CAUTION REGARDING FORWARD-LOOKING STATEMENTS

Dundee Corporation’s public communications may include written or oral forward-looking statements. Statements of this type are included in this annual information form (“AIF”) of the Company, and may be included in other filings with the Canadian and United States securities regulators, stock exchanges or in other communications. All such statements are made pursuant to the “safe harbour” provisions of applicable Canadian and U.S. Securities laws. Forward-looking statements may include, but are not limited to statements about anticipated future events or results including comments with respect to our objectives and priorities for 2010 and beyond, strategies or further actions with respect to the Company, its produc ts and services, business operations, financial performance and condition. Forward-looking statements are statements that are predictive in nature, depend upon or refer to future events or conditions or include words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates” or similar expressions concerning matters that are not historical facts. Such statements are based on current expectations of management of the Company and inherently involve numerous risks and uncertainties, known and unknown, including economic factors and those affecting the financial services industry generally. The forward-looking information contained in this AIF is presented for the purpose of assisting our shareholders in understanding our business and strategic priorities and objectives as at the periods indicated and may not be appropriate for other purposes. A number of risks, uncertainties and other factors may cause actual results to differ materially from the forward looking statements contained in this AIF, including, among others, those referenced in the Risk Factors section of this AIF on page 51 and in the section entitled “Managing Risk” in the Company’s Management’s Discussion and Analysis which section is incorporated by reference herein. These risks include: general economic and market conditions, our ability to execute our strategic plans and meet financial obligations, the performance of the Company’s principal subsidiaries and the Company’s ability to raise additional capital; our ability to create, attract and retain assets under management and assets under administrati on; risks relating to trading activities and investments; competition faced by the Company; regulation of the Company’s businesses; risks associated with the Company’s real estate and resources businesses and the Company’s investment holdings in general, including risks associated with oil and gas and mining exploration, development and processing activities, environmental risks, inflation, changes in interest rates, commodity prices and other financial exposures; the maintenance of minimum regulatory capital requirements for certain of the Company’s subsidiaries and the ability of the Company and its subsidiaries to attract and retain key personnel. The preceding list is not exhaustive of all possible risk factors that may influence actual results, and are identified based upon information available as of March 31, 2010. Assumptions about the future performance of the Canadian, U.S. and European economies were material factors considered by management when setting the Company’s priorities and objectives, and when determining our financial targets. In determining our expectations for economic growth in the financial services, real estate and resource sectors, we considered historical economic data provided by the Canadian government and its agencies and current market and general economic conditions. Forward-looking statements contained in this AIF are not guarantees of future performance and actual events and results could differ materially from those expressed or implied by forward-looking statements made by the Company. Prospective investors are cautioned to consider these and other factors carefully when making decisions with respect to the Company and not place undue reliance on forward-looking statements. As evidenced by the events of the past year, circumstances affecting the Company may change rapidly. Except as may be required by applicable law, the Company does not undertake any obligation to update publicly or revise any such forward-looking statements, whether as a result of new information, future events or otherwise. |

THE COMPANY

GENERAL

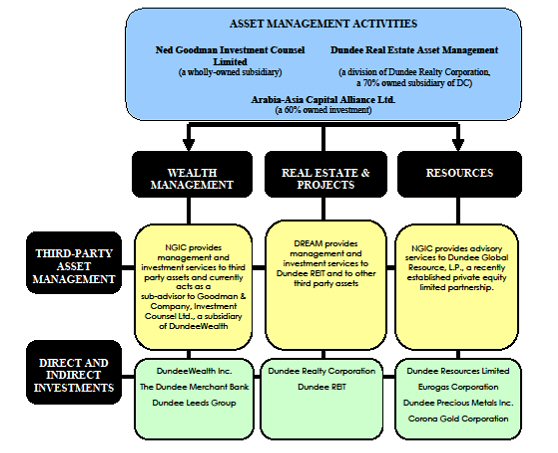

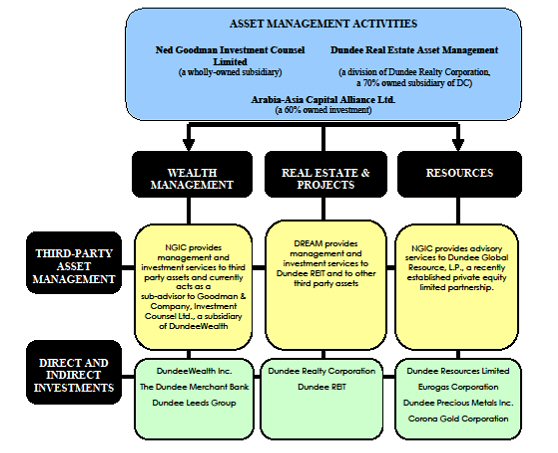

Dundee Corporation (the “Company” or “Dundee Corporation”) is an independent publicly-traded Canadian asset management company. The Company’s core focus is in the areas of wealth management, real estate and resources. Third-party asset management activities are carried out by Ned Goodman Investment Counsel Limited (“Ned Goodman Investment Counsel” or “NGIC”), formerly Ravensden Asset Management Inc., a registered portfolio manager in the province of Ontario, and by Dundee Real Estate Asset Management (“DREAM”), the asset management division of Dundee Realty Corporation (“Dundee Realty”), a subsidiary of the Company. Dundee Corporation also owns and manages its own direct investments in these core focus areas, through ownership of both p ublicly listed and private companies.

The Company’s investment in wealth management is conducted primarily through its subsidiary, DundeeWealth Inc. (“DundeeWealth”), as well as through operations carried out in Bermuda and in the Cayman Islands. These domestic and international wealth management operations provide a broad range of financial products and services to financial advisors, institutions, corporations and foundations.

Real estate operations are carried out through the Company’s investment in Dundee Realty, an owner and developer of residential and recreational properties in North America. Real estate operations also include an interest in Dundee Real Estate Investment Trust (“Dundee REIT”), a Canadian real estate investment trust.

Resource investments are managed through Dundee Resources Limited (“Dundee Resources”), a wholly-owned subsidiary of the Company. Resource activities also include our interest in Eurogas Corporation (“Eurogas”), a company involved in the development of a natural gas storage facility in Spain, as well as our interest in Eurogas International Inc. (“Eurogas International”), a company which carries out oil and gas exploration and development activities in Tunisia. The resources segment also includes certain portfolio holdings, including our interest in Dundee Precious Metals Inc. (“Dundee Precious”) and our interest in Breakwater Resources Ltd. (“Breakwater”).

The registered and head office of the Company is located at Dundee Place, 1 Adelaide Street East, 28th Floor, Toronto, Ontario, M5C 2V9. The Company is listed on The Toronto Stock Exchange (“TSX”) under the symbols (TSX – DC.A, DC.PR.A, DC.PR.B and DC.DB). As of February 28, 2010, the Company had 36 employees.

Unless otherwise indicated, the information appearing in this AIF is stated as of December 31, 2009 and all amounts are in Canadian dollars.

CORPORATE STRUCTURE

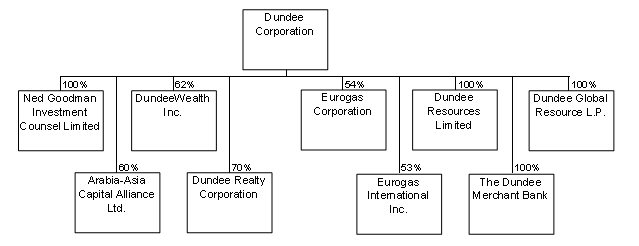

The following simplified corporate chart sets out the main subsidiaries of Dundee Corporation referenced in this AIF. The voting interest of Dundee Corporation in such subsidiaries reflects both the direct and indirect voting interest of the Company.

INCORPORATION AND ORGANIZATION

The Company was incorporated under the laws of the Province of Ontario by articles of incorporation effective November 2, 1984. The Company changed its name to Dundee Bancorp Inc. by articles of amendment effective July 26, 1991 and changed its name to its present form by articles of amendment effective December 14, 2004. The Company’s current share capital structure was created by articles of amendment effective October 10, 1991, October 24, 1991, October 29, 1991, March 17, 1993 and June 22, 2006. See “Description of Share Capital”. The stated capital of the Company was reduced by articles of amendment effective August 4, 1992. The Company was inactive prior to October 31, 1991, at which time it became a public company pursuant to articles of arrangement effecti ve October 30, 1991. The articles of amendment dated June 21, 2007 subdivided the Class A Subordinate Voting Shares (the Subordinate Voting Shares”) and the Class B Common Shares (the “Common Shares”) of the Company on a 3-for-1 basis, effective as of the close of business on July 6, 2007. On September 14, 2009, Articles of Amendment were filed authorizing a fifth series and sixth series of First Preference Shares, designated as first preference shares, series 2 and first preference shares, series 3, respectively. On January 1, 2010, in connection with an internal reorganization, Articles of Amalgamation were filed in connection with the amalgamation of Dundee Corporation with certain of its subsidiaries, 1255895 Ontario Limited, 1175885 Ontario Limited, DCC Equities Limited and Dundee Global Resource GP Inc. See “Description of Share Capital” below.

INTERCORPORATE RELATIONSHIPS

Principal Subsidiaries of the Company

The principal subsidiaries of the Company, the corresponding jurisdictions of incorporation and the Company’s percentage interest in such subsidiaries as of February 28, 2010 are set forth in the table below:

| Name | | Percentage Voting Interest held Directly or Indirectly by the Company | | Jurisdiction of Incorporation/ Formation |

| | | | | |

Dundee Capital Corporation (1) | | | 100 | % | Ontario |

Dundee Realty Corporation (2) | | | 70 | % | British Columbia |

DundeeWealth Inc. (3) | | | 62 | % | Ontario |

| | | | | | |

Notes:

| (1) | A number of investments of the Company are held through Dundee Capital Corporation. The Company holds 8,700 common shares of Dundee Capital Corporation. |

| (2) | The Company holds its interest in Dundee Realty directly and indirectly through 0764704 B.C. Ltd. The Company holds shares representing 70% of the votes of Dundee Realty, as well as various classes of preference shares. See “Business of the Company - Real Estate”. |

| (3) | The Company owns, directly and indirectly, 69,940,415 common shares of DundeeWealth and 5,453,668 first preference shares, series X of DundeeWealth. Dundee Corporation has voting control over 1,673,843 common shares of DundeeWealth that are held in escrow. All of the outstanding special shares, series C and special shares, series D of DundeeWealth are currently held in escrow and will be released from escrow and converted into common shares at a later date pursuant to regulatory requirements, initially on a one-for-one basis, subject to adjustment in certain circumstances. While the special shares, series C, and special shares, series D are held in escrow, they will be voted in the same manner as the shares of DundeeWealth held by the Company are voted at all meetings of the shareholders of the Company. Assuming the conversion of the first preference shares, series X, this represents a direct and indirect equity ownership of 49% and a direct and indirect or control over a 62% voting interest by the Company in DundeeWealth on a non-diluted basis. For additional principal subsidiaries of the Company that are principal subsidiaries of DundeeWealth, see “Intercorporate Relationships - Principal Subsidiaries of DundeeWealth”. |

Principal Subsidiaries of DundeeWealth

The Company’s most significant holding is its 49% direct and indirect equity ownership and 62% voting control of DundeeWealth. DundeeWealth carries on its business primarily through its wholly-owned subsidiary DWM Inc. (“DWM”) and through the operating subsidiaries of DWM. The following table sets forth the name and jurisdiction of incorporation of each of the principal subsidiaries of DundeeWealth and DWM as of February 28, 2010:

| Name | | Percentage Interest held Directly or Indirectly by DWM | | Jurisdiction of Incorporation/ Formation |

| | | | | |

Dundee Private Investors Inc. (1) | | | 100 | % | Ontario |

Dundee Securities Corporation (2) | | | 100 | % | Ontario |

Goodman & Company, Investment Counsel Ltd. (3) | | | 100 | % | Ontario |

| | | | | | |

Notes:

| (1) | Dundee Private Investors Inc. is a principal subsidiary of DundeeWealth. DPII Holding Corp., an Ontario company, owns 100% of the outstanding common shares of Dundee Private Investors Inc. DWM holds 100% of the shares of DPII Holding Corp. |

| (2) | Dundee Securities Corporation (“Dundee Securities”) is a principal subsidiary of DundeeWealth. DSC Holding Corp., an Ontario company, owns 100% of the outstanding shares of Dundee Securities. DWM holds 100% of the shares of DSC Holding Corp. |

| (3) | Goodman and Company, Investment Counsel Ltd. (“GCICL”) is a principal subsidiary of DundeeWealth. DMFL Holding Corp., an Ontario company, owns 100% of the outstanding shares of GCICL. DWM holds 100% of the shares of DMFL Holding Corp. |

DEVELOPMENT OF THE BUSINESS

The following is a summary of developments in each of the Company’s areas of business and in the Company’s corporate and other activities.

Ned Goodman Investment Counsel Limited

In February, 2010, the name of the Company’s registered portfolio manager was changed from Ravensden Asset Management Inc. to Ned Goodman Investment Counsel Limited, in order to better reflect the direct involvement of Ned Goodman as the President, Chief Executive Officer, and lead portfolio manager of NGIC. NGIC was acquired by the Company in 2008 and provides investment advice directly and in a sub-advisory role to institutional and individual clients and investment funds. NGIC has entered into a sub-advisory agreement with GCICL pursuant to which NGIC acts as a sub-advisor for certain funds managed by GCICL, including Canada Dominion Resources Limited Partnership, CMP Resource Limited Partnership, DMP Resource Class and CMP Gold Trust. In 2009, Ned Goodman Investment Counsel earned revenues of $7.7 millio n, including performance fee revenues of $4.8 million. See “Relationship Between the Company and Certain Related Parties – Ned Goodman Investment Counsel Sub-Advisory Agreement” below.

Dundee Corporation Offering Of Rate Reset Preference Shares, Series 2

On September 15, 2009 the Company announced that it had completed an offering of 4,600,000 Cumulative 5-Year Rate Reset First Preference Shares, Series 2 (“Series 2 Shares”) at a purchase price of $25.00 per Series 2 Share, for aggregate gross proceeds of $115,000,000. The Series 2 Shares are listed on the TSX under the symbol DC.PR.B

On September 21, 2009 the Company issued an additional 600,000 Series 2 Shares at a purchase price of $25.00 per share pursuant to the exercise of the over allotment option granted to the underwriters, for aggregate gross proceeds of $15,000,000. A portion of the proceeds of the offering were applied to the repayment in full of the Company’s credit facility. See “Corporate Transactions – Dundee Corporation Offering of Rate Reset Preference Shares, Series 2” below.

Dundee Corporation Credit Facility Renewal

In November, 2009, the Company renewed its revolving term credit facility with a Canadian chartered bank. The renewed facility in the amount of $200,000,000 expires on November 9, 2010. The renewed facility was further amended effective February 23, 2010 reflecting a reduction in fees, and outstanding amounts now bear interest, at the Company’s option, at a rate per annum equal to either the bank’s prime lending rate for loans plus 1.25% or, for bankers’ acceptances, at the bank’s then prevailing bankers’ acceptance rate plus 2.25%. The Company is subject to a standby fee of 0.7875% on unused amounts under the facility. See “Corporate Transactions - Credit Facility” below.

Dundee Global Resource L.P.

Dundee Global Resource L.P. (“Dundee Global Resource LP") is a limited partnership organized under the laws of the Cayman Islands. The general partner of the Dundee Global Resource LP is Dundee Global Resource GP Ltd. (the "General Partner"), a Cayman Islands corporation and a wholly-owned subsidiary of Dundee Corporation.

The Dundee Global Resource LP has been formed for the primary purpose of investing in equity or near-equity investments in private and public resource companies that offer the potential for significant capital appreciation. Dundee Corporation has committed to invest $200 million in limited partnership units of the Dundee Global Resource LP.

The General Partner will retain NGIC to provide sub-advisory management services to the General Partner and, together with Dundee Resources, provide technical expertise, advice and due diligence services to assist the General Partner with the review, selection and management of investment opportunities.

Investment in African Minerals

African Minerals Limited (“African Minerals”) is a mineral exploration and development company with significant iron ore and base metal interests in Sierra Leone, West Africa. In 2009, the Company acquired 4,000,000 common shares of African Minerals. Subsequent to 2009, the Company acquired a further 1,600,000 common shares and, as of February 28, 2010, held a 2.4% ownership interest in African Minerals. Two million shares of African Minerals have been allocated by the Company to the Dundee Global Resource LP as a prepayment of the Company’s $200 million commitment.

Establishment of Arabia-Asia Capital Alliance Ltd.

In March 2010, Arabia-Asia Capital Alliance Ltd., a 60% subsidiary of Dundee Corporation, was incorporated under the laws of the Dubai International Financial Centre and has recived preliminary approval from the Dubai Financial Services Authority to arrange for asset gathering for the Company and others in the Middle East and North Africa (MENA) region.

China Initiative

In 2009, the Company continued work on its China initiative, and has aligned with the CITIC Merchant group of Hong Kong in connection with its proposal to establish a Hong Kong based global resource fund aimed at raising $300 million for resource based investments.

DundeeWealth Highlights

At December 31, 2009, assets under management at DundeeWealth were $36.1 billion, a 42% growth year over year and represented an all time high for the Company’s wealth management subsidiary. The considerable growth in assets under management is a result of industry-leading asset gathering of $2.6 billion, combined with market appreciation of $7.5 billion. DundeeWealth’s market share increased to 3.76% from 3.03% at the end of 2008 as reported by the Investment Funds Institute of Canada.

DundeeWealth earned EBITDA of $184.7 million and net earnings of $51.6 million in 2009. DundeeWealth’s results include performance fee revenues earned during 2009 of $21.7 million, net of third party allocations and costs. Having repaid all bank debt subsequent to completion of its $200 million debt issuance, DundeeWealth enters 2010 with $400 million in cash, cash equivalents and marketable securities.

Changes to DundeeWealth Dividend Policy

In August 2009, DundeeWealth amended its dividend policy affecting common shares and special shares whereby 25% of DundeeWealth’s after tax net earnings related to performance fees in a given calendar year will be paid out as a special dividend in the following year. This special dividend is in addition to DundeeWealth’s regular quarterly dividend per common share and special share. In January 2010, DundeeWealth announced that the first such special dividend, in the amount of $0.025 per common share and special share, is payable on April 1, 2010.

In addition, in August 2009, DundeeWealth increased its regular quarterly dividend payments on common shares and special shares from $0.02 to $0.035 per share commencing with the dividend paid on October 1, 2009 and, in March 2010, further increased its regular quarterly dividend payments on common shares and special shares from $0.035 to $0.070 per share commencing with the dividend payable on April 15, 2010.

Integration and Realignment of DundeeWealth

DundeeWealth has embarked upon an enterprise-wide integration and realignment initiative. The goal of this initiative has been to support the rebranding of its diverse range of financial products and services under “DundeeWealth” and to capitalize on its position as an independent provider of wealth management solutions in an increasingly consolidated industry. DundeeWealth has completed the integration of its operating divisions creating a more efficient and unified DundeeWealth, and achieved significant annualized cost savings since the start of this initiative.

Issuance by DundeeWealth of $200 Million Series 1 Notes

In September 2009, DundeeWealth completed an offering of $200 million aggregate principal amount of Series 1 Notes (the “Series 1 Notes”). The Series 1 Notes bear interest at 5.10% per annum, payable semi-annually on March 25th and September 25th of each year, beginning on March 25, 2010.

The Series 1 Notes are unsecured obligations of DundeeWealth and rank equally with all other unsecured and unsubordinated indebtedness and obligations of DundeeWealth. Certain subsidiaries of DundeeWealth have fully and unconditionally guaranteed, on a joint and several basis, the repayment of principal and interest on the Series 1 Notes. The Series 1 Notes are redeemable, at DundeeWealth’s option. A portion of the proceeds from the offering of the Series 1 Notes were used to fully repay amounts owing under the DundeeWealth credit facility. The balance of the proceeds is being used for general corporate purposes.

Industry Awards

DundeeWealth’s investment management and capital markets divisions were both recognized by industry organizations for their achievements and efforts during 2009. Dynamic Funds earned top prizes at the annual Lipper Fund Awards 2009 Canada where it received 11 “Fund of the Year” awards and where three Dynamic Funds were recognized as being the best in their respective fund categories. In addition, GCICL was recognized as the Analyst’s Choice Investment Fund Company of the Year at the 2009 Canadian Investment Awards. Dundee Securities earned seven awards at the 2009 StarMine Analyst Awards, including four first place Stock Pickers awards and a first place Earnings Estimators award, putting it among the top ten most award-winning brokers in 2009.

Restructuring and Sale of Asset Backed Commercial Paper Investments

On January 12, 2009, the Ontario Superior Court of Justice granted the Amended Plan Implementation Order filed by the Pan-Canadian Investors Committee for third-party structured ABCP under the Companies’ Creditors Arrangement Act for restructuring of asset backed commercial paper (the “ABCP”). The restructuring was completed on January 21, 2009, at which time DundeeWealth exchanged the ABCP it held for floating rate notes (“FRNs”), designed to match the maturities of the underlying assets (the “ABCP Restructuring”). Under the ABCP Restructuring, approximately 71% of DundeeWealth’s original investment in ABCP was replaced with senior Class A-1 and Class A-2 FRNs and approximately 8% of its original investment in ABCP was replaced wit h subordinated Class B and Class C FRNs. Assets having uncertain credit quality were restructured on an individual transaction-by-transaction basis and DundeeWealth received FRNs for these assets, which represented approximately 19% of the original investment. DundeeWealth had no recourse to recover the remaining 2% of its ABCP.

In December 2009, DundeeWealth completed the sale of the Class A-1 and Class A-2 FRNs for net proceeds of approximately $139.5 million.

Investment in CNSX Markets Inc.

In September 2009, DundeeWealth made an investment in CNSX Markets Inc. (“CNSX Markets”), a privately held Canadian company that operates two markets, The Canadian National Stock Exchange and Pure Trading. The investment in CNSX Markets is in line with the corporate finance and trading initiatives of DundeeWealth’s capital markets division.

Product Development and Advisor Relations Initiatives

In 2009, DundeeWealth continued to develop innovative investment products and implemented strategic changes to existing investment solutions through its investment management division, including the launch of:

| · | Dynamic Strategic Yield Fund and Dynamic Strategic Yield Class; |

| · | Dynamic Strategic Gold Class; |

| · | Dynamic Real Estate & Infrastructure Income Fund; |

| · | Dynamic Charitable Giving Fund, a donor-advised giving program that combines tax benefits with investment management; |

| · | Dynamic Aurion Canadian Equity Class and Dynamic Aurion Tactical Balanced Class; |

| · | CMP 2009 Resource Limited Partnership, CMP 2009 II and Canada Dominion Resources 2009 Limited Partnership; and |

| · | Six new pooled investment funds available exclusively through Goodman Private Wealth Management, DundeeWealth’s private wealth management division. |

In 2009, DundeeWealth introduced Snapshots™, an online resource centre designed to assist advisors in delivering customized, specialized and value-added service and advice to clients at different life events such as parenthood, divorce, death of a loved one and caring for an ailing parent. Winner of the Investor and Advisor Education Canadian Investment Awards, Snapshots has been recognized for its ability to deepen relationships, facilitate dialogue and build trust and confidence with clients.

Additionally, DundeeWealth recently launched the Dynamic Short Term Bond Fund and completed the strategic mergers of the diversiFund closed-end investment funds into certain Dynamic mutual funds.

Dundee Realty Highlights

Dundee Realty’s performance in 2009 exceeded expectations and budgets developed at the end of the prior year. Propelled by strong buyer demand, housing and condominium activities outperformed levels originally anticipated and land sales in western Canada continue to show substantial growth. Contributions generated by the Company’s real estate subsidiary exceeded $60 million in 2009. Dundee Realty continues to prudently manage its capital, paying down its operating line debt from its peak of $103.9 million to $75.4 million, along with a further $77.9 million reduction in other debt at December 31, 2009.

In 2009, Dundee Realty, through its 20% interest in the Firelight Infrastructure Fund, invested $18.8 million in the Dalhousie windmill project in Nova Scotia. Construction was completed in December 2009 and commercial operations will commence in 2010 upon completion of testing and certification.

Subsequent to year end, Dundee Realty entered into an agreement to acquire an interest in the historic King Edward Hotel in downtown Toronto. Dundee Realty will act as the developer on the conversion of certain vacant space into condominiums.

Dundee REIT

Dundee REIT raised approximately $174 million in equity financings completed in September, 2009 and January, 2010. In March 2010, Dundee REIT completed an additional public offering of units for proceeds of $115 million. See “Business of the Company – Real Estate” below.

Dundee Precious

Dundee Precious recently completed a 20,000,000 common share bought deal equity financing at a price of $3.30 per common pursuant to which the Company acquired, upon TSX approval, an aggregate of 8,881,200 common shares. As a result of its participation in the financing, the Company increased its ownership interest in Dundee Precious to approximately a 24.1%. See “Business of the Company – Resources – Dundee Precious Metals” below.

BUSINESS STRATEGY

Dundee Corporation’s strategy is to shelter its valuation from future global inflation by managing high quality assets and businesses that demonstrate multi-opportunities to achieve sustained growth in core sectors and high returns on invested capital while increasing asset management fee revenues over the long term. The Company intends to continue to achieve growth and return through cash flows and value created, by acquiring direct ownership, as well as fiduciary, positions in assets, and by expanding its assets under management in core sectors, with a particular focus on managing third-party assets.

While Dundee Corporation has historically focused its efforts in North America, primarily in the areas of retail and high net worth clients, the Company has expanded its focus to include geographic regions beyond North America in order to access a broader range of investment partners, thereby increasing its access to capital, and non-retail and institutional clients.

The Company’s expansion of its management of third-party assets will be primarily conducted through its wholly-owned subsidiary NGIC (formerly, Ravensden Asset Management Inc.), and Dundee Real Estate Asset Management, the real estate asset management division of the Company’s subsidiary, Dundee Realty Corporation.

The Company’s expansion initiatives include the establishment of Arabia-Asia Capital Alliance Ltd., a 60% owned subsidiary of the Company incorporated in the Emirate of Dubai, as a registrant in the Emirate of Dubai to access capital in the Middle East and North Africa (MENA) region. The Company has also initiated the formation of Dundee Global Resource LP, which will focus on global equity and debt investments in both private and public resource companies. The Company has committed to invest $200 million of its own funds in limited partnership units. NGIC is being retained to provide sub-advisory management services to the general partner of Dundee Global Resource LP and to provide technical expertise, advice and due diligence services to assist the general partner with the review, selection and management of investment opportunities. In addition, DREAM is pursuing potential real estate investment opportunities in Canadian assets with foreign and Canadian investors and is designing products to support renewable energy infrastructure development.

As an independent Canadian asset management company with an established reputation and relationships in the core sectors, Dundee Corporation believes that it is well positioned to capitalize on its expertise to drive asset gathering activities, and thereby create long term value for the Company’s shareholders.

BUSINESS OF THE COMPANY

ASSET MANAGEMENT

As an asset manager, we raise, invest and manage capital on behalf of ourselves and our co-investors, and develop and maintain operating platforms that enable us to effectively manage these assets and enhance their values over time. In line with the Company’s business strategy, management directed significant effort in 2009 towards expanding this segment of our operations, primarily through the activities of NGIC and DREAM, and with the technical support of industry professionals at Dundee Realty, Dundee Resources and DundeeWealth. The Company also owns and continues to take direct interests in these types of assets. We believe that this strategy builds upon our existing operating platforms and expertise, enabling us to pursue a broader range of opportunities, resulting in higher returns on invested capital. ;In particular, our operating platforms provide us with the opportunity to seed funds with assets that we have owned and/ or operated for many years, and which represent attractive investment opportunities for our co-investors, both domestic and international.

The Company’s asset management activities include the management of assets, both domestic and international, consisting of:

| (1) | physical assets, primarily resource, real estate and infrastructure assets that are owned or co-owned within our core operating entities and managed on behalf of the Company and its co-investors; and |

| (2) | securities, which include significant positions in companies engaged in resource and real estate activities, and represent investments in physical assets such as those described above. Such securities are held on behalf of ourselves and our clients and are managed by dedicated teams of investment professionals within the Dundee group of companies. |

At December 31, 2009, Ned Goodman Investment Counsel provided sub-advisory and investment services to approximately 3.1 billion of AUM. Ned Goodman Investment Counsel is also working towards our initiative to raise up to $1 billion for private equity investment in the resource sector through Dundee Global Resource LP.

At December 31, 2009, DREAM, the asset management arm of Dundee Realty, managed assets of $3.3 billion. DREAM is aggressively pursuing opportunities offered by foreign investors for Canadian assets and is also designing products supporting infrastructure development, potentially through asset management arrangements.

A description of the Company’s operations in its core sectors follows. In addition to the information provided about the Company’s operations in this Annual Information Form, subsidiaries and investee companies of Dundee Corporation which are reporting issuers have filed public disclosure documents containing detailed information specific to their respective operations. Copies of these documents may be obtained on SEDAR at www.sedar.com.

WEALTH MANAGEMENT

The Company’s wealth management activities are carried out primarily by DundeeWealth, with international wealth management activities also being conducted by The Dundee Merchant Bank and Dundee Leeds through offices in Bermuda and the Cayman Islands. Our wealth management segment also includes certain of the activities undertaken by the Company’s wholly-owned subsidiary, NGIC which is registered as a Portfolio Manager in the province of Ontario.

DundeeWealth was created by the Company in 1998 and became a public company in 1999. DundeeWealth is a Canadian owned, diversified wealth management company that creates innovative asset management products and provides investment solution. In addition, DundeeWealth provides capital markets and advisory services to individuals, advisors, institutions, corporations and foundations and provides retail banking products through advisors.

In 2009, DundeeWealth focussed on the previously announced integration and re-alignment of its operations to support its core business activities: (1) investment management; (2) the development, production and distribution of investment products; (3) the provision of advisory services to institutional and retail clients; and (4) capital markets.

As of February 28, 2010, DundeeWealth had approximately $69.9 billion in fee earning assets. DundeeWealth carries on its business principally through its wholly-owned subsidiary DWM, and through the operating subsidiaries of DWM.

DundeeWealth’s investment management business consists of creating, managing, packaging and administering investment portfolios and providing internal and third-party management and advisory services. Revenues are derived primarily from management and performance fees charged for the management of investment products (including mutual funds, pooled funds and closed-end funds, third-party assets, tax-assisted investment products and private and institutional client accounts) and, accordingly, are primarily influenced by assets under management.

Investment Products and Services

DundeeWealth has responded to changing investor needs and attitudes by introducing investment products and services in addition to traditional mutual funds, including private client accounts, portfolio solutions, tax-assisted investment products, closed-end investment products and alternative investment

products. DundeeWealth, through its subsidiaries has created and is managing and administering, among others, the following investment products and services:

| · | Mutual Funds, including Dynamic Funds®, are publicly offered mutual funds that cover a broad range of asset classes (equity, fixed income, balanced, specialty), investment disciplines (value, growth, focus) and geographic focuses (Canadian, U.S., European, International). |

| · | Managed Asset Accounts consist of the institutional assets managed by DundeeWealth through Aurion Capital Management Inc. (“Aurion”) and GCICL. |

| · | Portfolio Solutions allow investors to invest in a specific portfolio of investments designed to achieve strategic asset allocation with multi-layered diversification and enhanced quarterly investor reporting, including Dynamic Strategic Portfolios®, DynamicEdge Portfolios® and Marquis Investment Program®. |

| · | Private Client Accounts consist of high net worth client accounts which are managed on a segregated, discretionary basis through Goodman Private Wealth Management, a division of GCICL. In addition, the following pooled investment funds are available exclusively through Goodman Private Wealth Management: Goodman Private Diversified Bond Pool™, Goodman Private Core Equity Pool™, Goodman & Company Canadian Value Strategy™, Goodman & Company, Equity Income Strategy™, Goodman & Company, Global Value Strategy™ and Goodman & Company Growth Strategy™. |

| · | Alternative Investment Products permit investors to diversify into varying investment strategies, such as short-selling, swaps and leveraging, and include a number of privately offered pooled and hedge funds such as Dynamic Alpha Performance Fund®, Dynamic Alternative Opportunities Fund™, Dynamic Contrarian Fund®, Dynamic Focus+ Alternative Fund™, Dynamic Income Opportunities Fund®, Dynamic Power Emerging Markets Fund™, Dynamic Power Hedge Fund™ and Dynamic Strategic Value Fund™. |

| · | Tax-assisted Investment Products allow investors to participate in tax-assisted investments which facilitate the allocation and utilization of income tax deductible expenses by the investors, including the flow-through limited partnerships of CMP® and Canada Dominion Resources™ which invest in a diversified portfolio of flow-through shares of resource companies. |

| · | Closed-end Funds, the securities of which are traded on an exchange, are designed to invest in one or more sectors and asset categories, including CMP Gold Trust® and DPF India Opportunities Fund®. |

DundeeWealth continually evaluates its investment products as well as investor needs in order to ensure that the investment products and solutions it offers remain competitive.

Investment Management and Advisory Services

The following investment management and advisory services are provided through DundeeWealth:

| · | GCICL, a registered portfolio manager in Ontario and in certain other jurisdictions in Canada and registered commodity trading manager in Ontario, is comprised of 15 portfolio managers and several analysts, provides investment management services in respect of managed investment products as well as certain third-party investment products. GCICL follows various investment strategies as detailed in public disclosure documents filed on SEDAR in respect of each fund. |

| · | Goodman Private Wealth Management, a division of GCICL, manages and services high net worth private client investment accounts, including accounts of individuals, taxable foundations, estates, institutions and personal trusts through comprehensive, personalized investment advice. |

| · | DundeeWealth S.A.®, a wholly-owned indirect subsidiary of GCICL, is a Luxembourg based management company that offers UCITS III investment funds to retail and institutional European investors. DundeeWealth S.A. is the distributor of the Dynamic Investment Fund, a Société d'Investissement à Capital Variable, which is an open-ended investment fund offering six sub-fund categories to institutional investors in European member states and is registered for retail sales in Luxembourg, the United Kingdom and France. GCICL is the manager of the Dynamic Investment Fund. |

| · | Aurion, a majority owned subsidiary of DundeeWealth and an affiliate of GCICL, is a registered portfolio manager and exempt market dealer in certain jurisdictions in Canada, including Ontario, that provides investment counselling services to a primarily institutional client base specializing in Canadian equities, fixed income (core and corporate portfolios), real estate, foreign equities and alternatives. |

| · | DundeeWealth US L.P., (“DundeeWealth US”) a majority owned limited partnership of DundeeWealth and an affiliate of GCICL, is a U.S.-based investment advisor registered with the U.S. Securities and Exchange Commission that focuses on product development, sales and marketing activities, providing investment solutions for U.S. investors. Currently, six Dynamic Funds are offered on the DundeeWealth US platform. |

| · | Goodman & Company, N.Y. Ltd., (“Goodman & Company US”) a wholly-owned subsidiary of GCICL, is a registered investment advisor with the U.S. Securities and Exchange Commission that provides investment advisory and investment management services to investors in the United States. Such investors include high net worth and institutional clients, personal holding corporations, estates, investment funds and trusts. |

Management of Dynamic Funds, Portfolio Solutions and Other Investment Solutions

GCICL’s core business activity is to: (i) manage, or arrange for the management of, and market investment portfolios; (ii) manage the overall business of the funds, including providing fund accounting and administration services and promoting the sales of the securities of the funds managed by GCICL; (iii) distribute the securities of the funds to the public through authorized distributors and dealers; (iv) carry out research and select investment opportunities for the funds; and (v) record the owners of securities of the funds, except where the transfer agency and registrar services are provided by Computershare Investor Services Inc., transfer redemption orders and issue investor account statements and annual tax reporting information for the funds. A substantial portion of the revenues of DundeeWealth’s investment manage ment business is derived from the services provided by GCICL to the funds.

Pursuant to a management agreement with each of the Dynamic Funds, the Portfolio Solutions and the Other Investment Solutions, each investment product pays a monthly or quarterly management fee to GCICL for management and distribution services provided to it by GCICL based on a specified percentage of the net asset value of the applicable fund. Such management fees are comparable to the management fees charged by GCICL’s competitors within the investment fund industry and can range from 0.25% to a maximum of 3.0% per annum of the net asset value of the applicable fund. The net asset value of a fund depends primarily on the market value of its portfolio investments. In addition, certain Dynamic Funds and Other Investment Solutions pay a performance fee to GCICL when such funds outperform applicable benchmarks. The performance fees payable by the Dynamic Funds, other than the Dynamic pooled or hedge funds, can range from 1% to a maximum of 3% of the net asset value of the fund. For certain Other Investment Solutions and Dynamic hedge funds, the performance fee can be up to 20% of the amount by which the fund’s performance exceeds its applicable benchmark. Management fees and performance fees may be increased only with the prior approval of security holders of the applicable funds. References in this paragraph to “Other Investment Solutions” do not include private client accounts managed by GCICL.

Pursuant to the management agreements in respect of the institutional accounts and investment products managed by Aurion, each of these portfolios pays a monthly or quarterly management fee to Aurion for its investment counselling services. These management fees can range from 0.10% to 2.0% per annum on the net asset value of the applicable portfolio. In addition, Aurion may receive a performance fee up to 20% in respect of certain portfolios if certain performance fee criteria are met.

In general, each investment fund managed by GCICL is responsible for its own administrative and operating expenses including, without limitation, audit and legal fees, registry and transfer agency fees, custodian fees, portfolio and investment costs, expenses of communication with security holders, all costs imposed by statute or regulation, and applicable taxes. From time to time, however, GCICL may absorb a portion of these expenses.

All of the management agreements between GCICL and the investment funds it manages have an indefinite term or have a defined term and automatically renew at the end of that defined term, except for the management agreements for the limited partnerships of CMP and Canada Dominion Resources which automatically terminate as disclosed in the publicly filed disclosure documents for the limited partnerships upon the effective date of the transfer of assets of the limited partnerships to Dynamic Managed Portfolios Ltd., a mutual fund corporation managed by GCICL. The management agreements between GCICL and the investment funds are terminable upon security holder approval and may be otherwise terminated in accordance with the terms of the agreements.

Certain Dynamic Funds, Portfolio Solutions and Other Investment Solutions are subject to investment sub-advisory agreements pursuant to which outside investment advisory firms have been retained to provide advice relating to all or a portion of the investment portfolios. These investment advisory firms receive a fee based on a percentage of the net asset value of the portion of the fund or account to which such firm provides advice and may receive a percentage of the performance fee earned, where applicable. These fees are paid to the investment advisory firms by GCICL from the compensation that GCICL receives as manager of the applicable funds or accounts. Pursuant to these agreements, the investment advisory firms may be terminated generally on 30 to 90 days’ notice and, in certain circumstances , upon payment to the advisory firm of a termination fee should the sub-advisory agreement be terminated prior to a specified date. Similarly, GCICL manages certain investment portfolios for third parties pursuant to investment sub-advisory agreements with such third parties. Pursuant to these agreements, GCICL’s investment sub-advisory services may be terminated generally on 60 to 90 days’ notice.

Ned Goodman Investment Counsel (formerly, Ravensden Asset Management Inc.), a wholly-owned subsidiary of the Company, and an affiliate of GCICL, is a registered portfolio manager in Ontario that provides investment advice directly and in a sub-advisory role to institutional and individual clients and investment funds. Mr. Ned Goodman, President and Chief Executive Officer of the Company, is the President and Chief Executive Officer and a portfolio manager of NGIC. Pursuant to the sub-advisory agreement between GCICL and NGIC, NGIC acts as a sub-advisor for certain funds managed by GCICL. The sub-advisory agreement is terminable by either GCICL or NGIC upon not less than one year prior written notice to the other. The sub-advisory agreement may also be terminated in respect of the funds manage d by GCICL upon 30 days’ prior written notice to NGIC in the event that Mr. Ned Goodman ceases to be the responsible portfolio manager under the sub-advisory agreement.

GCICL and Aurion have entered into a sub-advisory agreement dated January 14, 2009 pursuant to which Aurion acts as sub-advisor for certain funds managed by GCICL. These funds include Dynamic Aurion Canadian Equity Class and Dynamic Aurion Tactical Balanced Class. The sub-advisory agreement is terminable by either party upon not less than 90 days written notice to the other party or immediately by GCICL upon the occurrence of certain events, including upon the bankruptcy or insolvency of Aurion.

GCICL, DundeeWealth S.A. and Dynamic Investment Fund™ have entered into an investment management agreement dated April 10, 2008 pursuant to which GCICL acts as investment manager for Dynamic Investment Fund and its six sub-funds, which are Dynamic Precious Metals Sub-Fund™,

Dynamic Power Canadian Growth Sub-Fund™, Dynamic Power American Growth Sub-Fund™, Dynamic Global Dividend Sub-Fund™, Dynamic Global Discovery Sub-Fund™ and Dynamic Focus+ Resource Sub-Fund™. The investment management agreement is generally terminable by any party upon not less than 90 days written notice to the other parties. The agreement may also be terminated by any party upon not less than 30 days written notice to the other parties in the event of a breach of the agreement by a party, unless the breach has been cured. In addition, DundeeWealth S.A. may terminate the investment management agreement immediately when it is in the interests of the investors of Dynamic Investment Fund to do so.

Goodman & Company US and DundeeWealth US have entered into an investment advisory arrangement pursuant to which Goodman & Company US provides investment advisory and other services for certain funds distributed in the U.S. The investment advisory agreement is terminable by either party upon not less than 60 days written notice to the other party. The agreement may also be terminated by either a majority of the independent board of trustees of the fund or by a majority of the fund’s unitholders upon not less than 60 days’ written notice to Goodman & Company US and DundeeWealth US.

Distribution of Dynamic Funds, Portfolio Solutions and Other Investment Solutions

DundeeWealth’s investment management business employs a multi-channel strategy designed to achieve a broad distribution of Dynamic Funds, Portfolio Solutions and Other Investment Solutions. Dynamic Funds, Portfolio Solutions and Other Investment Solutions are distributed through approximately 33,500 financial advisors located across Canada and, in respect of closed-end investment products, investment dealer syndicates.

Dynamic Funds and Portfolio Solutions are generally offered for sale on a continuous basis. Investors may choose to purchase securities of these funds under a deferred sales charge method or under an initial sales charge method. In general, if the investor purchases under the deferred sales charge method, no initial commission is paid by the investor, the entire investment is invested in securities and, upon redemption within a specified period of the purchase, a redemption fee calculated as a percentage of the redemption proceeds is deducted by GCICL from the redemption proceeds. Generally, Dynamic Funds and Portfolio Solutions may be purchased under: (i) a regular deferred sales charge schedule in which the percentage representing the sales charge incurred on redemption decreases over a six-year perio d from 6% in the first year to nil after the sixth year; or (ii) a shorter schedule (“low load”) in which the percentage representing the sales charge incurred on redemption decreases over generally a three-year period from 3% during the first 18 months to 2% between 18 and 36 months (and nil thereafter). Generally, for investments made on a regular deferred sales charge basis, GCICL pays the investor’s dealer a sales commission of up to 5% of the total monies invested in a fund. For investments made on a low load redemption schedule basis, GCICL generally pays the investor’s dealer a 3% commission on the total monies invested in a fund. GCICL currently finances deferred sales charge commissions using internal cash resources although GCICL has used external financing mechanisms in the past.

If the investor purchases securities of a fund under the initial sales charge method, a sales commission is paid at the time of purchase and no commission, fees or other charges are charged at the time of redemption (other than a short term trading fee where applicable). Such front-end commissions are negotiated between the investors and their financial advisor.

GCICL pays trailer service fees to assist dealers in providing ongoing services to client accounts. These fees are payable in respect of the total client assets in qualifying funds serviced by these financial advisory firms. Payment is made either monthly or quarterly and is equal to a percentage of the total client assets serviced by such financial advisors in such period. Trailer service fees range from nil to 67% of the management fees earned by GCICL in respect of the services it provides to the Portfolio Solutions and up to 80% in respect of the services it provides to the Dynamic Funds. With respect to purchases made under the low load redemption schedule, GCICL does not generally commence the payment of trailers to dealers until one year after the date that such funds were purchased.&# 160; In certain cases, GCICL may pay reduced or no trailer service fees to dealers who do not service their client accounts. Trailer service fees may be discontinued or modified by GCICL at any time without notice.

As permitted under applicable securities laws and certain industry guidelines, GCICL provides a range of marketing support programs to assist financial advisors in their efforts to market DundeeWealth’s investment products, including providing research materials on Dynamic Funds and Portfolio Solutions and marketing materials generally describing the benefits of mutual fund investing. GCICL organizes educational conferences and seminars for financial advisors and, in compliance with regulatory requirements, may share with registered dealers and brokers the cost of advertising and marketing activities, including investor conferences and seminars. GCICL believes that its partnership-like relationship with independent financial advisors assists such financial advisors by improving their time with clients and pr ovides them with the opportunity to learn more about giving sound financial advice. Such programs may be discontinued or modified at any time without notice.

FINANCIAL ADVISORY

DundeeWealth’s financial advisory business encompasses the advisors of Dundee Securities, Dundee Private Investors Inc. (a mutual fund dealer), Dundee Insurance Agency Ltd. (a managing general agent) and Dundee Mortgage Services Inc. (a mortgage broker), all operating under the Dundee Wealth Management brand. The following is a breakdown of advisors and branches operating under the Dundee Wealth Management brand as of February 28, 2010 (1):

IIROC (3)Advisors | | | 535 | |

MFDA (4)Advisors | | | 525 | |

| Insurance-only Agents | | | 143 | |

| | | | 1,203 | |

| | | | | |

| IIROC Branches and Sub-Branches | | | 209 | |

| MFDA Branches and Sub-Branches | | | 247 | |

| | | | 456 | (2) |

Note:

| (1) | The majority of the branches are independent businesses owned and operated by the advisors under the Dundee Wealth Management brand. |

| (2) | This number includes 448 independent branches and sub-branches of DundeeWealth’s financial advisory network. |

| (3) | Investment Industry Regulatory Organization of Canada. |

| (4) | Mutual Fund Dealers Association of Canada |

DundeeWealth’s financial advisory business is a network of full service, independent financial planning and investment professionals, who provide a wide range of wealth management products and services to individuals and businesses across Canada. Our open architecture approach provides investment products created by third party entities as well as by the investment management business of DundeeWealth. Revenues are primarily derived from commissions, advisory fees, transaction fees and administration fees relating to the sale of investment, insurance and lending products. These products and services, designed to assist clients in achieving their financial goals, include the following:

| · | mutual funds, fee-based programs, portfolio solutions and managed account programs; |

| · | common and preferred shares of companies listed on various public markets and exchanges, initial public offerings, exchange traded funds and alternative investments; |

| · | fixed income securities including government and corporate bonds, money market instruments and guaranteed investment certificates (GICs); |

| · | life insurance, disability, critical illness and long term care insurance solutions for individuals and corporate applications; |

| · | segregated funds and annuities; |

| · | banking products including lending and deposit based products such as RRSP loans, residential mortgages and high yield savings accounts; and |

| · | financial planning, estate planning and comprehensive wealth management advice. |

DundeeWealth provides a flexible infrastructure for advisors to work within a full service securities platform, a mutual fund dealer platform or an insurance sales platform as either employees or independent agents. DundeeWealth’s flexibility is attractive to a wide variety of advisors.

DundeeWealth executes its strategy, in part, by providing access to high quality products, training and management tools to its advisors and clients. Both its MFDA and IIROC member firms share a common back office infrastructure and technology that provides comprehensive reporting and administrative capabilities.

DundeeWealth’s financial advisory business has grown from $5.2 billion in assets under administration at August 31, 1999 to $25.4 billion in assets under administration and, in addition, $2.1 billion assets under management, both as at February 28, 2010. $2.4 billion of such assets under administration and $755 million of such assets under management are attributable to Dundee Securities’ corporate financial group described below under the heading “Capital Markets – Corporate Financial Advisory”. DundeeWealth attributes this increase in assets under administration to:

| · | growth in new client relationships; |

| · | an increase in the sale of fee based investment products; |

| · | new advisors joining DundeeWealth; and |

| · | the introduction of tools and training that has assisted advisors in expanding their client base. |

DundeeWealth is committed to providing its advisors with the resources necessary to meet the ongoing needs of clients and expand their client base by:

| · | providing ongoing technical training and education programs on new investment products, risk management and portfolio management; |

| · | providing advisors with a broad range of new financial products such as exchange traded funds, tax advantaged investments and alternative investments; |

| · | providing investment research and economic commentaries prepared specifically for individual investor clients; and |

| · | providing professional sales and marketing support by investing together with its advisors in marketing and advertising designed to promote and grow the business. |

CAPITAL MARKETS

The capital markets business of DundeeWealth is conducted through Dundee Securities and operates under the Dundee Capital Markets brand. The principal activities included in this business unit are

investment banking, institutional equities sales and trading and investment research and corporate financial advisory services. It also includes proprietary equity trading as well as retail fixed income and foreign exchange activities, the latter two principally designed to service DundeeWealth’s financial advisory and asset management businesses. Dundee Capital Markets has aligned its principal focus into core sectors. Opportunities in other sectors will be explored where merited as a result of existing relationships, changing market conditions and other factors, but resources, including financial and intellectual capital, will be concentrated in these core sectors. Employee numbers provided below for Dundee Capital Markets a re as of February 28, 2010.

Investment Banking

Dundee Capital Markets’ investment banking group provides a variety of financial services, including underwriting the sale of securities to the public, private placements of securities and advisory services related to mergers and acquisitions, divestitures, restructurings and stock exchange listings. The investment banking group has technical expertise and specialized capabilities in its core sectors. In the last few years the investment banking group has continued to increase its presence in Canada's investment community with respect to its participation in both the number of transactions and in its general participation level within underwriting syndicates. The investment banking and equity capital markets group currently employs 30 professionals located in Toronto, Calgary and Vancouver.

Institutional Equities Sales and Trading

The primary focus of the institutional equities sales and trading group is the selling, purchasing and trading of equity and equity-related securities on behalf of institutional clients, including mutual funds, hedge funds, pension funds, banks and insurance companies, generally involving large blocks of listed and over-the-counter equities. These transactions are typically handled on an agency basis, but Dundee Capital Markets may, from time to time, take long or short positions as principal to facilitate client trading. Dundee Capital Markets utilizes its own capital for principal trading, both for its own account as well as to improve liquidity and facilitate client transactions.

The institutional sales and trading group is comprised of 15 institutional traders and 8 institutional sales professionals located in Toronto, Montreal and Vancouver representing Dundee Capital Markets on all Canadian stock exchanges and significant alternative trading systems. The institutional sales and trading group works closely with the investment banking and the research groups to meet the needs of institutional investors in creating and effecting equity based capital markets transactions. Additionally, Dundee Capital Markets has a proprietary equity trading team which is comprised of 3 professionals, based in Toronto. This team trades a proprietary account for Dundee Capital Markets in the equities markets.

Corporate Financial Advisory

Dundee Securities’ corporate financial advisory group is comprised of 40 retail investment advisors and portfolio managers. These advisors are employees of Dundee Securities and are located in Dundee’s corporate offices in Montreal, Toronto, Calgary, and Vancouver. The group was recently integrated into Dundee Capital Markets in order to leverage the synergies available from these advisors’ focus on portfolio management and equity and bond securities.

Investment Research

The research group provides individual investors and institutional clients with reports and opinions covering a number of industry sectors and specific companies to assist in the making of investment decisions. The Dundee Capital Markets’ research group has a total of 32 professionals including 18 research analysts and 14 research associates providing research coverage on approximately 147 specific companies with a principal focus on its core sectors.

Other

Dundee Capital Markets operations also include a retail fixed income operation comprised of 5 individuals which provides fixed income product to our financial advisory network and foreign exchange operations comprised of 2 individuals who provide foreign exchange services to our financial advisory network and to other parts of the DundeeWealth business.

REAL ESTATE

Dundee Corporation’s real estate activities consist of as of February 28, 2010: (i) the operations of its 70% owned subsidiary, Dundee Realty; and (ii) the Company’s approximate 14.5% interest in Dundee REIT.

Dundee Realty

Dundee Realty is involved in a wide spectrum of activities in the real estate sector including the acquisition, sale, and development of commercial and residential real estate. Dundee Realty has also established an asset management and advisory services business, Dundee Real Estate Asset Management, through which it provides third party asset management and advisory services in the real estate sector encompassing commercial real estate and real estate development, as well as investment in Canadian renewable energy infrastructure assets. As of December 31, 2009, DREAM managed real estate assets of $3.3 billion on behalf of its clients.

Dundee Realty currently has 306 employees.

Land

Dundee Realty’s portfolio of land under development and held for development extends across the country and into the United States.

Aggregate development costs on land were approximately $62.7 million during 2009 and were incurred mainly in the Harbour Landing project in Regina, Stonebridge project in Saskatoon and Meadows project in Edmonton. During 2009, Dundee Realty acquired 256 acres of land in Saskatoon for $4.2 million and the remaining 50% interest in the Willows development project, which includes 76 lots and 23 acres of land in Saskatoon from its joint venture partner for $5.8 million. In addition, Dundee Realty has entered into agreements to purchase over 200 acres of zoned land in Calgary for approximately $49 million from which it expects to generate sales commencing in 2010.

During 2009, Dundee Realty sold 854 lots at an average selling price of $107,000 per lot compared to 920 lots at an average selling price of $125,000 per lot in 2008. Dundee Realty also sold 42 parcel acres at an average price of $419,000 per acre in 2009 compared to 215 parcels at an average price of $286,000 per acre in 2008.

Twenty (20) lot sales were completed in Calgary in 2009. Development of new lot inventories in Calgary is currently limited to lands in High River, a development located approximately one hour from downtown Calgary. Subsequent to December 31, 2009, Dundee Realty entered into agreements to acquire in excess of 200 acres of undeveloped land in Calgary adjacent to two existing projects. These sites have received zoning approvals and are expected to generate sales commencing in 2010 through to 2014.

The market in Edmonton accelerated significantly in the second half of 2009 resulting in the purchase of new lots to meet increased demand. In 2009, Dundee Realty sold 332 lots and 10 parcel acres in Edmonton. In Regina, Sales at Dundee Realty’s Lakeridge project, which is a mature mid-range development are expected to do well in 2010 while Harbour Landing, a newer higher-end development, is expected to continue to increase momentum as the subdivision progresses. Aggregate sales in Regina totalled 164 lots and 2 parcel acres in 2009.

Dundee Realty sold 314 lots and 30 parcel acres in Saskatoon in 2009. Dundee Realty has high quality land holdings in Saskatoon with Willows, Stonebridge and Hampton Village providing residents with a wide selection of choices.

Housing and Condominiums

Construction on the 383-unit Pure Spirit condominium at The Distillery Historic District in Toronto is complete and registration has been received. An additional 19 units at the Pure Spirit condominium units closed in 2009, bringing the total sales to 379 out of 383 units. Closings in 2009 generated net proceeds of $85.8 million which were used to repay construction financing of approximately $58.6 million with the balance reducing the amount owing on Dundee Realty’s revolving term credit facility. The southeast corner project, originally a two-tower condominium development project on the Distillery site, has been modified into a two-phase project with re-zoning and official plan amendments having been approved. Phase 1 of the project, the 347-unit Clear Spirit tower, is 95% pre-sold at December 31, 2009 and construction commenced in September 2009 with anticipated closings in 2012. Phase 2 of the project, the Gooderham tower, is over 78% pre-sold and construction is expected to commence in the spring of 2010. The Corktown project in Toronto is progressing well with Phase 1 and Phase 2 both being 88% pre-sold. Two Gladstone Avenue, a 54-unit condominium project in Toronto is 78% pre-sold and construction is expected to commence in the spring of 2010.

Housing operations in western Canada continued to achieve modest growth in 2009, mainly as a result of strong demand and higher than average selling prices. Dundee Realty sold 203 units in western Canada at an average selling price of $344,000 per unit. At December 31, 2009, there were 123 housing units under construction of which 76 are pre-sold. Dundee Realty expects to have a profitable year in Regina and Saskatoon as the oversupply of lots that existed last year has been absorbed.

Construction is complete on the Base Camp project, a 64-unit flagship residential lodge in a prime ski in/ski out location at the Sol Vista ski area located in Granby, Colorado. In 2009, 10 closings were completed and two more contracts are expected to close in 2010.

Revenue Properties

In 2009, Dundee Realty, through its 20% interest in Firelight Infrastructure Fund, invested $18.8 million in the Dalhousie Mountain windmill project in Nova Scotia. The expenditures were comprised of site preparation costs and the purchase and installation of wind turbines and transmission equipment. Construction was completed in December 2009. Commercial operations will commence in March 2010 upon completion of testing and certification. Dundee Realty, through a joint venture arrangement, also acquired three retail units in Toronto for $1.1 million. In December 2009, Dundee Realty also acquired the remaining 50% interest in the Willows golf course from its joint venture partner for $1.1 million.

Capital expenditures related to other properties were minimal as Dundee Realty limited spending to essential items.

Dundee Real Estate Asset Management (“DREAM”)

DREAM is a fully diversified real estate investment and asset management company with a scope of business that includes real estate asset management and advisory services encompassing commercial real estate and real estate development, as well as investments in Canadian renewable energy infrastructure assets. At December 31, 2009, DREAM managed assets with an estimated value of $3.3 billion and earned management fee revenues of $11.8 million.

DREAM also earns asset management revenue in respect of projects in which Dundee Realty has invested capital, including Dundee Realty’s investments in real estate and infrastructure projects. In 2009, DREAM recognized $2.9 million of asset management revenues in respect of projects in which Dundee Realty has invested capital.

Dundee REIT

Dundee REIT is an unincorporated, open end, real estate investment trust and provides high quality, affordable business premises. It is focused on owning, acquiring, leasing and managing mid-sized urban and suburban office and industrial properties in Canada. At December 31, 2009, Dundee REIT’s portfolio consisted of approximately 7.4 million square feet of gross leasable area, located across Canada.

The Company’s interest in Dundee REIT is held through its interest in Dundee Realty and certain wholly- owned subsidiaries of the Company that own limited partnership units of Dundee Properties Limited Partnership (“DPLP”), which holds all of the rental properties of Dundee REIT, and Dundee REIT Units, Series A. The limited partnership units held indirectly by the Company are not publicly traded and are exchangeable into Dundee REIT Units, Series A at any time. Dundee REIT Units, Series A are traded on the TSX.

At February 28, 2010, Dundee Corporation owned 0.9 million Dundee REIT units and 3.5 million units of DPLP, representing a combined 14.5% interest in Dundee REIT.

Pursuant to Dundee REIT’s declaration of trust, the Company has the right to appoint up to one less than a majority of the trustees, provided that the Company and its affiliates continue to beneficially own, in the aggregate, at least 2,000,000 Dundee REIT Units, Series A (or securities exchangeable into Dundee REIT Units, Series A). The declaration of trust also provides the Company with pre-emptive rights on the issuance of Dundee REIT Units, Series A or any securities convertible into or exchangeable for Dundee REIT Units, Series A to maintain its proportionate interest in Dundee REIT.

RESOURCES

The Company’s resource activities are carried out primarily through its wholly-owned subsidiary, Dundee Resources which oversees operations in the Company’s 54% owned subsidiary Eurogas, which is involved in natural gas storage activities in Spain as well as the Company’s 53% owned subsidiary Eurogas International Inc., which carries out oil and gas exploration and development with interests in Tunisia. The resource segment followed by Dundee Resources also includes various other portfolio holdings including our ownership interests in Dundee Precious, Breakwater, Odyssey Resources Limited (“Odyssey”), Corona Gold Corporation (“Corona”), and Valdez Gold Inc. (“Valdez”).

Dundee Resources

Dundee Resources is a wholly-owned subsidiary of the Company that provides technical support to Dundee Corporation and certain of its subsidiaries, in evaluating potential investments in companies engaged in the mining and energy sectors, preparing due diligence and research reports in connection with such investments, and monitoring the ongoing performance of the Company’s portfolio of investments.

As of February 28, 2010, Dundee Resources had 10 employees.

Eurogas (TSX VENTURE: EUG)

Eurogas is a Canadian-based company whose common shares trade on the TSX Venture Exchange ("TSXV") under the symbol EUG. Eurogas is focused on creating long-term value through the development of high-impact energy projects. Eurogas holds interests, both directly and indirectly, in the development of an underground natural gas storage facility in Spain and in certain exploration programs for oil and natural gas located offshore of Tunisia.

Spanish Oil and Gas Projects

Eurogas’ 73.7% owned subsidiary, Castor UGS Limited Partnership (“CLP”), holds an interest in the Castor Exploration Permit through its investment in Escal UGS S.L. (“Escal”). The Castor Exploration Permit is owned directly by Escal and covers the abandoned Amposta oil field, which will be utilized by Escal for its Castor underground gas storage project (“Castor Project”).

The Castor Project and facility is expected to provide Spain with urgently needed gas storage capacity by converting the abandoned Amposta oil field to gas storage operations. The project consists of an underground gas storage reservoir that lies at a depth of 1800 metres approximately 21 kilometres off the east coast of Spain in the Mediterranean Sea; two offshore platforms for 13 wells and processing facilities; an onshore compression and processing plant located in the municipality of Vinaroz and an adjoining 30-inch pipeline. The estimated cost of the Castor Project is approximately €1.131 billion, with gas injection scheduled to begin in 2012.

The Castor underground gas storage facility’s anticipated significant working gas storage capacity of 1.3 billion cubic metres is expected to provide a reserve for seasonal and extraordinary peak demands, as well as the ability to respond to normal daily peak demands. The facility’s anticipated high delivery rate of 25 million cubic metres per day will contribute strategic storage and reliability of supply to industrial and domestic customers in Spain. Upon completion, the Castor Project and facility will become a regulated utility forming a crucial element of Spain’s energy infrastructure.

On June 15, 2008, the Castor Exploration Permit was replaced by a development concession, which allows Escal to construct and utilize the Castor Project (the “Development Concession”).

Investment in Escal UGS S.L.

In 2007, CLP entered into agreements with ACS Servicios Comunicaciones y Energia, S.L. (“ACS”) and Enagas, S.A. (the “ACS Transaction”) pursuant to which Escal issued shares to ACS such that ACS increased its ownership in Escal from 5% to 66.67%, reducing CLP’s interest to 33.33% from 95%. The completion of the ACS Transaction was conditional on receipt of certain concessions by the Spanish authorities, which Escal received in the second quarter of 2008.

As part of the ACS Transaction, Enagas S.A., the technical manager of the gas system and common carrier for the high pressure gas network in Spain, will acquire 50% of ACS’s interest in Escal at commissioning and start up of the project, subject to certain terms and conditions. The ACS Transaction provided for ACS repaying to CLP substantially all of the amounts it previously invested in the Castor Project aggregating approximately €27.9 million. As at December 31, 2009, CLP had received approximately €27.1 million against amounts receivable and approximately €0.4 million remained outstanding. CLP may receive further amounts up to a maximum of approximately €2.6 million at a future date, should some or all of the expenditures associated with those investments be recognized for remuner ation within the Castor Project.

In accordance with the terms of the ACS Transaction, ACS is also responsible for providing equity and arranging bridge and project financing for the Castor UGS Project, including providing all guarantees that may be required from the lenders and by local and central governments to the point of formal commissioning of the project into the Spanish gas system, with gas injection scheduled to begin in 2012.

Escal and its shareholders have engaged a group of banks to lead a process to obtain a 10-year loan for up to a maximum of €1.575 billion to finance the construction and commissioning of the Castor offshore and onshore facilities including pipelines, interest and guarantees during construction. This mandate has been given to Banco Español de Crédito, S.A., Caja de Ahorros y Monte de Piedad de Madrid, Banco Santander, S.A. and Société Général (jointly the “Coordinating Banks”), as the initial step in securing project financing and in order to establish the final terms and conditions to be agreed upon, if and when,

the banks formally complete the project financing. The Coordinating Banks have initiated the process of procuring potential participants in a financing syndicate.

As part of the arrangement, interim financing currently available to Escal will be replaced by way of a bridge loan to a maximum of €250 million, until mid-March 2010. The bridge financing will be repaid on closing of the project financing.

Onshore Site

The local authorities approved the site for the proposed onshore facilities in early 2008 and Escal has completed the procurement of land. The routing of the subsea pipeline from the shore to the site of the onshore facilities has been established and the necessary right of ways will be granted as part of the Administrative Authorization Permit which is expected shortly. Earth works on the site is expected to commence in early 2010.

Engineering, Procurement, Construction (“EPC”)