EXHIBIT 99.2 THE ALLSTATE CORPORATION Investor Supplement Third Quarter 2017 The consolidated financial statements and financial exhibits included herein are unaudited. These consolidated financial statements and exhibits should be read in conjunction with the consolidated financial statements and notes thereto included in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The results of operations for interim periods should not be considered indicative of results to be expected for the full year. Measures used in these financial statements and exhibits that are not based on generally accepted accounting principles ("non-GAAP") are denoted with an asterisk (*). These measures are defined on the page "Definitions of Non-GAAP Measures" and are reconciled to the most directly comparable generally accepted accounting principles ("GAAP") measure herein.

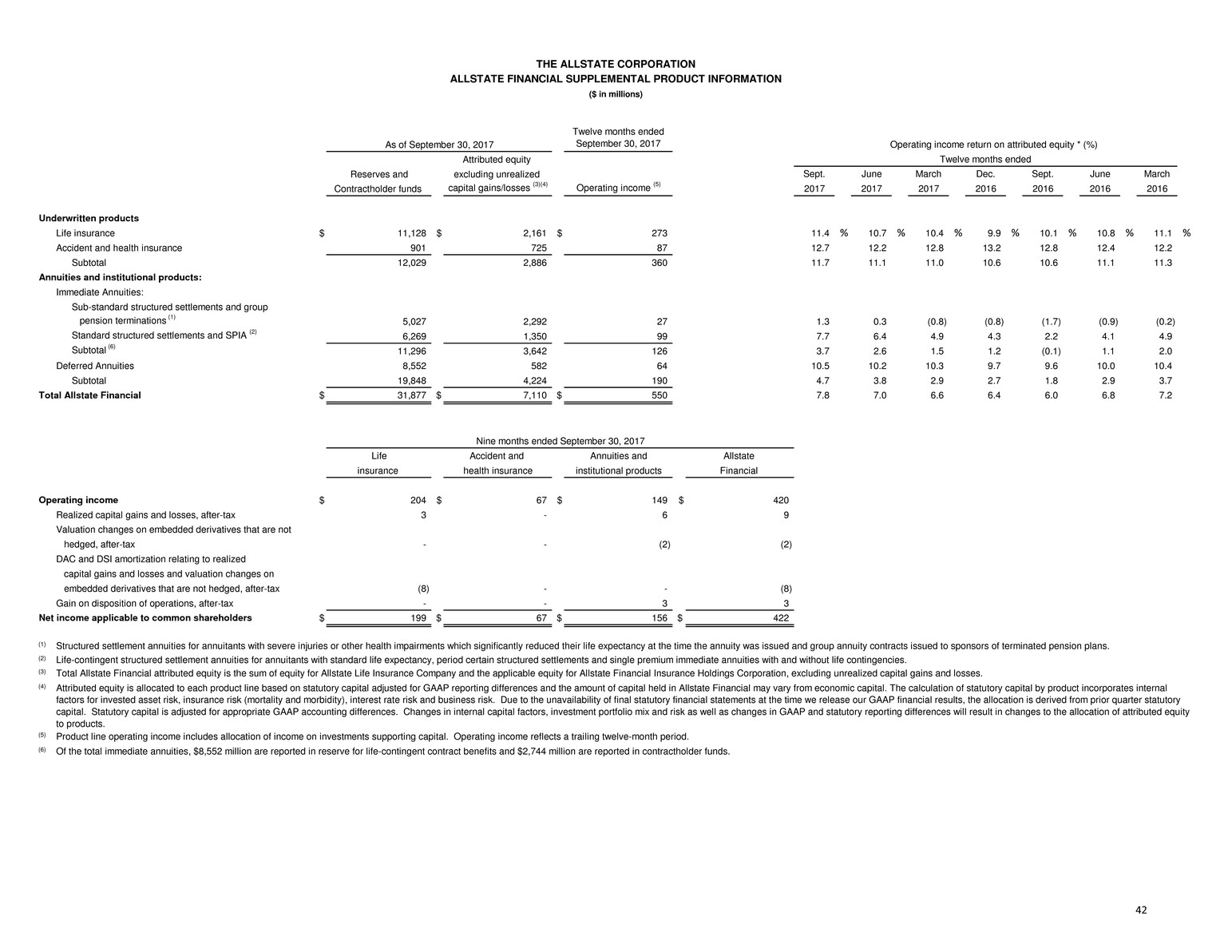

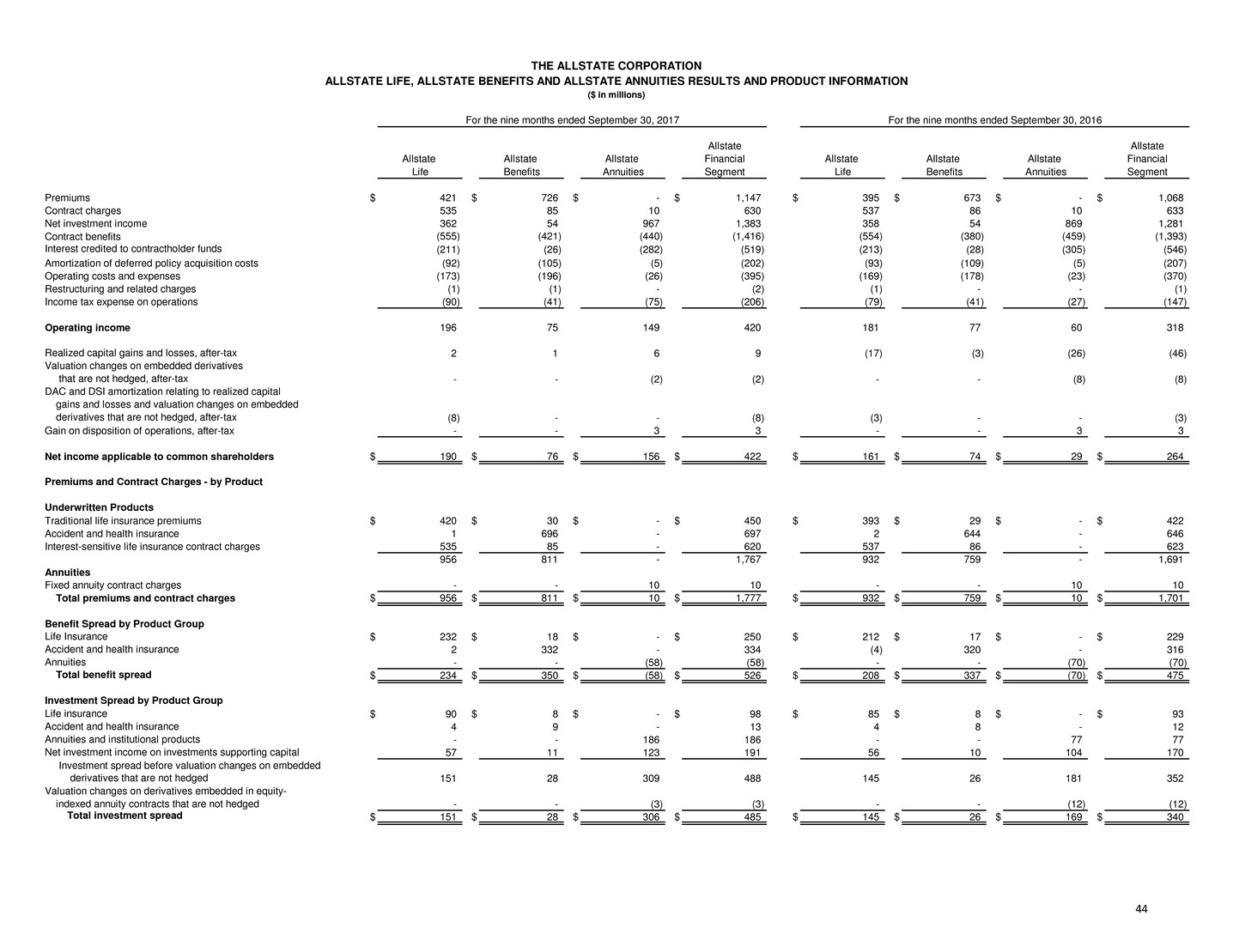

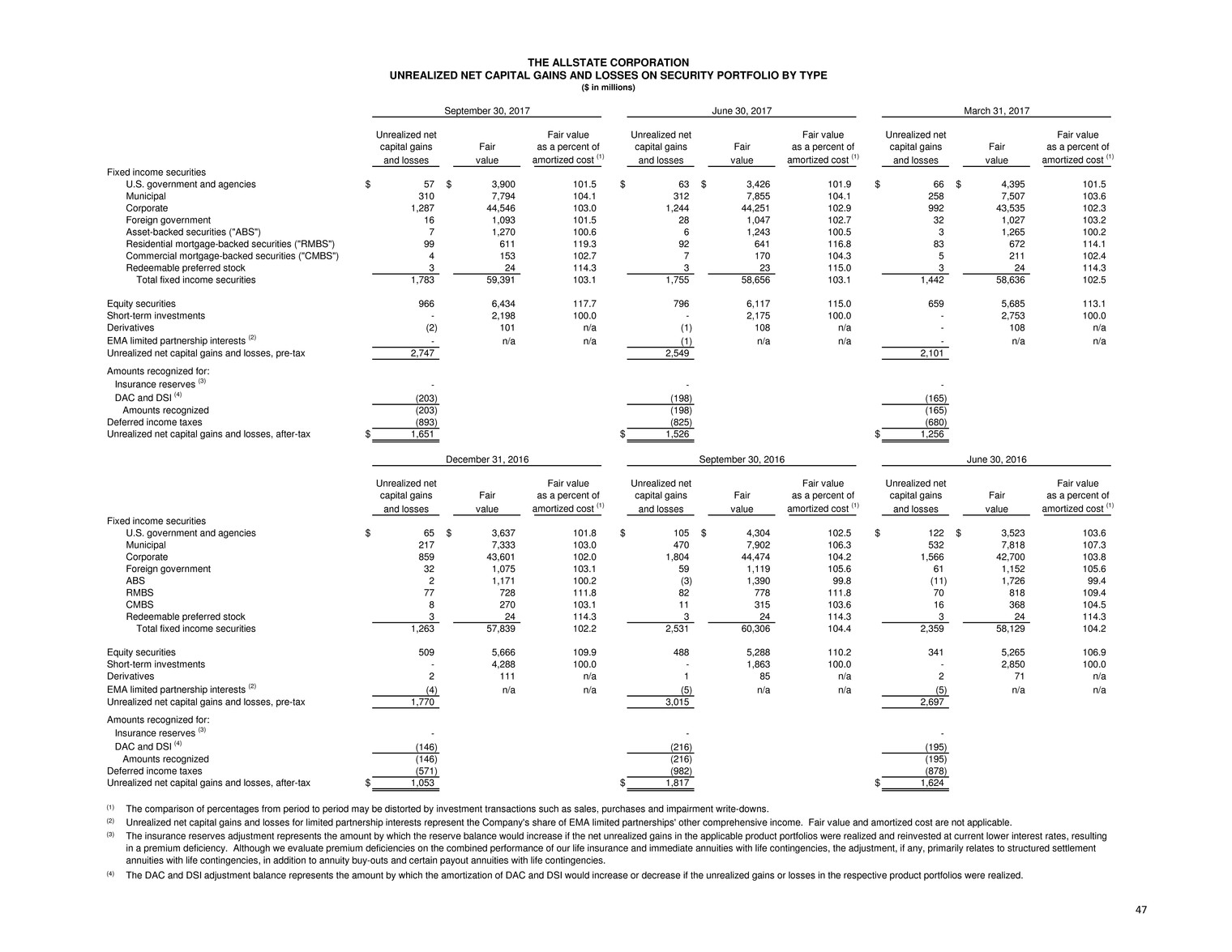

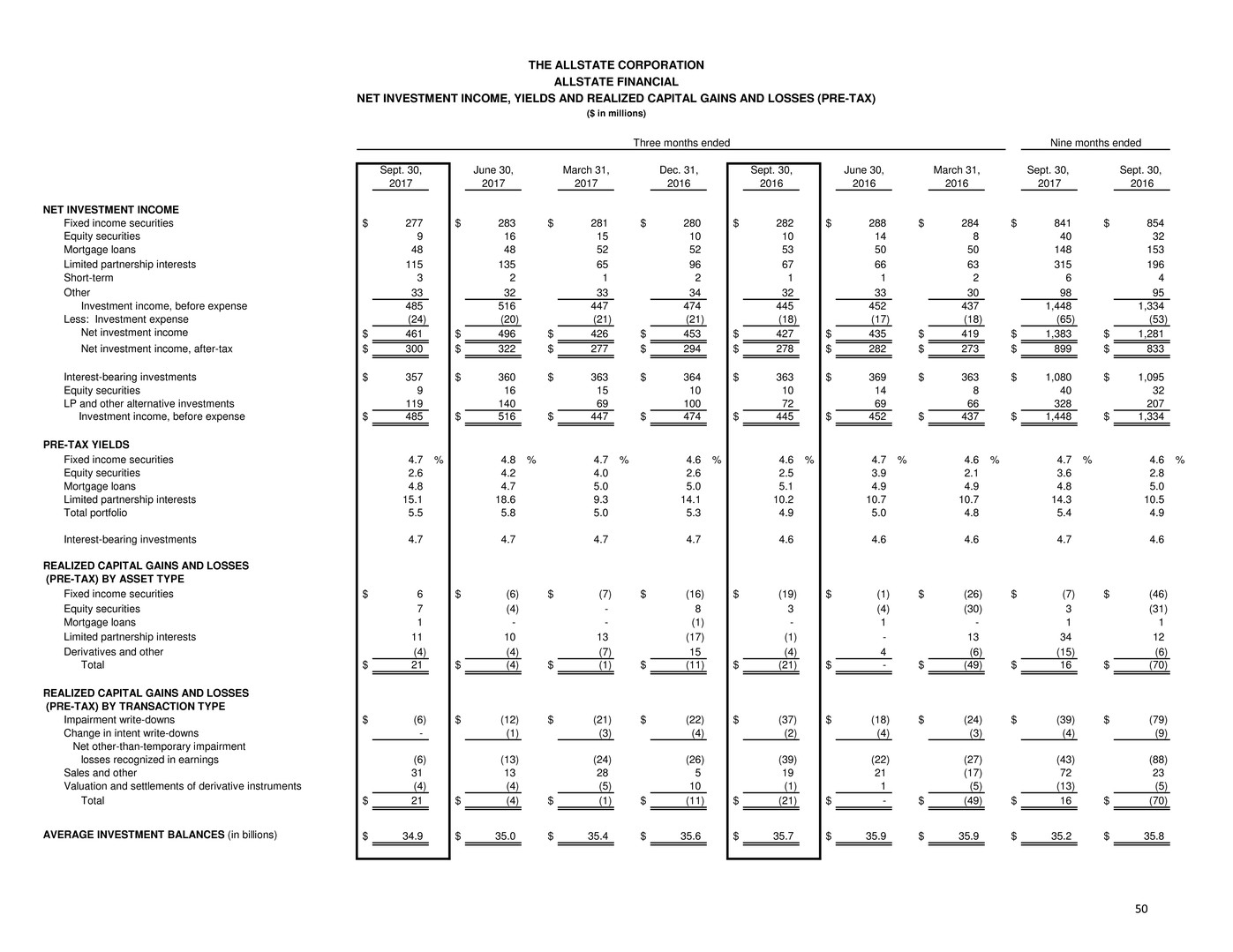

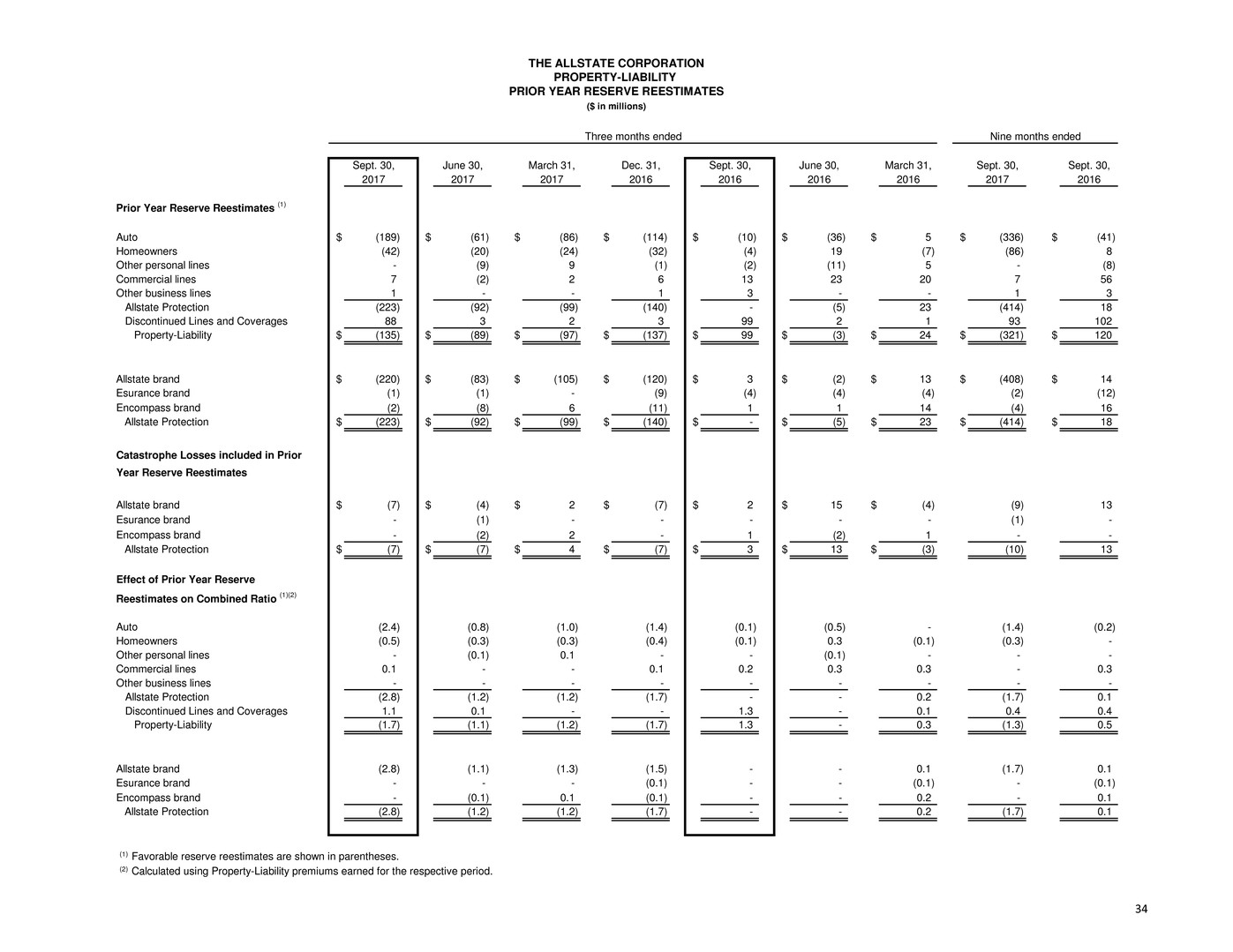

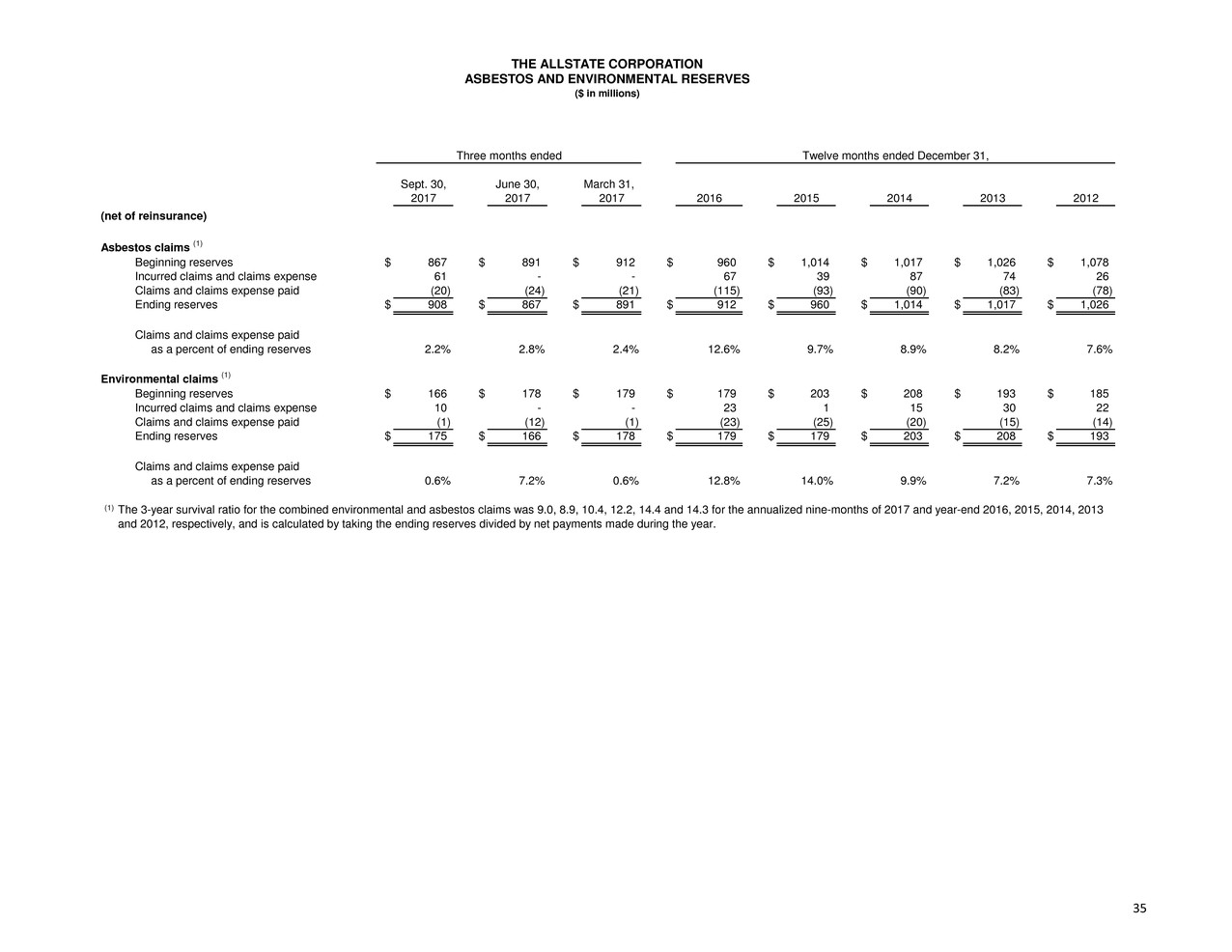

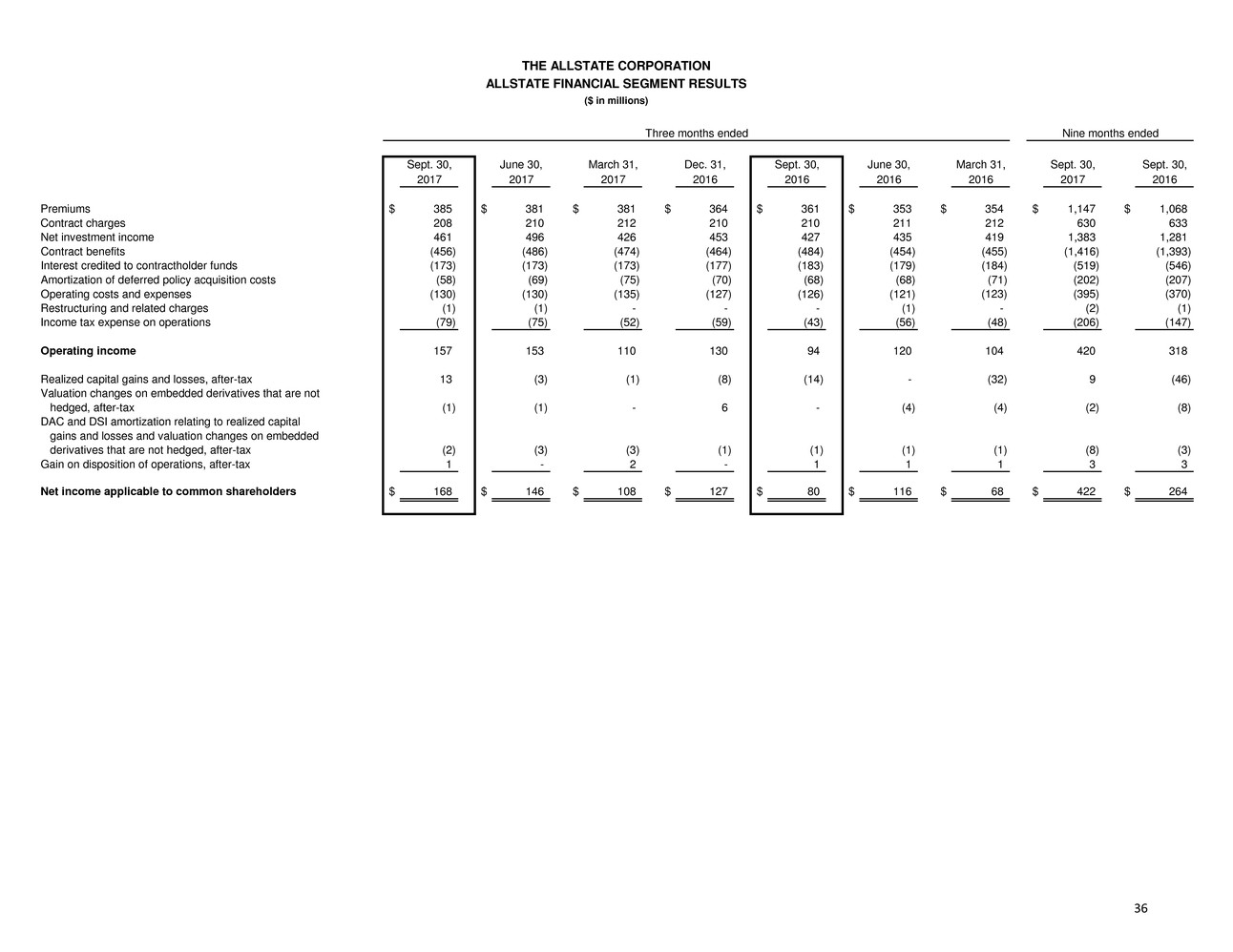

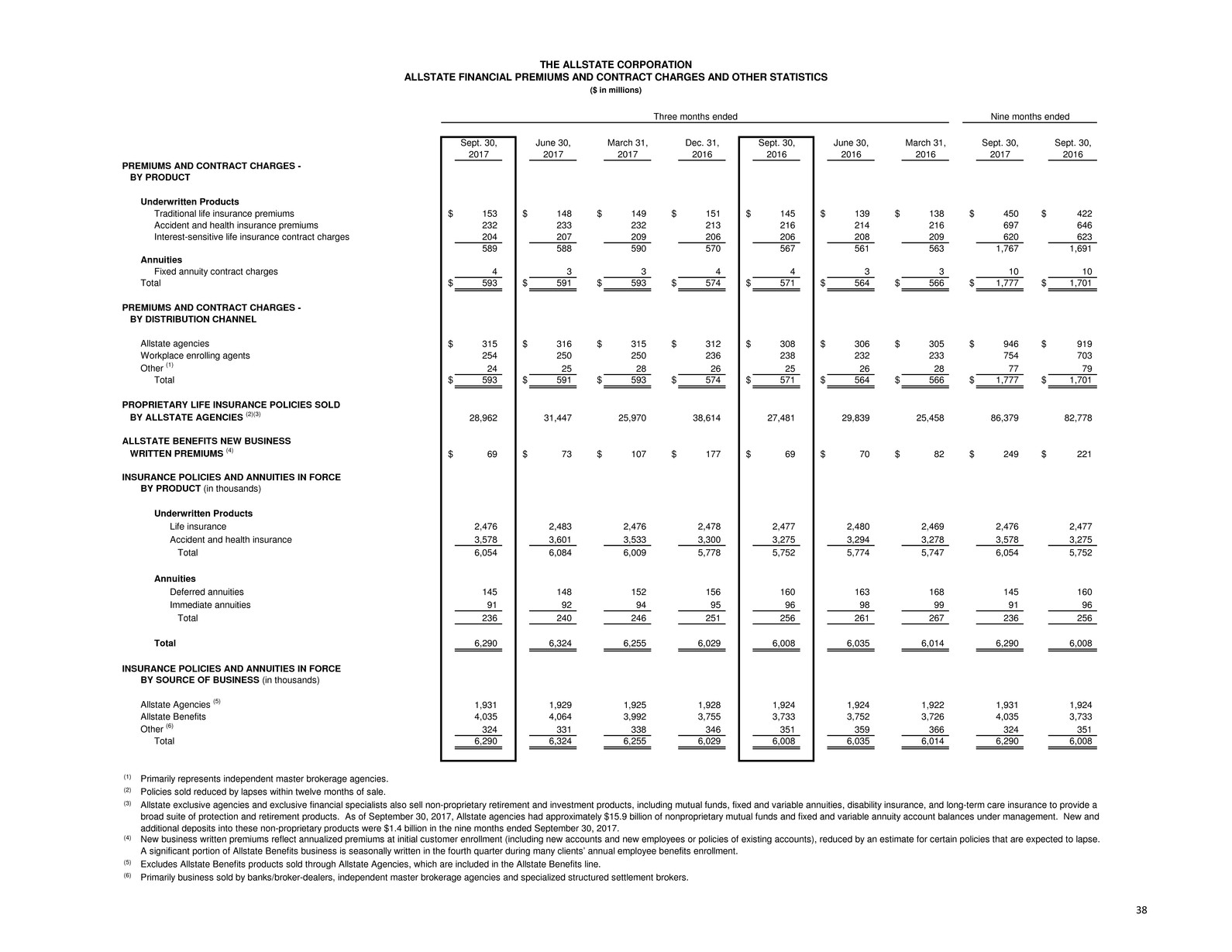

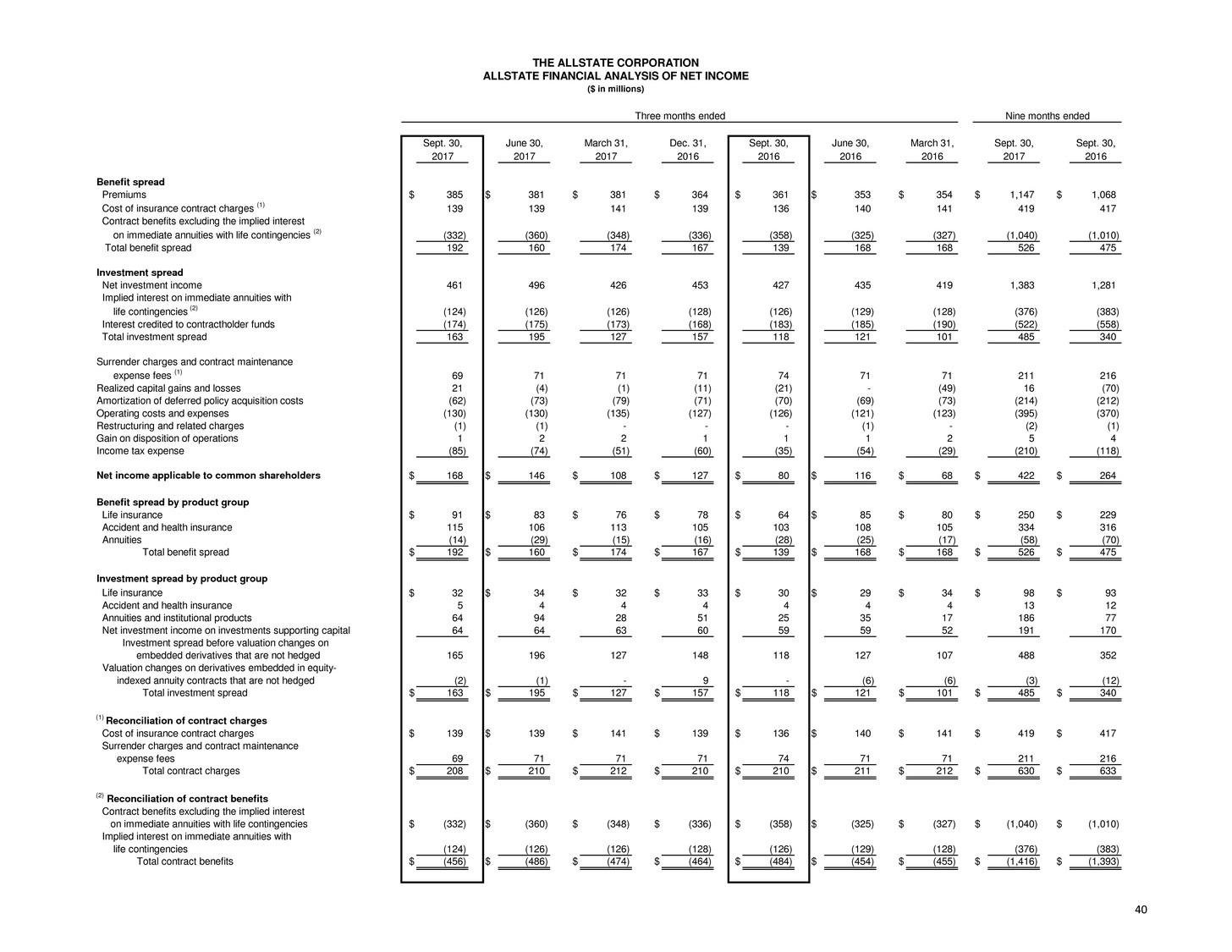

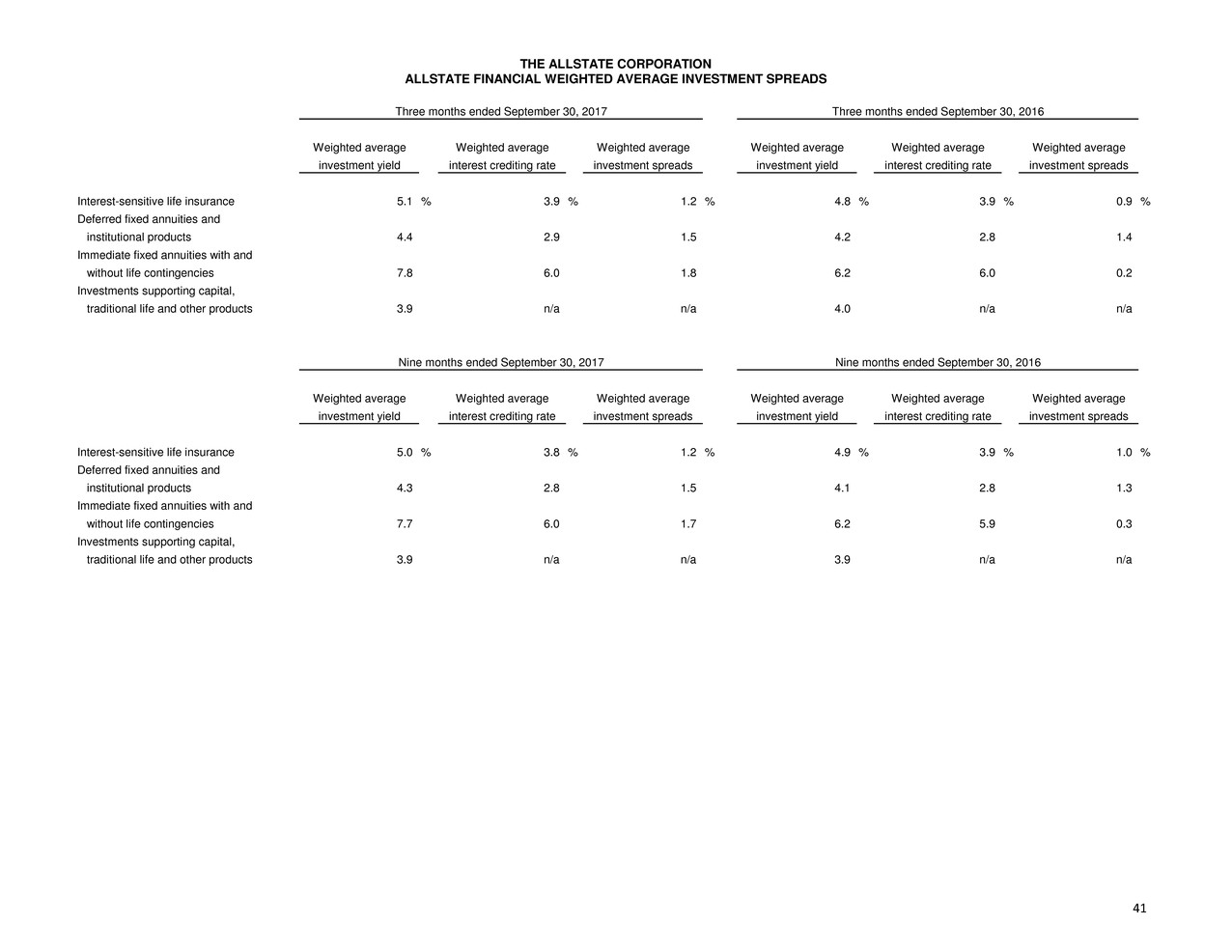

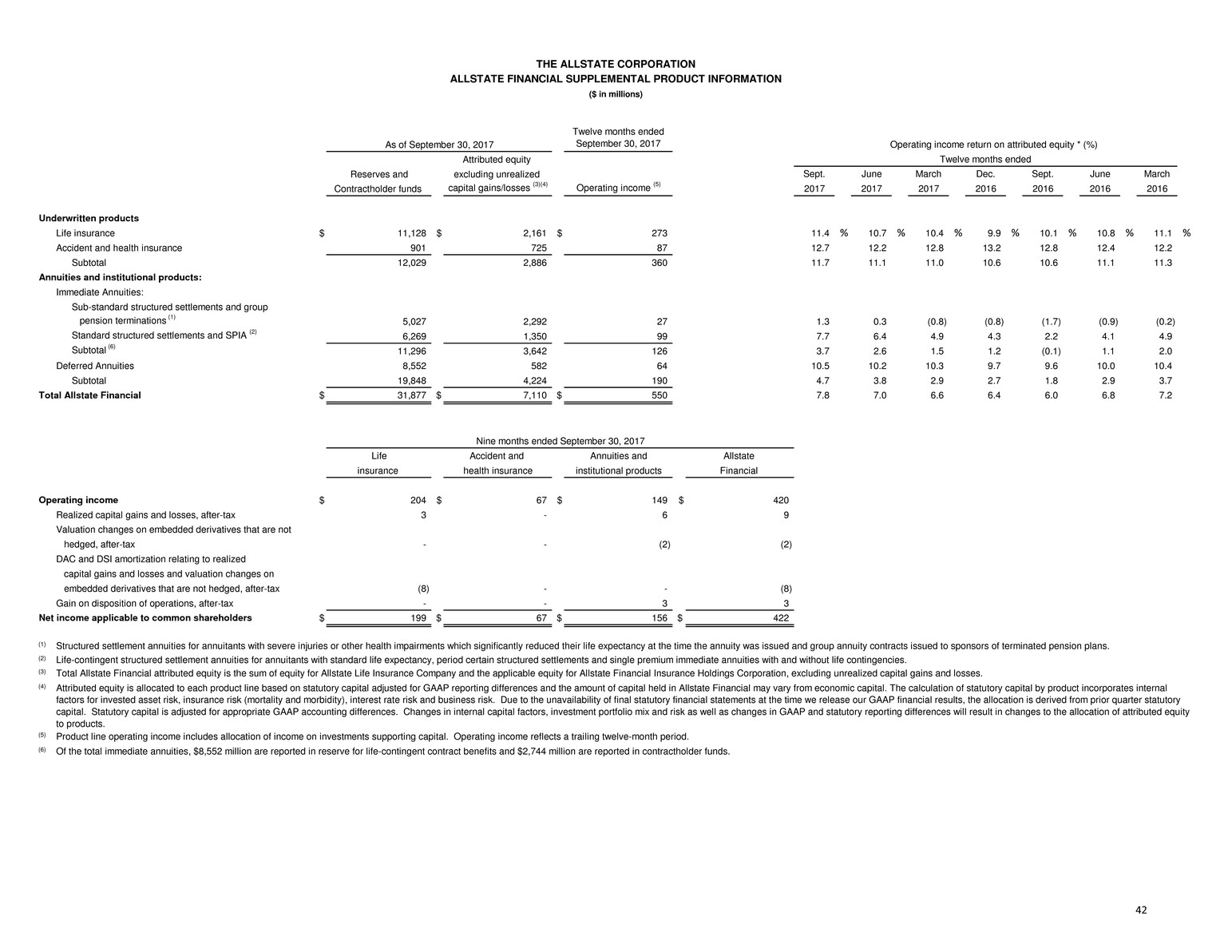

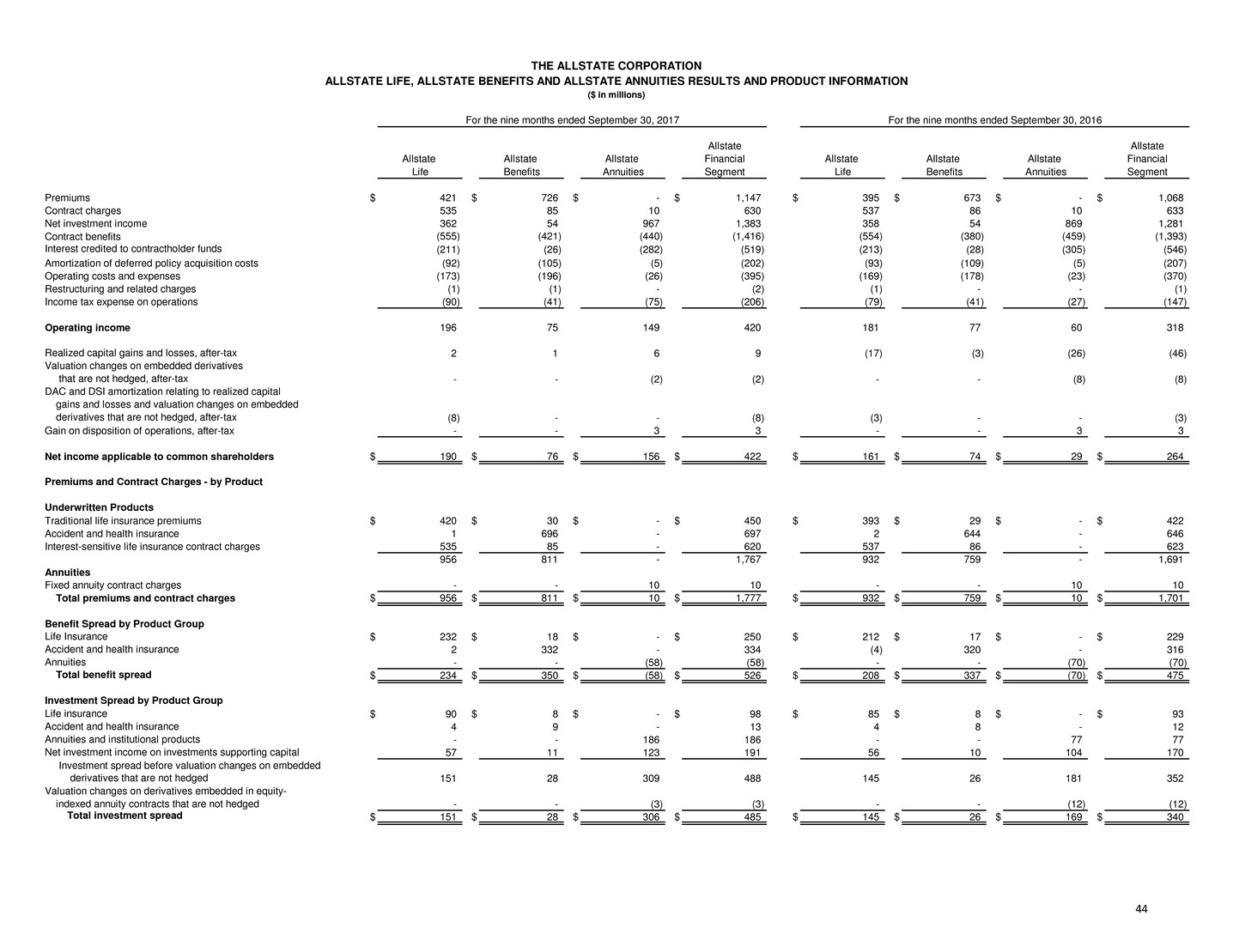

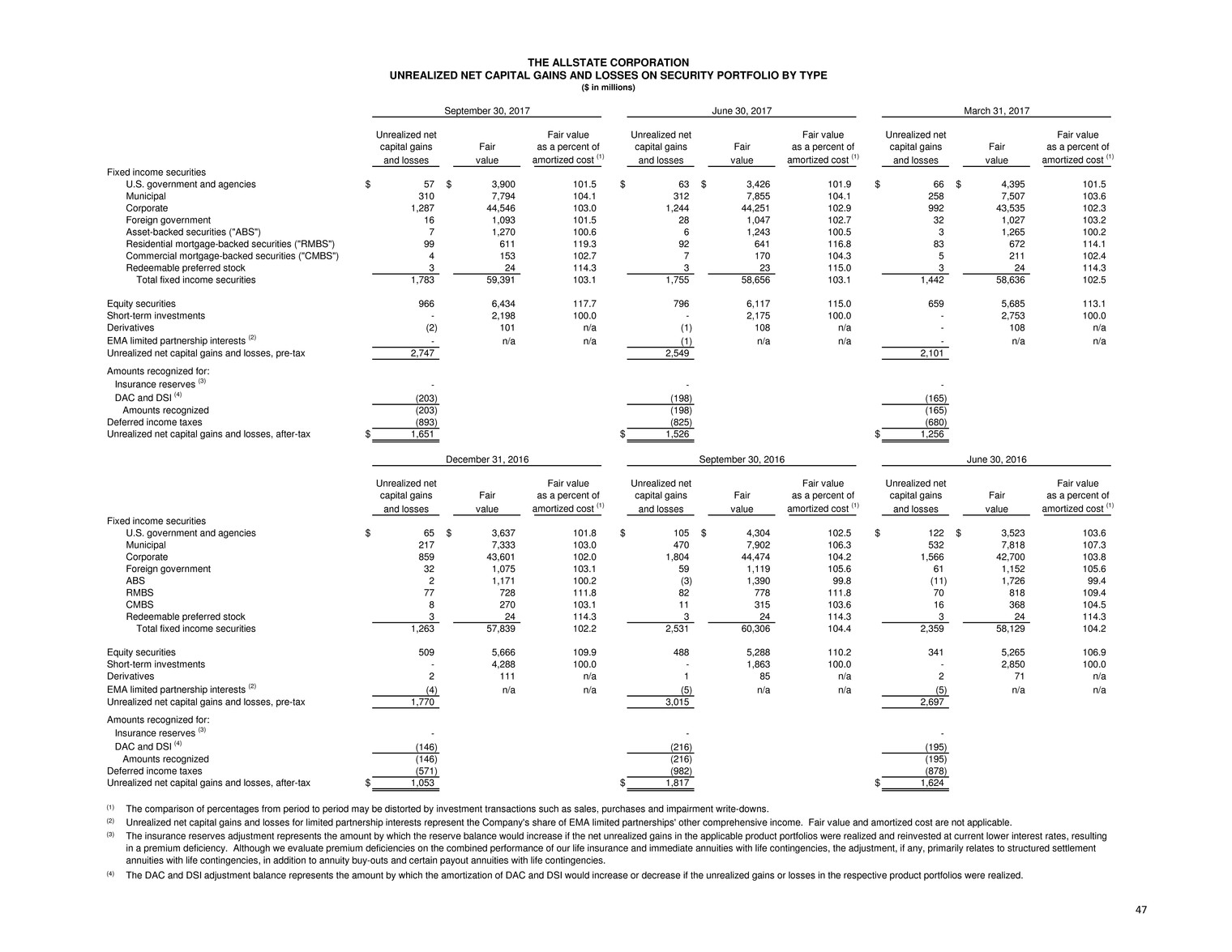

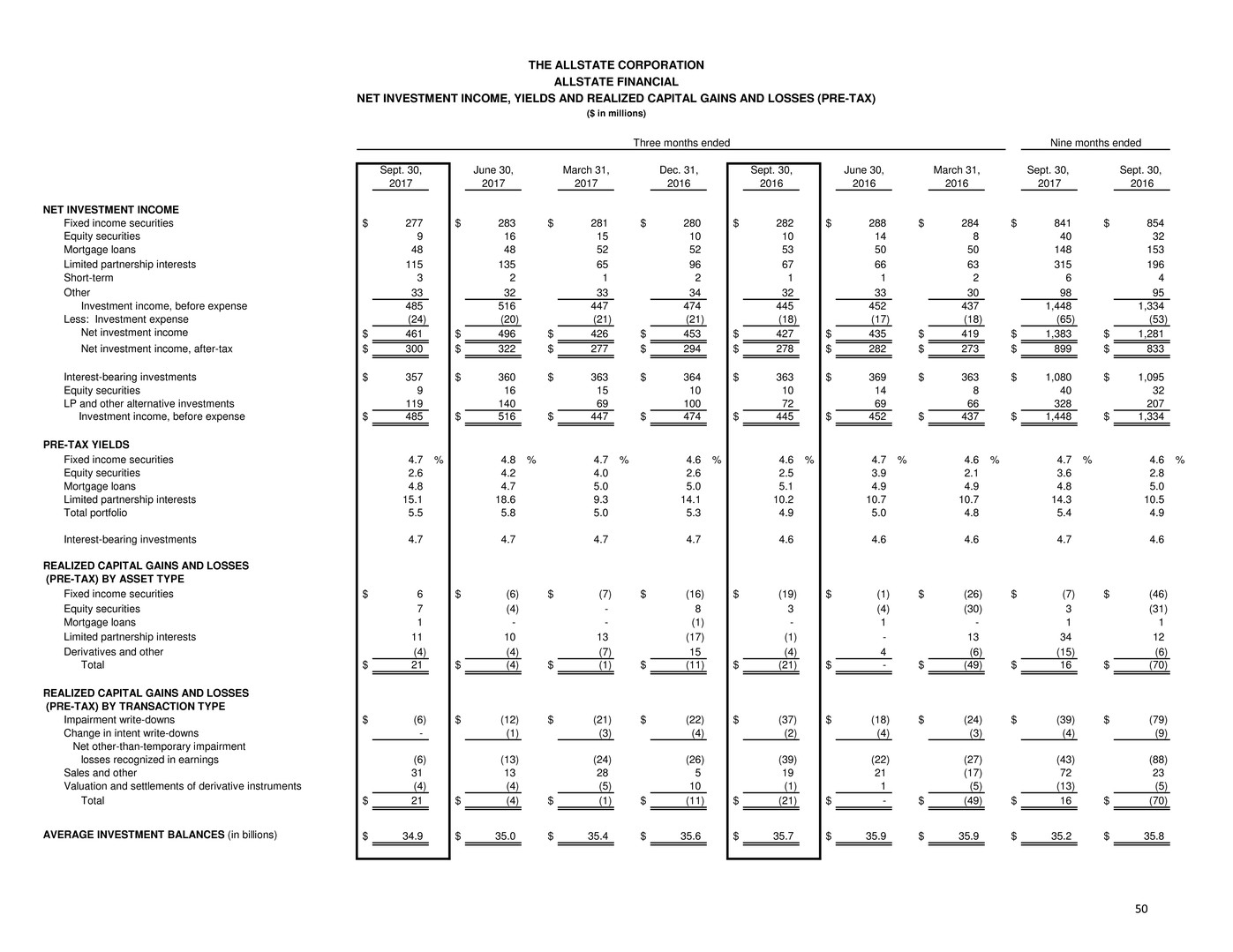

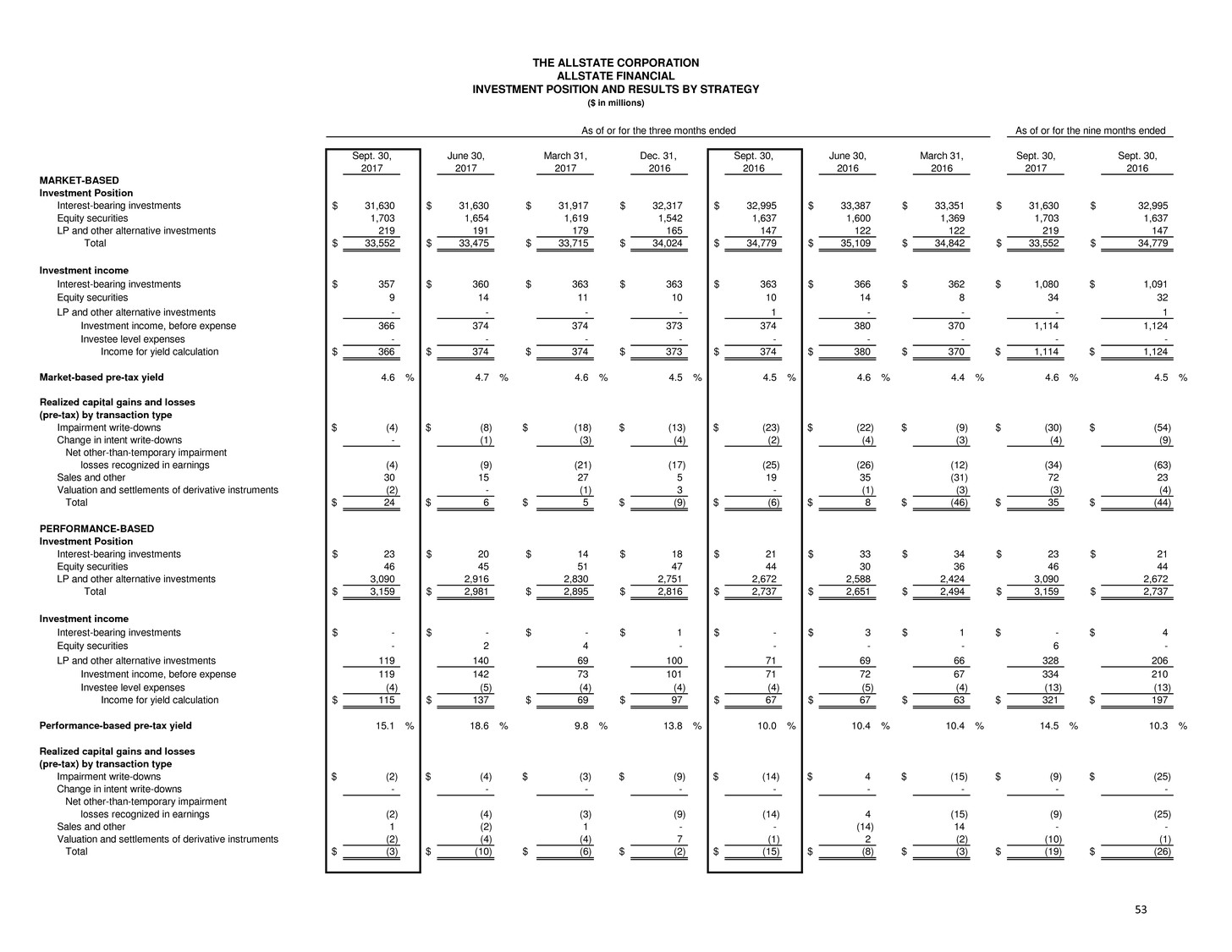

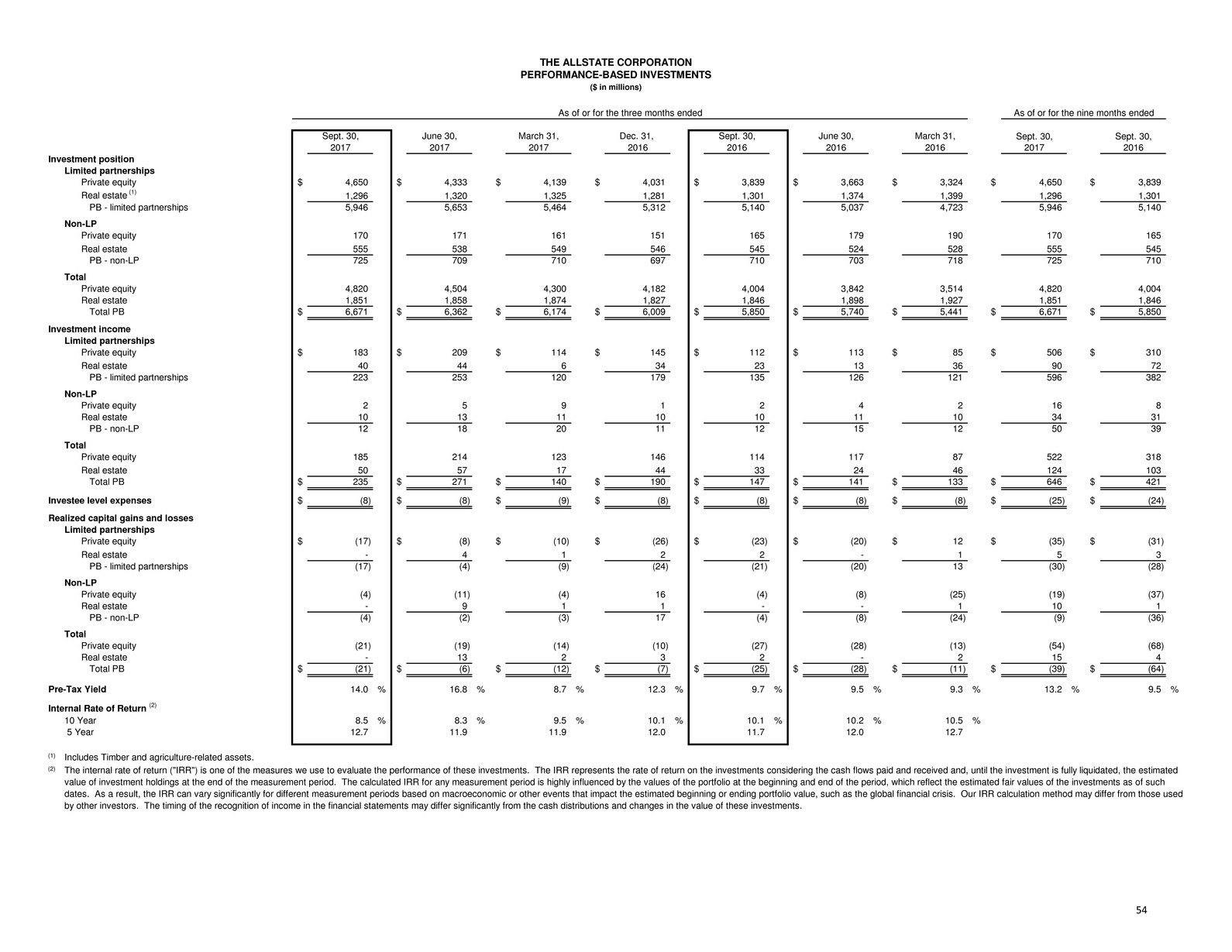

Consolidated Allstate Financial Operations Statements of Operations 1 Allstate Financial Segment Results 36 Contribution to Income 2 Return on Attributed Equity 37 Revenues 3 Allstate Financial Premiums and Contract Charges and Other Statistics 38 Segment Results 4,5 Allstate Financial Change in Contractholder Funds 39 Statements of Financial Position 6 Allstate Financial Analysis of Net Income 40 Book Value Per Common Share 7 Allstate Financial Weighted Average Investment Spreads 41 Return on Common Shareholders' Equity 8 Allstate Financial Supplemental Product Information 42 Debt to Capital 9 Allstate Life, Allstate Benefits and Allstate Annuities Results and Product Information 43,44 Statements of Cash Flows 10 Analysis of Deferred Policy Acquisition Costs 11,12 Corporate and Other Segment Results 45 Policies in Force and Other Statistics 13 Property-Liability Operations Investments Property-Liability Results 14 Investments 46 Property-Liability Underwriting Results by Area of Business 15 Unrealized Net Capital Gains and Losses on Security Portfolio by Type 47 Property-Liability Premiums Written by Brand 16 Net Investment Income, Yields and Realized Capital Gains and Losses (Pre-tax) 48 Impact of Net Rate Changes Approved on Premiums Written 17 Property-Liability Net Investment Income, Yields and Realized Capital Gains and Losses (Pre-tax) 49 Allstate Brand Profitability Measures 18 Allstate Financial Net Investment Income, Yields and Realized Capital Gains and Losses (Pre-tax) 50 Allstate Brand Statistics 19 Consolidated Investment Position and Results by Strategy 51 Allstate Brand Auto Claim Frequency Analysis 20,21 Property-Liability Consolidated Investment Position and Results by Strategy 52 Esurance Brand Profitability Measures and Statistics 22 Allstate Financial Consolidated Investment Position and Results by Strategy 53 Encompass Brand Profitability Measures and Statistics 23 Performance-Based Investments 54 SquareTrade Profitabillity Measures 24 Limited Partnership Interests 55 Auto Profitability Measures 25 Homeowners Profitability Measures 26 Definitions of Non-GAAP Measures 56 Other Personal Lines Profitability Measures 27 Commercial Lines Profitability Measures 28 Other Business Lines Profitability Measures 29 Allstate Brand Auto and Homeowners Underlying Loss and Expense 30 Homeowners Supplemental Information 31 Catastrophe Losses by Brand 32 Catastrophe Experience 33 Prior Year Reserve Reestimates 34 Asbestos and Environmental Reserves 35 THE ALLSTATE CORPORATION Investor Supplement - Third Quarter 2017 Table of Contents

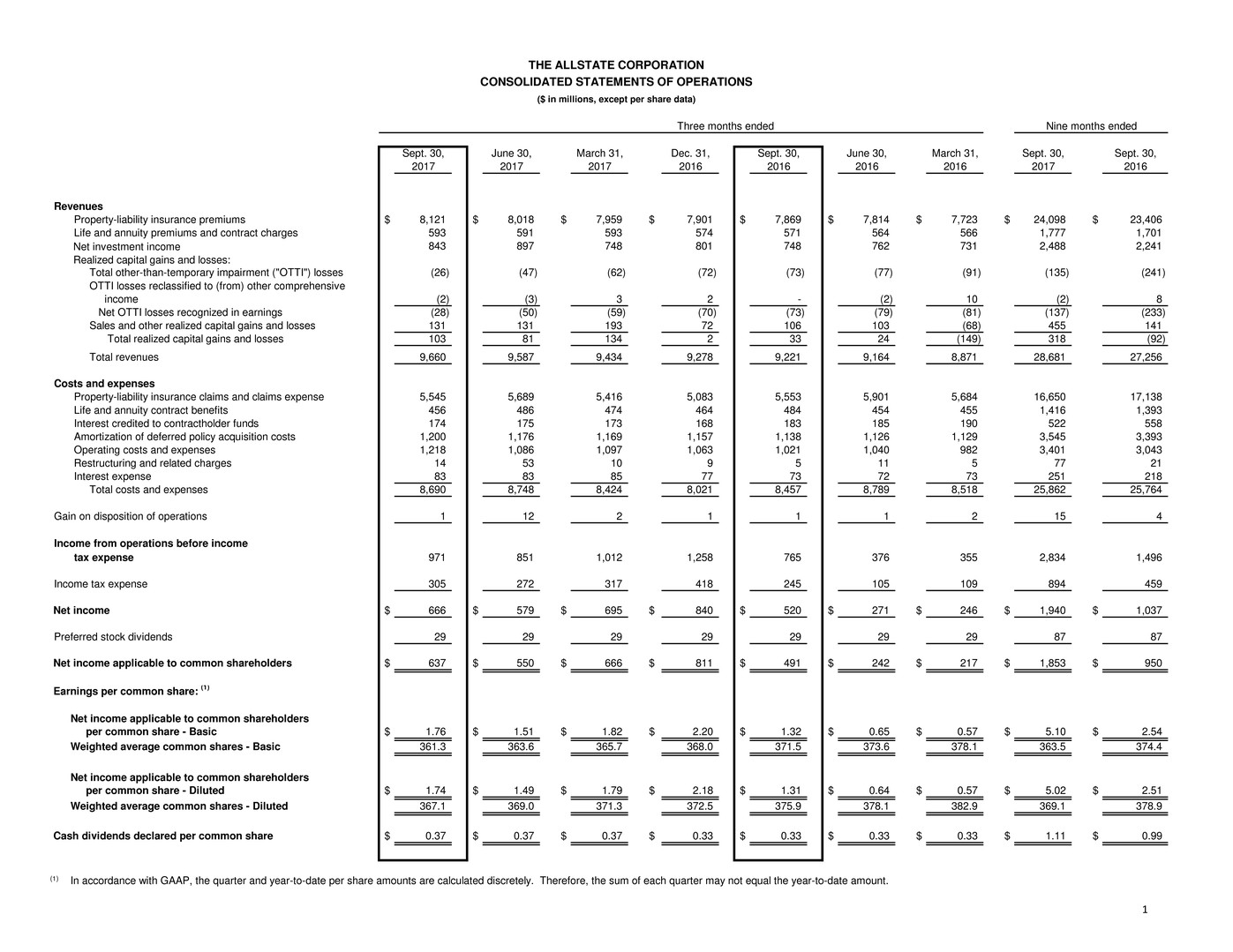

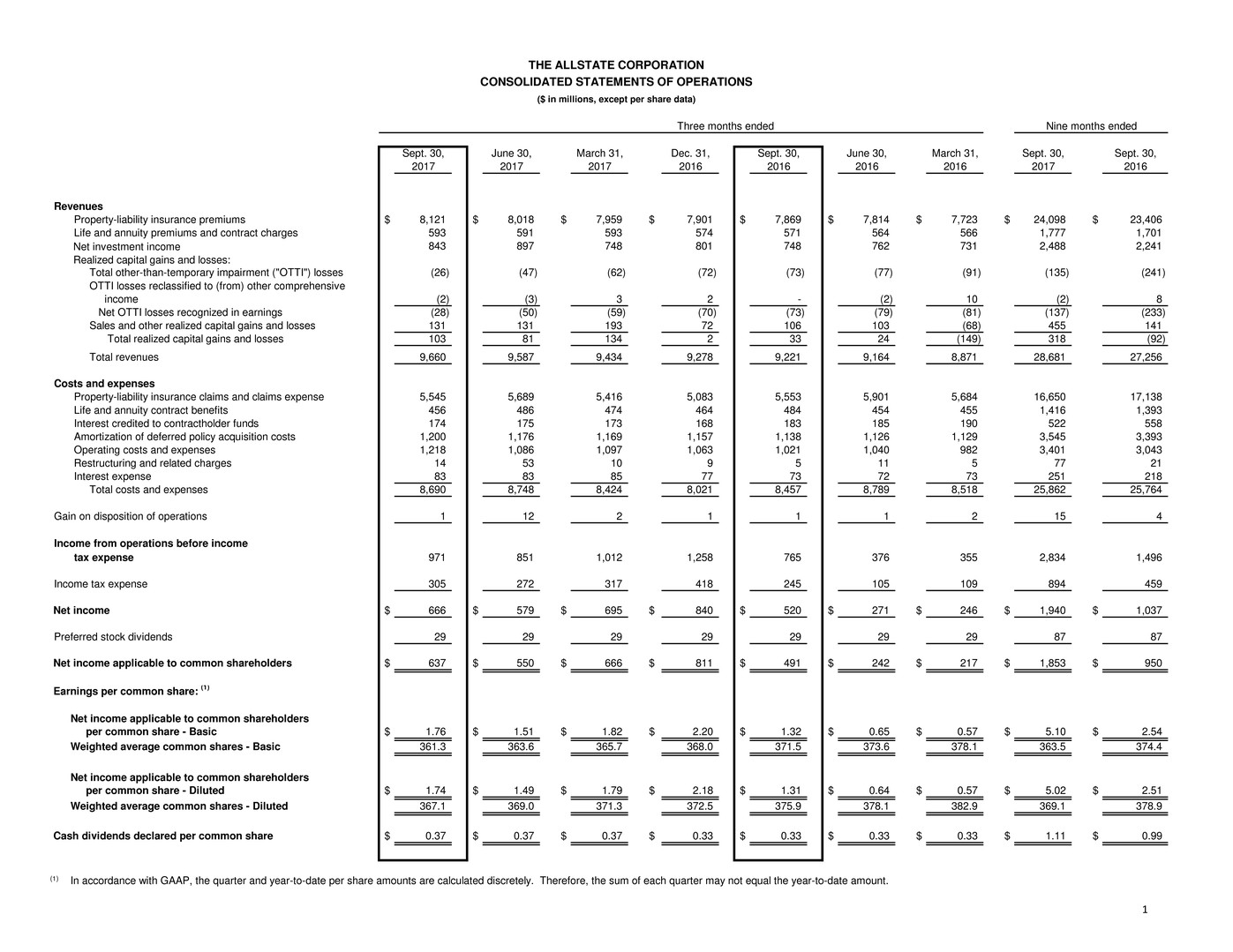

1 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Revenues Property-liability insurance premiums $ 8,121 $ 8,018 $ 7,959 $ 7,901 $ 7,869 $ 7,814 $ 7,723 $ 24,098 $ 23,406 Life and annuity premiums and contract charges 593 591 593 574 571 564 566 1,777 1,701 Net investment income 843 897 748 801 748 762 731 2,488 2,241 Realized capital gains and losses: Total other-than-temporary impairment ("OTTI") losses (26) (47) (62) (72) (73) (77) (91) (135) (241) OTTI losses reclassified to (from) other comprehensive income (2) (3) 3 2 - (2) 10 (2) 8 Net OTTI losses recognized in earnings (28) (50) (59) (70) (73) (79) (81) (137) (233) Sales and other realized capital gains and losses 131 131 193 72 106 103 (68) 455 141 Total realized capital gains and losses 103 81 134 2 33 24 (149) 318 (92) Total revenues 9,660 9,587 9,434 9,278 9,221 9,164 8,871 28,681 27,256 Costs and expenses Property-liability insurance claims and claims expense 5,545 5,689 5,416 5,083 5,553 5,901 5,684 16,650 17,138 Life and annuity contract benefits 456 486 474 464 484 454 455 1,416 1,393 Interest credited to contractholder funds 174 175 173 168 183 185 190 522 558 Amortization of deferred policy acquisition costs 1,200 1,176 1,169 1,157 1,138 1,126 1,129 3,545 3,393 Operating costs and expenses 1,218 1,086 1,097 1,063 1,021 1,040 982 3,401 3,043 Restructuring and related charges 14 53 10 9 5 11 5 77 21 Interest expense 83 83 85 77 73 72 73 251 218 Total costs and expenses 8,690 8,748 8,424 8,021 8,457 8,789 8,518 25,862 25,764 Gain on disposition of operations 1 12 2 1 1 1 2 15 4 Income from operations before income tax expense 971 851 1,012 1,258 765 376 355 2,834 1,496 Income tax expense 305 272 317 418 245 105 109 894 459 Net income $ 666 $ 579 $ 695 $ 840 $ 520 $ 271 $ 246 $ 1,940 $ 1,037 Preferred stock dividends 29 29 29 29 29 29 29 87 87 Net income applicable to common shareholders $ 637 $ 550 $ 666 $ 811 $ 491 $ 242 $ 217 $ 1,853 $ 950 Earnings per common share: (1) Net income applicable to common shareholders per common share - Basic $ 1.76 $ 1.51 $ 1.82 $ 2.20 $ 1.32 $ 0.65 $ 0.57 $ 5.10 $ 2.54 Weighted average common shares - Basic 361.3 363.6 365.7 368.0 371.5 373.6 378.1 363.5 374.4 Net income applicable to common shareholders per common share - Diluted $ 1.74 $ 1.49 $ 1.79 $ 2.18 $ 1.31 $ 0.64 $ 0.57 $ 5.02 $ 2.51 Weighted average common shares - Diluted 367.1 369.0 371.3 372.5 375.9 378.1 382.9 369.1 378.9 Cash dividends declared per common share $ 0.37 $ 0.37 $ 0.37 $ 0.33 $ 0.33 $ 0.33 $ 0.33 $ 1.11 $ 0.99 (1) In accordance with GAAP, the quarter and year-to-date per share amounts are calculated discretely. Therefore, the sum of each quarter may not equal the year-to-date amount. THE ALLSTATE CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS ($ in millions, except per share data) Nine months endedThree months ended

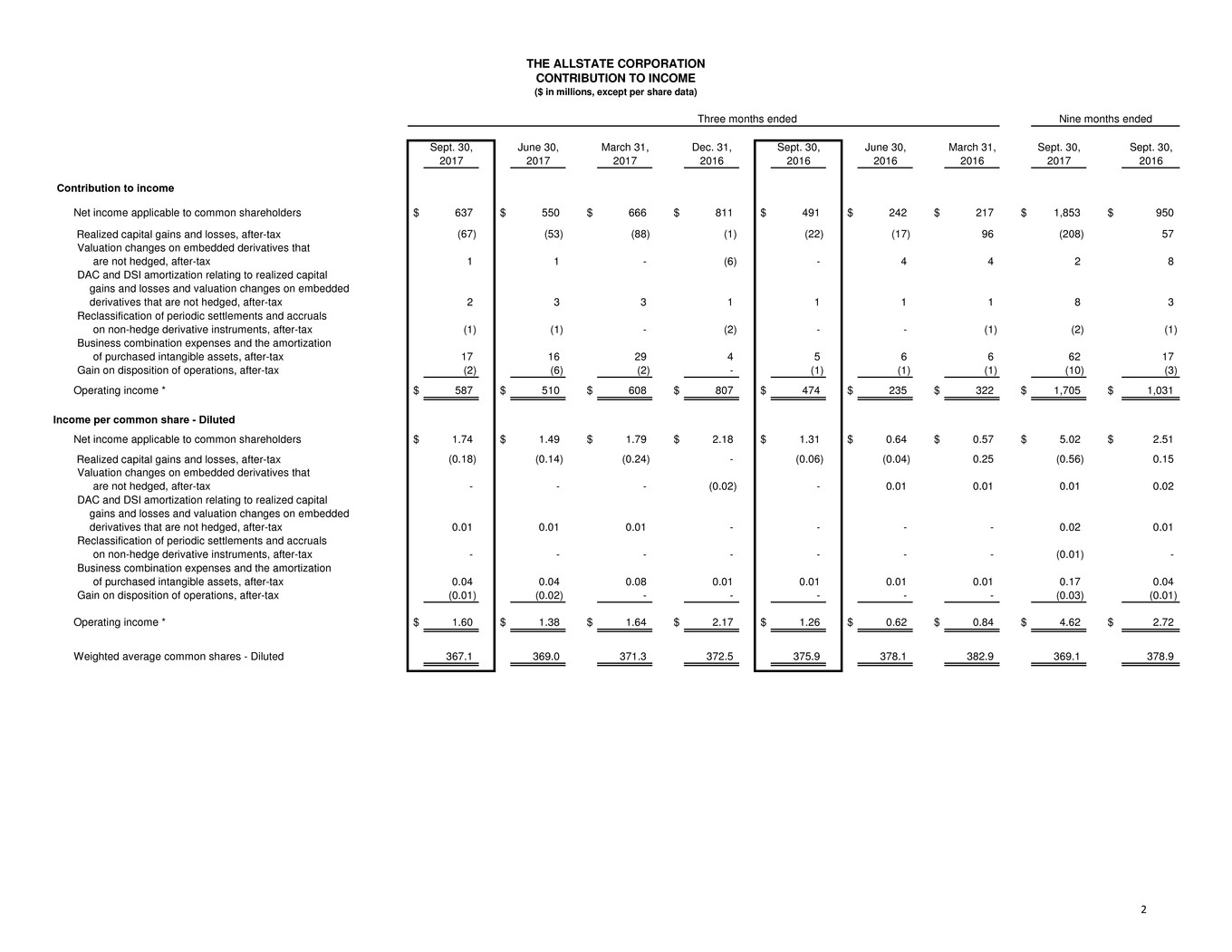

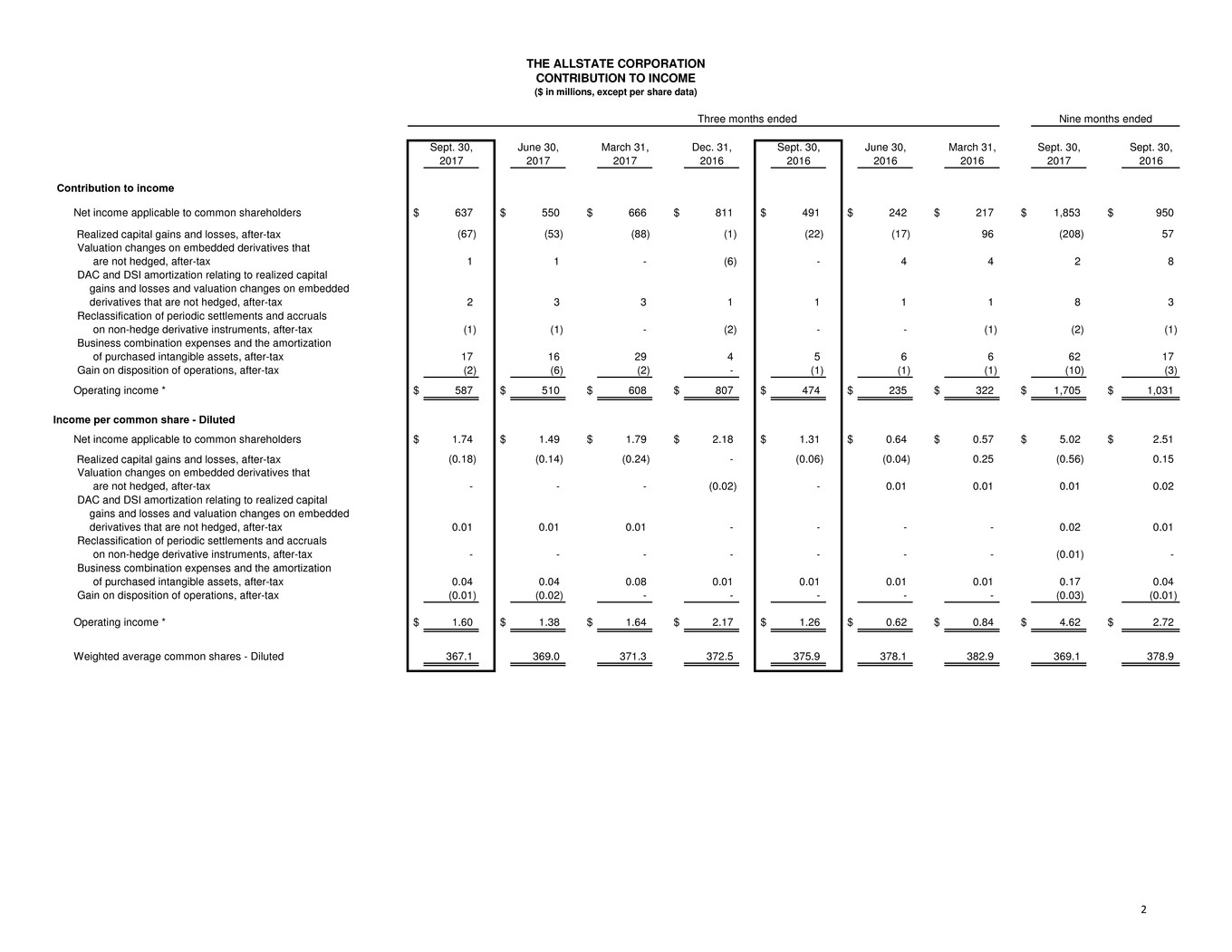

2 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Contribution to income Net income applicable to common shareholders $ 637 $ 550 $ 666 $ 811 $ 491 $ 242 $ 217 $ 1,853 $ 950 Realized capital gains and losses, after-tax (67) (53) (88) (1) (22) (17) 96 (208) 57 Valuation changes on embedded derivatives that are not hedged, after-tax 1 1 - (6) - 4 4 2 8 DAC and DSI amortization relating to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax 2 3 3 1 1 1 1 8 3 Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax (1) (1) - (2) - - (1) (2) (1) Business combination expenses and the amortization of purchased intangible assets, after-tax 17 16 29 4 5 6 6 62 17 Gain on disposition of operations, after-tax (2) (6) (2) - (1) (1) (1) (10) (3) Operating income * $ 587 $ 510 $ 608 $ 807 $ 474 $ 235 $ 322 $ 1,705 $ 1,031 Income per common share - Diluted Net income applicable to common shareholders $ 1.74 $ 1.49 $ 1.79 $ 2.18 $ 1.31 $ 0.64 $ 0.57 $ 5.02 $ 2.51 Realized capital gains and losses, after-tax (0.18) (0.14) (0.24) - (0.06) (0.04) 0.25 (0.56) 0.15 Valuation changes on embedded derivatives that are not hedged, after-tax - - - (0.02) - 0.01 0.01 0.01 0.02 DAC and DSI amortization relating to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax 0.01 0.01 0.01 - - - - 0.02 0.01 Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax - - - - - - - (0.01) - Business combination expenses and the amortization of purchased intangible assets, after-tax 0.04 0.04 0.08 0.01 0.01 0.01 0.01 0.17 0.04 Gain on disposition of operations, after-tax (0.01) (0.02) - - - - - (0.03) (0.01) Operating income * $ 1.60 $ 1.38 $ 1.64 $ 2.17 $ 1.26 $ 0.62 $ 0.84 $ 4.62 $ 2.72 Weighted average common shares - Diluted 367.1 369.0 371.3 372.5 375.9 378.1 382.9 369.1 378.9 THE ALLSTATE CORPORATION CONTRIBUTION TO INCOME ($ in millions, except per share data) Nine months endedThree months ended

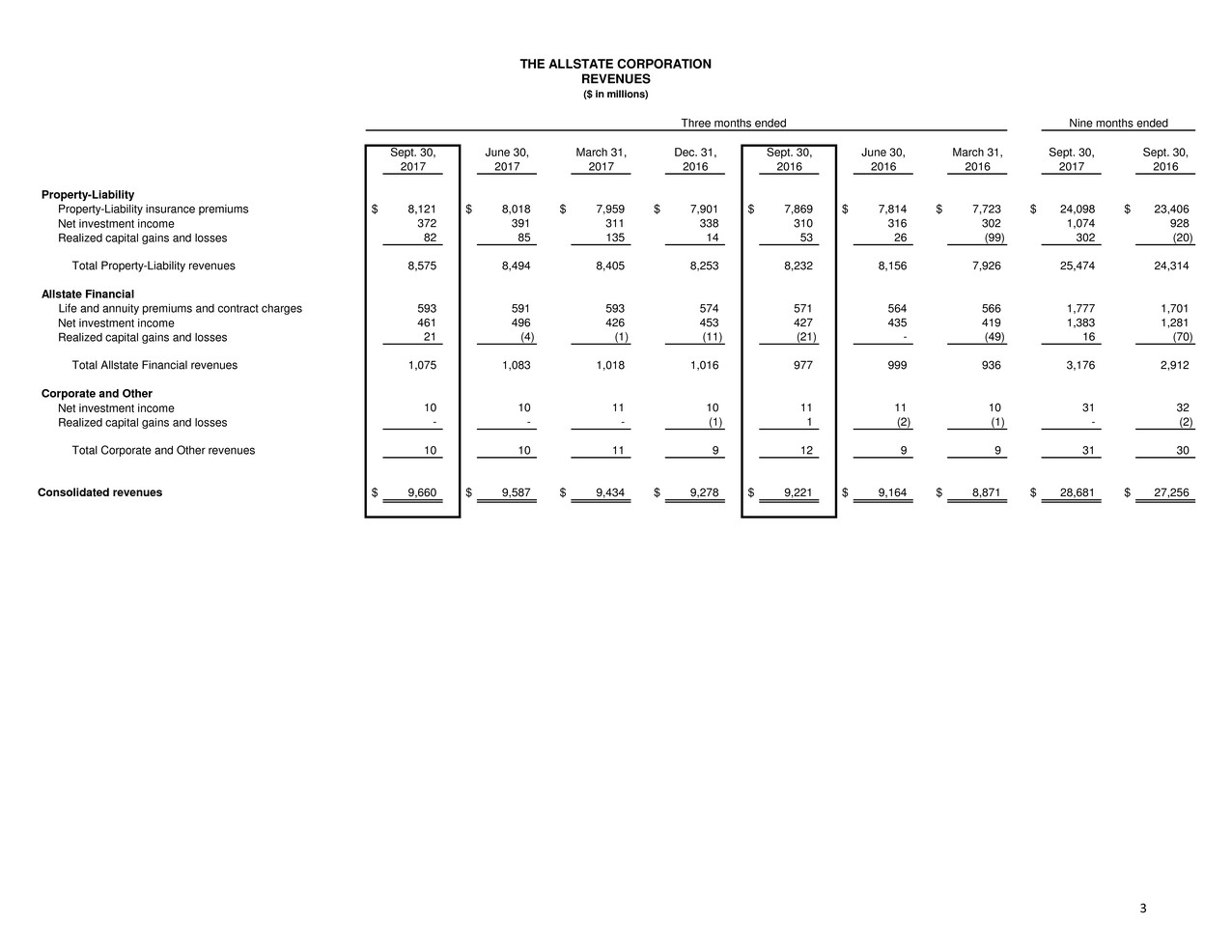

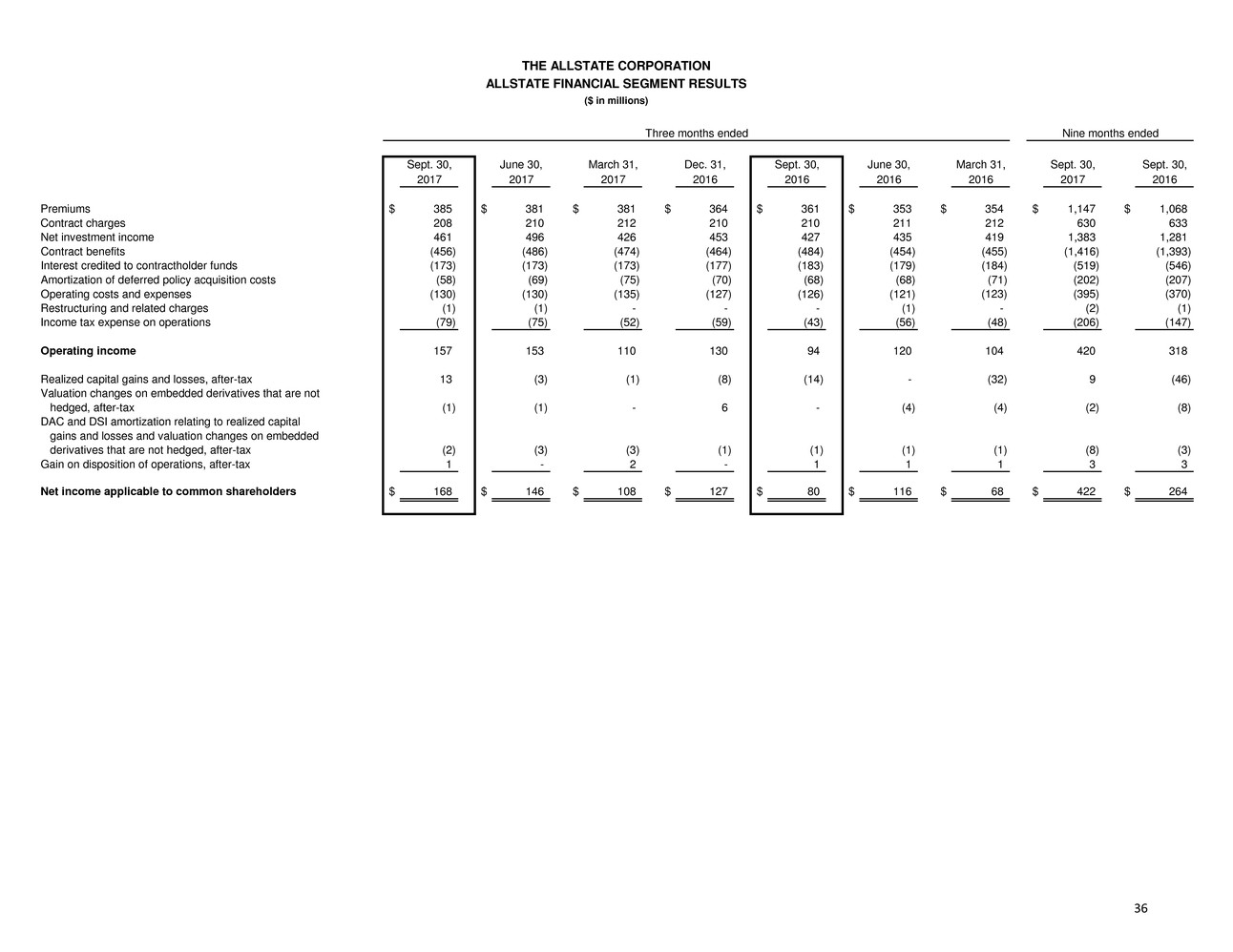

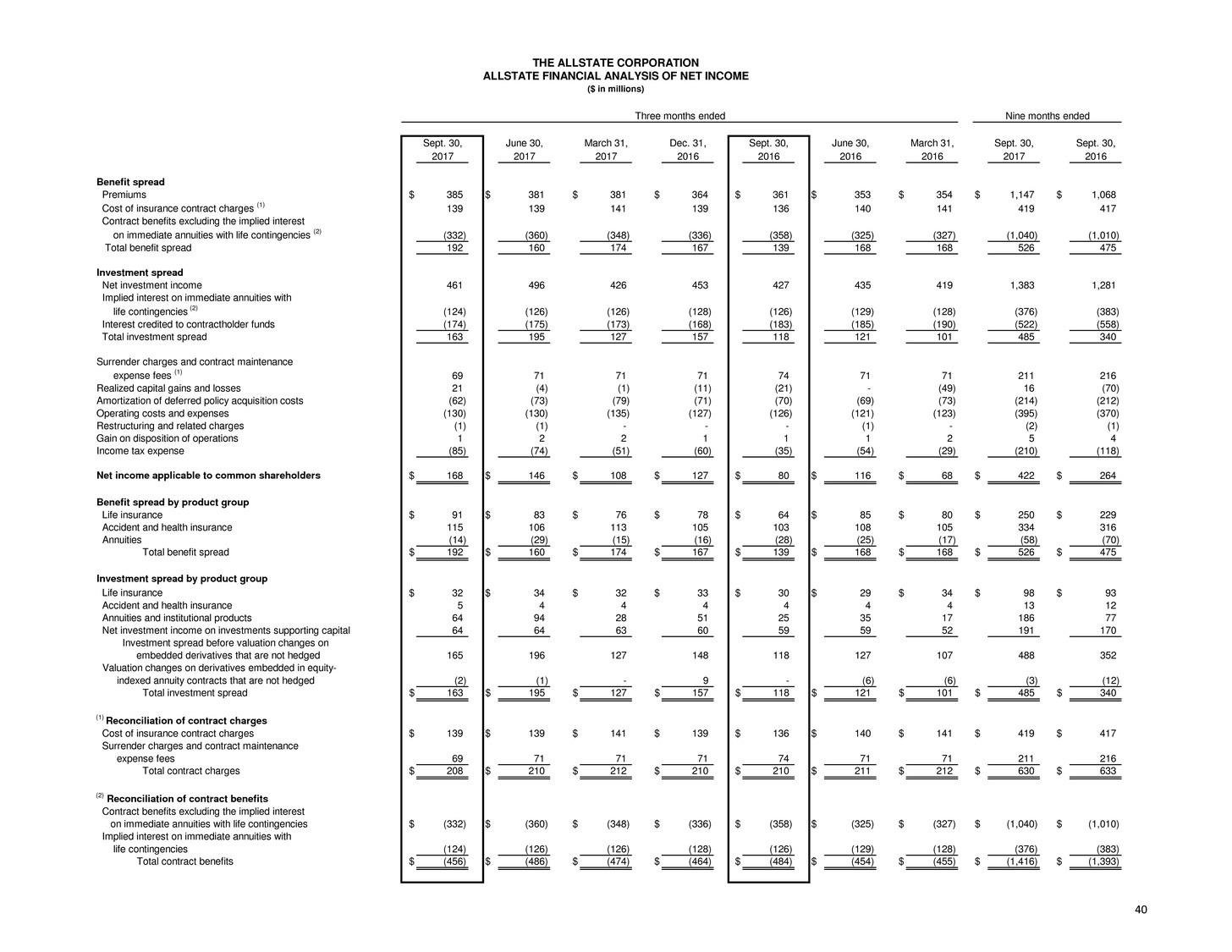

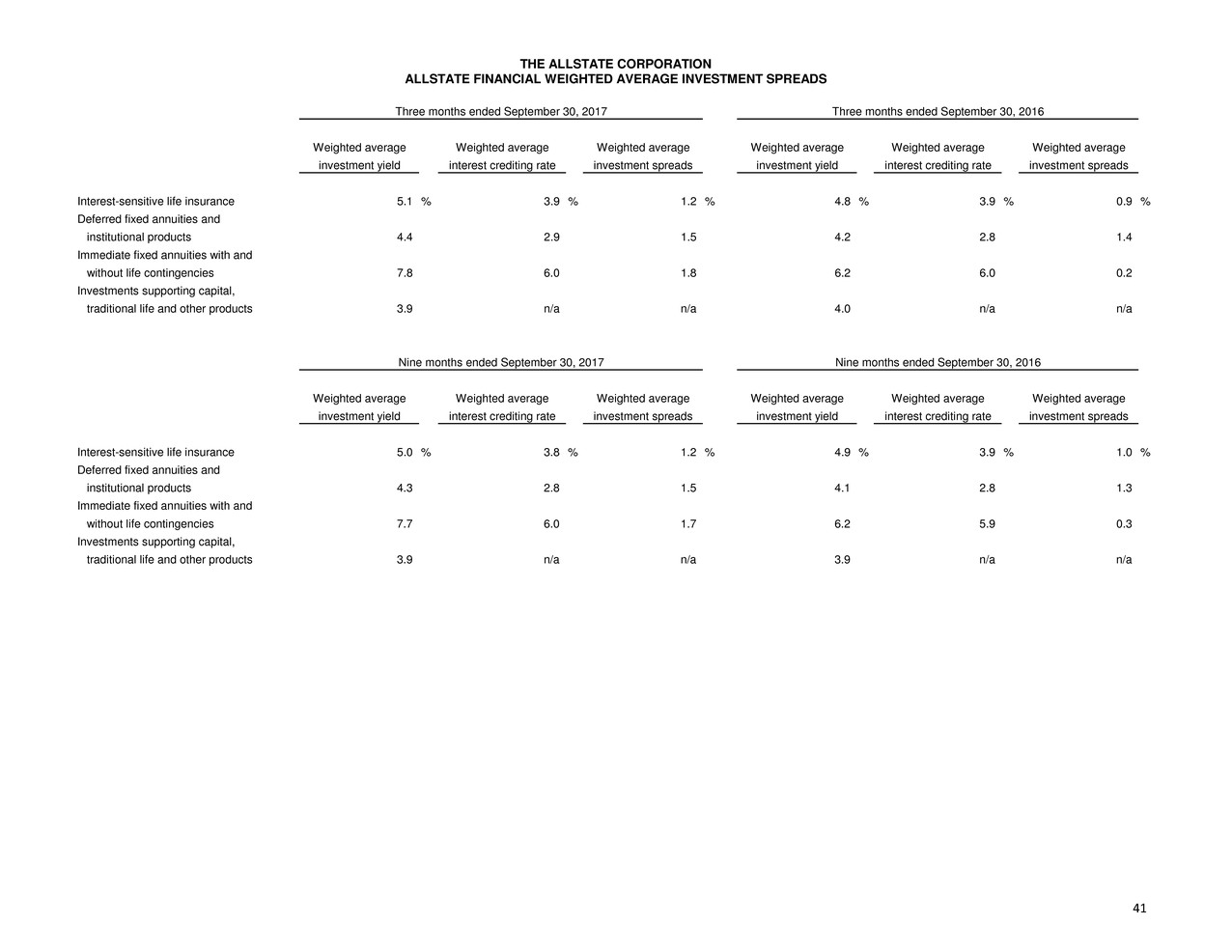

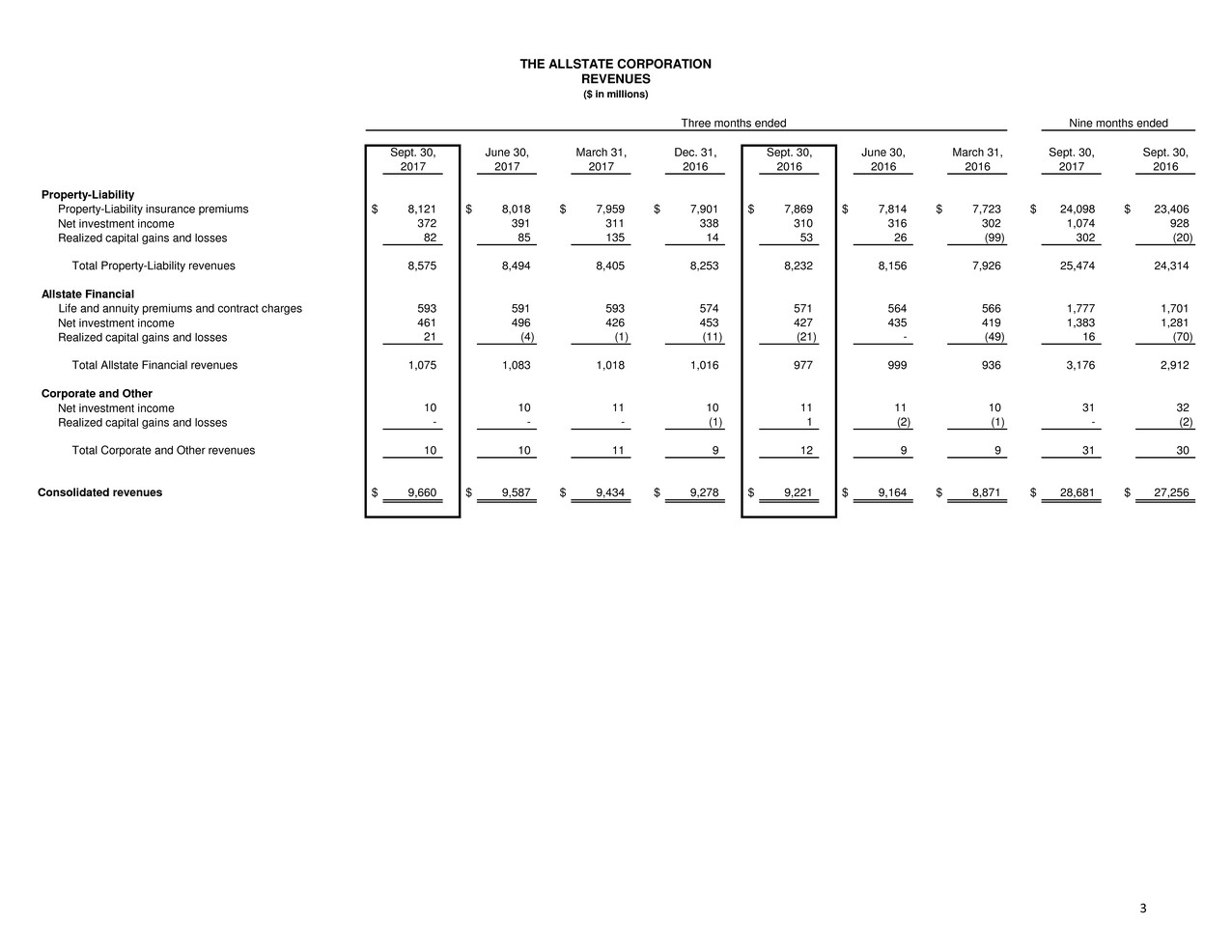

3 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Property-Liability Property-Liability insurance premiums $ 8,121 $ 8,018 $ 7,959 $ 7,901 $ 7,869 $ 7,814 $ 7,723 $ 24,098 $ 23,406 Net investment income 372 391 311 338 310 316 302 1,074 928 Realized capital gains and losses 82 85 135 14 53 26 (99) 302 (20) Total Property-Liability revenues 8,575 8,494 8,405 8,253 8,232 8,156 7,926 25,474 24,314 Allstate Financial Life and annuity premiums and contract charges 593 591 593 574 571 564 566 1,777 1,701 Net investment income 461 496 426 453 427 435 419 1,383 1,281 Realized capital gains and losses 21 (4) (1) (11) (21) - (49) 16 (70) Total Allstate Financial revenues 1,075 1,083 1,018 1,016 977 999 936 3,176 2,912 Corporate and Other Net investment income 10 10 11 10 11 11 10 31 32 Realized capital gains and losses - - - (1) 1 (2) (1) - (2) Total Corporate and Other revenues 10 10 11 9 12 9 9 31 30 Consolidated revenues $ 9,660 $ 9,587 $ 9,434 $ 9,278 $ 9,221 $ 9,164 $ 8,871 $ 28,681 $ 27,256 THE ALLSTATE CORPORATION REVENUES ($ in millions) Nine months endedThree months ended

4 Discontinued Total Allstate Lines and Property- Allstate Corporate Protection Coverages Liability Financial and Other Consolidated Premiums and contract charges $ 8,121 $ - $ 8,121 $ 593 $ - $ 8,714 Claims and claims expense (5,457) (88) (5,545) - - (5,545) Contract benefits and interest credited to contractholder funds - - - (630) - (630) Amortization of deferred policy acquisition costs (1,138) - (1,138) (62) - (1,200) Operating costs and expenses (995) - (995) (130) (93) (1) (1,218) Restructuring and related charges (13) - (13) (1) - (14) Interest expense (1) - (1) - (82) (83) Underwriting income (loss) $ 517 $ (88) $ 429 Net investment income 372 461 10 843 Realized capital gains and losses 82 21 - 103 Gain on disposition of operations - 1 - 1 Income tax (expense) benefit (279) (85) 59 (305) Preferred stock dividends - - (29) (29) Net income (loss) applicable to common shareholders $ 604 $ 168 $ (135) $ 637 Realized capital gains and losses, after-tax (54) (13) - (67) Valuation changes on embedded derivatives that are not hedged, after-tax - 1 - 1 DAC and DSI amortization relating to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax - 2 - 2 Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax (1) - - (1) Business combination expenses and the amortization of purchased intangible assets, after-tax 16 - 1 17 Gain on disposition of operations, after-tax (1) (1) - (2) Operating income (loss) * $ 564 $ 157 (2) $ (134) (2) $ 587 Discontinued Total Allstate Lines and Property- Allstate Corporate Protection Coverages Liability Financial and Other Consolidated Premiums and contract charges $ 7,869 $ - $ 7,869 $ 571 $ - $ 8,440 Claims and claims expense (5,454) (99) (5,553) - - (5,553) Contract benefits and interest credited to contractholder funds - - - (667) - (667) Amortization of deferred policy acquisition costs (1,068) - (1,068) (70) - (1,138) Operating costs and expenses (887) (1) (888) (126) (7) (1,021) Restructuring and related charges (5) - (5) - - (5) Interest expense - - - - (73) (73) Underwriting income (loss) $ 455 $ (100) $ 355 Net investment income 310 427 11 748 Realized capital gains and losses 53 (21) 1 33 Gain on disposition of operations - 1 - 1 Income tax (expense) benefit (235) (35) 25 (245) Preferred stock dividends - - (29) (29) Net income (loss) applicable to common shareholders $ 483 $ 80 $ (72) $ 491 Realized capital gains and losses, after-tax (36) 14 - (22) Valuation changes on embedded derivatives that are not hedged, after-tax - - - - DAC and DSI amortization relating to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax - 1 - 1 - - - - Business combination expenses and the amortization of purchased intangible assets, after-tax 5 - - 5 Gain on disposition of operations, after-tax - (1) - (1) Operating income (loss) * $ 452 $ 94 (2) $ (72) (2) $ 474 (1) (2) Operating income is the segment measure for Allstate Financial and Corporate and Other and is not a non-GAAP measure. Includes a pension settlement loss of $86 million recorded for the three months ended September 30, 2017. For the three months ended September 30, 2016 Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax THE ALLSTATE CORPORATION SEGMENT RESULTS ($ in millions) For the three months ended September 30, 2017

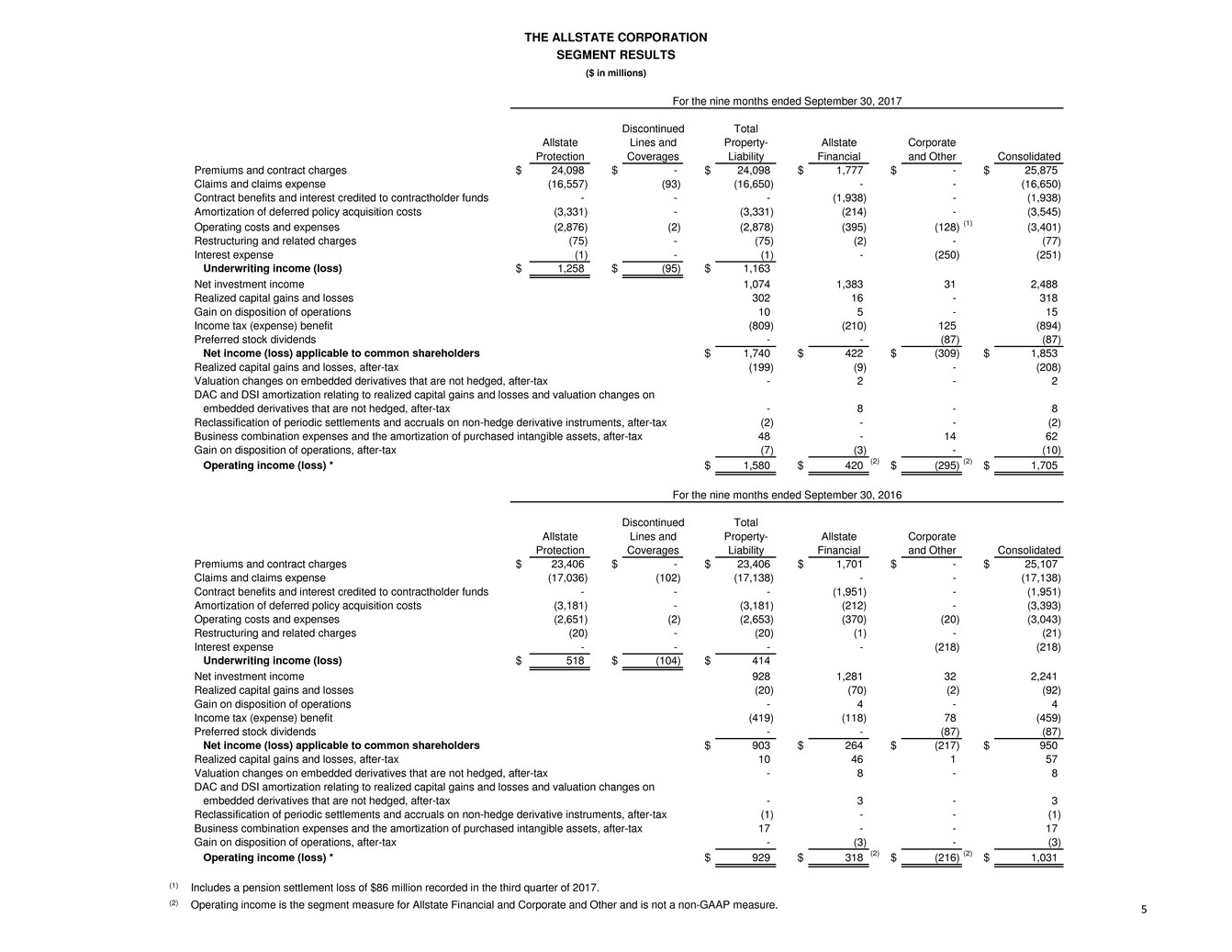

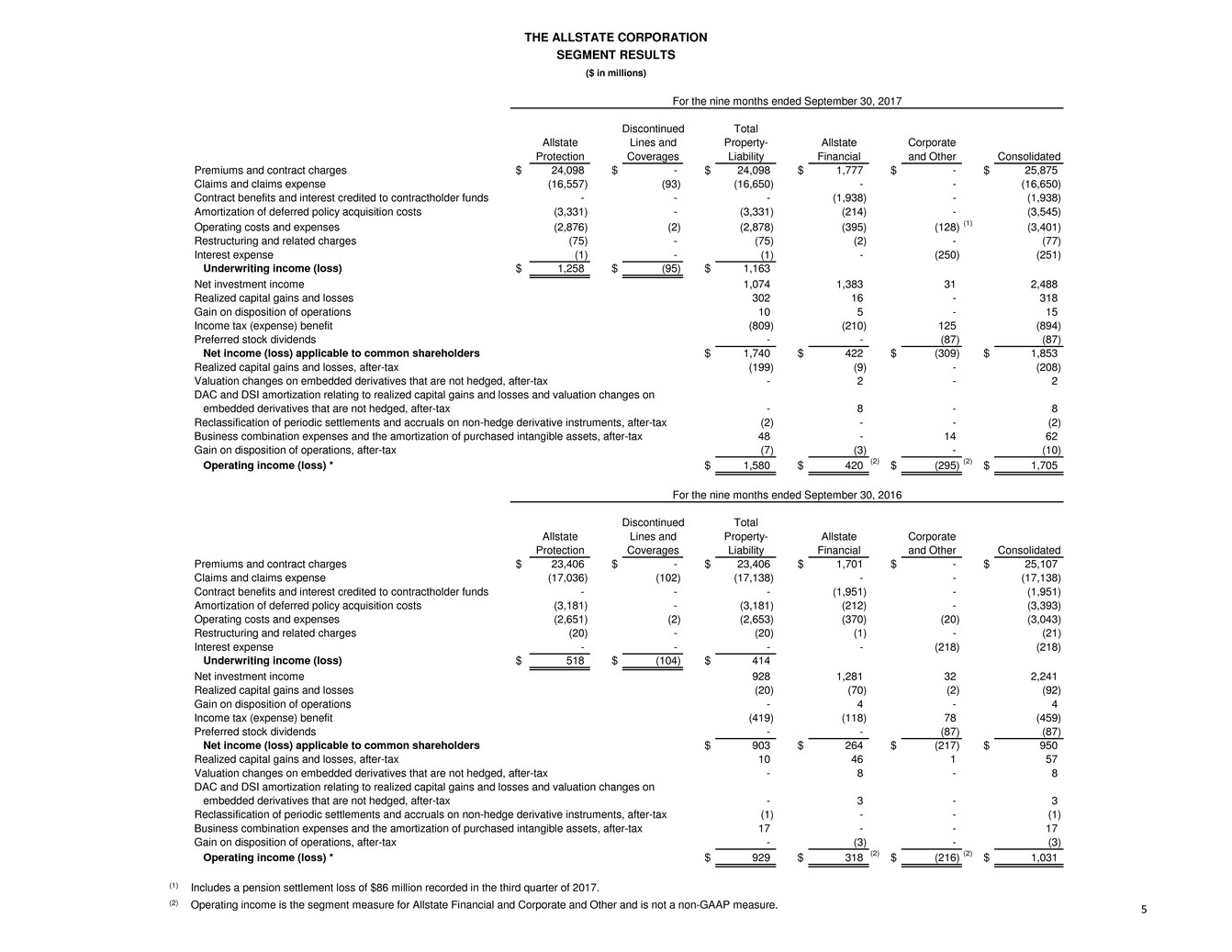

5 Discontinued Total Allstate Lines and Property- Allstate Corporate Protection Coverages Liability Financial and Other Consolidated Premiums and contract charges $ 24,098 $ - $ 24,098 $ 1,777 $ - $ 25,875 Claims and claims expense (16,557) (93) (16,650) - - (16,650) Contract benefits and interest credited to contractholder funds - - - (1,938) - (1,938) Amortization of deferred policy acquisition costs (3,331) - (3,331) (214) - (3,545) Operating costs and expenses (2,876) (2) (2,878) (395) (128) (1) (3,401) Restructuring and related charges (75) - (75) (2) - (77) Interest expense (1) - (1) - (250) (251) Underwriting income (loss) $ 1,258 $ (95) $ 1,163 Net investment income 1,074 1,383 31 2,488 Realized capital gains and losses 302 16 - 318 Gain on disposition of operations 10 5 - 15 Income tax (expense) benefit (809) (210) 125 (894) Preferred stock dividends - - (87) (87) Net income (loss) applicable to common shareholders $ 1,740 $ 422 $ (309) $ 1,853 Realized capital gains and losses, after-tax (199) (9) - (208) Valuation changes on embedded derivatives that are not hedged, after-tax - 2 - 2 DAC and DSI amortization relating to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax - 8 - 8 Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax (2) - - (2) Business combination expenses and the amortization of purchased intangible assets, after-tax 48 - 14 62 Gain on disposition of operations, after-tax (7) (3) - (10) Operating income (loss) * $ 1,580 $ 420 (2) $ (295) (2) $ 1,705 Discontinued Total Allstate Lines and Property- Allstate Corporate Protection Coverages Liability Financial and Other Consolidated Premiums and contract charges $ 23,406 $ - $ 23,406 $ 1,701 $ - $ 25,107 Claims and claims expense (17,036) (102) (17,138) - - (17,138) Contract benefits and interest credited to contractholder funds - - - (1,951) - (1,951) Amortization of deferred policy acquisition costs (3,181) - (3,181) (212) - (3,393) Operating costs and expenses (2,651) (2) (2,653) (370) (20) (3,043) Restructuring and related charges (20) - (20) (1) - (21) Interest expense - - - - (218) (218) Underwriting income (loss) $ 518 $ (104) $ 414 Net investment income 928 1,281 32 2,241 Realized capital gains and losses (20) (70) (2) (92) Gain on disposition of operations - 4 - 4 Income tax (expense) benefit (419) (118) 78 (459) Preferred stock dividends - - (87) (87) Net income (loss) applicable to common shareholders $ 903 $ 264 $ (217) $ 950 Realized capital gains and losses, after-tax 10 46 1 57 Valuation changes on embedded derivatives that are not hedged, after-tax - 8 - 8 DAC and DSI amortization relating to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged, after-tax - 3 - 3 (1) - - (1) Business combination expenses and the amortization of purchased intangible assets, after-tax 17 - - 17 Gain on disposition of operations, after-tax - (3) - (3) Operating income (loss) * $ 929 $ 318 (2) $ (216) (2) $ 1,031 (1) (2) Operating income is the segment measure for Allstate Financial and Corporate and Other and is not a non-GAAP measure. THE ALLSTATE CORPORATION SEGMENT RESULTS ($ in millions) For the nine months ended September 30, 2017 Includes a pension settlement loss of $86 million recorded in the third quarter of 2017. For the nine months ended September 30, 2016 Reclassification of periodic settlements and accruals on non-hedge derivative instruments, after-tax

6 Sept 30, June 30, March 31, Dec. 31, Sept. 30, Sept. 30, June 30, March 31, Dec. 31, Sept. 30, 2017 2017 2017 2016 2016 2017 2017 2017 2016 2016 Assets Liabilities Investments Reserve for property-liability insurance claims and Fixed income securities, at fair value claims expense $ 27,154 $ 25,884 $ 25,628 $ 25,250 $ 25,450 (amortized cost $57,608, $56,901, Reserve for life-contingent contract benefits 12,227 12,234 12,223 12,239 12,228 $57,194, $56,576 and $57,775) $ 59,391 $ 58,656 $ 58,636 $ 57,839 $ 60,306 Contractholder funds 19,650 19,832 20,051 20,260 20,583 Equity securities, at fair value Unearned premiums 13,535 13,024 12,705 12,583 12,772 (cost $5,468, $5,321, $5,026, Claim payments outstanding 959 939 845 879 934 $5,157 and $4,800) 6,434 6,117 5,685 5,666 5,288 Deferred income taxes 1,249 1,104 833 487 935 Mortgage loans 4,322 4,336 4,349 4,486 4,396 Other liabilities and accrued expenses 6,968 6,583 7,018 6,599 6,122 Limited partnership interests 6,600 6,206 5,982 5,814 5,588 Long-term debt 6,349 6,348 6,346 6,347 5,110 Short-term, at fair value Separate Accounts 3,422 3,416 3,436 3,393 3,469 (amortized cost $2,198, $2,175, $2,753, Total liabilities 91,513 89,364 89,085 88,037 87,603 $4,288 and $1,863) 2,198 2,175 2,753 4,288 1,863 Other 3,826 3,815 3,738 3,706 3,663 Equity Total investments 82,771 81,305 81,143 81,799 81,104 Preferred stock and additional capital paid-in, 72.2 thousand shares outstanding 1,746 1,746 1,746 1,746 1,746 Common stock, 360 million, 361 million, 365 million, 366 million and 368 million shares outstanding (2) 9 9 9 9 9 Additional capital paid-in 3,330 3,269 3,285 3,303 3,237 Retained income 42,125 41,622 41,208 40,678 39,990 Deferred ESOP expense (6) (6) (6) (6) (13) Treasury stock, at cost (540 million, 539 million, 535 million, 534 million and 532 million shares) (25,413) (25,241) (24,887) (24,741) (24,537) Accumulated other comprehensive income: Unrealized net capital gains and losses: Unrealized net capital gains and losses on fixed income securities with other-than-temporary impairments 68 65 59 57 56 Cash 690 482 442 436 389 Other unrealized net capital gains and losses 1,715 1,590 1,304 1,091 1,902 Premium installment receivables, net 5,922 5,693 5,649 5,597 5,799 Unrealized adjustment to DAC, DSI Deferred policy acquisition costs 4,147 4,037 3,988 3,954 3,886 and insurance reserves (132) (129) (107) (95) (141) Reinsurance recoverables, net (1) 9,748 8,722 8,723 8,745 8,922 Total unrealized net capital gains and losses 1,651 1,526 1,256 1,053 1,817 Accrued investment income 590 573 577 567 567 Unrealized foreign currency translation Property and equipment, net 1,067 1,072 1,067 1,065 1,013 adjustments (14) (42) (53) (50) (48) Goodwill 2,309 2,309 2,295 1,219 1,219 Unrecognized pension and other Other assets 2,966 3,256 2,923 1,835 2,169 postretirement benefit cost (1,309) (1,382) (1,400) (1,419) (1,267) Separate Accounts 3,422 3,416 3,436 3,393 3,469 Total accumulated other comprehensive income (loss) 328 102 (197) (416) 502 Total shareholders' equity 22,119 21,501 21,158 20,573 20,934 Total assets $ 113,632 $ 110,865 $ 110,243 $ 108,610 $ 108,537 Total liabilities and shareholders' equity $ 113,632 $ 110,865 $ 110,243 $ 108,610 $ 108,537 (1) (2) THE ALLSTATE CORPORATION CONSOLIDATED STATEMENTS OF FINANCIAL POSITION ($ in millions) Reinsurance recoverables of unpaid losses related to Property-Liability were $7.26 billion, $6.21 billion, $6.18 billion, $6.18 billion and $6.35 billion as of September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016 and September 30, 2016, respectively. Common shares outstanding were 359,787,293; 361,280,366; 365,015,746; 365,771,746 and 368,126,127 as of September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016 and September 30, 2016, respectively.

7 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, 2017 2017 2017 2016 2016 2016 2016 Book value per common share Numerator: Common shareholders' equity (1) $ 20,373 $ 19,755 $ 19,412 $ 18,827 $ 19,188 $ 18,807 $ 18,594 Denominator: Common shares outstanding and dilutive potential common shares outstanding 365.8 367.0 370.4 370.8 372.7 375.8 380.3 Book value per common share $ 55.69 $ 53.83 $ 52.41 $ 50.77 $ 51.48 $ 50.05 $ 48.89 Book value per common share, excluding the impact of unrealized net capital gains and losses on fixed income securities Numerator: Common shareholders' equity $ 20,373 $ 19,755 $ 19,412 $ 18,827 $ 19,188 $ 18,807 $ 18,594 Unrealized net capital gains and losses on fixed income securities 1,028 1,013 831 727 1,506 1,407 993 Adjusted common shareholders' equity $ 19,345 $ 18,742 $ 18,581 $ 18,100 $ 17,682 $ 17,400 $ 17,601 Denominator: Common shares outstanding and dilutive potential common shares outstanding 365.8 367.0 370.4 370.8 372.7 375.8 380.3 Book value per common share, excluding the impact of unrealized net capital gains and losses on fixed income securities * $ 52.88 $ 51.07 $ 50.16 $ 48.81 $ 47.44 $ 46.30 $ 46.28 (1) BOOK VALUE PER COMMON SHARE THE ALLSTATE CORPORATION ($ in millions, except per share data) Excludes equity related to preferred stock of $1,746 million in each period.

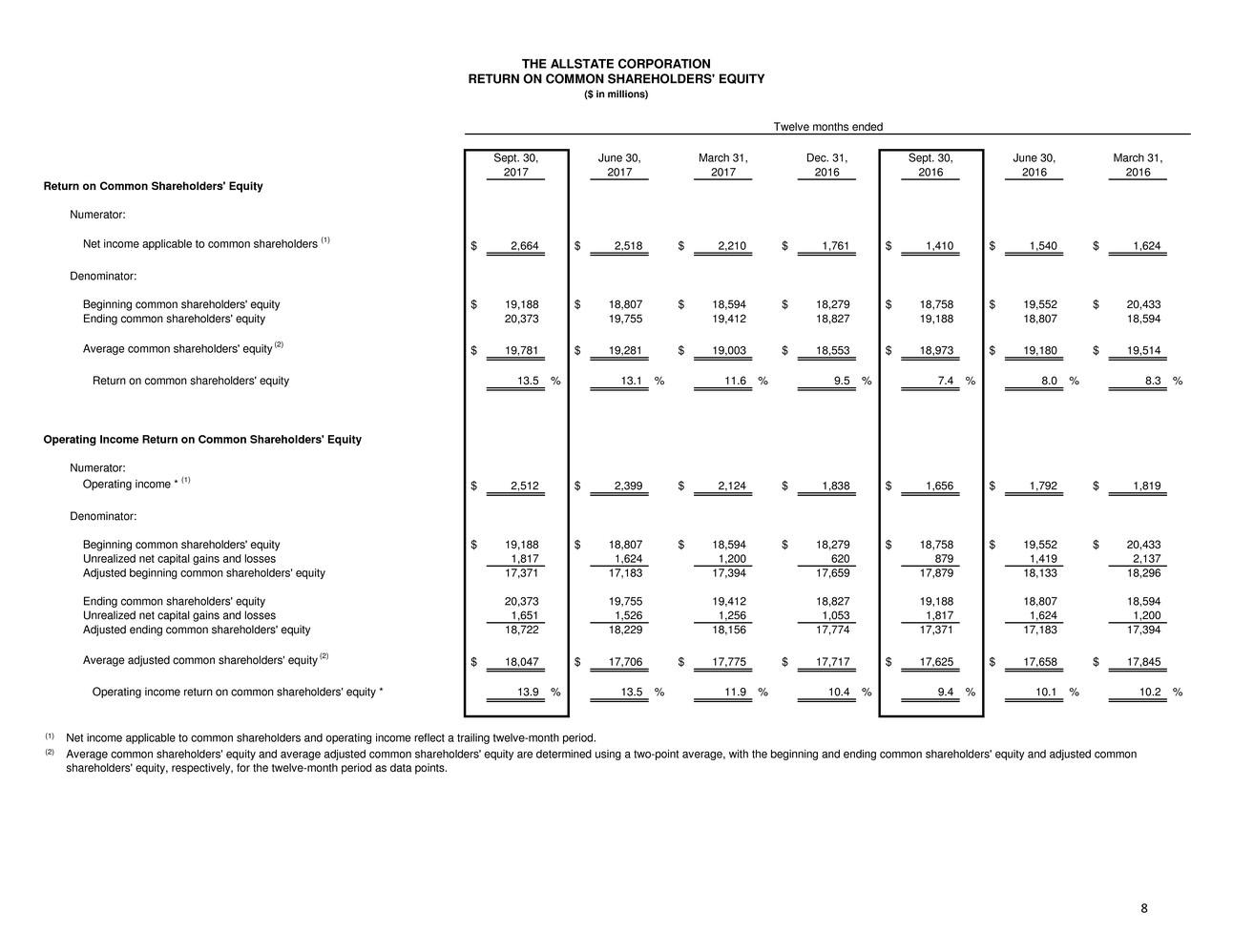

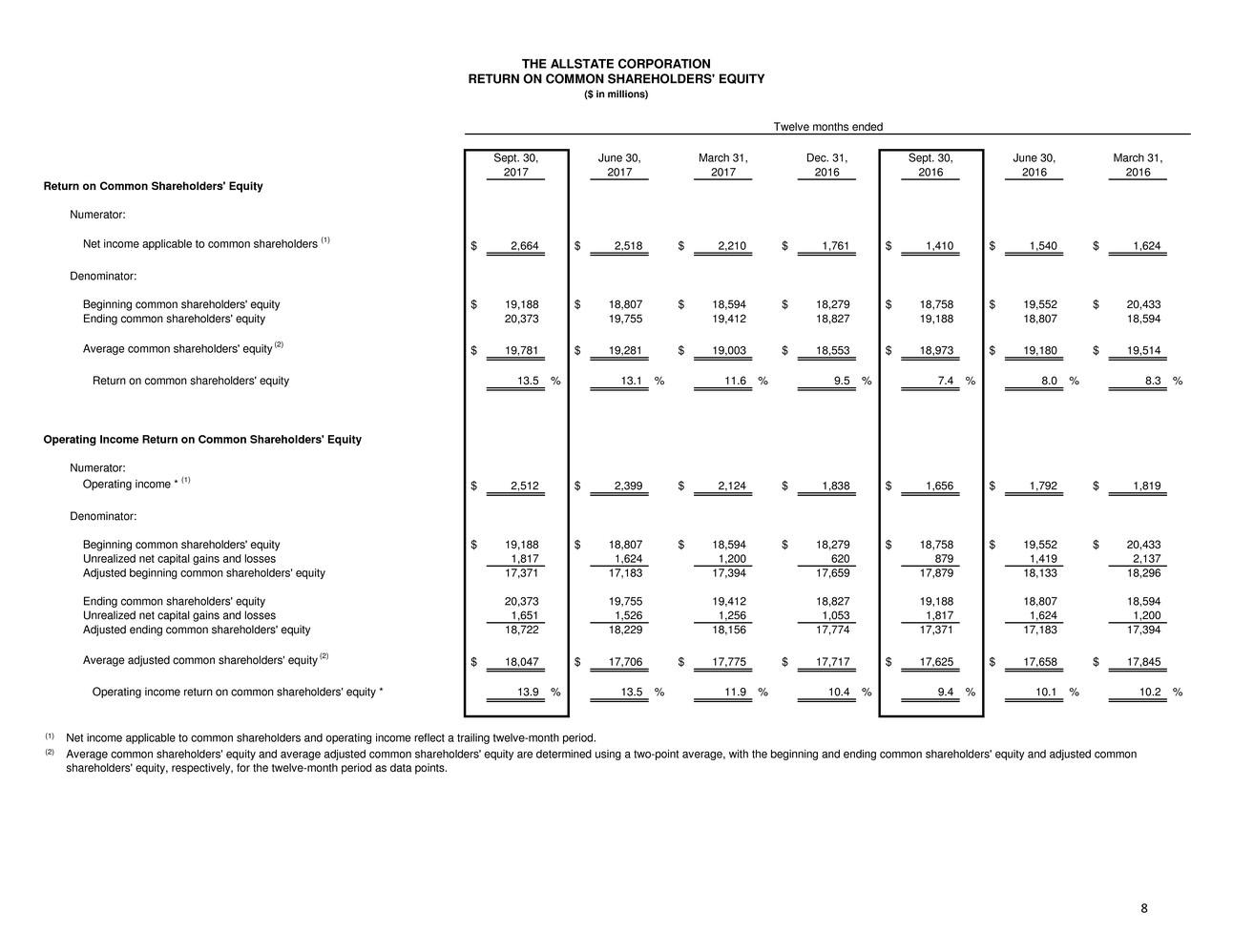

8 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, 2017 2017 2017 2016 2016 2016 2016 Return on Common Shareholders' Equity Numerator: Net income applicable to common shareholders (1) $ 2,664 $ 2,518 $ 2,210 $ 1,761 $ 1,410 $ 1,540 $ 1,624 Denominator: Beginning common shareholders' equity $ 19,188 $ 18,807 $ 18,594 $ 18,279 $ 18,758 $ 19,552 $ 20,433 Ending common shareholders' equity 20,373 19,755 19,412 18,827 19,188 18,807 18,594 Average common shareholders' equity (2) $ 19,781 $ 19,281 $ 19,003 $ 18,553 $ 18,973 $ 19,180 $ 19,514 Return on common shareholders' equity 13.5 % 13.1 % 11.6 % 9.5 % 7.4 % 8.0 % 8.3 % Operating Income Return on Common Shareholders' Equity Numerator: Operating income * (1) $ 2,512 $ 2,399 $ 2,124 $ 1,838 $ 1,656 $ 1,792 $ 1,819 Denominator: Beginning common shareholders' equity $ 19,188 $ 18,807 $ 18,594 $ 18,279 $ 18,758 $ 19,552 $ 20,433 Unrealized net capital gains and losses 1,817 1,624 1,200 620 879 1,419 2,137 Adjusted beginning common shareholders' equity 17,371 17,183 17,394 17,659 17,879 18,133 18,296 Ending common shareholders' equity 20,373 19,755 19,412 18,827 19,188 18,807 18,594 Unrealized net capital gains and losses 1,651 1,526 1,256 1,053 1,817 1,624 1,200 Adjusted ending common shareholders' equity 18,722 18,229 18,156 17,774 17,371 17,183 17,394 Average adjusted common shareholders' equity (2) $ 18,047 $ 17,706 $ 17,775 $ 17,717 $ 17,625 $ 17,658 $ 17,845 Operating income return on common shareholders' equity * 13.9 % 13.5 % 11.9 % 10.4 % 9.4 % 10.1 % 10.2 % (1) (2) THE ALLSTATE CORPORATION RETURN ON COMMON SHAREHOLDERS' EQUITY ($ in millions) Average common shareholders' equity and average adjusted common shareholders' equity are determined using a two-point average, with the beginning and ending common shareholders' equity and adjusted common shareholders' equity, respectively, for the twelve-month period as data points. Twelve months ended Net income applicable to common shareholders and operating income reflect a trailing twelve-month period.

9 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, 2017 2017 2017 2016 2016 2016 2016 Debt Short-term debt $ - $ - $ - $ - $ - $ - $ - Long-term debt 6,349 6,348 6,346 6,347 5,110 5,109 5,108 Total debt $ 6,349 $ 6,348 $ 6,346 $ 6,347 $ 5,110 $ 5,109 $ 5,108 Capital resources Debt $ 6,349 $ 6,348 $ 6,346 $ 6,347 $ 5,110 $ 5,109 $ 5,108 Shareholders' equity Preferred stock and additional capital paid-in 1,746 1,746 1,746 1,746 1,746 1,746 1,746 Common stock 9 9 9 9 9 9 9 Additional capital paid-in 3,330 3,269 3,285 3,303 3,237 3,203 3,237 Retained income 42,125 41,622 41,208 40,678 39,990 39,623 39,505 Deferred ESOP expense (6) (6) (6) (6) (13) (13) (13) Treasury stock (25,413) (25,241) (24,887) (24,741) (24,537) (24,310) (23,994) Unrealized net capital gains and losses 1,651 1,526 1,256 1,053 1,817 1,624 1,200 Unrealized foreign currency translation adjustments (14) (42) (53) (50) (48) (41) (46) Unrecognized pension and other postretirement benefit cost (1,309) (1,382) (1,400) (1,419) (1,267) (1,288) (1,304) Total shareholders' equity 22,119 21,501 21,158 20,573 20,934 20,553 20,340 Total capital resources $ 28,468 $ 27,849 $ 27,504 $ 26,920 $ 26,044 $ 25,662 $ 25,448 Ratio of debt to shareholders' equity 28.7 % 29.5 % 30.0 % 30.9 % 24.4 % 24.9 % 25.1 % Ratio of debt to capital resources 22.3 % 22.8 % 23.1 % 23.6 % 19.6 % 19.9 % 20.1 % THE ALLSTATE CORPORATION DEBT TO CAPITAL ($ in millions)

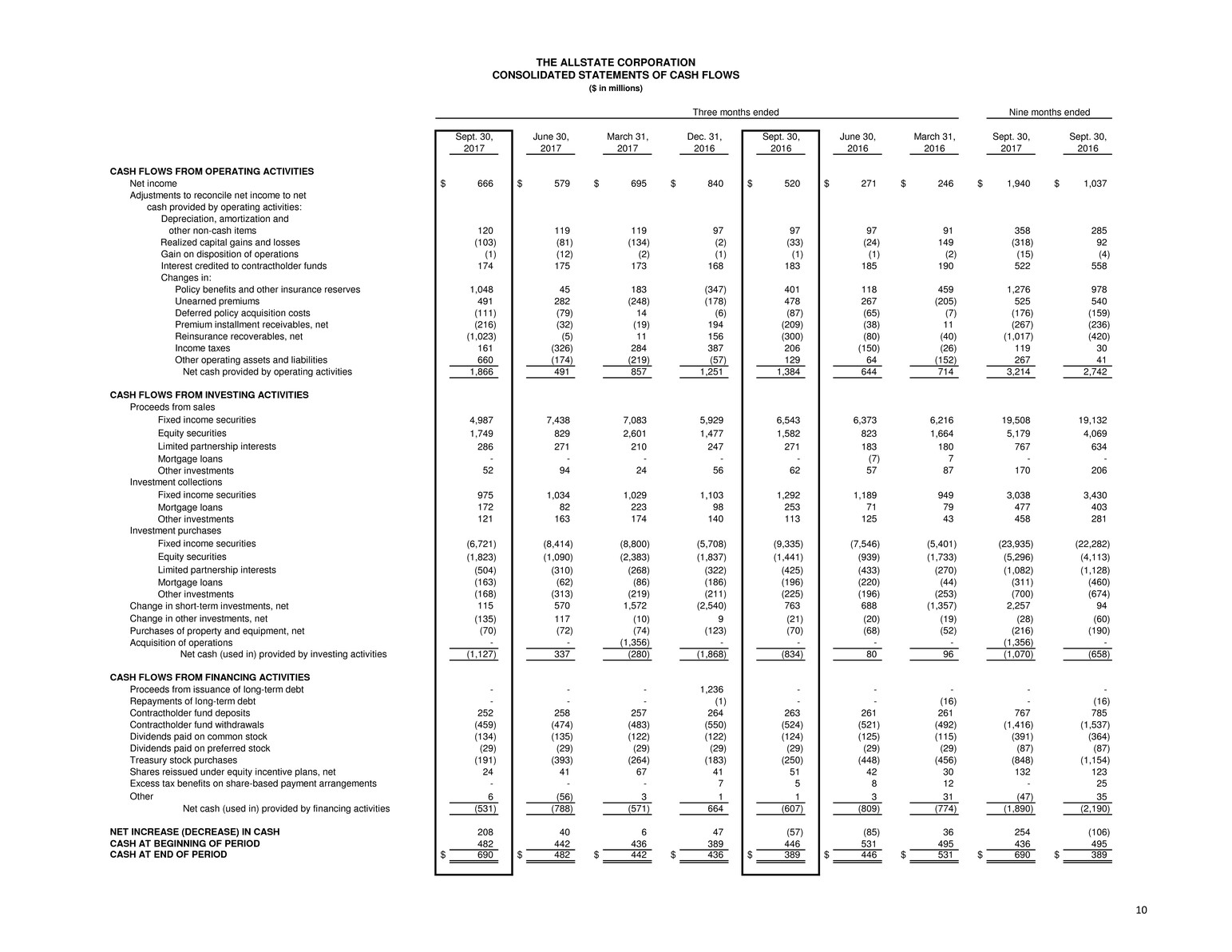

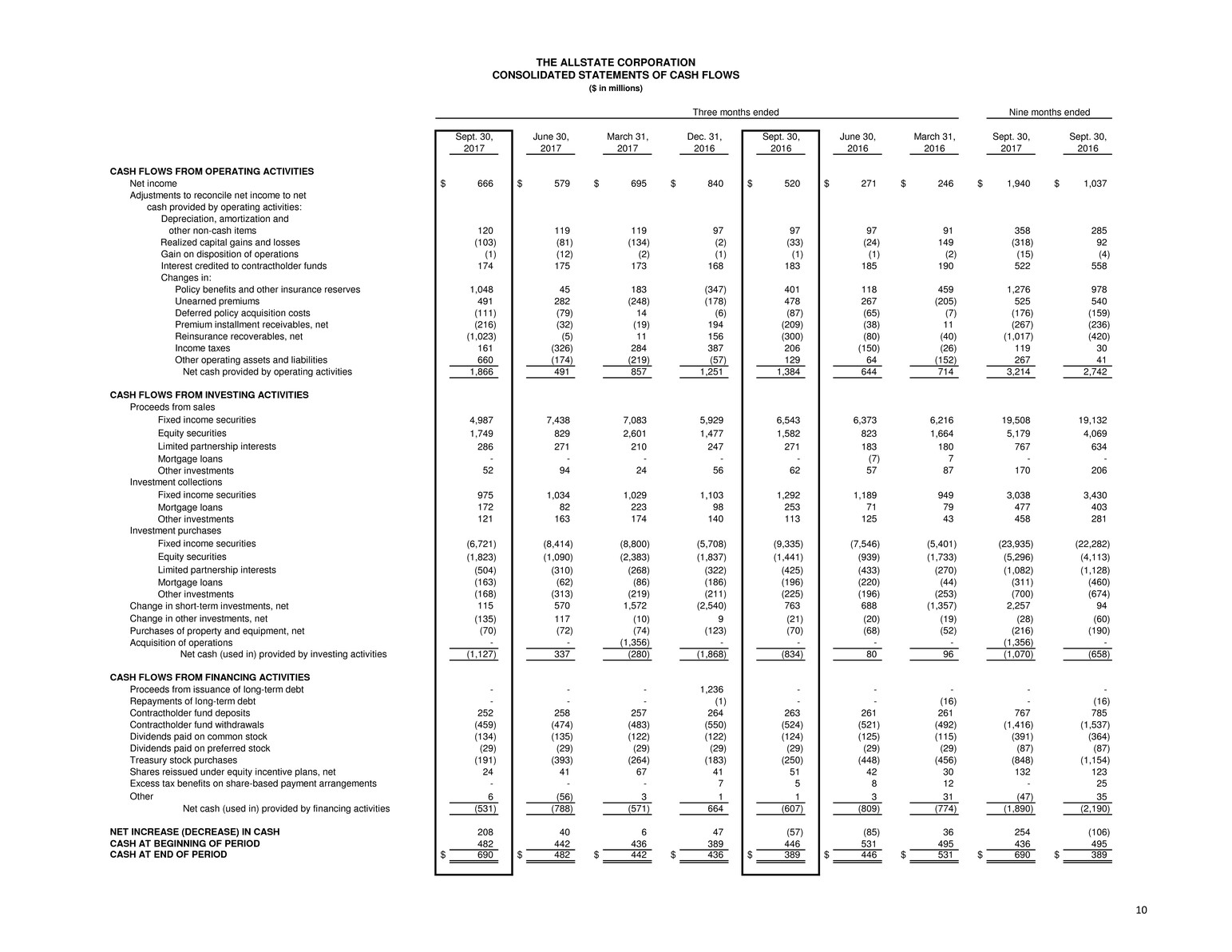

10 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 CASH FLOWS FROM OPERATING ACTIVITIES Net income $ 666 $ 579 $ 695 $ 840 $ 520 $ 271 $ 246 $ 1,940 $ 1,037 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation, amortization and other non-cash items 120 119 119 97 97 97 91 358 285 Realized capital gains and losses (103) (81) (134) (2) (33) (24) 149 (318) 92 Gain on disposition of operations (1) (12) (2) (1) (1) (1) (2) (15) (4) Interest credited to contractholder funds 174 175 173 168 183 185 190 522 558 Changes in: Policy benefits and other insurance reserves 1,048 45 183 (347) 401 118 459 1,276 978 Unearned premiums 491 282 (248) (178) 478 267 (205) 525 540 Deferred policy acquisition costs (111) (79) 14 (6) (87) (65) (7) (176) (159) Premium installment receivables, net (216) (32) (19) 194 (209) (38) 11 (267) (236) Reinsurance recoverables, net (1,023) (5) 11 156 (300) (80) (40) (1,017) (420) Income taxes 161 (326) 284 387 206 (150) (26) 119 30 Other operating assets and liabilities 660 (174) (219) (57) 129 64 (152) 267 41 Net cash provided by operating activities 1,866 491 857 1,251 1,384 644 714 3,214 2,742 CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from sales Fixed income securities 4,987 7,438 7,083 5,929 6,543 6,373 6,216 19,508 19,132 Equity securities 1,749 829 2,601 1,477 1,582 823 1,664 5,179 4,069 Limited partnership interests 286 271 210 247 271 183 180 767 634 Mortgage loans - - - - - (7) 7 - - Other investments 52 94 24 56 62 57 87 170 206 Investment collections Fixed income securities 975 1,034 1,029 1,103 1,292 1,189 949 3,038 3,430 Mortgage loans 172 82 223 98 253 71 79 477 403 Other investments 121 163 174 140 113 125 43 458 281 Investment purchases Fixed income securities (6,721) (8,414) (8,800) (5,708) (9,335) (7,546) (5,401) (23,935) (22,282) Equity securities (1,823) (1,090) (2,383) (1,837) (1,441) (939) (1,733) (5,296) (4,113) Limited partnership interests (504) (310) (268) (322) (425) (433) (270) (1,082) (1,128) Mortgage loans (163) (62) (86) (186) (196) (220) (44) (311) (460) Other investments (168) (313) (219) (211) (225) (196) (253) (700) (674) Change in short-term investments, net 115 570 1,572 (2,540) 763 688 (1,357) 2,257 94 Change in other investments, net (135) 117 (10) 9 (21) (20) (19) (28) (60) Purchases of property and equipment, net (70) (72) (74) (123) (70) (68) (52) (216) (190) Acquisition of operations - - (1,356) - - - - (1,356) - Net cash (used in) provided by investing activities (1,127) 337 (280) (1,868) (834) 80 96 (1,070) (658) CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from issuance of long-term debt - - - 1,236 - - - - - Repayments of long-term debt - - - (1) - - (16) - (16) Contractholder fund deposits 252 258 257 264 263 261 261 767 785 Contractholder fund withdrawals (459) (474) (483) (550) (524) (521) (492) (1,416) (1,537) Dividends paid on common stock (134) (135) (122) (122) (124) (125) (115) (391) (364) Dividends paid on preferred stock (29) (29) (29) (29) (29) (29) (29) (87) (87) Treasury stock purchases (191) (393) (264) (183) (250) (448) (456) (848) (1,154) Shares reissued under equity incentive plans, net 24 41 67 41 51 42 30 132 123 Excess tax benefits on share-based payment arrangements - - - 7 5 8 12 - 25 Other 6 (56) 3 1 1 3 31 (47) 35 Net cash (used in) provided by financing activities (531) (788) (571) 664 (607) (809) (774) (1,890) (2,190) NET INCREASE (DECREASE) IN CASH 208 40 6 47 (57) (85) 36 254 (106) CASH AT BEGINNING OF PERIOD 482 442 436 389 446 531 495 436 495 CASH AT END OF PERIOD $ 690 $ 482 $ 442 $ 436 $ 389 $ 446 $ 531 $ 690 $ 389 THE ALLSTATE CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS ($ in millions) Nine months endedThree months ended

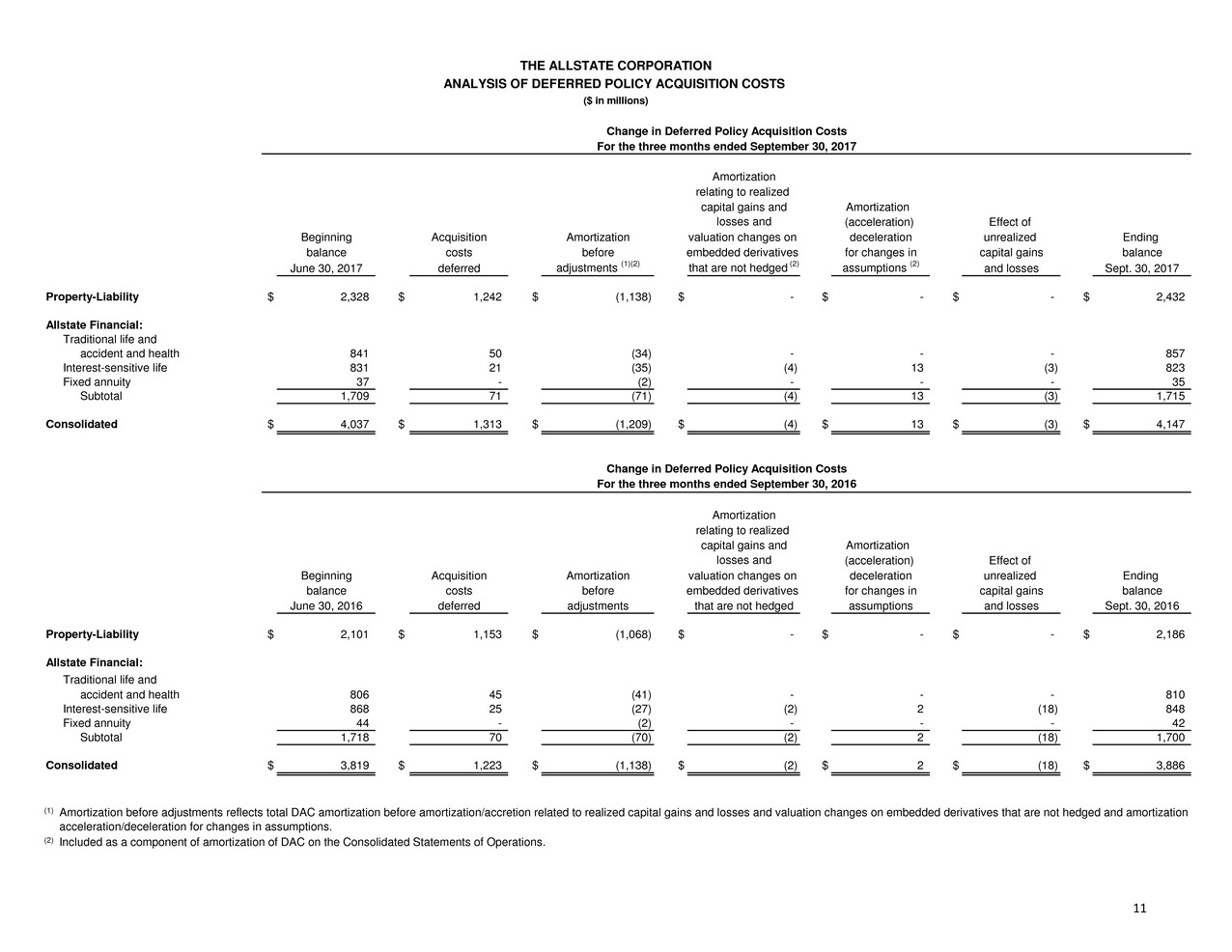

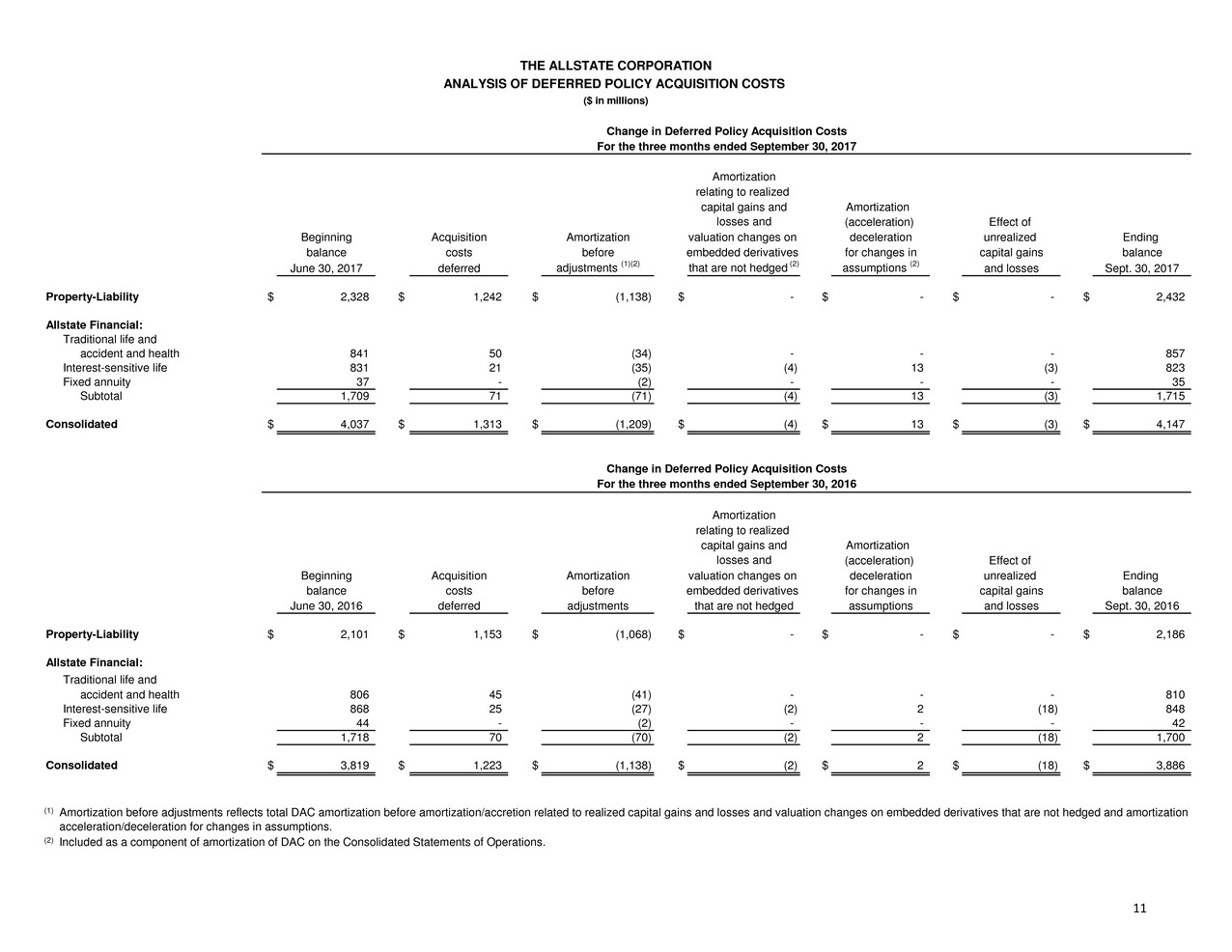

11 Amortization relating to realized capital gains and Amortization losses and (acceleration) Effect of Beginning Acquisition Amortization valuation changes on deceleration unrealized Ending balance costs before embedded derivatives for changes in capital gains balance June 30, 2017 deferred adjustments (1)(2) that are not hedged (2) assumptions (2) and losses Sept. 30, 2017 Property-Liability $ 2,328 $ 1,242 $ (1,138) $ - $ - $ - $ 2,432 Allstate Financial: Traditional life and accident and health 841 50 (34) - - - 857 Interest-sensitive life 831 21 (35) (4) 13 (3) 823 Fixed annuity 37 - (2) - - - 35 Subtotal 1,709 71 (71) (4) 13 (3) 1,715 Consolidated $ 4,037 $ 1,313 $ (1,209) $ (4) $ 13 $ (3) $ 4,147 Amortization relating to realized capital gains and Amortization losses and (acceleration) Effect of Beginning Acquisition Amortization valuation changes on deceleration unrealized Ending balance costs before embedded derivatives for changes in capital gains balance June 30, 2016 deferred adjustments that are not hedged assumptions and losses Sept. 30, 2016 Property-Liability $ 2,101 $ 1,153 $ (1,068) $ - $ - $ - $ 2,186 Allstate Financial: Traditional life and accident and health 806 45 (41) - - - 810 Interest-sensitive life 868 25 (27) (2) 2 (18) 848 Fixed annuity 44 - (2) - - - 42 Subtotal 1,718 70 (70) (2) 2 (18) 1,700 Consolidated $ 3,819 $ 1,223 $ (1,138) $ (2) $ 2 $ (18) $ 3,886 (1) (2) Included as a component of amortization of DAC on the Consolidated Statements of Operations. Amortization before adjustments reflects total DAC amortization before amortization/accretion related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged and amortization acceleration/deceleration for changes in assumptions. THE ALLSTATE CORPORATION ANALYSIS OF DEFERRED POLICY ACQUISITION COSTS ($ in millions) Change in Deferred Policy Acquisition Costs For the three months ended September 30, 2017 Change in Deferred Policy Acquisition Costs For the three months ended September 30, 2016

12 Amortization relating to realized capital gains and Amortization DAC before DAC after losses and (acceleration) Effect of impact of Impact of impact of Beginning Acquisition Amortization valuation changes on deceleration unrealized Ending unrealized unrealized unrealized balance costs before embedded derivatives for changes in capital gains balance capital gains capital gains capital gains Dec. 31, 2016 deferred adjustments (1)(2) that are not hedged (2) assumptions (2) and losses Sept. 30, 2017 and losses and losses and losses Property-Liability $ 2,188 $ 3,575 (3) $ (3,331) $ - $ - $ - $ 2,432 $ 2,432 $ - $ 2,432 Allstate Financial: Traditional life and accident and health 821 151 (115) - - - 857 857 - 857 Interest-sensitive life 905 64 (95) (12) 13 (52) 823 1,015 (192) 823 Fixed annuity 40 - (5) - - - 35 35 - 35 Subtotal 1,766 215 (215) (12) 13 (52) 1,715 1,907 (192) 1,715 Consolidated $ 3,954 $ 3,790 $ (3,546) $ (12) $ 13 $ (52) $ 4,147 $ 4,339 $ (192) $ 4,147 Amortization relating to realized capital gains and Amortization DAC before DAC after losses and (acceleration) Effect of impact of Impact of impact of Beginning Acquisition Amortization valuation changes on deceleration unrealized Ending unrealized unrealized unrealized balance costs before embedded derivatives for changes in capital gains balance capital gains capital gains capital gains Dec. 31, 2015 deferred adjustments (1)(2) that are not hedged (2) assumptions (2) and losses Sept. 30, 2016 and losses and losses and losses Property-Liability $ 2,029 $ 3,338 $ (3,181) $ - $ - $ - $ 2,186 $ 2,186 $ - $ 2,186 Allstate Financial: Traditional life and accident and health 792 139 (121) - - - 810 810 - 810 Interest-sensitive life 993 77 (83) (5) 2 (136) 848 1,050 (202) 848 Fixed annuity 47 - (5) - - - 42 42 - 42 Subtotal 1,832 216 (209) (5) 2 (136) 1,700 1,902 (202) 1,700 Consolidated $ 3,861 $ 3,554 $ (3,390) $ (5) $ 2 $ (136) $ 3,886 $ 4,088 $ (202) $ 3,886 (1) (2) (3) Included as a component of amortization of DAC on the Consolidated Statements of Operations. Includes $70 million recorded in connection with the SquareTrade acquisition on January 3, 2017. For the nine months ended September 30, 2017 Acquisition Costs as of September 30, 2017 THE ALLSTATE CORPORATION ANALYSIS OF DEFERRED POLICY ACQUISITION COSTS ($ in millions) Change in Deferred Policy Acquisition Costs Reconciliation of Deferred Policy Change in Deferred Policy Acquisition Costs Reconciliation of Deferred Policy For the nine months ended September 30, 2016 Acquisition Costs as of September 30, 2016 Amortization before adjustments reflects total DAC amortization before amortization/accretion related to realized capital gains and losses and valuation changes on embedded derivatives that are not hedged and amortization acceleration/deceleration for changes in assumptions.

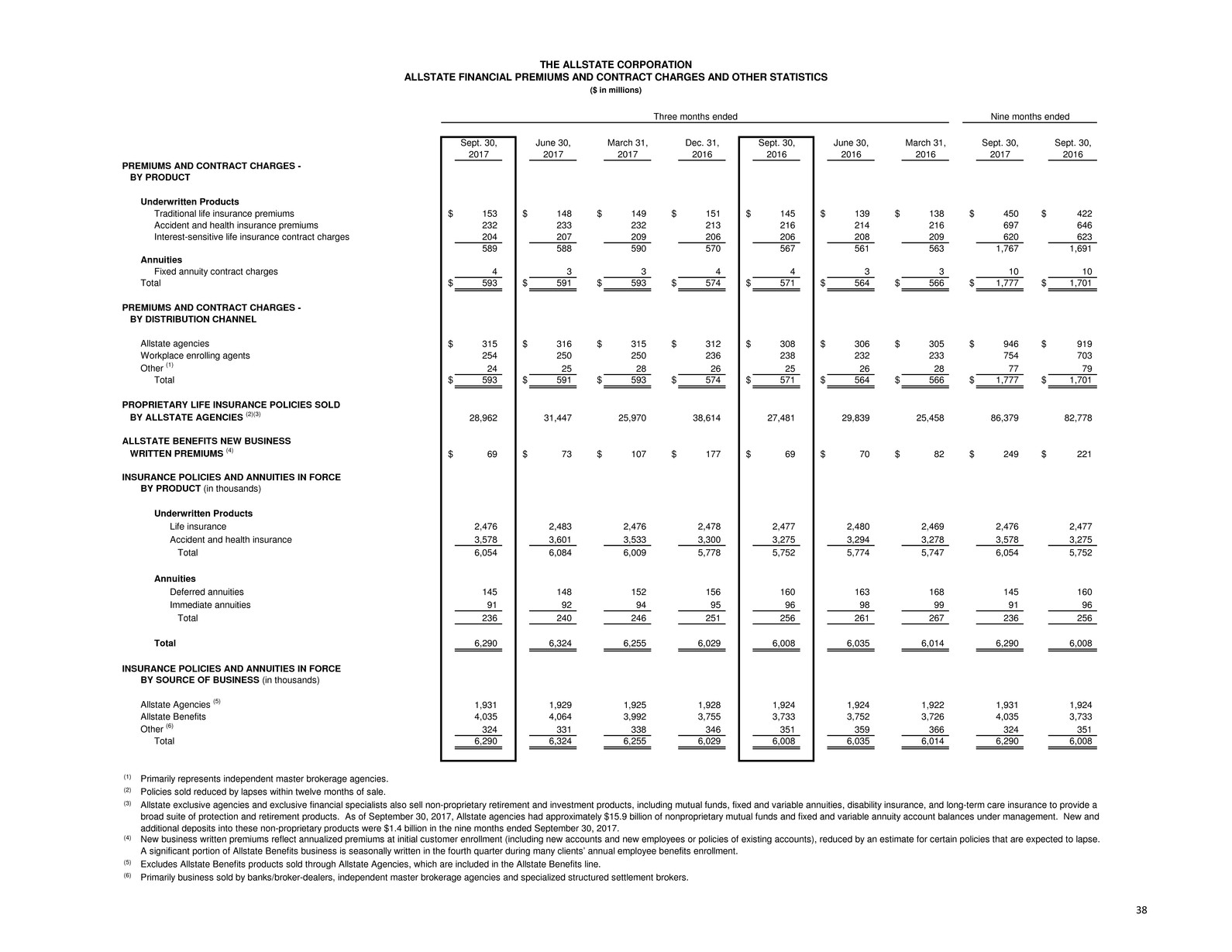

13 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, 2017 2017 2017 2016 2016 2016 2016 Policies in Force statistics (in thousands) Allstate Protection (1) Allstate brand Auto 19,513 19,548 19,565 19,742 19,852 20,061 20,145 Homeowners 6,071 6,075 6,090 6,120 6,131 6,158 6,176 Landlord 697 703 710 716 720 726 732 Renter 1,578 1,564 1,563 1,568 1,557 1,554 1,556 Condominium 662 662 663 666 665 667 667 Other 1,275 1,270 1,264 1,264 1,260 1,256 1,253 Other personal lines 4,212 4,199 4,200 4,214 4,202 4,203 4,208 Commercial lines 251 262 272 285 296 308 318 Allstate Roadside Services 708 724 743 768 797 824 856 Allstate Dealer Services 4,130 4,139 4,150 4,142 4,125 4,059 3,987 Other business lines 4,838 4,863 4,893 4,910 4,922 4,883 4,843 Total 34,885 34,947 35,020 35,271 35,403 35,613 35,690 Esurance brand Auto 1,369 1,388 1,400 1,391 1,395 1,409 1,428 Homeowners 76 69 63 58 52 44 37 Other personal lines 45 47 48 47 47 47 46 Total 1,490 1,504 1,511 1,496 1,494 1,500 1,511 Encompass brand Auto 548 571 595 622 649 676 701 Homeowners 262 273 284 295 305 318 329 Other personal lines 88 91 94 98 101 105 108 Total 898 935 973 1,015 1,055 1,099 1,138 SquareTrade (2) 34,078 31,258 29,907 - - - - Allstate Protection Policies in Force 71,351 68,644 67,411 37,782 37,952 38,212 38,339 Allstate Financial (3) Allstate Life 2,019 2,020 2,017 2,023 2,019 2,022 2,021 Allstate Benefits 4,035 4,064 3,992 3,755 3,733 3,752 3,726 Allstate Annuities 236 240 246 251 256 261 267 Allstate Financial Policies in Force 6,290 6,324 6,255 6,029 6,008 6,035 6,014 Total Policies in Force 77,641 74,968 73,666 43,811 43,960 44,247 44,353 Agency Data (4) Total Allstate agencies (5) 12,200 12,200 12,200 12,200 12,200 12,200 12,100 Licensed sales professionals (6) 23,900 24,000 23,600 23,800 23,600 23,800 24,000 Allstate independent agencies (7) 2,400 2,300 2,200 2,200 2,200 2,000 2,100 (1) (2) (3) (4) (5) (6) (7) SquareTrade had PIF of 28.5, 25.8, 24.4 and 23.0 million at December 31, 2016, September 30, 2016, June 30, 2016, and March 31, 2016, respectively. These numbers are prior to the acquisition of SquareTrade on January 3, 2017 and are not included in the periods above. THE ALLSTATE CORPORATION POLICIES IN FORCE AND OTHER STATISTICS Policy counts are based on items rather than customers. • A multi-car customer would generate multiple item (policy) counts, even if all cars were insured under one policy. • Non-proprietary products offered by Ivantage (insurance agency) and Answer Financial (independent insurance agency) are not included. • Allstate Roadside Services represents memberships in force and do not include their wholesale partners as the customer relationship is managed by the wholesale partner. • Allstate Dealer Services represents service contracts and other products sold in conjunction with auto lending and vehicle sales transactions and do not include their third party administrators (“TPAs”) as the customer relationship is managed by the TPAs. • SquareTrade represents active consumer product protection plans. Allstate Financial insurance policies and annuities in force reflect the number of contracts in force excluding sold blocks of business that remain on the balance sheet due to the dispositions of the business being effected through reinsurance arrangements. Policy counts associated with our voluntary employee benefits group business reflect certificate counts as opposed to group counts. Rounded to the nearest hundred. Total Allstate agencies represents exclusive Allstate agencies and financial representatives in the United States and Canada. Employees of Allstate agencies who are licensed to sell Allstate products. Includes 572 and 488 engaged Allstate independent agencies (“AIAs”) as of September 30, 2017 and December 31, 2016, respectively. Engaged AIAs, as currently determined, include those that achieve a minimum number of new policies written.

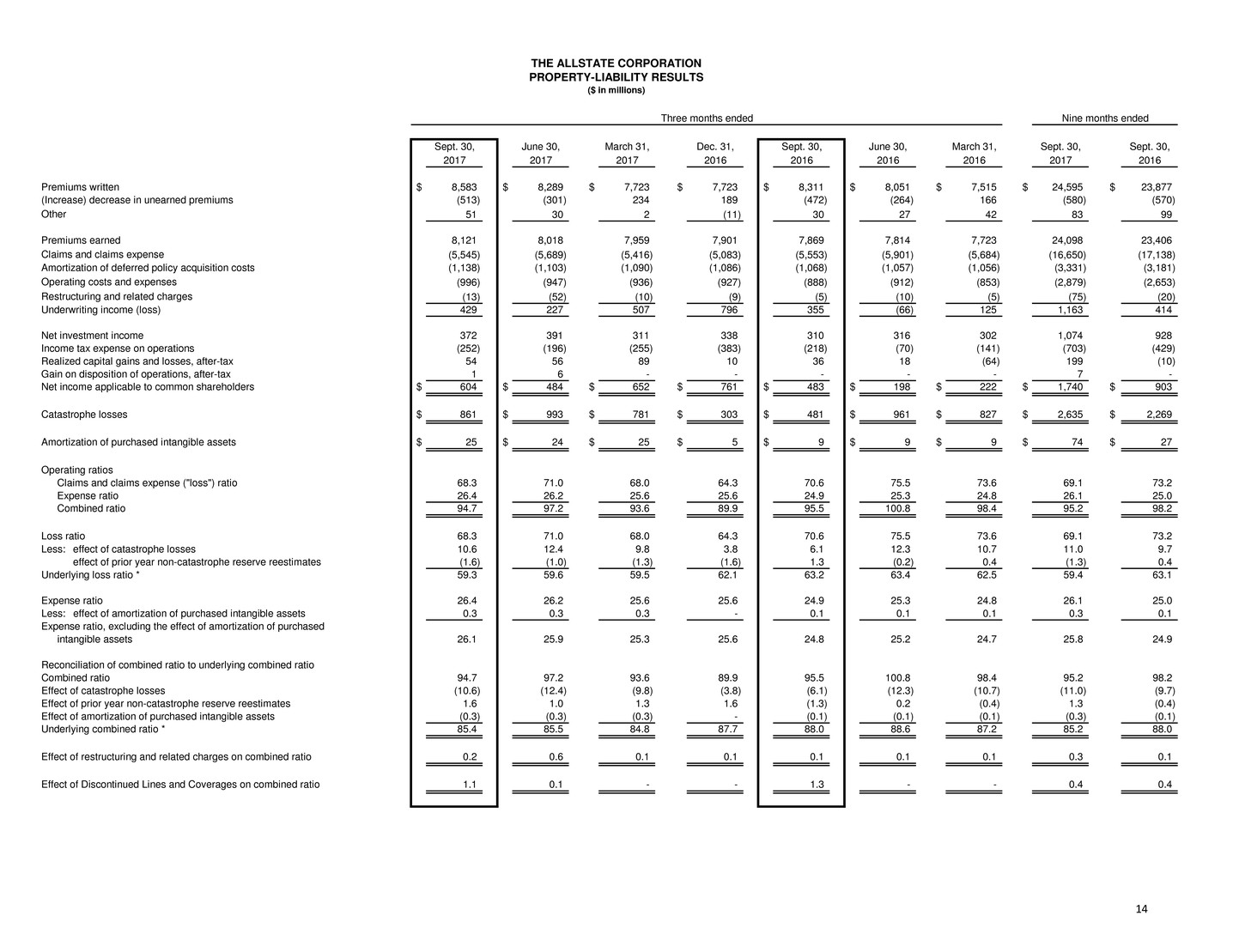

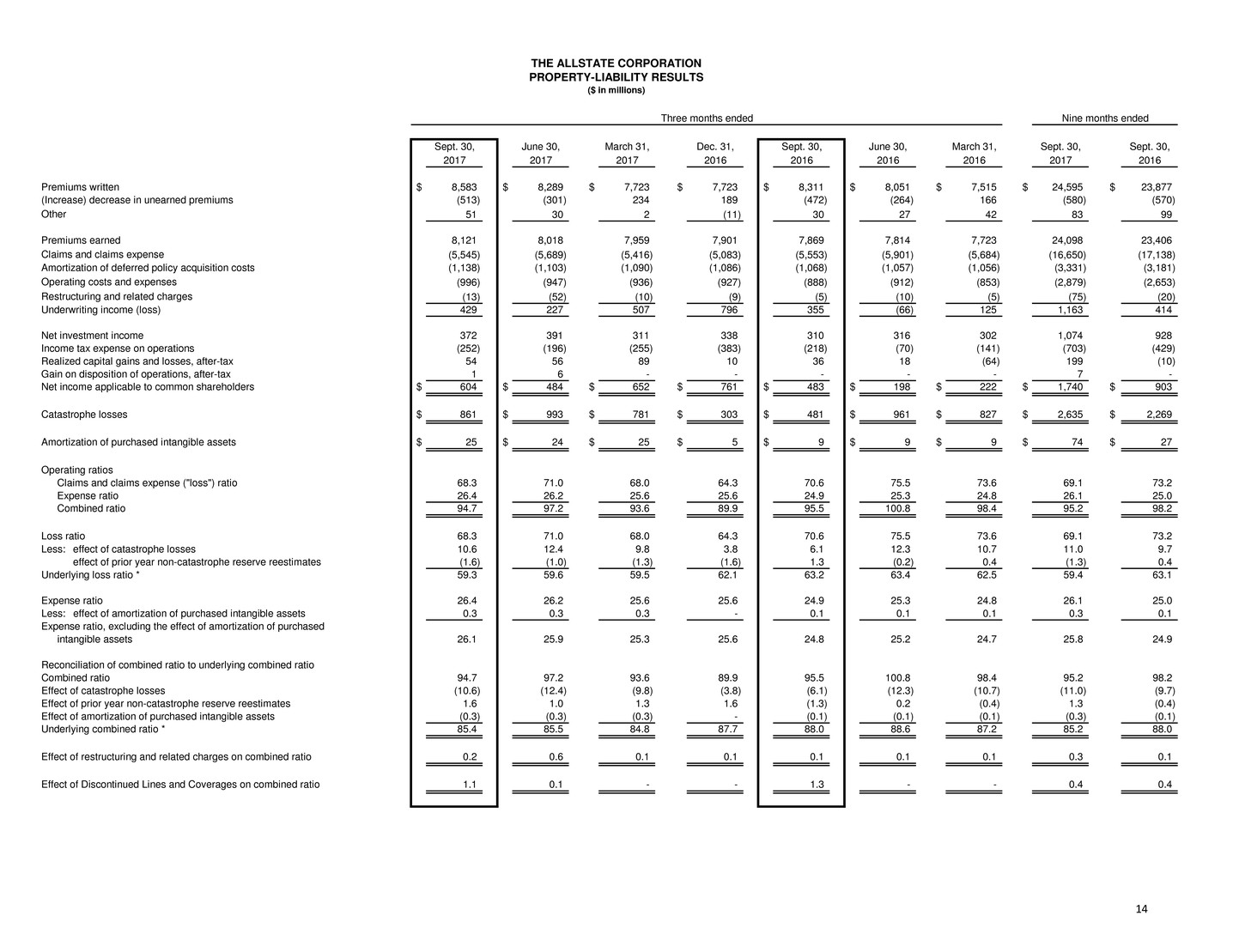

14 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Premiums written $ 8,583 $ 8,289 $ 7,723 $ 7,723 $ 8,311 $ 8,051 $ 7,515 $ 24,595 $ 23,877 (Increase) decrease in unearned premiums (513) (301) 234 189 (472) (264) 166 (580) (570) Other 51 30 2 (11) 30 27 42 83 99 Premiums earned 8,121 8,018 7,959 7,901 7,869 7,814 7,723 24,098 23,406 Claims and claims expense (5,545) (5,689) (5,416) (5,083) (5,553) (5,901) (5,684) (16,650) (17,138) Amortization of deferred policy acquisition costs (1,138) (1,103) (1,090) (1,086) (1,068) (1,057) (1,056) (3,331) (3,181) Operating costs and expenses (996) (947) (936) (927) (888) (912) (853) (2,879) (2,653) Restructuring and related charges (13) (52) (10) (9) (5) (10) (5) (75) (20) Underwriting income (loss) 429 227 507 796 355 (66) 125 1,163 414 Net investment income 372 391 311 338 310 316 302 1,074 928 Income tax expense on operations (252) (196) (255) (383) (218) (70) (141) (703) (429) Realized capital gains and losses, after-tax 54 56 89 10 36 18 (64) 199 (10) Gain on disposition of operations, after-tax 1 6 - - - - - 7 - Net income applicable to common shareholders $ 604 $ 484 $ 652 $ 761 $ 483 $ 198 $ 222 $ 1,740 $ 903 Catastrophe losses $ 861 $ 993 $ 781 $ 303 $ 481 $ 961 $ 827 $ 2,635 $ 2,269 Amortization of purchased intangible assets $ 25 $ 24 $ 25 $ 5 $ 9 $ 9 $ 9 $ 74 $ 27 Operating ratios Claims and claims expense ("loss") ratio 68.3 71.0 68.0 64.3 70.6 75.5 73.6 69.1 73.2 Expense ratio 26.4 26.2 25.6 25.6 24.9 25.3 24.8 26.1 25.0 Combined ratio 94.7 97.2 93.6 89.9 95.5 100.8 98.4 95.2 98.2 Loss ratio 68.3 71.0 68.0 64.3 70.6 75.5 73.6 69.1 73.2 Less: effect of catastrophe losses 10.6 12.4 9.8 3.8 6.1 12.3 10.7 11.0 9.7 effect of prior year non-catastrophe reserve reestimates (1.6) (1.0) (1.3) (1.6) 1.3 (0.2) 0.4 (1.3) 0.4 Underlying loss ratio * 59.3 59.6 59.5 62.1 63.2 63.4 62.5 59.4 63.1 Expense ratio 26.4 26.2 25.6 25.6 24.9 25.3 24.8 26.1 25.0 Less: effect of amortization of purchased intangible assets 0.3 0.3 0.3 - 0.1 0.1 0.1 0.3 0.1 Expense ratio, excluding the effect of amortization of purchased intangible assets 26.1 25.9 25.3 25.6 24.8 25.2 24.7 25.8 24.9 Reconciliation of combined ratio to underlying combined ratio Combined ratio 94.7 97.2 93.6 89.9 95.5 100.8 98.4 95.2 98.2 Effect of catastrophe losses (10.6) (12.4) (9.8) (3.8) (6.1) (12.3) (10.7) (11.0) (9.7) Effect of prior year non-catastrophe reserve reestimates 1.6 1.0 1.3 1.6 (1.3) 0.2 (0.4) 1.3 (0.4) Effect of amortization of purchased intangible assets (0.3) (0.3) (0.3) - (0.1) (0.1) (0.1) (0.3) (0.1) Underlying combined ratio * 85.4 85.5 84.8 87.7 88.0 88.6 87.2 85.2 88.0 Effect of restructuring and related charges on combined ratio 0.2 0.6 0.1 0.1 0.1 0.1 0.1 0.3 0.1 Effect of Discontinued Lines and Coverages on combined ratio 1.1 0.1 - - 1.3 - - 0.4 0.4 THE ALLSTATE CORPORATION PROPERTY-LIABILITY RESULTS ($ in millions) Nine months endedThree months ended

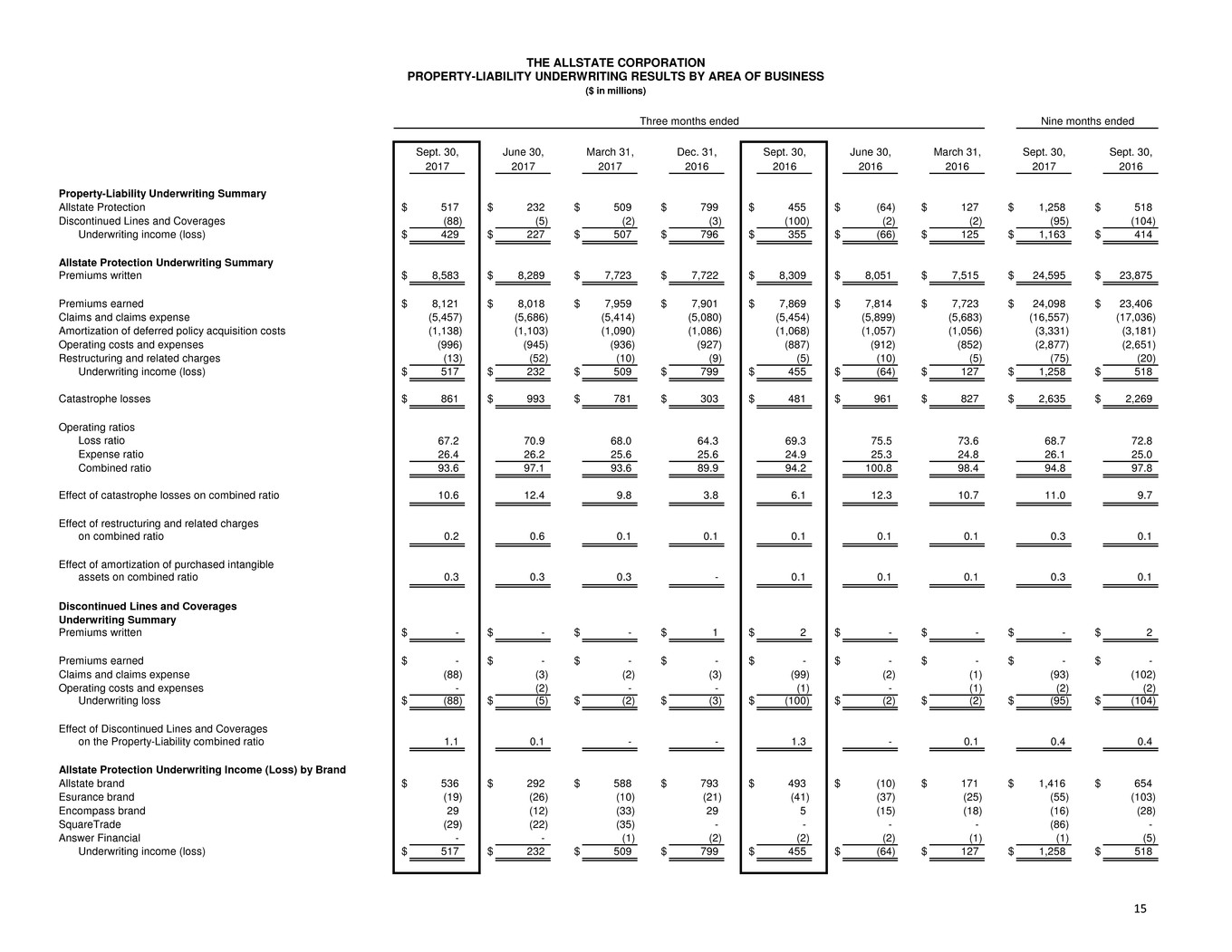

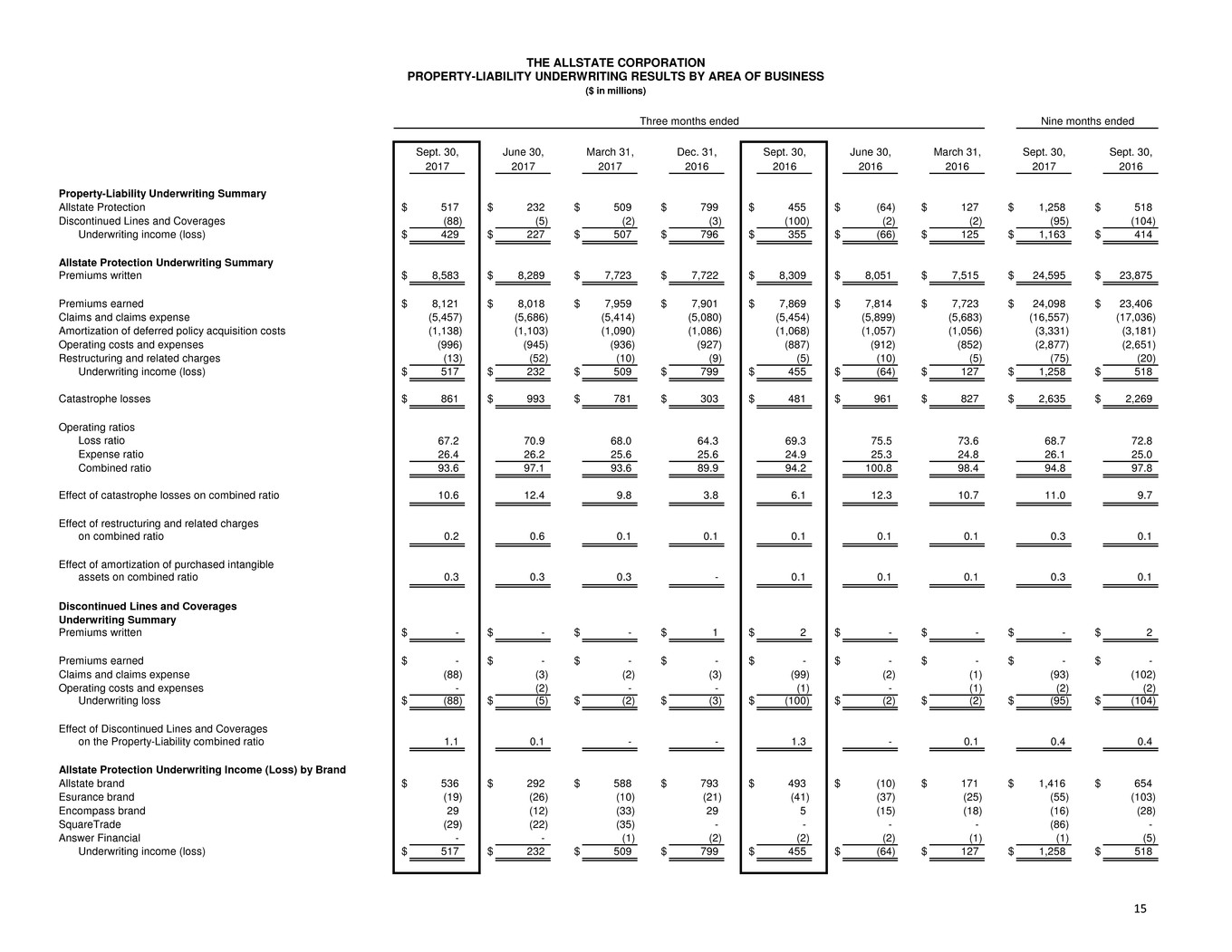

15 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Property-Liability Underwriting Summary Allstate Protection $ 517 $ 232 $ 509 $ 799 $ 455 $ (64) $ 127 $ 1,258 $ 518 Discontinued Lines and Coverages (88) (5) (2) (3) (100) (2) (2) (95) (104) Underwriting income (loss) $ 429 $ 227 $ 507 $ 796 $ 355 $ (66) $ 125 $ 1,163 $ 414 Allstate Protection Underwriting Summary Premiums written $ 8,583 $ 8,289 $ 7,723 $ 7,722 $ 8,309 $ 8,051 $ 7,515 $ 24,595 $ 23,875 Premiums earned $ 8,121 $ 8,018 $ 7,959 $ 7,901 $ 7,869 $ 7,814 $ 7,723 $ 24,098 $ 23,406 Claims and claims expense (5,457) (5,686) (5,414) (5,080) (5,454) (5,899) (5,683) (16,557) (17,036) Amortization of deferred policy acquisition costs (1,138) (1,103) (1,090) (1,086) (1,068) (1,057) (1,056) (3,331) (3,181) Operating costs and expenses (996) (945) (936) (927) (887) (912) (852) (2,877) (2,651) Restructuring and related charges (13) (52) (10) (9) (5) (10) (5) (75) (20) Underwriting income (loss) $ 517 $ 232 $ 509 $ 799 $ 455 $ (64) $ 127 $ 1,258 $ 518 Catastrophe losses $ 861 $ 993 $ 781 $ 303 $ 481 $ 961 $ 827 $ 2,635 $ 2,269 Operating ratios Loss ratio 67.2 70.9 68.0 64.3 69.3 75.5 73.6 68.7 72.8 Expense ratio 26.4 26.2 25.6 25.6 24.9 25.3 24.8 26.1 25.0 Combined ratio 93.6 97.1 93.6 89.9 94.2 100.8 98.4 94.8 97.8 Effect of catastrophe losses on combined ratio 10.6 12.4 9.8 3.8 6.1 12.3 10.7 11.0 9.7 Effect of restructuring and related charges on combined ratio 0.2 0.6 0.1 0.1 0.1 0.1 0.1 0.3 0.1 Effect of amortization of purchased intangible assets on combined ratio 0.3 0.3 0.3 - 0.1 0.1 0.1 0.3 0.1 Discontinued Lines and Coverages Underwriting Summary Premiums written $ - $ - $ - $ 1 $ 2 $ - $ - $ - $ 2 Premiums earned $ - $ - $ - $ - $ - $ - $ - $ - $ - Claims and claims expense (88) (3) (2) (3) (99) (2) (1) (93) (102) Operating costs and expenses - (2) - - (1) - (1) (2) (2) Underwriting loss $ (88) $ (5) $ (2) $ (3) $ (100) $ (2) $ (2) $ (95) $ (104) Effect of Discontinued Lines and Coverages on the Property-Liability combined ratio 1.1 0.1 - - 1.3 - 0.1 0.4 0.4 Allstate Protection Underwriting Income (Loss) by Brand Allstate brand $ 536 $ 292 $ 588 $ 793 $ 493 $ (10) $ 171 $ 1,416 $ 654 Esurance brand (19) (26) (10) (21) (41) (37) (25) (55) (103) Encompass brand 29 (12) (33) 29 5 (15) (18) (16) (28) SquareTrade (29) (22) (35) - - - - (86) - Answer Financial - - (1) (2) (2) (2) (1) (1) (5) Underwriting income (loss) $ 517 $ 232 $ 509 $ 799 $ 455 $ (64) $ 127 $ 1,258 $ 518 THE ALLSTATE CORPORATION PROPERTY-LIABILITY UNDERWRITING RESULTS BY AREA OF BUSINESS ($ in millions) Nine months endedThree months ended

16 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Allstate brand (1) Auto $ 5,096 $ 4,925 $ 4,882 $ 4,756 $ 4,940 $ 4,767 $ 4,746 $ 14,903 $ 14,453 Homeowners 1,921 1,847 1,403 1,638 1,869 1,831 1,392 5,171 5,092 Landlord 138 130 120 133 141 133 122 388 396 Renter 86 75 67 68 84 75 67 228 226 Condominium 71 68 55 63 70 67 53 194 190 Other 159 168 126 129 152 153 111 453 416 Other personal lines 454 441 368 393 447 428 353 1,263 1,228 Commercial lines 116 124 123 115 123 135 126 363 384 Other business lines 168 174 173 158 185 183 183 515 551 7,755 7,511 6,949 7,060 7,564 7,344 6,800 22,215 21,708 Esurance brand Auto 427 386 439 382 428 376 439 1,252 1,243 Homeowners 24 20 16 15 16 14 11 60 41 Other personal lines 2 2 2 2 2 2 2 6 6 453 408 457 399 446 392 452 1,318 1,290 Encompass brand Auto 141 148 125 138 153 162 138 414 453 Homeowners 108 112 91 103 121 126 104 311 351 Other personal lines 22 25 20 22 25 27 21 67 73 271 285 236 263 299 315 263 792 877 SquareTrade 104 85 81 - - - - 270 - Allstate Protection 8,583 8,289 7,723 7,722 8,309 8,051 7,515 24,595 23,875 Discontinued Lines and Coverages (2) - - - 1 2 - - - 2 Property-Liability $ 8,583 $ 8,289 $ 7,723 $ 7,723 $ 8,311 $ 8,051 $ 7,515 $ 24,595 $ 23,877 Allstate Protection Auto $ 5,664 $ 5,459 $ 5,446 $ 5,276 $ 5,521 $ 5,305 $ 5,323 $ 16,569 $ 16,149 Homeowners 2,053 1,979 1,510 1,756 2,006 1,971 1,507 5,542 5,484 Other personal lines 478 468 390 417 474 457 376 1,336 1,307 Commercial lines 116 124 123 115 123 135 126 363 384 Other business lines 168 174 173 158 185 183 183 515 551 SquareTrade 104 85 81 - - - - 270 - $ 8,583 $ 8,289 $ 7,723 $ 7,722 $ 8,309 $ 8,051 $ 7,515 $ 24,595 $ 23,875 Non-Proprietary Premiums Ivantage (3) $ 1,609 $ 1,584 $ 1,566 $ 1,544 $ 1,531 $ 1,528 $ 1,504 $ 4,759 $ 4,563 Answer Financial (4) 153 148 153 140 158 150 151 454 459 (1) Canada premiums included in Allstate brand Auto $ 236 $ 228 $ 171 $ 182 $ 220 $ 234 $ 164 $ 635 $ 618 Homeowners 69 65 44 52 64 64 41 178 169 Other personal lines 19 16 12 13 16 16 10 47 42 $ 324 $ 309 $ 227 $ 247 $ 300 $ 314 $ 215 $ 860 $ 829 (2) (3) (4) Represents non-proprietary premiums under management as of the end of the period related to personal and commercial line products offered by Ivantage when an Allstate product is not available. Fees for the three and nine months ended September 30, 2017 were $28.0 million and $78.3 million, respectively. Represents non-proprietary premiums written for the period. Commissions earned for the three and nine months ended September 30, 2017 were $17.8 million and $53.8 million, respectively. Primarily represents retrospective reinsurance premium recognized when billed. THE ALLSTATE CORPORATION PROPERTY-LIABILITY PREMIUMS WRITTEN BY BRAND ($ in millions) Nine months endedThree months ended

17 Number of Location Number of Location Number of Location locations (7) Total brand (%) (8) specific (%) (9) locations Total brand (%) specific (%) locations Total brand (%) specific (%) Allstate brand Auto (2)(3)(4) 17 0.4 3.0 23 0.7 3.2 18 1.7 (10) 5.3 (10) Homeowners (5)(6) 8 0.5 5.3 3 0.1 2.0 14 1.0 4.2 Esurance brand Auto 16 2.0 5.6 12 1.7 5.6 7 0.7 5.3 Homeowners - - - - - - - - - Encompass brand Auto 8 0.8 4.5 11 2.3 7.5 5 1.4 7.2 Homeowners 6 0.9 6.0 9 2.8 8.9 3 0.2 3.4 Number of Location Number of Location Number of Location locations Total brand (%) specific (%) locations Total brand (%) specific (%) locations Total brand (%) specific (%) Allstate brand Auto (2)(3)(4) 23 1.3 5.6 25 1.0 7.1 35 3.2 6.2 Homeowners (5)(6) 12 0.5 4.7 10 0.2 4.6 11 0.8 4.9 Esurance brand Auto 13 2.2 6.2 9 0.4 2.3 15 1.3 5.6 Homeowners 1 (0.5) (10) N/A N/A N/A N/A N/A N/A Encompass brand Auto 8 3.2 9.9 9 1.6 8.8 10 4.1 9.5 Homeowners 6 0.6 3.3 5 1.4 9.2 6 1.7 8.1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Includes a rate increase in California in first quarter 2017. Excluding California, Allstate brand auto total brand and location specific rate changes were 1.1% and 4.7% for the three months ended March 31, 2017, respectively. March 31, 2017 December 31, 2016 Three months ended Three months ended Three months ended Represents the impact in the states, the District of Columbia and Canadian provinces where rate changes were approved during the period as a percentage of total brand prior year-end premiums written. Represents the impact in the states, the District of Columbia and Canadian provinces where rate changes were approved during the period as a percentage of its respective total prior year-end premiums written in those same locations. Impacts of Allstate brand homeowners effective rate changes as a percentage of total brand prior year-end premiums written were 0.6%, 0.1%, 0.9%, 0.6%, 0.6% and 0.5% for the three months ended September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016, September 30, 2016 and June 30, 2016, respectively. Allstate brand auto and homeowners operates in 50 states, the District of Columbia, and 5 Canadian provinces. Esurance brand auto operates in 43 states and 2 Canadian provinces. Esurance brand homeowners operates in 31 states and 2 Canadian provinces. Encompass brand auto and homeowners operates in 39 states and the District of Columbia. Allstate brand auto rate changes were 4.1%, 4.7%, 7.2%, 7.2%, 7.8% and 8.4% for the trailing twelve months ended September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016, September 30, 2016 and June 30, 2016, respectively. Allstate brand auto rate changes were cumulatively $3.30 billion or 17.8% for the period of 2015 through September 30, 2017. Allstate brand homeowner rate changes were cumulatively $453 million or 6.6% for the period of 2015 through September 30, 2017. THE ALLSTATE CORPORATION PROPERTY-LIABILITY IMPACT OF NET RATE CHANGES APPROVED ON PREMIUMS WRITTEN Three months ended Impacts of Allstate brand auto effective rate changes as a percentage of total brand prior year-end premiums written were 0.4%, 1.8%, 1.1%, 1.1%, 1.5% and 3.4% for the three months ended September 30, 2017, June 30, 2017, March 31, 2017, December 31, 2016, September 30, 2016 and June 30, 2016, respectively. Rate changes are included in the effective calculations in the period the rate change is effective for renewal contracts. Three months ended Three months ended June 30, 2017September 30, 2017 (1) September 30, 2016 June 30, 2016 Rate changes include changes approved based on our net cost of reinsurance. These rate changes do not reflect initial rates filed for insurance subsidiaries initially writing business. Based on historical premiums written in those 50 states, the District of Columbia and Canadian provinces, rate changes approved for Allstate brand, Esurance brand and Encompass brand for the three month period ending September 30, 2017 are estimated to total $156 million. Rate changes do not include rating plan enhancements, including the introduction of discounts and surcharges that result in no change in the overall rate level in a location.

18 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Net premiums written $ 7,755 $ 7,511 $ 6,949 $ 7,060 $ 7,564 $ 7,344 $ 6,800 $ 22,215 $ 21,708 Net premiums earned Auto $ 4,951 $ 4,883 $ 4,839 $ 4,826 $ 4,793 $ 4,745 $ 4,667 $ 14,673 $ 14,205 Homeowners 1,707 1,691 1,688 1,691 1,683 1,684 1,678 5,086 5,045 Other personal lines 414 411 405 403 399 397 393 1,230 1,189 Commercial lines 124 118 125 123 127 127 129 367 383 Other business lines 146 142 141 145 150 142 143 429 435 Total 7,342 7,245 7,198 7,188 7,152 7,095 7,010 21,785 21,257 Incurred losses Auto $ 3,456 $ 3,441 $ 3,224 $ 3,416 $ 3,610 $ 3,634 $ 3,519 $ 10,121 $ 10,763 Homeowners 988 1,273 1,194 765 893 1,260 1,190 3,455 3,343 Other personal lines 312 258 265 234 236 256 261 835 753 Commercial lines 103 86 96 109 112 135 119 285 366 Other business lines 63 54 52 60 69 64 61 169 194 Total 4,922 5,112 4,831 4,584 4,920 5,349 5,150 14,865 15,419 Expenses Auto $ 1,242 $ 1,236 $ 1,161 $ 1,181 $ 1,134 $ 1,168 $ 1,103 $ 3,639 $ 3,405 Homeowners 400 371 387 396 384 373 377 1,158 1,134 Other personal lines 120 115 112 117 113 106 103 347 322 Commercial lines 36 34 33 34 34 35 38 103 107 Other business lines 86 85 86 83 74 74 68 257 216 Total 1,884 1,841 1,779 1,811 1,739 1,756 1,689 5,504 5,184 Underwriting income (loss) Auto $ 253 $ 206 $ 454 $ 229 $ 49 $ (57) $ 45 $ 913 $ 37 Homeowners 319 47 107 530 406 51 111 473 568 Other personal lines (18) 38 28 52 50 35 29 48 114 Commercial lines (15) (2) (4) (20) (19) (43) (28) (21) (90) Other business lines (3) 3 3 2 7 4 14 3 25 Total 536 292 588 793 493 (10) 171 1,416 654 Loss ratio 67.0 70.6 67.1 63.8 68.8 75.4 73.5 68.2 72.5 Expense ratio 25.7 25.4 24.7 25.2 24.3 24.7 24.1 25.3 24.4 Combined ratio 92.7 96.0 91.8 89.0 93.1 100.1 97.6 93.5 96.9 Loss ratio 67.0 70.6 67.1 63.8 68.8 75.4 73.5 68.2 72.5 Less: effect of catastrophe losses 11.3 12.7 9.8 4.0 6.2 12.9 11.2 11.3 10.0 effect of prior year non-catastrophe reserve reestimates (2.9) (1.1) (1.5) (1.5) - (0.3) 0.3 (1.9) - Underlying loss ratio * 58.6 59.0 58.8 61.3 62.6 62.8 62.0 58.8 62.5 Expense ratio 25.7 25.4 24.7 25.2 24.3 24.7 24.1 25.3 24.4 Less: effect of amortization of purchased intangible assets - - - - - - - - - Expense ratio, excluding the effect of amortization of purchased intangible assets 25.7 25.4 24.7 25.2 24.3 24.7 24.1 25.3 24.4 Reconciliation of combined ratio to underlying combined ratio Combined ratio 92.7 96.0 91.8 89.0 93.1 100.1 97.6 93.5 96.9 Effect of catastrophe losses (11.3) (12.7) (9.8) (4.0) (6.2) (12.9) (11.2) (11.3) (10.0) Effect of prior year non-catastrophe reserve reestimates 2.9 1.1 1.5 1.5 - 0.3 (0.3) 1.9 - Effect of amortization of purchased intangible assets - - - - - - - - - Underlying combined ratio * 84.3 84.4 83.5 86.5 86.9 87.5 86.1 84.1 86.9 Effect of prior year reserve reestimates on combined ratio (3.0) (1.1) (1.5) (1.6) - - 0.2 (1.9) 0.1 Effect of advertising expenses on combined ratio 2.0 1.8 2.0 2.4 2.2 2.2 1.5 2.0 2.0 THE ALLSTATE CORPORATION ALLSTATE BRAND PROFITABILITY MEASURES ($ in millions) Nine months endedThree months ended

19 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 New Issued Applications (in thousands) (2) Auto (3) 651 639 610 562 584 582 584 1,900 1,750 Homeowners (4) 198 195 163 167 188 193 164 556 545 Average Premium - Gross Written ($) (5) Auto 556 544 538 537 532 516 507 546 518 Homeowners 1,203 1,192 1,187 1,181 1,181 1,171 1,174 1,194 1,176 Average Premium - Net Earned ($) (6) Auto 507 499 492 487 479 471 461 499 470 Homeowners 1,119 1,106 1,106 1,105 1,099 1,090 1,082 1,110 1,090 Renewal Ratio (%) (7) Auto (8) 87.7 87.4 87.4 87.4 87.5 88.0 88.0 87.5 87.9 Homeowners (9) 87.5 87.0 87.1 87.5 87.9 87.8 88.1 87.2 87.9 Auto Claim Frequency (10) (% change year-over-year) Bodily Injury Gross (5.6) (4.7) (6.0) (2.0) 0.3 2.8 1.1 (5.5) 1.4 Bodily Injury Paid (11) (9.1) (23.7) (20.5) (19.2) (19.6) 1.5 5.9 (18.5) (4.0) Property Damage Gross (8.0) (5.2) (3.9) 1.2 3.9 5.6 2.1 (5.7) 3.8 Property Damage Paid (12) (9.0) (3.4) (3.2) (1.2) 0.1 (0.1) 2.4 (5.2) 0.8 Auto Paid Claim Severity (13) (% change year-over-year) Bodily injury (11) 15.0 28.3 25.1 18.8 12.4 (2.3) (5.5) 23.3 0.7 Property damage 4.9 1.6 4.8 1.9 1.9 5.3 7.5 3.8 4.8 Homeowners Excluding Catastrophe Losses (% change year-over-year) Gross Claim frequency (10) (2.6) 6.0 7.6 2.2 5.2 (12.5) (7.7) 3.3 (5.1) Paid Claim frequency (10) (5.4) 7.1 2.3 (0.5) 0.7 (14.3) (2.0) 1.0 (5.4) Paid Claim severity 8.1 (0.2) 4.1 1.8 (0.5) 4.7 (2.7) 4.1 0.6 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) (11) (12) (13) Paid claim frequency is calculated as annualized notice counts closed with payment in the period divided by the average of policies in force with the applicable coverage during the period. Gross claim frequency is calculated as annualized notice counts received in the period divided by the average of policies in force with the applicable coverage during the period. Gross claim frequency includes all actual notice counts, regardless of their current status (open or closed) or their ultimate disposition (closed with a payment or closed without payment). Frequency statistics exclude counts associated with catastrophe events. The percent change in paid or gross claim frequency is calculated as the amount of increase or decrease in the paid or gross claim frequency in the current period compared to the same period in the prior year; divided by the prior year paid or gross claim frequency. Bodily injury claim process changes in the second half of 2016 related to enhanced documentation of injuries and related medical treatments are having a related impact on paid claim frequency and severity due to payment mix and claim closure patterns. These process changes were implemented through the second half of 2016 and normalized during the first half of 2017 and the related impacts on the percent change in paid claim frequency and severity have begun to moderate in third quarter 2017. 6 and 3 of our largest 10 states experienced increases in the renewal ratio in the third quarter and first nine months of 2017, respectively, compared to the same periods of 2016. Of our largest 10 states, 3 and 2 experienced an increase in the renewal ratio in the third quarter and first nine months of 2017, respectively, compared to the same periods of 2016. Paid claim severity is calculated by dividing the sum of paid losses and loss expenses by claims closed with a payment during the period. The percent change in paid claim severity is calculated as the amount of increase or decrease in paid claim severity in the current period compared to the same period in the prior year; divided by the prior year paid claims severity. 47 states experienced a year over year decrease in property damage paid claim frequency in third quarter 2017 compared to third quarter 2016. THE ALLSTATE CORPORATION ALLSTATE BRAND STATISTICS (1) Nine months endedThree months ended Statistics presented for Allstate brand exclude excess and surplus lines. New Issued Applications: Item counts of automobiles or homeowners insurance applications for insurance policies that were issued during the period, regardless of whether the customer was previously insured by another Allstate Protection brand. Allstate brand includes automobiles added by existing customers when they exceed the number allowed (currently 10) on a policy. Average Premium - Gross Written: Gross premiums written divided by issued item count. Gross premiums written include the impacts from discounts, surcharges and ceded reinsurance premiums and exclude the impacts from mid-term premium adjustments and premium refund accruals. Average premiums represent the appropriate policy term for each line, which is 6 months for auto and 12 months for homeowners. Average Premium - Net Earned: Earned premium divided by average policies in force for the period. Earned premium includes the impacts from mid-term premium adjustments and ceded reinsurance, but does not include impacts of premium refund accruals. Average premiums represent the appropriate policy term for each line, which is 6 months for auto and 12 months for homeowners. Renewal ratio: Renewal policies issued during the period, based on contract effective dates, divided by the total policies issued 6 months prior for auto or 12 months prior for homeowners. 41 states, including all of our 10 largest states, experienced increases in new issued applications in the third quarter of 2017 compared to the same period of 2016. 40 states, including 8 of our 10 largest states, experienced increases in new issued applications in the first nine months of 2017 compared to the same period of 2016. Of our largest 10 states, 6 experienced increases in new issued applications in both the third quarter and first nine months of 2017 compared to the same periods of 2016.

20 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Change in auto claim frequency (2) (% change in frequency rate year over year) % Change in gross claim frequency -2.9% 1.2% -1.8% -3.1% -2.4% -1.1% 0.8% -1.7% -0.3% -2.8% -1.3% 4.0% 6.8% 6.8% 6.4% 3.9% 1.1% 2.8% 0.3% -2.0% -6.0% -4.7% -5.6% % Change in paid claim frequency (3) -0.2% 1.1% -1.0% 0.7% -2.3% -2.7% -2.1% -4.7% -4.7% -3.8% 0.2% 4.7% 2.3% 6.0% 3.5% 0.0% 5.9% 1.5% -19.6% -19.2% -20.5% -23.7% -9.1% (1) (2) (3) Bodily injury claim process changes in the second half of 2016 related to enhanced documentation of injuries and related medical treatments are having a related impact on paid claim frequency and severity due to payment mix and claim closure patterns. These process changes were implemented through the second half of 2016 and normalized during the first half of 2017 and the related impacts on the percent change in paid claim frequency and severity have begun to moderate in third quarter 2017. THE ALLSTATE CORPORATION ALLSTATE BRAND AUTO CLAIM FREQUENCY ANALYSIS (1) BODILY INJURY % CHANGE IN GROSS AND PAID CLAIM FREQUENCY Frequency statistics exclude counts associated with catastrophe events. Paid claim frequency is calculated as annualized notice counts closed with payment in the period divided by the average of policies in force with the applicable coverage during the period. Gross claim frequency is calculated as annualized notice counts received in the period divided by the average of policies in force with the applicable coverage during the period. Gross claim frequency includes all actual notice counts, regardless of their current status (open or closed) or their ultimate disposition (closed with a payment or closed without payment). Frequency statistics exclude counts associated with catastrophe events. The percent change in paid or gross claim frequency is calculated as the amount of increase or decrease in the paid or gross claim frequency in the current period compared to the same period in the prior year; divided by the prior year paid or gross claim frequency. 20172012 2013 2014 2015 2016 -28.0% -24.0% -20.0% -16.0% -12.0% -8.0% -4.0% 0.0% 4.0% 8.0% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2012 2013 2014 2015 2016 2017 % c ha ng e ye ar -o ve r- ye ar Rates of change in auto bodily injury frequency % change in gross claim frequency % change in paid claim frequency

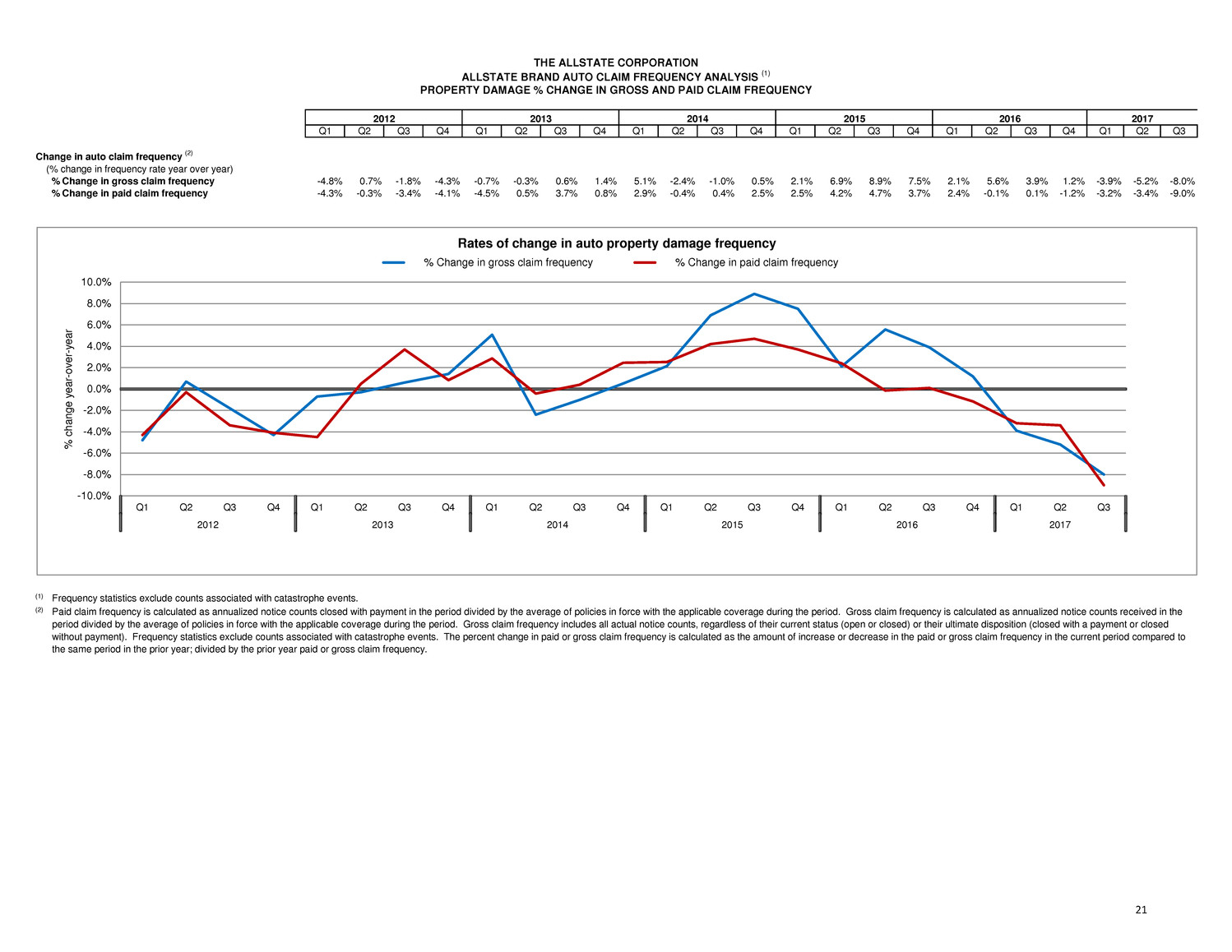

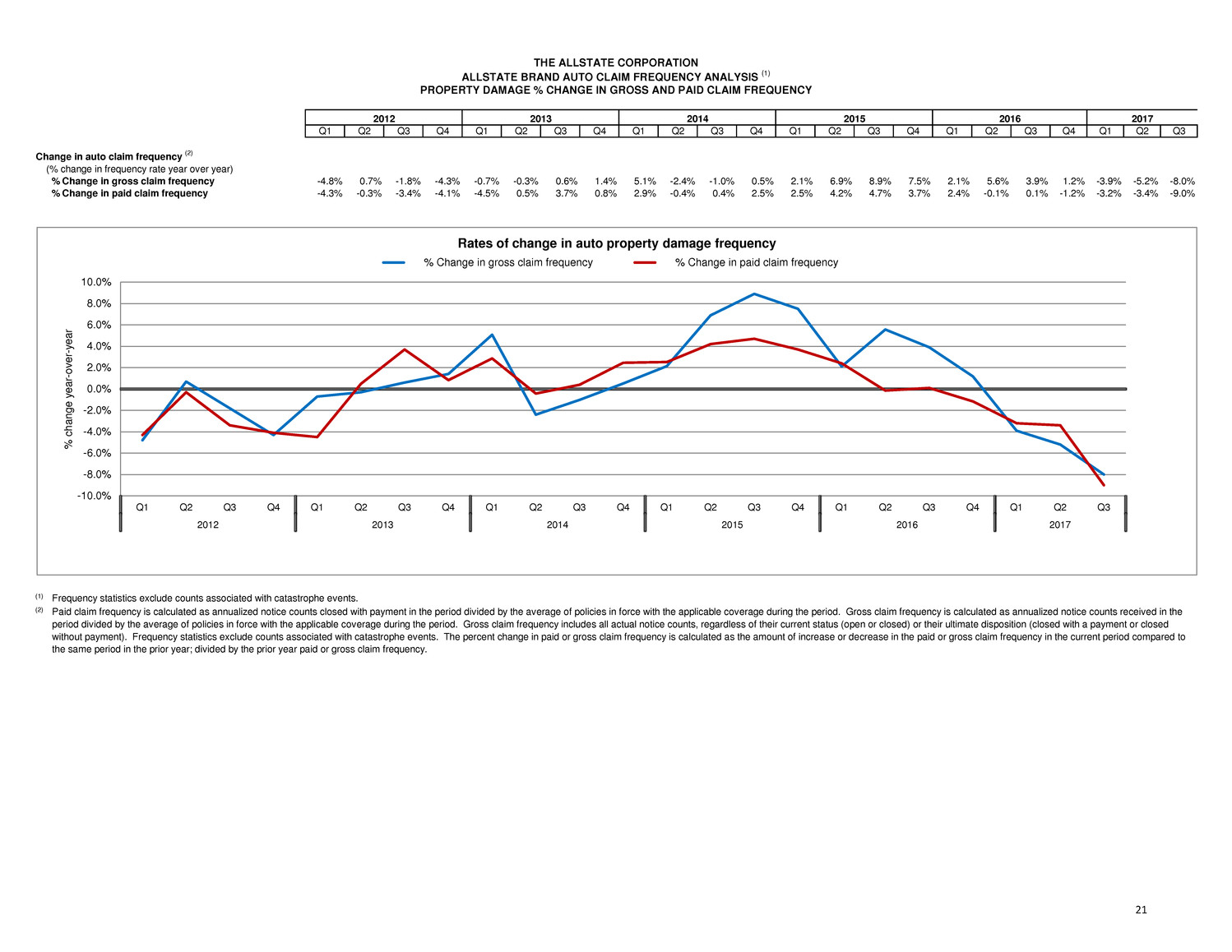

21 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Change in auto claim frequency (2) (% change in frequency rate year over year) % Change in gross claim frequency -4.8% 0.7% -1.8% -4.3% -0.7% -0.3% 0.6% 1.4% 5.1% -2.4% -1.0% 0.5% 2.1% 6.9% 8.9% 7.5% 2.1% 5.6% 3.9% 1.2% -3.9% -5.2% -8.0% % Change in paid claim frequency -4.3% -0.3% -3.4% -4.1% -4.5% 0.5% 3.7% 0.8% 2.9% -0.4% 0.4% 2.5% 2.5% 4.2% 4.7% 3.7% 2.4% -0.1% 0.1% -1.2% -3.2% -3.4% -9.0% (1) (2) THE ALLSTATE CORPORATION ALLSTATE BRAND AUTO CLAIM FREQUENCY ANALYSIS (1) PROPERTY DAMAGE % CHANGE IN GROSS AND PAID CLAIM FREQUENCY Frequency statistics exclude counts associated with catastrophe events. Paid claim frequency is calculated as annualized notice counts closed with payment in the period divided by the average of policies in force with the applicable coverage during the period. Gross claim frequency is calculated as annualized notice counts received in the period divided by the average of policies in force with the applicable coverage during the period. Gross claim frequency includes all actual notice counts, regardless of their current status (open or closed) or their ultimate disposition (closed with a payment or closed without payment). Frequency statistics exclude counts associated with catastrophe events. The percent change in paid or gross claim frequency is calculated as the amount of increase or decrease in the paid or gross claim frequency in the current period compared to the same period in the prior year; divided by the prior year paid or gross claim frequency. 20172012 2013 2014 2015 2016 -10.0% -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 2012 2013 2014 2015 2016 2017 % c ha ng e ye ar -o ve r- ye ar Rates of change in auto property damage frequency % Change in gross claim frequency % Change in paid claim frequency

22 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Net premiums written $ 453 $ 408 $ 457 $ 399 $ 446 $ 392 $ 452 $ 1,318 $ 1,290 Net premiums earned Auto $ 411 $ 411 $ 403 $ 408 $ 405 $ 403 $ 394 $ 1,225 $ 1,202 Homeowners 19 16 14 13 11 10 8 49 29 Other personal lines 2 2 2 2 2 2 2 6 6 Total 432 429 419 423 418 415 404 1,280 1,237 Incurred losses Auto $ 322 $ 324 $ 300 $ 310 $ 313 $ 308 $ 289 $ 946 $ 910 Homeowners 14 21 13 8 11 10 4 48 25 Other personal lines 1 1 1 1 2 1 1 3 4 Total 337 346 314 319 326 319 294 997 939 Expenses Auto $ 104 $ 100 $ 107 $ 114 $ 111 $ 107 $ 123 $ 311 $ 341 Homeowners 9 8 8 10 22 25 11 25 58 Other personal lines 1 1 - 1 - 1 1 2 2 Total 114 109 115 125 133 133 135 338 401 Underwriting income (loss) Auto (1) $ (15) $ (13) $ (4) $ (16) $ (19) $ (12) $ (18) $ (32) $ (49) Homeowners (4) (13) (7) (5) (22) (25) (7) (24) (54) Other personal lines - - 1 - - - - 1 - Total (19) (26) (10) (21) (41) (37) (25) (55) (103) Loss ratio 78.0 80.7 74.9 75.4 78.0 76.9 72.8 77.9 75.9 Expense ratio 26.4 25.4 27.5 29.6 31.8 32.0 33.4 26.4 32.4 Combined ratio 104.4 106.1 102.4 105.0 109.8 108.9 106.2 104.3 108.3 Loss ratio 78.0 80.7 74.9 75.4 78.0 76.9 72.8 77.9 75.9 Less: effect of catastrophe losses 3.9 5.6 1.9 1.2 3.3 3.4 0.7 3.8 2.5 effect of prior year non-catastrophe reserve reestimates (0.2) - - (2.1) (1.0) (1.0) (1.0) (0.1) (1.0) Underlying loss ratio * 74.3 75.1 73.0 76.3 75.7 74.5 73.1 74.2 74.4 Expense ratio 26.4 25.4 27.5 29.6 31.8 32.0 33.4 26.4 32.4 Less: effect of amortization of purchased intangible assets 0.2 - 0.3 0.9 1.5 1.7 1.5 0.2 1.5 Expense ratio, excluding the effect of amortization of purchased intangible assets 26.2 25.4 27.2 28.7 30.3 30.3 31.9 26.2 30.9 Reconciliation of combined ratio to underlying combined ratio Combined ratio (1) 104.4 106.1 102.4 105.0 109.8 108.9 106.2 104.3 108.3 Effect of catastrophe losses (3.9) (5.6) (1.9) (1.2) (3.3) (3.4) (0.7) (3.8) (2.5) Effect of prior year non-catastrophe reserve reestimates 0.2 - - 2.1 1.0 1.0 1.0 0.1 1.0 Effect of amortization of purchased intangible assets (0.2) - (0.3) (0.9) (1.5) (1.7) (1.5) (0.2) (1.5) Underlying combined ratio * 100.5 100.5 100.2 105.0 106.0 104.8 105.0 100.4 105.3 Effect of prior year reserve reestimates on combined ratio (0.2) (0.2) - (2.1) (1.0) (1.0) (1.0) (0.2) (1.0) Effect of advertising expenses on combined ratio 9.3 8.6 8.6 9.2 11.7 12.2 11.6 8.8 11.9 Policies in Force (in thousands) Auto 1,369 1,388 1,400 1,391 1,395 1,409 1,428 1,369 1,395 Homeowners 76 69 63 58 52 44 37 76 52 Other personal lines 45 47 48 47 47 47 46 45 47 1,490 1,504 1,511 1,496 1,494 1,500 1,511 1,490 1,494 New Issued Applications (in thousands) Auto 116 120 143 137 151 141 168 379 460 Homeowners 10 9 8 9 10 11 7 27 28 Other personal lines 6 7 8 8 9 8 10 21 27 132 136 159 154 170 160 185 427 515 Average Premium - Gross Written ($) Auto 574 564 571 555 546 538 547 570 544 Homeowners 924 910 919 861 872 855 891 919 877 Renewal Ratio (%) Auto 81.8 81.9 80.4 79.3 78.9 80.0 79.6 81.3 79.5 Homeowners (2) 85.8 86.1 83.5 82.9 83.1 83.9 81.6 85.3 83.3 (1) (2) Esurance’s renewal ratios exclude the impact of risk related cancellations. Customers can enter into a policy without a physical inspection. During the underwriting review period, a number of policies may be canceled if upon inspection the condition is unsatisfactory, causing the renewal ratio to appear lower. Auto underwriting income includes an underwriting loss related to Esurance expansion into Canada of $3 million and $2 million or 0.7 points and 0.5 points on the combined ratio and underlying combined ratio in the third quarter of 2017 and 2016. THE ALLSTATE CORPORATION ESURANCE PROFITABILITY MEASURES AND STATISTICS ($ in millions) Nine months endedThree months ended

23 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Net premiums written $ 271 $ 285 $ 236 $ 263 $ 299 $ 315 $ 263 $ 792 $ 877 Net premiums earned Auto $ 140 $ 143 $ 146 $ 151 $ 155 $ 158 $ 159 $ 429 $ 472 Homeowners 106 108 113 115 119 121 124 327 364 Other personal lines 23 23 24 24 25 25 26 70 76 Total 269 274 283 290 299 304 309 826 912 Incurred losses Auto $ 91 $ 105 $ 104 $ 104 $ 117 $ 130 $ 123 $ 300 $ 370 Homeowners 54 84 108 60 74 85 85 246 244 Other personal lines 13 10 21 13 17 16 31 44 64 Total 158 199 233 177 208 231 239 590 678 Expenses Auto $ 43 $ 46 $ 43 $ 44 $ 44 $ 45 $ 45 $ 132 $ 134 Homeowners 32 34 33 33 34 36 36 99 106 Other personal lines 7 7 7 7 8 7 7 21 22 Total 82 87 83 84 86 88 88 252 262 Underwriting income (loss) Auto $ 6 $ (8) $ (1) $ 3 $ (6) $ (17) $ (9) $ (3) $ (32) Homeowners 20 (10) (28) 22 11 - 3 (18) 14 Other personal lines 3 6 (4) 4 - 2 (12) 5 (10) Total 29 (12) (33) 29 5 (15) (18) (16) (28) Loss ratio 58.7 72.6 82.4 61.0 69.6 76.0 77.3 71.4 74.4 Expense ratio 30.5 31.8 29.3 29.0 28.7 28.9 28.5 30.5 28.7 Combined ratio 89.2 104.4 111.7 90.0 98.3 104.9 105.8 101.9 103.1 Loss ratio 58.7 72.6 82.4 61.0 69.6 76.0 77.3 71.4 74.4 Less: effect of catastrophe losses 4.5 19.0 23.7 3.1 9.0 11.2 13.3 15.8 11.2 effect of prior year non-catastrophe reserve reestimates (0.8) (2.2) 1.4 (3.8) - 0.9 4.2 (0.5) 1.8 Underlying loss ratio * 55.0 55.8 57.3 61.7 60.6 63.9 59.8 56.1 61.4 Expense ratio 30.5 31.8 29.3 29.0 28.7 28.9 28.5 30.5 28.7 Less: effect of amortization of purchased intangible assets - - - - - - - - - Expense ratio, excluding the effect of amortization of purchased intangible assets 30.5 31.8 29.3 29.0 28.7 28.9 28.5 30.5 28.7 Reconciliation of combined ratio to underlying combined ratio Combined ratio 89.2 104.4 111.7 90.0 98.3 104.9 105.8 101.9 103.1 Effect of catastrophe losses (4.5) (19.0) (23.7) (3.1) (9.0) (11.2) (13.3) (15.8) (11.2) Effect of prior year non-catastrophe reserve reestimates 0.8 2.2 (1.4) 3.8 - (0.9) (4.2) 0.5 (1.8) Underlying combined ratio * 85.5 87.6 86.6 90.7 89.3 92.8 88.3 86.6 90.1 Effect of prior year reserve reestimates on combined ratio (0.8) (2.9) 2.1 (3.8) 0.3 0.3 4.5 (0.5) 1.8 Effect of advertising expenses on combined ratio 0.4 - - 0.3 - 0.3 - 0.1 0.1 Policies in Force (in thousands) Auto 548 571 595 622 649 676 701 548 649 Homeowners 262 273 284 295 305 318 329 262 305 Other personal lines 88 91 94 98 101 105 108 88 101 898 935 973 1,015 1,055 1,099 1,138 898 1,055 New Issued Applications (in thousands) Auto 13 13 12 11 13 15 15 38 43 Homeowners 8 8 7 7 9 9 9 23 27 Average Premium - Gross Written ($) Auto 1,087 1,065 1,057 1,043 1,022 988 981 1,070 997 Homeowners 1,703 1,667 1,659 1,650 1,659 1,629 1,618 1,677 1,636 Renewal Ratio (%) Auto 72.0 74.2 73.1 73.1 73.1 75.5 76.1 73.2 74.9 Homeowners 77.7 78.7 78.2 78.3 77.9 79.9 81.5 78.2 79.7 THE ALLSTATE CORPORATION ENCOMPASS BRAND PROFITABILITY MEASURES AND STATISTICS ($ in millions) Nine months endedThree months ended

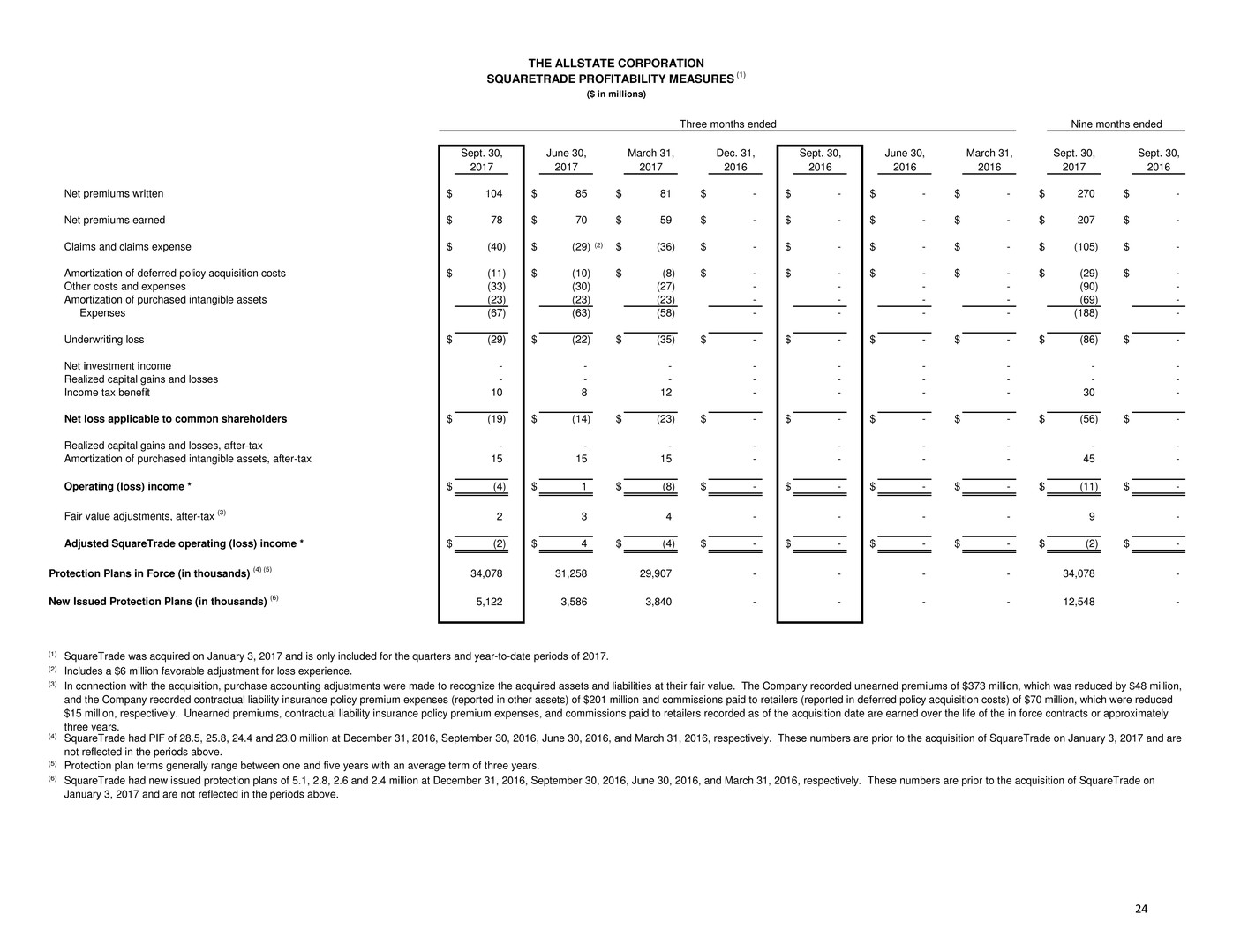

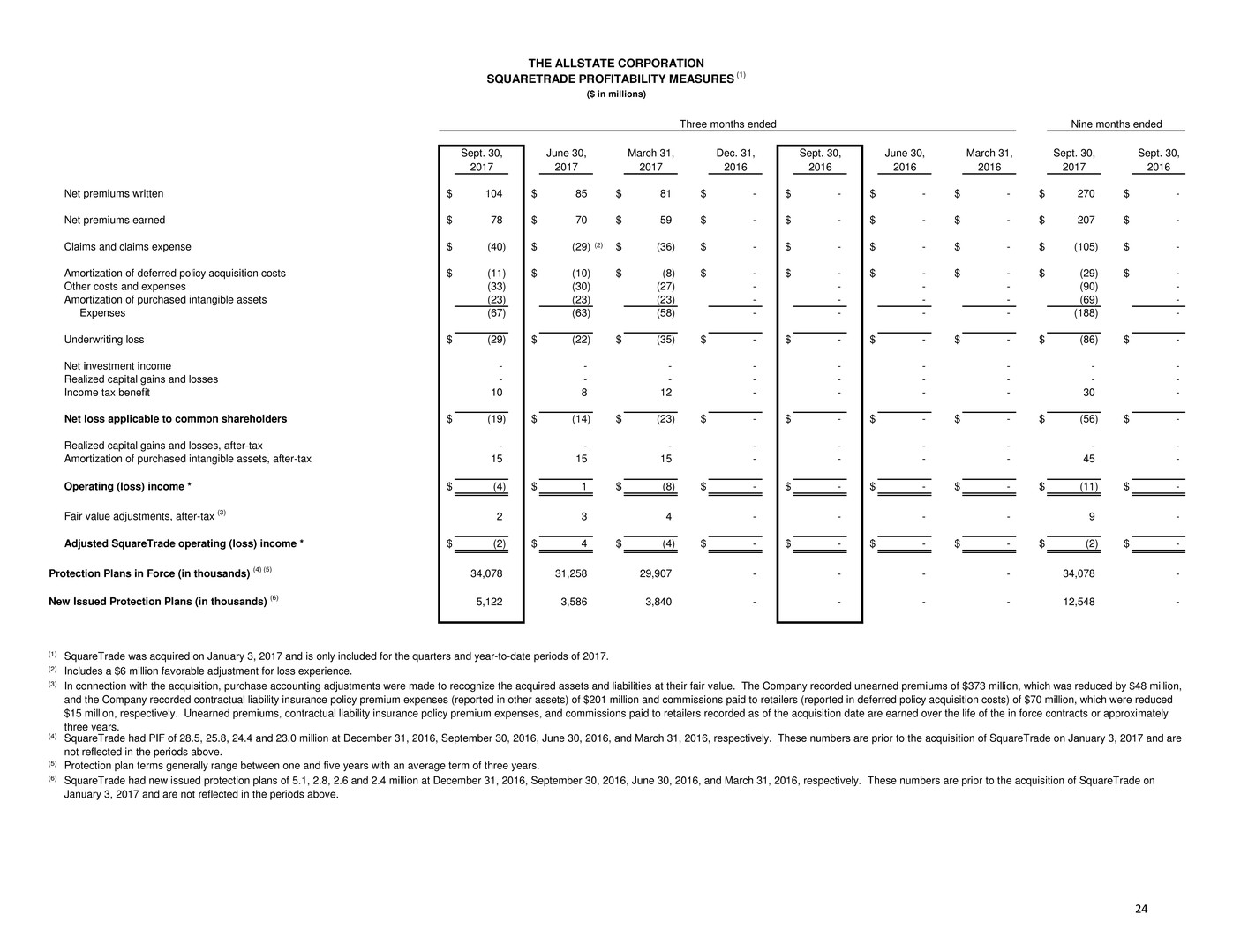

24 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Net premiums written $ 104 $ 85 $ 81 $ - $ - $ - $ - $ 270 $ - Net premiums earned $ 78 $ 70 $ 59 $ - $ - $ - $ - $ 207 $ - Claims and claims expense $ (40) $ (29) (2) $ (36) $ - $ - $ - $ - $ (105) $ - Amortization of deferred policy acquisition costs $ (11) $ (10) $ (8) $ - $ - $ - $ - $ (29) $ - Other costs and expenses (33) (30) (27) - - - - (90) - Amortization of purchased intangible assets (23) (23) (23) - - - - (69) - Expenses (67) (63) (58) - - - - (188) - Underwriting loss $ (29) $ (22) $ (35) $ - $ - $ - $ - $ (86) $ - Net investment income - - - - - - - - - Realized capital gains and losses - - - - - - - - - Income tax benefit 10 8 12 - - - - 30 - Net loss applicable to common shareholders $ (19) $ (14) $ (23) $ - $ - $ - $ - $ (56) $ - Realized capital gains and losses, after-tax - - - - - - - - - Amortization of purchased intangible assets, after-tax 15 15 15 - - - - 45 - Operating (loss) income * $ (4) $ 1 $ (8) $ - $ - $ - $ - $ (11) $ - Fair value adjustments, after-tax (3) 2 3 4 - - - - 9 - Adjusted SquareTrade operating (loss) income * $ (2) $ 4 $ (4) $ - $ - $ - $ - $ (2) $ - Protection Plans in Force (in thousands) (4) (5) 34,078 31,258 29,907 - - - - 34,078 - New Issued Protection Plans (in thousands) (6) 5,122 3,586 3,840 - - - - 12,548 - (1) (2) (3) (4) (5) (6) Protection plan terms generally range between one and five years with an average term of three years. SquareTrade had new issued protection plans of 5.1, 2.8, 2.6 and 2.4 million at December 31, 2016, September 30, 2016, June 30, 2016, and March 31, 2016, respectively. These numbers are prior to the acquisition of SquareTrade on January 3, 2017 and are not reflected in the periods above. THE ALLSTATE CORPORATION SQUARETRADE PROFITABILITY MEASURES (1) ($ in millions) Three months ended Nine months ended SquareTrade was acquired on January 3, 2017 and is only included for the quarters and year-to-date periods of 2017. In connection with the acquisition, purchase accounting adjustments were made to recognize the acquired assets and liabilities at their fair value. The Company recorded unearned premiums of $373 million, which was reduced by $48 million, and the Company recorded contractual liability insurance policy premium expenses (reported in other assets) of $201 million and commissions paid to retailers (reported in deferred policy acquisition costs) of $70 million, which were reduced $15 million, respectively. Unearned premiums, contractual liability insurance policy premium expenses, and commissions paid to retailers recorded as of the acquisition date are earned over the life of the in force contracts or approximately three years. SquareTrade had PIF of 28.5, 25.8, 24.4 and 23.0 million at December 31, 2016, September 30, 2016, June 30, 2016, and March 31, 2016, respectively. These numbers are prior to the acquisition of SquareTrade on January 3, 2017 and are not reflected in the periods above. Includes a $6 million favorable adjustment for loss experience.

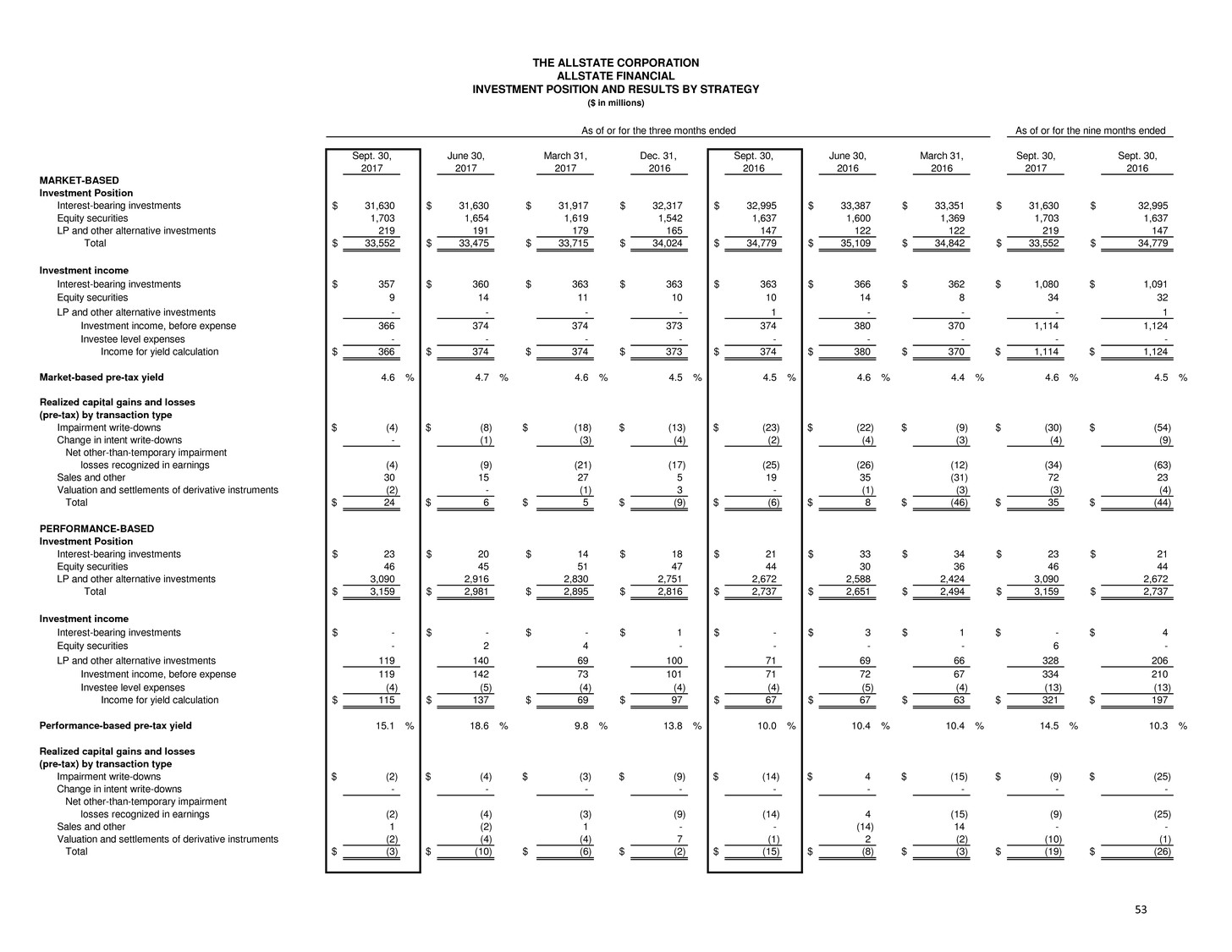

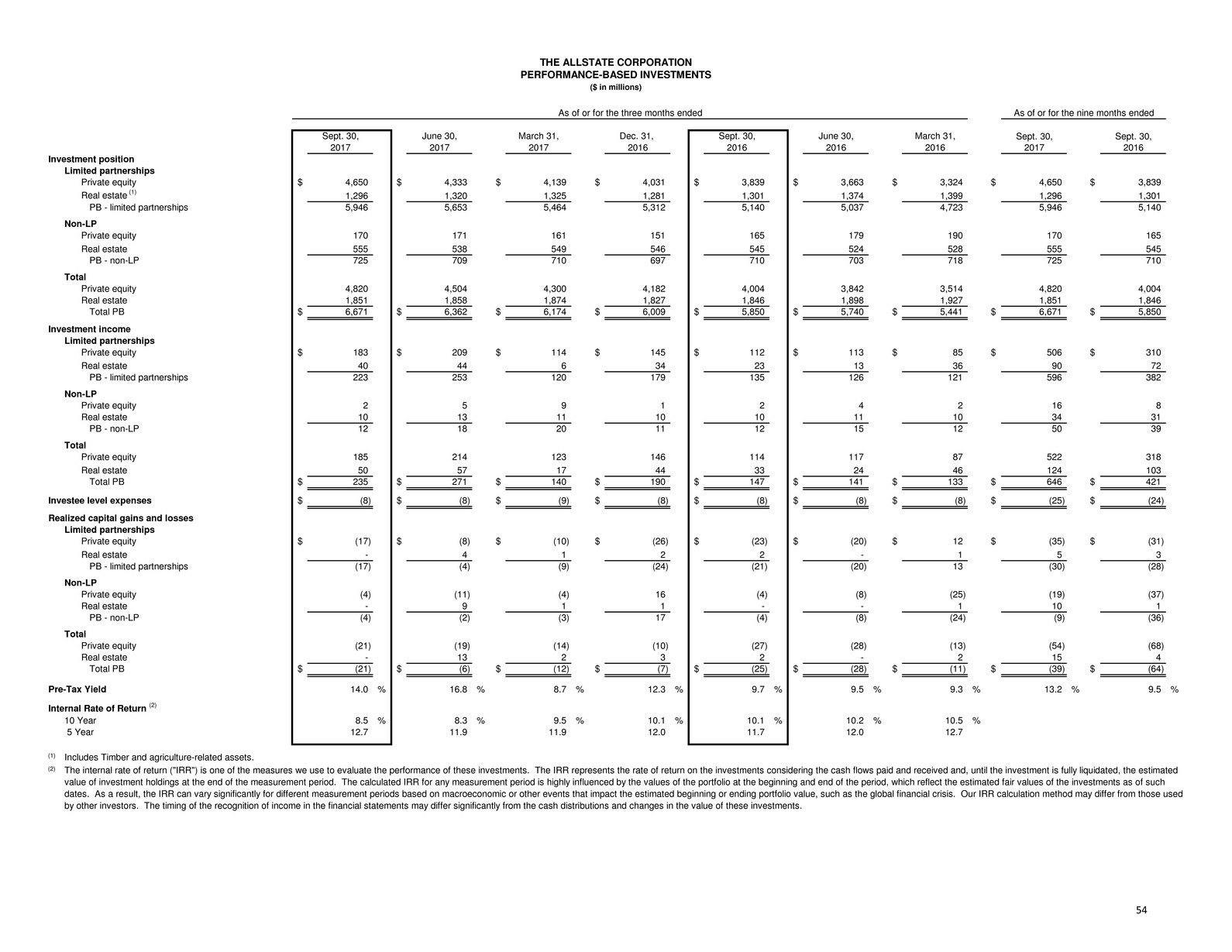

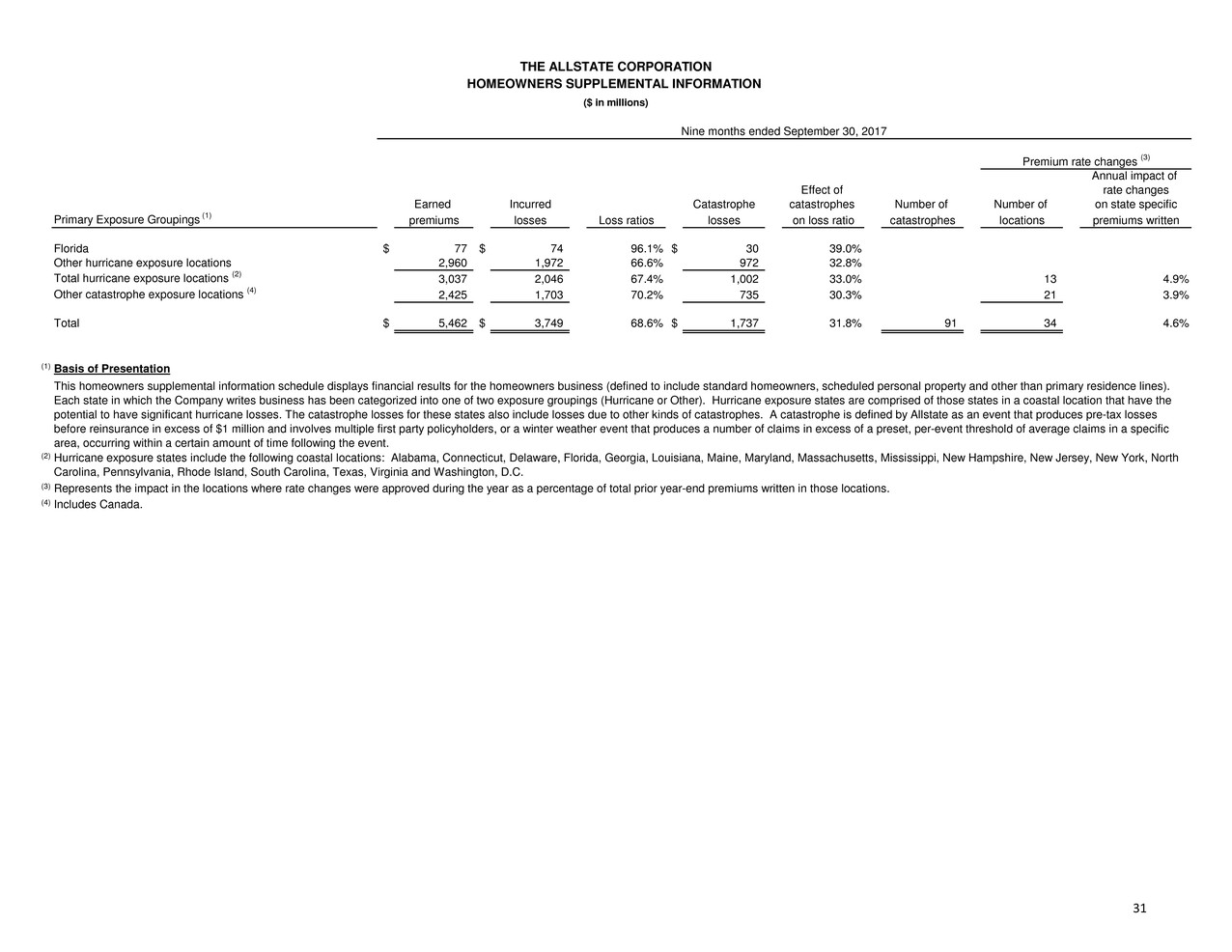

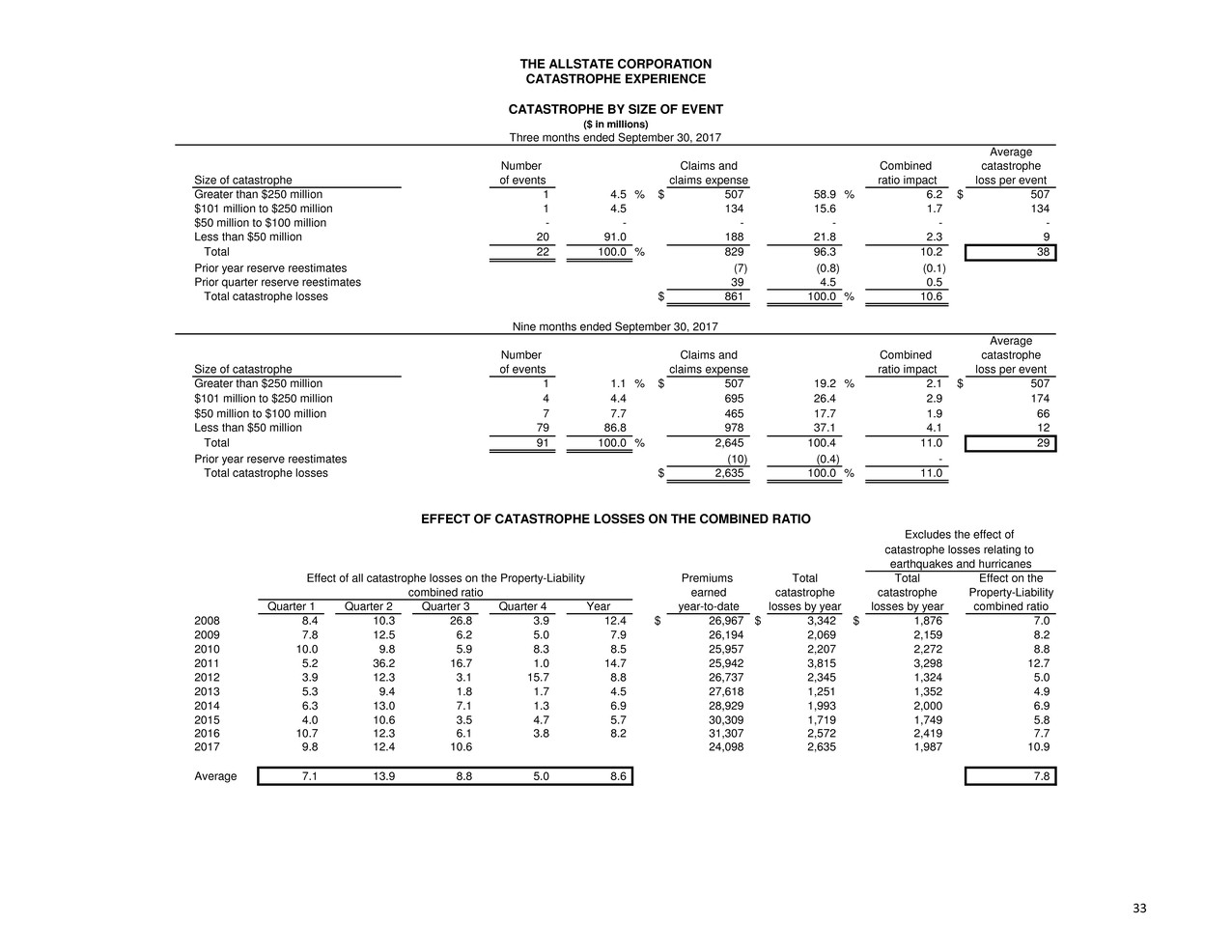

25 Sept. 30, June 30, March 31, Dec. 31, Sept. 30, June 30, March 31, Sept. 30, Sept. 30, 2017 2017 2017 2016 2016 2016 2016 2017 2016 Allstate brand auto Net premiums written $ 5,096 $ 4,925 $ 4,882 $ 4,756 $ 4,940 $ 4,767 $ 4,746 $ 14,903 $ 14,453 Net premiums earned $ 4,951 $ 4,883 $ 4,839 $ 4,826 $ 4,793 $ 4,745 $ 4,667 $ 14,673 $ 14,205 Incurred losses (3,456) (3,441) (3,224) (3,416) (3,610) (3,634) (3,519) (10,121) (10,763) Expenses (1,242) (1,236) (1,161) (1,181) (1,134) (1,168) (1,103) (3,639) (3,405) Underwriting income (loss) $ 253 $ 206 $ 454 $ 229 $ 49 $ (57) $ 45 $ 913 $ 37 Loss ratio 69.8 70.5 66.6 70.8 75.3 76.6 75.4 69.0 75.8 Less: effect of catastrophe losses 7.4 4.2 1.3 1.2 3.1 4.1 2.9 4.4 3.4 effect of prior year non-catastrophe reserve reestimates (3.7) (1.2) (1.6) (2.0) - (0.7) 0.2 (2.2) (0.2) Underlying loss ratio * 66.1 67.5 66.9 71.6 72.2 73.2 72.3 66.8 72.6 Expense ratio 25.1 25.3 24.0 24.5 23.7 24.6 23.6 24.8 23.9 Combined ratio 94.9 95.8 90.6 95.3 99.0 101.2 99.0 93.8 99.7 Effect of catastrophe losses (7.4) (4.2) (1.3) (1.2) (3.1) (4.1) (2.9) (4.4) (3.4) Effect of prior year non-catastrophe reserve reestimates 3.7 1.2 1.6 2.0 - 0.7 (0.2) 2.2 0.2 Underlying combined ratio * 91.2 92.8 90.9 96.1 95.9 97.8 95.9 91.6 96.5 Esurance brand auto Net premiums written $ 427 $ 386 $ 439 $ 382 $ 428 $ 376 $ 439 $ 1,252 $ 1,243 Net premiums earned $ 411 $ 411 $ 403 $ 408 $ 405 $ 403 $ 394 $ 1,225 $ 1,202 Incurred losses (322) (324) (300) (310) (313) (308) (289) (946) (910) Expenses (104) (100) (107) (114) (111) (107) (123) (311) (341) Underwriting income (loss) $ (15) $ (13) $ (4) $ (16) $ (19) $ (12) $ (18) $ (32) $ (49) Loss ratio 78.3 78.9 74.4 76.0 77.3 76.4 73.4 77.2 75.7 Less: effect of catastrophe losses 3.6 3.6 1.0 1.0 2.2 2.2 0.5 2.8 1.7 effect of prior year non-catastrophe reserve reestimates - 0.3 - (2.2) (1.0) (1.0) (1.0) - (1.0) Underlying loss ratio * 74.7 75.0 73.4 77.2 76.1 75.2 73.9 74.4 75.0 Expense ratio 25.3 24.3 26.6 27.9 27.4 26.6 31.2 25.4 28.4 Combined ratio 103.6 103.2 101.0 103.9 104.7 103.0 104.6 102.6 104.1 Effect of catastrophe losses (3.6) (3.6) (1.0) (1.0) (2.2) (2.2) (0.5) (2.8) (1.7) Effect of prior year non-catastrophe reserve reestimates - (0.3) - 2.2 1.0 1.0 1.0 - 1.0 Effect of amortization of purchased intangible assets (0.2) - (0.2) (0.9) (1.5) (1.8) (1.5) (0.2) (1.6) Underlying combined ratio * 99.8 99.3 99.8 104.2 102.0 100.0 103.6 99.6 101.8 Encompass brand auto Net premiums written $ 141 $ 148 $ 125 $ 138 $ 153 $ 162 $ 138 $ 414 $ 453 Net premiums earned $ 140 $ 143 $ 146 $ 151 $ 155 $ 158 $ 159 $ 429 $ 472 Incurred losses (91) (105) (104) (104) (117) (130) (123) (300) (370) Expenses (43) (46) (43) (44) (44) (45) (45) (132) (134) Underwriting income (loss) $ 6 $ (8) $ (1) $ 3 $ (6) $ (17) $ (9) $ (3) $ (32) Loss ratio 65.0 73.4 71.2 68.9 75.5 82.3 77.4 69.9 78.4 Less: effect of catastrophe losses 0.7 4.9 2.8 - 3.3 1.9 1.3 2.8 2.1 effect of prior year non-catastrophe reserve reestimates - - - (2.7) (1.3) 3.8 1.3 - 1.3 Underlying loss ratio * 64.3 68.5 68.4 71.6 73.5 76.6 74.8 67.1 75.0 Expense ratio 30.7 32.2 29.5 29.1 28.4 28.5 28.3 30.8 28.4 Combined ratio 95.7 105.6 100.7 98.0 103.9 110.8 105.7 100.7 106.8 Effect of catastrophe losses (0.7) (4.9) (2.8) - (3.3) (1.9) (1.3) (2.8) (2.1) Effect of prior year non-catastrophe reserve reestimates - - - 2.7 1.3 (3.8) (1.3) - (1.3) Underlying combined ratio * 95.0 100.7 97.9 100.7 101.9 105.1 103.1 97.9 103.4 THE ALLSTATE CORPORATION AUTO PROFITABILITY MEASURES BY BRAND ($ in millions) Three months ended Nine months ended