SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Filed by the Registrant: | | o |

| Filed by a Party other than the Registrant: | | X |

| Check the appropriate box: |

| | o | Preliminary Proxy Statement |

| | o | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| | o | Definitive Proxy Statement |

| | X | Definitive Additional Materials |

| | o | Soliciting Material Under Rule 14a-12 |

CROWN CRAFTS, INC.

(Name of Registrant as Specified in its Charter)

WYNNEFIELD PARTNERS SMALL CAP VALUE, L.P.

WYNNEFIELD PARTNERS SMALL CAP VALUE, L.P. I

WYNNEFIELD SMALL CAP VALUE OFFSHORE FUND, LTD.

WYNNEFIELD CAPITAL MANAGEMENT, LLC

WYNNEFIELD CAPITAL, INC.

CHANNEL PARTNERSHIP II, L.P.

WYNNEFIELD CAPITAL, INC. PROFIT SHARING & MONEY PURCHASE PLAN

NELSON OBUS

JOSHUA H. LANDES

JON C. BIRO

MELVIN L. KEATING

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box)

| | X | | No fee required. |

| | o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | (1) | Title of each class of securities to which transaction applies: |

| | | | (2) | Aggregate number of securities to which transaction applies: |

| | | | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| | | | | Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was |

| | | | | determined): |

| | | | (4) | Proposed maximum aggregate value of transaction: |

| | | | (5) | Total fee paid: |

| | o | | Fee paid previously with preliminary materials. |

| | o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify |

| | | | the filing for which the offsetting fee was paid previously. Identify the previous filing by |

| | | | registration statement number, or the Form or Schedule and the date of its filing. |

| | | | (1) | Amount Previously Paid: |

| | | | (2) | Form, Schedule or Registration Statement No.: |

| | | | (3) | Filing Party: |

| | | | (4) | Date Filed: |

WYNNEFIELD GROUP

450 SEVENTH AVENUE, SUITE 509

NEW YORK, NY 10123

July 23, 2010

VOTE THE GOLD PROXY CARD TODAY!

Dear Fellow Crown Crafts Stockholder:

Recently, we sent you materials explaining why, as Crown Crafts’ largest stockholder with approximately 17% of the Company’s outstanding shares, we are nominating two highly qualified independent directors, Jon C. Biro and Melvin L. Keating, to the Company’s Board of Directors. We urge you to review our proxy materials carefully and vote the GOLD proxy card for nominees who will work to enhance value for all stockholders.

CROWN CRAFTS HASN’T DELIVERED VALUE FOR STOCKHOLDERS;

CURRENT BOARD AND MANAGEMENT ARE RUNNING THE COMPANY FOR THEIR OWN

BENEFIT... AT STOCKHOLDERS’ EXPENSE

In our view, Crown Crafts has failed to deliver value to stockholders and faces critical issues because the management-endorsed Board majority has run the Company primarily for their own benefit:

| • | Enrichment: Lavish Board Pay, Executive Compensation and Excessive Severance Packages Incentivize Status Quo. Lavish director and executive compensation incentivizes management and its management-endorsed Board majority to maintain the status quo, at stockholder expense, rather than pursue the path of greatest stockholder value. Cash payments to directors were doubled in 2008 even as income from operations remained flat; lavish executive compensation and severance plans include golden parachute and tax gross-up payments that together could cost the Company more than $5 million – a sum exceeding Crown Crafts’ annual net income; |

| | |

• | Entrenching Themselves Through Governance Schemes. Contrary to best practices endorsed by leading corporate governance experts, the management-endorsed Board majority has put in place a series of old-style entrenchment devices – staggered Board elections, a “poison pill,” a combined Chairman/CEO position, lack of a disclosed CEO succession plan and excessive change-in-control severance plans; |

• | Depressed Stock Price, Illiquid Market. The stock has substantially underperformed its industry peer group over one, two and three years – as of July 13, 2010, it had fallen 32% from its ten-year high of $6.10 on February 6, 2007 – and the market for its shares are illiquid due to the Company’s failure to undertake efforts to broaden its stockholder base – but this did not stop the Company from repurchasing shares from Mr. Chestnut, Chairman/CEO, when he was unable to sell them in the open market; |

• | Despite Challenges, No Articulated Strategic Plan. The Company created a Strategic Review Committee at our urging in 2008 solely to settle our threatened proxy contest. However, the Board has never communicated its so called strategic plan to stockholders – stockholders still don’t know whether a serious review was ever conducted – the Company has merely used a variety of micro-acquisitions to mask its steadily declining core business... failing to create stockholder value; and |

• | Stagnant Core Business Now Faces Major Risks. The core infant-toddler business has remained flat for years and faces significant risks – including dependence on its two largest customers for approximately 64% of gross sales, and looming expiration of key licenses. |

DON’T BE DISTRACTED BY THEIR SMOKESCREEN: LET’S ADDRESS THE REAL ISSUES!

READING BETWEEN THE LINES:

UNEARTHING THE FACTS FROM THE BOARD’S LATEST MAILINGS

In its ongoing and misleading campaign to maintain the status quo at stockholder expense, the management-endorsed Board majority has mailed stockholders proxy materials that seek to obscure and distort the facts surrounding the key issues facing the Company. Let’s examine some of those issues:

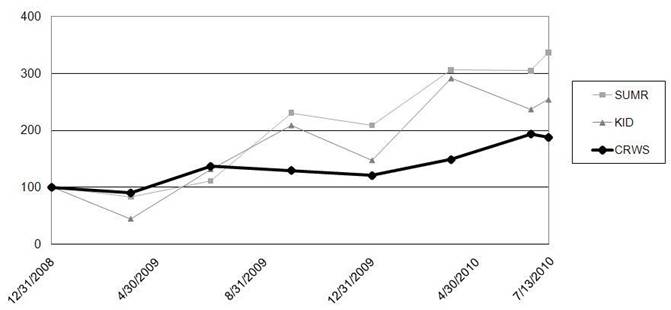

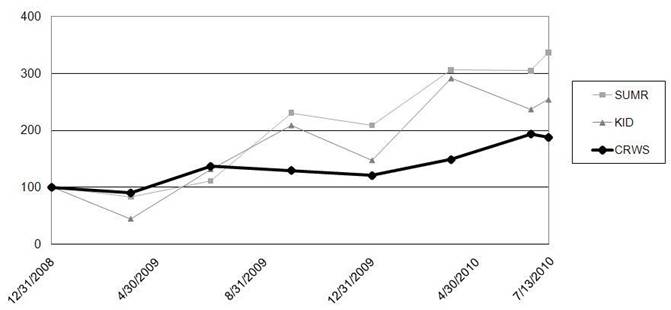

• | Stock Price Underperforming for Years. It’s true that Wynnefield is a long-term investor; we’ve been Crown Crafts stockholders for 14 years. But we, like many other stockholders, have bought shares at a number of price points from time to time. Many stockholders bought in at levels above the current share price. The Company failed to mention that Wynnefield has purchased shares as high as $14/share (October 1997). We stand shoulder to shoulder with all stockholders. We believe that the Board and management should work relentlessly to create stockholder value. In their letter, the management-endorsed Board majority highlights increases in the share price dating back to April 2001 – the period around the time of the stock market collapse in the wake of “dot-com” bust when dinosaurs still walked the Earth. Apparently, this Board believes that stockholders can wait forever. The Company claims we should be satisfied with those results. We are not. The chart below tells the real, modern-day history of Crown Craft stock’s underperformance relative to peers since the beginning of 2009. |

• | When It Comes to Directors’ Votes, It’s Quality, Not Quantity. The Board deceptively states that because Wynnefield’s 2007 nominee, Mr. Frederick Wasserman, voted with the Board majority a certain percentage of the time he somehow supported the Company’s business strategy. This is false! It’s not the percentage of votes that a director casts but his votes on key issues that affect shareholder value that matter. Compounding their deception, the Company would have you believe that Wynnefield did not re-nominate Mr. Wasserman to the Board. This is also false. Though Mr Wasserman was elected by the stockholders in 2007, the Company refused to re-nominate him after Wynnefield exercised its rights under its 2008 Standstill Agreement to have a Company director resign to create an additional vacancy on the Board to be filled by stockholder vote at the 2010 Annual Meeting. |

2

• | “Staggeringly” Lame Defense of Poor Corporate Governance. The Board re-hashes the same tired defense of its staggered board that similarly entrenched Boards have used for years. But the fact is that corporate governance best practice is to conduct annual elections for the entire Board. And the Board neglects to mention that the staggered board is but one of many elements of the “picket fence” of governance schemes it has put in place to entrench itself, including: the “poison pill” no public CEO succession plan; combined Chairman/CEO positions; overly generous change-in-control severance plans for senior executives; and a failure to undertake any efforts to broaden its stockholder base. |

• | Wynnefield Nominees “Stand in Marked Contrast” to Current Board: Have a Record of Creating Value. We agree with the Company’s statement that Wynnefield’s Nominees “stand in marked contrast” to the management-endorsed Board majority because Wynnefield’s Nominees have track records of working to create stockholder value. Mr. Keating, for example, has many years of wide-ranging experience serving on the boards of public companies, including providing strategic analysis and advice to committees reviewing strategic alternatives, as well as senior executive experience. For example, he served on the Strategic Committee of the White Electronic Designs Corp. Board overseeing the process by which that company delivered its stockholders a 28% premium in a strategic transaction. Mr. Biro is the CFO of a large public company and a certified public accountant with in depth business experience in finance, having served as CFO and director of public companies in a wide range of industries. The management-endorsed Board majority? Their track record on stockholder value speaks for itself. |

• | Would They Have Disclosed Anything Without Wynnefield’s Efforts? NO, NOTHING. The Company created a Strategic Review Committee in 2008 because we required them to as part of our Settlement Agreement. Only now, after Wynnefield’s was once again forced to nominate independent directors to the Board to protect the rights of all stockholders, has the Board proclaimed that it adopted a strategic plan in “early 2009.” This is the first stockholders have heard of it. How convenient! Other than proclaiming its existence only after Wynnefield announced its proxy contest, the Board still hasn’t disclosed any details about this purported “strategic plan.” If indeed they have such a plan, stockholders only know that it has not been successful, as evidenced by the Company’s continued underperformance. The recent announcement of the Company’s director of International Sales has nothing to do with any “plan,” but rather is just another example of management and the Board majority it endorses only taking steps in reaction to Wynnefield’s efforts to nominate truly independent nominees to the Board. |

• | A Product Line Announcement is NOT a “Strategic Plan”. Unfortunately, at best, it appears that this newly announced “plan” is not really a “strategic plan” at all, but just a business operational plan. For more than five years, we have urged the Company to fully explore and consider a broad range of strategic opportunities to broaden its business and grow stockholder value – apparently, to no avail. |

• | What’s Another Word for “Flat” Sales and Revenue? Randall Chestnut, Chairman/CEO decreed 2010 to be “a banner year” because the Company “maintained a stable top line” – which is just accounting lingo for “flat revenues.” Guess what? Flat ain’t up – either in revenue or earned operating profits. Unfortunately, the management and the Board it endorses are satisfied with stagnant performance every year because, we believe, their main mission is preserving the status quo – keeping themselves in power to continue to reap lavish compensation and benefits at stockholder expense. |

• | Trying to Mask Declining Domestic Business. While the Board trumpets that International sales grew, it neglects to mention that International comprise an insignificant 2% of gross sales. Given that overall gross sales remained flat, that implies a substantial decline in the Company’s core domestic sales this year. |

3

• | “Pet Project” Not Creating Value. Unfortunately, this venture into the highly competitive pet products industry appears to be just another smokescreen intended to hide the erosion of the Company’s core business, poor financial performance and deteriorating stockholder value. In our view, this foray into unknown territory, where the Company lacks any expertise, is unlikely to yield any significant sales, profits or cognizable stockholder value. |

A VOTE FOR WYNNEFIELD GROUP’S INDEPENDENT NOMINEES IS A VOTE FOR

STOCKHOLDER VALUE

Although they will only constitute a minority of the Board, our Nominees – Jon C. Biro and Melvin L. Keating – are committed to working constructively to design and implement both a strategic plan and the corporate governance changes necessary to increase value for all stockholders. You can read further about their qualifications in our proxy materials. There is a clear need for change and we ask that you support the Wynnefield Group’s Nominees to the Board by signing, dating and returning the GOLD proxy card today.

VOTE FOR JON C. BIRO AND MELVIN L. KEATING ON THE GOLD PROXY CARD TODAY

We urge you to read our proxy materials carefully. If you have any questions or need additional information, please feel free to contact our proxy solicitor Okapi Partners at (877) 285-5990 (Toll-Free) or (212) 297-0720 (Call Collect).

Thank you for your support.

| Wynnefield Partners Small Cap Value, LP |

4