UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the fiscal year ended October 1, 2005 |

| |

| or |

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the transition period from to |

Commission file number: 0-21272

Sanmina-SCI Corporation

(Exact name of registrant as specified in its charter)

Delaware | | 77-0228183 |

(State or other jurisdiction of | | (I.R.S. Employer |

incorporation or organization) | | Identification Number) |

| | |

2700 North First Street, San Jose, CA | | 95134 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code:

(408) 964-3500

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.01 Par Value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is an accelerated filer (as defined in Exchange Act Rule 12b-2). Yes ý No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

The aggregate value of Common Stock held by non-affiliates of the Registrant was approximately $2,675,239,223 as of April 2, 2005, based upon the average of Registrant’s Common Stock reported for such date on the Nasdaq National Market. Shares of Common Stock held by each executive officer and director and by each person who owns 10% or more of the outstanding Common Stock have been excluded in that such persons may be deemed to be affiliates. The determination of affiliate status is not necessarily a conclusive determination for other purposes. As of December 7, 2005, the Registrant had outstanding 529,556,913 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information is incorporated into Part III of this report by reference to the Proxy Statement for the Registrant’s annual meeting of stockholders to be held on February 27, 2006 to be filed with the Securities and Exchange Commission pursuant to Regulation 14A not later than 120 days after the end of the fiscal year covered by this Form 10-K.

SANMINA-SCI CORPORATION

INDEX

1

PART I

Item 1. Business

Overview

We are a leading independent global provider of customized, integrated electronics manufacturing services, or EMS. We provide these comprehensive services primarily to original equipment manufacturers, or OEMs, in the communications, computing and storage, multimedia, industrial and semiconductor capital equipment, defense and aerospace, medical, and automotive industries. The combination of our advanced technologies, extensive manufacturing expertise and economies of scale enables us to meet the specialized needs of our customers in these markets in a cost-effective manner.

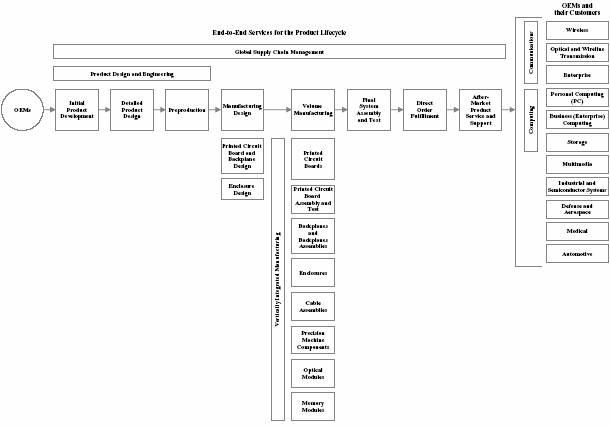

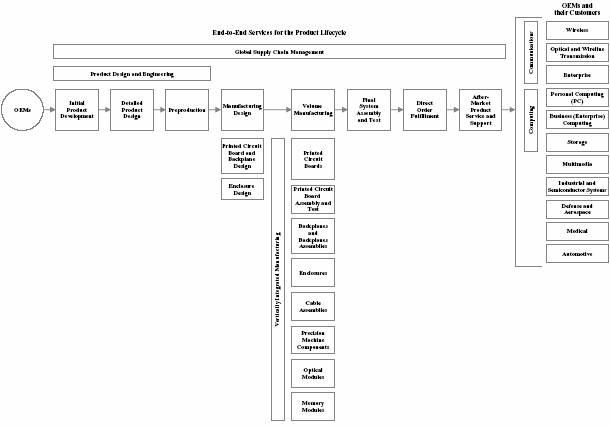

Our end-to-end services in combination with our global expertise in supply chain management enable us to manage our customers’ products throughout their life cycles. These services include:

• product design and engineering, including initial development, detailed design, preproduction services and manufacturing design;

• volume manufacturing of complete systems, components and subassemblies;

• final system assembly and test;

• direct order fulfillment and logistics services; and

• after-market product service and support.

Our high volume manufacturing services are vertically integrated, allowing us to manufacture key system components and subassemblies for our customers. By manufacturing key system components and subassemblies ourselves, we enhance continuity of supply and reduce costs for our customers. In addition, we are able to have greater control over the production of our customers’ products and retain incremental profit opportunities for the company. System components and subassemblies that we manufacture include high volume and high-end printed circuit boards, printed circuit board assemblies, backplanes and backplane assemblies, enclosures, cable assemblies, precision machine components, optical modules and memory modules.

We manufacture products in over 20 countries on five continents. We seek to locate our facilities near our customers and our customers’ end markets in major centers for the electronics industry or in lower cost locations. Many of our plants located near customers and their end markets are focused primarily on final system assembly and test, while our plants located in lower cost areas engage primarily in less complex component and subsystem manufacturing and assembly.

We have become one of the largest global EMS providers by capitalizing on our competitive strengths, including our:

• end-to-end services;

• product design and engineering resources;

• vertically integrated volume manufacturing services;

• advanced technologies;

• global capabilities;

• customer-focused organization;

• expertise in serving diverse end markets; and

• experienced management team.

Our business strategy enables us to win large outsourcing programs from leading multinational OEMs. Our customers primarily consist of OEMs that operate in a range of industries. Our top customers include: Alcatel, S.A., or Alcatel; Applied Materials, Inc., or Applied Materials; EchoStar Communications Corporation, or EchoStar; Hewlett-Packard Company, or HP; International Business Machines Corporation, or IBM; Koninklijke Philips Electronics NV, or Philips Electronics; Lenovo Group, Ltd., or Lenovo; LSI Logic Corporation, or LSI; Nokia Corp., or Nokia; Nortel Networks, or Nortel; Roche Diagnostics Operations, Inc., or Roche; Siemens A.G., or Siemens; Telefonaktiebolaget LM Ericsson, or Ericsson; and Tellabs, Inc., or Tellabs.

2

Industry Overview

EMS companies are the principal beneficiaries of the increased use of outsourced manufacturing services by the electronics and other industries. Outsourced manufacturing refers to an OEMs’ use of EMS companies, rather than internal manufacturing capabilities, to manufacture their products. Historically, EMS companies generally manufactured only components or partial assemblies. As the EMS industry has evolved, OEMs have increased their reliance on EMS companies for additional, more complex manufacturing services, including design services. Some EMS companies now often manufacture and test complete systems and manage the entire supply chains of their customers. Industry leading EMS companies offer end-to-end services, including product design and engineering, volume manufacturing, final system assembly and test, direct order fulfillment, after-market product service and support and global supply chain management.

We believe increased outsourced manufacturing by OEMs will continue because it allows OEMs to:

Reduce Operating Costs and Capital Investment. In the current economic environment, OEMs are under significant pressure to reduce manufacturing costs and capital expenditures. EMS companies can provide OEMs with flexible, cost-efficient manufacturing services. In addition, as OEM products have become more technologically advanced, the manufacturing and system test processes have become increasingly automated and complex, requiring significant capital investments. EMS companies enable OEMs to access technologically advanced manufacturing and test equipment and facilities, without additional capital expenditures.

Focus on Core Competencies. The electronics industry is highly competitive and subject to rapid technological change. As a result, OEMs increasingly are focusing their resources on activities and technologies in which they expect to add the greatest value. By offering comprehensive manufacturing services and supply chain management, EMS companies enable OEMs to focus on their core competencies, including next generation product design and development as well as marketing and sales.

Access Leading Design and Engineering Capabilities. The design and engineering of electronics products has become more complex and sophisticated and in an effort to become more competitive, OEMs are increasingly relying on EMS companies to provide product design and engineering support services. EMS companies’ design and engineering services can provide OEMs with improvements in the performance, cost and time required to bring products to market. EMS companies are providing more sophisticated design and engineering services to OEMs, including the design and engineering of complete products following an OEM’s development of a product concept.

Improve Supply Chain Management and Purchasing Power. OEMs face challenges in planning, procuring and managing their inventories efficiently due to fluctuations in customer demand, product design changes, short product life cycles and component price fluctuations. EMS companies employ sophisticated production management systems to manage their procurement and manufacturing processes in an efficient and cost-effective manner so that, where possible, components arrive on a just-in-time, as-and-when needed basis. EMS companies are significant purchasers of electronic components and other raw materials, and can capitalize on the economies of scale associated with their relationships with suppliers to negotiate price discounts, obtain components and other raw materials that are in short supply, and return excess components. EMS companies’ expertise in supply chain management and their relationships with suppliers across the supply chain enable them to help OEMs reduce their cost of goods sold and inventory exposure.

Access Global Manufacturing Services. OEMs seek to reduce their manufacturing costs by having EMS companies manufacture their products in the lowest cost locations that are appropriate for their products and end customers. OEMs also are increasingly requiring particular products to be manufactured simultaneously in multiple locations, often near end users, to bring products to market more quickly, reduce shipping and logistics costs and meet local product content requirements. Global EMS companies are able to satisfy these requirements by capitalizing on their geographically dispersed manufacturing facilities, including those in lower cost regions.

Accelerate Time to Market. OEMs face increasingly short product life cycles due to increased competition and rapid technological changes. As a result, OEMs need to reduce the time required to bring their products to

3

market. OEMs often can bring a product to market faster by using EMS companies’ expertise in new product introduction, including manufacturing design, engineering support and prototype production. OEMs often can more quickly achieve volume production of their products by capitalizing on EMS companies’ manufacturing expertise and global presence and infrastructure.

Competitive Overview

We offer our OEM customers end-to-end services that span the entire product life cycle:

Competitive Strengths

We believe that our competitive strengths differentiate us from our competitors and enable us to better serve the needs of OEMs. Our competitive strengths include:

• End-to-End Services. We provide services throughout the world to support our customers’ products during their products’ entire life cycles, from product design and engineering, through volume manufacturing, to direct order fulfillment and after-market product service and support. We believe that our end-to-end services are more comprehensive than the services offered by our competitors because of our focus on adding value before and after the actual manufacturing of our customers’ products. Our end-to-end services enable us to provide our customers with a single source of supply for their EMS needs, reduce the time required to bring products to market, lower product costs and allow our customers to focus on those activities in which they expect to add the highest value. We believe that our end-to-end services allow us to develop closer relationships with our customers and more effectively compete for their future business.

• Product Design and Engineering Resources. We provide product design and engineering services to produce advanced electronic systems for both custom and standard (or ODM) designs. Our global design and engineering teams include approximately 600 designers and engineers located in 19 design and new product introduction centers in 11 countries. Our designers and engineers work closely with our customers to develop new products and manage products throughout their life cycles. Our design centers provide both hardware and software engineering services for a range of product technologies, including high-speed digital, analog, radio frequency, wireless, optical and electro-mechanical technologies. We also provide component-level design services in connection with our vertically integrated volume manufacturing services, including the design of complex printed circuit boards and printed circuit board assemblies, backplanes and backplane assemblies, enclosures, cable assemblies and modular memory solutions.

• Vertically Integrated Volume Manufacturing Services. We provide a range of vertically integrated volume manufacturing services. Key system components that we manufacture include complete printed circuit boards and printed circuit board assemblies, backplanes and backplane assemblies, enclosures, cable assemblies,

4

precision machine components, memory modules and optical modules. By manufacturing these system components and subassemblies ourselves, we enhance continuity of supply and reduce costs for our customers. In addition, we are able to have greater control over the production of our customers’ products and retain incremental profit opportunities for us. Examples of products that we manufacture using our full range of services include wireless base stations, network switches, optical switches, enterprise-class servers, photolithography equipment, and equipment used in the semiconductor chip manufacturing process, including equipment for chemical mechanical polishing and physical vapor depositions and automated handling tools and robotics for wafer transfer.

• Advanced Technologies. We are a leader in providing services utilizing advanced technologies, which we believe allows us to differentiate ourselves from our competitors. These advanced technologies include the fabrication of complex printed circuit boards and backplanes having over 60 layers and process capabilities for a range of low signal loss, high performance materials, buried capacitors and resistors, and high density interconnects using micro via holes that are formed using laser drills. Our printed circuit board assembly technologies include micro ball grid arrays, fine pitch discretes, and small form factor radio frequency and optical components, as well as advanced packaging technologies used in high pin count application specific integrated circuits and network processors. We use innovative design solutions and advanced metal forming techniques to develop and fabricate high-performance indoor and outdoor chassis, enclosures and frames. Our assembly services use advanced technologies, including precision optical alignment, multi-axis precision stages and machine vision technologies. We use sophisticated procurement and production management tools to effectively manage inventories for our customers and ourselves. We have also developed build-to-order, or BTO, and configure-to-order, or CTO, systems that enable us to manufacture and ship finished systems within 48 to 72 hours after receipt of an order. To coordinate the development and introduction of new technologies to meet our customers’ needs in various locations and to increase collaboration among our facilities, we have established a centralized global technology group.

• Global Capabilities. Most of our customers compete and sell their products on a global basis. As such, they require global solutions that include regional manufacturing for selected end markets, especially when time to market, local manufacturing or content and low cost solutions are critical objectives. Our global network of facilities in more than 20 countries provides our customers a combination of sites to maximize both the benefits of regional and low cost manufacturing. To manage and coordinate our global operations, we employ an enterprise-wide software system that operates on a single IT platform and provides us with company-wide information regarding component inventories and orders. This system enables us to standardize planning and purchasing at the plant level and to optimize inventory management and utilization. Our systems also enable our customers to receive key information regarding the status of individual programs.

• Customer-Focused Organization. We believe customer relationships are critical to our success, and our organization is focused on providing our customers with responsive services. Our key customer accounts are managed by dedicated account teams, including a global business manager directly responsible for account management. Global business managers coordinate activities across divisions to effectively satisfy our customers’ requirements and have direct access to our senior management to quickly address customer concerns. Local customer account teams further support the global teams and are linked by a comprehensive communications and information management infrastructure.

• Expertise in Serving Diverse End Markets. We have experience in serving our customers in the communications, personal and business computing, enterprise computing and storage, multimedia, industrial and semiconductor capital equipment, defense and aerospace, medical and automotive markets. Our diversification across end markets reduces our dependence upon any one customer or segment. In order to cater to the specialized needs of customers in particular market segments, we have dedicated personnel, and in some cases facilities, with industry-specific capabilities and expertise. We also maintain compliance with industry standards and regulatory requirements applicable to certain markets including, among others, the medical and defense and aerospace sectors.

• Experienced Management Team. We believe that one of our principal assets is our experienced management team. Our chief executive officer, Jure Sola, co-founded Sanmina in 1980. Hari Pillai, President, Global Operations, joined our Company in 1994 and has served in manufacturing management positions since that time. We believe that the significant experience of our management team better enables us to capitalize on opportunities in the current business environment.

5

Our Business Strategy

Our objective is to maintain and enhance our leadership position in the EMS industry. Key elements of our strategy include:

Capitalizing on Our Comprehensive Services. We intend to capitalize on our end-to-end services, which we believe will allow us to both sell additional services to our existing customers and attract new customers. Our end-to-end services include product design and engineering, volume manufacturing, final system assembly and test, direct order fulfillment, after-market product service and support and supply chain management. Our vertically integrated volume manufacturing services enable us to manufacture additional system components and subassemblies for our customers. When we provide a customer with a number of services, such as component manufacturing or higher value-added services, we are often able to improve our margins and profitability. Consequently, our goal is to increase the number of manufacturing programs for which we provide multiple services. To achieve this goal, our sales and marketing organization seeks to cross-sell our services to customers.

Extending Our Technology Leadership. We rely on advanced processes and technologies to provide our vertically integrated volume manufacturing services. We continually strive to improve our manufacturing processes and have adopted a number of quality improvement and measurement techniques to monitor our performance. We work with our customers to anticipate their future manufacturing requirements and align our technology investment activities to meet their needs. We use our design expertise to develop product technology platforms that we can customize by incorporating other components and subassemblies to meet the needs of particular OEMs. These technologies enhance our ability to manufacture complex, high-value added products, allowing us to continue to win business from existing and new customers.

Original Design Manufacturing Solutions. As a result of customer demand, and our customers’ desire to manage research and development expenses, we have begun to offer product designs that our customer can either brand with its own name or integrate into its own system solution. In these cases, we act as the original design manufacturer, or ODM, for our customer. For ODM products, we typically retain the intellectual property rights and realize manufacturing revenue associated with building and shipping the product. Our current ODM portfolio covers several end markets, including enterprise computing, communications, and multimedia. For example, in the enterprise computing market, our two-processor 64-bit Opteron server is currently being shipped to multiple customers. The ODM server product roadmap includes multi-processor designs that will be scalable up to 32-processor systems.

Continuing to Penetrate Diverse End Markets. We focus our marketing efforts on major end markets within the electronics industry. We have targeted markets that we believe offer significant growth opportunities and for which OEMs sell complex products that are subject to rapid technological change because the manufacturing of these products requires higher value-added services. Our approach to our target markets is two-fold: we intend to strengthen our significant presence in the communications and enterprise computing markets, and also focus on under-penetrated target markets, including the medical, industrial and semiconductor capital equipment, automotive, and defense and aerospace industries, many of which have not extensively relied upon EMS companies in the past. We intend to continue our diversification across market segments and customers to reduce our dependence on any particular market.

Pursuing Strategic Transactions. We seek to undertake strategic transactions that give us the opportunity to access new customers, manufacturing and service capabilities, technologies and geographic markets, to lower our manufacturing costs and improve the margins on our product mix, and to further develop existing customer relationships. For example, in October 2004, we completed the acquisition of Pentex-Schweizer Circuits Limited, a printed circuit board manufacturer, in order to provide lower cost manufacturing capacity in China for our customers. In addition, we will continue to pursue OEM divestiture transactions that will augment existing strategic customer relationships with favorable supply agreement terms or build new relationships with customers in attractive end markets. Potential future transactions may include a variety of different business arrangements, including acquisitions, spin-offs, strategic partnerships, joint ventures, restructurings, divestitures, business combinations and equity or debt investments. We intend to continue to evaluate and pursue strategic opportunities on a highly selective basis.

Continuing to Seek Cost Savings and Efficiency Improvements. We seek to optimize our facilities to provide cost-efficient services for our customers. We maintain extensive operations in lower cost locations, including Latin America, Eastern Europe, China and Southeast Asia, and we plan to expand our presence in these lower cost locations, as appropriate, to meet the needs of our customers. We believe that we are well positioned to take advantage of future opportunities on a global basis as a result of our vertically integrated volume manufacturing strategy.

6

Our Products and Services

We offer our OEM customers end-to-end services that span the entire product life cycle. Examples of products that we manufacture for OEMs include wireless and wireline communications switches, personal computers, high-end computers and servers, avionics, medical imaging systems and digital satellite set-top boxes. The manufacture of these products may require us to use all or some of our end-to-end services. Each element of our end-to-end services is described in greater detail below.

Product Design and Engineering. Our design and engineering group, which we believe is one of the strongest in the EMS industry, provides customers with design and engineering services for initial product development, detailed product design and preproduction. This group also complements our vertically integrated volume manufacturing capabilities by providing manufacturing design services for the manufacture of printed circuit boards, backplanes and enclosures. We provide initial product development and detailed product design and engineering services for products such as communications base stations, optical switches and modules, radio frequency amplifier modules, network switches, personal computers and servers.

• Initial Product Development. We provide a range of design and engineering services to customers to complement their initial product development efforts. During this phase, our design engineers work with our customers’ product development engineers to assist with design reviews and product concepts.

• Detailed Product Design. During the detailed product design phase, we work with our customers’ product development engineers to optimize product designs to improve the efficiency of the volume manufacturing of these products and reduce manufacturing costs. We further analyze product design to improve the ability of tests used in the manufacturing process to identify product defects and failures. We provide software development support for product development, including installing operating systems on hardware platforms, developing software drivers for electronic devices, and developing diagnostic, production test and support software. We design components that are incorporated into our customers’ products, including printed circuit boards, backplanes and enclosures.

• Preproduction. After a detailed product design has been completed and the product is released for prototype production, we can build a prototype on a quick turn around basis. We then analyze the feasibility of manufacturing the product prototype and make any necessary design modifications to the prototype and test the prototype to validate its design. We also provide early-stage test development during the prototype phase. We evaluate prototypes to determine if they will meet safety and other standards, such as standards published by Underwriters Laboratories, an independent product safety testing and certification organization, and other similar domestic and international organizations. We also typically provide low-volume manufacturing to satisfy customers’ needs. We review the material and component content of customers’ designs with a view to designing in alternative components that may provide cost savings. Our preproduction services help our customers reduce the time required to bring new products to market.

• Manufacturing Design Services. We provide our own designs for our vertically integrated system components and subassemblies, including:

• Printed Circuit Board and Backplane Design. We have a dedicated printed circuit board design group that designs and engineers complex printed circuit boards and backplanes. These printed circuit boards and backplanes incorporate high layer counts and large form factors and are used in complex products such as optical networking products and communications switches. Our designs also incorporate component miniaturization technologies and other advanced technologies that increase the number and density of components that can be placed on a printed circuit board. These technologies enable OEMs to provide greater functionality in smaller products. We also provide signal integrity engineering services, which involve the maintenance of the quality and integrity of high speed electrical signals as they travel through a system.

• Enclosure Design. We have a dedicated enclosure design group that designs and engineers complex enclosures. We can design custom enclosures to meet customer specifications and offer a range of proprietary designs tailored to particular applications. Our enclosure design services include the design

7

of thermal management systems, which dissipate heat generated by the components within an enclosure. We design enclosures that are used in both indoor and outdoor environments. We also design enclosures that include both stackable and rack mount chassis configurations. In stackable configurations, component modules are stacked on top of each other, while in rack mount configurations, component modules slide into racks within the enclosure. Rack mount configurations often are used for complex products, such as communications switches that are frequently upgraded in the field by inserting new components. Our design engineers work with a range of materials, including metal, plastic and die-cast material. We design indoor and outdoor wireless base station cabinets, enclosures for high-end servers and data storage systems and enclosures for magnetic resonance imaging systems. We have developed a sophisticated proprietary enclosure with a thermal management system for high density servers used for managed hosting in data center applications. We offer this enclosure platform to our customers who can then customize it with modules and subsystems designed and manufactured to their specifications. By using our common platform, customers reduce their enclosure costs.

Volume Manufacturing. Volume manufacturing includes our vertically integrated manufacturing services described in greater detail below.

• Printed Circuit Boards. Our ability to reliably produce printed circuit boards with high layer counts and narrow circuit track widths makes us an industry leader in complex printed circuit board fabrication. Printed circuit boards are made of laminated materials and contain electrical circuits and connectors that interconnect and transmit electrical signals among the components that make up electronic devices. We are among a small number of manufacturers that specialize in manufacturing complex multi-layer printed circuit boards. Multi-layering, which involves incorporating numerous layers of electrical circuitry into a single printed circuit board, expands the number of circuits and components that can be contained on a printed circuit board and increases the operating speed of the system by reducing the distance that electrical signals must travel. Increasing the density of the circuitry in each layer is accomplished by reducing the width of the circuit tracks and placing them closer together in the printed circuit board. We are currently capable of efficiently producing printed circuit boards with up to 60 layers and circuit track widths as narrow as three mils. We use sophisticated circuit interconnections between certain layers to improve the performance of printed circuit boards. We have developed a proprietary material technology known as buried capacitance as well as various other processes that are designed to improve electrical performance and connection densities on printed circuit boards.

• Printed Circuit Board Assembly and Test. Printed circuit board assembly involves attaching electronic components, such as integrated circuits, capacitors, microprocessors, resistors and memory modules, to printed circuit boards. The most common technologies used to attach components to printed circuit boards are surface mount technology, or SMT, and pin-through-hole assembly, or PTH. SMT involves the use of an automated assembly system to solder components to the printed circuit board. In PTH, components are placed on the printed circuit board by insertion into holes punched in the circuit board. Components also may be attached using press-fit technology in which components are pressed into connectors affixed to the printed circuit board. We use SMT, PTH, press-fit as well as new attachment technologies that are focused on miniaturization and increasing the density of component placement on printed circuit boards. These technologies, which support the needs of our OEM customers to provide greater functionality in smaller products, include chip-scale packaging, ball grid array, direct chip attach and high density interconnect. We perform in-circuit and function testing of printed circuit board assemblies. In-circuit testing verifies that all components have been properly inserted and attached and that the electrical circuits are complete. We perform functional tests to confirm that the board or assembly operates in accordance with its final design and manufacturing specifications. We either design and procure test fixtures and develop our own test software, or we use our customers’ test fixtures and test software. In addition, we provide environmental stress tests of the board or assembly that are designed to confirm that the board or assembly will meet the environmental stresses, such as heat, to which it will be subject.

• Backplanes and Backplane Assemblies. Backplanes are very large printed circuit boards that serve as the backbones of sophisticated electronics products and provide interconnections for printed circuit boards, integrated circuits and other electronic components. We fabricate backplanes in our printed circuit board plants. Backplane fabrication is significantly more complex than printed circuit board fabrication due to the large size and thickness of the backplanes. We manufacture backplane assemblies by press fitting high density connectors into plated through holes in the bare backplane. In addition, many of the newer higher technology backplanes

8

require SMT attachment of passive discrete components as well as high pin count Ball Grid Array packages. These advanced assembly processes require specialized equipment and a strong focus on quality and process control. We also perform in-circuit and functional tests on backplane assemblies. We have developed proprietary technology and “know-how” which enables backplanes to run at data rates in excess of 10 gigabits per second, or Gbps. We are investing in research and development to manufacture backplanes with embedded optical channels capable of data rates over 40 Gbps. We currently have capabilities to manufacture backplanes with up to 60 layers in sizes up to 32 ´ 54 inches and 0.500 inches in thickness, utilizing a wide variety of high performance laminate materials. These are among the largest and most complex commercially manufactured backplanes, and we are one of a limited number of manufacturers with these capabilities.

• Enclosures. Enclosures are cabinets that house and protect complex and fragile electronic components, modules and subsystems. Our enclosure manufacturing services include fabrication of cabinets, chassis and racks integrated with various electronic components such as power and thermal management systems. We manufacture a broad range of enclosures with numerous materials including metal, plastics and die cast materials. Enclosures we manufacture range from basic enclosures, such as enclosures for personal computers, to large and highly complex enclosures, such as those for indoor and outdoor communications base station products. Our product offerings include a proprietary enclosure with a thermal management system designed for high density servers for managed hosting in data center applications. Our customers can have their unique products built on this platform by inserting their proprietary modules and subsystems.

• Cable Assemblies. Cable assemblies are used to connect modules, assemblies and subassemblies in electronic devices. We provide a broad range of cable assembly products and services. We design and manufacture a broad range of high-speed data, radio frequency and fiber optic cabling products. Cable assemblies that we manufacture are often used in large rack systems to interconnect subsystems and modules.

• Precision Machine Components. We provide a broad range of manufacturing services for metals and plastics. With some of the largest horizontal milling machines in the United States, we are a preferred supplier of vacuum chamber systems for the semiconductor and flat panel display equipment markets. We are able to support low volume engineering programs and high volume production. We utilize advanced computer numerically controlled machined tools enabling the manufacture of components to very tight tolerance standards.

• Optical Modules. Optical modules are integrated subsystems that use a combination of industry standard and/or custom optical components. We are a leading provider of complete optical systems for customers in telecommunications, networking, and military markets. Our experience in optical communications and networking products spans long haul/ultra long haul and metro regions for transport, access and switching applications, including last mile solutions. Our service offerings for optical communications customers are designed to deliver end-to-end solutions with special focus on system design, optical module assembly, optical test and integration.

• Memory Modules. Memory modules are integrated subsystems that use industry standard integrated circuits including digital signal processors, or DSPs, non-volatile flash memory and random access memory, or RAM. These modules consist of standard products that are sold for a wide range of applications to a broad base of customers and custom modules that are built for use in a particular OEM’s product or system. We design and manufacture a variety of modular solutions, including standard and custom DSP, flash memory modules and DRAM modules. In addition, we are a leading supplier of solutions to increase memory component density on printed circuit boards. We offer advanced NexMod memory modules that contain multiple memory layers vertically stacked and mounted to a printed circuit board. NexMod solutions are tailored for high-end network infrastructure and complex server applications. We also provide innovative DDRI and DDRII DRAM modules utilizing stacked CSP technology offering high densities in ultra small form factors. We provide custom module solutions including mixed memory and our proprietary foldable rigid assembly microelectronics module, or FRAMM. We integrate both standard and custom modules in products that we manufacture.

Final System Assembly and Test. We provide final system assembly and test in which assemblies and modules are combined to form complete, finished products. We often integrate printed circuit board assemblies manufactured by us with enclosures, cables and memory modules that we also produce. Our final assembly activities also may involve integrating components and modules that others manufacture. The complex, finished products that we produce typically require extensive test protocols. Our test services include both functional and environmental tests. We also test products for conformity to

9

applicable industry, product integrity and regulatory standards. Our test engineering expertise enables us to design functional test processes that assess critical performance elements, including hardware, software and reliability. By incorporating rigorous test processes into the manufacturing process, we can help to assure customers that their products will function as designed. Products for which we currently provide final system assembly and test include wireless base stations, wire line communications switches, optical networking products, high-end servers and personal computers.

Direct Order Fulfillment. We provide direct order fulfillment for our OEM customers. Direct order fulfillment involves receiving customer orders, configuring products to quickly fill the orders and delivering the products either to the OEM, a distribution channel (such as a retail outlet) or directly to the end customer. We manage our direct order fulfillment processes using a core set of common systems and processes that receive order information from the customer and provide comprehensive supply chain management, including procurement and production planning. These systems and processes enable us to process orders for multiple system configurations, and varying production quantities, including single units. Our direct order fulfillment services include BTO and CTO capabilities. BTO involves building a system having the particular configuration ordered by the OEM customer. CTO involves configuring systems to an end customer’s order. The end customer typically places this order by choosing from a variety of possible system configurations and options. We are capable of meeting a 48 to 72 hour turn-around-time for BTO and CTO by using advanced manufacturing processes and a real-time warehouse management system and data control on the manufacturing floor. We support our direct order fulfillment services with logistics that include delivery of parts and assemblies to the final assembly site, distribution and shipment of finished systems, and processing of customer returns. Our systems are sufficiently flexible to support direct order fulfillment for a variety of different products, such as desktop and laptop computers, servers, workstations, set-top boxes, medical devices, scanners, printers and monitors.

After-Market Product Service and Support. We provide a wide range of after-market product service and support services, including replacing products at customer locations, product repair, re-manufacturing and maintenance at repair depots, logistics and parts management, returns processing, warehousing and engineering change management. We also provide support services for products that are nearing the end of their life cycles. These end-of-life support services involve both customer support and manufacturing support activities. We support the customer by providing software updates and design modifications that may be necessary to reduce costs or design-in alternative components due to component obsolescence or unavailability. Manufacturing support involves test engineering support and manufacturability enhancements. We also assist with failure product analysis, warranty and repair and field service engineering activities.

Global Supply Chain Management

Supply chain management involves the planning, purchasing and warehousing of product components. The objective of our supply chain management services is to reduce excess component inventory in the supply chain by scheduling deliveries of components on a just-in-time, as-and-when-needed basis. We use sophisticated production management systems to manage our procurement and manufacturing processes in an efficient and cost effective manner. We collaborate with our customers to enable us to respond to their changing component requirements for their products and to reflect any changes in these requirements in our production management systems. These systems often enable us to forecast future supply and demand imbalances and develop strategies to help our customers manage their component requirements. Our enterprise-wide software systems provide us with company-wide information regarding component inventories and orders to standardize planning and purchasing at the plant level. These systems enable us to transfer product components between plants to respond to changes in customer requirements or to address component or other raw material shortages.

We purchase large quantities of electronic components and other raw materials from a range of suppliers. As a result, we often receive volume discounts or other favorable terms from suppliers, which can enable us to provide our customers with greater cost reductions than they can obtain themselves. Our supplier relationships often enable us to obtain electronic components and other raw materials that are in short supply or return excess inventories to suppliers even when they are not contractually obligated to accept them.

Our End Markets

We have targeted markets that offer significant growth opportunities and for which OEMs sell complex products that are subject to rapid technological change. We believe that markets involving complex, rapidly changing products offer us opportunities to produce products with higher margins because these products require higher value added manufacturing services and may also include our advanced vertically integrated components. Our approach to our target markets is two-fold—we intend to strengthen our significant presence in the communications and computing markets, while also focusing on other under-penetrated target markets, including the medical, automotive, industrial and semiconductor capital equipment and

10

defense and aerospace industries, many of which have not extensively relied upon EMS companies in the past. Our diversification across market segments and customers reduces our dependence on any particular market.

Communications: Wireless, Optical and Wireline Transmission and Enterprise. In the communications sector, we focus on wireless transmission systems, optical networking and wireline transmission systems and enterprise networking systems. Our product design and engineering staff has extensive experience designing advanced communications products for these markets. Products we manufacture include point-to-point microwave systems, optical switches, wireless base stations, wireline switches, routers, transceivers, satellite receivers, radio frequency and Bluetooth appliances, among others.

Computing: Personal and Business (Enterprise) Computing and Storage Systems. We provide services for OEMs of personal computer, or PC, systems, enterprise computing, and storage systems.

We provide services to multiple major PC manufacturers. These services include primarily BTO and CTO manufacturing of desktop PC systems serving primarily the enterprise markets. Our PC manufacturing plants can build and configure systems and have them ready for shipment within 48 to 72 hours of receipt of a customer order. These plants are typically located in the geographic region to which the finished system will be shipped to rapidly deliver finished products.

We also provide services to the storage and server markets. Our expertise in manufacturing products for the storage and server markets stems from our technological capabilities and vertical integration. We are also the leading vertically integrated supplier of complex, multilayer printed circuit boards and backplanes, and many high-end computer designs incorporate these components. We have developed a proprietary enclosure design for high density servers used in data center applications. High-end computing products we manufacture include complex, fault tolerant servers and enterprise storage.

Multimedia. We manufacture digital satellite set-top boxes, personal video recorders, digital home gateways and internet protocol entertainment devices. For our multimedia OEM customers, we manage the production process for multimedia products, including product design and engineering, test development, supply chain management, manufacturing of printed circuit boards and assemblies, final system assembly and test, and direct order fulfillment, including our BTO and CTO capabilities.

Industrial and Semiconductor Systems. Our expertise in manufacturing industrial instrumentation products includes production of semiconductor capital equipment, front-end environmental chambers, computer controllers, and test and inspection equipment. We also have significant experience manufacturing scanning equipment and devices, flat panel display test and repair equipment, optical inspection and x-ray equipment for use in the printed circuit board assembly industry, and deep ultraviolet photolithography equipment.

Defense and Aerospace. In December 2001, we merged with SCI Systems, Inc., or SCI. SCI began operations as Space-Craft, Inc., in the early 1960’s and was then principally a supplier to the defense and aerospace industries. We continue to offer our end-to-end services to the defense and aerospace industry. We believe that this industry currently represents a significant growth opportunity due to increased defense spending, as well as the growing desire of defense and aerospace OEMs to outsource non-core manufacturing activities to reduce costs. Our experience in serving the aerospace industry, as well as our product design and engineering capabilities, represent key competitive strengths for us in the defense and aerospace market. Defense and aerospace products that we manufacture include avionics systems, weapons guidance systems, cockpit communications systems, spread spectrum communications systems, and space systems.

Medical. We provide comprehensive manufacturing and related services to the medical industry, including design and regulatory approval support. The manufacturing of products for the medical industry requires compliance with domestic and foreign regulations, including the Food and Drug Administration’s, or FDA’s, quality system regulations and the European Union’s medical device directive. In addition to complying with these standards, our medical manufacturing facilities comply with ISO 13485 (formerly EN 46002) and ISO 9001:2000. Medical products that we manufacture include magnetic resonance imaging equipment, blood glucose meters, computer tomography scanners, respiration monitors, ventilators, anesthesia workstations, infusion pumps, thermo-regulation devices, and cardio-resuscitation systems.

Automotive. In recent years, the electronics content in automobiles has increased substantially as new entertainment, wireless communication and navigation systems are being offered as standard features or factory options. We believe that this increased usage of electronic devices in automobiles will continue, and that there will be significant opportunities for EMS companies to manufacture automotive electronics. Accordingly, we have formed an automotive products group to focus on these opportunities.

11

Customers

A relatively small number of customers historically have been responsible for a significant portion of our net sales. Sales to our ten largest customers accounted for 63.9% of our fiscal 2005 net sales, 69.3% of our fiscal 2004 net sales and 68.5% of our fiscal 2003 net sales. For fiscal 2005, only one customer, IBM, accounted for greater than 10% of our net sales at 23.2%. For fiscal 2004, two customers, IBM and HP, accounted for greater than 10% of our net sales at 28.4% and 12.0%, respectively.

We seek to establish and maintain long-term relationships with our customers and have served many of our principal customers for several years. Historically, we have had substantial recurring sales from existing customers. We have also expanded our customer base through acquisitions and our marketing and sales efforts. We have been successful in broadening relationships with customers by providing vertically integrated products and services, as well as multiple products and services in multiple locations.

We typically enter into supply agreements with our major OEM customers with terms ranging from three to five years. Many of these supply agreements were entered into in connection with divestiture transactions, which are transactions in which we also acquire plants, equipment and inventory from the OEM. In these divestiture-related supply agreements, the customer typically agrees to purchase from us its requirements for particular products in particular geographic areas and for a specific period of time. Our OEM customer supply agreements that were not entered into in connection with divestitures typically do not require the customer to purchase their product requirements from us, and in these cases customers may have alternate sources of supply available to them. Our supply agreements with our OEM customers generally do not obligate the customer to purchase minimum quantities of products. However, the customer typically remains liable for the cost of the materials and components that we have ordered to meet the customer’s production forecast but which are not used, provided that the material was ordered in accordance with an agreed-upon procurement plan. In some cases, the procurement plan contains provisions regarding the types of materials for which our customers will assume responsibility. In particular customers are increasingly requiring EMS companies, including us, to assume responsibility for industry standard components while retaining liability only for components specific to their products. Our supply agreements typically also contain provisions permitting cancellation and rescheduling of orders upon notice and subject, in some cases, to cancellation and rescheduling charges. Order cancellation charges typically vary by product type and depend upon how far in advance of shipment a customer notifies us of the cancellation of an order. In some circumstances, our supply agreements with customers provide for cost reduction objectives during the term of the agreement.

We generally do not obtain firm, long-term commitments from our customers under supply agreements. As a result, customers can cancel their orders, change production quantities or delay orders. Uncertain economic conditions and our general lack of long-term purchase contracts with our customers make it difficult for us to accurately predict revenue over the long term. Even in those cases where customers are contractually obligated to purchase products from us or repurchase unused inventory from us that we have ordered for them, we may elect not to immediately enforce our contractual rights because of the long-term nature of our customer relationships and for other business reasons, and instead may negotiate accommodations with customers regarding particular situations.

Backlog

At October 1, 2005 and October 2, 2004, our backlog was approximately $2.4 billion. Backlog consists of purchase orders received, including, in some instances, forecast requirements released for production under customer contracts. Cancellation and postponement charges generally vary depending upon the time of cancellation or postponement. Substantially all of our backlog as of October 1, 2005, is expected to be shipped in fiscal 2006. However, customers may cancel or postpone substantially all scheduled deliveries without significant penalty and backlog may therefore not be a meaningful indicator of future financial results.

Marketing and Sales

Our corporate marketing, sales and customer service staff consists of approximately 1,000 people. Our sales efforts are organized and managed on a regional basis, with regional sales managers in geographic regions in the United States and internationally.

We develop relationships with our customers and market our vertically integrated volume manufacturing services through our direct sales force and customer support specialists. Our sales resources are directed at multiple management and

12

staff levels within target accounts. Our direct sales personnel work closely with the customers’ engineering and technical personnel to better understand their requirements. Our marketing and sales staff supports our business strategy of providing end-to-end services by encouraging cross-selling of vertically integrated volume manufacturing services and component manufacturing across a broad range of major OEM products. To achieve this objective, our marketing and sales staff works closely with our various manufacturing and design and engineering groups and engages in marketing and sales activities targeted towards key customer opportunities.

Each of our key customer accounts are managed by a dedicated account team, including a global business manager directly responsible for account management. Global business managers coordinate activities across divisions to effectively satisfy customer requirements and have direct access to our senior management to quickly address customer concerns. Local customer account teams further support the global teams and are linked by a comprehensive communications and information management infrastructure.

Competition

We face competition from other major global EMS companies such as Celestica, Inc., Flextronics International Ltd., Hon Hai (FoxConn), Jabil Circuit, Inc. and Solectron Corporation, as well as other EMS companies that often have a regional or product, service or industry specific focus. In addition, our potential customers may also compare the benefits of outsourcing their manufacturing to us with the merits of manufacturing products themselves.

We compete with different companies depending on the type of service or geographic area. We believe that the primary basis of competition in our target markets is manufacturing technology, quality, responsiveness, provision of value-added services and price. To remain competitive, we must continue to provide technologically advanced manufacturing services, maintain quality levels, offer flexible delivery schedules, deliver finished products on a reliable basis and compete favorably on the basis of price. We believe that our primary competitive strengths include our ability to provide global end-to-end services, our product design and engineering resources, our advanced technologies, our high quality manufacturing assembly and test services, our customer focus, our expertise in serving diverse end markets and an experienced management team.

In addition to EMS companies, we also compete, with respect to certain of the EMS services we provide, with ODMs. These companies, typically based in Asia, design products and product platforms that are then sold to OEMs, system integrators and others who configure and resell them to end users. To date, ODM penetration has been greatest in the personal computer, including both desktop and notebook computers, and low-end server markets.

Intellectual Property

We hold various United States and foreign patents primarily related to printed circuit boards, methods of manufacturing printed circuit boards, and enterprise computing. For other proprietary processes, we rely primarily on trade secret protection. We also have registered trademarks in the United States and many other countries throughout the world. As the level of ODM services we provide increases, intellectual property will become of greater importance to our business.

Although we do not believe that our current trademarks, manufacturing processes or patents infringe on the intellectual property rights of third parties, we cannot assure you that third parties will not assert infringement claims against us in the future. If such an assertion were to be made, it may become necessary or useful for us to enter into licensing arrangements or to resolve such an issue through litigation. However, we cannot assure you that such license rights would be available to us on commercially acceptable terms if at all or that any such litigation would be resolved favorably. Additionally, such litigation could be lengthy and costly and could materially affect our financial condition regardless of the outcome of such litigation.

13

Environmental Controls

We are subject to a variety of local, state and federal environmental laws and regulations in the United States, as well as foreign laws and regulations, relating to the treatment, storage, use, discharge, emission and disposal of chemicals, solid waste and other hazardous materials used during our manufacturing processes, as well as occupational safety and health laws, and product take back, product labeling and product content requirements. Proper waste disposal is a major consideration in particular for printed circuit board manufacturers because metals and chemicals are used in the manufacturing process. Water used in the printed circuit board manufacturing process must be treated to remove metal particles and other contaminants before it can be discharged into municipal sanitary sewer systems. We operate on-site wastewater treatment systems at our printed circuit board manufacturing plants in order to treat wastewater generated in the fabrication process.

In addition, although the electronics assembly process generates significantly less wastewater than printed circuit board fabrication, maintenance of environmental controls is also important in the electronics assembly process because such operations can generate lead dust. We are undertaking remediation of lead dust in the interior of manufacturing facilities when vacating those facilities. Although there are no applicable standards for lead dust remediation in manufacturing facilities, we endeavor to make efforts to remove the residues. To date, lead dust remediation costs have not been material to our operations. We also monitor for airborne concentrations of lead in our buildings and are not aware of any significant lead concentrations in excess of the applicable OSHA standards.

We have a range of corporate programs in place with regard to environmental compliance and reduction of the use of hazardous materials in manufacturing. In the environmental compliance area, we are developing corporate-wide standardized environmental management systems, auditing programs and policies to enable us to better manage environmental compliance activities. We are also developing programs to certify our facilities under ISO 14001, a set of standards and procedures relating to environmental compliance management. In addition, the electronics industry is subject to the European Union’s Restrictions of Hazardous Substances, or RoHS, and Waste Electrical and Electronic Equipment, or WEEE, directives which will take effect during 2005 and 2006. Parallel initiatives are being proposed in other jurisdictions, including several states in the United States and the Peoples’ Republic of China. RoHS prohibits the use of lead, mercury and certain other specified substances in electronics products and WEEE requires industry OEMs to assume responsibility for the collection, recycling and management of waste electronic products and components. We are in the process of making our manufacturing process RoHS compliant. In the case of WEEE, the compliance responsibility rests primarily with OEMs rather than with EMS companies. However, OEMs may turn to EMS companies for assistance in meeting their WEEE obligations. We are in the process of developing programs that we can offer to our customers to assist them with WEEE compliance.

Asbestos containing materials, or ACM, are present at several of our manufacturing facilities. Although the ACM is being managed and controls have been put in place pursuant to ACM operations and maintenance plans, the presence of ACM could give rise to affirmative remediation obligations and other liabilities. No third-party claims relating to ACM have been brought at this time.

Each plant, to the extent required by law, operates under environmental permits issued by the appropriate governmental authority. These permits must be renewed periodically and are subject to revocation in the event of violations of environmental laws. Any such revocation could require us to cease or limit production at one or more of our facilities, thereby having an adverse impact on our results of operations.

Primarily as a result of certain of our acquisitions, we have incurred liabilities associated with environmental contamination at facilities, including facilities of companies that we have acquired. These liabilities include ongoing investigation and remediation activities at a number of sites, including our facilities located in Irvine, California (a former facility acquired as part of our acquisition of Elexsys); Owego, New York (a current facility that we acquired with our acquisition of Hadco Corporation); Derry, New Hampshire (a non-operating facility of Hadco) and Fort Lauderdale, Florida (a former facility of Hadco). Currently, we are unable to anticipate whether any third-party claims will be brought against us for the existence of such contamination. There can be no assurance that third-party claims will not arise and will not result in material liability to us. In addition, there are several sites, including our facilities in Wilmington, Massachusetts (acquired from Altron); Brockville, Ontario (acquired from Nortel) and Gunzenhausen, Germany (acquired from Alcatel) that are known to have groundwater contamination caused by a third party, and that third party has provided indemnity to us for the liability. Although we cannot assure you that we will not incur liability for clean-up costs or expenses at any of these sites, we have no reason to believe that such liability will occur and that it will be material to our business.

We have also been named as a potentially responsible party at several contaminated disposal sites operated by other parties, including the Casmalia Resources site, as a result of the past disposal of hazardous waste by companies we have

14

acquired or by our corporate predecessors. Although liabilities for such historic disposal activities have not materially affected our financial condition to date, we cannot assure you that past disposal activities will not result in liability that will materially affect us in the future.

We use an environmental consultant to assist us in evaluating the environmental liabilities of the companies that we acquire as well as those associated with our ongoing operations, site contamination issues and historical disposal activities in order to establish appropriate accruals in our financial statements. In addition to liabilities associated with site contamination and related issues, we could also incur exposures associated with inventories containing restricted substances that we do not consume by the RoHS effective dates. We have also undertaken a process of re-evaluating and updating the reserves over time. As of October 1, 2005, based on the evaluations of our consultants, we have accrued $13.5 million for our environmental liabilities. Although we believe these accruals are adequate, we cannot be certain that environmental liabilities will not exceed the accrued amounts

Employees

As of October 1, 2005, we had 48,621 employees, including 11,600 temporary employees. None of our U.S. employees are represented by a labor union. In certain international locations, particularly in Western Europe, our employees are represented by labor unions on either a national or plant level. Western European countries also often have mandatory legal provisions regarding terms of employment, severance compensation and other conditions of employment that are more restrictive than U.S. laws. We have never experienced a strike or work stoppage and we believe that our relationship with our employees is good.

Available Information

Our Internet address is http://www.sanmina-sci.com. We make available through our website, free of charge, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission, or SEC. All reports we file with the SEC are also available free of charge via EDGAR through the SEC’s website at http://www.sec.gov.

Item 1A. Risk Factors

Refer to the “Factors Affecting Operating Results” contained in Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

Item 1B. Unresolved Staff Comments

None

15

Item 2. Properties

Facilities. Our customers market numerous products throughout the world and therefore need to access manufacturing services on a global basis. To enhance our EMS offerings, we seek to locate our facilities either near our customers and our customers’ end markets in major centers for the electronics industry or, where appropriate, in lower cost locations. Many of our plants located near customers and their end markets are focused primarily on final system assembly and test, while plants located in lower cost areas are engaged primarily in less complex component and subsystem manufacturing and assembly.

As of October 1, 2005, we manufacture products in 79 plants, consisting of 55 electronics assembly facilities, 9 printed circuit board fabrication facilities, 4 cable assembly facilities, and 11 enclosure assembly facilities, located both domestically and internationally. Our domestic plants are located in key electronics industry centers, including Silicon Valley – (Northern California), Southern California, New England, Texas, Northern Alabama, the Research Park Triangle area and New York, as well as in several other locations. Internationally, we have plants in Australia, Latin America (Brazil and Mexico), Canada, Western Europe (United Kingdom, Ireland, France, Germany, Spain, Sweden, and Finland), Eastern Europe (Hungary), Israel and Asia (Peoples’ Republic of China, Indonesia, Japan, Malaysia, Singapore, and Thailand). For fiscal 2005, approximately 76.2% of our net sales were from operations outside of the United States.

Since the closing of our merger with SCI in December 2001, we have evaluated our global manufacturing operations and restructured our facilities and operations to bring our manufacturing capacity in line with demand and our manufacturing strategy and to provide cost efficient services for our customers. Through this process, we have closed certain facilities not required to satisfy current demand levels, but have retained strategic manufacturing facilities in the United States and Western Europe that focus on higher value added manufacturing activities. We provide extensive operations in lower cost locations, including Latin America, Eastern Europe, China and Southeast Asia, and we plan to expand our presence in these lower cost locations, as appropriate to meet the needs of our customers.

As of October 1, 2005, the approximate square footage of our facilities by country is as follows:

| | Approximate

Square

Footage | |

Australia | | 59,772 | |

Brazil | | 230,685 | |

Canada | | 585,485 | |

China | | 1,502,698 | |

Finland | | 384,769 | |

France | | 530,862 | |

Germany | | 551,025 | |

Hungary | | 966,642 | |

Indonesia | | 66,056 | |

Ireland | | 126,200 | |

Israel | | 253,296 | |

Japan | | 13,870 | |

Malaysia | | 315,000 | |

Mexico | | 1,635,197 | |

Singapore | | 403,313 | |

Spain | | 298,903 | |

Sweden | | 189,200 | |

Thailand | | 138,500 | |

United Kingdom | | 834,203 | |

United States | | 4,865,611 | |

TOTAL | | 13,951,287 | |

We also have manufacturing facilities (not included in the above figure) that are closed or in the process of closing as of October 1, 2005, which include facilities totaling approximately 1,995,820 square feet for domestic locations and approximately 1,137,433 square feet for international locations. We are currently undertaking an aggressive program to sublease or terminate leases for unused facilities and to sell owned properties that are no longer expected to serve our future

16

needs. In addition, we have 337,820 (not included in the above figure) square feet of non-manufacturing space that we no longer expect to use.

As of October 1, 2005, our active manufacturing facilities consist of approximately 9.4 million square feet in facilities that we own, with the remainder in leased facilities under lease terms expiring between fiscal 2006 and fiscal 2021.

We believe that our existing facilities are adequate to meet our reasonably foreseeable requirements. We regularly evaluate our expected future facilities requirements.

Certifications and Registrations. Certifications and registrations under industry standards are important to our business because many customers rely on them to confirm our adherence to manufacturing process and quality standards. Certain markets, such as communications, medical, defense, aerospace and automotive, require adherence to industry-specific standards. Substantially all of our manufacturing facilities are registered under ISO 9001:2000, a set of standards published by the International Organization of Standardization and used to document, implement and demonstrate quality management and assurance systems in design and manufacturing. As part of the ISO 9001:2000 certification process, we have developed a quality systems manual and an internal system of quality controls and audits. ISO 9001:2000 registration is of particular importance to the companies doing business in the European Community, and we believe that United States electronics manufacturers are increasing their use of ISO 9001:2000 registration as a criteria for suppliers.

In addition to ISO 9001:2000, many of our facilities have been TL 9000 registered. TL 9000 is a relatively new telecommunications standard. The TL 9000 quality system requirements and quality system metrics are designed specifically for the telecommunications industry to promote consistency, efficiency, and improved customer satisfaction. Included in the TL 9000 system are performance-based metrics that measure the reliability and quality performance of the product. The majority of our facilities are also Underwriters Laboratory compliant. These standards define requirements for quality, manufacturing process control and manufacturing documentation and are required by many OEMs in the communications sector of the electronics industry.

Our medical products division has identified certain manufacturing facilities to be centers of excellence for medical products manufacturing. Currently most of those facilities are FDA and ISO 13485 registered and fully compliant to the FDA’s quality systems regulations.

Our defense and aerospace operations are headquartered in the Huntsville, Alabama area and are housed in dedicated facilities to meet the specialized needs of our defense and aerospace customers. Our defense and aerospace facilities are AS9100 registered and also certified under various U.S. military specifications as well as under ANSI and other standards appropriate for defense and aerospace suppliers.

Our automotive facilities are strategically located worldwide. Substantially all of our automotive facilities are QS 9000 and/or TS 16949 registered and also certified under the Automotive Industry Standard.

Item 3. Legal Proceedings

We are a party to certain legal proceedings that have arisen in the ordinary course of our business. We believe that the resolution of these proceedings will not have a material adverse effect on our business, financial condition or results of operations.

Item 4. Submission of Matters to a Vote of Security Holders

None.

17

EXECUTIVES OF SANMINA-SCI

Pursuant to General Instruction G(3), the information regarding our executive officers required by Item 401(b) of Regulation S-K is hereby included in Part I of this report.

The following table sets forth the name of each executive officer of Sanmina-SCI, the office held by such officer and the age, as of December 7, 2005, of such officer.

Name | | Age | | Position |

Jure Sola | | 54 | | Chairman of the Board and Chief Executive Officer |

Hari Pillai | | 45 | | President, Global Operations |

David L. White | | 50 | | Executive Vice President of Finance and Chief Financial Officer |

Dennis Young | | 54 | | Executive Vice President of Worldwide Sales and Marketing |

Steve Bruton | | 53 | | President and General Manager, Printed Circuit Board Fabrication Division |

Michael Clarke | | 51 | | President and General Manager, Enclosures Division |

Jure Sola has served as our chief executive officer since April 1991, as chairman of our board of directors from April 1991 to December 2001 and from December 2002 to present, and co-chairman of our board of directors from December 2001 to December 2002. In 1980, Mr. Sola co-founded Sanmina and initially held the position of vice president of sales. In October 1987, he became vice president and general manager of Sanmina, responsible for manufacturing operations and sales and marketing and was president from October 1989 to March 1996.

Hari Pillai joined our company in 1994 and has served in manufacturing management positions since that time. In January 2002, Mr. Pillai was appointed president and general manager of the EMS division of our company and in October 2004 was appointed president, global operations.

David L. White has served as our executive vice president of finance and chief financial officer since August 2004. Prior to joining us, he was senior vice president and chief financial officer of Asyst Technologies, a provider of integrated automation solutions that enhance semiconductor and flat-panel display (FPD) manufacturing productivity. Previously, he was president and chief executive officer of Candescent Technologies, a developer of field emission display (FED) technology for next-generation thin FPDs.