ICR Conference January 9, 2023 Executing on Our Strategic Pillars 1 Exhibit 99.2

2 Forward-Looking Language This presentation contains statements concerning our current expectations, assumptions, plans, estimates, judgments and projections about our business and our industry and other statements that are not historical facts. These statements, including without limitation the slide entitled “Q4 2022 and FY 2022 Updated Outlook,” are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In most cases, words or phrases such as “aim,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “target,” “may,” “will,” “plans,” “path,” “outlook,” “project,” “should,” “strategy,” “potential,” “confident” and similar expressions identify forward-looking statements. These forward-looking statements are based largely on information currently available to our management and are subject to various risks and uncertainties that could cause actual results to differ materially from historical results or those expressed or implied by such forward-looking statements. Although we believe our expectations are based on reasonable estimates and assumptions, they are not guarantees of performance. There is no assurance that our expectations will occur or that our estimates or assumptions will be correct, and we caution investors and all others not to place undue reliance on such forward-looking statements. Factors that could cause actual results to differ include, but are not limited to, those described in Item 1A, “Risk Factors” in our most recent Annual Report on Form 10-K and, from time to time, in Item 1A, “Risk Factors” of our Quarterly Reports on Form 10-Q and the following: The effects of the pandemic, including uncertainties about its depth and duration, new variants of COVID-19 that have emerged, the speed, efficacy and availability of vaccines and treatments, its impact on general economic conditions, human capital management, consumer behavior and discretionary spending, the effectiveness of any actions taken in response to the pandemic, and the impact of the pandemic on our manufacturing operations, shipping costs and timelines and the global supply chain; the ability of our suppliers, logistics providers, vendors and landlords, to meet their obligations to us in light of financial stress, labor shortages, liquidity challenges, bankruptcy filings by other industry participants, and supply chain and other disruptions; increases in unemployment rates and labor shortages; our ability to sufficiently staff our retail stores; changes in general economic conditions, including but not limited to, consumer confidence and consumer spending patterns; the impacts of rising inflation, gasoline prices, and interest rates on consumer spending; market disruptions including pandemics or significant health hazards, severe weather conditions, natural disasters, terrorist activities, financial crises, political crises, war and other military conflicts (such as the war in Ukraine) or other major events, or the prospect of these events, including their impact on consumer spending, inflation and the global supply chain; domestic and global political and social conditions and the potential impacts of geopolitical turmoil or conflict; shifts in consumer behavior, and our ability to adapt, identify and respond to new and changing fashion trends and customer preferences, and to coordinate product development with buying and planning; changes in the general or specialty retail or apparel industries, including significant decreases in market demand and the overall level of spending for women’s private branded clothing and related accessories; our ability to secure and maintain customer acceptance of in-store and online concepts and styles; increased competition in the markets in which we operate, including for, among other things, premium mall space; our ability to remain competitive with customer shipping terms and costs; decreases in customer traffic at malls, shopping centers and our stores; fluctuations in foreign currency exchange rates and commodity prices; significant increases in the costs of manufacturing, raw materials, transportation, importing, distribution, labor and advertising; decreases in the quality of merchandise received from suppliers and increases in delivery times for receiving such merchandise; our ability to appropriately manage our store fleet, including the closing of underperforming stores and opening of new stores, and our ability to achieve the expected results of any such store openings or store closings; our ability to appropriately manage inventory and allocation processes and leverage targeted promotions; our ability to maintain cost saving discipline; our ability to operate our retail websites in a profitable manner; our ability to successfully identify and implement additional sales and distribution channels; our ability to successfully execute and achieve the expected results of our business, brand strategies, brand awareness programs, and merchandising and marketing programs including, but not limited to, the Company’s three-year strategic growth plan, retail fleet optimization plan, sales initiatives, multi- channel strategies and four strategic pillars which are: 1) customer led; 2) product obsessed; 3) digital first; and 4) operationally excellent; our ability to utilize our distribution center and other support facilities in an efficient and effective manner; our reliance on sourcing from foreign suppliers and significant adverse economic, labor, political or other shifts (including adverse changes in tariffs, taxes or other import regulations, particularly with respect to China, or legislation prohibiting certain imports from China); U.S. and foreign governmental actions and policies and changes thereto; the continuing performance, implementation and integration of our management information systems; our ability to successfully update our information systems; the impact of any system failure, cyber security or other data security breaches, including any security breaches resulting in the theft, transfer, or unauthorized disclosure of customer, employee, or company information; our ability to comply with applicable domestic and foreign information security and privacy laws, regulations and technology platform rules or other obligations related to data privacy and security; our ability to attract, hire, train, motivate and retain qualified employees in an inclusive environment; our ability to successfully recruit leadership or transition members of our senior management team; increased public focus and opinion on environmental, social and governance (“ESG”) initiatives and our ability to meet any announced ESG goals and initiatives; future unsolicited offers to buy the Company and actions of activist shareholders and others and our ability to respond effectively; our ability to secure and protect our intellectual property rights and to protect our reputation and brand images; unanticipated obligations or changes in estimates arising from new or existing litigation, income taxes and other regulatory proceedings; unanticipated adverse changes in legal, regulatory or tax laws; and our ability to comply with the terms of our credit agreement, including the restrictive provisions limiting our flexibility in operating our business and obtaining additional credit on commercially reasonable terms. These factors should be considered in evaluating forward-looking statements contained herein. All forward-looking statements that are made or attributable to us are expressly qualified in their entirety by this cautionary notice. The forward-looking statements included herein are only made as of the date of this presentation. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

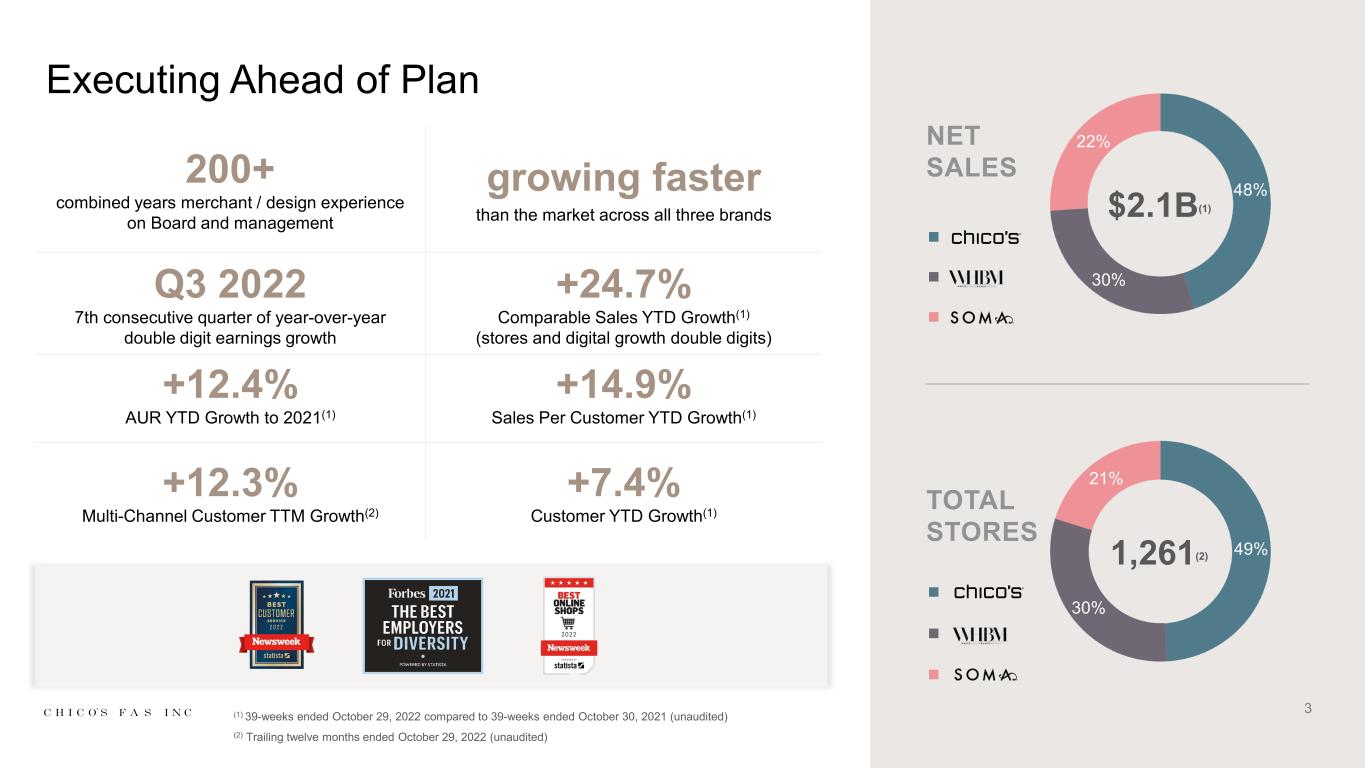

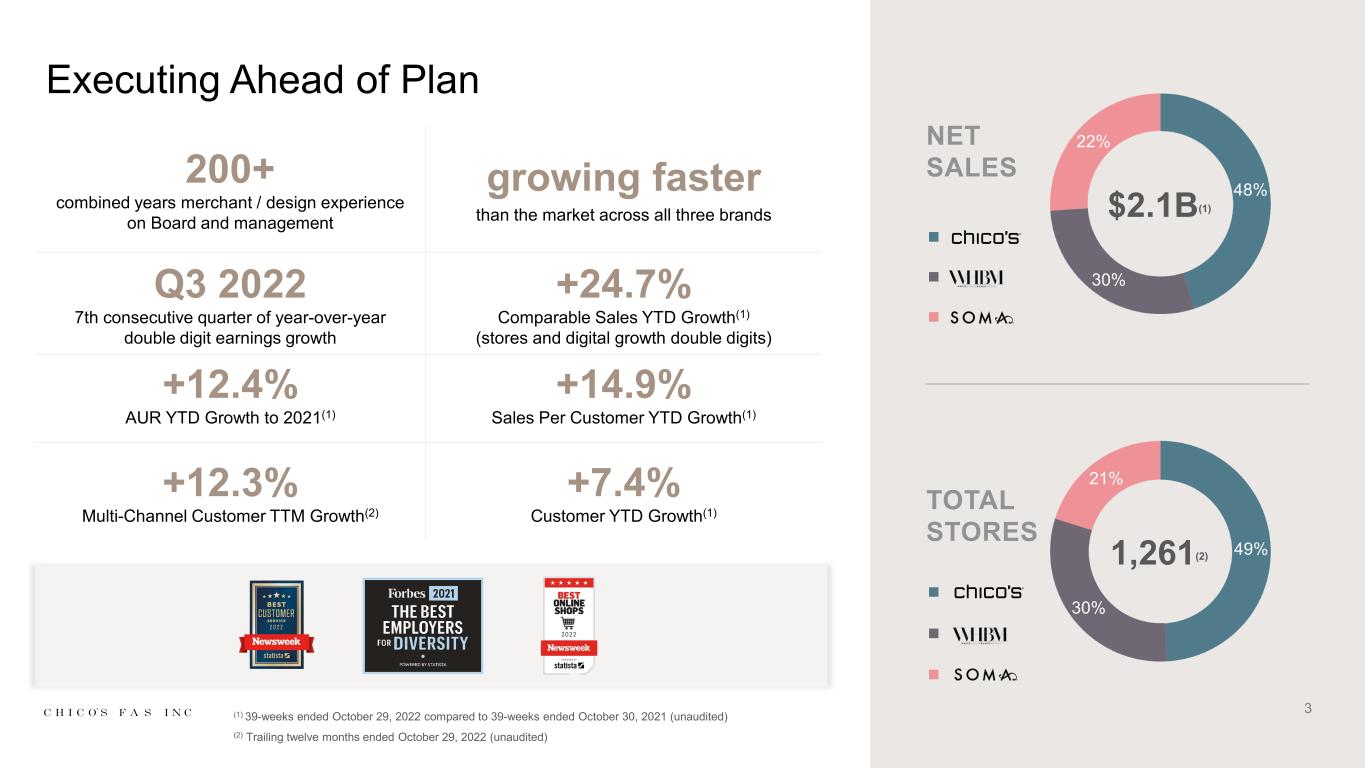

3 Executing Ahead of Plan 200+ combined years merchant / design experience on Board and management growing faster than the market across all three brands Q3 2022 7th consecutive quarter of year-over-year double digit earnings growth +24.7% Comparable Sales YTD Growth(1) (stores and digital growth double digits) +12.4% AUR YTD Growth to 2021(1) +14.9% Sales Per Customer YTD Growth(1) +12.3% Multi-Channel Customer TTM Growth(2) +7.4% Customer YTD Growth(1) 48% 30% 22% 49% 30% 21% $2.1B(1) 1,261(2) TOTAL STORES NET SALES (1) 39-weeks ended October 29, 2022 compared to 39-weeks ended October 30, 2021 (unaudited) (2) Trailing twelve months ended October 29, 2022 (unaudited)

4 Clearly Defined Strategic Pillars CUSTOMER LED PRODUCT OBSESSED DIGITAL FIRST OPERATIONALLY EXCELLENT

5 Customer Led CUSTOMER LED Community engagement New loyalty programs Digitize human experiences Increase lifetime value

6 Product Obsessed PRODUCT OBSESSED Distinctive, Premium Creative storytelling Sustainability Best-in-class items

7 Digital First DIGITAL FIRST Strengthen core platform Modernize merchandise, data and store systems Data-driven insights Test and learn

8 Operationally Excellent OPERATIONALLY EXCELLENT Fabric first Inventory management Enhanced supply chain Leveraging real estate

9 Loyal, Expanding Customer Base 28.8% YTD Comparable Sales Growth Q3 2022 over Q3 2021 17.0% YTD Comparable Sales Growth Q3 2022 over Q3 2021 34.7% YTD Comparable sales growth Q3 2022 over Q3 2019 11.7% Customer Growth Trailing Twelve-Months 16.0% Customer Growth Trailing Twelve-Months 4.1% Customer Growth Trailing Twelve-Months 12 years avg customer length 9 years avg customer length 6 years avg customer length 10 year avg reduction in customer age for new customers 3 year avg reduction in customer age for new customers 4 year avg reduction in customer age for new customers 2.8M total active customers 1.8M total active customers 2.8M total active customers All data is unaudited and as of Q3 2022 Soma comparable sales declined 5.8% in Q3 2022 compared to Q3 2021 reflecting continued slowdown in lounge and cozy

10 Boutique of solution-oriented products, focused on color and fit with core franchises

BRAND VISION Inspiring accomplished women to embrace and express their individuality BRAND AND CUSTOMER PERSONALITY Purposeful Genuine Magnetic Timeless CUSTOMER VALUES Family Friends Fun Creativity Self-expression BRAND POSITIONING For women who have grown to know themselves, we always have something new and unique just for them 11 Brand Ethos

Financial Highlights $801.6M Net Sales 33.2% Net Sales Growth YoY 36.0% Comparable Sales to 2021 10.6% Customer Growth TTM1 613 Stores 12 Unaudited, thirty-nine weeks ended October 29, 2022 (1) Trailing twelve months ended October 29, 2022 Customers responding to elevated product; building complete outfits

13 Designer details with feminine tailoring focused on core franchises with solutions

14 Brand Ethos BRAND VISION Inspiring independent women to embrace both their power and their femininity BRAND AND CUSTOMER PERSONALITY Authentic Smart Stylish Social Determined CUSTOMER VALUES Family Friendship Confidence Achievement Optimism BRAND POSITIONING For women who understand and accept their duality, we offer fashion infused with designer details that are as surprising as she is

15 Financial Highlights $485.1M Net Sales 33.2% Net Sales Growth YoY 35.6% Comparable Sales to 2021 13.7% Customer Growth TTM1 382 Stores Unaudited, thirty-nine weeks ended October 29, 2022 (1) Trailing twelve months ended October 29, 2022 Customers responding to versatile dressing; seasonless fabrics

16 Inclusive intimate apparel brand, providing beautiful solutions

17 BRAND VISION Inspiring all women to embrace their passion for both comfort and confidence BRAND AND CUSTOMER PERSONALITY Supportive Honest Clever Confident CUSTOMER VALUES Friendship Community Comfort Individuality Positivity BRAND POSITIONING Beautiful innovative solutions for all women who appreciate fashion as much as function, we offer bras, panties, pajamas and loungewear to give her the very best of both worlds Brand Ethos

18 Financial Highlights $347.5M Net Sales -4.7% Net Sales Growth YoY -5.8% Comparable Sales to 2021 (31% Comparable Sales to 2019) 3.5% Customer Growth TTM1 266 Stores Unaudited, thirty-nine weeks ended October 29, 2022 (1) Trailing twelve months ended October 29, 2022 Customers responding to core bra and panties; continued growth and market share gains

Compelling Digital & ECOM Capabilities Technology as an Enabler 19

Digital First Data Centricity conversion traffic marketing efficiency out of stock reduction Technology Enablement conversion avg order value speed to market retention Connected Commerce conversion lifetime value brand awareness basket size Digital Sales Expected to Reach $1B+ by 2024 20

21 ESG Integrated in Strategic Priorities CUSTOMER LED develop assortments with customers and associates for women of all shapes and sizes, providing solutions that create comfort and joy PRODUCT OBSESSED create sustainable styles made from recycled materials and natural fibers DIGITAL FIRST use digital tools to streamline steps in sourcing, design and production process OPERATIONALLY EXCELLENT source responsibly and leverage latest sustainable packaging and shipping methods People, Product and Packaging: Profitable Growth, Better World

Financial Update 22

Q3 2022 Financial Highlights Q3 2019 Q3 2020 Q3 2021 Q3 2022 Total Net Sales $484.7M $351.4M $453.6M $518.3M Gross Margin 35.3% 22.0% 40.7% 40.0% SG&A 37.3% 43.6% 35.8% 33.9% Operating Income (Loss) $(9.5)M $(75.9)M $22.0M $31.6M Diluted EPS $(0.07) $(0.48) $0.15 $0.20 Reported Q3 diluted EPS of $0.20, seventh consecutive quarter of double-digit earnings growth Q3 2022 net sales increased 14.3% and comparable sales grew 16.5% YoY Unaudited, in millions except per share and % data 23

24 Q4 2022 Outlook Full-Year 2022 Outlook Consolidated Net Sales $505M – $515M $2,128M – $2,138M EPS ($0.02) – $0.00 $0.80 – $0.82 Q4 2022 and FY 2022 Updated Outlook as of January 9, 2023 • Full-Year 2022 comparable sales growth expected in the high teens with EPS growth projected up ~120% over fiscal 2021

$1,510.8M $937.9M $1,313.7M $1,618.0M $61.3M $89.0M $167.9M Q3 YTD 2019 Q3 YTD 2020 Q3 YTD 2021 Q3 YTD 2022 Sales Adj. EBITDA 25 Delivering Growth and Profitability Sales / Adj. EBITDA1 (Unaudited) (Sales and Adjusted EBITDA in millions) (1) Adjusted EBITDA excludes goodwill and other impairment charges as reflected in the accompanying GAAP to Non-GAAP reconciliation -$202M

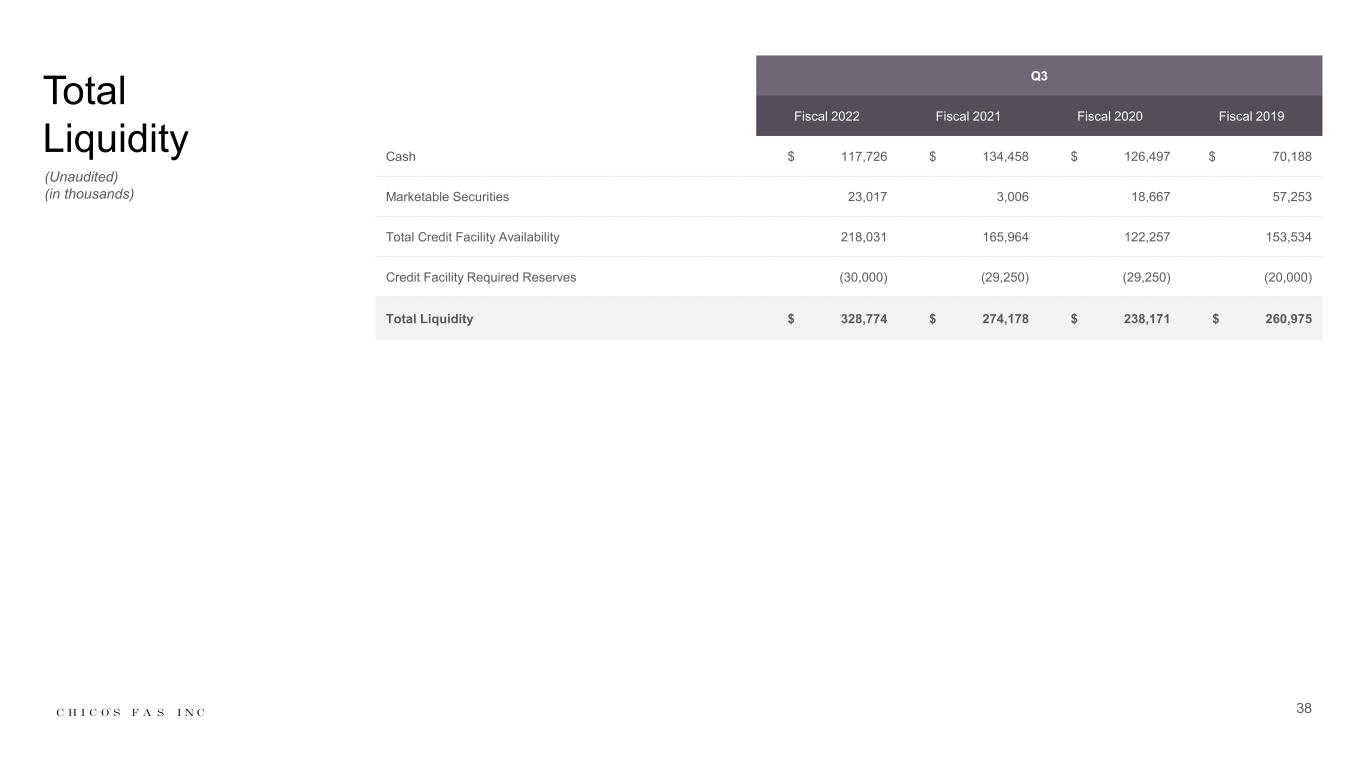

Strong Liquidity and Growing Cash Flow $141M $329M Cash and Marketable Securities Total Available Liquidity Q3 2022 Liquidity (1) Total liquidity represents cash, marketable securities and available borrowing capacity on our ABL credit facility less required reserves (2) Free Cash Flow is a non-GAAP financial measure that represents cash from operating activities less purchases of property and equipment in the quarter indicated; GAAP to Non-GAAP reconciliation provided in the Appendix (3) Trailing twelve months ended October 29, 2022 1 (in millions) $49M $32M FY 2019 FY 2020 FY 2021 TTM Free Cash Flow (Unaudited) 2 $(1M) $(109M) 3 26

27 We See a Clear Path to Delivering Shareholder Value $2.5B+ sales (~12.5% CAGR) $1B+ digital sales 40% gross margin 7.5% operating margin 15%+ annual EPS growth $400M cumulative 3-year cash flow from operations Targeting the Following by 2024 Projected effective income tax rate of 26% to 28% in fiscals 2022 to 2024 15%+ annual TSR

2021 2024E 36.7% 40.0%Gross Margin 2021 2024E 3.7% 7.5% 2021 2024E $400M 2021 2024E $0.37 $1.02 EPS 2022 Outlook: 2022 Outlook: 2022 Outlook: 2022 Outlook: Reflects targets communicated during the 2022 Investor Day Progress to Date – Four Key Metrics Ahead of Plan 28 Operating Margin Cumulative Cash from Operations

29 Balanced Capital Allocation Policy RETURN EXCESS CASH TO SHAREHOLDERS Share repurchase MAINTAIN STRONG LIQUIDITY Fund daily need and navigate macro environment INVESTMENT IN BRANDS AND SHARED PLATFORM Targeting 3.5% of annual sales in Capex REPAY DEBT Manage balance sheet to minimize financial risk

We Believe Investments Fuel Growth Across Channels Targeting Capital Expenditures of 3.5% of Sales Annually Allocated Across Digital, Stores and Infrastructure (Supply Chain, Facilities) Digital 1/3 of total forecasted investment Stores 1/3 of total forecasted investment Infrastructure Traffic drivers customer data platform, segmentation, brand shop applications Conversion / Acquisition drivers UX (search, browse, checkout, content), tools (Style Connect, My Closet) Retention drivers self service, personalization, social New Soma stores Store upgrade / refresh (lease required and pro-active) Add capacity to meet demand (existing campus in Winder and U.S. expansion) Call center support cloud-based system(s) System upgrades (POS, finance, HR) Investments expected to drive KPIs that support strong, sustainable growth: • Traffic • Conversion • New acquisition • Retention • Service / Experience • Loyalty 30

Optimizing Real Estate Footprint Mall Open Air Outlet Total Store Count as of October 29, 2022 Chico’s 126 365 122 613 WHBM 154 175 53 382 Soma 114 132 20 266 Total 394 672 195 1,261 31

Positioned to Grow and Create Shareholder Value Operating excellence – further building upon enhanced shared service platform with dynamic sourcing, digital and marketing capabilities World-class retail team – store associates across the organization are long-tenured with deep retail experience and a love for fashion that endears them to customers Strong financial position and lean cost structure – will allow for investment to grow topline and grow EPS Powerful portfolio with three unique brands – each thriving in its own market white space Leadership team with extensive retail experience – deploying a new strategy and operating model that has dramatically improved performance Competitive advantages that take years to build – operating with an incredibly loyal customer base, a customer-led culture and a diverse store footprint that is hard to replicate 32

33 Appendix

34 Income Statement (Unaudited) (in thousands, except per share data) Thirteen Weeks Ended Thirty-Nine Weeks Ended October 29, 2022 October 30, 2021 October 29, 2022 October 30, 2021 Amount % of Sales Amount % of Sales Amount % of Sales Amount % of Sales Net sales: Chico's $ 255,341 49.3 % $ 203,505 44.9 % $ 801,584 49.5 % $ 601,914 45.8 % White House Black Market 157,451 30.4 % 138,159 30.4 % 485,061 30.0 % 364,250 27.7 % Soma 105,540 20.3 % 111,980 24.7 % 331,322 20.5 % 347,501 26.5 % Total net sales 518,332 100.0 % 453,644 100.0 % 1,617,967 100.0 % 1,313,664 100.0 % Cost of goods sold 310,892 60.0 % 269,205 59.3 % 962,448 59.5 % 820,973 62.5 % Gross margin 207,440 40.0 % 184,439 40.7 % 655,519 40.5 % 492,691 37.5 % Selling, general and administrative expenses 175,841 33.9 % 162,469 35.8 % 520,296 32.1 % 442,637 33.7 % Income from operations 31,599 6.1 % 21,970 4.9 % 135,223 8.4 % 50,054 3.8 % Interest expense, net (1,080) (0.2) % (1,744) (0.4) % (3,111) (0.2)% (5,170) (0.4)% Income before income taxes 30,519 5.9 % 20,226 4.5 % 132,112 8.2 % 44,884 3.4 % Income tax provision 5,900 1.2 % 2,000 0.5 % 30,600 1.9 % 9,400 0.7 % Net income $ 24,619 4.7 % $ 18,226 4.0 % $ 101,512 6.3 % $ 35,484 2.7 % Per share data: Net income per common share-basic $ 0.20 $ 0.15 $ 0.84 $ 0.30 Net income per common and common equivalent share–diluted $ 0.20 $ 0.15 $ 0.82 $ 0.29 Weighted average common shares outstanding–basic 120,333 117,304 119,776 117,005 Weighted average common and common equivalent shares outstanding–diluted 124,887 123,166 124,016 121,897

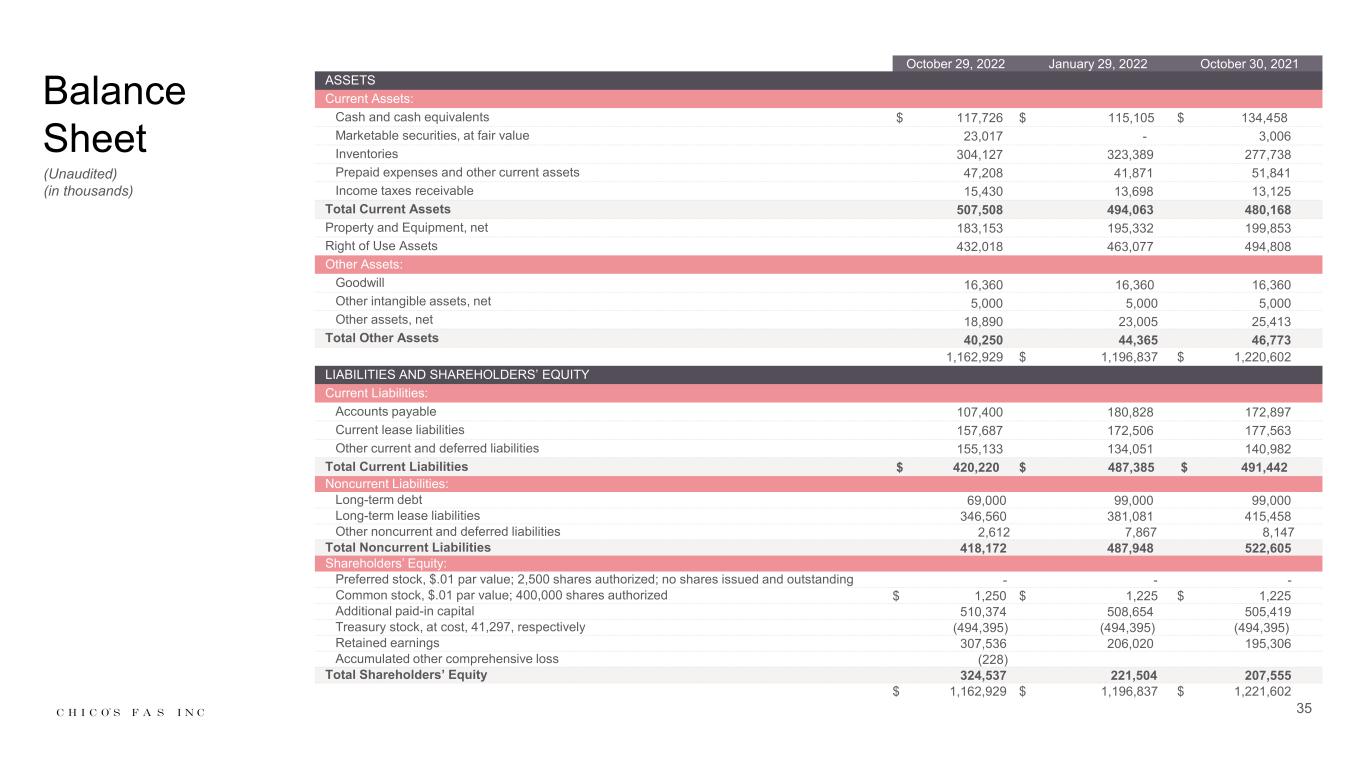

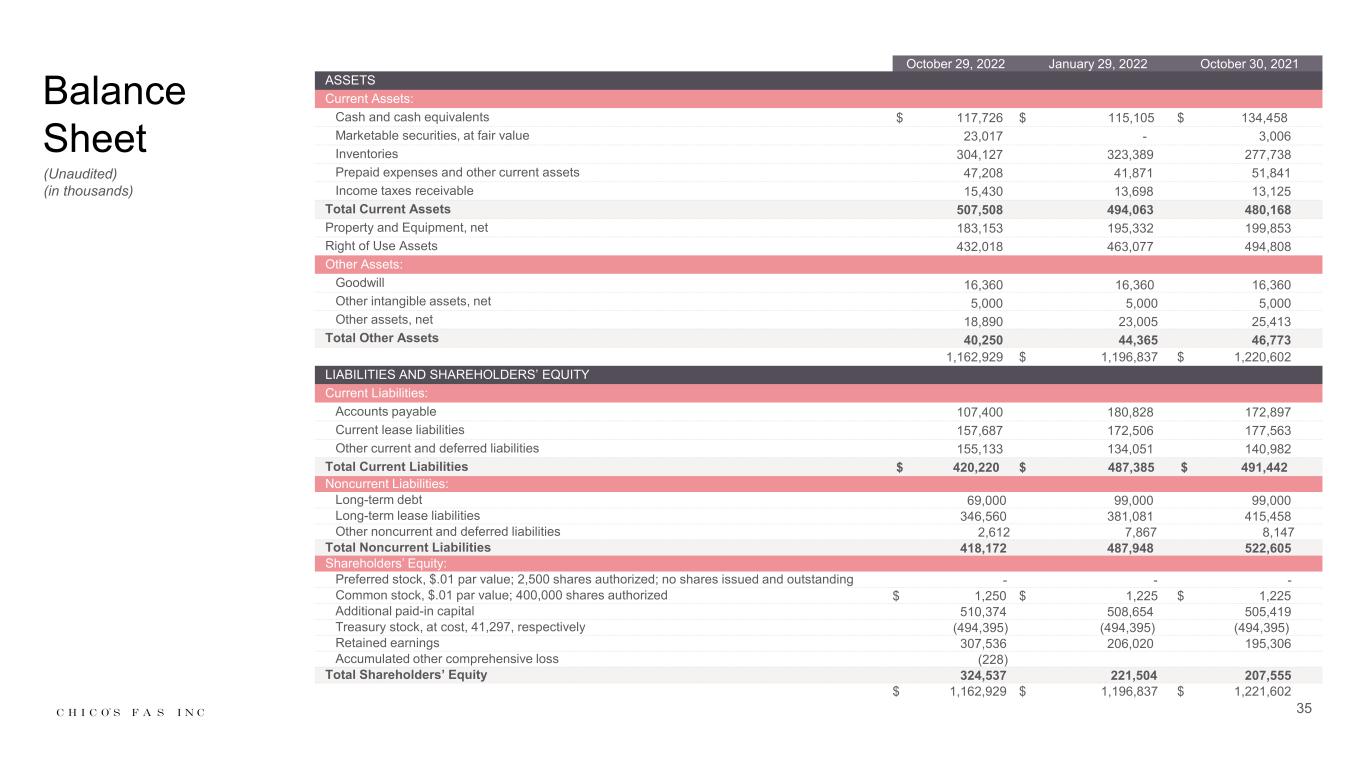

35 Balance Sheet (Unaudited) (in thousands) October 29, 2022 January 29, 2022 October 30, 2021 ASSETS Current Assets: Cash and cash equivalents $ 117,726 $ 115,105 $ 134,458 Marketable securities, at fair value 23,017 - 3,006 Inventories 304,127 323,389 277,738 Prepaid expenses and other current assets 47,208 41,871 51,841 Income taxes receivable 15,430 13,698 13,125 Total Current Assets 507,508 494,063 480,168 Property and Equipment, net 183,153 195,332 199,853 Right of Use Assets 432,018 463,077 494,808 Other Assets: Goodwill 16,360 16,360 16,360 Other intangible assets, net 5,000 5,000 5,000 Other assets, net 18,890 23,005 25,413 Total Other Assets 40,250 44,365 46,773 1,162,929 $ 1,196,837 $ 1,220,602 LIABILITIES AND SHAREHOLDERS’ EQUITY Current Liabilities: Accounts payable 107,400 180,828 172,897 Current lease liabilities 157,687 172,506 177,563 Other current and deferred liabilities 155,133 134,051 140,982 Total Current Liabilities $ 420,220 $ 487,385 $ 491,442 Noncurrent Liabilities: Long-term debt 69,000 99,000 99,000 Long-term lease liabilities 346,560 381,081 415,458 Other noncurrent and deferred liabilities 2,612 7,867 8,147 Total Noncurrent Liabilities 418,172 487,948 522,605 Shareholders’ Equity: Preferred stock, $.01 par value; 2,500 shares authorized; no shares issued and outstanding - - - Common stock, $.01 par value; 400,000 shares authorized $ 1,250 $ 1,225 $ 1,225 Additional paid-in capital 510,374 508,654 505,419 Treasury stock, at cost, 41,297, respectively (494,395) (494,395) (494,395) Retained earnings 307,536 206,020 195,306 Accumulated other comprehensive loss (228) Total Shareholders’ Equity 324,537 221,504 207,555 $ 1,162,929 $ 1,196,837 $ 1,221,602

36 Cash Flow Statement (Unaudited) (in thousands) Thirty-Nine Weeks Ended October 29, 2022 October 30, 2021 Cash Flows from Operating Activities: Net income $ 101,512 $ 35,484 Adjustments to reconcile net income to net cash used in operating activities: Inventory write-offs 826 374 Depreciation and amortization 33,350 39,662 Non-cash lease expense 137,184 139,116 Loss on disposal and impairment of property and equipment, net 1,804 1,432 Deferred tax benefit (381) 190 Share-based compensation expense 10,321 8,836 Changes in assets and liabilities: Inventories 18,436 (74,129) Prepaid expenses and other assets (2,591) (13,830) Income tax receivable (1,732) 45,015 Accounts payable (73,120) 56,503 Accrued and other liabilities 13,583 16,643 Lease liability (155,561) (166,990) Net cash provided by operating activities 83,631 88,306 Cash Flows from Investing Activities: Purchases of marketable securities (26,376) (269) Proceeds from sale of marketable securities 3,083 15,753 Purchases of property and equipment (21,207) (8,246) Proceeds from sale of assets 2,772 - Net cash (used in) provided by investing activities (41,728) 7,238 Cash Flows from Financing Activities: Payments on borrowings (30,000) (50,000) Payments of debt issuance costs (706) - Proceeds from issuance of common stock 239 - Payments of tax withholdings related to share-based awards (8,815) (1,877) Net cash used in financing activities (39,282) (51,877) Net increase in cash and cash equivalents 2,621 43,667 Cash and Cash Equivalents, Beginning of period 115,105 90,791 Cash and Cash Equivalents, End of period 117,726 134,458

GAAP to Non-GAAP Reconciliation: EBITDA Performance (Unaudited) (in thousands) 37 Thirty-Nine Weeks Ended October 29, 2022 Fiscal 2022 Fiscal 2021 Fiscal 2020 Fiscal 2019 Net Income (Loss) $ 101,512 $ 35,484 $ (281,003) $ (8,407) Adjustments to Net Income (Loss): Interest expense (income), net 3,111 5,170 1,387 (79) Income tax provision (benefit) 30,600 9,400 (113,300) 2,000 Depreciation and amortization 32,726 38,970 48,446 67,786 EBITDA $ 167,949 89,024 (344,470) 61,300 Adjustments to EBITDA Long-lived asset impairment - - 18,493 - Right of use asset impairment - - 2,442 - Goodwill and intangible impairment - - 113,180 - Adjusted EBITDA $ 167,949 $ 89,024 $ (201,972) $ 61,300 Sales $ 1,617,967 $ 1,313,664 $ 937,854 $ 1,510,790

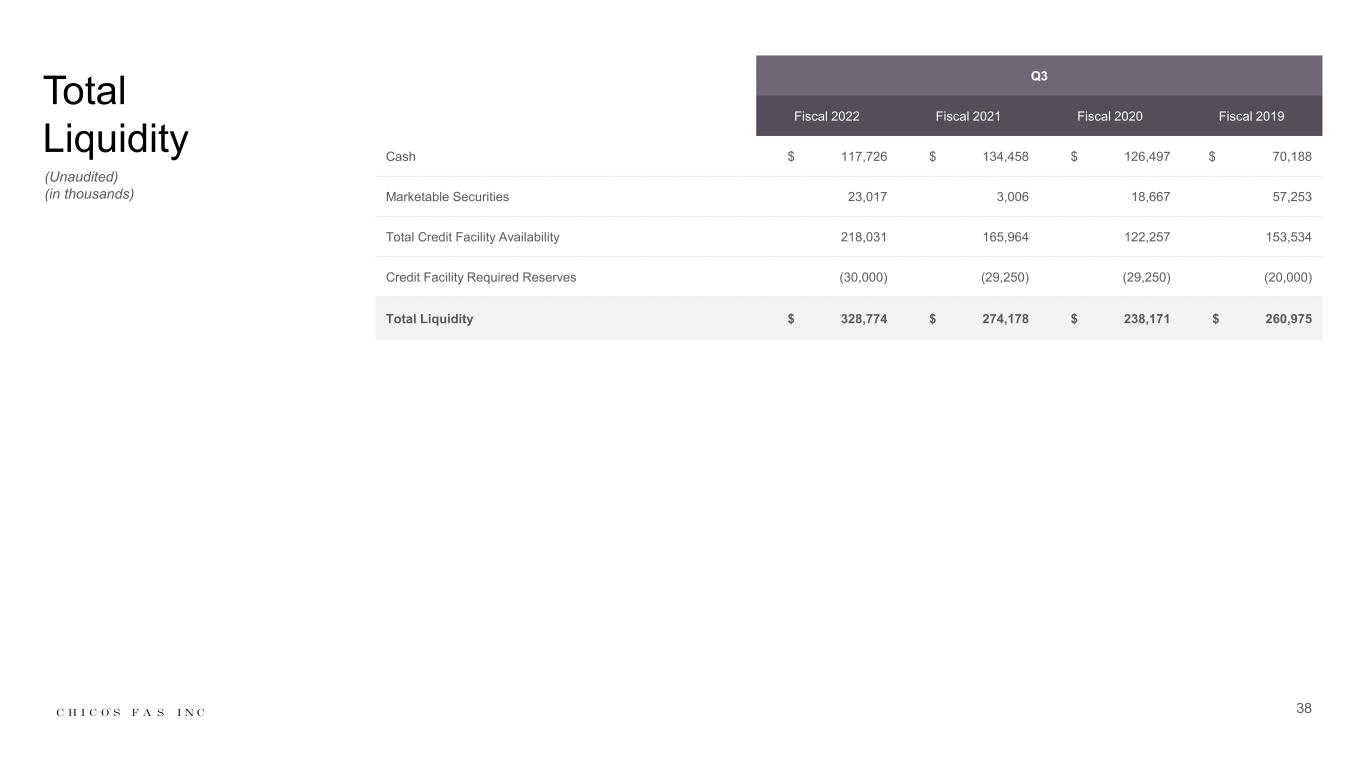

Total Liquidity (Unaudited) (in thousands) 38 Q3 Fiscal 2022 Fiscal 2021 Fiscal 2020 Fiscal 2019 Cash $ 117,726 $ 134,458 $ 126,497 $ 70,188 Marketable Securities 23,017 3,006 18,667 57,253 Total Credit Facility Availability 218,031 165,964 122,257 153,534 Credit Facility Required Reserves (30,000) (29,250) (29,250) (20,000) Total Liquidity $ 328,774 $ 274,178 $ 238,171 $ 260,975

GAAP to Non-GAAP Reconciliation: Free Cash Flow (Unaudited) (in thousands) 39 TTM1 YTD Fiscal 2022 Fiscal 2021 Fiscal 2020 Fiscal 2019 Cash Flows from Operating Activities $ 57,936 $ 62,611 $ (97,832) $ 33,344 Purchases of Property and Equipment (26,206) (13,245) (11,360) (33,939) Free Cash Flow $ 31,730 $ 49,366 $ (109,192) $ (595) (1) Trailing twelve months ended October 29, 2022