SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x | | |

|

Filed by a Party other than the Registrant ¨ | | |

|

| Check the appropriate box: | | |

|

x Preliminary Proxy Statement ¨ Definitive Proxy Statement ¨ Definitive Additional Materials ¨ Soliciting Material Pursuant to §240.14a-12 | | ¨ Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

CALYPTE BIOMEDICAL CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

1265 Harbor Bay Parkway

Alameda, California 94502

January 9, 2003

Dear Stockholder:

You are cordially invited to attend Calypte Biomedical Corporation’s Special Meeting of Stockholders on Friday, February 14, 2003. The meeting will begin promptly at 8:00 a.m. local time, at the Company’s offices located at 1265 Harbor Bay Parkway, Alameda, California 94502.

The official Notice of Special Meeting of Stockholders, Proxy Statement and form of proxy are included with this letter. The matter listed in the Notice of Meeting of Stockholders is described in detail in the Proxy Statement. We are also enclosing for your information a copy of Calypte’s 2001 Annual Report to Stockholders.

Your vote is important. Whether or not you plan to attend the meeting, I urge you to complete, sign and date the enclosed proxy card and return it in the accompanying envelope as soon as possible so that your stock may be represented at the meeting.

Sincerely,

Anthony J. Cataldo

Executive Chairman

1265 Harbor Bay Parkway

Alameda, California 94502

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To be held on February 14, 2003

A Special Meeting of Stockholders of Calypte Biomedical Corporation (the “Company”) will be held at the Company’s headquarters offices located at 1265 Harbor Bay Parkway, Alameda, California, 94502, on Friday, February 14, 2003, at 8:00 a.m. local time, for the following purpose:

| | 1. | | To amend the Company’s Amended and Restated Certificate of Incorporation to effect an increase in the number of authorized shares of the Company’s Common Stock from 200,000,000 to 800,000,000. |

Stockholders of record on December 16, 2002 will be eligible to vote at this meeting. Only stockholders of record at the close of business on such date will be entitled to notice of and to vote at the meeting. To ensure your representation at the meeting, you are urged to mark, sign, date and return the enclosed proxy as promptly as possible in the envelope enclosed for that purpose. If you attend the meeting, you may vote in person even if you return a proxy.

By order of the Board of Directors,

Nancy E. Katz

President and Chief Executive Officer

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the meeting, please complete and return the proxy card in the envelope provided, which requires no postage if mailed in the United States.

1265 Harbor Bay Parkway

Alameda, California 94502

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Calypte Biomedical Corporation (“Calypte” or the “Company”) for the Special Meeting of Stockholders (the “Special Meeting”), and any postponements or adjournments thereof, to be held at the Company’s principal executive offices located at 1265 Harbor Bay Parkway, Alameda, California 94502, on Friday, February 14, 2003, at 8:00 a.m. local time. The telephone number at that address is (510) 749-5100. Every stockholder shall have the right to vote whether in person or by one or more agents authorized by a written proxy signed by the stockholder and filed with the secretary of the Company. The shares represented by the proxies received, properly dated and executed, and not revoked will be voted at the Annual Meeting. A proxy may be revoked at any time before it is exercised by delivering to the Company a written notice of revocation or a duly executed proxy bearing a later date or by attending the Annual Meeting and voting in person.

INFORMATION CONCERNING SOLICITATION AND VOTING

The close of business on December 16, 2002 has been fixed as the record date (the “Record Date”) for determining the holders of shares of Common Stock of the Company, par value $.001 per share (“Common Stock”) entitled to notice of and to vote at the Special Meeting. As of the close of business on the Record Date, the Company had 139,127,447 shares of Common Stock outstanding and entitled to vote at the Special Meeting. The holders of a majority of voting power of the Common Stock issued and outstanding and entitled to vote, present in person or represented by proxy, shall constitute a quorum at the Special Meeting except as otherwise provided by statute. Each holder of Common Stock on the Record Date is entitled to one vote for each share of Common Stock held by such stockholder, and stockholders shall not be entitled to cumulate their votes with respect to any matter submitted to a vote of the stockholders.

Shares represented by proxies that reflect abstentions or broker non-votes will be counted as shares that are present and entitled to vote for purposes of determining the presence of a quorum. The Board may adjourn the Special Meeting, if necessary, to a later date in order to enable the Board of Directors to continue to solicit additional proxies in favor of the Proposal.

With respect to the Proposal, the affirmative vote of a majority of the shares of the Company’s Common Stock issued and outstanding as of the Record Date and entitled to vote is required for approval. Abstentions will be treated as shares that are present or represented and entitled to vote for purposes of determining the presence of a quorum but will not be treated as votes in favor of approval. Thus, abstentions have the effect of negative votes on the proposal. If no specific instructions are given in the proxy, the shares will be voted for approval of the Proposal. Shares as to which proxy authority has been withheld with respect to the Proposal, including broker non-votes, will not be considered as present or represented with respect to the proposal but will otherwise have the same effect as a negative vote on the Proposal.

The shares represented by all valid proxies received will be voted in the manner specified on the proxies. Where specific choices are not indicated, the shares represented by all valid proxies received will be voted for the authorization of an amendment to the Company’s Amended and Restated Certificate of Incorporation to effect an increase in the number of shares of the Company’s Common Stock.

The expense of printing and mailing proxy materials will be borne by the Company. In addition to the solicitation of proxies by mail, solicitations may be made by certain directors, officers and other employees of

1

the Company by personal interview, telephone or facsimile. No additional compensation will be paid for such solicitation. The Company may also at its discretion retain the services of a paid solicitor to solicit proxies. If the Company retains a solicitor, it is anticipated that the cost will be approximately $10,000 and will be paid by the Company. The Company will request brokers and nominees who hold stock in their names to furnish proxy material to beneficial owners of the shares and will reimburse such brokers and nominees for their reasonable expenses incurred in forwarding solicitation material to such beneficial owners.

Employment Agreements

In October 2002, the Company entered into a new employment agreement with Nancy E. Katz as the President and Chief Executive Officer of the Company, which provides for an annual salary of $300,000. The Company has deferred approximately 8% of Ms. Katz’s cash compensation, which it is accruing, until such time as Ms. Katz and the Company mutually agree that the Company is in a financial position to compensate here in accordance with the terms of her contract. In addition, Ms. Katz was granted 4,400,000 options, subject to shareholder approval, exercisable at $0.08, all of which will vest immediately. The measurement date for this grant will be upon stockholder approval of a future proposal to significantly increase the share authorization for the Company’s 2000 Equity Incentive Plan and to permit annual grants of up to 10 million shares to an individual plan participant and may result in compensation expense for any intrinsic value on that date. Ms. Katz is also entitled to potential annual bonuses and increases in her base salary subject to annual review of her performance by the Company’s Compensation Committee during the term of her agreement. In the event of a change in control of the Company or if Ms. Katz is discharged without cause, she will be entitled to receive the balance of any compensation due to her under the agreement, but in no event will she receive less than twelve months of severance payments.

In May 2002, the Company entered into an agreement with Anthony J. Cataldo, the Company’s current Executive Chairman of the Board of Directors, to serve through May 10, 2007. The agreement provides for an annual salary of $400,000. In the event of a change in control of the Company or if Mr. Cataldo is discharged without cause, he will be entitled to receive the balance of any compensation due to him under the agreement, but in no event will he receive less than twelve months of severance payments. In addition, Mr. Cataldo was granted 1,966,666 fully vested stock options exercisable at $.015 per share and 6,000,000 stock options exercisable at $.03 per share. Of the 6,000,000 options exercisable at $.03 per share, 3,000,000 options were exercisable upon grant, with the balance becoming exercisable upon the one (1) year anniversary of the grant. The aforementioned options are exercisable for a period of five (5) years from the date of grant. Mr. Cataldo is also eligible for a bonus upon an annual review of his performance.

In October 2002, the Company renegotiated the terms of the option grant contained in Mr. Cataldo’s Employment Agreement, canceling the option grants in excess of the 900,000 shares permitted by the Company’s 2000 Equity Incentive Plan to be issued annually to one plan participant and deferring a portion of his salary. An additional 7,066,666 of the previously granted options will be reissued out of the Company’s 2000 Equity Inventive Plan, subject to stockholders approval of a future proposal to significantly increase the share authorization for that Plan and to permit annual grants of up to 10 million shares to an individual plan participant. The Company has also deferred approximately 30% of Mr. Cataldo’s cash compensation, which the Company is accruing, until such time as Mr. Cataldo and the Company mutually agree the Company is in a financial position to compensate him in accordance with the terms of his agreement. In return for these concessions, the 7,066,666 options will be fully vested upon future stockholder approval. All other terms and conditions of the original grant remain unchanged. This modification in terms will trigger a new measurement date upon stockholder approval and may result in compensation expense for any intrinsic value on that date.

In May 2002, concurrent with the appointment of Mr. Cataldo, David Collins, the Company’s former Chairman, resigned as Chairman and as a member of the Company’s Board of Directors. There were no conflicts with the Company’s Board or management leading to Mr. Collins’ resignation. The Company cancelled all unvested options previously granted to Mr. Collins.

2

Certain Relationships and Related Transactions

In August 2001, the Company executed a promissory note in the amount of $400,000 to LHC Corporation, the parent company of Trilobite Lakes Corporation (“Trilobite”), its then-largest stockholder who currently holds approximately 1.2 million shares of the Company’s Common Stock. Trilobite is an affiliate of Claneil Enterprises, Inc. David Collins, the former Chairman of the Board of Calypte serves on the Board of Directors of Claneil and is a member of Claneil’s Compensation Committee. Pursuant to the Common Stock Purchase Agreement dated March 2, 2000, Claudie Williams, a representative designated by Trilobite was elected to Calypte’s Board of Directors. The Calypte Board will nominate a representative selected by Trilobite for election to the Calypte Board for so long as Trilobite holds one-half of the shares it acquired through the Common Stock Purchase Agreement. The note required interest at 8.5% per annum and principal plus accrued interest was due no later than September 14, 2001. The note was secured by certain inventory and accounts receivable. In December 2001, the parties agreed to execute a new note in the amount of $411,000, representing the unpaid principal and accrued but unpaid interest on the previous note. This note bears interest at 8.5% and was due in installments of $200,000 on February 28, 2002 and $35,000 per month thereafter until paid in full, plus accrued interest. On February 21, 2002, the Company renegotiated the payment terms to require monthly principal payments of $17,500 in February and March 2002, increasing to $35,000 thereafter unless and until the Company secured at least $2 million in additional financing, excluding the convertible debentures and warrant agreements entered into on February 11, 2002, at which time a $200,000 principal payment would be required. The Company made the required payment on February 28, 2002. On March 28, 2002 the Company again renegotiated the payment terms of this note, suspending any required principal or interest payments until the Company’s registration statement for the convertible debentures becomes effective, at which time the Company is required to resume making monthly payments of $35,000. No payments have been made on this note since February 2002.

In November 2001, the Company sold 1,575,855 shares of Common Stock under Regulation D to various investors in a private placement at $0.19 per share, receiving net proceeds of $295,000. The private placement did not include registration rights. Therefore, pursuant to Rule 144 of the Securities Act, the transfer of the securities purchased by the investors will be restricted for twelve months from the date of purchase. Two current members of the Company’s Board of Directors, Nancy Katz, and Mark Novitch, and the Company’s former Chairman, David Collins, purchased an aggregate of 721,154 shares of this offering.

In February 2002, the Company was experiencing financial difficulty in that it lacked sufficient working capital. As such, the Board determined to exercise its business judgment in an effort to continue business operations and preserve stockholders’ equity. The Company entered into an arrangement with Bristol Investment Fund, Ltd. whereby the Company issued two $425,000 debentures and an A warrant to purchase 1.7 million shares of common stock and a B warrant to purchase 12 million shares of common stock. The Class A and B warrants were intended to act as consideration for the investment by Bristol and provide the Company with immediate cash upon their exercise. The Class B warrant was intended to provide the Company with cash over a one year period following the effective date of the registration statement for the shares underlying the debentures and warrants.

The Company entered into an arms length letter agreement with Cataldo Investment Group (“CIG”) in May 2002. CIG is essentially a de facto entity comprised of a number of unaffiliated investors assembled by Mr. Anthony Cataldo, the Company’s executive chairman to facilitate investments in the Company. Mr. Cataldo does not have an affiliation or any agreements with any of the individual investors that are categorized as CIG. As a condition precedent to the initial investment, Mr. Cataldo requested that he be appointed executive chairman in connection with the restart of the Company’s operation. Additionally, Mr. Cataldo was granted a temporary limited right on behalf of CIG to appoint new directors constituting a majority of the board of directors. During the time period of the right, Mr. Cataldo recommended the appointment of one director, as a result of the resignation of a director during the limited time period. The Company initially came into contact with individual investors that comprise CIG via certain existing security holders of the Company who were concerned about the Company winding down its business affairs and their investment (holdings) in the Company. Thereafter,

3

Mr. Cataldo arranged for new financings, which were categorized under the acronym CIG. The individual investors that comprise the de facto entity referred as to CIG are not affiliated and Mr. Cataldo has no affiliation or beneficial ownership with the individual investors that comprise CIG. To the best of the Company’s knowledge, the individual investors of CIG are not affiliated with each other. Mr. Cataldo was a designee of the investors chosen in light of the tenuous financial condition of the Company at the time of the new financing. He continues to actively pursue raising the necessary capital to fund the Company’s ongoing operations. There are no defined terms with respect to investments that can be attributed to CIG and as such all financing arrangements must be negotiated on an individual basis.

To date, to the best of the Company’s knowledge, all investors that have been aggregated under the acronym CIG are offshore residents. However, as the Company may seek additional equity or other financings in the future that can be aggregated under the CIG umbrella, potential future investors considered a part of CIG may not be offshore residents.

The Company has entered into a series of agreements for consulting services with certain investors as set forth below:

| | • | | Mr. Jason Arasheben, a subscriber to a $100,000 8% Convertible Debenture in July of 2002 which was also fully converted in July, is currently providing consulting services to the Company related to establishing distribution relationship synergies, specifically, high volume small business relationships outside the U.S. life insurance industry pursuant to a consulting agreement effective November 20, 2002. |

| | • | | Mr. Kurt Benjamin, a General Partner of the Mercator Group, entered into a consulting agreement effective November 1, 2002 to provide general corporate services including arranging distribution relationships with various public health companies; arranging distribution and operating relationships with the State of California; and arranging synergistic relationships with the public service groups including the Children's United Nation, Magic Johnson Foundation, and Elizabeth Taylor. Mr. Benjamin and the Mercator Group disclaim any ownership interest or control of the Mercator Momentum Fund LP, an investor in the Company. |

| | • | | Mr. Anshuman Dube, the Managing Partner of the Mercator Group, entered into a consulting agreement effective November 1, 2002 to provide general corporate services including arranging distribution relationships in India, Indonesia, South Korea and other Asian Countries as needed; assisting the Company in restructuring its capital structure; assisting the Company in its general business strategy; and assisting the Company in its efforts to complete trials with the World Health Organization. Mr. Dube and the Mercator Group disclaim any ownership interest or control of the Mercator Momentum Fund LP, an investor in the Company. |

| | • | | Mr. Howard Schraub, a consultant to the Company pursuant to a consulting agreement effective November 20, 2002, provides assistance to the Company with research venues for foreign sales for the Company's products, foreign marketing of the Company's products and locating foreign strategic partners. Mr. Schraub is an investor in Camden Limited, however, Mr. Schraub does not exercise any control or decision making authority with respect to the investment strategy or decisions of the fund. |

4

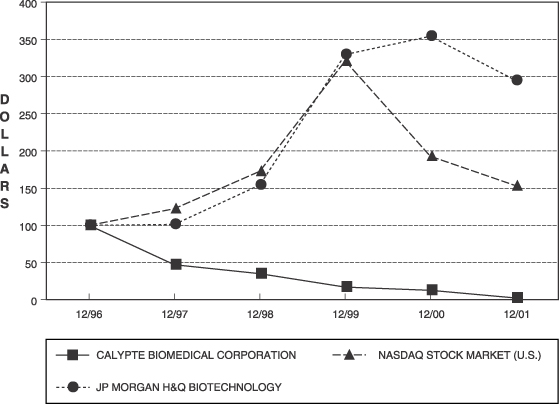

STOCK PERFORMANCE CHART

The graph below compares the cumulative total stockholder return on the Common Stock assuming an initial investment on December 31, 1996. The Corporation’s return is shown with the cumulative total return of the NASDAQ Stock Market—U.S. Index and the JP Morgan H&Q Biotechnology Index. The graph assumes a $100 investment made at the beginning of the respective period and reinvestment of all dividends.

COMPARISON OF 72 MONTH CUMULATIVE TOTAL RETURN*

AMONG CALYPTE BIOMEDICAL CORPORATION,

THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE HAMBRECHT & QUIST BIOTECHNOLOGY INDEX

* $100 INVESTED 12/31/96 IN STOCK OR INDEX—

INCLUDING REINVESTMENT OF DIVIDENDS.

FISCAL YEAR ENDING DECEMBER 31.

5

Security Ownership of Certain Beneficial Owners and Management

Except as set forth in the footnotes to this table, the following table sets forth information known to the Company with respect to the beneficial ownership of its Common Stock as of December 16, 2002 for (i) all persons known by the Company to own beneficially more than 5% of its outstanding Common Stock, (ii) each of the Company’s directors, (iii) each Named Executive Officer and (iv) all directors and executive officers of the Company as a group.

5% Stockholders, Directors and Officers(1)

| | Shares Beneficially Owned

| | % of Total(2)

| |

Mercator Momentum Fund, LP(3)(4) 555 S. Flower Street, Suite 4500 Los Angeles, CA 90071 | | 15,280,000 | | 9.99 | % |

Bristol Investment Fund, Ltd.(5)(6) Caledonian House Jennett Street Georgetown, Grand Cayman, Cayman Islands | | 15,280,000 | | 9.99 | |

Stonestreet Limited Partnership(7)(8) 260 Towne Centre Blvd., Suite 201 Markham, Ontario, Canada L3R 8H8 | | 15,280,000 | | 9.99 | |

Camden International Ltd.(9)(10) Charlotte House, Charlotte Street P.O. Box N 9204 Nassau, Bahamas | | 14,134,405 | | 9.49 | |

Alpha Capital Aktiengesellschaft(11)(12) Pradafant 7 9490 Furstentums Vaduz, Lichtenstein | | 12,810,745 | | 8.43 | |

Excalibur Limited Partnership(13)(14) c/o Excalibur Capital Management, Inc. 33 Prince Arthur Avenue Main Floor Toronto, Ontario, Canada M5R 1B2 | | 11,235,409 | | 7.47 | |

BNC Bach International, Ltd.(15)(16) C/o Ultra Finance Ltd. Grossmuensterplatz 6, P.O. Box 4401 Zurich, CH-8022, Switzerland | | 7,736,400 | | 5.27 | |

| Anthony J. Cataldo(17) | | 900,000 | | * | |

| Nancy E. Katz(18) | | 1,838,766 | | 1.31 | |

| Zafar Randawa, Ph.D.(19) | | 1,391,147 | | 1.00 | |

| Richard Brounstein(20) | | 583,334 | | * | |

| John DiPietro(21) | | 254,348 | | * | |

| Mark Novitch, M.D.(22) | | 252,397 | | * | |

| Paul Freiman(23) | | 147,000 | | * | |

| Julius Krevans, M.D.(24) | | 104,000 | | * | |

| All current directors and executive officers as a group (8 persons) | | 5,471,192 | | 3.93 | |

| * | | Represents beneficial ownership of less than 1%. |

| (1) | | To the Company’s knowledge, except as set forth in the footnotes to this table and subject to applicable community property laws, each person named in this table has sole voting and investment power with respect to the shares set forth opposite such person’s name. Except as otherwise indicated, the address of each of the persons in this table is as follows: c/o Calypte Biomedical Corporation, 1265 Harbor Bay Parkway, Alameda, California 94502. |

6

| (2) | | Based 139,127,447 shares outstanding as of December 16, 2002. |

| (3) | | David Firestone has voting and investment control over shares held by Mercator Momentum Fund L.P. |

| (4) | | Includes 11,303,971 shares subject to warrants exercisable or debentures convertible within 60 days. Ownership is limited to 9.99% without prior approval by the Company. |

| (5) | | Paul Kessler and Diana Derycz-Kessler have voting and investment control over shares held by Bristol Investment Fund Ltd. |

| (6) | | Includes 10,817,575 shares subject to warrants exercisable and debentures convertible within 60 days, including 1,700,000 shares subject to a Class A warrant exercisable within 60 days. Excludes 12,000,000 shares subject to a Class B warrant that does not have a currently determinable exercise date. Ownership is limited to 9.99% under the terms of the warrants. |

| (7) | | Includes 15,280,000 shares subject to notes convertible within 60 days. Ownership is limited to 9.99% under the terms of the notes. Ownership is limited to 9.99% under the terms of the notes. |

| (8) | | Elizabeth Leonard has voting and investment control over shares held by Stonestreet Limited Partnership. |

| (9) | | Includes 9,809,915 shares subject to notes convertible within 60 days. Ownership is limited to 9.99% under the terms of the notes. |

| (10) | | Anthony Inderieden has voting and investment control over shares held by Camden International Ltd. |

| (11) | | Includes 12,810,745 shares subject to notes convertible within 60 days. Ownership is limited to 9.99% under the terms of the notes. |

| (12) | | Ronald Ackerman has voting and investment control over shares held by Alpha Capital Aktiengesellschaft. |

| (13) | | Includes 11,235,409 shares subject to notes convertible within 60 days. Ownership is limited to 9.99% under the terms of the notes. |

| (14) | | Will Hechter has voting and investment control over shares held by Excalibur Limited Partnership. |

| (15) | | Includes 7,736,400 shares subject to notes convertible within 60 days. Ownership is limited to 9.99% under the terms of the notes. |

| (16) | | Mr. H.U. Bachofen has voting and investment control over shares held by BNC Bach International, Ltd. |

| (17) | | Includes 900,000 shares subject to options exercisable within 60 days. Excludes the grant of 7,066,666 options subject to future stockholder approval. |

| (18) | | Includes 1,543,869 shares subject to options exercisable within 60 days. Excludes the grant of 4,400,000 options subject to future stockholder approval. |

| (19) | | Includes 98,000 shares subject to options exercisable within 60 days. Dr. Randawa is a director of the Company and an affiliate of Otsuka Pharmaceutical Co., Ltd. All shares listed are held by Otsuka. Dr. Randawa disclaims beneficial ownership of the shares except to the extent of his affiliation with Otsuka. |

| (20) | | Includes 583,334 shares subject to options exercisable within 60 days. |

| (21) | | Includes 247,000 shares subject to options exercisable within 60 days. |

| (22) | | Includes 105,000 shares subject to options exercisable within 60 days. |

| (23) | | Includes 147,000 shares subject to options exercisable within 60 days. |

| (24) | | Includes 90,000 shares subject to options exercisable within 60 days. |

Compliance With Section 16(a) of the Exchange Act

Section 16(a) of the Securities Exchange Act of 1934, as amended (“Section 16(a)”), requires the Company’s executive officers, directors, and persons who own more than 10% of a registered class of the Company’s equity securities, to file reports of ownership on Form 3 and changes in ownership on Form 4 or Form 5 with the Securities and Exchange Commission. Such officers, directors and ten percent stockholders are also required by the Securities and Exchange Commission rules to furnish the Company with copies of all Section 16(a) forms that they file.

The Company believes that during fiscal years 2002 and 2001, all the Reporting Persons complied with all applicable filing requirements.

7

PROPOSED AMENDMENT TO THE COMPANY’S RESTATED

CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF SHARES OF

COMMON STOCK TO 800,000,000

By unanimous written consent of all Directors, the Board adopted, subject to Stockholder approval, an amendment to the Company’s. Restated Certificate of Incorporation (the “Amendment”) increasing the number of authorized shares of Common Stock from 200,000,000 to 800,000,000. The Board is requesting stockholder approval of the Amendment.

Description of the Proposal

In September 2001, the Company had requested and received shareholder approval for an increase in authorized shares of Common Stock from 50,000,000 to 200,000,000 shares. The Company’s Restated Certificate of Incorporation currently authorizes the issuance of 205,000,000 shares, of which 200,000,000 are authorized for issuance as Common Stock and 5,000,000 are authorized for issuance as Preferred Stock. As of the December 16, 2002 Record Date, the Company had 139,127,447 shares of Common Stock outstanding and no authorized shares of Preferred Stock outstanding. In addition, as of that date, the Company had approximately (i) 21.8 million shares of Common Stock reserved for issuance under its stock option and purchase plans. The exercise price of currently outstanding options granted to non-officer employees or consultants ranges from $0.10 to $7.00 per share, with the vast majority between $0.16 and $0.29 per share; (ii) approximately 1.0 million shares of Common Stock issuable upon exercise of various outstanding warrants issued prior to the restart and having exercise prices ranging from $0.115 to $12.00 per share; (iii) approximately 0.02 million shares of Common Stock reserved for and remaining for issuance under its Townsbury Equity Line of credit financing. The Company issued approximately 25.7 million shares of its Common Stock pursuant to the equity line between November 2001 and December 2002 at an average price of $0.131 per share; (iv) approximately 26.5 million shares of Common Stock reserved for issuance pursuant to the Bristol Investment Fund Ltd. 12% convertible debentures and warrants; and (v) approximately 12.0 million shares of Common Stock reserved for issuance upon conversion of outstanding notes and debentures and their related warrants that have conversion prices ranging from $0.05 to $0.07, based on recent market prices (as defined in the various agreements). All of the Company’s currently authorized shares of Common Stock are either outstanding or reserved for future issuance under existing benefit plans or financing arrangements as of the record date, leaving the Company without authorized shares to issue in the future.

8

Additionally, based on current market prices, as defined in recent financing agreements, the Company does not presently have sufficient authorized shares to accommodate the issuance of Common Stock potentially issuable upon the conversion of its outstanding notes and debentures or the exercise of related warrants. Material amounts of shares potentially issuable pursuant to recent financing arrangements calculated using November 30, 2002 market data, when the market price was approximately $0.10 per share and the low market prices as defined in the agreements was approximately $0.06 per share based on market prices in the previous 20 to 30 business days prior to November 30, 2002, including shares potentially issuable pursuant to remaining commitments, are as follows:

Financing

| | Potentially Issuable

|

| Unconverted and unissued portion of Bristol 12% convertible notes aggregating approximately $790,000 | | 12 million shares |

| Bristol Class A and B warrants | | 14 million shares |

| BNC Bach 10% Convertible Note $150,000 | | 3 million shares |

| Mercator 12% Convertible Debenture $550,000 (plus $1,450,000 unissued commitment) | | 36 million shares |

| Mercator 12% Convertible Debenture $300,000 and related $0.10 per share warrant | | 9 million shares |

| 8% Convertible Notes ($2,985,000 unconverted) to various parties including certain beneficial owners: | | |

| Alpha Capital Aktiengesellschaft ($500,000 unconverted) | | |

| Camden International ($380,000 unconverted) | | |

| Excalibur Limited Partnership ($450,000 unconverted) | | |

| Stonestreet Limited Partnership ($1,000,000 unconverted) | | |

| All other ($655,000 unconverted) | | 68 million shares |

| | |

|

| Total Potentially Issuable shares | | 142 million shares |

| Authorized and reserved shares available for above financings | | 39 million shares |

| | |

|

| Potential shortfall pursuant to recent financing arrangements | | 103 million shares |

| | |

|

The conversion prices on most of Calypte’s current financing arrangements are determined by a formula that considers the Company’s trading price during a specified time period prior to the conversion. Because of fluctuations in the trading price of the Company’s Common Stock, certain of these current financing arrangements require that the Company reserve for issuance a multiple of two times the number of shares potentially issuable. Consequently, the Company is required to reserve and register approximately an additional 130 million authorized shares in excess of the number of potentially issuable shares indicated in the table above.

The two times multiple share registration requirement is intended to allow for fluctuations in the trading price of Calypte’s Common Stock and for shares which might be issued in lieu of cash payments for interest on debt securities, or as a result of penalties or liquidated damages incurred under the terms of the various agreements. At the present time, Calypte is in registration for $525,000 of the Bristol 12% convertible debentures, and has not filed a registration statement for any of its subsequent financings. Many of these financings have requirements for registration and impose liquidated damages for delays. As of November 30, 2002, the Company has incurred approximately $92,000 in liquidated damages resulting from the delay in registration of the underlying shares of the Bristol debentures and approximately $400,000 in liquidated damages attributable to the delay in registration of the remaining financings. In most instances, the investor has the option of receiving the liquidated damages in either cash or the Company’s Common Stock, although one agreement specifies damages to be paid in stock at the rate of 250,000 shares for each 10 days of registration delay. As of November 30, 2002, the Company has neither paid cash nor issued stock in payment of liquidated damages. Based on current prices, the payment of liquidated damages in stock as of November 30, 2002 would require the Company to issue approximately 10 million shares of its Common Stock. Liquidated damages attributable to registration delays continue to accrue at a rate of approximately $78,000 per month (or approximately 1.5 million shares at current prices) plus 750,000 shares.

9

In addition to having an insufficient number of authorized shares of Common Stock to reserve or issue in accordance with the terms of currently existing financing arrangements, Calypte requires additional authorized shares to meet the requirements of both existing and expected future financings that will be necessary to sustain its operations until it achieves a positive cash flow. Calypte expects its future financings to be similar in nature to its most recent financings in 2002.

As discussed under Employment Agreements above, the Company needs to increase its share reserve under its 2000 Equity Incentive Plan and intends to request a significant increase at its 2003 Annual Shareholders’ Meeting. The maximum number of authorized shares on which options could be granted under the Incentive Plan will represent 2% of the total of 800,000,000 authorized shares of Common Stock, provided stockholders approve this proposal.

Further, while there are no current merger or acquisition plans, the Company at present does not have authorized shares available to consider such opportunities.

The increase in authorized shares is intended to provide for the potential requirements outlined above.

At December 31, 2001, the Company had issued 37.8 million shares of its Common Stock. As of the December 16, 2002 record date, the Company had 139.1 million shares outstanding, more than three times the number than at the previous year-end and an increase of 101.3 million shares. The primary components of the increase in shares outstanding during 2002 include:

| | • | | 22.5 million shares issued pursuant to the equity line with Townsbury at an average price of $0.127 per share |

| | • | | An aggregate of 41.6 million shares issued to consultants as follows: (i) 19.0 million shares at an average price of $0.015 per share issued pursuant to the exercise of warrants and options granted to consultants assisting with the May 2002 restart of the Company’s operations, and (ii) an additional 22.6 million shares issued pursuant to the exercise of warrants (20.5 million at an average price of $0.05) plus 2.1 million stock grants issued to consultants in November 2002 in conjunction with the expansion and continuation of consulting services. In May 2002 the Company retained consultants to provide legal, financial and business advisory services associated with the restart of its operations. By August 2002, all but one of those contracts had expired. In November, the Company expanded the role of certain consultants and engaged others to provide, in addition to the earlier services, business introductions and arrangements with respect to potential domestic and international product distribution agreements, assistance with international product trials and regulatory qualifications, and introductions for the development of synergistic relationships with appropriate public service organizations and for product marketing, such as for public service announcements. |

| | • | | 31.1 million shares issued pursuant to various CIG restart financing transactions upon the conversion of convertible notes and debentures or pursuant to PIPE transactions. Of these transactions, approximately 17.3 million shares were issued between $0.014 and $0.016 per share, including the partial conversion of the first Bristol debenture at $0.014 per share; approximately 11.7 million shares were issued between $0.05 and $0.07 per share; and the remaining 2.1 million shares were issued between $0.100 and $0.230 per share. The 29 million shares issued at less than $0.10 per share were the result of the Company’s immediate need for capital at the time of its restart and were issued pursuant to transactions that, in the Company’s belief, represented the best possible financing terms available in view of the Company’s tenuous financial condition at the time of the arrangement. |

| | • | | The remaining 5.2 million shares were issued pursuant to general business activities, including approximately 1.4 million shares issued to trade creditors in satisfaction of approximately $2.7 million of indebtedness and approximately 0.8 million shares issued pursuant to the exercise of employee stock options or stock bonus grants. |

10

The increase in the number of outstanding shares of Common Stock shall be accomplished by amending the first paragraph of Article IV of the Restated Certificate of Incorporation to state as follows:

The Corporation is authorized to issue two classes of shares of stock to be designated, respectively, Common Stock, $0.001 par value, and Preferred Stock, $0.001 par value. The total number of shares that the Corporation is authorized to issue is 805,000,000 shares. The number of shares of Common Stock authorized is 800,000,000 and the number of shares of Preferred Stock is 5,000,000.

The Board considers it both necessary and advisable to have additional authorized but unissued shares of Common Stock available to (i) allow the Company to act promptly with respect to future financings necessary to sustain its operations; (ii) to allow issuances under the Company’s employee benefit plans; (iii) to give the Company the ability to act in connection with possible future acquisition opportunities; and (iv) for other corporate purposes approved by the Board. Having additional authorized shares of Common Stock available for issuance would give the Company greater flexibility and allow shares of Common Stock to be issued without the expense or delay of a stockholders’ meeting, except as may be required by applicable laws or regulations. In addition, the Company currently does not have sufficient shares reserved under option and purchase plans and for exercise of outstanding warrants, debentures and notes.

A principal purpose for authorizing the additional shares is for issuance pursuant to arrangements to finance the Company’s continuing operations and to have available upon the exercise of certain derivative securities that have exercise or conversion prices that are subject to the market price of our Common Stock. In the past, Calypte has raised money through the sale of shares of its common stock at a discount to the current market price. Such arrangements have included the private sale of shares to investors on the condition that the Company register such shares for resale by the investors to the public. These arrangements have taken various forms including private placements commonly known as PIPE transactions, equity lines of credit and convertible notes or debentures.

In May of 2002, the Company entered into a series of consulting agreements with individuals who agreed to perform business, financial and management consulting services related in part to the restart of the Company’s business operations. An aggregate of 18,500,000 warrants with an exercise price of $.015 per share were issued to 7 consultants. The then current market price of common stock was $.03 per share. The Company issued the warrants with a reduced exercise price due to the Company’s lack of working capital and inability to pay cash compensation. Additionally in May, the Company issued 500,000 options to a consultant for financial services. The options had an exercise price of $.03, which was the fair market value of Calypte’s common stock as of the date of grant. All of the warrant and option grants were non-forfeitable and fully vested at the date of issuance and the underlying shares of Common Stock were registered for resale by the consultants under Form S-8. The consultants have exercised all the warrants and options and Calypte has issued 19 million shares and received proceeds of $292,500. All but one of the consulting agreements discussed above expired in August 2002 and we have entered into new consulting agreements for legal, financial, business advisory, and other services including business introductions and arrangements with respect to potential domestic and international product distribution agreements, assistance with international product trials and regulatory qualifications, and the development of synergistic relationships with appropriate public service organizations. In November 2002, Calypte issued warrants to purchase 28.5 million shares of our Common Stock and stock grants for 2.1 million shares of our stock to consultants under the terms of these new agreements. We issued 10.5 million warrants at an exercise price of $0.05 per share on November 1, 2002, when the market price of our stock was $0.14 per share. We issued an additional 18.0 million warrants at an exercise price of $0.05 on November 20, 2002, when the market price of our common stock was $0.09. All of the warrants and stock grants were issued as fully vested and non-forfeitable at the date of issuance and the underlying shares of Common Stock were registered for resale by the consultants under Form S-8. As of the record date, the consultants had exercised warrants to purchase 27,000,000 shares of Calypte’s Common Stock and we had received aggregate proceeds of approximately $1.4 million upon issuance of the shares. Due to our financial condition, Calypte continues to look for ways to minimize the use of our cash resources while obtaining required services; accordingly, we may continue to issue options, warrants, or stock grants in consideration for additional consulting services at below-market discounts in excess of 50%. We would subsequently register the option or warrant shares on a Form S-8.

11

More specifically, the table below summarizes the services of our more significant consultants, including some with whom we entered into consulting agreements in both May 2002 and November 2002. All of the consultants have directly reported to, received direction from, and provided advice to our Executive Chairman.

Consultant

| | Services Provided

|

| Peter Benz | | General and synergistic business advisory services; business introductions related to the Company’s risk management requirements and payroll services |

| David Mun Gavin | | European strategic opportunity consulting and business introductions for potential synergistic business opportunities |

| Anshuman Dube | | Business introductions and arrangements for establishing potential distribution relationships in India, Indonesia, South Korea and other Asian countries; assistance with completion of the Company’s clinical trials by the World Health Organization; general business and capital structure advisory services |

| Michael Rudolph | | Assistance with arranging settlements with the Company’s creditors, budgeting and strategic financial planning |

| George Furla | | Research regarding venues for product advertising; assistance in developing the Company’s marketing strategy; researching potential strategic partners |

The Company expects that its future financing arrangements will include: (i) PIPE Transactions; (ii) equity lines; (iii) convertible notes or debentures; and (iv) bank or institutional financings if qualified in the future.

Calypte has entered into a financing agreement with Bristol Investment Fund, Ltd. wherein there is a 9.9% limitation on Bristol’s ownership of shares in Calypte’s common stock. Additionally, we have also entered into an equity line of credit with Townsbury wherein we registered 30.0 million shares of common stock, of which 25.8 million shares under the equity line have been issued to Townsbury along with Townsbury exercising warrants for 4.2 million shares of our common stock. It is our belief that Townsbury has sold the shares of our common stock upon receiving the shares with drawdowns on our equity line and Townsbury’s exercise of the 4.2 million-share warrant. Further, we have obtained additional financing since our restart though the issuance of convertible securities to unaffiliated investors categorized under the acronym Cataldo Investment Group (“CIG”). To our knowledge, the investors under CIG are not affiliated with each other and, pursuant to their individual agreements, are subject to a 9.9% ownership limitation.

The Company at the present time intends to use the proceeds from future offerings or financings for general working capital purposes. Although the Company does not intend to use proceeds raised from any future offerings or financings for the payment of long-term notes or debentures, there can be no assurances regarding future allocations of funds received from offerings or financings, should the Company be successful in raising additional funds. In the past Calypte has issued an aggregate of 1.3 million restricted shares of common stock to 27 trade creditors to satisfy past due accounts payable of approximately $1.7 million, including past due royalty payments of approximately $1.0 million. The shares were issued in reliance of the exemption provided by Regulation D. At the current time, we are in arrears of approximately $1.3 million to trade creditors and approximately $0.1 million in royalty obligations. While it is Calypte’s intent to make payments on obligations to trade creditors and licensors from revenues generated from its business operations, it may not be able to generate sufficient revenues for this purpose. We may issue restricted shares of our common stock to satisfy our obligations or be compelled to use funds raised from future offerings and financings, if any, to satisfy obligations due to trade creditors and licensors.

The increase in authorized Common Stock will not have any immediate effect on the rights of existing stockholders. The Board will have the authority to issue authorized Common Stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or exchange regulations such as a change of control in the Company.

12

To the extent that the additional authorized shares are issued in the future, they will decrease the existing stockholders’ percentage equity ownership and, depending upon the price at which they are issued as compared to the price paid by existing stockholders for their shares, could be dilutive to the existing stockholders. The proposal to increase authorized shares for issuance is not submitted to shareholders as a result of or in response to any accumulation of stock or threatened takeover of the Company. Additionally, the Company does not at this time have any plans to implement any further anti-takeover measures beyond the Company’s current shareholder’s rights plan in effect.

If this Amendment is approved, the Board intends to cause a certificate of amendment to the Restated Certificate of Incorporation to be filed as soon as practicable after the date of the Special Meeting. Upon effectiveness of this Amendment, the Company will have approximately 601 million shares of Common Stock authorized but unissued and unreserved, of which approximately 200 million shares will be reserved pursuant to reserves required by current financing arrangements.

In the event we fail to obtain shareholder approval for this amendment to our Amended Restated Certificate of Incorporation authorizing an increase in the number of authorized shares of common stock, we may be compelled to change our business plans due to an inability to raise additional working capital through the issuance of available shares of common stock. Specifically, at current market prices for Calypte’s Common Stock, we will fail to have a sufficient number of shares for issuance upon exercise or conversion of issued and outstanding convertible securities.

If the stockholders do not approve this proposal to increase the number of authorized shares, the Company may not be able to arrange the financing necessary to sustain its existing operations through the first quarter of 2003.

Approval Required

Approval of this Proposal requires the affirmative votes of a majority of the outstanding shares of Common Stock of the Company.

The Board unanimously recommends a vote FOR the proposed amendment to the Restated Certificate of Incorporation to increase the authorized shares of Common Stock to 800,000,000. Proxies solicited by the Board will be so voted unless stockholders specify a different choice in their proxies.

OTHER MATTERS

Deadline for Receipt of Stockholder Proposals for Inclusion in the Company’s Proxy Statement for the 2003 Annual Meeting

Under the rules of the Securities and Exchange Commission, stockholder proposals submitted for the Company’s 2003 Annual Meeting must be received by the Company within a reasonable period of time before a solicitation is made. Accordingly, as the Company intends to hold its Annual Meeting for 2003 as soon as reasonably practical following its filing of its Form 10-K for the 2002 fiscal year, proposals must be submitted no later than March 15, 2003 to be considered. Proposals should be addressed to Jerrold Dotson, Secretary, Calypte Biomedical Corporation, 1265 Harbor Bay Parkway, Alameda, California 94502.

Any stockholder who wishes to bring a proposal before the Calypte Biomedical Corporation 2003 Annual Meeting of Stockholders, but does not wish to include it in the Company’s proxy materials, must provide written notice of the proposal to Calypte’s Secretary, at the above address, by April 15, 2003.

13

Other Information

The Company does not know of any matters other than those referred to in the accompanying Notice of Special Meeting of Stockholders that may properly come before the meeting or other matters incident to the conduct of the meeting. As to any other matter or proposal that may properly come before the meeting, including voting on a proposal omitted from this Proxy Statement pursuant to the rules of the Securities and Exchange Commission, it is intended that proxies received will be voted in accordance with the discretion of the proxy holders.

By order of the Board of Directors,

Nancy E. Katz

President and Chief Executive Officer

Alameda, California

January 9, 2003

14

CALYPTE BIOMEDICAL CORPORATION

1265 HARBOR BAY PARKWAY

ALAMEDA, CALIFORNIA 94502

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints ANTHONY J. CATALDO and NANCY E. KATZ, and each of them, with full power of substitution, as the proxy or proxies of the undersigned to vote all shares of Common Stock of Calypte Biomedical Corporation which the undersigned is entitled to vote at the meeting of stockholders of Calypte Biomedical Corporation to be held at the Company’s headquarters offices located at 1265 Harbor Bay Parkway, Alameda, California 94502 on February 14, 2003, at 8:00 a.m. local time, and at any adjournments or postponements thereof, with all powers that the undersigned would have if personally present thereat:

(CONTINUED ON OTHER SIDE)

/*\ FOLD AND DETACH HERE /*\

^Detach here from proxy voting card.^

You can now access your Calypte Biomedical Corporation account online.

Access your Calypte Biomedical Corporation shareholder/stockholder account online via Investor ServiceDirect™ (ISD).

Mellon Investor Services LLC, agent forCalypte Biomedical Corporation, now makes it easy and convenient to get current information on your shareholder account. After a simple and secure process of establishing a Personal Identification Number (PIN), you are ready to log in and access your account to:

| | | Ÿ View account status | | Ÿ View payment history for dividends | | |

| | | Ÿ View certificate history | | Ÿ Make address changes | | |

| | | Ÿ View book-entry information | | Ÿ Obtain a duplicate 1099 tax form | | |

| | | | | Ÿ Establish/change your PIN | | |

Visit us on the web at http://www.mellon-investor.com

and follow the instructions shown on this page.

Step 1: FIRST TIME USERS-Establish a PIN

| | Step 2: Log in for Account Access | | Step 3: Account Status Screen |

You must first establish a Personal Identification Number (PIN) online by following the directions provided in the upper right portion of the web screen as follows. You will also need your Social Security Number (SSN) available to establish a PIN. Investor ServiceDirect™ is currently only available for domestic individual and joint accounts. Ÿ SSN Ÿ PIN Ÿ Then click on the ESTABLISH PIN button Please be sure to remember your PIN, or maintain it in a secure place for future reference. | | You are now ready to log in. To access your account please enter your: Ÿ SSN Ÿ PIN Ÿ Then click on the SUBMIT button If you have more than one account, you will now be asked to select the appropriate account.

| | You are now ready to access your account information. Click on the appropriate button to view or initiate transactions. Ÿ Certificate History Ÿ Book-Entry Information Ÿ Issue Certificate Ÿ Payment History Ÿ Address Change Ÿ Duplicate 1099 |

For Technical Assistance Call 1-877-978-7778 between

9am-7pm Monday-Friday Eastern Time

Please mark your votes as this | | x |

This proxy when properly executed will be voted in the manner directed herein by the undersigned stockholder. If no direction is made, this proxy will be voted FOR the Proposal.

|

| 1. | | Proposal to amend the Company’s Amended and Restated Certificate of Incorporation to effect an increase in the number of shares of the Company’s Common Stock authorized for issuance from 200,000,000 to 800,000,000 shares. (The Board of Directors recommends a vote FOR.) | | FOR ¨ | | AGAINST ¨ | | ABSTAIN ¨ |

In their discretion, the proxies are authorized to vote upon such other business as may properly come before the meeting and at any adjournment or postponement thereof.

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE.

Signature of Stockholder Signature if held jointly Dated: , 2003

Please sign exactly as name appears above. When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by President or other authorized person.

· Detach here from proxy voting card. ·

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting are available through 4PM Eastern Time

the business day prior to annual meeting day.

Your telephone or Internet vote authorizes the named proxies to vote your shares in the same manner

as if you’ve marked, signed and returned your proxy card.

Internet http:www.eproxy.com/caly | | | | Telephone 1-800-435-6710 | | | | Mail |

| Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. You will be prompted to enter your control number, located in the box below, to create and submit an electronic ballot. | | OR | | Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. You will be prompted to enter your control number, located in the box below, and then follow the directions given. | | OR | | Mark, sign and date

your proxy card

and return it in the

enclosed postage-paid

envelope.

|

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.