Ernst & Young has served as the company’s independent auditors since 2003.

On Sept. 29, 2003, the company dismissed Deloitte & Touche LLP as its accountants and appointed Ernst & Young LLP.

Proposal Analysis

Management

1 Elect Nominees

PROXY Governance Vote Recommendation: FOR

Proposal:

To elect the following two directors for terms expiring in 2008: Frank J. Fertitta III and Lee S. Isgur. The company has a staggered board.

Analysis:

The company’s six-member board includes four independent directors (based on NYSE listing standards) and two employee directors (Chairman and CEO F. Fertitta and Vice Chairman and President Lorenzo J. Fertitta). F. Fertitta and L. Fertitta are brothers. Blake L. Sartini resigned from the board on Dec. 1, 2004 to devote his full time to other business interests.

The non-management directors hold executive sessions at least four times per year. The presiding director rotates between the chairpersons of the Audit Committee and the Governance and Compensation Committee.

We note that at the 2004 annual meeting, directors L. Fertitta and James E. Nave received a relatively high number of withhold votes (31.2% and 10.7%, respectively). According to the company, the withhold votes were the result of a temporary vacancy on the board that resulted in 50% of the board being independent. Many institutions withhold votes for directors as a matter of policy in that circumstance. The board is now 67% independent.

PROXY Governance believes that the NYSE’s standard of independence is satisfactory and does not support the use of an additional overlay of independence standards, which may vary among advisory services, institutional investors, and commentators. PROXY Governance believes that if the Self-Regulatory Organizations’ (SROs) standards are perceived to be inappropriate, interested parties should reopen the debate with the SROs or the SEC to have those standards adjusted.

Unless there is evidence of a breakdown in board monitoring or effectiveness—such as poor corporate performance relative to peers, excessive executive compensation, noncompliance with SEC rules or SRO listing standards, a lack of responsiveness to legitimate shareholder concerns, or various other factors—we presume that the board is properly discharging its oversight role and that it is adequately policing itself in terms of board organization, composition and functioning.

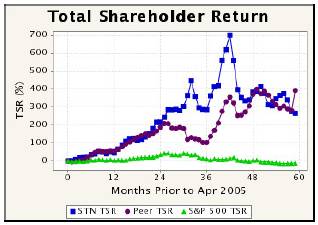

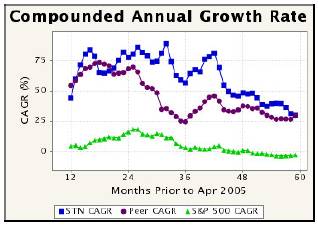

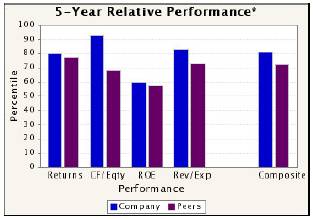

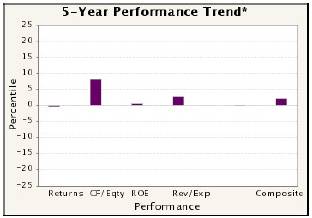

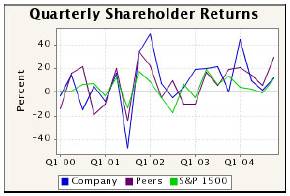

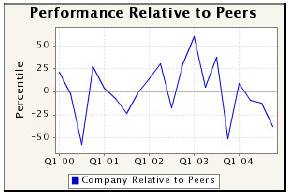

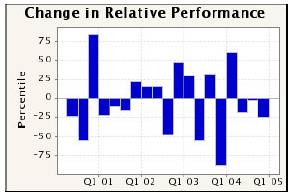

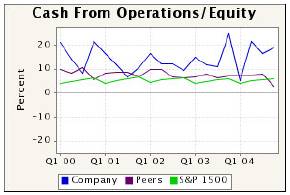

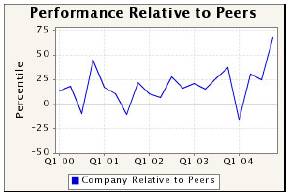

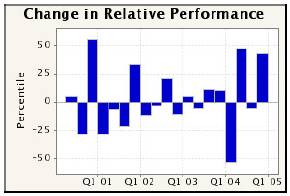

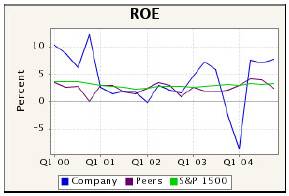

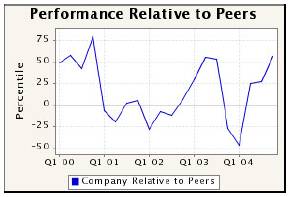

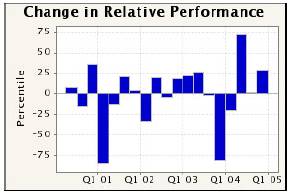

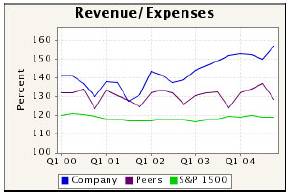

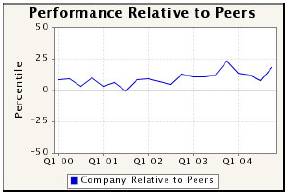

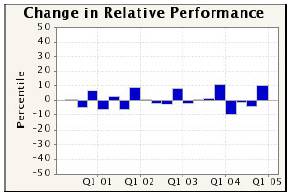

According to PROXY Governance’s performance analysis, the company has had five-year financial performance exceeding its peers, with Station Casinos ranked at the 81st percentile against the S&P 1500 compared to peers at the 72nd percentile. Cash flow from operations and revenue/expenses have been particularly strong, and have been improving on average relative to peers over the past five years. The company’s shareholder returns rank at the 80th percentile against the S&P 1500, versus peers at the 78th percentile.

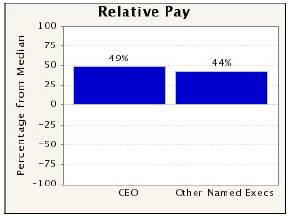

The three-year average pay to the CEO and other named executives is 49% and 44%, respectively, above the median level for peer companies. According to the Governance and Compensation Committee’s report, executive salaries and cash bonuses are based on the high end of the range of salaries paid by peer companies in the gaming industry. Although Station Casinos’ Compensation Committee uses an outside compensation consultant, it does not disclose what percentile within peer group pay is targeted—a practice that many companies have adopted which PROXY Governance supports. Management did point out to PROXY Governance that, unlike other gaming companies, Station Casinos’ executives have been willing to reduce compensation in difficult times, such as after 9/11. The Compensation Committee report states that bonuses are based on cash flow and earnings per share goals. We would prefer better disclosure on what quantitative targets were attained for receiving past payments, which is often the only way shareholders can assess the rigor of the goals, since most issuers will not typically disclose future targets for competitive reasons.

Restricted share awards constitute the largest component of pay, particularly for Chairman/CEO F. Fertitta and Vice Chairman L. Fertitta, where last year’s grant was valued at over $14 million. None of the executives received options, stock appreciation rights (SARs), or other long-term incentive awards in 2004 or in the previous two years. Nevertheless, we believe the size of the awards to F. Fertitta and L. Fertitta are high in view of the pay differentials among executives (F. Fertitta’s average three-year pay is over twice that of the next highest executive and over three-and-a-half times that of other named executives) and considering their sizable stake in the company already (15.8%). We note, too, that as of Dec. 31, 2004, F. Fertitta and L. Fertitta had $55.5 million and $39.5 million of in-the-money unexercised options, respectively. While we commend the company for switching from options to smaller grants of restricted shares—which now carry lengthy ten-year vesting periods—we would expect the company to use equity awards judiciously going forward.

We note that executives have change-in-control protections under which they will receive payments equal to three times 160% of base salary if terminated following a change in control. F. Fertitta will receive a payment equal to four times 220% of his base salary if terminated without cause or for good reason following a change in control, and L. Fertitta will receive payments equal to three times 190% of his base salary if terminated without cause following a change in control. The company stresses that these formulations amount to less than using a salary and highest bonus multiple. While the multiple for F. Fertitta may be industry competitive, we do not believe the loss of tax deductibility makes it cost effective to shareholders.

Overall, we consider Station Casinos’ executive compensation to be acceptable in comparison to peers in view of the company’s superior performance.

Proxy contest

UNITE HERE, an affiliate of the Culinary Workers Local Union 226, is conducting a counter-solicitation (BLUE proxy card) of

three non-binding shareholder proposals asking the company to repeal several of its anti-takeover defenses (poison pill, classified board, and supermajority vote requirement). The dissidents make no vote recommendations on management’s proposals.

The dissidents contend that despite Station Casinos’ unquestionably strong performance, the company’s takeover devices restrict shareholder rights and can serve to entrench management. This is of particular concern to them given the recent heightened M&A activity in the gaming industry. In 2004 alone, over $22 billion in gaming deals were announced, including recent deals at MGM Mirage/Mandalay Resort Group, Harrah’s Entertainment Inc./Caesars Entertainment Inc., and Penn National Gaming/Argosy Gaming Co., along with last year’s $1.4 billion acquisition of Coast Casinos, Inc. by Station Casinos competitor Boyd Gaming Corp., which created the largest locals casino operator in Las Vegas. The dissidents contend that the company’s high family and insider ownership (18.1%) have created a perception in the marketplace that the company is not a likely sale candidate. This is exacerbated by the company’s myriad anti-takeover mechanisms, including numerous protections under Nevada law (see chart in Section 2), which may deter or dissuade management from entertaining potential offers. In the union’s view, removing some of these defenses would signal the marketplace that the company is at least open to M&A activity. Although the dissidents are not advocating a sale per se, they believe the company could improve its business model with a more diversified geographic reach (85% of cash flow is derived from Nevada), as occurred when Caesar’s was integrated into Harrah’s national marketing program.

The union disputes any claims that its efforts are a veiled organizing tactic, noting its track record on governance advocacy. For example, UNITE HERE did a counter-solicitation at Station Casinos two years ago against a dilutive stock option plan, which has since been replaced with a restricted stock award program. And the union has similarly raised governance issues at Harrah’s and at companies in the hotel sector, both of which are sizable union employers.

Management position

Management insists that the UNITE HERE initiatives would effectively weaken integral parts of the company’s corporate governance system, which are designed to enable the board to adequately evaluate and negotiate an acquisition proposal. Virtually all of the defenses were put into place at the time of the IPO in 1993, except the poison pill, which was adopted in 1997. Management points out that many other public companies, including gaming firms, have similar provisions in place in addition to statutory protections, which in Nevada have not been well tested. Although management concedes that the pill and classified board are the most critical protections, it considers the company vulnerable to acquirers because its non-cash generating real estate and long-term pipeline of projects may not be reflected in the stock price since most analysts value gaming companies at a multiple of cash flows.

In management’s view, the real motive behind the union proposals is a “thinly disguised pressure tactic” to promote its own organizing agenda, particularly in view of UNITE HERE’s low ownership level in the company (262 shares, though AFL-CIO-affiliated funds own 2,000 shares). Station Casinos is one of the largest gaming companies in the world and it has never had union representation in its 25 years of operation—an anomaly in what is effectively a union town (Las Vegas). Management observes that despite having similar governance structures, the union isn’t targeting unionized gaming firms. Management also disputes the union having done any previous solicitation at Station Casinos regarding the stock compensation program. According to the company, a UNITE HERE representative made a statement at the annual meeting two years ago, but the plan was overwhelmingly approved by shareholders. The company maintains that its decision to switch from options to restricted shares had nothing to do with any union efforts.

Management stresses that none of the union proposals will have an impact Station Casinos’ financial success. The company posted record results in the first quarter of 2005 over the same period in 2004, including a 14% increase in revenue, a 28% increase in earnings before interest, taxes, depreciation, and amortization (EBITDA) and a 37% increase in diluted earnings per share (EPS)--the 13th consecutive quarter of year-over-year EBITDA and EPS growth. Growth projections for the next two years (and Station Casinos is one of the few gaming companies that gives guidance this far forward) include EBITDA in the range of $425-$440 million for 2005 and $510-$530 million for 2006, or a compound annual growth rate (CAGR) of 20%-22%. EPS growth estimates are $2.22-$2.35 in 2005 and $2.53-$2.71 for 2006, or a CAGR of 26%-29%. [We note that average analyst estimates for EPS are $2.50 for 2005 and $2.85 for 2006.] The stock, which has been up 50% in the past year, has been the leading performer in the casino industry in the past ten years and the second leading performer in the past five years.

Analysis

PROXY Governance addresses its approach to each of the dissidents’ proposals separately below. Overall, however, we believe the dissidents have not presented compelling reasons why their selected governance reforms are needed at Station Casinos at this time. While we consider it an appropriate use of the proxy resolution process to put these issues forward to assess shareholder sentiment on them—the dissidents’ stated purpose—we fail to see that these particular initiatives, if adopted by management, would have any direct impact on shareholder value.

Although there has been increased M&A activity in the gaming sector, there is no indication that Station Casinos has been the subject of any unsolicited approaches, nor does it appear vulnerable to such in terms of being undervalued (the current price of $65.11 is close to the company’s 52-week high of $71.22) or poorly managed, which, in any case, might confirm the need for maintaining protections rather than removing them. The dissidents contend that the mere presence of these defenses, along with the significant family/insider ownership, serve as a deterrent to potential bidders. We believe the

greater deterrent is the size of the company ($4.3 billion market cap, the 8th largest of publicly traded gaming firms) and the recent gaming consolidations that will likely focus competitors’ attention on integrating their current acquisitions.

PROXY Governance believes that the company’s superior financial performance and sound business strategy argue against the need for the dissidents’ proposed governance reforms. There is no evidence of board or management entrenchment or egregious practices, such as excessive executive compensation or rejection of favorable buyout offers, that would suggest these initiatives are imperative. Moreover, the sizable ownership stake of the directors and officers should motivate them to seriously evaluate value-enhancing transactions. We do, however, acknowledge longstanding shareholder concerns regarding certain types of anti-takeover mechanisms and their potential for abuse, and would advise Station Casinos to seriously evaluate its protections in conjunction with the shareholder vote on these issues.

We recommend that shareholders vote management’s WHITE proxy card in the manner set out below.

Rationale/Conclusion:

PROXY Governance believes the board is properly discharging its oversight role and adequately policing itself.

[back to top]

Management

2 Approve the 2005 Stock Compensation Program

PROXY Governance Vote Recommendation: FOR

Proposal:

Approve 2005 Stock Compensation Plan, which reserves 3 new million shares.

Management View:

The 2005 plan will replace the 1999 Stock Compensation Program (which includes the 1999 Compensatory Stock Option Plan and the 1999 Share Plan), Incentive Stock Option Plan, the Compensatory Stock Option Plan, the Restricted Share Plan, and the Non-employee Director Stock Option Plan. The board believes the 2005 plan is integral to Station Casinos’ compensation strategies and programs for directors, employees and independent contractors, and will provide the company with the flexibility to effectively recruit, motivate and retain the caliber of employees and directors essential for the firm’s success through stock ownership in the company.

Analysis:

The 2005 plan provides for grants of incentive and non-qualified stock options, stock appreciation rights (SARs), restricted stock, restricted stock units and other stock awards to employees, directors and independent contractors. Currently, there are 10,800 employees and four outside directors that are eligible to participate. Although authorized, Station Casinos does not presently plan to issue awards to independent contractors. We note that under the prior plans, executives have not been receiving stock options, SARs, or long-term incentive awards in the past three years, but only restricted shares. The restricted shares granted in 2004 vest over ten years, which is an unusually long vesting period that helps promote long-term stock ownership.

The maximum number of shares available for issuance under the plan will consist of 3 million new shares and 868,064 shares still available under prior plans (as of Feb. 28, 2005). The shares reserved under the plan represent 5.7% of the total shares outstanding. Shares reserved for the plan and shares reserved for granted but unexercised awards represent 9.9% of fully diluted shares outstanding. To control dilution going forward, each full value award will count against the plan reserve as 1.9 shares. In any year, no participant may receive awards that are not subject to performance goals covering more than 500,000 shares. All options and SARs must be priced at fair market value and expire in ten years or less. The plan will terminate in ten years.

Shareholders must vote on equity plans by regulation, but the plans themselves and their features should not be the sole focus. PROXY Governance believes the emphasis should be on overall compensation costs for a company as a whole, company performance, and specifically, in terms of possible self-dealing, executive compensation. Where pay is unreasonable, the Compensation Committee should be held responsible, and we would recommend withhold votes accordingly.

According to PROXY Governance’s analysis, the company’s overall performance exceeds peers on a composite basis (81st percentile for the company versus 72nd for peers). Shareholder returns have similarly been strong over the past five years, with the Station Casinos ranked at the 80th percentile of the S&P 1500, compared to the 78th percentile for peers. The compensation of the CEO and named executive officers are 49% and 44% above the median of peers, which we consider reasonable in view of the company’s performance.

Rationale/Conclusion:

PROXY Governance supports this broad-based plan, which can promote stock ownership among a wide range of employees. Plan dilution is reasonable and executive compensation is similarly reasonable compared to peers and to performance.

[back to top]

Management

3 Ratify Appointment of Auditors Ernst & Young

PROXY Governance Vote Recommendation: FOR

Proposal:

The Audit Committee has selected Ernst & Young LLP as the company’s outside auditor for 2005.

Analysis:

Barring circumstances where there is an audit failure due to the auditor not following its own procedures or where the auditor is otherwise complicit in an accounting treatment that misrepresents the financial condition of the company, PROXY Governance recommends the company’s choice of auditor. PROXY Governance believes that concerns about a corporation’s choice of auditor and the services performed (e.g., high non-audit fees) should be directed through withhold votes from the members of the Audit Committee, which is responsible for retaining and compensating the auditor.

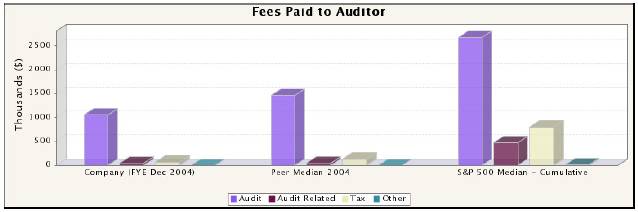

On Sept. 29, 2003, the Company dismissed its certifying accountant, Deloitte & Touche LLP and appointed Ernst & Young. We note that there were no disagreements between Deloitte & Touche and the company on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure. In addition to fees billed by Ernst & Young for 2004, Deloitte & Touche billed the following fees for services: $18,740 for audit services, $ 2,000 for audit-related services, and $2,000 for tax services.

Stockholder ratification of the independent auditors is not required under Nevada law or under the company’s articles or bylaws. Nevertheless, if the auditor is not ratified by shareholders, the Audit Committee will evaluate whether to select a new audit firm either in the current or subsequent year.

Rationale/Conclusion:

We believe that, in this circumstance, the board/Audit Committees should be accorded discretion in its selection of the auditor.

[back to top]

Shareholder

4 Eliminate Supermajority Vote - Bylaw Provision

PROXY Governance Vote Recommendation: AGAINST

Proposal:

UNITE HERE asks the board to take the steps necessary to lower the 67% voting requirement for shareholders to amend the bylaws to a simple majority.

Proponent:

UNITE HERE

Shareholder View:

The union contends that the current supermajority requirement unduly constrains outside shareholders from affecting fundamental changes to the bylaws and gives the significant insider owners veto power over the will of a majority of shareholders.

Management View:

Currently 67% of the outstanding shares must approve amendments, alterations or the repeal of the company’s bylaws. The board believes this requirement protects shareholders against self-interested actions by one or a few large shareholders by ensuring that carefully considered corporate governance rules are not changed without the consensus of a substantial majority of shareholders.

Analysis:

PROXY Governance reviews proposals requesting the elimination of supermajority provisions on a case-by-case basis, taking into account such factors as the proponent’s rationale in targeting the company with the proposal, the company’s performance, the board’s effectiveness, evidence of board entrenchment, and the ownership base, including the presence of a significant shareholder. Supermajority provisions are not inherently good or bad but a perception exists that they may be employed in a harmful manner by management or a significant shareholder to frustrate the wishes of a majority of shareholders. They can also work against management in gaining sufficient shareholder support for actions it favors.

We note that at Station Casinos’ 67% supermajority provisions apply not only to bylaw amendments, but also to business combinations, director removal by shareholders, and amendments to articles relating to the board and shareholders’ ability to call special meetings or act by written consent. The union proposal, however, only addresses the vote requirement to amend the bylaws which, from an anti-takeover aspect, is the more benign provision. It is therefore unclear what benefit would accrue to shareholders from making this single change as opposed to seeking a simple majority vote requirement on all of the actions enumerated above. There could be particular merit to that considering that insiders own 18% of the stock, which gives them significant influence—if not near veto power--over such actions.

Rationale/Conclusion:

We do not believe the proponent has sufficiently justified the need for this particular initiative.

[back to top]

Shareholder

5 Eliminate Classified Board

PROXY Governance Vote Recommendation: AGAINST

Proposal:

UNITE HERE requests that the board take the necessary steps to declassify the board and institute annual election of directors. This should be done in a manner that will not affect the incumbents’ unexpired terms.

Proponent:

UNITE HERE

Shareholder View:

The proponent maintains that the classified board, with each director serving a three-year term, reduces director accountability to shareholders and is an unnecessary takeover defense. Annual elections would give shareholders the opportunity to register their views on the performance of the board and each director on a yearly basis.

Management View:

Management contends that the classified board provides continuity and stability which facilitate long-term planning by the board. Three-year staggered terms preclude sudden disruptive changes to the board composition, ensuring that a majority of board members have prior knowledge and experience of the company. In addition, a longer elected term may help attract new director candidates and enhance director independence since directors do not have to continually consider an upcoming nomination for reelection. In management’s view, the staggered board is not intended as an entrenchment device–evidenced by the company’s strong performance–but can assist directors in negotiating a takeover situation. Management believes that these features of the current board structure are particularly important now as Station Casinos continues its growth into a larger business enterprise.

Analysis:

PROXY Governance recognizes that a classified board can offer certain benefits over an annually elected board, such as promoting director independence and maintaining a core of experienced board members, and should not be disparaged as simply another anti-takeover device. In fact, the arguments against classified boards relating to their anti-takeover effect are actually dependent on the classification being coupled with restrictions on shareholders’ ability to remove directors other than for cause. If the classified board were to stand alone without such a restriction, there would essentially be no anti-takeover effect. Thus, much of the motivation and rationale for declassification proposals--the anti-takeover aspect--is misdirected at the classified board concept when it should be directed at the removal provision, particularly in states where board classification and “removal for cause only” provisions can be decoupled. Shareholders, however, rarely focus on this dichotomy and, even rarer, attempt director removal, other than in the context of a proxy fight.

In Nevada, where Station Casinos is domiciled, directors may be removed by the vote of 67% of the shares outstanding. The company’s articles stipulate that it must be for cause only.

As noted earlier, the company has a considerable number of anti-takeover defenses at its disposal. In management’s view (as acknowledged to PROXY Governance), the key provisions are the classified board and poison pill. We would therefore suggest that the company carefully evaluate the degree of defenses in place, particularly if the vote at this annual meeting underscores shareholder concerns about them.

That notwithstanding, we do not believe the proponent has demonstrated compelling reasons for declassifying the Station Casinos board. Company performance has been excellent, and there is no evidence of board entrenchment (such as excessive executive compensation or rejection of takeover offers) or lack of responsiveness to shareholders. We therefore do not believe that board declassification is necessary at this time.

Rationale/Conclusion:

We do not believe the classified board has been detrimental to shareholders and may, in fact, provide benefits such as promoting director independence and stability. We therefore, do not support this resolution.

[back to top]

Shareholder

6 Allow Shareholder Approval of Poison Pill

PROXY Governance Vote Recommendation: AGAINST

Proposal:

UNITE HERE asks the board to submit the company’s shareholder rights plan to a shareholder vote or redeem it, and to seek shareholder approval before extending the current poison pill or adopting another one.

Proponent:

UNITE HERE

Shareholder View:

The sponsors do not believe the possibility of an unsolicited bid justifies the board’s unilateral implementation of a poison pill, which can give a target company’s board absolute veto power over any proposed business combination, even if shareholders favor it.

Management View:

Management considers the poison pill one of the most effective tools for protecting shareholders against takeover abuses by giving the board bargaining power and practical leverage to ensure a fair price and fair treatment of all shareholders. Although a number of governance advocates believe pills can entrench boards by allowing them to apply a “just say no” defense contrary to the wishes of a majority of shareholders, management believes the adoption of a rights plan is consistent with directors’ fiduciary duties to maximize value for all shareholders. In view of this, management does not believe it is necessary to submit the pill to a shareholder vote nor would it be in shareholders’ interests to redeem it.

Analysis:

Although PROXY Governance can appreciate shareholder concerns about potential pill abuses, we view these initiatives and corporate actions on them as largely unproductive. Companies typically have “shadow pills” that can be rolled out at any time if the company were threatened by a hostile acquirer. Thus, requests to redeem current pills or put them to a shareholder vote are essentially meaningless since a board can always adopt another pill. As for future pills, no board is likely to commit a future board to never, whatever the circumstances, putting a pill into place. In fact, consistent with statutory law, the board would be ill-advised to obligate itself to obtaining a shareholder vote upon adopting a pill if that process would compromise the board’s exercise of its good faith business judgment in evaluating and responding to certain extraordinary corporate events.

PROXY Governance believes there are valid reasons to have a rights plan, including empirical evidence that pills can yield higher takeover premiums in the hands of an independent board. We are therefore not inclined to oppose a pill unless the rights plan contains egregious features or the company has abused its pill or other takeover protections in the past. We would be more inclined to support such a proposal in cases where the company has had poor performance and there are indications of board entrenchment or rejections of promising takeover offers. In this case, we note that the pill, which was adopted in 1997, has a reasonable (15%) flip-in and no apparently egregious features. The company’s five-year composite performance has exceeded peers, and shareholder returns, in particular, have been strong. There is no apparent sign of board entrenchment. We therefore, do not believe this resolution is necessary at this time.

Rationale/Conclusion:

In view of the company’s excellent performance and the absence of any indications of board entrenchment or abuse of takeover defenses, we do not believe the proposal is warranted.

[back to top]

© 2005 by PROXY Governance, Inc.™ All Rights Reserved. The information contained in this proxy analysis is confidential, for internal use only in accordance with the terms of the subscriber’s subscription agreement, and may not be reproduced or redistributed in any manner without prior written consent from PROXY Governance, Inc. All information is provided “as is” and without any warranty, is not intended to solicit votes, and should not be relied on for investment or other purposes.