SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

| | |

| Filed by the Registrant: | |

| Filed by a Party other than the Registrant: | x |

| | |

| Check the appropriate box: |

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Under Rule 14a-12 |

OMEGA PROTEIN CORPORATION

(Name of Registrant as Specified in its Charter)

WYNNEFIELD PARTNERS SMALL CAP VALUE, L.P.

WYNNEFIELD PARTNERS SMALL CAP VALUE, L.P. I

WYNNEFIELD SMALL CAP VALUE OFFSHORE FUND, LTD.

WYNNEFIELD CAPITAL MANAGEMENT, LLC

WYNNEFIELD CAPITAL, INC.

WYNNEFIELD CAPITAL, INC. PROFIT SHARING & MONEY PURCHASE PLAN

NELSON OBUS

JOSHUA H. LANDES

Michael N. Christodolou

David H. Clarke

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

| | | |

| Payment of Filing Fee (Check the appropriate box) |

| x | No fee required. |

| | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| | (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed: |

On June 8, 2016, Wynnefield Capital, Inc. and its affiliates posted on its website at www.unlockomegavalue.com a presentation entitled “Omega Protein Corporation: A Case of Poor Board Quality, Capital Misallocation and Anti-Shareholder Corporate Governance” a copy of which is attached hereto as Exhibit A and is incorporated herein by reference.

Additional Information and Where to Find It

Wynnefield Partners Small Cap Value, L.P.; Wynnefield Partners Small Cap Value, L.P. I; Wynnefield Small Cap Value Offshore Fund, Ltd.; Wynnefield Capital, Inc. Profit Sharing & Money Purchase Plan; Wynnefield Capital Management, LLC; Wynnefield Capital, Inc.; Joshua H. Landes; and Nelson Obus (collectively, “Wynnefield Capital”) together with Michael N. Christodolou and David H. Clarke are participants in the solicitation of proxies from stockholders in connection with the 2016 Annual Meeting of Stockholders (the "Annual Meeting") of Omega Protein Corporation (the "Company"). Wynnefield has filed a definitive proxy statement and related materials (the "2016 Proxy Statement") with the Securities and Exchange Commission (the "SEC") in connection with the solicitation of proxies for the Annual Meeting unless it withdraws its nominations.

Wynnefield may be deemed to beneficially own 1,752,636 shares of the Company's common stock, representing approximately 7.9% of the Company's outstanding common stock. None of the other participants own any shares of the Company's common stock. Additional information regarding such participants, including their direct or indirect interests, by security holdings or otherwise, will be included in the 2016 Proxy Statement and other relevant documents to be filed with the SEC in connection with the Annual Meeting.

On or about June 1, 2016, Wynnefield commenced mailing of the definitive 2016 Proxy Statement and an accompanying proxy card to some or all stockholders pursuant to applicable SEC rules. STOCKHOLDERS ARE URGED TO READ THE 2016 PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, copies of the definitive 2016 Proxy Statement and any other documents filed by Wynnefield with respect to the Company with the SEC in connection with the Annual Meeting at the SEC's website (http://www.sec.gov).

EXHIBIT A

Omega Protein: A Case of Poor Board Quality, Capital Misallocation and Anti - Shareholder Corporate Governance © 2016 Wynnefield Capital, Inc. All rights reserved.

2 Disclaimer This presentation (the “Presentation”) is for discussion and general informational purposes only. It does not have regard to the s pec ific investment objective, financial situation, suitability, or the particular need of any specific person who may receive this Presentation, and should not be taken as advi ce on the merits of any investment decision. This Presentation is not an offer to sell or the solicitation of an offer to buy interests in a fund managed by and/or affiliated wit h Wynnefield Capital, Inc. and its affiliates (collectively, “ Wynnefield” and/or “Wynnefield Capital”) and is being provided to the recipient for informational purposes only. The views expressed herein represent the opinions of the Wynnefield, and are based on publicly available information with respect to Omega Protein Corporation (the “Issuer”). Certain financial i nfo rmation and data used in the Presentation have been derived or obtained from public filings, including filings made by the Issuer with the Securities and Exc hange Commission (“SEC”), and other sources. Wynnefield has not sought or obtained consent from any third party to use any statements or information indicated in the Presentation as ha ving been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the supp ort of such third party for the views expressed herein. No warranty is made that data or information, whether derived or obtained from filings made with the SEC or from any thi rd party, are accurate. No agreement, arrangement, commitment or understanding exists or shall be deemed to exist between or among Wynnefield and any third party or parties by virtue of furnishing this Presentation. Except for the historical information contained herein, the matters addressed in this Presentation are forward - loo king statements that involve certain risks and uncertainties. Any person who may receive this Presentation should be aware that actual results may differ materially from th ose contained in the forward - looking statements. Any person who may receive this Presentation undertakes to keep all information contained herein, as well as any additional i nfo rmation that might be later supplied to such person, confidential. Neither Wynnefield, its advisors, nor their respective directors, officers, employees, shareholders, members, partners, managers or advisers, sha ll be responsible or have any liability to any person in relation to the distribution or possession of this Presentation in any jurisdiction. Neither Wynnefield, its advisors, nor their respective directors, officers, employees, shareholders, members, partners, managers or advisers shall be responsible or have any liability for any misinform ati on, errors or omissions contained in any SEC filing, any third party report or this Presentation. The estimates, projections and/or pro forma information set forth herein ar e based on assumptions which Wynnefield believes to be reasonable, but there can be no assurance or guarantee that actual results or performance of the Issuer will not differ , a nd such differences may be material. This Presentation does not recommend the purchase or sale of any security. Wynnefield reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. Wynnefield disclaims any obligation to update the information contained herein. Under no circumstances is this Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security.

3 Table of Contents » Executive Summary 4 » Board Quality is a Critical Issue 13 » Total Share Return Driven by Many Factors 20 » Capital Misallocation Due to Non - Core Human Nutrition Acquisitions 24 » Poor Corporate Governance 29 » Conclusion 37 » Appendix I: Unfriendly Bylaws 39 » Appendix II: Wynnefield Engagement Timeline with Omega Protein 44 Note: Omega Protein’s Annual Meeting of Shareholders is scheduled for 9:00am CDT in Houston, TX on June 28, 2016.

4 Executive Summary

5 Wynnefield Asks For Your Support VOTE FOR Independent Board Nominee Michael N. Christodolou » FOR electing directors with superior experience and expertise » FOR improving capital allocation policy » FOR addressing corporate governance » Wynnefield’s other nominee, David H. Clarke, subsequently has been endorsed and nominated by Omega Protein for its Board of D ire ctors. » Omega Protein’s Board of Directors has serious deficiencies, that both nominees are highly qualified to address. Mr. Christod olo u and Mr. Clarke are a complementary duo with exceptional skills that will fill important and different existing voids. » Mr. Christodolou has thirty years of investment and corporate governance experience with publicly traded companies. See slide 18. » Mr. Clarke has executive and operational experience in the fishmeal and fish oil industries. See slide 19. » The Company��s entrenched Board lacks the necessary skills and experience to develop and execute on a successful strategic plan, a nd twice recently approved – unilaterally and without shareholder approval – bylaw amendments intended to frustrate shareholder democracy. » Wynnefield believes it has never observed a more glaring case of “Diworsification” than the risky and unsuccessful effort of Ome ga Protein to enter the human nutrition field – capital misallocation of $160mm now worth $100mm by the Company’s own acknowledgement. See slide 27.

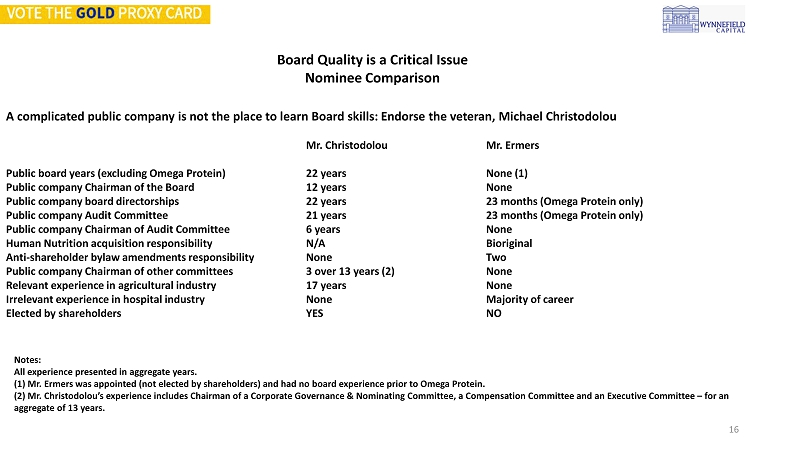

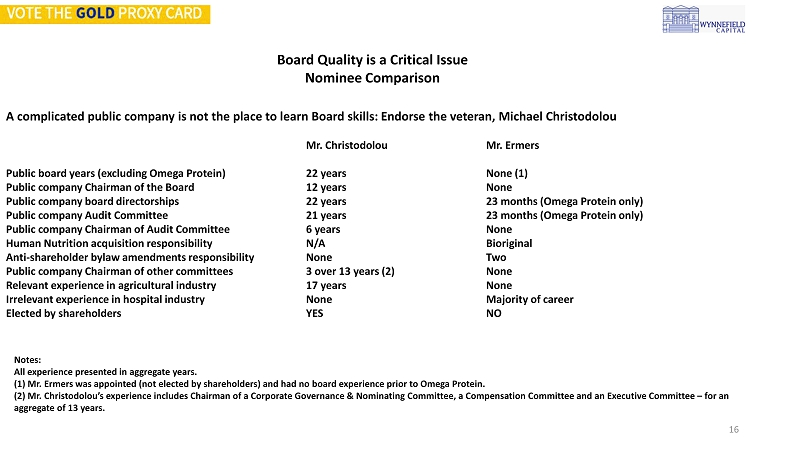

6 Board Quality is a Critical Issue Nominee comparison A complicated company is not the place to learn Board skills: Vote FOR the veteran, Michael Christodolou Mr. Christodolou Mr. Ermers Public board years (excluding Omega Protein) 22 years None (1) Public company Chairman of the Board 12 years None Public company board directorships 22 years 23 months Public company Audit Committee 21 years 23 months Public company Chairman of Audit Committee 6 years None Human Nutrition acquisition responsibility N/A Bioriginal Anti - shareholder bylaw change responsibility None Two Public company Chairman of other committees 3 over 13 years (2) None Relevant experience in agricultural industry 17 years None Irrelevant experience in hospital industry None Majority of career Elected by shareholders YES NO Notes: All experience presented in aggregate years. (1) Mr. Ermers was appointed (not elected by shareholders) and had no board experience prior to Omega Protein. (2) Mr. Christodolou’s experience includes Chairman of a Corporate Governance & Nominating Committee, a Compensation Committe e a nd an Executive Committee – for an aggregate of 13 years.

7 » Wynnefield employs an equity small - cap value special situations strategy with identifiable catalysts. » The investment team seeks out under - followed, misunderstood and undervalued companies which lead to the largest pricing ineffici encies and opportunities in the public market space. » The investment manager holds core positions about 6 - 8 years, turning the portfolio approximately 25% per year, providing its lim ited partners the benefit of tax efficient returns. » Wynnefield was founded in 1992 by Nelson Obus and Joshua Landes, both formerly of Lazard Freres and Co. Mr. Obus has 50 years ex perience investing in small cap companies. » The fund has an annualized net return of approximately 13.0% since inception in 1992. » Wynnefield owns 7.9% of the total outstanding shares of Omega Protein. Wynnefield Capital Overview

8 Wynnefield Capital has a history of introducing highly qualified Board nominees for its portfolio company boards » Wynnefield has successfully placed 11 i ndependent directors over the last 10 years. » Independent d irectors are not representatives of Wynnefield. They have no affiliation with and receive no compensation from Wynnefield. » By leveraging Wynnefield’s extensive human capital network, we seek to upgrade with specific skills needed to fill existing v oid s on boards to help create shareholder value for the benefit of ALL shareholders. Wynnefield’s interests are entirely aligned with ALL shareholde rs – including management teams. Wynnefield Capital Overview

9 Unfriendly Shareholder Treatment Board rejects Wynnefield for a year . » May 2015: Oceana announces proposed acquisition of Daybrook for $382 million . At the time of Oceana’s announcement, Daybrook’s EV/EBITDA multiple was 7.96x ; OME shares traded at an EV/adjusted EBITDA multiple of 4.52x . » September 2015: The Board refused to even speak to a highly skilled independent nominee (Mr. Christodolou) from one of Omega Pro tein’s largest shareholders, Wynnefield. Board reacts with unfriendly shareholder policies . (1) » In 2015, Omega Protein’s Board twice unilaterally adopted, without shareholder approval , amendments to its Amended and Restated Bylaws with the express intention of restricting the right and ability of shareholders to nominate directors and/or submit proposals fo r consideration at the Annual Meeting of Shareholders. Omega Protein has a long history of treating shareholders poorly; this is endemic and defines the Company’s culture, even surviving recent Board director changes . Strategic alternatives review process never discussed by management . » September 25, 2015: Omega Protein announces a strategic alternatives review. » This was a reactive step by Omega Protein’s board, after Wynnefield’s repetitive concerns – following many conversations and its Schedule 13D . » May 4, 2016: Omega Protein’s 1Q16 financial results press release. » After silence for eight months, the Company announced the completion of its strategic alternatives review. » May 5, 2016: Omega Protein’s 1Q16 financial results conference call. » The Board of Directors “determined that the continued execution of the Company’s strategy represents the best path forward to maximize value for stockholders.” Wynnefield strongly disagrees. » Bret Scholtes repeated two prior announcements – originally discussed in March: 1) the decision to invest $18mm in the fish harv esting and processing operations (Animal Nutrition) and 2) the decision to exit its concentrated Omega - 3 operations (Human Nutrition). » Wynnefield believes shareholders have disturbingly few details on Omega Protein’s strategic alternatives review and many ques tio ns remain. (1) See corporate governance on slides 29 - 36.

10 Engagement Timeline Between Wynnefield and Omega Protein » June to July 2015 : Wynnefield’s initiated conversations with the Company. » August 4, 2015 and November 5, 2015 : The Company’s Board twice unilaterally and without shareholder approval adopted bylaw amendments. These amendments were designed to further entrench incumbent Board and make it more difficult for shareholders to nominate di rec tors for election and frustrate shareholder democracy. » April 8, 2016 to May 9, 2016 : Wynnefield made numerous settlement offers and remained open to reasonable discussion throughout the process. The Company’s counsel delay strategy is best characterized by Company’s counsel response on May 9, 2016 to Wynnefield’s couns el’ s proposed settlement offer of April 8, 2016 – a delay of one - month, during which Wynnefield initiated two calls to the Company’s counsel – which were not returned, and one email to the Company’s counsel seeking a response – all of which were ignored. » May 18, 2016 : Wynnefield counsel offered to make Mr. Christodolou available to meet again with Omega Protein’s Board. » May 19, 2016 : The Company’s counsel rejected Wynnefield’s May 11, 2016 settlement proposal claiming the Board did not believe that Mr. Christodolou would add additional skills or expertise not already possessed by the Company’s currently serving Board members. » May 20, 2016 : Wynnefield filed a preliminary proxy statement with the SEC in connection with the 2016 Annual Meeting. Wynnefield identifi ed Messrs. Christodolou and Clarke as independent director nominees and in the spirit of reasonableness withdrew Mr. Sherbert. W ynn efield made a demand for the Company’s shareholder list including NOBO and Cede lists. » May 23, 2016 : The Company announced the record date of June 7, 2016 and the annual meeting date of June 28, 2016. » May 31, 2016 : The Company rejected Wynnefield’s request and refused to make available the requested shareholder lists. Wynnefield files i ts definitive proxy statement with the SEC in connection with the 2016 Annual Meeting. » June 3, 2016 : Wynnefield was compelled to litigate in Nevada court to obtain shareholder lists ( in possession of Omega Protein ) to solicit proxy votes. Note: For additional engagement details see Appendix II on slides 45 - 47 ; For full details see pages 10 - 15 of Wynnefield’s filed proxy statement.

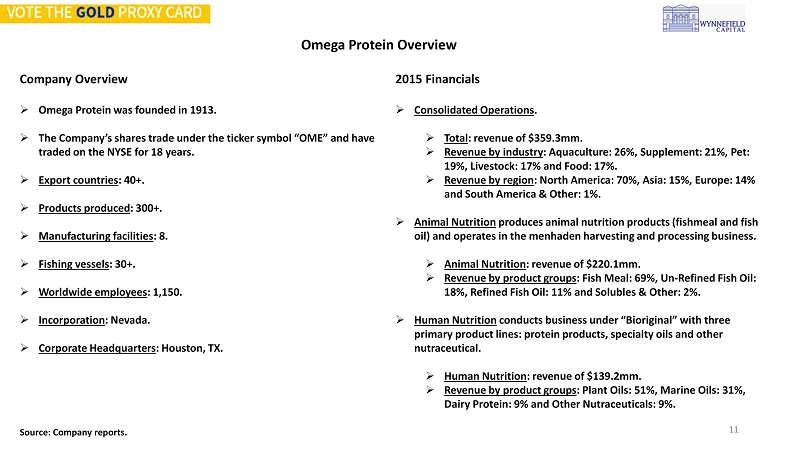

11 Omega Protein Overview Company Overview » Omega Protein was founded in 1913. » The Company’s shares trade under the ticker symbol “OME” and have traded on the NYSE for 18 years. » Export countries : 40+. » Products produced : 300+. » Manufacturing facilities : 8. » Fishing vessels : 30+. » Worldwide employees : 1,150. » Incorporation : Nevada. » Corporate Headquarters : Houston, TX. Source: Company reports. 2015 Financials » Consolidated Operations . » Total : revenue of $359.3mm. » Revenue by industry : Aquaculture: 26%, Supplement: 21%, Pet: 19%, Livestock: 17% and Food: 17%. » Revenue by region : North America: 70%, Asia: 15%, Europe: 14% and South America & Other: 1%. » Animal Nutrition produces animal nutrition products (fishmeal and fish oil) and operates in the menhaden harvesting and processing business. » Animal Nutrition : revenue of $220.1mm. » Revenue by product groups : Fish Meal: 69%, Un - Refined Fish Oil: 18%, Refined Fish Oil: 11% and Solubles & Other: 2%. » Human Nutrition conducts business under “Bioriginal” with three primary product lines: protein products, specialty oils and other nutraceutical. » Human Nutrition : revenue of $139.2mm. » Revenue by product groups : Plant Oils: 51%, Marine Oils: 31%, Dairy Protein: 9% and Other Nutraceuticals: 9%.

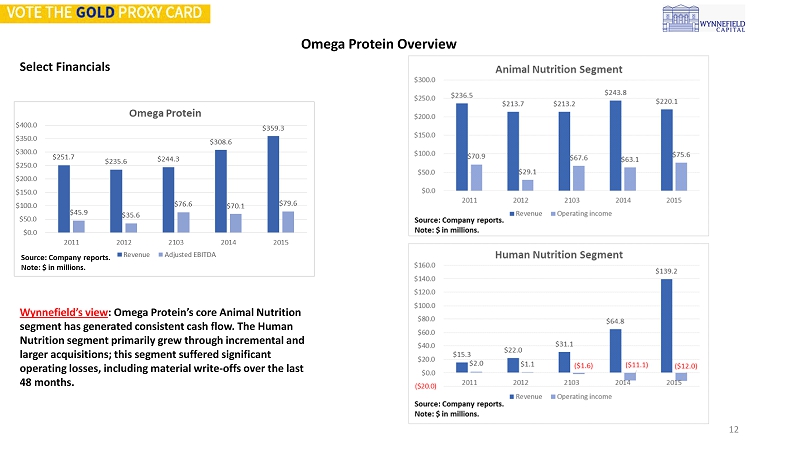

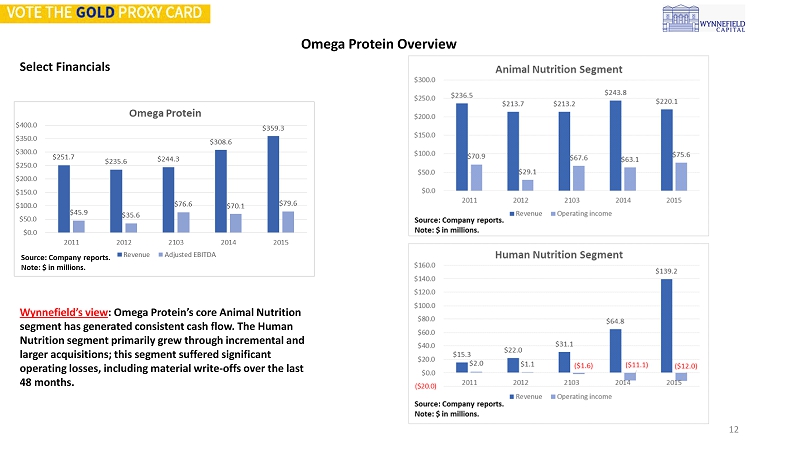

12 Omega Protein Overview Select Financials Wynnefield’s view : Omega Protein’s core Animal Nutrition segment has generated consistent cash flow. The Human Nutrition segment primarily grew through incremental and larger acquisitions; this segment suffered significant operating losses, including material write - offs over the last 48 months.

13 Board Quality is a Critical Issue

14 Board Quality is a Critical Issue Wynnefield has No Confidence in Existing Board Members Omega Protein’s current Board members have limited industry, public company, risk management, financial, operational, investm ent and public company experience. » Wynnefield believes existing Board members lack experience: » To take the steps necessary to enhance stockholder value through better capital allocation and corporate governance practices at Omega Protein. » To provide operational guidance and oversight to the Chief Executive Officer – whose experience Wynnefield believes is primarily in Mergers & Acquisitions and the architect of Omega Protein’s failed Human Nutrition acquisition strategy. » Half (4 out of 8) of Omega Protein’s current Board had received a majority of withhold votes – making these Zombie directors (1) . Note: (1) Zombie directors received a majority of withhold votes in prior elections.

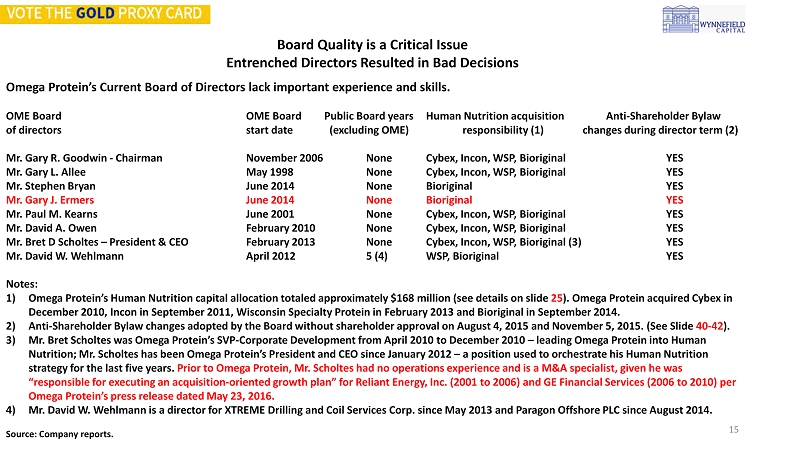

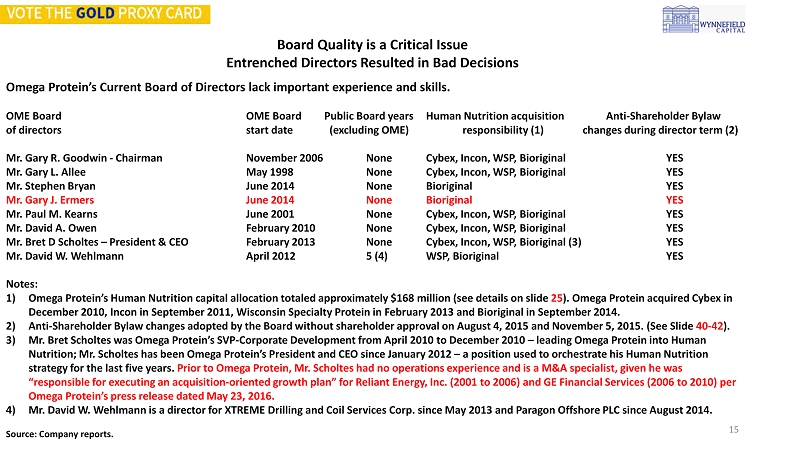

15 Board Quality is a Critical Issue Entrenched Directors Resulted in Bad Decisions Omega Protein’s Current Board of Directors lack important experience and skills. OME Board OME Board Public Board years Human Nutrition acquisition Anti - Shareholder B ylaw of directors start date (excluding OME) responsibility (1) changes during director term (2) Mr. Gary R. Goodwin - Chairman November 2006 None Cybex, Incon, WSP, Bioriginal YES Mr. Gary L. Allee May 1998 None Cybex, Incon, WSP, Bioriginal YES Mr. Stephen Bryan June 2014 None Bioriginal YES Mr. Gary J. Ermers June 2014 None Bioriginal YES Mr. Paul M. Kearns June 2001 None Cybex, Incon, WSP, Bioriginal YES Mr. David A. Owen February 2010 None Cybex, Incon, WSP, Bioriginal YES Mr. Bret D Scholtes – President & CEO February 2013 None Cybex, Incon, WSP, Bioriginal (3) YES Mr. David W. Wehlmann April 2012 5 (4) WSP, Bioriginal YES Notes: 1) Omega Protein’s Human Nutrition capital allocation totaled approximately $168 million (see details on slide 25 ). Omega Protein acquired Cybex in December 2010, Incon in September 2011, Wisconsin Specialty Protein in February 2013 and Bioriginal in September 2014. 2) Anti - Shareholder Bylaw changes adopted by the Board without shareholder approval on August 4, 2015 and November 5, 2015. (See Sl ide 40 - 42 ). 3) Mr. Bret Scholtes was Omega Protein’s SVP - Corporate Development from April 2010 to December 2010 – leading Omega Protein into Hu man Nutrition; Mr. Scholtes has been Omega Protein’s President and CEO since January 2012 – a position used to orchestrate his Human Nutrition strategy for the last five years. Prior to Omega Protein, Mr. Scholtes had no operations experience and is a M&A specialist, given he was “responsible for executing an acquisition - oriented growth plan” for Reliant Energy, Inc. (2001 to 2006) and GE Financial Service s (2006 to 2010) per Omega Protein’s press release dated May 23, 2016. 4) Mr. David W. Wehlmann is a director for XTREME Drilling and Coil Services Corp. since May 2013 and Paragon Offshore PLC since Au gust 2014. Source: Company reports.

16 Board Quality is a Critical Issue Nominee Comparison A complicated public company is not the place to learn Board skills: Endorse the veteran, Michael Christodolou Mr. Christodolou Mr. Ermers Public board years (excluding Omega Protein) 22 years None (1) Public company Chairman of the Board 12 years None Public company board directorships 22 years 23 months (Omega Protein only) Public company Audit Committee 21 years 23 months (Omega Protein only) Public company Chairman of Audit Committee 6 years None Human Nutrition acquisition responsibility N/A Bioriginal Anti - shareholder bylaw amendments responsibility None Two Public company Chairman of other committees 3 over 13 years (2) None Relevant experience in agricultural industry 17 years None Irrelevant experience in hospital industry None Majority of career Elected by shareholders YES NO Notes: All experience presented in aggregate years. (1) Mr. Ermers was appointed (not elected by shareholders) and had no board experience prior to Omega Protein. (2) Mr. Christodolou’s experience includes Chairman of a Corporate Governance & Nominating Committee, a Compensation Committe e a nd an Executive Committee – for an aggregate of 13 years.

17 Board Quality is a Critical Issue Wynnefield board nominees have relevant experience and are independent to serve all shareholders Highly skilled nominee duo have complementary expertise and fill crucial voids on Omega Protein’s Board Michael N. Christodolou » Thirty years of investment and corporate governance experience with publicly - traded companies. » Pivotal – a leading sell - side research firm – supports Mr. Christodolou’s nomination and Omega Protein’s Human Nutrition strategy. » On March 10, 2016, Pivotal’s research report stated, “ Shareholder activism , which has criticized Omega’s diversification into the Human Nutrition business, has helped the share performance , up 60.7% Y/Y… Michael Christodolou is an excellent potential director of OME – we’ve known Mike for 25 years and would concur that he would be terrific for OME …” David H. Clarke » Extensive executive and operational experience in the fishmeal and fish oil industries. » Wynnefield’s other nominee, Mr. Clarke, subsequently has been endorsed and nominated by Omega Protein for its Board of Direct ors – a recognition of his outstanding experience. » Mr. Clarke served as Executive Chairman of International Proteins Corporation, subsequently Marine Harvest International. He was CEO of Seacoast Products, which was sold to Hanson Plc and was sold to Zapata Corporation, the predecessor of Omega Protein Corporat ion .

18 Board Quality is a Critical Issue Wynnefield Offers Superior Board Nominee for Shareholder C onsideration Not one of Omega Protein’s existing Board members’ experience compares to Michael Christodolou’s - especially not Omega Protein’s Mr. Ermers. Michael N. Christodolou Omega Protein would benefit from Mr. Christodolou’s aggregate 22 years of public Board experience, both as Chairman and as a dir ector, and service on numerous committees. He has significant experience collaborating and assisting management teams and Board of Directors on cor por ate and financial strategies to create value for ALL shareholders. » Extensive Board experience : As a director of Lindsay Corporation, a $750 million market capitalization New York Stock Exchange company, since 1999, Mr. Christodolou served as Chairman of the Board, Chair of the Corporate Governance & Nominating Committee, Chair of the Audit Committee and as a member of the Compensation Committee. As a director of XTRA Corporation from 1998 - 2001, Mr. Christodolo u served as Chairman of XTRA’s Audit Committee and as a member of its Compensation Committee, until the Company was acquired by Berkshire Hathaway. » Strong capital allocation experience : As Chairman of Lindsay, Mr. Christodolou led the development of a comprehensive Capital Allocation Program. » Corporate governance and financial strategies expert : Mr. Christodolou is an expert in corporate governance and able to leverage his 12 - year experience as Chairman of the Board of Directors and Chair of the Corporate Governance & Nominating Committee at Lindsay. » Relevant industry knowledge : Mr. Christodolou has substantial agricultural industry - related experience to be an effective director of Omega Protein – as an experienced investor, industry analyst and as long - time Chairman of Lindsay – a manufacturer of agricultural irr igation equipment since 1999. His investment experience spans 30 years of performing in - depth fundamental analysis and financial valuati ons, as well as providing the perspective of the institutional investor. Note: For full details on Mr. Christodolou’s background, see page 21 of Wynnefield’s proxy statement.

19 Board Quality is a Critical Issue Omega Protein Offers Superior Board Nominee for Shareholder Consideration David H. Clarke Mr. Clarke’s industry knowledge and experience is so extensive, Omega Protein nominated him as a director on their slate. » Extensive industry knowledge : Mr. Clarke has highly relevant executive and operational experience in the fishmeal and fish oil industry having served as Executive Chairman of International Proteins Corporation, subsequently Marine Harvest International, one of the lar ges t aquaculture companies in the world, engaged in fishing for menhaden, sardines and anchovies as well as the production and dis tri bution of fishmeal and fish oil worldwide. » Significant operational expertise : Mr. Clarke has tremendous knowledge about Omega Protein. Prior to Marine Harvest, Mr. Clarke was CEO of his family’s menhaden fishmeal business, Seacoast Products, which was sold to Hanson Plc and was sold to Zapata Corporatio n, the predecessor of Omega Protein Corporation. » Valuable board experience : Mr. Clarke was Chairman of International Proteins Corporation, a publicly - traded company from 1989 to 1995 and Chairman & CEO of Jacuzzi Brands, a New York Stock Exchange listed Company, a multi - billion dollar conglomerate from 1995 to 200 6. Note: For full details on Mr. Clarke’s background, see page 22 of Wynnefield’s proxy statement.

20 Total Share Return Driven by Many Factors

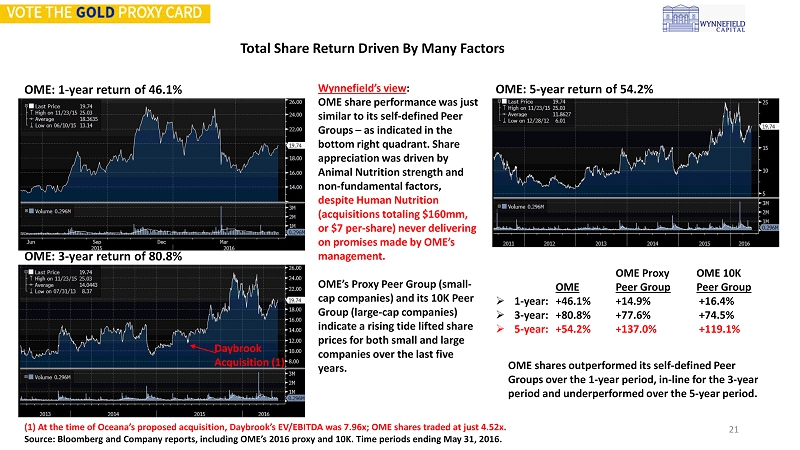

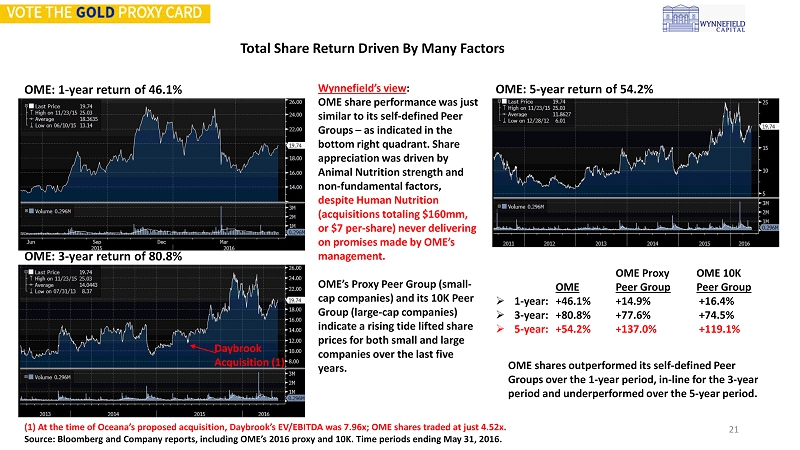

21 Total Share Return Driven By Many Factors OME: 1 - year return of 46.1% OME: 3 - year return of 80.8% OME: 5 - year return of 54.2% OME Proxy OME 10K OME Peer Group Peer Group » 1 - year: +46.1% +14.9% +16.4% » 3 - year: +80.8% +77.6% +74.5% » 5 - year: +54.2% +137.0% +119.1% (1) At the time of Oceana’s proposed acquisition, Daybrook’s EV/EBITDA was 7.96x; OME shares traded at just 4.52x. Source: Bloomberg and Company reports, including OME’s 2016 proxy and 10K. Time periods ending May 31, 2016. Wynnefield’s view : OME share performance was just similar to its self - defined Peer Groups – as indicated in the bottom right quadrant. Share appreciation was driven by Animal Nutrition strength and non - fundamental factors, despite Human Nutrition (acquisitions totaling $160mm, or $7 per - share) never delivering on promises made by OME’s management. OME’s Proxy Peer Group (small - cap companies) and its 10K Peer Group (large - cap companies) indicate a rising tide lifted share prices for both small and large companies over the last five years. OME shares outperformed its self - defined Peer Groups over the 1 - year period, in - line for the 3 - year period and underperformed over the 5 - year period. Daybrook Acquisition (1)

22 Total Share Return Details Share appreciation driven by Animal Nutrition results and Non - Fundamental factors; Human Nutrition is a financial drag » May 19, 2015: Oceana Group Limited announces proposed acquisition of Daybrook Fisheries for $382 million . » Fact : Oceana disclosed Daybrook’s revenue of $114 million and EBITDA of $48 million in 2014. » Fact : In 2014, Omega Protein reported revenue of $308.6 million and adjusted EBITDA of $61.6 million. » Valuation : At the time of Oceana’s announcement, Daybrook’s EV/EBITDA multiple was 7.96x ; OME shares traded at an EV/adjusted EBITDA multiple of 4.52x . » Action : Share performance after: 1 - day return +12.3% , 1 - month return +18.6% . » August 5, 2015: Omega Protein releases Second Quarter financial results . » Fact : Reported 2Q15 revenue of $93.2mm and adjusted EBITDA of $21.6mm. The Animal Nutrition segment generated revenue of $56.9mm and operating income of $19.7mm. The Human Nutrition segment reported revenue of $36.3mm and an operating loss of ($0.1mm) . » Action : Share performance after: 1 - day +4.3% , 1 - month return +11.2% . » August 11, 2015: Wynnefield files its initial Schedule 13D . » View : Alleges misallocation of shareholder equity, highlights classified board, suggests hiring financial advisors to explore all strategic alternatives. » Action : Share performance after: 1 - day return +3.4% , 1 - month return (2.1%) . » September 25, 2015: Omega Protein announces strategic alternatives review . » Fact : Hires J.P. Morgan to conduct a strategic alternatives review process. This was a reactive step by Omega Protein’s board, after Wynnefield’s repetitive concerns – following many conversations and its Schedule 13D. » Action : Share performance after: 1 - day return (1.5%) , 1 - month return +8.6% . Source: Company reports.

23 Total Share Return Details Share appreciation driven by Animal Nutrition results and Non - Fundamental factors; Human Nutrition represents a drag » November 4, 2015: Omega Protein releases Third Quarter financial results . » Fact : Reported 3Q15 revenue of $112.2mm and adjusted EBITDA of $28.7mm . The Animal Nutrition segment generated revenue of $73.2mm and operating income of $27.3mm. The Human Nutrition segment reported revenue of $39.0mm and an operating loss of ($3.6mm) . » View : Animal Nutrition delivered a record quarter , while Human Nutrition continued to underperform with a significant operating loss . Investors remained focused on Animal Nutrition profitability, shareholder activism and the company’s strategic alternatives r evi ew potential. » Action : Share performance after: 1 - day return +11.4% , 1 - month return +35.4% . » March 9, 2016: Omega Protein releases Fourth Quarter financial results . » Fact : Reported 4Q15 revenue of $82.3mm and adjusted EBITDA of $18.9mm . The Animal Nutrition segment generated revenue of $53.3mm and operating income of $19.6mm. The Human Nutrition segments reported revenue of $29.0mm and operating losses ($7.5mm) . » View : Animal Nutrition continued to perform well, BUT investors became highly concerned over Human Nutrition’s operating losses and significant write - offs . No news on the strategic review was unsettling too. » Action : Share performance after: 1 - day return (22.1%) , 1 - month return (25.5%) . » May 4, 2016: Omega Protein releases First Quarter financial results . » Fact : Reported 1Q16 revenue of $84.8mm and adjusted EBITDA of $20.4mm . The Animal Nutrition segment generated revenue of $50.2mm and operating income of $20.0mm. The Human Nutrition segment reported revenue of $34.6mm and an operating loss of ($0.4mm) . Completes strategic review and announces $40 million non - binding and discretionary share repurchase program. » View : Wynnefield believes an eight - month long strategic review that yields just a board authorization for a non - binding and discretion ary share buyback (OME’s is non - binding over 36 months) is insufficient . Few strategic review details are available to shareholders to date. » Action : Share performance after: 1 - day return +1.2% , 1 - month return +6.3% . Source: Company reports (Omega Protein and Oceana Group) and SEC filings.

24 Capital Misallocation Due to Non - Core Human Nutrition Acquisitions

25 Capital Misallocation Into Non - Core Human Nutrition Segment Abject Failure over Four Years Omega Protein’s total capital allocation into Human Nutrition Human Nutrition acquisitions (2) Acquisition Date Price Description Cyvex (3) December 2010 $13.2mm Ingredient supplier to nutraceutical industry. Incon (1), (3) September 2011 $8.7mm Specialty processor that utilizes molecular distillation technology. Incon discontinued operations March 2016 Exited concentrated Omega - 3 oils operation. Wisconsin Specialty Protein (WSP) (1) February 2013 $26.5mm Manufacturer of specialty dairy proteins and related products. Incremental investment August 2013 $5.0mm Dairy protein expansion. 2Q15 conference call August 2015 Bret Scholtes announces excess dairy protein supply. Bioriginal (1) September 2014 $70.5mm Supplier of plant and marine - based specialty oils and fatty acids. Incremental investment August 2013 $20.0mm Dairy protein expansion. 2Q15 conference call August 2015 Bret Scholtes announces excess dairy protein supply. Operating loss 2012 - 2015 – aggregate $23.6mm Total $168 million (or approximately $7 per - share) Source: Company reports. Notes: (1) Total cash price excludes excess working capital of $0.6mm for Incon, $0.6mm for WSP and $0.7mm for Bioriginal. (2) Write - offs total $4.9mm in 2014 and $10.0mm in 2015, including impairment of intangibles, other g/l and g/l on disposal of a ssets. (3) Cyvex and Incon suffered impairment charges of $4.7mm and $4.5mm in 2014 and 2015, respectively.

26 Capital Misallocation into Non - Core Human Nutrition Segment Abject Failure over Four Years The Board and Management never delivered on Human Nutrition promises: » To reduce Animal Nutrition’s volatility through diversification. » To create an accretive operation through its Human Nutrition acquisition strategy. Instead: » Human Nutrition has consistently generated gross profit margins significantly below Animal Nutrition. » As the Human Nutrition segment became a larger operation, operating losses mounted and write - offs followed – especially over the last 24 months. » Human Nutrition generated operating income of $1.1mm in 2012, ($1.6mm) in 2013, ($11.1mm) in 2014 and ($12.0mm) in 2015 – or an aggregate operating loss of $23.6mm over the four - year period of 2012 to 2015 . » In March 2016, management announced closure of its Incon concentrated Omega - 3 oil operation – the only piece that directly linked the Human Nutrition strategy to its core Animal Nutrition segment .

27 Capital Misallocation into Non - Core Human Nutrition Segment Abject Failure over Four Years Bret Scholtes and Pivotal’s sell - side analyst – AGREE … » That Omega Protein’s Human Nutrition segment is worth $60 million less than its original capital allocation of approximately $ 160 million – nearly 40% less! » Bret Scholtes is emboldened by an entrenched board and Wynnefield believes treats the value loss casually. » The Pivotal analyst has no ownership accountability and describes the massive value loss as “ spilt milk.” Scholtes - Pivotal exchange on Omega Protein’s 1Q16 earnings conference call, May 5, 2016 : » < Q - Timothy S. Ramey - Pivotal> : “So , other than the sort of crying over spilt milk, we paid $160 million for these assets , maybe they're only worth $100 million if we try to monetize them today. I mean, we're just kind of done here, aren't we ? It's sort of – it seems to me your analysis is correct . And if you're right and I have no reason to believe you're not, if Bioriginal is the majority of that business, we did in two minutes what your committee did in nine months. Let's buy back some stock and move on .” » <A - Bret D. Scholtes – Omega Protein> : “ I agree with you . ” Two considerations : » Wynnefield believes the destruction of $60 million of value (nearly 14% of OME’s market capitalization) is a serious matter NOT simply “ crying over spilt milk ” and Wynnefield is concerned the remaining $100 million (another nearly 23% of OME’s market capitalization) balance remains at risk (1). » If a comprehensive strategic review was conducted by Omega Protein’s Board and financial advisor, what dollar value was ascri bed to the Human Nutrition segment – how many bids were received and at what valuations? Were any constraints placed on the Strategic Revie w by Omega Protein? Many questions remain unanswered. (1) Omega Protein’s market capitalization is approximately $438 million (share price: $19.74; total shares: 22.2mm) as of May 31, 2016 . Note: Pivotal Research Group’s analyst rates OME shares with a Buy and a price target of $25 per its published report dated M ay 5, 2016.

28 Capital Misallocation into Non - Core Human Nutrition Segment Consistent Abject Failure Over Four Years Disappointing conclusion to Omega Protein’s strategic alternatives review » The Company never established a customary special Strategic Review Committee of independent members of the Board. » Strategic review completed more than eight months after it was commenced. » This process yielded one disappointing announcement – a non - binding, discretionary stock repurchase program over 36 months. » Shareholders have been told few details of the strategic review and still have few answers for the Company’s Human Nutrition cap ital allocation of approximately $168 million, including operating losses of $23.6 million over the four years ending December 31, 2015. Conclusion » As a result, Wynnefield questions whether all reasonable alternative business strategies were pursued. » Why should the Board and management spend more capital and/or their time on Human Nutrition – a losing strategy – over the last 4 years? » Wynnefield believes Human Nutrition has generated substantial destruction of shareholder capital over the past four years – as Pivotal and Mr. Scholtes agree (slide 27 ) – along with many shareholders.

29 Poor Corporate Governance Reflects Entrenched Board of Directors

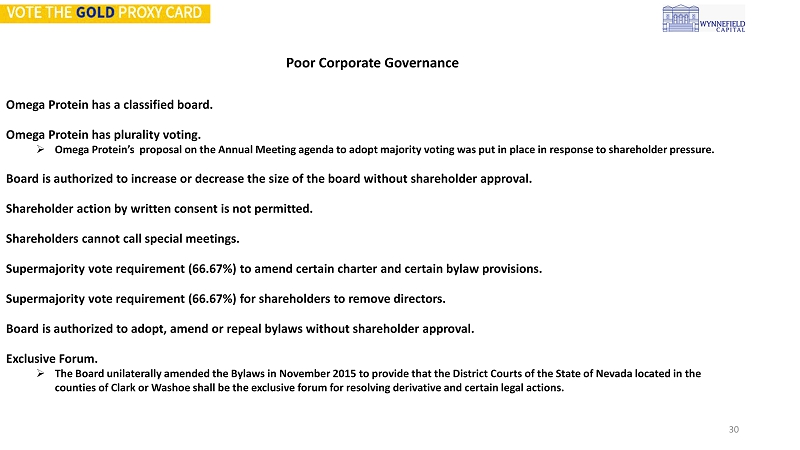

30 Poor Corporate Governance Omega Protein has a classified board. Omega Protein has plurality voting. » Omega Protein’s proposal on the Annual Meeting agenda to adopt majority voting was put in place in response to shareholder pressure. Board is authorized to increase or decrease the size of the board without shareholder approval. Shareholder action by written consent is not permitted. Shareholders cannot call special meetings. Supermajority vote requirement (66.67%) to amend certain charter and certain bylaw provisions. Supermajority vote requirement (66.67%) for shareholders to remove directors. Board is authorized to adopt, amend or repeal bylaws without shareholder approval. Exclusive Forum. » The Board unilaterally amended the Bylaws in November 2015 to provide that the District Courts of the State of Nevada located in the counties of Clark or Washoe shall be the exclusive forum for resolving derivative and certain legal actions.

31 Hostile Actions Impacting Shareholders Shareholder Unfriendly Bylaw Provisions Recently Adopted by the Board – Without Shareholder Approval. » In 2015, Omega Protein’s Board twice unilaterally adopted, without shareholder approval, amendments to its Amended and Restated Bylaws: » Pushing back the deadline by which shareholders must nominate directors or submit proposal to a date 30 days earlier than stated in Omega Protein’s 2015 proxy statement. » Increasing the timing burdens and disclosure requirements on shareholders seeking to submit nominations and proposals by imposing detailed and cumbersome requirements that Wynnefield believes are not required by the Securities and Exchange Commission’s pr oxy rules. Wynnefield believes that these amendments to Omega Protein’s Bylaws were adopted by the Board with the express intention of restricting the right and ability of Wynnefield and Omega Protein’s other shareholders , to nominate directors and/or submit shareholder proposals for consideration at Omega Protein’s annual meeting of shareholders. The Board has Significantly Reduced the Time for Shareholders to Vote at the 2016 Annual Meeting – An Obvious Tactic to Frustrat e the Shareholder Voting Franchise. » In an apparent attempt to limit the shareholder franchise to vote, the Board unilaterally reduced the amount of time shareholders have to vote at the 2016 Annual Meeting. » The Board set June 7, 2016 as the voting record date and June 28 as the Annual Meeting date – this tactic gives shareholders only 21 days to vote from the voting record date to the Annual Meeting. » In the past five years, the average amount of time between the voting record date and the annual meeting has been 57 days: 2011 – 56 days 2012 – 58 days 2013 – 57 days 2014 – 56 days 2015 – 58 days 2016 – 21 days

32 Omega Protein Board Has a History of Terrible Corporate Governance & Unresponsiveness to it Shareholders » For the last several years, 4 Omega Directors (at least half of the Omega Board) have served on the Board, despite having pre vio usly received a majority of withhold votes cast against their election . » Director Allee , Owen, Goodwin and Kearns have all received majority withhold votes in the past for: » adopting a poison pill in 2010 without shareholder approval (all of them ). » failure to respond to majority withhold votes cast against its directors for three consecutive years (2011 - 2013 ). » affiliated outsider on a key committee (Director Kearns, who sat on two key committees for 8 years, despite shareholder concerns annually over his independence ). » In 2013/2014, four of the six Omega directors were directors who previously received a majority of withhold votes (“Zombie Di rec tors”). » For the last three years, two of three key committees of the board, the compensation & nominating / governance committees hav e b een chaired by a “Zombie” Director. » For the last three years, the entire nominating & governance committee has been comprised of “Zombie” Directors. » The Chairman of the OME Board, Goodwin, is a “Zombie” Director. » Wynnefield has no confidence that the Board, as presently constituted, will act in the best interests of shareholders. » After numerous years of inaction, if the Board were serious about a commitment to good corporate governance, it would have ta ken proactive measures to improve the Company’s corporate governance and increase the Board’s accountability to shareholders. » The Omega Board only takes action in the face of stockholder pressure and recent improvements to its corporate governance hav e b een reactive to Wynnefield’s campaign.

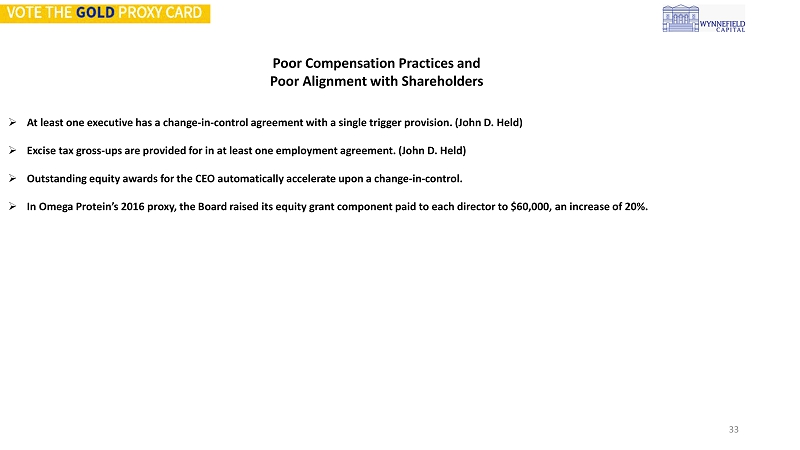

33 Poor Compensation Practices and Poor Alignment with Shareholders » At least one executive has a change - in - control agreement with a single trigger provision. (John D. Held) » Excise tax gross - ups are provided for in at least one employment agreement. (John D. Held) » Outstanding equity awards for the CEO automatically accelerate upon a change - in - control . » In Omega Protein’s 2016 proxy, the Board raised its equity grant component paid to each director to $60,000, an increase of 2 0%.

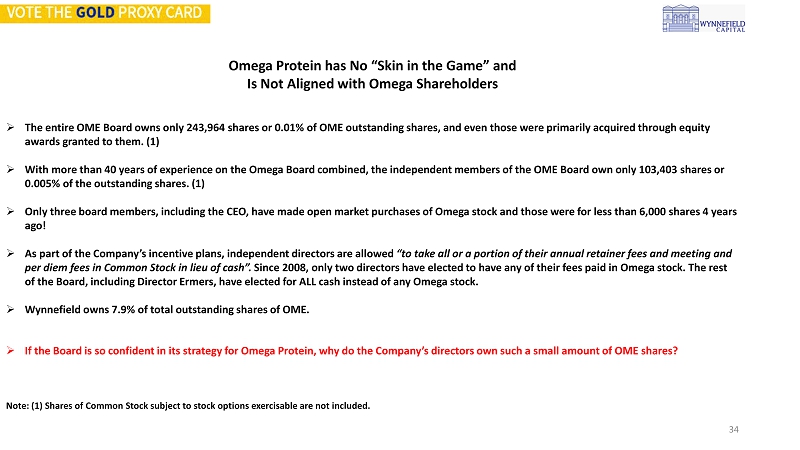

34 Omega Protein has No “Skin in the Game” and Is Not Aligned with Omega Shareholders » The entire OME Board owns only 243,964 shares or 0.01% of OME outstanding shares, and even those were primarily acquired thro ugh equity awards granted to them. (1) » With more than 40 years of experience on the Omega Board combined, the independent members of the OME Board own only 103,403 sha res or 0.005% of the outstanding shares. ( 1 ) » Only three board members, including the CEO, have made open market purchases of Omega stock and those were for less than 6,00 0 s hares 4 years ago! » As part of the Company’s incentive plans, independent directors are allowed “to take all or a portion of their annual retainer fees and meeting and per diem fees in Common Stock in lieu of cash”. Since 2008, only two directors have elected to have any of their fees paid in Omega stock. The rest of the Board, including Director Ermers, have elected for ALL cash instead of any Omega stock. » Wynnefield owns 7.9% of total outstanding shares of OME. » If the Board is so confident in its strategy for Omega Protein, why do the Company’s directors own such a small amount of OME sh ares? Note: (1) Shares of Common Stock subject to stock options exercisable are not included.

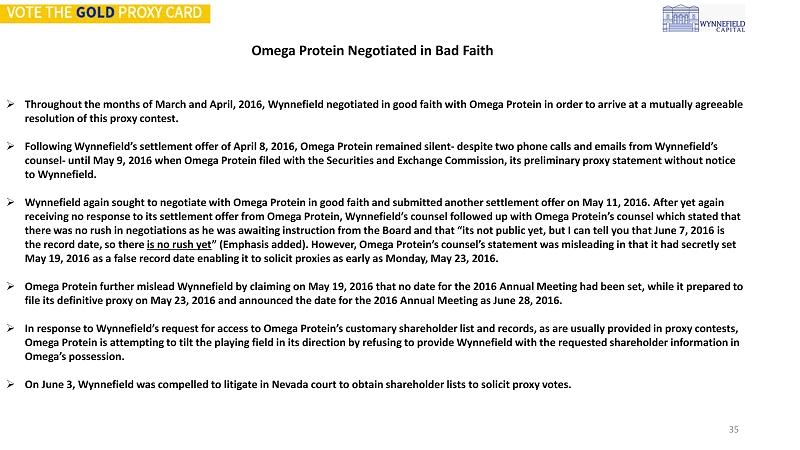

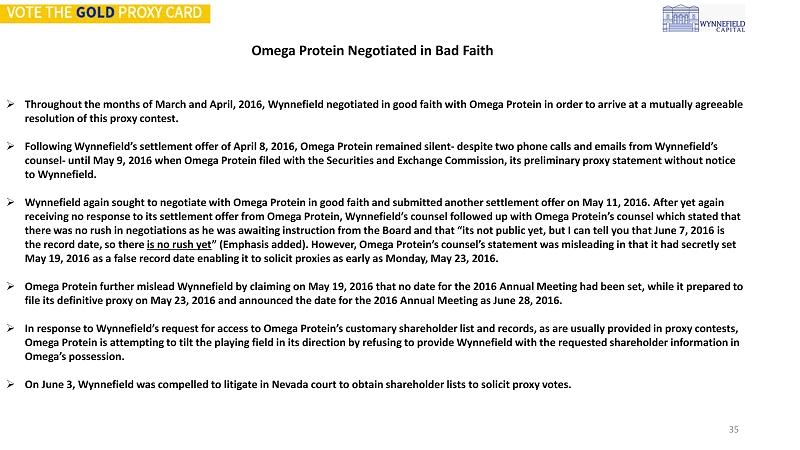

35 Omega Protein Negotiated in Bad Faith » Throughout the months of March and April, 2016, Wynnefield negotiated in good faith with Omega Protein in order to arrive at a mutually agreeable resolution of this proxy contest. » Following Wynnefield’s settlement offer of April 8, 2016, Omega Protein remained silent - despite two phone calls and emails from Wynnefield’s counsel - until May 9, 2016 when Omega Protein filed with the Securities and Exchange Commission, its preliminary proxy statement without notice to Wynnefield. » Wynnefield again sought to negotiate with Omega Protein in good faith and submitted another settlement offer on May 11, 2016. Af ter yet again receiving no response to its settlement offer from Omega Protein, Wynnefield’s counsel followed up with Omega Protein’s counsel which stated that there was no rush in negotiations as he was awaiting instruction from the Board and that “its not public yet, but I can tell you that June 7, 2016 is the record date, so there is no rush yet ” (Emphasis added). However, Omega Protein’s counsel’s statement was misleading in that it had secretly set May 19, 2016 as a false record date enabling it to solicit proxies as early as Monday, May 23, 2016. » Omega Protein further mislead Wynnefield by claiming on May 19, 2016 that no date for the 2016 Annual Meeting had been set, w hil e it prepared to file its definitive proxy on May 23, 2016 and announced the date for the 2016 Annual Meeting as June 28, 2016. » In response to Wynnefield’s request for access to Omega Protein’s customary shareholder list and records, as are usually provided in proxy contests, Omega Protein is attempting to tilt the playing field in its direction by refusing to provide Wynnefield with the requested s har eholder information in Omega’s possession . » On June 3, Wynnefield was compelled to litigate in Nevada court to obtain shareholder lists to solicit proxy votes.

36 Omega Protein’s Proposal No. 4 Too Little, Too Late » Omega’s Proposal No. 4 - implementing majority voting for director elections - is a sham to try to make Omega’s Bylaws appear to be shareholder friendly and try to score some governance points with proxy advisory firms. » However, the truth is that Omega’s Board was forced to include this proposal in order to co - opt a proposal submitted by an unaffiliated shareholder pursuant to Rule 14a - 8 of the proxy rules. Wynnefield strongly supports this proposal. » This proposal is a tactical response to Wynnefield’s announcement of its intention to submit its own slate of director candidates at the 2016 An nua l Meeting. Omega clearly does not want to defend against a shareholder proposal that ISS has supported and a proxy contest simu lta neously. » This proposal is merely a band - aid on Omega’s broken corporate governance. If Omega’s Board was serious about improving its dism al corporate governance policies, it would immediately propose to declassify its board of directors and submit its entire restated Bylaws for shareholder approval.

37 Conclusion

38 Wynnefield Asks For Your Support VOTE FOR Independent Board Nominee Michael N. Christodolou » FOR electing directors with superior experience and expertise » FOR improving capital allocation policy » FOR addressing corporate governance

39 Unfriendly Bylaws Appendix I » Recent Amendments – Slides 40 - 42 . » Original Bylaws – Slide 43 .

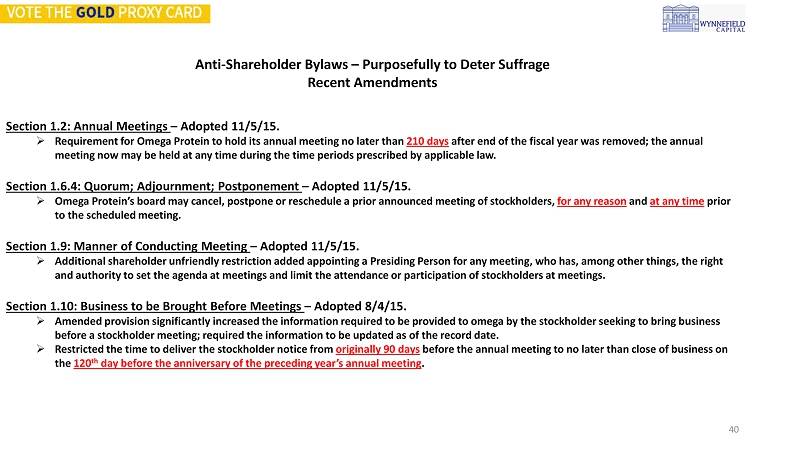

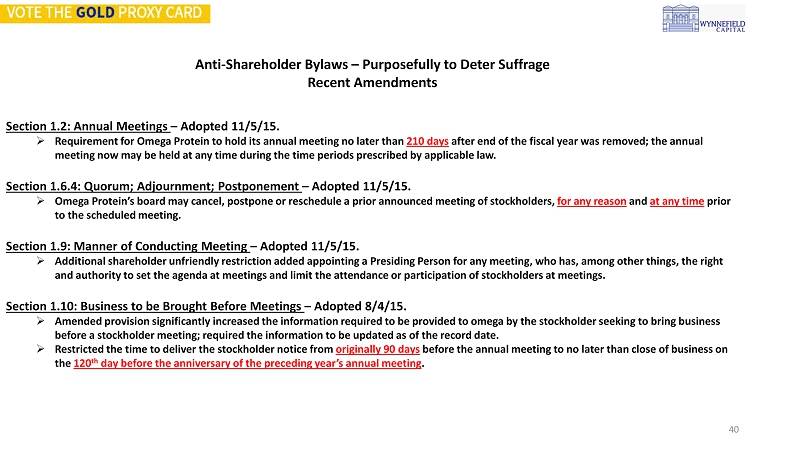

40 Anti - Shareholder Bylaws – Purposefully to Deter Suffrage Recent Amendments Section 1.2: Annual Meetings – Adopted 11/5/15. » Requirement for Omega Protein to hold its annual meeting no later than 210 days after end of the fiscal year was removed; the annual meeting now may be held at any time during the time periods prescribed by applicable law. Section 1.6.4: Quorum; Adjournment; Postponement – Adopted 11/5/15. » Omega Protein’s board may cancel, postpone or reschedule a prior announced meeting of stockholders, for any reason and at any time prior to the scheduled meeting. Section 1.9: Manner of Conducting Meeting – Adopted 11/5/15. » Additional shareholder unfriendly restriction added appointing a Presiding Person for any meeting, who has, among other thing s, the right and authority to set the agenda at meetings and limit the attendance or participation of stockholders at meetings. Section 1.10: Business to be Brought Before Meetings – Adopted 8/4/15. » Amended provision significantly increased the information required to be provided to omega by the stockholder seeking to brin g b usiness before a stockholder meeting; required the information to be updated as of the record date. » Restricted the time to deliver the stockholder notice from originally 90 days before the annual meeting to no later than close of business on the 120 th day before the anniversary of the preceding year’s annual meeting .

41 Anti - Shareholder Bylaws – Purposefully to Deter Suffrage Recent Amendments Section 1.10: Further Amendment – Adopted 11/5/15. » Provision requires stockholders to provide further burdensome information with respect to bringing before a stockholder meeti ng; added the additional requirement that the information be updated as of the 10 th business day before the date of the annual meeting as well as the record date. Section 1.11: Notice of Nomination – Adopted 8/4/15. » Significantly increased the information provided about nominees for election as directors to Omega Protein’s board; required the information to be updated as of the record date. » Restricted the time to deliver the stockholder notice from originally the 60 th day before the anniversary of the preceding year’s annual meeting to no later than close of the business on the 120 th day before the anniversary of the preceding year’s annual meeting . Section 1.11: Further Amendment – Adopted 11/5/15. » Added provision 1.11.2 requires director nominees to submit a biographical questionnaire and sign a representation agreement whi ch requires the director nominees to certify that they ( i ) are not and will not become a party to a voting agreement; (ii) are not and will not become a party to a compensation agreement or arrangement with another entity other than Omega Protein without disclosing the arrangement to omega; and (iii) will comply with all applicable laws and all publically disclosed corporate governance regula tio ns. » Added the additional requirement that the director nominee and stockholder information be updated as of the 10 th business day before the date of the annual meeting as well as the record date.

42 Anti - Shareholder Bylaws – Purposefully to Deter Suffrage Recent Amendments Article XI: Forum For Adjudication of Disputes – Adopted 11/5/15. » Shareholder unfriendly provision requiring that the District Courts of the State of Nevada located in Clark or Washoe countie s b e the sole and exclusive forums for: » Any derivative action. » Any action asserting breach of fiduciary duty by a director or officer. » Any action asserting a claim arising under the Bylaws, the Articles of Incorporation or the Nevada Revised Statues. » Any action asserting a claim governed by the internal affairs doctrine.

43 Anti - Shareholder Bylaws Original Bylaws Section 2.3: Classes of Directors and term of Office – Original Bylaws. » Section provides for a classified Board of Directors with three classes of directors. Section 2.4.1: Election of Directors – Original Bylaws. » Provision provides for plurality voting for the election of directors at a shareholder meeting. NOTE: this section is propose d to be amended to allow for majority voting in non - contested director elections as set forth in Omega’s proxy statement. Section 2.5: Removal of Directors – Original Bylaws. » Provision requires a supermajority (66 2/3%) vote of stockholders to remove a director, other than directors elected by holders of preferred stock. Section 8.1: Supermajority Required for Certain Amendments – Original Bylaws. » Provision requires Supermajority (66 2/3%) vote of shareholders or majority vote of directors to amend or repeal Sections 1.3, 1.5, 1.7, 1.10, 1.11, 2.2, 2.5 and 2.10 of the Bylaws.

44 » Dialogue Summary » See Slides 45 - 47 Engagement Timeline Between Wynnefield and Omega Protein Appendix II

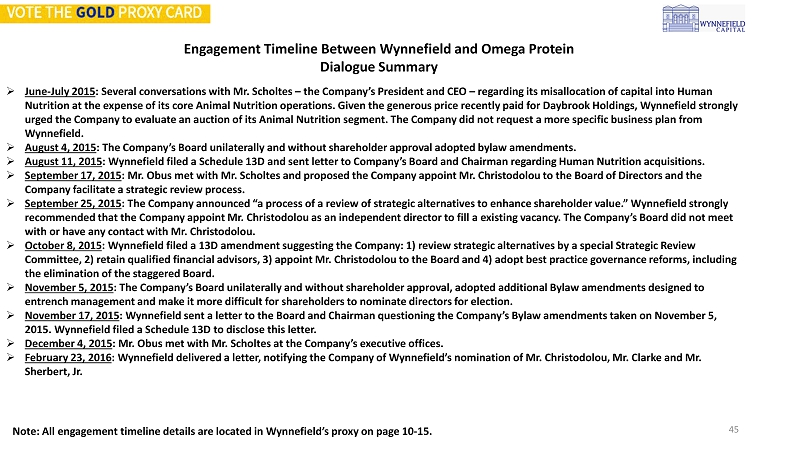

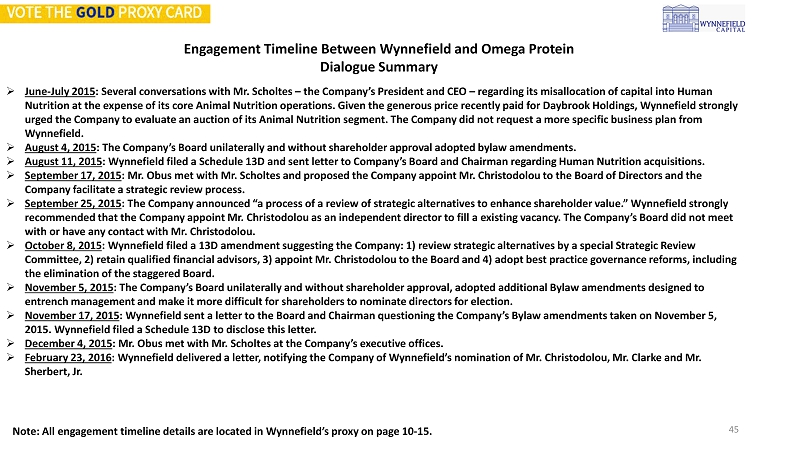

45 Engagement Timeline Between Wynnefield and Omega Protein Dialogue Summary » June - July 2015 : Several conversations with Mr. Scholtes – the Company’s President and CEO – regarding its misallocation of capital into Human Nutrition at the expense of its core Animal Nutrition operations. Given the generous price recently paid for Daybrook Holding s, Wynnefield strongly urged the Company to evaluate an auction of its Animal Nutrition segment. The Company did not request a more specific busines s p lan from Wynnefield. » August 4, 2015 : The Company’s Board unilaterally and without shareholder approval adopted bylaw amendments. » August 11, 2015 : Wynnefield filed a Schedule 13D and sent letter to Company’s Board and Chairman regarding Human Nutrition acquisitions. » September 17, 2015 : Mr. Obus met with Mr. Scholtes and proposed the Company appoint Mr. Christodolou to the Board of Directors and the Company facilitate a strategic review process. » September 25, 2015 : The Company announced “a process of a review of strategic alternatives to enhance shareholder value.” Wynnefield strongly recommended that the Company appoint Mr. Christodolou as an independent director to fill a existing vacancy. The Company’s Bo ard did not meet with or have any contact with Mr. Christodolou. » October 8, 2015 : Wynnefield filed a 13D amendment suggesting the Company: 1) review strategic alternatives by a special Strategic Review Committee, 2) retain qualified financial advisors, 3) appoint Mr. Christodolou to the Board and 4) adopt best practice govern anc e reforms, including the elimination of the staggered Board. » November 5, 2015 : The Company’s Board unilaterally and without shareholder approval, adopted additional Bylaw amendments designed to entrench management and make it more difficult for shareholders to nominate directors for election. » November 17, 2015 : Wynnefield sent a letter to the Board and Chairman questioning the Company’s Bylaw amendments taken on November 5, 2015. Wynnefield filed a Schedule 13D to disclose this letter. » December 4, 2015 : Mr. Obus met with Mr. Scholtes at the Company’s executive offices. » February 23, 2016 : Wynnefield delivered a letter, notifying the Company of Wynnefield’s nomination of Mr. Christodolou, Mr. Clarke and Mr. Sherbert, Jr. Note: All engagement timeline details are located in Wynnefield’s proxy on page 10 - 15.

46 » March 1, 2016 : Wynnefield’s counsel responded to the Company’s counsel request seeking further information with respect to Wynnefield’s nominees as of February 23, 2016. Wynnefield filed an amendment to its Schedule 13D. » March 9, 2016 : The Company filed its Annual Report on Form 10 - K – which confirmed Wynnefield’s ongoing concerns regarding the Company’s allocation of capital. » March 10, 2016 : Wynnefield’s counsel responded to the Company’s counsel request seeking further supplemental information with respect to Wynnefield’s nominees as of February 23, 2016. » March 11, 2016 : Wynnefield issued and filed with the SEC, a press release highlighting its concerns regarding Omega Protein’s fourth quart er and full - year financial results for the year ended December 31, 2015. The company sent a letter to Wynnefield acknowledging that the director nomination notice dated February 23, 2016 satisfied the requirements of the Company’s bylaw. » March 19, 2016 : Messrs. Christodolou, Clarke and Sherbert met in Houston, Texas with members of the Board’s Corporate Governance and Nominating Committee. » March 28, 2016 : The Company’s counsel sent Wynnefield a proposal to settle the election contest. The “standstill” agreement would have requir ed Wynnefield to vote in favor of any strategic initiative proposed by the Board, although the Company had not yet announced the re sults of its “strategic review.” » March 30, 2016 : Wynnefield filed an amendment to its Schedule 13D disclosing an increase in it beneficial ownership of the Company’s Common Stock. » March 31, 2016 : Wynnefield counsel informed the Company’s counsel of Wynnefield’s belief that the Company’s proposed settlement offer was unacceptable. » April 8, 2016 : Wynnefield submitted to the Company a proposed settlement offer. Furthermore, Wynnefield counsel informed the Company’s counsel by email that “Although our proposal speaks for itself, we are certainly open to reasonable discussion.” Company’s co uns el rejected Wynnefield’s settlement offer and did not respond until May 9, 2016. Engagement Timeline Between Wynnefield and Omega Protein Dialogue Summary Note: All engagement timeline details are located in Wynnefield’s proxy on page 10 - 15.

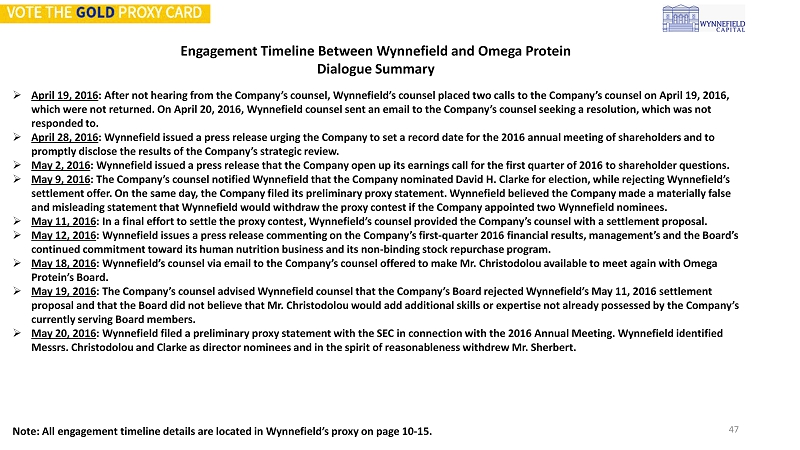

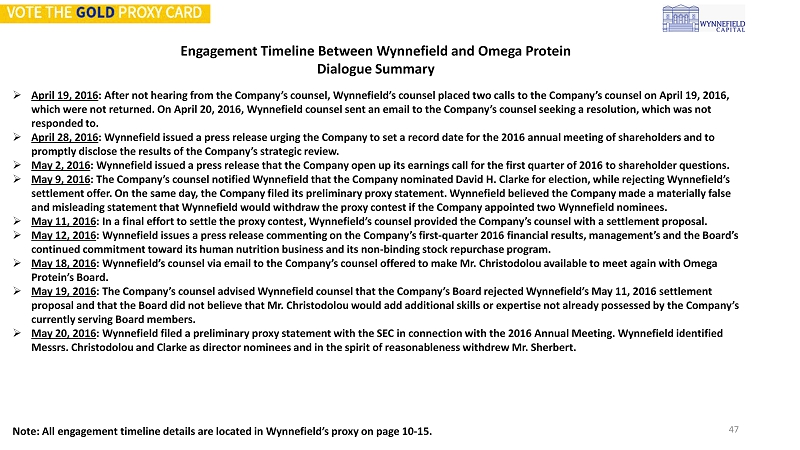

47 Engagement Timeline Between Wynnefield and Omega Protein Dialogue Summary Note: All engagement timeline details are located in Wynnefield’s proxy on page 10 - 15. » April 19, 2016 : After not hearing from the Company’s counsel, Wynnefield’s counsel placed two calls to the Company’s counsel on April 19, 201 6, which were not returned. On April 20, 2016, Wynnefield counsel sent an email to the Company’s counsel seeking a resolution, w hic h was not responded to. » April 28, 2016 : Wynnefield issued a press release urging the Company to set a record date for the 2016 annual meeting of shareholders and to promptly disclose the results of the Company’s strategic review. » May 2, 2016 : Wynnefield issued a press release that the Company open up its earnings call for the first quarter of 2016 to shareholder que st ions. » May 9, 2016 : The Company’s counsel notified Wynnefield that the Company nominated David H. Clarke for election, while rejecting Wynnefield ’s settlement offer. On the same day, the Company filed its preliminary proxy statement. Wynnefield believed the Company made a mat erially false and misleading statement that Wynnefield would withdraw the proxy contest if the Company appointed two Wynnefield nominees. » May 11, 2016 : In a final effort to settle the proxy contest, Wynnefield’s counsel provided the Company’s counsel with a settlement proposal . » May 12, 2016 : Wynnefield issues a press release commenting on the Company’s first - quarter 2016 financial results, management’s and the Board’ s continued commitment toward its human nutrition business and its non - binding stock repurchase program. » May 18, 2016 : Wynnefield’s counsel via email to the Company’s counsel offered to make Mr. Christodolou available to meet again with Omega Protein’s Board. » May 19, 2016 : The Company’s counsel advised Wynnefield counsel that the Company’s Board rejected Wynnefield’s May 11, 2016 settlement proposal and that the Board did not believe that Mr. Christodolou would add additional skills or expertise not already posses sed by the Company’s currently serving Board members. » May 20, 2016 : Wynnefield filed a preliminary proxy statement with the SEC in connection with the 2016 Annual Meeting. Wynnefield identified Messrs. Christodolou and Clarke as director nominees and in the spirit of reasonableness withdrew Mr. Sherbert.

Omega Protein: A Case of Poor Board Quality, Capital Misallocation and Anti - Shareholder Corporate Governance © 2016 Wynnefield Capital, Inc. All rights reserved.