QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant /x/

|

| Filed by a Party other than the Registrant / / |

Check the appropriate box: |

| / / | | Preliminary Proxy Statement |

| / / | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| / / | | Definitive Additional Materials |

| / / | | Soliciting Material Pursuant to §240.14a-12

|

CINERGY CORP. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| /x/ | | No fee required. |

| / / | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| / / | | Fee paid previously with preliminary materials. |

| / / | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

March 14, 2003

Dear Shareholder:

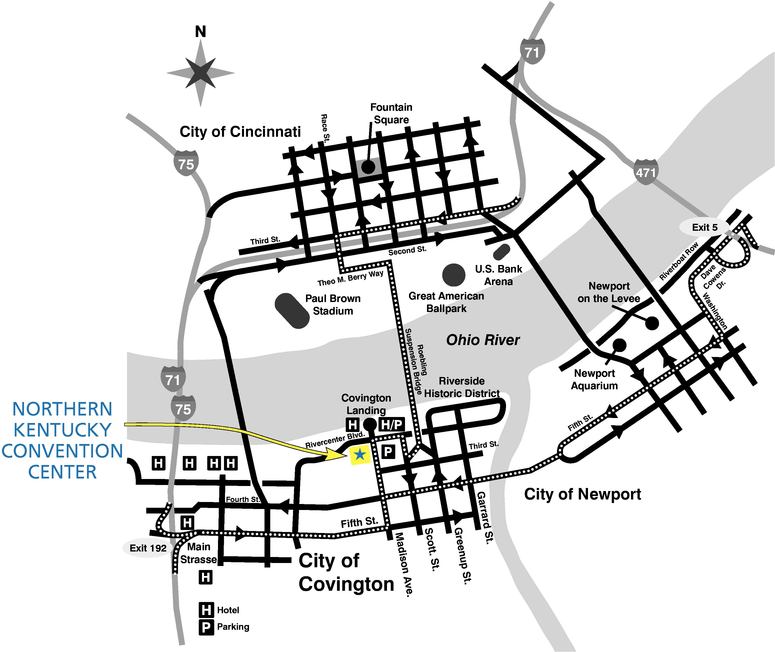

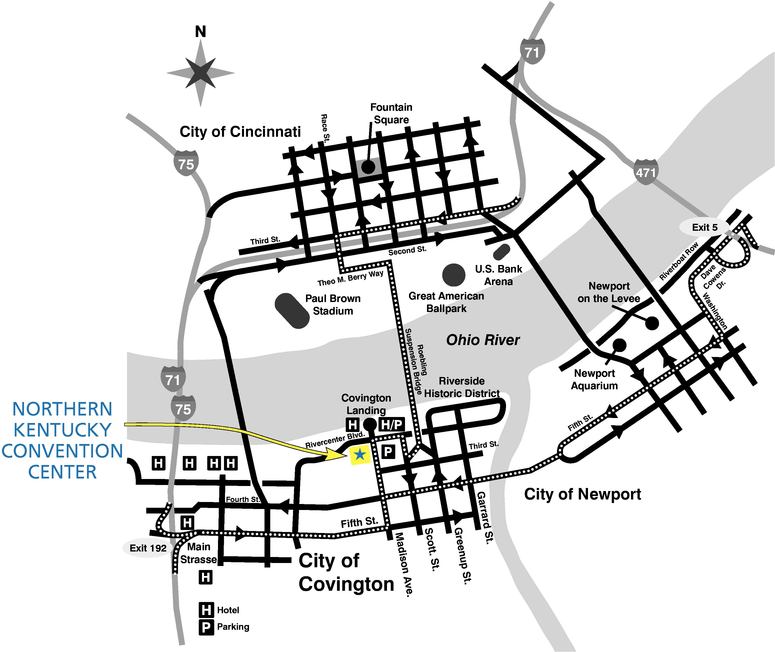

You are cordially invited to attend the Annual Meeting of Shareholders of Cinergy Corp. to be held on Tuesday, April 22, 2003, at 9:00 a.m., eastern daylight time, in Ballrooms D & E of the Northern Kentucky Convention Center, One West Rivercenter Boulevard, Covington, Kentucky.

As explained in the enclosed proxy statement, at this year's meeting you will be asked to vote for the election of three Class III directors and to consider any other business that properly comes before the meeting.

It is important that all Cinergy shareholders, regardless of the number of shares owned, participate in the affairs of the company. Last year, over 86% of Cinergy's shares were represented in person or by proxy at the annual meeting.

Even if you plan to attend this year's meeting, it is a good idea to vote your shares now before the meeting, just in case your plans change. You may vote by using the toll-free telephone number provided or via the Internet. If you wish to use either of these methods, please follow the telephone or Internet voting instructions that are printed on your enclosed proxy card. Alternatively, you may mark, date and sign your proxy card and return it using the envelope provided, on which no postage stamp is necessary if mailed in the United States.

Whether you choose to vote by telephone, via Internet or by mail, your response is greatly appreciated.

We hope you will find it possible to attend this year's meeting, and thank you for your continued interest in Cinergy.

Cinergy Corp.

139 East Fourth Street

Cincinnati, Ohio 45202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 22, 2003

We will hold the Annual Meeting of Shareholders of Cinergy Corp. on Tuesday, April 22, 2003 at 9:00 a.m., eastern daylight time, in BALLROOMS D & E of the NORTHERN KENTUCKY CONVENTION CENTER, One West Rivercenter Boulevard, Covington, Kentucky.

The purposes of the Annual Meeting are to:

- •

- elect three Class III directors to serve for three-year terms ending in 2006; and

transact any other business that may properly come before the meeting (or any adjournment or postponement of the meeting).

Shareholders of record at the close of business on Friday, February 21, 2003 may vote at the Annual Meeting. It is important that your shares be represented at this meeting.

Whether or not you expect to be present at the Annual Meeting, please vote by toll-free telephone or Internet, or mark, date and sign the enclosed proxy card and return it using the enclosed, postage-paid envelope. Regardless of the manner in which you vote, we urge and greatly appreciate your prompt response.

| | | By order of the Board of Directors, |

|

|

JULIA S. JANSON

Corporate Secretary |

Dated: March 14, 2003

Cinergy Corp.

139 East Fourth Street

Cincinnati, Ohio 45202

(513) 421-9500

PROXY STATEMENT

Introduction

Cinergy Corp. is a Delaware corporation and a registered holding company under the Public Utility Holding Company Act of 1935. Cinergy is the parent company of:

- •

- PSI Energy, Inc., our operating utility that provides electric service to our customers in north central, central and southern Indiana;

- •

- The Cincinnati Gas & Electric Company, our operating utility that provides electric and gas service to our customers in southwestern Ohio and, through a principal subsidiary, The Union Light, Heat and Power Company, to our customers in adjacent areas in Kentucky;

- •

- Cinergy Services, Inc., the subsidiary we use to provide a variety of centralized administrative, management and support services to our companies;

- •

- Cinergy Global Resources, Inc., the subsidiary we primarily use to hold our international businesses and certain domestic investments; and

- •

- Cinergy Investments, Inc., the subsidiary we use to hold most of our domestic, non-utility businesses.

Cinergy has other subsidiaries formed for a variety of purposes, including holding our interests in new technology initiatives and investment opportunities in the telecommunications industry and in energy and power generation.

Mailing and Solicitation of Proxies

This solicitation of proxies is made by Cinergy's Board of Directors for the Annual Meeting of Shareholders to be held on April 22, 2003. Cinergy's Annual Report to Shareholders, including our consolidated financial statements and accompanying notes for the year ended December 31, 2002, is also enclosed.

We began mailing our proxy material to shareholders on or about March 14, 2003.

Cinergy will pay the cost of the solicitation of proxies by the Board. We have hired Georgeson Shareholder Communications, Inc. to help us mail the proxy material and to solicit proxies. Their fee for these services is $9,500, plus out-of-pocket expenses. We can solicit proxies by mail, personally or by telephone. Our officers and employees may assist in this process; however, they will not receive additional pay for these services. We have asked brokerage houses and other custodians, nominees and fiduciaries to forward our proxy material to the beneficial owners of Cinergy common stock, and we will reimburse them for their out-of-pocket expenses for doing so.

What You Are Voting On

You are being asked to vote on:

- •

- the election of three Class III directors (Phillip R. Cox, James E. Rogers and John J. Schiff, Jr.) for three-year terms ending in 2006.

The Board recommends that you voteFOR each nominee.

Who Can Vote

Holders of record of Cinergy common stock on February 21, 2003, the record date, may vote at the Annual Meeting. Our common stock is Cinergy's only voting security. There were 175,508,555 shares of Cinergy common stock outstanding on the record date. In order to conduct the Annual Meeting, holders of a majority of the outstanding shares must be present in person or represented by proxy so that there is a quorum. It is important that you vote promptly so that your shares are counted toward the quorum.

How You Can Vote

By Proxy – Before the Annual Meeting, you can give a proxy to vote your shares of Cinergy common stock in one of the following ways:

- •

- by calling the toll-free telephone number;

- •

- by using the Internet; or

- •

- by completing and signing your proxy card and mailing it in time to be received before the Annual Meeting.

The telephone and Internet voting procedures are designed to confirm your identity, to allow you to give your voting instructions and to verify that your instructions have been properly recorded. If you wish to vote by telephone or Internet, please follow the instructions that are printed on your enclosed proxy card.

If you mail us your properly completed and signed proxy card, or vote by telephone or Internet, your shares of Cinergy common stock will be voted according to the choices that you specify. If you sign and mail your proxy card without marking any choices, your proxy will be voted FOR the election of all nominees for director. We do not expect that any other matters will be brought before the Annual Meeting. However, by giving your proxy you appoint the persons named as proxies as your representatives at the Annual Meeting. If an issue comes up for vote at the Annual Meeting that is not included in the proxy material, the proxy holders will vote your shares in accordance with their best judgment.

In Person – You may come to the Annual Meeting and cast your vote there. If your shares are held in the name of your broker, bank or other nominee and you wish to vote at the Annual Meeting, you must bring an account statement or letter from the nominee indicating that you were the owner of the shares on February 21, 2003.

2

How You Can Revoke Your Proxy

You may revoke your proxy at any time after you give it and before it is voted in one of the following ways:

- •

- by notifying Cinergy's Corporate Secretary in writing that you are revoking your proxy;

- •

- by giving another signed proxy that is dated after the proxy you wish to revoke;

- •

- by using the telephone or Internet voting procedures; or

- •

- by attending the Annual Meeting and voting in person.

How Votes Are Counted

Each share of Cinergy common stock is entitled to one vote on each matter voted on at the Annual Meeting. For the election of directors, the three persons receiving the greatest number of votes will be elected to the Board. Any other matter that comes up for vote at the Annual Meeting will be determined by the affirmative vote of the majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the matter. In counting the vote on any other matter, abstentions will have the same effect as votes against the matter and shares that are the subject of a broker non-vote will be deemed absent and have no effect on the outcome of the vote. A broker non-vote occurs when a broker or other nominee who holds shares for another person has not received voting instructions from the owner of the shares and, under New York Stock Exchange rules, does not have discretionary authority to vote on a proposal.

Cinergy has retained Corporate Election Services, Inc. to preliminarily count the votes. Inspectors of election will be appointed by the presiding officer at the Annual Meeting, and they will determine the final count and announce the voting results at the Annual Meeting.

3

ITEM 1. ELECTION OF DIRECTORS

Cinergy's Board is divided into three classes (Class I , Class II and Class III), with all classes as nearly equal in number as possible. The three-year terms of each class are staggered so that the term of one class expires at each annual meeting. The terms of the Class III directors will expire at the Annual Meeting.

The Board has nominated:

- •

- Phillip R. Cox, James E. Rogers and John J. Schiff, Jr. for re-election as Class III directors for three-year terms ending in 2006.

If any director is unable to stand for re-election, the Board may reduce the number of directors or designate a substitute. In that case, the shares represented by your proxy may be voted for a substitute director. However, we do not expect that any nominee will be unavailable or unable to serve.

The following brief biographies contain information about the three nominees for director and about the directors whose terms extend beyond the Annual Meeting. The information includes each person's principal occupations and business experience for at least the past five years. Mr. Rogers is the only director who is an employee of Cinergy or its subsidiaries or affiliates.

The Board of Directors Recommends Voting FOR ALL Nominees, Designated on the Proxy as Item 1.

4

Class III Director Nominees for three-year terms ending in 2006

PHILLIP R. COX

Director of Cinergy since 1994;

Chair of the Public Policy Committee and

Member of the Corporate Governance Committee.

Director of CG&E from 1994 to 1995. Age 56.

Mr. Cox is President and Chief Executive Officer of Cox Financial Corporation, a provider of financial and estate planning services. He is a director of Broadwing Inc., the Federal Reserve Bank of Cleveland, Long Stanton Manufacturing Co. and Touchstone Mutual Funds.

JAMES E. ROGERS

Director of Cinergy since 1993;

Chair of the Executive Committee.

Director of PSI since 1988 and CG&E since 1994. Age 55.

Mr. Rogers is Chairman of the Board, President and Chief Executive Officer of Cinergy. Previously, he served as Vice Chairman, President and Chief Executive Officer. Mr. Rogers also holds, or has held, similar executive officer positions with Cinergy's principal subsidiaries. He is a director of Duke Realty Corp., Fifth Third Bancorp and Fifth Third Bank.

JOHN J. SCHIFF, JR.

Director of Cinergy since 1994;

Member of the Audit Committee and

Compensation Committee.

Director of CG&E from 1986 to 1995. Age 59.

Mr. Schiff is Chairman of the Board, President and Chief Executive Officer of Cincinnati Financial Corporation, an insurance holding company, and The Cincinnati Insurance Company. He is a director of Fifth Third Bancorp, Fifth Third Bank and The Standard Register Company.

Class I Directors with terms ending in 2004

MICHAEL G. BROWNING

Director of Cinergy since 1994;

Chair of the Compensation Committee and

Member of the Corporate Governance Committee and Executive Committee.

Director of PSI since 1990. Age 56.

Mr. Browning is Chairman and President of Browning Investments, Inc., which is engaged in real estate development. He also serves as owner, general partner or managing member of various real estate entities.

5

GEORGE C. JUILFS

Director of Cinergy since 1994;

Member of the Compensation Committee and

Public Policy Committee.

Director of CG&E from 1980 to 1995. Age 63.

Mr. Juilfs is Chairman of the Board and Chief Executive Officer of SENCORP, an international holding company with subsidiaries that manufacture and market powered fastening systems and that commercialize healthcare technologies. He is also the past chairman of the board of directors of the Cincinnati branch of the Federal Reserve Bank of Cleveland.

DUDLEY S. TAFT

Director of Cinergy since 1994;

Chair of the Corporate Governance Committee and

Member of the Executive Committee.

Director of CG&E from 1985 to 1995. Age 62.

Mr. Taft is President and Chief Executive Officer of Taft Broadcasting Company, which holds investments in media-related activities. He is a director of Fifth Third Bancorp, Fifth Third Bank, Tribune Company, The Union Central Life Insurance Company and U.S. Playing Card Company.

Class II Directors with terms ending in 2005

THOMAS E. PETRY

Director of Cinergy since 1994;

Member of the Compensation Committee and

Executive Committee.

Director of CG&E from 1986 to 1995. Age 63.

Mr. Petry is retired as Chairman of the Board and Chief Executive Officer of Eagle-Picher Industries, Inc., a diversified manufacturer of industrial and automotive products. He is a director of The Union Central Life Insurance Company and U.S. Bancorp.

MARY L. SCHAPIRO

Director of Cinergy since 1999;

Chair of the Audit Committee and

Member of the Public Policy Committee. Age 47.

Ms. Schapiro has served as Vice Chairman of NASD (formerly The National Association of Securities Dealers, Inc.) and President of Regulatory Policy and Oversight since May 2002. Previously, she was President and a board member of NASD Regulation, Inc. Regulatory Policy and Oversight (as successor entity to NASD Regulation) has responsibility for regulating all member brokerage firms and individual registered representatives and for oversight of The Nasdaq Stock Market. Ms. Schapiro is also a member of the Board of Governors of NASD and serves as a director of Kraft Foods Inc.

6

PHILIP R. SHARP

Director of Cinergy since 1995;

Member of the Audit Committee and

Public Policy Committee. Age 60.

Mr. Sharp is a Senior Research Fellow at Harvard University's John F. Kennedy School of Government, and a Senior Policy Advisor to the law firm of Van Ness Feldman, PC. He served as a member of the Secretary of Energy's Advisory Board and chaired the Secretary's Electric System Reliability Task Force. A 10-term Congressman from Indiana, Mr. Sharp was a ranking member of the House Energy and Commerce Committee and was chairman of the House Energy and Power Subcommittee. He is a director of Proton Energy Systems, Inc.

Meetings and Committees of the Board

Cinergy's Board met 13 times during 2002. All directors attended more than 75% of the total number of Board meetings and meetings of the committees on which they served. The Board has five standing committees to help carry out its responsibilities. Directors' committee memberships are included with their biographical information above.

The Audit Committee met 9 times during 2002. Each of its members is a non-employee director of Cinergy, and also an "independent" director within the meaning of Paragraphs 303.01(B)(2)(a) and 303.01(B)(3) of the New York Stock Exchange's listing standards. This Committee selects and retains a firm of independent public accountants to conduct audits of the accounts of Cinergy and its subsidiaries. It also reviews with the independent public accountants the scope and results of their audits, as well as the accounting procedures, internal controls, and accounting and financial reporting policies and practices of Cinergy and its subsidiaries, and makes reports and recommendations to the Board as it deems appropriate. The Audit Committee's charter, which was included as an appendix to our 2001 proxy statement and was amended during December 2002, is available on our website atwww.cinergy.com. For more information, please see "Audit Committee Report" below.

The Compensation Committee met 5 times during 2002. The nature and scope of the Compensation Committee's responsibilities are described in the "Board Compensation Committee Report on Executive Compensation" (see page 12).

The Corporate Governance Committee met 4 times during 2002. This Committee recommends to the Board the slate of nominees for director for each year's annual meeting and, when vacancies occur, names of individuals who would make suitable directors of Cinergy. It also consults with appropriate officers of Cinergy on matters relating to the organization of the Board and its committees. The Committee has no established procedures for consideration of nominees recommended by shareholders.

The other standing committees of the Board are the Executive Committee and the Public Policy Committee.

7

Audit Committee Report

The Audit Committee has reviewed and discussed Cinergy's audited consolidated financial statements with management. Further, the Audit Committee has discussed with the independent public accountants the matters required to be discussed by the Statement on Auditing Standards No. 61 (SAS 61 – Communication with Audit Committees), as amended, relating to the accountants' judgment about the quality of Cinergy's accounting principles, judgments and estimates, as applied in its financial reporting.

The Audit Committee also has received the written disclosures and the letter from the independent public accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) that relates to the accountants' independence from Cinergy and its subsidiaries, and has discussed with the independent public accountants their independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements be included in Cinergy's Annual Report on Form 10-K for the year ended December 31, 2002, for filing with the Securities and Exchange Commission.

Compensation of Directors

Effective January 1, 2003, each of Cinergy's non-employee directors is entitled to receive an annual retainer fee of $60,000, payable 50% in shares of Cinergy common stock granted under the Cinergy Corp. 1996 Long-Term Incentive Compensation Plan (the "LTIP"), which may be voluntarily deferred at the director's election, and 50% in cash. Each non-employee director also receives a fee of $2,000 for each Board meeting attended. Non-employee directors who serve on one or more Board committees receive an annual retainer fee of $6,000 for each committee membership, plus a fee of $2,000 for each committee meeting attended. Chairpersons of the committees receive an additional annual retainer fee of $6,000. The fee is $1,250 for any Board or committee meeting held by conference call. Directors who are employees of Cinergy receive no compensation for their services as directors.

The number of shares of Cinergy common stock payable as 50% of the annual retainer fee is determined by dividing $30,000 by the "Fair Market Value" (as defined in the LTIP) of a share of Cinergy common stock on January 1 of the year of payment. Unless voluntarily deferred, these shares are delivered to the director as soon as practicable after January 1 each year. If voluntarily deferred, the shares are credited to an individual bookkeeping account maintained by Cinergy on behalf of the non-employee director and must remain in the account until he or she ceases to be a director, at which time they will be

8

distributed to the director. Each non-employee director's account will be credited with dividends at the same time and rate as they are paid to holders of Cinergy common stock.

Under our Directors' Deferred Compensation Plan, each non-employee director of Cinergy and its subsidiaries may choose to defer the portion of his or her fees that is otherwise payable in cash into a bookkeeping account denominated in either:

- •

- units representing shares of Cinergy common stock, and/or

- •

- cash.

If deferred in units, dividends are credited to the director's account, acquiring additional units at the same time and rate as dividends are paid to holders of Cinergy common stock. Amounts deferred into a cash bookkeeping account earn interest at the annual rate (adjusted quarterly) equal to the interest rate on a one-year certificate of deposit for $100,000 (as quoted inThe Wall Street Journal) on the first business day of the calendar quarter. Deferred units are distributed as shares of Cinergy common stock, and accrued cash accounts are paid in cash, generally in the year immediately following the year in which the director retires from the board.

Under Cinergy's Stock Option Plan or under the LTIP, each non-employee director is granted a non-qualified stock option to purchase 12,500 shares of Cinergy common stock when he or she first is elected to the Board. All such options have exercise prices at least equal to 100% of the fair market value of Cinergy common stock on the date of the grant, vest at the rate of 20% per year over a five-year period and may be exercised over a ten-year term.

Under Cinergy's Directors' Equity Compensation Plan, each non-employee director receives an annual award on December 31 equal to 450 shares of Cinergy common stock. Each such award is credited to a bookkeeping account maintained on behalf of the non-employee director and is paid beginning when he or she ceases to be a director. The accrual of future benefits under Cinergy's Retirement Plan for Directors was eliminated effective January 1, 1999. Each of our currently serving non-employee directors who had an accrued cash benefit under the Plan on that date converted the benefit to units representing shares of Cinergy common stock, payable commencing at the time of retirement from the Board. Each stock unit account in the Directors' Equity Compensation Plan and the Retirement Plan for Directors acquires additional units by the crediting of dividends to the account, at the same time and rate as dividends are paid to holders of Cinergy common stock.

9

Security Ownership of Certain Beneficial Owners and Management

Listed on the following table are the owners of 5% or more of Cinergy's outstanding shares of common stock, as of December 31, 2002. This information is based on the most recently available reports filed with the Securities and Exchange Commission and provided to us by the companies listed.

Name and Address

of Beneficial Owner

| | Amount and Nature

of Beneficial Ownership

| | Percent

of Class

| |

|---|

Wellington Management Company, LLP

75 State Street

Boston, Massachusetts 02109 | | 13,059,712 shares | (1) | 7.8 | % |

AXA Financial, Inc.

1290 Avenue of the Americas

New York, NY 10104 |

|

10,378,778 shares |

(2) |

6.2 |

% |

U. S. Trust Company of California, N.A.

515 South Flower Street

Los Angeles, CA 90071 |

|

10,065,719 shares |

(3) |

6.0 |

% |

- (1)

- Holder reports having shared voting power with respect to 6,619,722 shares, shared dispositive power with respect to all shares, and sole voting and sole dispositive power with respect to none of these shares.

- (2)

- Holder reports having sole voting power with respect to 5,228,660 shares, shared voting power with respect to 981,664 shares and sole dispositive power with respect to all shares.

- (3)

- Shares held as trustee of a trust established in connection with certain benefit plans and arrangements for directors and employees of Cinergy and its subsidiaries. Participants have the right to vote shares credited to their accounts; the trustee has discretion to vote shares not voted by participants.

10

Listed on the following table is the number of shares of Cinergy common stock beneficially owned by each director, each executive officer named in the Summary Compensation Table and all directors and executive officers as a group, as of the record date.

Name of Beneficial Owner

| | Amount and Nature

of Beneficial Ownership(1)

| | Percent

of Class

| |

|---|

| Michael G. Browning | | 117,920 shares | | * | |

| Phillip R. Cox | | 18,794 shares | | * | |

| Michael J. Cyrus | | 318,499 shares | | * | |

| R. Foster Duncan | | 94,591 shares | | * | |

| William J. Grealis | | 401,130 shares | | * | |

| George C. Juilfs | | 42,396 shares | | * | |

| Thomas E. Petry | | 60,792 shares | | * | |

| James E. Rogers | | 1,743,939 shares | | * | |

| Mary L. Schapiro | | 22,043 shares | | * | |

| John J. Schiff, Jr. | | 60,836 shares | (2) | * | |

| Philip R. Sharp | | 33,175 shares | | * | |

| Dudley S. Taft | | 26,385 shares | | * | |

| James L. Turner | | 76,691 shares | | * | |

All directors and executive officers

as a group (25 persons) | | 3,472,119 shares | | 1.98 | % |

- *

- Represents less than 1%.

- (1)

- Includes shares that there is a right to acquire within 60 days pursuant to the exercise of stock options in the following amounts: Mr. Browning – 18,500; Mr. Cox – 18,500; Mr. Cyrus – 191,100; Mr. Duncan – 80,000; Mr. Grealis – 226,731; Mr. Juilfs – 18,500; Mr. Petry – 18,500; Mr. Rogers – 1,250,135; Ms. Schapiro – 16,000; Mr. Schiff – 18,500; Mr. Sharp – 16,000; Mr. Taft – 18,500; Mr. Turner – 47,300; and all directors and executive officers as a group – 2,190,105.

Does not include units representing shares of Cinergy common stock credited under Cinergy's directors' deferred retainer fee arrangement, Retirement Plan for Directors, Directors' Equity Compensation Plan, Directors' Deferred Compensation Plan and/or 401(k) Excess Plan in the following amounts: Mr. Browning – 33,323; Mr. Cox – 9,401; Mr. Cyrus – 587; Mr. Duncan – 888; Mr. Grealis – 935; Mr. Juilfs – 16,514; Mr. Petry – 13,656; Mr. Rogers – 47,853; Ms. Schapiro – 6,650; Mr. Schiff – 12,398; Mr. Sharp – 6,998; Mr. Taft – 13,251; and Mr. Turner – 589.

- (2)

- Includes 3,334 shares owned of record by a trust of which Mr. Schiff is one of three trustees who share voting and investment power equally.

11

Board Compensation Committee Report on Executive Compensation

The primary responsibilities of the Compensation Committee include:

- •

- establishing Cinergy's executive compensation policy;

- •

- recommending, overseeing and administering compensation plans for executive officers and key employees;

- •

- determining compensation for the Chief Executive Officer; and

- •

- reviewing and approving compensation for our other executive officers.

During 2002, the Committee consisted of Messrs. Michael G. Browning (Chair), George C. Juilfs, Thomas E. Petry and John J. Schiff, Jr. Each of the members is a "non-employee director" within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934 and an "outside director" within the meaning of Section 162(m) of the Internal Revenue Code.

Compensation Policy

Our compensation program for executive officers includes salary, annual cash incentives and long-term incentives. The program is designed to attract, retain and motivate the high quality employees needed to provide superior service to customers and to maximize returns to shareholders.

Base salaries for the executive group are competitive (targeted at the 50th–75th percentile) with those provided by (i) comparably sized utility companies for utility specific executives or (ii) general industry for general corporate executives. Base salaries are reviewed annually. Increases in base salary are based on such factors as competitive industry salaries, Cinergy's financial results and an assessment of each executive's performance, role and skills.

Our executive compensation program also seeks to link executive and shareholder interests through cash and equity incentive plans, in order to reward corporate and individual performance. Annual and long-term incentive plans are intended to provide executive officers with the opportunity to earn compensation targeted at the 75th percentile as compared to such compensation provided by comparably sized utility companies, assuming financial objectives are satisfied (see "Annual Incentive Compensation" and "Long-Term Incentive Compensation" for a description of the annual and long-term incentive plans in which the named executive officers participate). This represents a change from the Committee's previous philosophy, which targeted the 50th percentile of general industry annual and long-term incentives. The previous target was approximately 30% higher than the revised target. This revision has been adopted because the Committee believes that the use of comparably sized utility company benchmarks is more appropriate given Cinergy's business model, the evolution of the electric power industry and the current business environment.

12

Each of base salaries and annual and long-term incentives for the executive group are closely monitored by the Committee. Moreover, the Committee continuously reviews the performance of Cinergy and its executives in determining the targeted percentile level of earnings as compared to comparably sized utility companies.

The Committee believes strongly that annual and long-term incentive opportunities assist in motivating the types of behavior necessary to successfully manage short- and long-term corporate goals. This emphasis results in a compensation mix in which targeted annual and long-term incentives make up, on the average, at least 50% of the annual compensation that can be earned by the Chief Executive Officer and the other executive officers.

Cinergy also has the following two non-qualified deferred compensation plans under which executive officers can elect to defer salary and/or bonus:

- •

- the Nonqualified Deferred Incentive Compensation Plan allows deferral of all or a portion of the annual cash incentive awards; and

- •

- the 401(k) Excess Plan allows deferral of a portion of base salaries above that which can be deferred under Cinergy's Non-Union Employees' 401(k) Plan because of federal limitations on the amount of compensation that can be deferred into qualified plans.

In furtherance of Cinergy's objective to align its executive officers' interests with those of its shareholders, in 2002, nonelective contributions were made to the 401(k) Excess Plan on behalf of the executive group in lieu of providing merit increases (additional base salary increases were provided to two members of the executive group). These contributions ranged from 1.8 % to 8.1% of the executives' base salaries. The percentage allocated to each executive was determined based upon an assessment of his/her individual 2001 performance. These amounts are deemed to be invested in Cinergy common stock and, generally, are not payable until termination of employment.

Also, in an effort to align the interests of its shareholders and its Chief Executive Officer and executive officers, Cinergy has implemented a minimum stock ownership policy. Under this program, the Chief Executive Officer and the executive officers are required to maintain a minimum ownership interest in Cinergy equal to a multiple of their salaries that varies based on position. The executives have a transition period to comply with this requirement. The directors, the Chief Executive Officer and the executive officers also have agreed not to dispose of any shares of Cinergy common stock acquired through the exercise of stock options (except to the extent necessary to pay the exercise price and/or any accompanying tax obligations) until 90 days after their termination from employment or other service with Cinergy.

13

Annual Incentive Compensation

Approximately 350 employees, including all named executive officers, participate in Cinergy's Annual Incentive Plan. Each participant is eligible to receive an incentive cash award or bonus to the extent that certain pre-determined corporate and individual goals are achieved. For 2002, potential awards ranged from 2.5% to 130% of an employee's annual base salary (including the nonelective contributions made to the 401(k) Excess Plan, as discussed above), depending upon achievement levels and the employee's position (for the named executive officers, the maximum annual incentive opportunity ranged from 105% to 130%). Graduated standards for achievement were developed to encourage each employee's contribution.

For 2002, the Annual Incentive Plan was based on a corporate earnings per share goal, business unit goals and individual goals. For corporate center employees and business unit chief executive officers (which includes, among others, the named executive officers), the corporate earnings per share and individual goals were each weighted at 50% of the total possible award. For other business unit employees, the corporate earnings per share goal was weighted at 50% of the total possible award, with business unit specific goals and individual goals accounting for 25% each.

Achievement levels for goals under the Annual Incentive Plan are based on a sliding scale from 1.0 to 3.0. For 2002, the named executive officers earned achievement levels ranging from 2.5 to 3.0 for their individual business goals based on an assessment of the extent to which the goals were achieved. These goals included maintaining an investment grade for Cinergy's senior unsecured debt, maintaining a certain dividend level and implementing cost savings initiatives. Cinergy earned an achievement level of 1.0 for its corporate earnings per share goal. In addition, the Committee elected to award a supplemental cash bonus (or nonelective contribution to the 401(k) Excess Plan, in the case of Mr. Rogers) to the Annual Incentive Plan participants in recognition of Cinergy's exemplary performance during a very difficult environment for the utility industry in 2002. The supplemental award, together with the aforementioned bonus, gave each participant an amount equivalent to what they would have earned had Cinergy's earnings per share achievement level been a 2.5.

For 2003, the Committee intends that the Annual Incentive Plan will be based on a corporate net income goal, business unit goals and individual goals. For the named executive officers, the corporate net income goal and aggregate individual goals are equally weighted. The 2003 annual incentive bonus for other participants in the Annual Incentive Plan will be determined based on the corporate net income goal, business unit specific goals and individual goals as appropriate.

14

Long-Term Incentive Compensation

Cinergy has a long-term incentive compensation program under the terms of the LTIP. The LTIP is designed to align the interests of our shareholders, customers and management to enhance value by increasing total shareholder return. The LTIP ties a large portion of the participants' potential pay to long-term performance. This approach provides a greater upside potential for outperforming peer companies, plus downside risk for underperforming. Approximately 120 management employees, including all executive officers, participate in the LTIP.

The LTIP consists of overlapping three-year performance cycles, with a new three-year performance cycle starting each January 1. The cycle that ended December 31, 2002 covered calendar years 2000 through 2002, and the cycle that started on January 1, 2003 continues through December 31, 2005.

For each current performance cycle, the annualized target award opportunity as a percentage of base salary (including applicable nonelective contributions made to the 401(k) Excess Plan) ranges from 20% to 160% depending on the participant's position. The target LTIP award values are 160% of base salary for the Chief Executive Officer and 90% of base salary for each of the other named executive officers. Stock options comprised 25% of the total award opportunity under the cycles that began January 1, 2001, 2002, and 2003, and the Value Creation Plan (discussed below) comprised the other 75%.

The Value Creation Plan portion of the LTIP consists of a target grant of performance shares for each cycle. These performance shares generally vest only to the extent that Cinergy's total shareholder return ("TSR") targets for the cycle are met as compared with the TSR of a peer group of companies. The peer group is derived from the S&P Electric Supercomposite Index, in which Cinergy is included. TSR means share price appreciation plus dividends, divided by the stock price at the beginning of the cycle. Prospectively, Cinergy plans to pay performance share awards 50% in Cinergy common stock and 50% in cash.

The Committee determined that Cinergy's TSR performance percentile for the cycle that ended December 31, 2002 was 0.877, which generally corresponds to an award of 200% of the target grant of performance shares.

Chief Executive Officer

The Committee approved a $312,000 nonelective contribution to the Cinergy Corp. 401(k) Excess Plan in lieu of increasing Mr. Rogers' base salary for 2002. The Committee approved this nonelective contribution based primarily on Cinergy's accomplishments in 2001 and the Committee's assessment of Mr. Rogers' individual performance in 2001. This contribution was also intended to assist in meeting our objective of compensating Mr. Rogers at the 75thpercentile of total compensation provided to chief executive officers of comparably sized utility companies, consistent with the Committee's compensation

15

policy outlined above. For 2002, Mr. Rogers received a cash award under the Annual Incentive Plan in the amount of $1,240,003. The award was based on Cinergy's achievement of its corporate earnings per share goal for the year, and the Committee's determination of Mr. Rogers' achievement of objective individual goals. Mr. Rogers' maximum potential 2002 award under the Annual Incentive Plan was equal to 130% of his annual base salary (including the nonelective contribution made to the 401(k) Excess Plan on his behalf in lieu of a 2002 base salary increase and deferred compensation). Also, as described above under "Annual Incentive Compensation," the Committee awarded Mr. Rogers a nonelective contribution to the 401(k) Excess Plan equal to $561,877, which is the additional award that he would have received under the Annual Incentive Plan based on a Cinergy achievement level of 2.5 with respect to the corporate earnings per share goal. Also, based on Cinergy's TSR achievement relative to the peer group for the performance cycle of the LTIP that ended December 31, 2002, Mr. Rogers received 98,100 shares of Cinergy common stock, a portion of which was contributed to the 401(k) Excess Plan. The nonelective contributions that were made for Mr. Rogers to the 401(k) Excess Plan are deemed invested in Cinergy common stock and are generally not payable until his termination of employment.

Code Section 162(m)

Internal Revenue Code Section 162(m) generally limits Cinergy's annual federal income tax deduction to one million dollars for compensation paid to each of the named executive officers. However, qualifying performance-based compensation is exempted from the deduction limit under certain conditions. The Committee's intent is to qualify the incentive compensation of the named executive officers for full corporate deductibility whenever feasible and consistent with the goals of the Committee's compensation policy. Thus, Cinergy has taken steps to qualify compensation related to grants of stock options and performance shares under the LTIP and bonuses paid pursuant to objective goals under the Annual Incentive Plan for full deductibility as performance- based compensation. However, in order to be competitive with comparable companies as to base salary and incentive compensation, and to attract and retain skilled employees, the Committee also awards compensation that may not qualify for exemption from the deduction limit under Section 162(m) of the Internal Revenue Code.

The tables that follow, and accompanying footnotes, reflect the decisions covered by this discussion.

16

Summary Compensation Table

The following table shows, for the past three years, the compensation paid to our Chief Executive Officer and the other four most highly compensated executive officers in 2002. These amounts include payments for services in all capacities to Cinergy and its subsidiaries. We sometimes refer to the persons listed below as the "named executive officers."

| |

| |

| |

| |

| | Long-Term Compensation

|

|---|

| |

| | Annual Compensation

| | Awards

| | Payouts

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other

Annual

Compensation

($)

| | Securities

Underlying

Options/SARs

(#)

| | LTIP

Payouts(1)

($)

| | All Other

Compen-

sation(2)

($)

|

|---|

James E. Rogers

Chairman of the Board, President and

Chief Executive Officer |

|

2002

2001

2000 |

|

1,250,004

1,250,004

1,100,000 |

|

1,240,003

1,281,250

990,000 |

|

7,620

47,196

32,268 |

|

123,200

100,900

433,600 |

|

4,719,363

2,163,875

841,870 |

|

1,278,639

147,728

121,151 |

Michael J. Cyrus

Executive Vice President of Cinergy,

and Chief Executive Officer of

the Energy Merchant Business Unit |

|

2002

2001

2000 |

|

575,004

575,004

524,700 |

|

488,615

345,002

314,820 |

|

1,165

15,129

68,859 |

|

31,900

27,100

52,500 |

|

1,507,497

1,745,652

256,826 |

|

48,360

26,716

19,576 |

William J. Grealis

Executive Vice President

Special Projects |

|

2002

2001

2000 |

|

550,008

550,008

485,535 |

|

541,418

391,881

292,561 |

|

19,059

30,096

73,472 |

|

30,500

25,800

47,500 |

|

1,365,307

597,845

232,586 |

|

61,547

27,469

19,545 |

R. Foster Duncan(3)

Executive Vice President

and Chief Financial Officer |

|

2002

2001 |

|

522,504

430,744 |

|

514,339

602,693 |

|

10,839

2,237 |

|

29,000

224,500 |

|

629,005

309,721 |

|

54,667

8,199 |

James L. Turner

Executive Vice President of Cinergy,

and Chief Executive Officer of the

Regulated Businesses Business Unit |

|

2002

2001

2000 |

|

346,500

320,250

271,044 |

|

341,089

192,019

134,000 |

|

3,939

4,705

4,179 |

|

19,200

15,500

28,400 |

|

815,942

347,254

123,377 |

|

36,679

16,687

9,413 |

- (1)

- Amounts appearing in this column reflect payouts of performance shares under the LTIP.

- (2)

- Amounts appearing in this column for 2002 include for Messrs. Rogers, Cyrus, Grealis, Duncan and Turner, respectively: (i) nonelective contributions to the 401(k) Excess Plan of $1,096,265, $17,946, $28,604, $27,169 and $18,021; (ii) employer matching contributions under the 401(k) plan and related 401(k) Excess Plan of $60,938, $28,032, $26,813, $25,472 and $16,892; and (iii) insurance premiums paid with respect to executive/group-term life insurance of $622, $2,382, $6,130, $2,026 and $1,766. For Mr. Rogers, the amount also includes above-market interest of $110,426 on amounts deferred under his Deferred Compensation Agreement and benefits under a life insurance agreement of $10,388.

- (3)

- Mr. Duncan was first employed by Cinergy in February 2001.

17

Option/SAR Grants Table

The following table shows individual grants of options to purchase Cinergy common stock made to the named executive officers during 2002.

Individual Grants(1)

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term(2)

|

|---|

Name

| | Number of

Securities

Underlying

Options/SARs

Granted

(#)

| | % of

Total

Options/SARs

Granted to

Employees in

Fiscal Year

| | Exercise

or Base

Price

($/Sh)

| | Expiration

Date

| | 5%

($)

| | 10%

($)

|

|---|

| James E. Rogers | | 123,200 | | 10.27 | % | 33.64 | | 1/1/2012 | | 2,606,912 | | 6,604,752 |

| Michael J. Cyrus | | 31,900 | | 2.66 | % | 33.64 | | 1/1/2012 | | 675,004 | | 1,710,159 |

| William J. Grealis | | 30,500 | | 2.54 | % | 33.64 | | 1/1/2012 | | 645,380 | | 1,635,105 |

| R. Foster Duncan | | 29,000 | | 2.42 | % | 33.64 | | 1/1/2012 | | 613,640 | | 1,554,690 |

| James L. Turner | | 19,200 | | 1.60 | % | 33.64 | | 1/1/2012 | | 406,272 | | 1,029,312 |

- (1)

- All options were granted pursuant to the LTIP effective January 1, 2002 and become exercisable on January 1, 2005, the third anniversary of the grant. In the case of a change-in-control of Cinergy or the retirement of an executive, all stock options become immediately exercisable.

- (2)

- The amounts shown in right-hand columns represent hypothetical potential appreciation of Cinergy common stock and do not represent either historical performance or, necessarily, expected future levels of appreciation. The actual values which may be realized, if any, upon the exercise of stock options will depend on the future market price of Cinergy common stock, which cannot be forecast with reasonable accuracy.

18

Aggregated Option/SAR Exercises and Year End Option/SAR Values Table

The following table shows, for each named executive officer, information concerning (i) stock options exercised during 2002, including the value realized (i.e., the spread between the exercise price and the market price on the date of exercise), and (ii) the number of shares covered by options held on December 31, 2002 and the value of the person's "in the money" options. "In-the-money" value is the positive spread between the closing market price of Cinergy common stock on December 31, 2002 ($33.72 per share) and an option's exercise price per share.

| |

| |

| | Number of

Securities Underlying

Unexercised

Options/SARs at

Year End

(#)

| | Value of

Unexercised

In-The-Money

Options/SARs at

Year End

($)

|

|---|

Name

| | Shares Acquired

on Exercise

(#)

| | Value

Realized

($)

| | Exercisable/

Unexercisable

| | Exercisable/

Unexercisable

|

|---|

| James E. Rogers | | 239,894 | | 2,395,342 | | 1,170,135/729,600 | | 6,586,107/1,994,819 |

| Michael J. Cyrus | | 0 | | 0 | | 191,100/150,300 | | 1,382,288/597,002 |

| William J. Grealis | | 52,304 | | 441,193 | | 226,731/146,800 | | 1,595,351/596,890 |

| R. Foster Duncan | | 0 | | 0 | | 80,000/202,500 | | 141,600/258,085 |

| James L. Turner | | 0 | | 0 | | 47,300/81,900 | | 388,788/251,196 |

19

Long-Term Incentive Plan Awards Table

Both stock option grants and target awards of performance shares were made for the three-year LTIP performance cycle that began January 1, 2002. The stock option grants are reported on the "Option/SAR Grants Table" above. The following table reports potential payouts of performance shares awarded to the named executive officers during 2002.

| |

| |

| | Estimated Future Payouts

under Non-Stock Price-Based

Plans(2)

|

|---|

Name

| | Number of Shares,

Units or Other

Rights

(#)

| | Performance or

Other Period

Until Maturation

or Payout

| | Threshold

(#)

| | Target

(#)

| | Maximum

(#)

|

|---|

| James E. Rogers | | (1) | | 1/1/02 – 12/31/04 | | 19,357 | | 62,443 | | 124,886 |

Michael J. Cyrus |

|

(1) |

|

1/1/02 – 12/31/04 |

|

5,009 |

|

16,157 |

|

32,314 |

William J. Grealis |

|

(1) |

|

1/1/02 – 12/31/04 |

|

4,791 |

|

15,455 |

|

30,910 |

R. Foster Duncan |

|

(1) |

|

1/1/02 – 12/31/04 |

|

4,551 |

|

14,682 |

|

29,364 |

James L. Turner |

|

(1) |

|

1/1/02 – 12/31/04 |

|

3,018 |

|

9,736 |

|

19,472 |

- (1)

- See "Option/SAR Grants Table."

- (2)

- Payouts of performance shares are tied to Cinergy's total shareholder return ("TSR") targets for a cycle as compared with the TSR of a peer group derived from the companies comprising the S&P Electric Supercomposite Index. The threshold, target and maximum amounts are earned if Cinergy's TSR meets or exceeds the 30th, 55th and 85th percentiles, respectively, of the peer group's TSR. Except in the case of disability, death or retirement on or after age 50 during the cycle, a participant must be employed on January 1 following the end of a cycle to receive an earned award. See "Summary Compensation Table" above for payouts related to the cycle ended December 31, 2002 and "Board Compensation Committee Report on Executive Compensation – Long-Term Incentive Compensation" for additional information.

20

Pension Benefits

At retirement, the named executive officers will receive benefits under our Non-Union Employees' Pension Plan, plus certain supplemental plans or agreements. Our Pension Plan is a defined benefit pension plan, to which participants do not contribute.

Effective January 1, 2003, we amended our Pension Plan in connection with a new "Retirement Choice Program." Prior to 2003, the named executive officers participated in the Pension Plan's Traditional Program. At the end of 2002, each active participant in the Pension Plan was provided a one-time election to continue to earn benefits under the Pension Plan's Traditional Program or to earn future benefits under one of two new cash balance programs under the Pension Plan: the Balanced Program or the Investor Program (with these three programs being part of our same defined benefit Pension Plan). Each of the named executive officers other than Mr. Cyrus elected to continue to earn benefits under the Traditional Program; Mr. Cyrus elected to switch to the Balanced Program.

The Pension Plan's formula for benefits under the Traditional Program takes into account the participant's highest average earnings, years of plan participation and covered compensation. Highest average earnings is the average annual earnings during the employee's three consecutive years producing the highest average within the ten years immediately preceding his or her retirement. Highest average earnings also includes any short-term incentive compensation. Covered compensation is the average social security taxable wage base over a period of up to 35 years.

Our formula for calculating the annual pension benefit under the Traditional Program is:

- •

- 1.1% of highest average earningsplus 0.5% of highest average earnings in excess of covered compensation,

Under the Balanced Program's benefit formula, an annual pay credit equal to 3%, 4% or 5% (depending on the participant's years of service) of a participant's eligible earnings is made to a hypothetical account established for the participant. In addition, a participant's account under the Balanced Program grows with annual interest credits, currently based on the 30-year Treasury bond rate. Cinergy may adjust the interest-crediting rate from time to time. Under the Investor Program's benefit formula, an annual pay credit equal to 2% of eligible earnings, regardless of the participant's number of years of service, is made to a hypothetical account established for the participant. In addition, a participant's account under the Investor Program grows with annual interest credits in the same manner as under the Balanced Program.

Participants in the Balanced and Investor Programs, but not participants in the Traditional Program, are also entitled to receive profit sharing contributions to their account under Cinergy's 401(k) Plan. The amount of the profit sharing contributions will be based

21

on Cinergy's performance, using the same measure as is used for awards under the Annual Incentive Plan. The profit sharing contributions will be made to Cinergy's 401(k) Plan and will be invested in Cinergy common stock. Potential profit sharing contributions can be as much as 5% of eligible earnings for participants in the Balanced Program and as much as 15% of eligible earnings for participants in the Investor Program. Cinergy may, from time to time, change the performance measure used to determine the amount of profit sharing contributions.

Each year, the Internal Revenue Service establishes a dollar limit on the amount of pay that can be counted for purposes of benefits under a tax-qualified 401(k) plan or defined benefit pension plan. As a result, we also have an Excess Pension Plan and Excess Profit Sharing Plan, each of which is designed to restore benefits, calculated in accordance with the formulas given above, to those individuals whose benefits under the Pension Plan and 401(k) Plan otherwise would be reduced by the IRS limits. The Excess Pension Plan also considers certain nonelective contributions to the 401(k) Excess Plan when determining benefits. Each named executive officer is covered under our Excess Pension Plan and Mr. Cyrus is covered under the Excess Profit Sharing Plan as well.

The following table shows the estimated annual pension benefits payable as a straight-life annuity under our Pension Plan's Traditional Program and Excess Pension Plan to participants who retire at age 62. The benefits are not subject to any deduction for social security or other offset amounts.

| | Years of Service

|

|---|

Compensation

| | 5

| | 10

| | 15

| | 20

| | 25

| | 30

| | 35

| | 40

|

|---|

| $ | 500,000 | | $ | 38,730 | | $ | 77,465 | | $ | 116,195 | | $ | 154,930 | | $ | 193,660 | | $ | 232,390 | | $ | 271,125 | | $ | 306,125 |

| | 750,000 | | | 58,730 | | | 117,465 | | | 176,195 | | | 234,930 | | | 293,660 | | | 352,390 | | | 411,125 | | | 463,625 |

| | 1,000,000 | | | 78,730 | | | 157,465 | | | 236,195 | | | 314,930 | | | 393,660 | | | 472,390 | | | 551,125 | | | 621,125 |

| | 1,250,000 | | | 98,730 | | | 197,465 | | | 296,195 | | | 394,930 | | | 493,660 | | | 592,390 | | | 691,125 | | | 778,625 |

| | 1,500,000 | | | 118,730 | | | 237,465 | | | 356,195 | | | 474,930 | | | 593,660 | | | 712,390 | | | 831,125 | | | 936,125 |

| | 1,750,000 | | | 138,730 | | | 277,465 | | | 416,195 | | | 554,930 | | | 693,660 | | | 832,390 | | | 971,125 | | | 1,093,625 |

| | 2,000,000 | | | 158,730 | | | 317,465 | | | 476,195 | | | 634,930 | | | 793,660 | | | 952,390 | | | 1,111,125 | | | 1,251,125 |

| | 2,250,000 | | | 178,730 | | | 357,465 | | | 536,195 | | | 714,930 | | | 893,660 | | | 1,072,390 | | | 1,251,125 | | | 1,408,625 |

| | 2,500,000 | | | 198,730 | | | 397,465 | | | 596,195 | | | 794,930 | | | 993,660 | | | 1,192,390 | | | 1,391,125 | | | 1,566,125 |

| | 2,750,000 | | | 218,730 | | | 437,465 | | | 656,195 | | | 874,930 | | | 1,093,660 | | | 1,312,390 | | | 1,531,125 | | | 1,723,625 |

| | 3,000,000 | | | 238,730 | | | 477,465 | | | 716,195 | | | 954,930 | | | 1,193,660 | | | 1,432,390 | | | 1,671,125 | | | 1,881,125 |

| | 3,250,000 | | | 258,730 | | | 517,465 | | | 776,195 | | | 1,034,930 | | | 1,293,660 | | | 1,552,390 | | | 1,811,125 | | | 2,038,625 |

| | 3,500,000 | | | 278,730 | | | 557,465 | | | 836,195 | | | 1,114,930 | | | 1,393,660 | | | 1,672,390 | | | 1,951,125 | | | 2,196,125 |

For purposes of the table, the estimated credited years of service at age 62 for the named executive officers are as follows: Mr. Rogers, 20 years; Mr. Grealis, 12 years; Mr. Duncan, 16 years; and Mr. Turner, 26 years. For purposes of this table, Mr. Rogers' current highest average earnings is $2,349,588 and his covered compensation is $63,132. The estimated annual benefits payable upon retirement at normal retirement age for Mr. Cyrus under the Pension Plan's Balanced Program and the Excess Pension Plan is $152,064. This estimate is based on the assumption that Mr. Cyrus remains employed until normal retirement age, that his compensation increases at an annual rate of 3%, that he receives his target annual bonus each year and that current interest rates remain constant.

22

In addition to our pension programs and Excess Pension Plan, we have a Supplemental Executive Retirement Plan ("SERP"). The Senior Executive Supplement portion of the SERP provides selected executive officers an opportunity to earn a pension benefit that will replace up to 60% of their final pay. Each participant accrues a retirement income replacement percentage at the rate of 4% per year from the date that the participant begins service as a senior executive, up to a maximum of 15 years. The Senior Executive Supplement is an amount equal to a maximum of 60% of the greater of the employee's highest average earnings (as defined in our Pension Plan but including certain nonelective contributions under the 401(k) Excess Plan) or the final 12 months of base pay (including certain nonelective contributions to the 401(k) Excess Plan) and Annual Incentive Plan pay. The Senior Executive Supplement is reduced by the actual benefits provided under our pension programs and our Excess Pension Plan, and further reduced by 50% of the employee's age 62 social security benefit. Messrs. Rogers, Cyrus, Grealis, Duncan and Turner are covered under the Senior Executive Supplement; the estimated retirement income replacement percentage for each is 60%, 60%, 48%, 60% and 60%, respectively.

Our Executive Supplemental Life Insurance Program provides key management personnel, including the named executive officers, with additional life insurance during employment and with post-retirement deferred compensation. At the later of age 50 or retirement, the life insurance coverage is canceled and, instead, the participant receives the value of the coverage in the form of deferred compensation, payable in ten equal annual installments of $15,000 per year.

Employment Agreements and Severance Arrangements

In 2002, our employment agreements with our named executive officers, other than Mr. Rogers, were amended to provide benefits more comparable to industry standards, to incorporate a uniform definition of "change in control," and generally to provide standard severance benefits. Cinergy intends to make similar changes to Mr. Rogers' contract in 2003. Set forth below is a description of the terms of the employment agreements currently in effect for our named executive officers.

The initial term of the employment agreements expires on December 31, 2004 (December 31, 2002 for Mr. Rogers), and, beginning on December 31, 2002 (December 31, 2000 for Mr. Rogers) and each year thereafter, the term is automatically extended for one additional year absent notice of earlier termination by either party.

The named executive officers currently receive the following minimum annual salaries: $1,250,004 for Mr. Rogers, $575,004 for Mr. Cyrus, $573,876 for Mr. Duncan, $550,008 for Mr. Grealis and $422,672 for Mr. Turner. Each named executive officer is entitled to receive the same perquisites as are provided to our other senior executives and to participate in the same benefit and retirement plans offered to our executive officers, including the SERP, Annual Incentive Plan and the LTIP, with the minimum, target and maximum incentive awards under those plans to be not less than as specified in the employment

23

agreements. We will also reimburse the named executive officers for taxes applicable to certain benefits they receive.

In general, when a named executive officer retires after age 55 or dies prior to retirement but after attaining age 55, he (or his spouse) will be entitled to a supplemental retirement benefit equal to the excess of 60% of his "highest average earnings," as defined in the SERP, over his total benefit under our Pension Plan, Excess Pension Plan and SERP. For purposes of calculating Mr. Rogers' supplemental retirement benefit, his "highest average earnings" is as defined under the Pension Plan (without regard to tax code limitations) and includes certain amounts deferred under deferred compensation arrangement(s) and 401(k) Excess Plan. Under the new 2002 employment agreements that were entered into with each named executive officer other than Mr. Rogers, in the event of a "change in control" of Cinergy, the executives generally have the right to receive their supplemental retirement benefit in the form of a single lump sum in the event of termination of service prior to the second anniversary of such "change in control" of Cinergy.

We have the right under each of the employment agreements to terminate the executive's employment at any time upon a determination by a majority of our directors of "cause," which includes:

- •

- the willful and continued failure to perform;

- •

- a breach of the confidentiality provisions; or

- •

- the conviction of a felony or any willful or grossly negligent action or inaction by the executive that has an adverse effect on us.

Mr. Roger's agreement limits the definition of "cause" to the conviction of a felony that has an adverse effect on Cinergy.

Each named executive officer may terminate his employment voluntarily for "good reason," which includes:

- •

- a reduction in compensation or other benefits, except for across-the-board reductions affecting all management personnel;

- •

- a reduction in the officer's title, duties or responsibilities;

- •

- Cinergy's breach of any material provision of the employment agreement;

- •

- the officer's physical or mental illness or injury; or

- •

- the failure by a successor entity to assume the employment agreement.

If we terminate a named executive officer's employment for "cause," or if the executive terminates his employment other than for "good reason," then he will be entitled to receive only his accrued benefits, consisting of earned but unpaid compensation and benefits, including a pro rata portion of the executive's projected bonus under the Annual Incentive Plan (or, in the case of Mr. Rogers, a bonus amount that is not less than target and not in excess of maximum).

24

If prior to, or more than twenty-four months after, a "change in control" we terminate a named executive officer's employment without "cause" or the executive terminates his employment for "good reason," then, in addition to his accrued benefits, the executive will be entitled to receive the following severance benefits:

- •

- three times the sum of (i) his annual base salary and (ii) the higher of his prior year annual bonus or his current year projected bonus (but not less than target);

- •

- continued medical and welfare benefits through the end of the term of the employment agreement or a cash equivalent (reduced by coverage obtained from subsequent employers); and

- •

- tax counseling services.

Mr. Rogers generally is entitled to the same benefits, except that for purposes of the severance calculation, his annual bonus is based on a discretionary amount that may not be less than target. In addition, Mr. Rogers is entitled to ownership of his company car, the payment of all deferred compensation and executive life insurance benefits, whether or not vested at the time of his termination of employment, and the aggregate amount that he would have received had he remained employed through the end of the employment term under the performance share awards that he holds on the date of his termination of employment.

In general, if within twenty-four months after a "change in control" we terminate a named executive officer's employment without "cause" or the executive terminates his employment for "good reason," then the executive will be entitled to receive, in addition to his accrued benefits, the following severance benefits:

- •

- three times the higher of (i) his then current annual base salary and target annual bonus or (ii) his annual base salary in effect immediately prior to the change in control and annual bonus (based on the higher of his prior year annual bonus, his annual bonus for the year prior to the change in control, or his current year projected bonus (but not less than target));

- •

- the present value of any benefits under our Executive Supplemental Life Program;

- •

- full vesting of his accrued benefits under our Pension Plan, Excess Pension Plan and SERP;

- •

- three additional years of age and service for purposes of calculating the supplemental retirement benefit and benefits under our Pension Plan, Excess Pension Plan and SERP;

- •

- welfare benefits for a thirty-six month period following termination of service or a cash equivalent (reduced by coverage obtained from subsequent employers);

- •

- a payment of $50,000 in lieu of additional automobile benefits; and

- •

- miscellaneous benefits including tax counseling services, country club dues and outplacement services.

25

In lieu of the benefits described above, Mr. Rogers is entitled to receive the greater of:

- •

- The present value of the amounts described above that he would have received if the termination occurred prior to or more than twenty-four months after a "change in control", other than the medical and welfare benefits, the automobile benefit and the payment for performance shares, or

- •

- Three times the sum of:

- (a)

- His current year base salary or if higher, his base salary in effect immediately prior to the change in control, plus

- (b)

- His prior year bonus or if higher, his bonus for the year prior to the change in control.

Mr. Rogers is also entitled to welfare benefits for a thirty-six month period following termination of service or a cash equivalent (reduced by coverage obtained from subsequent employers), ownership of his company car, and certain tax counseling services.

If the employment of a named executive officer is terminated other than by death, the executive will be entitled to reimbursement for reasonable relocation costs (reduced by relocation benefits obtained from subsequent employers). Mr. Duncan's relocation benefits include reimbursement for any loss he incurs on the sale of his principal residence. Cinergy will pay legal fees incurred by each named executive officer as a result of successfully disputing a termination of employment that entitles him to benefits under his employment agreement. In the event any payment made to a named executive officer results in the imposition of the golden parachute excise tax, Cinergy must make an additional payment to him to cover all such excise taxes and any taxes on the additional payments.

Under the employment agreements entered into in 2002 with each named executive officer other than Mr. Rogers, any stock options or stock appreciation rights held by the executives become immediately exercisable upon a "change in control" to the extent not otherwise provided in the applicable plan document. Moreover, if an executive terminates employment within twenty-four months following the "change in control," his stock options and stock appreciation rights remain exercisable for at least three months following termination of employment.

26

Deferred Compensation Agreements

Mr. Rogers has a deferred compensation agreement with Cinergy under which he was credited annually, from 1992 through 2001, with a $50,000 base salary increase in the form of deferred compensation. When his employment terminates for any reason other than death, Mr. Rogers will receive an annual cash benefit over a 15-year period beginning the first January following termination of his employment, but in no event beginning later than January 2010. The annual cash benefit amount payable for the 15-year period ranges from $210,000 per year, if payment begins in January 2004, to $554,400 per year, if payment begins in January 2010. Comparable amounts are payable if Mr. Rogers dies before these payments begin.

In addition, if Mr. Rogers' employment terminates for any reason other than death, he will receive an additional annual cash benefit over a 15-year period beginning the first January following termination of his employment, but in no event beginning earlier than January 2008 or later than January 2010. This annual cash benefit will range from $179,000 per year, if payment begins in January 2008, to $247,000 per year if payment begins in January 2010. Comparable amounts are payable if Mr. Rogers dies before payment of these benefits begins.

27

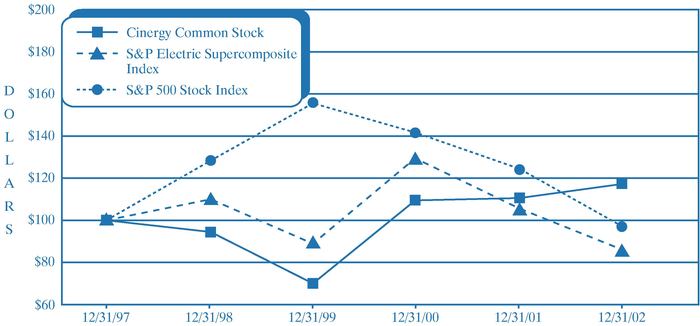

Performance Graph

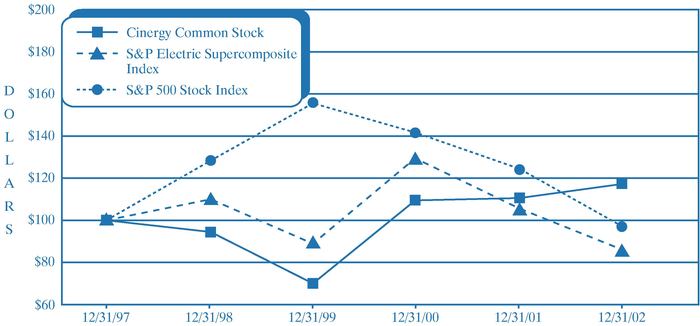

The following line graph compares the cumulative total shareholder return of Cinergy common stock with the cumulative total returns during the same time period of the S&P Electric Supercomposite Index and the S&P 500 Stock Index. The graph tracks performance from December 31, 1997 through December 31, 2002, and assumes a $100 initial investment and dividend reinvestment.

| | 12/31/97

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

|

|---|

| Cinergy Common Stock | | $ | 100.00 | | $ | 94.50 | | $ | 69.90 | | $ | 109.50 | | $ | 110.30 | | $ | 117.40 |

S&P Electric

Supercomposite Index | | $ | 100.00 | | $ | 110.10 | | $ | 89.10 | | $ | 129.70 | | $ | 105.30 | | $ | 86.10 |

| S&P 500 Stock Index | | $ | 100.00 | | $ | 128.60 | | $ | 155.60 | | $ | 141.50 | | $ | 124.70 | | $ | 97.10 |

28

Certain Relationships and Related Transactions

Director, Officer and Key Employee Stock Purchase Program

During February 2000, under Cinergy's Director, Officer and Key Employee Stock Purchase Program, directors, officers and key employees were able to purchase shares of Cinergy common stock, thereby further aligning their interests with those of our shareholders. Five current directors and eight current executive officers are participating in the financing portion of the Program described below. As of December 31, 2002, totals of $12,900,000 of common stock purchased by current directors and executive officers and $11,150,000 purchased by other current officers and key employees were being financed through the Program. Individual purchases financed through the Program ranged from $150,000 to $3,000,000. No additional purchases have been made under the Program since February 2000.

Participants had the option of financing the purchases through a five-year credit facility arranged by Cinergy with a bank. Loans to participants under the facility bear interest at the rate of 8.68% per year. Each participant is obligated to repay the bank the principal, interest and any prepayment fees associated with his or her loan, and each has assigned his or her dividend rights on the purchased shares to the bank to be applied to interest payments on the loan. Cinergy Services and, in part, Cinergy have guaranteed repayment to the bank of 100% of each participant's loan obligations and the associated interest, and each participant has agreed to indemnify the guarantor for any payments made by it under the guaranty on the participant's behalf. A participant's obligations to the bank are unsecured, and no restrictions are placed on the participant's ability to sell, pledge or otherwise encumber or dispose of his or her purchased shares. If a participant incurs a prepayment penalty upon the prepayment of all his or her loans under the Program during the two-year period commencing upon a change in control of Cinergy, Cinergy will reimburse the participant for the prepayment penalty and related taxes.

Miscellaneous

Mr. Benjamin C. Rogers, age 31, is the son of our Chairman and Chief Executive Officer and began employment with Cinergy Services, Inc., a subsidiary of Cinergy, in March 2002. During 2002, Mr. Benjamin Rogers was paid an aggregate of approximately $95,400 in base salary, $75,000 in bonus and $45,200 relating to relocation benefits.

29

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires Cinergy's directors and executive officers, and any persons owning more than ten percent of Cinergy's common stock, to file with the SEC and New York Stock Exchange initial reports of beneficial ownership and certain changes in that beneficial ownership, with respect to the equity securities of Cinergy. We prepare and file these reports on behalf of our directors and executive officers. During 2002, one Form 4 reporting three transactions by Mr. Taft was filed after its due date. To our knowledge, all other Section 16(a) reporting requirements applicable to our directors and executive officers were complied with during 2002.

Independent Public Accountants

On April 26, 2002, Cinergy's Board of Directors, upon recommendation of its Audit Committee, dismissed Arthur Andersen LLP ("Arthur Andersen") as independent public accountants for Cinergy and its subsidiaries, effective May 15, 2002, and approved the selection of Deloitte & Touche LLP ("Deloitte & Touche") as independent public accountants for Cinergy and its subsidiaries for the remainder of 2002. Deloitte & Touche has been re-selected as independent public accountants for Cinergy and its subsidiaries for 2003.

Arthur Andersen's reports on Cinergy's consolidated financial statements for the fiscal years ended December 31, 2000 and 2001 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

During 2000 and 2001, and the subsequent interim period through May 15, 2002, there were no disagreements with Arthur Andersen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Arthur Andersen, would have caused Arthur Andersen to make reference thereto in its reports on Cinergy's consolidated financial statements. Also, during those years and interim period, there were no "reportable events," as such term is used in Item 304(a)(1)(v) of Regulation S-K.