Exhibit 99.2

Tanger Factory Outlet Centers, Inc.

Supplemental Operating and Financial Data

March 31, 2022

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/22

Notice

Beginning in the fourth quarter of 2021, the Company has revised the presentation of certain metrics to include the Company’s share of unconsolidated joint ventures, as detailed in the following pages. The Company believes that this presentation provides additional information on the impacts of the operating results of its unconsolidated joint ventures and improves comparability to other retail REITs. Prior period results have been revised to conform with the current period presentation.

For a more detailed discussion of the factors that affect our operating results, interested parties should review the Tanger Factory Outlet Centers, Inc. Annual Report on Form 10-K for the year ended December 31, 2021.

This Supplemental Portfolio and Financial Data is not an offer to sell or a solicitation to buy any securities of the Company. Any offers to sell or solicitations to buy any securities of the Company shall be made only by means of a prospectus.

2

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Table of Contents

| | | | | |

| Section | |

| |

| Portfolio Data: | |

| |

| Summary Operating Metrics | |

| Geographic Diversification | |

| Property Summary - Occupancy at End of Each Period Shown | |

| Portfolio Occupancy at the End of Each Period | |

| Outlet Center Ranking | |

| Top 25 Tenants Based on Percentage of Total Annualized Base Rent | |

| Lease Expirations as of March 31, 2022 | |

| Capital Expenditures | |

| Leasing Activity | |

| |

| | |

| Financial Data: | |

| | |

| Consolidated Balance Sheets | |

| Consolidated Statements of Operations | |

| Components of Rental Revenues | |

| |

| Unconsolidated Joint Venture Information | |

| Debt Outstanding Summary | |

| Future Scheduled Principal Payments | |

| Senior Unsecured Notes Financial Covenants | |

| Enterprise Value, Net Debt, Liquidity, Debt Ratios and Credit Ratings | |

| |

| Non-GAAP and Supplemental Measures: | |

| |

| Non-GAAP Definitions | |

| FFO and FAD Analysis | |

| Portfolio NOI and Same Center NOI | |

| Adjusted EBITDA and EBITDAre | |

| Net Debt | |

| Pro Rata Balance Sheet Information | |

| Pro Rata Statement of Operations Information | |

| |

| Investor Information | |

3

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Summary Operating Metrics

| | | | | | | | | | | | | | | | | |

| | | March 31, |

| | | | | 2022 | | 2021 |

| Outlet Centers in Operation at End of Period: | | | | | | | |

| Consolidated | | | | | 30 | | | 30 | |

| Partially owned - unconsolidated | | | | | 6 | | | 6 | |

| Total Properties | | | | | 36 | | | 36 | |

| | | | | | | |

| Gross Leasable Area Open at End of Period (in thousands): | | | | | | | |

| Consolidated | | | | | 11,453 | | | 11,456 | |

| Partially owned - unconsolidated | | | | | 2,113 | | | 2,113 | |

| Partially owned - pro-rata share of unconsolidated | | | | | 1,056 | | | 1,056 | |

| | | | | | | |

| Total Properties | | | | | 13,566 | | | 13,569 | |

Total Properties including pro rata share of unconsolidated JVs (1) | | | | | 12,510 | | | 12,512 | |

| | | | | | | |

| | | | | | | |

| Ending Occupancy: | | | | | | | |

| Consolidated properties | | | | | 94.1 | % | | 91.7 | % |

| Partially owned - unconsolidated | | | | | 96.1 | % | | 95.3 | % |

| Total Properties including pro rata share of unconsolidated JVs | | | | | 94.3 | % | | 92.0 | % |

| | | | | | | |

| | | | | | | |

Average Tenant Sales Per Square Foot (2) (3): | | | | | | | |

| Consolidated properties | | | | | $ | 464 | | | |

| Partially owned - unconsolidated | | | | | $ | 471 | | | |

| Total Properties including pro rata share of unconsolidated JVs | | | | | $ | 464 | | | |

| | | | | | | |

Occupancy Cost Ratio (3) (4) | | | | | 8.3 | % | | |

(1)Amounts may not recalculate due to the effect of rounding.

(2)Sales per square foot are presented for the trailing twelve months ended March 31, 2022 and include stores that have been occupied a minimum of twelve months and are less than 20,000 square feet.

(3)Sales and occupancy cost ratio are not presented for the trailing twelve months ended March 31, 2021 due to the portfolio-wide store closures experienced during the second quarter of 2020 as a result of COVID-19 mandates.

(4)Occupancy cost ratio represents annualized occupancy costs as of the end of the reporting period as a percentage of tenant sales for the trailing twelve-month period for consolidated properties and the Company’s pro rata share of unconsolidated joint ventures.

4

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Geographic Diversification

As of March 31, 2022

Consolidated Properties

| | | | | | | | | | | | | | | | | |

| State | # of Centers | | GLA | | % of GLA |

| South Carolina | 5 | | | 1,605,812 | | | 14 | % |

| New York | 2 | | | 1,468,429 | | | 13 | % |

| Georgia | 3 | | | 1,121,579 | | | 10 | % |

| Pennsylvania | 3 | | | 999,442 | | | 9 | % |

| Texas | 2 | | | 823,557 | | | 7 | % |

| Michigan | 2 | | | 671,571 | | | 6 | % |

| Alabama | 1 | | | 554,649 | | | 5 | % |

| Delaware | 1 | | | 549,890 | | | 5 | % |

| New Jersey | 1 | | | 487,718 | | | 4 | % |

| Tennessee | 1 | | | 447,810 | | | 4 | % |

| North Carolina | 2 | | | 422,895 | | | 3 | % |

| Arizona | 1 | | | 410,753 | | | 3 | % |

| Florida | 1 | | | 351,721 | | | 3 | % |

| Missouri | 1 | | | 329,861 | | | 3 | % |

| Mississippi | 1 | | | 324,801 | | | 3 | % |

| Louisiana | 1 | | | 321,066 | | | 3 | % |

| Connecticut | 1 | | | 311,229 | | | 3 | % |

| New Hampshire | 1 | | | 250,558 | | | 2 | % |

| Total Consolidated Properties | 30 | | | 11,453,341 | | | 100 | % |

| | | | | |

| Unconsolidated Joint Venture Properties | | | | | |

| # of Centers | | GLA | | Ownership % |

| Charlotte, NC | 1 | | | 398,698 | | | 50.00 | % |

| Ottawa, ON | 1 | | | 357,209 | | | 50.00 | % |

| Columbus, OH | 1 | | | 355,245 | | | 50.00 | % |

| Texas City, TX | 1 | | | 352,705 | | | 50.00 | % |

| National Harbor, MD | 1 | | | 341,156 | | | 50.00 | % |

| Cookstown, ON | 1 | | | 307,883 | | | 50.00 | % |

| Total Unconsolidated Joint Venture Properties | 6 | | | 2,112,896 | | | |

| Tanger’s Pro Rata Share of Unconsolidated Joint Venture Properties | | | 1,056,448 | | | |

| | | | | |

| Grand Total including pro rata share of unconsolidated JVs | 36 | | | 12,509,789 | | | |

5

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Property Summary - Occupancy at End of Each Period Shown

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Location | Total GLA

3/31/22 | | % Occupied

3/31/22 | | % Occupied

12/31/21 | | | | % Occupied

3/31/21 | |

| Deer Park, NY | 739,148 | | | 95.3 | % | | 95.0 | % | | | | 92.9 | % | |

| Riverhead, NY | 729,281 | | | 92.2 | % | | 94.7 | % | | | | 88.1 | % | |

| Foley, AL | 554,649 | | | 92.1 | % | | 91.7 | % | | | | 87.1 | % | |

| Rehoboth Beach, DE | 549,890 | | | 93.2 | % | | 94.3 | % | | | | 91.4 | % | |

| Atlantic City, NJ | 487,718 | | | 80.1 | % | | 80.5 | % | | | | 79.4 | % | |

| San Marcos, TX | 471,816 | | | 93.5 | % | | 94.8 | % | | | | 89.3 | % | |

| Sevierville, TN | 447,810 | | | 98.3 | % | | 100.0 | % | | | | 97.1 | % | |

| Savannah, GA | 429,089 | | | 99.3 | % | | 100.0 | % | | | | 97.7 | % | |

| Myrtle Beach Hwy 501, SC | 426,523 | | | 96.0 | % | | 98.2 | % | | | | 96.6 | % | |

| Glendale, AZ (Westgate) | 410,753 | | | 97.8 | % | | 99.5 | % | | | | 94.2 | % | |

| Myrtle Beach Hwy 17, SC | 404,710 | | | 98.8 | % | | 100.0 | % | | | | 100.0 | % | |

| Charleston, SC | 386,328 | | | 97.6 | % | | 100.0 | % | | | | 96.8 | % | |

| Lancaster, PA | 375,883 | | | 98.9 | % | | 100.0 | % | | | | 99.1 | % | |

| Pittsburgh, PA | 373,863 | | | 92.9 | % | | 96.6 | % | | | | 88.6 | % | |

| Commerce, GA | 371,408 | | | 97.4 | % | | 98.9 | % | | | | 90.1 | % | |

| Grand Rapids, MI | 357,133 | | | 87.3 | % | | 88.5 | % | | | | 85.6 | % | |

| Fort Worth, TX | 351,741 | | | 97.8 | % | | 100.0 | % | | | | 98.1 | % | |

| Daytona Beach, FL | 351,721 | | | 99.1 | % | | 99.1 | % | | | | 98.6 | % | |

| Branson, MO | 329,861 | | | 98.1 | % | | 99.2 | % | | | | 98.5 | % | |

| Southaven, MS | 324,801 | | | 100.0 | % | | 100.0 | % | | | | 95.6 | % | |

| Locust Grove, GA | 321,082 | | | 98.0 | % | | 100.0 | % | | | | 94.7 | % | |

| Gonzales, LA | 321,066 | | | 94.1 | % | | 93.2 | % | | | | 88.7 | % | |

| Mebane, NC | 318,886 | | | 100.0 | % | | 100.0 | % | | | | 99.4 | % | |

| Howell, MI | 314,438 | | | 78.3 | % | | 78.1 | % | | | | 74.2 | % | |

| Mashantucket, CT (Foxwoods) | 311,229 | | | 78.7 | % | | 78.7 | % | | | | 76.2 | % | |

| Tilton, NH | 250,558 | | | 86.1 | % | | 81.2 | % | | | | 78.8 | % | |

| Hershey, PA | 249,696 | | | 96.2 | % | | 100.0 | % | | | | 97.6 | % | |

| Hilton Head II, SC | 206,564 | | | 100.0 | % | | 100.0 | % | | | | 96.2 | % | |

| Hilton Head I, SC | 181,687 | | | 99.4 | % | | 96.6 | % | | | | 94.6 | % | |

| Blowing Rock, NC | 104,009 | | | 89.8 | % | | 100.0 | % | | | | 88.4 | % | |

| Total Consolidated | 11,453,341 | | | 94.1 | % | | 95.2 | % | | | | 91.7 | % | |

| Charlotte, NC | 398,698 | | | 98.9 | % | | 98.9 | % | | | | 97.9 | % | |

| Ottawa, ON | 357,209 | | | 95.4 | % | | 96.0 | % | | | | 95.4 | % | |

| Columbus, OH | 355,245 | | | 95.8 | % | | 96.9 | % | | | | 94.3 | % | |

| Texas City, TX (Galveston/Houston) | 352,705 | | | 96.1 | % | | 94.5 | % | | | | 91.5 | % | |

| National Harbor, MD | 341,156 | | | 99.3 | % | | 99.3 | % | | | | 100.0 | % | |

| Cookstown, ON | 307,883 | | | 90.3 | % | | 93.4 | % | | | | 91.9 | % | |

| Total Unconsolidated | 2,112,896 | | | 96.1 | % | | 96.6 | % | | | | 95.3 | % | |

| Tanger’s pro rata share of unconsolidated JVs | 1,056,448 | | | 96.1 | % | | 96.6 | % | | | | 95.3 | % | |

| | | | | | | | | | |

| | | | | | | | | | |

| Grand Total including pro rata share of unconsolidated JVs | 12,509,789 | | | 94.3 | % | | 95.3 | % | | | | 92.0 | % | |

6

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

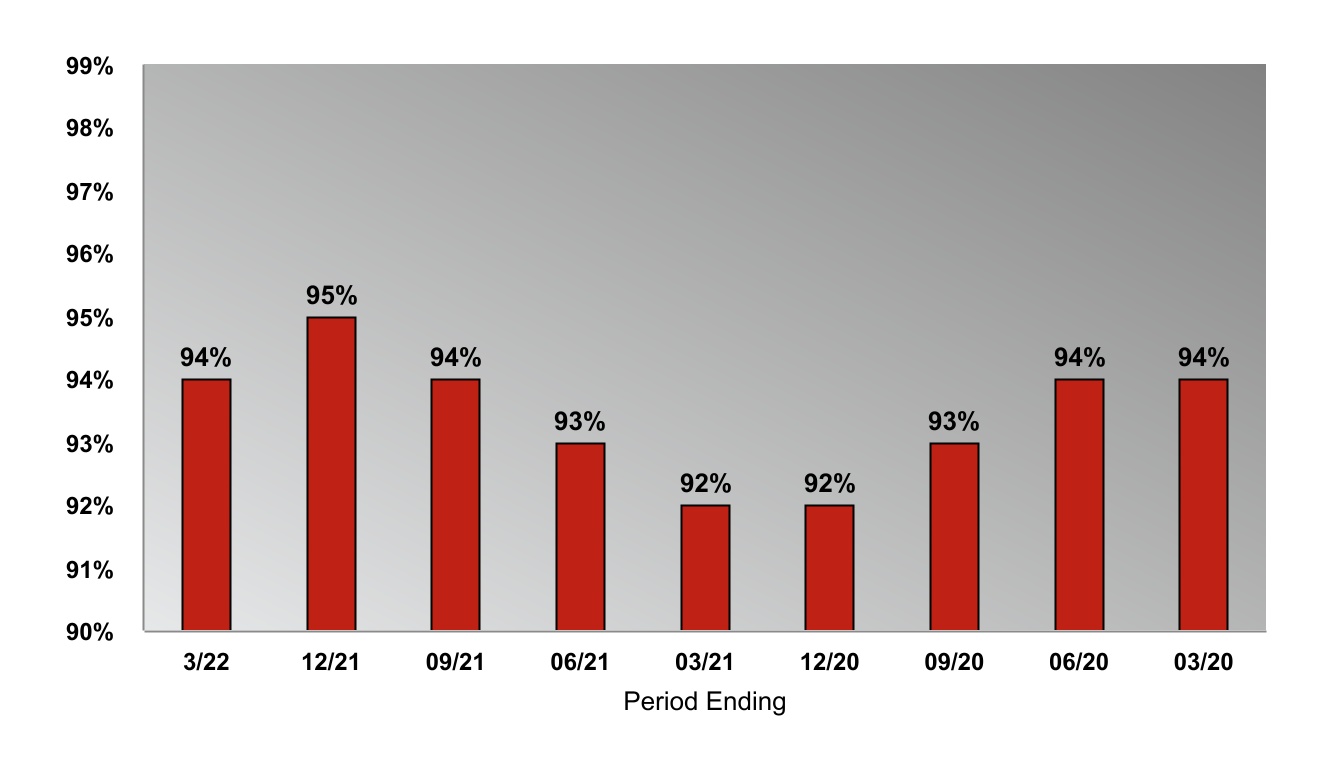

Portfolio Occupancy at the End of Each Period (1)

(1) Includes the Company’s pro rata share of unconsolidated joint ventures.

7

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Outlet Center Ranking as of March 31, 2022 (1)

| | | | | | | | | | | | | | | | | | | | | | | | |

Ranking (2) | 12 Months

SPSF | | Period End

Occupancy | Sq Ft

(thousands) | % of

Square Feet | % of Portfolio NOI (3) |

| Consolidated Centers | | | | | |

| Centers 1 - 5 | $ | 605 | | | 96 | % | 2,551 | | 20 | % | 29 | % |

| Centers 6 - 10 | $ | 517 | | | 96 | % | 2,075 | | 17 | % | 19 | % |

| Centers 11 - 15 | $ | 460 | | | 96 | % | 1,500 | | 12 | % | 11 | % |

| Centers 16 - 20 | $ | 412 | | | 96 | % | 1,948 | | 16 | % | 15 | % |

| Centers 21 - 25 | $ | 374 | | | 89 | % | 2,132 | | 17 | % | 12 | % |

| Centers 26 - 30 | $ | 322 | | | 90 | % | 1,247 | | 10 | % | 6 | % |

| | | | | | |

Ranking (2) | Cumulative 12 Months

SPSF | | Cumulative Period End

Occupancy | Cumulative Sq Ft

(thousands) | Cumulative

% of

Square Feet | Cumulative % of Portfolio NOI (3) |

| Consolidated Centers | | | | | |

| Centers 1 - 5 | $ | 605 | | | 96 | % | 2,551 | | 20 | % | 29 | % |

| Centers 1 - 10 | $ | 565 | | | 96 | % | 4,626 | | 37 | % | 48 | % |

| Centers 1 - 15 | $ | 539 | | | 96 | % | 6,126 | | 49 | % | 59 | % |

| Centers 1 - 20 | $ | 507 | | | 96 | % | 8,074 | | 65 | % | 74 | % |

| Centers 1 - 25 | $ | 480 | | | 95 | % | 10,206 | | 82 | % | 86 | % |

| Centers 1 - 30 | $ | 464 | | | 94 | % | 11,453 | | 92 | % | 92 | % |

| | | | | | |

Unconsolidated Centers at Pro Rata Share (4) | $ | 471 | | | 96 | % | 1,056 | | 8 | % | 8 | % |

Total Centers at Pro Rata Share (5) | $ | 464 | | | 94 | % | 12,510 | | 100 | % | 100 | % |

| |

| (1) | Centers are ranked by sales per square foot for the trailing twelve months ended March 31, 2022 and sales per square foot include stores that have been occupied for a minimum of twelve months and are less than 20,000 square feet. |

| | | | | | | | |

| (2) | Outlet centers included in each ranking group above are as follows (in alphabetical order): |

| Centers 1 - 5: | Deer Park, NY | Glendale, AZ (Westgate) | | Myrtle Beach Hwy 17, SC | Rehoboth Beach, DE | Sevierville, TN | |

| Centers 6 - 10: | Branson, MO | Lancaster, PA | | Locust Grove, GA | Mebane, NC | Riverhead, NY | |

| Centers 11 - 15: | Charleston, SC | Grand Rapids, MI | | Hershey, PA | Hilton Head I, SC | Southaven, MS | |

| Centers 16 - 20: | Fort Worth, TX | Gonzales, LA | | Pittsburgh, PA | San Marcos, TX | Savannah, GA | |

| Centers 21 - 25: | Atlantic City, NJ | Daytona Beach, FL | | Foley, AL | Mashantucket, CT (Foxwoods) | Myrtle Beach Hwy 501, SC | |

| Centers 26 - 30: | Blowing Rock, NC | Commerce, GA | | Hilton Head II, SC | Howell, MI | Tilton, NH | |

| | | | | | | | |

| (3) | Based on the Company’s forecast of 2022 Portfolio NOI (see non-GAAP definitions), excluding centers not yet stabilized (none). The Company’s forecast is based on management’s estimates as of March 31, 2022 and may be considered a forward-looking statement that is subject to risks and uncertainties. Actual results could differ materially from those projected due to various factors including, but not limited to, the risks associated with general economic and real estate conditions. For a more detailed discussion of the factors that affect operating results, interested parties should review the Tanger Factory Outlet Centers, Inc. Annual Report on Form 10-K for the year ended December 31, 2021 and Quarterly Report on Form 10-Q for the three months ended March 31, 2022. |

| |

| (4) | Includes outlet centers open 12 full calendar months presented on a gross basis (in alphabetical order): |

| Unconsolidated: | Charlotte, NC | Columbus, OH | | Cookstown, ON | National Harbor, MD | Ottawa, ON | Texas City, TX (Galveston/Houston) |

| | | | | | | | |

| (5) | Includes consolidated portfolio and the Company’s pro rata share of unconsolidated joint ventures. Amounts may not recalculate due to the effect of rounding. |

8

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Top 25 Tenants Based on Percentage of Total Annualized Base Rent

As of March 31, 2022 (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | At Pro Rata Share (2) | |

| Tenant | Brands | # of

Stores | | GLA | | % of

Total GLA | | % of Total Annualized Base Rent (3) | |

| The Gap, Inc. | Gap, Banana Republic, Old Navy | 101 | | | 969,046 | | | 7.7 | % | | 6.1 | % | |

| SPARC Group | Aéropostale, Brooks Brothers, Eddie Bauer, Forever 21, Lucky Brands, Nautica, Reebok | 103 | | | 566,752 | | | 4.5 | % | | 4.9 | % | |

| Premium Apparel, LLC; The Talbots, Inc. | LOFT, Ann Taylor, Lane Bryant, Talbots | 81 | | | 416,713 | | | 3.3 | % | | 4.0 | % | |

| PVH Corp. | Tommy Hilfiger, Van Heusen, Calvin Klein | 49 | | | 333,140 | | | 2.7 | % | | 3.7 | % | |

| Tapestry, Inc. | Coach, Kate Spade, Stuart Weitzman | 58 | | | 257,502 | | | 2.1 | % | | 3.5 | % | |

| American Eagle Outfitters, Inc. | American Eagle Outfitters, Aerie | 50 | | | 311,595 | | | 2.5 | % | | 3.1 | % | |

| Under Armour, Inc. | Under Armour, Under Armour Kids | 34 | | | 260,649 | | | 2.1 | % | | 3.1 | % | |

| Nike, Inc. | Nike, Converse, Hurley | 39 | | | 406,982 | | | 3.3 | % | | 2.7 | % | |

| Columbia Sportswear Company | Columbia Sportswear | 28 | | | 198,567 | | | 1.6 | % | | 2.5 | % | |

| Carter’s, Inc. | Carters, OshKosh B Gosh | 49 | | | 193,904 | | | 1.6 | % | | 2.2 | % | |

| Capri Holdings Limited | Michael Kors, Michael Kors Men’s | 32 | | | 147,846 | | | 1.2 | % | | 2.2 | % | |

| Ralph Lauren Corporation | Polo Ralph Lauren, Polo Children, Polo Ralph Lauren Big & Tall | 38 | | | 391,204 | | | 3.1 | % | | 2.1 | % | |

| Signet Jewelers Limited | Kay Jewelers, Zales, Jared Vault | 54 | | | 113,065 | | | 0.9 | % | | 2.0 | % | |

| Hanesbrands Inc. | Hanesbrands, Maidenform, Champion | 37 | | | 178,227 | | | 1.4 | % | | 2.0 | % | |

| Rack Room Shoes, Inc. | Rack Room Shoes | 28 | | | 199,032 | | | 1.6 | % | | 2.0 | % | |

| Skechers USA, Inc. | Skechers | 34 | | | 165,940 | | | 1.3 | % | | 2.0 | % | |

| Express Inc. | Express Factory | 28 | | | 182,194 | | | 1.5 | % | | 1.9 | % | |

| Chico’s, FAS Inc. | Chicos, White House/Black Market, Soma Intimates | 41 | | | 111,845 | | | 0.9 | % | | 1.8 | % | |

| V. F. Corporation | The North Face, Vans, Timberland, Dickies, Work Authority | 30 | | | 150,602 | | | 1.2 | % | | 1.8 | % | |

| H & M Hennes & Mauritz LP. | H&M | 20 | | | 408,924 | | | 3.3 | % | | 1.8 | % | |

| Luxottica Group S.p.A. | Sunglass Hut, Oakley, Lenscrafters | 63 | | | 86,870 | | | 0.7 | % | | 1.7 | % | |

| Levi Strauss & Co. | Levi's | 31 | | | 118,167 | | | 0.9 | % | | 1.6 | % | |

| Adidas AG | Adidas | 25 | | | 161,584 | | | 1.3 | % | | 1.6 | % | |

| Caleres Inc. | Famous Footwear, Allen Edmonds | 31 | | | 163,737 | | | 1.3 | % | | 1.6 | % | |

| Rue 21 | Rue 21 | 20 | | | 117,359 | | | 0.9 | % | | 1.4 | % | |

| Total of Top 25 tenants | | 1,104 | | | 6,611,446 | | | 52.9 | % | | 63.3 | % | |

(1)Excludes leases that have been entered into but which tenant has not yet taken possession, temporary leases and month-to-month leases. Includes all retail concepts of each tenant group; tenant groups are determined based on leasing relationships.

(2)Includes the Company’s pro rata share of unconsolidated joint ventures.

(3)Annualized base rent is defined as the minimum monthly payments due as of the end of the reporting period annualized, excluding periodic contractual fixed increases. Includes rents which are based on a percentage of sales in lieu of fixed contractual rents.

9

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

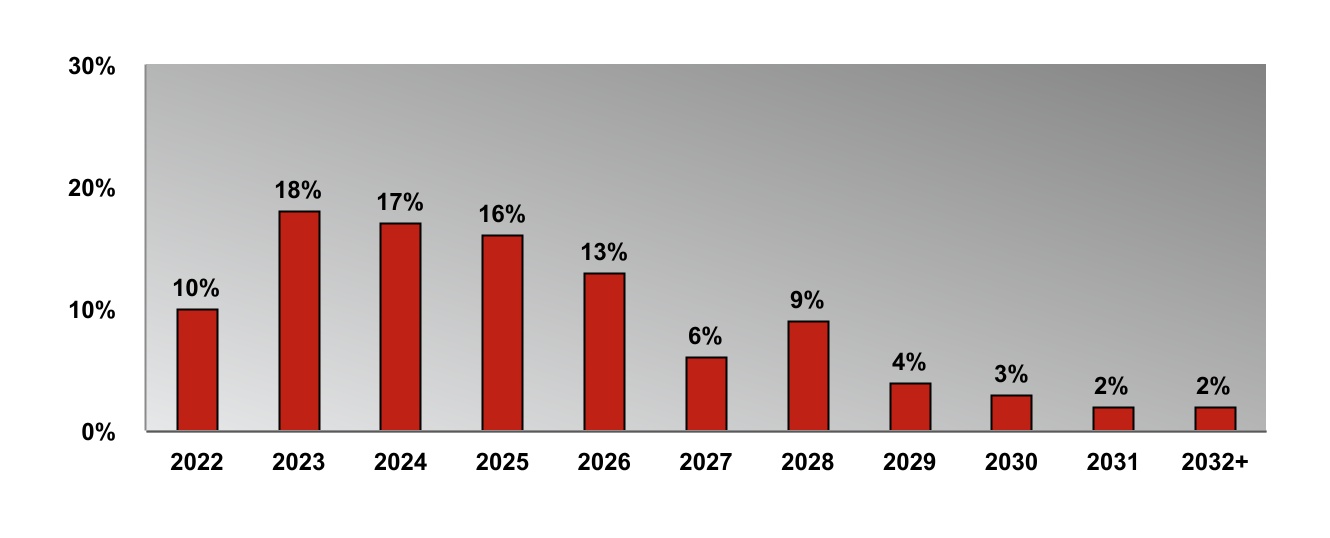

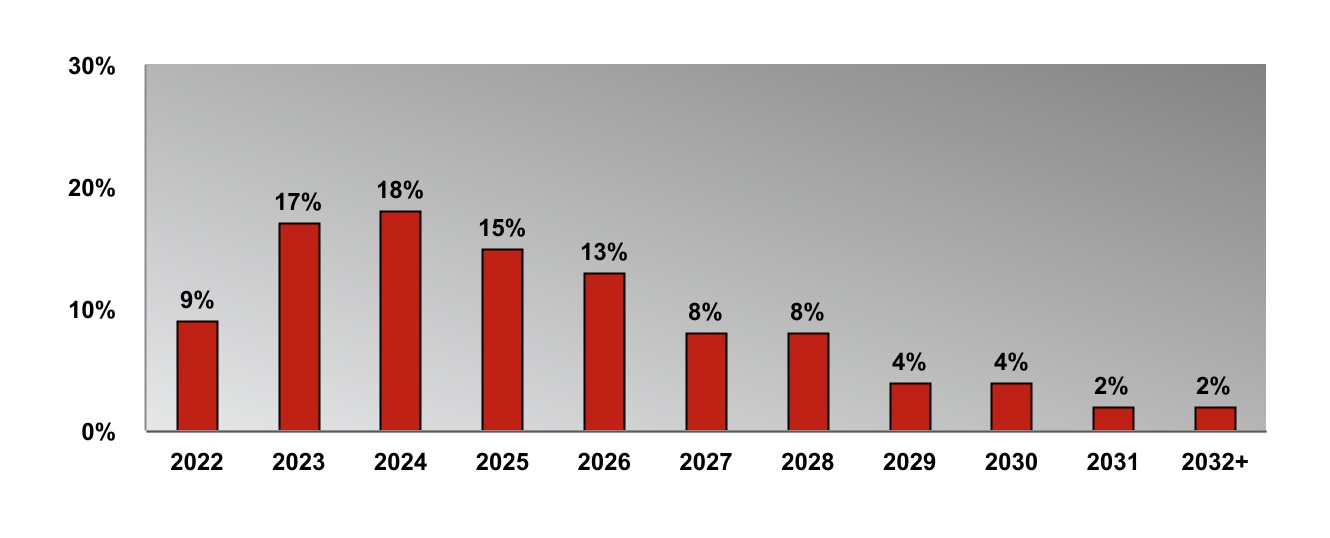

Lease Expirations as of March 31, 2022

Percentage of Total Gross Leasable Area (1)

Percentage of Total Annualized Base Rent (1)

(1) Includes the Company’s pro rata share of unconsolidated joint ventures.

10

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Capital Expenditures for the Three Months Ended March 31, 2022 (in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | Consolidated

Properties | | Unconsolidated Joint Ventures at Pro Rata Share | | Total

at Pro Rata Share |

| Value-enhancing: | | | | | | |

| New center developments, first generation tenant allowances and expansions | | $ | 2,439 | | | $ | 11 | | | $ | 2,450 | |

| Other | | 218 | | | 4 | | | 222 | |

| Total new center developments and expansions | | 2,657 | | | 15 | | | 2,672 | |

| | | | | | |

| Recurring capital expenditures: | | | | | | |

| Second generation tenant allowances | | 1,252 | | | 3 | | | 1,255 | |

| Operational capital expenditures | | 1,409 | | | 37 | | | 1,446 | |

| Renovations | | — | | | — | | | — | |

| Total recurring capital expenditures | | 2,661 | | | 40 | | | 2,701 | |

| | | | | | |

| Total additions to rental property-accrual basis | | $ | 5,318 | | | $ | 55 | | | $ | 5,373 | |

11

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Leasing Activity for the Trailing Twelve Months Ended March 31 - Comparable Space for Executed Leases (1) (2)

| | | | | | | | | | | | | | | | | | | | |

| Leasing Transactions | Square Feet (in 000s) | New Initial Rent (psf) (3) | Rent Spread % (4) | Tenant Allowance (psf) (5) | Average Initial Term

(in years) |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total space | | | | | | |

| 2022 | 314 | 1,539 | | $ | 30.90 | | 1.3 | % | $ | 4.24 | | 3.57 | |

| 2021 | 243 | 1,209 | | $ | 23.82 | | (7.4) | % | $ | 3.65 | | 2.50 | |

| | | | | | |

| Re-tenanted space | | | | | | |

| 2022 | 57 | 200 | | $ | 31.50 | | 1.2 | % | $ | 26.90 | | 7.74 | |

| 2021 | 28 | 124 | | $ | 27.53 | | (9.5) | % | $ | 13.83 | | 3.78 | |

| | | | | | |

| Renewed space | | | | | | |

| 2022 | 257 | 1,339 | | $ | 30.81 | | 1.3 | % | $ | 0.85 | | 2.95 | |

| 2021 | 215 | 1,085 | | $ | 23.40 | | (7.1) | % | $ | 2.49 | | 2.35 | |

| | | | | | |

| | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Refer to footnotes below the following table.

Leasing Activity for the Trailing Twelve Months Ended March 31 - Comparable and Non-Comparable Space for Executed Leases (1) (2)

| | | | | | | | | | | | | | | | | | | | |

| Leasing Transactions | Square Feet (in 000s) | New Initial Rent (psf) (3) | | Tenant Allowance (psf) (5) | Average Initial Term

(in years) |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total space | | | | | | |

| 2022 | 375 | | 1,765 | | $ | 31.34 | | | $ | 11.69 | | 4.03 | |

| 2021 | 264 | 1,273 | | $ | 23.81 | | | $ | 3.79 | | 2.55 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1)For consolidated properties and domestic unconsolidated joint ventures at pro rata share owned as of the period-end date, except for leasing transactions, which are shown at 100%. Represents leases for new stores or renewals that were executed during the respective trailing 12-month periods and excludes license agreements, seasonal tenants, month-to-month leases and new developments.

(2)Comparable space excludes leases for space that was vacant for more than 12 months (non-comparable space).

(3)Represents average initial cash rent (base rent and common area maintenance (“CAM”)).

(4)Represents change in average initial and expiring cash rent (base rent and CAM).

(5)Includes other landlord costs.

12

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Consolidated Balance Sheets (dollars in thousands)

| | | | | | | | | | | |

| | March 31, | | December 31, |

| | 2022 | | 2021 |

| Assets | | | |

| Rental property: | | | |

| Land | $ | 268,269 | | | $ | 268,269 | |

| Buildings, improvements and fixtures | 2,528,223 | | | 2,532,489 | |

| Construction in progress | 6,175 | | | — | |

| | 2,802,667 | | | 2,800,758 | |

| Accumulated depreciation | (1,166,231) | | | (1,145,388) | |

| Total rental property, net | 1,636,436 | | | 1,655,370 | |

| Cash and cash equivalents | 152,847 | | | 161,255 | |

| Investments in unconsolidated joint ventures | 82,955 | | | 82,647 | |

| Deferred lease costs and other intangibles, net | 69,861 | | | 73,720 | |

| | | |

| Operating lease right-of-use assets | 79,519 | | | 79,807 | |

| Prepaids and other assets | 112,614 | | | 104,585 | |

| Total assets | $ | 2,134,232 | | | $ | 2,157,384 | |

| | | | |

| Liabilities and Equity | | | |

| Liabilities | | | |

| Debt: | | | |

| Senior, unsecured notes, net | $ | 1,036,635 | | | $ | 1,036,181 | |

| Unsecured term loan, net | 298,590 | | | 298,421 | |

| Mortgages payable, net | 61,312 | | | 62,474 | |

| Unsecured lines of credit | — | | | — | |

| Total debt | 1,396,537 | | | 1,397,076 | |

| Accounts payable and accrued expenses | 58,016 | | | 92,995 | |

| Operating lease liabilities | 88,610 | | | 88,874 | |

| Other liabilities | 80,492 | | | 78,650 | |

| Total liabilities | 1,623,655 | | | 1,657,595 | |

| Commitments and contingencies | | | |

| Equity | | | |

| Tanger Factory Outlet Centers, Inc.: | | | |

| Common shares, $0.01 par value, 300,000,000 shares authorized, 104,469,061 and 104,084,734 shares issued and outstanding at March 31, 2022 and December 31, 2021, respectively | 1,044 | | | 1,041 | |

| Paid in capital | 978,734 | | | 978,054 | |

| Accumulated distributions in excess of net income | (482,206) | | | (483,409) | |

| Accumulated other comprehensive loss | (9,252) | | | (17,761) | |

| Equity attributable to Tanger Factory Outlet Centers, Inc. | 488,320 | | | 477,925 | |

| Equity attributable to noncontrolling interests: | | | |

| Noncontrolling interests in Operating Partnership | 22,257 | | | 21,864 | |

| Noncontrolling interests in other consolidated partnerships | — | | | — | |

| Total equity | 510,577 | | | 499,789 | |

| Total liabilities and equity | $ | 2,134,232 | | | $ | 2,157,384 | |

13

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Consolidated Statements of Operations (in thousands, except per share data)

| | | | | | | | | | | | | | | | | |

| | | Three months ended |

| | | March 31, |

| | | | | 2022 | | 2021 |

| Revenues: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Rental revenues | | | | | $ | 104,609 | | | $ | 97,467 | |

| Management, leasing and other services | | | | | 1,527 | | | 1,372 | |

| Other revenues | | | | | 2,732 | | | 1,855 | |

| Total revenues | | | | | 108,868 | | | 100,694 | |

| Expenses: | | | | | | | |

| Property operating | | | | | 36,758 | | | 35,311 | |

| General and administrative | | | | | 15,467 | | | 16,793 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Depreciation and amortization | | | | | 26,243 | | | 28,150 | |

| Total expenses | | | | | 78,468 | | | 80,254 | |

| Other income (expense): | | | | | | | |

| Interest expense | | | | | (11,634) | | | (14,362) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Other income (expense) (1) | | | | | 183 | | | (3,505) | |

| Total other income (expense) | | | | | (11,451) | | | (17,867) | |

| Income before equity in earnings of unconsolidated joint ventures | | | | | 18,949 | | | 2,573 | |

| Equity in earnings of unconsolidated joint ventures | | | | | 2,513 | | | 1,769 | |

| Net income | | | | | 21,462 | | | 4,342 | |

| Noncontrolling interests in Operating Partnership | | | | | (944) | | | (209) | |

| Noncontrolling interests in other consolidated partnerships | | | | | — | | | — | |

| Net income attributable to Tanger Factory Outlet Centers, Inc. | | | | | 20,518 | | | 4,133 | |

| Allocation of earnings to participating securities | | | | | (215) | | | (207) | |

Net income available to common shareholders of

Tanger Factory Outlet Centers, Inc. | | | | | $ | 20,303 | | | $ | 3,926 | |

| | | | | | | |

| Basic earnings per common share: | | | | | | | |

| Net income | | | | | $ | 0.20 | | | $ | 0.04 | |

| | | | | | | |

| Diluted earnings per common share: | | | | | | | |

| Net income | | | | | $ | 0.19 | | | $ | 0.04 | |

(1)The three months ended March 31, 2021 includes a $3.6 million charge related to the foreign currency effect of the sale of the Saint-Sauveur, Quebec property by the RioCan joint venture in March 2021.

14

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Components of Rental Revenues (in thousands)

As a lessor, substantially all of our revenues are earned from arrangements that are within the scope of Accounting Standards Codification Topic 842 “Leases” (“ASC 842”). We utilized the practical expedient in ASU 2018-11 to account for lease and non-lease components as a single component which resulted in all of our revenues associated with leases being recorded as rental revenues on the consolidated statements of operations.

The table below provides details of the components included in consolidated rental revenues:

| | | | | | | | | | | | | | | | | |

| | | Three months ended |

| | | March 31, |

| | | | | 2022 | | 2021 |

| Rental revenues: | | | | | | | |

Base rentals | | | | | $ | 70,667 | | | $ | 66,675 | |

| Percentage rentals | | | | | 3,671 | | | 1,991 | |

| Tenant expense reimbursements | | | | | 27,697 | | | 28,994 | |

| Lease termination fees | | | | | 2,596 | | | 673 | |

| Market rent adjustments | | | | | (83) | | | 305 | |

| Straight-line rent adjustments | | | | | (1,337) | | | (1,043) | |

| Uncollectible tenant revenues | | | | | 1,398 | | | (128) | |

| Rental revenues | | | | | $ | 104,609 | | | $ | 97,467 | |

15

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Unconsolidated Joint Venture Information

The following table details certain information as of March 31, 2022, except for Net Operating Income (“NOI”) which is for the three months ended March 31, 2022, about various unconsolidated real estate joint ventures in which we have an ownership interest (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Joint Venture | | Center Location | | Tanger’s Ownership % | | Square Feet | | Tanger’s

Pro Rata

Share of Total Assets | | Tanger’s Pro Rata

Share of NOI | | Tanger’s Pro Rata Share of Debt (1) |

| Charlotte | | Charlotte, NC | | 50.0 | % | | 398,698 | | | $ | 33.7 | | | $ | 1.8 | | | $ | 49.8 | |

| Columbus | | Columbus, OH | | 50.0 | % | | 355,245 | | | 35.6 | | | 1.1 | | | 35.4 | |

| Galveston/Houston | | Texas City, TX | | 50.0 | % | | 352,705 | | | 18.6 | | | 1.0 | | | 32.2 | |

| National Harbor | | National Harbor, MD | | 50.0 | % | | 341,156 | | | 36.4 | | | 1.3 | | | 47.3 | |

RioCan Canada (2) | | Various | | 50.0 | % | | 665,092 | | | 83.0 | | | 1.5 | | | — | |

| | | | | | | | | | | | |

| Total | | | | | | 2,112,896 | | | $ | 207.3 | | | $ | 6.7 | | | $ | 164.7 | |

(1)Net of debt origination costs and premiums.

(2)Includes a 307,883 square foot outlet center in Cookstown, Ontario; and a 357,209 square foot outlet center in Ottawa, Ontario.

16

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Debt Outstanding Summary

As of March 31, 2022

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total Debt Outstanding | | Pro Rata Share of Debt | | Stated

Interest Rate | | End of Period Effective Interest Rate(1) | | Maturity Date (2) | | Weighted Average Years to Maturity (2) |

| Consolidated Debt: | | | | | | | | | | | |

| Unsecured debt: | | | | | | | | | | | |

Unsecured lines of credit (3) | $ | — | | | $ | — | | | LIBOR + 1.20% | | 1.7 | % | | 7/14/2026 | | 4.3 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| 2026 Senior unsecured notes | 350,000 | | | 350,000 | | | 3.125 | % | | 3.2 | % | | 9/1/2026 | | 4.4 | |

| 2027 Senior unsecured notes | 300,000 | | | 300,000 | | | 3.875 | % | | 3.9 | % | | 7/15/2027 | | 5.3 | |

| 2031 Senior unsecured notes | 400,000 | | | 400,000 | | | 2.750 | % | | 2.9 | % | | 9/1/2031 | | 9.4 | |

| Unsecured term loan | 300,000 | | | 300,000 | | | LIBOR(4) + 1.25% | | 1.8 | % | | 4/22/2024 | | 2.1 | |

| Net debt discounts and debt origination costs | (14,775) | | | (14,775) | | | | | | | | | |

| Total net unsecured debt | 1,335,225 | | | 1,335,225 | | | | | 3.1 | % | | | | 5.6 | |

| Secured mortgage debt: | | | | | | | | | | | |

| Atlantic City, NJ | 20,468 | | | 20,468 | | | 6.44% - 7.65% | | 5.1 | % | | 12/15/2024 - 12/8/2026 | | 3.8 | |

| Southaven, MS | 40,144 | | | 40,144 | | | LIBOR + 1.80% | | 2.3 | % | | 4/28/2023 | | 1.1 | |

| Debt premium and debt origination costs | 700 | | | 700 | | | | | | | | | |

| Total net secured mortgage debt | 61,312 | | | 61,312 | | | | | 3.2 | % | | | | 2.0 | |

| Total consolidated debt | 1,396,537 | | | 1,396,537 | | | | | 3.1 | % | | | | 5.4 | |

| Unconsolidated JV debt: | | | | | | | | | | | |

| Charlotte | 100,000 | | | 50,000 | | | 4.27 | % | | 4.3 | % | | 7/1/2028 | | 6.3 | |

| Columbus | 71,000 | | | 35,500 | | | LIBOR + 1.85% | | 2.3 | % | | 11/28/2022 | | 0.7 | |

| Galveston/Houston | 64,500 | | | 32,250 | | | LIBOR + 1.85% | | 2.3 | % | | 7/1/2023 | | 1.3 | |

| National Harbor | 95,000 | | | 47,500 | | | 4.63 | % | | 4.6 | % | | 1/5/2030 | | 7.8 | |

| Debt origination costs | (1,012) | | | (506) | | | | | | | | | |

| Total unconsolidated JV net debt | 329,488 | | | 164,744 | | | | | 3.6 | % | | | | 4.5 | |

| Total | $ | 1,726,025 | | | $ | 1,561,281 | | | | | 3.1 | % | | | | 5.3 | |

(1)The effective interest rate includes the impact of discounts and premiums, mark-to-market adjustments for mortgages assumed in conjunction with property acquisitions and interest rate swap agreements, as applicable.

(2)Includes applicable extensions available at our option.

(3)The Company has unsecured lines of credit that provide for borrowings of up to $520.0 million, including a $20.0 million liquidity line and a $500.0 million syndicated line. A 25 basis point facility fee is due annually on the entire committed amount of each facility. In certain circumstances, total line capacity may be increased to $1.2 billion through an accordion feature in the syndicated line.

(4)If LIBOR is less than 0.25% per annum, the rate will be deemed to be 0.25% for any portion of the bank term loan not fixed with an interest rate swap. Currently the entire outstanding balance is fixed with interest rate swaps, as summarized on the following page.

17

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Summary of Our Share of Fixed and Variable Rate Debt

As of March 31, 2022

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Total Debt % | | Pro Rata Share of Debt | | End of Period Effective Interest Rate | | Average Years to Maturity(1) |

| | | | | | | |

| Consolidated: | | | | | | | |

Fixed (2) | 97 | % | | $ | 1,356,440 | | | 3.1 | % | | 5.5 | |

| Variable | 3 | % | | 40,097 | | | 2.3 | % | | 1.1 | |

| 100 | % | | 1,396,537 | | | 3.1 | % | | 5.4 | |

| Unconsolidated Joint ventures: | | | | | | | |

| Fixed | 59 | % | | $ | 97,109 | | | 4.4 | % | | 7.0 | |

| Variable | 41 | % | | 67,635 | | | 2.3 | % | | 0.9 | |

| 100 | % | | 164,744 | | | 3.6 | % | | 4.5 | |

| Total: | | | | | | | |

| Fixed | 93 | % | | $ | 1,453,549 | | | 3.2 | % | | 5.6 | |

| Variable | 7 | % | | 107,732 | | | 2.3 | % | | 1.0 | |

| Total share of debt | 100 | % | | $ | 1,561,281 | | | 3.1 | % | | 5.3 | |

(1)Includes applicable extensions available at our option.

(2)The effective interest rate includes interest rate swap agreements that fix the base LIBOR rate at a weighted average of 0.5% on notional amounts aggregating $300.0 million as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Effective Date | | Maturity Date | | Notional Amount | | Bank Pay Rate | | Company Fixed Pay Rate |

| Interest rate swaps: | | | | | | | | | |

| July 1, 2019 | | February 1, 2024 | | $ | 25,000 | | | 1 | month LIBOR | | 1.75 | % |

| January 1, 2021 | | February 1, 2024 | | 150,000 | | | 1 | month LIBOR | | 0.60 | % |

| January 1, 2021 | | February 1, 2024 | | 100,000 | | | 1 | month LIBOR | | 0.22 | % |

| March 1, 2021 | | February 1, 2024 | | 25,000 | | | 1 | month LIBOR | | 0.24 | % |

| Total | | | | $ | 300,000 | | | | | | |

18

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Future Scheduled Principal Payments (dollars in thousands) (1)

As of March 31, 2022

| | | | | | | | | | | | | | | | | |

| Year | Tanger

Consolidated

Payments | | Tanger’s Pro Rata Share

of Unconsolidated

JV Payments | | Total

Scheduled

Payments |

| | | | | |

| 2022 | $ | 3,360 | | | $ | 35,500 | | | $ | 38,860 | |

| 2023 | 44,916 | | | 33,281 | | | 78,197 | |

| 2024 | 305,130 | | | 1,636 | | | 306,766 | |

| 2025 | 1,501 | | | 1,710 | | | 3,211 | |

| 2026 | 355,705 | | | 1,788 | | | 357,493 | |

| 2027 | 300,000 | | | 1,869 | | | 301,869 | |

| 2028 | — | | | 46,944 | | | 46,944 | |

| 2029 | — | | | 984 | | | 984 | |

| 2030 | — | | | 41,538 | | | 41,538 | |

| 2031 & thereafter | 400,000 | | | — | | | 400,000 | |

| | $ | 1,410,612 | | | $ | 165,250 | | | $ | 1,575,862 | |

| Net debt discounts and debt origination costs | (14,075) | | | (506) | | | (14,581) | |

| | $ | 1,396,537 | | | $ | 164,744 | | | $ | 1,561,281 | |

(1)Includes applicable extensions available at our option.

Senior Unsecured Notes Financial Covenants (1)

As of March 31, 2022

| | | | | | | | | | | | | |

| | Required | | Actual | | |

| Total Consolidated Debt to Adjusted Total Assets | < 60% | | 41 | % | | |

| Total Secured Debt to Adjusted Total Assets | < 40% | | 2 | % | | |

| Total Unencumbered Assets to Unsecured Debt | > 150% | | 232 | % | | |

| Consolidated Income Available for Debt Service to Annual Debt Service Charge | > 1.5 x | | 5.5 | x | | |

(1)For a complete listing of all debt covenants related to the Company’s Senior Unsecured Notes, as well as definitions of the above terms, please refer to the Company’s filings with the Securities and Exchange Commission.

Unsecured Lines of Credit & Term Loan Financial Covenants (1)

As of March 31, 2022

| | | | | | | | | | | | | |

| | Required | | Actual | | |

| Total Liabilities to Total Adjusted Asset Value | < 60% | | 39 | % | | |

| Secured Indebtedness to Adjusted Unencumbered Asset Value | < 35% | | 5 | % | | |

| EBITDA to Fixed Charges | > 1.5 x | | 4.4 | x | | |

| Total Unsecured Indebtedness to Adjusted Unencumbered Asset Value | < 60% | | 35 | % | | |

| Unencumbered Interest Coverage Ratio | > 1.5 x | | 5.3 | x | | |

(1)For a complete listing of all debt covenants related to the Company’s Unsecured Lines of Credit & Term Loan, as well as definitions of the above terms, please refer to the Company’s filings with the Securities and Exchange Commission.

19

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Enterprise Value, Net Debt, Liquidity, Debt Ratios and Credit Ratings - March 31, 2022

(in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | |

| | | Consolidated | | Pro Rata Share of Unconsolidated JVs | | Total at

Pro Rata Share |

| | | | |

| Enterprise Value: | | | | | | |

| Market value: | | | | | | |

| Common shares outstanding | | 104,469 | | | | | 104,469 | |

| Exchangeable operating partnership units | | 4,762 | | | | | 4,762 | |

Total shares (1) | | 109,231 | | | | | 109,231 | |

| Common share price | | $ | 17.19 | | | | | $ | 17.19 | |

Total market value (1) | | $ | 1,877,674 | | | | | $ | 1,877,674 | |

| | | | | | |

| Debt: | | | | | | |

| Senior, unsecured notes | | $ | 1,050,000 | | | $ | — | | | $ | 1,050,000 | |

| Unsecured term loans | | 300,000 | | | — | | | 300,000 | |

| Mortgages payable | | 60,612 | | | 165,250 | | | 225,862 | |

| Unsecured lines of credit | | — | | | — | | | — | |

| Total principal debt | | 1,410,612 | | | 165,250 | | | 1,575,862 | |

| Less: Net debt discounts | | (6,386) | | | — | | | (6,386) | |

| Less: Debt origination costs | | (7,689) | | | (506) | | | (8,195) | |

| Total debt | | 1,396,537 | | | 164,744 | | | 1,561,281 | |

| Less: Cash and cash equivalents | | (152,847) | | | (7,369) | | | (160,216) | |

| Net debt | | 1,243,690 | | | 157,375 | | | 1,401,065 | |

| Total enterprise value | | $ | 3,121,364 | | | $ | 157,375 | | | $ | 3,278,739 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Liquidity: | | | | | | |

| Cash and cash equivalents | | $ | 152,847 | | | $ | 7,369 | | | $ | 160,216 | |

| Unused capacity under unsecured lines of credit | | 520,000 | | | — | | | 520,000 | |

| Total liquidity | | $ | 672,847 | | | $ | 7,369 | | | $ | 680,216 | |

| | | | | | |

Ratios (2): | | | | | | |

| | | | | | |

| | | | | | |

Net debt to Adjusted EBITDA (3)(4) | | 5.2 | x | | | | 5.4 | x |

| | | | | | |

Interest coverage ratio (4)(5) | | 4.8 | x | | | | 4.6 | x |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1)Amounts may not recalculate due to the effect of rounding.

(2)Ratios are presented for the trailing twelve-month period.

(3)Net debt to Adjusted EBITDA represents net debt for the respective portfolio divided by Adjusted EBITDA (consolidated) or Adjusted EBITDAre (total at pro rata share).

(4)Net debt, Adjusted EBITDA and Adjusted EBITDAre are non-GAAP measures. Refer to pages 29-30 for reconciliations of net income to Adjusted EBITDA and Adjusted EBITDAre and page 31 for a reconciliation of total debt to net debt.

(5)Interest coverage ratio represents Adjusted EBITDA (consolidated) or Adjusted EBITDAre (total at pro rata share) divided by interest expense.

.

| | | | | | | | | | | |

| Credit Ratings: | | | |

| Agency | Rating | Outlook | Latest Action |

| Moody’s Investors Services | Baa3 | Stable | April 14, 2021 |

| Standard & Poor’s Ratings Services | BBB- | Stable | February 19, 2021 |

20

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

NON-GAAP SUPPLEMENTAL MEASURES

Funds From Operations

Funds From Operations (“FFO”) is a widely used measure of the operating performance for real estate companies that supplements net income (loss) determined in accordance with generally accepted accounting principles in the United States (“GAAP”). We determine FFO based on the definition set forth by the National Association of Real Estate Investment Trusts (“NAREIT”), of which we are a member. In December 2018, NAREIT issued “NAREIT Funds From Operations White Paper - 2018 Restatement” which clarifies, where necessary, existing guidance and consolidates alerts and policy bulletins into a single document for ease of use. NAREIT defines FFO as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP, excluding (i) depreciation and amortization related to real estate, (ii) gains or losses from sales of certain real estate assets, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) after adjustments for unconsolidated partnerships and joint ventures calculated to reflect FFO on the same basis.

FFO is intended to exclude historical cost depreciation of real estate as required by GAAP which assumes that the value of real estate assets diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. Because FFO excludes depreciation and amortization of real estate assets, gains and losses from property dispositions and extraordinary items, it provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities and interest costs, providing perspective not immediately apparent from net income (loss).

We present FFO because we consider it an important supplemental measure of our operating performance. In addition, a portion of cash bonus compensation to certain members of management is based on our FFO or Core FFO, which is described in the section below. We believe it is useful for investors to have enhanced transparency into how we evaluate our performance and that of our management. In addition, FFO is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is also widely used by us and others in our industry to evaluate and price potential acquisition candidates. We believe that FFO payout ratio, which represents regular distributions to common shareholders and unit holders of the Operating Partnership expressed as a percentage of FFO, is useful to investors because it facilitates the comparison of dividend coverage between REITs. NAREIT has encouraged its member companies to report their FFO as a supplemental, industry-wide standard measure of REIT operating performance.

FFO has significant limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

•FFO does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

•FFO does not reflect changes in, or cash requirements for, our working capital needs;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and FFO does not reflect any cash requirements for such replacements; and

•Other companies in our industry may calculate FFO differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, FFO should not be considered as a measure of discretionary cash available to us to invest in the growth of our business or our dividend paying capacity. We compensate for these limitations by relying primarily on our GAAP results and using FFO only as a supplemental measure.

Core FFO

If applicable, we present Core Funds from Operations (“Core FFO”) as a supplemental measure of our performance. We define Core FFO as FFO further adjusted to eliminate the impact of certain items that we do not consider indicative of our ongoing operating performance. These further adjustments are itemized in the table below, if applicable. You are encouraged to evaluate these adjustments and the reasons we consider them appropriate for supplemental analysis. In evaluating Core FFO you should be aware that in the future we may incur expenses that are the same as or similar to some of the adjustments in this presentation. Our presentation of Core FFO should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items.

We present Core FFO because we believe it assists investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. In addition, we believe it is useful for investors to have enhanced transparency into how we evaluate management’s performance and the effectiveness of our business strategies. We use Core FFO when certain material, unplanned transactions occur as a factor in evaluating management’s performance and to evaluate the effectiveness of our business strategies, and may use Core FFO when determining incentive compensation.

21

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Core FFO has limitations as an analytical tool. Some of these limitations are:

•Core FFO does not reflect our cash expenditures, or future requirements, for capital expenditures or contractual commitments;

•Core FFO does not reflect changes in, or cash requirements for, our working capital needs;

•Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Core FFO does not reflect any cash requirements for such replacements;

•Core FFO does not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of our ongoing operations; and

•Other companies in our industry may calculate Core FFO differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Core FFO should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Core FFO only as a supplemental measure.

Funds Available for Distribution

Funds Available for Distribution (“FAD”) is a non-GAAP financial measure that we define as FFO, excluding corporate depreciation, amortization of finance costs, amortization of net debt discount (premium), amortization of equity-based compensation, straight-line rent amounts, market rent amounts, second generation tenant allowances and lease incentives, recurring capital improvement expenditures, and our share of the items listed above for our unconsolidated joint ventures. Investors, analysts and the Company utilize FAD as an indicator of common dividend potential. The FAD payout ratio, which represents regular distributions to common shareholders and unit holders of the Operating Partnership expressed as a percentage of FAD, facilitates the comparison of dividend coverage between REITs.

We believe that net income (loss) is the most directly comparable GAAP financial measure to FAD. FAD does not represent cash generated from operating activities in accordance with GAAP and should not be considered as an alternative to net income (loss) as an indication of our performance or to cash flows as a measure of liquidity or our ability to make distributions. Other companies in our industry may calculate FAD differently than we do, limiting its usefulness as a comparative measure.

Portfolio Net Operating Income and Same Center Net Operating Income

We present portfolio net operating income (“Portfolio NOI”) and same center net operating income (“Same Center NOI”) as supplemental measures of our operating performance. Portfolio NOI represents our property level net operating income which is defined as total operating revenues less property operating expenses and excludes termination fees and non-cash adjustments including straight-line rent, net above and below market rent amortization, impairment charges, loss on early extinguishment of debt and gains or losses on the sale of assets recognized during the periods presented. We define Same Center NOI as Portfolio NOI for the properties that were operational for the entire portion of both comparable reporting periods and which were not acquired, or subject to a material expansion or non-recurring event, such as a natural disaster, during the comparable reporting periods. We present Portfolio NOI and Same Center NOI on both a consolidated and total portfolio, including pro rata share of unconsolidated joint ventures, basis.

We believe Portfolio NOI and Same Center NOI are non-GAAP metrics used by industry analysts, investors and management to measure the operating performance of our properties because they provide performance measures directly related to the revenues and expenses involved in owning and operating real estate assets and provide a perspective not immediately apparent from net income (loss), FFO or Core FFO. Because Same Center NOI excludes properties developed, redeveloped, acquired and sold; as well as non-cash adjustments, gains or losses on the sale of outparcels and termination rents; it highlights operating trends such as occupancy levels, rental rates and operating costs on properties that were operational for both comparable periods. Other REITs may use different methodologies for calculating Portfolio NOI and Same Center NOI, and accordingly, our Portfolio NOI and Same Center NOI may not be comparable to other REITs.

Portfolio NOI and Same Center NOI should not be considered alternatives to net income (loss) or as an indicator of our financial performance since they do not reflect the entire operations of our portfolio, nor do they reflect the impact of general and administrative expenses, acquisition-related expenses, interest expense, depreciation and amortization costs, other non-property income and losses, the level of capital expenditures and leasing costs necessary to maintain the operating performance of our properties, or trends in development and construction activities which are significant economic costs and activities that could materially impact our results from operations. Because of these limitations, Portfolio NOI and Same Center NOI should not be viewed in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Portfolio NOI and Same Center NOI only as supplemental measures.

22

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Adjusted EBITDA, EBITDAre and Adjusted EBITDAre

We present Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) as adjusted for items described below (“Adjusted EBITDA”), EBITDA for Real Estate (“EBITDAre”) and Adjusted EBITDAre, all non-GAAP measures, as supplemental measures of our operating performance. Each of these measures is defined as follows:

We define Adjusted EBITDA as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP before interest expense, income taxes (if applicable), depreciation and amortization, gains and losses on sale of operating properties, joint venture properties, outparcels and other assets, impairment write-downs of depreciated property and of investment in unconsolidated joint ventures caused by a decrease in value of depreciated property in the affiliate, compensation related to voluntary retirement plan and other executive severance, casualty gains and losses, gains and losses on extinguishment of debt, net and other items that we do not consider indicative of the Company's ongoing operating performance.

We determine EBITDAre based on the definition set forth by NAREIT, which is defined as net income (loss) available to the Company’s common shareholders computed in accordance with GAAP before interest expense, income taxes (if applicable), depreciation and amortization, gains and losses on sale of operating properties, gains and losses on change of control and impairment write-downs of depreciated property and of investment in unconsolidated joint ventures caused by a decrease in value of depreciated property in the affiliate and after adjustments to reflect our share of the EBITDAre of unconsolidated joint ventures.

Adjusted EBITDAre is defined as EBITDAre excluding gains and losses on extinguishment of debt, net, casualty gains and losses, compensation related to voluntary retirement plan and other executive severance, casualty gains and losses, gains and losses on sale of outparcels, and other items that that we do not consider indicative of the Company's ongoing operating performance.

We present Adjusted EBITDA, EBITDAre and Adjusted EBITDAre as we believe they are useful for investors, creditors and rating agencies as they provide additional performance measures that are independent of a Company’s existing capital structure to facilitate the evaluation and comparison of the Company’s operating performance to other REITs and provide a more consistent metric for comparing the operating performance of the Company’s real estate between periods.

Adjusted EBITDA, EBITDAre and Adjusted EBITDAre have significant limitations as analytical tools, including:

•They do not reflect our interest expense;

•They do not reflect gains or losses on sales of operating properties or impairment write-downs of depreciated property and of investment in unconsolidated joint ventures caused by a decrease in value of depreciated property in the affiliate;

•Adjusted EBITDA and Adjusted EBITDAre do not reflect gains and losses on extinguishment of debt and other items that may affect operations; and

•Other companies in our industry may calculate these measures differently than we do, limiting its usefulness as a comparative measure.

Because of these limitations, Adjusted EBITDA, EBITDAre and Adjusted EBITDAre should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. We compensate for these limitations by relying primarily on our GAAP results and using Adjusted EBITDA, EBITDAre and Adjusted EBITDAre only as supplemental measures.

Net Debt

We define Net Debt as Total Debt less Cash and Cash Equivalents and present this metric for both the consolidated portfolio and for the total portfolio, including the consolidated portfolio and the Company’s pro rata share of unconsolidated joint ventures. Net debt is a component of the Net debt to Adjusted EBITDA ratio, which is defined as Net debt for the respective portfolio divided by Adjusted EBITDA (consolidated portfolio) or Adjusted EBITDAre (total portfolio at pro rata share). We use the Net debt to Adjusted EBITDA and the Net debt to Adjusted EBITDAre ratios to evaluate the Company's leverage. We believe this measure is an important indicator of the Company's ability to service its long-term debt obligations.

Non-GAAP Pro Rata Balance Sheet and Income Statement Information

The pro rata balance sheet and pro rata income statement information is not, and is not intended to be, a presentation in accordance with GAAP. The pro rata balance sheet and pro rata income statement information reflect our proportionate economic ownership of each asset in our portfolio that we do not wholly own. These assets may be found in the table earlier in this report entitled, “Unconsolidated Joint Venture Information.” The amounts in the column labeled “Pro Rata Portion Unconsolidated Joint Ventures” were derived on a property-by-property basis by applying to each financial statement line item the ownership percentage interest used to arrive at our share of net income or loss during the period when applying the equity method of accounting. A similar calculation was performed for the amounts in the column labeled “Pro Rata Portion Noncontrolling interests.”

23

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

We do not control the unconsolidated joint ventures and the presentations of the assets and liabilities and revenues and expenses do not represent our legal claim to such items. The operating agreements of the unconsolidated joint ventures generally provide that partners may receive cash distributions (1) quarterly, to the extent there is available cash from operations, (2) upon a capital event, such as a refinancing or sale or (3) upon liquidation of the venture. The amount of cash each partner receives is based upon specific provisions of each operating agreement and vary depending on factors including the amount of capital contributed by each partner and whether any contributions are entitled to priority distributions. Upon liquidation of the joint venture and after all liabilities, priority distributions and initial equity contributions have been repaid, the partners generally would be entitled to any residual cash remaining based on the legal ownership percentage shown in the table found earlier in this report entitled “Unconsolidated Joint Venture Information”.

We provide pro rata balance sheet and income statement information because we believe it assists investors and analysts in estimating our economic interest in our unconsolidated joint ventures when read in conjunction with the Company’s reported results under GAAP. The presentation of pro rata financial information has limitations as an analytical tool. Some of these limitations include:

•The amounts shown on the individual line items were derived by applying our overall economic ownership interest percentage determined when applying the equity method of accounting and do not necessarily represent our legal claim to the assets and liabilities, or the revenues and expenses; and

•Other companies in our industry may calculate their pro rata interest differently than we do, limiting the usefulness as a comparative measure.

Because of these limitations, the pro rata balance sheet and income statement information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP. We compensate for these limitations by relying primarily on our GAAP results and using the pro rata balance sheet and income statement information only supplementally.

24

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Reconciliation of Net Income to FFO and Core FFO (dollars and shares in thousands)

| | | | | | | | | | | | | | | | | | |

| | | | | Three months ended |

| | | | | March 31, |

| | | | | | | 2022 | | 2021 |

| Net income | | | | | | $ | 21,462 | | | $ | 4,342 | |

| Adjusted for: | | | | | | | | |

| Depreciation and amortization of real estate assets - consolidated | | | | | | 25,661 | | | 27,554 | |

| Depreciation and amortization of real estate assets - unconsolidated joint ventures | | | | | | 2,754 | | | 2,996 | |

| | | | | | | | |

| | | | | | | | |

Loss on sale of joint venture property, including foreign currency effect (1) | | | | | | — | | | 3,704 | |

| | | | | | | | |

| | | | | | | | |

| FFO | | | | | | 49,877 | | | 38,596 | |

| | | | | | | | |

| Allocation of earnings to participating securities | | | | | | (434) | | | (392) | |

FFO available to common shareholders (2) | | | | | | $ | 49,443 | | | $ | 38,204 | |

| As further adjusted for: | | | | | | | | |

Compensation related to voluntary retirement plan and other executive severance (3) | | | | | | — | | | 2,418 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Impact of above adjustments to the allocation of earnings to participating securities | | | | | | — | | | (22) | |

Core FFO available to common shareholders (2) | | | | | | $ | 49,443 | | | $ | 40,600 | |

FFO available to common shareholders per share - diluted (2) | | | | | | $ | 0.45 | | | $ | 0.38 | |

Core FFO available to common shareholders per share - diluted (2) | | | | | | $ | 0.45 | | | $ | 0.40 | |

| | | | | | | | | |

| Weighted Average Shares: | | | | | | | | |

| Basic weighted average common shares | | | | | | 103,520 | | | 94,812 | |

| Effect of notional units | | | | | | 802 | | | 288 | |

| Effect of outstanding options | | | | | | 736 | | | 717 | |

| Diluted weighted average common shares (for earnings per share computations) | | | | | | 105,058 | | | 95,817 | |

| | | | | | | | |

| | | | | | | | |

| Exchangeable operating partnership units | | | | | | 4,762 | | | 4,794 | |

Diluted weighted average common shares (for FFO per share computations) (2) | | | | | | 109,820 | | | 100,611 | |

(1)Includes a $3.6 million charge related to the foreign currency effect of the sale of the Saint-Sauveur, Quebec property by the RioCan joint venture in March 2021.

(2)Assumes the Class A common limited partnership units of the Operating Partnership held by the noncontrolling interests are exchanged for common shares of the Company. Each Class A common limited partnership unit is exchangeable for one of the Company’s common shares, subject to certain limitations to preserve the Company’s REIT status.

(3)Includes compensation costs related to a voluntary retirement plan offer that required eligible participants to give notice of acceptance by December 1, 2020 for an effective retirement date of March 31, 2021.

25

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Reconciliation of FFO to FAD (dollars and shares in thousands)

| | | | | | | | | | | | | | | | | | |

| | | | | Three months ended |

| | | | | March 31, |

| | | | | | | 2022 | | 2021 |

| FFO available to common shareholders | | | | | | $ | 49,443 | | | $ | 38,204 | |

| Adjusted for: | | | | | | | | |

| Corporate depreciation excluded above | | | | | | 582 | | | 596 | |

| Amortization of finance costs | | | | | | 759 | | | 1,173 | |

| Amortization of net debt discount | | | | | | 117 | | | 127 | |

| Amortization of equity-based compensation | | | | | | 2,708 | | | 3,845 | |

| Straight-line rent adjustments | | | | | | 1,337 | | | 1,043 | |

| Market rent adjustments | | | | | | 176 | | | (213) | |

| Second generation tenant allowances and lease incentives | | | | | | (1,252) | | | (778) | |

| Capital improvements | | | | | | (1,409) | | | (956) | |

| Adjustments from unconsolidated joint ventures | | | | | | 227 | | | (543) | |

FAD available to common shareholders (1) | | | | | | $ | 52,688 | | | $ | 42,498 | |

| Dividends per share | | | | | | $ | 0.1825 | | | $ | 0.1775 | |

| | | | | | | | |

| | | | | | | | |

| FFO payout ratio | | | | | | 41 | % | | 47 | % |

| FAD payout ratio | | | | | | 38 | % | | 42 | % |

Diluted weighted average common shares (1) | | | | | | 109,820 | | | 100,611 | |

(1)Assumes the Class A common limited partnership units of the Operating Partnership held by the noncontrolling interests are exchanged for common shares of the Company. Each Class A common limited partnership unit is exchangeable for one of the Company’s common shares, subject to certain limitations to preserve the Company’s REIT status.

26

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Reconciliation of Net Income to Portfolio NOI and Same Center NOI for the consolidated portfolio and total portfolio at pro rata share (in thousands)

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended |

| | | | March 31, |

| | | | | | 2022 | | 2021 |

| Net income | | | | | | $ | 21,462 | | | $ | 4,342 | |

| Adjusted to exclude: | | | | | | | | |

| Equity in earnings of unconsolidated joint ventures | | | | | | (2,513) | | | (1,769) | |

| Interest expense | | | | | | 11,634 | | | 14,362 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Other (income) expense | | | | | | (183) | | | 3,505 | |

| | | | | | | | |

| Depreciation and amortization | | | | | | 26,243 | | | 28,150 | |

| Other non-property (income) expenses | | | | | | 172 | | | (400) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Corporate general and administrative expenses | | | | | | 15,486 | | | 16,770 | |

Non-cash adjustments (1) | | | | | | 1,520 | | | 844 | |

| Lease termination fees | | | | | | (2,596) | | | (673) | |

| Portfolio NOI - Consolidated | | | | | | 71,225 | | | 65,131 | |

| Non-same center NOI - Consolidated | | | | | | 63 | | | (83) | |

Same Center NOI - Consolidated (2) | | | | | | $ | 71,288 | | | $ | 65,048 | |

| | | | | | | | |

| Portfolio NOI - Consolidated | | | | | | $ | 71,225 | | | $ | 65,131 | |

| Pro rata share of unconsolidated joint ventures | | | | | | 6,904 | | | 6,419 | |

| Portfolio NOI - total portfolio at pro rata share | Non-same center NOI | | | | | 78,129 | | | 71,550 | |

| Non-same center NOI - total portfolio at pro rata share | | | | | | 63 | | | (423) | |

Same Center NOI - total portfolio at pro rata share (2) | | | | | | $ | 78,192 | | | $ | 71,127 | |

(1)Non-cash items include straight-line rent, above and below market rent amortization, straight-line rent expense on land leases and gains or losses on outparcel sales, as applicable.

(2)Sold outlet centers excluded from Same Center NOI:

| | | | | | | | |

| Outlet centers sold: |

| | |

| Jeffersonville | January 2021 | Consolidated |

| Saint-Sauveur, Quebec | March 2021 | Unconsolidated JV |

27

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Same Center NOI - total portfolio at pro rata share (in thousands)

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | Three months ended | |

| | | | | March 31, | % |

| | | | | | | 2022 | | 2021 | Change |

| Same Center Revenues: | | | | | | | | | | |

| Base rentals | | | | | | | $ | 77,062 | | | $ | 72,279 | | 6.6 | % |

| Percentage rentals | | | | | | | 4,451 | | | 2,433 | | 82.9 | % |

| Tenant expense reimbursement | | | | | | | 31,190 | | | 32,486 | | -4.0 | % |

| Uncollectible tenant revenues | | | | | | | 1,656 | | | (340) | | -587.1 | % |

| Rental revenues | | | | | | | 114,359 | | | 106,858 | | 7.0 | % |

| Other revenues | | | | | | | 3,067 | | | 2,288 | | 34.0 | % |

| Total same center revenues | | | | | | | 117,426 | | | 109,146 | | 7.6 | % |

| Same Center Expenses: | | | | | | | | | | |

| Property operating | | | | | | | 39,181 | | | 37,970 | | 3.2 | % |

| General and administrative | | | | | | | 52 | | | 49 | | 6.1 | % |

| Total same center expenses | | | | | | | 39,233 | | | 38,019 | | 3.2 | % |

| Same Center NOI - total portfolio at pro rata share | | | | | | | $ | 78,193 | | | $ | 71,127 | | 9.9 | % |

28

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Reconciliation of Net Income to Adjusted EBITDA (in thousands)

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended |

| | | | March 31, |

| | | | | | 2022 | | 2021 |

| Net income | | | | | | $ | 21,462 | | | $ | 4,342 | |

| Adjusted to exclude: | | | | | | | | |

| Interest expense | | | | | | 11,634 | | | 14,362 | |

| Depreciation and amortization | | | | | | 26,243 | | | 28,150 | |

| | | | | | | | |

| | | | | | | | |

Loss on sale of joint venture property, including foreign currency effect (1) | | | | | | — | | | 3,704 | |

| | | | | | | | |

Compensation related to voluntary retirement plan and other executive severance (2) | | | | | | — | | | 2,418 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted EBITDA | | | | | | $ | 59,339 | | | $ | 52,976 | |

| | | | | | | | | | | | | | | | | | |

| | | | Twelve months ended |

| | | | March 31, | | December 31, |

| | | | | | 2022 | | 2021 |

| Net income | | | | | | $ | 26,678 | | | $ | 9,558 | |

| Adjusted to exclude: | | | | | | | | |

| Interest expense | | | | | | 50,138 | | | 52,866 | |

| Depreciation and amortization | | | | | | 108,101 | | | 110,008 | |

Impairment charges - consolidated (3) | | | | | | 6,989 | | | 6,989 | |

| | | | | | | | |

Loss on sale of joint venture property, including foreign currency effect (1) | | | | | | — | | | 3,704 | |

| | | | | | | | |

Compensation related to voluntary retirement plan and other executive severance (2) | | | | | | 1,161 | | | 3,579 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Casualty gain | | | | | | (969) | | | (969) | |

| | | | | | | | |

| | | | | | | | |

Loss on early extinguishment of debt (4) | | | | | | 47,860 | | | 47,860 | |

| Adjusted EBITDA | | | | | | $ | 239,958 | | | $ | 233,595 | |

(1)Includes a $3.6 million charge related to the foreign currency effect of the sale of the Saint-Sauveur, Quebec property by the RioCan joint venture in March 2021.

(2)Includes compensation costs related to a voluntary retirement plan offer that required eligible participants to give notice of acceptance by December 1, 2020 for an effective retirement date of March 31, 2021, as well as other executive severance costs incurred during the year ended December 31, 2021.

(3)Includes $563,000 for the twelve months ended December 31, 2021 of impairment loss attributable to the right-of-use asset associated with the ground lease at the Mashantucket (Foxwoods), Connecticut outlet center.

(4)In April 2021, the Company completed a partial redemption of $150.0 million aggregate principal amount of its $250.0 million 3.875% senior notes due December 2023 (the “2023 Notes”) for $163.0 million in cash. In September 2021, the Company completed a redemption of the remaining 2023 Notes, $100.0 million in aggregate principal amount outstanding, and all of its 3.750% senior notes due 2024, $250.0 million in aggregate principal outstanding, for $381.9 million in cash. The loss on extinguishment of debt includes make-whole premiums of $44.9 million for both of these redemptions.

29

Supplemental Operating and Financial Data for the

Quarter Ended 3/31/2022

Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre (in thousands)

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended |

| | | | March 31, |

| | | | | | 2022 | | 2021 |

| | | | | | | | |

| Net income | | | | | | $ | 21,462 | | | $ | 4,342 | |

| Adjusted to exclude: | | | | | | | | |

| Interest expense | | | | | | 11,634 | | | 14,362 | |

| Depreciation and amortization | | | | | | 26,243 | | | 28,150 | |

| | | | | | | | |

| | | | | | | | |

Loss on sale of joint venture property, including foreign currency effect (1) | | | | | | — | | | 3,704 | |

| | | | | | | | |

| Pro rata share of interest expense - unconsolidated joint ventures | | | | | | 1,458 | | | 1,472 | |

Pro rata share of depreciation and amortization - unconsolidated joint ventures | | | | | | 2,754 | | | 2,996 | |

| EBITDAre | | | | | | $ | 63,551 | | | $ | 55,026 | |

Compensation related to voluntary retirement plan and other executive severance (2) | | | | | | — | | | 2,418 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Adjusted EBITDAre | | | | | | $ | 63,551 | | | $ | 57,444 | |

| | | | | | | | | | | | | | | | | | |

| | | | Twelve months ended |

| | | | March 31, | | December 31, |

| | | | | | 2022 | | 2021 |

| | | | | | | | |

| Net income | | | | | | $ | 26,678 | | | $ | 9,558 | |

| Adjusted to exclude: | | | | | | | | |

| Interest expense | | | | | | 50,138 | | | 52,866 | |

| Depreciation and amortization | | | | | | 108,101 | | | 110,008 | |

Impairment charges - consolidated (3) | | | | | | 6,989 | | | 6,989 | |

| | | | | | | | |

Loss on sale of joint venture property, including foreign currency effect (1) | | | | | | — | | | 3,704 | |

| | | | | | | | |

| Pro-rata share of interest expense - unconsolidated joint ventures | | | | | | 5,844 | | | 5,858 | |

| Pro-rata share of depreciation and amortization - unconsolidated joint ventures | | | | | | 11,376 | | | 11,618 | |

| EBITDAre | | | | | | $ | 209,126 | | | $ | 200,601 | |

Compensation related to voluntary retirement plan and other executive severance (2) | | | | | | 1,161 | | | 3,579 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Casualty gain | | | | | | (969) | | | (969) | |

| | | | | | | | |

Loss on early extinguishment of debt (4) | | | | | | 47,860 | | | 47,860 | |

| Adjusted EBITDAre | | | | | | $ | 257,178 | | | $ | 251,071 | |

(1)Includes a $3.6 million charge related to the foreign currency effect of the sale of the Saint-Sauveur, Quebec property by the RioCan joint venture in March 2021.