of the date made . Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we assume no obligation to update any of these forward - looking statements to reflect actual results, changes in assumptions or changes in other factors affecting these forward - looking statements . Nothing contained herein shall be deemed to be a forecast, projection or estimate of the future financial performance of Destination Maternity, Orchestra Prémaman , or the combined company, following the implementation of the proposed Merger or otherwise . No statement in this press release should be interpreted to mean that the earnings per share, profits, margins or cash flows of Destination Maternity, Orchestra - Prémaman or the combined company for the current or future financial years would necessarily match or exceed the historical published figures .

1 | HIGHLIGHTS 2 | FINANCIAL RESULTS 3 | OUTLOOK 4 | CONCLUSION

1 | HIGHLIGHTS

5 HIGHLIGHTS • The second successive year of major investments (nearly €100m) • Critical mass achieved in Childcare products • Start of international roll - out of large format stores • Significant progress in terms of organisation and human resources to shore up the group’s foundations

6 HIGHLIGHTS Growth continues to outperform the market A key driver: Childcare products (¾ of growth) Double - digit growth in international activities Ongoing migration towards mixed stores and megastores Textile activities impacted by the adverse dollar effect, which was not reflected in sales prices Take - off of large formats slower than expected Over €10.9m in non - recurring expenses + -

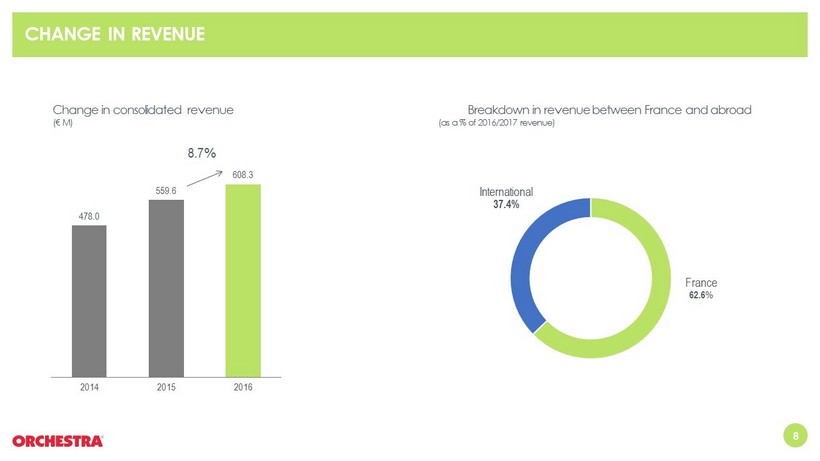

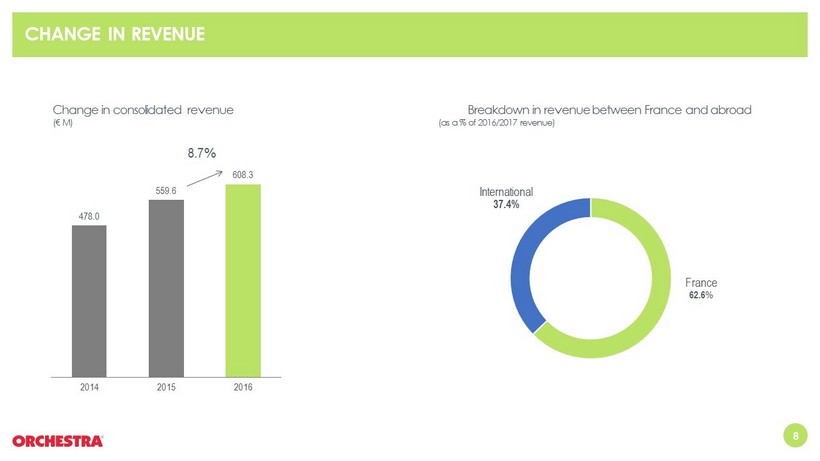

7 HIGHLIGHTS • Revenue growth +8.7% Revenue of €608.3m vs. €559.6m in 2015 +33,000 m² in sales space created mainly in large format stores and 19 new stores • Current gross operating income €37.4m, 6.2% of revenue • Reinforced financial structure, banking covenants observed €111.5m in restated net financial debt at 28/02/2017 (vs. €131.7m at 29/02/2016) €39.6m in investments (vs. €42m in 2015) • Business model confirmed but action needed to improve execution quality and restore performance

CHANGE IN REVENUE 8 478.0 559.6 608.3 2014 2015 2016 8.7% Breakdown in revenue between France and abroad (as a % of 2016/2017 revenue) France 62.6 % International 37.4% Change in consolidated revenue (€ M)

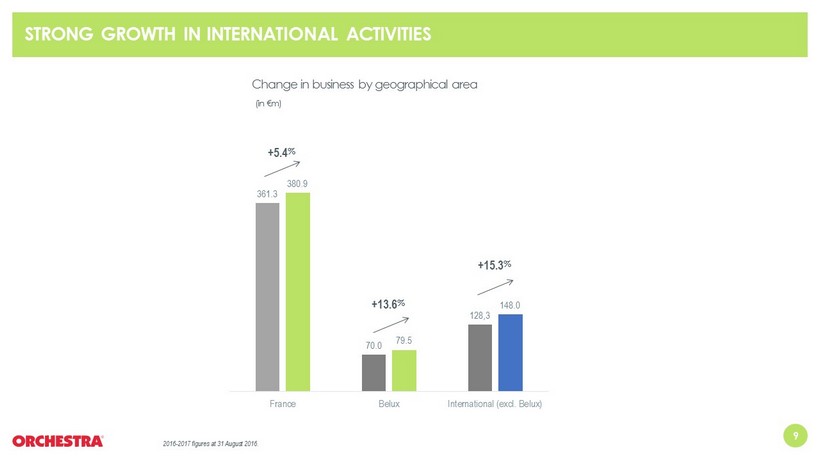

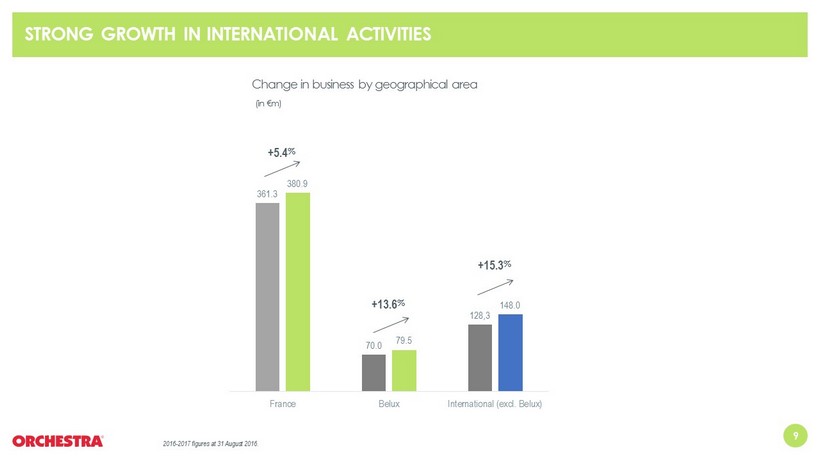

361.3 70.0 128,3 380.9 79.5 148.0 France Belux International (excl. Belux) STRONG GROWTH IN INTERNATIONAL ACTIVITIES 2016 - 2017 figures at 31 August 2016. +5.4 % +13.6 % +15.3 % Change in business by geographical area (in €m) 9

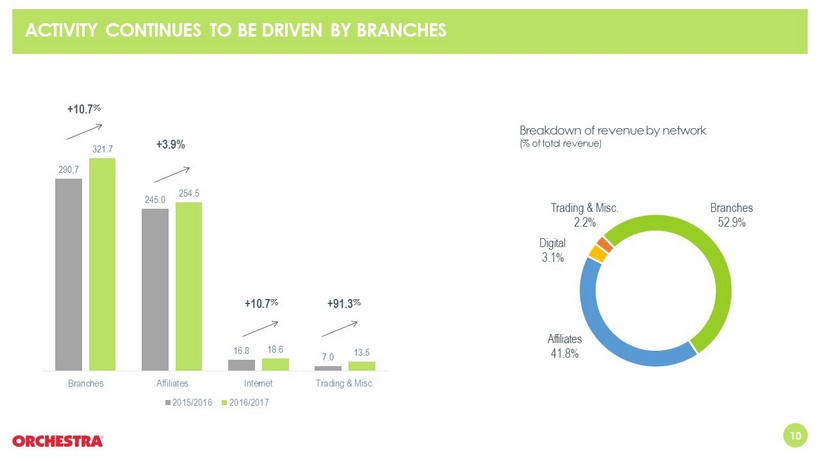

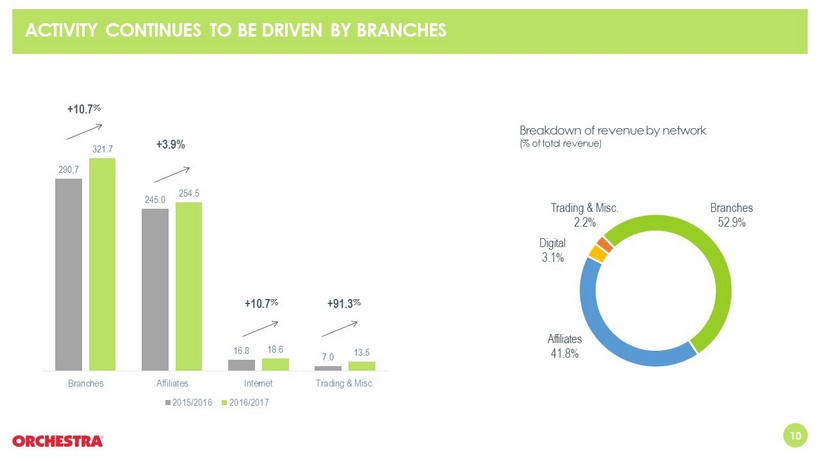

ACTIVITY CONTINUES TO BE DRIVEN BY BRANCHES 13 290,7 245.0 16.8 7.0 321.7 254.5 18.6 13.5 Branches Affiliates Internet Trading & Misc. 2015/2016 2016/2017 +10.7 % +3.9% +10.7 % +91.3 % Breakdown of revenue by network (% of total revenue) Branches 52.9% Affiliates 41.8% Trading & Misc. 2.2% Digital 3.1% 10

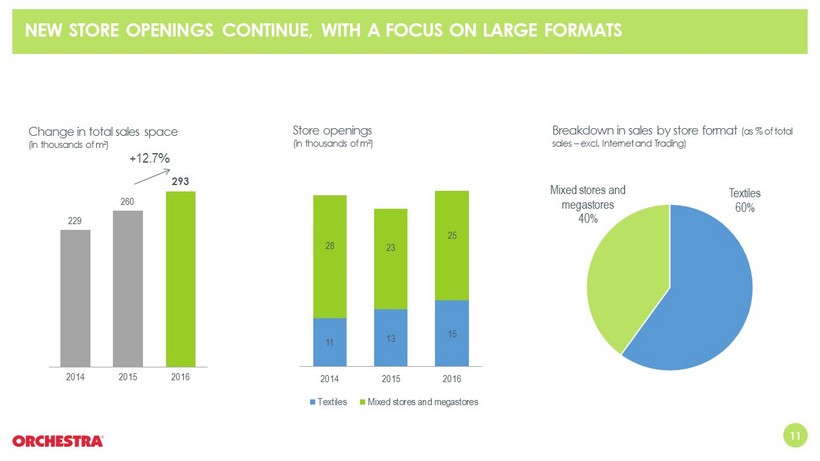

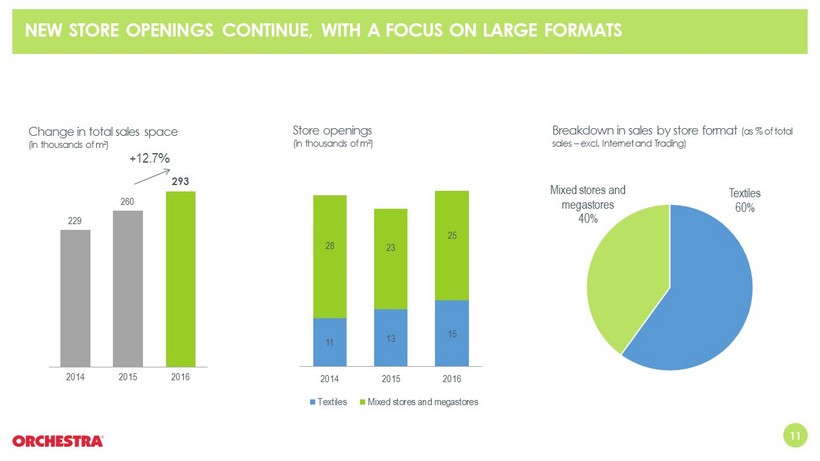

NEW STORE OPENINGS CONTINUE, WITH A FOCUS ON LARGE FORMATS 15 229 260 293 2014 2015 2016 Change in total sales space (in thousands of m²) Store openings (in thousands of m²) 11 13 15 28 23 25 2014 2015 2016 Textiles Mixed stores and megastores Breakdown in sales by store format (as % of total sales – excl. Internet and Trading) Textiles 60% Mixed stores and megastores 40% +12.7% 11

CONFIRMATION OF THE STRONG PERFORMANCE OF CHILDCARE ACTIVITIES 11 +€48.8m (+8.7%) Of which: • Childcare products: +€36.6m (+50%) • Textiles: +€7m (+2%) • Club card: +€2.3m (+6%) 110 18 41 408 31 2016 €608.3m 73 20 39 401 26 2015 €559.6m Textiles Childcare products Club card Footwear Other 12

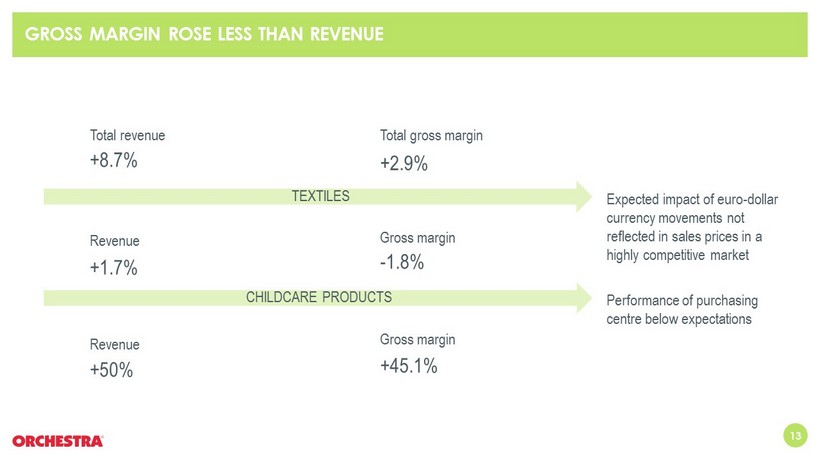

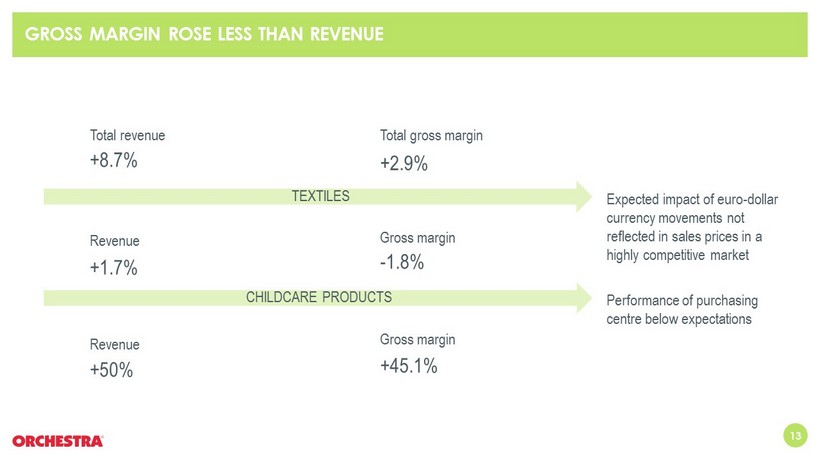

13 GROSS MARGIN ROSE LESS THAN REVENUE Total revenue Total gross margin +8.7% +2.9% Revenue +50% Gross margin +45.1% Revenue +1.7% Gross margin - 1.8% Expected impact of euro - dollar currency movements not reflected in sales prices in a highly competitive market Performance of purchasing centre below expectations TEXTILES CHILDCARE PRODUCTS

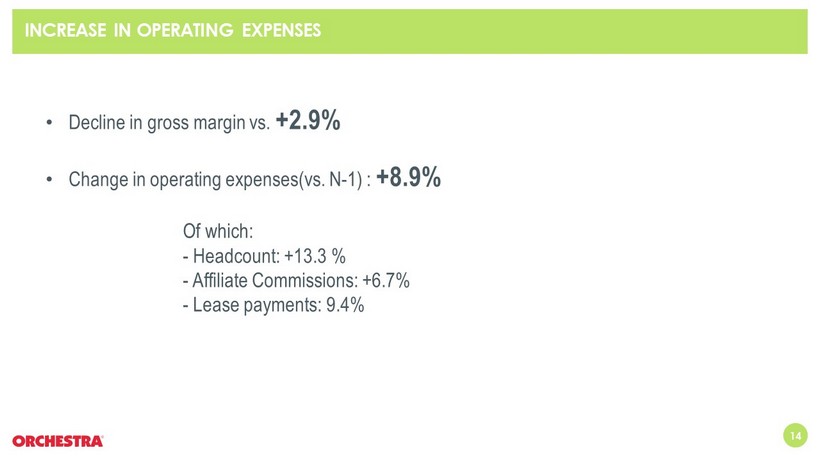

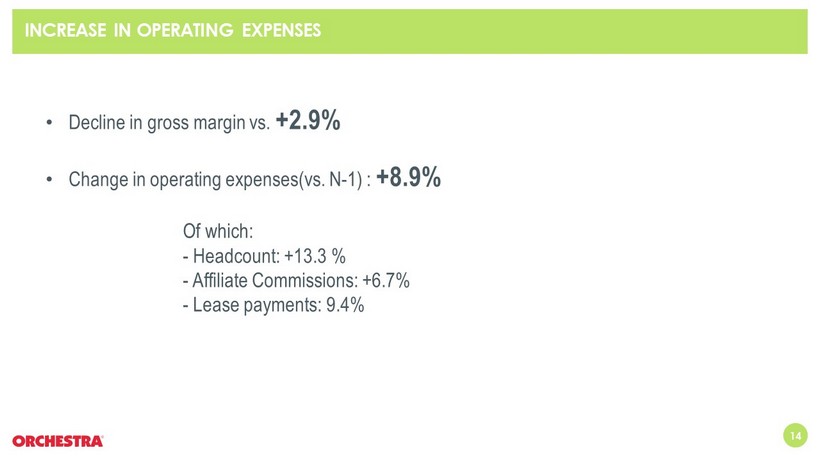

INCREASE IN OPERATING EXPENSES 16 14 • Decline in gross margin vs. +2.9% • Change in operating expenses(vs. N - 1) : +8.9% Of which: - Headcount: +13.3 % - Affiliate Commissions: +6.7% - Lease payments: 9.4%

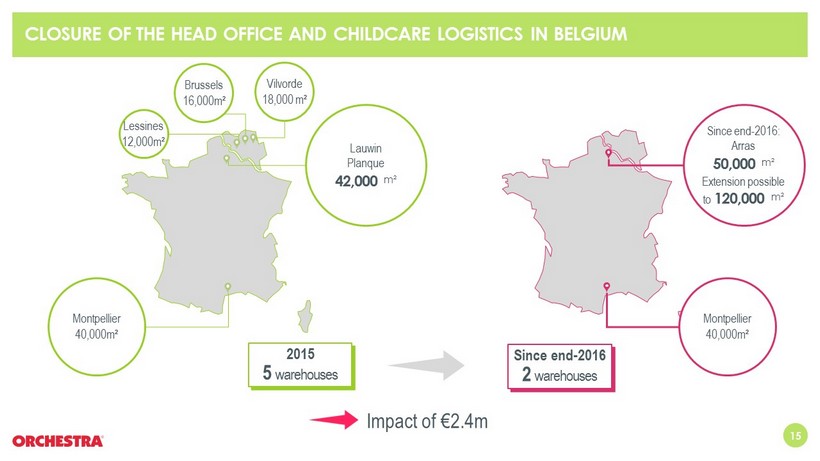

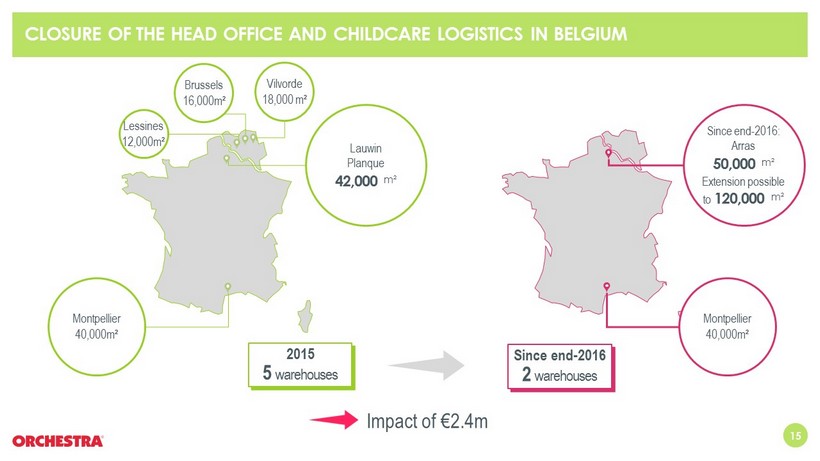

CLOSURE OF THE HEAD OFFICE AND CHILDCARE LOGISTICS IN BELGIUM 15 Impact of €2.4m 15 2015 5 warehouses Montpellier 40,000m² Lauwin Planque 42,000 m² Lessines 12,000m² Brussels 16,000m² Vilvorde 18,000 m² Since end - 2016 2 warehouses Montpellier 40,000m² Since end - 2016: Arras 50,000 m² Extension possible to 120,000 m²

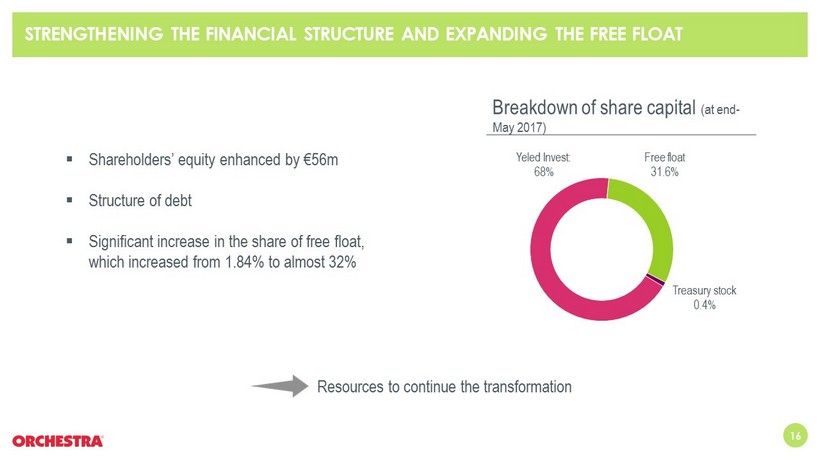

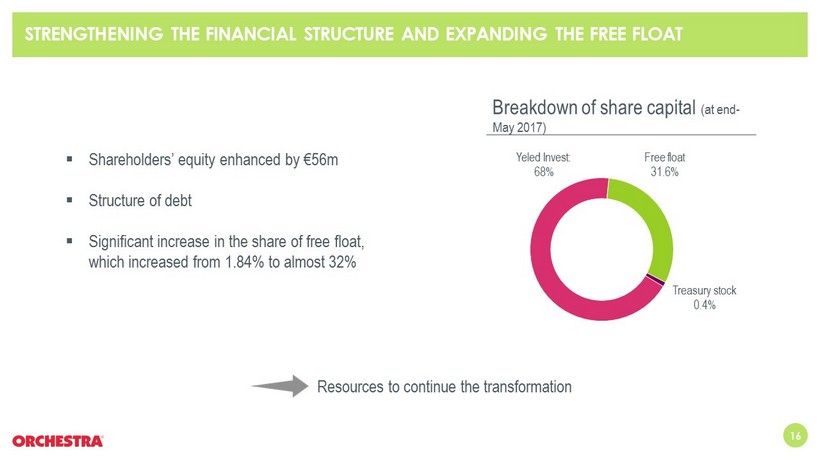

STRENGTHENING THE FINANCIAL STRUCTURE AND EXPANDING THE FREE FLO AT 8 ▪ Shareholders’ equity enhanced by €56m ▪ Structure of debt ▪ Significant increase in the share of free float, which increased from 1.84% to almost 32% Breakdown of share capital (at end - May 2017) Free float 31.6% Yeled Invest: 68% Treasury stock 0.4% Resources to continue the transformation 16

2 | FINANCE

MAIN IMPACT ON GROSS OPERATING INCOME 18 On gross operating income ▪ Dilutive effect of product mix on gross margin Childcare products: 18% of total revenue in 2016 - 2017 vs. 13.1% in 2015 - 2016 ▪ Lag in expected margin increases on the Childcare products purchasing centre ▪ Impact of euro - dollar currency movements not reflected in sales prices in a highly competitive market • 2015 - 2016 hedging price: 1.33 • 2016 - 2017 hedging price: 1.17 ▪ Increase in operating expenses

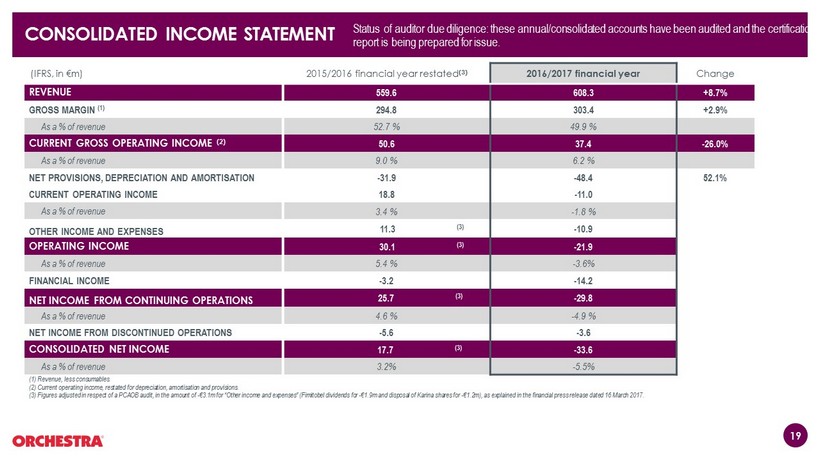

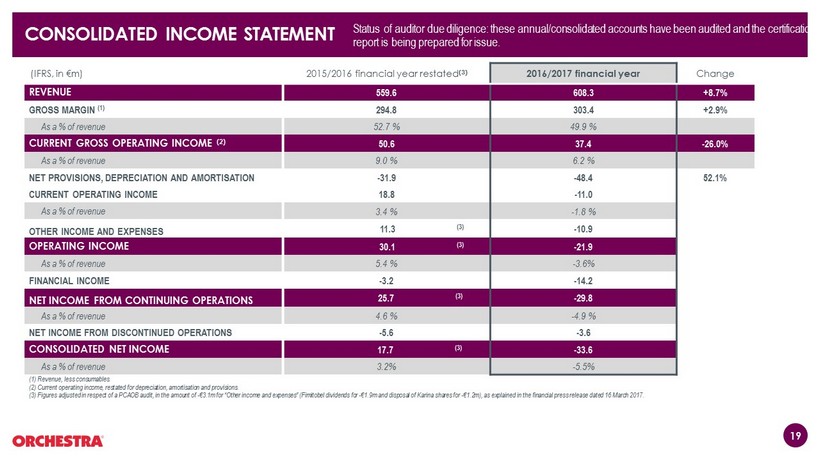

CONSOLIDATED INCOME STATEMENT 19 (IFRS, in €m) 2015/2016 financial year restated (3) 2016/2017 financial year Change REVENUE 559.6 608.3 +8.7% GROSS MARGIN (1) 294.8 303.4 +2.9% As a % of revenue 52.7 % 49.9 % CURRENT GROSS OPERATING INCOME (2) 50.6 37.4 - 26.0% As a % of revenue 9.0 % 6.2 % NET PROVISIONS, DEPRECIATION AND AMORTISATION - 31.9 - 48.4 52.1% CURRENT OPERATING INCOME 18.8 - 11.0 As a % of revenue 3.4 % - 1.8 % OTHER INCOME AND EXPENSES 11.3 (3) - 10.9 OPERATING INCOME 30.1 (3) - 21.9 As a % of revenue 5.4 % - 3.6% FINANCIAL INCOME - 3.2 - 14.2 NET INCOME FROM CONTINUING OPERATIONS 25.7 (3) - 29.8 As a % of revenue 4.6 % - 4.9 % NET INCOME FROM DISCONTINUED OPERATIONS - 5.6 - 3.6 CONSOLIDATED NET INCOME 17.7 (3) - 33.6 As a % of revenue 3.2% - 5.5% (1) Revenue, less consumables. (2) Current operating income, restated for depreciation, amortisation and provisions. (3) Figures adjusted in respect of a PCAOB audit, in the amount of - €3.1m for “Other income and expenses” (Fimitobel dividends f or - €1.9m and disposal of Karina shares for - €1.2m), as explained in the financial press release dated 16 March 2017. Status of auditor due diligence: these annual/consolidated accounts have been audited and the certification report is being prepared for issue.

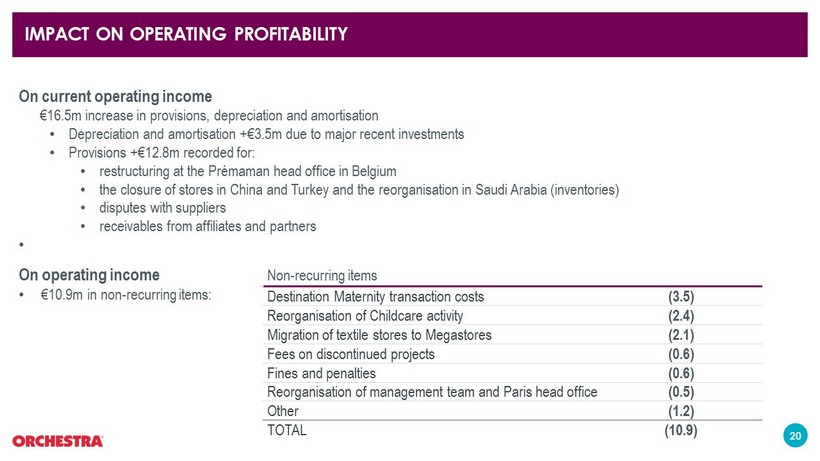

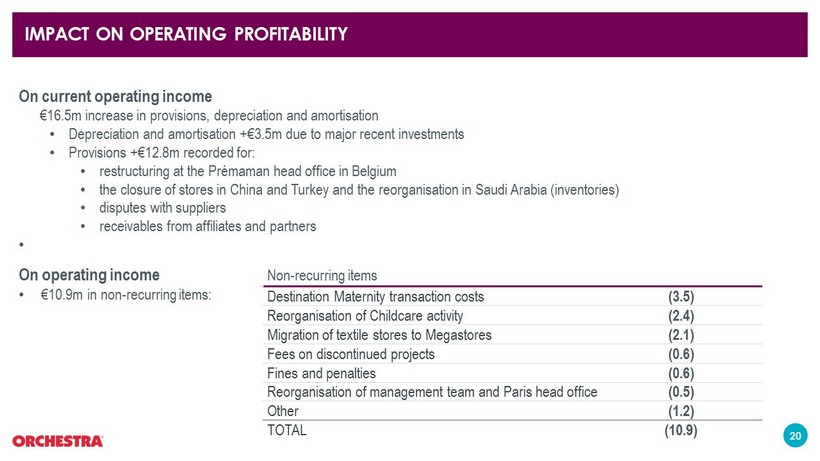

20 On current operating income €16.5m increase in provisions, depreciation and amortisation • Depreciation and amortisation +€3.5m due to major recent investments • Provisions +€12.8m recorded for: • restructuring at the Prémaman head office in Belgium • the closure of stores in China and Turkey and the reorganisation in Saudi Arabia (inventories) • disputes with suppliers • receivables from affiliates and partners • (3) On operating income • €10.9m in non - recurring items: IMPACT ON OPERATING PROFITABILITY Non - recurring items Destination Maternity transaction costs (3.5) Reorganisation of Childcare activity (2.4) Migration of textile stores to Megastores (2.1) Fees on discontinued projects (0.6) Fines and penalties (0.6) Reorganisation of management team and Paris head office (0.5) Other (1.2) TOTAL (10.9)

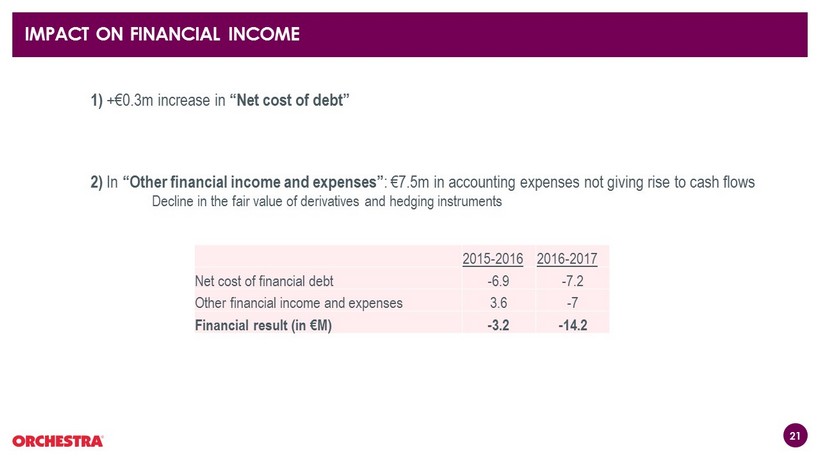

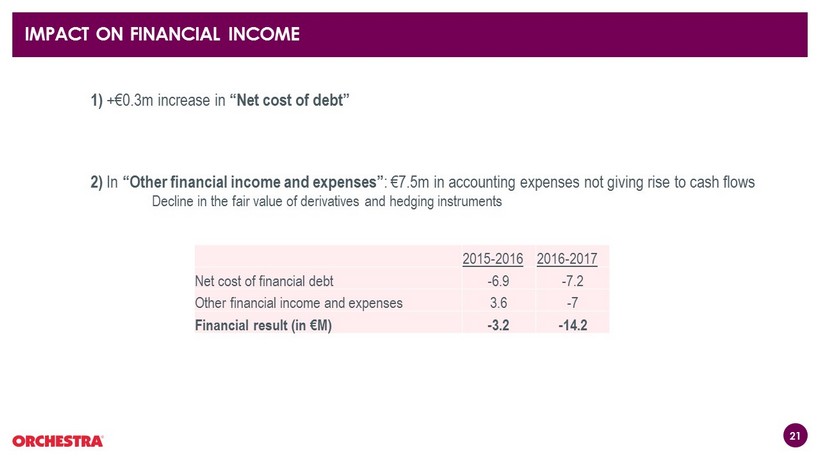

IMPACT ON FINANCIAL INCOME 21 1) +€0.3m increase in “Net cost of debt” 2) In “Other financial income and expenses” : €7.5m in accounting expenses not giving rise to cash flows Decline in the fair value of derivatives and hedging instruments 2015 - 2016 2016 - 2017 Net cost of financial debt - 6.9 - 7.2 Other financial income and expenses 3.6 - 7 Financial result (in €M) - 3.2 - 14.2

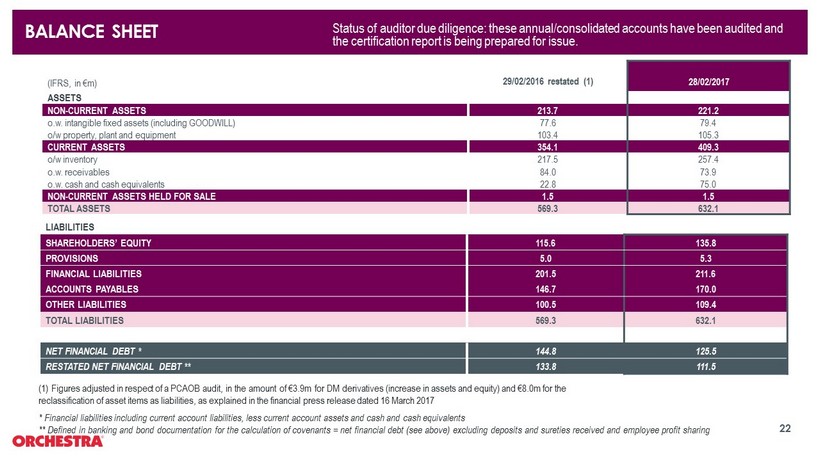

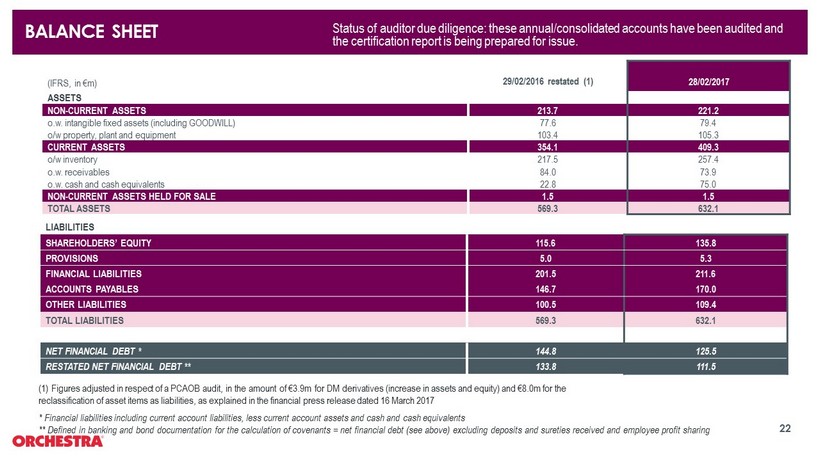

BALANCE SHEET (IFRS, in €m) 29/02/2016 restated (1) 28/02/2017 ASSETS NON - CURRENT ASSETS 213.7 221.2 o.w. intangible fixed assets (including GOODWILL) 77.6 79.4 o/w property, plant and equipment 103.4 105.3 CURRENT ASSETS 354.1 409.3 o/w inventory 217.5 257.4 o.w. receivables 84.0 73.9 o.w. cash and cash equivalents 22.8 75.0 NON - CURRENT ASSETS HELD FOR SALE 1.5 1.5 TOTAL ASSETS 569.3 632.1 LIABILITIES SHAREHOLDERS’ EQUITY 115.6 135.8 PROVISIONS 5.0 5.3 FINANCIAL LIABILITIES 201.5 211.6 ACCOUNTS PAYABLES 146.7 170.0 OTHER LIABILITIES 100.5 109.4 TOTAL LIABILITIES 569.3 632.1 NET FINANCIAL DEBT * 144.8 125.5 RESTATED NET FINANCIAL DEBT ** 133.8 111.5 22 * Financial liabilities including current account liabilities, less current account assets and cash and cash equivalents ** Defined in banking and bond documentation for the calculation of covenants = net financial debt (see above) excluding depo sit s and sureties received and employee profit sharing (1) Figures adjusted in respect of a PCAOB audit, in the amount of €3.9m for DM derivatives (increase in assets and equity) a nd €8.0m for the reclassification of asset items as liabilities, as explained in the financial press release dated 16 March 2017 Status of auditor due diligence: these annual/consolidated accounts have been audited and the certification report is being prepared for issue.

STATEMENT OF CASH FLOWS 23 (IFRS, in €m) 29/02/2016 restated 28/02/2017 OPERATING CASH FLOW BEFORE TAX AND FINANCIAL INCOME 40.7 23.5 TAX PAID (3.4) (3.1) CHANGE IN WCR (32.3) (16.2) o.w. CHANGES IN INVENTORY o.w. CHANGES IN OPERATING LIABILITIES OTHER (4.4) (10.2) (17.7) (41.1) 22.7 2.2 NET OPERATING CASH FLOW 5.0 4.2 INVESTMENTS NET OF DISPOSALS (61.3) (38.1) o.w. ACQUISITIONS (74.3) (42.7) o.w. DISPOSALS 12.8 2.6 FREE CASH FLOW (56.3) (33.9) OTHER ITEMS 42.8 87.2 o.w. CAPITAL TRANSACTIONS (1.7) 56.1 o.w. CHANGE IN BORROWINGS AND COST OF DEBT 53.8 30.7 o.w. DIVIDENDS PAID (9.0) (0.4) CHANGE IN CASH POSITION (13.5) 53.3 * (1) (1) Adjusted for accounting transactions involving amounts provisioned or received that are not included in the cash flow stateme nt, as set out in the financial press release dated 16 March 2017 * Positive change in cash and cash equivalents of €52.2m (€75.0 at 28/02/2017 vs. €22.8m at 29/02/2016) + positive change in ba nk overdrafts of €1.1m Status of auditor due diligence: these annual/consolidated accounts have been audited and the certification report is being prepared for issue.

FINANCIAL DEBT Diversified sources of financing Average maturity of five years 24 Gross financial debt: €211.6m A balanced breakdown of financing sources between banks and bondholders Other 18 % € 38.6 m Bonds 47 % • Bondholders: €99.2 m Banks 35 % • Syndication: €46 m • Bilateral: €27.8 m Restated net financial debt: €111.5m Financial debt with staggered maturities and average maturity of almost five years Less than one year: net cash surplus on debt repayments. 20 41 38 16 20 1 1 2 1 1 10 0 - 40 1 year 2 years 3 years 4 years 5 years 6 years and more Bonds Banks Other Net cash surplus on debt repayments €m

3 | OUTLOOK

26 Business model and strategy confirmed • Growth and increase in market share in Childcare • Potential for profitability confirmed in large format stores Ambition confirmed: • Creation of a global leader in childcare products And... An action plan is needed to improve execution quality and return to robust levels of profitability OVERVIEW

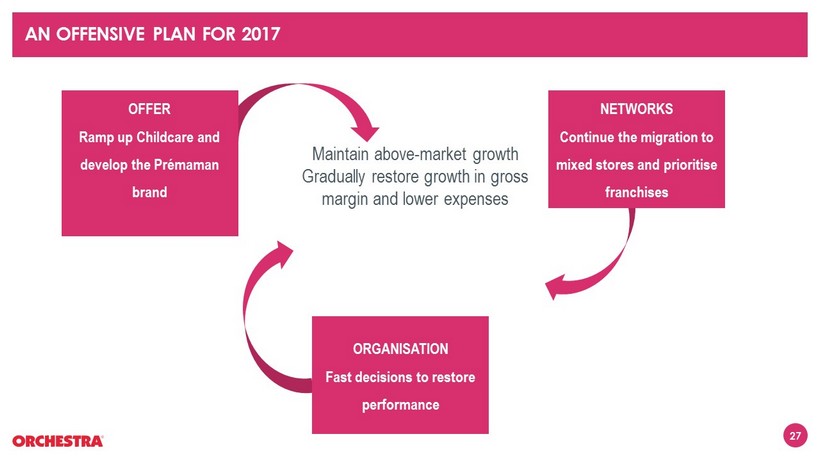

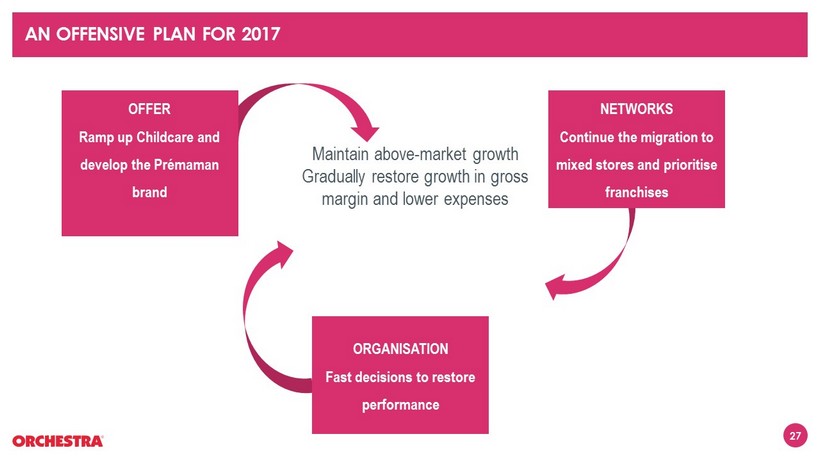

27 AN OFFENSIVE PLAN FOR 2017 Maintain above - market growth Gradually restore growth in gross margin and lower expenses OFFER Ramp up Childcare and develop the Prémaman brand NETWORKS Continue the migration to mixed stores and prioritise franchises ORGANISATION Fast decisions to restore performance

OFFER 28 Ramp up Childcare and develop the Prémaman brand Increase the contribution of Childcare products Develop the proprietary brand Prémaman Increase margins Increase the number of items on sale Improve purchasing terms on national brands Reduce logistics costs

NETWORKS 29 Continue the migration to mixed stores and prioritise franchises Optimise margins and expenses on the existing network Continue the migration of Textile stores to mixed formats Sharp reduction in CAPEX by developing franchises Step up online sales Baby registries Develop Childcare range online In - store reservation via the e - shop Orchestra app Focus on improving the contribution of the existing network

NETWORKS 30 Continue the migration to mixed stores and prioritise franchises In 5 years: Around fifty stores over €100m in potential revenue 5 key partnerships have been signed in markets the group knows and understands December 2016: CFAO Africa February 2017: CEVITAL group Algeria March 2017: CREO group French Antilles and Guyana March 2017: LOCATE group Reunion May 2017: Al - Othaim group Saudi Arabia

ORGANISATION 31 Fast decisions to restore performance Optimisation of organisation and formation of a new management team Measures effective as of Q3 2017 Already completed: 1. Supply Chain: - Creation of a department to oversee Textile and Childcare product flows - Appointment of Sylvain Cheret as Head of Products Supply Chain - Improve WCR and sales performance: - Accelerate stock rotation - Increase product availability rate

ORGANISATION 32 Fast decisions to restore performance Optimisation of organisation and formation of a new management team Measures effective as of Q3 2017 Already completed: 2 Finance: - Roll out of new monitoring and oversight software - Appointment of Stefan Janiszewski as Deputy CEO Finance - Enhance forecast accuracy and performance oversight Head of finance control, financial planning and consolidation Royal Canin - 2013 - 2017 Chief Financial Officer Pernod Ricard Nederland - 2010 - 2005 Group Consolidation Manager Pernod Ricard - 2005 - 2010 Chief Financial Officer Pernod Ricard Nederland - 2003 - 2005 Stefan Janiszewski

4 | CONCLUSION

34 DESTINATION MATERNITY Following the announcement of the planned merger approved on 20 December 2016 Continuation of the regulatory process and work on integration plans Preparation of Registration Statement on Form F - 4 to be filed with the US Securities and Exchange Commission (SEC) and of the filing to be made with the AMF Merger subject to usual terms including approval of the Annual General Meetings of both Destination Maternity and Orchestra - Prémaman Transaction should be completed before the end of the third quarter of Destination Maternity’s 2017 financial year .

35 CONCLUSION • 2016 - 2017: a year of transition focused on investment and increasing market share to build the foundations of future growth • 2017 - 2018: the priority is to improve profitability to return to a solid growth path > Target for 2020: gross operating income 9%

FY 2016/2017 RESULTS PRESENTATION