As filed with the Securities and Exchange Commission on January 3, 2025

File No. 333-______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

FORM N-14

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. ___

Post-Effective Amendment No. ___

(Check appropriate box or boxes)

_____________________________________________

PRINCIPAL FUNDS, INC.

(Exact Name of Registrant as Specified in Charter)

711 High Street, Des Moines, Iowa 50392

(Address of Principal Executive Offices) (Number, Street, City, State, Zip Code)

_____________________________________________

(515) 247-5111

(Area Code and Telephone Number)

The Principal Financial Group

Des Moines, Iowa 50392

(Name and Address of Agent for Service)

_____________________________________________

Copy to:

John L. Sullivan

Counsel and Assistant Secretary

711 High Street, Des Moines, Iowa 50392

(515) 247-6651

_____________________________________________

Approximate date of proposed public offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933, as amended.

Title of Securities Being Registered: Institutional Class Shares, par value $0.01 per share.

It is proposed that this filing will become effective on February 3, 2025 pursuant to Rule 488 under the Securities Act of 1933, as amended.

No filing fee is due because an indefinite number of shares have been registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

| | | | | |

Principal Funds, Inc.

711 High Street, Des Moines, IA 50392

515 247 5111 tel | |

February __, 2025

Dear Shareholder:

The Board of Directors of Principal Funds, Inc. ("PFI") has approved a Plan of Acquisition (the "Plan") providing for the reorganization of the High Income Fund (the "Acquired Fund") into the High Yield Fund (the "Acquiring Fund") (together, the "Funds"). Each of these Funds is a separate series of PFI.

Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for newly issued shares of the Acquiring Fund; and (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund in complete liquidation and termination of the Acquired Fund (the "Reorganization"). As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange ("NYSE") on the closing date of the Reorganization. Holders of Institutional Class shares of the Acquired Fund will receive, respectively, Institutional Class shares of the Acquiring Fund. The Reorganization is expected to occur on or about the close of regularly scheduled trading on the NYSE on February 28, 2025.

The Board of Directors believes that the Reorganization is in the best interests of shareholders of both Funds for reasons described in Information Statement/Prospectus. Combining the Funds will not result in any dilution of the interests of existing shareholders of the Funds.

The Funds will obtain an opinion of legal counsel to the effect that no gain or loss should be recognized by any shareholder for federal income tax purposes as a result of the Reorganization. The direct expenses and out-of-pocket fees incurred in connection with the Reorganization will be borne by Principal Global Investors, LLC, the advisor to both Funds.

Please note that PFI is not required to obtain shareholder approval of the Reorganization. Consequently, we are not asking you for a proxy, and we are requesting that you not send us a proxy. The enclosed Information Statement/Prospectus, however, provides information about the Reorganization and the Plan.

If you have any questions regarding your Fund's Reorganization, please call our Shareholder Services Department toll-free at 1 (800) 222-5852.

| | | | | |

| Sincerely, |

| |

| |

| Kamal Bhatia |

| Director, Chair, President and Chief Executive Officer |

PRINCIPAL FUNDS, INC.

711 High Street, Des Moines, Iowa 50392

1 (800) 222-5852

---------------------------------

IMPORTANT NOTICE OF INTERNET AVAILABILITY OF INFORMATION STATEMENT/PROSPECTUS

This Information Statement/Prospectus is available at

https://brandassets.principal.com/m/7ff1cb4501e7bd00/original/PFI-High-Income-Fund-Information-Statement.pdf.

---------------------------------

RELATING TO THE REORGANIZATION OF

THE HIGH INCOME FUND INTO THE HIGH YIELD FUND

This Information Statement/Prospectus is furnished in connection with a Plan of Acquisition (the "Plan") providing for the reorganization of the High Income Fund (the "Acquired Fund") into the High Yield Fund (the "Acquiring Fund") (together, the "Funds"). Each of these Funds is a separate series or fund of Principal Funds, Inc. ("PFI").

Under the Plan: (i) the Acquiring Fund will acquire all the assets, subject to all the liabilities, of the Acquired Fund in exchange for newly issued shares of the Acquiring Fund; and (ii) the Acquiring Fund shares will be distributed to the shareholders of the Acquired Fund in complete liquidation and termination of the Acquired Fund (the "Reorganization"). As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. The total value of all shares of the Acquiring Fund issued in the Reorganization will equal the total value of the net assets of the Acquired Fund. The number of full and fractional shares of the Acquiring Fund received by a shareholder of the Acquired Fund will be equal in value to the value of that shareholder’s shares of the Acquired Fund as of the close of regularly scheduled trading on the New York Stock Exchange ("NYSE") on the closing date of the Reorganization. Holders of Institutional Class shares of the Acquired Fund will receive, respectively, Institutional Class shares of the Acquiring Fund. The Reorganization is expected to occur on or about the close of regularly scheduled trading on the NYSE on February 28, 2025. The terms and conditions of the Reorganization are more fully described below in this Information Statement/Prospectus and in the Form of Plan of Acquisition, which is attached hereto as Appendix A.

Please note: PFI is not required to obtain shareholder approval of the Reorganization.

Consequently, we are not asking you for a proxy, and we are requesting that you not send us a proxy.

This Information Statement/Prospectus contains information shareholders should know about the Reorganization. Please read it carefully and retain it for future reference. The Annual and Semi-Annual Reports to Shareholders of PFI contain additional information about the investments of the Acquired Fund and the Acquiring Fund. The Annual Report contains discussions of the market conditions and investment strategies that significantly affected these Funds during the fiscal year ended October 31, 2024. Copies of these reports may be obtained at no charge by calling our Shareholder Services Department toll-free at 1 (800) 222-5852 or online at www.principalfunds.com/prospectuses.

The Statement of Additional Information dated February __, 2025 (the "Statement of Additional Information" or "SAI") relating to this Information Statement/Prospectus has been filed with the SEC (File No. 333‑________) and is incorporated by reference into this Information Statement/Prospectus. PFI’s Prospectus for both the Acquired Fund and Acquiring Fund dated March 1, 2024 and as supplemented, and the Statement of Additional Information for both the Acquired Fund and Acquiring Fund dated March 1, 2024, as supplemented, have been filed with the SEC (File No. 033-59474). Copies of these documents may be obtained without charge by writing to Principal Funds, Inc., P.O. Box 219971, Kansas City, MO 64121-9971 or by calling our Shareholder Services Department toll-free at 1 (800) 222-5852. You may also call our Shareholder Services Department toll free at 1 (800) 222-5852 if you have any questions regarding your Fund's Reorganization.

PFI is subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and the Securities and Exchange Commission (the "SEC") under the Investment Company Act of 1940, as amended (the "1940 Act"), and files reports, proxy materials, and other information with the SEC. Such reports, proxy materials, and other information are available on the SEC’s EDGAR Database on its Internet site at www.sec.gov.

The SEC has not approved or disapproved these securities or passed upon the accuracy or adequacy of this Information Statement/Prospectus. Any representation to the contrary is a criminal offense.

The date of this Information Statement/Prospectus is February __, 2025

| | | | | |

| TABLE OF CONTENTS |

| |

| Page |

| |

| INTRODUCTION | |

| THE REORGANIZATION | |

| Plan of Acquisition Providing for the Reorganization of the High Income Fund into the High Yield Fund | |

| Comparison of Acquired and Acquiring Funds | |

| Comparison of Investment Objectives and Strategies | |

| Comparison of Principal Investment Risks | |

| Fees and Expenses of the Funds | |

| Performance | |

| Board Consideration of the Reorganization | |

| INFORMATION ABOUT THE REORGANIZATION | |

| Plan of Acquisition | |

| Description of the Securities to Be Issued | |

| Federal Income Tax Consequences | |

| CAPITALIZATION | |

| ADDITIONAL INFORMATION ABOUT INVESTMENT STRATEGIES AND RISKS | |

| ADDITIONAL INFORMATION ABOUT THE FUNDS | |

| Multiple Classes of Shares | |

| Intermediary Compensation | |

| Dividends and Distributions | |

| Pricing of Fund Shares | |

| TAX INFORMATION | |

| DISTRIBUTION PLAN AND ADDITIONAL INFORMATION REGARDING INTERMEDIARY COMPENSATION | |

| THE COST OF INVESTING AND ONGOING FEES | |

| FREQUENT PURCHASES AND REDEMPTIONS | |

| SHAREHOLDER RIGHTS | |

| PURCHASE OF FUND SHARES | |

| REDEMPTION OF FUND SHARES | |

| EXCHANGE OF FUND SHARES | |

| PORTFOLIO HOLDINGS INFORMATION | |

| OUTSTANDING SHARES AND SHARE OWNERSHIP | |

| FINANCIAL STATEMENTS | |

| LEGAL MATTERS | |

| OTHER INFORMATION | |

| APPENDIX A - Form of Plan of Acquisition | |

| APPENDIX B - Financial Highlights | |

INTRODUCTION

This Information Statement/Prospectus is being furnished to shareholders of the Acquired Fund to provide information regarding the Plan and the Reorganization.

Principal Funds, Inc. PFI is a Maryland corporation and an open-end management investment company registered with the SEC under the 1940 Act. PFI currently offers 76 separate series (the "PFI Funds"), including the Acquired Fund and the Acquiring Fund. The sponsor of PFI is Principal Life Insurance Company ("Principal Life"), and the investment advisor to the PFI Funds is Principal Global Investors, LLC ("PGI"). Principal Funds Distributor, Inc. (the "Distributor" or "PFD") is the distributor for all share classes. Principal Life is an insurance company organized in 1879 under the laws of the State of Iowa. Principal Life, PGI, and PFD are indirect, wholly-owned subsidiaries of Principal Financial Group, Inc. ("PFG"). Principal Life, PGI, and PFD’s address is the Principal Financial Group, 711 High Street, Des Moines, Iowa 50392.

Investment Management. Pursuant to an investment advisory agreement with PFI, PGI provides investment advisory services to each PFI Fund and is also responsible for, among other things, administering the business and affairs of each PFI Fund. PGI is also responsible for selecting, contracting with, compensating, and monitoring the performance of any sub-advisors that manage the investment of the assets of the PFI Funds pursuant to sub-advisory agreements. PGI, with respect to the management of the Acquired Fund, has entered into sub-advisory agreements with Insight North America LLC, Polen Capital Credit, LLC, and Post Advisory Group, LLC. The Acquiring Fund has no sub-advisors.

PGI is located at 801 Grand Avenue, Des Moines, IA 50392. PGI is an indirect, wholly owned subsidiary of PFG.

THE REORGANIZATION

At its meeting held on October 31, 2024, the PFI Board of Directors (the "Board"), including all the Directors who are not "interested persons" (as defined in the 1940 Act) of PFI (the "Independent Directors"), approved the Reorganization pursuant to the Plan providing for the reorganization of the Acquired Fund into the Acquiring Fund. The Board concluded that the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of the Funds will not be diluted as a result of the Reorganization. The factors that the Board considered in deciding to approve the Reorganization are discussed under "THE REORGANIZATION - Board Consideration of the Reorganization."

The Reorganization contemplates: (i) the transfer of all the assets, subject to all of the liabilities, of the Acquired Fund to the Acquiring Fund in exchange for newly issued shares of the Acquiring Fund; and (ii) the distribution to Acquired Fund shareholders of the Acquiring Fund shares in complete liquidation and termination of the Acquired Fund. As a result of the Reorganization, each shareholder of the Acquired Fund will become a shareholder of the Acquiring Fund. In the Reorganization, the Acquiring Fund will issue to the Acquired Fund a number of shares with a total value equal to the total value of the net assets of the Acquired Fund, and each shareholder of the Acquired Fund will receive a number of full and fractional shares of the Acquiring Fund with a value equal to the value of that shareholder’s shares of the Acquired Fund, as of the close of regularly scheduled trading on the NYSE on the closing date of the Reorganization (the "Effective Time"). The closing date of the Reorganization is expected to be on or about February 28, 2025. Holders of Institutional Class shares of the Acquired Fund will receive, respectively, Institutional Class shares of the Acquiring Fund. The terms and conditions of the Reorganization are more fully described below in this Information Statement/Prospectus and in the Form of Plan of Acquisition, which is attached hereto as Appendix A.

Please see "THE REORGANIZATION - Board Consideration of the Reorganization" for additional information about the Board's consideration of the Reorganization.

Furthermore, the Funds will obtain an opinion of legal counsel to the effect that no gain or loss should be recognized by any shareholder for federal income tax purposes as a result of the Reorganization. Please see "Information About the Reorganization - Federal Income Tax Consequences" for additional information about the federal income tax consequences of the Reorganization.

PGI serves as investment advisor to both the Acquired Fund and the Acquiring Fund. In addition, the Acquired Fund is sub-advised by three different sub-advisory firms whereas the Acquired Fund is not sub-advised by any sub-advisory firms. If the Reorganization is approved, the portfolio managers of the Acquiring Fund, which are different from the portfolio managers of the Acquired Fund, will remain the portfolio managers of the Acquiring Fund post-Reorganization. Please see "Plan of Acquisition Providing for the Reorganization of the High Income Fund into the High Yield Fund" below for additional comparison information between the Acquired Fund and Acquiring Fund, as well as information about the Acquiring Fund post-Reorganization.

The direct expenses and out-of-pocket fees incurred in connection with the Reorganization, including printing, mailing and audit fees, will be paid by PGI as the advisor to the Acquired Fund. The costs are estimated to be $12,275.

Each of the Acquired Fund and the Acquiring Fund qualifies, and following the Reorganization it is expected that the Acquiring Fund will continue to qualify, as a Regulated Investment Company for tax purposes.

Plan of Acquisition Providing for the Reorganization of the

High Income Fund into the High Yield Fund

At its meeting held on October 31, 2024, the Board of PFI, including the Independent Directors, approved the Plan, which provides for the reorganization of the High Income Fund ("Acquired Fund") into the High Yield Fund (the "Acquiring Fund"). PFI is not required to obtain, and is not seeking, shareholder approval of the Reorganization.

Comparison of Acquired and Acquiring Funds

The following tables provide comparative information with respect to the Acquired Fund and the Acquiring Fund. The Funds have the substantially identical investment objectives despite the difference in wording: The Acquired Fund seeks high current income, and the Acquiring seeks to provide a high level of current income. In terms of principal investment strategies, both Funds invest in below investment grade bonds and bank loans (often called "high yield" or "junk"), although the Acquiring Fund invests at least 80% of its nets assets, plus any borrowing for investment purposes, in this asset class. Both Funds also invest in investment grade bank loans (also known as senior floating rate interests) and securities of foreign issuers.

PGI is the investment advisor for both the Acquired Fund and the Acquiring Fund. In managing the Acquired Fund, PGI allocates the Fund's assets among three different sub-advisors (listed below) that use differing approaches in making their investment decisions, which include actively managed and more passive investment strategies. PGI actively manages the Acquiring Fund and does not employ sub-advisors to implement the Fund's investment strategies. Further, the Acquired Fund and the Acquiring Fund are each managed by a different team of portfolio managers. The portfolio managers listed below for the Acquiring Fund will remain the portfolio managers of the Acquiring Fund post-Reorganization.

| | | | | | | | |

HIGH INCOME FUND (Acquired Fund) | | HIGH YIELD FUND (Acquiring Fund) |

| | |

Approximate Net Assets as of October 31, 2024 | | Approximate Net Assets as of October 31, 2024 |

| $598,450,000 | | $5,850,503,000 |

| | |

| Investment Advisor | | Investment Advisor |

| PGI | | PGI |

| | |

| Sub-Advisors | | Sub-Advisors |

| Insight North America LLC | | None |

| Polen Capital Credit, LLC | | |

| Post Advisory Group, LLC | | |

| | | | | | | | |

HIGH INCOME FUND (Acquired Fund) | | HIGH YIELD FUND (Acquiring Fund) |

| PGI Portfolio Managers | | PGI Portfolio Managers |

| | |

James W. Fennessey has been with Principal® since 2000. Mr. Fennessey earned a bachelor’s degree in Business Administration, with an emphasis in Finance, and a minor in Economics from Truman State University. He has earned the right to use the Chartered Financial Analyst designation. Randy L. Welch has been with Principal® since 1989. He earned a bachelor’s degree in Business/Finance from Grand View College and an M.B.A. from Drake University. Mr. Welch is an affiliate member of the Chartered Financial Analysts (CFA) Institute. | | Mark P. Denkinger has been with Principal® since 1990. He earned a bachelor’s degree in Finance and an M.B.A. with a Finance emphasis from the University of Iowa. Mr. Denkinger has earned the right to use the Chartered Financial Analyst designation. Josh Rank has been with Principal® since 2013. He earned a bachelor’s degree in Finance from Iowa State University. Mr. Rank has earned the right to use the Chartered Financial Analyst designation. Darrin E. Smith has been with Principal® since 2007. He earned a bachelor’s degree in Economics from Iowa State University and an M.B.A. from Drake University. Mr. Smith has earned the right to use the Chartered Financial Analyst designation. |

| | | | | | | | |

HIGH INCOME FUND (Acquired Fund) | | HIGH YIELD FUND (Acquiring Fund) |

| | |

| Investment Objective | | Investment Objective |

| The Fund seeks current income. | | The Fund seeks to provide a high level of current income. |

| | |

| | | | | | | | |

HIGH INCOME FUND (Acquired Fund) | | HIGH YIELD FUND (Acquiring Fund) |

| | |

| Principal Investment Strategies | | Principal Investment Strategies |

Under normal circumstances, the Fund invests primarily in below investment grade bonds and bank loans (sometimes called “high yield” or “junk”), which are rated, at the time of purchase, Ba1 or lower by Moody’s Investors Service, Inc. (“Moody’s”) and BB+ or lower by S&P Global Ratings (“S&P Global”). If the bond or bank loan has been rated by only one of the rating agencies, that rating will determine the rating of the bond or bank loan; if the bond or bank loan is rated differently by the rating agencies, the highest rating will be used; and if the bond or bank loan has not been rated by either of the rating agencies, those selecting such investments will determine the quality of the bond or bank loan. The Fund also invests in investment grade bank loans (also known as senior floating rate interests) and securities of foreign issuers. In managing the Fund, Principal Global Investors, LLC (“PGI”), the Fund’s investment advisor, allocates the Fund’s assets among multiple sub-advisors that use differing approaches in making their investment decisions, which include actively managed and more passive investment strategies. With respect to the passive strategy, the Fund uses a sampling methodology to purchase securities with generally the same risk and return characteristics as the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (the “Index”) in an attempt to match or exceed the performance of the Index. Under normal circumstances, the Fund maintains an average portfolio duration that is within ±25% of the duration of the Index, which as of January 31, 2024 was 3.33 years. The Fund is not managed to a particular maturity. | | Under normal circumstances, the Fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in below investment grade bonds and bank loans (sometimes called “high yield” or “junk”), which are rated, at the time of purchase, Ba1 or lower by Moody’s Investors Service, Inc. (“Moody’s”) and BB+ or lower by S&P Global Ratings (“S&P Global”). If the bond or bank loan has been rated by only one of the rating agencies, that rating will determine the rating of the bond or bank loan; if the bond or bank loan is rated differently by the rating agencies, the highest rating will be used; and if the bond or bank loan has not been rated by either of those agencies, those selecting such investments will determine the quality of the bond or bank loan. The Fund also invests in investment grade bank loans (also known as senior floating rate interests) and securities of foreign issuers. Under normal circumstances, the Fund maintains an average portfolio duration that is within ±20% of the duration of the Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, which as of January 31, 2024 was 3.33 years. The Fund is not managed to a particular maturity. |

Temporary Defensive Investing

For temporary defensive purposes in times of unusual or adverse market, economic, or political conditions, each Fund may invest up to 100% of its assets in cash and cash equivalents. In taking such defensive measures, either Fund may fail to achieve its investment objective.

Securities Lending

To generate additional income, a Fund may lend its portfolio securities to broker-dealers and other institutional borrowers to the extent permitted under the 1940 Act or the rules, regulations or interpretations thereunder. A Fund that lends its securities will continue to receive amounts equal to the interest or dividend payments generated by the loaned securities. In addition to receiving these amounts, the Fund generates income on the loaned securities by receiving a fee from the borrower, and by earning interest on the collateral received from the borrower. A negotiated portion of the income is paid to a securities lending agent (e.g., a bank or trust company) who arranged the loan. During the term of the loan, the Fund’s investment performance will reflect changes in the value of the loaned securities.

A borrower’s obligations under a securities loan is secured continuously by collateral posted by the borrower and held by the custodian in an amount at least equal to the market value of the loaned securities. Generally, cash collateral that a Fund receives from securities lending activities will be invested in the Principal Funds, Inc. Government Money Market Fund, which is managed by PGI and for which PGI receives a management fee. The collateral may also be invested in unaffiliated money market funds.

Securities lending involves exposure to certain risks, including the risk of losses resulting from problems in the settlement and accounting process, the risk of a mismatch between the return on cash collateral reinvestments and the fees each Fund has agreed to pay a borrower, and credit, legal, counterparty and market risk. A Fund’s participation in a securities lending transaction may affect the amount, timing, and character of distributions derived from such transaction to shareholders. Qualified dividend income does not include "payments in lieu of dividends," which the Funds anticipate they will receive in securities lending transactions.

Fundamental Investment Restrictions

The Funds are subject to identical fundamental investment restrictions, which may not be changed without a shareholder vote. These fundamental restrictions deal with such matters as the issuance of senior securities, purchasing or selling real estate or commodities, borrowing money, making loans, underwriting securities of other issuers, diversification or concentration of investments, and short sales of securities. The fundamental investment restrictions of the Funds are described in the Statement of Additional Information under "Description of the Funds' Investments and Risks - Fundamental Restrictions."

The Funds are subject to differing non-fundamental investment restrictions regarding their ability to invest in foreign securities. Non-fundamental investment restrictions may be changed without shareholder approval. The Acquired Fund may not invest more than 25% of its assets in foreign securities whereas the Acquiring Fund may not invest more than 35% of its assets in foreign securities. The non-fundamental investment restrictions of the Funds are described in the Statement of Additional Information under "Description of the Funds' Investments and Risks - Non-Fundamental Restrictions."

Additional Information

The investment objective of each Fund may be changed by the Board without shareholder approval.

Additional information about the investment strategies and the types of securities in which the Funds may invest is discussed below under "Additional Information About Investment Strategies and Risks," as well as in the Statement of Additional Information.

The Statement of Additional Information provides further information about the portfolio managers for each Fund, including information about compensation, other accounts managed, and ownership of Fund shares.

Comparison of Principal Investment Risks

Shareholders should consider the amount and character of investment risk involved in the respective investment objectives and strategies of the Acquired Fund and the Acquiring Fund.

Principal Risks Applicable to Both Funds:

The following principal risks are applicable to the Acquired Fund and the Acquiring Fund:

Bank Loans Risk. Changes in economic conditions are likely to cause issuers of bank loans (also known as senior floating rate interests) to be unable to meet their obligations. In addition, the value of the collateral securing the loan (if any) may decline, causing a loan to be substantially unsecured. Underlying credit agreements governing the bank loans, reliance on market makers, priority of repayment, and overall market volatility may harm the liquidity of loans.

Fixed-Income Securities Risk. Fixed-income securities are subject to interest rate, credit quality, and liquidity risks. The market value of fixed-income securities generally declines when interest rates rise, and increased interest rates may adversely affect the liquidity of certain fixed-income securities. Moreover, an issuer of fixed-income securities could default on its payment obligations due to increased interest rates or for other reasons.

Foreign Securities Risk. The risks of foreign securities include loss of value as a result of: political or economic instability; nationalization, expropriation, or confiscatory taxation; settlement delays; and limited government regulation (including less stringent reporting, accounting, and disclosure standards than are required of U.S. companies).

High Yield Securities Risk. High yield fixed-income securities (commonly referred to as “junk bonds”) are subject to greater credit quality risk than higher rated fixed-income securities and should be considered speculative.

Portfolio Duration Risk. Portfolio duration is a measure of the expected life of a fixed-income security and its sensitivity to changes in interest rates. The longer a fund’s average portfolio duration, the more sensitive the fund will be to changes in interest rates, which means funds with longer average portfolio durations may be more volatile than those with shorter durations.

Redemption and Large Transaction Risk. Ownership of the Fund’s shares may be concentrated in one or a few large investors (such as funds of funds, institutional investors, and asset allocation programs) that may redeem or purchase shares in large quantities. These transactions may cause the Fund to sell securities to meet redemptions or to invest additional cash at times it would not otherwise do so, which may result in increased transaction costs, increased expenses, changes to expense ratios, and adverse effects to Fund performance. Such transactions may also accelerate the realization of taxable income if sales of portfolio securities result in gains. Moreover, reallocations by large shareholders among share classes of a fund may result in changes to the expense ratios of affected classes, which may increase the expenses paid by shareholders of the class that experienced the redemption.

Additional Principal Risks of Investing in the Acquired Fund:

There are no additional principal risks of investing in the Acquired Fund that are not included above in "Principal Risks Applicable to Both Funds."

Additional Principal Risks of Investing in the Acquiring Fund:

There are no additional principal risks of investing in the Acquiring Fund that are not included above in "Principal Risks Applicable to Both Funds."

Fees and Expenses of the Funds

Shareholder Fees (fees paid directly from your investment)

The Institutional Class shares of the Funds and the Class R-6 shares of the Acquiring Fund are not subject to sales charges or redemption fees.

Fees and Expenses as a % of average daily net assets

The following table shows: (a) the ratios of expenses to average net assets of the Acquired Fund for the fiscal year ended October 31, 2024; (b) the ratios of expenses to average net assets of the Acquiring Fund for the fiscal year ended October 31, 2024; and (c) the pro forma expense ratios of the Acquiring Fund for the fiscal year ended October 31, 2024 assuming that the Reorganization had taken place at the commencement of the fiscal year ended October 31, 2024.

If you purchase Institutional Class shares through certain programs offered by certain financial intermediaries, you may be required to pay a commission and/or other forms of compensation to the broker, or to your Financial Professional or other financial intermediary.

Holders of Institutional Class shares of the Acquired Fund will receive Institutional Class shares of the Acquiring Fund. Following the Reorganization, eligible shareholders who receive Institutional Class shares of the Acquiring Fund in the Reorganization will be able to exchange their Institutional Class shares of the Acquiring Fund for Class R-6 Class shares of the Acquiring Fund on a tax-free basis and without exchange fees. To determine if you are an eligible shareholder, see "Purchase of Fund Shares--Eligible Purchasers" below.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | | | | | | | | | | | | |

(a) HIGH INCOME FUND (Acquired Fund) |

| Class | Management Fees | Distribution

and/or Service (12b-1) Fees | Other Expenses | Acquired Fund Fees and Expenses | Total Operating Expenses | Fee Waiver(1) | Net Expenses |

| Institutional | 0.61% | N/A | 0.01% | 0.00% | 0.62% | (0.02)% | 0.60% |

(b) HIGH YIELD FUND (Acquiring Fund) |

| Class | Management Fees(2) | Distribution and/or Service (12b-1) Fees | Other Expenses | Acquired Fund Fees and Expenses | Total Operating Expenses | Expense Reimbursement(3) | Net Expenses |

| Institutional | 0.51% | N/A | 0.12% | 0.00% | 0.63% | (0.03)% | 0.60% |

| R-6 | 0.51% | N/A | 0.02% | 0.00% | 0.53% | N/A | 0.53% |

| | | | | | | |

(c) HIGH YIELD FUND (Acquiring Fund) (Pro forma assuming Reorganization) |

| Class | Management Fees(2) | Distribution and/or Service (12b-1) Fees | Other Expenses | Acquired Fund Fees and Expenses | Total Operating Expenses | Expense Reimbursement(3) | Net Expenses |

| Institutional | 0.50% | N/A | 0.10% | 0.00% | 0.60% | 0.00% | 0.60% |

| R-6 | 0.50% | N/A | 0.01% | 0.00% | 0.51% | N/A | 0.51% |

(1)PGI, the investment advisor, has contractually agreed to waive a portion of the Fund's management fees through the period ending February 28, 2026. The fee waiver will reduce the Fund's management fees by 0.015% (expressed as a percent of average net assets on an annualized basis). It is expected that the fee waiver will continue through the period disclosed; however, PFI and PGI, the parties to the agreement, may mutually agree to terminate the fee waiver prior to the end of the period.

(2)Fees have been restated to reflect current fees.

(3)PGI, the investment advisor, has contractually agreed to limit the Fund's expenses by paying, if necessary, expenses normally payable by the Fund(excluding interest expense, expenses related to fund investments, acquired fund fees and expenses, and tax reclaim recovery expenses and other extraordinary expenses) to maintain a total level of operating expenses (expressed as a percent of average net assets on an annualized basis) not to exceed 0.60% for Institutional Class shares. It is expected that the expense limit will continue through the period ending February 28, 2026; however, PFI and PGI, the parties to the agreement, may mutually agree to terminate the expense limit prior to the end of the period. Subject to applicable expense limits, the Fund may reimburse PGI for expenses incurred during the current fiscal year.

Examples: The following examples are intended to help you compare the costs of investing in shares of the Acquired Fund and the Acquiring Fund. The examples assume that fund expenses continue at the rates shown in the table above, that you invest $10,000 in the particular fund for the time periods indicated, and that all dividends and distributions are reinvested. The examples also assume that your investment has a 5% return each year. The calculation of costs takes into account any applicable contractual fee waivers and/or expense reimbursements for the periods noted in the table above. The examples should not be considered a representation of future expense of the Acquired Fund or the Acquiring Fund. Actual expense may be greater or less than those shown.

| | | | | | | | | | | | | | |

(a) HIGH INCOME FUND (Acquired Fund) |

Assumes redemption at the end of the periods listed: |

| Class | 1 year | 3 years | 5 years | 10 years |

| Institutional | $61 | $197 | $344 | $772 |

| | | | |

(b) HIGH YIELD FUND (Acquiring Fund) |

Assumes redemption at the end of the periods listed: |

| Class | 1 year | 3 years | 5 years | 10 years |

| Institutional | $61 | $199 | $348 | $783 |

| R-6 | 54 | 170 | 296 | 665 |

| | | | |

(c) HIGH YIELD FUND (Acquiring Fund) (Pro forma assuming Reorganization) |

Assumes redemption at the end of the periods listed: |

| Class | 1 year | 3 years | 5 years | 10 years |

| Institutional | $61 | $192 | $335 | $750 |

| R-6 | 52 | 164 | 285 | 640 |

Portfolio Turnover

Each Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction fees and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the examples, affect the Fund’s performance. During the fiscal year ended October 31, 2024, the portfolio turnover rate for the Acquired Fund was 73.9% of the average value of its portfolio while the portfolio turnover rate for the Acquiring Fund was 39.1%.

Investment Management Fees

The management fee each Fund paid (as a percentage of the Fund's average daily net assets) for the fiscal year ended October 31, 2024:

| | |

High Income Fund

(Acquired Fund) |

| 0.61% |

| | |

High Yield Fund

(Acquiring Fund) |

| 0.51% |

Availability of the discussions regarding the basis for the Board's approval of the management agreement is as follows:

| | | | | | | | |

| Form N-CSR Filed with the SEC

for the period ending October 31, 2024 |

| Fund | Management Agreement | Sub-Advisory Agreement |

High Income (Acquired Fund) | X | X |

High Yield (Acquiring Fund) | X | N/A |

Performance

The following information provides some indication of the risks of investing in the Fund. Past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You may get updated performance information at www.principalfunds.com.

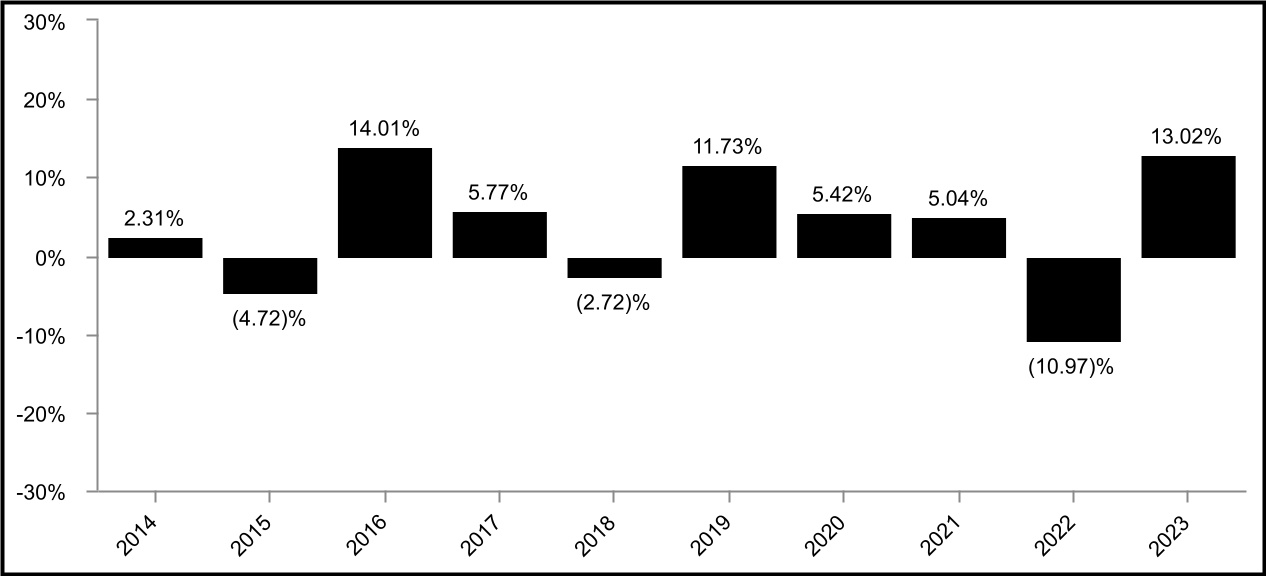

The bar chart shows the investment returns of the Acquired Fund’s Institutional Class shares for each full calendar year of operations for 10 years (or, if shorter, the life of the Acquired Fund). The table shows for the last one, five, and ten calendar year periods (or, if shorter, the life of the Acquired Fund), how the Acquired Fund’s average annual total returns compare with those of one or more broad measures of market performance.

Calendar Year Total Return (%) as of 12/31 Each Year

High Income Fund (Acquired Fund)

| | | | | | | | |

| Highest return for a quarter during the period of the bar chart above: | Q2 2020 | 8.47% |

| Lowest return for a quarter during the period of the bar chart above: | Q1 2020 | (12.72)% |

Average Annual Total Returns For the periods ended December 31, 2023

| | | | | | | | | | | |

| 1 Year | 5 Years | 10 Years |

| Institutional Class Return Before Taxes | 13.02% | 4.48% | 3.59% |

| Institutional Class Return After Taxes on Distributions | 9.73% | 1.85% | 1.05% |

| Institutional Class Return After Taxes on Distributions and Sale of Fund Shares | 7.58% | 2.29% | 1.60% |

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 5.53% | 1.10% | 1.81% |

| Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (reflects no deduction for fees, expenses, or taxes) | 13.44% | 5.35% | 4.59% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

Effective March 1, 2024, the Fund changed its primary broad-based index to the Bloomberg U.S. Aggregate Bond Index in order to meet the revised definition of “broad-based securities market index.” The Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index is included as an additional index for the Fund as it shows how the Fund’s performance compares with the returns of an index of funds with similar investment objectives.

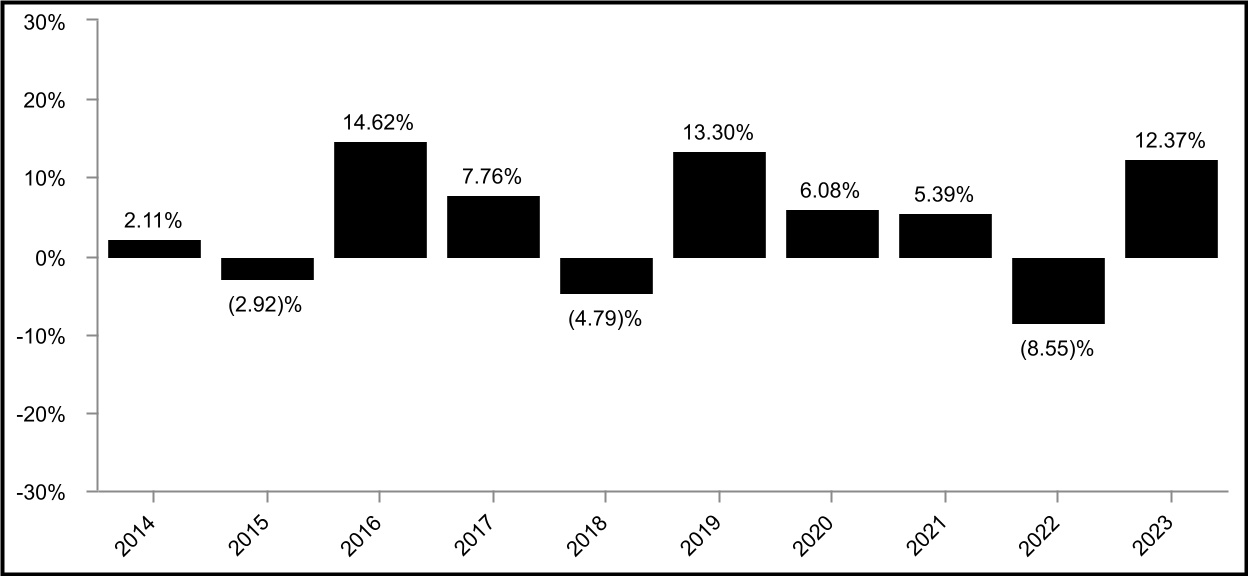

The bar chart shows the investment returns of the Acquiring Fund’s Institutional Class shares for each full calendar year of operations for 10 years (or, if shorter, the life of the Acquiring Fund). The table shows for the last one, five, and ten calendar year periods (or, if shorter, the life of the Acquiring Fund), how the Acquiring Fund’s average annual total returns compare with those of one or more broad measures of market performance.

Calendar Year Total Return (%) as of 12/31 Each Year

High Yield Fund (Acquiring Fund)

| | | | | | | | |

| Highest return for a quarter during the period of the bar chart above: | Q2 2020 | 8.73 | % |

| Lowest return for a quarter during the period of the bar chart above: | Q1 2020 | (12.01) | % |

Average Annual Total Returns For the periods ended December 31, 2023

| | | | | | | | | | | |

| 1 Year | 5 Years | 10 Years |

| Class A Return Before Taxes | 8.12% | 4.62% | 3.86% |

| Class A Return After Taxes on Distributions | 5.59% | 2.40% | 1.50% |

| Class A Return After Taxes on Distributions and Sale of Fund Shares | 4.73% | 2.58% | 1.87% |

| Class C Return Before Taxes | 10.46% | 4.61% | 3.64% |

| Institutional Class Return Before Taxes | 12.86% | 5.76% | 4.58% |

| Class R-6 Return Before Taxes | 12.79% | 5.82% | 4.54% |

| Bloomberg U.S. Aggregate Bond Index (reflects no deduction for fees, expenses, or taxes) | 5.53% | 1.10% | 1.81% |

| Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index (reflects no deduction for fees, expenses, or taxes) | 13.44% | 5.35% | 4.59% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown for Institutional Class shares only and would be different for the other share classes.

Effective March 1, 2024, the Fund changed its primary broad-based index to the Bloomberg U.S. Aggregate Bond Index in order to meet the revised definition of “broad-based securities market index.” The Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index is included as an additional index for the Fund as it shows how the Fund’s performance compares with the returns of an index of funds with similar investment objectives.

Board Consideration of the Reorganization

At its October 31, 2024, meeting, the PFI Board of Directors considered information presented by PGI regarding the proposed Reorganization of the Acquired Fund into the Acquiring Fund, and the Board evaluated such information as it deemed necessary to consider the proposed Reorganization. At the meeting, the Board approved the Reorganization after concluding that participation in the Reorganization is in the best interests of the Acquired Fund and the Acquiring Fund and that the interests of existing shareholders of each Fund will not be diluted as a result of the Reorganization.

In determining whether to approve the Reorganization, the Board made inquiry into a number of matters and considered, among other things, the following factors, in no order of priority:

•the prospects for growth of and for achieving economies of scale by the Acquired Fund as compared to those of the Acquiring Fund;

•the Funds’ substantially identical investment objectives, similar principal investment strategies and principal risks, and identical fundamental investment restrictions;

•the Funds’ current management fee rates and expense ratios and the expected management fee rate and expense ratios of the Acquiring Fund following the Reorganization;

•the estimated direct costs of the Reorganization, including audit and registration statement-related costs, and that such costs will be borne by PGI;

•the estimated trading costs, if any, associated with disposing of any portfolio securities of the Acquired Fund and reinvesting the proceeds in connection with the Reorganization or post-Reorganization;

•the multi-manager structure of the Acquired Fund versus the single-advisor structure of the Acquiring Fund and the different portfolio management teams of the Acquired Fund and the Acquiring Fund;

•information regarding the Funds' investment performance and risk-return profiles;

•the direct or indirect federal income tax consequences of the Reorganization;

•any direct or indirect benefits, including potential economic benefits, expected to be derived by PGI and its affiliates from the Reorganization;

•the absence of any material differences in the rights of shareholders of the Funds;

•the Reorganization will not result in the dilution of the interests of shareholders of the Acquired Fund or the Acquiring Fund;

•the terms and conditions of the Plan; and

•possible alternatives to the Reorganization, including maintaining the status quo or pursuing the liquidation of the Acquired Fund.

The Board believes that the Reorganization will serve the best interests of existing shareholders for the following reasons, among others:

•the Acquired Fund and the Acquiring Fund have substantially identical investment objectives, similar principal investment strategies and principal risks, and identical fundamental investment restrictions;

•PGI has advised that the prospects for growth of and for achieving economies of scale are better for the Acquiring Fund than the Acquired Fund;

•the post-Reorganization management fee rate for the Acquiring Fund is expected to be lower than the pre-Reorganization management fee rate for the Acquired Fund;

•the post-Reorganization expense ratio for the Institutional Class shares of the Acquiring Fund is expected to be the same as the pre-Reorganization expense ratio for the corresponding share class of the Acquired Fund and less than the expense ratio for the corresponding share class of the Acquired Fund (taking into consideration the anticipated expense ratio of the Acquired Fund if the Reorganization were not to occur);

•the post-Reorganization expense ratio for the Class R-6 shares of the Acquiring Fund is expected to be less than the pre-Reorganization expense ratio for the Institutional Class shares of the Acquired Fund, and eligible shareholders of the Acquired Fund who receive Institutional Class shares of the Acquiring Fund in the Reorganization will be able to exchange their Institutional Class shares of the Acquiring Fund for Class R-6 shares of the Acquiring Fund on a tax-free basis and without exchange fees after completion of the Reorganization;

•based on information provided by PGI, the Acquiring Fund outperformed the Acquired Fund over the one-, three-, and five-year periods ended September 30, 2024;

•estimated trading costs from repositioning certain holdings of the Acquired Fund will be borne by the Acquiring Fund and its shareholders post-Reorganization when trading costs are anticipated to be lower because of efficiencies that can be realized through trade techniques and timing considerations available in the Acquiring Fund that are not available in the Acquired Fund;

•the Funds will obtain an opinion of legal counsel to the effect that the Reorganization should qualify as a tax-free reorganization for U.S. federal income tax purposes, and no gain or loss should be recognized as a result of the Reorganization by the Funds and their shareholders;

•PGI, as investment advisor to the Acquiring Fund, is expected to provide high quality investment advisory services and personnel;

•PGI, as investment advisor to the Acquired Fund, will pay all direct expenses and out-of-pocket fees, including audit and registration statement-related costs, incurred in connection with the Reorganization; and

•liquidation of the Acquired Fund, as an alternative to the Reorganization, would cause a distribution to the Acquired Fund shareholders that is unanticipated and may be inconsistent with the shareholders’ investment plan or goals and a liquidation could have negative tax consequences for certain Acquired Fund shareholders.

INFORMATION ABOUT THE REORGANIZATION

Plan of Acquisition

The terms of the Plan are summarized below. The summary is qualified in its entirety by reference to the Form of the Plan, which is attached as Appendix A to this Information Statement/Prospectus.

Under the Plan, the Acquiring Fund will acquire all the assets and assume all the liabilities of the Acquired Fund. We expect that the closing date will be February 28, 2025, or such earlier or later date as Fund management may determine, and that the Effective Time of the Reorganization will be as of the close of regularly scheduled trading on the NYSE (normally 3:00 p.m., Central Time) on that date. Each Fund will determine its net asset values as of the close of trading on the NYSE using the procedures described in its then-current prospectus (the procedures applicable to the Acquired Fund and the Acquiring Fund are identical). The Acquiring Fund will issue to the Acquired Fund a number of shares with a total value equal to the total value of the net assets of the corresponding share class of the Acquired Fund outstanding at the Effective Time.

Immediately after the Effective Time, the Acquired Fund will distribute to its shareholders Acquiring Fund shares of the same class as the Acquired Fund shares each shareholder owns in exchange for all Acquired Fund shares of that class. Acquired Fund shareholders will receive a number of full and fractional shares of the Acquiring Fund that are equal in value to the value of the shares of the Acquired Fund that are surrendered in the exchange. In connection with the exchange, the Acquiring Fund will credit on its books an appropriate number of its shares to the account of the Acquired Fund shareholder, and the Acquired Fund will cancel on its books all its shares registered to the account of that shareholder. After the Effective Time, the Acquired Fund will be terminated in accordance with applicable law.

The Plan may be amended by the Board, except that after notification to the shareholders of the Acquired Fund, no amendment may be made that, in the opinion of the Board, would materially adversely affect the interests of the shareholders of the Acquired Fund. The Board may abandon and terminate the Plan at any time before the Effective Time if it believes that consummation of the transactions contemplated by the Plan would not be in the best interests of the shareholders of either of the Funds.

Under the Plan, PGI will pay all direct expenses and out-of-pocket fees incurred in connection with the Reorganization which will be approximately $12,275.

If the Reorganization is not completed for any reason, the Acquired Fund will continue to operate as a series of PFI, and PFI's Board may take any further action as it deems to be in the best interests of the Acquired Fund and its shareholders.

Description of the Securities to Be Issued

PFI is a Maryland corporation that is authorized to issue its shares of common stock in separate series and separate classes of series. The Acquired Fund and the Acquiring Fund are each a separate series of PFI, and the Institutional Class shares of common stock of the Acquiring Fund to be issued in connection with the Reorganization represent interests in the assets belonging to that series and have identical dividend, liquidation, and other rights, except that expenses allocated to a particular series or class are borne solely by that series or class and may cause differences in services as described below under "The Cost of Investing and Ongoing Fees." Expenses related to the distribution of, and other identified expenses properly allocated to, the shares of a particular series or class are charged to, and borne solely by, that series or class, and the bearing of expenses by a particular series or class may be appropriately reflected in the net asset value attributable to, and the dividend and liquidation rights of, that series or class.

All shares of PFI have equal voting rights and are voted in the aggregate and not by separate series or class of shares except that shares are voted by series or class: (i) when expressly required by Maryland law or the 1940 Act and (ii) on any matter submitted to shareholders that the Board has determined affects the interests of only a particular series or class.

The share classes of the Acquired Fund have the same rights with respect to the Acquired Fund that the share classes of the Acquiring Fund have with respect to the Acquiring Fund.

Shares of both Funds, when issued, have no cumulative voting rights, are fully paid and non-assessable, have no preemptive or conversion rights, and are freely transferable. Each fractional share has proportionately the same rights as are provided for a full share.

Federal Income Tax Consequences

To be considered a tax-free "reorganization" under Section 368 of the Internal Revenue Code of 1986, as amended (the "Code"), a reorganization must exhibit a continuity of business enterprise. Because the Acquiring Fund will use a significant portion of the Acquired Fund’s assets in its business and will continue the Acquired Fund’s historic business, the combination of the Acquired Fund into the Acquiring Fund should exhibit a continuity of business enterprise. Therefore, it is expected that the combination should be considered a tax-free "reorganization" under applicable provisions of the Code. In the opinion of tax counsel to PFI, no gain or loss should be recognized by the Acquired Fund or its shareholders in connection with the combination, the tax cost basis of the Acquiring Fund shares received by shareholders of the Acquired Fund should equal the tax cost basis of their shares in the Acquired Fund, and their holding periods for the Acquiring Fund shares should include their holding periods for the Acquired Fund shares.

Capital Loss Carryforward. As of October 18, 2024, the Acquired Fund had capital loss carryforwards, which will likely be subject to loss limitations.

Distribution of Income and Gains. Prior to the Reorganization, the Acquired Fund, whose taxable year will end as a result of the Reorganization, may declare to its shareholders of record one or more distributions of all of its previously undistributed net investment income and net realized capital gain, including capital gains or losses on any securities disposed of in connection with the Reorganization. Such distributions will be made to shareholders before the Reorganization. An Acquired Fund shareholder will be required to include any such distributions in such shareholder’s taxable income. This may result in the recognition of income that could have been deferred or might never have been realized had the Reorganization not occurred.

The foregoing is only a summary of the principal federal income tax consequences of the Reorganization and should not be considered to be tax advice. There can be no assurance that the Internal Revenue Service will concur on all or any of the issues discussed above. You may wish to consult with your own tax advisors regarding the federal, state, and local tax consequences with respect to the foregoing matters and any other considerations that may apply in your particular circumstances.

CAPITALIZATION

The following tables show as of October 31, 2024: (i) the capitalization of the Acquired Fund; (ii) the capitalization of the Acquiring Fund; and (iii) the pro forma combined capitalization of the Acquiring Fund as if the Reorganization has occurred as of that date. As of October 31, 2024, the Acquired Fund had one outstanding classes of shares; Institutional.

As of October 31, 2024, the Acquiring Fund had four outstanding classes of shares; Class A, Class C, Institutional, and R-6.

The implicit fees and expenses associated with any sales and purchases of any portfolio securities to reposition the assets of the Acquired Fund will occur post-Reorganization. The Acquired Fund shareholders (once they are shareholders of the Acquiring Fund post-Reorganization) and the other Acquiring Fund shareholders will pay these implicit fees and expenses, which are estimated to be $425,000. Based on the value of the Acquired Fund's portfolio securities as of October 31, 2024, the estimated capital loss to be realized upon the Acquiring Fund's sale of certain Acquired Fund portfolio securities received in the Reorganization would be approximately $31,188,000 ($0.03 per share) on a U.S. GAAP basis.

PGI, investment advisor to the Funds, will pay all direct expenses and out-of-pocket fees incurred in connection with the Reorganization which is estimated to be approximately $12,275.

| | | | | | | | | | | | | | | | | | | | |

HIGH INCOME FUND (Acquired Fund) |

| Class | Net Assets

(000s) | | Net Asset Value

Per Share | | Shares

(000s) |

| Institutional | $598,450 | | $8.17 | | 73,268 |

| | $598,450 | | | | 73,268 |

| | | | | | |

HIGH YIELD FUND (Acquiring Fund) |

| Class | Net Assets

(000s) | | Net Asset Value

Per Share | | Shares

(000s) |

| A | $421,065 | | $6.83 | | 61,688 |

| C | 24,716 | | 6.93 | | 3,568 |

| Institutional | 1,359,544 | | 6.76 | | 201,163 |

| R-6 | 4,045,178 | | 6.76 | | 598,558 |

| | $5,850,503 | | | | 864,977 |

| | | | | | |

| Increase in shares outstanding of the Acquired Fund to reflect the exchange for shares of the Acquiring Fund. | | | | | |

| Institutional | | | | | 15,260 |

| | | | | | |

| | | | | | |

HIGH YIELD FUND (Acquiring Fund) (pro forma assuming Reorganization) |

| Class | Net Assets

(000s) | | Net Asset Value

Per Share | | Shares Outstanding

(000s) |

| A | $421,065 | | $6.83 | | 61,688 |

| C | 24,716 | | 6.93 | | 3,568 |

| Institutional | 1,957,994 | | 6.76 | | 289,691 |

| R-6 | 4,045,178 | | 6.76 | | 598,558 |

| | 6,448,953 | | | | 953,505 |

ADDITIONAL INFORMATION ABOUT INVESTMENT STRATEGIES AND RISKS

Each Fund’s investment objective is described in the summary section for each Fund. The summary section also describes each Fund’s principal investment strategies, including the types of securities in which each Fund invests, and the principal risks of investing in each Fund. The principal investment strategies are not the only investment strategies available to each Fund, but they are the ones each Fund primarily uses to achieve its investment objective.

Except for Fundamental Restrictions described in PFI’s Statement of Additional Information, the Board may change any Fund’s objective or investment strategies without a shareholder vote if it determines such a change is in the best interests of the Fund. If there is a material change to a Fund’s investment objective or investment strategies, you should consider whether the Fund remains an appropriate investment for you. There is no guarantee that each Fund will meet its objective.

Each Fund is designed to be a portion of an investor’s portfolio. No Fund is intended to be a complete investment program. Investors should consider the risks of a Fund before making an investment; it is possible to lose money by investing in a Fund.

The following investment strategies and risks (before the “Strategy and Risk Table” below) apply to the Funds and, depending on market conditions, can materially impact the management of the Funds.

Active Management

The performance of a fund that is actively managed (including hybrid funds or passively managed funds that use a sampling approach that includes some actively managed components) will reflect, in part, the ability of those managing the investments of the fund to make investment decisions that are suited to achieving the fund’s investment objective. Actively managed funds may invest differently from the benchmark against which the Fund’s performance is compared. When making decisions about whether to buy or sell equity securities, considerations may include, among other things, a company’s strength in fundamentals, its potential for earnings growth over time, its ability to navigate certain macroeconomic environments, the current price of its securities relative to their perceived worth and relative to others in its industry, and analysis from computer models. When making decisions about whether to buy or sell fixed-income investments, considerations may include, among other things, the strength of certain sectors of the fixed-income market relative to others, interest rates; a range of economic, political, and financial factors; the balance between supply and demand for certain asset classes; the credit quality of individual issuers; the fundamental strengths of corporate and municipal issuers; and other general market conditions.

Models, which may assist portfolio managers and analysts in formulating their securities trading and allocation decisions by providing investment and risk management insights, may also expose a fund to risks. Models may be predictive in nature, which models depend heavily on the accuracy and reliability of historical data that is supplied by others and may be incorrect or incorrectly input. The fund bears the risk that the quantitative models used will not be successful in identifying trends or in determining the size and direction of investment positions that will enable the fund to achieve its investment objective. In addition, “model prices” will often differ substantially from market prices, especially for instruments with complex characteristics, such as derivative instruments.

An active fund’s investment performance depends upon the successful allocation of the fund’s assets among asset classes, geographical regions, industry sectors, and specific issuers and investments. There is no guarantee that these allocation techniques and decisions will produce the desired results. It is possible to lose money on an investment in a fund as a result of these allocation decisions. If a fund’s investment strategies do not perform as expected, the fund could underperform other funds with similar investment objectives or lose money. Moreover, buying and selling securities to adjust the fund’s asset allocation may increase portfolio turnover and generate transaction costs.

Investment advisors with large assets under management in a Fund, or in other funds that have the same strategy as a Fund, may have difficulty fully investing such Fund’s assets according to its investment objective due to potential liquidity constraints and high transaction costs. Typically, small-cap, mid-cap, and emerging market equity funds are more susceptible to such a risk. A Fund may add additional investment advisors or close the Fund to new investors to address such risks.

Cash Management

A Fund may have uninvested cash balances pending investment in other securities, pending payment of redemptions, or in other circumstances where liquidity is necessary or desirable. A Fund may hold uninvested cash; invest it in cash equivalents such as money market funds, including the Principal Funds, Inc. - Government Money Market Fund; lend it to other Funds pursuant to the Funds' interfund lending facility; and/or invest in other instruments that those managing the Fund’s assets deem appropriate for cash management purposes. Generally, these types of investments offer less potential for gains than other types of securities. For example, to attempt to provide returns similar to its benchmark, a Fund (regardless of how it designates usage of derivatives and investment companies) may invest uninvested cash in derivatives, such as stock index futures contracts, or exchange-traded funds (“ETFs”), including Principal Exchange-Traded Funds ETFs. In selecting such investments, PGI may have conflicts of interest due to economic or other incentives to make or retain an investment in certain affiliated funds instead of in other investments that may be appropriate for a Fund.

Liquidity

The Funds have established a liquidity risk management program as required by the U.S. Securities and Exchange Commission’s (the “SEC”) Liquidity Rule. Under the program, PGI assesses, manages, and periodically reviews each Fund’s liquidity risk, which is the risk that a Fund could not meet requests to redeem shares issued by the Fund without significant dilution of the remaining investors’ interests in the Fund. As part of the program, PGI classifies each investment as a “highly liquid investment,” “moderately liquid investment,” “less liquid investment,” or “illiquid investment.” The liquidity of a Fund’s portfolio investments is determined based on relevant market, trading, and investment-specific considerations under the program. To the extent that an investment is deemed to be an illiquid investment or a less liquid investment, a Fund can expect to be exposed to greater liquidity risk.

Certain fund holdings may be deemed to be less liquid or illiquid because they cannot be readily sold without significantly impacting the value of the holdings. A fund is exposed to liquidity risk when trading volume, lack of a market maker, or legal restrictions impair its ability to sell particular securities or close derivative positions at an advantageous price. Funds with principal investment strategies that involve securities of companies with smaller market capitalizations, foreign securities, derivatives, high yield bonds, and bank loans, or securities with substantial market and/or credit risk, tend to have the greatest exposure to liquidity risk.

Liquidity risk also refers to the risk of unusually high redemption requests, redemption requests by certain large shareholders such as institutional investors or asset allocators, or other unusual market conditions that may make it difficult for a fund to sell investments within the allowable time period to meet redemptions. Meeting such redemption requests could require a fund to sell securities at reduced prices or under unfavorable conditions, which would reduce the value of the fund.

Market Volatility and Securities Issuers

The value of a fund’s portfolio securities may decrease in response to overall stock or bond market movements. Markets tend to move in cycles, with periods of rising prices and periods of falling prices. Stocks tend to go up and down in value more than bonds. The value of a security may decline for reasons directly related to the issuer, such as management performance, financial leverage, and reduced demand for the issuer’s goods or services. As a result, the value of an individual security or particular type of security can be more volatile than the market as a whole and can perform differently from the value of the market as a whole.

Additionally, U.S. and world economies, as well as markets (or certain market sectors), may experience greater volatility in response to the occurrence of natural or man-made disasters and geopolitical events, such as war, acts of terrorism, pandemics, military actions, trade disputes, or political instability. Moreover, if a fund’s investments are concentrated in certain sectors, its performance could be worse than the overall market.

Global events can impact the securities markets. Russia's invasion of Ukraine in 2022 has resulted in sanctions being levied by the United States, European Union, and other countries against Russia. Russia's military actions and the resulting sanctions could adversely affect global energy and financial markets and, thus, could affect the value of the fund's investments, even beyond any direct exposure the fund may have to Russian issuers or the adjoining geographic regions. The extent and duration of the military action, sanctions, and resulting market disruptions could be substantial.

Other market disruption events include the pandemic spread of the novel coronavirus designated as COVID-19. The transmission of COVID-19 and efforts to contain its spread resulted in border closings and other travel restrictions and disruptions; disruptions to business operations, supply chains, and customer activity; event cancellations and restrictions; service cancellations and reductions; significant challenges in the healthcare industry; and quarantines. Health crises may exacerbate other pre-existing political, social, economic, market, and financial risks and negatively affect the global economy, as well as the economies of individual countries, the financial performance of individual companies and sectors, and the markets in general in significant ways.

Market disruption events could also impair the information technology and other operational systems upon which a fund’s investment advisor or sub-advisor rely, and could otherwise disrupt the ability of the fund’s service providers to perform essential tasks. In certain cases, an exchange or market may close or issue trading halts on either specific securities or even the entire market, which may result in a fund being, among other things, unable to buy or sell certain securities or financial instruments or accurately price its investments.

Governmental and quasi-governmental authorities and regulators throughout the world, such as the Federal Reserve, have in the past responded to major economic disruptions with a variety of significant fiscal and monetary policy changes, including but not limited to, direct capital infusions into companies, new monetary programs, and dramatic changes to interest rates. Certain of those policy changes were implemented or considered in response to the COVID-19 outbreak and inflationary pressures. Such policy changes may adversely affect the value, volatility, and liquidity of dividend and interest-paying securities.

The impact of current and future market disruption events may last for an extended period of time and could result in a substantial economic downturn or recession. Such events could have significant adverse direct or indirect effects on the funds and their investments, and may result in a fund’s inability to achieve its investment objective, cause funds to experience significant redemptions, cause the postponement of reconstitution/rebalance dates of passive funds’ underlying indices, adversely affect the prices and liquidity of the securities and other instruments in which a fund invests, negatively impact the fund’s performance, and cause losses on your investment in the fund. You should also review this Prospectus and the SAI to understand each Fund’s discretion to implement temporary defensive measures, as well as the circumstances in which a Fund may satisfy redemption requests in-kind.

Securities Lending

To generate additional income, a Fund may lend its portfolio securities to broker-dealers and other institutional borrowers to the extent permitted under the 1940 Act or the rules, regulations, or interpretations thereunder. A Fund that lends its securities will continue to receive amounts equal to the interest or dividend payments generated by the loaned securities. In addition to receiving these amounts, the Fund generates income on the loaned securities by receiving a fee from the borrower, and by earning interest on the collateral received from the borrower. A negotiated portion of the income is paid to a securities lending agent (e.g., a bank or trust company) that arranged the loan. During the term of the loan, the Fund’s investment performance will reflect changes in the value of the loaned securities.

A borrower’s obligations under a securities loan is secured continuously by collateral posted by the borrower and held by the custodian in an amount at least equal to the market value of the loaned securities. Generally, cash collateral that a Fund receives from securities lending activities will be invested in the Principal Funds, Inc. - Government Money Market Fund, which is managed by PGI and for which PGI receives a management fee. The collateral may also be invested in unaffiliated money market funds.

Securities lending involves exposure to certain risks, including the risk of losses resulting from problems in the settlement and accounting process; the risk of a mismatch between the return on cash collateral reinvestments and the fees each Fund has agreed to pay a borrower; and credit, legal, counterparty, and market risk. A Fund’s participation in a securities lending transaction may affect the amount, timing, and character of distributions derived from such transaction to shareholders. Qualified dividend income does not include “payments in lieu of dividends,” which the Funds anticipate they will receive in securities lending transactions.

Temporary Defensive Measures

From time to time, as part of its investment strategy, a Fund may invest without limit in cash and cash equivalents for temporary defensive purposes in response to adverse market, economic, or political conditions. For this purpose, cash equivalents include: bank notes, bank certificates of deposit, bankers’ acceptances, repurchase agreements, commercial paper, and commercial paper master notes, which are floating rate debt instruments without a fixed maturity. In addition, a Fund may purchase U.S. government securities, preferred stocks, and debt securities, whether or not convertible into or carrying rights for common stock. There is no limit on the extent to which a Fund may take temporary defensive measures. In taking such measures, a Fund may lose the benefit of upswings and may limit its ability to meet, or fail to achieve, its investment objective.

Strategy and Risk Table

The following table lists each Fund and identifies whether the strategies and risks discussed in this section (listed in alphabetical order and not in order of significance) are principal for a Fund. The SAI contains additional information about investment strategies and their related risks.

| | | | | | | | |

INVESTMENT STRATEGIES AND RISKS | HIGH INCOME | HIGH YIELD |

| Bank Loans (also known as Senior Floating Rate Interests) | X | X |

| Fixed-Income Securities | X | X |

| Foreign Securities | X | X |

| High Yield Securities | X | X |

| Portfolio Duration | X | X |

| Redemption and Large Transaction Risk | X | X |

Bank Loans (also known as Senior Floating Rate Interests)

Bank loans typically hold the most senior position in the capital structure of a business entity (the “Borrower”), are secured by specific collateral, and have a claim on the Borrower’s assets and/or stock that is senior to that held by the Borrower’s unsecured subordinated debtholders and stockholders. The proceeds of bank loans primarily are used to finance leveraged buyouts, recapitalizations, mergers, acquisitions, stock repurchases, dividends, and, to a lesser extent, to finance internal growth and for other corporate purposes. Bank loans are typically structured and administered by a financial institution that acts as the agent of the lenders participating in the bank loan. The Funds may purchase bank loans that are rated below-investment-grade (sometimes called “junk”) or will be comparable if unrated, which means they are more likely to default than investment-grade loans. A default could lead to non-payment of income, which would result in a reduction of income to the fund, and there can be no assurance that the liquidation of any collateral would satisfy the Borrower’s obligation in the event of non-payment of scheduled interest or principal payments, or that such collateral could be readily liquidated. Most bank loans are not traded on any national securities exchange. Bank loans generally have less liquidity than investment-grade bonds, and there may be less public information available about them. Bank loan interests may not be considered “securities,” and purchasers, therefore, may not be entitled to rely on the anti-fraud protections of the federal securities laws.

The primary and secondary market for bank loans may be subject to irregular trading activity, wide bid/ask spreads, and extended trade settlement periods, which may cause a fund to be unable to realize full value and, thus, cause a material decline in a fund’s net asset value. Because transactions in bank loans may be subject to extended settlement periods, a fund may not receive proceeds from the sale of a bank loan for a period of time after the sale. As a result, sale proceeds may not be available to make additional investments or to meet a fund’s redemption obligations for a period of time after the sale of the bank loans, which could lead to a fund having to sell other investments, borrow to meet obligations, or borrow to remain fully invested while awaiting settlement.

Bank loans pay interest at rates that are periodically reset by reference to a base lending rate plus a spread. These base lending rates are generally the prime rate offered by a designated U.S. bank, the Secured Overnight Financing Rate ("SOFR"), or the prime rate offered by one or more major U.S. banks.

Bank loans generally are subject to mandatory and/or optional prepayment. Because of these prepayment conditions and because there may be significant economic incentives for the borrower to repay, prepayments may occur.

Fixed-Income Securities