FORM 6 – K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report on Foreign Issuer

Pursuant to Rule 13a – 16 or 15d – 16

of the Securities Exchange Act of 1934

For the Month of May, 2022

Gilat Satellite Networks Ltd.(Translation of Registrant’s Name into English)

Gilat House, Yegia Kapayim Street

Daniv Park, Kiryat Arye, Petah Tikva, Israel

(Address of Principal Corporate Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): N/A

Attached hereto is Registrant’s IR presentation as posted on Registrant’s website.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | Gilat Satellite Networks Ltd. | |

| | (Registrant) | |

| | | |

| Dated May 24, 2022 | By: /s/ Yael Shofar | |

| | Yael Shofar | |

| | General Counsel |

Gilat Satellite networks May 2022 Investors Presentation

Forward Looking Statements Disclaimer Certain statements made in this presentation that are not historical are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. The words "estimate", "project", "intend", "expect", "believe" and similar expressions are intended to identify forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties. Many factors could cause the actual results, performance or achievements of Gilat to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, changes in general economic and business conditions, inability to maintain market acceptance to Gilat's products, inability to obtain financing and/or timely develop and introduce new technologies, products and applications, rapid changes in the market for Gilat's products, loss of market share and pressure on prices resulting from competition, introduction of competing products by other companies, inability to manage growth and expansion, loss of key OEM partners, inability to attract and retain qualified personnel, inability to protect the Company's proprietary technology and risks associated with Gilat's international operations and its location in Israel. Gilat undertakes no obligation to update or revise any forward-looking statements for any reason. For additional information regarding these and other risks and uncertainties associated with Gilat's business, reference is made to Gilat's reports filed from time to time with the Securities and Exchange Commission. Unaudited/Non-GAAP Financial MeasuresThis presentation includes financial data that is not audited and financial data that was not prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP). Non-GAAP financial measures appearing in this presentation consist of GAAP financial measures adjusted to exclude, non-cash share-based compensation expenses, impairment of goodwill and long-lived assets, amortization of acquired intangible assets, restructuring, trade secrets litigation expenses, tax expenses under amnesty program, deferred tax benefit that was recorded for the first time and other non-recurring expenses and net income or loss from discontinued operations. Gilat believes these non-GAAP financial measures provide consistent and comparable measures to help investors understand Gilat’s current and future operating performance. However, our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read in conjunction with Gilat’s consolidated financial statements prepared in accordance with GAAP.

A world leader in satellite communications INNOVATIVE GROUND EQUIPMENT TECHNOLOGY 1987 Founded 5 R&D Centers 3 NOC Centers GILT NASDAQ /TASE 20 Sales Offices +800 Employees Cellular Backhaul 2G 3G 4G 5G Enterprise Telecom infrastructure & services Consumer Aero / IFC Maritime Land Defense leader in NGSO & VHTS Satellite Networks Government

Leading Global Customer Base SYSTEM INTEGRATORS 100+ COUNTRIES 900+ NETWORKS 300+ CUSTOMERS SATELLITE OPERATOR mPOWER SERVICE PROVIDERS & MNO’s

Value chain GROUND EQUIPMENT SATELLITE MANUFACTURER SATELLITE OPERATOR SERVICEPROVIDER END USERS

UNIQUELY POSITIONED TO UNLOCK GROWTH OPPORTUNITIES 1 VHTS & NGSO Constellations - Abundance of Capacity IFC, Maritime, Cellular Backhaul, Enterprise, Social Inclusion 2 3 Strong Tailwinds in Defense Increased focus on military SATCOM networks Peru Terrestrial Networks "Investment" Shifting to Operation Recurring revenue model

NGSO/VHTS Constellations - Abundance of Capacity OneWeb ~2.5 Tbps 650 Satellites Telesat ~3-8 Tbps 192-300 Satellites SpaceX ~10+ Tbps 1,584 -> 42,000 Satellites Amazon ~10+Tbps 3,236 Satellites HTS/VHTS ~50-500 Gbps SES/O3B ~1-3 Tbps 22 Satellites mPower MEO 2,000-10,000 km ~120msec GEO 35,786 km ~550msec LEO 500-2,000 km ~15msec LARGE CAPITAL SPENDING IN SATELLITE INDUSTRY MORE THAN 50,000 LEO SATELLITES EXPECTED WITHIN A DECADE; INVESTMENT OVER $30 BILLION A MULTI-BILLION DOLLAR EQUIPMENT MARKET Impacted by COVID-19 (excl. Satellite TV) NSR

SkyEdge IV – industry leading ground platform for VHTS & NGSO

Post COVID-19 IFC Rebound Includes Free WIFI Tailwind LONG TERM IFC INVESTMENT CYCLE Transceivers Aero Antennas 400Mbps Modem Ground Equipment Superior Passenger Experience Enabling large IFC global Network GLOBAL COVERAGE | > 30 SATELLITES | 18 TELEPORTS | 20 AIRLINES | GLOBAL NETWORK MANAGEMENT SYSTEM Expanding Fleets ~ 6,800 (2020) ~14,500(2029) COMMERCIAL AIRCRAFT (Ka/Ku) ~1,400 (2020) ~7,700(202) BUSINESS JETS (Ka/Ku) CAGR 7.9% CAGR 18.4% GROWTH OPPORTUNITIES DRIVEN BY INCREASE IN DEMAND AND MARKET PENETRATION Source: Valour 2020 1

Maritime ACTIVE VSAT TERMINALS 2021 2031 MERCHANT PASSENGER LEISURE FISHING 20,773 46,144 1,014 2,354 5,267 11,808 4,037 10,483 Source: Euroconsult 2022 1

4G/5G Ubiquitous Connectivity Bridging the Digital Divide of satellite backhaul 4G/LTE MARKET SHARE { NSR, 2021 } Gilat continues to lead in shipmentswith big wins and business expansions worldwide End-to-end service with recurring revenue ~$100M(2020) ~$500M(2029) EQUIPMENT ~CAGR 19% ~$1.6B(2020) ~$6.4B(2029) CAPACITY, SERVICE & EQUIPMENT ~CAGR 16% { Gilat estimation, 2021 } 1

5G TOTAL ADDRESSABLE MARKET EXPANDING DRAMATICALLY HIGH SPEED Speeds >1Gbps Innovative Wideband Technology FLEXIBLE NETWORK ARCHITECTURE Satellite Ground Segment Integration Into 5G Eco-System Utilize SDN/NFV, Cloud, Edge Computing & Network Slicing LOW LATENCY Order of Magnitude Reduction in Latency Leverage Our NGSO Baseband GILAT EXPERTISE AND INNOVATION MAKING 5G A REALITY 1 4G/5G Ubiquitous Connectivity Bridging the Digital Divide

Strong Tailwinds in Defense Transportable On-the-Move Military Aircraft On-the-Pause Unmanned Aerial Vehicle 2 INCREASED FOCUS ON MILITARY SATCOM NETWORKS GOVERNMENT & MILITARY SATELLITE COMMUNICATIONS Expected Market Value~$930M in 2025 Source: NSR 2020 Satcom Network HIGH-BANDWIDTH REQUIRED IN BATTLEFIELD

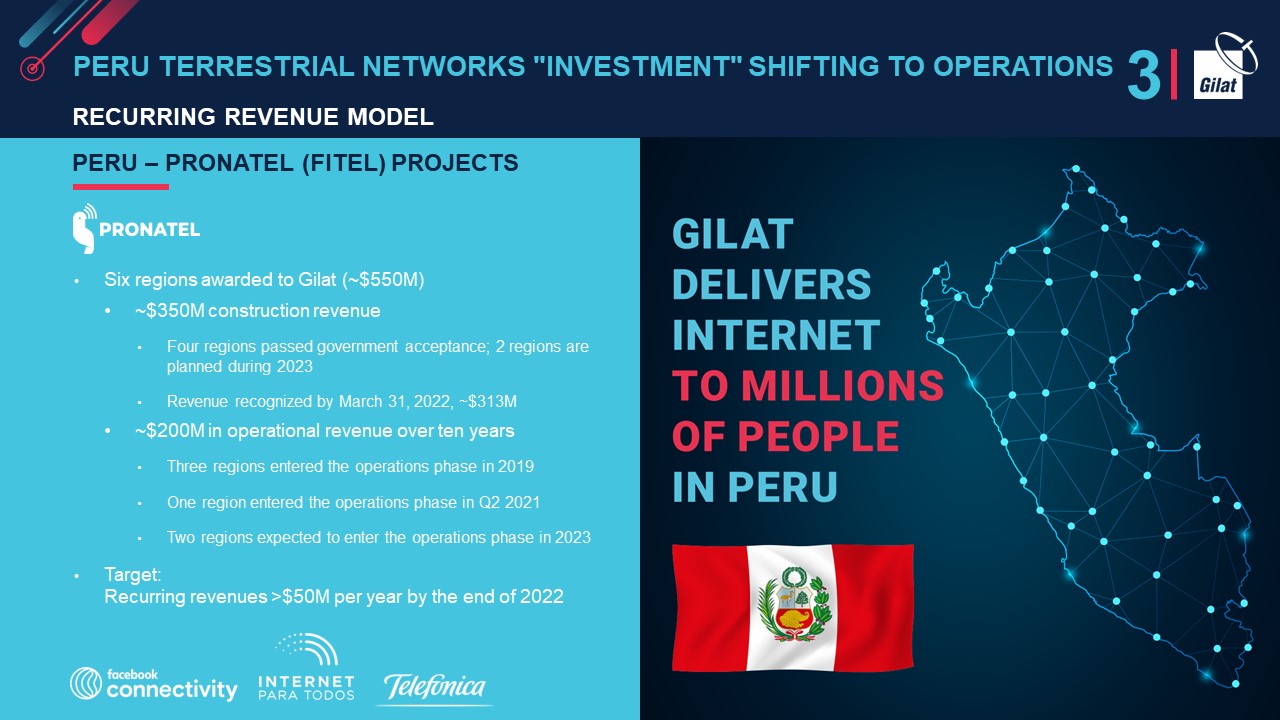

PERU – PRONATEL (FITEL) PROJECTS 3 RECURRING REVENUE MODEL PERU Terrestrial Networks "Investment" Shifting to operations Six regions awarded to Gilat (~$550M) ~$350M construction revenue Four regions passed government acceptance; 2 regions are planned during 2023 Revenue recognized by March 31, 2022, ~$313M ~$200M in operational revenue over ten years Three regions entered the operations phase in 2019 One region entered the operations phase in Q2 2021 Two regions expected to enter the operations phase in 2023 Target: Recurring revenues >$50M per year by the end of 2022

Financial Indicators Highlights

Segment Commentary US$ MILLIONS SATELLITE NETWORKS 2020 was affected by the COVID19 pandemic 2021 was a transition year, the IFC market started to recover Growth is driven by NGSO, Cellular Backhaul, Defense, and Enterprise markets Significant multi-million award from SES and Intelsat INTEGRATED SOLUTIONS 2020 was heavily affected by the COVID19 pandemic Revenues are significantly recovered in 2021 Growth driven by IFC, NGSO and Defense markets NETWORK INFRASTRUCTURE AND SERVICES Construction of six regional projects in Peru – consider as an “Investment” for future recurring revenues Four regions ended construction and are in the operation phase. The last two regions are expected to enter operation in 2022-2023 Additional revenues from infrastructure and services projects in Peru

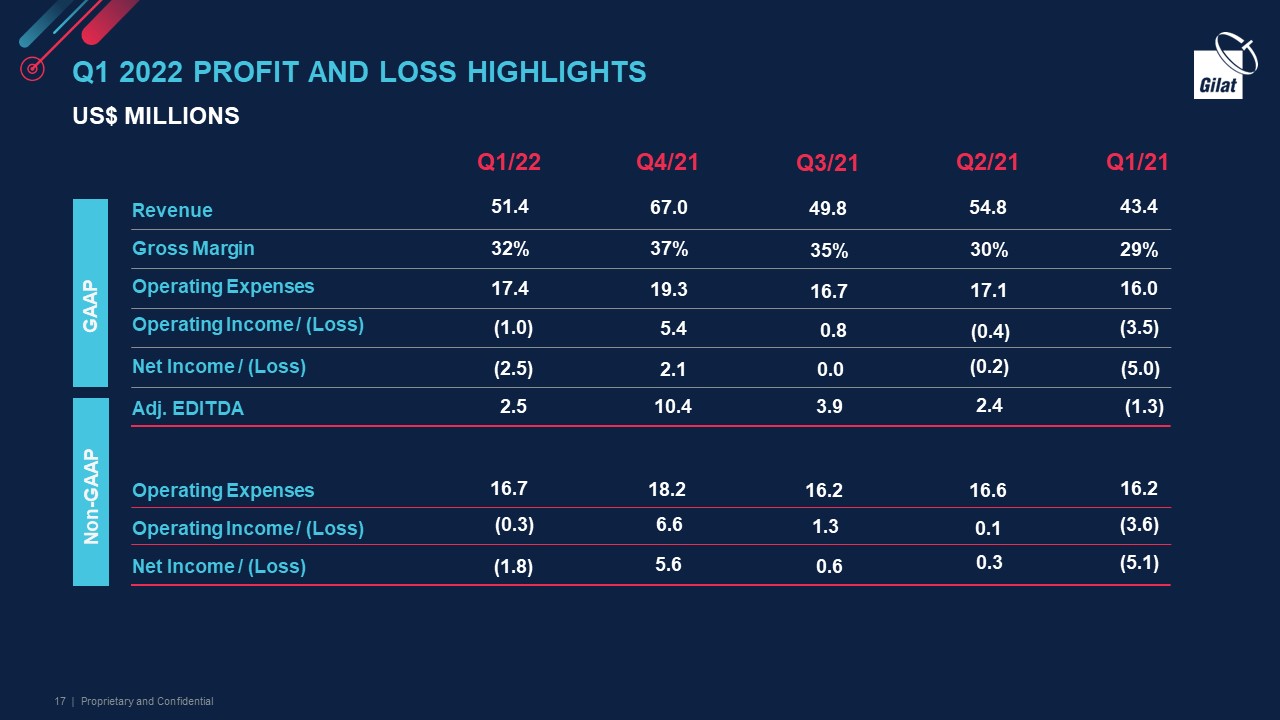

Q1 2022 Profit and Loss Highlights US$ MILLIONS Revenue Gross Margin Operating Expenses Operating Income / (Loss) Net Income / (Loss) Adj. EDITDA Operating Expenses Operating Income / (Loss) Net Income / (Loss) Q2/21 (0.2) 2.4 0.3 Q1/21 43.4 29% 16.0 (3.5) (5.0) (1.3) 16.2 (3.6) (5.1) Q1/22 51.4 32% 17.4 (1.0) (2.5) 2.5 16.7 (0.3) (1.8) Q4/21 67.0 37% 19.3 5.4 2.1 10.4 18.2 6.6 5.6 GAAP Non-GAAP Q3/21 3.9 16.7 17.1 16.2 16.6 49.8 54.8 35% 30% 0.8 (0.4) 0.0 1.3 0.1 0.6

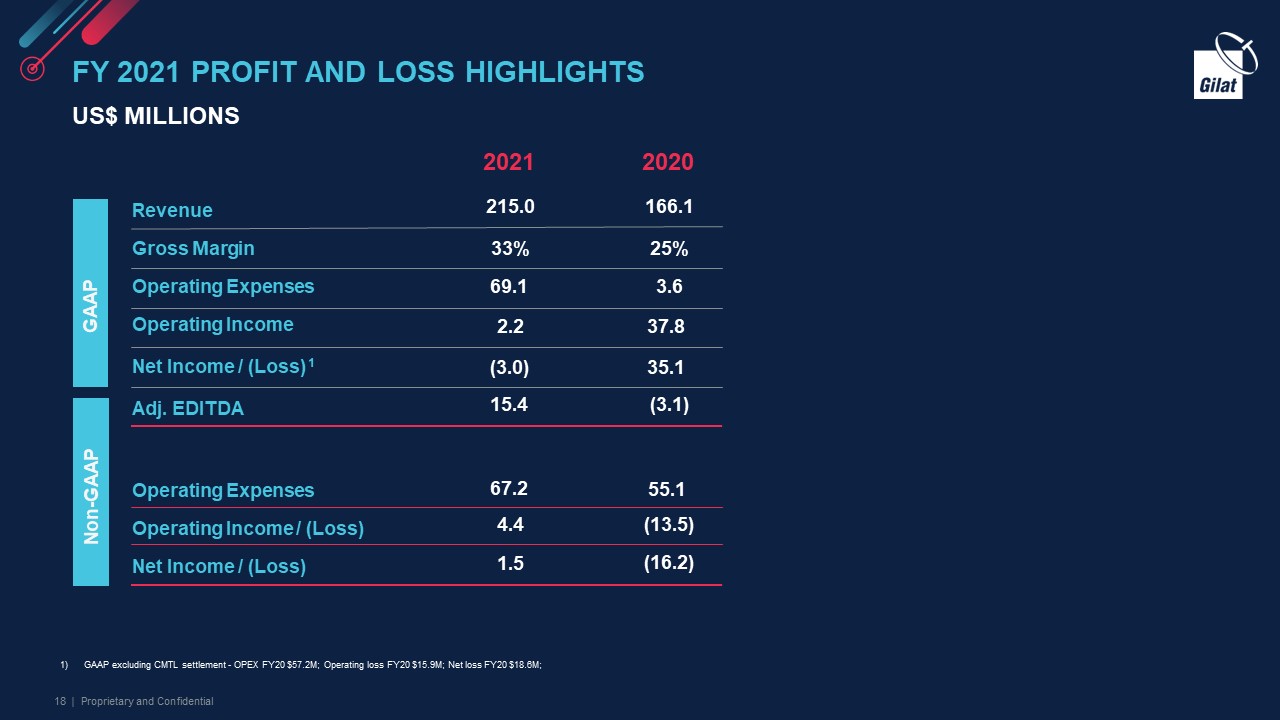

Fy 2021 Profit and Loss Highlights US$ MILLIONS GAAP excluding CMTL settlement - OPEX FY20 $57.2M; Operating loss FY20 $15.9M; Net loss FY20 $18.6M; Revenue Gross Margin Operating Expenses Operating Income Net Income / (Loss) 1 Adj. EDITDA Operating Expenses Operating Income / (Loss) Net Income / (Loss) 2021 215.0 33% 69.1 2.2 (3.0) 15.4 67.2 4.4 1.5 2020 166.1 25% 3.6 37.8 35.1 (3.1) 55.1 (13.5) (16.2) GAAP Non-GAAP

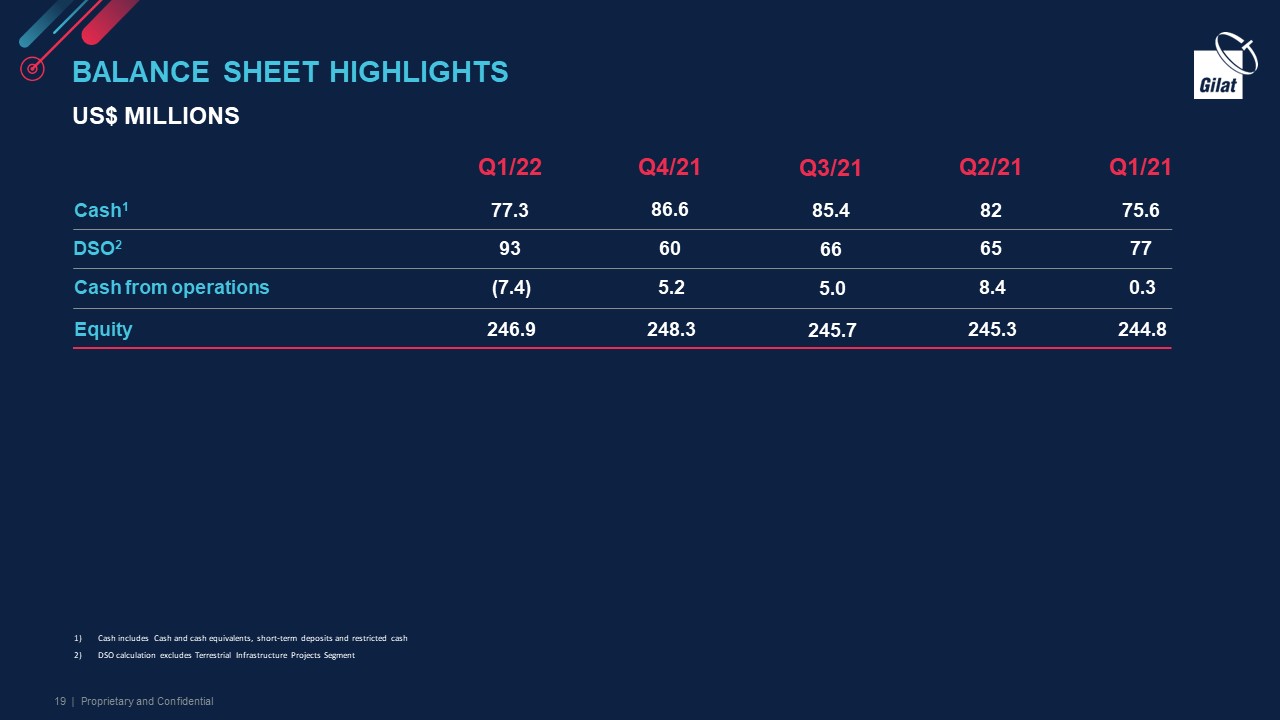

244.8 Balance Sheet Highlights US$ MILLIONS Cash1 DSO2 Cash from operations Equity Q2/21 82 65 8.4 245.3 Q1/21 75.6 77 0.3 Q1/22 77.3 93 (7.4) 246.9 Q4/21 86.6 60 5.2 248.3 Q3/21 85.4 66 5.0 245.7 Cash includes Cash and cash equivalents, short-term deposits and restricted cash DSO calculation excludes Terrestrial Infrastructure Projects Segment

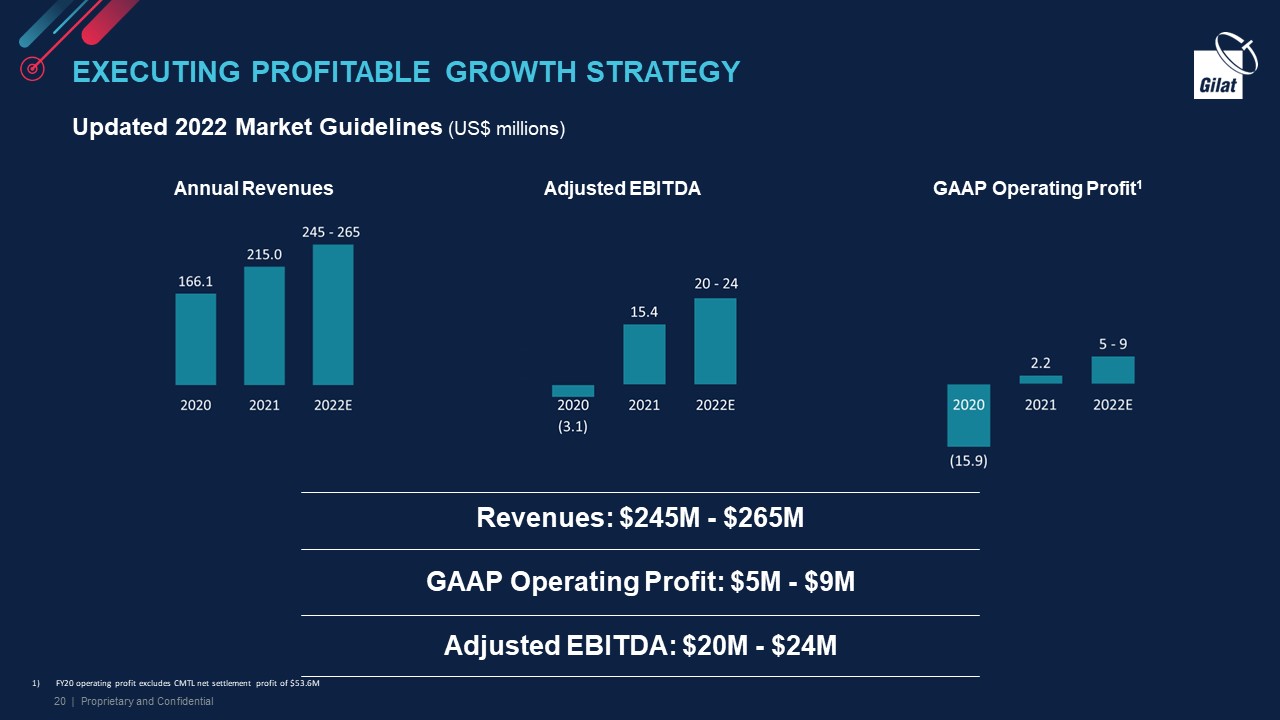

Executing Profitable Growth Strategy Revenues: $245M - $265M GAAP Operating Profit: $5M - $9M Adjusted EBITDA: $20M - $24M Annual Revenues Adjusted EBITDA GAAP Operating Profit1 Updated 2022 Market Guidelines (US$ millions) FY20 operating profit excludes CMTL net settlement profit of $53.6M

VHTS and NGSO Opening New Markets Leading in Main Growth Areas – Cellular Backhaul (4G, 5G) &In-Flight Connectivity SUMMARY UNIQUELY POSITIONED TO UNLOCK GROWTH OPPORTUNITIES SkyEdge IV is a leading VHTS and NGSO Platform Focused on Profitable Growth Increased Focus on Military SATCOM Networks