Listed in the table below are the names, ages and titles of each of the members of the Company’s Executive Committee (which includes all of the Company’s executive officers) as of April 9, 2007. Executive officers are elected by and serve at the discretion of the Board until their successors are duly chosen and qualified.

Mr. Edwardson’s biographical information is provided above in Proposal 1 as he also serves as a director and is seeking reelection.

Pepsico, Inc. and GTE Corporation. Mr. Berger graduated from Northeastern University with a Bachelor’s in Business Administration in 1988 and earned a Master of Business Administration degree from Washington University in St. Louis in 2003.

Douglas E. Eckroteserves as our Senior Vice President – Operations. Mr. Eckrote is responsible for warehousing, distribution, customer relations, facilities, security, technical services, strategy and delivery of CDW services, and CDW Canada, Inc. Mr. Eckrote joined us in January 1989 and since that time has served as an Account Manager, Sales Manager and Director of Operations. Mr. Eckrote was appointed Vice President – Operations in January 1999, Senior Vice President – Purchasing in April 2001 and Senior Vice President – Purchasing and Operations in October 2001. In January 2006 he became Senior Vice President – Operations and in October 2006 he became responsible for CDW Canada, Inc. Mr. Eckrote currently serves as President of the Board for the Center for Enriched Living, and Vice Chair of the Board for the Make A Wish Foundation of Illinois. He is a 1986 graduate of Purdue University where he earned a Bachelor of Science degree in Agricultural Sales and Marketing.

Barbara A. Kleinserves as our Senior Vice President and Chief Financial Officer. Ms. Klein joined us in February 2002 and is responsible for financial planning and analysis, accounting, treasury, tax, risk management, internal audit and investor relations. Prior to joining us she served as Vice President, Finance and Chief Financial Officer of Dean Foods Company, a food and beverage company. Prior to Dean Foods, Ms. Klein served as Vice President and Corporate Controller for Ameritech Corporation. Additionally, Ms. Klein has held senior management positions at Pillsbury and Sears, Roebuck and Co. and currently serves on the Board of Directors of Corn Products International, Inc. Ms. Klein graduated from Marquette University in 1976 with a Bachelor of Science degree in Accounting and Finance and earned a Master of Business Administration degree from Loyola University in 1977. She is a certified public accountant and member of the American Institute of CPAs, the Illinois Society of CPAs, The Chicago Network, Financial Executives Institute and Chicago Finance Exchange.

Christine A. Leahyserves as our Senior Vice President, General Counsel and Corporate Secretary and is responsible for our legal, corporate governance and compliance functions. Ms. Leahy joined us in January 2002 as Vice President, General Counsel and Corporate Secretary. In January of 2007, she was named Senior Vice President. Before joining CDW, Ms. Leahy served as a corporate partner in the Chicago office of Sidley Austin LLP where she specialized in corporate governance, securities law, mergers and acquisitions and strategic counseling. Ms. Leahy received her undergraduate degree from Brown University in 1986 and her J.D. from Boston College Law School in 1991. She also completed the CEO Perspective and Women’s Director Development Programs at Kellogg School of Management at Northwestern University.

Paul S. Shainserves as our Senior Vice President, a role he has served in since January 2007. He also serves as Chief Executive Officer of Berbee Information Networks Corporation, a wholly-owned subsidiary of CDW Corporation, acquired in October 2006. He is responsible for leading the Berbee business and jointly overseeing all aspects of the integration of Berbee into CDW. Prior to joining us, Mr. Shain joined Berbee in 2000 as President and was appointed Chief Executive Officer in 2005. Previously, Mr. Shain was Managing Director and Director of Research for Robert W. Baird & Co., Inc. Mr. Shain graduated from the University of Wisconsin - Madison with a Bachelor’s in Business Administration in 1985 and earned a Master of Business Administration degree from the University Wisconsin – Madison in 1986.

Jonathan J. Stevensserves as our Senior Vice President and Chief Information Officer. Mr. Stevens joined us in June 2001 as Vice President – Information Technology, was named Chief Information Officer in January 2002 and Vice President – International and CIO from 2005 until December 2006. In January 2007, he was named Senior Vice President and Chief Information Officer. Mr. Stevens is responsible for the strategic direction of our information technology and

17

e-commerce initiatives including content, development, online marketing and e-procurement. Prior to joining CDW, Mr. Stevens served as regional technology director for Avanade, an international technology integration company formed through an alliance between Microsoft and Accenture. Previously, Mr. Stevens was a principal with Microsoft Consulting Services and led an IT group for a corporate division of AT&T/NCR. Mr. Stevens is a graduate of the University of Dayton in 1993 where he earned a Bachelor of Science degree in Computer Information Systems Management.

Mark J. Gambillserves as our Vice President, Marketing. Mr. Gambill joined CDW in August 2006 and is responsible for the strategy and development of our advertising, marketing intelligence and research, catalogs and collateral materials, creative services, relationship marketing and corporate communications.Prior to joining CDW, Mr. Gambill served as Vice President of Marketing (2000-2005) and Vice President of Global Strategic Marketing for Manpower, Inc., an employment services company. Prior to Manpower, Inc., Mr. Gambill served as Vice President of Marketing (1997) and Senior Vice President and Chief Marketing Officer (1997-1999) at ESI Corp. Mr. Gambill received his undergraduate degree from Florida State University in 1984 and has completed executive leadership and strategic marketing programs through INSEAD and the University of Chicago. Mr. Gambill is on the advisory board of Market Velocity, Inc.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis describes the material compensation elements for CDW’s named executive officers (“NEOs”), comprised of the Chief Executive Officer, the Chief Financial Officer and the Company’s next three most highly compensated executive officers. The Compensation and Stock Option Committee of CDW’s Board (for purposes of this Compensation Discussion and Analysis, the “Committee”) acts pursuant to a Board approved charter and is responsible for establishing, implementing and reviewing on an annual basis the compensation structure and compensation for our NEOs. Elements of the Company’s compensation program primarily include base salary, annual cash incentives and equity awards of stock options and restricted stock.

Compensation Philosophy and Framework

During 2006, the Committee completed a comprehensive review of the Company’s executive compensation program. The following represents the framework of the compensation program, including the program’s philosophy, objectives, principles and measures of success.

Philosophy

CDW is a leading provider of technology products and services to business, government and education. The Company was built on the core business philosophy known as the CDW CIRCLE OF SERVICE, which places the customer at the center of all of the Company’s actions. The CDW CIRCLE OF SERVICE philosophy is based on the premise that “People Do Business With People They Like” and reflects CDW’s tradition of fostering an entrepreneurial and a personally empowered culture to better serve customers. Fundamental to the continued success of the CDW CIRCLE OF SERVICE philosophy is our ability to motivate executives and managers to drive the Company’s success and to share in the Company’s achievements.

CDW’s vision is to be the world’s biggest — and best — direct technology provider for business, government and education. To support both our vision and the CDW CIRCLE OF SERVICE philosophy, the Committee believes our total compensation program should reinforce

18

pay for performance and promote an entrepreneurial environment in which all key executives and managers are committed to our long-term success. To that end, the compensation philosophy includes the following beliefs:

- The CDW business model is highly dependent on coworkers who think, act and perform with an entrepreneurial spirit – coworkers who aspire to innovate and are passionate about their work.

- Our compensation programs must promote a performance-driven culture that inspires, recognizes and rewards actions that drive (1) customer satisfaction, (2) sustained long-term profitable revenue growth and (3) higher profitability than our peer group.

- To encourage both Company and individual performance, our executive compensation program balances compensation elements that drive focus and commitment to CDW’s long-term success, rewards excellence in execution and achievement of short-term goals, and differentiates truly exceptional individual performance.

Objectives

The primary purpose of CDW’s compensation program is to attract, retain and motivate highly talented executives who will enable the Company to achieve its performance goals. To help accomplish this, we have developed a compensation program that rewards pay for performance. Specific compensation objectives are to:

- Focus executives on the long-term success of the organization while balancing rewards based on both short-term and long-term performance

- Sustain CDW’s position as an innovative, customer-focused industry leader

- Support overall business objectives to profitably grow revenue and outperform our peers

- Provide effective differentiation in rewards based on individual and team performance

- Align our executives’ long-term interests with those of our shareholders

- Promote CDW’s high-performance culture

Principles

The following guiding principles provide a framework for establishing, implementing and reviewing the compensation program:

| | 1. | | Support for our performance-based culture:CDW believes that individual compensation awards should be tied to overall business results and individual performance, with a portion of executive compensation designed to create incentives for superior performance and consequences for below target performance. |

| |

| 2. | | Business strategy alignment:CDW believes in creating a strong link between its total compensation programs and its business strategy and goals by: |

| |

| | | l | | Encouraging profitable growth of the business |

| | | l | | Rewarding achievement of short term operating goals and the execution of long-term strategy |

| | | l | | Clarifying accountability and expectations as executives work to achieve common goals |

| |

| 3. | | Competitiveness in the marketplace in which we compete for talent:To attract and retain talent, the total executive compensation program is competitive with the external market. Overall, the total compensation opportunity compared to a peer group |

19

| | | of companies is intended to create an executive compensation program that provides above median total compensation if performance targets, which are generally set above expected market growth rates, are met or exceeded. |

| |

| | 4. | | Alignment with shareholders’ interests:CDW believes that compensation levels should reflect overall total shareholder returns and be linked to total shareholder returns with shareholder-aligned equity compensation vehicles. |

| |

| 5. | | Affirmation of our values:Supporting the CDW CIRCLE OF SERVICE business philosophy is “The CDW Way,” which represents the cornerstone of our culture and defines our success. Total compensation programs should reflect the following values that guide the Company’s executives and coworkers: |

The CDW Way:

- We run our business with passion and integrity.

- We empower others to do their jobs.

- We keep our commitments.

- We treat others with respect.

- We listen.

- We solve conflict directly.

- We include stakeholders in the decision process.

- We live our “philosophies of success” everyday.

- We make things happen.

Measures of Success

CDW measures the success of our programs by:

- Ability to attract and retain high-performing executive talent

- Executive focus on the Company’s long-term success

- Overall business performance relative to achievement of short-term operating goals

- Ability to effectively differentiate rewards based on team and individual achievement

- A superior rate of return to long-term shareholders

- Sustainability of CDW’s business philosophy and high-performance cultural values

Independent Compensation Consultant

The Committee has the authority under its charter to retain consultants as it deems appropriate to assist the Committee in the discharge of its duties and responsibilities. In accordance with this authority, the Committee has engaged Hewitt as its independent compensation consultant. Hewitt provides input to the Committee on executive compensation trends and the design of the Company’s executive compensation program, and provides advice to the Committee in its decisions regarding the compensation of the Company’s NEOs. During 2006, Hewitt also made initial recommendations to the Committee regarding the compensation philosophy discussed above, based upon its interviews with the Committee and the Company’s senior management and its analysis of competitive data. In addition, Hewitt provides the Committee with other advice and information as requested by the Committee.

Peer Group Companies

The Committee reviews compensation levels and practices at peer group companies in setting the compensation of its NEOs. With the assistance of Hewitt, the Committee selected a compensation peer group consisting of 20 public companies. The peer group is used for perspective purposes

20

only to understand executive compensation levels at companies that are similar to CDW or compete with us for talent. Hewitt provides information regarding compensation levels and practices at and performance comparisons with these companies.

Each of the peer group companies meets one or more of the following criteria:

- The company operates in the same line of business as CDW (e.g., competitors/other technology resellers);

- The company operates close to CDW’s line of business (e.g., technology wholesalers);

- The company operates in a business-to-business distribution environment (e.g., similar core business model to CDW); or

- The company competes with CDW for talent (e.g., Chicago or regional-based companies similar in size to CDW).

In addition, revenue size is considered when determining which companies to include in the peer group. The median annual revenue of the peer group based on public information for the most recent fiscal year is approximately $6.0 billion, which compares to the 2006 revenue of CDW of $6.8 billion.

In 2006, the peer group consisted of the following companies:

| | Anixter International Inc. | NCR Corp. |

| Arrow Electronics Inc. | Office Depot |

| Avaya Inc. | Office Max Incorporated |

| Best Buy Co. Inc. | PC Connection Inc. |

| C.R. Bard, Inc. | Radio Shack Corporation |

| Dade Behring Holdings Inc. | Staples, Inc. |

| GTSI Corporation | Tech Data Corporation |

| Illinois Tool Works | United Stationers Inc. |

| Ingram Micro Inc. | W.W. Grainger, Inc. |

| Insight Enterprise Inc. | WESCO International, Inc. |

The Committee reviews the list of peer group companies on an annual basis and determines whether to amend the peer group based on the company characteristics outlined above.

Further information regarding the Committee’s use of peer group data in setting the compensation of our NEOs is included in this Compensation Discussion and Analysis under Base Salary, Performance-Based Incentive Compensation Annual Cash Incentive Awards and Equity Awards below.

Executive Compensation Practices and Elements

The Company’s compensation program reflects the compensation points outlined above. The practices with respect to each of the compensation elements for NEOs are outlined below, including a discussion of the specific factors considered in determining elements of fiscal 2006 compensation. The principal components of compensation for NEOs were:

- base salary

- annual cash incentive awards

- long term equity awards

21

Compensation elements are designed to focus executives on the long-term success of the organization while rewarding attainment of shorter term annual operating business objectives:

| Principal | | |

| Compensation | | |

| Elements | Short-term (annual) Focus | Long-term (multi-year) Focus |

| Total Compensation = | Base | | Performance-based | | Equity Awards (linked directly |

| | Salary | + | Cash Incentive Awards | + | to overall performance of the |

| | | | l | Primarily based on | | Company) |

| | | | | achievement of operating | | l | Stock options |

| | | | | income goals | | l | Restricted stock |

| | | | l | Secondarily based on | | | |

| | | | | individual performance | | | |

Base Salary

Base salaries are included in the Company’s total compensation package to provide a portion of compensation in a fixed and liquid form. The Committee reviews the base salaries of our NEOs annually and adjusts their base salaries from time to time based on the scope of their responsibilities and Company and individual performance. In addition, the Committee generally sets base salaries for NEOs at below the market median of salaries for executives in similar positions and with similar responsibilities in our peer group.

Mr. Edwardson’s Employment Agreement as described on page 31 of this proxy statement requires the Committee’s annual review of his base salary. The Committee may consider an increase to, but not a decrease to, Mr. Edwardson’s base salary. The Committee sets Mr. Edwardson’s base salary based upon the full Board’s review of his performance. The Committee considers Mr. Edwardson’s recommendations and review of the NEOs’ individual performance when setting the base salaries of the other NEOs.

In keeping with the compensation philosophy to support a performance-driven culture, the Committee believes that base salary should not become a substantial portion of executive compensation. For NEOs in 2006, base salaries were less than 25% of total compensation.

Among the NEOs, the salary for each was changed effective January 1, 2006. Mr. Edwardson’s base salary was increased $30,000 to $760,000. The base salary for Ms. Klein was increased $12,500 to $282,500. The base salary of Mr. Harczak was increased $8,000 to $320,000. The base salary of Mr. Shanks was increased $50,000 to $320,000. The base salary of Mr. Eckrote was increased $10,000 to $260,000.

Performance-Based Incentive Compensation: Annual Cash Incentive Awards

Our NEOs are eligible for annual cash incentive awards under the Company’s Senior Management Incentive Plan (“SMIP”), which was first approved by shareholders at the Annual Meeting in 2000. Under the SMIP, an NEO is paid a cash bonus only if, and to the extent that, performance goals set by the Committee are met. The SMIP ties each NEO’s cash compensation to overall business results and individual performance and creates incentives for superior performance and consequences for below target performance, as described below.

At the beginning of 2006, the Committee set the maximum bonus under Section 162(m) of the Internal Revenue Code for each NEO based on a percentage of net income. The Committee based the actual bonus awards for 2006 on attainment of an operating income objective and personal performance objectives. The actual 2006 bonus awards were less than the maximum bonuses established at the beginning of the year.

22

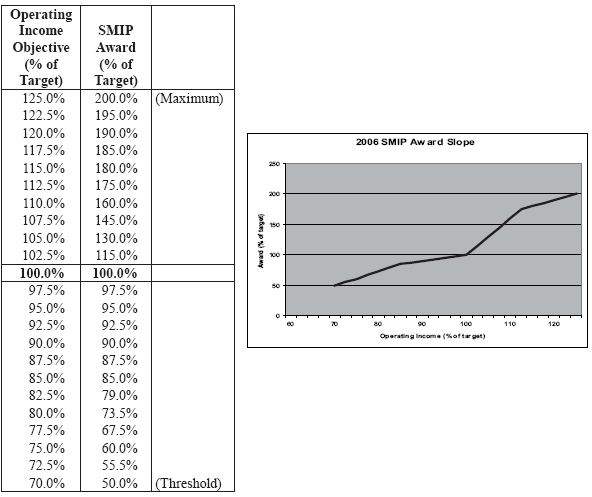

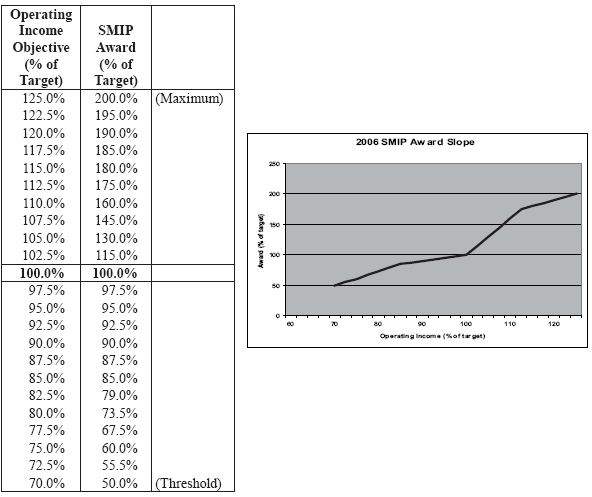

Operating Income Objective:

The Committee chose operating income as the Company performance objective under SMIP for 2006. The calculation of operating income takes into account such key measures as revenue growth, gross margin and operating expense control, which are the primary factors management must balance and control to achieve desired earnings objectives. The Committee set the 2006 operating income target under SMIP to be consistent with the operating income goal approved by the Board as part of the Company’s 2006 annual plan. The operating income goal under the 2006 annual plan was based on above-market revenue growth rates.

The Committee also set the threshold, target and maximum payouts under SMIP based on the level of achievement of the 2006 operating income objective for each NEO, as set forth in the 2006 Grants of Plan-Based Awards Table on page 30 of this proxy statement. In setting the target payout for each NEO, the Committee used as perspective the total cash compensation (base plus bonus) of the peer group companies for similar positions at the 50thand 75thpercentiles of the peer group. The Committee considered the full Board’s review of Mr. Edwardson’s performance when setting his annual incentive target. The Committee considered the recommendations of Mr. Edwardson when setting the annual incentive targets for the other NEOs. The threshold and maximum bonuses then were established by the Committee as a percentage of this target amount. The following table and graph outline the bonus that would be paid (as a percentage of target) based upon how well the Company did against its operating income objective:

23

The Committee determined the threshold for the SMIP award payout beginning at the 70th percentile of the operating income objective and the levels of the payout curve above and below target achievement based on the aggressiveness of the operating income objective (which was tied to above-market revenue growth rates). This payout schedule establishes a strong connection between pay and performance.

Over the past four years, the Company has achieved below the target level set for the company performance objective under SMIP three times and above target once. The payout percentage has ranged between 92.5% and 130% of the SMIP target during these years. The Committee set the operating income goal for 2006 with a level of appropriate aggressiveness that it believed was consistent with that of prior years. For 2006, performance against the operating income objective was below the target level.

- Individual Performance Objectives:

Individual performance objectives under SMIP are linked to the Company’s overall strategy. The full Board set the individual performance objectives for Mr. Edwardson and Mr. Edwardson set the individual performance objectives for the other NEOs. The Committee does not set a target SMIP amount based upon individual performance. Rather, the Committee awards each NEO between 0% and 25% of the SMIP target set above, based upon the Committee’s review of individual performance.

The Committee determined Mr. Edwardson’s 2006 individual performance SMIP award after the full Board reviewed Mr. Edwardson’s performance. Mr. Edwardson reviewed the 2006 performance of the other NEOs with the Committee and the Committee determined each of their 2006 individual performance SMIP awards, taking into consideration Mr. Edwardson’s recommendations.

For 2006, the average individual performance SMIP award for the NEOs was 10.25% of the executives’ Company performance SMIP target. This award level is below the average individual performance SMIP award for these NEOs for the most recent three years.

Equity Awards

The equity award element of the Company’s executive compensation program is designed to motivate leaders to drive Company performance long-term and to ensure that leaders’ interests are aligned with shareholders’ interests by ensuring that compensation levels reflect total shareholder returns. In determining the size of the equity awards to NEOs, the Committee considers:

- the Company’s overall financial performance;

- the executive’s personal contribution to the Company’s performance; and

- total compensation of the peer group companies for similar positions at the 50th and 75th percentiles of the peer group, which the Committee uses as perspective.

The size of Mr. Edwardson’s equity grant is based upon his Employment Agreement, which states that Mr. Edwardson will be granted 150,000 stock options annually, subject to Committee approval.

The Committee grants equity awards under the CDW 2006 Stock Incentive Plan (the “Stock Incentive Plan”) that was approved by shareholders at the 2006 Annual Meeting. The Stock Incentive Plan provides for awards in the form of stock options, restricted stock, restricted stock units and stock appreciation rights. In 2006, NEOs received 67% of the total value of their equity awards in stock options and 33% in restricted stock. The Committee believed this balance was appropriate due to the emphasis on shareholder value creation, as stock option grants only reward executive officers when the stock price increases. Restricted stock grants create an immediate linkage with shareholders as the value of awards to the NEOs is affected by stock price valuation.

24

The Committee awarded Mr. Edwardson with the same mix of stock options and restricted stock as the other NEOs. The total value of Mr. Edwardson’s awards was approximately equivalent to the 150,000 stock option award set forth in his Employment Agreement. The Committee considered the recommendations of Mr. Edwardson when setting the total value of the equity awards to the other NEOs. The number of stock options and restricted stock awards granted to each NEO is set forth in the 2006 Grants of Plan-Based Awards Table on page 30 of this proxy statement.

The stock options granted to NEOs in 2006 vest over a five-year period, with 20% becoming exercisable on each of the first five anniversaries of the grant date, and have a ten-year term. All options are granted with an exercise price equal to the fair market value of the Company’s Common Stock on the grant date. Option repricing without shareholder approval is expressly prohibited by the terms of the Stock Incentive Plan.

The restricted stock awards granted in 2006 vest over a five-year period, with restrictions lapsing on 20% of the shares on each of the first five anniversaries of the grant date. Recipients of restricted stock receive dividends on, and may vote the shares subject to a grant. Shares of restricted stock, however, may not be sold or otherwise transferred prior to the lapse of the restrictions on the shares.

Equity Grant Practices.The Company does not have any program, plan or practice to time equity awards to NEOs in coordination with the release of material non-public information. The Committee has generally followed a practice of making all equity grants to its NEOs, and all other equity award recipients, on a single date each year. Starting in 2006, the Committee determined that it would generally grant equity awards on the date of the Annual Meeting of Shareholders. The Committee chose this date to support consistency in the grant date from year to year, including years in which shareholder approval of a new equity plan or an amendment to an existing equity plan is required.

While the majority of the Company’s equity awards are granted under the annual grant program, the Committee has the right to grant equity awards on other dates and has done so in the case of granting equity awards to newly hired or promoted executives to immediately link their compensation with the long-term performance of the Company.

All options granted to NEOs, other coworkers and directors are granted with an exercise price equal to the fair market value of the Company’s Common Stock on the grant date. Fair market value is defined to be the closing market price of a share of the Company’s Common Stock on the grant date.

Under the terms of the Stock Incentive Plan, the Committee is not permitted to delegate its authority with respect to equity awards to be made to any executive officer. The Committee, however, is permitted to delegate its authority to grant equity awards to other coworkers under the Stock Incentive Plan. The Committee has delegated authority to Mr. Edwardson to award up to 100,000 stock options to coworkers below the manager level on an annual basis.

25

Stock Ownership Guidelines

To further align senior management’s long-term interests with those of shareholders, stock ownership guidelines were established in 2006. The guidelines require equity interests held by officers to be at the following levels within a five-year period:

Stock Ownership Guidelines

| | (As a multiple |

| Position | | of base salary) |

| Chief Executive Officer | 6x |

| Chief Operating Officer or President (Not Currently Applicable) | 5x |

| Executive Vice President | 4x |

| Executive Committee Member | 3x |

| All Other Officers | 1x |

Stock owned by the executive or the executive’s immediate family or trust, stock purchased by the executive under the Company’s Employee Stock Purchase Plan, the after-tax value of all vested stock options, the after-tax value of all shares of unvested restricted stock and all shares of restricted stock that have vested are considered when determining whether the executive has met the stock ownership guidelines.

Benefits and Perquisites

The Company’s NEOs are provided benefits that are generally commensurate with the benefits provided to all CDW coworkers. Consistent with the Company’s performance-based culture, the Company does not offer a service-based defined benefit pension plan or other similar benefits to its coworkers. The Company also does not offer its NEOs perquisites that are often provided at other companies, such as supplemental executive retirement plans, Company matching into a deferred compensation plan, automobile allowance, car or driver, corporate aircraft, country club memberships, financial planning services or tax return preparation. This lack of perquisites reinforces the Company’s pay for performance philosophy.

Deferred Compensation Plan

The Company’s Deferred Compensation Plan allows certain members of senior management, including the NEOs, to defer receipt of salary, bonuses and commissions. Deferred amounts are credited with earnings and losses based upon the rate of return of mutual funds selected by each participant. The Company does not provide any matching contributions on the deferrals under this plan. The Company offers this plan so that eligible participants may defer compensation on a pre-tax basis in excess of the tax law limitations under the Company’s tax-qualified 401(k) plan. A more detailed discussion of the Company’s Deferred Compensation Plan is set forth under the 2006 Nonqualified Deferred Compensation Table on pages 34-35 of this proxy statement.

Separation and Change in Control Arrangements

The Company has entered into an Employment Agreement with Mr. Edwardson that provides for payments and other benefits in connection with a termination of his employment with the Company. The Company also has entered into a Transitional Compensation Agreement with Mr. Edwardson that would govern his employment relationship with the Company for two years after a change in control of the Company. Additional information regarding Mr. Edwardson’s Employment Agreement and Transitional Compensation Agreement, including a quantification of benefits that would have been received by Mr. Edwardson had his employment terminated on December 29, 2006, is provided under the heading Potential Payments Upon Termination or Change in Control on page 35 of this proxy statement.

26

The Company has adopted a Compensation Protection Plan in which each NEO other than Mr. Edwardson participates, which provides for payments and other benefits in connection with a termination of the NEO’s employment with the Company. In addition, the Company has entered into a Transitional Compensation Agreement with each such NEO, which provides for payments and other benefits if he or she is terminated under certain circumstances within two years after a change in control of the Company. Additional information regarding the Compensation Protection Plan and the Transitional Compensation Agreements, including a quantification of benefits that would have been received by each such NEO had his or her employment terminated on December 29, 2006, is provided under the heading Potential Payments Upon Termination or Change in Control on page 35 of this proxy statement.

The Committee believes these arrangements are an important part of overall compensation for the Company’s NEOs. The Committee believes that these arrangements will help to secure the continued employment and dedication of our NEOs prior to or following a change in control, notwithstanding any concern that they might have at such time regarding their own continued employment. In addition, the Committee believes that these arrangements enhance the Company’s value to a potential acquirer because the NEOs have noncompetition, nonsolicitation and confidentiality provisions that apply after any termination of employment, including after a change in control of the Company. The Committee also believes that these arrangements are important as a recruitment and retention device, as all or nearly all of the companies with which we compete for executive talent have similar agreements in place for their senior management.

Tax Deductibility of Compensation

Section 162(m) of the Internal Revenue Code generally disallows a federal income tax deduction to public companies for compensation over $1,000,000 paid to the chief executive officer and the four other most highly compensated executive officers (the “Covered Executives”). Qualified performance-based compensation will not be subject to the deduction limit if certain requirements are met. The Company generally structures the performance-based portion of the compensation of its Covered Executives in a manner intended to comply with this provision so that such amounts will be deductible to the Company. However, there may be circumstances when the Company determines to forgo any or all of the tax deduction to further the long-term interests of our shareholders.

27

Report of The Compensation and Stock Option Committee

The Compensation Committee oversees CDW Corporation’s compensation program on behalf of the Board. In fulfilling its oversight responsibilities, the Compensation Committee reviewed and discussed with management the Compensation Discussion and Analysis set forth in this proxy statement.

In reliance on the review and discussions referred to above, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2006 and the Company’s proxy statement to be filed in connection with the Company’s 2007 Annual Meeting of Shareholders.

COMPENSATION AND STOCK OPTION COMMITTEE

Casey G. Cowell

Stephan A. James

Susan D. Wellington

Brian E. Williams

28

Executive Compensation Tables

The 2006 Summary Compensation Table below summarizes the total compensation paid, earned or awarded to each of our NEOs for the fiscal year ended December 31, 2006. For further information regarding elements of compensation for our NEOs in 2006, please refer to the Compensation and Discussion Analysis on pages 21-27 of this proxy statement.

2006 Summary Compensation Table

| | | | | | | Non-Equity | All | |

| | | | | Stock | Option | Incentive Plan | Other | |

| | | Salary | Bonus | Awards | Awards | Compensation | Compensation | Total |

| Name and Principal Position | Year | ($) | ($)(1) | ($)(2) | ($)(3) | ($)(4) | ($)(5) | ($) |

| John A. Edwardson | 2006 | $ | 760,000 | $ | 629 | $ | 169,677 | $ | 2,560,270 | $ | 1,055,000 | $ | 4,792 | $ | 4,550,368 |

| Chairman of the | | | | | | | | | | | | | | | |

| Board and Chief | | | | | | | | | | | | | | | |

| Executive Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Barbara A. Klein | 2006 | $ | 282,500 | $ | 499 | $ | 34,981 | $ | 453,254 | $ | 537,500 | $ | 4,792 | $ | 1,313,526 |

| Senior Vice | | | | | | | | | | | | | | | |

| President and Chief | | | | | | | | | | | | | | | |

| Financial Officer | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Harry J. Harczak, Jr. | 2006 | $ | 320,000 | $ | 639 | $ | 46,105 | $ | 1,058,934 | $ | 782,925 | $ | 5,042 | $ | 2,213,645 |

| Executive Vice | | | | | | | | | | | | | | | |

| President | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| James R. Shanks | 2006 | $ | 320,000 | $ | 639 | $ | 46,105 | $ | 934,697 | $ | 754,325 | $ | 4,792 | $ | 2,060,558 |

| Executive Vice | | | | | | | | | | | | | | | |

| President | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Douglas E. Eckrote | 2006 | $ | 260,000 | $ | 639 | $ | 30,859 | $ | 861,408 | $ | 618,450 | $ | 4,792 | $ | 1,776,148 |

| Senior Vice President - Operations | | | | | | | | | | | | | | | |

| (1) | The amounts shown in this column reflect each NEO’s portion of a company–wide incentive bonus program based on the partial achievement of specific financial objectives for 2005. |

| |

| (2) | The amounts shown in this column reflect the compensation cost of restricted stock awards attributable to the year ended December 31, 2006. The amount of the compensation cost is computed in accordance with SFAS 123R. Estimates of forfeitures related to service-based vesting conditions which are required under SFAS 123R for financial reporting purposes have been disregarded pursuant to the SEC’s rules governing executive compensation disclosure. See Note 11 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2006 for a discussion of the valuation of these awards. |

| |

| (3) | The amounts shown in this column reflect the compensation cost of stock option awards attributable to the year ended December 31, 2006. The grant date fair value is recognized over the respective service-based vesting period. The stock option awards for which compensation cost was recognized in 2006 were granted from 1996 though 2006 and vary by NEO. The amount of the compensation cost is computed in accordance with SFAS 123R. Estimates of forfeitures related to service-based vesting periods, which are required under SFAS 123R for financial reporting purposes, have been disregarded pursuant to the SEC’s rules governing executive compensation disclosure. See Note 11 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ended December 31, 2006 and the corresponding stock-based compensation footnote to the consolidated financial statements for the years ended December 31, 1996 through 2005 for a discussion of the assumptions made in the valuation of these awards. |

29

| (4) | The amounts shown in this column constitute amounts earned under the Company’s SMIP. One component of an executive’s SMIP award is based upon the attainment of a Company performance objective established by the Compensation Committee at the outset of each year. For fiscal year 2006, the Compensation Committee selected operating income as the Company performance objective for executives. A second component of SMIP awards is based upon the executive’s performance against pre-established individual performance objectives. |

| |

| (5) | The amounts shown in this column include contributions made by the Company on behalf of each NEO to the CDW Corporation Employees’ Profit Sharing Plan. The amounts for the 2006 contributions are estimates, as final calculations have not been completed at the date of this proxy statement. |

2006 Grants of Plan-Based Awards

| | | | | | | All | All Other | | |

| | | | | | | Other | Option | | |

| | | | | | | Stock | Awards: | | |

| | | | | | | Awards: | Number | | |

| | | | | | | Number | of | Exercise | Grant Date |

| | | | | | | of | Securities | or Base | Fair Value |

| | | | Estimated Future Payouts Under | Shares | Under- | Price of | of Stock |

| | | Compensation | Non-Equity Incentive PlanAwards | of Stock | lying | Option | and Option |

| | | Committee | Threshold | Target | Maximum | or Units | Options | Awards | Awards |

| Name | Grant Date | Action Date | ($)(1) | ($)(1) | ($)(1) | (#) (2) | (#) (3) | ($/Sh) | ($)(4) |

| John A. Edwardson | — | — | $ 500,000 | $ 1,000,000 | $ 2,000,000 | | | | |

| | 05/17/2006 | 05/16/2006 | | | | 24,529 | | | $ 1,358,907 |

| | 05/17/2006 | 05/16/2006 | | | | | 100,475 | $ 55.40 | $ 2,491,780 |

| | | | | | | | | | |

| Barbara A. Klein | — | — | $ 250,000 | $ 500,000 | $ 1,000,000 | | | | |

| | 05/17/2006 | 05/16/2006 | | | | 5,057 | | | $ 280,158 |

| | 05/17/2006 | 05/16/2006 | | | | | 20,715 | $ 55.40 | $ 513,732 |

| | | | | | | | | | |

| Harry J. Harczak, Jr. | — | — | $ 357,500 | $ 715,000 | $ 1,430,000 | | | | |

| | 05/17/2006 | 05/16/2006 | | | | 6,665 | | | $ 369,241 |

| | 05/17/2006 | 05/16/2006 | | | | | 27,302 | $ 55.40 | $ 677,090 |

| | | | | | | | | | |

| James R. Shanks | — | — | $ 357,500 | $ 715,000 | $ 1,430,000 | | | | |

| | 05/17/2006 | 05/16/2006 | | | | 6,665 | | | $ 369,241 |

| | 05/17/2006 | 05/16/2006 | | | | | 27,302 | $ 55.40 | $ 677,090 |

| | | | | | | | | | |

| Douglas E. Eckrote | — | — | $ 285,000 | $ 570,000 | $ 1,140,000 | | | | |

| | 05/17/2006 | 05/16/2006 | | | | 4,461 | | | $ 247,139 |

| | 05/17/2006 | 05/16/2006 | | | | | 18,275 | $ 55.40 | $ 453,220 |

| (1) | Consists of awards under the SMIP. For the amounts actually earned by each NEO, please refer to the Non- Equity Incentive Plan Compensation column in the 2006 Summary Compensation Table on page 29 of this proxy statement. The threshold, target and maximum award levels shown in the table above relate only to the component of the SMIP award that is based upon Company performance. An additional component of the SMIP award is based upon individual performance against pre-established individual performance objectives. There is no threshold, target or maximum set for the individual component of the SMIP award. Additional discussion regarding the SMIP award criteria is provided under Compensation Discussion and Analysis on pages 22-24 of this proxy statement. |

| |

| (2) | Consists of shares of restricted stock awarded under the 2006 CDW Stock Incentive Plan. The awards are subject to a service-based vesting schedule; 20% of the awards vest on each of the first through fifth anniversaries of the grant date. |

30

| (3) | Consists of stock options awarded under the 2006 CDW Stock Incentive Plan. The awards are subject to a service-based vesting schedule; 20% of the awards vest on each of the first through fifth anniversaries of the grant date. |

| |

| (4) | See Note 11 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the year ending December 31, 2006 for a discussion of the assumptions made in the valuation of the awards. Amounts are computed as the total shares granted under the award multiplied by the per share grant date fair value; estimated forfeitures over service-based vesting periods have been disregarded. |

Employment Agreement with John A. Edwardson

We entered into an Employment Agreement with Mr. Edwardson on January 28, 2001. The Employment Agreement sets forth, among other things, Mr. Edwardson’s initial base salary of $600,000, which is reviewed by the Compensation Committee on an annual basis and may be increased, but not decreased. For 2006, Mr. Edwardson’s base salary was $760,000.

The Employment Agreement also contemplates that Mr. Edwardson would be granted annually non-qualified stock options to purchase 150,000 shares of the Company’s Common Stock. As described under Compensation Discussion and Analysis on page 24 of this proxy statement, in 2006 the Compensation Committee determined that NEOs would receive 67% of the total value of their equity awards in stock options and 33% in restricted stock. The Committee granted Mr. Edwardson equity awards with the same mix of stock options and restricted stock as the other NEOs, with the total value of his awards approximately equivalent to the 150,000 stock option award called for by his Employment Agreement.

In addition, pursuant to the terms of his Employment Agreement, Mr. Edwardson is entitled to participate in the Company’s Senior Management Incentive Plan and in the Company’s employee benefit plans generally available to executives of the Company.

31

2006 Outstanding Equity Awards At Fiscal Year-End

| | Option Awards | StockAwards |

| | | | Number of | | | Number | | |

| | | Number of | Securities | | | of Shares | Market Value |

| | | Securities | Underlying | | | or Units | of Shares |

| | | Underlying | Unexercised | | | of Stock | or Units of |

| | | Unexercised | Options | Option | | That | Stock Held |

| | Equity | Options | (#) | Exercise | Option | Have Not | That Have Not |

| | Award Grant | (#) | Unexercisable | Price | Expiration | Vested | Vested |

| Name | Date | Exercisable | (1) | ($) | Date | (#) (2) | ($) |

| John A. Edwardson | 01/28/2001 | 1,600,000 | — | $36.63 | 01/28/2011 | | | |

| | 02/01/2002 | 80,000 | 20,000 | $55.63 | 02/01/2012 | | | |

| | 02/01/2003 | 90,000 | 60,000 | $44.09 | 02/01/2013 | | | |

| | 02/02/2004 | 50,000 | 75,000 | $68.00 | 02/02/2014 | | | |

| | 05/02/2005 | 29,900 | 119,960 | $54.86 | 05/02/2015 | | | |

| | 05/17/2006 | — | 100,475 | $55.40 | 05/17/2016 | | | |

| | 05/17/2006 | | | | | 24,529 | $ | 1,724,879 |

| | | | | | | | | |

| Barbara A. Klein | 02/01/2002 | 13,760 | 3,440 | $55.63 | 02/01/2012 | | | |

| | 02/04/2002 | 12,000 | 3,000 | $54.97 | 02/04/2012 | | | |

| | 02/01/2003 | 12,300 | 8,200 | $44.09 | 02/01/2013 | | | |

| | 02/02/2004 | 7,160 | 10,740 | $68.00 | 02/02/2014 | | | |

| | 02/02/2004 | 1,400 | 2,100 | $68.00 | 02/02/2014 | | | |

| | 05/02/2005 | 5,744 | 22,978 | $54.86 | 05/02/2015 | | | |

| | 05/17/2006 | — | 20,715 | $55.40 | 05/17/2016 | | | |

| | 05/17/2006 | | | | | 5,057 | $ | 355,608 |

| | | | | | | | | |

| Harry J. Harczak, Jr. | 12/31/1996 | 9,375 | — | $14.83 | 12/31/2016 | | | |

| | 12/31/1997 | 9,375 | 3,125 | $13.03 | 12/31/2017 | | | |

| | 12/31/1998 | 8,625 | 5,750 | $23.99 | 12/31/2018 | | | |

| | 10/08/1999 | 100,000 | 150,000 | $24.88 | 10/08/2019 | | | |

| | 12/31/2000 | 4,400 | 1,100 | $27.88 | 12/31/2020 | | | |

| | 03/12/2001 | 9,500 | — | $33.38 | 03/12/2021 | | | |

| | 02/01/2002 | 20,000 | 5,000 | $55.63 | 02/01/2012 | | | |

| | 02/01/2003 | 21,000 | 14,000 | $44.09 | 02/01/2013 | | | |

| | 02/02/2004 | 9,440 | 14,160 | $68.00 | 02/02/2014 | | | |

| | 02/02/2004 | 2,000 | 3,000 | $68.00 | 02/02/2014 | | | |

| | 05/02/2005 | 7,586 | 30,344 | $54.86 | 05/02/2015 | | | |

| | 05/17/2006 | — | 27,302 | $55.40 | 05/17/2016 | | | |

| | 05/17/2006 | | | | | 6,665 | $ | 468,683 |

| | | | | | | | | |

32

| | Option Awards | StockAwards |

| | | | Number of | | | Number | |

| | | Number of | Securities | | | of Shares | Market Value |

| | | Securities | Underlying | | | or Units | of Shares |

| | | Underlying | Unexercised | | | of Stock | or Units of |

| | | Unexercised | Options | Option | | That | Stock Held |

| | Equity | Options | (#) | Exercise | Option | Have Not | That Have Not |

| | Award Grant | (#) | Unexercisable | Price | Expiration | Vested | Vested |

| Name | Date | Exercisable | (1) | ($) | Date | (#) (2) | ($) |

| James R. Shanks | 12/31/1996 | 9,375 | — | $14.83 | 12/31/2016 | | |

| | 12/31/1997 | 9,375 | 3,125 | $13.03 | 12/31/2017 | | |

| | 12/31/1998 | 8,625 | 5,750 | $23.99 | 12/31/2018 | | |

| | 10/08/1999 | 100,000 | 150,000 | $24.88 | 10/08/2019 | | |

| | 12/31/2000 | 3,300 | 1,100 | $27.88 | 12/31/2020 | | |

| | 03/12/2001 | 3,800 | — | $33.38 | 03/12/2021 | | |

| | 02/01/2002 | 13,200 | 4,400 | $55.63 | 02/01/2012 | | |

| | 02/01/2003 | 14,760 | 9,840 | $44.09 | 02/01/2013 | | |

| | 02/02/2004 | 7,040 | 10,560 | $68.00 | 02/02/2014 | | |

| | 02/02/2004 | 1,600 | 2,400 | $68.00 | 02/02/2014 | | |

| | 05/02/2005 | 5,744 | 22,978 | $54.86 | 05/02/2015 | | |

| | 05/17/2006 | — | 27,302 | $55.40 | 05/17/2016 | | |

| | 05/17/2006 | | | | | 6,665 | $ 468,683 |

| | | | | | | | |

| Douglas E. Eckrote | 12/31/1996 | 2,125 | — | $14.83 | 12/31/2016 | | |

| | 12/31/1997 | 2,125 | 2,125 | $13.03 | 12/31/2017 | | |

| | 12/31/1998 | 2,875 | 5,750 | $23.99 | 12/31/2018 | | |

| | 10/08/1999 | 47,800 | 150,000 | $24.88 | 10/08/2019 | | |

| | 12/31/2000 | 2,504 | 1,100 | $27.88 | 12/31/2020 | | |

| | 03/12/2001 | 2,472 | — | $33.38 | 03/12/2021 | | |

| | 02/01/2002 | 9,307 | 3,840 | $55.63 | 02/01/2012 | | |

| | 02/01/2003 | 9,453 | 9,000 | $44.09 | 02/01/2013 | | |

| | 02/02/2004 | 6,400 | 9,600 | $68.00 | 02/02/2014 | | |

| | 02/02/2004 | 1,400 | 2,100 | $68.00 | 02/02/2014 | | |

| | 05/02/2005 | 5,169 | 20,676 | $54.86 | 05/02/2015 | | |

| | 05/17/2006 | — | 18,275 | $55.40 | 05/17/2016 | | |

| | 05/17/2006 | | | | | 4,461 | $ 313,698 |

| (1) | The following table provides information with respect to the vesting of each NEO’s outstanding options: |

| Option Grant Date | Vesting Schedule |

12/31/1996

12/31/1997

12/31/1998

10/08/1999

| 12.5% of the options vest 3 years from the date of grant and 12.5% of the options vesteach subsequent year through 10 years from the date of grant |

| |

| 12/31/2000 | 20% of the options vest 3 years from the date of grant and 20% of the options vest each subsequent year through 7 years from the date of grant |

| Grant dates on or | 20% of the options vest each year for 5 years from date of grant |

| after 01/28/2001 | |

33

| (2) | Each NEO’s shares of restricted stock were granted on May 17, 2006 and vest 20% per year for 5 years from the date of grant. |

2006 Option Exercises and Stock Vested

| | OptionAwards |

| | Number of | Value |

| | Shares Acquired | Realized Upon |

| | on Exercise | Exercise |

| Name | (#) | ($) |

| John A. Edwardson | 8,067 | $ | 474,219 |

| | | | |

| Barbara A. Klein | — | $ | — |

| | | | |

| Harry J. Harczak, Jr. | 6,549 | $ | 385,497 |

| | | | |

| James R. Shanks | 6,549 | $ | 383,937 |

| | | | |

| Douglas E. Eckrote | 55,097 | $ | 2,381,507 |

2006 Nonqualified Deferred Compensation

Under the Company’s Deferred Compensation Plan, the Company’s NEOs, in addition to other members of senior management, may defer up to fifty percent (50%) of salary, fifty percent (50%) of commissions and one hundred percent (100%) of SMIP or other bonus compensation on an annual basis, up to a total annual deferral of $200,000. The Company does not make contributions to participants’ accounts under the Deferred Compensation Plan. Deferral amounts are credited with earnings or losses based upon the rate of return of mutual funds selected by the executive, which the executive may change on a quarterly basis.

Unless an in-service distribution is elected, distributions are paid after the earlier to occur of the participant’s death, disability, retirement or other termination of employment, subject to any applicable waiting period imposed by Internal Revenue Code Section 409A. In the case of death, disability or retirement, distributions are paid in a lump sum or installments, as elected by the participant, and in the case of other termination of employment, distributions are paid in a lump sum. An executive may elect a lump sum in-service distribution for a specified date that is at least five (5) years after the end of the year for which the deferral is made. Amounts deferred on or prior to December 31, 2004 may be withdrawn at any time upon the executive’s written request, subject to a penalty of ten percent (10%) of the gross amount of the distribution. In addition, upon a showing of a severe financial hardship, an executive may receive a distribution of all or a portion of his or her deferred compensation account.

34

| | | | | | Aggregate |

| | Executive | Aggregate | Balance at |

| | Contributions | Earnings in | Last Fiscal |

| | in Last Fiscal | Last Fiscal | Year End |

| | Year(2006) | Year(2006) | (12/31/06) |

| Name | ($)(1) | ($)(2) | ($)(3) |

| John A. Edwardson | | — | $ | 134,515 | $ | 1,056,219 |

| | | | | | | |

| Barbara A. Klein | | — | | — | | — |

| | | | | | | |

| Harry J. Harczak, Jr. | $ | 200,000 | $ | 148,519 | $ | 1,446,754 |

| | | | | | | |

| James R. Shanks | $ | 200,000 | $ | 164,070 | $ | 1,389,575 |

| | | | | | | |

| Douglas E. Eckrote | $ | 20,000 | $ | 2,009 | $ | 22,009 |

| (1) | Amounts in this column are included in the “Salary” column of the Summary Compensation Table. |

| |

| (2) | Amounts in this column are not included in the Summary Compensation Table. |

| |

| (3) | Amounts in this column were previously reported in the Summary Compensation Table in previous years as follows: |

| | Deferred Compensation |

| | Plan Balance-Previously |

| Name | Reported Amounts ($) |

| John A. Edwardson | $ | 700,000 |

| Barbara A. Klein | $ | — |

| Harry J. Harczak, Jr. | $ | 900,000 |

| James R. Shanks | $ | 828,000 |

| Douglas E. Eckrote | $ | — |

Potential Payments Upon Termination or Change In Control

As noted under the Compensation Discussion and Analysis on pages 26-27 of this proxy statement, we have entered into an Employment Agreement and a Transitional Compensation Agreement with Mr. Edwardson, which provide for certain payments and benefits upon a qualifying termination of his employment, including after a change in control. The remaining NEOs participate in a Compensation Protection Plan and have entered into Transitional Compensation Agreements with the Company, which provide for certain payments and other benefits upon a qualifying termination of employment, including after a change in control.

A description of the material terms of each of these arrangements, and estimates of the payments and benefits each NEO would receive upon a termination of employment, are set forth below. The estimates have been calculated assuming a termination date of December 29, 2006 and are based upon the closing price of the Company’s Common Stock on that date of $70.32. However, actual payments and benefits to be paid upon a termination of a NEO’s employment with the Company under these arrangements can only be determined at the time of termination.

All of the Company’s NEOs are bound by noncompetition agreements with the Company. Mr. Edwardson is bound by noncompetition and nonsolicitation provisions that apply for a period of two years following any termination of his employment, including after a change in control, and confidentiality provisions that apply for an unlimited period of time following any termination of his employment. The remaining NEOs are bound by noncompetition and nonsolicitation provisions that apply for a period of twelve months (if the NEO is not eligible for severance upon termination) or eighteen months (if the NEO is eligible for severance upon termination) following any termination

35

of employment, including a termination of employment after a change in control. They also are bound by confidentiality provisions that apply for an unlimited period of time following termination.

Termination Payments and Benefits Outside of a Change in Control

John A. Edwardson

We entered into an Employment Agreement with Mr. Edwardson on January 28, 2001 that provides for payments and other benefits in connection with the termination of his employment with the Company outside of a change in control.

If Mr. Edwardson’s employment is terminated due to Mr. Edwardson’s death or disability, Mr. Edwardson would receive the following payments and benefits under the Employment Agreement: (1) accrued base salary; (2) any SMIP bonus earned and payable, but not yet paid, for the prior fiscal year; (3) pro rata SMIP bonus (based upon target) for the year in which the termination occurs, through the date of termination; (4) any employee benefits to which Mr. Edwardson is otherwise entitled; and (5) immediate vesting of all of his outstanding equity awards. If Mr. Edwardson’s employment is terminated by the Company for “cause” or by Mr. Edwardson without “good reason”, Mr. Edwardson would receive only the benefits described in (1), (2) and (4) above. If Mr. Edwardson’s employment is terminated by the Company without “cause” or by Mr. Edwardson for “good reason,” both as defined below, Mr. Edwardson would receive the payments and benefits described in (1) through (4) above and the following additional payments and benefits: (1) a lump sum payment of two times the sum of his base salary plus his average annual incentive bonus for the last three full fiscal years and (2) immediate vesting of one-half of his outstanding equity awards.

The Company has “cause” to terminate Mr. Edwardson’s employment under the Employment Agreement if he refuses to follow directions of the Company’s Board consistent with the scope and nature of his duties and responsibilities, acts with gross negligence or willful misconduct which results in a material loss to or material damage to the reputation of the Company or any of its subsidiaries, is convicted of a felony, or takes other actions specified in the definition. Mr. Edwardson has “good reason” to terminate his employment under the Employment Agreement if, subject to a right to cure for isolated, insubstantial or inadvertent actions not in bad faith: (1) the Company assigns him any duties materially inconsistent with his position; (2) the Company fails to pay him the compensation set forth in his Employment Agreement; (3) the Company requires that his principal office be relocated more than 50 miles outside the greater Chicago metropolitan area; (4) the Company breaches his Employment Agreement in any material way; or (5) the Board does not reelect him to the office of Chairman of the Board at its meeting following each annual meeting of shareholders.

If Mr. Edwardson’s employment terminates due to his retirement, he is not eligible for any payments or benefits under his Employment Agreement. If Mr. Edwardson’s employment terminates due to his retirement after he has (1) attained the age of 62 and (2) served at least ten years with the Company, under the terms of the Company’s equity plans, all of his outstanding stock options would continue to vest in accordance with the applicable vesting schedule even after he retires. As of December 29, 2006, Mr. Edwardson had not attained the age of 62.

Named Executive Officers Other than Mr. Edwardson

With respect to the Company’s NEOs other than Mr. Edwardson, the Company has adopted a Compensation Protection Plan in which each such NEO participates, which provides for payments and other benefits upon a termination of the NEO outside of a change in control for any reason other than a non-qualifying termination as defined in the plan. A non-qualifying termination means (1) a termination by the Company for cause (as defined below); (2) a termination due to the NEO’s death, disability or retirement; (3) a voluntary termination of employment by the NEO; (4)

36

the transfer of the named executive officer’s employment to a subsidiary or affiliate of the Company; (5) the divestiture by the Company of the subsidiary, division or operation that employs the NEO and the continuance, or offer, of employment by the new or acquiring entity with cash compensation no less favorable to the NEO in the aggregate as in effect immediately prior to such disposition or of such other terms and conditions acceptable to the NEO; or (6) a termination of employment of the NEO under circumstances that entitle him or her to receive salary and bonus replacement pursuant to the terms of his or her Transitional Compensation Agreement with the Company.

The Company has “cause” to terminate a NEO’s employment under the Compensation Protection Plan if he or she has engaged in any of a list of specified activities, including refusing to perform duties consistent with the scope and nature of his or her position, committing an act materially detrimental to the financial condition and/or goodwill of the Company or its subsidiaries, commission of a felony, or other actions specified in the definition.

If the NEO is terminated for reasons other than a non-qualifying termination, the NEO would receive the following payments and benefits: (1) accrued base salary; (2) pro rata portion of the SMIP bonus the NEO would have received had he or she remained employed by the Company for the full year in which the termination occurs, through the date of termination; (3) continuation in accordance with the Company’s regular payroll practices of the NEO’s base salary for two years; (4) payment of two times the NEO’s SMIP bonus that would have been earned had the NEO remained employed by the Company for the full year in which the termination occurs, which payment would be made in two equal installments on the first and second anniversaries of the NEO’s termination date; (5) continuation of medical, dental, accident and life insurance coverage for two years, or if earlier, the date that the NEO became eligible for each such type of insurance coverage from a subsequent employer; and (6) outplacement services of up to $20,000. The receipt of all of the payments and benefits above, except payment of accrued base salary, is conditioned upon the NEO’s execution of a general release agreement in which he or she waives all claims that he or she might have against the Company and certain associated individuals and entities. The Compensation Protection Plan does not include acceleration or continuation of vesting under any of our equity plans.

As set forth above in the definition of a non-qualifying termination, if a NEO’s employment terminates due to his or her death, disability or retirement, he or she is not eligible for any payments or benefits under the Compensation Protection Plan. However, if a NEO’s employment with the Company terminates due to his or her death or disability, all of the NEO’s outstanding equity awards would immediately vest under the terms of each of the Company’s equity plans. If the NEO’s employment terminates due to his or her retirement after he or she has (1) attained the age of 62 and (2) served at least ten years with the Company, under the terms of the Company’s equity plans, all of his or her outstanding stock options would continue to vest in accordance with the applicable vesting schedule even after he or she retires. As of December 29, 2006, no NEO had attained the age of 62.

Termination Payments and Benefits After a Change in Control

John A. Edwardson

The Company has entered into a Transitional Compensation Agreement with Mr. Edwardson that would govern Mr. Edwardson’s employment relationship with the Company for two years after a change in control of the Company. A change in control under the Agreement means (1) an acquisition by a person or group of both 25% or more of the Company’s voting stock and voting power equal to or in excess of the voting power held by the Michael P. Krasny family (excluding an acquisition from or by the Company or by a Company benefit plan, by a member of the Michael P. Krasny family, or certain reorganizations, mergers or consolidations), (2) a change in a majority of the Board of the Company, or (3) a reorganization, merger or consolidation (unless stockholders receive more than 50% of the combined voting power of the surviving company) or a liquidation, dissolution or sale of substantially all of the Company’s assets.

37

Mr. Edwardson’s Transitional Compensation Agreement provides that all unvested stock options, restricted stock and other equity awards to Mr. Edwardson will vest in full upon a change in control of the Company, and will remain exercisable for the period provided in the applicable award agreement.

If Mr. Edwardson’s employment is terminated due to Mr. Edwardson’s death or disability under the terms of the Transitional Compensation Agreement, Mr. Edwardson would receive the following payments and benefits: (1) all accrued obligations, including under the Company’s employee benefit plans; and (2) pro rata SMIP bonus (based upon target) for the year in which the termination occurs, through the date of termination. If Mr. Edwardson’s employment is terminated by the Company with “cause” or by Mr. Edwardson without “good reason,” Mr. Edwardson would receive only the benefits described in (1) above. However, the Compensation Committee may award Mr. Edwardson the benefits described in (2) above if he terminates his employment without “good reason” or due to his retirement. If Mr. Edwardson’s employment is terminated by the Company without “cause,” by Mr. Edwardson for “good reason” or by Mr. Edwardson for any reason during the 30-day period commencing six months after the date of the change in control, Mr. Edwardson would receive the payments and benefits described in (1) and (2) above and the following additional payments and benefits: (1) a lump sum payment of 300% of Mr. Edwardson’s base salary in effect prior to his termination; (2) a lump sum payment of 300% of his average SMIP bonus for the last three full fiscal years; and (3) continuation of all welfare benefits and senior executive perquisites for two years after termination or an equivalent cash payment. If the payments and benefits to Mr. Edwardson under his Transitional Compensation Agreement would subject him to the excise tax imposed by Section 4999 of the Internal Revenue Code, he would be entitled to receive a “gross-up” payment, unless his net after-tax benefit resulting from such gross-up payment, as compared to a reduction of such payments and benefits so that no excise tax is incurred, is less than $100,000.

The definition of cause and good reason differ somewhat from the definitions of these terms under Mr. Edwardson’s Employment Agreement. Under Mr. Edwardson’s Transitional Compensation Agreement, the Company has “cause” to terminate Mr. Edwardson’s employment if he has engaged in any of a list of specified activities, including the commission of an act materially and demonstrably detrimental to the financial condition and/or goodwill of the Company or its subsidiaries, conviction of a felony involving moral turpitude (other than those based on vicarious liability) or commission of other acts specified in the definition. Mr. Edwardson will have “good reason” to terminate his employment with the Company if he is not re-elected as the Chairman, President and Chief Executive Officer of the Company, he is assigned duties inconsistent with his position, authority, duties or responsibilities, or any other action by the Company that results in a substantial diminution of his position, authority, duties or responsibilities (subject to a right to cure for isolated, insubstantial and inadvertent actions), any reduction in his compensation (subject to a right to cure for isolated, insubstantial and inadvertent actions), reassignment to an office location more than 50 miles outside or the Greater Chicago metropolitan area, or under other circumstances specified in the definition.

Named Executive Officers Other Than Mr. Edwardson

The Company has entered into a Transitional Compensation Agreement with each NEO that provides for payments and other benefits if he or she is terminated under certain circumstances within two years after a change in control of CDW Corporation. Any payments and benefits received by a NEO upon a termination of employment under his or her Transitional Compensation Agreement are in lieu of payments of benefits under the Compensation Protection Plan. The definition of a change in control under the Transitional Compensation Agreements is the same as the definition of a change in control under Mr. Edwardson’s Transitional Compensation Agreement, which is described above.

38

Each NEO is eligible to receive the payments and benefits outlined in his or her Transitional Compensation Agreement if the NEO is terminated by the Company without cause or the NEO terminates his or her employment for good reason within 2 years following a change in control. The NEO is not eligible for the payments and benefits under his or her Agreement if the NEO’s employment terminates due to his or her death or disability.

The Company has “cause” to terminate the NEO’s employment under the Transitional Compensation Agreement if the NEO has engaged in any of a list of specified activities, including the commission of an act materially and demonstrably detrimental to the financial condition and/or goodwill of the Company or its subsidiaries, the NEO has been convicted of a felony involving moral turpitude (other than those based on vicarious liability) or commission of other acts specified in the definition. This definition is somewhat narrower than the definition of cause under the Compensation Protection Plan applicable to these NEOs.

Under the Transitional Compensation Agreements, unlike under the Compensation Protection Plan, the NEO may terminate his or her employment for good reason and receive the same payments and benefits as if he or she had been terminated by the Company without cause. The NEO has “good reason” to terminate his or her employment if (1) there is a change in the NEO’s reporting responsibilities, titles or offices with the Company as in effect immediately prior to the change in control that is adverse to the NEO; (2) the NEO is assigned duties inconsistent with the NEO’s position, authority, duties, responsibilities or status, or the Company takes any other action that results in a substantial diminution of the NEO’s position, authority, duties, responsibilities or status (subject to a right to cure for isolated, insubstantial and inadvertent actions not made in bad faith); (3) there is any reduction in the NEO’s compensation (subject to a right to cure for isolated, insubstantial and inadvertent actions not made in bad faith); (4) the NEO is reassigned to an office location more than 50 miles from the NEO’s place of employment at the time of the change in control; or (5) there are other circumstances specified in the definition.

If the NEO’s employment is terminated by the Company without cause or by the NEO for good reason within two years following a change in control, the NEO would receive the following payments and benefits: (1) payment of all accrued obligations through the date of termination in a lump sum; (2) pro rata SMIP bonus (based upon target) for the year in which the termination occurs, through the date of termination; (3) a lump sum payment of 250% of the NEO’s highest base salary during the 12 month period prior to the date of termination; (4) a lump sum payment of 250% of the NEO’s SMIP bonus, calculating the amount of the bonus as the higher of the NEO’s target SMIP bonus in the year in which the change in control occurs and the NEO’s average SMIP bonus in the last three full fiscal years; (5) continuation of all welfare benefits for a period of two years or an equivalent cash payment; and (6) outplacement services of up to $20,000. If the payments and benefits to a NEO under the Transitional Compensation Agreement would subject the NEO to the excise tax imposed by Section 4999 of the Internal Revenue Code, the NEO would be entitled to receive a “gross-up” payment, unless the NEO’s net after-tax benefit resulting from such gross-up payment, as compared to a reduction of such payments and benefits so that no excise tax is incurred, is less than $100,000.

While the Transitional Compensation Agreements do not contain a provision regarding acceleration of equity awards, all equity awards under the Company’s 2000 Incentive Stock Option Plan and 2006 Stock Incentive Plan would immediately vest upon a change in control. Unvested options under the Company’s 1996 Incentive Stock Option Plan and the Company’s Incentive Stock Option Plan would either immediatelyvest or would be substituted with options of the acquiring company, as determined by the Company’s Board or a committee thereof. For purposes of all estimates contained in this proxy statement, we have assumed that all outstanding equity awards become vested upon the change in control.

39

Estimated Termination and Change in Control Payments

Assuming that the termination of the NEO’s employment or the change in control referenced in the charts below occurred on December 29, 2006, the following is an estimate of the payments and benefits that each NEO would have received in addition to any accrued obligations:

John A. Edwardson

| | | | Unvested | | | | |

| | | Unvested | Restricted | Welfare | | | |

| | Severance | Stock Option | Stock | Benefit | | | |

| | Payments | Acceleration | Acceleration | Continuation | | Tax Gross-Up | TOTAL |

| Type of Termination | (1) | (2) | (3) | (4)(5) | Outplacement | Payment (6) | (7) |

| Voluntary | | | | | | | | | | | | | | | | |

| Termination by | | | | | | | | | | | | | | | | |

| the Executive | | | | | | | | | | | | | | | | |

| without | | | | | | | | | | | | | | | | |

| Good Reason | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | $ 0 | $ 0 | | $ 0 |

| Voluntary | | | | | | | | | | | | | | | | |

| Termination by | | | | | | | | | | | | | | | | |

| the Executive | | | | | | | | | | | | | | | | |

| with Good Reason | $ | 3,747,834 | | $ | 2,550,733 | | $ | 862,440 | | | $ 0 | | $ 0 | $ 0 | $ | 7,161,007 |

| Death/Disability | | $ 0 | | $ | 5,101,465 | | $ | 1,724,880 | | | $ 0 | | $ 0 | $ 0 | $ | 6,826,345 |

| Retirement | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | $ 0 | $ 0 | | $ 0 |

| Involuntary | | | | | | | | | | | | | | | | |

| Termination by | | | | | | | | | | | | | | | | |

| the Company | | | | | | | | | | | | | | | | |

| without Cause | $ | 3,747,834 | | $ | 2,550,733 | | $ | 862,440 | | | $ 0 | | $ 0 | $ 0 | $ | 7,161,007 |

| Involuntary | | | | | | | | | | | | | | | | |

| Termination by | | | | | | | | | | | | | | | | |

| the Company | | | | | | | | | | | | | | | | |

| with Cause | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | $ 0 | $ 0 | | $ 0 |

| Change in | | | | | | | | | | | | | | | | |

| Control without | | | | | | | | | | | | | | | | |

| a Qualifying | | | | | | | | | | | | | | | | |

| Termination | | $ 0 | | $ | 5,101,465 | | $ | 1,724,880 | | | $ 0 | | $ 0 | $ 0 | $ | 6,826,345 |

| Change in | | | | | | | | | | | | | | | | |

| Control with | | | | | | | | | | | | | | | | |

| a Qualifying | | | | | | | | | | | | | | | | |

| Termination | $ | 5,621,750 | | $ | 5,101,465 | | $ | 1,724,880 | | $ | 6,043 | | $ 0 | $ 0 | $ | 12,454,138 |

40

| Barbara A. Klein |

| |

| | | Unvested | Unvested | | | | |

| | | Stock | Restricted | Welfare | | | |

| | Severance | Option | Stock | Benefit | | Tax Gross-Up | |

| | Payments | Acceleration | Acceleration | Continuation | Outplacement | Payment | TOTAL |

| Type of Termination | (1) | (2) | (3) | (4) | (8) | (6) | (7) |

| Voluntary | | | | | | | | | | | | | | | | | | | | |

| Termination by | | | | | | | | | | | | | | | | | | | | |

| the Executive | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 |

| Death/Disability | | $ 0 | | $ | 909,186 | | $ | 355,610 | | | $ 0 | | | $ 0 | | | $ 0 | | $ | 1,264,796 |

| Retirement | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 |

| Involuntary | | | | | | | | | | | | | | | | | | | | |

| Termination By | | | | | | | | | | | | | | | | | | | | |

| the Company | | | | | | | | | | | | | | | | | | | | |

| without Cause | $ | 1,640,000 | | | $ 0 | | | $ 0 | | $ | 6,770 | | $ | 20,000 | | | $ 0 | | $ | 1,666,770 |

| Involuntary | | | | | | | | | | | | | | | | | | | | |

| Termination by | | | | | | | | | | | | | | | | | | | | |

| the Company | | | | | | | | | | | | | | | | | | | | |

| with Cause | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 | | | $ 0 |

| Change in | | | | | | | | | | | | | | | | | | | | |

| Control without | | | | | | | | | | | | | | | | | | | | |

| a Qualifying | | | | | | | | | | | | | | | | | | | | |

| Termination | | $ 0 | | $ | 909,186 | | $ | 355,610 | | | $ 0 | | | $ 0 | | | $ 0 | | $ | 1,264,796 |

| Change in | | | | | | | | | | | | | | | | | | | | |

| Control with | | | | | | | | | | | | | | | | | | | | |

| a Qualifying | | | | | | | | | | | | | | | | | | | | |

| Termination | $ | 2,131,667 | | $ | 909,186 | | $ | 355,610 | | $ | 6,770 | | $ | 20,000 | | $ | 935,754 | | $ | 4,358,987 |

| |

| Harry J. Harczak, Jr. |

| |

| | | | Unvested | | | | | | | |

| | | Unvested | Restricted | Welfare | | | | | | |

| | Severance | Stock Option | Stock | Benefit | | Tax Gross-Up | | | |

| | Payments | Acceleration | Acceleration | Continuation | Outplacement | Payment | | TOTAL |

| Type of Termination | (1) | (2) | (3) | (4) | (8) | (6) | | (7) |

| Voluntary | | | | | | | | | | | | | | | | | | | |

| Termination by | | | | | | | | | | | | | | | | | | | | |