SEPTEMBER 30, 2007

RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

DOMESTIC EQUITY FUNDS

MULTI-CAP CORE EQUITY FUND

SECTOR ROTATION FUND

ALTERNATIVE INVESTMENT FUNDS

ABSOLUTE RETURN STRATEGIES FUND

COMMODITIES STRATEGY FUND

(Formerly, Commodities Fund)

HEDGED EQUITY FUND

INTERNATIONAL ROTATION FUND

(Formerly, Managed Futures Fund)

MANAGED FUTURES STRATEGY FUND

REAL ESTATE FUND

(Formerly, Dynamic Strengthening Dollar Fund)

STRENGTHENING DOLLAR 2x STRATEGY FUND

(Formerly, Dynamic Weakening Dollar Fund)

WEAKENING DOLLAR 2x STRATEGY FUND

This report and the financial statements contained herein are submitted for the general information of our shareholders. The

report is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

Distributed by Rydex Distributors, Inc.

TABLE OF CONTENTS

LETTER TO OUR SHAREHOLDERS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

A BRIEF NOTE ON THE COMPOUNDING OF RETURNS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

ABOUT SHAREHOLDERS’ FUND EXPENSES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

FUND PROFILES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

SCHEDULES OF INVESTMENTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

STATEMENTS OF ASSETS AND LIABILITIES

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

46

STATEMENTS OF OPERATIONS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

48

STATEMENTS OF CHANGES IN NET ASSETS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

50

FINANCIAL HIGHLIGHTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

54

NOTES TO FINANCIAL STATEMENTS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

58

OTHER INFORMATION

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

70

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

74

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

1

LETTER TO OUR SHAREHOLDERS

DEAR SHAREHOLDER:

The second and third quarters of 2007 represented one of the most challenging environments for investors

in recent memory. The major market averages started off the period by setting new highs only to

dramatically change course in a four-week period from mid-July to mid-August by staging a gut-wrenching

decline. From there, equity markets embarked on a spectacular rally, retracing almost all of their earlier

losses by the end of September. During this period, global credit markets seized up, and interest rates on

super-safe U.S. Treasury securities fell while interest rates on everything else rose. Investors were right to

ask what was happening.

What was happening was that the democratization of credit and its dispersion throughout the global

financial system was showing its nastier side. Reckless home lending practices here in the U.S. found

their way into financial markets across the globe through an array of highly engineered securities with

acronyms such as CDOs, CLOs and CMOs. Regardless of the moniker, the common thread was that by

over-collateralizing low-quality debt, as if by alchemy, vast pools of low-quality mortgages could be

transformed from junk status into AAA fixed-income securities.

Hedge funds purchased vast quantities of these structured products and leveraged this seemingly secure

income stream in order to maximize returns. The problem was that Wall Street did not fully take into

account how much the creditworthiness of home buyers had deteriorated in an era of loose underwriting

standards. As rising defaults began to eat into collateral, rating agencies rushed to downgrade large

swaths of the mortgage-backed bond market, sparking a stampede for the door.

Hedge funds were unable to meet redemption requests as investors backed away from credit exposure of

all kinds. A classic credit squeeze began to unfold as buyers disappeared and lenders, not knowing where

subprime risk resided, refused to lend.

With hedge funds failing and credit markets beginning to shut down, central banks stepped in to restore

order to the credit markets. Unfortunately, this backfired and the equity markets recoiled. Midcaps,

international stocks, energy, materials and consumer discretionary stocks all declined by double digit rates

as investors attempted to limit their exposure to the global financial system and to the U.S. consumer who

looked to be going into shock.

In this environment, short-term rates came screaming down and credit spreads exploded wider as

investors ran for the safety of short maturity government debt.

The events of August ushered in the most profound development of the period—a change in monetary

policy by the Federal Reserve (“Fed”). For the first time in four years, the Fed cut the benchmark Fed

Funds target rate. Given the events leading up to this, the Fed’s September move was not unanticipated.

What was a surprise, however, was the magnitude of the move. The central bank dropped the Fed Funds

rate by a half-point to 4.75%.

With that, the markets exploded in a massive rally that brought the averages almost back to where they

had started the quarter. Moreover, all the sectors that had been pummeled during the previous four

weeks led the way higher. Having suffered through the roughest market in years, investment managers

were determined not to miss the rebound.

One of the investment themes that strongly reasserted itself after the July-August sell-off was global

growth. With economic growth in the U.S. slowing, investors are favoring sectors—such as energy,

technology and basic materials—that derive much of their revenues and profits from overseas. For

investors who had the fortitude to maintain their exposure to Rydex sector funds representing those areas

over the last six months, they were handsomely rewarded with strong double digit-returns.

We also think it is very reasonable to assume that equity market volatility will be with us for some time.

Low volatility strategies as represented by the Rydex Absolute Return Strategies, Hedged Equity and

Managed Futures Strategy Funds should provide a nice offset to the more dynamic global growth theme.

We appreciate the trust you have placed in our firm’s quality and integrity by investing with us.

Sincerely,

Director of Portfolio Strategies

David Reilly, CFA

2

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

A BRIEF NOTE ON THE COMPOUNDING OF RETURNS (Unaudited)

Some of the Rydex Funds described in this report are benchmarked daily to leveraged versions of

published indices. To properly evaluate the performance of these funds, it is essential to understand the

effect of mathematical compounding on their respective returns.

Because of the nonlinear effects of leverage applied over time, it is possible for a fund to perform in line

with its benchmark for several individual periods in a row, yet seem to trail the benchmark over the entire

period. It is also possible that a fund that performs in-line with its benchmark on a daily basis may seem to

outperform its benchmark over longer periods.

An Example of Compounding

For example, consider a hypothetical fund that is designed to produce returns that correspond to 150%

of an index. On the first day of a period, the index rises from a level of 100 to a level of 106, producing a

6.0% gain and an expectation that the fund will rise by 9.0%. On the same day, the fund’s net asset value

(“NAV”) increases from $10.00 to $10.90 for a gain of 9.0%–in line with its benchmark.

On day two, assume the index falls from 106 to 99 for a loss of about 6.6%. The fund, as expected, falls

9.9% to a price of $9.82. On each day, the fund performed exactly in line with its benchmark, but for the

two-day period, the fund was down 1.8%, while the index was down only 1.0%. Without taking into

account the daily compounding of returns, one would expect the fund to lose 1.5% and would see the

fund as trailing by 0.3% when in fact it had performed perfectly. This example is summarized in the table

below.

Index

Index

Fund

Fund

Level

Performance

Expectation

Fund NAV

Performance

Assessment

Start

100

$10.00

Day 1

106

6.0%

9.0%

$10.90

9.0%

In line

Day 2

99

-6.6%

-9.9%

$ 9.82

-9.9%

In line

Cumulative

-1.0%

-1.5%

-1.8%

-0.3%

As illustrated by this simple example, the effect of leverage can make it difficult to form expectations or

judgments about fund performance given only the returns of the unleveraged index.

In general, any change in direction in an index will produce compounding that seems to work against an

investor. Were the index to move in the same direction (either up or down) for two or more periods in a

row, the compounding of those returns would work in an investor’s favor, causing the fund to seemingly

beat its benchmark.

As a general rule of thumb, more leverage in a fund will magnify the compounding effect, while less

leverage will generally produce results that are more in line with expectations. In addition, periods of high

volatility in an underlying index will also cause the effects of compounding to be more pronounced, while

lower volatility will produce a more muted effect.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

3

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)

All mutual funds have operating expenses and it is important for our shareholders to understand the

impact of costs on their investments. Shareholders of a Fund incur two types of costs: (i) transaction costs,

including sales charges (loads) on purchase payments, reinvested dividends, or other distributions;

redemption fees; and exchange fees; and (ii) ongoing costs, including management fees, administrative

services, and shareholder reports, among others. These ongoing costs, or operating expenses, are

deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense

ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of

investing in a Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the

entire six-month period beginning March 31, 2007 and ending September 30, 2007.

The following tables illustrate a Fund’s costs in two ways:

Table 1. Based on actual Fund return. This section helps investors estimate the actual expenses paid over

the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fourth

column shows the dollar amount that would have been paid by an investor who started with $1,000 in

the Fund. Investors may use the information here, together with the amount invested, to estimate the

expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an

$8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under

the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return. This section is intended to help investors compare a Fund’s

cost with those of other mutual funds. The table provides information about hypothetical account val-

ues and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return

of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values

and expenses may not be used to estimate the actual ending account balance or expenses paid during

the period. The example is useful in making comparisons because the U.S. Securities and Exchange

Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return.

Investors can assess a Fund’s costs by comparing this hypothetical example with the hypothetical

examples that appear in shareholder reports of other funds.

Certain retirement plans such as IRA, SEP, Roth IRA and 403(b) accounts are charged an annual $15

maintenance fee. Upon liquidating a retirement account, a $15 account-closing fee will be taken from

the proceeds of the redemption.

The calculations above assume no shares were bought or sold during the period. Actual costs may have

been higher or lower, depending on the amount of investment and the timing of any purchases or

redemptions.

Note that the expenses shown in the table are meant to highlight and help compare ongoing costs only

and do not reflect any transactional costs which may be incurred by a Fund.

More information about a Fund’s expenses, including annual expense ratios for the past five years, can be

found in the Financial Highlights section of this report. For additional information on operating expenses

and other shareholder costs, please refer to the appropriate Fund prospectus.

4

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (continued)

Beginning

Ending

Expenses

Expense

Account Value

Account Value

Paid During

Ratio†

March 31, 2007

September 30, 2007

Period*

Table 1. Based on actual Fund return

Multi-Cap Core Equity Fund

A-Class

1.26%

$1,000.00

$

999.41

$

6.32

C-Class

2.00%

1,000.00

995.73

10.01

H-Class

1.26%

1,000.00

999.41

6.32

Sector Rotation Fund

A-Class

1.66%

1,000.00

1,174.72

9.05

C-Class

2.41%

1,000.00

1,170.10

13.11

H-Class

1.66%

1,000.00

1,174.22

9.05

Absolute Return Strategies Fund

A-Class

1.80%

1,000.00

1,024.21

9.13

C-Class

2.55%

1,000.00

1,020.66

12.92

H-Class

1.80%

1,000.00

1,024.19

9.13

Commodities Strategy Fund

A-Class

1.52%

1,000.00

1,137.32

8.14

C-Class

2.27%

1,000.00

1,132.49

12.14

H-Class

1.51%

1,000.00

1,136.48

8.09

Hedged Equity Fund

A-Class

1.92%

1,000.00

1,019.40

9.72

C-Class

2.66%

1,000.00

1,015.78

13.44

H-Class

1.92%

1,000.00

1,019.39

9.72

International Rotation Fund**

A-Class

1.68%

1,000.00

1,062.40

1.28

C-Class

2.43%

1,000.00

1,062.40

1.85

H-Class

1.66%

1,000.00

1,062.80

1.27

Managed Futures Strategy Fund

A-Class

1.67%

1,000.00

1,006.39

8.40

C-Class

2.45%

1,000.00

1,002.40

12.30

H-Class

1.71%

1,000.00

1,006.39

8.60

Real Estate Fund

A-Class

1.62%

1,000.00

901.57

7.72

C-Class

2.37%

1,000.00

897.87

11.28

H-Class

1.62%

1,000.00

901.52

7.72

Strengthening Dollar 2x Strategy Fund

A-Class

1.67%

1,000.00

907.30

7.98

C-Class

2.41%

1,000.00

903.96

11.50

H-Class

1.66%

1,000.00

907.22

7.94

Weakening Dollar 2x Strategy Fund

A-Class

1.66%

1,000.00

1,135.22

8.89

C-Class

2.41%

1,000.00

1,130.96

12.87

H-Class

1.66%

1,000.00

1,134.84

8.88

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

5

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) (concluded)

Beginning

Ending

Expenses

Expense

Account Value

Account Value

Paid During

Ratio†

March 31, 2007

September 30, 2007

Period*

Table 2. Based on hypothetical 5% return

Multi-Cap Core Equity Fund

A-Class

1.26%

$1,000.00

$1,018.67

$

6.40

C-Class

2.00%

1,000.00

1,014.92

10.15

H-Class

1.26%

1,000.00

1,018.67

6.40

Sector Rotation Fund

A-Class

1.66%

1,000.00

1,016.64

8.43

C-Class

2.41%

1,000.00

1,012.83

12.23

H-Class

1.66%

1,000.00

1,016.64

8.43

Absolute Return Strategies Fund

A-Class

1.80%

1,000.00

1,015.93

9.14

C-Class

2.55%

1,000.00

1,012.83

12.95

H-Class

1.80%

1,000.00

1,015.93

9.14

Commodities Strategy Fund

A-Class

1.52%

1,000.00

1,017.35

7.72

C-Class

2.27%

1,000.00

1,013.54

11.52

H-Class

1.51%

1,000.00

1,017.40

7.67

Hedged Equity Fund

A-Class

1.92%

1,000.00

1,015.32

9.75

C-Class

2.66%

1,000.00

1,011.56

13.50

H-Class

1.92%

1,000.00

1,015.32

9.75

International Rotation Fund**

A-Class

1.68%

1,000.00

1,016.54

8.53

C-Class

2.43%

1,000.00

1,012.73

12.34

H-Class

1.66%

1,000.00

1,016.64

8.43

Managed Futures Strategy Fund

A-Class

1.67%

1,000.00

1,016.59

8.48

C-Class

2.45%

1,000.00

1,012.63

12.44

H-Class

1.71%

1,000.00

1,016.39

8.68

Real Estate Fund

A-Class

1.62%

1,000.00

1,016.84

8.22

C-Class

2.37%

1,000.00

1,013.04

12.03

H-Class

1.62%

1,000.00

1,016.84

8.22

Strengthening Dollar 2x Strategy Fund

A-Class

1.67%

1,000.00

1,016.59

8.48

C-Class

2.41%

1,000.00

1,012.83

12.23

H-Class

1.66%

1,000.00

1,016.64

8.43

Weakening Dollar 2x Strategy Fund

A-Class

1.66%

1,000.00

1,016.64

8.43

C-Class

2.41%

1,000.00

1,012.83

12.23

H-Class

1.66%

1,000.00

1,016.64

8.43

*

Expenses are equal to the Fund's annualized expense ratio, multiplied by the average account value over the period, multiplied by

the number of days in the most recent fiscal half-year, then divided by 365.

**

Since the commencement of operations: August 31, 2007. Due to the limited length of Fund operations, current expense ratios may

not be indicative of future expense ratios.

†

This ratio represents annualized Total Expenses, which include dividend expense from securities sold short and expenses waived by

Rydex Investments. Excluding short dividend expense, the operating expense ratio would be 0.41%, 0.53% and 0.04% lower in each

class of the Absolute Return Strategies Fund, Hedged Equity Fund and Managed Futures Strategy Fund, respectively. Excluding

waived expenses, the net expense ratio of the Commodities Strategy Fund would be 0.32%, 0.32% and 0.31% lower for A-Class,

C-Class and H-Class, respectively.

6

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

FUND PROFILES (Unaudited)

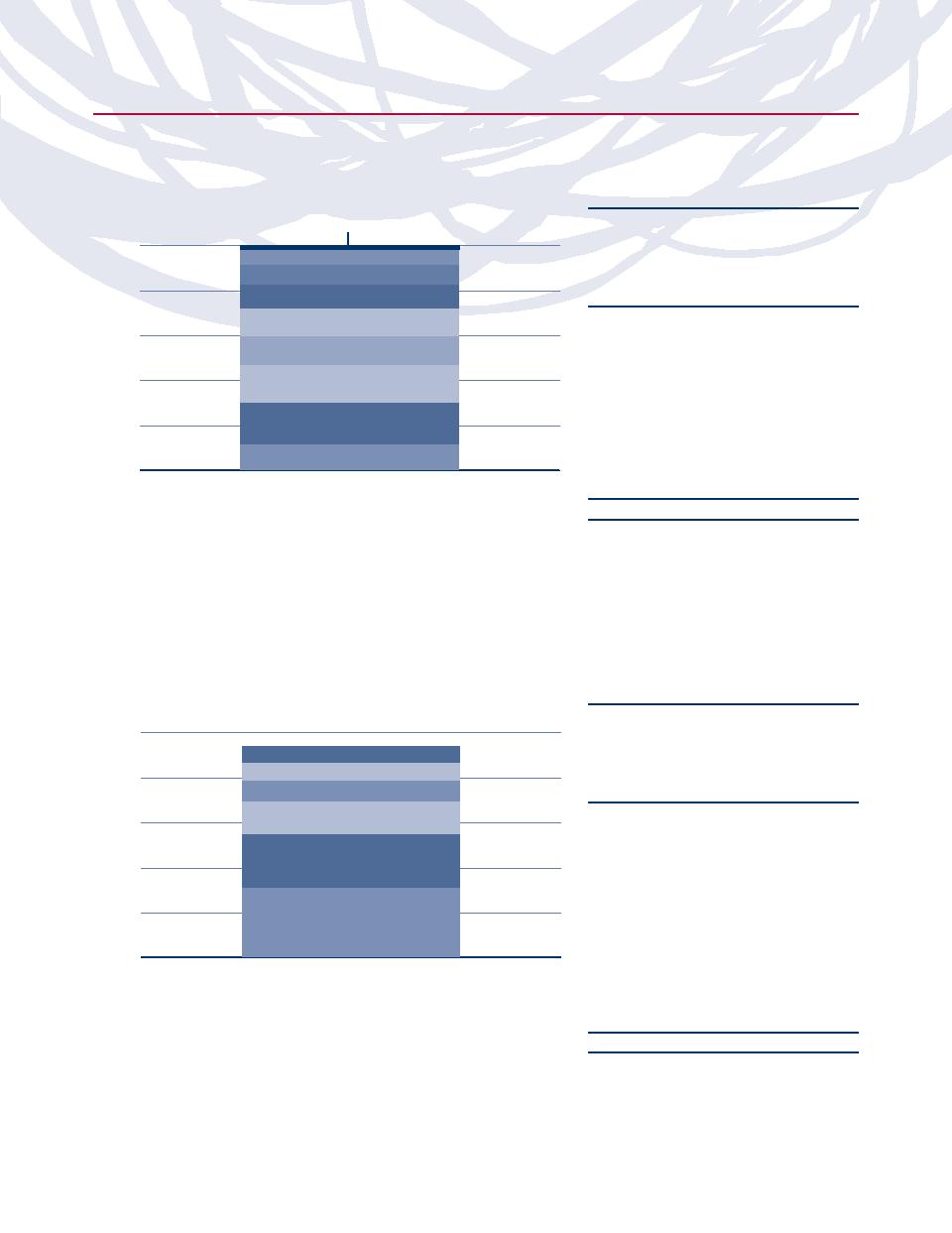

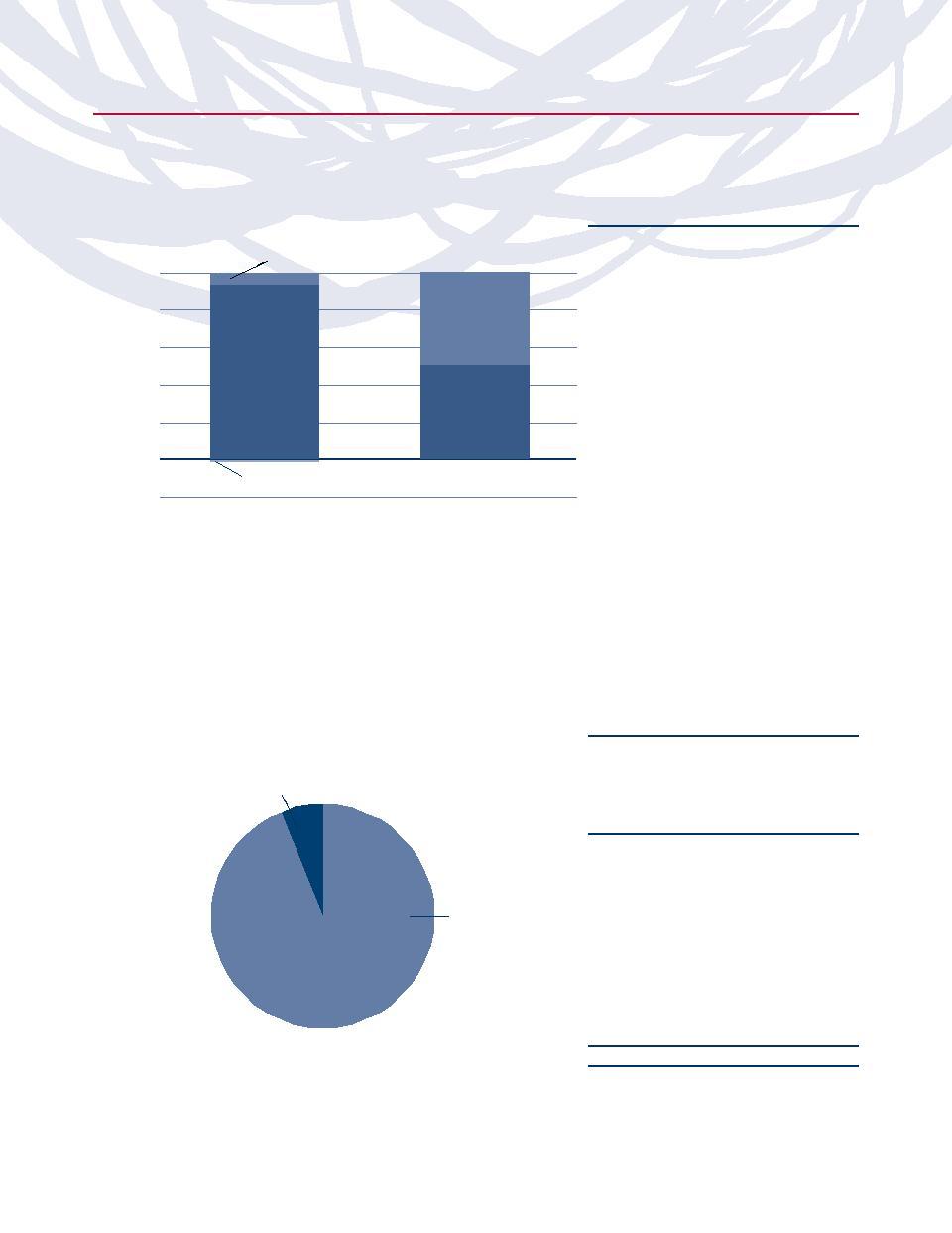

MULTI-CAP CORE EQUITY FUND

OBJECTIVE: Seeks long-term capital appreciation.

Inception Dates:

Holdings Diversification (Market Exposure as % of Net Assets)

Futures Contracts

A-Class

March 31, 2004

100%

C-Class

September 23, 2002

Consumer Staples

H-Class

September 23, 2002

Energy

80%

Health Care

Ten Largest Holdings (% of Total Net Assets)

Industrials

Exxon Mobil Corp.

1.8%

60%

Consumer

General Electric Co.

1.1%

Discretionary

AT&T, Inc.

1.0%

40%

Information

Bank of America Corp.

0.9%

Technology

Chevron Corp.

0.8%

Cisco Systems, Inc.

0.8%

20%

Financials

International Business Machines Corp.

0.7%

Other

Microsoft Corp.

0.7%

0%

JPMorgan Chase & Co.

0.7%

Multi-Cap Core Equity Fund

Pfizer, Inc.

0.7%

Top Ten Total

9.2%

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

“Ten Largest Holdings” exclude any temporary cash

or derivative investments.

SECTOR ROTATION FUND

OBJECTIVE: Seeks long-term capital appreciation.

Holdings Diversification (Market Exposure as % of Net Assets)

Inception Dates:

A-Class

March 31, 2004

100%

C-Class

March 22, 2002

Energy

H-Class

March 22, 2002

80%

Consumer Discretionary

Telecommunication Services

Ten Largest Holdings (% of Total Net Assets)

60%

Information Technology

Amazon.com, Inc.

2.4%

BHP Billiton Ltd. — SP ADR

2.1%

Materials

Fluor Corp.

2.1%

40%

China Mobile Ltd. —

SP ADR

2.1%

20%

Industrials

Foster Wheeler Ltd.

1.8%

Companhia Vale do Rio Doce —

0%

SP ADR

1.8%

Sector Rotation Fund

Jacobs Engineering Group, Inc.

1.8%

ArcelorMittal

1.7%

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

KBR, Inc.

1.6%

temporary cash investments.

Kirby Corp.

1.5%

Top Ten Total

18.9%

“Ten Largest Holdings” exclude any temporary cash

or derivative investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

7

FUND PROFILES (Unaudited) (continued)

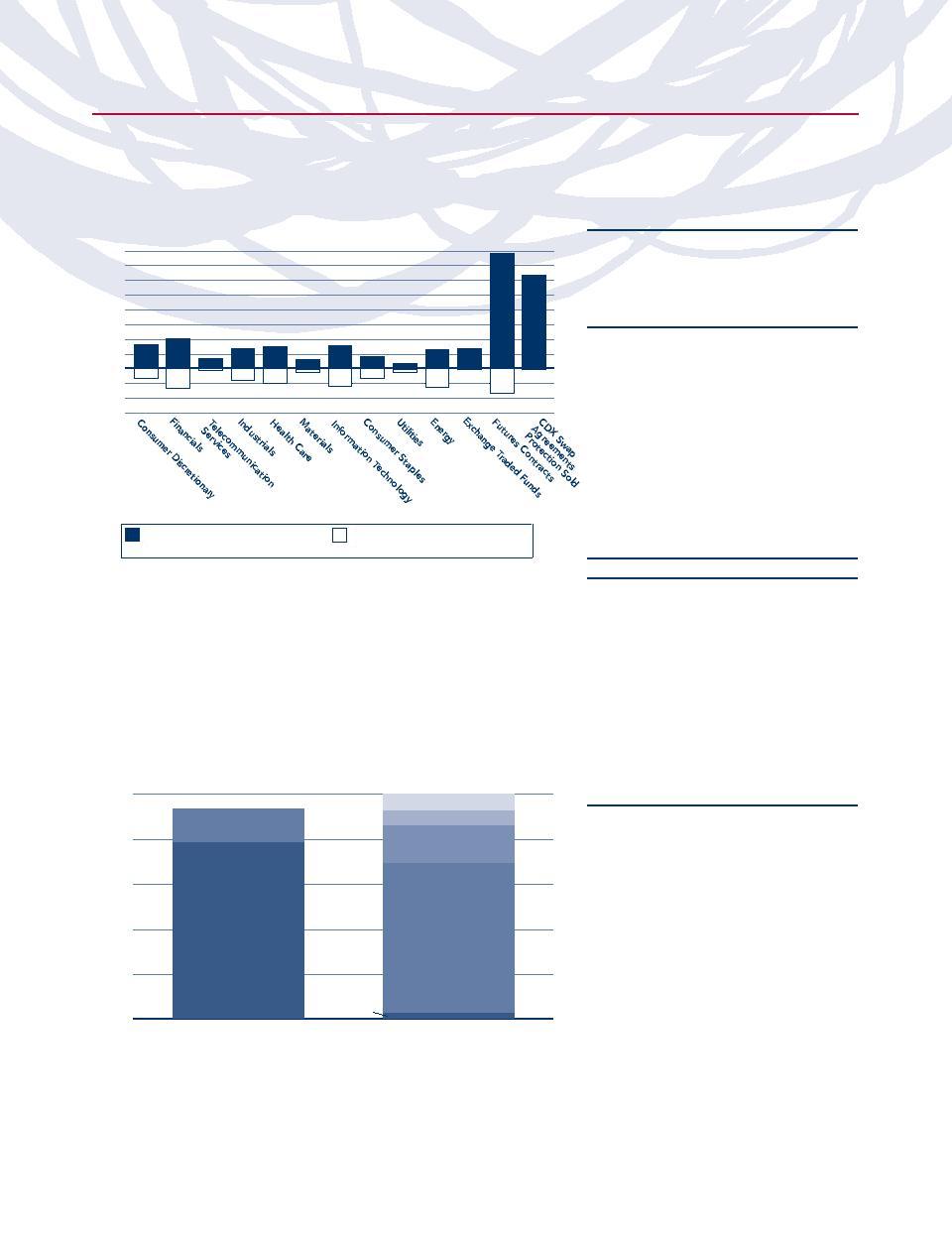

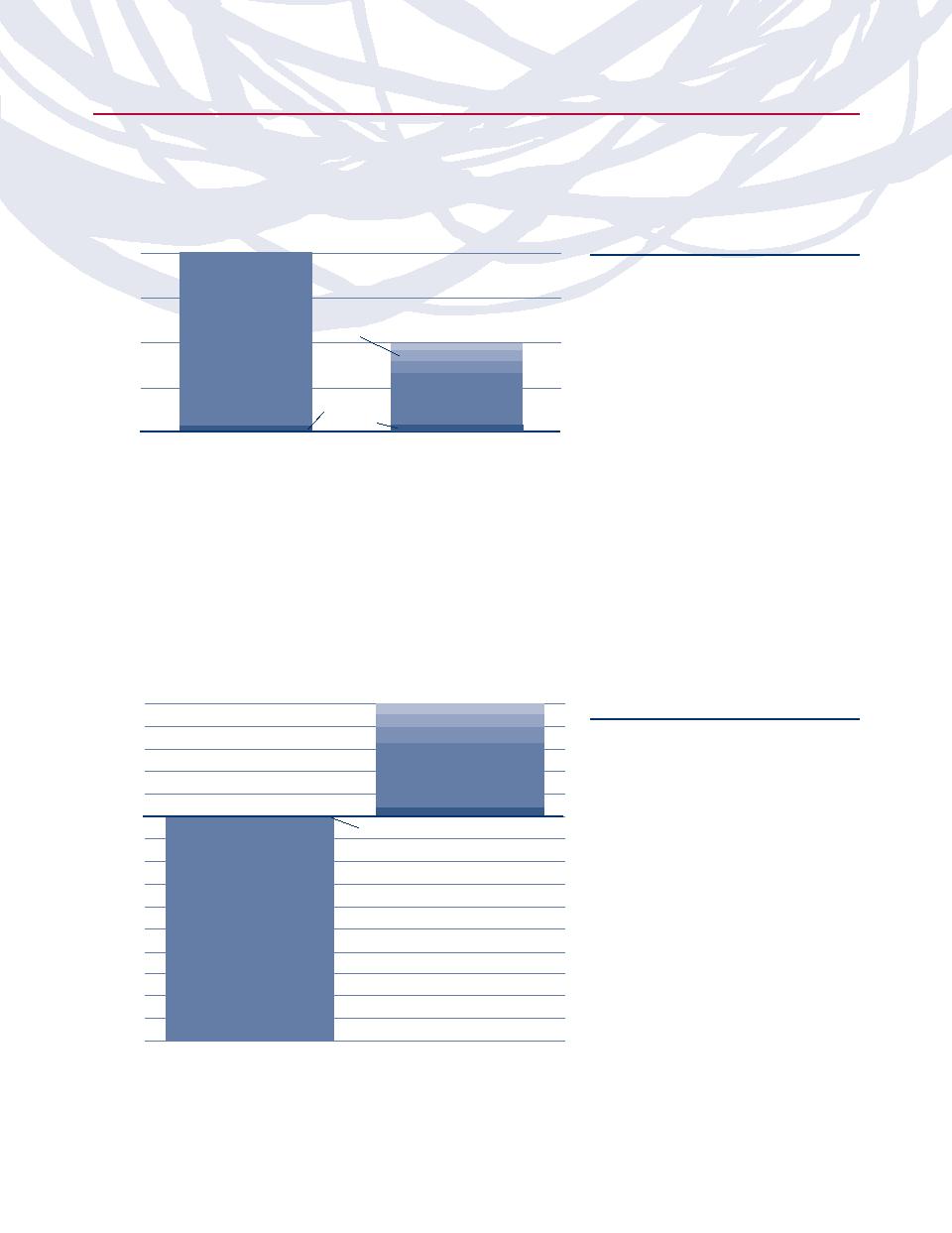

ABSOLUTE RETURN STRATEGIES FUND

OBJECTIVE: To provide capital appreciation consistent with the return and risk characteristics of the hedge fund universe. The

secondary objective is to achieve these returns with low correlation to and less volatility than equity indices.

Holdings Diversification (Market Exposure as % of Net Assets)

Inception Dates:

40%

A-Class

September 19, 2005

35%

C-Class

September 19, 2005

30%

H-Class

September 19, 2005

20%

25%

15%

Ten Largest Holdings (% of Total Net Assets)

5%

10%

iShares MSCI Emerging Markets

0%

Index Fund

4.5%

Indexed Trust

-5%

iShares S&P GSCI Commodity

-10%

2.3%

-15%

Hewlett-Packard Co.

1.0%

AT&T, Inc.

0.9%

ConocoPhillips

0.8%

National-Oilwell Varco, Inc.

0.7%

Goldman Sachs Group, Inc.

0.7%

Safeway, Inc.

0.6%

Long Holdings

Short Holdings

Absolute Return Strategies Fund

Absolute Return Strategies Fund

0.6%

Verizon Communications, Inc.

0.6%

Wal-Mart Stores, Inc.

Top Ten Total

12.7%

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

“Ten Largest Holdings” exclude any

temporary cash or derivative investments.

COMMODITIES STRATEGY FUND

OBJECTIVE: Seeks to provide investment results that correlate to the performance of a benchmark for commodities. The

Fund’s current benchmark is the S&P GSCI™ Commodity Index.

Holdings Diversification (Market Exposure as % of Net Assets)

100%

Livestock

Inception Dates:

Traded Funds

Exchange

Industrial Metals

A-Class

May 25, 2005

80%

Agriculture

C-Class

May 25, 2005

H-Class

May 25, 2005

60%

The Fund invests principally in exchange

Structured Notes

traded funds and in derivative instruments

40%

Energy

such as structured notes, futures contracts,

and options on index futures.

20%

0%

Other

Commodities

S&P GSCITM

Strategy Fund

Commodity Index

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

8

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

FUND PROFILES (Unaudited) (continued)

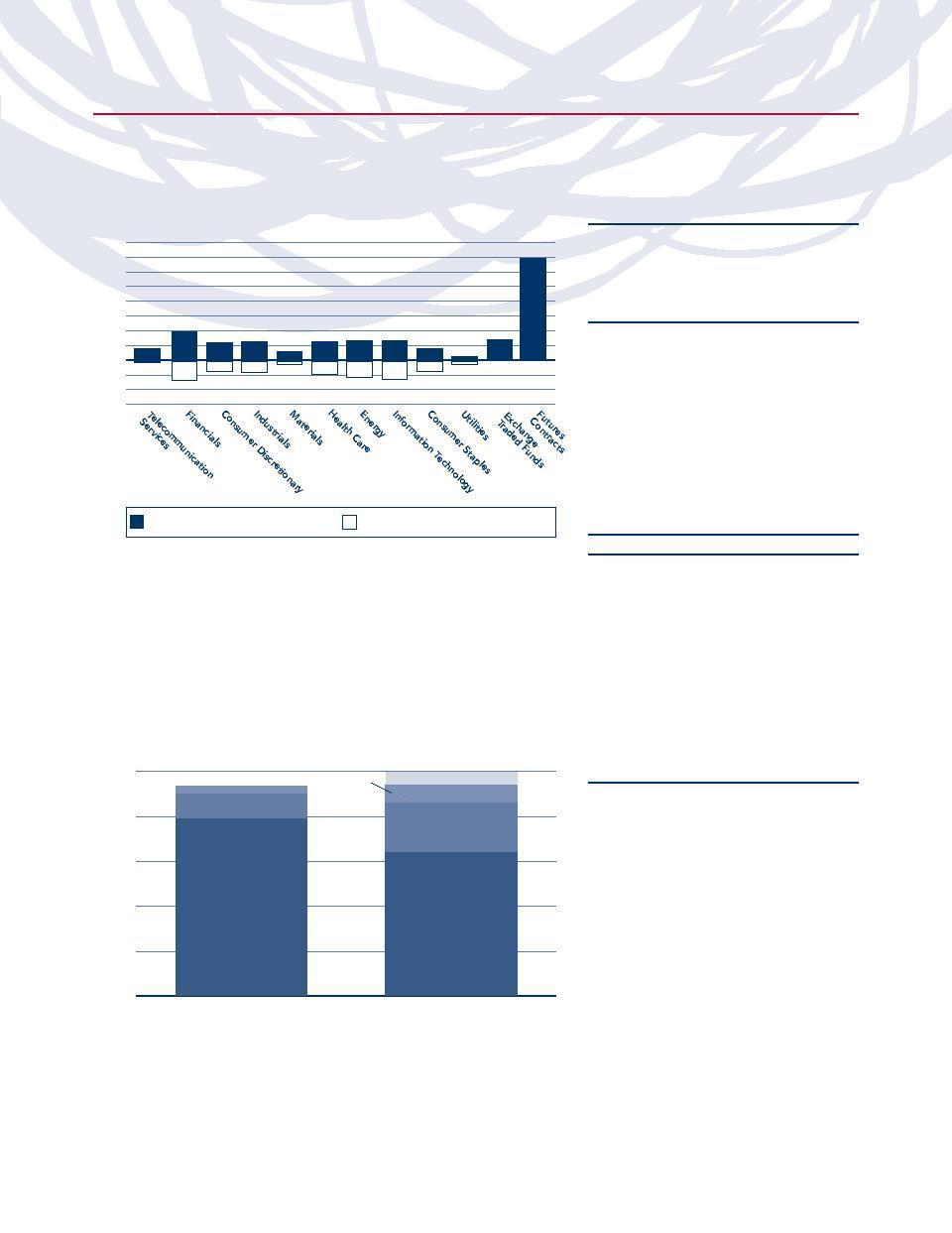

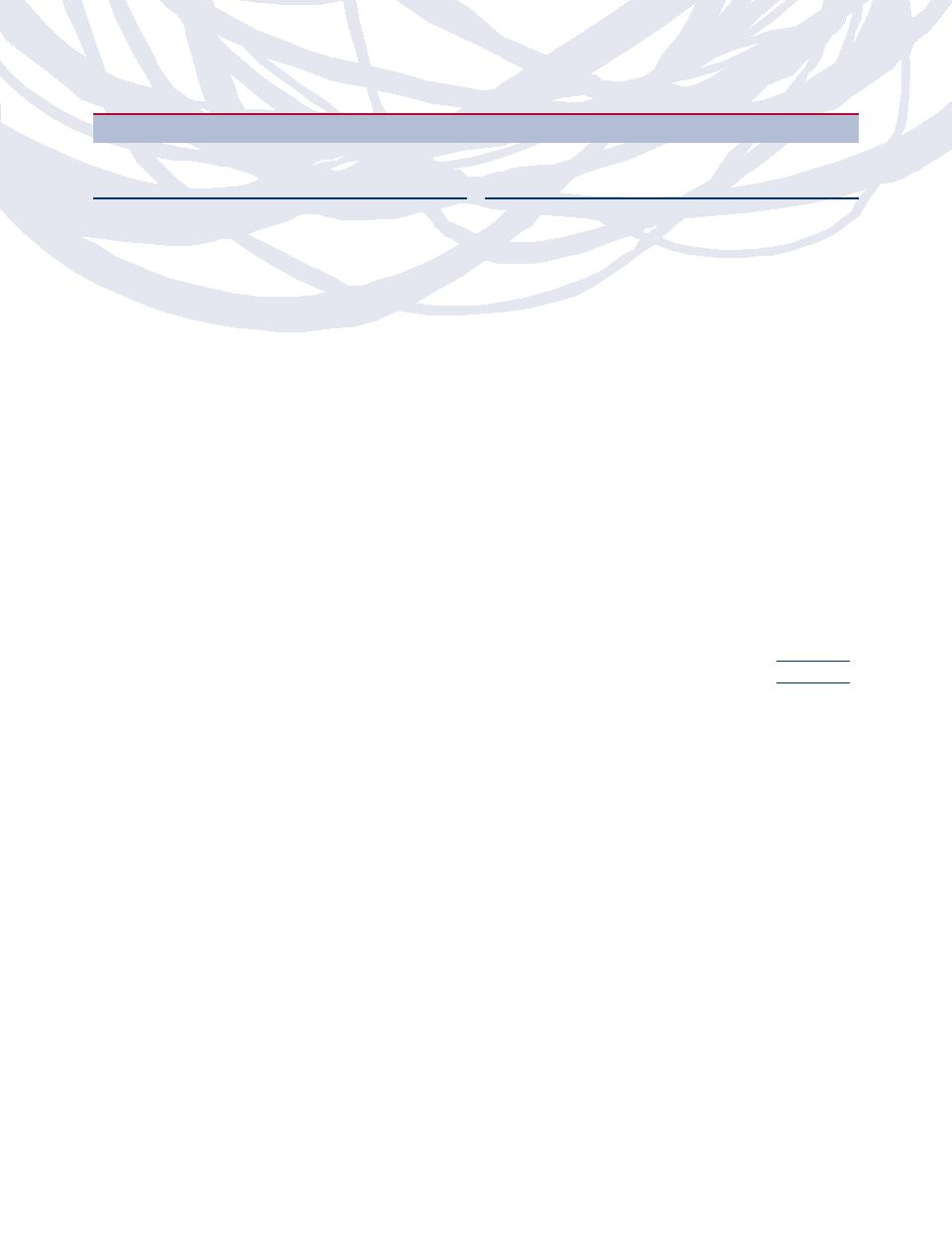

HEDGED EQUITY FUND

OBJECTIVE: To provide capital appreciation consistent with the return and risk characteristics of the long/short hedge fund

universe. The secondary objective is to achieve these returns with low correlation to and less volatility than equity indices.

Holdings Diversification (Market Exposure as % of Net Assets)

Inception Dates:

40%

A-Class

September 19, 2005

35%

C-Class

September 19, 2005

30%

H-Class

September 19, 2005

20%

25%

10%

15%

Ten Largest Long Holdings (% of Total Net Assets)

5%

iShares MSCI Emerging Markets

0%

Index Fund

6.8%

-5%

Hewlett-Packard Co.

1.1%

-15%

-10%

AT&T, Inc.

0.9%

ConocoPhillips

0.8%

National-Oilwell Varco, Inc.

0.7%

Goldman Sachs Group, Inc.

0.7%

Safeway, Inc.

0.7%

Verizon Communications, Inc.

0.6%

Expedia, Inc.

0.6%

Hedged Equity Fund Long Holdings

Hedged Equity Fund Short Holdings

Wal-Mart Stores, Inc.

0.6%

Top Ten Total

13.5%

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

“Ten Largest Long Holdings” exclude any

temporary cash investments.

temporary cash or derivative investments.

INTERNATIONAL ROTATION FUND

OBJECTIVE: Seeks long-term capital appreciation.

Holdings Diversification (Market Exposure as % of Net Assets)

100%

North America

Inception Dates:

Australia

(Canada)

Australia

Asia

A-Class

August 31, 2007

80%

Asia

C-Class

August 31, 2007

H-Class

August 31, 2007

60%

The Fund invests principally in exchange

traded funds and derivative investments such

options on currencies.

40%

Europe

as swap agreements, futures contracts and

Europe

20%

International

MSCI World

0%

Rotation Fund

Ex-US Index

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

9

FUND PROFILES (Unaudited) (continued)

MANAGED FUTURES STRATEGY FUND

OBJECTIVE: To provide investment results that match the performance of a benchmark for measuring trends in the commodity

and financial futures markets. The Fund’s current benchmark is the Standard & Poor’s Diversified Trends Indicator®.

Holdings Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Exchange Traded

A-Class

March 2, 2007

Funds

C-Class

March 2, 2007

100%

H-Class

March 2, 2007

Commodities

80%

Contracts

Futures

The Fund invests principally in exchange

traded funds and derivative investments such

60%

as commodity, currency and financial linked

Structured Notes

notes, futures contracts, and options on index

40%

futures.

Financial

Futures

20%

Contracts

Exchange Traded

0%

-20%

Funds Short Sales

Managed Futures

S&P Diversified

Strategy Fund

Trends Indicator

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

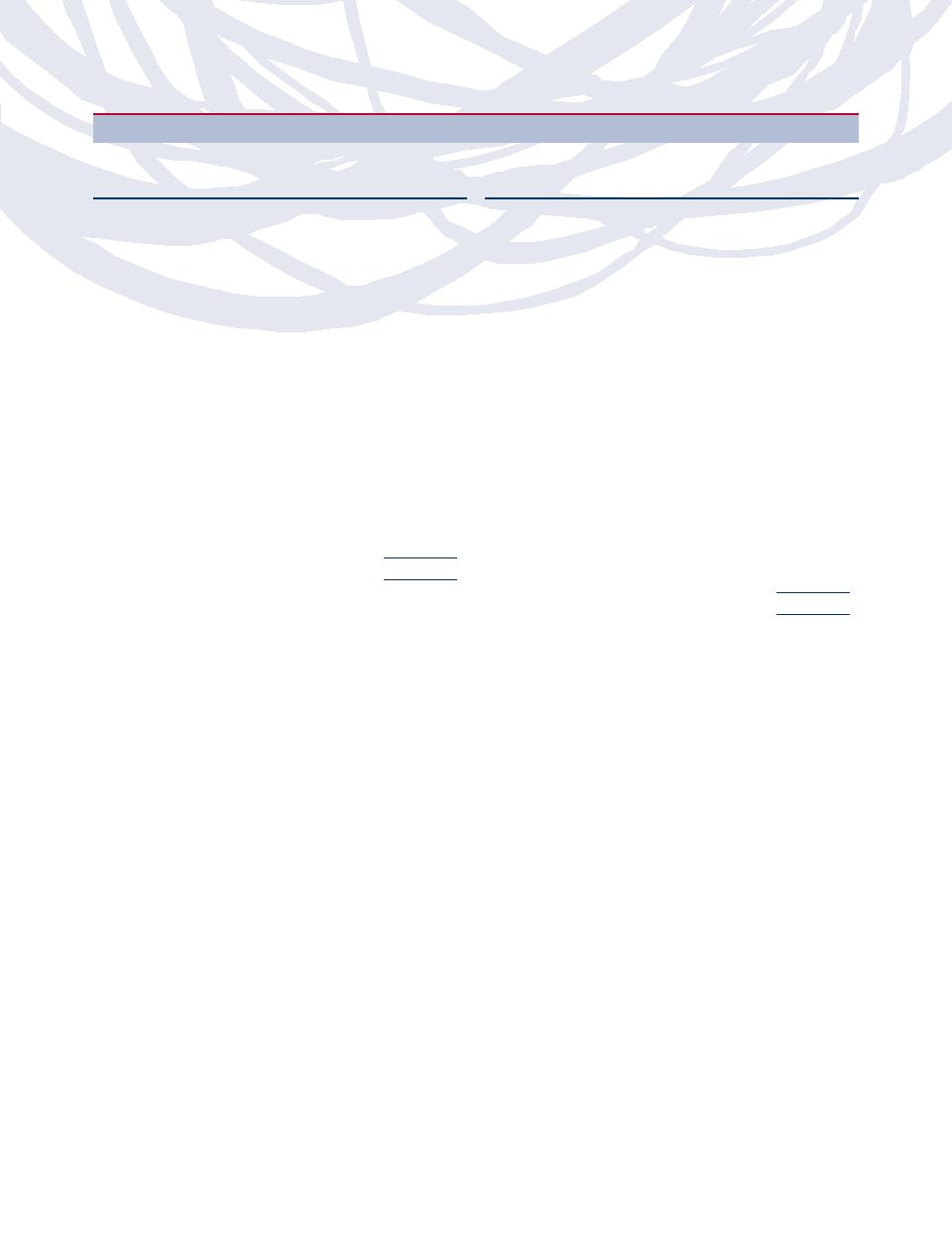

REAL ESTATE FUND

OBJECTIVE:

Seeks to provide capital appreciation by investing in companies that are involved in the real estate industry

including real estate investment trusts (“REITs”).

Industry Diversification (Market Exposure as % of Net Assets)

Inception Dates:

Real Estate

A-Class

September 1, 2004

& Development

Management

C-Class

February 20, 2004

H-Class

February 20, 2004

6%

Ten Largest Holdings (% of Total Net Assets)

Simon Property Group, Inc.

2.8%

Brookfield Asset Management,

Real Estate

Inc. — Class A

2.7%

Investment

ProLogis

2.6%

Trusts

Vornado Realty Trust

2.3%

94%

Archstone-Smith Trust

2.2%

Public Storage, Inc.

2.1%

KIMCO Realty Corp.

2.1%

General Growth Properties, Inc.

2.1%

Boston Properties, Inc.

2.0%

Equity Residential

2.0%

Real Estate Fund

Top Ten Total

22.9%

“Industry Diversification (Market Exposure as % of Net Assets)” excludes any

“Ten Largest Holdings” exclude any temporary cash

temporary cash investments.

or derivative investments.

10

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

FUND PROFILES (Unaudited) (concluded)

STRENGTHENING DOLLAR 2x STRATEGY FUND

OBJECTIVE: To provide investment results that will match the performance of a specific benchmark on a daily basis. The Fund’s

current benchmark is 200% of the performance of the U.S. Dollar Index®.

Holdings Diversification (Market Exposure as % of Net Assets)

200%

Inception Dates:

A-Class

May 25, 2005

C-Class

May 25, 2005

H-Class

May 25, 2005

150%

100%

Swap Agreements

Canadian Dollar

Currency Index

The Fund invests principally in derivative

British Pound

Japanese Yen

investments such as currency index swap

50%

agreements, futures contracts, and options

Futures

on index futures.

Contracts

Euro

0%

Other

Strengthening Dollar

U.S. Dollar Index

2x Strategy Fund

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

WEAKENING DOLLAR 2x STRATEGY FUND

OBJECTIVE: To provide investment results that will match the performance of a specific benchmark on a daily basis. The Fund’s

current benchmark is 200% of the inverse performance of the U.S. Dollar Index.

Holdings Diversification (Market Exposure as % of Net Assets)

British Pound

100%

Canadian Dollar

Inception Dates:

80%

Japanese Yen

A-Class

May 25, 2005

60%

C-Class

May 25, 2005

40%

Euro

H-Class

May 25, 2005

Other

20%

0%

The Fund invests principally in derivative

Futures Contracts

investments such as currency index swap

-20%

Short Sales

agreements, futures contracts, and options

-40%

on index futures.

-60%

Currency Index Swap

-80%

-100%

Agreements Short Sales

-120%

-140%

-160%

-180%

-200%

Weakening Dollar

U.S. Dollar Index

2x Strategy Fund

“Holdings Diversification (Market Exposure as % of Net Assets)” excludes any

temporary cash investments.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

11

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2007

MULTI-CAP CORE EQUITY FUND

MARKET

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

VALUE

VALUE

COMMON STOCKS 97.8%

First Citizens BancShares, Inc. —

Class A

733

$

127,835

FINANCIALS 18.4%

Capital Trust, Inc. — Class A†

3,590

127,445

Bank of America Corp.

11,090

$

557,494

Amerisafe, Inc.*

7,640

126,366

JPMorgan Chase & Co.

9,320

427,042

Reinsurance Group of America,

Wells Fargo & Co.

9,890

352,282

Inc.

2,220

125,852

Citigroup, Inc.

7,200

336,024

Allied World Assurance Holdings

Wachovia Corp.†

6,090

305,413

Ltd

2,420

125,622

Merrill Lynch & Co., Inc.†

3,280

233,798

AmeriCredit Corp.*†

7,070

124,291

ProLogis†

3,190

211,656

Resource Capital Corp.†

11,010

123,973

U.S. Bancorp†

5,790

188,349

Patriot Capital Funding, Inc.†

9,220

123,271

Genworth Financial, Inc. —

Gramercy Capital Corp.

4,870

122,578

Class A

6,000

184,380

Colonial Properties Trust†

3,562

122,177

Travelers Cos, Inc.

3,640

183,238

NYMAGIC, Inc.†

4,380

121,808

Hartford Financial Services

Federal Agricultural Mortgage

Group, Inc.†

1,979

183,156

Corp.

4,145

121,697

KeyCorp†

5,525

178,623

FirstFed Financial Corp.*†

2,440

120,902

American International Group,

Arbor Realty Trust, Inc.

6,390

120,707

Inc.

2,576

174,266

CNA Financial Corp.

2,925

115,011

SunTrust Banks, Inc.

2,200

166,474

Taylor Capital Group, Inc.

4,100

114,513

PNC Financial Services Group,

Capital Southwest Corp.†

920

112,939

Inc.†

2,440

166,164

Hersha Hospitality Trust

11,360

112,464

Lincoln National Corp.

2,460

162,286

Imperial Capital Bancorp, Inc.

3,970

112,152

Aspen Insurance Holdings Ltd.

5,720

159,645

BRT Realty Trust

6,460

112,016

Franklin Resources, Inc.

1,250

159,375

HRPT Properties Trust†

11,240

111,164

Regions Financial Corp.†

5,370

158,308

DiamondRock Hospitality Co.†

6,270

109,161

M&T Bank Corp.

1,510

156,209

UnumProvident Corp.

4,120

100,816

American Capital Strategies,

E*Trade Financial Corp.*†

7,710

100,693

Ltd.†

3,600

153,828

NorthStar Realty Finance Corp.†

9,760

96,917

Zions Bancorporation

2,210

151,761

Deerfield Triarc Capital Corp.†

10,250

92,762

Senior Housing Properties Trust†

6,855

151,221

ACE Ltd.

1,481

89,704

National Retail Properties, Inc.

6,100

148,718

Whitney Holding Corp.

3,380

89,164

Max Capital Group Ltd.

5,250

147,210

Anthracite Capital, Inc.†

8,110

73,801

A.G. Edwards, Inc.

1,740

145,725

MCG Capital Corp.

5,040

72,526

PMI Group, Inc.

4,380

143,226

Capital One Financial Corp.

1,070

71,080

Annaly Mortgage Management,

Radian Group, Inc.†

2,890

67,279

Inc.

8,940

142,414

First Community Bancorp†

1,160

63,464

Philadelphia Consolidated

Community Bancorp*

2,470

62,096

Holding Corp.*

3,420

141,383

NGP Capital Resources Co.

3,630

58,915

Alleghany Corp.*

340

138,040

RAIT Financial Trust†

6,930

57,034

Advanta Corp.

5,030

137,923

ACA Capital Holdings, Inc.*†

9,140

55,663

Hercules Technology Growth

Morgan Stanley

847

53,361

Capital, Inc.†

10,330

137,079

Discover Financial Services*

2,448

50,918

FBL Financial Group, Inc. —

Goldman Sachs Group, Inc.

220

47,683

Class A

3,390

133,871

Cowen Group, Inc.*

3,400

46,988

East-West Bancorp, Inc.†

3,702

133,124

Asta Funding, Inc.†

1,060

40,619

Nationwide Financial Services,

Triad Guaranty, Inc.*†

2,120

40,216

Inc.

2,440

131,321

Assurant, Inc.

695

37,183

Navigators Group, Inc.*

2,420

131,285

Allstate Corp.

310

17,729

Hospitality Properties Trust†

3,180

129,267

Bear Stearns Cos., Inc.

100

12,281

MainSource Financial Group,

American Express Co.†

180

10,687

Inc.†

7,320

129,052

iStar Financial, Inc.

300

10,197

Banco Latinoamericano de

Ocwen Financial Corp.*†

640

6,035

Exportaciones SA

7,060

128,351

Total Financials

11,587,022

Financial Federal Corp.†

4,580

128,286

12

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited) (continued)

September 30, 2007

MULTI-CAP CORE EQUITY FUND

MARKET

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

VALUE

VALUE

INFORMATION TECHNOLOGY 16.6%

Authorize.Net Holdings, Inc.*

6,190

$

109,130

Cisco Systems, Inc.*

15,690

$

519,496

Rudolph Technologies, Inc.*

7,780

107,597

International Business Machines

Convergys Corp.*

6,150

106,764

Corp.

3,880

457,064

Symantec Corp.*†

5,470

106,009

Microsoft Corp.

14,720

433,651

JDA Software Group, Inc.*

5,130

105,986

Hewlett-Packard Co.

7,690

382,885

MKS Instruments, Inc.*

5,420

103,088

Oracle Corp.*

13,290

287,729

Photronics, Inc.*

9,020

102,918

Google, Inc. — Class A*

415

235,417

Intevac, Inc.*

6,735

102,372

eBay, Inc.*†

5,390

210,318

Optium Corp.*†

9,740

101,101

Xerox Corp.*

11,280

195,595

Compuware Corp.*

12,430

99,689

Intel Corp.

6,905

178,563

eSpeed, Inc. — Class A*

11,040

94,171

Applied Materials, Inc.

8,480

175,536

Sybase, Inc.*†

3,950

91,364

Electronic Data Systems Corp.

7,910

172,754

Advanced Energy Industries,

Computer Sciences Corp.*

3,000

167,700

Inc.*

6,020

90,902

Accenture Ltd. — Class A

4,160

167,440

MPS Group, Inc.*†

8,096

90,270

Apple, Inc.*

1,050

161,217

PC Connection, Inc.*

6,970

87,125

Imergent, Inc.†

7,060

158,356

The Knot, Inc.*

2,620

55,701

Western Digital Corp.*

6,250

158,250

Tellabs, Inc.*

5,253

50,009

Lam Research Corp.*†

2,960

157,650

Ciber, Inc.*

5,920

46,235

Avaya, Inc.*

9,250

156,880

Lexmark International, Inc.*

1,050

43,607

Network Appliance, Inc.*

5,770

155,271

Fair Isaac Corp.†

1,095

39,540

Intersil Corp. — Class A

4,630

154,781

Silicon Storage Technology, Inc.*

9,570

30,815

Parametric Technology Corp.*

8,710

151,728

LSI Logic Corp.*

3,470

25,747

Comtech Telecommunications

TIBCO Software, Inc.*†

2,690

19,879

Corp.*

2,830

151,377

Qualcomm, Inc.

390

16,481

Cadence Design Systems, Inc.*†

6,780

150,448

Synopsys, Inc.*

400

10,832

Amkor Technology, Inc.*

13,050

150,336

Total Information Technology

10,477,313

Avnet, Inc.*

3,740

149,076

Fiserv, Inc.*

CONSUMER DISCRETIONARY 13.0%

2,902

147,596

Arrow Electronics, Inc.*

3,470

147,544

Walt Disney Co.†

7,410

254,830

Novellus Systems, Inc.*

5,110

139,299

Time Warner, Inc.

13,650

250,614

McDonald’s Corp.

Insight Enterprises, Inc.*

5,370

138,600

4,550

247,838

Comcast Corp. — Class A*†

9,700

234,546

Brooks Automation, Inc.*

9,700

138,128

Harris Corp.

2,380

Starwood Hotels & Resorts

137,540

EMC Corp*

6,580

Worldwide, Inc.

2,830

171,922

136,864

Brocade Communications Systems,

DIRECTV Group, Inc.*

6,930

168,260

Wynn Resorts Ltd.

1,060

167,014

Inc.*

15,900

136,104

AVX Corp.

8,200

132,020

Genuine Parts Co.

3,260

163,000

CBS Corp.†

THQ, Inc.*

5,280

131,894

5,150

162,225

Expedia, Inc.*

5,070

161,632

SPSS, Inc.*

3,190

131,237

Gannett Co., Inc.

3,550

155,135

Vignette Corp.*

6,470

129,853

Total System Services, Inc.

4,600

127,788

Clear Channel Communications,

Inc.

4,120

154,253

Checkpoint Systems, Inc.*

4,840

127,728

American Greetings Corp. —

Methode Electronics, Inc. —

Class A

8,460

127,323

Class A

5,731

151,298

Sherwin-Williams Co.†

2,290

150,476

SI International, Inc.*

4,450

127,137

ADC Telecommunications, Inc.*

6,430

Mattel, Inc.†

126,092

6,400

150,144

CommScope, Inc.*

2,420

121,581

CBRL Group, Inc.†

3,570

145,656

American Eagle Outfitters, Inc.

5,530

145,494

RealNetworks, Inc.*

17,540

118,921

Vishay Intertechnology, Inc.*

8,880

Black & Decker Corp.

1,740

144,942

115,706

IAC/InterActiveCorp*

4,850

Teradyne, Inc.*†

143,899

8,280

114,264

Entegris, Inc.*

13,140

114,055

Autoliv, Inc.

2,360

141,010

Arris Group, Inc.*†

9,110

112,509

Kohl’s Corp.*

2,440

139,885

Scholastic Corp.*

3,970

138,394

EMS Technologies, Inc.*

4,525

110,998

Macy’s, Inc.

4,240

Mattson Technology, Inc.*

12,680

109,682

137,037

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

13

SCHEDULE OF INVESTMENTS (Unaudited) (continued)

September 30, 2007

MULTI-CAP CORE EQUITY FUND

MARKET

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

VALUE

VALUE

Mohawk Industries, Inc.*†

1,685

$

136,990

Brinker International, Inc.

245

$

6,723

Dillard’s, Inc. — Class A†

6,170

134,691

Charming Shoppes, Inc.*

610

5,124

Conn’s, Inc.*†

5,610

134,023

Total Consumer Discretionary

8,174,593

Big Lots, Inc.*†

4,450

132,788

INDUSTRIALS 12.2%

Jos. A. Bank Clothiers, Inc.*†

3,970

132,677

Churchill Downs, Inc.

2,630

131,395

General Electric Co.

17,476

723,506

Bob Evans Farms, Inc.

4,340

130,981

CSX Corp.†

5,140

219,632

Eaton Corp.

2,000

198,080

IHOP Corp.†

2,030

128,560

Weyco Group, Inc.

4,070

127,839

Lockheed Martin Corp.

1,810

196,367

AnnTaylor Stores Corp.*

4,036

127,820

General Dynamics Corp.

2,250

190,057

Illinois Tool Works, Inc.

3,090

Staples, Inc.

5,926

127,350

184,288

Union Pacific Corp.

1,620

183,157

News Corp. — Class A

5,740

126,223

Movado Group, Inc.

3,950

126,084

Cummins, Inc.

1,420

181,604

Parker Hannifin Corp.

1,620

181,165

Polo Ralph Lauren Corp.

1,620

125,955

Raytheon Co.†

2,800

178,696

Monarch Casino & Resort, Inc.*

4,350

123,757

L-3 Communications Holdings,

Perry Ellis International, Inc.*

4,460

123,587

Inc.

1,730

176,702

Helen of Troy Ltd.*

6,320

122,039

FedEx Corp.

1,660

173,885

Office Depot, Inc.*

5,790

119,390

Meredith Corp.

2,070

118,611

Northrop Grumman Corp.

2,210

172,380

Books-A-Million, Inc.

8,481

112,204

Norfolk Southern Corp.†

3,140

162,997

Danaher Corp.†

1,950

161,284

Jackson Hewitt Tax Service, Inc.†

3,880

108,485

Cooper Industries Ltd. —

Hasbro, Inc.

3,760

104,829

NVR, Inc.*†

220

103,455

Class A

3,150

160,933

Service Corporation

SPX Corp.

1,735

160,592

AMETEK, Inc.

3,470

149,973

International

7,390

95,331

Stewart Enterprises, Inc. —

Deluxe Corp.

4,070

149,939

Thomas & Betts Corp.*†

2,415

141,616

Class A

11,420

87,020

Dress Barn, Inc.*

4,970

84,540

Perini Corp.*

2,520

140,944

West Marine, Inc.*†

7,270

83,968

DRS Technologies, Inc.†

2,550

140,556

Manitowoc Co., Inc.

3,120

Aftermarket Technology Corp.*

2,620

83,159

138,154

Belden, Inc.†

2,935

137,681

Stanley Works†

1,480

83,072

Kellwood Co.

4,870

83,034

Aerovironment, Inc.*

5,940

136,679

Children’s Place Retail Stores,

Goodman Global, Inc.*

5,720

136,594

Teleflex, Inc.†

1,745

135,970

Inc.*†

3,360

81,581

Continental Airlines, Inc. —

OfficeMax, Inc.

2,200

75,394

Class B*†

4,100

135,423

Core-Mark Holding Co., Inc.*

2,130

75,040

Jarden Corp.*

2,219

68,656

Gardner Denver, Inc.*

3,460

134,940

Steelcase, Inc. — Class A†

7,460

134,131

Standard Motor Products, Inc.

7,280

68,432

URS Corp.*

2,310

130,400

Warnaco Group, Inc.*

1,740

67,982

CDI Corp.

4,650

129,642

Systemax, Inc.†

2,990

61,116

Darden Restaurants, Inc.

1,360

56,930

Columbus McKinnon Corp. —

Class A*

5,130

127,686

Thor Industries, Inc.

930

41,841

Getty Images, Inc.*

1,400

38,976

School Specialty, Inc.*

3,590

124,322

G-III Apparel Group Ltd.*

1,710

33,670

On Assignment, Inc.*

13,120

122,541

Spherion Corp.*

14,710

121,505

Family Dollar Stores, Inc.

970

25,763

ValueVision Media, Inc. —

Republic Airways Holdings, Inc.*

5,655

119,716

Class A*

3,290

24,379

ABM Industries, Inc.

5,850

116,883

Cascade Corp.

1,780

116,003

Marriott International, Inc. —

Tredegar Corp.

Class A

490

21,300

6,636

114,471

Home Depot, Inc.†

653

21,183

Manpower, Inc.

1,740

111,969

Copa Holdings SA

2,620

104,931

J.C. Penney Co., Inc.

320

20,278

NACCO Industries, Inc. —

Starbucks Corp.*†

535

14,017

Class A

930

96,236

CKE Restaurants, Inc.

610

9,888

Snap-On, Inc.

190

9,413

Honeywell International, Inc.

1,590

94,557

WESCO International, Inc.*†

DG FastChannel, Inc.*

320

7,546

1,680

72,139

14

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited) (continued)

September 30, 2007

MULTI-CAP CORE EQUITY FUND

MARKET

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

VALUE

VALUE

Precision Castparts Corp.

410

$

60,672

Analogic Corp.

1,770

$

112,855

Boeing Co.

560

58,794

Greatbatch, Inc.*

4,140

110,083

CBIZ, Inc.*†

6,280

49,926

Healthspring, Inc.*

5,635

109,882

UAL Corp.*†

1,040

48,391

Merck & Co., Inc.

2,090

108,032

Robbins & Myers, Inc.

730

41,822

King Pharmaceuticals, Inc.*

8,460

99,151

Con-way, Inc.

870

40,020

Watson Pharmaceuticals, Inc.*

2,860

92,664

United Technologies Corp.

465

37,423

Viropharma, Inc.*

10,170

90,513

Crane Co.

770

36,937

Bio-Rad Laboratories, Inc. —

Burlington Northern Santa Fe

Class A*

1,000

90,500

Corp.†

390

31,656

Emergent Biosolutions, Inc.*

9,660

85,781

Caterpillar, Inc.†

390

30,588

Medical Action Industries, Inc.*

3,290

77,841

3M Co.†

300

28,074

Air Methods Corp.*

1,550

71,610

Allied Waste Industries, Inc.*†

1,880

23,970

HLTH Corp.*†

4,940

70,000

Tyco International Ltd.

370

16,406

Cubist Pharmaceuticals, Inc.*

3,100

65,503

Atlas Air Worldwide Holdings

DENTSPLY International, Inc.

1,565

65,167

Co., Inc.*

260

13,424

Abbott Laboratories

990

53,084

Beacon Roofing Supply, Inc.*†

1,060

10,833

Genentech, Inc.*

590

46,032

Hardinge, Inc.

245

8,533

Medtronic, Inc.

490

27,641

Robert Half International, Inc.

285

8,510

AmerisourceBergen Corp.

390

17,679

Kelly Services, Inc.

410

8,122

Wyeth

350

15,593

Total Industrials

7,675,027

Millennium Pharmaceuticals,

HEALTH CARE 10.7%

Inc.*†

1,290

13,094

Pfizer, Inc.

17,130

418,486

Total Health Care

6,771,187

Johnson & Johnson, Inc.

4,630

304,191

ENERGY 8.9%

Amgen, Inc.*

4,330

244,948

Exxon Mobil Corp.†

12,410

1,148,669

UnitedHealth Group, Inc.

5,000

242,150

Chevron Corp.†

5,650

528,727

Schering-Plough Corp.

6,920

218,880

ConocoPhillips

4,630

406,375

WellPoint, Inc.*

2,650

209,138

National-Oilwell Varco, Inc.*

1,740

251,430

Baxter International, Inc.

3,557

200,188

Occidental Petroleum Corp.

3,490

223,639

Aetna, Inc.

3,300

179,091

GlobalSantaFe Corp.

2,750

209,055

Humana, Inc.*

2,560

178,893

Marathon Oil Corp.

3,520

200,710

Thermo Fisher Scientific, Inc.*

2,920

168,542

Valero Energy Corp.

2,860

192,135

Biogen Idec, Inc.*

2,440

161,845

ENSCO International, Inc.†

2,897

162,522

Zimmer Holdings, Inc.*

1,970

159,550

Pride International, Inc.*

4,080

149,124

AMERIGROUP Corp.*

4,430

152,746

Golar LNG Ltd.†

6,580

146,866

WellCare Health Plans, Inc.*

1,380

145,493

Tesoro Corp.

3,070

141,281

Steris Corp.†

5,270

144,029

Patterson-UTI Energy, Inc.†

6,140

138,580

Martek Biosciences Corp.*†

4,950

143,698

Global Industries Ltd.*

5,310

136,786

CIGNA Corp.

2,690

143,350

GulfMark Offshore, Inc.*

2,775

135,031

Perrigo Co.

6,680

142,618

Schlumberger Ltd.

1,270

133,350

Cephalon, Inc.*†

1,940

141,736

Tidewater, Inc.†

2,120

133,221

Omnicell, Inc.*

4,940

140,988

SEACOR Holdings, Inc.*

1,390

132,189

Sciele Pharma, Inc.*†

5,210

135,564

Overseas Shipholding Group,

Arrow International, Inc.

2,960

134,650

Inc.†

1,660

127,538

Res-Care, Inc.*

5,880

134,299

Bronco Drilling Co., Inc.*†

8,330

123,284

Zoll Medical Corp.*

5,110

132,451

Holly Corp.

2,030

121,455

Cutera, Inc.*

5,030

131,836

Allis-Chalmers Energy, Inc.*†

6,391

121,045

Conmed Corp.*

4,640

129,874

Delek US Holdings, Inc.

4,650

116,622

Albany Molecular Research, Inc.*

8,130

122,763

Alon USA Energy, Inc.

3,290

111,136

Salix Pharmaceuticals Ltd.*†

9,710

120,598

Trico Marine Services, Inc.*†

3,310

98,638

McKesson Corp.

2,045

120,226

USEC, Inc.*†

7,840

80,360

Affymax, Inc.*

4,350

117,711

Plains Exploration & Production

Noven Pharmaceuticals, Inc.*

7,160

114,059

Co.*†

1,280

56,602

Mylan Laboratories, Inc.

7,136

113,891

Callon Petroleum Co.*

2,630

36,610

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

15

SCHEDULE OF INVESTMENTS (Unaudited) (continued)

September 30, 2007

MULTI-CAP CORE EQUITY FUND

MARKET

VALUE

VALUE

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

Mariner Energy, Inc.*†

1,655

$

34,275

Celanese Corp.

3,280

$

127,854

T-3 Energy Services, Inc. —

Cabot Corp.

3,540

125,776

Class A*

300

12,792

Headwaters, Inc.*†

7,600

113,088

Total Energy

5,610,047

PolyOne Corp.*

15,110

112,872

CONSUMER STAPLES 6.5%

Reliance Steel & Aluminum Co.

1,940

109,688

Altria Group, Inc.

5,900

410,227

Mercer International, Inc.*†

10,640

100,548

Procter & Gamble Co.

4,685

329,543

AEP Industries, Inc.*

2,170

91,878

CVS Corp.

6,240

247,291

Buckeye Technologies, Inc.*

5,130

77,668

Safeway, Inc.

5,786

191,575

Sonoco Products Co.

2,395

72,281

Kroger Co.†

5,830

166,272

CF Industries Holdings, Inc.

740

56,173

Loews Corp. — Carolina Group

2,000

164,460

Pactiv Corp.*

560

16,050

Molson Coors Brewing Co. —

Total Materials

2,899,227

Class B

1,630

162,462

UTILITIES 3.8%

General Mills, Inc.

2,690

156,047

Mirant Corp.*

4,171

169,651

Coca-Cola Co.

2,620

150,571

FPL Group, Inc.

2,710

164,985

Cal-Maine Foods, Inc.†

5,810

146,644

Duke Energy Corp.†

8,700

162,603

Pepsi Bottling Group, Inc.†

3,920

145,706

DTE Energy Co.†

3,290

159,368

Energizer Holdings, Inc.*

1,310

145,214

FirstEnergy Corp.

2,360

149,482

Church & Dwight Co., Inc.

3,000

141,120

WGL Holdings, Inc.

4,350

147,422

Corn Products International, Inc.

3,030

138,986

Energen Corp.

2,500

142,800

Herbalife Ltd.

3,000

136,380

TECO Energy, Inc.†

8,680

142,612

Village Super Market

2,600

135,200

Alliant Energy Corp.†

3,710

142,167

PepsiCo, Inc.

1,840

134,798

Avista Corp.

6,915

140,720

TreeHouse Foods, Inc.*

4,970

134,439

Energy East Corp.

5,150

139,308

J.M. Smucker Co.

2,480

132,482

Sierra Pacific Resources

8,680

136,536

NBTY, Inc.*

3,260

132,356

Puget Energy, Inc.

5,530

135,319

Winn-Dixie Stores, Inc.*†

6,580

123,178

AGL Resources, Inc.

3,390

134,312

Del Monte Foods Co.

10,260

107,730

Portland General Electric Co.

4,750

132,050

Central Garden and Pet Co. —

Reliant Energy, Inc.*

3,970

101,632

Class A*†

11,350

101,923

Atmos Energy Corp.

2,710

76,747

Prestige Brands Holdings, Inc. —

Allete, Inc.

1,060

47,446

Class A*

8,670

95,197

Wal-Mart Stores, Inc.

2,080

90,792

Total Utilities

2,425,160

Kimberly-Clark Corp.

605

42,507

TELECOMMUNICATION SERVICES 3.1%

Central European Distribution

AT&T, Inc.

15,050

636,766

Corp.*†

540

25,871

Telephone & Data Systems, Inc.

2,320

154,860

Universal Corp.†

315

15,419

CenturyTel, Inc.

3,110

143,744

NTELOS Holdings Corp.

4,840

142,586

Imperial Sugar Co., Inc.

200

5,226

Verizon Communications, Inc.

Total Consumer Staples

4,109,616

3,170

140,368

Atlantic Tele-Network, Inc.

3,640

132,314

MATERIALS 4.6%

U.S. Cellular Corp.*

1,316

129,231

Dow Chemical Co.

4,750

204,535

Shenandoah Telecommunications

Freeport-McMoRan Copper &

Co.†

5,910

128,602

Gold, Inc. — Class B

1,920

201,389

Syniverse Holdings, Inc.*

7,780

123,702

United States Steel Corp.

1,740

184,336

Sprint Nextel Corp.†

5,500

104,500

Albemarle Corp.

3,530

156,026

USA Mobility, Inc.*

5,055

85,278

Nucor Corp.†

2,550

151,648

American Tower Corp. —

International Paper Co.

4,195

150,475

Class A*

1,080

47,023

Cytec Industries, Inc.

2,150

147,038

Total Telecommunication Services

Lubrizol Corp.

2,240

145,734

1,968,974

Total Common Stocks

Rock-Tenn Co. — Class A

4,940

142,766

(Cost $56,329,159)

Ashland, Inc.†

2,315

139,386

61,698,166

Carpenter Technology Corp.

1,060

137,811

Temple-Inland, Inc.†

2,550

134,207

16

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited) (concluded)

September 30, 2007

MULTI-CAP CORE EQUITY FUND

FACE

VALUE

MARKET

AMOUNT

(NOTE 1)

REPURCHASE AGREEMENTS 2.1%

Repurchase Agreement (Note 5)

Mizuho Financial Group, Inc.

issued 09/28/07 at 3.96%

due 10/01/07

$

778,841

$

778,841

Lehman Brothers Holdings, Inc.

issued 09/28/07 at 3.90%

due 10/01/07

435,199

435,199

Morgan Stanley

issued 09/28/07 at 3.80%

due 10/01/07

91,628

91,628

Credit Suisse Group

issued 09/28/07 at 3.95%

due 10/01/07

2,749

2,749

Total Repurchase Agreements

(Cost $1,308,417)

1,308,417

SECURITIES LENDING COLLATERAL 12.9%

Investment in Securities Lending Short Term

Investment Portfolio Held by

U.S. Bank (Note 8)

8,163,346

8,163,346

Total Securities Lending Collateral

(Cost $8,163,346)

8,163,346

Total Investments 112.8%

(Cost $65,800,922)

$ 71,169,929

Liabilities in Excess of

Other Assets – (12.8)%

$ (8,093,338)

Net Assets – 100.0%

$ 63,076,591

UNREALIZED

CONTRACTS

(NOTE 1)

LOSS

FUTURES CONTRACTS PURCHASED

December 2007 S&P 500 Index

Mini Futures Contracts

(Aggregate Market Value

of Contracts $1,307,513)

17

$

(4,280)

*

Non-Income Producing Security.

†

All or a portion of this security is on loan at September 30, 2007—See Note 8.

ADR—American Depository Receipt.

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

17

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2007

SECTOR ROTATION FUND

VALUE

VALUE

MARKET

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

COMMON STOCKS 94.3%

Southern Copper Corp.†

31,700

$

3,925,411

Barrick Gold Corp.

85,000

3,423,800

INDUSTRIALS 30.9%

Monsanto Co.†

38,500

3,300,990

Fluor Corp.

53,200

$

7,659,736

Rio Tinto PLC — SP ADR†

9,000

3,090,600

Foster Wheeler Ltd.*

51,400

6,747,792

Alcoa, Inc.

78,300

3,063,096

Jacobs Engineering Group,

E.I. du Pont de Nemours and

Inc.*†

85,200

6,439,416

Co.

58,000

2,874,480

KBR Inc.*

153,899

5,966,664

Potash Corporation of

Kirby Corp.*†

120,898

5,336,438

Saskatchewan†

25,500

2,695,350

Diana Shipping, Inc.†

182,991

5,215,244

Dow Chemical Co.

61,800

2,661,108

Shaw Group, Inc.*†

87,300

5,072,130

Teck Cominco Ltd. — Class B†

53,916

2,572,332

Quanta Services, Inc.*†

191,169

5,056,420

Goldcorp, Inc.†

81,600

2,493,696

ABB Ltd. — SP ADR

186,100

4,881,403

The Mosaic Co.*

42,451

2,271,978

Alexander & Baldwin, Inc.†

95,144

4,769,569

Praxair, Inc.

26,700

2,236,392

Emerson Electric Co.

78,055

4,154,087

Newmont Mining Corp.

48,500

2,169,405

Seaspan Corp.†

125,068

4,114,737

Air Products & Chemicals, Inc.

20,900

2,043,184

DryShips, Inc.†

45,200

4,106,420

Nucor Corp.†

33,300

1,980,351

Chicago Bridge & Iron, Co. NV

92,000

3,961,520

Ecolab, Inc.†

31,600

1,491,520

URS Corp.*

60,700

3,426,515

Lyondell Chemical Co.

31,400

1,455,390

Horizon Lines, Inc. — Class A†

107,925

3,294,950

PPG Industries, Inc.

19,100

1,443,005

Washington Group International,

Rohm & Haas Co.

25,100

1,397,317

Inc.*

36,300

3,187,503

Agrium, Inc.

23,900

1,299,682

EMCOR Group, Inc.*

81,300

2,549,568

Sigma-Aldrich Corp.

21,900

1,067,406

Granite Construction, Inc.

46,800

2,481,336

Huntsman Corp.

39,300

1,041,057

Perini Corp.*

41,798

2,337,762

Eastman Chemical Co.

14,500

967,585

Genco Shipping & Trading Ltd.†

35,419

2,321,007

Freeport-McMoRan Copper &

Rockwell Automation, Inc.

28,546

1,984,232

Gold, Inc. — Class B

7,035

737,901

Cooper Industries Ltd. —

Total Materials

86,486,846

Class A†

34,500

1,762,605

INFORMATION TECHNOLOGY 14.8%

First Solar, Inc.*†

14,900

1,754,326

International Business Machines

Eagle Bulk Shipping, Inc.†

59,648

1,535,340

Suntech Power Holdings Co.

Corp.†

38,100

4,488,180

Apple, Inc.*

28,200

4,329,828

Ltd. — SP ADR*†

38,200

1,524,180

Hewlett-Packard Co.

83,900

4,177,381

Roper Industries, Inc.†

23,200

1,519,600

Cisco Systems, Inc.*

125,800

4,165,238

AMETEK, Inc.

31,300

1,352,786

Quintana Maritime Ltd.†

60,194

1,147,900

Nokia Oyj — SP ADR†

104,200

3,952,306

Dell, Inc.*

100,200

Thomas & Betts Corp.*†

18,500

1,084,840

2,765,520

Hubbell, Inc. — Class B

Qualcomm, Inc.

59,900

2,531,374

18,400

1,051,008

EMC Corp*

119,200

2,479,360

Insituform Technologies, Inc. —

Research In Motion Ltd.*

Class A*†

68,600

1,044,778

25,100

2,473,605

Telefonaktiebolaget LM

General Cable Corp.*†

15,400

1,033,648

Acuity Brands, Inc.†

15,800

797,584

Ericsson — SP ADR†

57,200

2,276,560

Motorola, Inc.

105,600

1,956,768

Belden, Inc.†

16,800

788,088

Corning, Inc.

74,000

1,824,100

Genlyte Group, Inc.*

11,300

726,138

Sun Microsystems, Inc.*

295,300

1,656,633

Baldor Electric Co.†

17,600

703,120

Total Industrials

112,890,390

Juniper Networks, Inc.*

37,100

1,358,231

Seagate Technology†

52,500

1,342,950

MATERIALS 23.7%

Alcatel-Lucent†

128,700

1,310,166

BHP Billiton Ltd. — SP ADR†

97,622

7,673,089

SanDisk Corp.*†

22,400

1,234,240

Companhia Vale do Rio Doce —

Network Appliance, Inc.*†

38,500

1,036,035

SP ADR

198,694

6,741,687

NCR Corp.*

20,400

1,015,920

ArcelorMittal†

77,000

6,033,720

Western Digital Corp.*

35,100

888,732

Anglo American PLC —

Logitech International SA*†

28,900

853,995

SP ADR†

155,199

5,191,407

Harris Corp.

14,200

820,618

POSCO — SP ADR†

28,700

5,130,699

Avaya, Inc.*

47,900

812,384

Alcan, Inc.

40,100

4,013,208

Nortel Networks Corp.*†

43,100

731,838

18

|

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

See Notes to Financial Statements.

SCHEDULE OF INVESTMENTS (Unaudited) (concluded)

September 30, 2007

SECTOR ROTATION FUND

MARKET

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

VALUE

VALUE

Brocade Communications

Tenaris SA — SP ADR

44,000

$

2,315,280

Systems, Inc.*

82,400

$

705,344

Transocean, Inc.*†

20,200

2,283,610

Lexmark International, Inc.*†

15,900

660,327

Baker Hughes, Inc.†

23,700

2,141,769

Diebold, Inc.†

12,700

576,834

National-Oilwell Varco, Inc.*

14,000

2,023,000

Tellabs, Inc.*

59,700

568,344

Weatherford International Ltd.*

28,500

1,914,630

Ciena Corp.*

13,600

517,888

GlobalSantaFe Corp.

21,800

1,657,236

JDS Uniphase Corp.*

34,300

513,128

Diamond Offshore Drilling, Inc.†

13,900

1,574,731

Total Information Technology

54,023,827

Smith International, Inc.

21,000

1,499,400

TELECOMMUNICATION SERVICES 9.3%

Noble Corp.

29,100

1,427,355

China Mobile Ltd. —

Cameron International Corp.*

13,700

1,264,373

SP ADR†

91,500

7,506,660

ENSCO International, Inc.

20,400

1,144,440

Vodafone Group PLC —

Nabors Industries Ltd.*

37,000

1,138,490

SP ADR†

131,400

4,769,820

BJ Services Co.

41,100

1,091,205

America Movil SAB de CV —

Total Energy

28,265,059

SP ADR†

59,100

3,782,400

Total Common Stocks

Sprint Nextel Corp.†

119,400

2,268,600

(Cost $293,339,156)

344,151,967

Vimpel-Communications —

SP ADR

76,600

2,071,264

Mobile Telesystems — SP ADR

28,400

1,968,404

AMOUNT

FACE

Rogers Communications, Inc. —

Class B

41,700

1,898,601

REPURCHASE AGREEMENTS 4.8%

Alltel Corp.

23,300

1,623,544

Repurchase Agreement (Note 5)

Turkcell Iletisim Hizmet AS,

Mizuho Financial Group, Inc.

Inc. — SP ADR†

68,600

1,459,808

issued 09/28/07 at 3.96%

SK Telecom Co. Ltd. — SP ADR†

45,000

1,336,500

due 10/01/07

$10,525,929

10,525,929

American Tower Corp. —

Lehman Brothers Holdings, Inc.

Class A*

30,200

1,314,908

issued 09/28/07 at 3.90%

NII Holdings, Inc. — Class B*

13,600

1,117,240

due 10/01/07

5,881,645

5,881,645

U.S. Cellular Corp.*

10,742

1,054,864

Morgan Stanley

Philippine Long Distance

issued 09/28/07 at 3.80%

Telephone Co. — SP ADR†

16,200

1,042,308

due 10/01/07

1,238,345

1,238,345

Crown Castle International

Credit Suisse Group

Corp.*†

21,300

865,419

issued 09/28/07 at 3.95%

Total Telecommunication Services

34,080,340

due 10/01/07

37,150

37,150

CONSUMER DISCRETIONARY 7.8%

Total Repurchase Agreements

Amazon.com, Inc.*†

93,872

8,744,177

(Cost $17,683,069)

17,683,069

Expedia, Inc.*

123,200

3,927,616

Liberty Media Corp – Interactive*

181,199

3,480,833

SECURITIES LENDING COLLATERAL 21.9%

IAC/InterActiveCorp*

94,600

2,806,782

Investment in Securities Lending Short Term

Priceline.com, Inc.*†

29,700

2,635,875

Investment Portfolio Held by

GSI Commerce, Inc.*†

52,739

1,402,857

U.S. Bank (Note 8)

79,793,952

79,793,952

Netflix, Inc.*†

64,000

1,326,080

Total Securities Lending Collateral

NutriSystem, Inc.*†

27,500

1,289,475

(Cost $79,793,952)

79,793,952

Systemax, Inc.†

53,397

1,091,435

Total Investments 121.0%

Blue Nile, Inc.*†

10,309

970,283

(Cost $390,816,177)

$ 441,628,988

Gmarket, Inc.*†

31,134

730,092

Liabilities in Excess of

Total Consumer Discretionary

28,405,505

Other Assets – (21.0)%

$ (76,553,415)

ENERGY 7.8%

Net Assets – 100.0%

$ 365,075,573

Schlumberger Ltd.

42,500

4,462,500

Halliburton Co.

60,600

2,327,040

*

Non-Income Producing Security.

†

All or a portion of this security is on loan at September 30, 2007—See Note 8.

ADR—American Depository Receipt.

See Notes to Financial Statements.

THE RYDEX SERIES FUNDS SEMI-ANNUAL REPORT

|

19

SCHEDULE OF INVESTMENTS (Unaudited)

September 30, 2007

ABSOLUTE RETURN STRATEGIES FUND

VALUE

VALUE

MARKET

MARKET

SHARES

(NOTE 1)

SHARES

(NOTE 1)

COMMON STOCKS 58.8%

Fidelity National Financial, Inc. —

Class A†

21,080

$

368,478

FINANCIALS 10.0%

PMI Group, Inc.†

11,150

364,605

Goldman Sachs Group, Inc.†

10,060

$

2,180,404

American Financial Group, Inc.

12,300

350,796

Travelers Cos, Inc.

30,660

1,543,424

Capital One Financial Corp.

5,250

348,758

JPMorgan Chase & Co.

24,470

1,121,215

Protective Life Corp.

7,860

333,578

Allstate Corp.

19,100

1,092,329

Marsh & McLennan Cos., Inc.

12,860

327,930

HSBC Holdings PLC — SP ADR†

11,660

1,079,716

Nuveen Investments, Inc. —

Hartford Financial Services

Class A

5,180

320,849

Group, Inc.†

11,360

1,051,368

Host Hotels & Resorts, Inc.

14,040

315,058

A.G. Edwards, Inc.†

12,380

1,036,825

MGIC Investment Corp.†

9,720

314,053

Chubb Corp.†

16,440

881,842

UnumProvident Corp.

12,500

305,875

ACE Ltd.

14,460

875,842

Credit Suisse Group — SP ADR†

4,520

299,812

Morgan Stanley†

12,450

784,350

Horace Mann Educators Corp.

13,590

267,859

Fannie Mae

12,800

778,368

National City Corp.†

9,700

243,373

Genworth Financial, Inc. —

Commerce Group, Inc.†

8,200

241,654

Class A

22,820

701,259

Apartment Investment &

KNBT Bancorp, Inc.

37,540

620,912

Management Co. — Class A†

4,350

196,316

CIT Group, Inc.

14,970

601,794

Cincinnati Financial Corp.

4,110

178,004

UBS AG — SP ADR

10,660

567,645

W.R. Berkley Corp.

5,490

162,669

Loews Corp.

11,610

561,343

Radian Group, Inc.†

6,240

145,267

Banco Santander Central

Cousins Properties, Inc.†

4,140

121,550

Hispano SA — SP ADR†

28,840

556,900

Potlatch Corp.†

2,690

121,131

Archstone-Smith Trust

9,250

556,295

XL Capital Ltd.†

1,390

110,088

Republic Property Trust

37,840

555,113

Everest Re Group Ltd.

720

79,373

James River Group, Inc.

17,010

551,124

Equity Inns, Inc.

24,180

545,984

Total Financials

33,129,847

CONSUMER DISCRETIONARY 8.1%

First Indiana Corp.

17,410

545,281

Expedia, Inc.*

60,240

1,920,451

Chittenden Corp.

15,400

541,464

Time Warner, Inc.

75,700

1,389,852

International Securities

Exchange Holdings, Inc.

8,110

539,072

Buffalo Wild Wings, Inc.*

35,694

1,346,378

Ambac Financial Group, Inc.†

8,400

528,444

Home Depot, Inc.†

27,930

906,049

Sterling Financial Corp.

Hilton Hotels Corp.†

17,960

834,960

30,480

522,732

Yardville National Corp.

15,330

515,548

Harrah’s Entertainment, Inc.

8,950

778,023

Carnival Corp.†

14,980

725,481

U.S.B. Holding Co.†

22,160

514,777

XM Satellite Radio

Allianz AG – SP ADR

21,560

501,701

Holdings, Inc.*†

49,640

703,399

Banco Bilbao Vizcaya

Tribune Co.

Argentaria SA — SP ADR†

20,310

472,817

24,300

663,876

CKX, Inc.*†

48,910

602,082

Federated Investors, Inc. —

Cumulus Media, Inc. —

Class B†

11,600

460,520

ING Groep NV — SP ADR