November Investor Presentation November 16, 2022 Karim Mikhail President & CEO Exhibit 99.1

Forward Looking Statements & Disclaimer This presentation contains forward-looking statements, such as those relating to the commercial potential of VASCEPA® (VAZKEPA® in Europe), clinical and regulatory efforts and timelines, potential regulatory and pricing approvals, patent litigation, generic product launch, intellectual property, cash flow, research and development, and other statements that are forward-looking in nature and depend upon or refer to future events or conditions, including financial guidance and milestones. These statements involve known and unknown risks, uncertainties and other factors that can cause actual results to differ materially. Investors should not place undue reliance on forward-looking statements, which speak only as of the presentation date of this presentation. Please refer to the “Risk Factors” section in Amarin’s most recent Forms 10-K and 10-Q filed with the SEC and cautionary statements outlined in recent press releases for more complete descriptions of risks in an investment in Amarin. THIS PRESENTATION IS INTENDED FOR COMMUNICATION WITH INVESTORS AND NOT FOR DRUG PROMOTION. AMARIN, VASCEPA, VAZKEPA and REDUCE-IT are trademarks of Amarin Pharmaceuticals Ireland Limited. VAZKEPA is a registered trademark in Europe and other countries and regions and is pending registration in the United States.

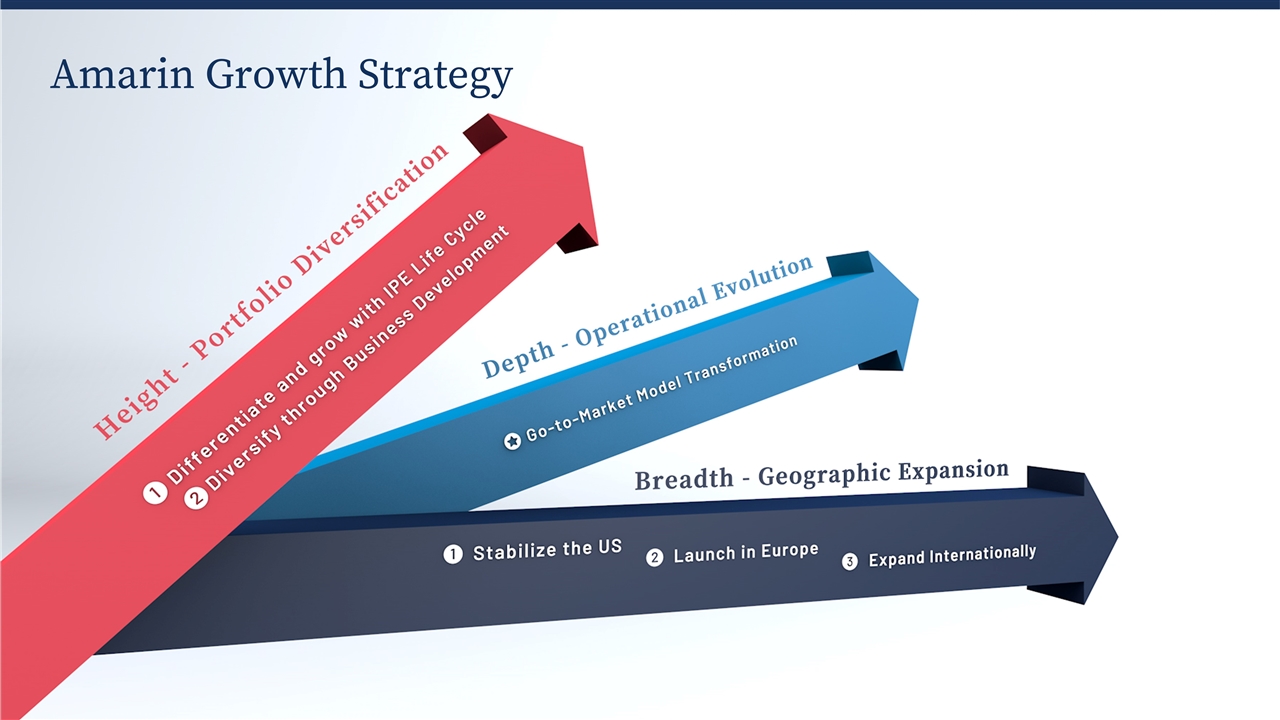

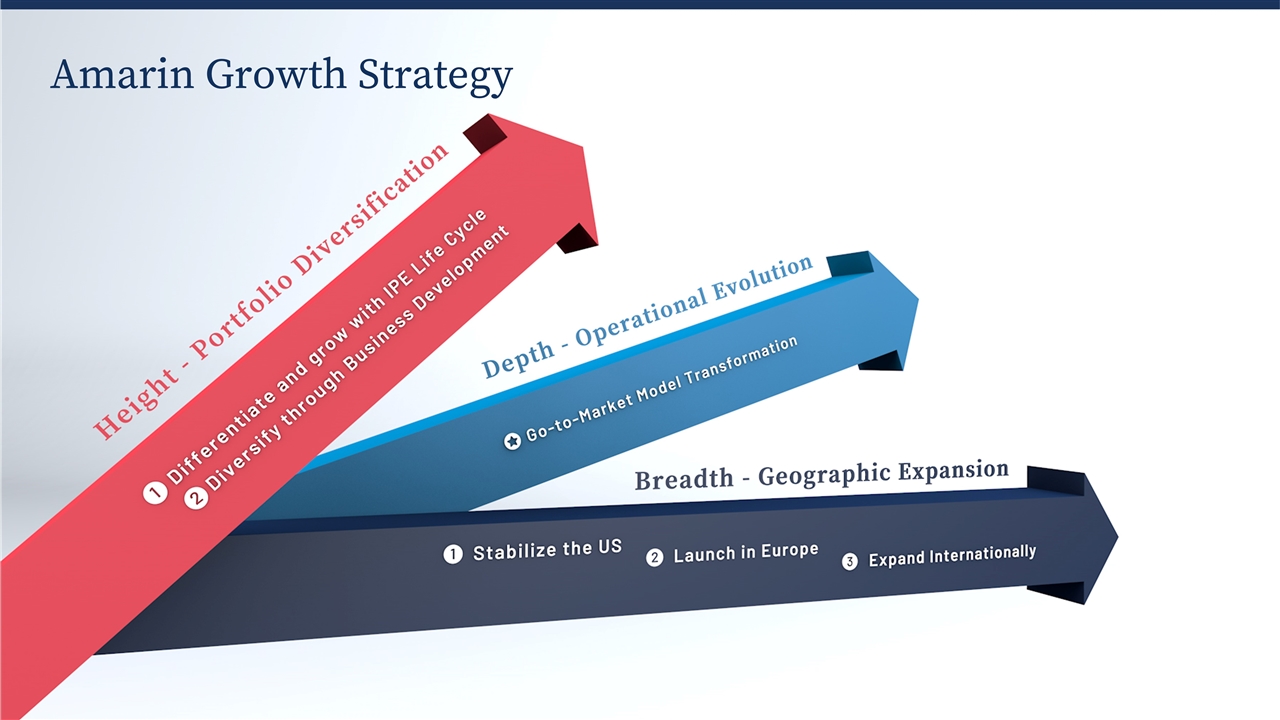

Amarin Growth Strategy

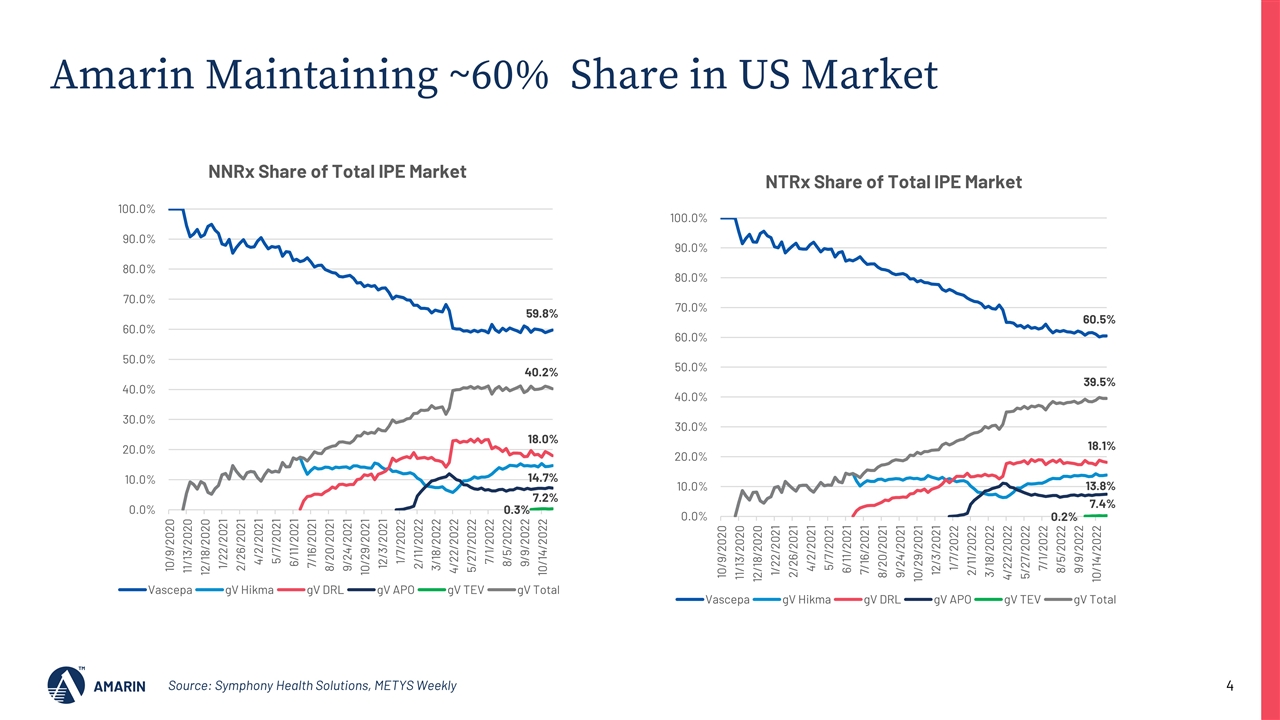

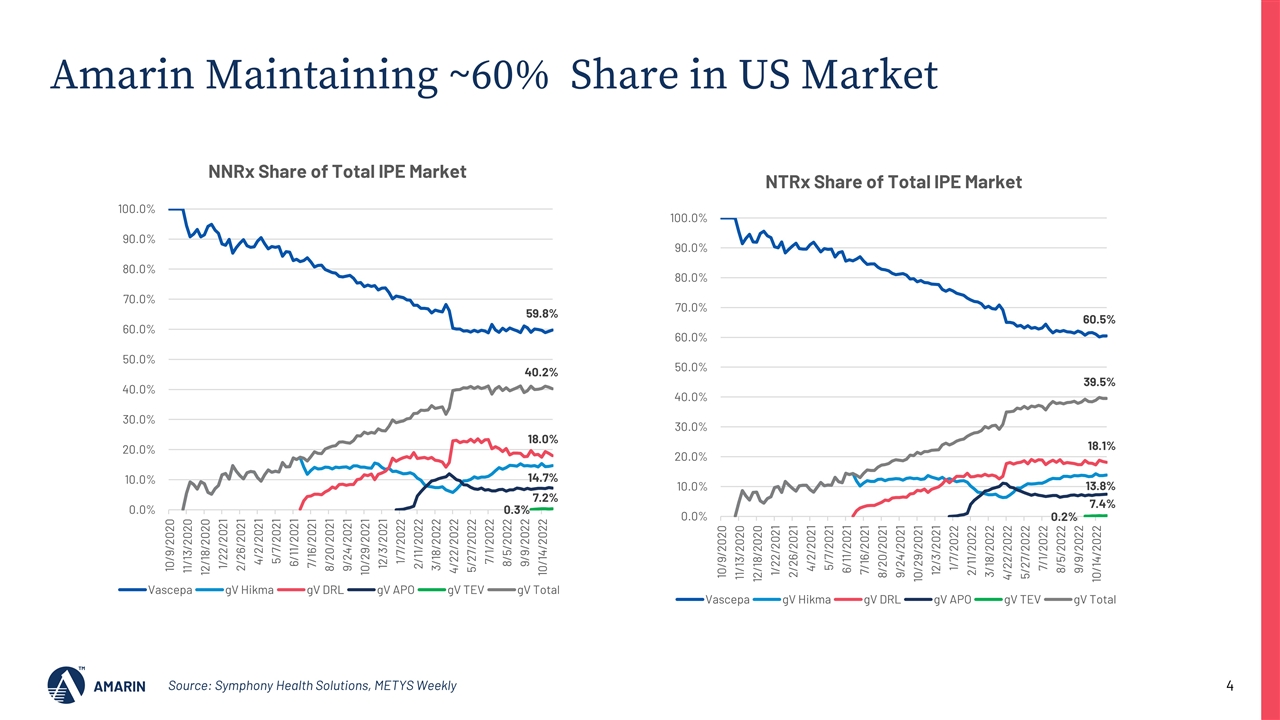

Source: Symphony Health Solutions, METYS Weekly Amarin Maintaining ~60% Share in US Market

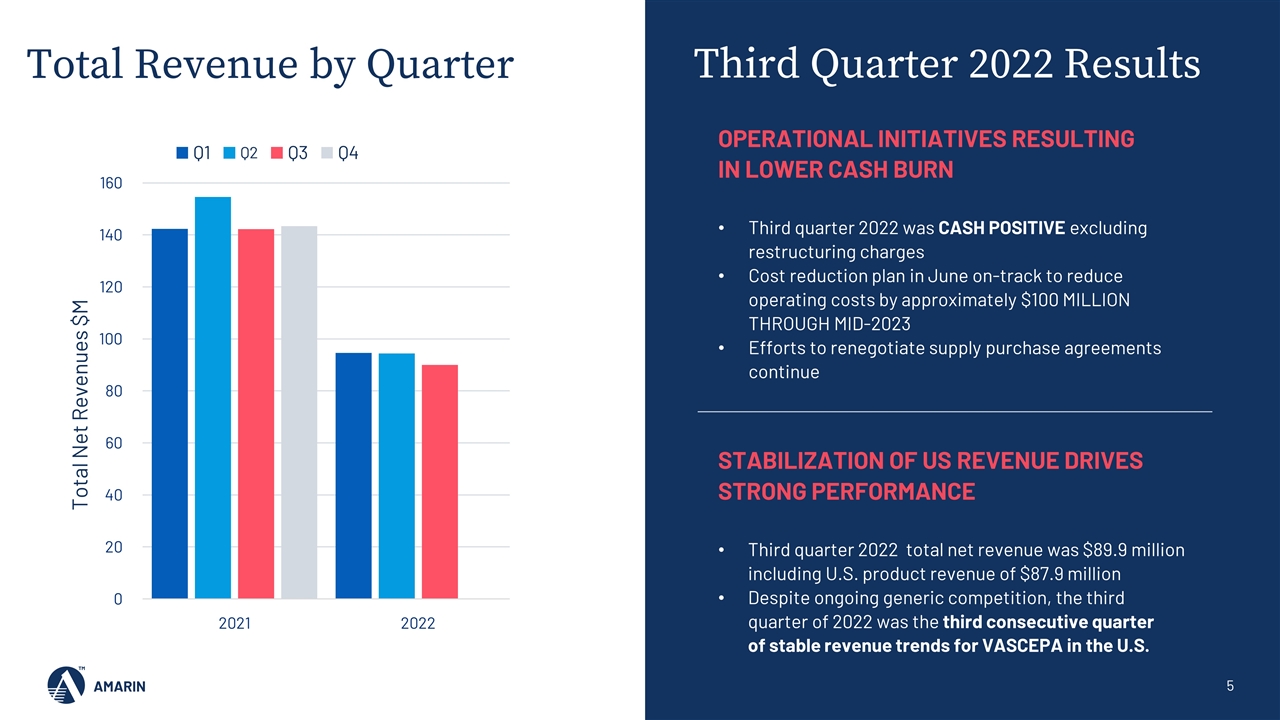

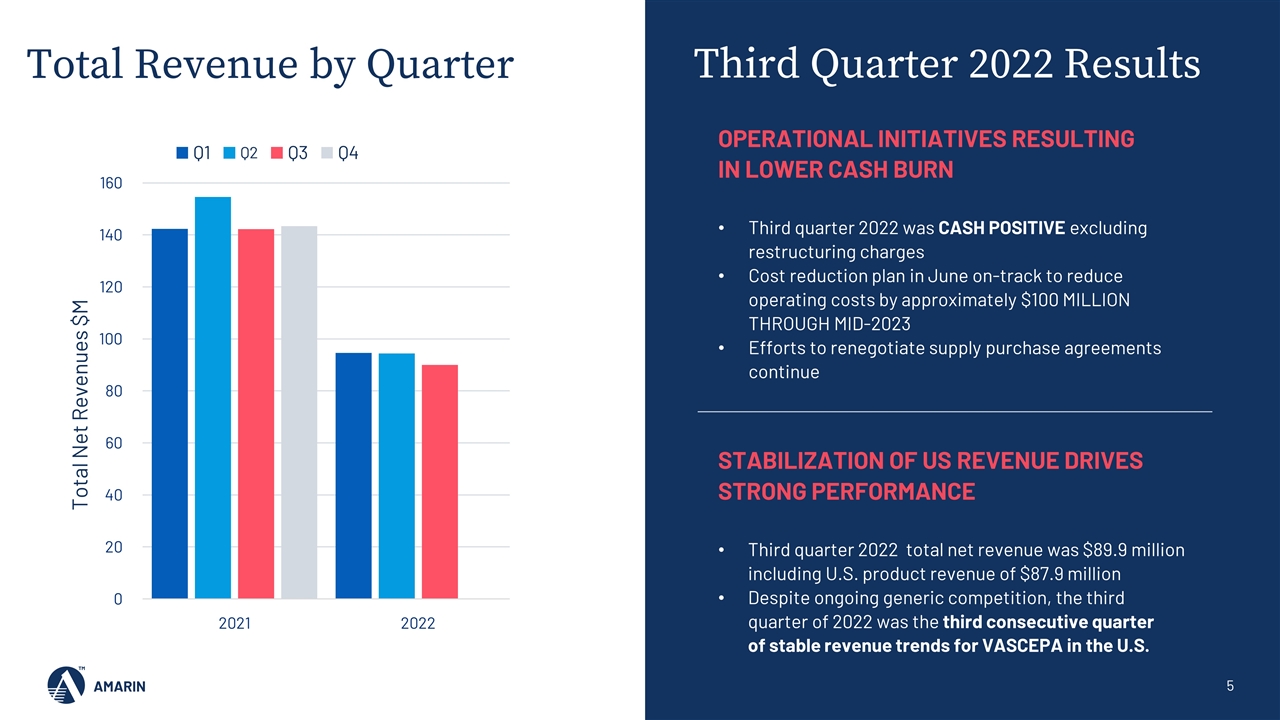

Third Quarter 2022 Results Total Revenue by Quarter OPERATIONAL INITIATIVES RESULTING IN LOWER CASH BURN Third quarter 2022 was CASH POSITIVE excluding restructuring charges Cost reduction plan in June on-track to reduce operating costs by approximately $100 MILLION THROUGH MID-2023 Efforts to renegotiate supply purchase agreements continue STABILIZATION OF US REVENUE DRIVES STRONG PERFORMANCE Third quarter 2022 total net revenue was $89.9 million including U.S. product revenue of $87.9 million Despite ongoing generic competition, the third quarter of 2022 was the third consecutive quarter of stable revenue trends for VASCEPA in the U.S.

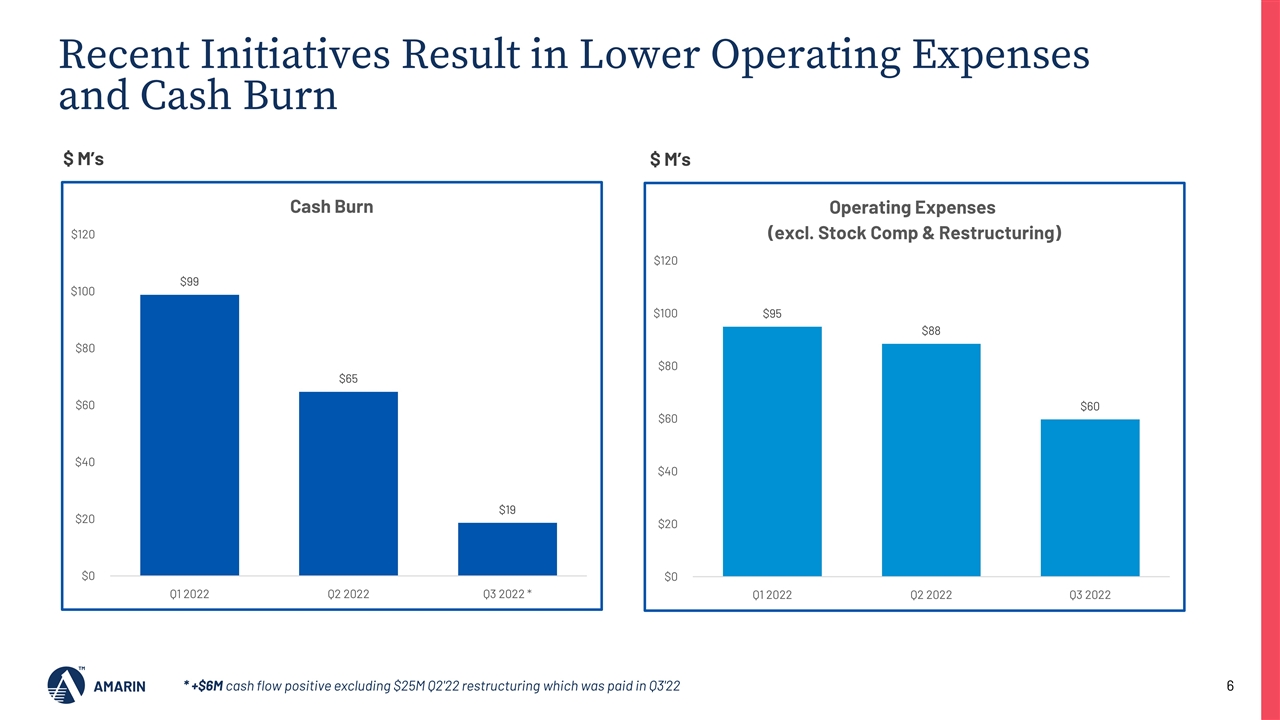

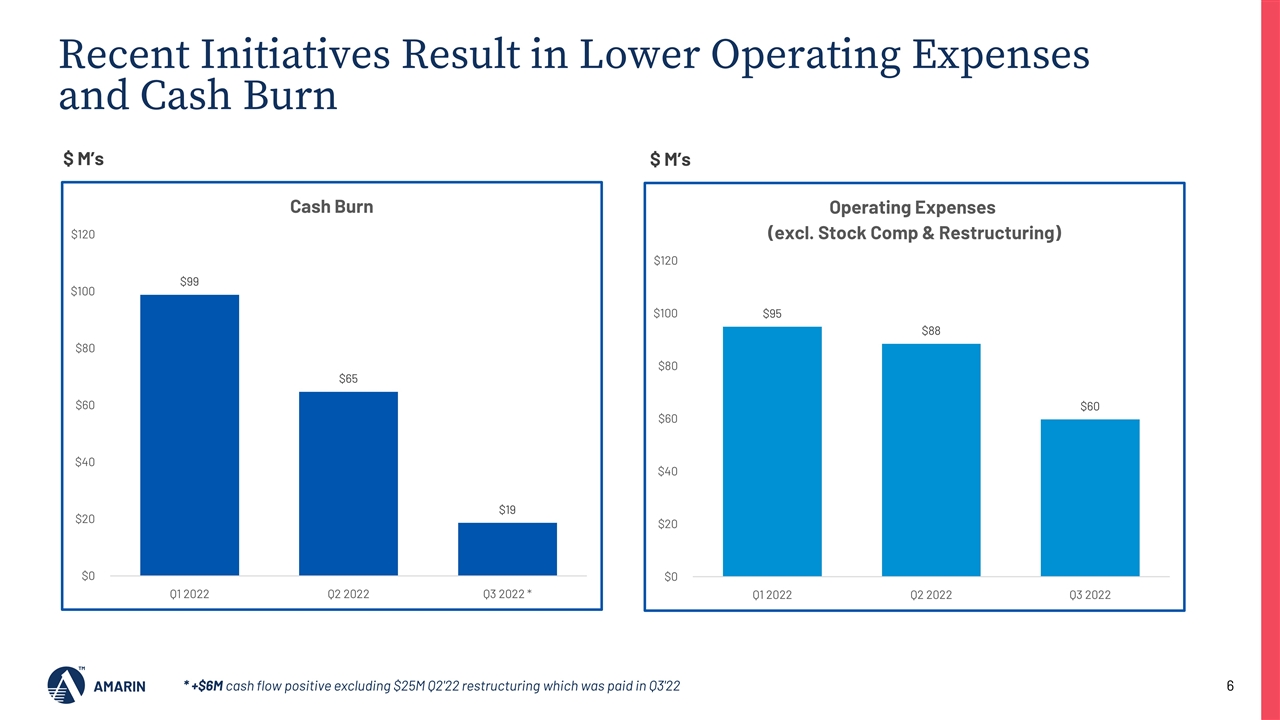

Recent Initiatives Result in Lower Operating Expenses and Cash Burn $95 $87 $19* $60 $ M’s * +$6M cash flow positive excluding $25M Q2'22 restructuring which was paid in Q3'22 $ M’s

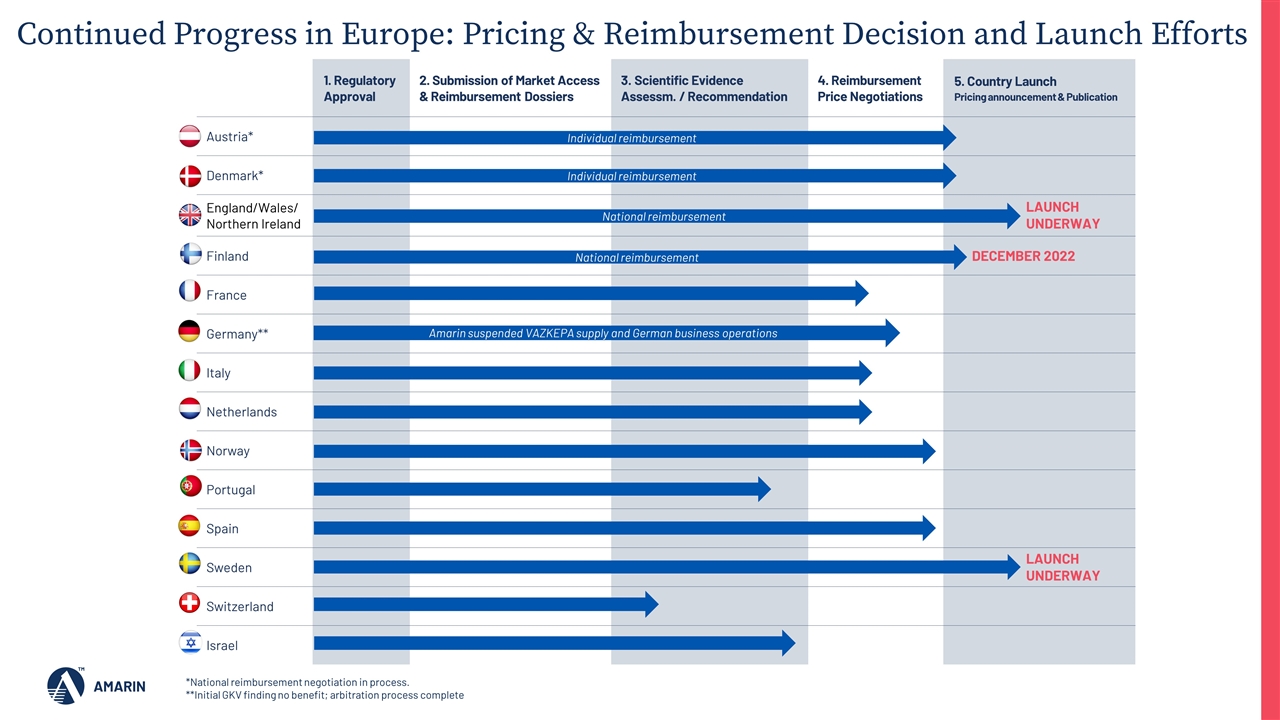

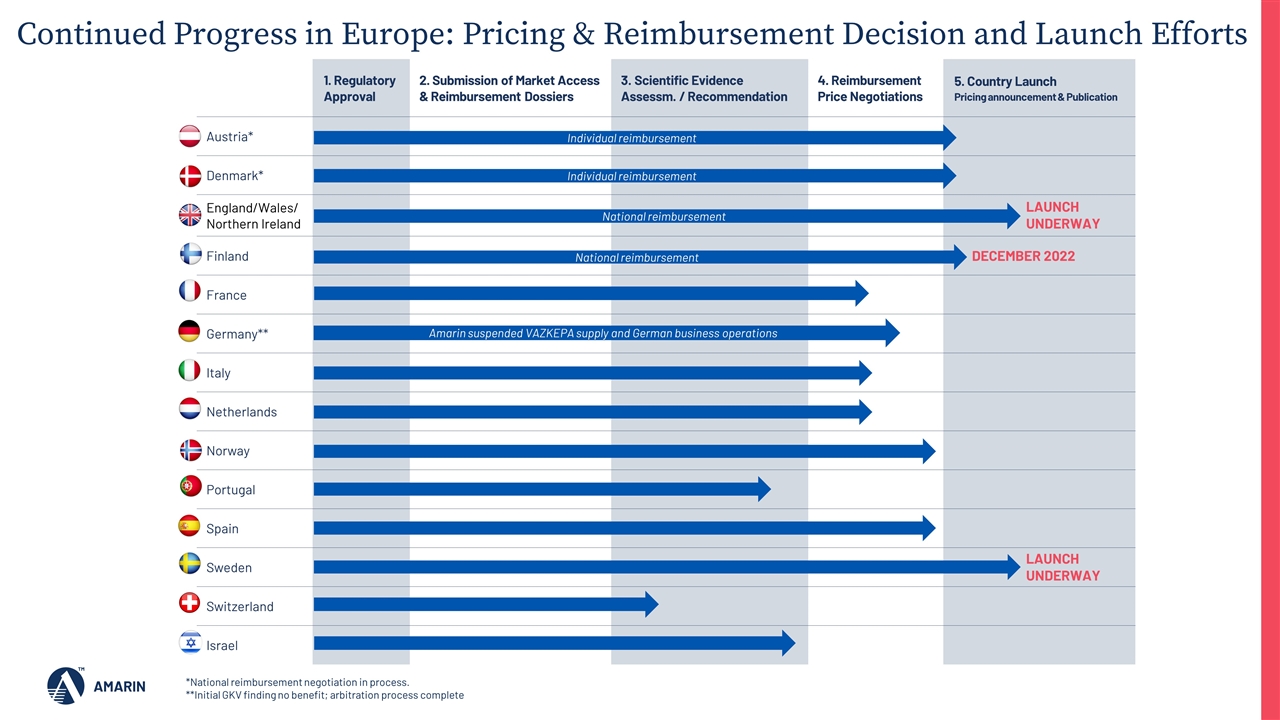

Europe Progress To Date in 2022: Achieved national reimbursements in Sweden, England, Wales, Northern Ireland, and Finland and have obtained individual reimbursement in Denmark and Austria Launched in England and Wales as planned on October 13, 2022 Also making progress in additional key European markets: Spain: Pricing & reimbursement negotiations nearing conclusion with Ministry of Health, likely pricing and reimbursement decision before the end of 2022 or early 2023 Italy: Dossier has received positive scientific assessment and moved to pricing and reimbursement negotiations France: Received positive reimbursement assessment from HAS; price negotiations continue to progress Portugal, Switzerland, Scotland, Israel: All previously submitted dossiers and progressing pricing and reimbursement negotiations 4M ~€210B annual CVD costs to European Union2 10+ ESC: Cardiovascular Disease Statistics 2019 European Heart Network. European Cardiovascular Disease Statistics 2017. https://ehnheart.org/cvd-statistics/cvd-statistics-2017.html. Accessed January 2022 Significant Market Opportunity deaths per year in Europe WHO region due to CVD1 years of market exclusivity in Europe

1. Regulatory Approval 2. Submission of Market Access & Reimbursement Dossiers 3. Scientific Evidence Assessm. / Recommendation 4. Reimbursement Price Negotiations 5. Country Launch Pricing announcement & Publication Austria* Denmark* England/Wales/Northern Ireland Finland France Germany** Italy Netherlands Norway Portugal Spain Sweden Switzerland Israel National reimbursement Individual reimbursement Continued Progress in Europe: Pricing & Reimbursement Decision and Launch Efforts *National reimbursement negotiation in process. **Initial GKV finding no benefit; arbitration process complete Amarin suspended VAZKEPA supply and German business operations LAUNCH UNDERWAY DECEMBER 2022 LAUNCH UNDERWAY Individual reimbursement National reimbursement

Note: The company is pursuing expansion into these various additional markets and the status of regulatory and/or patent approval will vary market to market. Plans to Bring Unique Cardioprotective Benefits of VASCEPA/VAZKEPA to 20 Additional Markets 1ST WAVE 2022 UP TO Supported by REDUCE-IT Study and U.S. FDA and EMA Filings International Growth Expansion Through Partnerships Represents Potential $1B Opportunity 5 COUNTRIES 9 COUNTRIES 6 COUNTRIES 2ND WAVE 2023 UP TO 3RD WAVE 2024 UP TO Hong Kong, Saudi Arabia, Bahrain, & Australia Achieved in November 2022; Additional markets pending including New Zealand

Continued Presence, Key Data Featured at Global Congresses OCT 27-30th NOV 5-7th NOV 6-9th AUG 26-29th

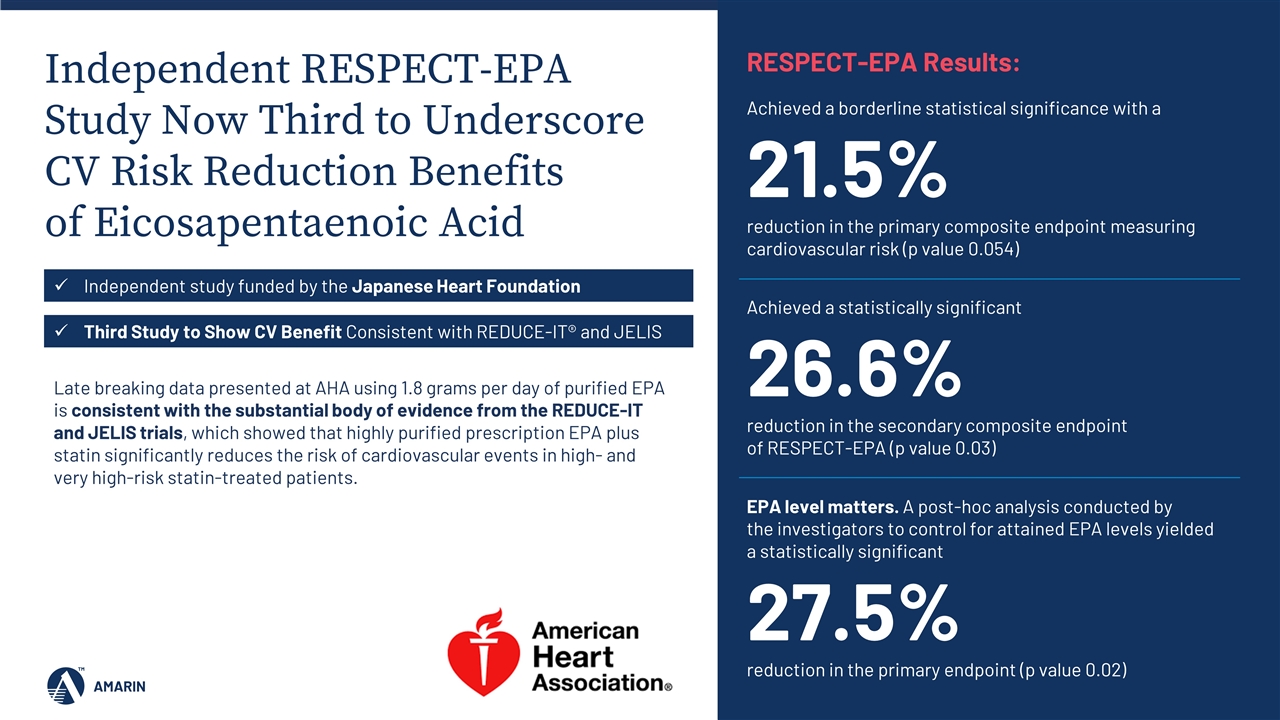

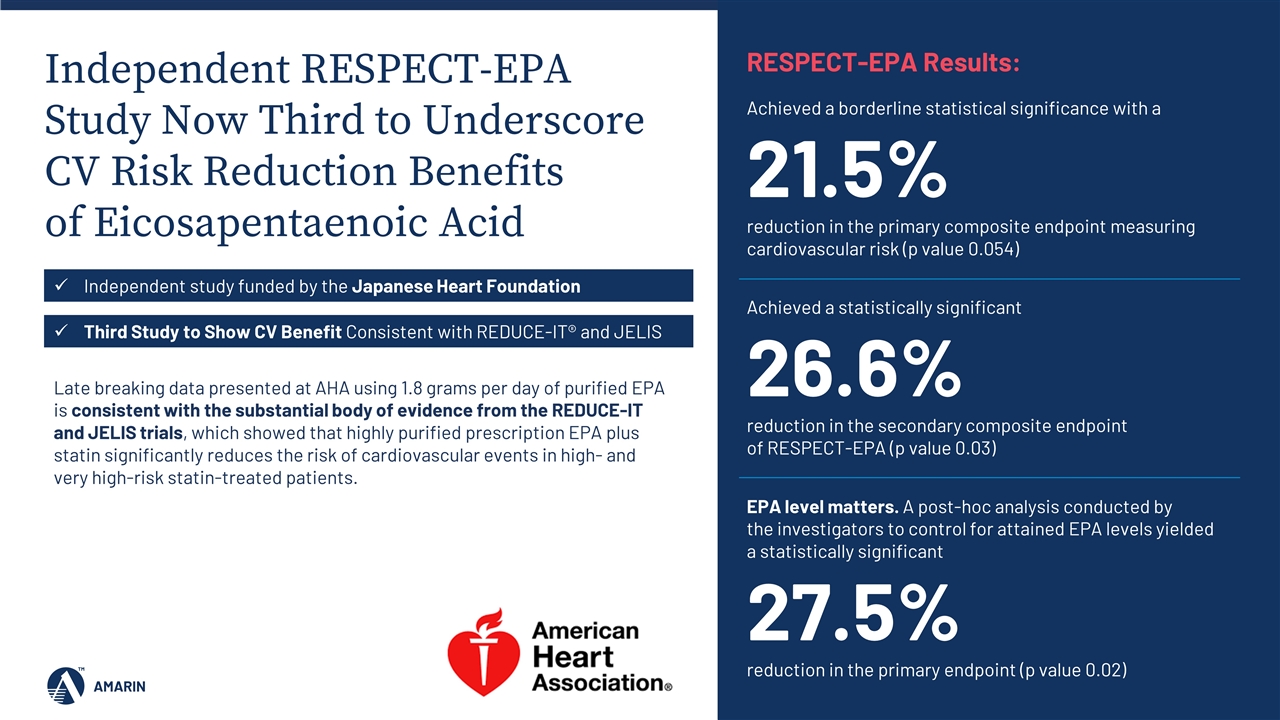

Independent RESPECT-EPA Study Now Third to Underscore CV Risk Reduction Benefits of Eicosapentaenoic Acid Late breaking data presented at AHA using 1.8 grams per day of purified EPA is consistent with the substantial body of evidence from the REDUCE-IT and JELIS trials, which showed that highly purified prescription EPA plus statin significantly reduces the risk of cardiovascular events in high- and very high-risk statin-treated patients. Independent study funded by the Japanese Heart Foundation Third Study to Show CV Benefit Consistent with REDUCE-IT® and JELIS Achieved a borderline statistical significance with a 21.5% reduction in the primary composite endpoint measuring cardiovascular risk (p value 0.054) RESPECT-EPA Results: Achieved a statistically significant 26.6% reduction in the secondary composite endpoint of RESPECT-EPA (p value 0.03) EPA level matters. A post-hoc analysis conducted by the investigators to control for attained EPA levels yielded a statistically significant 27.5% reduction in the primary endpoint (p value 0.02)

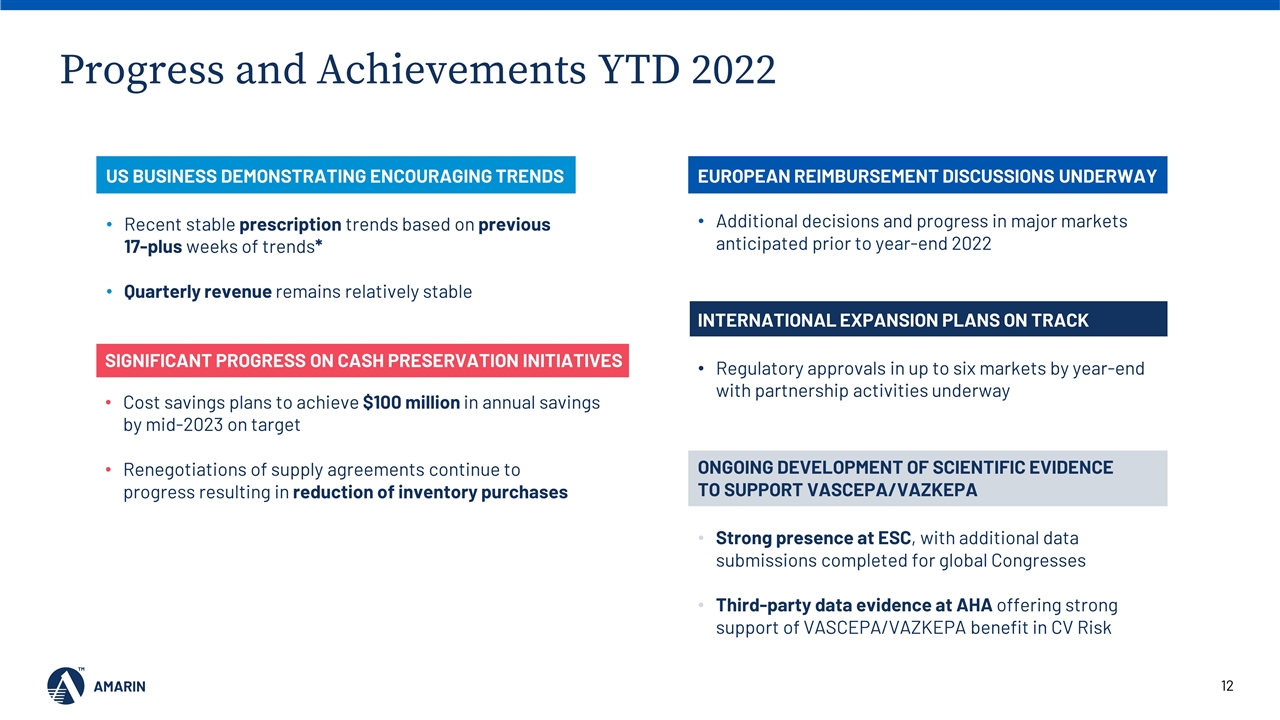

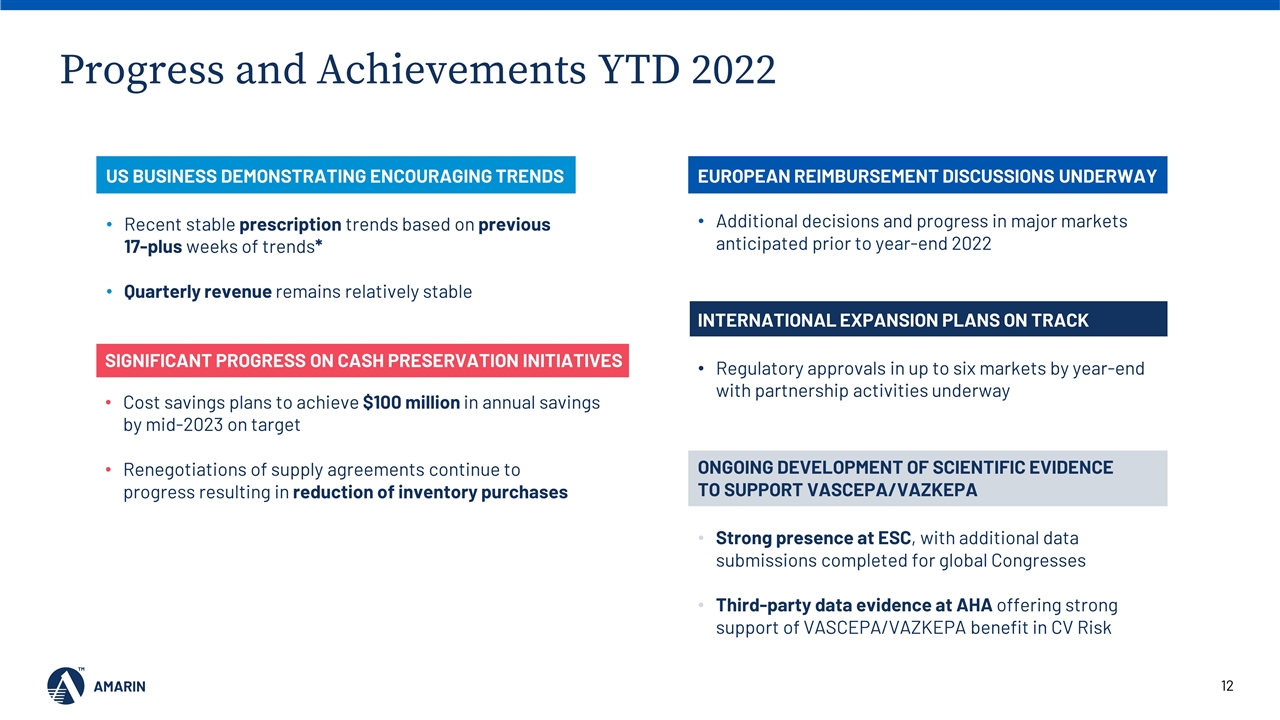

US BUSINESS DEMONSTRATING ENCOURAGING TRENDS Recent stable prescription trends based on previous 17-plus weeks of trends* Quarterly revenue remains relatively stable Progress and Achievements YTD 2022 SIGNIFICANT PROGRESS ON CASH PRESERVATION INITIATIVES Cost savings plans to achieve $100 million in annual savings by mid-2023 on target Renegotiations of supply agreements continue to progress resulting in reduction of inventory purchases EUROPEAN REIMBURSEMENT DISCUSSIONS UNDERWAY Additional decisions and progress in major markets anticipated prior to year-end 2022 INTERNATIONAL EXPANSION PLANS ON TRACK Regulatory approvals in up to six markets by year-end with partnership activities underway ONGOING DEVELOPMENT OF SCIENTIFIC EVIDENCE TO SUPPORT VASCEPA/VAZKEPA Strong presence at ESC, with additional data submissions completed for global Congresses Third-party data evidence at AHA offering strong support of VASCEPA/VAZKEPA benefit in CV Risk

Upcoming Drivers of Success OPERATIONAL TRENDS CONTINUE TO IMPROVE CASH POSITION Maintaining stabilization of U.S. Business Reduce operational spending as outlined in cost savings plan Completion of additional cash preservation initiatives to continue to reduce cash burn GLOBAL EXPANSION PLANS ON TRACK IN MAJOR MARKETS Successful VAZKEPA Commercialization start in the UK on 10/13/22 Potential pricing & reimbursement decisions in additional major EU markets (including Spain, Italy, Netherlands, France) Achieve international regulatory approvals in additional countries and further partnership activities GLOBAL FOCUS ON CONTINUING TO BUILD DATA EVIDENCE Continue to generate additional data evidence in support of VASCEPA/VAZKEPA globally Maintain active presence at medical meetings including upcoming AHA meeting in November

AMBITIONS for Leading a new paradigm in preventive cardiovascular care and growing our impact for patients globally AMARIN

Investor Presentation November 2022