As filed with the Securities and Exchange Commission on March 10, 2014.

Registration No. 333-________

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

[ ] Pre-Effective Amendment No. ___

[ ] Post-Effective Amendment No. ____

PRINCIPAL FUNDS, INC.

(Exact name of Registrant as specified in charter)

655 9th Street, Des Moines, Iowa 50392

(Address of Registrant's Principal Executive Offices)

515-235-9328

(Registrant's Telephone Number, Including Area Code)

Adam U. Shaikh

Assistant Counsel, Principal Funds, Inc.

655 9th Street

Des Moines, Iowa 50392

(Name and Address of Agent for Service)

|

| |

| Copies of all communications to: |

| | |

| | JOSHUA B. DERINGER |

| | Drinker Biddle & Reath, LLP |

| | One Logan Square, Ste 2000 |

| | Philadelphia, PA 19103-6996 |

| | 215-988-2959 |

Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective.

Title of Securities Being Registered: R-1, R-2, R-3, R-4, R-5, and Institutional Class Shares common stock, par value $.01 per share.

No filing fee is due because an indefinite number of shares have been registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

PRINCIPAL FUNDS, INC.

655 9th Street, Des Moines, Iowa 50392

1-800-222-5852

April ____, 2014

Dear Shareholder:

A Special Meeting of Shareholders of Principal Funds, Inc. (“PFI”) will be held at 655 9th Street, Des Moines, Iowa 50392, on May 30, 2014 at 10:00 a.m. Central Time (the “Meeting”).

At the Meeting, shareholders of the LargeCap Value Fund I (the “Acquired Fund”) will be asked to consider and approve a Plan of Acquisition (the “Plan”) providing for the reorganization of the Acquired Fund into the LargeCap Value Fund III (the “Acquiring Fund”).

Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund; and (iii) the Acquired Fund will liquidate and terminate (the “Reorganization”). As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization. Holders of Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquired Fund will receive, respectively, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquiring Fund. The Reorganization is expected to occur as of the close of regularly scheduled trading on the NYSE on June 6, 2014. All share classes of the Acquired Fund will vote in the aggregate and not by class with respect to the Reorganization.

The value of your investment will not be affected by the Reorganization. Furthermore, in the opinion of legal counsel, no gain or loss will be recognized by any shareholder for federal income tax purposes as a result of the Reorganization.

*****

Enclosed you will find a Notice of Special Meeting of Shareholders, a Proxy Statement/Prospectus, and a proxy card for shares of each Acquired Fund you owned as of March 25, 2014, the record date for the Meeting. The Proxy Statement/Prospectus provides background information and concisely describes in detail the matters to be voted on at the Meeting.

The Board of Directors has unanimously voted in favor of the proposed Reorganization and recommends that you vote FOR the Proposal.

In order for shares to be voted at the Meeting, we urge you to read the Proxy Statement/Prospectus and then complete and mail your proxy card(s) in the enclosed postage-paid envelope, allowing sufficient time for receipt by us by May 28, 2014 or otherwise vote in a manner provided below by such date. As a convenience, we offer three options by which to vote your shares:

By Internet: Follow the instructions located on your proxy card.

By Phone: The phone number is located on your proxy card. Be sure you have your control number, as printed on your proxy card, available at the time you call.

By Mail: Sign your proxy card and enclose it in the postage-paid envelope provided in this proxy package.

We appreciate your taking the time to respond to this important matter. Your vote is important. If you have any questions regarding the Reorganization, please call our shareholder services department toll free at 1-800-222-5852.

Sincerely,

Nora M. Everett

President and Chief Executive Officer

PRINCIPAL FUNDS, INC.

655 9th Street

Des Moines, Iowa 50392

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To the Shareholders of the LargeCap Value Fund I:

Notice is hereby given that a Special Meeting of Shareholders (the “Meeting”) of the LargeCap Value Fund I ( the “Acquired Fund”), a separate series of Principal Funds, Inc. (“PFI”), will be held at 655 9th Street, Des Moines, Iowa 50392, on May 30, 2014, at 10:00 a.m. Central Time. A Proxy Statement/Prospectus providing information about the following proposal to be voted on at the Meeting is included with this notice. The Meeting is being held to consider and vote on such proposal as well as any other business that may properly come before the Meeting or any adjournment thereof:

| |

| Proposal | Approval of a Plan of Acquisition providing for the reorganization of the LargeCap Value Fund I into the LargeCap Value Fund III. |

The Board of Directors of PFI recommends that shareholders of the Acquired Fund vote FOR the Proposal.

Approval of the Proposal will require the affirmative vote of the holders of at least a “Majority of the Outstanding Voting Securities” (as defined in the accompanying Proxy Statement/Prospectus) of the Acquired Fund.

Each shareholder of record at the close of business on March 25, 2014 is entitled to receive notice of and to vote at the Meeting.

Please read the attached Proxy Statement/Prospectus.

By order of the Board of Directors

Nora M. Everett

President and Chief Executive Officer

April ____, 2014

Des Moines, Iowa

PRINCIPAL FUNDS, INC.

655 9th Street

Des Moines, Iowa 50392

______________________

PROXY STATEMENT/PROSPECTUS

SPECIAL MEETING OF SHAREHOLDERS TO BE HELD MAY 30, 2104

RELATING TO THE REORGANIZATION OF THE LARGECAP VALUE FUND I INTO THE LARGECAP VALUE FUND III

This Proxy Statement/Prospectus is furnished in connection with the solicitation by the Board of Directors (the “Board” or “Directors”) of Principal Funds, Inc. (“PFI”) of proxies to be used at a Special Meeting of Shareholders of PFI to be held at 655 9th Street, Des Moines, Iowa 50392, on May 30, 2014 at 10:00 a.m. Central Time (the “Meeting”).

At the Meeting, shareholders of the LargeCap Value Fund I (the “Acquired Fund”) will be asked to consider and approve a Plan of Acquisition (the “Plan”) providing for the reorganization of the Acquired Fund into the LargeCap Value Fund III (the “Acquiring Fund”). Each of the Acquired Fund and the Acquiring Fund are generally referred to herein as a "Fund" and collectively, as the "Funds."

Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for shares of the Acquiring Fund; (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund; and (iii) the Acquired Fund will liquidate and terminate (the “Reorganization”). As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange (“NYSE”) on the closing date of the Reorganization. Holders of Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquired Fund will receive, respectively, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquiring Fund. The Reorganization is expected to occur as of the close of regularly scheduled trading on the NYSE on June 6, 2014. All share classes of the Acquired Fund will vote in the aggregate and not by class with respect to the Reorganization.

This Proxy Statement/Prospectus contains information shareholders should know before voting on the Reorganization. Please read it carefully and retain it for future reference. The Annual Report to Shareholders of PFI contains additional information about the investments of the Acquired and Acquiring Funds, and discussions of the market conditions and investment strategies that significantly affected the Acquired and Acquiring Funds during the fiscal year ended October 31, 2013. Copies of this report may be obtained without charge by writing PFI at the address noted above or by calling our shareholder services department toll free at 1-800-247-4123.

A Statement of Additional Information dated April _____, 2014 (the “Statement of Additional Information”) relating to this Proxy Statement/Prospectus has been filed with the Securities and Exchange Commission (“SEC”) and is incorporated by reference into this Proxy Statement/Prospectus. PFI’s Prospectus, dated March 1, 2014 and as supplemented, (File No. 033-59474) and the Statement of Additional Information for PFI, dated March 1, 2014 and as supplemented (“PFI SAI”), have been filed with the SEC and, insofar as they relate to the Acquired Fund, are incorporated by reference into this Proxy Statement/Prospectus. Copies of these documents may be obtained without charge by writing to PFI at the address noted above or by calling our shareholder services department toll free at 1-800-222-5852. You may also call our shareholder services department toll free at 1-800-222-5852 if you have any questions regarding the Reorganization.

PFI is subject to the informational requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940 (the “1940 Act”) and files reports, proxy materials and other information with the SEC. Such reports, proxy materials and other information may be inspected and copied at the Public Reference Room of the SEC at 100 F Street, N.E., Washington, D.C. 20549 (information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-202-551-5850). Such materials are also available on the SEC’s EDGAR Database on its Internet site at www.sec.gov, and copies may be obtained, after paying a duplicating fee, by email request addressed to publicinfo@sec.gov or by writing to the SEC’s Public Reference Room.

The SEC has not approved or disapproved these securities or passed upon the accuracy or adequacy of this Proxy Statement/Prospectus. Any representation to the contrary is a criminal offense.

The date of this Proxy Statement/Prospectus is April ____, 2014.

|

| | |

| TABLE OF CONTENTS |

| INTRODUCTION | |

| THE REORGANIZATION | |

| PROPOSAL: | Approval of a Plan of Acquisition Providing for the Reorganization of the LargeCap Value Fund I into the LargeCap Value Fund III | |

| | Comparison of Acquired and Acquiring Funds | |

| | Comparison of Investment Objectives and Strategies | |

| | Comparison of Principal Investment Risks | |

| | Fees and Expenses of the Funds | |

| | Performance | |

| | Reasons for the Reorganization | |

| | Board Consideration of the Reorganization | |

| INFORMATION ABOUT THE REORGANIZATION | |

| | Plan of Acquisition | |

| | Description of the Securities to Be Issued | |

| | Federal Income Tax Consequences | |

| CAPITALIZATION | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | |

| | Certain Investment Strategies and Related Risks of the Funds | |

| | Multiple Classes of Shares | |

| | Costs of Investing in the Funds | |

| | Distribution Plans and Intermediary Compensation | |

| | Other Payments to Financial Intermediaries | |

| | Pricing of Fund Shares | |

| | Purchase of Fund Shares | |

| | Redemption of Fund Shares | |

| | Exchange of Fund Shares | |

| | Frequent Purchases and Redemptions | |

| | Dividends and Distributions | |

| | Tax Considerations | |

| | Portfolio Holdings Information | |

| VOTING INFORMATION | |

| OUTSTANDING SHARES AND SHARE OWNERSHIP | |

| FINANCIAL HIGHLIGHTS | |

| FINANCIAL STATEMENTS | |

| LEGAL MATTERS | |

| OTHER INFORMATION | |

| APPENDIX A Form of Plan of Acquisition | |

INTRODUCTION

This Proxy Statement/Prospectus is being furnished to shareholders of the Acquired Fund to provide information regarding the Plan and the Reorganization.

Principal Funds, Inc. PFI is a Maryland corporation and an open-end management investment company registered with the SEC under the Investment Company Act of 1940, as amended (the "1940 Act"). PFI currently offers 66 separate series or funds (the “PFI Funds”), including the Acquired and Acquiring Funds. The sponsor of PFI is Principal Life Insurance Company (“Principal Life”), and the investment advisor to the PFI Funds is Principal Management Corporation (“PMC”). Principal Funds Distributor, Inc. (the “Distributor” or “PFD”) is the distributor for all share classes of the Acquired and Acquiring Funds. Principal Life, an insurance company organized in 1879 under the laws of Iowa, PMC and PFD are indirect, wholly-owned subsidiaries of Principal Financial Group, Inc. (“PFG”). Their address is the Principal Financial Group, Des Moines, Iowa 50392.

Investment Management. Pursuant to an investment advisory agreement with PFI with respect to the Acquired and Acquiring Funds, PMC provides investment advisory services and certain corporate administrative services to the Funds. As permitted by the investment advisory agreement, PMC has entered into sub-advisory agreements with respect to the Acquired and Acquiring Funds as follows:

|

| |

| Acquired Fund | Sub-Advisor |

| LargeCap Value Fund I | Herndon Capital Management, LLC (“Herndon”) Thompson, Siegel & Walmsley LLC ("TS&W") |

| | |

| Acquiring Fund | Sub-Advisor |

| LargeCap Value Fund III | Barrow, Hanley, Mewhinney & Strauss, LLC (“BHMS”) Westwood Management Corp. ("Westwood") |

Each of PMC, BHMS, Herndon, TS&W, and Westwood is registered with the SEC as an investment advisor under the Investment Advisers Act of 1940.

Herndon Capital Management, LLC is located at 191 Peachtree Street NE, Suite 2500, Atlanta, GA 30303.

Thompson, Siegel & Walmsley LLC is located at 6806 Paragon Place, Suite 300, Richmond, VA 23230.

Barrow, Hanley, Mewhinney & Strauss, LLC is located at 2200 Ross Avenue, 31st Floor, Dallas, Texas 75201.

Westwood Management Corp. is located at 200 Crescent Court, Suite 1200, Dallas, Texas 75201

THE REORGANIZATION

At its meeting held on January 30, 2014, the Board of Directors of PFI (the “Board”), including all the Directors who are not “interested persons” (as defined in the 1940 Act) of PFI (the “Independent Directors”), approved the Reorganization pursuant to the Plan providing for the combination of the Acquired Fund into the Acquiring Fund. The Board concluded with respect to the combination that the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of each Fund will not be diluted as a result of the Reorganization. The factors that the Board considered in deciding to approve the Reorganization as to the Acquired Fund are discussed under "Proposal: Approval of a Plan of Acquisition Providing for the Reorganization of the LargeCap Value Fund I into the LargeCap Value Fund III -- Board Consideration of the Reorganization.”

The Reorganization contemplates: (i) the transfer of all the assets, subject to all of the liabilities, of the Acquired Fund to the Acquiring Fund in exchange for shares of the Acquiring Fund; (ii) the distribution to Acquired Fund shareholders of the Acquiring Fund shares; and (iii) the liquidation and termination of the Acquired Fund. As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. In the Reorganization, the Acquiring Fund will issue a number of shares with a total value equal to the total value of the net assets of the Acquired Fund, and each shareholder of the Acquired Fund will receive a number of full and fractional shares of the Acquiring Fund with a value equal to the value of that shareholder’s shares of the Acquired Fund, as of the close of regularly scheduled trading on the NYSE on the closing date of the Reorganization (the “Effective Time”). The closing date of the Reorganization is expected to be June 6, 2014. Holders of Institutional Class, Class R-1, Class R-2, Class R-3, Class R-4, and Class R-5 shares of LargeCap Value Fund I will receive, respectively, Institutional Class, Class R-1, Class R-2, Class R-3, Class R-4, and Class R-5 shares of LargeCap Value Fund III. The terms and conditions of the Reorganization are more fully described below in this Proxy Statement/Prospectus and in the Form of the Plan attached hereto as Appendix A.

The Board believes that the Reorganization of the Acquired Fund into the Acquiring Fund will serve the best interests of the shareholders of both Funds. The Acquired and Acquiring Funds have experienced similar investment performance, with the Acquiring Fund outperforming the Acquired Fund over the one, three, and five-year periods ended September 30, 2013 and the one year period ended December 31, 2013. The Acquiring Fund has a far greater asset base (approximately $2.6 billion in assets as of December 31, 2013) compared to the Acquired Fund (approximately $215 million in assets as of December 31, 2013). The Acquiring Fund, as a fund with greater assets, may be expected to afford shareholders of the Acquired Fund, on an ongoing basis, greater prospects for growth and efficient management. The Funds have the same investment objective in that both seek to provide long-term growth of capital, and they also have similar principal investment strategies and risks in that both invest principally in value equity securities of companies with large market capitalizations.

The Acquiring Fund has a lower advisory fee than the Acquired Fund. The Acquired Fund shareholders are expected to see lower overall net operating expense ratios with respect to all share classes, taking into account large redemptions in the Acquired Fund that occurred after October 31, 2013. Combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

In the opinion of legal counsel, the Reorganization will qualify as a tax-free reorganization and, for federal income tax purposes, no gain or loss will be recognized as a result of the Reorganization by the Acquired or Acquiring Fund shareholders. Please see “Information About the Reorganization -- Federal Income Tax Consequences” for a discussion of the tax consequences to the Acquired Fund and its shareholders of disposing of portfolio securities, as described below, and their relation to available pre-reorganization capital losses of the Acquired Fund.

The Reorganization will not result in any material change in the purchase, redemption, and exchange procedures followed with respect to the distribution of shares. See “Additional Information About the Funds -- Purchase of Fund Shares, Redemption of Fund Shares, Exchange of Fund Shares, and Frequent Purchases and Redemptions.”

With respect to the Reorganization, the Acquired Fund is expected to achieve the greatest benefit from the reorganization. As discussed above and as a result of the reorganization, shareholders of the Acquired Fund will become shareholders of an Acquiring Fund that has similar historical performance and better prospects for growth than the Acquired Fund, and they are not expected to experience increased fund operating expenses. The expenses and out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing, and legal fees, will be paid for by PMC. The costs are estimated to be $12,000. The Acquired Fund will pay any trading costs associated with disposing, prior to the Reorganization, of any portfolio securities of the Acquired Fund that would not be compatible with the investment objective and strategies of the Acquiring Fund and reinvesting the proceeds in securities that would be compatible. The trading costs are estimated to be $78,000 with an approximate gain of $82,023,000 on a U.S. GAAP basis. The per share capital gain is estimated to be $1.29.

PROPOSAL:

Approval of a Plan of Acquisition Providing for the Reorganization of the

LargeCap Value Fund I into the LargeCap Value Fund III

Shareholders of the LargeCap Value Fund I (the “Acquired Fund”) are being asked to approve the reorganization of the Acquired Fund into the LargeCap Value Fund III (the “Acquiring Fund”).

Comparison of Acquired and Acquiring Funds

The following table provides comparative information with respect to the Acquired and Acquiring Funds. As indicated in the table, the Funds have the same investment objectives in that both Funds seek to provide long-term growth of capital. In addition, both Funds invest primarily in securities of large-cap companies. Both Funds invest in value equity securities; value orientation emphasizes buying equity securities of companies that appear to be undervalued.

|

| | | |

LargeCap Value Fund I (Acquired Fund) | LargeCap Value Fund III (Acquiring Fund) |

| Approximate Net Assets as of October 31, 2013 | |

| $912,070,000 | $1,763,095,000 |

| Investment Advisor: | PMC (for both funds) | |

| Sub-Advisors: |

| Herndon | BHMS |

| TS&W | Westwood |

|

| | | |

LargeCap Value Fund I (Acquired Fund) | LargeCap Value Fund III (Acquiring Fund) |

| Comparison of Investment Objectives and Strategies |

| Investment Objective: | Both Funds seek long-term growth of capital. | |

| Principal Investment Strategies: | |

Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in securities of companies with large market capitalizations at the time of each purchase. For this Fund, companies with large market capitalizations are those with market capitalizations similar to companies in the Russell 1000® Value Index (as of December 31, 2013, this range was between approximately $1.126 billion and $526.685 billion). The Fund invests in value equity securities, an investment strategy that emphasizes buying equity securities that appear to be undervalued. Principal Management Corporation invests between 10% and 35% of the Fund's assets in equity securities in an attempt to match or exceed the performance of the Fund's benchmark index by purchasing securities in the index while slightly overweighting and underweighting certain individual equity securities relative to their weight in the Fund's benchmark index. | Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in companies with large market capitalizations at the time of each purchase. For this Fund, companies with large market capitalizations are those with market capitalizations similar to companies in the Russell 1000® Value Index (as of December 31, 2013, the range of the index was between approximately $1.126 billion and $526.685 billion). The Fund invests in value equity securities, an investment strategy that emphasizes buying equity securities that appear to be undervalued. Principal Management Corporation invests between 10% and 35% of the Fund's assets in equity securities in an attempt to match or exceed the performance of the Fund's benchmark index by purchasing securities in the index while slightly overweighting and underweighting certain individual equity securities relative to their weight in the Fund's benchmark index. |

The investment objective of each Fund may be changed by the Board without shareholder approval.

Additional information about the investment strategies and the types of securities in which the Funds may invest is discussed below under “Certain Investment Strategies and Related Risks of the Funds” as well as in the Statement of Additional Information.

The Statement of Additional Information provides further information about the portfolio manager(s) for each Fund, including information about compensation, other accounts managed and ownership of Fund shares.

Comparison of Principal Investment Risks

In deciding whether to approve the Reorganization, shareholders should consider the amount and character of investment risk involved in the respective investment objectives and strategies of the Acquired and Acquiring Funds. Because the Funds have identical investment objectives and substantially similar principal policies, the Funds’ risks are substantially similar. The Fund's differ in that the Acquiring Fund is subject to the risk of being an underlying fund. Many factors affect the value of investments in the Funds, and it is possible to lose money by investing in either Fund.

Risks Applicable to both Funds:

Equity Securities Risk. The value of equity securities could decline if the issuer's financial condition declines or in response to overall market and economic conditions. A fund's principal market segment(s), such as large cap, mid cap or small cap stocks, or growth or value stocks, may underperform other market segments or the equity markets as a whole. Investments in smaller companies and mid-size companies may involve greater risk and price volatility than investments in larger, more mature companies.

Value Stock Risk. The market may not recognize the intrinsic value of value stocks for a long time, or they may be appropriately priced at the time of purchase.

Risk Applicable to Acquiring Fund:

Risk of Being an Underlying Fund. A fund is subject to the risk of being an underlying fund to the extent that a fund of funds invests in the fund. An underlying fund of a fund of funds may experience relatively large redemptions or investments as the fund of funds periodically reallocates or rebalances its assets. These transactions may cause the underlying fund to sell portfolio securities to meet such redemptions, or to invest cash from such investments, at times it would not otherwise do so, and may as a result increase transaction costs and adversely affect underlying fund performance.

Fees and Expenses of the Funds

The tables below compare the fees and expenses of the shares of the Acquired and Acquiring Funds. In the Reorganization, the holders of Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of the Acquired Fund will receive, respectively, Class R-1, Class R-2, Class R-3, Class R-4, Class R-5, and Institutional Class shares of the Acquiring Fund. The Class R-1, Class R-2, Class R-3, Class R-4 and Class R-5 shares are collectively referred to herein as "Retirement Class shares."

Shareholder Fees (fees paid directly from your investment) (for both Funds)

The Retirement Class and Institutional Class shares are not subject to sales charges or redemption fees.

Fees and Expenses as a % of average daily net assets

The following table shows: (a) the ratios of expenses to average net assets of the Acquired Fund for the fiscal year ended October 31, 2013; (b) the ratios of expenses to average net assets of the Acquiring Fund for the fiscal year ended October 31, 2013; and (c) the pro forma expense ratios of the Acquiring Fund for the fiscal year ending October 31, 2013 assuming that the Reorganization had taken place at the commencement of that fiscal year.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

| | | | | | | | | | | | | | | | | | |

| Class |

Management Fees |

12b-1 Fees |

Other Expenses | Total Operating Expense Ratio | Fee Waiver | Total Operating Expenses After Expense Reimbursement |

| (a) LargeCap Value Fund I (Acquired Fund) | |

| Institutional | 0.77 | % | – |

| % | – |

| % | 0.77 |

| % | 0.01 |

| %(1) | 0.76 |

| % |

| R-1 | 0.77 | | 0.35 |

| | 0.53 |

| | 1.65 |

| | 0.01 |

| (1) | 1.64 |

| |

| R-2 | 0.77 | | 0.30 |

| | 0.45 |

| | 1.52 |

| | 0.01 |

| (1) | 1.51 |

| |

| R-3 | 0.77 | | 0.25 |

| | 0.32 |

| | 1.34 |

| | 0.01 |

| (1) | 1.33 |

| |

| R-4 | 0.77 | | 0.10 |

| | 0.28 |

| | 1.15 |

| | 0.01 |

| (1) | 1.14 |

| |

| R-5 | 0.77 | | – |

| | 0.26 |

| | 1.03 |

| | 0.01 |

| (1) | 1.02 |

| |

| (b) LargeCap Value Fund III ( Acquiring Fund) | |

| Institutional | 0.79 | % | – |

| % | 0.01 |

| % | 0.80 |

| % | 0.01 |

| (2) | 0.79 |

| % |

| R-1 | 0.79 | | 0.35 |

| | 0.54 |

| | 1.68 |

| | 0.01 |

| (2) | 1.67 |

| |

| R-2 | 0.79 | | 0.30 |

| | 0.46 |

| | 1.55 |

| | 0.01 |

| (2) | 1.54 |

| |

| R-3 | 0.79 | | 0.25 |

| | 0.33 |

| | 1.37 |

| | 0.01 |

| (2) | 1.36 |

| |

| R-4 | 0.79 | | 0.10 |

| | 0.29 |

| | 1.18 |

| | 0.01 |

| (2) | 1.17 |

| |

| R-5 | 0.79 | | – |

| | 0.27 |

| | 1.06 |

| | 0.01 |

| (2) | 1.05 |

| |

(c) LargeCap Value Fund III (Acquiring Fund) (Pro forma assuming Reorganization) | |

| Institutional | 0.79 | % | – |

| % | – |

| % | 0.79 |

| % | 0.01 |

| %(3) | 0.78 |

| % |

| R-1 | 0.79 | | 0.35 |

| | 0.53 |

| | 1.67 |

| | 0.01 |

| (3) | 1.66 |

| |

| R-2 | 0.79 | | 0.30 |

| | 0.45 |

| | 1.54 |

| | 0.01 |

| (3) | 1.53 |

| |

| R-3 | 0.79 | | 0.25 |

| | 0.32 |

| | 1.36 |

| | 0.01 |

| (3) | 1.35 |

| |

| R-4 | 0.79 | | 0.10 |

| | 0.28 |

| | 1.17 |

| | 0.01 |

| (3) | 1.16 |

| |

| R-5 | 0.79 | | – |

| | 0.26 |

| | 1.05 |

| | 0.01 |

| (3) | 1.04 |

| |

|

| | | | | | | |

(1) | Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund's Management Fees through the period ending February 28, 2015. The fee waiver will reduce the Fund's Management Fees by 0.014% (expressed as a percent of average net assets on an annualized basis). It is expected that the fee waiver will continue through the period disclosed; however, Principal Funds, Inc. and Principal, the parties to the agreement may agree to terminate the fee waiver prior to the end of the period. |

| | |

(2) | Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund's Management Fees through the period ending February 28, 2015. The fee waiver will reduce the Fund's Management Fees by 0.012% (expressed as a percent of average net assets on an annualized basis). It is expected that the fee waiver will continue through the period disclosed; however, Principal Funds, Inc. and Principal, the parties to the agreement may agree to terminate the fee waiver prior to the end of the period. |

| | | | | | | | |

(3) | Principal Management Corporation ("Principal"), the investment advisor, has contractually agreed to limit the Fund's Management Fees through the period ending February 28, 2016. The fee waiver will reduce the Fund's Management Fees by 0.012% (expressed as a percent of average net assets on an annualized basis). It is expected that the fee waiver will continue through the period disclosed; however, Principal Funds, Inc. and Principal, the parties to the agreement may agree to terminate the fee waiver prior to the end of the period. |

Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired and Acquiring Funds. The examples assume that fund expenses continue at the rates shown in the table above, that you invest $10,000 in the particular fund for the time periods indicated and that all dividends and distributions are reinvested. The examples also assume that your investment has a 5% return each year. The examples also take into account the relevant contractual expense limit until the date of expiration. The examples should not be considered a representation of future expense of the Acquired or Acquiring fund. Actual expense may be greater or less than those shown.

|

| | | | | | | | | | | | | | | | |

| If you sell your shares at the end of the period: | 1 Year | | 3 Years | | 5 Years | | 10 Years |

| LargeCap Value Fund I (Acquired Fund) | Institutional Class | $ | 78 |

| | $ | 245 |

| | $ | 427 |

| | $ | 953 |

|

| | Class R-1 | 167 |

| | 519 |

| | 896 |

| | 1,954 |

|

| | Class R-2 | 154 |

| | 479 |

| | 828 |

| | 1,812 |

|

| | Class R-3 | 135 |

| | 423 |

| | 733 |

| | 1,612 |

|

| | Class R-4 | 116 |

| | 364 |

| | 632 |

| | 1,396 |

|

| | Class R-5 | 104 |

| | 327 |

| | 567 |

| | 1,258 |

|

| LargeCap Value Fund III (Acquiring Fund) | Institutional Class | 81 |

| | 254 |

| | 443 |

| | 989 |

|

| | Class R-1 | 170 |

| | 528 |

| | 911 |

| | 1,986 |

|

| | Class R-2 | 157 |

| | 488 |

| | 844 |

| | 1,844 |

|

| | Class R-3 | 138 |

| | 433 |

| | 749 |

| | 1,645 |

|

| | Class R-4 | 119 |

| | 374 |

| | 648 |

| | 1,431 |

|

| | Class R-5 | 107 |

| | 336 |

| | 584 |

| | 1,293 |

|

| LargeCap Value Fund III (Acquiring Fund) | Institutional Class | 80 |

| | 250 |

| | 437 |

| | 976 |

|

| (Pro forma assuming Reorganization) | Class R-1 | 169 |

| | 524 |

| | 905 |

| | 1,974 |

|

| | Class R-2 | 156 |

| | 484 |

| | 837 |

| | 1,833 |

|

| | Class R-3 | 137 |

| | 429 |

| | 743 |

| | 1,633 |

|

| | Class R-4 | 118 |

| | 369 |

| | 642 |

| | 1,418 |

|

| | Class R-5 | 106 |

| | 332 |

| | 577 |

| | 1,281 |

|

Portfolio Turnover

Each of the Funds pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes for shareholders who hold Fund shares in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the portfolio turnover rate for the Acquired Fund was 68.2% of the average value of its portfolio while the portfolio turnover rate for the Acquiring Fund was 64.8%.

Investment Management Fees/Sub-Advisory Arrangements

Each Fund pays its investment advisor, PMC, an advisory fee which for each Fund is calculated as a percentage of the Fund’s average daily net assets pursuant to the following fee schedule:

|

| | | | |

LargeCap Value Fund I (Acquired Fund) | | LargeCap Value Fund III (Acquiring Fund) |

First $500 million Next $500 million Next $500 million Next $500 million Next $1 billion Over $3 billion | 0.80% 0.78% 0.76% 0.75% 0.74% 0.73% | | First $500 million Next $500 million Next $500 million Next $500 million Next $1 billion Over $3 billion | 0.80% 0.78% 0.76% 0.75% 0.73% 0.70% |

The sub-advisor to each Fund receives sub-advisory fees paid by PMC and not by the Fund.

A discussion of the basis of the Board’s approval of the advisory and sub-advisory agreements with respect to the Acquired and Acquiring Funds is available in PFI’s Annual Report to Shareholders for the fiscal year ended October 31, 2013.

Performance

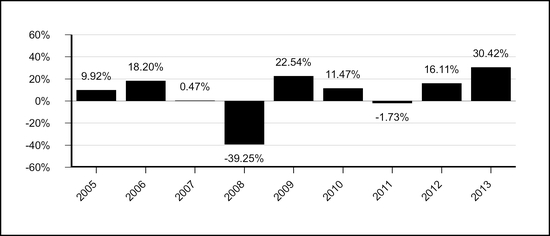

The following information provides an indicator of the risks of investing in the Funds. The bar chart below shows how each Fund’s total return has varied year-by-year, while the table below shows each Fund’s performance over time (along with the returns of a broad-based market index for reference). Annual returns do not reflect any applicable sales charges and would be lower if they did. A Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You may get updated performance information online at www.principalfunds.com or by calling 1-800-222-5852.

CALENDAR YEAR TOTAL RETURN (%) AS OF 12/31 EACH YEAR (Institutional Class Shares)

LargeCap Value Fund I (Acquired Fund)

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q2 '09 | 19.23 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q4 '08 | -24.98 | % |

CALENDAR YEAR TOTAL RETURN (%) AS OF 12/31 EACH YEAR (Institutional Class Shares)

LargeCap Value Fund III (Acquiring Fund)

|

| | | |

| Highest return for a quarter during the period of the bar chart above: | Q3 '09 | 15.89 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q4 '08 | -21.54 | % |

|

| | | | | | | | | |

| Average Annual Total Returns (%) for periods ended December 31, 2013 |

| | 1 Year | 5 Years | Since Inception |

| LargeCap Value Fund I (Acquired Fund) | | | | | | |

| Institutional Class Return Before Taxes | 30.42 | % | | 15.24 | % | | 6.42 | % | |

| Institutional Class Return After Taxes on Distributions | 8.32 | % | | 10.83 | % | | 4.07 | % | |

| Institutional Class Return After Taxes on Distribution and Sale of Fund Shares | 21.67 | % | | 10.85 | % | | 4.51 | % | |

| Class R-1 Return Before Taxes | 29.19 | % | | 14.23 | % | | 5.49 | % | |

| Class R-2 Return Before Taxes | 29.38 | % | | 14.38 | % | | 5.62 | % | |

| Class R-3 Return Before Taxes | 29.59 | % | | 14.59 | % | | 5.82 | % | |

| Class R-4 Return Before Taxes | 29.86 | % | | 14.80 | % | | 6.02 | % | |

| Class R-5 Return Before Taxes | 30.01 | % | | 14.94 | % | | 6.15 | % | |

| Russell 1000 Value Index (reflects no deduction for fees, expenses, or taxes) | 32.53 | % | | 16.67 | % | | 7.75 | % | |

|

| | | | | | | | | |

| Average Annual Total Returns (%) for periods ended December 31, 2013 | |

| | 1 Year | 5 Years | 10 Years |

| LargeCap Value Fund III (Acquiring Fund) | | | | | | |

| Institutional Class Return Before Taxes | 31.56 | % | | 14.78 | % | | 5.14 | % | |

| Institutional Class Return After Taxes on Distributions | 31.36 | % | | 14.49 | % | | 4.63 | % | |

| Institutional Class Return After Taxes on Distribution and Sale of Fund Shares | 18.02 | % | | 11.96 | % | | 4.24 | % | |

| Class R-1 Return Before Taxes | 30.29 | % | | 13.77 | % | | 4.21 | % | |

| Class R-2 Return Before Taxes | 30.52 | % | | 13.94 | % | | 4.36 | % | |

| Class R-3 Return Before Taxes | 30.71 | % | | 14.12 | % | | 4.54 | % | |

| Class R-4 Return Before Taxes | 31.05 | % | | 14.33 | % | | 4.74 | % | |

| Class R-5 Return Before Taxes | 31.08 | % | | 14.47 | % | | 4.87 | % | |

| Russell 1000 Value Index (reflects no deduction for fees, expenses, or taxes) | 32.53 | % | | 16.67 | % | | 7.58 | % | |

_________________________________

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Institutional Class shares only and would be different for Class R-1, R-2, R-3, R-4 and R-5 shares.

Reasons for the Reorganization

The Board believes that the Reorganization of the Acquired Fund into the Acquiring Fund will serve the best interests of the shareholders of both Funds. The Acquired and Acquiring Funds have experienced similar investment performance, with the Acquiring Fund outperforming the Acquired Fund over the one, three, and five-year periods ended September 30, 2013 and the one year ended December 31, 2013. The Acquiring Fund has a far greater asset base (approximately $2.6 billion in assets as of December 31, 2013) compared to the Acquired Fund (approximately $215 million in assets as of December 31, 2013). The Acquiring Fund, as a fund with greater assets, may be expected to afford shareholders of the Acquired Fund, on an ongoing basis, greater prospects for growth and efficient management. The Funds have the same investment objective in that both seek to provide long-term growth of capital, and they also have similar principal policies and risks in that both invest principally in value equity securities of companies with large market capitalizations.

Board Consideration of the Reorganization

At its January 30, 2014 meeting, the Board considered information presented by PMC, and the Independent Directors were assisted by independent legal counsel. The Board requested and evaluated such information as it deemed necessary to consider the Reorganization. At the meeting, the Board unanimously approved the Reorganization after concluding that participation in the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization.

In determining whether to approve the Reorganization, the Board made inquiry into a number of matters and considered, among others, the following factors, in no order of priority:

| |

| (1) | the investment objectives and principal investment strategies and risks of the Funds; |

| |

| (2) | identical fundamental investment restrictions; |

| |

| (3) | estimated trading costs associated with disposing of any portfolio securities of the Acquired Fund and reinvesting the proceeds in connection with the Reorganization; |

| |

| (4) | expense ratios and available information regarding the fees and expenses of the Funds; |

| |

| (5) | comparative investment performance of and other information pertaining to the Funds; |

| |

| (6) | the prospects for growth of and for achieving economies of scale by the Acquired Fund in combination with the Acquiring Fund; |

| |

| (7) | the absence of any material differences in the rights of shareholders of the Funds; |

| |

| (8) | the financial strength, investment experience and resources of BHMS and Westwood, which currently serve as sub-advisors to the Acquiring Fund; |

| |

| (9) | any direct or indirect benefits, including potential economic benefits, expected to be derived by PMC and its affiliates from the Reorganization; |

| |

| (10) | the direct or indirect federal income tax consequences of the Reorganization, including the expected tax-free nature of the Reorganization and the impact of any federal income tax loss carry forwards and the estimated capital gain or loss expected to be incurred in connection with disposing of any portfolio securities that would not be compatible with the investment objectives and strategies of the Acquiring Fund; |

| |

| (11) | the fact that the Reorganization will not result in any dilution of Acquired or Acquiring Fund shareholder values; |

| |

| (12) | the terms and conditions of the Plan; and |

| |

| (13) | possible alternatives to the Reorganization including liquidation of the Acquired Fund or continuing the Acquired Fund as currently operated. |

The Board’s decision to recommend approval of the Reorganization was based on a number of factors, including the following:

| |

| (1) | it should be reasonable for shareholders of the Acquired Fund to have similar investment expectations after the Reorganization because the Funds have the same investment objectives and substantially similar principal investment strategies and risks; |

| |

| (2) | BHMS and Westwood, as sub-advisors responsible for managing the assets of the Acquiring Fund, may be expected to provide high quality investment advisory services and personnel for the foreseeable future; |

| |

| (3) | the Acquiring Fund has a lower advisory fee than the Acquired Fund, and the Acquired Fund shareholders are expected to see lower net operating expense ratios with respect to all share classes. |

| |

| (4) | the Acquiring Fund has outperformed the Acquired fund for the one-, three-, and five-year periods ended September 30, 2013; and |

| |

| (5) | the combination of the Acquired and Acquiring Funds may be expected to afford shareholders of the Acquired Fund on an ongoing basis greater prospects for growth and efficient management. |

INFORMATION ABOUT THE REORGANIZATION

Plan of Acquisition

The terms of the Plan are summarized below. The summary is qualified in its entirety by reference to the Form of the Plan attached as Appendix A to this Proxy Statement/Prospectus.

Under the Plan, the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund. We expect that the closing date will be June 6, 2014, or such earlier or later date as PMC may determine, and that the Effective Time of the Reorganization will be as of the close of regularly scheduled trading on the NYSE (normally 3:00 p.m., Central Time) on that date. Each Fund will determine its net asset values as of the close of trading on the NYSE using the procedures described in its then current prospectus (the procedures applicable to the Acquired Fund and the Acquiring Fund are identical). The Acquiring Fund will issue to the Acquired Fund a number of shares of each share class with a total value equal to the total value of the net assets of the corresponding share class of the Acquired Fund outstanding at the Effective Time.

Immediately after the Effective Time, the Acquired Fund will distribute to its shareholders Acquiring Fund shares of the same class as the Acquired Fund shares each shareholder owns in exchange for Acquired Fund shares of that class. Acquired Fund shareholders will receive a number of full and fractional shares of the Acquiring Fund that are equal in value to the value of the shares of the Acquired Fund that are surrendered in the exchange. In connection with the exchange, the Acquiring Fund will credit on its books an appropriate number of its shares to the account of each Acquired Fund shareholder, and the Acquired Fund will cancel on its books all its shares registered to the account of that shareholder.

The Plan may be amended, but no amendment may be made which in the opinion of the Board would materially adversely affect the interests of the shareholders of the Acquired Fund. The Board may abandon and terminate the Plan at any time before the Effective Time if it believes that consummation of the transaction contemplated by the Plan would not be in the best interests of the shareholders of either or both of the Funds.

Under the Plan related to the Reorganization , PMC will pay all of the out-of-pocket costs in connection with the transaction contemplated under this Plan.

If a Reorganization is not consummated for any reason, the Board will consider other possible courses of action, including the liquidation (and termination) of the Acquired Fund.

Description of the Securities to Be Issued

PFI is a Maryland corporation that is authorized to issue its shares of common stock in separate series and separate classes of series. Each of the Acquired and Acquiring Funds is a separate series of PFI, and the Class R-1, Class R-2, Class R-3, Class R-4, Class R-5 and Institutional Class shares of common stock of the Acquiring Fund to be issued in connection with the Reorganization represent interests in the assets belonging to that series and have identical dividend, liquidation and other rights, except that expenses allocated to a particular series or class are borne solely by that series or class and may cause differences in rights as described herein. Expenses related to the distribution of, and other identified expenses properly allocated to, the shares of a particular series or class are charged to, and borne solely by, that series or class, and the bearing of expenses by a particular series or class may be appropriately reflected in the net asset value attributable to, and the dividend and liquidation rights of, that series or class.

All shares of PFI have equal voting rights and are voted in the aggregate and not by separate series or class of shares except that shares are voted by series or class: (i) when expressly required by Maryland law or the 1940 Act and (ii) on any matter submitted to shareholders which the Board has determined affects the interests of only a particular series or class.

The share classes of the Acquired Fund have the same rights with respect to the Acquired Fund that the share classes of the Acquiring Fund have with respect to the Acquiring Fund.

Shares of all Funds, when issued, have no cumulative voting rights, are fully paid and non-assessable, have no preemptive or conversion rights and are freely transferable. Each fractional share has proportionately the same rights as are provided for a full share.

Federal Income Tax Consequences

To be considered a tax-free “reorganization” under Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), a reorganization must exhibit a continuity of business enterprise. Because the Acquiring Fund will use a portion of the Acquired Fund’s assets in its business and will continue the Acquired Fund’s historic business, the combination of the Acquired Fund into the Acquiring Fund will exhibit a continuity of business enterprise. Therefore each combination will be considered a tax-free “reorganization” under applicable provisions of the Code. In the opinion of tax counsel to PFI, no gain or loss will be recognized by the Acquired Fund or its shareholders in connection with each combination, the tax cost basis of the Acquiring Fund shares received by shareholders of the Acquired Fund will equal the tax cost basis of their shares in the Acquired Fund, and their holding periods for the Acquiring Fund shares will include their holding periods for the Acquired Fund shares.

Capital Loss Carryforward. As of October 31, 2013, the Acquired Fund had no accumulated capital loss carryforwards.

Capital Gains from Disposition of Portfolio Securities. The disposition of portfolio securities by the Acquired Fund prior to and in connection with the Reorganization could result in the Acquired Fund incurring long-term and short-term capital gains. Any such capital gains will be passed through to the shareholders of the Acquired Fund and will be subject to taxation as described below.

Distribution of Income and Gains. Prior to the Reorganization, the Acquired Fund, whose taxable year will end as a result of the Reorganization, will declare to its shareholders of record one or more distributions of all of its previously undistributed net investment income and net realized capital gain, including capital gains on any securities disposed of in connection with the Reorganization. Such distributions will be made to shareholders before the Reorganization. An Acquired Fund shareholder will be required to include any such distributions in such shareholder’s taxable income. This may result in the recognition of income that could have been deferred or might never have been realized had the Reorganization not occurred.

The foregoing is only a summary of the principal federal income tax consequences of the Reorganization and should not be considered to be tax advice. There can be no assurance that the Internal Revenue Service will concur on all or any of the issues discussed above. You may wish to consult with your own tax advisors regarding the federal, state, and local tax consequences with respect to the foregoing matters and any other considerations which may apply in your particular circumstances.

CAPITALIZATION

The following tables show as of October 31, 2013: (i) the capitalization of the Acquired Fund; (ii) the capitalization of the Acquiring Fund; and (iii) the pro forma combined capitalization of the Acquiring Fund as if the Reorganization has occurred as of that date. As of October 31, 2013, the Acquired Fund had outstanding six classes of shares; Institutional, R-1, R-2, R-3, R-4, and R-5 and the Acquiring Fund has outstanding seven classes of shares; Institutional, J, R-1, R-2, R-3, R-4 and R-5.

The Acquired Fund will pay any trading costs associated with the disposing of any portfolio securities of the Acquired Fund that would not be compatible with the investment objectives and strategies of the Acquiring Fund and reinvesting the proceeds in securities that would be compatible. The trading costs are estimated to be $78,000 with an approximate gain of $82,023,000 ($1.29 per share) on a U.S. GAAP basis.

|

| | | | | | | | | | | |

| | Net Assets(000s) | NAV | Shares (000s) |

| LargeCap Value Fund I | Institutional | $ | 898,307 |

| | 14.42 |

| | 62,318 |

|

| (Acquired Fund) | R-1 | 2,966 |

| | 14.34 |

| | 207 |

|

| | R-2 | 2,696 |

| | 14.34 |

| | 188 |

|

| | R-3 | 3,034 |

| | 14.35 |

| | 211 |

|

| | R-4 | 3,156 |

| | 14.34 |

| | 220 |

|

| | R-5 | 1,911 |

| | 14.43 |

| | 132 |

|

| | | $ | 912,070 |

| | | | 63,276 |

|

| | | | | |

| LargeCap Value Fund III | Institutional | $ | 1,657,474 |

| | 13.74 |

| | 120,642 |

|

| (Acquiring Fund) | J | 73,120 |

| | 13.56 |

| | 5,391 |

|

| | R-1 | 2,175 |

| | 13.71 |

| | 159 |

|

| | R-2 | 5,605 |

| | 13.66 |

| | 410 |

|

| | R-3 | 10,306 |

| | 14.18 |

| | 727 |

|

| | R-4 | 5,773 |

| | 13.71 |

| | 422 |

|

| | R-5 | 8,642 |

| | 13.77 |

| | 627 |

|

| | | $ | 1,763,095 |

| | | 128,378 |

|

| | | | | | |

| | | | | |

| Increase in shares outstanding of the Acquired | Institutional | | | | | 3,061 |

|

| Fund to reflect the exchange of shares of the | R-1 | | | | | 9 |

|

| Acquiring Fund. | R-2 | | | | 9 |

|

| | R-3 | | | | | 3 |

|

| | R-4 | | | 10 |

|

| | R-5 | | | 7 |

|

| | | | | |

| | | | | |

| LargeCap Value Fund III | Institutional | $ | 2,555,781 |

| | 13.74 |

| | $ | 186,021 |

|

| (Acquiring Fund) | J | 73,120 |

| | 13.56 |

| | 5,391 |

|

| (pro forma assuming Reorganization) | R-1 | 5,141 |

| | 13.71 |

| | 375 |

|

| | R-2 | 8,301 |

| | 13.66 |

| | 607 |

|

| | R-3 | 13,340 |

| | 14.18 |

| | 941 |

|

| | R-4 | 8,929 |

| | 13.71 |

| | 652 |

|

| | R-5 | 10,553 |

| | 13.77 |

| | 766 |

|

| | | $ | 2,675,165 |

| | | $ | 194,753 |

|

| | | | | | |

ADDITIONAL INFORMATION ABOUT THE FUNDS

Certain Investment Strategies and Related Risks of the Funds

This section provides information about certain investment strategies and related risks of the Funds. The Statement of Additional Information contains additional information about investment strategies and their related risks.

The value of each Fund’s securities may fluctuate on a daily basis. As with all mutual funds, as the values of each Fund’s assets rise or fall, the Fund’s share price changes. If an investor sells Fund shares when their value is less than the price the investor paid, the investor will lose money. As with any security, the securities in which the Funds invest have associated risks.

The table below identifies the strategies and risks that apply to the Funds and indicates for each Fund whether such strategies and risks are principal, non-principal or not applicable. The only difference between both Funds is that the Acquiring Fund is subject to the risk of being an underlying fund.

|

| | |

| INVESTMENT STRATEGIES AND RISKS | LARGECAP VALUE I | LARGECAP VALUE III |

| Convertible Securities | Non-Principal | Non-Principal |

| Derivatives | Non-Principal | Non-Principal |

| Equity Securities | Principal | Principal |

| Exchange Traded Funds (ETFs) | Non-Principal | Non-Principal |

| Fixed-Income Securities | Non-Principal | Non-Principal |

| Foreign Securities | Non-Principal | Non-Principal |

| Hedging | Non-Principal | Non-Principal |

| Initial Public Offerings ("IPOs") | Non-Principal | Non-Principal |

| Leverage | Non-Principal | Non-Principal |

Liquidity Risk(1) | Non-Principal | Non-Principal |

Management Risk(1) | Non-Principal | Non-Principal |

Market Volatility and Issuer Risk(1) | Non-Principal | Non-Principal |

| Master Limited Partnerships | Non-Principal | Non-Principal |

| Portfolio Turnover | Non-Principal | Non-Principal |

| Preferred Securities | Non-Principal | Non-Principal |

| Real Estate Investment Trusts | Non-Principal | Non-Principal |

| Real Estate Securities | Non-Principal | Non-Principal |

| Repurchase Agreements | Non-Principal | Non-Principal |

| Royalty Trusts | Non-Principal | Non-Principal |

| Small and Medium Market Capitalization Companies | Non-Principal | Non-Principal |

| Temporary Defensive Measures | Non-Principal | Non-Principal |

| Underlying Funds | Not Applicable | Principal |

| |

(1) | These risks are not deemed principal for purposes of this table because they apply to almost all funds; however, in certain circumstances, they could significantly affect the net asset value, yield, and total return. |

Convertible Securities

Convertible securities are usually fixed-income securities that a fund has the right to exchange for equity securities at a specified conversion price. Convertible securities could also include corporate bonds, notes or preferred stocks of U.S. or foreign issuers. The option allows the fund to realize additional returns if the market price of the equity securities exceeds the conversion price. For example, the fund may hold fixed-income securities that are convertible into shares of common stock at a conversion price of $10 per share. If the market value of the shares of common stock reached $12, the fund could realize an additional $2 per share by converting its fixed-income securities.

Convertible securities have lower yields than comparable fixed-income securities. In addition, at the time a convertible security is issued the conversion price exceeds the market value of the underlying equity securities. Thus, convertible securities may provide lower returns than non-convertible fixed-income securities or equity securities depending upon changes in the price of the underlying equity securities. However, convertible securities permit the fund to realize some of the potential appreciation of the underlying equity securities with less risk of losing its initial investment.

Depending on the features of the convertible security, the fund will treat a convertible security as either a fixed-income or equity security for purposes of investment policies and limitations because of the unique characteristics of convertible securities. Funds that invest in convertible securities may invest in convertible securities that are below investment grade. Many convertible securities are relatively illiquid.

Derivatives

A fund may invest in certain derivative strategies to earn income, manage or adjust the risk profile of the fund, replace more direct investments, or obtain exposure to certain markets. Generally, a derivative is a financial arrangement, the value of which is derived from, or based on, a traditional security, asset, or market index. Certain derivative securities are described more accurately as index/structured securities. Index/structured securities are derivative securities whose value or performance is linked to other equity securities (such as depositary receipts), currencies, interest rates, indices, or other financial indicators (reference indices).

There are many different types of derivatives and many different ways to use them. Futures, forward contracts, and options are commonly used for traditional hedging purposes to attempt to protect a fund from loss due to changing interest rates, securities prices, asset values, or currency exchange rates and as a low-cost method of gaining exposure to a particular market without investing directly in those securities or assets. A fund may enter into put or call options, futures contracts, options on futures contracts, over-the-counter swap contracts (e.g., interest rate swaps, total return swaps and credit default swaps), currency futures contracts and options, options on currencies, and forward currency contracts or currency swaps for both hedging and non-hedging purposes. A fund also may use foreign currency options and foreign currency forward and swap contracts to increase exposure to a foreign currency or to shift exposure to foreign currency fluctuations from one country to another. A forward currency contract involves a privately negotiated obligation to purchase or sell a specific currency at a future date at a price set in the contract. A fund will not hedge currency exposure to an extent greater than the approximate aggregate market value of the securities held or to be purchased by the fund (denominated or generally quoted or currently convertible into the currency). A fund may enter into forward commitment agreements, which call for the fund to purchase or sell a security on a future date at a fixed price. A fund may also enter into contracts to sell its investments either on demand or at a specific interval.

Generally, a fund may not invest in a derivative security unless the reference index or the instrument to which it relates is an eligible investment for the fund or the reference currency relates to an eligible investment for the fund.

The return on a derivative security may increase or decrease, depending upon changes in the reference index or instrument to which it relates. If a fund's Sub-Advisor hedges market conditions incorrectly or employs a strategy that does not correlate well with the fund's investment, these techniques could result in a loss. These techniques may increase the volatility of a fund and may involve a small investment of cash relative to the magnitude of the risk assumed.

The risks associated with derivative investments include:

| |

• | the risk that the underlying security, currency, interest rate, market index, or other financial asset will not move in the direction PMC and/or the sub-advisor anticipated; |

| |

• | the possibility that there may be no liquid secondary market which may make it difficult or impossible to close out a position when desired; |

| |

• | the risk that adverse price movements in an instrument can result in a loss substantially greater than a fund's initial investment; |

| |

• | the possibility that the counterparty may fail to perform its obligations; and |

| |

| • | the inability to close out certain hedged positions to avoid adverse tax consequences. |

Swap agreements involve the risk that the party with whom the fund has entered into the swap will default on its obligation to pay the fund and the risk that the fund will not be able to meet its obligations to pay the other party to the agreement.

Credit default swap agreements involve special risks because they may be difficult to value, are highly susceptible to liquidity and credit risk, and generally pay a return to the party that has paid the premium only in the event of an actual default by the issuer of the underlying obligation (as opposed to a credit downgrade or other indication of financial difficulty). Credit default swaps can increase credit risk because the fund has exposure to both the issuer of the referenced obligation and the counterparty to the credit default swap.

Forward, swap, and futures contracts are subject to special risk considerations. The primary risks associated with the use of these contracts are (a) the imperfect correlation between the change in market value of the instruments held by the fund and the price of the forward or futures contract; (b) possible lack of a liquid secondary market for a forward, swap, or futures contract and the resulting inability to close a forward, swap, or futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the sub-advisor’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates, asset values, and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the fund has insufficient cash, it may have to sell securities from its portfolio to meet daily variation margin requirements, and the fund may have to sell securities at a time when it may be disadvantageous to do so.

For currency contracts, there is also a risk of government action through exchange controls that would restrict the ability of the fund to deliver or receive currency.

Some of the risks associated with options include imperfect correlation, counterparty risk, difference in trading hours for the options markets and the markets for the underlying securities (rate movements can take place in the underlying markets that cannot be reflected in the options markets), and an insufficient liquid secondary market for particular options.

Equity Securities

Equity securities include common stocks, convertible securities, depositary receipts, rights (a right is an offering of common stock to investors who currently own shares which entitle them to buy subsequent issues at a discount from the offering price), and warrants (a warrant grants its owner the right to purchase securities from the issuer at a specified price, normally higher than the current market price). Common stocks, the most familiar type, represent an equity (ownership) interest in a corporation. The value of a company's stock may fall as a result of factors directly relating to that company, such as decisions made by its management or lower demand for the company's products or services. A stock's value may also fall because of factors affecting not just the company, but also companies in the same industry or in a number of different industries, such as increases in production costs. The value of a company's stock may also be affected by changes in financial markets that are relatively unrelated to the company or its industry, such as changes in interest rates or currency exchange rates. In addition, a company's stock generally pays dividends only after the company invests in its own business and makes required payments to holders of its bonds and other debt. For this reason, the value of a company's stock will usually react more strongly than its bonds and other debt to actual or perceived changes in the company's financial condition or prospects. Some funds focus their investments on certain market capitalization ranges. Market capitalization is defined as total current market value of a company's outstanding equity securities. The market capitalization of companies in a fund’s portfolio and its related index(es) will change over time and, the fund will not automatically sell a security just because it falls outside of the market capitalization range of its index(es). Stocks of smaller companies may be more vulnerable to adverse developments than those of larger companies.

Exchange Traded Funds ("ETFs")

Generally, ETFs invest in a portfolio of stocks, bonds or other assets. ETFs are a type of index or actively managed fund bought and sold on a securities exchange. An ETF trades like common stock. Shares in an index ETF represent an interest in a fixed portfolio of securities designed to track a particular market index. A fund could purchase shares issued by an ETF to gain exposure to a portion of the U.S. or a foreign market while awaiting purchase of underlying securities or for other reasons. The risks of owning an ETF generally reflect the risks of owning the underlying securities or other assets they are designed to track, although ETFs have management fees that increase their costs. Fund shareholders indirectly bear their proportionate share of the expenses of the ETFs in which the fund invests.

Fixed-Income Securities

Fixed-income securities include bonds and other debt instruments that are used by issuers to borrow money from investors (some examples include corporate bonds, convertible securities, mortgage-backed securities, U.S. government securities and asset-backed securities). The issuer generally pays the investor a fixed, variable, or floating rate of interest. The amount borrowed must be repaid at maturity. Some debt securities, such as zero coupon bonds, do not pay current interest, but are sold at a discount from their face values.

| |

| • | Interest Rate Changes: Fixed-income securities are sensitive to changes in interest rates. In general, fixed-income security prices rise when interest rates fall and fall when interest rates rise. If interest rates fall, issuers of callable bonds may call (repay) securities with high interest rates before their maturity dates; this is known as call risk. In this case, a fund would likely reinvest the proceeds from these securities at lower interest rates, resulting in a decline in the fund's income. Floating rate securities generally are less sensitive to interest rate changes but may decline in value if their interest rates do not rise as much, or as quickly, as interest rates in general. Conversely, floating rate securities will not generally increase in value if interest rates decline. Average duration is a mathematical calculation of the average life of a bond (or bonds in a bond fund) that serves as a useful measure of its price risk. Duration is an estimate of how much the value of the bonds held by a fund will fluctuate in response to a change in interest rates. For example, if a fund has an average duration of 4 years and interest rates rise by 1%, the value of the bonds held by the fund will decline by approximately 4%, and if the interest rates decline by 1%, the value of the bonds held by the fund will increase by approximately 4%. Longer term bonds and zero coupon bonds are generally more sensitive to interest rate changes. Duration, which measures price sensitivity to interest rate changes, is not necessarily equal to average maturity. |

| |

| • | Credit Risk: Fixed-income security prices are also affected by the credit quality of the issuer. Investment grade debt securities are medium and high quality securities. Some bonds, such as lower grade or "junk" bonds, may have speculative characteristics and may be particularly sensitive to economic conditions and the financial condition of the issuers. Credit risk refers to the possibility that the issuer of the security will not be able to make principal and interest payments when due. |

Foreign Securities

Principal defines foreign securities as those issued by:

| |

• | companies with their principal place of business or principal office outside the U.S. or |

| |

• | companies whose principal securities trading market is outside the U.S. |

Foreign companies may not be subject to the same uniform accounting, auditing, and financial reporting practices as are required of U.S. companies. In addition, there may be less publicly available information about a foreign company than about a U.S. company. Securities of many foreign companies are less liquid and more volatile than securities of comparable U.S. companies. Commissions on foreign securities exchanges may be generally higher than those on U.S. exchanges.

Foreign markets also have different clearance and settlement procedures than those in U.S. markets. In certain markets there have been times when settlements have been unable to keep pace with the volume of securities transactions, making it difficult to conduct these transactions. Delays in settlement could result in temporary periods when a portion of fund assets is not invested

and earning no return. If a fund is unable to make intended security purchases due to settlement problems, the fund may miss attractive investment opportunities. In addition, a fund may incur a loss as a result of a decline in the value of its portfolio if it is unable to sell a security.

With respect to certain foreign countries, there is the possibility of expropriation or confiscatory taxation, political or social instability, or diplomatic developments that could affect a fund's investments in those countries. In addition, a fund may also suffer losses due to nationalization, expropriation, or differing accounting practices and treatments. Investments in foreign securities are subject to laws of the foreign country that may limit the amount and types of foreign investments. Changes of governments or of economic or monetary policies, in the U.S. or abroad, changes in dealings between nations, currency convertibility or exchange rates could result in investment losses for a fund. Finally, even though certain currencies may be convertible into U.S. dollars, the conversion rates may be artificial relative to the actual market values and may be unfavorable to fund investors. To protect against future uncertainties in foreign currency exchange rates, the funds are authorized to enter into certain foreign currency exchange transactions.

Foreign securities are often traded with less frequency and volume, and therefore may have greater price volatility, than is the case with many U.S. securities. Brokerage commissions, custodial services, and other costs relating to investment in foreign countries are generally more expensive than in the U.S. Though the funds intend to acquire the securities of foreign issuers where there are public trading markets, economic or political turmoil in a country in which a fund has a significant portion of its assets or deterioration of the relationship between the U.S. and a foreign country may reduce the liquidity of a fund's portfolio. The funds may have difficulty meeting a large number of redemption requests. Furthermore, there may be difficulties in obtaining or enforcing judgments against foreign issuers.

A fund may choose to invest in a foreign company by purchasing depositary receipts. Depositary receipts are certificates of ownership of shares in a foreign-based issuer held by a bank or other financial institution. They are alternatives to purchasing the underlying security but are subject to the foreign securities risks to which they relate.

Hedging

The success of a fund’s hedging strategy will be subject to the Sub-Advisor’s ability to correctly assess the degree of correlation between the performance of the instruments used in the hedging strategy and the performance of the investments in the portfolio being hedged. Since the characteristics of many securities change as markets change or time passes, the success of a fund’s hedging strategy will also be subject to the Sub-Advisor’s ability to continually recalculate, readjust, and execute hedges in an efficient and timely manner. For a variety of reasons, the Sub-Advisor may not seek to establish a perfect correlation between such hedging instruments and the portfolio holdings being hedged. Such imperfect correlation may prevent a fund from achieving the intended hedge or expose a fund to risk of loss. In addition, it is not possible to hedge fully or perfectly against any risk, and hedging entails its own costs.

Initial Public Offerings ("IPOs")

An IPO is a company's first offering of stock to the public. IPO risk is that the market value of IPO shares will fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. In addition, the market for IPO shares can be speculative and/or inactive for extended periods of time. The limited number of shares available for trading in some IPOs may make it more difficult for a fund to buy or sell significant amounts of shares without an unfavorable impact on prevailing prices. Investors in IPO shares can be affected by substantial dilution in the value of their shares by sales of additional shares and by concentration of control in existing management and principal shareholders.