UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the registrant [ X ]

Filed by a Party other than the registrant [ ]

Check the appropriate box:

[ ] Preliminary proxy statement.

[ ] Definitive proxy statement.

[X] Definitive additional materials.

[ ] Soliciting material under Rule 14a-12.

[ ] Confidential, for use of the Commission only (as permitted by Rule 14a-b(e)(2))

Lord Abbett Securities Trust

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

________________________

Payment of filing fee (check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

______________________________________________________________________________

| 2) | Aggregate number of securities to which transaction applies: |

______________________________________________________________________________

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

______________________________________________________________________________

| 4) | Proposed maximum aggregate value of transaction: |

______________________________________________________________________________

______________________________________________________________________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

1) Amount Previously Paid:

______________________________________________________________________________

2) Form, Schedule or Registration Statement No.:

______________________________________________________________________________

3) Filing Party:

______________________________________________________________________________

4) Date Filed:

______________________________________________________________________________

Approved - Solicitation Script

Lord Abbett Stock Appreciation Fund

March 15, 2013

877-777-5613

|

Inbound Greeting: |

Thank you for calling the Broadridge Proxy Services Center for Lord Abbett Stock Appreciation Fund. My name is <Agent Name> and this call is being recorded for quality assurance. How may I assist you today? |

|

Outbound Greeting: |

Hello is Mr. /Ms. ___________ available please? |

|

Hi Mr. /Ms____________, my name is <Agent Name> and I am calling on behalf of Lord Abbett Stock Appreciation Fund on a recorded line. Recently we sent you proxy materials for the upcoming Special Meeting of Shareholders to be held on March 15, 2013 and have not yet received your vote.

|

Voting: |

Your Fund’s Board of Trustees recommends that you vote“FOR” approval of the proposal. Would you like to vote along with the recommendation of the Board? |

The process will only take a few moments.

For the record, would you please state your full name and full mailing address?

Are you authorized to vote on all shares of Stock Appreciation Fund in all accounts?(Should have already identified shares s/he is authorized to vote)

Again, my name is <Agent Name>, a proxy voting specialist on behalf of Lord Abbett Stock Appreciation Fund. Today’s date is <Date> and the time is <Time> (am/pm) Eastern Time.

Mr. / Ms.___________, I have recorded your [FOR/AGAINST/ABSTAIN] vote for all of your Lord Abbett Stock Appreciation Fund accounts and will be sending you a written confirmation for each. If you wish to make any changes you may call us at1-877-777-5613 before the meeting. Thank you very much for your participation and have a great day/evening.

If Unsure of voting or does not want to vote along with the recommendation of the Board:

“Would you like me to review the proposal with you? “(After review, ask them if they would like to vote now over the phone).

|

If Not Received/Requesting material to be re-mailed: |

I can resend the materials to you. Can you please verify your full mailing address?(Verify entire address, including street name, number, town, state & zip)Do you have an email address this can be sent to?(If yes, enter the email address in the notes and read it back phonetically to the shareholder) |

Thank you. You should receive these materials shortly and the materials will inform you of the methods available to you to cast your vote, one of which is to call us back at 1-877-777-5613. Thank you again for your time today, and have a wonderful day/evening.

|

If Not Interested: |

(Use rebuttal) I am sorry for the inconvenience. Your vote is important. Please fill out and return your proxy card at your earliest convenience. If you would rather not do that, you can always vote via the other methods outlined in the proxy materials. Thank you again for your time today, and have a wonderful day/evening. |

|

ANSWERING MACHINE MESSAGE: |

Hello, my name is <Agent Name> and I am a proxy voting specialist on behalf of Lord Abbett Stock Appreciation Fund. You should have received proxy materials in the mail concerning the Special Meeting of Shareholders to be held on March 15, 2013, but you can vote now.

|

Your participation is very important. There are two ways to vote: To vote over the telephone, call toll-free at 1-877-777-5613 and a proxy voting specialist will assist you with voting your shares. Specialists are available Monday through Friday, 9:30 AM to 9:00 PM Eastern Time. To vote on line 24 hours a day, 7 days a week, log ontowww.proxyvote.com and enter the control number indicated by an arrow on your proxy card. Voting takes just a few moments.

Thank you for your vote.

|

AUTOMATED ANSWERING MACHINE MESSAGE: |

Hello, this is the Broadridge Proxy Services Center calling with an important message on behalf of Lord Abbett Stock Appreciation Fund. You should have received proxy materials in the mail concerning the Special Meeting of Shareholders to be held on March 15, 2013, but you can vote now.

|

Your vote is important. To vote over the telephone, call toll-free at1-877-777-5613and a proxy voting specialist will assist you with voting your shares. Specialists are available Monday through Friday, 9:30 AM to 9:00 PM Eastern Time. To vote online, 24 hours a day, 7 days a week, log ontowww.proxyvote.com and enter the control number indicated by an arrow on your proxy card. Voting takes just a few moments.

Thank you for your vote.

|

INBOUND - CLOSED RECORDING: |

“Thank you for calling the Broadridge Proxy Services Center for Lord Abbett Stock Appreciation Fund. Our offices are now closed. Please call us back during our normal business hours which are, Monday through Friday, 9:30 AM to 9:00 PM Eastern Time. To vote online, 24 hours a day, 7 days a week, log ontowww.proxyvote.com and enter the control number indicated by an arrow on your proxy card. Thank you.”

|

|

INBOUND - CALL IN QUEUE MESSAGE: |

“Thank you for calling the Broadridge Proxy Services Center for Lord Abbett Stock Appreciation Fund. Our proxy specialists are currently assisting other shareholders. Your call is important to us. If you would like to vote now and you have your proxy card, you can vote online atwww.proxyvote.com using the control number indicated by an arrow on the card. Otherwise, please continue to hold and your call will be answered in the order in which it was received.”

|

|

END OF CAMPAIGN MESSAGE: |

“Thank you for calling the Broadridge Proxy Services Center for Lord Abbett Stock Appreciation Fund. The Shareholder meeting has been held and as a result, this toll free number is no longer in service for proxy related calls. If you have questions about your Lord Abbett Fund,please contact your Financial Advisor or call the Lord Abbett Funds at 1-888-522-2388. Thank you for investing in the Lord Abbett Funds.”

|

|

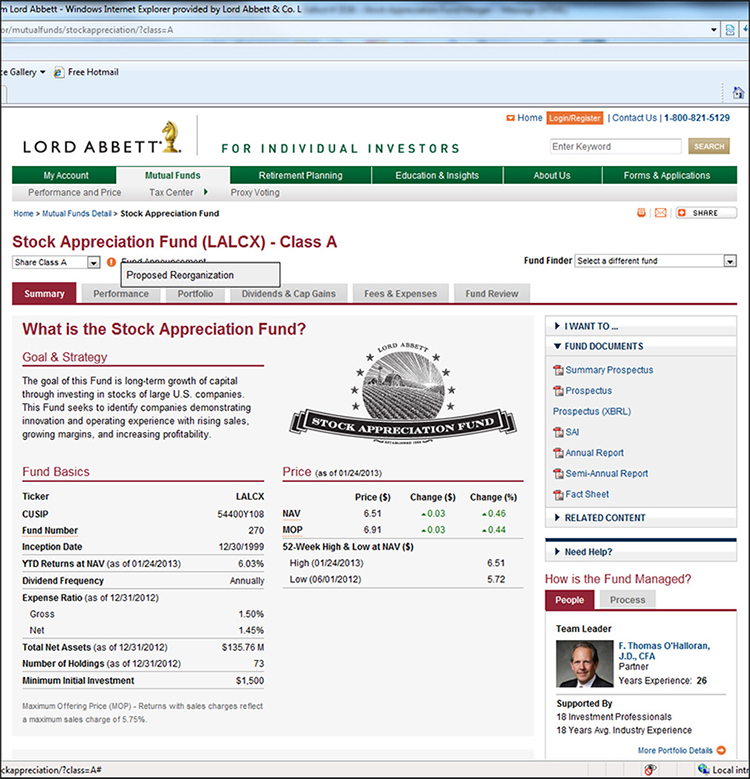

Stock Appreciation Fund |

Merger into Growth Leaders Fund |

Background and Q&A |

|

Background |

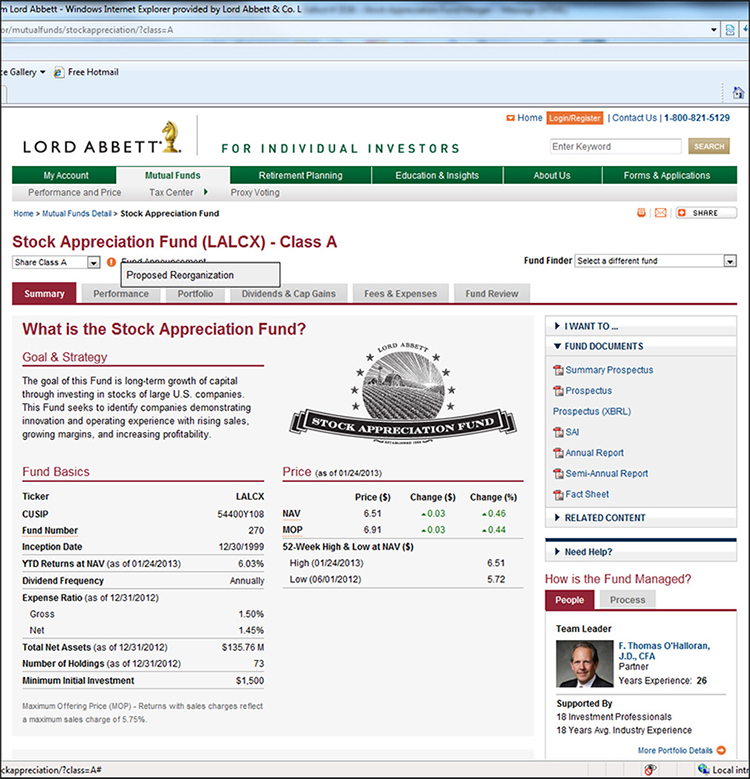

The Board of Trustees for each of Stock Appreciation Fund and Growth Leaders Fund has approved the merger of Stock Appreciation Fund into Growth Leaders Fund, pending Stock Appreciation Fund shareholder approval onMarch 15, 2013. The Fund would be merged into Growth Leaders Fund after the close of business onMarch 22, 2013. |

|

Please review the attached background and Q&A for additional information. |

| | | | | |

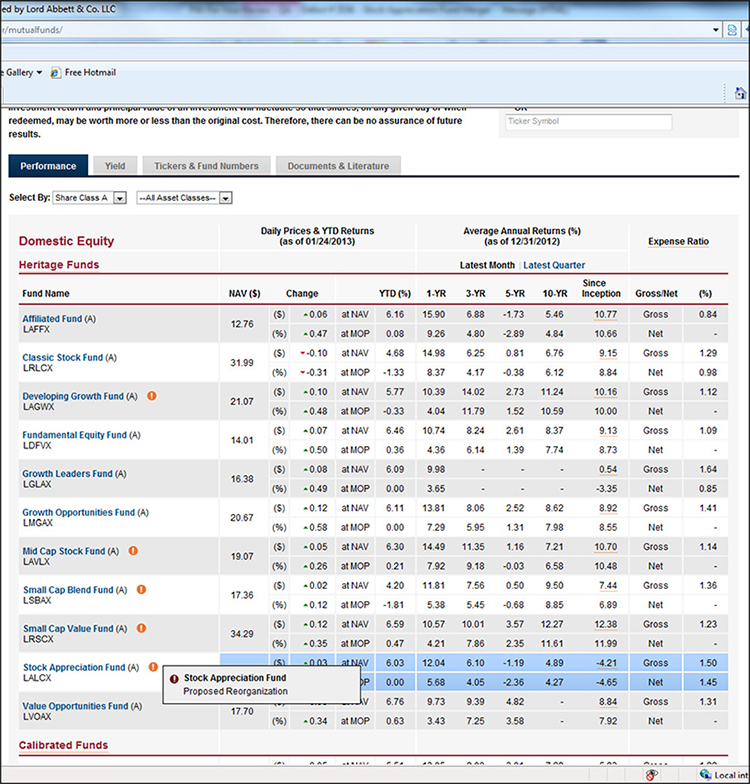

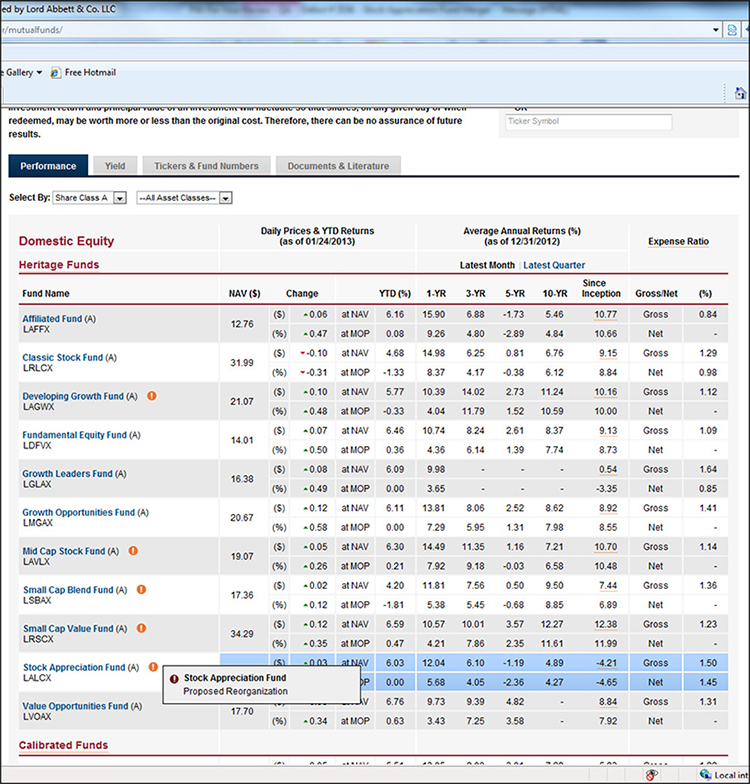

Key Fund facts: |

| - | Among our Allocation Strategies, Stock Appreciation is only held in the Diversified Equity Strategy Fund. As of December 31, 2012, the position was $18.2 million (or 10.0% of Stock Appreciation). |

| - | As of December 31, 2012: |

| | | ○ | Approximately $3.6 million in Class F shares |

| | | ○ | DCIO assets were approximately $4.6 million and Small Plan Retirement assets were $47.8 million |

| | | | § | Therefore, total retirement assets were $52.4 million |

| |

Timeline | |

September 13 | Board of Trustees approves: (i) merger on behalf of both Funds; and (ii) filing of sticker to Stock Appreciation Fund prospectus |

| |

September 14 | Stock Appreciation Fund sticker is filed notifying shareholders of proposed merger |

| |

November 29 | Initial proxy filed with the SEC |

| |

December 20 | Record Date – Stock Appreciation Fund shareholders of record this date may vote the proxy |

| |

January 18 | Definitive proxy filed with the SEC and provided to proxy vendor for printing and mailing |

| |

January 31 | Proxy Solicitation Date: Communication with Shareholders and FAs may begin |

| |

March 15 | Proxy vote by shareholders of record of Stock Appreciation Fund |

| |

March 22 | Official merger date |

|

Timeline for Merger |

The prospectus sticker is a public document and as such it may be sent to advisors and shareholders in response to inquiries received. However, until confirmation that the proxy has been mailed (expected mailing date is January 31, 2013), shareholders and advisors must not be proactively solicited. If shareholder inquiries are received, questions may be answered, but shareholders should ultimately be informed to consult with their financial advisors once proxy documents are received in the mail. Proactive home office notification is permissible, including providing details and rationale behind the proxy; however, no solicitation is permitted and no opinion should be rendered. |

| | |

Jan. 31st: Public Communication Permitted(anticipated date – you will receive e-mail confirmation day of) |

| • | Update marketing literature |

| • | Advisor and shareholder notification can begin |

1

FOR INTERNAL USE ONLY

| | |

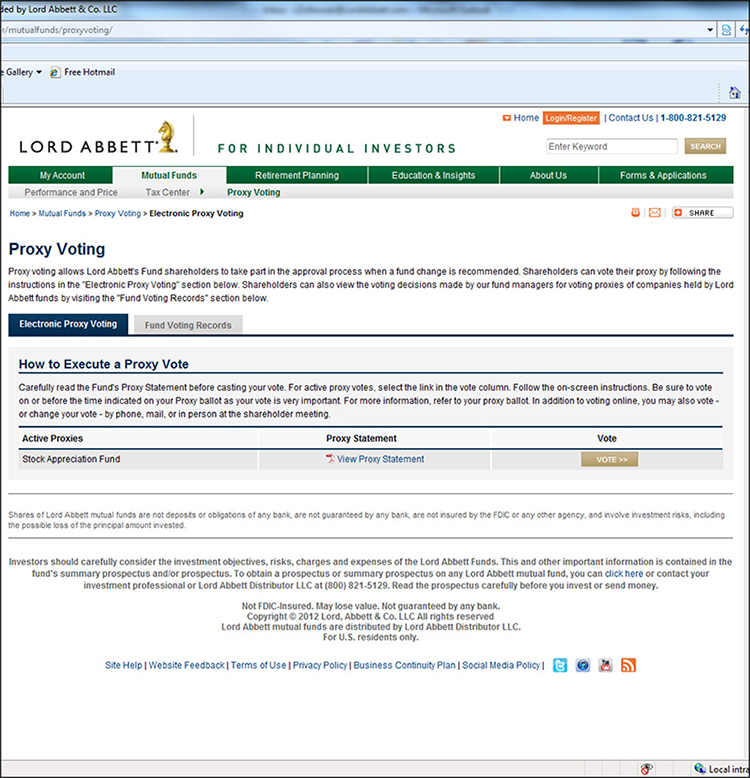

Jan. 31th – Mar. 15th: Solicitation Period |

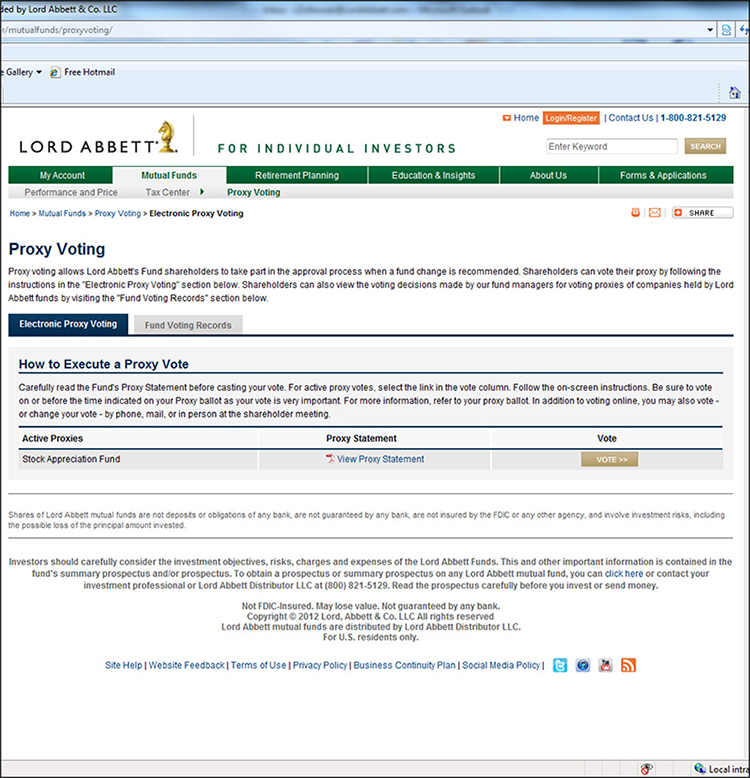

| • | Shareholders will begin to receive the proxy statement, Growth Leaders Fund Statutory Prospectus, Q&A, and proxy card (instructions) in the mail Shareholders may vote via proxy card (mail), phone call, or website |

| | |

Mar. 15th: Last Day to Vote |

| • | Shareholder votes must be received before 9:00 a.m. on March 15, 2013. |

| | |

Mar. 22nd: Stock Appreciation Fund merges into Growth Leaders Fund |

| • | If the Stock Appreciation Fund passes the vote it will merge into the Growth Leaders Fund |

| • | Share Conversion Ratios will be posted to Sales & Marketing screen |

| • | Advisors and shareholders will be notified of the proxy results through a prospectus sticker to be issued on or after the meeting date. |

| | | | |

Effective immediately: |

| • | CAN proactively reach out to home offices to alert them to the fact that there is a planned proxy – |

| | | ○ | Lord Abbett is proposing (proxy vote by shareholders) that the Stock Appreciation Fund merge into the Growth Leaders Fund, effectiveMarch 22, 2013. |

| | |

| • | CAN respond to inquiries with regard to why we are proposing the merger - |

| | | ○ | Lord Abbett believes that the merger offers (1) Lower fund expenses for shareholders (1.45% vs 0.85%) and (2) greater investment flexibility that is offered through the Growth Leaders Fund (multi-cap growth versus a large-cap growth only) strategy. |

| | | ○ | Stay within the scope of the September 14 sticker. |

| | |

| • | CANNOT appear to solicit a merger vote for the proxy - |

| | | ○ | Can discuss merits of the proxy but cannot appear to encourage them to have the underlying shareholders vote “yes” for the proxy. |

| | | ○ | Discussions should be factual rather than persuasive. |

| |

Questions | |

| |

1. | Why are we making this transition? |

| Lord Abbett believes this merger has two primary advantages for Fund shareholders: (1) Lower fund expenses for shareholders (1.45% vs 0.85%) and (2) greater investment flexibility that is offered through the Growth Leaders Fund (multi-cap growth versus a large-cap growth only) strategy. |

| |

2. | How will we get approval from shareholders to make the transition? |

| Beginning January 31, 2013, we may begin the process of advocating the merger with Stock Appreciation Fund shareholders of record as well as financial advisors. We believe that the cost savings and benefits of a broader investment mandate are two strong reasons for Stock Appreciation Fund shareholders to approve the merger. |

2

FOR INTERNAL USE ONLY

| |

3. | Since Growth Leaders Fund will now be a much larger fund what effect will this transition have on the expense ratio of the combined fund? |

| The Growth Leaders Fund currently has an expense ratio of 0.85% for Class A shares which includes a contractual management fee waiver/expense limitation agreement that currently is scheduled to remain in place through 02/28/2014. Lord Abbett expects to maintain Growth Leaders Fund’s contractual management fee waiver/limitation at the same level after the merger takes place. |

| |

4. | If approved, will the merger be final on 3/22/13? |

| Yes. If we receive Stock Appreciation Fund shareholder approval we will merge the holdings of the Stock Appreciation Fund into the Growth Leaders Fund effective as of the close of business on March 22, 2013. |

| |

5. | What are the criteria for the proxy to pass? |

| The proxy will pass if at least two-thirds of Stock Appreciation Fund’s shares voted at the meeting are voted in favor of the merger, so long as more than 50% of Stock Appreciation Fund’s outstanding shares vote. Shareholders will vote in proportion to the number of shares they own. Growth Leaders Fund’s shareholders’ approval is not needed for the proxy to pass. |

| |

6. | Are there any tax implications for shareholders? |

| The merger is expected to be tax free for federal income tax purposes, meaning that the merger is not intended to result in any income, gain or loss being recognized for U.S. federal income tax purposes by either participating fund or its shareholders. In addition, shareholders will not be charged any sales loads, commissions, or transaction fees. The impact of the merger will depend on an investor’s own financial situation; therefore, each shareholder should consult his or her financial advisor. |

| |

7. | Do we plan on launching another large-cap growth strategy at some point? |

| While we currently do not plan on launching another large-cap growth strategy in the near term, we are continually evaluating the needs of our clients to ensure we are providing a quality investment experience and a diversified suite of strategies. If we find that there is a growing need for a large-cap growth mandate as compared to a multi-cap growth or mid-cap growth mandate, we would anticipate considering a new approach to large-cap growth investing. |

| |

8. | What happens with any applicable CDSCs? |

| No sales charges, commissions, or transaction fees will be imposed in connection with the merger. For any purchases of the Stock Appreciation Fund effected prior to the merger, any and all applicable CDSCs will carry over and continue to be assessed in accordance with the fee schedule in place at the time of original purchase. In addition, any purchases of the Growth Leaders Fund effected after the merger will be subject to any and all applicable CDSCs. |

| |

9. | What will happen to Invest-a-Matic purchases after the merger takes place? |

| Any scheduled Invest-a-Matic purchases – after the merger date - will be deemed to be orders for an investment in the Growth Leaders Fund. A shareholder can cancel the IAM by speaking with their financial advisor or by contacting DST directly. |

3

FOR INTERNAL USE ONLY