An article on Westlaw Business, dated March 4, 2010, entitled “Proxy Disclosure: Boards Stagger to Declassification,” discussing modern trends in board declassification, concludes that “declassification is clearly the trend in corporate best practices and many of America’s largest corporations are putting a stop to their staggering...”

A study by noted Harvard Law School professor Lucian A. Bebchuk and University of South California professor Ehud Kamar, entitled “Bundling and Entrenchment,” stated that between 1995 and 2007:

“Shareholders were strongly opposed to staggered boards, and firms that did not already have a staggered board in their charter were general unable to adopt one. Indeed, during the period we study, shareholders were persistently pressuring firms that had staggered boards to dismantle them. From 1995 through 2007, shareholders voted on more than four hundred proposals to dismantle a staggered board. Over roughly the same period, the average percentage of votes cast in favor of these proposals increased steadily from 45% in 1996 to 68% in 2007.”

Further, the study went to state that as a result of the support of the shareholders for these proposals, the number of S&P 500 companies with staggered boards dropped from 62% to 45% between 1998 and 2006.

The October 2004 issue of CGQ View summarizes academic research on staggered boards presented by professors Lucian A. Bebchuk and Alma Cohen, entitled “The Costs of Entrenched Boards, which studies the association between staggered boards and firm value during the period 1995-2002, determined that “staggered boards are associated with a lower firm value.” CGQ View reported that according to the Bebchuk/Cohen study, “staggered boards do not merely reflect lower firm value,” but such boards “actually cause lower firm value that is economically meaningful.”

And in an article in the September 15, 2004 Dow Jones Corporate Governance Newsletter commenting on Procter & Gamble’s proposal to end its classified board, the author indicated as follows:

“Proponents of good corporate governance say that having directors stand for election each year gives investors the ability to remove board members who aren’t doing a good job in a timely manner. Annual elections also can help bring fresh perspectives to the board.”

Separating the Roles of Chief Executive Officer and Chairman of the Board

An article posted on the Wall Street Journal on January 14, 2008, entitled “When Chairman and CEO Roles Get a Divorce,” discussing the separation of the roles of the CEO and Chairman states that the division of labor of the two roles has been long favored by governance advocates.

An article entitled “Corporate Governance Best Practices: Chairman-CEO Split Gains Support,” published on March 30, 2009, discussing a report prepared by Millstein Center for Corporate Governance and Performance at Yale University’s Schools of Management, whereby the importance of the “Chairman-CEO split as a corporate governance best practice” (emphasis added), is outlined. The report by Millstein Center also states that “[i]n the context of this economic crisis, boards should adopt independent chairmanship as an important voluntary and proactive element in restoring market trust in enterprise.” Finally, the report concludes that now is the time to make independent chairmanship the default model of board leadership in corporate North America and urges companies to implement this change.

Empirical date and trends support the assertion that the separation of the roles of CEO and Chairman is now a corporate best practice. According to the RMG 2009 Post Season Report entitled “A New Voice in Governance: Global Policymakers Shape the Road to Reform,” “most compensation-related shareholder proposals, call for separation or independent chairs have resonated with investors in 2009, with 31 proposals averaging 36.3% of support between January 1 and June 30.” This is a 6.5% increase from 2008 and 11.5% increase since 2007.

Further, RMG stated in its Governance Group Issues Report on December 17, 2008, entitled “Board Practices: Trends in Board Structure at S&P 1,500 Companies,” that “study trends suggest that companies are beginning to view separate chairs more favorable,” and that “[i]ssuers are demonstrating increased importance placed on CEO succession planning, with 88 percent now disclosing a board committee with formal responsibilities for such work, up eight percentage points from 2007 and more than double the level in 2006.”

Poison Pill

Studies have found that poison pills significantly reduce shareholder value as noted in a case study entitled “Grading the Goldfield Poison” by Aaron Brown, adapted by Professor Ian Giddy of New York University. It further stated that “pills are not aimed at hostile acquirers, but

A-2

at any shareholders who challenge management and that the “real purpose of pills is to entrench board power rather than prevent takeovers.”

For the last several years RMG, has followed guidelines set out in its RiskMetics Group, U.S. Corporate Governance Policy; 2009 Updates 14-16, and voted against the re-election of a board that has adopted a poison pill without shareholder consent and only supported shareholder approved poison pills if they contain watered-down protections.

In an article in the May/June 2008 McDermott Will & Emery “Inside M&A” Newsletter, discussing corporate trends and specifically corporate defense tactics, the author indicated as follows:

“Generally, the number of publicly traded U.S. companies with structural defenses, such as staggering boards, poison pills and other measures, has been declining. The decline of poison pills is particularly striking. According to Georgeson, the number of public companies with poison pills in force dropped from 60 percent in 2002 to approximately 30 percent by year-end 2007.”

The article further stated that “a rights plan is often viewed as a mechanism that entrenches management, erodes accountability and unduly limits a shareholder’s ability to consider a change of control provision.”

An article posted by Latham & Watkins on the Harvard Law School Forum on Corporate Governance and Financial Regulation further elaborates that while in 2002 approximately 60% of S&P 500 corporations had rights plans in place, by 2008, only 22% still maintained rights plans.

Succession Planning

An article from the Stanford University Graduate School of Business Closer Look Series: Topics, Issues, and Controversies in Corporate Governance, dated June 24, 2010, entitled “CEO Succession Planning: Who’s Behind Door Number One?” discussing the importance of successive planning for CEOs of companies states that “one of the most important decisions that a board of directors must make is the selection of the chief executive officer (CEO) of the company and concludes that in order to perform this function the board needs to have a succession plan in place. The article looks to the SEC Staff Legal Bulletin 14E (CF), “Shareholder proposals,” dated October 27, 2009, whereby the SEC states that “one of the board’s key functions is to provide for succession planning so that the company is not adversely affected due to vacancy in leadership,” as support for disclosure of CEO succession.

Further, a study by the Hay Group conducted in 2007, entitled “What Makes the Most Admired Companies Great: Board Governance and Effective Human Capital Management,” found that “85% of the Most Admired Company boards have well-defined CEO succession plans to prepare for replacement of the CEO on a long-term basis and that 91% have a well defined plan to cover the emergency loss of the CEO that is discussed at least annually by the board.”

A-3

An article at Forbes.com published on November 9, 2007, entitled “Best Practices in Succession Planning,” states that “[b]ecause the board of directors has the responsibility for governance, the development and execution of a thoughtful succession-planning process must receive its full consideration,” supporting the assertion that CEO succession planning is an essential part of best corporate governance practices.

A-4

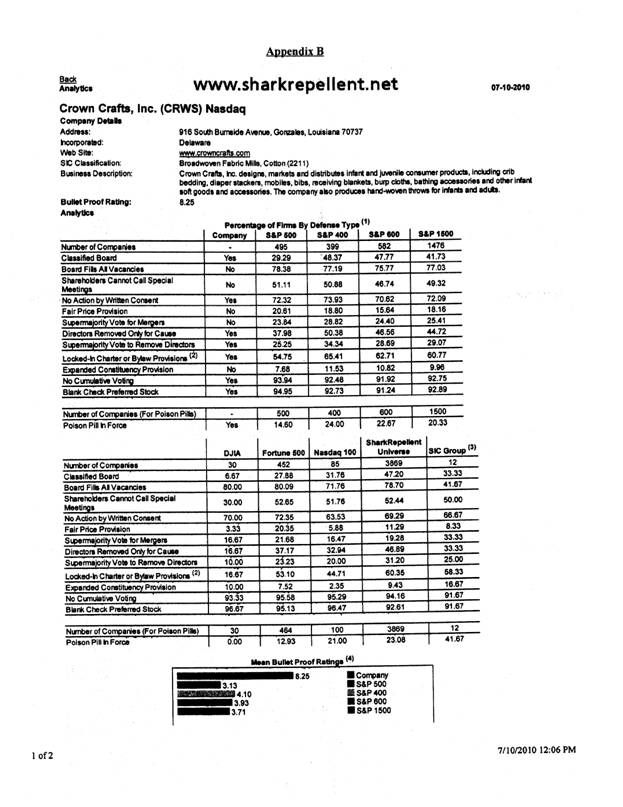

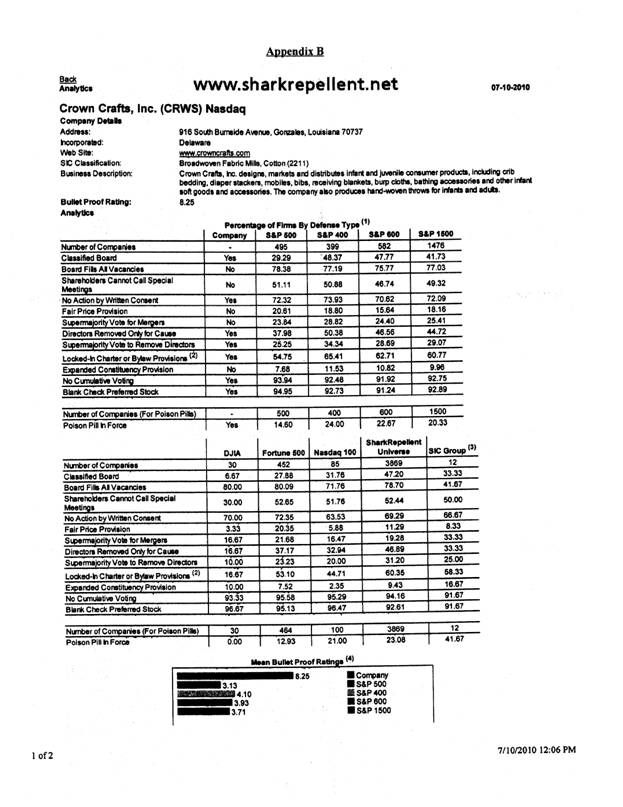

B-1

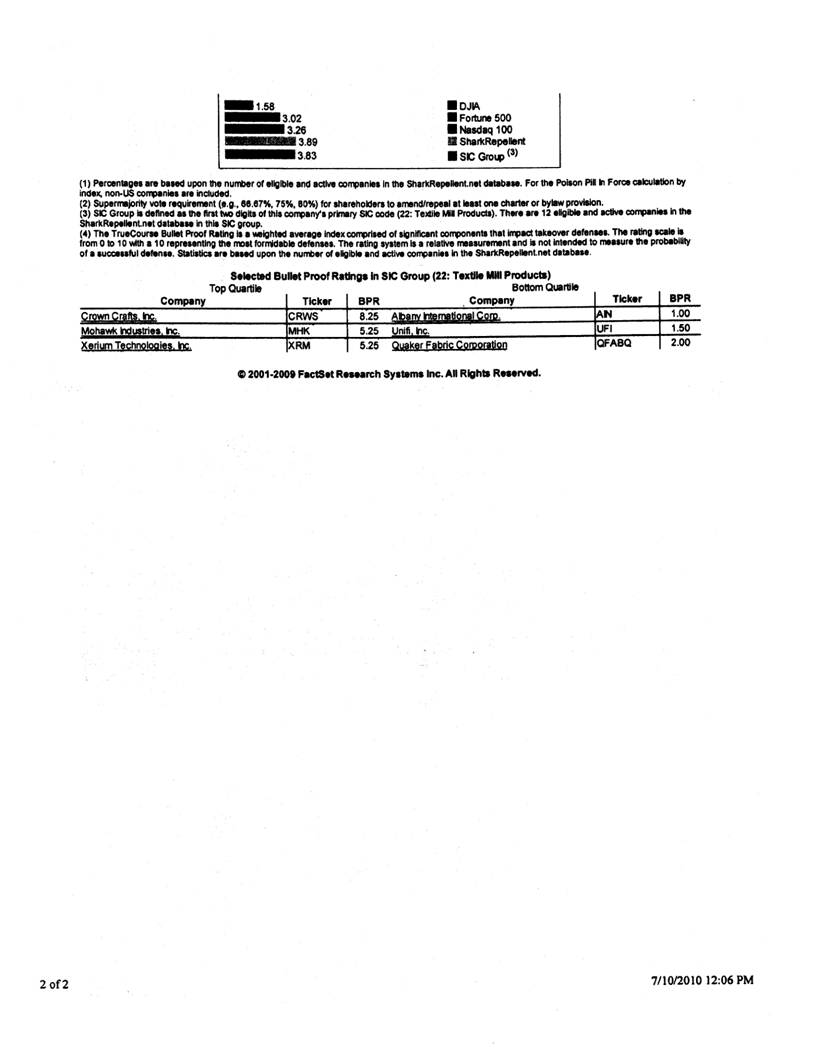

B-2

Appendix C

C-1