Ms. Kimberly A. Browning

January 14, 2013

Page 9 of 10

Response: We have made the requested changes.

Response: We have made the requested changes.

Response: We have made the requested changes.

Response: As indicated in our response to item 17, we do not believe it is feasible or advisable to identify securities that might be sold to facilitate the Reorganization. We do not believe, however, that we can conclusively state at this early stage that no securities will be sold to facilitate the Reorganization.

Response: There were no such transfers during the 12-month period ended October 31, 2012, which we have indicated in a new footnote to the table that appears in Note 3.

The Trust acknowledges in connection with this filing the following: (1) it is responsible for the adequacy and accuracy of the disclosure in the Prospectus/Proxy; (2) Commission staff comments or changes to the disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the Prospectus/Proxy; and (3) it may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

Ms. Kimberly A. Browning

January 14, 2013

Page 10 of 10

If you have any questions, please call Ms. Fapohunda at (201) 827-2279 or the undersigned at (201) 827-2225.

| | |

| Sincerely, | |

| | |

| /s/ Thomas R. Phillips | |

|

| |

| Thomas R. Phillips | |

| Vice President and Assistant Secretary | |

Lord Abbett Stock Appreciation Fund

90 Hudson Street

Jersey City, New Jersey 07302-3973

888-522-2388

Dear Fellow Shareholder,

In an effort to improve the quality of our clients’ investment experience and better meet their evolving investment needs, we are asking you to approve the reorganization of Lord Abbett Stock Appreciation Fund (“Target Fund”) into another similarly managed Lord Abbett Fund, Lord Abbett Growth Leaders Fund (“Acquiring Fund”). Target Fund follows a large cap growth investing strategy, while Acquiring Fund invests in growth companies of all sizes. Thus, the reorganization will benefit Target Fund shareholders by enabling them to pursue substantially similar investment objectives and strategies, but as part of a larger fund with greater investment flexibility.

We believe the reorganization offers shareholders of Target Fund other potential benefits, including lower total annual operating expenses. The Funds’ expense structures differ in that Acquiring Fund has a lower management fee, the same share class-specific Rule 12b-1 fee rates, and higher other (i.e., non-management) expenses than Target Fund. It is expected that you will pay lower total annual operating expenses after the reorganization as a shareholder of Acquiring Fund than you currently pay as a shareholder of Target Fund.

The transaction will qualify as a tax-free reorganization for federal income tax purposes, and you will not be charged any sales charges, commissions, or transaction fees in connection with it. The attached Questions & Answers and Combined Prospectus/Proxy Statement contain more information, including information about differences between the Funds and key factors that you may find helpful in evaluating the proposal to reorganize Target Fund.

This change requires your approval. We encourage you to review the attached materials carefully and recommend that you vote “FOR” the approval of the proposal. By voting promptly, you can help avoid the expense of additional follow-up mailings and solicitations.

You can vote in any of the following ways (please refer to your attached proxy card for more detailed voting instructions):

|

• | | | | Via the Internet |

|

• | | | | By telephone |

|

• | | | | By mail |

|

• | | | | At the shareholder meeting: March 15, 2013, 9:00 a.m., at 90 Hudson Street, Jersey City, NJ 07302-3973 |

We encourage you to vote by the internet or telephone, using the “control” number that appears on your proxy card. We must receive your vote before 9:00 a.m. on March 15, 2013 in order to count your vote. Regardless of the method you choose, please take the time to read the full text of the attached Combined

Prospectus/Proxy Statement before voting.Please vote now. Your vote is important.

Thank you for investing in the Lord Abbett Family of Funds. It is a privilege to manage your investment. If you have any questions or need assistance voting, please contact your financial advisor or call 877-777-5613.

| | |

| | Sincerely, |

| |

|

| | Daria L. Foster

President, Chief Executive Officer, and Trustee |

Lord Abbett Stock Appreciation Fund

90 Hudson Street

Jersey City, New Jersey 07302-3973

888-522-2388

QUESTIONS AND ANSWERS

Your vote is important.

Below are answers to some commonly asked questions that are intended to help you understand the proposal on which shareholders of Lord Abbett Stock Appreciation Fund (“Target Fund”) are being asked to vote. This proposal is described in more detail in the Combined Prospectus/Proxy Statement, which you should read carefully. If you have a question or need assistance in voting, please call 877-777-5613.

Why am I being asked to vote?

Lord, Abbett & Co. LLC (“Lord Abbett”) is seeking your vote because you are, or were as of December 20, 2012 (the “Record Date”), a shareholder of Target Fund. As discussed in more detail below, Lord Abbett is proposing a change to Target Fund that requires approval of the Fund’s shareholders at a special meeting of shareholders scheduled to be held on March 15, 2013. The Board of Trustees (the “Board”) of Target Fund has approved the proposal described below and recommends that you vote “FOR” it.

What proposal am I being asked to vote on?

Shareholders are being asked to approve a proposal to reorganize Target Fund into Lord Abbett Growth Leaders Fund (“Acquiring Fund” and, together with Target Fund, the “Funds”) (the “Reorganization”). After the Reorganization is completed, you will become a shareholder of Acquiring Fund and Target Fund will be terminated. Like Target Fund, Acquiring Fund seeks capital appreciation and employs a growth investing style. One material difference between these two Funds is that Target Fund invests mainly in large cap equity securities while Acquiring Fund invests in large, mid, and small cap equity securities. Both Funds define large cap companies as those that fall within the market capitalization range of companies in the Russell 1000® Index. An additional material difference between the Funds’ investment approaches is that Acquiring Fund engages in more active trading than Target Fund. Therefore, Acquiring Fund has a significantly higher portfolio turnover rate than Target Fund.

The Combined Prospectus/Proxy Statement provides more information about Acquiring Fund and the Reorganization. It is both a Prospectus for Acquiring Fund and a Proxy Statement for Target Fund.

Why does the Board recommend that I vote “FOR” the proposal?

Due to a number of factors, most notably Lord Abbett’s concerns about Target Fund’s long-term viability, the Board believes that it is in shareholders’ best interests to reorganize the Fund into Acquiring Fund, which has a broader investment focus, a lower management fee rate, and lower overall expenses. The Reorganization thus would permit Target Fund shareholders to pursue substantially similar investment objectives and strategies, but as part of a larger fund (the “Combined Fund”) with greater investment flexibility and lower overall expenses. The specific reasons why the Board recommends that shareholders vote “FOR” the proposal are discussed in more detail on pages 9 through 11 of the Combined Prospectus/Proxy Statement.

How do the Funds’ expense structures compare?

The annual expense ratio of the Combined Fund is expected to be the same as or lower than the current annual expense ratio of Acquiring Fund, which is lower than the current annual expense ratio of Target Fund. The specific components of each Fund’s operating expenses compare as follows: Acquiring Fund’s management fee rate is lower than Target Fund’s management fee rate; Rule 12b-1 fees applicable to a particular class of shares are the same for both Funds; and Acquiring Fund’s other (i.e., non-management) expenses are higher than those of Target Fund. We believe Acquiring Fund’s comparatively higher other expenses are attributable to its relatively short operating history of less than two years. As Acquiring Fund grows – including by acquiring Target Fund’s assets in the Reorganization – it is expected that it will realize economies of scale that will lower its other expenses (as a percentage of Fund assets) over time. Another material difference between the Funds’ expense structures is that Lord Abbett has contractually capped Acquiring Fund’s total annual operating expenses at a lower level than it has contractually capped Target Fund’s total annual operating expenses. Thus, Target Fund shareholders will experience a reduction in total annual operating expenses as a result of the Reorganization, decreasing the overall cost of their investment.

Will the value of my investment change as a result of the Reorganization?

No. Although the aggregate value of your investment will not change as a result of the Reorganization, the number of shares you own likely will change. The reason for this potential change is that your Target Fund shares will be exchanged for Acquiring Fund shares at the net asset value per share of Acquiring Fund, which likely will differ from the net asset value per share of Target Fund.

Will I pay any taxes, sales charges, or similar fees in connection with the Reorganization?

No. The Reorganization is expected to qualify as a tax free reorganization pursuant to Section 368(a) of the Internal Revenue Code of 1986, and no sales charges or other similar fees will be charged in connection with it. However, any other investment or redemption would be subject to any applicable sales charges.

When would the Reorganization take place?

If shareholders approve the Reorganization, the transaction is expected to be completed as soon as possible after the shareholder meeting scheduled to be held on March 15, 2013.

Who will manage the portfolio of the Combined Fund following the Reorganization?

F. Thomas O’Halloran heads each Fund’s investment team. In managing Acquiring Fund, Mr. O’Halloran is assisted by Paul J. Volovich and Arthur K. Weise, who will continue to manage the Combined Fund after the Reorganization. Accordingly, the Reorganization will promote continuity of portfolio management.

Who will pay the costs associated with the Reorganization?

The Funds will share equally the costs associated with the Reorganization, including the cost of hiring a proxy solicitation firm to request and record shareholders’ votes, the cost of filing, printing and mailing this Combined Prospectus/Proxy Statement, accounting fees, and legal fees. We estimate that these costs will total approximately $175,000. Lord Abbett will indirectly bear the costs of the Reorganization on behalf of each Fund because of the fee waiver and expense reimbursement agreement Lord Abbett has with each Fund.

What if there are not enough votes to approve the proposal?

If Target Fund does not receive enough votes to approve the proposal before the shareholder meeting, the meeting may be postponed to permit further solicitation of proxy votes. If Target Fund does not receive enough votes to approve the proposal even after postponing the meeting, the proposal will not be implemented, and the Board and Lord Abbett will consider other strategic alternatives for the Fund, possibly including its liquidation.

What is Broadridge Financial Solutions, Inc.?

Broadridge Financial Solutions, Inc. (“Broadridge”), which is not affiliated with either Fund or Lord Abbett, is the proxy solicitation firm that will contact shareholders and record their votes. As the shareholder meeting date approaches, shareholders who have not yet voted may receive telephone calls or emails from Broadridge asking them to vote so that the meeting will not need to be postponed.

How many votes am I entitled to cast?

You are entitled to one vote for each full share and a proportionate fractional vote for each fractional share you own of Target Fund on the Record Date (December 20, 2012). Only shareholders of Target Fund as of the Record Date may vote.

How do I submit my vote?

You may vote in any of the following four ways:

| | |

Internet: | | Please use the website and control number provided on your proxy card. |

Telephone: | | Please use the telephone number and control number provided on your proxy card. |

Mail: | | Please sign and date your proxy card and return it to the address shown on the card. |

In Person: | | At the shareholder meeting at 9:00 a.m. on March 15, 2013, at 90 Hudson Street, Jersey City, NJ 07302. |

Please vote now.You can help reduce costs by voting promptly. Your vote is important, regardless of how many shares you own. Please read the Combined Prospectus/Proxy Statement and vote your shares. If you have a question or need assistance in voting, please call 877-777-5613.

Thank you for investing in the Lord Abbett Family of Funds.

Lord Abbett Stock Appreciation Fund

90 Hudson Street

Jersey City, New Jersey 07302-3973

888-522-2388

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be Held on March 15, 2013

NOTICE IS HEREBY GIVEN of a Special Meeting of the Shareholders of Lord Abbett Stock Appreciation Fund (“Target Fund”) (the “Meeting”). The Meeting will be held at the offices of Lord, Abbett & Co. LLC at 90 Hudson Street, Jersey City, New Jersey, on March 15, 2013 at 9:00 a.m. for the purpose of considering the following proposals:

(1) To approve an Agreement and Plan of Reorganization between Target Fund and Lord Abbett Growth Leaders Fund (“Acquiring Fund” and, together with Target Fund, the “Funds”), providing for: (a) the transfer of all of the assets of Target Fund to Acquiring Fund in exchange for shares of the corresponding class of Acquiring Fund and the assumption by Acquiring Fund of all of the liabilities of Target Fund; (b) the distribution of such shares to the shareholders of Target Fund; and (c) the termination of Target Fund; and

(2) To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof.

The Board has fixed the close of business on December 20, 2012 as the record date for determination of shareholders of Target Fund entitled to notice of and to vote at the Meeting and any adjournments or postponements thereof. Shareholders are entitled to one vote for each full share held and a proportionate vote for each fractional share held.

Your vote is important regardless of how many shares you hold. By voting promptly, you can help avoid the expense of additional follow-up mailings and solicitations. You may vote via the Internet, by telephone, by signing and returning your proxy card, or by attending the Meeting in person, as described in the attached Combined Prospectus/Proxy Statement.

| | |

| | By order of the Board |

| |

|

| | Lawrence H. Kaplan |

January 23, 2013 | | Vice President and Secretary |

Combined Prospectus/Proxy Statement

Dated January 23, 2013

Lord Abbett Stock Appreciation Fund

90 Hudson Street

Jersey City, New Jersey 07302-3973

888-522-2388

Lord Abbett Growth Leaders Fund

(a series of Lord Abbett Securities Trust)

90 Hudson Street

Jersey City, New Jersey 07302-3973

888-522-2388

This Combined Prospectus/Proxy Statement relates to the proposed Reorganization (defined below) of Lord Abbett Stock Appreciation Fund (“Target Fund”), a registered open-end management investment company, into Lord Abbett Growth Leaders Fund, a series of Lord Abbett Securities Trust, another registered open-end management investment company (the “Trust”) (“Acquiring Fund” and, together with Target Fund, the “Funds”). The proposed Reorganization is intended to achieve potential operating efficiencies and economies of scale by combining similarly managed equity funds advised by Lord, Abbett & Co. LLC (“Lord Abbett”), resulting in potential cost savings for shareholders. The Reorganization would combine similarly managed Funds into a single larger fund. The Board of Trustees of each of Target Fund and the Trust, on behalf of Acquiring Fund (together, the “Board”), has determined unanimously, following Lord Abbett’s recommendation, that the Reorganization would be in the best interests of each Fund and its shareholders.

By voting promptly, you can help avoid the expense of additional follow-up mailings and solicitations. Your vote is important regardless of the size of your holdings in Target Fund. If you have a question or need assistance in voting, please call 877-777-5613.

This Combined Prospectus/Proxy Statement is both a Prospectus for Acquiring Fund and a Proxy Statement for Target Fund. It concisely sets forth the information that a Target Fund shareholder should know before voting on the Reorganization. Shareholders should read it and retain it for future reference. Attached as Exhibit A to this Combined Prospectus/Proxy Statement is a copy of the form of Agreement and Plan of Reorganization (the “Plan”) that describes the terms of the Reorganization in greater detail. This Combined Prospectus/Proxy Statement is accompanied by Acquiring Fund’s Prospectus dated November 28, 2012, as may be supplemented, which is incorporated by reference into (legally considered to be a part of) this Combined Prospectus/Proxy Statement.

Additional information about the Funds has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and can be found in the following documents, which are incorporated by reference into this Combined Prospectus/Proxy Statement:

|

• | | | | Target Fund’s Prospectus dated December 1, 2012, as may be supplemented; |

|

• | | | | The Statement of Additional Information dated January 23, 2013 relating to this Combined Prospectus/Proxy Statement; |

|

• | | | | The Statement of Additional Information dated December 1, 2012, as may be supplemented, relating to Target Fund’s Prospectus dated December 1, 2012, as supplemented; |

|

• | | | | The Statement of Additional Information dated November 28, 2012, as may be supplemented, relating to Acquiring Fund’s Prospectus dated November 28, 2012, as may be supplemented; |

|

• | | | | Target Fund’s Annual Report for the fiscal year ended July 31, 2012; and |

|

• | | | | Acquiring Fund’s Annual Report for the fiscal year ended October 31, 2012. |

These documents are available free of charge via Lord Abbett’s website at www.lordabbett.com, by calling 888-522-2388, or by writing to the Funds at 90 Hudson Street, Jersey City, NJ 07302-3973.

Acquiring Fund will publish a new prospectus and statement of additional information effective March 1, 2013. As of that date, you may obtain copies of these documents from Lord Abbett’s website at www.lordabbett.com or by calling 888-522-2388.

The Funds are subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended (the “1940 Act”), and in accordance therewith, file reports and other information, including proxy materials, with the SEC.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Combined Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

TABLE OF CONTENTS

SPECIAL MEETING OF SHAREHOLDERS

OF

Lord Abbett Stock Appreciation Fund

This Combined Prospectus/Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Trustees of Lord Abbett Stock Appreciation Fund (“Target Fund”), to be used at a special meeting of shareholders of Target Fund, to be held at 9:00 a.m. on March 15, 2013, at the offices of Lord, Abbett & Co. LLC (“Lord Abbett”) at 90 Hudson Street, Jersey City, New Jersey, and at any adjournments or postponements thereof (the “Meeting”).

The Meeting is being held for the purpose of considering the following proposals:

(1) To approve an Agreement and Plan of Reorganization between Target Fund and Lord Abbett Securities Trust (the “Trust”), on behalf of its series, Lord Abbett Growth Leaders Fund (“Acquiring Fund” and, together with Target Fund, the “Funds”), providing for: (a) the transfer of all of the assets of Target Fund to Acquiring Fund in exchange for shares of the corresponding class of Acquiring Fund and the assumption by Acquiring Fund of all of the liabilities of Target Fund; (b) the distribution of such shares to the shareholders of Target Fund; and (c) the termination of Target Fund (the “Reorganization”).

(2) To transact such other business as may properly come before the Meeting.

Only shareholders of record of Target Fund as of the close of business on December 20, 2012 (the “Record Date”) will be entitled to notice of, and to vote at, the Meeting or any adjournment or postponement thereof. This Combined Prospectus/Proxy Statement and the enclosed proxy card initially are being mailed to shareholders on or about January 23, 2013.

A vote in favor of the Reorganization is a vote to become a shareholder of Acquiring Fund and terminate Target Fund. The votes of Acquiring Fund’s shareholders are not being solicited because their approval or consent is not necessary for the Reorganization to proceed. If shareholders do not approve the Reorganization, or if the Reorganization is not completed for any other reason, the Board will consider other strategic alternatives for Target Fund, possibly including its liquidation.

1

FEES AND EXPENSES

The tables below provide a summary comparison of the expenses of each class of shares of each Fund. Target Fund’s annual fund operating expenses are based on the Fund’s fees and expenses for the fiscal year ended July 31, 2012 and Acquiring Fund’s annual fund operating expenses are based on the Fund’s fees and expenses for the fiscal year ended October 31, 2012. The annual fund operating expenses of Acquiring Fund giving effect to the proposed Reorganization (the “Combined Fund”) are shown on apro formabasis as of October 31, 2012, as if the Reorganization had been completed on that date.

The Funds are subject to the same sales charges. You may qualify for sales charge discounts if you and certain members of your family invest, or agree to invest in the future, at least $50,000 in the Lord Abbett Family of Funds. More information about these and other sales charge discounts is available from your financial professional, in “Sales Charge Reductions and Waivers” on page 21 of Acquiring Fund’s prospectus and in “Purchases, Redemptions, Pricing, and Payments to Dealers” on page 8-1 of Acquiring Fund’s statement of additional information (“SAI”).

2

Class A

| | | | | | |

Fee Table | | Target

Fund | | Acquiring

Fund | | Pro Forma

Combined

Fund |

Shareholder Fees

(Fees paid directly from your investment) | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | 5.75% | | 5.75% | | 5.75% |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price or redemption proceeds, whichever is lower) | | None(1) | | None(1) | | None(1) |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.75% | | 0.55% | | 0.55% |

Distribution and Service (12b-1) Fees | | 0.35% | | 0.35% | | 0.35% |

Other Expenses(2) | | 0.40% | | 0.65% | | 0.35% |

Total Annual Fund Operating Expenses | | 1.50% | | 1.55% | | 1.25% |

Fee Waiver and/or Expense Reimbursement | | -0.05%(3) | | -0.70%(4) | | -0.40%(4) |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | 1.45%(3) | | 0.85%(4) | | 0.85%(4) |

Class B

| | | | | | |

Fee Table | | Target

Fund | | Acquiring

Fund | | Pro Forma

Combined

Fund |

Shareholder Fees

(Fees paid directly from your investment) | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | None | | None | | None |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price or redemption proceeds, whichever is lower) | | 5.00% | | 5.00% | | 5.00% |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.75% | | 0.55% | | 0.55% |

Distribution and Service (12b-1) Fees | | 1.00% | | 1.00% | | 1.00% |

Other Expenses(2) | | 0.40% | | 0.65% | | 0.35% |

Total Annual Fund Operating Expenses | | 2.15% | | 2.20% | | 1.90% |

Fee Waiver and/or Expense Reimbursement | | -0.05%(3) | | -0.70%(4) | | -0.40%(4) |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | 2.10%(3) | | 1.50%(4) | | 1.50%(4) |

3

Class C

| | | | | | |

Fee Table | | Target

Fund | | Acquiring

Fund | | Pro Forma

Combined

Fund |

Shareholder Fees

(Fees paid directly from your investment) | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | None | | None | | None |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price or redemption proceeds, whichever is lower) | | 1.00%(5) | | 1.00%(5) | | 1.00%(5) |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.75% | | 0.55% | | 0.55% |

Distribution and Service (12b-1) Fees | | 1.00% | | 1.00% | | 1.00% |

Other Expenses(2) | | 0.40% | | 0.65% | | 0.35% |

Total Annual Fund Operating Expenses | | 2.15% | | 2.20%(6) | | 1.90% |

Fee Waiver and/or Expense Reimbursement | | -0.05%(3) | | -0.70%(4) | | -0.40%(4) |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | 2.10%(3) | | 1.50%(4) | | 1.50%(4) |

Class F

| | | | | | |

Fee Table | | Target

Fund | | Acquiring

Fund | | Pro Forma

Combined

Fund |

Shareholder Fees

(Fees paid directly from your investment) | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | None | | None | | None |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price or redemption proceeds, whichever is lower) | | None | | None | | None |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.75% | | 0.55% | | 0.55% |

Distribution and Service (12b-1) Fees | | 0.10% | | 0.10% | | 0.10% |

Other Expenses(2) | | 0.40% | | 0.65% | | 0.35% |

Total Annual Fund Operating Expenses | | 1.25% | | 1.30% | | 1.00% |

Fee Waiver and/or Expense Reimbursement | | -0.05%(3) | | -0.70%(4) | | -0.40%(4) |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | 1.20%(3) | | 0.60%(4) | | 0.60%(4) |

4

Class I

| | | | | | |

Fee Table | | Target

Fund | | Acquiring

Fund | | Pro Forma

Combined

Fund |

Shareholder Fees

(Fees paid directly from your investment) | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | None | | None | | None |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price or redemption proceeds, whichever is lower) | | None | | None | | None |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.75% | | 0.55% | | 0.55% |

Distribution and Service (12b-1) Fees | | None | | None | | None |

Other Expenses(2) | | 0.40% | | 0.65% | | 0.35% |

Total Annual Fund Operating Expenses | | 1.15% | | 1.20% | | 0.90% |

Fee Waiver and/or Expense Reimbursement | | -0.05%(3) | | -0.70%(4) | | -0.40%(4) |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | 1.10%(3) | | 0.50%(4) | | 0.50%(4) |

Class R2

| | | | | | |

Fee Table | | Target

Fund | | Acquiring

Fund | | Pro Forma

Combined

Fund |

Shareholder Fees

(Fees paid directly from your investment) | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | None | | None | | None |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price or redemption proceeds, whichever is lower) | | None | | None | | None |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.75% | | 0.55% | | 0.55% |

Distribution and Service (12b-1) Fees | | 0.60% | | 0.60% | | 0.60% |

Other Expenses(2) | | 0.40% | | 0.65%(6) | | 0.35% |

Total Annual Fund Operating Expenses | | 1.75% | | 1.80%(6) | | 1.50% |

Fee Waiver and/or Expense Reimbursement | | -0.05%(3) | | -0.70%(4)(6) | | -0.40%(4) |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | 1.70%(3) | | 1.10%(4)(6) | | 1.10%(4) |

5

Class R3

| | | | | | |

Fee Table | | Target

Fund | | Acquiring

Fund | | Pro Forma

Combined

Fund |

Shareholder Fees

(Fees paid directly from your investment) | | | | | | |

Maximum Sales Charge (Load) Imposed on Purchases

(as a percentage of offering price) | | None | | None | | None |

Maximum Deferred Sales Charge (Load)

(as a percentage of offering price or redemption proceeds, whichever is lower) | | None | | None | | None |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | | | | | | |

Management Fees | | 0.75% | | 0.55% | | 0.55% |

Distribution and Service (12b-1) Fees | | 0.50% | | 0.50% | | 0.50% |

Other Expenses(2) | | 0.40% | | 0.65%(6) | | 0.35% |

Total Annual Fund Operating Expenses | | 1.65% | | 1.70%(6) | | 1.40% |

Fee Waiver and/or Expense Reimbursements | | -0.05%(3) | | -0.70%(4)(6) | | -0.40%(4) |

Total Annual Fund Operating Expenses After

Fee Waiver and/or Expense Reimbursement | | 1.60%(3) | | 1.00%(4)(6) | | 1.00%(4) |

|

(1) | | | | A contingent deferred sales charge (“CDSC”) of 1.00% may be assessed on certain Class A shares purchased or acquired without a sales charge if they are redeemed before the first day of the month of the one-year anniversary of their purchase. See each Fund’s prospectus for more information. |

|

(2) | | | | Other expenses exclude non-recurring estimated Reorganization expenses. |

|

(3) | | | | For the period from December 1, 2012 through November 30, 2013, Lord Abbett has contractually agreed to waive its fees and reimburse expenses to the extent necessary to limit total net annual operating expenses for each class, excluding 12b-1 fees, if any, to an annual rate of 1.10%. This agreement may be terminated only by Target Fund’s Board of Trustees. |

|

(4) | | | | For the period from November 28, 2012 through February 28, 2014, Lord Abbett has contractually agreed to waive its fees and reimburse expenses to the extent necessary to limit total net annual operating expenses for each class, excluding 12b-1 fees, if any, to an annual rate of 0.50%. This agreement may be terminated only by Acquiring Fund’s Board of Trustees. |

|

(5) | | | | A CDSC of 1.00% may be assessed on Class C shares if they are redeemed before the first anniversary of their purchase. See each Fund’s prospectus for more information. |

|

(6) | | | | These amounts have been updated from fiscal year amounts to reflect current fees and expenses. |

6

Examples

The following examples are intended to help you compare the cost of investing in the relevant Fund with the cost of investing in other mutual funds. The example for each Fund assumes that you invest $10,000 in such Fund at the maximum sales charge, if any, for the time periods indicated (for the periods ended July 31, 2012 for Target Fund and October 31, 2012 for Acquiring Fund and the Pro Forma Combined Fund) and then redeem all of your shares at the end of those periods. The examples also assume that your investment has a 5% return each year, that dividends and distributions are reinvested, and that the relevant Fund’s operating expenses remain the same (except that the example takes into account the relevant Fund’s contractual fee waiver and expense limitation agreement with Lord Abbett for the term of the relevant agreement). The examples assume a deduction of the applicable contingent deferred sales charge (“CDSC”) for the one-year, three-year, and five-year periods for Class B shares and for the one-year period for Class C shares. Class B shares automatically convert to Class A shares after approximately eight years. The expense example for Class B shares for the ten-year period reflects the conversion to Class A shares. The first example assumes that you redeem all of your shares at the end of the periods. Although your actual costs may be higher or lower, based on these assumptions, your costs (including any applicable CDSC) would be as shown below. No sales charge will be imposed in connection with the Reorganization. The second example assumes that you do not redeem and instead keep your shares.

| | | | | | | | |

If Shares Are Redeemed | | 1 year | | 3 years | | 5 years | | 10 years |

Target Fund Class A Shares | | | $ | | 714 | | | | $ | | 1,017 | | | | $ | | 1,342 | | | | $ | | 2,259 | |

Acquiring Fund Class A Shares | | | $ | | 657 | | | | $ | | 954 | | | | $ | | 1,292 | | | | $ | | 2,243 | |

Pro Forma Combined Fund Class A

Shares | | | $ | | 657 | | | | $ | | 901 | | | | $ | | 1,176 | | | | $ | | 1,957 | |

Target Fund Class B Shares | | | $ | | 713 | | | | $ | | 968 | | | | $ | | 1,350 | | | | $ | | 2,314 | |

Acquiring Fund Class B Shares | | | $ | | 653 | | | | $ | | 903 | | | | $ | | 1,298 | | | | $ | | 2,299 | |

Pro Forma Combined Fund Class B

Shares | | | $ | | 653 | | | | $ | | 848 | | | | $ | | 1,179 | | | | $ | | 2,011 | |

Target Fund Class C Shares | | | $ | | 313 | | | | $ | | 668 | | | | $ | | 1,150 | | | | $ | | 2,479 | |

Acquiring Fund Class C Shares | | | $ | | 253 | | | | $ | | 603 | | | | $ | | 1,098 | | | | $ | | 2,464 | |

Pro Forma Combined Fund Class C

Shares | | | $ | | 253 | | | | $ | | 548 | | | | $ | | 979 | | | | $ | | 2,181 | |

Target Fund Class F Shares | | | $ | | 122 | | | | $ | | 392 | | | | $ | | 682 | | | | $ | | 1,507 | |

Acquiring Fund Class F Shares | | | $ | | 61 | | | | $ | | 324 | | | | $ | | 628 | | | | $ | | 1,490 | |

Pro Forma Combined Fund Class F Shares | | | $ | | 61 | | | | $ | | 268 | | | | $ | | 503 | | | | $ | | 1,178 | |

Target Fund Class I Shares | | | $ | | 112 | | | | $ | | 360 | | | | $ | | 628 | | | | $ | | 1,393 | |

Acquiring Fund Class I Shares | | | $ | | 51 | | | | $ | | 293 | | | | $ | | 574 | | | | $ | | 1,376 | |

Pro Forma Combined Fund Class I Shares | | | $ | | 51 | | | | $ | | 236 | | | | $ | | 449 | | | | $ | | 1,061 | |

7

| | | | | | | | |

If Shares Are Redeemed | | 1 year | | 3 years | | 5 years | | 10 years |

Target Fund Class R2 Shares | | | $ | | 173 | | | | $ | | 546 | | | | $ | | 944 | | | | $ | | 2,058 | |

Acquiring Fund Class R2 Shares | | | $ | | 112 | | | | $ | | 480 | | | | $ | | 892 | | | | $ | | 2,043 | |

Pro Forma Combined Fund Class R2 Shares | | | $ | | 112 | | | | $ | | 424 | | | | $ | | 770 | | | | $ | | 1,747 | |

Target Fund Class R3 Shares | | | $ | | 163 | | | | $ | | 515 | | | | $ | | 892 | | | | $ | | 1,950 | |

Acquiring Fund Class R3 Shares | | | $ | | 102 | | | | $ | | 449 | | | | $ | | 840 | | | | $ | | 1,934 | |

Pro Forma Combined Fund Class R3 Shares | | | $ | | 102 | | | | $ | | 393 | | | | $ | | 717 | | | | $ | | 1,636 | |

If Shares Are Not Redeemed | | | | | | | | |

| | | | | | | | |

Target Fund Class A Shares | | | $ | | 714 | | | | $ | | 1,017 | | | | $ | | 1,342 | | | | $ | | 2,259 | |

Acquiring Fund Class A Shares | | | $ | | 657 | | | | $ | | 954 | | | | $ | | 1,292 | | | | $ | | 2,243 | |

Pro Forma Combined Fund Class A

Shares | | | $ | | 657 | | | | $ | | 901 | | | | $ | | 1,176 | | | | $ | | 1,957 | |

Target Fund Class B Shares | | | $ | | 213 | | | | $ | | 668 | | | | $ | | 1,150 | | | | $ | | 2,314 | |

Acquiring Fund Class B Shares | | | $ | | 153 | | | | $ | | 603 | | | | $ | | 1,098 | | | | $ | | 2,299 | |

Pro Forma Combined Fund Class B

Shares | | | $ | | 153 | | | | $ | | 548 | | | | $ | | 979 | | | | $ | | 2,011 | |

Target Fund Class C Shares | | | $ | | 213 | | | | $ | | 668 | | | | $ | | 1,150 | | | | $ | | 2,479 | |

Acquiring Fund Class C Shares | | | $ | | 153 | | | | $ | | 603 | | | | $ | | 1,098 | | | | $ | | 2,464 | |

Pro Forma Combined Fund Class C

Shares | | | $ | | 153 | | | | $ | | 548 | | | | $ | | 979 | | | | $ | | 2,181 | |

Target Fund Class F Shares | | | $ | | 122 | | | | $ | | 392 | | | | $ | | 682 | | | | $ | | 1,507 | |

Acquiring Fund Class F Shares | | | $ | | 61 | | | | $ | | 324 | | | | $ | | 628 | | | | $ | | 1,490 | |

Pro Forma Combined Fund Class F

Shares | | | $ | | 61 | | | | $ | | 268 | | | | $ | | 503 | | | | $ | | 1,178 | |

Target Fund Class I Shares | | | $ | | 112 | | | | $ | | 360 | | | | $ | | 628 | | | | $ | | 1,393 | |

Acquiring Fund Class I Shares | | | $ | | 51 | | | | $ | | 293 | | | | $ | | 574 | | | | $ | | 1,376 | |

Pro Forma Combined Fund Class I Shares | | | $ | | 51 | | | | $ | | 236 | | | | $ | | 449 | | | | $ | | 1,061 | |

Target Fund Class R2 Shares | | | $ | | 173 | | | | $ | | 546 | | | | $ | | 944 | | | | $ | | 2,058 | |

Acquiring Fund Class R2 Shares | | | $ | | 112 | | | | $ | | 480 | | | | $ | | 892 | | | | $ | | 2,043 | |

Pro Forma Combined Fund Class R2 Shares | | | $ | | 112 | | | | $ | | 424 | | | | $ | | 770 | | | | $ | | 1,747 | |

Target Fund Class R3 Shares | | | $ | | 163 | | | | $ | | 515 | | | | $ | | 892 | | | | $ | | 1,950 | |

Acquiring Fund Class R3 Shares | | | $ | | 102 | | | | $ | | 449 | | | | $ | | 840 | | | | $ | | 1,934 | |

Pro Forma Combined Fund Class R3 Shares | | | $ | | 102 | | | | $ | | 393 | | | | $ | | 717 | | | | $ | | 1,636 | |

Portfolio Turnover.Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in the annual fund operating expenses or in the example, affect each Fund’s performance. During each Fund’s most recent fiscal year, Target Fund’s portfolio turnover rate was 110.79% and Acquiring Fund’s portfolio turnover rate was 683.50% of the average value of each Fund’s portfolio.

8

SUMMARY OF PROPOSAL

This Combined Prospectus/Proxy Statement provides pertinent information about the Reorganization and Acquiring Fund that a Target Fund shareholder should consider before voting on the proposal. The following summarizes certain information contained elsewhere in or incorporated by reference into this Combined Prospectus/Proxy Statement. You should read the more complete information in the rest of this Combined Prospectus/Proxy Statement, as well as in each Fund’s prospectus, and each of Target Fund’s and Acquiring Fund’s annual report. You also should review the SAI relating to this Combined Prospectus/Proxy Statement. This Combined Prospectus/Proxy Statement is qualified in its entirety by reference to these documents. You should read the entire Combined Prospectus/Proxy Statement before voting.

Overview of the Proposed Reorganization

As a result of the Reorganization, each shareholder of Target Fund will become a shareholder of Acquiring Fund and receive Acquiring Fund shares of the same class with a total value equal to the shareholder’s investment in Target Fund. When this occurs, each such shareholder will cease to be a shareholder in Target Fund. Completion of the Reorganization is subject to the approval of Target Fund’s shareholders and other conditions.

No front-end sales charge or CDSC will be imposed at the time of the Reorganization. Any other investment or redemption will be subject to any applicable sales charges. After the Reorganization is completed, any CDSC on the redemption of shares of Acquiring Fund will be calculated from the date of original purchase of Target Fund shares.

As you evaluate the Reorganization, please consider the following:

|

• | | | | The proposed Reorganization provides for the transfer to Acquiring Fund of all of the assets of Target Fund in exchange for shares of Acquiring Fund and the assumption by Acquiring Fund of all of the liabilities of Target Fund. Target Fund will distribute all Acquiring Fund shares received by it among its shareholders so that each shareholder of Target Fund will receive a pro rata distribution of Acquiring Fund shares (or fractions thereof). Acquiring Fund shares received by a shareholder of Target Fund will be of the same class and have an aggregate value equal to the aggregate value of the shareholder’s Target Fund shares as of the date of the exchange. After the Reorganization, Target Fund will be terminated. |

|

• | | | | Following the Reorganization, the resulting Fund (the “Combined Fund”) will be managed according to the investment objective and strategies of Acquiring Fund. Acquiring Fund has the same investment objective as Target Fund, uses similar investment strategies to pursue its investment objective and is guided by similar investment policies and restrictions. The material differences between the Funds’ investment |

9

| | | | objectives, strategies, risks, policies and restrictions are discussed immediately below. |

|

• | | | | Each Fund pursues capital appreciation by normally investing at least 80% of its assets in equity securities, and each Fund employs a growth investing style. A material difference between the Funds is that Target Fund (under normal market conditions) invests at least 80% of its net assets in equity securities of large cap companies, while Acquiring Fund (under normal market conditions) invests at least 50% of its net assets in equity securities of large cap companies, and the remainder in equity securities of mid-sized and small companies. Both Funds define large cap companies by reference to the Russell 1000® Index. Securities of companies with smaller capitalizations can enhance Acquiring Fund’s investment flexibility and the diversification of its portfolio, but carry different and generally greater risks. An additional material difference between the Funds’ investment approaches is that Acquiring Fund engages in more active trading than Target Fund. Therefore, Acquiring Fund has a significantly higher portfolio turnover rate than Target Fund. |

|

• | | | | As indicated in each of the fee tables in the “Fees and Expenses” section above, as a percentage of each Fund’s assets over each Fund’s respective fiscal year ended 2012, Acquiring Fund’s total annual operating expenses are lower than Target Fund’s total annual operating expenses (after giving effect to the contractual fee waiver and expense limitation currently in place for each Fund). The specific components of the Fund’s operating expenses compare as follows: Acquiring Fund’s management fee is lower than Target Fund’s management fee; Rule 12b-1 fees applicable to a particular class of shares are the same for both Funds; and Acquiring Fund’s other (i.e., non-management) expenses are higher than those of Target Fund. In the aggregate, Target Fund shareholders will pay lower total annual operating expenses after the Reorganization. |

|

• | | | | We believe Acquiring Fund’s comparatively higher other expenses are attributable to its relatively short operating history of less than two years. A large share of other expenses consists of shareholder servicing costs, which tend to be fixed and therefore do not rise in proportion to Fund assets. Accordingly, as Acquiring Fund grows – including by acquiring Target Fund’s assets in the Reorganization – it is expected that it will realize economies of scale that will lower its other expenses (as a percentage of Fund assets) over time. |

|

• | | | | The sales charges of each Fund are the same. |

|

• | | | | Acquiring Fund outperformed Target Fund for the period from Acquiring Fund’s June 30, 2011 inception through December 31, 2012. During that period, Acquiring Fund’s Class A shares returned 0.54% (without sales charges), while Target Fund’s Class A shares returned -0.96% (without sales charges). Performance comparisons for longer time periods are not |

10

| | | | possible because of Acquiring Fund’s limited operating history. For more information about each Fund’s performance, please see “Performance” below or visit Lord Abbett’s website at www.lordabbett.com. A Fund’s past performance is not an indication of future results. |

|

• | | | | The Reorganization will qualify as a tax-free reorganization for federal income tax purposes. You will not be charged any sales charges, commissions, or transaction fees in the Reorganization. |

|

• | | | | For a period of years after the Reorganization, the Combined Fund’s sale of appreciated portfolio securities, as part of the day-to-day management of its portfolio, likely will result in greater taxable capital gain distributions to a former Target Fund shareholder than would Target Fund’s sale of its appreciated portfolio securities in the absence of the Reorganization. |

|

• | | | | The Acquiring Fund shares you will receive as a result of the Reorganization will be of the same share class with the same Rule 12b-1 fee level and sales charge structure, and will have the same value, as your shares in Target Fund immediately before the Reorganization. In addition, as discussed under “Shareholder Rights” below, both Funds are organized as Delaware statutory trusts, are governed by the same Board and have substantially similar charters and identical by-laws, and are subject to the same legal and regulatory standards. Therefore, the interests of Target Fund’s shareholders will not be diluted by the Reorganization. The specific terms of the Reorganization are set forth in the Plan, a copy of which is attached as Exhibit A. |

|

• | | | | Target Fund will be terminated as part of the Reorganization. |

|

• | | | | Because the Funds have similar investment objectives and investment strategies, there is substantial overlap in the portfolio securities they hold. Either Fund may sell a portion of its holdings in connection with the Reorganization (though it is not necessarily obligated to do so), and consequently may incur transaction costs from restructuring its portfolio. If such sale occurs before the Reorganization, Target Fund generally will bear the related transaction costs. If such sale occurs after the Reorganization, the Combined Fund will bear the related transaction costs. |

|

• | | | | F. Thomas O’Halloran heads each Fund’s investment team. In managing Acquiring Fund, Mr. O’Halloran is assisted by Paul J. Volovich and Arthur K. Weise, who will continue to manage the Combined Fund after the Reorganization. Accordingly, the Reorganization will promote continuity of portfolio management. |

|

• | | | | Subject to shareholder approval, the Reorganization is expected to be effected as soon as practicable following the Meeting. |

|

• | | | | After the Reorganization is completed, any purchase orders for Target Fund will be deemed to be purchase orders for Acquiring Fund. |

11

Board Considerations in Approving the Reorganization

The Board, on behalf of the Fund, and Acquiring Fund’s Board of Trustees (together with the Board, the “Boards”), on behalf of Acquiring Fund, considered the proposed Reorganization, with related data and analysis, as presented by Lord Abbett at a meeting held on September 13, 2012. At the meeting, the Boards considered a number of factors, including:

|

• | | | | The compatibility of Target Fund’s investment objective, strategies, risks, policies, and restrictions with those of Acquiring Fund; |

|

• | | | | The relative expense ratios of the Funds and the impact of the Reorganization on those expense ratios; |

|

• | | | | The relative investment performance of the Funds; |

|

• | | | | The relative sizes of the Funds; |

|

• | | | | The relative past and current growth in assets of each Fund and its expected future prospects for growth; |

|

• | | | | The anticipated tax consequences of the Reorganization with respect to each Fund and its shareholders; |

|

• | | | | The estimated costs of the Reorganization and the extent to which each Fund would bear such costs, including proxy solicitation expenses and portfolio transaction costs; and |

|

• | | | | The potential benefits of the Reorganization for the shareholders of each Fund. |

In considering such factors, the Boards questioned Lord Abbett about the compatibility of each Fund’s investment parameters, the performance and growth of assets of the Funds, the costs and anticipated tax consequences of the Reorganization, and the potential benefits to shareholders. The Boards’ considerations and conclusions are summarized below.

The Boards compared each Fund’s total annual operating expenses as a percentage of Fund assets (“operating expenses”). The Boards observed that Acquiring Fund’s total net operating expenses were lower than Target Fund’s total net operating expenses for each Fund’s 2011 fiscal period. The Boards noted that distribution and service (Rule 12b-1) fees and administrative services fees, each a component of operating expenses, were the same for each Fund’s respective share classes. The Boards noted that another component of operating expenses, management fees, were lower for Acquiring Fund, both at the average asset level of each Fund over each Fund’s 2011 fiscal period and at other asset levels. The Boards observed that the contractual fee waiver and/or reimbursement for Acquiring Fund had the effect of capping the Fund’s operating expenses at a lower level than the fee waiver and/or reimbursement for Target Fund. The Boards also considered the fact that Lord Abbett would renew Acquiring Fund’s waiver at least at the same level through February 28, 2014.

12

The Boards considered whether portfolio transaction costs would be incurred given the substantial overlap of the Funds’ portfolio securities, and the extent to which such costs might be borne by each Fund.

The Boards also considered the Funds’ relative historical performance. The Boards observed that as of August 31, 2012, Acquiring Fund’s Class A shares have outperformed Target Fund’s Class A shares for the period since Acquiring Fund’s June 30, 2011 performance inception. The Boards noted that both Funds share the same Lipper Category Average. The Boards observed that within this classification as of August 31, 2012, Acquiring Fund’s Class A shares’ performance ranked in the 69th percentile and Target Fund’s Class A shares’ performance ranked in the 94th percentile for the period since each Fund’s inception.

Also, the Boards considered the level of investment management services provided by Lord Abbett to each Fund; the investment management experience of Mr. O’Halloran, the lead portfolio manager of both Target Fund and Acquiring Fund, and Messrs. Volovich and Weise, the other portfolio managers of Acquiring Fund; the prospects for future sales of Target Fund shares, in light of its investment objective and strategy; the related possibility of future declines or increases in Target Fund’s asset level, and their effect on administrative, portfolio management, distribution, shareholder servicing, and other operating efficiencies; and the magnitude of the increase in Acquiring Fund’s assets from the Reorganization, the likelihood of future sales of Acquiring Fund, the effect of each on Acquiring Fund’s asset level, and any resulting administrative, portfolio management, distribution, shareholder servicing, and other operating efficiencies. The Board noted that Acquiring Fund had a smaller asset size due to its relatively short operating history of less than two years.

The Boards also considered that the Reorganization would provide Target Fund shareholders with greater exposure to small and mid cap stocks. The Boards considered the potential that such exposure would enhance portfolio diversification and increase investment risk.

The Boards also considered the tax-free nature of the Reorganization; the compatibility of the Funds’ respective investment objectives, strategies, and policies; the risk factors associated with each Fund’s investment strategy; and the fact that the Funds share the same service providers, including their investment adviser, distributor, administrator, custodian, and transfer agent. The Boards considered the fact that after the Reorganization, the same trustees would continue to oversee the interests of Target Fund shareholders under a similar charter and identical by-laws as those of the Trust, and under the same legal and regulatory standards. The Boards considered alternatives to the Reorganization, including the liquidation of Target Fund, but concluded that the Reorganization was preferable to those alternatives.

Each of the Boards evaluated the relevant factors described above independently and approved the Reorganization separately. In light of these factors and their

13

fiduciary duty under federal and state law, the Boards, including all of the trustees who were not interested persons of either Fund (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)), unanimously determined, separately on behalf of their respective Fund, that: (1) the Reorganization is in the best interests of the Fund and its shareholders; and (2) the Reorganization will not result in a dilution of the interests of the Fund’s shareholders.

Investment Objectives and Principal Investment Strategies

This section describes the similarities and differences between the investment objectives and strategies of Target Fund and those of Acquiring Fund. For a complete description of the investment objective and strategies of Acquiring Fund, you should read that Fund’s prospectus and SAI.

Each Fund invests principally in equity securities of U.S. and multinational companies. The similarities and differences between the key investment attributes of Target Fund on the one hand and Acquiring Fund on the other are discussed below.

| | | | | | |

Similarities | | Differences |

|

Investment Objectives |

|

• | | Both Funds seek capital appreciation. | | | | |

|

Principal Investment Strategies |

|

• | | Both Funds invest primarily in a diversified portfolio of equity securities of U.S. and multinational companies that each Fund’s investment team believes exhibits above-average growth. | | • | | Target Fund normally invests at least80%of its net assets in equity securities of large cap companies, while Acquiring Fund normally invests at least50%of its net assets in large cap companies, and the remainder in securities of mid- sized and small companies. Acquiring Fund thus is able to make more substantial investments in the small and mid cap segments of the equity market than Target Fund. |

• | | Each Fund may invest in any security that represents equity ownership in a company. Currently, each Fund invests in equity securities consisting of common stocks, preferred stocks, equity interests in trusts (including real estate investment trusts), partnerships, joint ventures, and limited liability companies. | | | | |

• | | Each Fund may engage in active and frequent trading of its portfolio securities in seeking to achieve its investment objective, and as of each Fund’s fiscal year ended 2012, has an annual portfolio turnover rate of over 100%. | | • | | Target Fund may invest up to10%and Acquiring Fund may invest up to20%of its net assets in securities of foreign (including emerging market) companies that are traded on a non-U.S. exchange and denominated in a foreign currency. |

| | | | • | | Acquiring Fund engages in more active trading than Target Fund and thus has a significantly higher portfolio turnover rate than Target Fund. |

14

| | | | | | |

Similarities | | Differences |

|

Diversification |

|

• | | Both Funds are diversified, meaning that with respect to 75% of each Fund’s total assets, the Fund normally will not purchase a security if, as a result, more than 5% of the Fund’s total assets would be invested in securities of a single issuer or the Fund would hold more than 10% of the

outstanding voting securities of the issuer. | | | | |

|

Sell Discipline |

|

• | | Both Funds may sell a security if it no longer meets the Fund’s investment criteria or for a variety of other reasons, such as to secure gains, limit losses, redeploy assets into opportunities believed to be more promising, or satisfy redemption requests, among others. | | | | |

• | | In considering whether to sell a security, each Fund may evaluate factors including, but not limited to, the condition of the economy, changes in the issuer’s competitive position or financial condition, changes in the

outlook for the issuer’s industry, and the

Fund’s valuation target for the security. | | | | |

|

Temporary Defensive Investments |

|

• | | Each Fund seeks to remain fully invested in accordance with its investment objective. To respond to adverse economic, market, political or other conditions that are unfavorable for investors, however, each Fund may invest its assets in a temporary defensive manner by holding all or a substantial portion of its assets in cash, cash equivalents or other high quality short-term investments, money market fund shares, and other money market instruments. | | | | |

• | | Each Fund also may invest in these types of securities or hold cash while looking for suitable investment opportunities or to maintain liquidity. When investing in this manner, a Fund may be unable to achieve its investment objective. | | | | |

15

Principal Risk Factors

This section describes the principal risk factors of Acquiring Fund and compares them to those associated with an investment in Target Fund. For a more complete description of the risks of Acquiring Fund, you should read that Fund’s prospectus and SAI.

Each Fund is subject to the same material risks, with the exception of: Acquiring Fund’s greater exposure to the risks of investing in small- and mid-sized companies, Target Fund’s greater exposure to the risks of investing in large companies, Acquiring Fund’s greater exposure to the risks of investing in foreign companies, and Acquiring Fund’s greater exposure to high portfolio turnover risk.

The principal risks that could adversely affect either Fund’s performance or increase volatility include the following:

|

• | | | | Portfolio Management Risk: The strategies used and securities selected by a Fund’s investment team may fail to produce the intended result and the Fund may not achieve its objective. The securities selected for a Fund may not perform as well as other securities that were not selected for the Fund. As a result, a Fund may suffer losses or underperform other funds with the same investment objective or strategies, even in a rising market. |

|

• | | | | Equity Securities Risk: Common stocks and other equity securities, as well as equity-like securities such as convertible bonds, may experience significant volatility. Such securities may fall sharply in response to adverse events affecting overall markets, a particular industry or sector, or an individual company’s financial condition. |

|

• | | | | Mid-sized and Small Company Risk: Investments in mid-sized or small company stocks generally involve greater risks than investments in large company stocks. Mid-sized or small companies may be less able to weather economic shifts or other adverse developments than larger, more established companies. They may have less experienced management and unproven track records. They may rely on limited product lines and have more limited financial resources. These factors may make them more susceptible to setbacks or economic downturns. Mid-sized or small company stocks tend to have fewer shares outstanding and trade less frequently than the stocks of larger companies. In addition, there may be less liquidity in mid-sized or small company stocks, subjecting them to greater price fluctuations than larger company stocks. |

|

• | | | | Large Company Risk: Larger, more established companies may be unable to respond quickly to certain market developments. In addition, larger companies may have slower rates of growth as compared to successful, but less well-established, smaller companies, especially during market cycles corresponding to periods of economic expansion. |

16

|

• | | | | Growth Investing Risk: Each Fund uses a growth investing style, which may be out of favor or may not produce the best results over short or longer time periods. In addition, growth stocks tend to be more volatile than slower-growing value stocks. |

|

• | | | | Foreign Company Risk: A Fund’s investments in foreign (including emerging market) companies and in U.S. companies with economic ties to foreign markets generally involve special risks that can increase the likelihood that the Fund will lose money. For example, as compared with companies organized and operated in the U.S., these companies may be more vulnerable to economic, political, and social volatility and subject to less government supervision, lack of transparency, inadequate regulatory and accounting standards, and foreign taxes. In addition, the securities of foreign companies also may be subject to inadequate exchange control regulations, higher transaction and other costs, and delays in settlement to the extent they are traded on non-U.S. exchanges or markets. Foreign company securities also may be subject to thin trading volumes and reduced liquidity, which may lead to greater price fluctuation. A change in the value of a foreign currency relative to the U.S. dollar will change the value of securities held by a Fund that are denominated in that foreign currency, including the value of any income distributions payable to the Fund as a holder of such securities. These and other factors can materially adversely affect the prices of securities a Fund holds, impair the Fund’s ability to buy or sell securities at their desired price or time, or otherwise adversely affect the Fund’s operations. A Fund may invest in securities of issuers whose economic fortunes are linked to non-U.S. markets, but which principally are traded on a U.S. securities market or exchange and denominated in U.S. dollars. To the extent a Fund invests in this manner, the percentage of the Fund’s assets that is exposed to the risks associated with foreign companies may exceed the percentage of the Fund’s assets that is invested in foreign securities that are principally traded outside of the U.S. A Fund’s investments in emerging market companies generally are subject to heightened risks compared to its investments in developed market companies. |

|

• | | | | Industry/Sector Risk: To the extent a Fund overweights a single market sector or industry relative to its benchmark index, it can accumulate relatively large positions in a single issuer, industry, or sector. As a result, a Fund’s performance may be tied more directly to the success or failure of a relatively smaller or less diversified group of portfolio holdings. |

|

• | | | | High Portfolio Turnover Risk: High portfolio turnover (more than 100%) may result in increased brokerage fees or other transaction costs. These costs are not reflected in either Fund’s annual operating expenses or in the expense examples, but they can reduce each Fund’s investment |

17

| | | | performance. If a Fund realizes capital gains when it sells investments, it generally must pay those gains to shareholders, resulting in higher taxes to shareholders when Fund shares are held in a taxable account. The Financial Highlights table at the end of each Fund’s prospectus shows such Fund’s portfolio turnover rate during the past fiscal period. |

An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Federal Income Tax Considerations

The Reorganization is not intended to result in any income, gain or loss being recognized for U.S. federal income tax purposes by Target Fund or its shareholders and will not take place unless each Fund receives a satisfactory opinion from Wilmer Cutler Pickering Hale and Dorr LLP, counsel to the Funds, substantially to the effect that the Reorganization will be a “reorganization” within the meaning of Section 368(a) of the Code.

Shareholders should note that, if necessary, in accordance with Target Fund’s policy of distributing its investment company taxable income and net capital gains for each taxable year in order to qualify for favorable tax treatment as a regulated investment company and avoid federal income and excise tax at the fund level, the Fund will declare and pay a distribution of any such previously undistributed income and gains to its shareholders immediately before the Reorganization. Such distributions will be taxable to Target Fund shareholders. Based on October 31, 2012 data, Target Fund may not have any net capital gains to distribute immediately before the Reorganization, in part because Target Fund currently has a capital loss carryover.

For additional information about the tax consequences of the Reorganization, see “More Information about the Reorganization – Material Federal Income Tax Consequences of the Reorganization” below.

Classes of Shares

Each Fund has the following classes of shares: Class A, Class B, Class C, Class F, Class I, Class R2, and Class R3, each of which invests in the same portfolio, but bears different expenses and receives different levels of dividends. If the Reorganization is completed, Target Fund shareholders will receive the same class of shares in Acquiring Fund as they currently own in Target Fund.

Purchases and Exchanges

Acquiring Fund shares are available through certain authorized dealers at the public offering price, which is the net asset value (“NAV”) plus any applicable sales charge. In accordance with Target Fund’s prospectus, shareholders of Target Fund may exchange their shares for shares of Acquiring Fund or certain other Lord Abbett-sponsored funds at any time before the Reorganization; however, each such exchange will represent a sale of shares for which a shareholder may recognize a

18

taxable gain or loss. In contrast, no gain or loss will be recognized by shareholders of Target Fund upon the exchange of their Target Fund shares for shares of Acquiring Fund received as a result of the Reorganization.

If shareholders do not approve the Reorganization, the Board will consider other strategic alternatives for Target Fund, possibly including its liquidation.

Under normal circumstances, NAV per share for each class of Fund shares is calculated each business day at the close of regular trading on the New York Stock Exchange, normally 4:00 p.m. Eastern Time. Purchases and sales of each Fund’s shares are executed at the NAV next determined after the Fund receives an order in proper form. In calculating NAV, securities for which market quotations are available are valued at those quotations. Securities for which such quotations are not readily available are valued by Lord Abbett at fair value under procedures approved by the Board.

Dividend Policies

The Funds have the same dividend and distribution policies. Each Fund expects to pay dividends from its net investment income at least annually. Each Fund expects to distribute any net capital gains annually as “capital gain distributions.” All distributions, including dividends from net investment income, will be reinvested in Fund shares unless you instruct a Fund to pay them to you in cash. Your election to receive distributions in cash and payable by check will apply only to distributions totaling $10.00 or more. Accordingly, any distribution totaling less than $10.00 will be reinvested in Fund shares and will not be paid to you by check. This policy does not apply to you if you have elected to receive distributions that are directly deposited into your bank account. Retirement and benefit plan accounts may not receive distributions in cash. There are no sales charges on dividend reinvestments.

Redemption Procedures

The Funds’ redemption procedures are the same. Shareholders may redeem shares through their brokers, by telephone, or by mail, as explained in each Fund’s prospectus.

Capitalization

The following table sets forth the capitalization of Target Fund and Acquiring Fund as of October 31, 2012 and thepro formacapitalization of the Combined Fund if the proposed Reorganization had occurred on that date. Non-recurring expenses, including expenses associated with the Reorganization, are reflected in the table. The table should not be relied upon to determine the amount of Acquiring Fund shares that actually will be received and distributed in the Reorganization. The actual exchange ratio will be determined based on the Funds’ relative NAVs and the number of shares of Target Fund outstanding on or about the date on which the Reorganization is completed (the “Closing Date”).

19

| | | | | | | | | | Target

Fund | | Acquiring

Fund | | Pro Forma

Adjustments | | Pro Forma

Combined

Fund |

Class A Net Assets | | | $ | | 74,524,015 | | | | $ | | 15,371,864 | | | | $ | | (51,885 | )(1) | | | | $ | | 89,843,994 | |

Class A NAV | | | $ | | 6.02 | | | | $ | | 15.15 | | | | | | $ | | 15.14 | |

Class A Shares Outstanding | | | | 12,372,124 | | | | | 1,014,827 | | | | | (7,452,172 | )(2) | | | | | 5,934,779 | |

Class B Net Assets | | | $ | | 8,121,711 | | | | $ | | – | * | | | | $ | | (4,688 | )(1) | | | | $ | | 8,117,023 | |

Class B NAV | | | $ | | 5.55 | | | | $ | | – | * | | | | | | $ | | 15.14 | |

Class B Shares Outstanding | | | | 1,464,482 | | | | | – | * | | | | | (928,300 | )(2) | | | | | 536,182 | |

Class C Net Assets | | | $ | | 24,997,217 | | | | $ | | 1,897,914 | | | | $ | | (15,523 | )(1) | | | | $ | | 26,879,608 | |

Class C NAV | | | $ | | 5.55 | | | | $ | | 15.02 | | | | | | $ | | 15.01 | |

Class C Shares Outstanding | | | | 4,507,201 | | | | | 126,388 | | | | | (2,842,573 | )(2) | | | | | 1,791,016 | |

Class F Net Assets | | | $ | | 3,580,016 | | | | $ | | 3,797,323 | | | | $ | | (4,258 | )(1) | | | | $ | | 7,373,081 | |

Class F NAV | | | $ | | 6.10 | | | | $ | | 15.18 | | | | | | $ | | 15.17 | |

Class F Shares Outstanding | | | | 586,767 | | | | | 250,130 | | | | | (350,951 | )(2) | | | | | 485,946 | |

Class I Net Assets | | | $ | | 21,807,203 | | | | $ | | 2,696,952 | | | | $ | | (14,143 | )(1) | | | | $ | | 24,490,012 | |

Class I NAV | | | $ | | 6.17 | | | | $ | | 15.20 | | | | | | $ | | 15.19 | |

Class I Shares Outstanding | | | | 3,534,442 | | | | | 177,467 | | | | | (2,099,465 | )(2) | | | | | 1,612,444 | |

Class R2 Net Assets | | | $ | | 9,400 | | | | $ | | 10,163 | | | | $ | | (11 | )(1) | | | | $ | | 19,552 | |

Class R2 NAV | | | $ | | 6.13 | | | | $ | | 15.19 | | | | | | $ | | 15.18 | |

Class R2 Shares Outstanding | | | | 1,533 | | | | | 669 | | | | | (914 | )(2) | | | | | 1,288 | |

Class R3 Net Assets | | | $ | | 4,305,620 | | | | $ | | 11,250 | | | | $ | | (2,492 | )(1) | | | | $ | | 4,314,378 | |

Class R3 NAV | | | $ | | 5.98 | | | | $ | | 15.16 | | | | | | $ | | 15.15 | |

Class R3 Shares Outstanding | | | | 719,505 | | | | | 742 | | | | | (435,525 | )(2) | | | | | 284,722 | |

Total Net Assets | | | $ | | 137,345,182 | | | | $ | | 23,785,466 | | | | $ | | (93,000 | )(1) | | | | $ | | 161,037,648 | |

Total Shares Outstanding | | | | 23,186,054 | | | | | 1,570,223 | | | | | (14,109,900 | )(2) | | | | | 10,646,377 | |

|

* | | | | As of October 31, 2012, Acquiring Fund did not offer Class B shares. |

|

(1) | | | | Adjustments due to one-time proxy solicitation cost in connection with the Reorganization and elimination of duplicative expenses achieved by merging the Funds. |

|

(2) | | | | Adjustment reflects additional shares issued in connection with the Reorganization. |

Performance

Target Fund

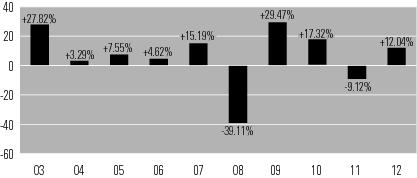

The bar chart and table below provide some indication of the risks of investing in Target Fund by illustrating the variability of the Fund’s returns. Each assumes reinvestment of dividends and distributions. Target Fund’s past performance, before

20

and after taxes, is not necessarily an indication of how Target Fund will perform in the future.

The bar chart shows changes in the performance of Target Fund’s Class A shares from calendar year to calendar year. This chart does not reflect the sales charge applicable to Class A shares. If the sales charge were reflected, returns would be lower. Performance for Target Fund’s other share classes will vary due to the different expenses each class bears. Updated performance information is available at www.lordabbett.com or by calling 888-522-2388.

Bar Chart (per calendar year) — Class A Shares

| | |

Best Quarter1st Q ’12+17.15% | | Worst Quarter4th Q ’08-21.70% |

The table below shows how Target Fund’s average annual total returns compare to the returns of a securities index. The Fund’s average annual total returns include applicable sales charges.

The after-tax returns of Class A shares included in the table below are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. In some cases, the return after taxes on distributions and sale of Fund shares may exceed the return before taxes due to a tax benefit resulting from realized losses on a sale of Fund shares at the end of the period that is used to offset other gains. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements such as 401(k) plans or Individual Retirement Accounts (“IRAs”). After-tax returns for other share classes are not shown in the table and will vary from those shown for Class A shares.

21

| | | | | | | | | | | | |

Average Annual Total Returns

(for the periods ended December 31, 2012) |

|

Class | | 1 Year | | 5 Years | | 10 Years | | Life of Class | | Inception

Date for

Performance |

|

Class A Shares | | |

|

Before Taxes | | 5.68% | | -2.36% | | 4.27% | | – | | |

|

After Taxes on Distributions | | 5.68% | | 2.36% | | 4.27% | | – | | |

|

After Taxes on Distributions and Sale of Fund Shares | | 3.69% | | -1.99% | | 3.73% | | – | | |

|

Class B Shares | | 6.02% | | -2.27% | | 4.34% | | – | | |

|

Class C Shares | | 10.24% | | -1.84% | | 4.22% | | – | | |

|

Class F Shares | | 12.27% | | -0.94% | | – | | -0.92% | | 9/28/2007 |

|

Class I Shares | | 12.32% | | -0.87% | | 5.22% | | – | | |

|

Class R2 Shares | | 12.21% | | -0.81% | | – | | -0.83% | | 9/28/2007 |

|

Class R3 Shares | | 11.74% | | -1.36% | | – | | -1.32% | | 9/28/2007 |

|

Index |

|

Russell 1000® Growth Index

(reflects no deduction for fees, expenses, or taxes) | | 15.26% | | 3.12% | | 7.52% | | 2.82% | | 9/28/2007 |

Acquiring Fund

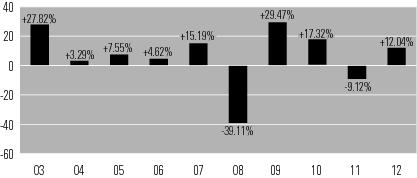

The bar chart and table below provide some indication of the risks of investing in Acquiring Fund by illustrating the variability of the Fund’s returns. Each assumes reinvestment of dividends and distributions. Acquiring Fund’s past performance, before and after taxes, is not necessarily an indication of how Acquiring Fund will perform in the future. No performance is shown for Class B shares because Acquiring Fund has not issued Class B shares to date.

The bar chart shows the performance of Acquiring Fund’s Class A shares for its first full calendar year. This chart does not reflect the sales charge applicable to Class A shares. If the sales charge were reflected, returns would be lower. Performance for Acquiring Fund’s other share classes will vary due to the different expenses each class bears. Updated performance information is available at www.lordabbett.com or by calling 888-522-2388.

22

Bar Chart (per calendar year) — Class A Shares

| | |

Best Quarter1st Q ’12+15.41% | | Worst Quarter2nd Q ’12 -5.85% |

The table below shows how Acquiring Fund’s average annual total returns compare to the returns of securities indices. The Fund’s average annual total returns include applicable sales charges.