Filed by ON Semiconductor Corporation

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Catalyst Semiconductor, Inc.

This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements related to the benefits of the proposed transaction between ON Semiconductor Corporation (“ON”) and Catalyst Semiconductor (“Catalyst Semiconductor”) and the future financial performance of ON. These forward-looking statements are based on information available to ON and Catalyst Semiconductor as of the date of this release and current expectations, forecasts and assumptions and involve a number of risks and uncertainties that could cause actual results to differ materially from those anticipated by these forward-looking statements. Such risks and uncertainties include a variety of factors, some of which are beyond ON’s or Catalyst Semiconductor’s control. In particular, such risks and uncertainties include difficulties encountered in integrating merged businesses; the risk that the transaction does not close, including the risk that the requisite stockholder and regulatory approvals may not be obtained; the variable demand and the aggressive pricing environment for semiconductor products; dependence on each company’s ability to successfully manufacture in increasing volumes on a cost-effective basis and with acceptable quality its current products; the adverse impact of competitive product announcements; revenues and operating performance, changes in overall economic conditions, the cyclical nature of the semiconductor industry, changes in demand for our products, changes in inventories at customers and distributors, technological and product development risks, availability of raw materials, competitors’ actions, pricing and gross margin pressures, loss of key customers, order cancellations or reduced bookings, changes in manufacturing yields, control of costs and expenses, significant litigation, risks associated with acquisitions and dispositions, risks associated with leverage and restrictive covenants in debt agreements, risks associated with international operations, the threat or occurrence of international armed conflict and terrorist activities both in the United States and internationally, risks and costs associated with increased and new regulation of corporate governance and disclosure standards (including pursuant to Section 404 of the Sarbanes-Oxley Act of 2002), and risks involving environmental or other governmental regulation. Information concerning additional factors that could cause results to differ materially from those projected in the forward-looking statements is contained in ON’s Annual Report on Form 10-K as filed with the Securities and Exchange Commission (the “SEC”) on February 12, 2008, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other of ON’s SEC filings, and Catalyst Semiconductor’s Annual Report on Form 10-K as filed with the SEC on July 3, 2008, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other of Catalyst Semiconductor SEC filings. These forward-looking statements should not be relied upon as representing ON’s or Catalyst Semiconductor’s views as of any subsequent date and neither undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made.

This communication is being made in respect of the proposed transaction involving ON and Catalyst Semiconductor. In connection with the proposed transaction, ON plans to file with the SEC a Registration Statement on Form S-4 containing a Proxy Statement of Catalyst Semiconductor and a Prospectus of ON, and each of ON and Catalyst Semiconductor plan to file with the SEC other documents regarding the proposed transaction. The definitive Proxy Statement/Prospectus will be mailed to stockholders of Catalyst Semiconductor. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus (when available) and other documents filed with the SEC by ON and Catalyst Semiconductor through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of the Registration Statement and the Proxy Statement/Prospectus (when available) and other documents filed with the SEC from ON by directing a request to ON Semiconductor Corporation, 5005 East McDowell Road, Phoenix, AZ, 85008, Attention: Investor Relations (telephone: (602) 244-3437) or going to ON’s corporate website at www.onsemi.com, or from Catalyst Semiconductor by directing a request to Catalyst Semiconductor, Inc., 2975 Stender Way, Santa Clara, CA 95054, Attention: Investor Relations (telephone: (408) 542-1200) or going to Catalyst Semiconductor’s corporate website at www.catsemi.com.

ON and Catalyst Semiconductor and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding ON’s directors and executive officers is contained in ON’s annual proxy statement filed with the SEC on April 4, 2008, as supplemented a Current Report on Form 8-K filed with the SEC on March 17, 2008. Information regarding Catalyst Semiconductor’s directors and executive officers is contained in Catalyst Semiconductor’s annual proxy statement filed with the SEC on August 24, 2007. Additional information regarding the interests of such potential participants will be included in the Proxy Statement/Prospectus and the other relevant documents filed with the SEC (when available).

Filed below is a presentation to ON Sales, ON Sales Representatives, ON Marketing, and ON Customer Service Representatives on July 17, 2008 regarding ON’s proposed acquisition of Catalyst.

Sales Operations Confidential Proprietary ON Semiconductor Catalyst Semiconductor Announcement Outreach Training – Customer Facing Teams |

Sales Operations Confidential Proprietary |

Sales Operations Confidential Proprietary Call Agenda • ON Semiconductor / Catalyst Semiconductor Announcement • Catalyst Semiconductor Overview • Customer Communication • Expectations from Sales and Marketing and Customer Facing Teams |

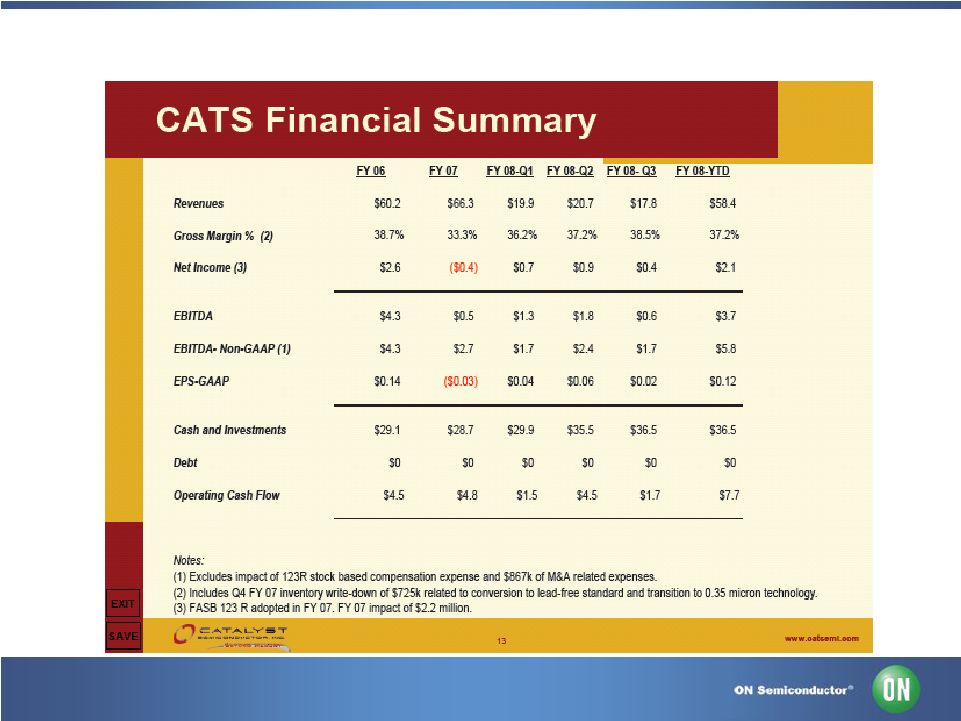

Sales Operations Confidential Proprietary ON Semiconductor to Acquire Catalyst Semiconductor, Inc. in an All-Stock Transaction PHOENIX, AZ and SANTA CLARA, CA – July 17, 2008 – ON Semiconductor Corporation (Nasdaq: ONNN) and Catalyst Semiconductor, Inc. (Nasdaq: CATS) today announced the signing of a definitive merger agreement providing for the acquisition of Catalyst Semiconductor by ON Semiconductor in an all-stock transaction in which Catalyst shareholders will receive 0.706 shares of ON Semiconductor common stock for each share of Catalyst common stock they own. This represents an equity value of approximately $115 million and an enterprise value of approximately $85 million. “The acquisition of Catalyst Semiconductor will add to our high gross margin analog and mixed-signal product offerings for the digital consumer and wireless end-markets,” said Keith Jackson, ON Semiconductor president and CEO. “Catalyst Semiconductor’s analog and mixed-signal business represented more than $11 million in sales as of their April 2008 fiscal year end - a business that grew more than 90 percent versus the prior year. Catalyst Semiconductor’s EEPROM technology will strengthen our custom application-specific circuits (ASIC) and power products capabilities expanding our ability to more comprehensively address our customers’ needs. With the combination of ON Semiconductor's global footprint, effective channels of distribution, and top-tier customer relationships, we expect to be able to support a broader and deeper penetration of Catalyst's overall product portfolio. This should enable us to accelerate their revenue growth and increase market share. We also believe additional revenue from Catalyst Semiconductor’s strong portfolio offering will benefit from ON Semiconductor’s manufacturing capabilities. We look forward to welcoming Gelu Voicu, Catalyst Semiconductor’s CEO, as well as the talented Catalyst employee base to ON Semiconductor.” |

Sales Operations Confidential Proprietary ON Semiconductor to Acquire Catalyst Semiconductor, Inc. in an All-Stock Transaction Continued “This transaction represents a compelling opportunity for Catalyst employees, customers and shareholders,” stated Gelu Voicu, CEO of Catalyst Semiconductor. “To compete successfully in today’s global marketplace, size and scale are very important. We are pleased to become part of a leading global company in the semiconductor sector. ON Semiconductor’s world-class operational capabilities and supply chain will enable Catalyst Semiconductor’s products to better penetrate the automotive, consumer, and industrial end-markets utilizing ON Semiconductor’s global customer and channel footprint.“ Transaction Details Under the terms of the agreement, which has been approved by both boards of directors, the fixed exchange ratio will be 0.706 shares of ON Semiconductor common stock for each share of Catalyst Semiconductor common stock. Based on the closing stock price of ON Semiconductor on July 16, 2008, this represents a value to Catalyst Semiconductor shareholders of approximately $6.24 per share. Upon completion of the transaction, ON Semiconductor will issue approximately 13 million shares of common stock on a fully diluted basis to complete the transaction or approximately 3 percent of ON Semiconductor’s fully diluted shares outstanding. The transaction is subject to the approval of shareholders of Catalyst Semiconductor as well as customary closing conditions and regulatory approvals. The companies expect the transaction to close in the fourth quarter of 2008. Upon closing, ON Semiconductor may record a one-time charge for purchased in-process research and development expenses and other deal related costs. The amount of that charge, if any, has not yet been determined. |

Sales Operations Confidential Proprietary ON Semiconductor to Acquire Catalyst Semiconductor, Inc. in an All-Stock Transaction Continued “This acquisition is directly aligned with both our strategic and financial goals,” said Donald Colvin, ON Semiconductor executive vice president and CFO. “Net of cash and short term investments of approximately $30 million at the end of April 2008, the transaction value represents approximately 1.1 times trailing twelve month sales. We also believe ON Semiconductor’s operational strengths will significantly benefit the revenue and margin potential of Catalyst Semiconductor. Excluding the impact of amortization expense, write-up of inventory to fair market value, one-time and other deal related charges discussed above, we expect the acquisition will have minimal impact to earnings per share in the first year post the transaction close and should be accretive to our earnings per share thereafter. ON Semiconductor’s business and the integration of AMIS Holdings, Inc. has proceeded as anticipated and we are comfortable with the guidance and current level of revenue and earnings expectations provided on our May 5, 2008 conference call. We intend to provide further details on the acquisition and our second quarter 2008 results on our regularly scheduled quarterly earnings conference call on Aug. 6, 2008.” Shares of the combined company will trade on the NASDAQ Global Exchange under the symbol “ONNN.” JP Morgan acted as exclusive financial advisor and DLA Piper US LLP acted as legal counsel to ON Semiconductor. Houlihan Lokey acted as exclusive financial advisor and O’Melveny & Myers LLP acted as legal counsel to Catalyst Semiconductor. |

Sales Operations Confidential Proprietary Call Agenda • ON Semiconductor / Catalyst Semiconductor Announcement • Catalyst Semiconductor Overview • Customer Communication • Expectations from Sales and Marketing and Customer Facing Teams |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

Sales Operations Confidential Proprietary Catalyst Semiconductor |

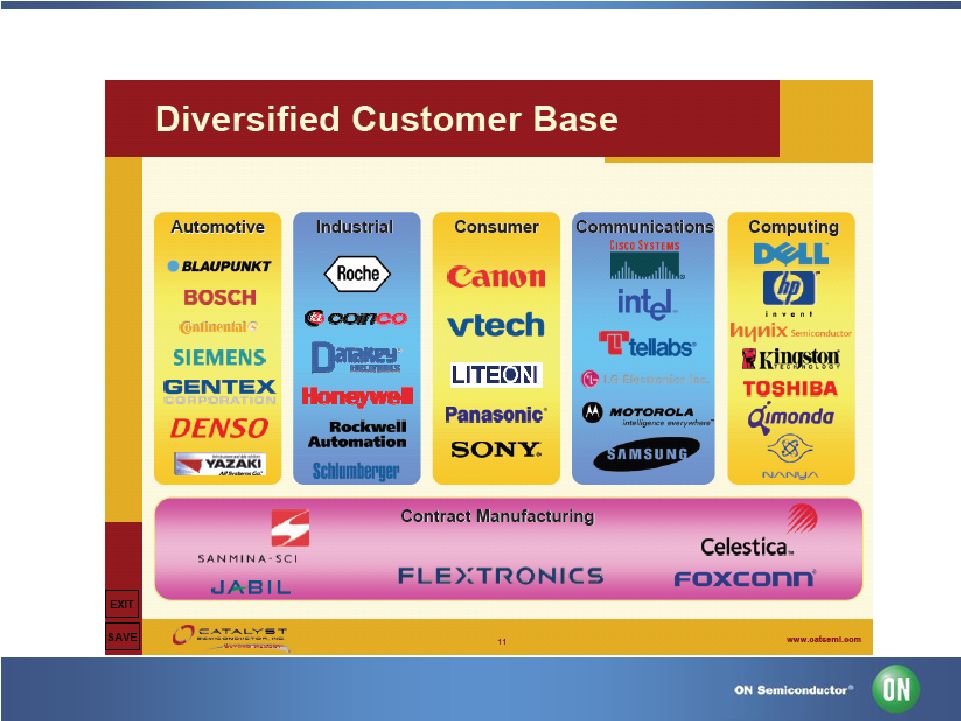

Sales Operations Confidential Proprietary Catalyst Semiconductor Top Distributors • Arrow • Avnet (incl Memec Div) • Digi-Key • Future • Kanematsu • Pernas • Yosun |

Sales Operations Confidential Proprietary Call Agenda • ON Semiconductor / Catalyst Semiconductor Announcement • Catalyst Semiconductor Overview • Customer Communication • Important Information • Expectations from Sales and Marketing and Customer Facing Teams |

Sales Operations Confidential Proprietary TO: Our Valued Customers, Sales Representatives and Distributors DATE: July 17, 2008 SUBJ: Acquisition of Catalyst Semiconductor by ON Semiconductor Today ON Semiconductor announced the signing of a definitive merger agreement providing for the acquisition of Catalyst Semiconductor Inc. The transaction is subject to the approval of shareholders of Catalyst Semiconductor as well as customary closing conditions and regulatory approvals. The companies expect the transaction to close in the fourth quarter of 2008. I would like to share with you the vision of a technologically broader and operationally stronger company serving your needs. The acquisition of Catalyst Semiconductor will add to our analog and mixed-signal product offerings for the telecommunications, networking systems, computing, automotive, industrial and consumer markets. Catalyst Semiconductor’s EEPROM technology will strengthen our custom application-specific circuits (ASIC) and power products capabilities expanding our ability to more comprehensively address our customers’ needs. With the combination of ON Semiconductor's global footprint, effective channels of distribution, and top-tier customer relationships, we expect to be able to support a broader and deeper penetration of Catalyst's overall product portfolio. Operationally it will be business as normal for customers. We will communicate any potential changes to you at the earliest possible time, but ask that you continue to do business using your normal contacts and processes for Catalyst Semiconductor products. We remain committed to providing you with outstanding customer service, advanced technology solutions, industry-leading supply chain management, and world-class quality and manufacturing. We look forward to a long and mutually beneficial relationship. If you have any questions or concerns, please contact your local sales contact. You may e-mail questions to transitions@onsemi.com. Best Regards, Keith Jackson President and CEO ON Semiconductor Customer Letter for Sales Use |

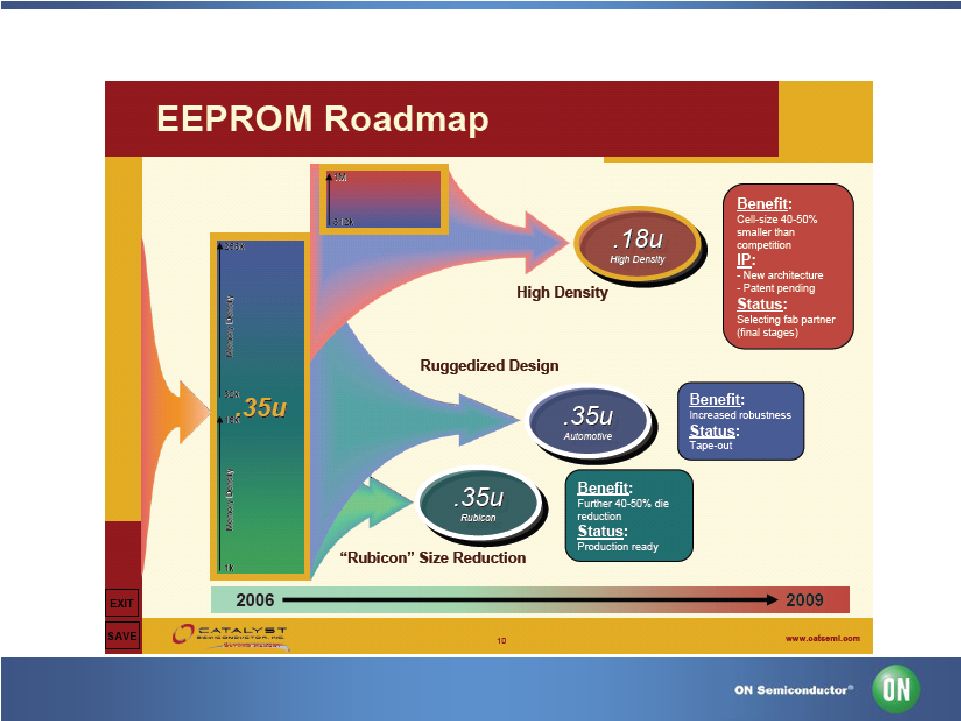

Sales Operations Confidential Proprietary Key Talking Points Talking Points • On July 17, ON Semiconductor announced the signing of a definitive merger agreement providing for the acquisition of Catalyst Semiconductor by ON Semiconductor in an all-stock transaction in which Catalyst shareholders will receive 0.706 shares of ON Semiconductor common stock for each share of Catalyst common stock they own. Benefits of the deal • The acquisition of Catalyst Semiconductor will add to ON Semiconductor’s analog and mixed signal products offerings • Catalyst’s EEPROM technology will strengthen ON Semiconductor’s ASIC and power products capabilities expanding ON Semiconductor's ability to more comprehensively address its customers’ needs • The EEPROM segment provides a new total available market (TAM) opportunity for ON Semiconductor of approximately $800 million to $1 billion • With the combination of ON Semiconductor's global footprint, effective channels of distribution, and top-tier customer relationships, ON Semiconductor expects to be able to support a broader and deeper penetration of Catalyst's overall product portfolio • Catalyst has a long history of developing proprietary Intellectual Property (IP) and proven designs. • Catalyst Semiconductor’s strong portfolio offering should also benefit from ON Semiconductor’s integrated manufacturing capabilities. The acquisition also further enhances the utilization of the Gresham facility • To compete successfully in today’s global marketplace, size and scale are important. ON Semiconductor provides Catalyst with: - Enhanced scale - Deeper customer relationships and sales channels - Integrated manufacturing capabilities - An expanded addressable market Next Steps • We expect the deal to close sometime during the fourth quarter of 2008 • The company will continue the integration of AMIS processes prior to integrating Catalyst Semiconductor • ON Semiconductor intends to have Catalyst Semiconductor operate as a stand alone basis for the foreseeable future • Look for ongoing acquisition and integration updates on The Connection or The Circuit |

Sales Operations Confidential Proprietary Customer and Employee Escalation Email address used to handle questions: • Questions to: transitions@onsemi.com – Transition team members will be managing and answering these common email accounts for the next several weeks |

Sales Operations Confidential Proprietary Call Agenda • ON Semiconductor / Catalyst Semiconductor Announcement • Catalyst Semiconductor Overview • Customer Communication • Expectations from Sales and Marketing and Customer Facing Teams |

Sales Operations Confidential Proprietary What We Expect From You? • Sales / Customer Service to be in contact with each other to ensure customer is communicated to appropriately, and no duplication of efforts. – Convey the message to all customers that it is business as usual – Continue to use their Catalyst Sales contact and processes – The acquisition is anticipated to close during the fourth quarter of 2008, but is subject to Catalyst shareholder approval and other normal regulatory requirements • Use the communication materials provided to keep customers informed • Report back to transitions@onsemi.com any customer concerns and issues that need to be escalated. |

Sales Operations Confidential Proprietary FAQ’s FREQUENTLY ASKED QUESTIONS Transaction Summary What does the announcement mean? ON Semiconductor and Catalyst Semiconductor have signed a definitive merger agreement providing for the acquisition of Catalyst Semiconductor by ON Semiconductor in an all-stock transaction. At the closing date, if you own shares of Catalyst Semiconductor common stock, you would receive 0.706 shares of ON Semiconductor common stock for each shared owned of Catalyst Semiconductor. If you have Catalyst Semiconductor stock options, they will be exchanged for options which represent 0.706 shares of ON Semiconductor stock options for each Catalyst Semiconductor stock option owned. The exercise price of the options would take the original stock option grant price divided by 0.706 to calculate the new exercise price. Why does ON Semiconductor want to acquire Catalyst Semiconductor? •Catalyst Semiconductor adds to the high gross margin analog and mixed-signal product offerings for the digital consumer and wireless end-markets of ON Semiconductor •Catalyst Semiconductor’s analog and mixed-signal business represented more than $11 million in sales as of their April 2008 fiscal year end - a business that grew more than 90 percent versus the prior year •Catalyst expands our product offering into the non-volatile memory market •Catalyst Semiconductor’s EEPROM technology will strengthen our custom application-specific circuits (ASIC) and power products capabilities expanding our ability to more comprehensively address our customers’ needs •Additional revenue from Catalyst Semiconductor’s strong portfolio offering will benefit from ON Semiconductor’s manufacturing capabilities Does the announcement mean a deal has been finalized? This transaction is not done. There are a number of processes and government filings that we need to complete before the deal is closed. We currently expect the deal to close in ON’s fourth quarter of 2008 subject to the approval of Catalyst shareholders as well as customary closing conditions and regulatory approvals. Do ON Semiconductor shareholders have to approve the transaction? ON Semiconductor shareholders are not required to vote and approve the pending transaction. Only Catalyst Semiconductor shareholders will need to vote and approve the pending transaction. A Catalyst shareholder meeting will most likely take place during the fourth quarter of 2008. How many Catalyst employees are impacted by this decision? All of the approximately 250 Catalyst employees will be directly impacted by this decision. |

Sales Operations Confidential Proprietary FAQ’s FREQUENTLY ASKED QUESTIONS How many Catalyst employees will be offered a position at ON Semiconductor? Substantially all of the Catalyst employees will be offered a position. Where are the majority of the employees involved in this deal located? The majority of employees are located in Santa Clara, California, Bucharest, Romania and Thailand with field sales and other employees dispersed throughout the world. What resources will ON Semiconductor utilize for the purchase? This will be an all stock transaction. The press release mentioned enterprise value. What does that mean? Enterprise value is a measure of a company’s value. It is calculated as the market capitalization (share price x shares outstanding) plus any debt minus cash and short term investments. What should I tell my customers about the acquisition? If asked, tell customers that the deal is still pending subject to the official close. However, if the deal is completed, there are long-term benefits to customers including stronger product portfolio, integrated sales channels, integrated manufacturing capabilities to meet demand changes and enhanced scale. What if customers ask me questions that I don’t know the answers to? If you don’t know the answers, it’s okay to say that you don’t know, but that you will find out and get back to them. The best way to do this is to contact your manager. What should I do if a journalist asks me a question? Please direct all media inquiries to the media relations department of ON Semiconductor. ON Semiconductor Anne Spitza Manager, media relations (602) 244-6398 anne.spitza@onsemi.com Catalyst Semiconductor Sherry Hill Director, Marketing & IR Communications (408) 542-1080 Sherry.hill@catsemi.com |

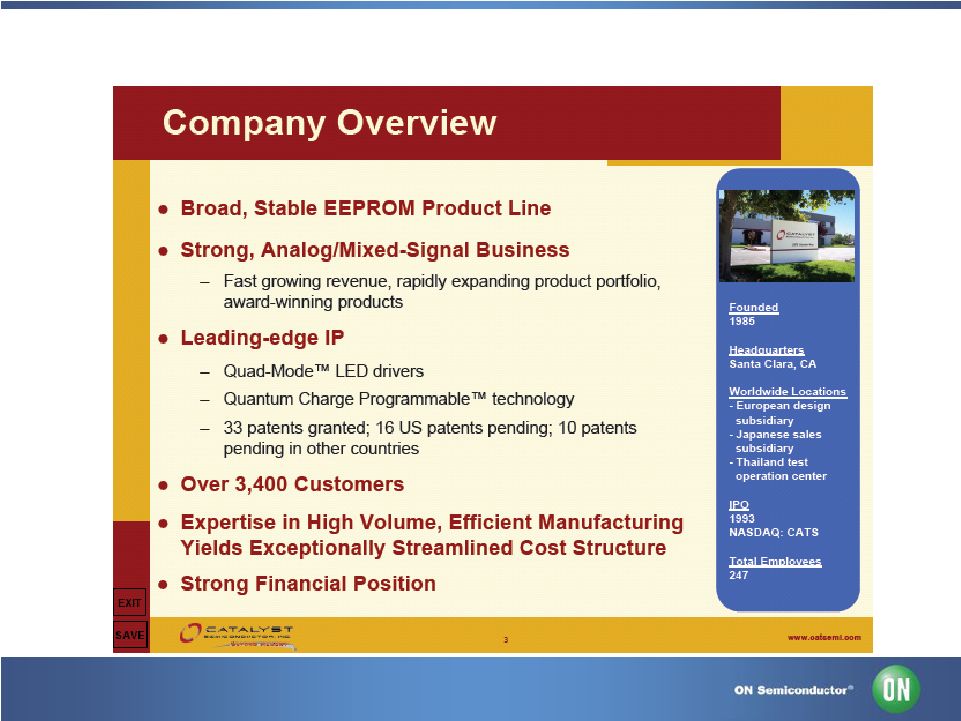

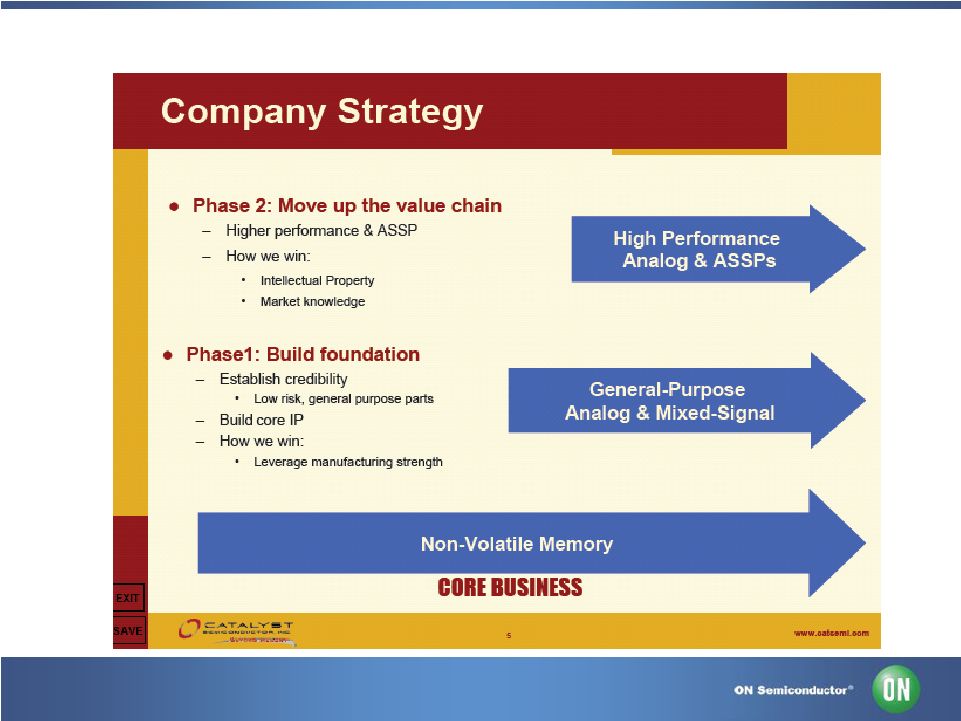

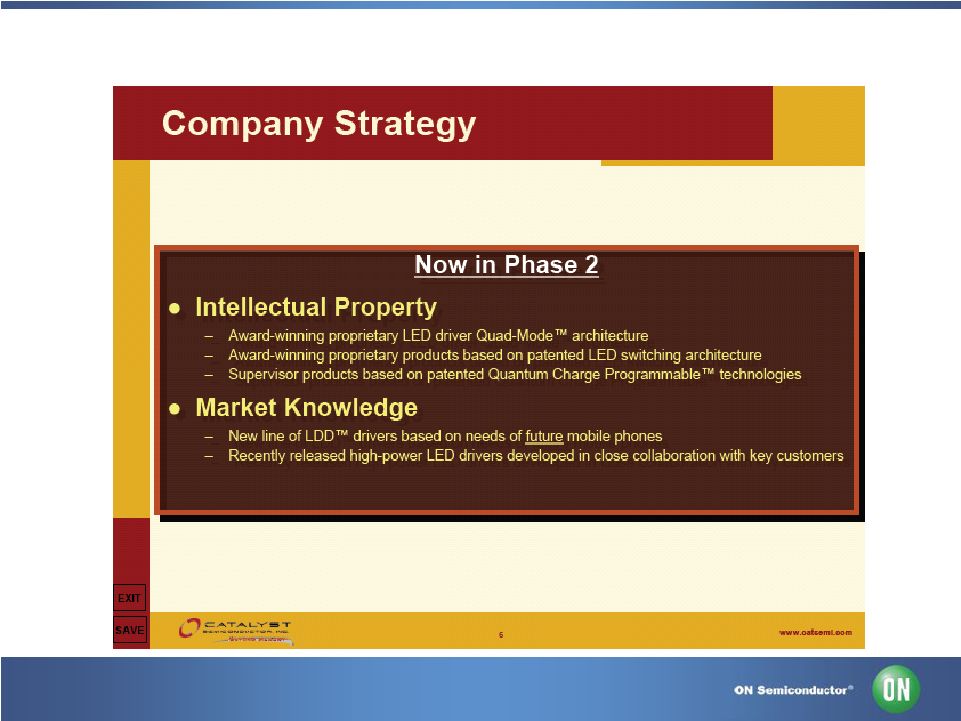

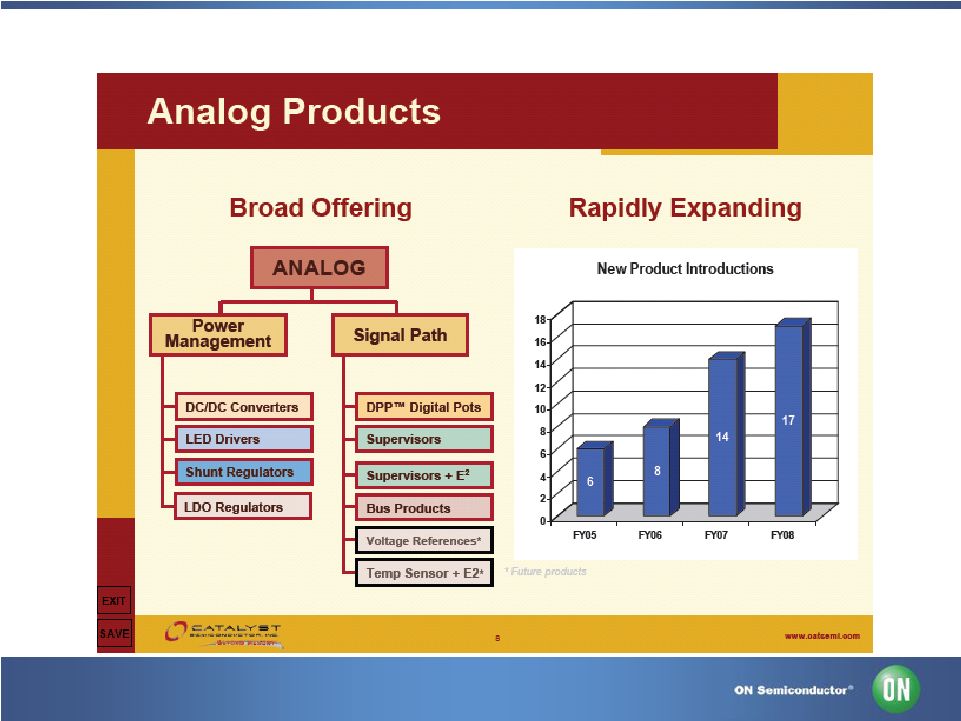

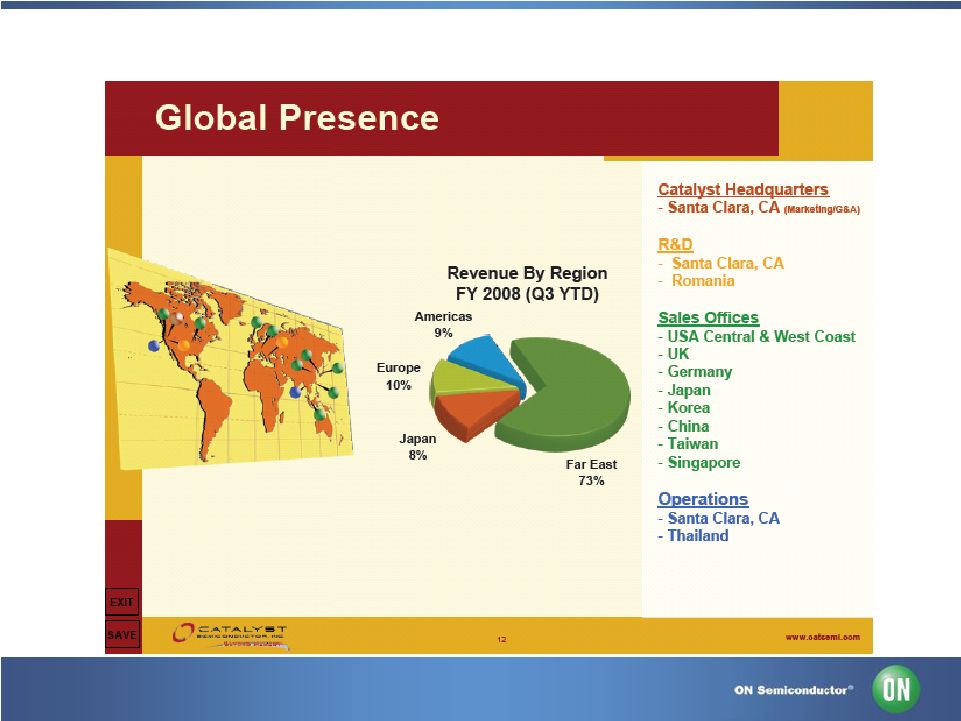

Sales Operations Confidential Proprietary FAQ’s FREQUENTLY ASKED QUESTIONS Acquisition Background Who is Catalyst Semiconductor? Catalyst Semiconductor (NASDAQ:CATS) is committed to helping today's electronics designers balance system performance and board costs with a rapidly growing portfolio of analog, mixed-signal and non-volatile memory ICs for telecommunications, networking systems, computation, automotive, industrial and consumer markets. Products include Digitally Programmable Potentiometers [DPP™], white and color LED drivers, DC/DC converters, voltage supervisors, I/O expanders, serial and parallel EEPROMs, Flash memories, and NVRAMs. Typical applications for ICs include LCD displays, cellular phones, automotive illumination and instrumentation, optical networks, wireless LANs, network cards, DIMM modules, printers, digital satellite box receivers and set-top boxes. The Catalyst headquarters facility is located in Santa Clara, California with regional sales operations and technical support offices in China, Korea, Taiwan, Thailand, Southeast Asia, Japan, UK, Germany and the Americas. The company’s strategy is to combine a fabless business model with in-house design centers in Santa Clara, California and Bucharest, Romania to provide customers with the high-performance and low-cost required for success in today's electronics markets. For more information visit http://www.catsemi.com/ When do you expect the deal to close? We expect to close the deal within sometime during ON’s fourth quarter of 2008 subject to Catalyst shareholder and regulatory approval and the satisfaction of customary closing conditions. What happens after this initial announcement? Work will continue on all levels to finalize details needed to close the sale. |

Sales Operations Confidential Proprietary FAQ’s FREQUENTLY ASKED QUESTIONS About ON Semiconductor Who is ON Semiconductor? ON Semiconductor (Nasdaq: ONNN) is a preferred supplier of power solutions to engineers, purchasing professional, distributors, and contract manufacturers in the computer, cell phone, portable devices, automotive and industrial markets. They design, manufacture and market an extensive portfolio of semiconductor components that addresses the design needs of sophisticated electronic systems and products. •Their power management semiconductor components distribute and monitor the supply of power to the different elements within a wide variety of electronic devices. •Their data management semiconductor components provide high-performance clock management and data flow management for precision computing and communications systems. •Their standard semiconductor components serve as “building block” components within virtually all electronic devices. For more details please go to our Web site at www.onsemi.com Where is the ON Semiconductor’s headquarters? The company is headquartered in Phoenix, Arizona, USA. The company owns and operates several development centers and several manufacturing facilities located throughout the U.S., Europe and Asia. How many employees are employed by ON Semiconductor? Worldwide, ON Semiconductor employs more than 14,000 employees. What is ON Semiconductor’s company mission? To provide our customers with high quality, cost-effective solutions to solve the demanding power and signal management design challenges. What is ON Semiconductor’s company vision? ON Semiconductor is dedicated to becoming the premier supplier of high performance energy efficient silicon solutions worldwide. |

Sales Operations Confidential Proprietary FAQ’s FREQUENTLY ASKED QUESTIONS What is ON Semiconductor’s business strategy? •ON Semiconductor’s business strategy is to become the supplier of choice by: •Leveraging our operational strengths •Building intimate relationships with market-making customers •Improving our technological capabilities to provide leadership in power and signal management solutions What is ON Semiconductor’s Quality/Service philosophy/statement? ON Semiconductor’s Quality statement is: “Every ON Semiconductor employee is personally responsible for ensuring the highest quality in products and services delivered to internal and external customers. Continuous improvement in the quality of processes, products, and service is fundamental to the achievement of customer satisfaction.” |