| Peerless Systems Corporation 300 Atlantic St., Suite 301 Stamford, CT 06901 |

Ms. Peggy Kim

Special Counsel

Office of Mergers & Acquisitions

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549-3628

| Re: | Moduslink Global Solutions, Inc. (the “Company”) Soliciting materials filed under Rule 14a-12 by Peerless Systems Corporation, V Investment Partners III LLC, Locksmith Capital Advisors Inc., Timothy E. Brog and Jeffrey S. Wald Filed October 4, 2011 File No. 0-23262 |

Dear Ms. Kim:

Reference is made to the Soliciting Materials filed on October 4, 2011 (“October 4, 2011 Soliciting Material”) with the Securities and Exchange Commission (the “Commission”) by Peerless Systems Corporation, V Investment Partners III LLC, Locksmith Capital Advisors Inc., Timothy E. Brog and Jeffrey S. Wald (collectively, the “Peerless Group”), in connection with the Peerless Group’s solicitation of proxies from the stockholders of the Company for use at its 2011 Annual Meeting of Stockholders.

Submitted for your review are two copies of (i) a memorandum, attached as Annex A hereto, setting forth Peerless’ responses to your comments made by letter dated October 5, 2011 and (ii) supplemental materials (attached thereto as Exhibits A-I) in response to comments 1 and 2. For your convenience, each of the numbered paragraphs in Annex A corresponds to the numbered comment in the Staff’s comment letter.

In connection with responding to the Staff’s comments, a certificate signed by each of the participants containing the three acknowledgments requested by the Staff is attached hereto.

The Staff is invited to contact the undersigned with any comments or questions it may have. We would appreciate your prompt advice as to whether the Staff has any further comments.

Very truly yours,

PEERLESS SYSTEMS CORPORATION

By: /s/ Robert Kalkstein

Robert Kalkstein

Acting Chief Financial Officer

| Peerless Systems Corporation 300 Atlantic St., Suite 301 Stamford, CT 06901 |

Annex A

Peerless’ Responses to Comments

Transmitted by Letter dated October 5, 2011

| | 1. | We note the following statements about the Company’s financial or operating performance: |

| | ● | “The reasons for the nominations are that over the past five years the current Board of Directors have overseen the Company’s declining stock price, misuse of its balance sheet through disastrous acquisitions and investments, and poor operating performance;” |

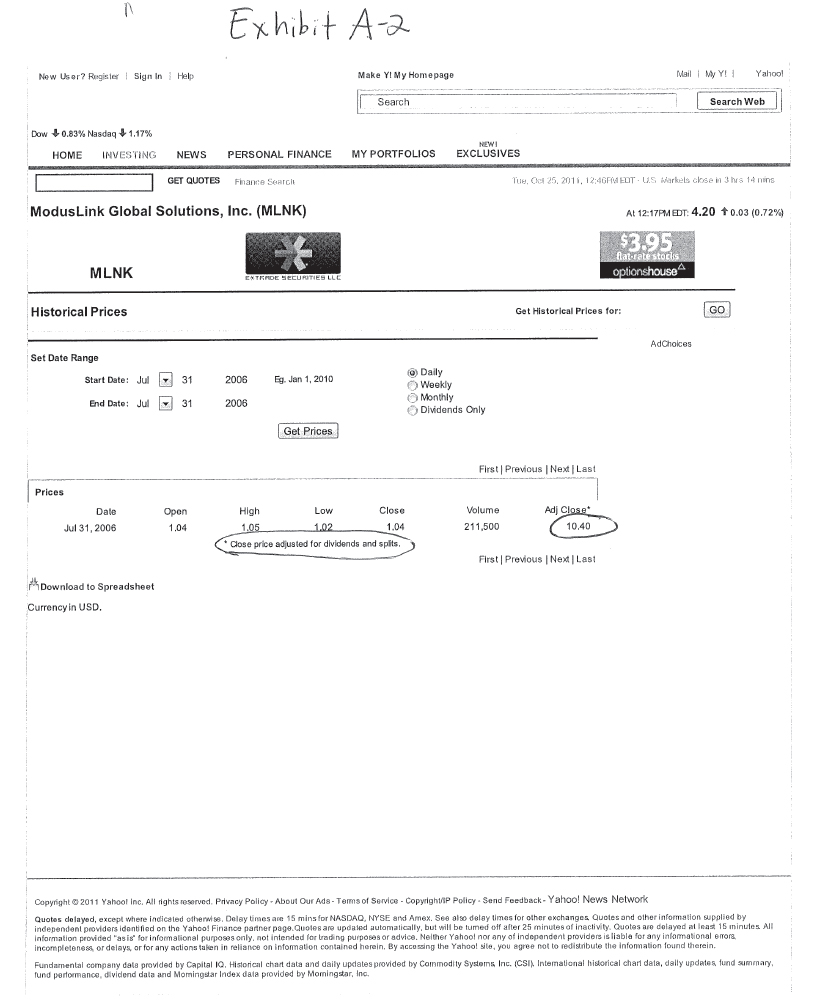

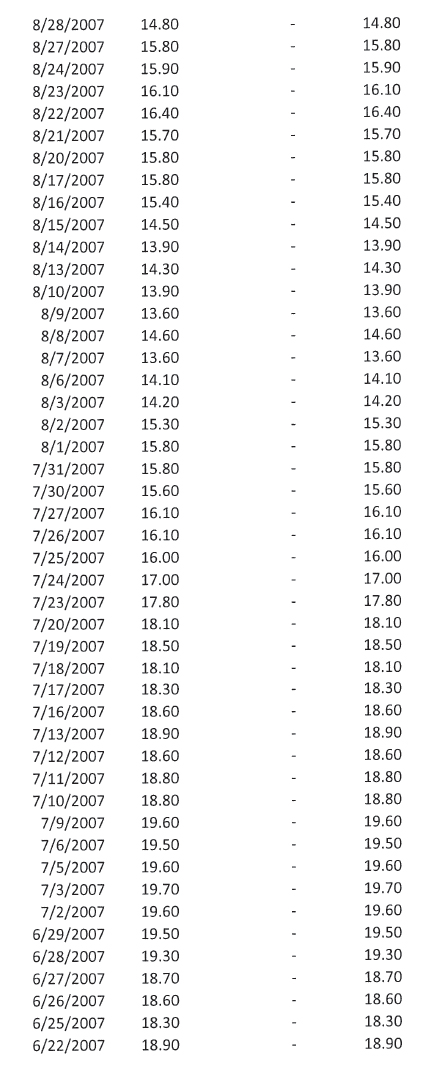

Over the last five fiscal years, ModusLink’s share price declined 59.7% from $10.40 per share on the close of July 31, 2006 to $4.19 per share on the close of July 29, 2011. Please see the attached Exhibits A-1 and A-2 for support of this supplemental information.

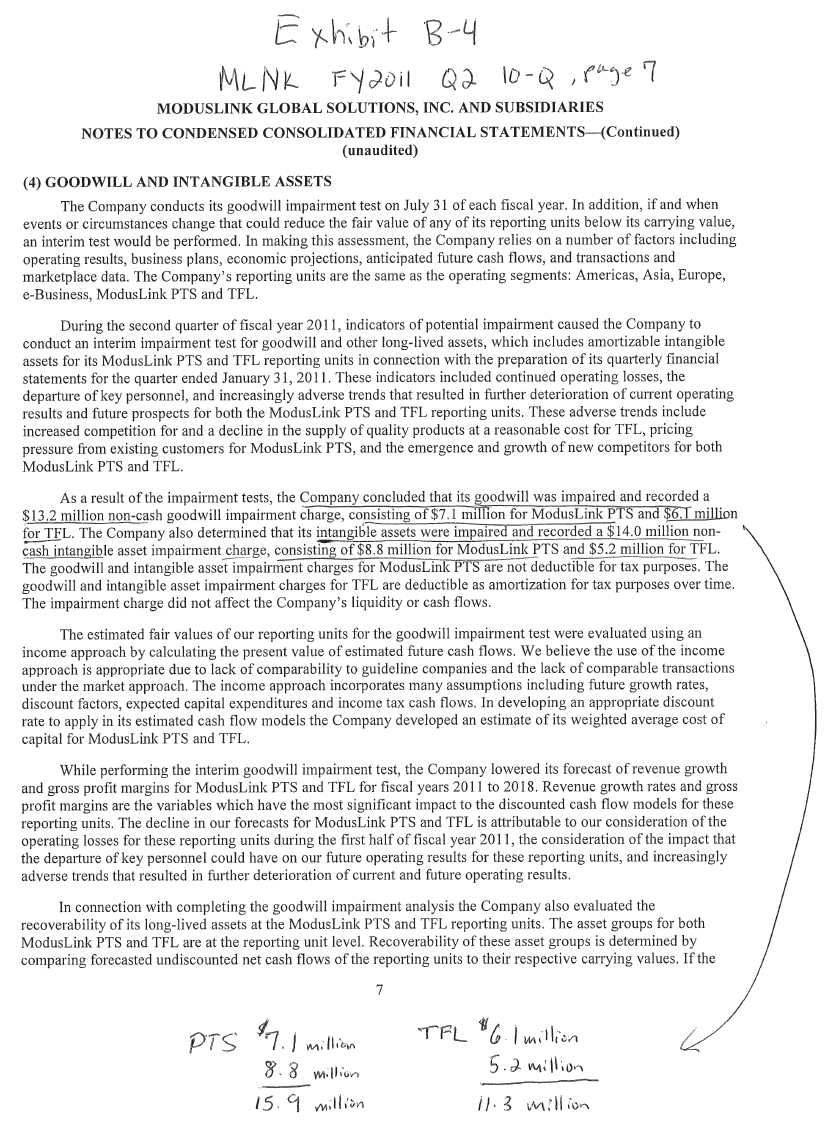

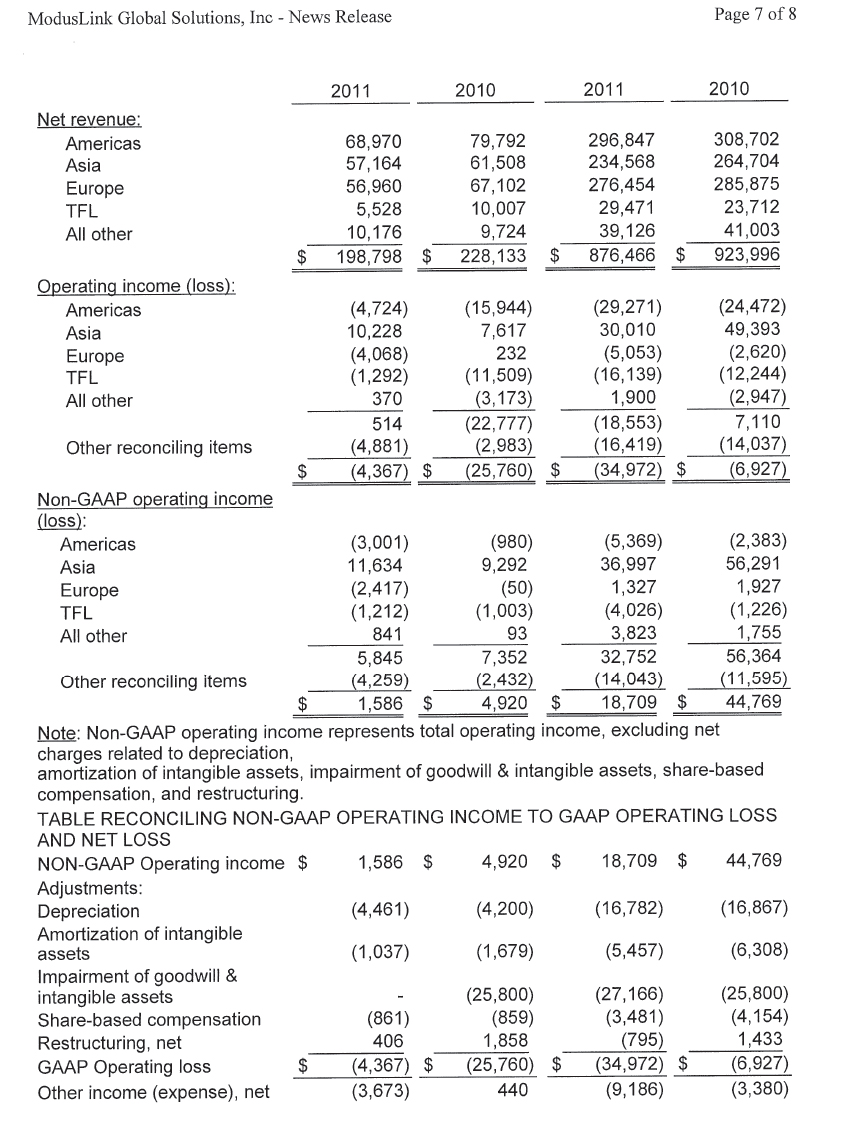

The Company’s Board of Directors misused its balance sheet by spending $90.5 million for two acquisitions in 2008 and one in 2009 whose aggregate value has subsequently been written down by 59%. The table set forth below, shows the date, acquisition, purchase price, and subsequent write-downs associated with each transaction. Please see the attached Exhibits B-1, B-2, B-3 and B-4 for support of this supplemental information.

| Date | | Acqusition | Business Description | Purchase Price (cash $ millions) | Write Down in Q4'10 ($ millions) | Write Down in Q2'11 ($ millions) | Total Write Downs ($ millions) | % of purchase price |

| 3/18/2008 | A | Open Channel Solutions "OCS" | Provides entitlement and e-business management services and solutions to software publishers and digital content providers. | $13.70 | A | $2.80 | C | | | $2.80 | 20% |

| 5/2/2008 | A | PTS Electronics "PTS" | Remanufacturer of wireless products and HDTV’s | 45.80 | A | 12.80 | C | 15.90 | D | 28.70 | 63% |

| 12/4/2009 | B | Tech For Less "TFL" | Buys returned consumer electronics products and excess inventory from retailers. Resells refurbished products through its own website. | 31.00 | B | 10.20 | C | 11.30 | D | 21.50 | 69% |

| | | | TOTALS | $90.50 | | $25.80 | | $27.20 | | $53.00 | 59% |

| Tickmark Legend |

A - Refer to Exhibit B-1 |

B - Refer to Exhibit B-2 |

C - Refer to Exhibit B-3 |

D - Refer to Exhibit B-4 |

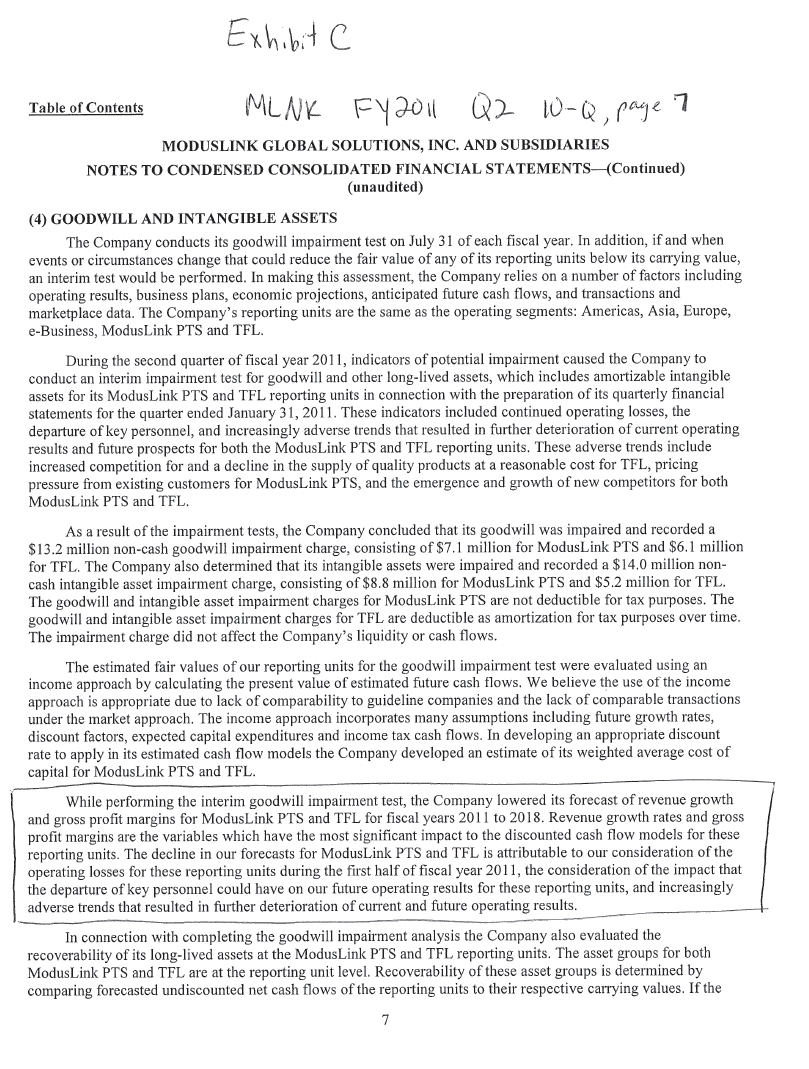

In addition, as noted on page 7 of the Company’s fiscal second quarter 10-Q filing on March 14, 2011, the Company lowered its revenue growth forecast for two of the three acquisitions for the foreseeable future as noted in the attached Exhibit C for supplemental information that supports our statement.

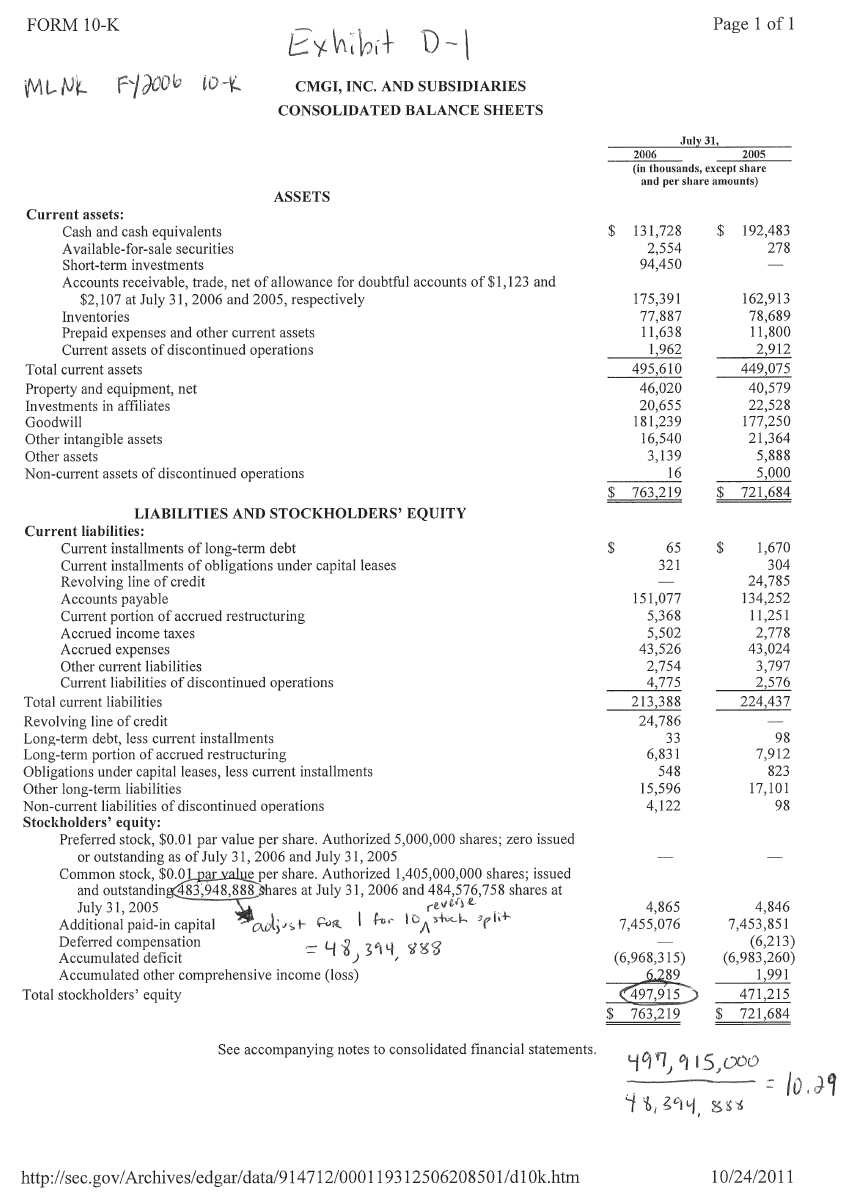

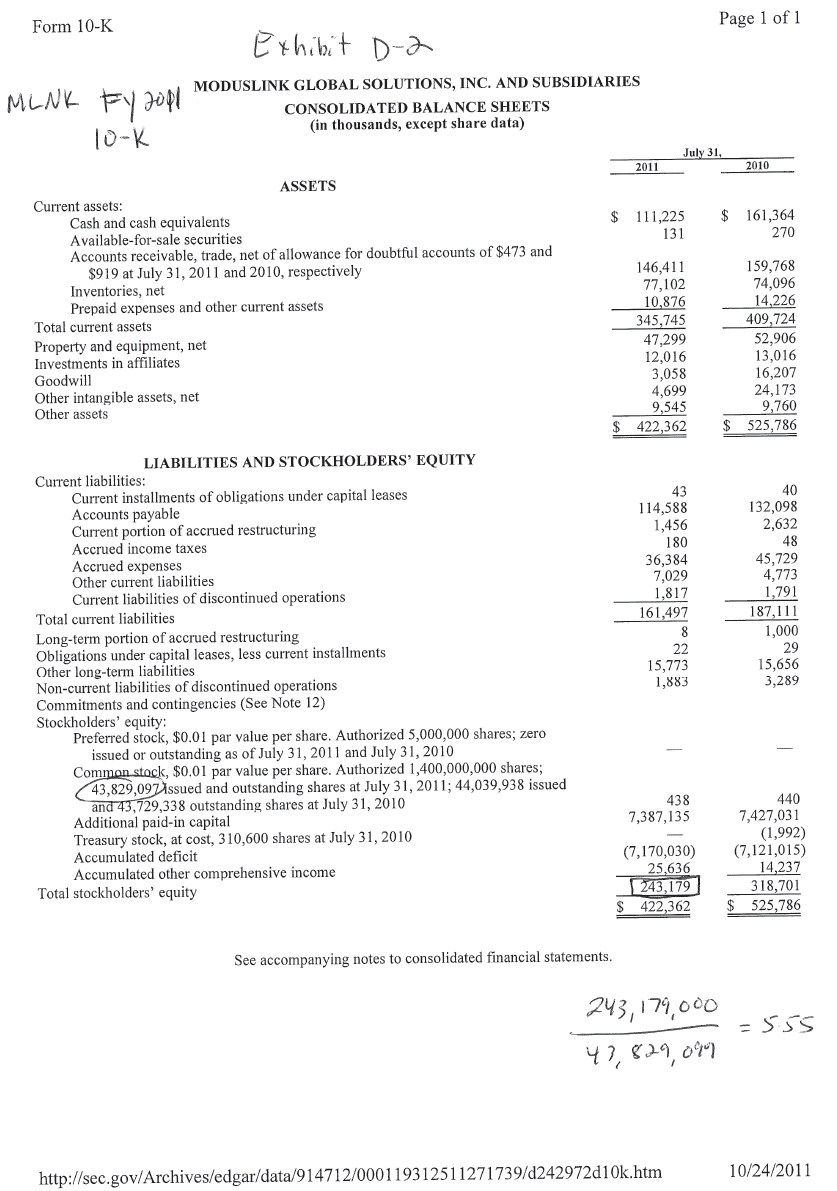

Furthermore over the last five fiscal years, from July 31, 2006 through July 31, 2011, shareholder’s equity (or book value per share) declined from $10.29 per share to $5.55 per share representing a 46.1% decrease during that period. See table below and the attached Exhibits D-1 and D-2 that supports our statement.

| | | Years Ended July 31, | | |

| Balance Sheet Data | | 2011 | | | 2006 | | |

| Book Value (Total Stockholder's Equity) | | $ | 243,179 | | | $ | 497,915 | | |

| Shares of common stock outstanding | | | 43,820,641 | | | | 48,394,888 | | (adjusted for a 1 for 10 reverse stock split) |

| | | | | | | | | | |

| | | | | | | | | | |

| Book Value Per Share | | $ | 5.55 | | | $ | 10.29 | | |

| Year-Over-Year % Change | | | (46.1 | )% | | | | | |

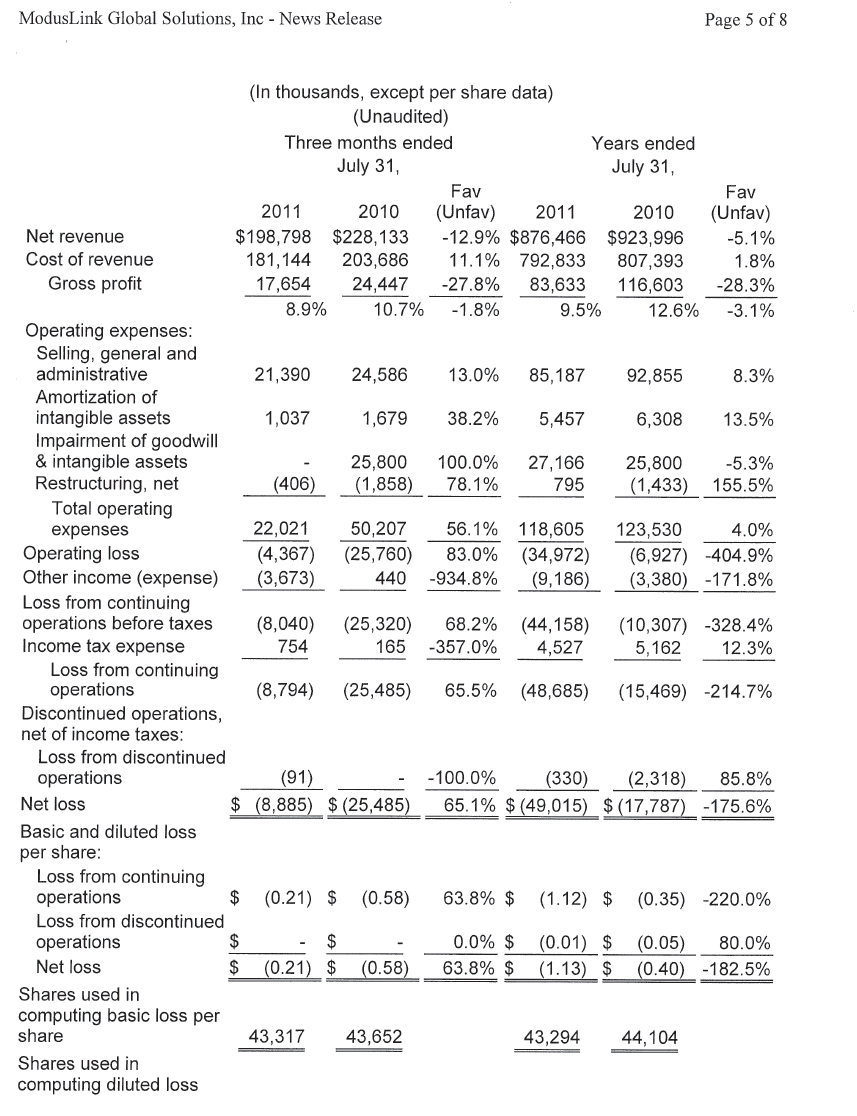

During the last five fiscal years from August 1, 2006 through July 31, 2011, which is the time period Joseph Lawler has been Chairman of the Board, revenues declined 23.7%, gross profit decreased 29.7%, gross margins declined 75 basis points, and recurring operating income (excluding impairment of goodwill and restructuring charges) fell by 169.4%. Please refer to the data below and the attached Exhibits E-1 and E-2 for support of this supplemental information.

| | | Years Ended July 31, | |

| Income Statement Data ($ amounts in millions) | | 2011 | | | 2006 | |

| Revenues | | $ | 876,466 | | | $ | 1,148,886 | |

| Gross Profit | | $ | 83,633 | | | $ | 118,231 | |

| Gross Margin | | | 9.5 | % | | | 10.3 | % |

| Recurring Operating Income* | | $ | (7,011 | ) | | $ | 10,106 | |

| | | | | | | | | |

| % Change from 2006 to 2011 | | | | | | | | |

| Revenues | | | (24 | )% | | | | |

| Gross Profit | | | (29 | )% | | | | |

| Gross Margins | | | (75 | ) | | basis points | |

| Operating Income | | | (169 | )% | | | | |

| | | | | | | | | |

| * Recurring Operating Income calculation | | | 2011 | | | | 2006 | |

| Reported operating income | | $ | (34,972 | ) | | $ | 585 | |

| Plus: Restructuring, net | | $ | 795 | | | $ | 9,521 | |

| Plus: Impairment of Goodwill | | $ | 27,166 | | | $ | 0 | |

| Recurring Operating Profit | | $ | (7,011 | ) | | $ | 10,106 | |

● | The directors “have chronically failed at applying a return on investment approach to many of the large expenditure decisions made by the Company;” |

The Company implemented an Enterprise Resource Planning (“ERP”) software for approximately $33 million. Please refer to the attached Exhibit F-1 for supplemental information that supports our statement.

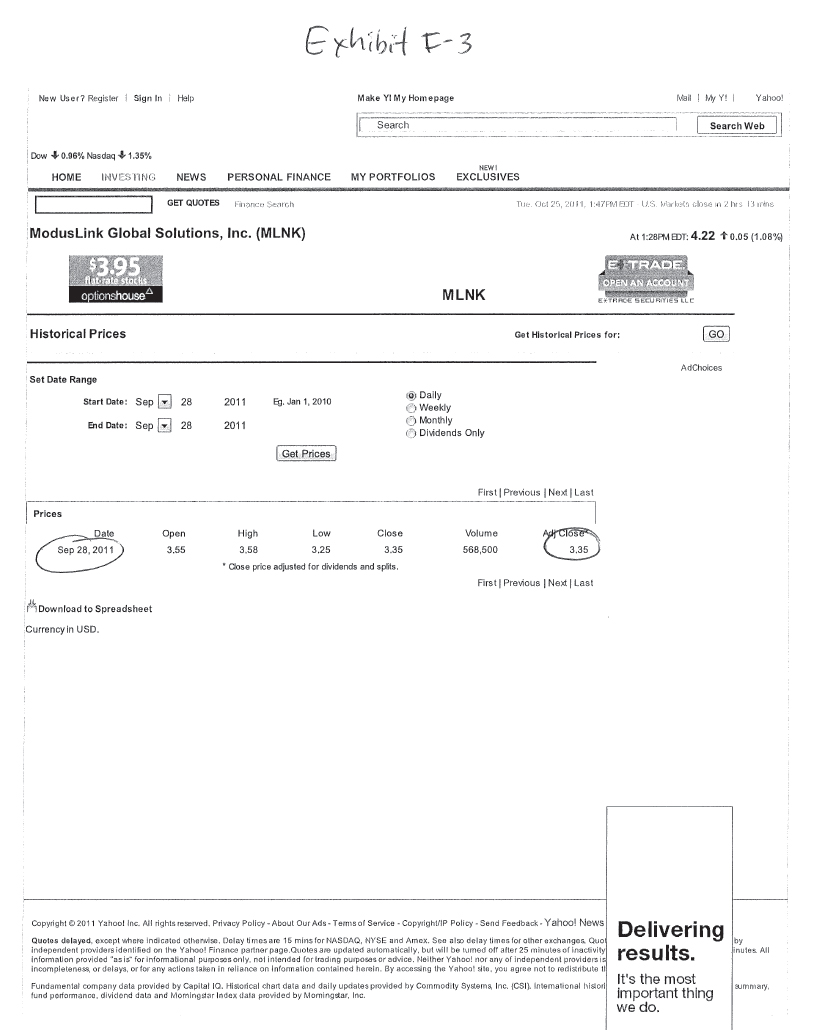

The Company has failed to achieve a return on investment on this large expenditure when considering that the enterprise value for the Company decreased from approximately $378 million, from when the project was being integrated at the end of the Company’s fiscal 2007 to approximately $21.8 million on the close of September 28, 2011, the day before Peerless issued its press release. This represents a 94% decrease in enterprise value. Please refer to the table below that calculates the Company’s enterprise values for the referenced two time periods.

| Period End | | 7/31/07 | | | 7/31/11 | |

| Stock price at Close | | 10/15/07 | | | 9/28/11 | |

| | | | | | | |

| Stock price (Exhibits F-2 and F-3) | | $ | 14.10 | | | $ | 3.35 | |

| | | | | | | | | |

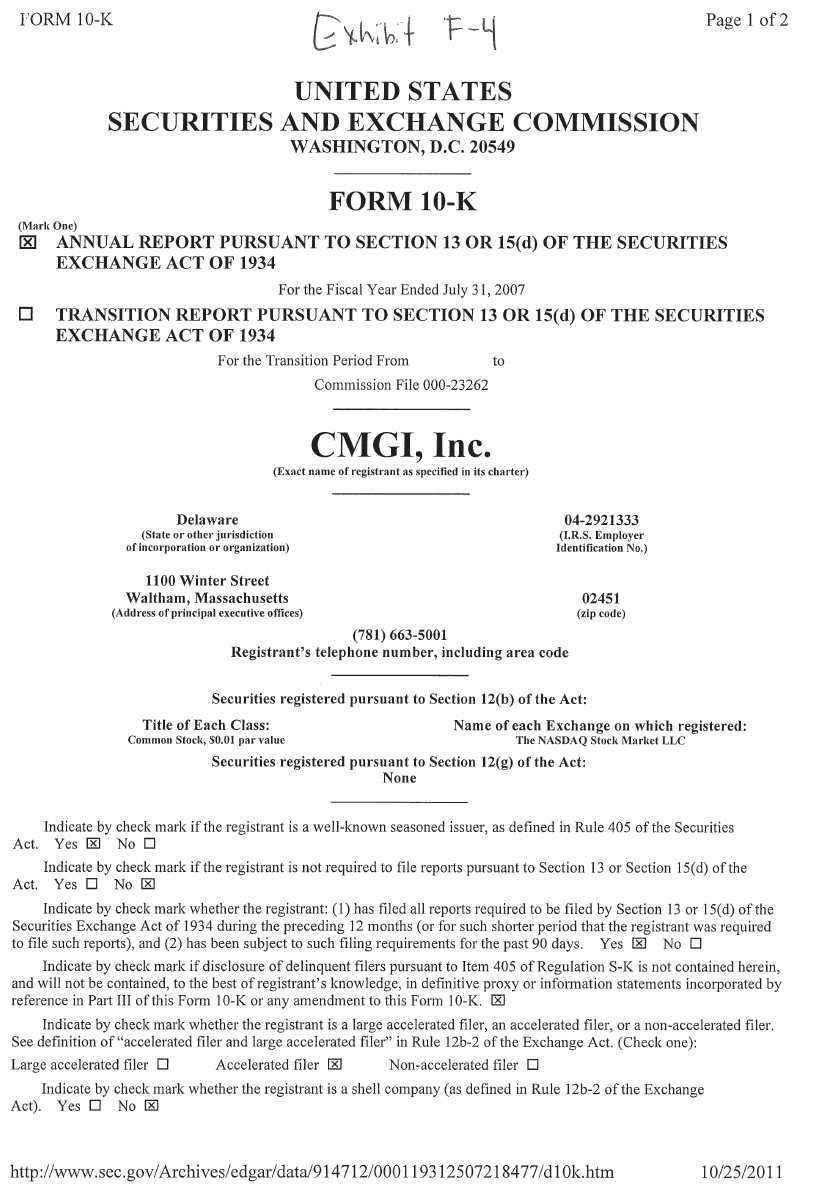

| Shares outstanding date | | 10/10/2007 | | | 7/31/2011 | |

| Shares outstanding (Exhibits F-4 and F-5) | | | 48,925 | | | | 43,820 | |

| Market Cap | | $ | 689,838 | | | $ | 146,797 | |

| | | | | | | | | |

| Plus: Debt | | $ | 0 | | | $ | 0 | |

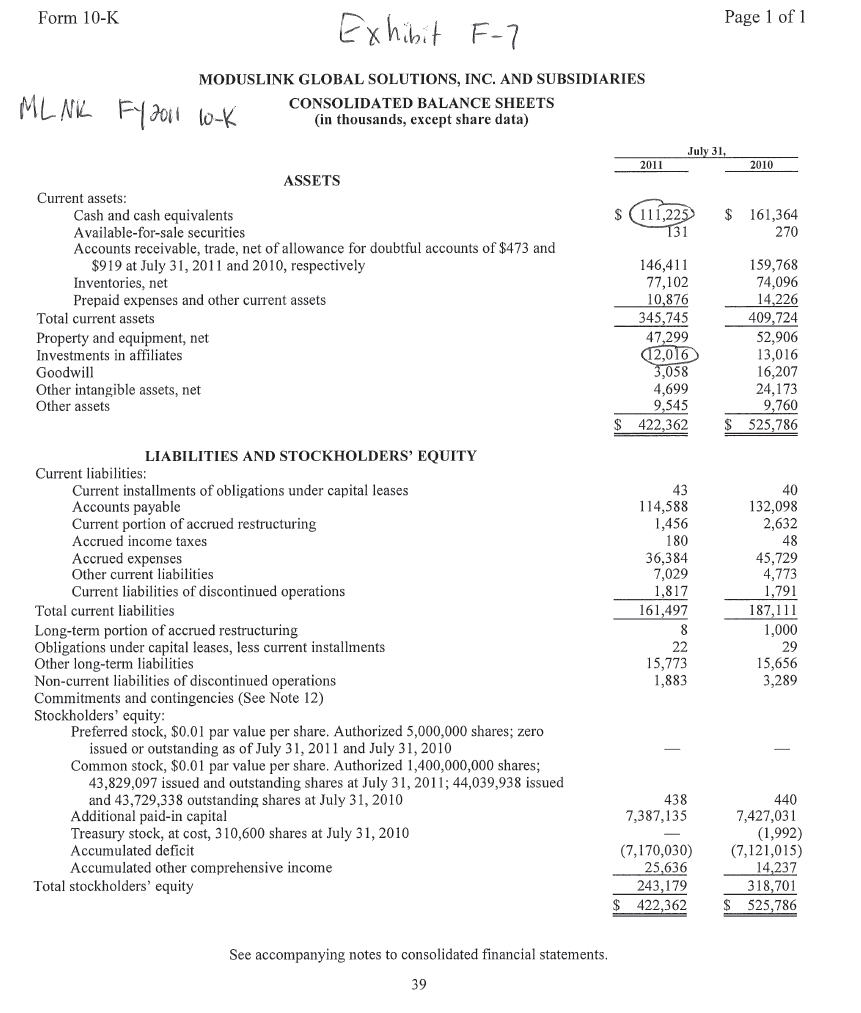

| Less: Cash (Exhibits F-6 and F-7) | | $ | 169,481 | | | $ | 111,225 | |

| Less: Short-term investments (Exhibit F-6) | | $ | 111,850 | | | $ | 0 | |

| Less: Investments (Exhibit F-6 and F-7) | | $ | 30,460 | | | $ | 12,016 | |

| | | | | | | | | |

| Enterprise Value | | $ | 378,047 | | | $ | 21,794 | |

| | | | | | | | | |

| Percent decrease | | | | | | | (94.2 | )% |

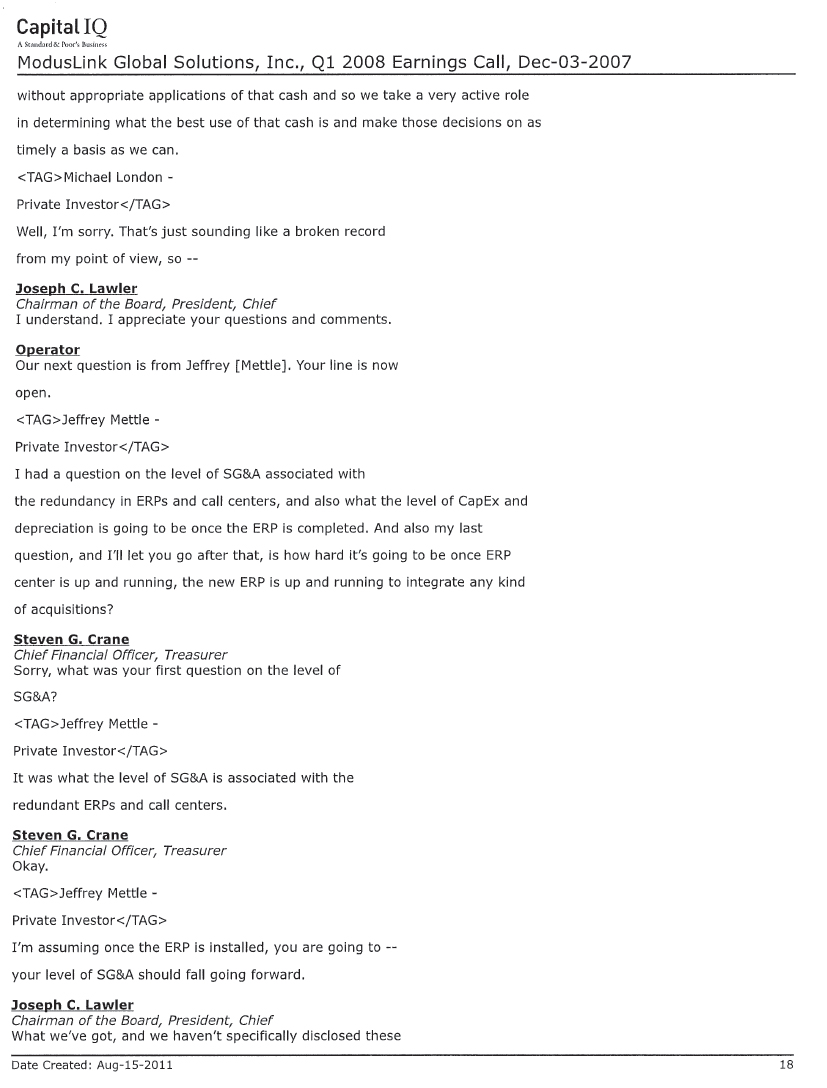

Please refer to the Exhibit G-1, as well as the paragraph below, of the excerpt from the Company’s earnings call transcript further supporting our statements.

Joe Lawler’s, comments ModusLink Global Solutions, Inc., Q1 2008 Earnings Call, December 3, 2007.

… [W]e operate about nine different ERP systems to date, nine different instances of a couple of different ERP systems. The cost of all of those things is one of the reasons that we have said publicly that we will bring the cost of our SG&A expense as a percentage of revenue from the 10% to 11% range down into the 7% range. So there’s both the elimination of those duplicate costs, there’s further standardization that is enabled as a result of those costs, but then we also need and expect revenue growth, which also reduces that percentage of SG&A as a percentage of revenue.”

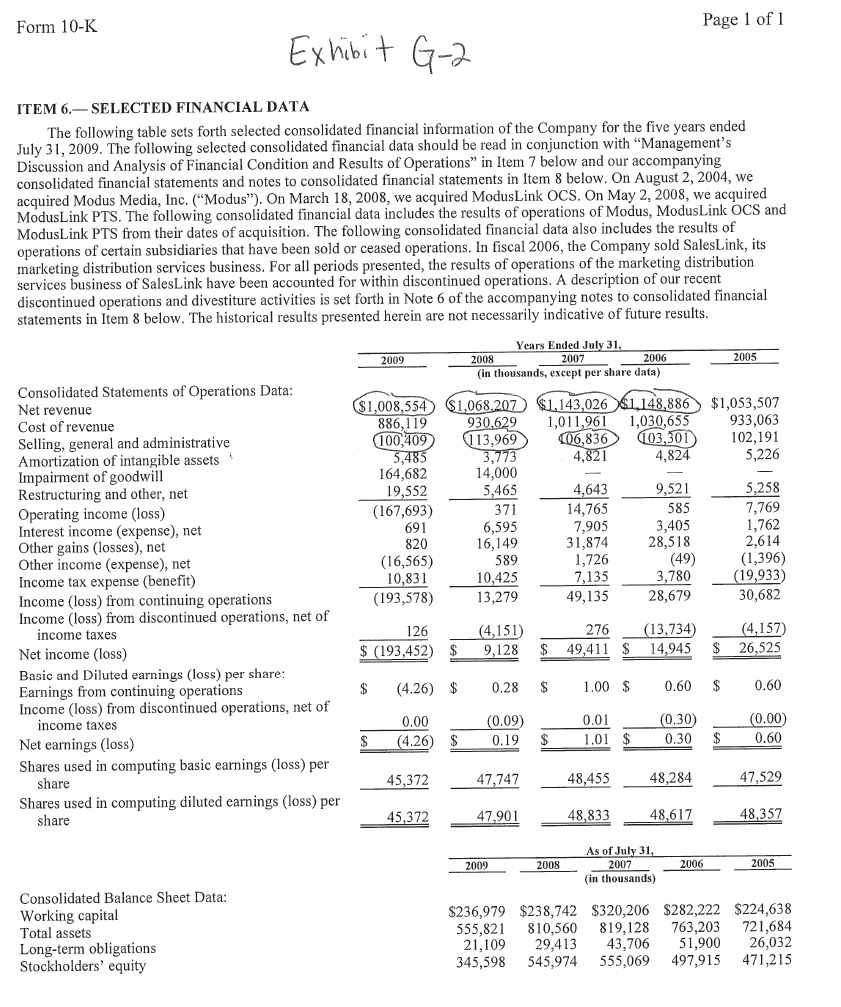

So far, the cost savings benefits from the ERP initiative measured by SG&A expense as a percentage of revenues, never came down to the 7% range as Joe Lawler, the Company’s CEO and Chairman publicly stated. The table below, as well as the supplemental information provided in Exhibit G-2, supports our statement.

| | | Years Ended July 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Net Revenues | | $ | 876,466 | | | $ | 923,996 | | | $ | 1,008,554 | | | $ | 1,068,207 | | | $ | 1,143,026 | | | $ | 1,148,886 | |

| SG&A | | $ | 85,187 | | | $ | 92,855 | | | $ | 100,409 | | | $ | 113,969 | | | $ | 106,836 | | | $ | 103,301 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| SG&A as % of Net Revenues | | | 9.7 | % | | | 10.0 | % | | | 10.0 | % | | | 10.7 | % | | | 9.3 | % | | | 9.0 | % |

● | It is evident that the chronic underperformance of the Company and the dramatically declining stock price, which is trading at its multi-year low, that the Board of Directors are clearly not getting the job done.” |

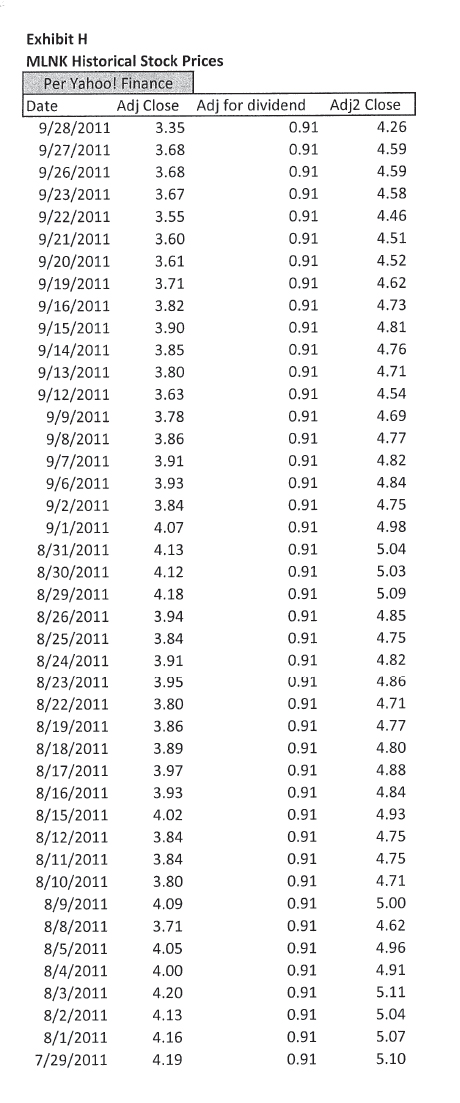

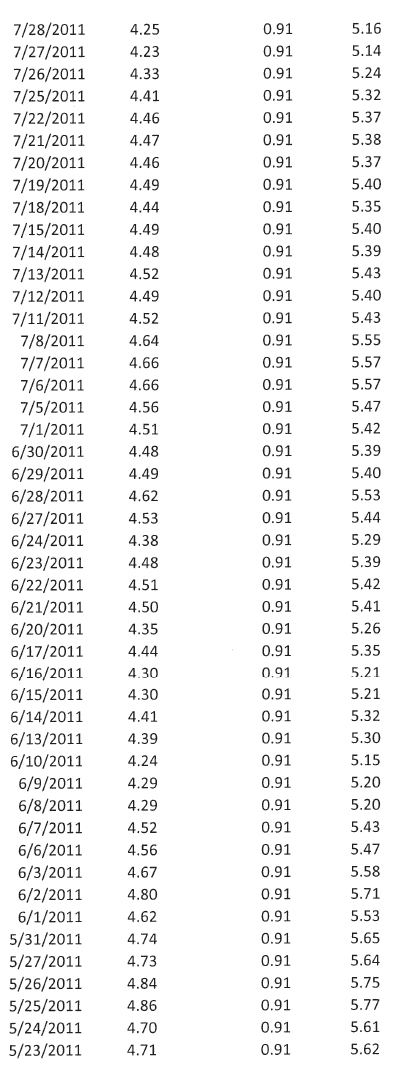

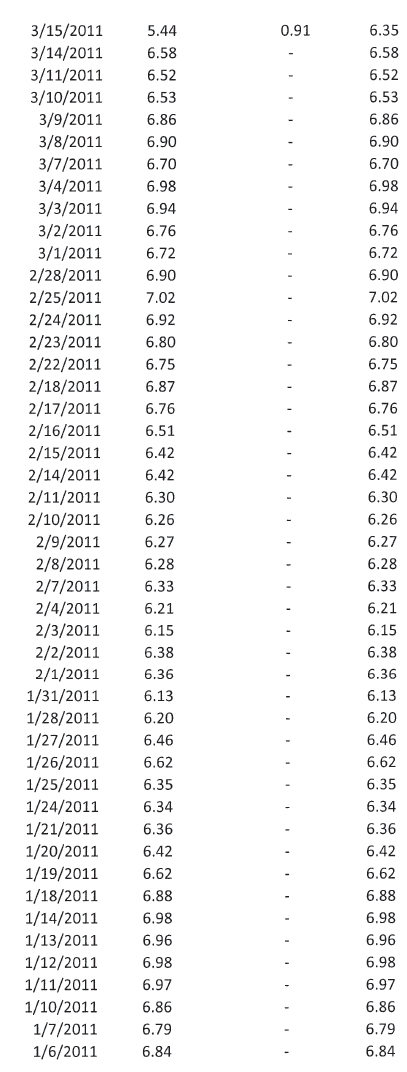

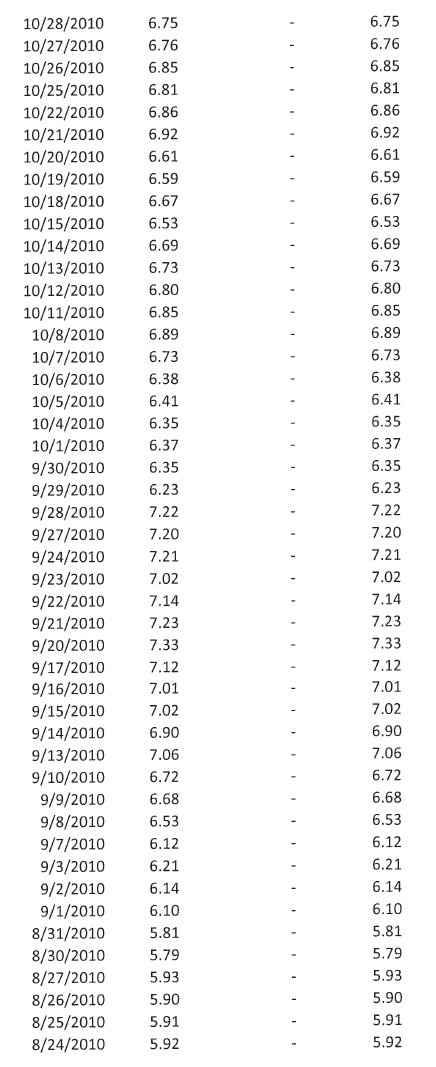

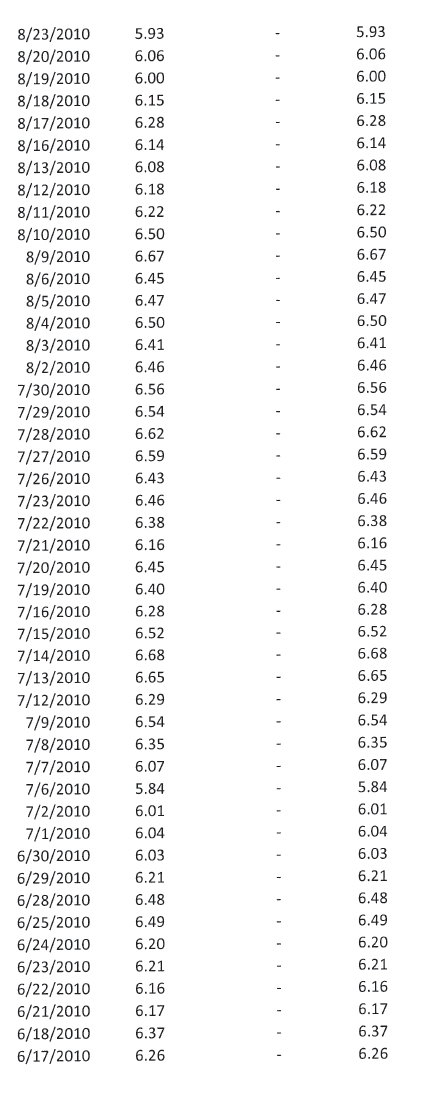

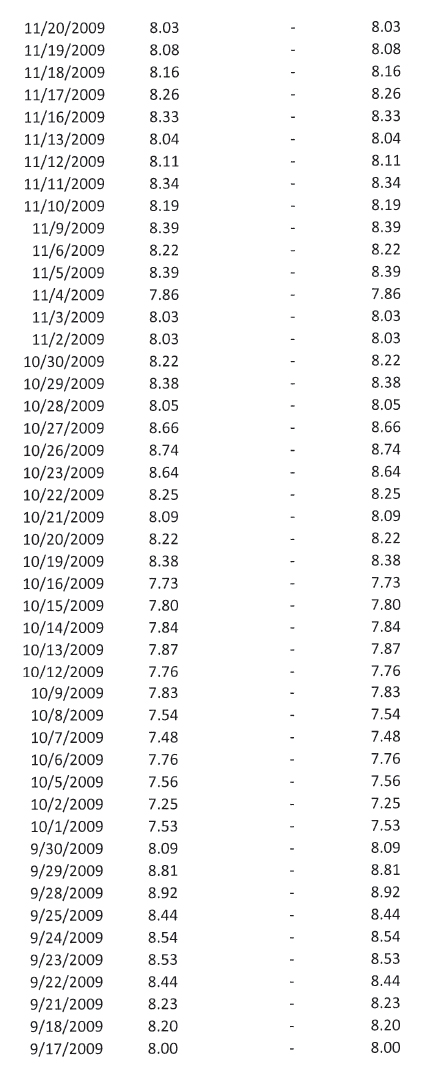

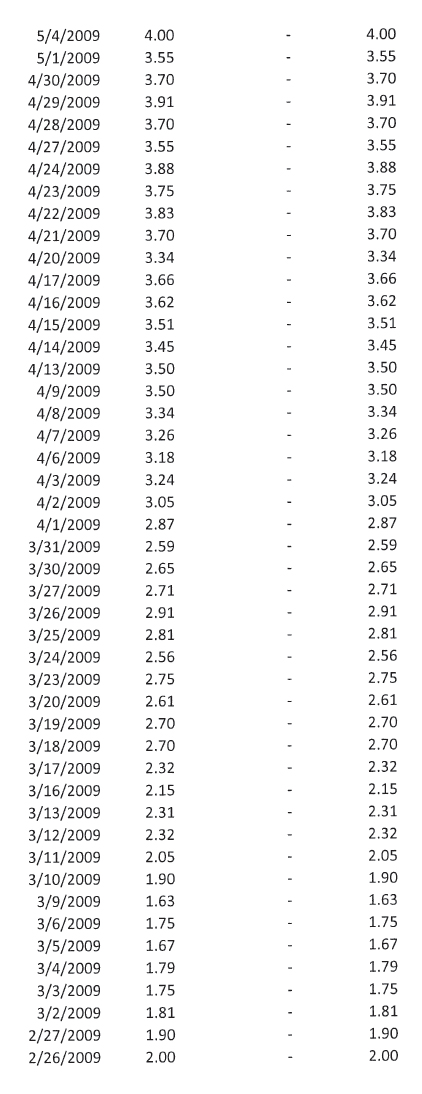

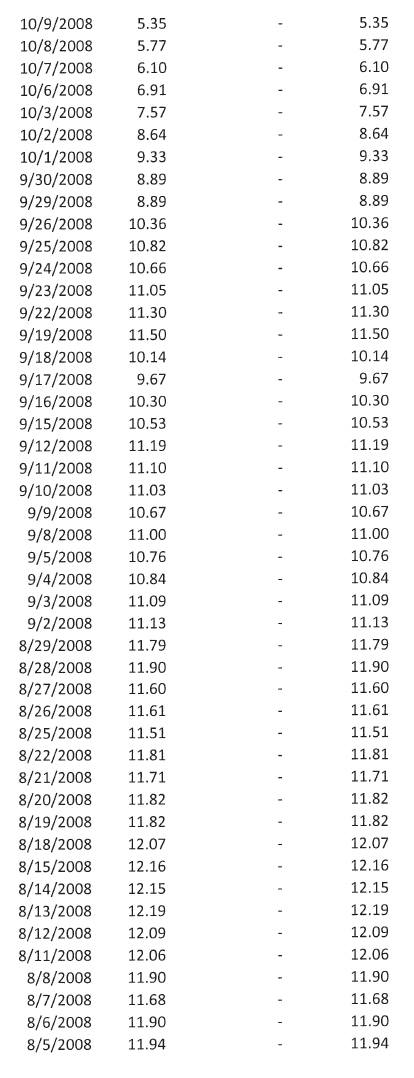

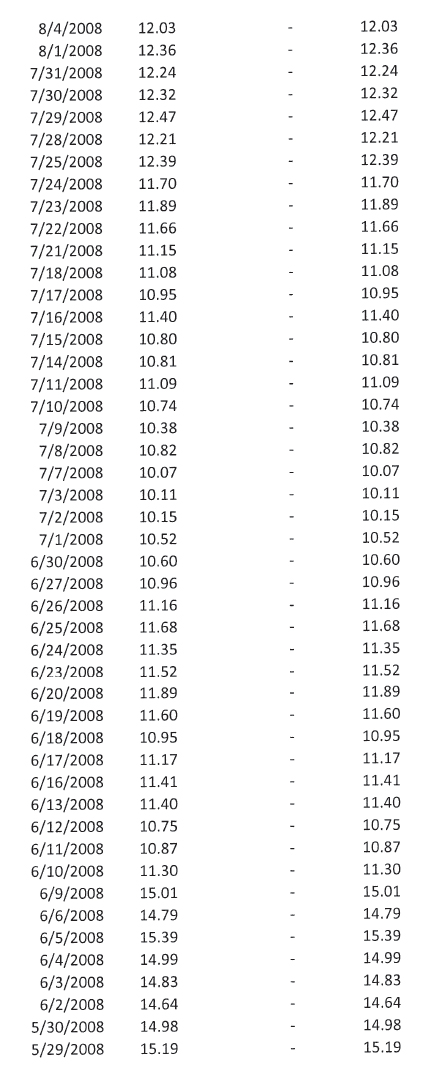

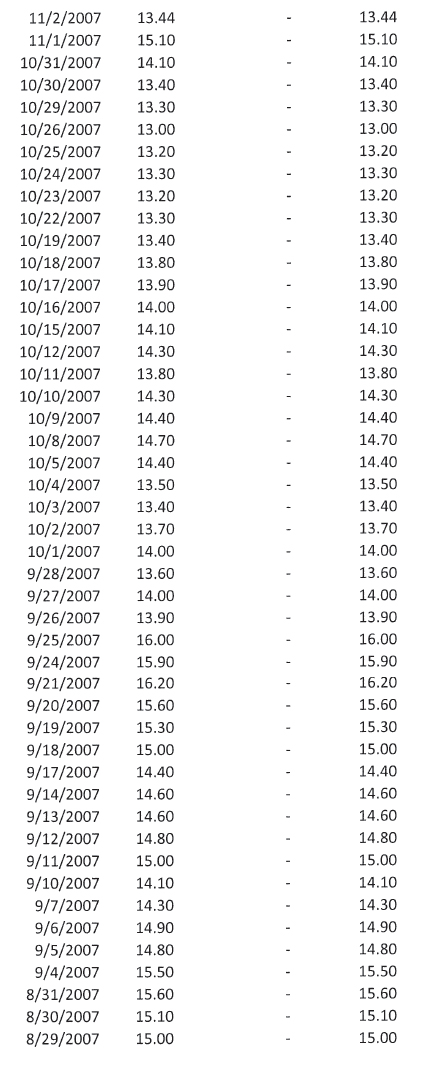

ModusLink’s stock was trading, when adjusting for the special dividend of $.91 per share of cash paid in March 2011 and the 1 for 10 reverse stock split, at $10.40 per share on July 31, 2006 and at $4.26 per share on September 28, 2011. Please see the attached Exhibit H that supports our statement.

ModusLink’s Historical Stock Price Performance From July 31, 2006 – September 28, 2011*

*Adjusted for the special dividend of $.91 of cash per share paid in March 2011 and the 10 for 1 reverse stock split.

Source: Exhibit H

| | 2. | Please further describe how the nominees will be “rationalizing the costs of the Company’s core business” and any specific plans regarding the sale of the company. Please revise to clarify that your board nominees’ plans could change subject to their fiduciary duty to stockholders if elected. |

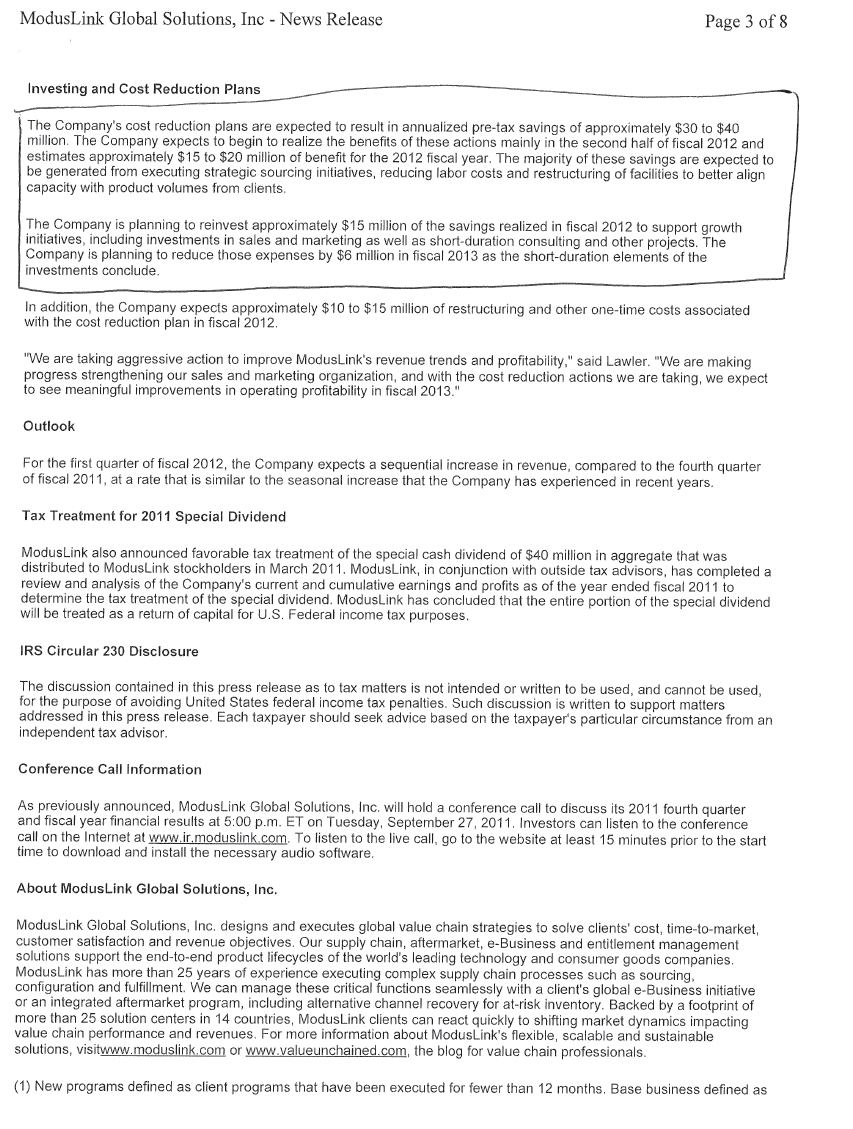

The Company’s September 27, 2011 press release (Exhibit I) indicated that it is undertaking various cost savings initiatives during fiscal 2012 and 2013. Specifically, according to the press release the Company plans on cost reductions of $30 to $40 million during fiscal 2012 and 2013 of which $15 to $20 million of these savings are expected to be realized during fiscal 2012. Our nominees will assess and justify rational business costs at the Company, continuing the plans as noted by the Company in its September 27, 2011 press release:

“The Company's cost reduction plans are expected to result in annualized pre-tax savings of approximately $30 to $40 million. The Company expects to begin to realize the benefits of these actions mainly in the second half of fiscal 2012 and estimates approximately $15 to $20 million of benefit for the 2012 fiscal year. The majority of these savings are expected to be generated from executing strategic sourcing initiatives, reducing labor costs and restructuring of facilities to better align capacity with product volumes from clients.”

Currently, Peerless does not have any specific plans regarding the sale of the Company. However, the Peerless nominees, if elected, will ensure that ModusLink undergoes a thorough and comprehensive strategic review of opportunities to maximize stockholder value. This process could include the sale of all or part of the Company. We will act as fiduciaries for the ModusLink stockholders and attempt to make sure that no fire sales or reactionary decisions will be taken by the Company, or conversely, that no attractive offers for all or part of the Company will be rejected without due consideration.

The Peerless nominees acknowledge that any ideas or strategies that we have prior to joining the Board may change based upon our fiduciary responsibilities if elected to the Board of ModusLink.

| | 3. | We note you indicate that a description of direct and indirect interests will be contained in disclosure documents to be filed later. Please note that although participants relying upon Rule 14a-12 may refer to participant information provided in another filed document, the information must be available, current, and on file for review by security holders at the time the Rule 14a-12 materials are made publicly available. Participants may not refer to participant information to be provided at some future time such as the proxy statement. Refer to Rule 14a-12(a)(1)(i) and Exchange Act Release No. 42055, October 22, 1999, at Section II.C.1.b. In future filings, please revise to describe any direct or indirect interests. |

The appropriate disclosures have been included in the Preliminary Proxy Statement, which was filed yesterday, October 24, 2011, with the Commission.

ACKNOWLEDGMENT

In connection with responding to the comments of the Staff of the Securities and Exchange Commission (“SEC”) relating to the Soliciting Material under Rule 14a-12 (the “Soliciting Material”) filed by Peerless Systems Corporation on October 4, 2011, each of the undersigned acknowledges the following:

| | ● | The undersigned is responsible for the adequacy and accuracy of the disclosure in the Soliciting Material relating to such participant. |

| | ● | The Staff’s comments or changes to disclosure in response to Staff comments in the Soliciting Material reviewed by the Staff do not foreclose the SEC from taking any action with respect to the Soliciting Material. |

| | ● | The undersigned may not assert Staff comments as a defense in any proceeding initiated by the SEC or any person under the federal securities laws of the United States. |

PEERLESS SYSTEMS CORPORATION

By: /s/ Timothy Brog

Name: Timothy E. Brog

Title: Chief Executive Officer

V INVESTMENT PARTNERS III LLC

By: /s/ Timothy Brog

Name: Timothy E. Brog

Title: Portfolio Manager

LOCKSMITH CAPITAL ADVISORS INC.

By: /s/ Timothy Brog

Name: Timothy E. Brog

Title: Chief Executive Officer

TIMOTHY E. BROG

JEFFREY S. WALD