| |

| As filed with the Securities and Exchange Commission on April 6, 2010. |

| |

| | Registration No. 333-________ |

| |

| |

| U.S. SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| |

| FORM N-14 |

| |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X] |

| |

| [ ] Pre-Effective Amendment No. |

| [ ] Post-Effective Amendment No. |

| |

| PRINCIPAL FUNDS, INC. |

| f/k/a Principal Investors Fund, Inc. |

| (Exact name of Registrant as specified in charter) |

| |

| 680 8th Street, Des Moines, Iowa 50392-2080 |

| (Address of Registrant's Principal Executive Offices) |

| |

| 515-248-3842 |

| (Registrant's Telephone Number, Including Area Code) |

| |

| Michael D. Roughton |

| Counsel, Principal Funds, Inc. |

| 711 High Street |

| \Des Moines, Iowa 50392-2080 |

| (Name and Address of Agent for Service) |

| |

| | Copies of all communications to: |

| | John W. Blouch |

| | Dykema Gossett PLLC |

| 1300 I Street, N.W. |

| | Washington, D.C. 20005-3353 |

| | 202-906-8714; 202-906-8669 (Fax) |

| |

| Approximate date of proposed public offering: As soon as practicable after this Registration |

| Statement becomes effective. | |

| |

| Title of Securities Being Registered: Class A, Class B, Class C, and Institutional Class Shares |

| common stock, par value $.01 per share. |

| |

| No filing fee is due because an indefinite number of shares have been registered in reliance on |

| Section 24(f) under the Investment Company Act of 1940, as amended. |

| |

| It is proposed that this filing will become effective on May 6, 2010, pursuant to Rule 488. |

|

| PRINCIPAL FUNDS, INC. |

| 680 8th Street |

| Des Moines, Iowa 50392-2080 |

| |

| |

| _________, 2010 |

| Dear Shareholder: |

| A Special Meeting of Shareholders of Principal Funds, Inc. (“PFI”) will be held at 680 8th Street, Des Moines, Iowa 50392-2080, on |

| July 15, 2010 at 10 a.m., Central Time. |

| At the meeting, shareholders of the Short-Term Bond Fund (the “Acquired Fund”) will be asked to consider and approve a Plan of |

| Acquisition (the “Plan”) providing for the reorganization of the Short-Term Bond Fund into the Short-Term Income Fund (the “Acquiring |

| Fund”). Each of these Funds is a separate series or fund of PFI. |

| Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for |

| shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund; and (iii) the |

| Acquired Fund will liquidate and terminate (the “Reorganization”). As a result of the Reorganization, each shareholder of the Acquired Fund |

| will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal |

| the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a |

| shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of |

| regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization. Holders of Class A, |

| Class C, Class J, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquired Fund will receive, |

| respectively, Class A, Class C, Class J, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquiring |

| Fund. The Reorganization is expected to occur as of the close of regularly scheduled trading on the NYSE on July 23, 2010. All share classes |

| of the Acquired Fund will vote in the aggregate and not by class with respect to the Reorganization. |

| The Board of Directors of PFI believes that the Reorganization will serve the best interests of shareholders of both the Acquired and |

| Acquiring Funds. The Funds have the similar investment objectives in that the Acquired Fund seeks to provide current income while the |

| Acquiring Fund seeks to provide as high a level of current income as is consistent with prudent investment management and stability of |

| principal. The Funds also have substantially similar principal policies and risks in that both invest primarily in short-term fixed-income |

| securities. Although the Acquiring Fund has higher advisory fee rates and, absent contractual expense limitations, higher expense ratios than |

| the Acquired fund, the Acquiring Fund has outperformed the Acquired Fund over the three-year and five-year periods ended December 31, |

| 2009. Moreover, the Acquiring Fund has larger assets than the Acquired Fund, and the Reorganization may be expected to afford |

| shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. Combining the Funds will not |

| result in any dilution of the interests of existing shareholders of the Funds. |

| The value of your investment will not be affected by the Reorganization. Furthermore, in the opinion of legal counsel, no gain or loss |

| will be recognized by any shareholder for federal income tax purposes as a result of the Reorganization. |

| ***** |

| Enclosed you will find a Notice of Special Meeting of Shareholders, a Proxy Statement/Prospectus, and a proxy card for shares of the |

| Acquired Fund you owned as of April 26, 2010, the record date for the Meeting. The Proxy Statement/Prospectus provides background |

| information and describes in detail the matters to be voted on at the Meeting. |

| The Board of Directors has unanimously voted in favor of the proposed Reorganization and recommends that you vote FOR the |

| Proposal. |

| In order for shares to be voted at the Meeting, we urge you to read the Proxy Statement/Prospectus and then complete and mail |

| your proxy card(s) in the enclosed postage-paid envelope, allowing sufficient time for receipt by us by July 14, 2010. As a |

| convenience, we offer three options by which to vote your shares: |

| By Internet: Follow the instructions located on your proxy card. |

| By Phone: The phone number is located on your proxy card. Be sure you have your control number, as printed on your proxy card, |

| available at the time you call. |

| By Mail: Sign your proxy card and enclose it in the postage-paid envelope provided in this proxy package. |

| We appreciate your taking the time to respond to this important matter. Your vote is important. If you have any questions regarding the |

| Reorganization, please call our shareholder services department toll free at 1-800-222-5852. |

| |

| PRINCIPAL FUNDS, INC. |

| 680 8th Street |

| Des Moines, Iowa 50392-2080 |

| NOTICE OF SPECIAL MEETING OF SHAREHOLDERS |

| To the Shareholders of the Short-Term Bond Fund: |

| Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of the Short-Term Bond Fund, a separate series of |

| Principal Funds, Inc. (“PFI”), will be held at 680 8th Street, Des Moines, Iowa 50392-2080, on July 15, 2010 at 10 a.m., Central Time. A |

| Proxy Statement/Prospectus providing information about the following proposal to be voted on at the Meeting is included with this notice. |

| The Meeting is being held to consider and vote on such proposal as well as any other business that may properly come before the Meeting or |

| any adjournment thereof: |

| Proposal: | Approval of a Plan of Acquisition providing for the reorganization of the Short-Term Bond Fund (the “Fund”) into the |

| | Short-Term Income Fund. |

| | The Board of Directors of PFI recommends that shareholders of the Fund vote FOR the Proposal. |

| Approval of the Proposal will require the affirmative vote of the holders of at least a “Majority of the Outstanding Voting Securities” (as |

| defined in the accompanying Proxy Statement/Prospectus) of the Fund. |

| Each shareholder of record at the close of business on April 26, 2010 is entitled to receive notice of and to vote at the Meeting. |

| Please read the attached Proxy Statement/Prospectus. |

| | By order of the Board of Directors |

| | Nora M. Everett |

| | President and Chief Executive Officer |

| ______________, 2010 |

| Des Moines, Iowa |

|

| PRINCIPAL FUNDS, INC. |

| 680 8th Street |

| Des Moines, Iowa 50392-2080 |

| |

| ————————— |

| |

| PROXY STATEMENT/PROSPECTUS |

| SPECIAL MEETING OF SHAREHOLDERS |

| TO BE HELD JULY 15, 2010 |

| |

| RELATING TO THE REORGANIZATION OF: |

| THE SHORT-TERM BOND FUND INTO |

| THE SHORT-TERM INCOME FUND |

| |

| This Proxy Statement/Prospectus is furnished in connection with the solicitation by the Board of Directors (the “Board” or “Directors”) |

| of Principal Funds, Inc. (“PFI”) of proxies to be used at a Special Meeting of Shareholders of PFI to be held at 680 8th Street, Des Moines, |

| Iowa 50392-2080, on July 15, 2010, at 10 a.m., Central Time (the “Meeting”). |

| |

| At the Meeting, shareholders of the Short-Term Bond Fund (the “Acquired Fund”) will be asked to consider and approve a proposed |

| Plan of Acquisition (the “Plan”) providing for the reorganization of the Acquired Fund into the Short-Term Income Fund (the “Acquiring |

| Fund”). |

| |

| Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities of the Acquired Fund in exchange for |

| shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the Shareholders of the Acquired Fund; and (iii) the |

| Acquired Fund will liquidate and terminate (the “Reorganization”). As a result of the Reorganization, each shareholder of the Acquired Fund |

| will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal |

| the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a |

| shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of |

| regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization. Holders of Class A, |

| Class C, Class J, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquired Fund will receive, |

| respectively, Class A, Class C, Class J, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquiring |

| Fund. If approved by shareholders of the Acquired Fund, the Reorganization is expected to occur immediately after the close of regularly |

| scheduled trading on the NYSE on July 23, 2010 (the “Effective Time”). All share classes of the Acquired Fund will vote in the aggregate |

| and not by class. The terms and conditions of the Reorganization are more fully described below in this Proxy Statement/Prospectus and the |

| Form of Plan of Acquisition which is attached hereto as Appendix A. |

| |

| This Proxy Statement/Prospectus contains information shareholders should know before voting on the Reorganization. Please read it |

| carefully and retain it for future reference. The Annual and Semi-Annual Reports to Shareholders of PFI contain additional information about |

| the investments of the Acquired and Acquiring Funds, and the Annual Report contains discussions of the market conditions and investment |

| strategies that significantly affected the Acquired and Acquiring Funds during the fiscal year ended October 31, 2009. Copies of these |

| reports may be obtained at no charge by calling our shareholder services department toll free at 1-800-247-4123. |

| |

| A Statement of Additional Information dated ___________, 2010 (the “Statement of Additional Information”) relating to this Proxy |

| Statement/Prospectus has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated by reference into this Proxy |

| Statement/Prospectus. PFI’s Prospectus, dated March 1, 2010 and as supplemented, (File No. 33-59474) and the Statement of Additional |

| Information for PFI, dated March 1, 2010 and as supplemented (“PFI SAI”), have been filed with the SEC and, insofar as they relate to the |

| Short-Term Bond Fund, are incorporated by reference into this Proxy Statement/Prospectus. Copies of these documents may be obtained |

| without charge by writing to PFI at the address noted above or by calling our shareholder services department toll free at 1-800-222-5852. |

| You may also call our shareholder services department toll fee at 1-800-222-5852 if you have any questions regarding the Reorganization. |

| |

| PFI is subject to the informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940 (the |

| “1940 Act”) and files reports, proxy materials and other information with the SEC. Such reports, proxy materials and other information may |

| be inspected and copied at the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 (information on the |

| operation of the Public Reference Room may be obtained by calling the SEC at 1-202-551-5850). Such materials are also available on the |

| SEC’s EDGAR Database on its Internet site at www.sec.gov, and copies may be obtained, after paying a duplicating fee, by email request |

| addressed to publicinfo@sec.gov or by writing to the SEC’s Public Reference Room. |

| |

| The SEC has not approved or disapproved these securities or passed upon the accuracy or adequacy of this Proxy |

| Statement/Prospectus. Any representation to the contrary is a criminal offense. |

| |

| The date of this Proxy Statement/Prospectus is __________, 2010. |

| | |

| | TABLE OF CONTENTS | |

| | | Page |

| INTRODUCTION | 3 |

| THE REORGANIZATION | 3 |

| PROPOSAL: | APPROVAL OF A PLAN OF ACQUISITION PROVIDING FOR THE REORGANIZATION | |

| | OF THE SHORT-TERM BOND FUND INTO THE SHORT-TERM INCOME FUND | 4 |

| Comparison of Acquired and Acquiring Funds | 4 |

| Comparison of Investment Objectives and Strategies | 4 |

| Fees and Expenses of the Funds | 6 |

| Comparison of Principal Investment Risks | 8 |

| Performance | 9 |

| INFORMATION ABOUT THE REORGANIZATION | 10 |

| Plan of Acquisition | 10 |

| Reasons for the Reorganization | 10 |

| Board Consideration of the Reorganization | 10 |

| Description of the Securities to Be Issued | 11 |

| Federal Income Tax Consequences | 11 |

| CAPITALIZATION | 12 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | 13 |

| Certain Investment Strategies and Related Risks of the Funds | 13 |

| Multiple Classes of Shares | 16 |

| Costs of Investing in the Funds | 16 |

| Distribution Plans and Intermediary Compensation | 17 |

| Other Payments to Financial Intermediaries | 18 |

| Pricing of Fund Shares | 19 |

| Purchase of Fund Shares | 20 |

| Redemption of Fund Shares | 22 |

| Exchange of Fund Shares | 24 |

| Frequent Purchases and Redemptions | 25 |

| Dividends and Distributions | 26 |

| Tax Considerations | 26 |

| Portfolio Holdings Information | 27 |

| VOTING INFORMATION | 27 |

| OUTSTANDING SHARES AND SHARE OWNERSHIP | 28 |

| FINANCIAL HIGHLIGHTS | 30 |

| FINANCIAL STATEMENTS | 34 |

| LEGAL MATTERS | 34 |

| OTHER INFORMATION | 34 |

| APPENDIX A Form of Plan of Acquisition | A-1 |

| APPENDIX B Description of Indices | B-1 |

| |

| INTRODUCTION |

| |

| This Proxy Statement/Prospectus is being furnished to shareholders of the Acquired Fund to provide information regarding the Plan and |

| the Reorganization. | |

| |

| Principal Funds, Inc. PFI is a Maryland corporation and an open-end management investment company registered with the SEC under |

| the 1940 Act. PFI currently offers 67 separate series or funds (the “PFI Funds”), including the Acquired and Acquiring Funds. The sponsor |

| of PFI is Principal Life Insurance Company (“Principal Life”), and the investment advisor to the PFI Funds is Principal Management |

| Corporation (“PMC”). Principal Funds Distributor, Inc. (the “Distributor” or “PFD”) is the distributor for all share classes of the Acquired |

| and Acquiring Funds. Principal Life, an insurance company organized in 1879 under the laws of Iowa, PMC and PFD are indirect, wholly- |

| owned subsidiaries of Principal Financial Group, Inc. (“PFG”). Their address is the Principal Financial Group, Des Moines, Iowa 50392- |

| 2080. | |

| |

| Investment Management. Pursuant to an investment advisory agreement with PFI with respect to the Acquired and Acquiring Funds, |

| PMC provides investment advisory services and certain corporate administrative services to the Funds. As permitted by the investment |

| advisory agreement, PMC has entered into sub-advisory agreements with respect to the Acquired and Acquiring Funds as follows: |

| |

| Acquired Fund | Sub-Advisor |

| Short-Term Bond Fund | Principal Global Investors, LLC (“PGI”) |

| |

| Acquiring Fund | Sub-Advisor |

| Short-Term Income Fund | Edge Asset Management, Inc. (“Edge”) |

| |

| PMC and each sub-advisor are registered with the SEC as investment advisors under the Investment Advisers Act of 1940. |

| |

| PGI is located at 801 Grand Avenue, Des Moines, IA 50392. PGI is an affiliate of PFG. |

| |

| Edge is located at 601 Union Street, Suite 2200, Seattle, WA 98101-1377. Both PGI and Edge are affiliates of PFG. |

| |

| THE REORGANIZATION |

| |

| At its meeting held on March 8, 2010, the Board, including all the Directors who are not “interested persons” (as defined in the 1940 |

| Act) of PFI (the “Independent Directors”), approved the Reorganization pursuant to the Plan providing for the combination of the Acquired |

| Fund into the Acquiring Fund. The Board concluded that the Reorganization is in the best interests of the Acquired Fund and the Acquiring |

| Fund and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization. The factors that the |

| Board considered in deciding to approve the Reorganization are discussed below under “Information About the Reorganization – Board |

| Consideration of the Reorganization.” | |

| |

| The Reorganization contemplates: (i) the transfer of all the assets, subject to all of the liabilities, of the Acquired Fund to the Acquiring |

| Fund in exchange for shares of the Acquiring Fund; (ii) the distribution to Acquired Fund shareholders of the Acquiring Fund shares; and (iii) |

| the liquidation and termination of the Acquired Fund. As a result of the Reorganization, each shareholder of the Acquired Fund will become |

| a shareholder of the Acquiring Fund. In the Reorganization, the Acquiring Fund will issue a number of shares with a total value equal to the |

| total value of the net assets of the Acquired Fund, and each shareholder of the Acquired Fund will receive a number of full and fractional |

| shares of the Acquiring Fund with a value equal to the value of that shareholder’s shares of the Acquired Fund, as of the close of regularly |

| scheduled trading on the NYSE on the closing date of the Reorganization (the “Effective Time”). The closing date of the Reorganization is |

| expected to be July 23, 2010. Holders of Class A, Class C, Class J, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional |

| Class shares of the Acquired Fund will receive, respectively, Class A, Class C, Class J, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 |

| and Institutional Class shares of the Acquiring Fund. The terms and conditions of the Reorganization are more fully described below in this |

| Proxy Statement/Prospectus and in the Form of Plan of Acquisition, which is attached hereto as Appendix A. |

| |

| The Board of Directors of PFI believes that the Reorganization will serve the best interests of shareholders of both the Acquired and |

| Acquiring Funds. The Funds have the similar investment objectives in that the Acquired Fund seeks to provide current income while the |

| Acquiring Fund seeks to provide as high a level of current income as is consistent with prudent investment management and stability of |

| principal. The Funds also have substantially similar principal policies and risks in that both invest primarily in short-term fixed-income |

| securities. Although the Acquiring Fund has higher advisory fee rates and, absent contractual expense limitations, higher expense ratios than |

| the Acquired fund, the Acquiring Fund has outperformed the Acquired Fund over the three-year and five-year periods ended December 31, |

| 2009. Moreover, the Acquiring Fund has larger assets than the Acquired Fund, and the Reorganization may be expected to afford |

| shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. Combining the Funds will not |

| result in any dilution of the interests of existing shareholders of the Funds. |

| |

| In the opinion of legal counsel, the Reorganization will qualify as a tax-free reorganization and, for federal income tax purposes, no gain |

| or loss will be recognized as a result of the Reorganization by the Acquired or Acquiring Fund shareholders. See “Information About the |

| Reorganization – Federal Income Tax Consequences.” | |

| |

| The Reorganization will not result in any material change in the purchase and redemption procedures followed with respect to the |

| distribution of shares. See “Additional Information About the Funds – Purchases, Redemptions and Exchanges of Shares.” |

| |

| PMC will cover all out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing, and legal fees. These |

| expenses and fees are expected to total $54,327. The Acquired Fund, which is expected to achieve the greatest benefit from the |

| Reorganization, will pay any trading costs associated with disposing of any portfolio securities of the Acquired Fund that would not be |

|

| compatible with the investment objectives and strategies of the Acquiring Fund and reinvesting the proceeds in securities that would be |

| compatible. It is expected that 28% of the portfolio securities of the Acquired Fund will be disposed of. The estimated loss, including trading |

| costs, is expected to be approximately $16,395,000 on a U.S. GAAP basis. The estimated per share capital loss is approximately $1.14. |

| |

| PROPOSAL: |

| APPROVAL OF A PLAN OF ACQUISITION PROVIDING |

| FOR THE REORGANIZATION OF THE |

| SHORT-TERM BOND FUND |

| INTO THE SHORT-TERM INCOME FUND |

| |

| Shareholders of the Short-Term Bond Fund (the “Acquired Fund”) are being asked to approve the reorganization of the Acquired Fund |

| into the Short-Term Index Fund (the “Acquiring Fund.) |

| |

| Comparison of Acquired and Acquiring Funds |

| |

| The following table provides comparative information with respect to the Acquired and Acquiring Funds. As indicated in the table, the |

| Funds have similar investment objectives in that the Acquired Fund seeks to provide current income while the Acquiring Fund seeks to |

| provide as high a level of current income as is consistent with prudent investment management and stability of principal. The Funds also |

| have substantially similar principal policies and risks in that both invest primarily in short-term fixed-income securities within the same credit |

| quality range and both may invest in foreign fixed-income securities. The Funds differ principally in that the Acquired Fund generally holds |

| securities with an average maturity of four years or less and dollar–weighted effective maturity of not more than three years while the |

| Acquiring Fund generally holds securities with an average maturity of five years or less and a dollar-weighted average duration of not more |

| than three years. In addition, the Acquired Fund may invest in high yield securities. |

| | |

| Short-Term Bond Fund | | Short-Term Income Fund |

| (Acquired Fund) | | (Acquiring Fund) |

| |

| Approximate Net Assets as of October 31, 2009: | | |

| $125,663,000 | | $469,155,000 |

| |

| Investment Advisor: | PMC | |

| |

| Sub-Advisors and Portfolio Managers: | | |

| |

| PGI | | Edge |

| Craig Dawson (since 2005). Mr. Dawson has been with PGI since | Scott J. Peterson (since 2010). Mr. Peterson has been with Edge |

| 1998. He earned a Bachelor’s degree in Finance and an MBA | since 2002. He earned a Bachelor’s degree in Mathematics from |

| from the University of Iowa. Mr. Dawson has earned the right to | Brigham Young University and an MBA from New York |

| use the Chartered Financial Analyst designation. | | University’s Stern School of Business. Mr. Peterson has earned |

| |

| Timothy R. Warrick (since 2009). Mr. Warrick has been with PGI | the right to use the Chartered Financial Analyst designation. |

| since 1990. He earned a Bachelor’s degree in Accounting and | |

| Economics from Simpson College and an MBA in Finance from | |

| Drake University. Mr. Warrick has earned the right to use the | |

| Chartered Financial Analyst designation. | | |

| |

| Comparison of Investment Objectives and Strategies |

| |

| Investment Objective: | | |

| |

| The Acquired Fund seeks to provide current income. | The Acquiring Fund seeks to provide as high a level of current |

| | | income as is consistent with prudent investment management and |

| | | stability of principal. |

| Principal Investment Strategies: | | |

| The Fund invests primarily in short-term fixed-income securities. | The Fund invests in high quality short-term bonds and other fixed- |

| Under normal circumstances, the Fund maintains an effective | income securities that, at the time of purchase, are rated BBB- or |

| maturity of four years or less and a dollar-weighted effective | higher by Standard & Poor’s Rating Service or Baa3 or higher by |

| maturity of not more than three years. In determining the average | Moody’s Investors Service, Inc. or, if unrated, in the opinion of |

| effective maturity of the Fund’s assets, the maturity date of a | Edge of comparable quality. Under normal circumstances, the |

| callable security or probable securities may be adjusted to reflect | Fund maintains an effective maturity of five years or less and a |

| the judgment of PGI regarding the likelihood of the security being | dollar-weighted average duration of three years or less. The |

| called or prepaid. The Fund considers the term “bond” to mean | Fund’s investments may also include corporate securities, U.S. |

| any debt security. Under normal circumstances, it invests at least | and foreign government securities, repurchase agreements, |

| 80% of its net assets (plus any borrowings for investment | mortgage-backed and asset-backed securities, and real estate |

| purposes) in the following types of securities rated, at the time of | investment trust securities. |

| purchase, BBB- or higher by Standard & Poor's Rating Service | |

| ("S&P") or Baa3 or higher by Moody's Investors Service, Inc. | The Fund may invest in foreign fixed-income securities, primarily |

| ("Moody's"): | | bonds of foreign governments or their political subdivisions, |

| | |

| · | securities issued or guaranteed by the U.S. government or its | foreign companies and supranational organizations, including non- |

| | agencies or instrumentalities; | U.S. dollar-denominated securities and U.S. dollar-denominated |

| · | debt securities of U.S. issuers; and | fixed-income securities issued by foreign issuers and foreign |

| · | mortgage-backed securities representing an interest in a pool | branches of U.S. banks. The Fund may invest in preferred |

| | of mortgage loans. | securities. The Fund may enter into dollar roll transactions, which |

| | | may involve leverage. The Fund may utilize derivative strategies, |

| The Fund may invest in below-investment-grade fixed-income | which are financial contracts whose value depends upon, or is |

| securities (commonly known as “junk bonds” or “high yield | derived from, the value of an underlying asset, reference rate, or |

| securities”) (rated at the time of purchase BB+ or lower by S&P or | index, and may relate to stocks, bonds, interest rates, currencies or |

| Ba1 or lower by Moody’s). | currency exchange rates, and related indexes. Derivative strategies |

| The Fund may invest in Eurodollar and Yankee Obligations and | may include certain options transactions, financial futures |

| foreign securities. The Fund may invest in asset-backed securities. | contracts, swaps, currency forwards, and related options for |

| The Fund may enter into dollar roll transactions, which may | purposes such as earning income and enhancing returns, managing |

| involve leverage. The Fund may utilize derivative strategies, | or adjusting the risk profile of the Fund, replacing more traditional |

| which are financial contracts whose value depends upon, or is | direct investments, or obtaining exposure to certain markets. This |

| derived from, the value of an underlying asset, reference rate, or | Fund may be used as part of a fund of funds strategy. |

| index, and may relate to stocks, bonds, interest rates, currencies or | |

| currency exchange rates, and related indexes. Derivative strategies | |

| may include certain options transactions, financial futures | |

| contracts, swaps, currency forwards, and related options for | |

| purposes such as earning income and enhancing returns, managing | |

| or adjusting the risk profile of the Fund, replacing more traditional | |

| direct investments, or obtaining exposure to certain markets. | |

| During the fiscal year ended October 31, 2009, the average ratings | |

| of the Fund's fixed-income assets, based on market value at each | |

| month-end, were as follows (all ratings are by Moody's): | |

| | 54.64% in securities rated Aaa | |

| | 6.13% in securities rated Aa | |

| | 12.64% in securities rated A | |

| | 20.94% in securities rated Baa | |

| | 2.47% in securities rated Ba | |

| | 1.04% in securities rated B | |

| | 1.71% in securities rated Caa | |

| | 0.28% in securities rated Ca | |

| | 0.00% in securities rated C | |

| | 0.02% in securities rated D | |

| | 0.13% in securities not rated | |

|

| Hedging and Other Strategies: |

| Each of the Funds may invest in inverse floating rate obligations, may engage in hedging transactions through the use of financial |

| futures and options thereon and may also purchase and sell securities on a when-issued or forward commitment basis, invest in |

| mortgage-backed securities, enter into repurchase agreements, invest in stand-by commitments, engage in swap agreements, and lend |

| portfolio securities. Each of the Funds may invest in floating rate and variable rate obligations, including participation interests therein. |

| Temporary Defensive Investing: |

| For temporary defensive purposes in times of unusual or adverse market, economic, or political conditions, each Fund may invest up to |

| 100% of its assets in cash and cash equivalents. In taking such defensive measures, either Fund may fail to achieve its investment |

| objective. |

| Fundamental Investment Restrictions: |

| The Funds are subject to identical fundamental investment restrictions. These fundamental restrictions deal with such matters as the |

| issuance of senior securities, purchasing or selling real estate or commodities, borrowing money, making loans, underwriting securities |

| of other issuers, diversification or concentration of investments, and short sales of securities. The fundamental investment restrictions of |

| the Funds are described in the Statement of Additional Information. |

| The investment objective of each Fund may be changed by the Board of Directors of PFI without shareholder approval. |

| |

| Additional information about the investment strategies and the types of securities in which the Funds may invest is discussed below |

| under “Certain Investment Strategies and Related Risks of the Funds” as well as in the Statement of Additional Information. |

| |

| The Statement of Additional Information provides further information about the portfolio manager(s) for each Fund, including |

| information about compensation, other accounts managed and ownership of Fund shares. |

| | | |

| Fees and Expenses of the Funds |

| |

| The tables below compare the fees and expenses of the shares of the Acquired and Acquiring Funds. In the Reorganization, the holders |

| of Class R-1, Class R-2, Class R-3, Class R-4, class R-5 ("Retirement Class shares"), Class A, Class C, Class J, and Institutional Class shares |

| of the Acquired Fund will receive, respectively, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5, Class A, Class C, Class J, and |

| Institutional Class shares of the Acquiring Fund. | | | |

| |

| Shareholder Fees (fees paid directly from your investment) | | | |

| |

| The following table shows the fees and expenses you may pay when you buy and redeem Class A, C and J shares of the Funds. These |

| fees and expenses are more fully described under "Additional Information About the Funds –Costs of Investing in the Funds." The |

| Retirement Class and Institutional Class shares are not subject to sales charges or redemption fees. | |

| |

| | Class A | Class C | Class J |

| Maximum Sales Charge (Load) Imposed on Purchases | | | |

| (as a percentage of offering price) | 2.25% | None | None |

| |

| Maximum Deferred Sales Charge (Load) | 1.00% | 1.00% | 1.00%(1) |

| (as a percentage of dollars subject to charge) | | | |

| (1) A CDSC may apply on certain redemptions made within 18 months. | | |

| |

| Fees and Expenses as a % of average daily net assets | | | |

| |

| The following table shows: (a) the ratios of expenses to average net assets of the Acquired Fund for the fiscal year ended October 31, |

| 2009; (b) the ratios of expenses to average net assets of Class A, Class C and the Institutional Class shares, and the estimated pro forma |

| expense ratios of the Class J, Class R-1, Class R-2, Class R-3, Class R-4, and Class R-5 shares (assuming they had been outstanding during |

| the period) of the Acquiring Fund for the fiscal year ended October 31, 2009; and (c) the pro forma expense ratios of the Acquiring Fund for |

| the fiscal year ending October 31, 2009 assuming that the Reorganization had taken place at the commencement of the fiscal year ending |

| October 31, 2009. | | | |

| | | | | |

| PMC has contractually agreed to limit the Acquired Fund’s expenses attributable to Class C shares and, if necessary, pay expenses |

| normally payable by the Acquired Fund, excluding interest expense, through the period ending February 28, 2011. The expense limit will |

| maintain a total level of operating expenses (expressed as a percent of average net assets on an annualized basis) not to exceed 1.70% for |

| Class C shares. | | | | | |

| |

| PMC has contractually agreed to limit the Acquiring Fund’s expenses attributable to Class A and Class C shares and, if necessary, pay |

| expenses normally payable by the Acquiring Fund, excluding interest expense, through the period ending February 28, 2011. The expense |

| limit will maintain a total level of operating expenses (expressed as a percent of average net assets on an annualized basis) not to exceed |

| 0.95% for Class A and 1.67% for Class C shares. | | | | | |

| |

| The Distributor has voluntarily agreed to limit the Acquired and the Acquiring Fund’s 12b-1 Fees normally payable by the Acquired and |

| the Acquiring Fund. The expense limit will maintain the level of 12b-1 Fees (expressed as a percent of average net assets on an annualized |

| basis) not to exceed 0.40% for Class J shares. The expense limit may be terminated at any time. | | |

| |

| PMC has voluntarily agreed to limit the Acquired Fund’s expenses attributable to Institutional Class shares and, if necessary, pay |

| expenses normally payable by the Acquired Fund, excluding interest expense. The expense limit will maintain a total level of operating |

| expenses (expressed as a percent of average net assets on an annualized basis) not to exceed 0.45%. The expense limit may be terminated at |

| any time. | | | | | |

| |

| PMC has voluntarily agreed to limit the Acquiring Fund’s expenses attributable to Institutional Class shares and, if necessary, pay |

| expenses normally payable by the Acquiring Fund, excluding interest expense. The expense limit will maintain a total level of operating |

| expenses (expressed as a percent of average net assets on an annualized basis) not to exceed 0.54%. The expense limit may be terminated at |

| any time. | | | | | |

| |

| PMC has contractually agreed to limit the Acquiring Fund’s expenses attributable to Class J, Class R-1, Class R-2, Class R-3, Class R-4, |

| and Class R-5 shares and, if necessary, pay expenses normally payable by the Acquiring Fund, excluding interest expense, through the period |

| ending February 29, 2012. The expense limit will maintain a total level of operating expenses (expressed as a percent of average net assets on |

| an annualized basis) not to exceed 1.07% for Class J, 1.30% for Class R-1, 1.18% for Class R-2, 0.99% for Class R-3, 0.79% for Class R-4, |

| and 0.68% for Class R-5. | | | | | |

| |

| The costs associated with the Reorganization are not reflected in the Annual Fund Operating Expenses table. PMC will pay the costs |

| associated with the Reorganization which are estimated to be $54,327. | | | | |

| |

| Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired and Acquiring |

| Funds. The examples assume that fund expenses continue at the rates shown in the table above, that you invest $10,000 in the particular fund |

| for the time periods indicated and that all dividends and distributions are reinvested. The examples also assume that your investment has a |

| 5% return each year. The examples also take into account the relevant contractual expense limit until the date of expiration. The examples |

| should not be considered a representation of future expense of the Acquired or Acquiring fund. Actual expense may be greater or |

| less than those shown. | | | | | |

| |

| If you sell your shares at the end of the period: | | 1 Year | 3 Years | 5 Years | 10 Years |

| Short-Term Bond Fund (Acquired Fund) | Class A | $307 | $481 | $ 670 | $1,216 |

| | Class C | 273 | 664 | 1,194 | 2,646 |

| | Class J | 214 | 356 | 617 | 1,363 |

| | Class R-1 | 132 | 412 | 713 | 1,568 |

| | Class R-2 | 119 | 372 | 644 | 1,421 |

| | Class R-3 | 101 | 315 | 547 | 1,213 |

| | Class R-4 | 82 | 255 | 444 | 990 |

| | Class R-5 | 69 | 218 | 379 | 847 |

| | Institutional | 67 | 211 | 368 | 822 |

| |

| Short-Term Income Fund (Acquiring Fund) | Class A | $308 | $484 | $675 | $1,227 |

| | Class C | 270 | 526 | 907 | 1,976 |

| | Class J | 209 | 364 | 641 | 1,431 |

| | Class R-1 | 132 | 426 | 742 | 1,639 |

| | Class R-2 | 120 | 386 | 674 | 1,494 |

| | Class R-3 | 101 | 329 | 577 | 1,287 |

| | Class R-4 | 81 | 268 | 473 | 1,064 |

| | Class R-5 | 69 | 231 | 409 | 923 |

| | Institutional | 54 | 170 | 296 | 665 |

| | | |

| Portfolio Turnover | | | |

| |

| The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio |

| turnover rate may indicate higher transaction costs and may result in higher taxes for shareholders who hold Fund shares in a taxable account. |

| These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most |

| recent fiscal year, the portfolio turnover rate for the Acquired Fund was 33.9% of the average value of its portfolio while the portfolio |

| turnover rate for the Acquiring Fund was 40.8%. | | | |

| |

| Investment Management Fees/Sub-Advisory Arrangements |

| |

| Each Fund pays its investment advisor, PMC, an advisory fee which for each Fund is calculated as a percentage of the Fund’s average |

| daily net assets pursuant to the following fee schedule: | | |

| |

| Short-Term Bond Fund | | Short-Term Income Fund | |

| (Acquired Fund) | | (Acquiring Fund) | |

| First $500 million | 0.40% | | |

| Next $500 million | 0.38% | First $200 million | 0.50% |

| Next $500 million | 0.36% | Next $300 million | 0.45% |

| Over $1.5 billion | 0.35% | Over $500 million | 0.40% |

| |

| A discussion of the basis of the Board’s approval of the advisory and sub-advisory agreements with respect to the Acquired and |

| Acquiring Funds is available in PFI’s Annual Report to Shareholders for the fiscal year ended October 31, 2009. | |

| |

| | Comparison of Principal Investment Risks | |

| |

| In deciding whether to approve the Reorganization, shareholders should consider the amount and character of investment risk involved |

| in the respective investment objectives and strategies of the Acquired and Acquiring Funds. Because the Funds have similar investment |

| objectives and substantially similar principal policies, the Funds’ risks are substantially similar. As described below, the Funds also have |

| some different risks. | | | |

| |

| Risks Applicable to both Funds: | | | |

| |

| Derivatives Risk. Transactions in derivatives (such as options, futures, and swaps) may increase volatility, cause the liquidation of portfolio |

| positions when not advantageous to do so and produce disproportionate losses. Certain Fund transactions, such as reverse repurchase |

| agreements, loans of portfolio securities, and the use of when-issued, delayed delivery or forward commitment transactions, or derivative |

| instruments, may give rise to leverage, causing the Fund to be more volatile than if it had not been leveraged. | |

| |

| Fixed-Income Securities Risk. Fixed-income securities are subject to interest rate risk and credit quality risk. The market value of fixed- |

| income securities generally declines when interest rates rise, and an issuer of fixed-income securities could default on its payment |

| obligations. | | | |

|

| Foreign Securities Risk. The risks of foreign securities include loss of value as a result of: political or economic instability; nationalization, |

| expropriation or confiscatory taxation; changes in foreign exchange rates and foreign exchange restrictions; settlement delays; and limited |

| government regulation (including less stringent reporting, accounting, and disclosure standards than are required of U.S. companies). |

| |

| Portfolio Duration Risk. Portfolio duration is a measure of the expected life of a fixed-income security and its sensitivity to changes in |

| interest rates. The longer a fund's average portfolio duration, the more sensitive the fund will be to changes in interest rates. |

| |

| Prepayment Risk. Unscheduled prepayments on mortgage-backed and asset-backed securities may have to be reinvested at lower rates. A |

| reduction in prepayments may increase the effective maturities of these securities, exposing them to the risk of decline in market value over |

| time (extension risk). |

| |

| Real Estate Securities Risk. Real estate securities (including real estate investment trusts ("REITs")) are subject to the risks associated with |

| direct ownership of real estate, including declines in value, adverse economic conditions, increases in expenses, regulatory changes and |

| environmental problems. A REIT could fail to qualify for tax-free passthrough of income under the Internal Revenue Code, and Fund |

| shareholders will indirectly bear their proportionate share of the expenses of REITs in which the Fund invests. |

| |

| U.S. Government Securities Risk. Yields available from U.S. government securities are generally lower than yields from many other fixed- |

| income securities. |

| |

| U.S. Government Sponsored Securities Risk. Securities issued by U.S. government-sponsored or –chartered enterprises such as the Federal |

| Home Loan Mortgage Corporation, the Federal National Mortgage Association, and the Federal Home Loan Banks are not issued or |

| guaranteed by the U.S. Treasury. |

| |

| Risks Applicable to the Acquired Fund: |

| |

| High Yield Securities Risk. High yield fixed-income securities (commonly referred to as "junk bonds") are subject to greater credit quality |

| risk than higher rated fixed-income securities and should be considered speculative. |

| |

| Risk Applicable to the Acquiring Fund: |

| |

| Underlying Fund Risk. An underlying fund to a fund of funds may experience relatively large redemptions or investments as the fund of |

| funds periodically reallocates or rebalances its assets. These transactions may cause the underlying fund to sell portfolio securities to meet |

| such redemptions, or to invest cash from such investments, at times it would not otherwise do so, and may as a result increase transaction |

| costs and adversely affect underlying fund performance. |

| |

| Performance |

| |

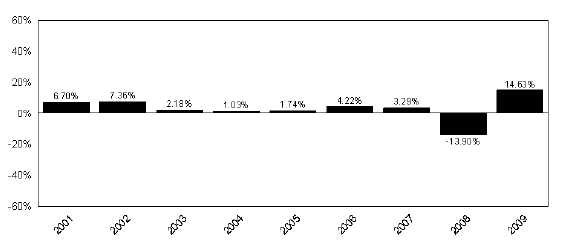

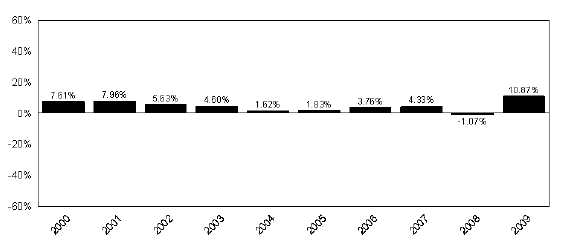

| The following information provides an indication of the risks of investing in the Funds. The bar chart below shows how the Acquired |

| Fund’s total return has varied year-by-year, while the table below shows each Fund’s performance over time (along with the returns of a |

| broad-based market index for reference). A Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund |

| will perform in the future. You may get updated performance information online at www.principal.com or by calling 1-800-222-5852. |

| |

| Short-Term Bond Fund Institutional Class shares and Class J shares were first sold on March 1, 2001, Class R-1 shares were first sold |

| on November 1, 2004, Class A shares commenced operations on June 28, 2005, and Class C shares were first sold on January 16, 2007. The |

| returns for these classes of shares, for the periods prior to those dates, are based on the performance of the R-3 Class shares adjusted to reflect |

| the fees and expenses of these share classes. The adjustments result in performance for such periods that is no higher than the historical |

| performance of the R-3 Class shares. R-3 Class shares were first sold on December 6, 2000. |

| |

| The Short-Term Income Fund commenced operations after succeeding to the operations of another fund on January 12, 2007. |

| Performance for periods prior to that date is based on the performance of the predecessor fund which commenced operations November 1, |

| 1993. The predecessor fund’s performance between 1996 and 2005 benefited from the agreement of Edge and its affiliates to limit the Fund’s |

| expenses. The Short-Term Income Fund will first issue Class J, Class R-1, Class R-2, Class R-3, Class R-4, and Class R-5 in connection with |

| the Reorganization. Performance for periods prior to the Reorganization is based on the performance of Class A shares adjusted to reflect the |

| fees and expenses of these share classes. The adjustment resulted in performance for such periods that is no higher than the historical |

| performance of Class A shares. |

| | | |

| Average Annual Total Returns (%) (with Maximum Sales Charge) for periods ended December 31, 2009 | |

| | | | |

| | 1 Year | 5 Years | 10 Years |

| Short-Term Income Fund (Acquiring Fund) | | | |

| -- Class A (before taxes) | 8.42% | 3.43% | 4.43% |

| (after taxes on distributions) (1) | 7.10 | 2.09 | 2.85 |

| (after taxes on distributions and sale of shares) (1) | 5.44 | 2.13 | 2.83 |

| -- Class C | 8.95 | 3.11 | 3.88 |

| -- Class J(3) | 9.68 | 3.67 | 4.46 |

| -- Class R-1(3) | 10.43 | 3.43 | 4.23 |

| -- Class R-2(3) | 10.56 | 3.55 | 4.35 |

| -- Class R-3(3) | 10.77 | 3.75 | 4.55 |

| -- Class R-4(3) | 10.87 | 3.87 | 4.66 |

| -- Class R-5(3) | 10.87 | 3.87 | 4.66 |

| -- Institutional Class | 11.22 | 4.26 | 5.07 |

| Citigroup Broad Investment-Grade Credit 1-3 Years (reflects no | 11.04 | 4.73 | 5.50 |

| |

| deduction for fees, expenses, or taxes) | | | |

| (1) After-tax returns are shown for Class A shares only and would be different for the other share classes. They are calculated using the historical highest |

| individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation |

| and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax- deferred arrangements such |

| as 401(k) plans or individual retirement accounts. | | | |

| (2) During 2008, the Class experienced a significant withdrawal of assets. As the remaining shareholders held relatively small positions, the total return amounts |

| expressed herein are greater than those that would have been experienced without the withdrawal. | | |

| (3) The Fund commenced operations after succeeding to the operations of another fund on January 12, 2007. Performance for periods prior to that date is based on |

| the performance of the predecessor fund which commenced operations on November 1, 1993. The predecessor fund’s performance between 1996 and 2005 |

| benefited from the agreement of Edge and its affiliates to limit the fund’s expenses. The Class J, R-1, R-2, R-3, R-4, and R-5 Class shares will first be sold on |

| July 23, 2010. | | | |

|

| INFORMATION ABOUT THE REORGANIZATION |

| |

| Plan of Acquisition |

| |

| The terms of the Plan are summarized below. The summary is qualified in its entirety by reference to the Form of the Plan which is |

| attached as Appendix A to this Proxy Statement/Prospectus. |

| |

| Under the Plan, the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund. We expect that the |

| closing date will be July 23, 2010, or such earlier or later date as PMC may determine, and that the Effective Time of the Reorganization will |

| be as of the close of regularly scheduled trading on the NYSE (normally 3:00 p.m., Central Time) on that date. Each Fund will determine its |

| net asset values as of the close of trading on the NYSE using the procedures described in its then current prospectus (the procedures |

| applicable to the Acquired Fund and the Acquiring Fund are identical). The Acquiring Fund will issue to the Acquired Fund a number of |

| shares of each share class with a total value equal to the total value of the net assets of the corresponding share class of the Acquired Fund |

| outstanding at the Effective Time. |

| |

| Immediately after the Effective Time, the Acquired Fund will distribute to its shareholders Acquiring Fund shares of the same class as |

| the Acquired Fund shares each shareholder owns in exchange for all Acquired Fund shares of that class. Acquired Fund shareholders will |

| receive a number of full and fractional shares of the Acquiring Fund that are equal in value to the value of the shares of the Acquired Fund |

| that are surrendered in the exchange. In connection with the exchange, the Acquiring Fund will credit on its books an appropriate number of |

| its shares to the account of each Acquired Fund shareholder, and the Acquired Fund will cancel on its books all its shares registered to the |

| account of that shareholder. After the Effective Time, the Acquired Fund will be dissolved in accordance with applicable law. |

| |

| The Plan may be amended, but no amendment may be made which in the opinion of the Board would materially adversely affect the |

| interests of the shareholders of the Acquired Fund. The Board may abandon and terminate the Plan at any time before the Effective Time if it |

| believes that consummation of the transactions contemplated by the Plan would not be in the best interests of the shareholders of either of the |

| Funds. |

| |

| Under the Plan, PMC will pay all expenses and out-of-pocket fees incurred in connection with the Reorganization. As stated above, |

| portfolio transitioning costs will be borne by the Acquired Fund. |

| |

| If the Plan is not consummated for any reason, the Board will consider other possible courses of action. |

| |

| Reasons for the Reorganization |

| The Board of Directors of PFI believes that the Reorganization will serve the best interests of shareholders of both the Acquired and |

| Acquiring Funds. The Funds have the similar investment objectives in that the Acquired Fund seeks to provide current income while the |

| Acquiring Fund seeks to provide as high a level of current income as is consistent with prudent investment management and stability of |

| principal. The Funds also have substantially similar principal policies and risks in that both invest primarily in short-term fixed-income |

| securities. Although the Acquiring Fund has higher advisory fee rates and, absent contractual expense limitations, higher expense ratios than |

| the Acquired fund, the Acquiring Fund has outperformed the Acquired Fund over the three-year and five-year periods ended December 31, |

| 2009. Moreover, the Acquiring Fund has larger assets than the Acquired Fund, and the Reorganization may be expected to afford |

| shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. Combining the Funds will not |

| result in any dilution of the interests of existing shareholders of the Funds. |

| Board Consideration of the Reorganization |

| At its March 8, 2010 meeting, the Board considered information presented by PMC, and the Independent Directors were assisted by |

| independent legal counsel. The Board requested and evaluated such information as it deemed necessary to consider the Reorganization. At |

| the meeting, the Board unanimously approved the Reorganization after concluding that participation in the Reorganization is in the best |

| interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of the Funds will not be diluted as a |

| result of the Reorganization. |

| In determining whether to approve the Reorganization, the Board made inquiry into a number of matters and considered, among others, |

| the following factors, in no order of priority: |

| (1) | the investment objectives and principal investment strategies and risks of the Funds; |

| (2) | identical fundamental investment restrictions; |

| (3) | estimated trading costs associated with disposing of any portfolio securities of the Acquired Fund and reinvesting the proceeds in |

| | connection with the Reorganization; |

| (4) | expense ratios and available information regarding the fees and expenses of the Funds; |

| (5) | comparative investment performance of and other information pertaining to the Funds |

| (6) | the prospects for growth of and for achieving economies of scale by the Acquired Fund in combination with the Acquiring Fund; |

| (7) | the absence of any material differences in the rights of shareholders of the Funds; |

| (8) | the financial strength, investment experience and resources of Edge, which currently serves as sub-advisor to the Acquiring Fund; |

| (9) | any direct or indirect benefits expected to be derived by PMC and its affiliates from the Reorganization; |

| (10) | the direct or indirect federal income tax consequences of the Reorganization, including the expected tax-free nature of the |

| | Reorganization and the impact of any federal income tax loss carry forwards and the estimated capital gain or loss expected to be |

| | incurred in connection with disposing of any portfolio securities that would not be compatible with the investment objectives and |

| | strategies of the Acquiring Fund; |

| (11) the fact that the Reorganization will not result in any dilution of Acquired or Acquiring Fund shareholder values; |

| (12) the terms and conditions of the Plan; and |

| (13) possible alternatives to the Reorganization. |

| The Board’s decision to recommend approval of the Reorganization was based on a number of factors, including the following: |

| (1) | it should be reasonable for shareholders of the Acquired Fund to have similar investment expectations after the Reorganization |

| | because the Funds have similar investment objectives and substantially similar principal investment strategies and risks; |

| (2) | Edge as sub-advisor responsible for managing the assets of the Acquiring Fund may be expected to provide high quality investment |

| | advisory services and personnel for the foreseeable future; |

| (3) | Deal with the higher fees/expenses (e.g., as a factor, the higher advisory fees of the Acquiring Fund were outweighed by the |

| | benefits of the Reorganization) |

| (4) | the combination of the Acquired and Acquiring Funds may be expected to afford shareholders of the Acquired Fund on an ongoing |

| | basis greater prospects for growth and efficient management; and |

|

| Description of the Securities to Be Issued |

| |

| PFI is a Maryland corporation that is authorized to issue its shares of common stock in separate series and separate classes of series. |

| Each of the Acquired and Acquiring Funds is a separate series of PFI, and the Class A, Class C, Class J, Class R-1, Class R-2, Class R-3, |

| Class R-4, Class R-5 and Institutional Class shares of common stock of the Acquiring Fund to be issued in connection with the |

| Reorganization represent interests in the assets belonging to that series and have identical dividend, liquidation and other rights, except that |

| expenses allocated to a particular series or class are borne solely by that series or class and may cause differences in rights as described |

| herein. Expenses related to the distribution of, and other identified expenses properly allocated to, the shares of a particular series or class are |

| charged to, and borne solely by, that series or class, and the bearing of expenses by a particular series or class may be appropriately reflected |

| in the net asset value attributable to, and the dividend and liquidation rights of, that series or class. |

| |

| All shares of PFI have equal voting rights and are voted in the aggregate and not by separate series or class of shares except that shares |

| are voted by series or class: (i) when expressly required by Maryland law or the 1940 Act and (ii) on any matter submitted to shareholders |

| which the Board has determined affects the interests of only a particular series or class. |

| |

| The share classes of the Acquired Fund have the same rights with respect to the Acquired Fund that the share classes of the Acquiring |

| Fund have with respect to the Acquiring Fund. |

| |

| Shares of both Funds, when issued, have no cumulative voting rights, are fully paid and non-assessable, have no preemptive or |

| conversion rights and are freely transferable. Each fractional share has proportionately the same rights as are provided for a full share. |

| |

| Federal Income Tax Consequences |

| |

| To be considered a tax-free “reorganization” under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), a |

| reorganization must exhibit a continuity of business enterprise. Because the Acquiring Fund will use a portion of the Acquired Fund’s assets |

| in its business and will continue the Acquired Fund’s historic business, the combination of the Acquired Fund into the Acquiring Fund will |

| exhibit a continuity of business enterprise. Therefore, the combination will be considered a tax-free “reorganization” under applicable |

| provisions of the Code. In the opinion of tax counsel to PFI, no gain or loss will be recognized by either of the Funds or their shareholders in |

| connection with the combination, the tax cost basis of the Acquiring Fund shares received by shareholders of the Acquired Fund will equal |

| the tax cost basis of their shares in the Acquired Fund, and their holding periods for the Acquiring Fund shares will include their holding |

| periods for the Acquired Fund shares. |

| |

| Capital Loss Carryforward. As of October 31, 2009, the Acquired Fund had an accumulated capital loss carryforward of approximately |

| $30,842,000. After the Reorganization, these losses will be available to the Acquiring Fund to offset its capital gains, although the amount of |

| offsetting losses in any given year may be limited. As a result of this limitation, it is possible that the Acquiring Fund may not be able to use |

| these losses as rapidly as the Acquired Fund might have, and part of these losses may not be useable at all. The ability of the Acquiring Fund |

| to utilize the accumulated capital loss carryforward in the future depends upon a variety of factors that cannot be known in advance, |

| including the existence of capital gains against which these losses may be offset. In addition, the benefits of any capital loss carryforward |

| currently are available only to shareholders of the Acquired Fund. After the Reorganization, however, these benefits will inure to the benefit |

| of all shareholders of the Acquiring Fund. |

| |

| Distribution of Income and Gains. Prior to the Reorganization, the Acquired Fund, whose taxable year will end as a result of the |

| Reorganization, will declare to its shareholders of record one or more distributions of all of its previously undistributed net investment |

| income and net realized capital gain, including capital gains on any securities disposed of in connection with the Reorganization. Such |

| distributions will be made to shareholders before the Reorganization. An Acquired Fund shareholder will be required to include any such |

| distributions in such shareholder’s taxable income. This may result in the recognition of income that could have been deferred or might never |

| have been realized had the Reorganization not occurred. |

| |

| The foregoing is only a summary of the principal federal income tax consequences of the Reorganization and should not be considered |

| to be tax advice. There can be no assurance that the Internal Revenue Service will concur on all or any of the issues discussed above. You |

| may wish to consult with your own tax advisors regarding the federal, state, and local tax consequences with respect to the foregoing matters |

| and any other considerations which may apply in your particular circumstances. |

| |

| CAPITALIZATION |

| |

| The following tables show as of October 31, 2009: (i) the capitalization of the Acquired Fund; (ii) the capitalization of the Acquiring |

| Fund; and (iii) the pro forma combined capitalization of the Acquiring Fund as if the Reorganization has occurred as of that date. As of |

| October 31, 2009, the Acquired Fund had outstanding nine classes of shares; Class A, Class C, Class J, Institutional, Class R-1, Class R-2, |

| Class R-3, Class R-4, and Class R-5. The Acquiring Fund will first issue Class J, Class R-1, Class R-2, Class R-3, Class R-4, and Class R-5 |

| in connection with the Reorganization. |

| |

| PMC will pay all expenses and out-of-pocket fees incurred in connection with the Reorganization including printing, mailing, and legal |

| fees. These expenses are estimated to be $54,327. |

| |

| The Acquired Fund will pay any trading costs associated with disposing of any portfolio securities of the Acquired Fund that would not |

| be compatible with the investment objectives and strategies of the Acquiring Fund and reinvesting the proceeds in securities that would be |

| compatible. The estimated loss, including trading costs, would be $16,395,000 on a U.S. GAAP basis. The estimated per share capital loss |

| would be $1.14. |

|

| ADDITIONAL INFORMATION ABOUT THE FUNDS |

| |

| Certain Investment Strategies and Related Risks of the Funds |

| |

| This section provides information about certain investment strategies and related risks of the Funds. The Statement of Additional |

| Information contains additional information about investment strategies and their related risks. |

| |

| Some of the principal investment risks vary between the Funds and the variations are described above. The value of each Fund’s |

| securities may fluctuate on a daily basis. As with all mutual funds, as the values of each Fund’s assets rise or fall, the Fund’s share price |

| changes. If an investor sells Fund shares when their value is less than the price the investor paid, the investor will lose money. As with any |

| security, the securities in which the Funds invest have associated risk. |

| |

| Market Volatility. The value of a fund’s portfolio securities may go down in response to overall stock or bond market movements. Markets |

| tend to move in cycles, with periods of rising prices and periods of falling prices. Stocks tend to go up and down in value more than bonds. If |

| the fund’s investments are concentrated in certain sectors, its performance could be worse than the overall market. The value of an individual |

| security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the |

| market as a whole. It is possible to lose money when investing in the fund. |

| |

| Fixed-Income Securities. Fixed-income securities include bonds and other debt instruments that are used by issuers to borrow money from |

| investors (some examples include investment grade corporate bonds, mortgagebacked securities, U.S. government securities and asset- |

| backed securities). The issuer generally pays the investor a fixed, variable or floating rate of interest. The amount borrowed must be repaid at |

| maturity. Some debt securities, such as zero coupon bonds, do not pay current interest, but are sold at a discount from their face values. |

|

| Interest Rate Changes. Fixed-income securities are sensitive to changes in interest rates. In general, fixed-income security prices rise when |

| interest rates fall and fall when interest rates rise. Longer term bonds and zero coupon bonds are generally more sensitive to interest rate |

| changes. If interest rates fall, issuers of callable bonds may call (repay) securities with high interest rates before their maturity dates; this is |

| known as call risk. In this case, a fund would likely reinvest the proceeds from these securities at lower interest rates, resulting in a decline in |

| the fund's income. |

| |

| Credit Risk. Fixed-income security prices are also affected by the credit quality of the issuer. Investment grade debt securities are medium |

| and high quality securities. Some bonds, such as lower grade or “junk” bonds, may have speculative characteristics and may be particularly |

| sensitive to economic conditions and the financial condition of the issuers. |

| |

| Counterparty Risk. Each of the Funds is subject to the risk that the issuer or guarantor of a fixed-income security or other obligation, the |

| counterparty to a derivatives contract or repurchase agreement, or the borrower of a portfolio’s securities will be unable or unwilling to make |

| timely principal, interest, or settlement payments, or otherwise to honor its obligations. |

| |

| Management Risk. The Funds are actively managed and prepared to invest in securities, sectors, or industries differently from the |

| benchmark. For the Funds, if a sub-advisor's investment strategies do not perform as expected, the Fund could underperform other funds with |

| similar investment objectives or lose money. |

| |

| Liquidity Risk. A fund is exposed to liquidity risk when trading volume, lack of a market maker, or legal restrictions impair the fund’s |

| ability to sell particular securities or close derivative positions at an advantageous price. Funds with principal investment strategies that |

| involve securities of companies with smaller market capitalizations, foreign securities, derivatives, or securities with substantial market |

| and/or credit risk tend to have the greatest exposure to liquidity risk. |

| |

| Repurchase Agreements. Although not a principal investment strategy, the Funds may invest a portion of its assets in repurchase |

| agreements. Repurchase agreements typically involve the purchase of debt securities from a financial institution such as a bank, savings and |

| loan association, or broker-dealer. A repurchase agreement provides that the Fund sells back to the seller and that the seller repurchases the |

| underlying securities at a specified price on a specific date. Repurchase agreements may be viewed as loans by a Fund collateralized by the |

| underlying securities. This arrangement results in a fixed rate of return that is not subject to market fluctuation while the Fund holds the |

| security. In the event of a default or bankruptcy by a selling financial institution, the affected Fund bears a risk of loss. To minimize such |

| risks, the Fund enters into repurchase agreements only with parties a Sub-Advisor deems creditworthy (those that are large, well-capitalized |

| and well-established financial institutions). In addition, the value of the securities collateralizing the repurchase agreement is, and during the |

| entire term of the repurchase agreement remains, at least equal to the repurchase price, including accrued interest. |

| |

| Real Estate Investment Trusts. The Funds may invest in real estate investment trust securities, herein referred to as “REITs.” REITs |

| involve certain unique risks in addition to those risks associated with investing in the real estate industry in general (such as possible declines |

| in the value of real estate, lack of availability of mortgage funds, or extended vacancies of property). Equity REITs may be affected by |

| changes in the value of the underlying property owned by the REITs, while mortgage REITs may be affected by the quality of any credit |

| extended. REITs are dependent upon management skills, are not diversified, and are subject to heavy cash flow dependency, risks of default |

| by borrowers, and self-liquidation. As an investor in a REIT, the Fund will be subject to the REIT’s expenses, including management fees, |

| and will remain subject to the Fund’s advisory fees with respect to the assets so invested. REITs are also subject to the possibilities of failing |

| to qualify for the special tax treatment accorded REITs under the Internal Revenue Code, and failing to maintain their exemptions from |

| registration under the 1940 Act. Investment in REITs involves risks similar to those associated with investing in small capitalization |

| companies. REITs may have limited financial resources, may trade less frequently and in a limited volume, and may be subject to more |

| abrupt or erratic price movements than larger company securities. |

| |

| High Yield Securities. The Funds may invest in debt securities rated at the time of purchase BB+ or lower by S&P or Ba1 or lower by |

| Moody’s or, if not rated, determined to be of equivalent quality by the Sub-Advisor. Such securities are sometimes referred to as high yield |

| or “junk bonds” and are considered speculative. |

| |

| Investment in high yield bonds involves special risks in addition to the risks associated with investment in highly rated debt securities. High |

| yield bonds may be regarded as predominantly speculative with respect to the issuer’s continuing ability to meet principal and interest |

| payments. Moreover, such securities may, under certain circumstances, be less liquid than higher rated debt securities. |

| |

| Analysis of the creditworthiness of issuers of high yield securities may be more complex than for issuers of higher quality debt securities. |

| The ability of a Fund to achieve its investment objective may, to the extent of its investment in high yield bonds, be more dependent on such |

| credit analysis than would be the case if the Fund were investing in higher quality bonds. |

| |

| High yield bonds may be more susceptible to real or perceived adverse economic and competitive industry conditions than higher-grade |

| bonds. The prices of high yield bonds have been found to be less sensitive to interest rate changes than more highly rated investments, but |

| more sensitive to adverse economic downturns or individual corporate developments. If the issuer of high yield bonds defaults, a Fund may |

| incur additional expenses to seek recovery. |

| |

| The secondary market on which high yield bonds are traded may be less liquid than the market for higher-grade bonds. Less liquidity in the |

| secondary trading market could adversely affect the price at which a Fund could sell a high yield bond and could adversely affect and cause |

| large fluctuations in the daily price of the Fund’s shares. Adverse publicity and investor perceptions, whether or not based on fundamental |

| analysis, may decrease the value and liquidity of high yield bonds, especially in a thinly traded market. |

| |

| The use of credit ratings for evaluating high yield bonds also involves certain risks. For example, credit ratings evaluate the safety of |

| principal and interest payments, not the market value risk of high yield bonds. Also, credit rating agencies may fail to change credit ratings in |

| a timely manner to reflect subsequent events. If a credit rating agency changes the rating of a portfolio security held by a Fund, the Fund may |

| retain the security if the Sub-Advisor thinks it is in the best interest of shareholders. |

| |

| Municipal Obligations and AMT-Subject Bonds. The two principal classifications of municipal bonds are “general obligation” and |

| “revenue” bonds. General obligation bonds are secured by the issuer’s pledge of its full faith and credit, with either limited or unlimited |

| taxing power for the payment of principal and interest. Revenue bonds are not supported by the issuer’s full taxing authority. Generally, they |

| are payable only from the revenues of a particular facility, a class of facilities, or the proceeds of another specific revenue source. |

| |

| “AMT-subject bonds” are municipal obligations issued to finance certain “private activities,” such as bonds used to finance airports, housing |

| projects, student loan programs, and water and sewer projects. Interest on AMT-subject bonds is an item of tax preference for purposes of the |

| federal individual alternative minimum tax (“AMT”) and will also give rise to corporate alternative minimum taxes. See “Tax |

| Considerations” for a discussion of the tax consequences of investing in the Funds. |

| |

| Current federal income tax laws limit the types and volume of bonds qualifying for the federal income tax exemption of interest, which may |

| have an effect upon the ability of the Fund to purchase sufficient amounts of tax-exempt securities. |

| |

| Derivatives. To the extent permitted by its investment objectives and policies, the Funds may invest in securities that are commonly |