Exhibit 99.2

IN THE UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF INDIANA

INDIANAPOLIS DIVISION

In re: | ) | Chapter 11 |

| ) | |

ATA Holdings Corp., et al.,(1) | ) | Case No. 04-19866 |

| ) | (Jointly Administered) |

Debtors. | ) | |

DISCLOSURE STATEMENT WITH RESPECT TO FIRST

AMENDED JOINT CHAPTER 11 PLAN FOR REORGANIZING DEBTORS(2)

James M. Carr (#3128-49) | |

Terry E. Hall (#22041-49) | |

Stephen A. Claffey (#3233-98) | |

Jeffrey C. Nelson (#25173-49) | |

BAKER & DANIELS LLP | |

300 North Meridian Street, Suite 2700 | |

Indianapolis, Indiana 46204 | Hearing Date: |

Telephone: (317) 237-0300 | December 12, 2005 |

Facsimile: (317) 237-1000 | 1:30 P.M. (EST), New Albany, IN |

| |

Jerald I. Ancel (#2390-49) | Objection Deadline: |

Michael O’Neil (#21478-49) | December 5, 2005 at 4:00 P.M. (EST) |

Jeffrey J. Graham (#20899-49) | |

| |

SOMMER BARNARD ATTORNEYS PC | |

1 Indiana Square, Suite 3500 | |

Indianapolis, Indiana 46204 | |

Telephone: 317-713-3500 | |

Facsimile: 317-713-3699 | |

| |

Wendy W. Ponader (#14633-49) | |

PONADER & ASSOCIATES, LLP | |

5241 North Meridian Street | |

Indianapolis, Indiana 46208 | |

Telephone: (317) 496-3072 | |

Facsimile: (317) 257-5776 | |

| |

Attorneys for Debtors | |

Dated: December 14, 2005 | |

(1) The Debtors are the following entities: ATA Holdings Corp. (04-19866), ATA Airlines, Inc. (04-19868), Ambassadair Travel Club, Inc. (04-19869), ATA Leisure Corp. (04-19870), Amber Travel, Inc. (04-19871), American Trans Air Execujet, Inc. (04-19872), ATA Cargo, Inc. (04-19873), and C8 Airlines, Inc. f/k/a Chicago Express Airlines, Inc. (04-19874).

(2) The Reorganizing Debtors are ATA Holdings Corp. (04-19866), ATA Airlines, Inc. (04-19868); ATA Leisure Corp. (04-19870), ATA Cargo, Inc. (04-19873), and American Trans Air Execujet, Inc. (04-19872).

THIS DISCLOSURE STATEMENT (HEREINAFTER, THE “DISCLOSURE STATEMENT”) CONTAINS SUMMARIES OF CERTAIN PROVISIONS OF THE FIRST AMENDED JOINT CHAPTER 11 PLAN FOR REORGANIZING DEBTORS (THE “PLAN”) AND CERTAIN OTHER DOCUMENTS AND FINANCIAL INFORMATION. THE INFORMATION INCLUDED HEREIN IS FOR PURPOSES OF SOLICITING ACCEPTANCE OF THE PLAN AND THE SALE AND PURCHASE OF CERTAIN SECURITIES OFFERED, ISSUED, SOLD AND PURCHASED PURSUANT TO THE PLAN AND THE RIGHTS OFFERING CONTAINED THEREIN AND SHOULD NOT BE RELIED UPON FOR ANY OTHER PURPOSE. THE REORGANIZING DEBTORS BELIEVE THAT THESE SUMMARIES ARE FAIR AND ACCURATE. THE SUMMARIES OF THE PLAN, FINANCIAL INFORMATION AND DOCUMENTS ARE QUALIFIED IN THEIR ENTIRETY BY REFERENCE TO SUCH PLAN INFORMATION AND DOCUMENTS. IN THE EVENT OF ANY INCONSISTENCY OR DISCREPANCY BETWEEN A DESCRIPTION IN THIS DISCLOSURE STATEMENT AND THE TERMS AND PROVISIONS OF THE PLAN OR OTHER DOCUMENTS OR FINANCIAL INFORMATION, THE PLAN, SUCH OTHER DOCUMENTS OR SUCH FINANCIAL INFORMATION, AS THE CASE MAY BE, SHALL GOVERN FOR ALL PURPOSES.

THE STATEMENTS AND FINANCIAL INFORMATION CONTAINED HEREIN HAVE BEEN MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. HOLDERS OF CLAIMS AND INTERESTS REVIEWING THIS DISCLOSURE STATEMENT SHOULD NOT INFER AT THE TIME OF SUCH REVIEW THAT THERE HAVE BEEN NO CHANGES IN THE FACTS OR CIRCUMSTANCES SET FORTH HEREIN SINCE THE DATE HEREOF. EACH HOLDER OF A CLAIM OR INTEREST ENTITLED TO VOTE ON THE PLAN SHOULD CAREFULLY REVIEW THE PLAN, THIS DISCLOSURE STATEMENT, AND THE PLAN EXHIBITS IN THEIR ENTIRETY BEFORE CASTING A BALLOT. THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE. ANY PERSON DESIRING ANY SUCH ADVICE OR OTHER ADVICE SHOULD CONSULT WITH ITS, HIS, OR HER OWN ADVISORS.

NO PARTY IS AUTHORIZED TO PROVIDE ANY INFORMATION WITH RESPECT TO THE PLAN OTHER THAN THAT WHICH IS CONTAINED IN THIS DISCLOSURE STATEMENT. NO REPRESENTATIONS CONCERNING THE REORGANIZING DEBTORS OR THE VALUE OF THEIR PROPERTY HAVE BEEN AUTHORIZED BY THE REORGANIZING DEBTORS OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT. ANY INFORMATION, REPRESENTATIONS, OR INDUCEMENTS MADE TO OBTAIN AN ACCEPTANCE OF THE PLAN THAT ARE OTHER THAN, OR INCONSISTENT WITH, THE INFORMATION CONTAINED HEREIN AND IN THE PLAN SHOULD NOT BE RELIED UPON BY ANY HOLDER OF A CLAIM OR INTEREST.

WITH RESPECT TO CONTESTED MATTERS, ADVERSARY PROCEEDINGS, AND OTHER PENDING, THREATENED OR POTENTIAL LITIGATION OR ACTIONS, THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE AND MAY NOT BE CONSTRUED AS AN ADMISSION OF FACT, LIABILITY, STIPULATION OR

WAIVER, BUT RATHER AS A STATEMENT MADE IN CONNECTION WITH SETTLEMENT NEGOTIATIONS.

THE SECURITIES DESCRIBED HEREIN WILL BE ISSUED WITHOUT REGISTRATION UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, OR ANY SIMILAR FEDERAL, STATE OR LOCAL LAW, GENERALLY IN RELIANCE ON THE EXEMPTIONS SET FORTH IN SECTION 1145 OF THE BANKRUPTCY CODE AND SECTION 4(2) OF THE SECURITIES ACT.

THIS DISCLOSURE STATEMENT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), NOR HAS THE SEC PASSED UPON THE ACCURACY OR ADEQUACY OF THE STATEMENTS CONTAINED HEREIN.

ALTHOUGH THE REORGANIZING DEBTORS HAVE USED THEIR BEST EFFORTS TO ENSURE THE ACCURACY OF THE FINANCIAL INFORMATION PROVIDED IN THIS DISCLOSURE STATEMENT, THE FINANCIAL INFORMATION CONTAINED IN, OR INCORPORATED BY REFERENCE INTO, THIS DISCLOSURE STATEMENT HAS NOT BEEN AUDITED, EXCEPT FOR CERTAIN FINANCIAL STATEMENTS FILED WITH THE SEC.

THE FINANCIAL PROJECTIONS PROVIDED IN THIS DISCLOSURE STATEMENT HAVE BEEN PREPARED BY THE MANAGEMENT OF THE REORGANIZING DEBTORS AND THEIR ADVISORS. THESE PROJECTIONS, WHILE PRESENTED WITH NUMERICAL SPECIFICITY, ARE NECESSARILY BASED ON A VARIETY OF ESTIMATES AND ASSUMPTIONS WHICH, THOUGH CONSIDERED REASONABLE BY MANAGEMENT, MAY NOT BE REALIZED AND ARE INHERENTLY SUBJECT TO SIGNIFICANT BUSINESS, ECONOMIC, COMPETITIVE, INDUSTRY, REGULATORY, MARKET AND FINANCIAL UNCERTAINTIES, AND CONTINGENCIES, MANY OF WHICH ARE BEYOND THE REORGANIZING DEBTORS’ CONTROL. THE REORGANIZING DEBTORS CAUTION THAT NO REPRESENTATIONS CAN BE MADE AS TO THE ACCURACY OF THESE PROJECTIONS OR TO THE LIKELIHOOD THAT THE REORGANIZED COMPANIES ACHIEVE THE PROJECTED RESULTS. SOME ASSUMPTIONS INEVITABLY WILL NOT MATERIALIZE. FURTHER, EVENTS AND CIRCUMSTANCES OCCURRING SUBSEQUENT TO THE DATE ON WHICH THESE PROJECTIONS WERE PREPARED MAY BE DIFFERENT FROM THOSE ASSUMED OR, ALTERNATIVELY, MAY HAVE BEEN UNANTICIPATED, AND THUS THE OCCURRENCE OF THESE EVENTS MAY AFFECT FINANCIAL RESULTS IN A MATERIALLY ADVERSE OR MATERIALLY BENEFICIAL MANNER. THE PROJECTIONS, THEREFORE, MAY NOT BE RELIED UPON AS A GUARANTY OR OTHER ASSURANCE OF THE ACTUAL RESULTS THAT WILL OCCUR.

SEE SECTION XI OF THIS DISCLOSURE STATEMENT, ENTITLED “CONSIDERATIONS AND RISK FACTORS” FOR A DISCUSSION OF CERTAIN CONSIDERATIONS AND RISKS IN CONNECTION WITH A DECISION BY A HOLDER OF AN IMPAIRED CLAIM OR IMPAIRED INTEREST TO ACCEPT THE PLAN OR INVEST IN THE SECURITIES.

THE BANKRUPTCY COURT HAS SCHEDULED THE CONFIRMATION HEARING TO BEGIN ON JANUARY 30, 2006 AT 10:00 A.M./ EST BEFORE THE HONORABLE BASIL H. LORCH, III, UNITED STATES BANKRUPTCY JUDGE, IN THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF INDIANA, INDIANAPOLIS DIVISION, LOCATED AT 46 EAST OHIO STREET, INDIANAPOLIS, INDIANA 46204. THE CONFIRMATION HEARING MAY BE ADJOURNED FROM TIME TO TIME BY THE ANNOUNCEMENT OF THE ADJOURNED DATE MADE AT THE CONFIRMATION HEARING OR ANY ADJOURNMENT THEREOF.

OBJECTIONS TO CONFIRMATION OF THE PLAN MUST BE FILED AND SERVED ON OR BEFORE 4:00 P.M. EST, JANUARY 23, 2006, IN ACCORDANCE WITH THE SOLICITATION NOTICE FILED AND SERVED ON CREDITORS, EQUITY INTEREST HOLDERS, AND OTHER PARTIES IN INTEREST. UNLESS OBJECTIONS TO CONFIRMATION ARE TIMELY SERVED AND FILED IN COMPLIANCE WITH THE SOLICITATION NOTICE, THEY WILL NOT BE CONSIDERED BY THE BANKRUPTCY COURT.

PLEASE NOTE THAT THE OFFICIAL COMMITTEE OF UNSECURED CREDITORS (THE “CREDITORS’ COMMITTEE”), BY A LETTER DATED DECEMBER 12, 2005 AND INCLUDED WITH THIS DISCLOSURE STATEMENT, URGES ALL UNSECURED CREDITORS OF THE REORGANIZING DEBTORS TO VOTE TO ACCEPT (IN FAVOR OF) THE PLAN.

TABLE OF CONTENTS

TABLE OF CONTENTS | i |

EXHIBITS | | xiii |

| I. | EXECUTIVE SUMMARY OF THE PLAN | 1 |

| | A. | Purpose of the Plan and Recommendations of Reorganizing Debtors and the Creditors’ Committee To Vote To Accept the Plan | 2 |

| | B. | Reorganizing Debtors’ Principal Assets and Indebtedness | 3 |

| | C. | Structure of the Plan | 3 |

| | D. | Claims | 4 |

| | E. | Executory Contracts and Unexpired Leases | 7 |

| | F. | New Equity Investment in Reorganized Companies | 8 |

| | G. | Reorganized Companies | 9 |

| | H. | Release and Discharge | 10 |

| II. | GENERAL INFORMATION | 10 |

| | A. | Definitions and Clarifications | 10 |

| | B. | Purpose and Disclaimer | 11 |

| | C. | Notice To Holders Of Claims And Interests | 11 |

| III. | PLAN VOTING INSTRUCTIONS AND PROCEDURES | 13 |

| | A. | Record Date | 13 |

| | B. | Solicitation Package | 13 |

| | C. | General Voting Procedures, Ballots, and Voting Deadlines | 14 |

| | D. | Questions about Voting Procedures | 15 |

| | E. | Confirmation Hearing and Deadline for Objections to Confirmation | 15 |

| | F. | Holders of Claims and Equity Interests Entitled To Vote | 18 |

| | G. | Treatment of Certain Unliquidated, Contingent, or Disputed Claims for Voting | 19 |

| | H. | Vote Required for Acceptance by a Class | 20 |

| | I. | Confirmation of Plan Over Rejection by an Impaired Class (“Cram-Down”) | 20 |

| IV. | DESCRIPTION OF THE REORGANIZING DEBTORS | 22 |

| | A. | Introduction | 22 |

| | B. | History | 23 |

| | C. | Corporate Structure | 24 |

| | D. | Existing Capital Structure Of The Reorganizing Debtors | 24 |

| | E. | Operations | 28 |

| | F. | Employees | 30 |

| | G. | Fleet and Ground Properties | 31 |

| | H. | Management | 33 |

| V. | THE CHAPTER 11 CASES | 36 |

| | A. | Events and Circumstances Leading To Commencement Of The Chapter 11 Cases | 36 |

| | B. | Need for Restructuring and Chapter 11 Relief | 37 |

| | C. | Business Stabilization | 38 |

| | D. | Retention of Professionals | 42 |

| | E. | DIP Financing and Exit Financing | 43 |

| | F. | Restructuring the Fleet | 45 |

| | G. | Midway Asset Transactions | 49 |

| | H. | The Sale of Assets of Subsidiaries | 54 |

| | I. | Codeshare Agreement | 57 |

| | J. | Labor Issues | 58 |

| | K. | Claims | 59 |

| | L. | Executory Contracts and Unexpired Leases | 60 |

| | M. | Plan Exclusivity | 60 |

| | N. | Retained Actions and Avoidance Actions | 61 |

| | O. | Litigation | 61 |

| VI. | COMMITMENT FOR NEW INVESTOR CAPITAL INVESTMENT AND INTER-RELATED TRANSACTIONS | 61 |

| VII. | NEW BUSINESS PLAN AND FINANCIAL PROJECTIONS | 64 |

| VIII. | SUMMARY OF THE PLAN | 76 |

| | A. | Overview of Chapter 11 | 76 |

| | B. | Overall Structure Of The Plan | 77 |

| | C. | Substantive Consolidation | 77 |

| | D. | Claims | 83 |

| | E. | New Capital and the Rights Offering | 88 |

| | F. | Reorganized Companies | 88 |

| | G. | Unexpired Leases and Executory Contracts | 89 |

| | H. | Distributions | 90 |

| | I. | Procedures for Treating and Resolving Disputed and Contingent Claims | 90 |

| | J. | Release by the Debtors of Certain Parties | 91 |

| | K. | Preservation of Causes of Action | 93 |

�� | IX. | THE RIGHTS OFFERING | 93 |

| X. | SECURITIES LAWS MATTERS | 97 |

| XI. | CONSIDERATIONS AND RISK FACTORS | 101 |

| | A. | General Considerations | 101 |

| | B. | Certain Bankruptcy Considerations | 102 |

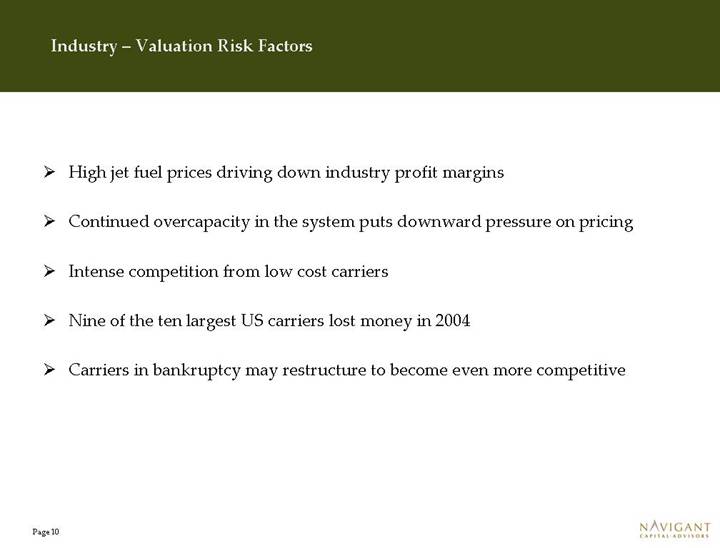

| | C. | Risks Associated with the Airline Industry | 104 |

| | D. | Risks Relating to the Reorganizing Debtors’ Business | 107 |

| | E. | Risks Relating to the Securities to be Issued in the Plan | 117 |

| XII. | CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 121 |

| XIII. | FEASIBILITY OF THE PLAN AND BEST INTERESTS TEST | 128 |

| | A. | Feasibility of the Plan and Financial Projections | 128 |

| | B. | Acceptance of the Plan | 129 |

| | C. | Best Interests Test | 129 |

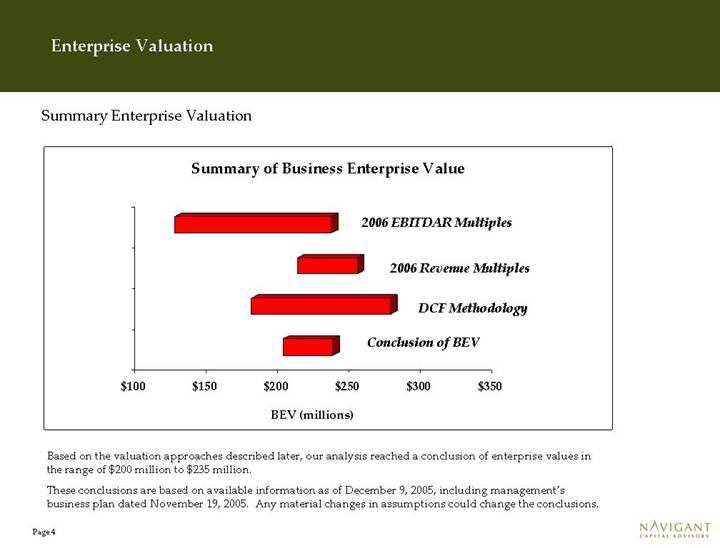

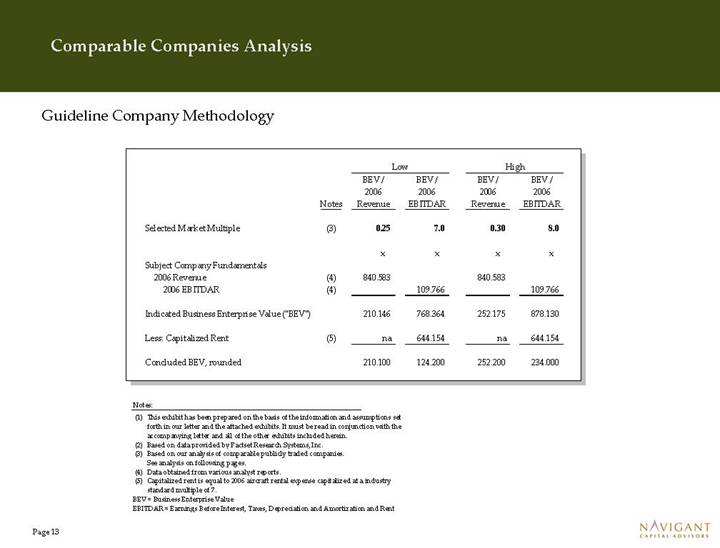

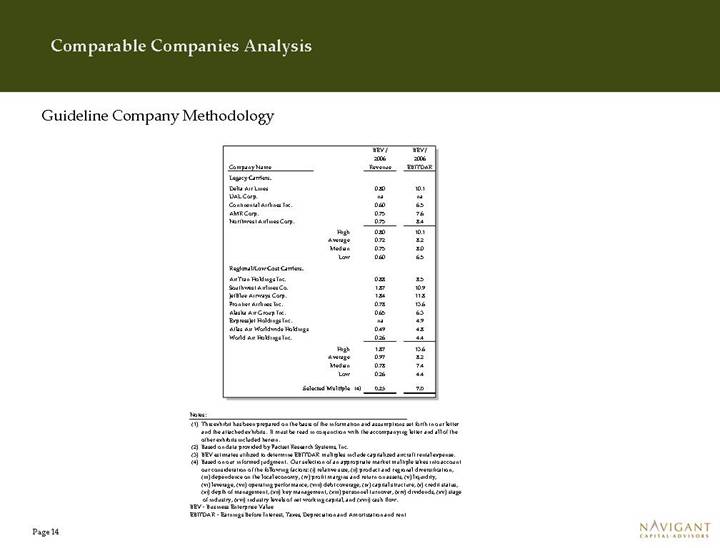

| | D. | Estimated Valuation of the Reorganized Companies | 130 |

| | E. | Application of the Best Interests Test to the Liquidation Analysis and the Valuation of the Reorganized Companies | 130 |

| | F. | Confirmation Without Acceptance of Impaired Class; The “Cramdown” Alternative | 131 |

| | G. | Conditions to Confirmation and/or Consummation of the Plan | 132 |

ii

| | H. | Waiver of Conditions to Confirmation or Consummation of the Plan | 134 |

| | I. | Retention of Jurisdiction | 134 |

| XIV. | ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN | 136 |

| | A. | Chapter 7 or Chapter 11 Liquidation | 136 |

| | B. | Alternative Plans | 137 |

| XV. | RECOMMENDATION | 137 |

| XVI. | CONCLUSION | 137 |

iii

EXHIBITS

1. Amended Joint Chapter 11 Plan for the Reorganizing Debtors(3)

2. Pro Forma Financial Projections

3. Valuation of Reorganized Companies

4. Liquidation Analysis

5. ATSB Secured Claim Term Sheet

6. New Investor Exit Facility Term Sheet

7. Warrant Agreement Term Sheet

(3) Pursuant to the Solicitation Procedures Order, entered December 14, 2005, Exhibits to the Plan will be filed on or before January 9, 2006.

iv

I. EXECUTIVE SUMMARY OF THE PLAN

The following summary is qualified in its entirety by the more detailed information contained in the Plan and elsewhere in this Disclosure Statement. All capitalized terms not defined herein have the meanings given them in the Plan attached as Exhibit 1.

ATA Holdings Corp. (“Holdings”) is a holding company whose principal, wholly-owned subsidiary is ATA Airlines, Inc. (“ATA”). ATA’s operations consist primarily of the “scheduled service” transportation of persons to many locations in the United States and abroad and the provision of military charter service for the United States military. ATA’s operations account for most of Holdings revenues and expenses.

On October 26, 2004 (the “Petition Date”), Holdings, ATA, and six other direct wholly-owned subsidiaries of Holdings (collectively, the “Debtors”) filed voluntary petitions for relief under chapter 11 of the United States Bankruptcy Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of Indiana, Indianapolis Division (the “Bankruptcy Court”). The Plan is proposed by five of the Debtors (Holdings, ATA, ATA Leisure Corp. (“Leisure”), American Trans Air Execujet, Inc. (“Execujet”), and ATA Cargo, Inc. (“Cargo”), which five are collectively referred to herein as the “Reorganizing Debtors”). On or after the Effective Date, the Reorganizing Debtors (other than Holdings) are referred to collectively with their new parent companies as the “Reorganized Companies” and each individually as a “Reorganized Company”. Holdings will not be a part of the Reorganized Companies and, from and after the Effective Date, is referred to herein as “Reorganized Holdings.” The assets of the other three Debtors (Ambassadair Travel Club, Inc. (“Ambassadair”), Amber Travel, Inc. (“Amber”), and C8 Airlines Inc., formerly named Chicago Express Airlines, Inc. (“C8”), and collectively referred to as the “Liquidating Debtors”) are or will be sold or otherwise liquidated. The proceeds from the liquidation of the assets of the Liquidating Debtors and the distribution of the liquidation proceeds will be made to post-Petition Date (and perhaps pre-Petition Date) creditors pursuant to one or more additional chapter 11 plans or through a conversion of one or more of the chapter 11 cases for the Liquidating Debtors to one or more cases under chapter 7 of the Bankruptcy Code.

The Plan contemplates the substantive consolidation of the Estates of Holdings, Cargo, Execujet and Leisure into the Estate of ATA for purposes related to the Plan, including voting, confirmation, and distribution. However, except as expressly provided with respect to and following the pre-Effective Date merger of Cargo and Leisure into ATA, each of the Reorganizing Debtors, each of the Reorganized Companies and Reorganized Holdings will remain at all times an entity separate from the others. The Plan does not affect Claims against or Interests in or the assets of the Liquidating Debtors, including Administrative Claims and other Claims of Reorganizing Debtors against the Liquidating Debtors. The Claims of the Liquidating Debtors are scheduled as subject to set off.

This Disclosure Statement is being furnished by the Reorganizing Debtors as proponents of the First Amended Joint Chapter 11 Plan For Reorganizing Debtors (as may be amended from time to time, the “Plan”, a copy of which is attached to this Disclosure Statement as Exhibit 1), pursuant to Section 1125 of the Bankruptcy Code and in connection with the

solicitation of votes for the acceptance or rejection of the Plan and the sale of securities in connection with the Rights Offering. MatlinPatterson Global Advisors LLC, a Delaware limited liability company (“MatlinPatterson”) on behalf of the New Investor, is also a co-proponent of the Plan, as the term proponent is used in Section 1129 of the Bankruptcy Code. The Reorganizing Debtors and MatlinPatterson are referred to herein and in the Plan collectively as the “Plan Proponents.” MatlinPatterson is an affiliate of the New Investor and New DIP Lender. MatlinPatterson, the New Investor, and New DIP Lender are more fully described in Section VI of this Disclosure Statement.

This Disclosure Statement describes certain aspects of the Plan, including the treatment of holders of Claims against, and Interests in, the Reorganizing Debtors, and also describes certain aspects of the Reorganizing Debtors’ operations, projections and other related matters.

A. Purpose of the Plan and Recommendations of Reorganizing Debtors and the Creditors’ Committee To Vote To Accept the Plan

Based upon the New DIP Facility, the New Investor Equity, and the New Investor Exit Facility, to which the New Investor and New DIP Lender(s) have committed under certain terms and conditions to provide, and after careful review of the current business operations of the Reorganizing Debtors, their prospects as ongoing business enterprises, and the estimated recoveries of creditors in various liquidation scenarios, the Reorganizing Debtors have concluded that the recovery by holders of Allowed Claims will be maximized by the continued operation of the businesses of the Affiliate Debtors pursuant to a “New Business Plan” described in Section VII of this Disclosure Statement. The Reorganizing Debtors (other than Holdings) believe that their businesses and assets have significant value that would not be realized in a liquidation scenario. According to the liquidation analysis described herein (the “Liquidation Analysis”) attached hereto as Exhibit 4, the Valuation of Reorganized Companies attached hereto as Exhibit 3, and the other analyses of the Reorganizing Debtors, the value of the Reorganizing Debtors’ Estates is considerably greater as a going concern than on a liquidation basis.

Accordingly, the Reorganizing Debtors believe that the Plan provides the best recoveries possible for the holders of Allowed Claims and strongly recommend that, if you are entitled to vote, you vote to accept the Plan. The Reorganizing Debtors believe that any alternative to Confirmation of the Plan, such as liquidation or attempts by another party in interest to file a plan of reorganization, could result in significant delays, litigation, and additional costs. For more information, see the Liquidation Analysis in Exhibit 4 to this Disclosure Statement.

The Creditors’ Committee also recommends that unsecured creditors vote to accept (in favor of) the Plan. Included with this Disclosure Statement is a letter dated December 12, 2005 from the Creditors’ Committee (the “Creditors’ Committee Recommendation Letter”) setting forth its recommendation which contains the following:

2

. . . , the Creditors’ Committee believes that the Plan embodies a favorable result for the unsecured creditors of the Reorganizing Debtors under the circumstances of the Debtors’ bankruptcy cases. Accordingly, the Creditors’ Committee urges each unsecured creditor to complete and return a ballot voting in favor of the Plan. In addition, the Creditors’ Committee suggests that due consideration be given to participating in the rights offering since Compass believes that the value of the new common stock of the Reorganizing Debtors may be higher than the Debtors’ valuation.

B. Reorganizing Debtors’ Principal Assets and Indebtedness

Holdings’ principal asset is the stock of ATA and the other Reorganizing Debtor-subsidiaries. Most of the going concern value for the Reorganizing Debtors resides in ATA. The Plan provides for the substantive consolidation of the Estates of Holdings, Leisure, Execujet, and Cargo into ATA for all purposes under the Plan (including voting). The principal prepetition Claims against the Reorganizing Debtors consist of the obligations of one or more of the Reorganizing Debtors (1) to the ATSB Lenders (approximately $140.6 million), (2) on Old Holdings Unsecured Notes (approximately $300 million), (3) under a settlement between ATA and ALPA, the union representing ATA’s pilots ($129 million), and (4) with respect to ATA’s rejection of leases of aircraft (estimated to be approximately $618 million).

On the Effective Date, the prepetition secured debt of the Reorganizing Debtors to the ATSB Lenders will be termed out as provided in the Amended and Restated ATSB Loan Documents and all prepetition equity in Holdings will be canceled. The Southwest DIP Facility Claim will be paid in full in cash (except for a letter of credit issued for the account of ATA to the City of Chicago, referred to as the Chicago LOC, which shall be secured) and the New DIP Facility Claim will be exchanged for DIP New Shares, which are shares of common stock of New Holding Company, the ultimate parent of Reorganized ATA. On the Effective Date, the Reorganized Companies will be owned, directly or indirectly, by the New Investor and holders of Allowed Class 6 Claims (including such holders who are Qualified Holders and participate in the Rights Offering), subject to dilution for New Shares issued pursuant to the Original Warrants, the Additional Warrants, if issued, the ALPA Stock Option Plan and the Management Stock Option Plan.

C. Structure of the Plan

The Plan is formulated based upon the substantive consolidation of the Estates of Holdings, Cargo, Execujet and Leisure into the Estate of ATA for purposes of voting, confirmation, and distribution. Unless substantive consolidation has been approved by a prior order of the Bankruptcy Court, the Plan shall serve as a motion by the Reorganizing Debtors seeking entry of an Order of the Bankruptcy Court substantively consolidating the Estates of the Reorganizing Debtors.

3

1. Multiple Claims

Under substantive consolidation, multiple Claims asserted against more than one Reorganizing Debtor arising out of the same primary obligation, facts, or circumstances (“Multiple Claims) (for example, a primary obligation of one Reorganizing Debtor with one or more guarantees or co-obligations by one or more of the other Reorganizing Debtors) will be for purposes of voting (both number and amount), distribution, and the Rights Offering, an Allowed Claim (if Allowed) in the largest amount of any of the otherwise Allowable Multiple Claims. See Article 1.147 of the Plan and the “Multiple Claims Rule.”

2. Claims Aggregation

For purposes of determining whether an Allowed General Unsecured Claim qualifies for treatment as an Unsecured Convenience Class Claim, all General Unsecured Claims (after application of the Multiple Claims Rule) held by a single holder and all of its Affiliates (as “Affiliate” is defined in section 101(2) of the Bankruptcy Code) will be aggregated. If the total amount of all such aggregated General Unsecured Claims is greater than $1 million (unless greater than $1 million but not more than $2 million and the holder makes an election to participate in the Unsecured Convenience Class) then each of the aggregated General Unsecured Claims of the holder and its Affiliates will be treated as Class 6 Claims.

D. Claims

1. Administrative Claims

Holders of Allowed Administrative Claims that are liquidated (other than Claims for Professional Fees and Administrative Claims with respect to the New DIP Facility Claim and the Southwest DIP Facility Claim) shall be paid on the first Periodic Distribution Date after such Administrative Claim becomes an Allowed Administrative Claim or as otherwise agreed, Cash equal to the Allowed Claim or as otherwise agreed between the holder of the Allowed Administrative Claim and the Reorganizing Debtors.

Creditors providing service and/or goods in the ordinary course to the Reorganizing Debtors shall be paid for such ordinary course services and/or goods in the ordinary course by the Reorganizing Debtors or the Reorganized Companies.

2. Priority Tax Claims

Priority Tax Claims will be paid in full in Cash or over time as allowed under the Bankruptcy Code or as otherwise agreed.

3. Southwest DIP Facility Claim

On the Effective Date, Southwest will receive Cash and satisfactory protection of Southwest with respect to any draw against the $7 million Chicago LOC, as defined in Section V.E.2, in full satisfaction and release of the Southwest DIP Facility Claim. However, please see Section V.E.2 regarding the continuing obligation of Southwest with respect to its

4

guaranty of ATA’s Obligations under the Loan Agreement for Funding ATA Expansion Gate, dated March 17, 2003 (the “Expansion Gate Loan Agreement”), and the ongoing effectiveness of the Chicago LOC.

4. New DIP Facility Claim

On the Effective Date, the New DIP Lender will receive, in full satisfaction and release of the New DIP Facility Claim, DIP New Shares.

5. Classified Claims

The Plan divides all Claims against and Interests in the substantively consolidated Estates into nine classes. With the exception of the Classes established for prepetition equity Interests, which are deemed to have rejected the Plan pursuant to Section 1126(g) of the Bankruptcy Code, and Class 5 “Other Priority Claims” and Claims that are Reinstated in Class 4, which are deemed to have accepted the Plan pursuant to Section 1124 of the Bankruptcy Code, all Classes of Claims are entitled to vote on the Plan.

5

Class | | Claim | | Plan Treatment of Claim | | Projected

Recovery | | Status | | Voting

Rights |

1 | | ATSB Secured

Claim | | $4.5 million in Cash on December 31, 2005 and; delivery of Amended and Restated ATSB Loan Agreement and related documents | | 100% | | Impaired | | Entitled to vote |

2 | | Fleet Secured

Claim A | | New Fleet Note A | | 100% | | Impaired | | Entitled to vote |

3 | | Fleet Secured

Claim B | | New Fleet Note B | | 100% | | Impaired | | Entitled to vote |

4 | | Other Secured

Claims | | Reinstated; Collateral returned; or other treatment as agreed upon. | | 100% | | Impaired | | Entitled to vote(4) |

5 | | Other Priority

Claims | | Cash in full; or other treatment as agreed upon. | | 100% | | Unimpaired | | Deemed to accept |

6 | | General

Unsecured

Claims | | Pro Rata share of Unsecured Creditors New Shares, Original Warrants, Additional Warrants (if issued) and for Qualified Holders, the Subscription Rights | | 0.57 to 0.71%(5) | | Impaired | | Entitled to vote |

7 | | Unsecured

Convenience

Class Claims | | Pro Rata share of Convenience Class Distribution | | 1.0%(6) (not to exceed $1.5 million in total) | | Impaired | | Entitled to vote |

8 | | Old Holdings

Preferred Stock

Interests | | Not entitled to receive any distribution. | | 0% | | Impaired | | Deemed to reject |

9 | | Old Holdings

Common Stock

Interests | | Not entitled to receive any distribution. | | 0% | | Impaired | | Deemed to reject |

Holders of Allowed Class 6 Claims will receive on the applicable Distribution Dates a Pro Rata share of the Unsecured Creditors New Shares and a Pro Rata share of the

(4) Any Allowed Claim in Class 4 that is Reinstated is Unimpaired and is deemed to accept the Plan.

(5) The projected range of recovery for Claims in Class 6 is based in part upon (a) the mid-point in the Reorganizing Debtors’ range of enterprise valuation of the Reorganized Companies, see Section XIII.D and Exhibit 3, (b) an estimate that the total Allowed Class 6 Claims (after reduction of Claims participating in Class 7) total approximately $1.3 to $1.6 billion, and (c) attributing $700,000 value to the Original Warrants and Additional Warrants in calculating the low end of the recovery range and $1.4 million of value for such warrants on the high end. In addition, no dollar value is attributed to the subscription rights provided to Qualified Holders of Allowed Class 6 Claims to participate in the Rights Offering. The Creditors’ Committee’s financial advisors do not agree with the Reorganizing Debtors’ estimate of enterprise value presented in Exhibit 3 to the Disclosure Statement. The Creditors’ Committee’s financial advisors believe the enterprise value is substantially higher than that above. Neither estimate includes the value attributable to the Rights Offering.

(6) The percentage recovery for Class 7 Claims is based upon a Claim of $1,000,000 or less and not upon an Allowed Class 6 Claim that elects to reduce its Claim, as permitted by this Plan, to receive the Convenience Distribution. The projected recovery further assumes that the cap of $1.5 million in total disbursements is not reached.

6

Holders of Allowed Class 6 Claims will receive on the applicable Distribution Dates a Pro Rata share of the Unsecured Creditors New Shares and a Pro Rata share of the Original Warrants and, if issued, the Additional Warrants. The Additional Warrants will be issued if, but only if, all of the Rights Offering New Shares are subscribed for and purchased by Qualified Holders in the Rights Offering. Qualified Holders of Allowed Class 6 Claims will have an opportunity to exercise Subscription Rights to purchase Rights Offering New Shares. An Unsecured Convenience Class is proposed for the distribution of Cash in the amount of 1% of the allowed amounts of Unsecured Convenience Class Claims (held in an allowed amount of $1,000,000 or less) or in an amount of $10,000 (1% of $1,000,000) for each General Unsecured Claim allowed in an amount between $1,000,000 and $2,000,000 where the holder voluntarily elects to participate in the Unsecured Convenience Class and thereby reduces its Claim by an election on the Ballot or as otherwise agreed by the Reorganizing Debtors or Reorganized Companies to $1,000,000.

Recoveries by holders of Allowed Class 6 Claims are based on certain assumptions contained in the Valuation of Reorganized Companies attached as Exhibit 4 to this Disclosure Statement including an assumed reorganization value of the New Shares equal to $10.00 per share (“Per Share Value”). See footnote 5.

The New Holding Company does not intend to register the New Shares or any other class of equity securities under Section 12 of the Exchange Act unless and until it is required to do so. Registering the New Shares, or any other class of equity securities, under the Exchange Act would be required if and when the New Holding Company has a class of equity securities held by 500 or more holders of record at the end of any fiscal year. Accordingly, the earliest that the New Holding Company would be required to register the New Shares or any other class of equity securities under the Exchange Act would be within 120 days after December 31, 2006. Prior to any such registration, the New Holding Company will not be required to file any periodic reports under the Exchange Act and the New Shares will not be eligible for trading on any exchange or Nasdaq. See “Risk Factors and Other Considerations.”

The Reorganizing Debtors estimate that at the conclusion of the Claims objection, reconciliation, and resolution process (120 days after the Effective Date unless otherwise extended by Bankruptcy Court Order), Allowed Secured Claims against the Reorganizing Debtors will aggregate approximately $97 million, Allowed Priority Tax Claims and other Priority Claims will aggregate approximately $1.9 million, and Allowed General Unsecured Claims will aggregate approximately $1.3 to $1.6 billion. Allowed Unsecured Convenience Class Claims will aggregate approximately $60 million (as may be adjusted by the voluntary election of holders of General Unsecured Claims in amounts more than $1 million but not more than $2 million to reduce such Claims to the amount of $1 million to participate in the Unsecured Convenience Class).

Allowed Administrative Claims at the conclusion of the Claims objection, reconciliation and resolution process (including Claims associated with the Cure of assumed contracts and leases, reclamation rights, and 1110(b) stipulations, but not including ordinary course obligations or Professional Fees) are estimated to aggregate approximately $11.0 million.

7

E. Executory Contracts and Unexpired Leases

The Plan provides that all executory contracts and unexpired leases not already assumed or specifically listed on Exhibit H to the Plan (as may be supplemented or revised prior to the Confirmation Date) will be rejected as of the Confirmation Date. Exhibit G to the Plan contains a nonexclusive list of executory contracts and unexpired leases that will be rejected as of the Confirmation Date. The assumption of and Cures associated with the contracts and leases listed on Exhibit H to the Plan will be established as listed on Exhibit H on the Confirmation Date absent an objection to such Cure filed and served no later than the Plan Objection Deadline. The Plan Proponents reserve the right to withdraw the proposed assumption and to reject any contract or lease listed on Exhibit H to the Plan if a dispute as to any Cure is not resolved to the satisfaction of the Plan Proponents on or before the Confirmation Date. The Plan Proponents further reserve the right to amend or supplement Exhibit H and Exhibit G prior to the Confirmation Date.

F. New Equity Investment in Reorganized Companies

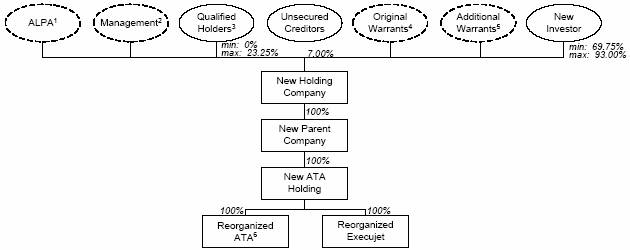

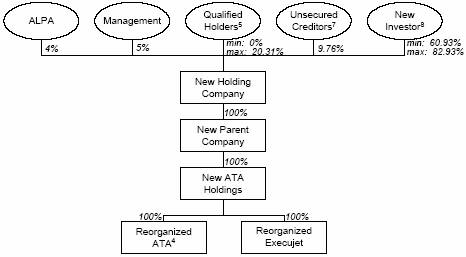

The Plan provides for the incorporation of a New Holding Company prior to the Effective Date, as the ultimate parent of Reorganized ATA and Reorganized Execujet and as the issuer of New Shares under the Plan. As a critical element, the Plan requires the equity investment of up to $100 million by the New Investor. The New Investor’s investment includes (i) the New DIP Facility which constitutes up to $30 million in debtor-in-possession financing which will be exchanged for DIP New Shares on the Effective Date and (ii) the New Investor New Shares which represent an investment of up to $70 million in the form of an equity investment and a standby purchase commitment for any Rights Offering New Shares not subscribed for in the Rights Offering. As a result of its investment in New Holding Company and dependent on the exercise of Subscription Rights by Qualified holders of Allowed Class 6 Claims, the New Investor will hold between 69.75% and 93.0% of the outstanding New Shares as of the Effective Date and between 60.93% and 82.93% on a “Fully Diluted Basis”.(7)

Qualified Holders may purchase, pursuant to Section IX hereof, Rights Offering New Shares representing 23.25% of the outstanding New Shares as of the Effective Date and 20.31% on a Fully Diluted Basis of the New Holding Company at the same Per Share Value as paid by the New Investor for its equity investment. Qualified Holders are Holders of Allowed Class 6 Claims that qualify as “accredited investors” as defined in Rule 501(a) of Regulation D promulgated under the Securities Act and who meet certain U.S. citizenship requirements.

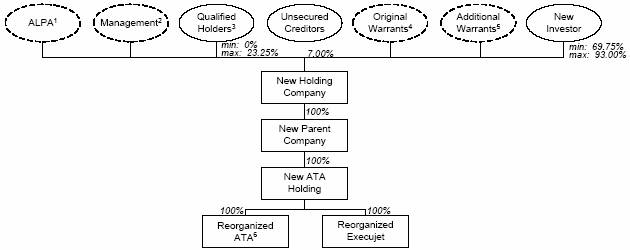

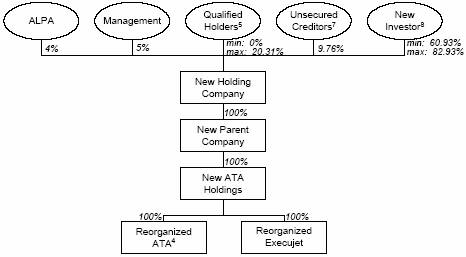

The ownership structure of the Reorganized Companies as of the Effective Date and on a fully diluted basis is as follows:

(7) “Fully Diluted Basis” means a percentage of the equity of the New Holding Company assuming that in addition to the Issued New Shares, all New Shares issuable pursuant to the Original Warrants, the Additional Warrants (if issued), the Management Stock Option Plan and the ALPA Stock Option Plan have also been issued.

8

Ownership Structure - Effective Date

Ownership Structure - Fully Diluted

(1) Represents options to purchase up to 482,291 shares if the Additional Warrants are not issued or 492,339 shares if the Additional Warrants are issued of New Holding Company common stock.

(2) Represents options to purchase up to 602,864 shares if the Additional Warrants are not issued or 615,424 shares if the Additional Warrants are issued of New Holding Company common stock.

(3) Certain holders of allowed Class 6 Claims will be entitled to subscribe for up to 2,500,000 shares of New Holding Company common stock in the Rights Offering.

(4) The Original Warrants entitle the Unsecured Creditors to purchase an aggregate of 219,443 shares of New Holding Company common stock at $10.00 per share.

(5) The Additional Warrants, if issued, will entitle the Unsecured Creditors to purchase an aggregate of 228,586 additional shares of New Holding Company common stock at $10.00 per share. The Additional Warrants will be issued to Unsecured Creditors only if all of the shares in the Rights Offering are subscribed for and purchased by Qualified Holders of allowed Class 6 Claims.

(6) ATA Cargo and ATA Leisure will be merged into ATA Airlines on or before the Effective Date.

(7) Includes the 752,688 shares of New Holding Company common stock issued to the Unsecured Creditors on the Effective Date and assumes the full exercise of the Original Warrants and the Additional Warrants. If the Additional Warrants are not issued, the fully diluted ownership interest of the Unsecured Creditors would be 8.06%.

(8) New Investor will be obligated to purchase any shares not subscribed for in the Rights Offering. In the event New Investor is required to purchase all of the shares subject to the Rights Offering, its ownership interest would be increased to 82.93%.

9

G. Reorganized Companies

Each of Reorganized Holdings, Reorganized Execujet, and Reorganized ATA (into which Leisure and Cargo are to be merged on or prior to the Effective Date) shall continue as separate entities with all the powers of a corporation under the laws of the state of incorporation without prejudice to any right to alter or terminate its existence. Except as otherwise provided in the Plan, on and after the Effective Date, all property of each Estate and any property acquired by the Reorganizing Debtors under the Plan shall vest in Reorganized Holdings, Reorganized Execujet, and Reorganized ATA, respectively, free and clear of all Liens, Claims, charges or other encumbrances. On and after the Effective Date, each of Reorganized Holdings, Reorganized Execujet, and Reorganized ATA may operate its business and may use, acquire, or dispose of property and compromise or settle any Claims or Interests without supervision or approval of the Bankruptcy Court and free of any restrictions of the Bankruptcy Code or Bankruptcy Rules other than those restrictions expressly imposed by the Plan and the Confirmation Order.

H. Release and Discharge

The Plan provides that from and after the Effective Date, all Persons are permanently enjoined from commencing or continuing in any manner, suit, action, or other proceeding, on account of or respecting any Claim, obligation, debt, right, Cause of Action, remedy, or liability discharged, exculpated, released, or to be released pursuant to Article XI of the Plan.

II. GENERAL INFORMATION

A. Definitions and Clarifications

Unless stated otherwise, terms which are defined in Article 1 of the Plan and are not otherwise defined in this Disclosure Statement shall have the meanings ascribed to them in Article I of the Plan.

Unless noted, all references to monetary figures refer to United States currency.

Internal portions of this Disclosure Statement are referred to as “Sections.” Exhibits to this Disclosure Statement are designated by Arabic numerals.

Internal portions of the Plan are referred to as “Articles”. Exhibits to the Plan are designated by letters of the Latin alphabet.

Indianapolis, Indiana is currently in the Eastern Standard Time Zone and does not observe Daylight Savings Time. Currently scheduled to begin April 1, 2006, Indianapolis, Indiana will observe Daylight Savings Time. All times referenced herein shall be the prevailing time in Indianapolis, Indiana, which is Eastern Standard Time (“EST”), unless otherwise noted.

10

B. Purpose and Disclaimer

The information contained in this Disclosure Statement may not be relied upon for any purpose other than to determine how to vote on the Plan and whether to subscribe for Rights Offering New Shares in the Rights Offering. No person is authorized to provide any information or make any representations, other than the information and representations contained in this Disclosure Statement, regarding the Plan or the solicitation of acceptances of the Plan or the Rights Offering.

All holders of Claims and Interests entitled to vote on the Plan are advised and encouraged to read this Disclosure Statement and the Plan in its entirety before voting to accept or reject the Plan. Summaries and statements made in this Disclosure Statement are qualified in their entirety by reference to the Plan and the Exhibits annexed to the Plan and to this Disclosure Statement. The statements contained in this Disclosure Statement are made only as of the date hereof, and there can be no assurance that the statements contained herein will continue to be accurate at any time after the date hereof. In the event of any conflict between any description set forth in this Disclosure Statement and the actual terms of the Plan, the terms of the Plan shall govern.

This Disclosure Statement has been prepared in accordance with Section 1125 of the United States Bankruptcy Code and rule 3016(b) of the Federal Rules of Bankruptcy Procedure and not necessarily in accordance with federal or state securities laws or other non-bankruptcy law. This Disclosure Statement has been neither approved nor disapproved by the SEC, nor has the SEC passed upon the accuracy or adequacy of the statements contained herein. Persons or entities trading in or otherwise purchasing, selling or transferring securities, interests in or claims of or against Holdings or any of its subsidiaries or affiliates should evaluate this Disclosure Statement and the Plan in light of the purpose for which each were prepared.

As to any contested matter, adversary proceeding, and other action or threatened action, this Disclosure Statement shall not constitute or be construed as an admission of any fact or liability, stipulation or waiver, but rather as a statement made in or as a part of settlement negotiations. This Disclosure Statement shall not be admissible as evidence in any non-bankruptcy action or proceeding nor shall it be construed to be conclusive advice on the tax, securities, or other legal effects of the Plan or as to holders of Claims against, or equity Interests in any of the Debtors.

Certain affiliates of Holdings did not commence chapter 11 cases or similar proceedings in other jurisdictions. These affiliates are not affected by the Chapter 11 Cases and continue to operate their businesses outside of bankruptcy.

C. Notice To Holders Of Claims And Interests

This Disclosure Statement is being transmitted to certain holders of Claims against and/or equity Interests in the Reorganizing Debtors for the purpose of soliciting votes on the Plan and to Qualified Holders for the Rights Offering and to others for informational purposes. The purpose of this Disclosure Statement is to provide adequate information to enable

11

the holder of a Claim against or an equity Interest in the Reorganizing Debtors to make a reasonably informed decision with respect to the Plan prior to exercising its right to vote to accept or reject the Plan or to participate in the Rights Offering.

PLEASE MAKE NOTE OF AND ATTEND TO THE FOLLOWING:

• By order entered December 14, 2005, the Bankruptcy Court approved this Disclosure Statement as containing information of a kind and in sufficient and adequate detail to enable such holders of Claims and equity Interests to make an informed judgment with respect to acceptance or rejection of the Plan and a decision on the Rights Offering.

• The Bankruptcy Court’s approval of this Disclosure Statement does not constitute either a guaranty of the accuracy or completeness of the information contained herein or an endorsement of the Plan by the Bankruptcy Court.

• Holders of Claims or equity Interests entitled to vote on the Plan are encouraged to read this Disclosure Statement and its Exhibits carefully and in their entirety before deciding to vote to either accept or reject the Plan. Holders of Claims and equity Interests are further encouraged to review the Plan and Exhibits in their entirety in conjunction with their review of this Disclosure Statement.

• No representations concerning the Reorganizing Debtors or the value of their assets have been authorized by the Bankruptcy Court other than as set forth in this Disclosure Statement.

• The Reorganizing Debtors are not responsible for any information, representation or inducement made to obtain your acceptance, which is other than, or inconsistent with, information contained herein and in the Plan.

• Certain of the information contained in this Disclosure Statement is by its nature forward looking and contains estimates, assumptions, and projections that may be materially different from actual future results.

• Except with respect to the Pro Forma Financial Projections (the “Projections”) set forth in Exhibit 2 annexed hereto and except as otherwise specifically and expressly stated herein, this Disclosure Statement does not reflect any events that may occur subsequent to the date hereof and that may have a material impact on the information contained in this Disclosure Statement. Neither the Reorganizing Debtors nor the Reorganized Companies intend to update the Projections for the purposes hereof; thus the Projections will not reflect

12

the impact of any subsequent events not already accounted for in the assumptions underlying the Projections. Further, the Reorganizing Debtors do not anticipate that any amendments or supplements to this Disclosure Statement will be distributed to reflect such occurrences. Accordingly, delivery of this Disclosure Statement shall not under any circumstances imply that the information herein is correct or complete as of any time subsequent to the date hereof.

• Except where specifically noted, the financial information contained in this Disclosure Statement and its Exhibits has not been audited by a certified public accounting firm and has not been prepared in accordance with generally accepted accounting principles.

• This Disclosure Statement contains summaries of certain provisions of the Plan, statutory provisions, documents relating to the Plan, events that have or are expected to occur in the Chapter 11 Cases, and certain financial information. Although the Reorganizing Debtors believe that the summaries of the Plan and the related documents and statutes are fair and accurate, such summaries are qualified to the extent that they do not set forth the entire text of such documents or statutory provisions. Factual information contained in this Disclosure Statement has been provided by the Reorganizing Debtors’ management, except where otherwise noted. The Reorganizing Debtors do not warrant or represent that the information contained herein, including the financial information, is without any material inaccuracy or omission.

III. PLAN VOTING INSTRUCTIONS AND PROCEDURES

A. Record Date

Pursuant to Bankruptcy Rule 3017(d) and the Solicitation Procedures Order, the record date for determining holders of Claims and equity Interests entitled to vote on the Plan is December 12, 2005 (the “Voting Record Date”).

B. Solicitation Package

Accompanying this Disclosure Statement are, among other things, copies of (1) the Plan (Exhibit 1); (2) the notice approved by the Solicitation Procedures Order (the “Solicitation Notice”) setting forth the time for submitting Ballots to accept or reject the Plan, the date, time, and place of the hearing to consider confirmation of the Plan (the “Confirmation Hearing”) and related matters, the treatment of unliquidated, disputed, and contingent claims, and the time for filing objections to confirmation of the Plan; (3) the Creditors Committee Recommendation Letter; (4) if you are entitled to vote on the Plan, one or more Ballots to be used by you in voting to accept or reject the Plan, and (5) if you hold a Claim recognized by the Reorganizing Debtors as an Allowed Class 6 Claim, the forms of Subscription Documents with respect to the Rights Offering.

13

C. General Voting Procedures, Ballots, and Voting Deadlines

On December 14, 2005, the Bankruptcy Court entered an order (the “Disclosure Statement Approval Order”), that among other things, approved this Disclosure Statement. On December 14, 2005, the Bankruptcy Court entered an order (the “Solicitation Procedures Order”) establishing objection and voting deadlines and voting procedures, approving Subscription Documents and establishing dates with respect to the Rights Offering, scheduling a Confirmation Hearing, approving the Solicitation Notice, and setting forth certain balloting procedures. A copy of the Disclosure Statement Approval Order, the Solicitation Procedures Order, and the Solicitation Notice are enclosed with this Disclosure Statement as part of the Solicitation Package. The Solicitation Procedures Order sets forth in detail, among other things, procedures governing voting deadlines and objection deadlines. The Solicitation Procedures Order, the Solicitation Notice, and the instructions attached to the Ballot should be read in connection with this Section of the Disclosure Statement.

After carefully reviewing the Plan, this Disclosure Statement, and (if you are entitled to vote) the detailed instructions accompanying your Ballot, indicate your acceptance or rejection of the Plan by voting in favor of or against the Plan by checking the appropriate box on the enclosed Ballot. Complete and sign your original Ballot (copies will not be accepted) and return it to the address indicated below. You must provide all the information requested on the Ballot. Failure to fully complete the Ballot may result in your Ballot being voided.

Holders of Claims arising out of public debt including leveraged aircraft leasing arrangements and/or securities (“Public Holders”) may receive Ballot instructions specific to the means of voting and the transmittal of votes or directions to vote that are designed to be consistent to their Claims as governed by the documents through which they hold. These Public Holders should read and follow the specific instructions accompanying their Ballots and complete and return their Ballots in the manner and to the addresses listed on the Ballots.

Each Ballot, except Master Ballots and Ballots sent to beneficial holders, has been coded to reflect the Class of Claims it represents and the amount of the Claim. To the extent you hold Claims classified in more than one Class, you should expect to receive one Ballot per Claim per Class of Claims held. Accordingly, in voting to accept or reject the Plan, you must use only the coded Ballot or Ballots sent to you with this Disclosure Statement. Your Ballot will be counted only as to the amount preprinted, unless you obtain an order from the Bankruptcy Court establishing another amount. IF YOU DISAGREE WITH THE AMOUNT PRINTED ON YOUR BALLOT, YOU SHOULD CONTACT THE VOTING AGENT, BMC GROUP, IMMEDIATELY AT 1-888-909-0100.

In order for your Ballot to be counted, your ballot must be properly completed as set forth above and in accordance with the voting instructions on the Ballot and must be ACTUALLY RECEIVED NO LATER THAN January 20, 2006 by 4:00 p.m. (EST) (the “Voting Deadline”) by the Voting Agent. The Voting Agent is BMC Group at the following address:

14

If by U.S. Mail:

BMC Group

Attention: ATA Voting Agent

PO Box 1035

El Segundo, CA 90245-1035

If by overnight courier or hand delivery:

BMC Group

Attn: ATA Voting Agent

1330 E. Franklin Avenue

El Segundo, CA 90245

BALLOTS RECEIVED AFTER THE VOTING DEADLINE WILL NOT BE COUNTED. BALLOTS SHOULD NOT BE DELIVERED DIRECTLY TO THE REORGANIZING DEBTORS, THE BANKRUPTCY COURT, THE CREDITORS’ COMMITTEE OR COUNSEL TO THE REORGANIZING DEBTORS OR COUNSEL TO THE CREDITORS’ COMMITTEE.

BALLOTS SENT TO ANY ENTITY OTHER THAN THE VOTING AGENT WILL NOT BE FORWARDED TO THE VOTING AGENT AND WILL NOT BE COUNTED.

D. Questions about Voting Procedures

If you have any questions about the procedure for voting your Claim, the packet of materials you have received, the amount of your Claim or Interest, or if you wish to obtain at your own expense, unless otherwise required by Bankruptcy Rule 3017(d), an additional copy of the Plan, this Disclosure Statement, or the Exhibits, contact: BMC Group toll free at (888) 909-0100. http://www.bmccorp.net/ata/. The Plan, this Disclosure Statement, and all Exhibits may be viewed, printed, and downloaded without cost at the Voting Agent’s website.

E. Confirmation Hearing and Deadline for Objections to Confirmation

Pursuant to Section 1128 of the Bankruptcy Code and Bankruptcy Rule 3017(c), the Bankruptcy Court has scheduled a Confirmation Hearing to commence on January 30, 2006 (EST), before the Honorable Basil H. Lorch III, United States Bankruptcy Judge, at the United States Bankruptcy Court, Room 310, 46 E. Ohio Street, Indianapolis, Indiana. The Confirmation Hearing may be adjourned from time to time by the Bankruptcy Court without further notice except for the announcement of the adjournment date made at the Confirmation Hearing or at any subsequent adjourned Confirmation Hearing. The Bankruptcy Court has directed that objections, if any, to confirmation of the Plan must be filed with the Bankruptcy Court and served so that they are ACTUALLY RECEIVED on or before January 23, 2006 by 4:00 P.M. (EST) (the “Objection Deadline”).

15

Service of any objections, by United States mail, overnight delivery, hand delivery, facsimile, or email to the confirmation of the Plan must be effected by the Objection Deadline upon:

The Reorganizing Debtors:

ATA Airlines, Inc.

7337 West Washington Street

Indianapolis, IN 46231-1328

Attn: Brian T. Hunt, Senior Vice President and General Counsel

Fax: 317-282-7091

Brian.Hunt@iflyata.com

Counsel for the Reorganizing Debtors:

Baker & Daniels LLP

300 North Meridian Street, Suite 2700

Indianapolis, Indiana 46204

Attn: | James M. Carr |

| Terry E. Hall |

Fax: (317) 237-1000

jim.carr@bakerd.com

terry.hall@bakerd.com

Counsel for the Official Committee of Unsecured Creditors of the Reorganizing Debtors:

Akin Gump Strauss Hauer & Feld LLP

590 Madison Avenue

New York, New York 10022-2524

Attn: Lisa Beckerman

Fax: (212) 872-1002

lbeckerman@akingump.com

Greenebaum Doll & McDonald PLLC

3300 National City Tower

101 S. Fifth Street

Louisville, KY 40202

Fax: 502-587-3695

Attn: C. R. Bowles, Jr.

CRB@gdm.com

16

Counsel for the ATSB:

United States Department of Justice

Commercial Litigation Branch

Civil Division

P.O. Box 875, Ben Franklin Station

Washington, D.C. 20044

FOR OVERNIGHT DELIVERY:

1100 L Street, NW

Room 10006

Washington, DC 20005

Fax: | (202) 307-0494 |

| (202) 514-9163 |

Attn: | Andrea Horowitz Handel |

| Matthew J. Troy |

andrea.handel@usdoj.gov

matthew.troy@usdoj.gov

- and -

Curtis, Mallet-Prevost, Colt & Mosle, LLP

101 Park Avenue

New York, NY 10178-0061

Fax: (212) 697-1559

Attn: | Steven J. Reisman |

| Andrew M. Thau |

sreisman@cm-p.com

athau@cm-p.com

Counsel for Southwest Airlines, Co.:

Bell, Boyd & Lloyd LLC

70 West Madison Street

Suite 3300

Chicago, IL 60602-4207

Fax: (312) 827-8000

Attn: | David H. Heroy |

| Steven A. Domanowski |

| DHeroy@bellboyd.com |

| SDomanowski@bellboyd.com |

17

Counsel for New Investor, New DIP Lender, or MatlinPatterson:

Sidley Austin Brown and Wood LLP

787 Seventh Avenue

New York, New York 10019

Fax: (212) 839-5599

Attn: | Duncan N. Darrow |

| Shalom Kohn |

ddarrow@sidley.com

skohn@sidley.com

United States Trustee:

Office of the United States Trustee

101 West Ohio Street, Suite 1000

Indianapolis, Indiana 46204

Fax: (317) 226-6356

Attn: Joseph McGonigal

joe.mcgonigal@usdoj.gov

F. Holders of Claims and Equity Interests Entitled To Vote

Under Section 1124 of the Bankruptcy Code, a class of claims or equity interests is deemed to be “impaired” under a plan unless (1) the plan leaves unaltered the legal, equitable, and contractual rights to which such claim or interest entitles the holder thereof; or (2) notwithstanding any legal right to an accelerated payment of such claim or interest, the plan (a) cures all existing defaults (other than defaults resulting from the occurrence of events of bankruptcy), (b) reinstates the maturity of such claim or interest as it existed before the default, (c) compensates the holder of such claim or interest for any damages resulting from such holder’s reasonable reliance on such legal right to an accelerated payment, and (d) does not otherwise alter the legal, equitable, or contractual rights to which such claim or interest entitles the holder of such claim or interest.

In general, a holder of a claim or interest may vote to accept or reject a plan if (1) the claim or interest is “allowed” which means generally that it is not disputed, contingent, or unliquidated, and (2) the claim or interest is impaired by a plan. If the holder of an impaired claim or interest will not receive any distribution under the plan in respect of such claim or interest, the Bankruptcy Code deems such holder to have rejected the plan and provides that the holder of such claim or interest is not entitled to vote. If the claim or interest is not impaired, the Bankruptcy Code conclusively presumes that the holder of such claim or interest has accepted the plan and provides that the holder is not entitled to vote.

The holder of a Claim or Interest against any Reorganizing Debtor (and such Claim or Interest is “Impaired” under the Plan) is entitled to vote to accept or reject the Plan if (1) the Plan provides a distribution in respect of such Claim or Interest; and (2) (a) the Claim has been scheduled by the Reorganizing Debtors (and is not scheduled as disputed, contingent, or

18

unliquidated), or (b) the holder filed a proof of Claim on or before January 24, 2005 (or April 24, 2005 for governmental entities or such other date as established by order of the Bankruptcy Court), pursuant to Sections 502(a) and 1126(a) of the Bankruptcy Code and Bankruptcy Rules 3003 and 3018 and there is not, as of the Voting Deadline, an objection pending with respect to the Claim (unless and to the extent the Claim is temporarily allowed for voting purposes under Bankruptcy Rule 3018(a)).

ALL HOLDERS OF ALLOWED CLAIMS IN IMPAIRED CLASSES ARE ENTITLED TO VOTE ON THE PLAN.

G. Treatment of Certain Unliquidated, Contingent, or Disputed Claims for Voting

Pursuant to the Solicitation Procedures Order and Section 1126 of the Bankruptcy Code, holders of Claims or Interests that appear on the Schedules as disputed, contingent, or unliquidated and that are not the subject of a timely filed proof of Claim, shall not be treated as a creditor with respect to such Claim or Interest for purposes of voting on the Plan, receiving distributions under the Plan, or receiving notices, other than by publication.

Proofs of claim (a) filed against any of the Reorganizing Debtors for a Claim that is within an impaired class and are (1) in an unliquidated or unknown or unascertained amount or (2) purports to be contingent (an “Unliquidated/Contingent Claim”), and (b) that are not the subject of a pending objection by Reorganizing Debtors are objected to under the Solicitation Procedures Order.

Unless the Holder of an Unliquidated/Contingent Claim obtains an order pursuant to Bankruptcy Rule 3018(a) as ordered in the Solicitation Procedures Order, any Ballot with respect to such Unliquidated/Contingent Claim shall be counted in determining whether the numerosity requirement of Section 1126(c) of the Bankruptcy Code has been satisfied, but shall be counted only in the amount of $1.00 in determining whether the aggregate dollar amount requirement of Section 1126(c) of the Bankruptcy Code has been satisfied.

Any Claim or Interest, as to which an objection (including Unliquidated/Contingent Claims) has been filed on or before December 21, 2005, shall not be counted for any purpose in determining whether the requirements of Section 1126(c) of the Bankruptcy Code have been met, unless (a) such Claim or Interest has been temporarily allowed for voting purposes pursuant to Bankruptcy Rule 3018(a) and in accordance with the Solicitation Procedures Order or (b) to the extent that the objection to such Claim or Interest has been resolved by the Bankruptcy Court in favor of the purported Claim or Interest holder asserting the Claim or Interest.

As set forth in the Solicitation Procedures Order, holders of Claims or Interests that are the subject of an objection that has been filed on or before December 21, 2005 must file motions to have their Claims temporarily allowed for voting purposes on or before January 13, 2006. A holder of a Claim whose Claim may be objected to after December 21, 2005 but before January 13, 2006, will have ten (10) days from the date the objection is filed to file a motion to have their claim temporarily allowed under Bankruptcy Rule 3018(a). Claims that are objected

19

to after January 13, 2006 must file a 3018(a) motion as soon as practicable, but in no event less than two (2) days prior to the Confirmation Hearing, so as to allow a hearing on such motion at the Confirmation Hearing. Estimation of Claims for voting may also be stipulated by agreement with the Reorganizing Debtors and approved by the Bankruptcy Court. Ballots may be sent to holders of Claims whose Claims are the subject of an objection, however, unless an order of the Bankruptcy Court has been entered estimating the Claim for voting purposes on or prior to the Confirmation Hearing any such Ballot will not be counted.

IF YOU HOLD A CLAIM OR INTEREST TO WHICH THE REORGANIZING DEBTORS HAVE OBJECTED, IN ORDER TO HAVE YOUR CLAIM OR INTEREST TEMPORARILY ALLOWED FOR VOTING PURPOSES YOU MUST FILE AND SERVE A RULE 3018(a) MOTION IN ACCORDANCE WITH THE SOLICITATION PROCEDURES ORDER. HOLDERS OF CLAIMS THAT ARE THE SUBJECT OF AN OBJECTION WHO DO NOT TIMELY FILE A RULE 3018(a) MOTION SHALL NOT BE ENTITLED TO VOTE AND ANY SUCH VOTE SHALL NOT BE COUNTED.

H. Vote Required for Acceptance by a Class

As a condition to confirmation of the Plan, the Bankruptcy Code requires that each Class of Impaired Claims vote to accept the Plan, except under certain circumstances.

Section 1126(c) of the Bankruptcy Code defines acceptance of a plan by a class of impaired claims as acceptance by holders of at least two-thirds in dollar amount and more than one-half in number of claims in that class, but for that purpose, counts only those who actually vote to accept or reject the plan. Thus, a Class of Claims will have voted to accept the Plan only if two-thirds in dollar amount and a majority in number actually voting cast their Ballots in favor of acceptance. Holders of Claims who fail to vote are not counted as either accepting or rejecting the Plan or in determining whether the requisite majorities have voted to accept the Plan.

A vote may be disregarded if the Bankruptcy Court determines, pursuant to Section 1126(e) of the Bankruptcy Code, that is was not solicited or procured in good faith or in accordance with the provisions of the Bankruptcy Code.

The Solicitation Procedures Order sets forth other criteria for vote tabulation as well as assumptions and procedures for tabulating Ballots that are not completed fully or correctly.

I. Confirmation of Plan Over Rejection by an Impaired Class (“Cram-Down”)

Section 1129(b) of the Bankruptcy code allows a bankruptcy court to confirm a chapter 11 plan, even if such plan has not been accepted by all impaired classes entitled to vote on such plan; provided, however, that such plan has been accepted by at lease one impaired class.

20

Section 1129(b) of the Bankruptcy codes states that notwithstanding the failure of an impaired class to accept a chapter 11 plan, the plan shall be confirmed, on request of the proponent of the plan, in a procedure commonly known as “cram-down,” so long as the plan does not “discriminate unfairly” and is “fair and equitable” with respect to each class of claims or equity interests that is impaired under, and has not accepted, the plan.

In general, a plan does not discriminate unfairly if it provides a treatment to the class that is substantially equivalent to the treatment that is provided to other classes that have equal rank. In determining whether a plan discriminates unfairly, courts will take into account a number of factors, including the effect of applicable subordination agreements between parties. Accordingly, two classes of unsecured Creditors could be treated differently without unfairly discriminating against either class.

The condition that a plan be “fair and equitable” with respect to a non-accepting class of secured claims includes the requirements that: (i) the holders of such secured claims retain the Liens securing such claims to the extent of the allowed amount of the secured claims, whether the property subject to the Liens is retained by debtor or transferred to another entity under the plan; and (ii) each holder of a secured claim in the class receives deferred cash payments totaling at least the allowed amount of such claim with a present value, as of the Effective Date, at least equivalent to the value of the secured claimant’s interest in the debtor’s property subject to the liens.

The condition that a plan be “fair and equitable” with respect to a non-accepting class of unsecured claims includes the requirement that either: (i) the plan provides that each holder of a claim of such class receive or retain on account of such claim property of a value, as of the Effective Date, equal to the allowed amount of such claim; or (ii) the holder of any claim or interest that is junior to the claims of such class will not receive or retain any property under the plan on account of such junior claim or interest.

The condition that a plan be “fair and equitable” with respect to a non-accepting class of equity interests includes the requirements that either: (i) the plan provide that each holder of an equity interest in such class receive or retain under the plan, on account of such equity interest, property of a value, as of the Effective Date, equal to the greater of (a) the allowed amount of any fixed liquidation preference to which such holder is entitled, (b) any fixed redemption price to which such holder is entitled, or (c) the value of such interest; or (ii) if the class does not receive such an amount as required under (i), no class of equity interests junior to the non-accepting class may receive a distribution under the plan.

The Plan Proponents shall seek Confirmation of the Plan pursuant to Section 1129(b) of the Bankruptcy Code with respect to any Impaired Class, as applicable, presumed to reject the Plan, and reserve the right to do so with respect to any other rejecting Class of Claims or Interests, as applicable, and/or to modify the Plan. Section 1129(a)(10) of the Bankruptcy Code shall be satisfied for purposes of Confirmation by acceptance of the Plan by at least one Class that is Impaired under the Plan.

21

IV. DESCRIPTION OF THE REORGANIZING DEBTORS

A. Introduction

Since the Petition Date and with the assistance of new management, the Reorganizing Debtors have made a number of fundamental changes to their business operations designed to improve their financial results and to allow Reorganized ATA to emerge from its Chapter 11 Case as a competitive low cost passenger air carrier. Key initiatives include: focusing on a business plan for scheduled service to maximize the benefit of the codesharing arrangement with Southwest Airlines Co. (“Southwest”); maintaining ATA’s position as a leading provider of military passenger charter services; eliminating unprofitable routes; reducing operating costs, including management and other employee expenses; and rejecting or renegotiating uneconomic contracts and leases to reduce associated costs and ultimately to achieve sustained profitability.

The Reorganizing Debtors have taken a number of steps to achieve these objectives, including, among other things:

• Appointed a new management team led by Chief Executive Officer John Denison;

• Eliminated unprofitable scheduled service routes;

• Established a codesharing arrangement with Southwest for scheduled passenger air transportation service;

• Obtained the commitment from the New Investor and New DIP Lender(s) to provide the New DIP Facility, the New Investor Equity, and the New Investor Exit Facility;

• Liquidated the assets of certain Affiliates, including a captive regional carrier based in Chicago (C8), and a travel club and travel agency (Ambassadair and Amber Travel), eliminating the need to continue subsidization of those operations by ATA and Holdings to the extent such need existed;

• Reduced aircraft equipment expenses through the rejection and renegotiation of leases;

• Amended the collective bargaining agreements with the unions representing the cockpit crews and the flight attendants to achieve significant cost savings;

• Entered into an agreement with the Indianapolis Airport Authority (“IAA”) and Regions Bank (“Regions”) to substantially reduce occupancy costs for the corporate headquarters and Indianapolis Maintenance Facility and eliminate a substantial mortgage obligation;

22

• Outsourced certain maintenance functions and rebid certain maintenance contracts and outsourced reservations functions, and took other actions to generate savings;

• Reduced occupancy and use costs at Chicago Midway International Airport (“Midway”), and obtained a $20 million reduction of secured debtor-in-possession loan indebtedness to Southwest in connection with that downsizing; and

• Negotiated agreements with Southwest and the City of Chicago, resulting in an enhanced codesharing arrangement, a more efficient and economical scheduled service presence at Midway, and the resolution of various Claims by the City of Chicago against the Reorganizing Debtors.

The Reorganizing Debtors believe these actions and the actions contemplated in the New Business Plan described in Section VII of this Disclosure Statement will result in the viability of the business of the Reorganized Companies outside of the protections of Chapter 11 of the Bankruptcy Code.

B. History

The predecessor of ATA was founded in 1973 as Ambassadair, an air travel club, by J. George Mikelsons in Indianapolis, Indiana. When the airline industry was deregulated in 1978, ATA became certified as a common-air carrier and acquired eight Boeing 707s. In 1984, Mr. Mikelsons formed Amtran, Inc. (“Amtran”), which served as a holding company for Ambassadair, ATA and future affiliates. In 1990 and 1991, ATA was the largest civilian passenger carrier, based on missions flown, for the U.S. military transporting 108,000 military personnel on 494 missions to the Persian Gulf for Operation Desert Storm.

In 1992, ATA began providing scheduled service from Midway, serving 500,000 passengers in its first year. Amtran completed an initial public offering in 1993 and began to trade on the Nasdaq Market. ATA began providing scheduled service to the Hawaiian market in 1994. In early 2002, Midway opened a new terminal and ATA initiated nonstop service to additional domestic and international destinations. In 2002, Amtran changed its name to ATA Holdings Corp.(8) In 2003, ATA changed its name from American Trans Air, Inc. to ATA Airlines, Inc.

When the terrorist attacks of September 11, 2001 forced the entire industry to contract, ATA was the largest carrier operating from both Indianapolis and Midway and the third largest carrier overall in Chicago, based on the number of passengers flown. In November 2002, the Air Transportation Stabilization Board (the “ATSB”) guaranteed $148.5 million of a $168 million term loan made by the ATSB Lenders to ATA. However, that cash infusion proved to be

(8) Shortly after the Petition Date, Holdings’ securities were delisted from the Nasdaq Market. Since the delisting, Holdings’ common stock has continued to trade under the symbol “ATAHQ” on the over the counter market.

23

insufficient to overcome the problems facing ATA such as escalating fuel prices, a fleet designed for a robust expansion, onerous aircraft rental terms agreed to under circumstances no longer extant, increasing labor costs, loss of cash due to the 100% holdback imposed by ATA’s primary credit card processor, and $300 million of unsecured debt maturities. These challenges combined with effects of the events of September 11, 2001 caused the Debtors to seek to reorganize under the Bankruptcy Code.

C. Corporate Structure

The Reorganizing Debtors consist of Holdings and its wholly owned subsidiaries: ATA, Cargo, Execujet, and Leisure.

Holdings is the sole shareholder of the following non-debtor entities: Kodiak Call Centre Ltd., AATC Holding, Inc., Key Tours, Inc., Amber Holdings, Inc., Travel Charter International, LLC, Consultrav, Inc, Washington Street Aviation, LLC, and Sixty-Third Street Aviation, LLC. The assets of those non-debtor entities are immaterial to Holdings. These non-debtor entities are not affected by the Chapter 11 Cases.

D. Existing Capital Structure Of The Reorganizing Debtors

1. Senior Unsecured Notes

In January, 2004, in a continued effort to address the liquidity problems created by the economic conditions the Debtors faced since 2001, Holdings successfully completed exchange offers (“Exchange Offers”) for its then existing $300 million of senior unsecured notes consisting of $175 million 10 1/2% Senior Notes due in August 2004 (“2004 Notes”) and $125 million 9 5/8 % Senior Notes due December 2005 (“2005 Notes” and together with the 2004 Notes, the “Exchangeable Notes”).

Under the Exchange Offers, $155 million of the 2004 Notes and $105 million of the 2005 Notes were tendered and exchanged. Holdings paid $7.8 million and issued $163.1 million in aggregate principal amount of 2009 Senior Unsecured Notes for the 2004 Notes exchanged, and paid $5.2 million and issued $110.2 million in aggregate principal amount of 2010 Senior Unsecured Notes for the 2005 Notes exchanged.

In connection with the Exchange Offers, Holdings also obtained the consent of the holders of the Exchangeable Notes to amend or eliminate certain of the restrictive operating covenants and certain default provisions of the indentures governing the Exchangeable Notes. The unexchanged 2004 Notes matured in early August 2004 and were redeemed. The 2009 Senior Unsecured Notes, 2010 Senior Unsecured Notes and the unexchanged 2005 Notes are collectively referred to as the “Old Holdings Unsecured Notes.”

The aggregate principal amount of the Old Holdings Unsecured Notes outstanding as of the Petition Date was approximately $293,302,000. Wells Fargo Bank Northwest, N.A., as the indenture trustee (“Indenture Trustee”) of the Old Holdings Unsecured Notes, filed proofs of claim on behalf of the holders of the Old Holdings Unsecured Notes.

24

2. Old Holdings Common Stock and Preferred Stock

Holdings is a publicly held company. As of the Petition Date, Holdings had approximately 280 registered shareholders and its common stock was listed on the Nasdaq National Market under the symbol “ATAH.” On November 5, 2004, the common stock was delisted. Holdings has not paid dividends to its common shareholders since becoming publicly held.

In late 2000, Holdings issued and sold 500 shares of Series A redeemable preferred stock, without par value (“Existing Series A Preferred Stock”), at a price and liquidation amount of $100,000 per share.

Also in late 2000, Holdings issued and sold 300 shares of Series B convertible redeemable preferred stock, without par value (“Existing Series B Preferred Stock”), at a price and liquidation amount of $100,000 per share.

3. ATSB Loan