UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2006

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12936

TITAN INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

Illinois | | 36-3228472 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2701 Spruce Street, Quincy, IL 62301

(Address of principal executive offices)

(217) 228-6011

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common stock, no par value | New York Stock Exchange (Symbol: TWI) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filer o Accelerated filer x Non-accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

The aggregate market value of the shares of common stock of the registrant held by non-affiliates was $227,988,853 based upon the closing price of the common stock on the New York Stock Exchange on June 30, 2006.

As of February 15, 2007, 20,024,032 shares of common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates information by reference from the registrant's definitive proxy statement for its annual meeting of stockholders to be held May 17, 2007.

TITAN INTERNATIONAL, INC.

Index to Annual Report on Form 10-K

| | | |

| Part I. | | Page |

| | | |

Item 1. | Business | 3-9 |

| | | |

Item 1A. | Risk Factors | 9 |

| | | |

Item 1B. | Unresolved Staff Comments | 9 |

| | | |

Item 2. | Properties | 10 |

| | | |

Item 3. | Legal Proceedings | 10 |

| | | |

Item 4. | Submission of Matters to a Vote of Security Holders. | 10 |

| | | |

| Part II. | | |

| | | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 11 |

| | | |

Item 6. | Selected Financial Data | 12 |

| | | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 13-32 |

| | | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 33 |

| | | |

Item 8. | Financial Statements and Supplementary Data | 33 |

| | | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 33 |

| | | |

Item 9A. | Controls and Procedures | 33 |

| | | |

Item 9B. | Other Information | 33 |

| | | |

| Part III. | | |

| | | |

Item 10. | Directors, Executive Officers and Corporate Governance | 34 |

| | | |

Item 11. | Executive Compensation | 34 |

| | | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 35 |

| | | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 35 |

| | | |

Item 14. | Principal Accounting Fees and Services | 35 |

| | | |

| Part IV. | | |

| | | |

Item 15. | Exhibits, Financials Statement Schedules | 36 |

| | | |

| | Signatures | 37 |

PART I

ITEM 1 - BUSINESS

INTRODUCTION

Titan International, Inc. and its subsidiaries (Titan or the Company) are leading manufacturers of wheels, tires and assemblies for off-highway vehicles used in the agricultural, earthmoving/construction and consumer markets. Titan’s earthmoving/construction market also includes products supplied to the U.S. government, while the consumer market includes products for all-terrain vehicles (ATVs) and recreational/utility trailer applications. Titan manufactures both wheels and tires for the majority of these market applications, allowing the Company to provide the value-added service of delivering complete wheel and tire assemblies. The Company offers a broad range of products that are manufactured in relatively short production runs to meet the specifications of original equipment manufacturers (OEMs) and/or the requirements of aftermarket customers.

As one of the few companies dedicated to the off-highway wheel and tire market, Titan’s engineering and manufacturing resources are focused on addressing the real-life concerns of the end-users of our products. Titan’s commitment to product innovation is demonstrated by the development of the low sidewall (LSW) series of wheel and tire assemblies, which considerably enhances the performance of off-highway vehicles by pairing a larger diameter wheel with a shorter sidewall tire.

In 2006, Titan’s agricultural market sales represented 62% of net sales, the earthmoving/construction market represented 27% and the consumer market represented 11% of net sales. For information concerning the revenues, certain expenses, income from operations and assets attributable to each of the segments in which the Company operates, see Note 28 to the consolidated financial statements of Titan, included in Item 8 herein.

COMPETITIVE STRENGTHS

Titan’s competitive strengths include the Company’s strong market position in the off-highway wheel and tire market and the Company’s long-term core customer relationships. These competitive strengths along with Titan’s dedication to the off-highway tire and wheel market continue to drive the Company forward.

Strong Market Position The Company has achieved a strong position in the domestic market for off-highway wheels, tires and assembly products. Titan’s ability to offer a broad range of different products has increased the Company’s visibility and has enhanced its ability to cross-sell products and consolidate market positions. Innovative marketing programs have strengthened Titan’s image in the marketplace, and the Company is reaching an increasing number of customers in the aftermarket. Years of product design and engineering experience have enabled Titan to improve existing products and develop new ones that have been well received in the marketplace. In addition, Titan believes it has benefited from significant barriers to entry, such as the substantial investment necessary to replicate the Company’s manufacturing equipment and numerous tools, dies and molds.

Long-Term Core Customer Relationships The Company’s top customers, including global leaders in agricultural and construction equipment manufacturing, have been purchasing wheels from Titan or its predecessors for many decades on average. Customers including AGCO Corporation, Caterpillar Inc., CNH Global N.V., Deere & Company, Kubota Corporation and the U.S. Government have helped sustain Titan’s leadership in wheel, tire and assembly innovation.

BUSINESS STRATEGY

Titan’s business strategy is to increase its penetration of the aftermarket for tires and the private branding business, to continue to improve operating efficiencies, to maintain emphasis on new product development and to explore possible additional strategic acquisitions.

Increase Aftermarket Tire Business and Private Branding Business The Company has concentrated on increasing its penetration of the tire aftermarket. The aftermarket offers higher profit margins and the tire aftermarket is larger and somewhat less cyclical than the OEM market. Additionally, Titan has developed a unique and efficient method of private branding the sidewall of its tires for sale through OEM retail distribution networks.

Improve Operating Efficiencies The Company continually works to improve the operating efficiency of its assets and manufacturing facilities. Titan integrates each facility’s strength, which may include transferring equipment and business to the facilities that are best equipped to handle the work. This provides capacity to increase utilization and spread operating costs over a greater volume of products. Titan is also continuing a comprehensive program to refurbish, modernize and enhance the computer technology of its manufacturing equipment. The Company has centralized and streamlined inventory controls. These efforts have led to improved management of order backlogs and have substantially improved Titan’s ability to respond to customer orders on a timely basis.

Improve Design Capacity and Increase New Product Development Equipment manufacturers constantly face changing industry dynamics. Titan directs its business and marketing strategy to understand and address the needs of its customers and demonstrate the advantages of its products. In particular, the Company often collaborates with customers in the design of new and upgraded products. Titan will occasionally recommend modified products to its customers based on its own market information. The Company tests new designs and technologies and develops methods of manufacturing to improve product quality and performance. These value-added services enhance Titan’s relationships with its customers.

Explore Additional Strategic Acquisitions The Company’s expertise in the manufacture of off-highway steel wheels and tires has permitted it to take advantage of opportunities to acquire businesses in the United States that complement this product line, including companies engaged in the tire market and companies that have wheel and tire assembly capabilities. In the future, Titan may make additional strategic acquisitions of businesses that have an off-highway focus.

ACQUISITION OF CONTINENTAL’S OTR ASSETS

On July 31, 2006, Titan Tire Corporation of Bryan, a subsidiary of Titan International, Inc., acquired the off-the-road (OTR) tire assets of Continental Tire North America, Inc. (Continental) in Bryan, Ohio. Titan Tire Corporation of Bryan purchased the assets of Continental’s OTR tire facility for approximately $53 million in cash proceeds. The assets purchased included Continental’s OTR plant, property and equipment located in Bryan, Ohio, and inventory and other current assets. The acquisition included an agreement with Continental to use the Continental and General trademarks on OTR tires.

ACQUISITION OF GOODYEAR’S NORTH AMERICAN FARM TIRE ASSETS

On December 28, 2005, Titan Tire Corporation, a subsidiary of Titan International, Inc., acquired The Goodyear Tire & Rubber Company’s North American farm tire assets. Titan Tire purchased the assets of Goodyear’s North American farm tire business for approximately $100 million in cash proceeds. The assets purchased include Goodyear’s North American plant, property and equipment located in Freeport, Illinois, and Goodyear’s North American farm tire inventory. The acquisition included a long-term license agreement with The Goodyear Tire & Rubber Company to manufacture and sell certain off-highway tires in North America, which includes the right to use the Goodyear trademark.

AGRICULTURAL MARKET

Titan’s agricultural rims, wheels and tires are manufactured for use on various agricultural and forestry equipment, including tractors, combines, skidders, plows, planters and irrigation equipment, and are sold directly to OEMs and to the aftermarket through independent distributors, equipment dealers and Titan’s own distribution centers. The wheels and rims range in diameter from 9” to 54” with the 54” diameter being the largest agricultural wheel manufactured in North America. Basic configurations are combined with distinct variations (such as different centers and a wide range of material thickness) allowing the Company to offer a broad line of product models to meet customer specifications. Titan’s agricultural tires range from 8” to 85” in diameter and from 4.8” to 44” in width. The Company offers the added value of delivering a complete wheel and tire assembly to customers.

EARTHMOVING/CONSTRUCTION MARKET

The Company manufactures rims, wheels and tires for various types of earthmoving, mining, military and construction equipment, including skid steers, aerial lifts, cranes, graders and levelers, scrapers, self-propelled shovel loaders, articulated dump trucks, load transporters, haul trucks and backhoe loaders. The Company provides customers with a broad range of earthmoving/construction wheels ranging in diameter from 20” to 63” and in weight from 125 pounds to 7,000 pounds. The 63” diameter wheel is the largest manufactured in North America for the earthmoving/construction market. The earthmoving/construction wheels and tires produced by Titan are sold to OEMs and the aftermarket. Titan’s earthmoving/construction tires range from 30” to 109” in diameter and in weight from 50 pounds to 6,200 pounds. The Company offers the added value of wheel and tire assembly for certain applications in the earthmoving/construction market.

CONSUMER MARKET

Titan builds a variety of products for all-terrain vehicles (ATV), turf, golf and trailer applications. Consumer wheels and rims range from 8” to 16” in diameter. Likewise, Titan produces a variety of tires for the consumer market. ATV tires using the new stripwinding manufacturing process have been introduced to the marketplace, which improves tread durability. Titan’s sales in the consumer market include sales to Goodyear, which include an off-take/mixing agreement. This agreement includes mixed stock, which is a prepared rubber compound used in tire production. For the domestic boat, recreational and utility trailer markets, the Company provides wheels and tires and assembles brakes, actuators and components. The Company also offers the value-added service of a wheel and tire assembly for the consumer market.

MARKET CONDITIONS OUTLOOK

The Company experienced a softening in demand from OEMs for the Company’s products in 2006. The Company recorded an increase in sales as a result of the Goodyear North American farm tire acquisition and the Continental OTR acquisition. Titan is using the expanded agricultural product offering of Goodyear branded farm tires and the expanded earthmoving/construction product offering supplied by the Bryan facility, along with added manufacturing capacity from the Freeport and Bryan facilities to expand market share. Anticipated market conditions are as follows: (i) the agricultural market is expected to maintain current sales levels in 2007, (ii) the earthmoving/ construction market is anticipated to remain strong as a result of strong energy and mining markets, (iii) the performance of the consumer market, Titan’s smallest market, is largely tied to recreational spending habits and many other factors including weather, competitive pricing, energy prices and consumer attitude. Consumer market sales to Goodyear fluctuate significantly based upon their future product requirements. However, the Company expects the remaining consumer market sales to remain relatively stable in 2007.

OPERATIONS

Titan’s operations include manufacturing wheels, manufacturing tires, and combining these wheels and tires into assemblies for use in the agricultural, earthmoving/construction and consumer markets. These operations entail many manufacturing processes in order to complete the finished products.

Wheel Manufacturing Process Most agricultural wheels are produced using a rim and a center disc. A rim is produced by first cutting large steel sheets to required width and length specifications. These steel sections are rolled and welded to form a circular rim, which is flared and formed in the rollform operation. The majority of discs are manufactured using presses that both blank and form the center to specifications in multiple stage operations. The Company e-coats wheels using a multi-step process prior to the final paint top coating.

Large earthmoving/construction steel wheels are manufactured from hot and cold-rolled steel sections. Hot-rolled sections are generally used to increase cross section thickness in high stress areas of large diameter wheels. A special cold forming process for certain wheels is used to increase cross section thickness while reducing the number of wheel components. Rims are built from a series of hoops that are welded together to form a rim base. The complete rim base is made from either three or five separate parts that lock together after the rubber tire has been fitted to the wheel and inflated.

For most consumer market wheels, the Company manufactures rims and center discs from steel sheets. Rims are rolled and welded, and discs are stamped and formed from the sheets. The manufacturing process then entails welding the rims to the centers and painting the assembled product.

Tire Manufacturing Process The first stage in tire production is the mixing of rubber, carbon black and chemicals to form various rubber compounds. These rubber compounds are then extruded and processed with textile or steel materials to make specific components. These components - beads (wire bundles that anchor the tire with the wheel), plies (layers of fabric that give the tire strength), belts (fabric or steel fabric wrapped under the tread in some tires), tread and sidewall - are then assembled into an uncured tire carcass. The uncured carcass is placed into a press that molds and vulcanizes the carcass under set time, temperature and pressure into a finished tire.

Wheel and Tire Assemblies The Company’s position as a manufacturer of both wheels and tires allows Titan to mount and deliver one of the largest selections of off-highway assemblies in North America. Titan offers this value-added service of one-stop shopping for wheel and tire assemblies for the agricultural, earthmoving/construction and consumer markets. Customer orders are entered into the Company’s system either through electronic data interchange or manually. The appropriate wheel-tire assembly delivery schedule is formulated based on each customer’s requirements and products are received by the customer on a just-in-time basis.

Quality Control The Company is ISO certified at all five main manufacturing facilities located in Bryan, Ohio; Des Moines, Iowa; Freeport, Illinois; Quincy, Illinois; and Saltville, Virginia. The ISO series is a set of related and internationally recognized standards of management and quality assurance. The standards specify guidelines for establishing, documenting and maintaining a system to ensure quality. The ISO certifications are a testament to Titan’s dedication to providing quality products for its customers.

RAW MATERIALS

Steel and rubber are the primary raw materials used by the Company in all segments. To ensure a consistent steel supply, Titan purchases raw steel from key steel mills and maintains relationships with steel processors for steel preparation. The Company is not dependent on any single producer for its steel supply. Rubber and other raw materials for tire manufacture represent some of the Company’s largest commodity expenses. Titan buys rubber in markets where there are several sources of supply. In addition to the development of key domestic suppliers, the Company’s strategic procurement plan includes international steel and rubber suppliers to assure competitive price and quality in the global marketplace. As is customary in the industry, the Company does not have long-term contracts for the purchase of steel or rubber and, therefore, purchases are subject to price fluctuations.

CAPITAL EXPENDITURES

Capital expenditures for 2006, 2005 and 2004 were $8.3 million, $6.8 million and $4.3 million, respectively. Capital expenditures in 2006 were used primarily for updating manufacturing equipment, expanding manufacturing capacity and for further automation at the Company’s facilities. Capital expenditures for 2007 are forecasted to be approximately $16 million to $18 million and will be used to enhance the Company’s existing facilities and manufacturing capabilities including additional capacity for OTR tire production.

PATENTS AND TRADEMARKS

The Company owns various patents and trademarks and continues to apply for patent protection for new products. While patents are considered significant to the operations of the business, at this time Titan does not consider any one of them to be of such importance that the patent’s expiration or invalidity could materially affect the Company’s business. However, due to the difficult nature of predicting the interpretation of patent laws, the Company cannot anticipate or predict the material adverse effect on its operations, cash flows or financial condition as a result of associated liabilities created under such patent interpretations.

MARKETING AND DISTRIBUTION

The Company employs an internal sales force and utilizes several manufacturing representative firms for sales in North America. Sales representatives are primarily organized within geographic regions.

Titan distributes wheels and tires directly to OEMs. The distribution of aftermarket tires occurs primarily through a network of independent and OEM-affiliated dealers. The Company distributes wheel and tire assemblies directly to OEMs and aftermarket customers through its distribution network consisting of nine facilities in the United States.

SEASONALITY

Agricultural equipment sales are seasonal by nature. Farmers generally order equipment to be delivered before the growing season. Shipments to OEMs usually peak during the Company’s first and second quarters for the spring planting period. Earthmoving/construction and consumer markets also historically tend to experience higher demand in the first and second quarters. These markets are affected by mining, building and economic conditions.

RESEARCH, DEVELOPMENT AND ENGINEERING

The Company’s research, development and engineering staff tests original designs and technologies and develop new manufacturing methods to improve product performance. These services enhance the Company’s relationships with customers. The Company continues to develop and introduce new LSW wheel and tire assemblies for the agricultural, earthmoving/construction and consumer markets. LSW wheel and tire assemblies reduce bounce, power hop, road lope and heat build-up, and provide more stability and safety for operators, which in turn may lead to greater productivity. The key to the success of the LSW is an increase in wheel diameter while maintaining the original outside tire diameter. This is accomplished by lowering the sidewall (LSW is an acronym for low sidewall) and increasing its strength. Maintaining the original outside diameter of the tire allows the LSW to improve the performance of agricultural, earthmoving/construction and consumer equipment without further modification.

CUSTOMERS

The Company’s 10 largest customers accounted for approximately 53% of net sales for the year ended December 31, 2006, compared to 55% for the year ended December 31, 2005. Net sales to Deere & Company in Titan’s agricultural, earthmoving/construction and consumer markets combined represented 17% of the Company’s consolidated revenues for the year ended December 31, 2006, and 20% for the year ended 2005. Net sales to CNH Global N.V. in Titan’s three markets represented 11% of the Company’s consolidated revenues for both of the years ended December 31, 2006 and 2005. No other customer accounted for more than 10% of the Company’s net sales in 2006 or 2005. Management believes the Company is not totally dependent on any single customer, however, certain products are dependent on a few customers. While the loss of any substantial customer could impact Titan’s business, the Company believes that its diverse product mix and customer base minimizes a longer-term impact caused by any such loss.

ORDER BACKLOG

As of January 31, 2007, Titan estimates $171 million in firm orders compared to $122 million at January 31, 2006, for the Company’s operations. The large increase in firm orders is primarily due to the Company’s recent acquisitions. Orders are considered firm if the customer would be obligated to accept the product if manufactured and delivered pursuant to the terms of such orders. The Company believes that the majority of the current order backlog will be filled during the present year.

INTERNATIONAL OPERATIONS

The Company accounted for its interest in Titan Europe Plc as an equity investment subsequent to the sale of a majority interest in April 2004. In December 2005, Titan Europe Plc issued additional shares of stock for an acquisition. As a result of these additional shares, the Company’s interest in Titan Europe Plc was diluted and decreased from 29.3% at December 31, 2004, to 15.4% at December 31, 2005. The Company recorded the gain resulting from the change in ownership interest to equity in accordance with SAB 51. With the decreased ownership percentage, effective December 2005, the Company no longer uses the equity method to account for its interest in Titan Europe Plc.

In accordance with Statement of Financial Accounting Standards (SFAS) No. 115, the Company records the Titan Europe Plc investment as an available-for-sale security and reports the investment at fair value, with unrealized gains and losses excluded from earnings and reported as a separate component of comprehensive income in stockholders’ equity. The Company’s stock ownership interest in Titan Europe Plc was 17.3% at December 31, 2006, and 15.4% at December 31, 2005. The increase in ownership percentage resulted from a December 2006 transaction in which Titan Europe Plc issued additional shares to the Company in payment of approximately $7.9 million U.S. dollars of debt, representing the entire remaining long-term debt owed by Titan Europe Plc to the Company. The fair value of the Company’s investment in Titan Europe Plc was $65.9 million and $48.5 million at December 31, 2006 and 2005. Titan Europe Plc is publicly traded on the AIM market in London, England.

For the year ended December 31, 2004, the Company generated $49.4 million, or approximately 10% percent, of its net sales from foreign operations. All of these sales were recorded in the first quarter, prior to the Titan Europe sale.

EMPLOYEES

At December 31, 2006, the Company employed approximately 2,700 people in the United States. Approximately 48% of the Company’s employees in the United States were covered by collective bargaining agreements. In December 2005, the workers at the Des Moines and Freeport facilities ratified new labor agreements through November 2010. The workers at the Bryan facility ratified a new labor agreement in July 2006 with the same November 2010 expiration date. The Company believes employee relations are generally good.

EXPORT SALES

The Company had total aggregate export sales of approximately $57.4 million, $39.0 million and $56.2 million, for the years ended December 31, 2006, 2005 and 2004, respectively.

Exports to foreign markets are subject to a number of special risks, including but not limited to risks with respect to currency exchange rates, economic and political destabilization, other disruption of markets and restrictive actions by foreign governments (such as restrictions on transfer of funds, export duties and quotas and foreign customs). Other risks include changes in foreign laws regarding trade and investment, difficulties in obtaining distribution and support, nationalization, reforms of laws and policies of the United States affecting trade, foreign investment and loans and foreign tax laws. There can be no assurance that one, or a combination, of these factors will not have a material adverse effect on the Company’s ability to increase or maintain its export sales.

The Company purchases a portion of its raw materials from foreign suppliers. The production costs, profit margins and competitive position of the Company are affected by the strength of the currencies in countries where Titan purchases goods, relative to the strength of the currencies in countries where the products are sold. The Company’s results of operations, cash flows and financial position may be affected by fluctuations in foreign currencies.

ENVIRONMENTAL LAWS AND REGULATIONS

In the ordinary course of business, like other industrial companies, Titan is subject to extensive and evolving federal, state and local environmental laws and regulations, and has made provisions for the estimated financial impact of environmental cleanup. The Company’s policy is to accrue environmental cleanup-related costs of a non-capital nature when those costs are believed to be probable and can be reasonably estimated. Expenditures that extend the life of the related property, or mitigate or prevent future environmental contamination, are capitalized. The Company does not currently anticipate any material capital expenditures for environmental control facilities. The quantification of environmental exposures requires an assessment of many factors, including changing laws and regulations, advances in environmental technologies, the quality of information available related to specific sites, the assessment stage of the site investigation, preliminary findings and the length of time involved in remediation or settlement. Due to the difficult nature of predicting future environmental costs, the Company cannot anticipate or predict the material adverse effect on its operations, cash flows or financial condition as a result of efforts to comply with, or its liabilities under, environmental laws.

COMPETITION

The Company competes with several domestic and international companies, some of which are larger and have greater financial and marketing resources than Titan. The Company believes it is a primary source of steel wheels and rims to the majority of its North American customers. Major competitors in the off-highway wheel market include Carlisle Companies Incorporated, GKN Wheels, Ltd., Topy Industries, Ltd. and certain other foreign competitors. Significant competitors in the off-highway tire market include Bridgestone/Firestone, Carlisle Companies Incorporated, Michelin and certain other foreign competitors.

The Company competes primarily on the basis of price, quality, customer service, design capability and delivery time. The Company’s ability to compete with international competitors may be adversely affected by currency fluctuations. In addition, certain of the Company’s OEM customers could, under individual circumstances, elect to manufacture the Company’s products to meet their requirements or to otherwise compete with the Company. There can be no assurance that the Company will not be adversely affected by increased competition in the markets in which it operates, or that competitors will not develop products that are more effective, less expensive or otherwise render certain of Titan’s products less competitive. From time to time, certain of the Company’s competitors have reduced their prices in particular product categories, which has prompted Titan to reduce prices as well. There can be no assurance that competitors of the Company will not further reduce prices in the future or that any such reductions would not have a material adverse effect on the Company.

NEW YORK STOCK EXCHANGE CERTIFICATION

The Company submitted to the New York Stock Exchange during fiscal 2006 the Annual CEO Certification required by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual.

AVAILABLE INFORMATION

The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are made available, without charge, through the Company’s website located at www.titan-intl.com as soon as reasonably practicable after they are filed with the Securities and Exchange Commission (SEC). The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at www.sec.gov website. The following documents are also posted on the Company’s website:

Audit Committee Charter

Compensation Committee Charter

Nominating/Corporate Governance Committee Charter

Business Conduct Policy

Printed copies of these documents are available, without charge, by writing to: Secretary of Titan International, Inc., 2701 Spruce Street, Quincy, IL 62301.

ITEM 1A - RISK FACTORS

The Company is subject to various risks and uncertainties relating to or arising out of the nature of its business and general business, economic, financing, legal and other factors or conditions that may affect the Company. Realization of any of the following risks could have a material adverse effect on Titan’s business, financial condition, cash flows and results of operations.

| · | The Company operates in cyclical industries and, accordingly, its business is subject to the numerous and continuing changes in the economy. |

| · | The Company’s debt and related interest expense may limit Titan’s financial and operating flexibility. |

| · | The Company has incurred, and may incur in the future, net losses. |

| · | The Company is exposed to price fluctuations of key commodities, which are primarily steel and rubber. |

| · | The Company relies on a limited number of suppliers for key commodities, which consist primarily of steel and rubber. |

| · | The Company’s revenues are seasonal due to Titan’s dependence on agricultural, construction and recreational industries, which are seasonal and typically have lower sales in the second half of the year. |

| · | The Company may be adversely affected by changes in government regulations and policies, especially those related to farm and ethanol subsidies and those related to infrastructure construction. |

| · | The Company is subject to corporate governance requirements, and costs related to compliance with, or failure to comply with, existing and future requirements could adversely affect Titan’s business. |

| · | The Company’s customer base is relatively concentrated with Titan’s ten largest customers historically accounting for over 50% of sales. |

| · | The Company faces substantial competition from domestic and international companies, some of which operate in low wage markets. |

| · | The Company’s business could be negatively impacted if Titan fails to maintain satisfactory labor relations. |

| · | Unfavorable outcomes of legal proceedings could adversely affect the Company’s financial condition and results of operations. |

| · | Acquisitions may require significant resources and/or result in significant unanticipated losses, costs or liabilities for the Company. |

| · | The Company may be subject to claims for damages for defective products. |

| · | The Company is subject to risks associated with environmental laws and regulations. |

ITEM 1B - UNRESOLVED STAFF COMMENTS

None.

ITEM 2 - PROPERTIES

The Company’s properties are detailed by the location, size and focus of each facility as provided in the table below:

| | | Approximate square footage | | | | | |

| Location | | Owned | | Leased | | Use | | Segment | |

| Des Moines, Iowa | | | 2,207,000 | | | | | | Manufacturing, distribution | | | All segments | |

| Freeport, Illinois | | | 1,202,000 | | | 211,000 | | | Manufacturing, distribution | | | All segments | |

| Quincy, Illinois | | | 1,134,000 | | | | | | Manufacturing, distribution | | | All segments | |

| Brownsville, Texas | | | 993,000 | | | | | | Storage | | | See note(a) | |

| Bryan, Ohio | | | 500,000 | | | | | | Manufacturing, distribution | | | All segments | |

| Walcott, Iowa | | | 378,000 | | | | | | Storage | | | See note(a) | |

| Greenwood, S. Carolina | | | 110,000 | | | | | | Storage | | | See note(a) | |

| Dublin, Georgia | | | 20,000 | | | | | | Distribution | | | All segments | |

| Saltville, Virginia | | | 14,000 | | | 245,000 | | | Manufacturing, distribution | | | Earthmoving/Construction | |

| Natchez, Mississippi | | | | | | 1,203,000 | | | Storage | | | See note(a) | |

| Cartersville, Georgia | | | | | | 169,000 | | | Distribution | | | All segments | |

| Pendergrass, Georgia | | | | | | 120,000 | | | Distribution | | | All segments | |

| Elko, Nevada | | | | | | 4,000 | | | Distribution | | | Earthmoving/Construction | |

| (a) | The Brownsville, Greenwood and Natchez facilities are currently being used for storage. The Company’s facilities in Brownsville, Texas, Greenwood, South Carolina, Natchez, Mississippi, and Walcott, Iowa, are not in operation. The Company has a contract for sale on the Walcott building. |

The Company considers each of its facilities to be in good condition and adequate for present use. Management believes that the Company has sufficient capacity to meet current market demand with the active facilities. The Company has no current plans to restart manufacturing at the storage facilities described in note (a) above.

ITEM 3 - LEGAL PROCEEDINGS

The Company is a party to routine legal proceedings arising out of the normal course of business. Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss, the Company believes at this time that none of these actions, individually or in the aggregate, will have a material adverse effect on the consolidated financial condition, results of operations or cash flows of the Company. However, due to the difficult nature of predicting future legal claims, the Company cannot anticipate or predict the material adverse effect on its consolidated financial condition, results of operations or cash flows as a result of efforts to comply with or its liabilities pertaining to legal judgments.

ITEM 4 - SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to the vote of security holders during the fourth quarter of 2006.

PART II

ITEM 5 - MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Company’s common stock is traded on the New York Stock Exchange (NYSE) under the symbol TWI. On February 15, 2007, there were approximately 800 holders of record of Titan common stock and an estimated 2,800 beneficial stockholders. The following table sets forth the high and low sales prices per share of common stock as reported on the NYSE, as well as information concerning per share dividends declared for the periods indicated.

2006 | | High | | Low | | Dividends Declared | |

| First quarter | | $ | 17.64 | | $ | 16.55 | | $ | 0.005 | |

| Second quarter | | | 19.76 | | | 16.20 | | | 0.005 | |

| Third quarter | | | 19.40 | | | 16.65 | | | 0.005 | |

| Fourth quarter | | | 20.85 | | | 17.52 | | | 0.005 | |

| | | | | | | | | | | |

2005 | | | | | | | | | | |

| First quarter | | $ | 15.45 | | $ | 12.30 | | $ | 0.005 | |

| Second quarter | | | 15.85 | | | 13.12 | | | 0.005 | |

| Third quarter | | | 14.58 | | | 12.64 | | | 0.005 | |

| Fourth quarter | | | 18.17 | | | 13.15 | | | 0.005 | |

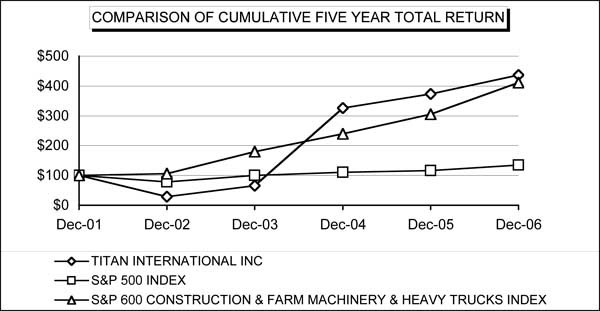

PERFORMANCE COMPARISON GRAPH

The following performance graph compares cumulative total return for the Company’s common stockholders over the past five years against the cumulative total return of the Standard & Poor’s 500 Stock Index, and against the Standard & Poor’s 600 Construction and Farm Machinery and Heavy Trucks Index. The graph depicts the value on December 31, 2006, of a $100 investment made on December 31, 2001, in Company common stock and each of the other two indices, with all dividends reinvested. The Company’s common stock is currently traded on the New York Stock Exchange under the symbol TWI.

Fiscal Year Ended December 31,

| | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | |

| Titan International, Inc. | | $ | 100.00 | | $ | 28.49 | | $ | 65.97 | | $ | 326.28 | | $ | 373.25 | | $ | 436.47 | |

| S&P 500 Index | | | 100.00 | | | 77.90 | | | 100.25 | | | 111.15 | | | 116.61 | | | 135.03 | |

| S&P 600 Const. & Farm Machinery Index | | | 100.00 | | | 106.30 | | | 179.20 | | | 240.18 | | | 305.31 | | | 411.72 | |

ITEM 6 - SELECTED FINANCIAL DATA

The selected financial data presented below, as of and for the years ended December 31, 2006, 2005, 2004, 2003, and 2002, are derived from the Company’s consolidated financial statements, as audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, and should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto.

(All amounts in thousands, except per share data)

| | | Year Ended December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Net sales | | $ | 679,454 | | $ | 470,133 | | $ | 510,571 | | $ | 491,672 | | $ | 462,820 | |

| Gross profit | | | 72,778 | | | 64,210 | | | 79,500 | | | 29,703 | | | 29,741 | |

| Income (loss) from operations | | | 22,011 | | | 11,999 | | | 33,322 | | | (16,220 | ) | | (14,086 | ) |

| Income (loss) before income taxes | | | 8,574 | | | (2,885 | ) | | 15,215 | | | (33,668 | ) | | (44,293 | ) |

| Net income (loss) | | | 5,144 | | | 11,042 | | | 11,107 | | | (36,657 | ) | | (35,877 | ) |

| Net income (loss) per share - basic | | | .26 | | | .61 | | | .62 | | | (1.75 | ) | | (1.73 | ) |

| Net income (loss) per share - diluted | | | .26 | | | .60 | | | .61 | | | (1.75 | ) | | (1.73 | ) |

| Dividends declared per common share | | | .02 | | | .02 | | | .02 | | | .02 | | | .02 | |

| | | | |

| (All amounts in thousands) | | As of December 31, | |

| | | 2006 | | 2005 | | 2004 | | 2003 | | 2002 | |

| Working capital | | $ | 247,009 | | $ | 157,984 | | $ | 114,898 | (a) | $ | 183,971 | | $ | 170,263 | |

| Current assets | | | 309,933 | | | 206,167 | | | 154,668 | (a) | | 286,946 | | | 254,569 | |

| Total assets | | | 585,126 | | | 440,756 | | | 354,166 | (a) | | 523,084 | | | 531,999 | |

| Long-term debt (b) | | | 291,266 | | | 190,464 | | | 169,688 | (a) | | 248,397 | | | 249,119 | |

| Stockholders’ equity | | | 187,177 | | | 167,813 | | | 106,881 | (a) | | 111,956 | | | 144,027 | |

(a) Amounts were affected by the April 2004 sale of a majority interest in Titan Europe, which is no longer consolidated. (b) Excludes amounts due within one year and classified as a current liability. |

ITEM 7 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s discussion and analysis of financial condition and results of operations (MD&A) is designed to provide readers of these financial statements with a narrative from the perspective of the management of Titan International, Inc. (Titan or the Company) on Titan’s financial condition, results of operations, liquidity and other factors which may affect the Company’s future results.

FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements, including statements regarding, among other items:

| · | Anticipated trends in the Company’s business |

| · | Future expenditures for capital projects |

| · | The Company’s ability to continue to control costs and maintain quality |

| · | Ability to meet financial covenants and conditions of loan agreements |

| · | The Company’s business strategies, including its intention to introduce new products |

| · | Expectations concerning the performance and success of the Company’s existing and new products |

| · | The Company’s intention to consider and pursue acquisitions and divestitures |

Readers of this Form 10-K should understand that these forward-looking statements are based on the Company’s expectations and are subject to a number of risks and uncertainties, certain of which are beyond the Company’s control.

Actual results could differ materially from these forward-looking statements as a result of certain factors, including:

| · | Changes in the Company’s end-user markets as a result of world economic or regulatory influences |

| · | Fluctuations in currency translations |

| · | Changes in the marketplace, including new products and pricing changes by the Company’s competitors |

| · | Availability and price of raw materials |

| · | Levels of operating efficiencies |

| · | Actions of domestic and foreign governments |

| · | Ability to secure financing at reasonable terms |

Any changes in such factors could lead to significantly different results. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks and uncertainties, there can be no assurance that the forward-looking information contained in this document will in fact transpire.

OVERVIEW

Titan International, Inc. and its subsidiaries are leading manufacturers of wheels, tires and assemblies for off-highway vehicles used in the agricultural, earthmoving/construction and consumer markets. Titan’s earthmoving/construction market also includes products supplied to the U.S. government, while the consumer market includes products for all-terrain vehicles (ATVs) and recreational/utility trailer applications. Titan manufactures both wheels and tires for the majority of these market applications, allowing the Company to provide the value-added service of delivering complete wheel and tire assemblies. The Company offers a broad range of products that are manufactured in relatively short production runs to meet the specifications of original equipment manufacturers (OEMs) and/or the requirements of aftermarket customers.

The Company’s major OEM customers include large manufacturers of off-highway equipment such as AGCO Corporation, Caterpillar Inc., CNH Global N.V., Deere & Company and Kubota Corporation, in addition to many other off-highway equipment manufacturers. The Company distributes products to OEMs, independent and OEM-affiliated dealers, and through a network of distribution facilities.

The following table provides highlights for the year ended December 31, 2006, compared to 2005 (amounts in thousands):

| | | 2006 | | 2005 | | % Increase (Decrease) | |

| Net sales | | $ | 679,454 | | $ | 470,133 | | | 45 | % |

| Income from operations | | | 22,011 | | | 11,999 | | | 83 | % |

| Net income | | | 5,144 | | | 11,042 | | | (53 | %) |

The Company recorded sales of $679.5 million for 2006, which were 45% higher than 2005 sales of $470.1 million. The significantly higher sales level was attributed to the expanded agricultural product offering of Goodyear branded farm tires and the expanded earthmoving, construction and mining product offering of Continental & General branded off-the-road (OTR) tires. These product offerings came with the added manufacturing capacity from the Freeport, Illinois, facility, which was acquired in December 2005, and the Bryan, Ohio, OTR facility, which was acquired in July 2006.

Income from operations was $22.0 million for 2006 as compared to $12.0 million in 2005. Titan’s net income was $5.1 million for 2006, compared to $11.0 million in 2005. Basic earnings per share were $.26 in 2006, compared to $.61 in 2005. The Company’s net income was lower in 2006 as compared to 2005 as the result of a higher effective tax rate of 40% in 2006 as compared to a tax benefit recorded in 2005, resulting in an increase in income tax expense of $17.4 million in 2006 when compared to 2005.

RECENT DEVELOPMENTS

Convertible Note Conversion Offer

In January 2007, the Company filed a registration statement relating to an offer to the holders of its 5.25% senior unsecured convertible notes due 2009 to convert their notes into Titan’s common stock at an increased conversion rate (the “Conversion Offer”). Per the Offer, each $1,000 principal amount of notes is convertible into 81.0000 shares of common stock, which is equivalent to a conversion price of approximately $12.35 per share. The offering price set forth will not include accrued interest; therefore, no accrued interest will be paid on the notes that accept this offering. Prior to the Offer, each $1,000 principal amount of notes was convertible into 74.0741 shares of common stock, which was equivalent to a conversion price of approximately $13.50 per share. The registration statement relating to the shares of common stock to be offered was declared effective on February 21, 2007. The offer is scheduled to expire on March 20, 2007, unless extended or terminated.

Credit Facility Amendment

On February 8, 2007, the Company amended its revolving credit facility with LaSalle Bank National Association. The amendment extended the termination date to October 2009 (previously October 2008). The amendment also lowered borrowing rates, which will be based on a pricing grid. The borrowings under the facility will bear interest at a floating rate of LIBOR plus 1% to 2% (previously 2.75%). The amendment lowered the revolving loan availability from $250 million to $125 million with the ability to request an increase back to $250 million.

RESULTS OF OPERATIONS

The following table sets forth the Company’s statement of operations expressed as a percentage of net sales for the periods indicated. This table and subsequent discussions should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto.

As a Percentage of Net Sales

Year ended December 31,

| | | 2006 | | 2005 | | 2004 | |

| Net sales | | | 100.0 | % | | 100.0 | % | | 100.0 | % |

| Cost of sales | | | 89.3 | | | 86.3 | | | 84.4 | |

| Gross profit | | | 10.7 | | | 13.7 | | | 15.6 | |

| | | | | | | | | | | |

| Selling, general and administrative expenses | | | 6.2 | | | 6.9 | | | 7.5 | |

| Royalty expense | | | 0.7 | | | 0.0 | | | 0.0 | |

| Idled assets marketed for sale depreciation | | | 0.5 | | | 1.0 | | | 1.0 | |

| Dyneer legal charge | | | 0.0 | | | 3.2 | | | 0.0 | |

| Goodwill impairment on Titan Europe | | | 0.0 | | | 0.0 | | | 0.6 | |

| Income from operations | | | 3.3 | | | 2.6 | | | 6.5 | |

| | | | | | | | | | |

| Interest expense | | | (2.5 | ) | | (1.8 | ) | | (3.2 | ) |

| Noncash convertible debt conversion charge | | | 0.0 | | | (1.6 | ) | | 0.0 | |

| Debt termination expense | | | 0.0 | | | 0.0 | | | (0.7 | ) |

| Other income, net | | | 0.5 | | | 0.2 | | | 0.4 | |

| Income (loss) before income taxes | | | 1.3 | | | (0.6 | ) | | 3.0 | |

| Provision (benefit) for income taxes | | | 0.5 | | | (2.9 | ) | | 0.8 | |

| Net income | | | 0.8 | % | | 2.3 | % | | 2.2 | % |

In addition, the following table sets forth components of the Company’s net sales classified by segment for the years ended December 31, (in thousands):

| | | 2006 | | 2005 | | 2004 | |

| Agricultural | | $ | 421,096 | | $ | 310,361 | | $ | 316,235 | |

| Earthmoving/Construction | | | 183,357 | | | 131,982 | | | 160,297 | |

| Consumer | | | 75,001 | | | 27,790 | | | 34,039 | |

| Total | | $ | 679,454 | | $ | 470,133 | | $ | 510,571 | |

The following is a summary of the Titan Europe results included in the historical results of the Company for the years ended December 31, (in thousands):

| | | 2006 (a) | | 2005 (a) | | 2004 (a) | |

| Agricultural | | $ | 0 | | $ | 0 | | $ | 24,264 | |

| Earthmoving/Construction | | | 0 | | | 0 | | | 23,460 | |

| Consumer | | | 0 | | | 0 | | | 1,722 | |

| Total | | $ | 0 | | $ | 0 | | $ | 49,446 | |

| (a) | Majority interest in Titan Europe sold in April 2004. |

SENIOR UNSECURED NOTES

In December 2006, the Company closed its offering of $200 million 8% senior unsecured notes. The notes were sold at par and are due January 2012. Titan used the net proceeds from this offering to repay outstanding existing debt at the time of closing, excluding the 5.25 percent senior unsecured convertible notes. The outstanding balance on the Company’s revolving credit facility was paid down in December and had no cash borrowings at December 31, 2006. The Company anticipates paying off approximately $10 million of industrial revenue bonds in the first quarter of 2007 and will use the remaining cash for general corporate purposes.

ACQUISITION OF CONTINENTAL’S OTR ASSETS

On July 31, 2006, Titan Tire Corporation of Bryan, a subsidiary of Titan International, Inc., acquired the off-the-road (OTR) tire assets of Continental Tire North America, Inc. (Continental) in Bryan, Ohio. Titan Tire Corporation of Bryan purchased the assets of Continental’s OTR tire facility for approximately $53 million in cash proceeds. The assets purchased included Continental’s OTR plant, property and equipment located in Bryan, Ohio, inventory and other current assets. The acquisition included an agreement with Continental to use the Continental and General trademarks on OTR tires. In addition, the Company recorded intangibles related to the acquisition as noncurrent assets and assumed warranty liabilities. This acquisition expanded Titan’s product offering into larger earthmoving, construction and mining tires and added the manufacturing capacity of the Bryan, Ohio, facility.

The productivity obtained since startup after the July 31 acquisition date associated with the Bryan facility is meeting Titan’s current expectations. The Bryan facility achieved a manufacturing output of approximately $41 million since the July 31, 2006, acquisition date through year-end December 31, 2006.

ACQUISITION OF GOODYEAR’S NORTH AMERICAN FARM TIRE ASSETS

On December 28, 2005, Titan Tire Corporation, a subsidiary of Titan International, Inc., acquired The Goodyear Tire & Rubber Company’s North American farm tire assets. Titan Tire purchased the assets of Goodyear’s North American farm tire business for approximately $100 million in cash proceeds. The assets purchased include Goodyear’s North American plant, property and equipment located in Freeport, Illinois, and Goodyear’s North American farm tire inventory. In addition, the Company recorded intangibles related to the acquisition as noncurrent assets. This acquisition expanded Titan’s product offering into Goodyear branded farm tires and added the manufacturing capacity of the Freeport, Illinois, facility.

The productivity obtained during 2006 associated with the Freeport facility is meeting Titan’s current expectations. The Freeport facility achieved a manufacturing output of approximately $186 million during the year ended December 31, 2006.

OTR PRODUCTION REALIGNMENT

Due to capacity constraints at Titan’s Bryan, Ohio, OTR tire facility, the Company is adding OTR tire capacity at its Freeport, Illinois, and Des Moines, Iowa, facilities. Titan is aligning synergies, which includes retooling, retraining personnel and movement of equipment at the Bryan, Freeport and Des Moines facilities. This realignment decreased the Company’s gross margin for the fourth quarter of 2006 as labor costs that are normally dedicated to making products were instead used for retooling, retraining and movement of equipment.

IDLED ASSETS MARKETED FOR SALE

The idled assets marketed for sale had no balance at December 31, 2006, and a balance of $18.3 million at December 31, 2005. The idled assets marketed for sale were being depreciated in accordance with SFAS No. 144. Depreciation on these idled assets was $3.6 million, $4.7 million, and $5.3 million for the years ended December 31, 2006, 2005 and 2004, respectively.

As a result of the Goodyear North American farm tire asset acquisition and the Continental OTR asset acquisition, the Company is placing these assets back into service primarily at the Des Moines, Iowa, Freeport, Illinois, and Bryan, Ohio facilities. Therefore, the idled assets marketed for sale balance, of approximately $14 million, at December 31, 2006, was reclassified to property, plant and equipment.

TERMINATION OF CASH MERGER OFFER

On October 11, 2005, the Company received an offer from One Equity Partners LLC (One Equity), a private equity affiliate of JPMorgan Chase & Co., indicating One Equity’s interest in acquiring Titan International, Inc. in a cash merger for $18.00 per share of Titan common stock. On April 12, 2006, Titan and One Equity announced the termination of discussions regarding the proposed cash merger. On April 17, 2006, the Company’s Board of Directors met and thanked the Special Committee, which had been formed to pursue discussions regarding One Equity’s proposed cash merger, for all their efforts expended and agreed that their Special Committee responsibilities have been completed.

CONVERTIBLE NOTE CONVERSION

In June of 2005, Titan finalized a private transaction in which the Company issued 3,022,275 shares of common stock in exchange for the cancellation of $33.8 million principal amount of the Company’s outstanding 5.25% senior convertible notes due 2009, as proposed to the Company by certain note holders. Titan recognized a noncash charge of $7.2 million in connection with this exchange in accordance with SFAS No. 84, “Induced Conversions of Convertible Debt.”

SALE OF A MAJORITY INTEREST IN TITAN EUROPE

In April 2004, Titan Luxembourg Sarl, a wholly-owned European subsidiary of the Company, sold 70% of the common stock of Titan Europe to the public on the AIM market in London. Titan Luxembourg was the largest single stockholder in Titan Europe Plc, retaining a 30% interest on the date of the transaction. In the first quarter of 2004, the Company recognized a $3.0 million goodwill impairment charge on the pending sale of a majority interest in Titan Europe in accordance with the Company’s goodwill impairment process. The historical results of the Company for the year ended December 31, 2004, included Titan Europe results of $49.4 million in net sales, $8.3 million in gross profit and $0.4 million in income from operations.

The Company accounted for its interest in Titan Europe Plc as an equity investment subsequent to the sale of a majority interest in April 2004. The Company recognized equity income on its investment in Titan Europe Plc of $2.9 million in 2005 and $1.3 million in 2004. In December 2005, Titan Europe Plc issued additional shares of stock for an acquisition. As a result of these additional shares, the Company’s interest in Titan Europe Plc was diluted and decreased from 29.3% at December 31, 2004, to a 15.4% ownership position at December 31, 2005. The Company recorded the gain resulting from the change in ownership interest to equity in accordance with SAB 51. With the decreased ownership percentage, effective December 2005, the Company no longer uses the equity method to account for its interest in Titan Europe Plc.

In accordance with SFAS No. 115, the Company records the Titan Europe Plc investment as an available-for-sale security and reports the investment at fair value, with unrealized gains and losses excluded from earnings and reported as a separate component of comprehensive income in stockholders’ equity. The Company’s stock ownership interest in Titan Europe Plc was 17.3% at December 31, 2006, and 15.4% at December 31, 2005. The increase in ownership percentage resulted from a December 2006 transaction in which Titan Europe Plc issued additional shares to the Company in payment of approximately $7.9 million U.S. dollars of debt, representing the entire remaining long-term debt owed by Titan Europe Plc to the Company. The fair value of the Company’s investment in Titan Europe Plc was $65.9 million and $48.5 million at December 31, 2006 and 2005, respectively. Cash dividends received from Titan Europe Plc were $1.3 million, $0.9 million and $0.3 million for the years ended December 31, 2006, 2005 and 2004, respectively. Titan Europe Plc is publicly traded on the AIM market in London, England.

CRITICAL ACCOUNTING ESTIMATES

Preparation of the financial statements and related disclosures in compliance with accounting principles generally accepted in the United States of America requires the application of appropriate technical accounting rules and guidance, as well as the use of estimates. The Company’s application of these policies involves assumptions that require difficult subjective judgments regarding many factors, which, in and of themselves, could materially impact the financial statements and disclosures. A future change in the estimates, assumptions or judgments applied in determining the following matters, among others, could have a material impact on future financial statements and disclosures.

Inventories

Inventories are valued at the lower of cost or market. Cost is determined using the first-in, first-out (FIFO) method in 2006 for approximately 74% of inventories and the last-in, first-out (LIFO) method for approximately 26% of inventories. The major rubber material inventory and related work-in-process and their finished goods are accounted for under the FIFO method. The major steel material inventory and related work-in-process and their finished goods are accounted for under the LIFO method. Market value is estimated based on current selling prices. Estimated provisions are established for excess and obsolete inventory, as well as inventory carried above market price based on historical experience. Should this experience change, adjustments to the estimated provisions would be necessary.

Impairment of Goodwill

The Company reviews goodwill to assess recoverability from future operations during the fourth quarter of each annual reporting period, and whenever events and circumstances indicate that the carrying values may not be recoverable. The Company’s goodwill was $11.7 million at December 31, 2006 and 2005. Significant assumptions relating to future operations must be made when estimating future cash flows in analyzing goodwill for impairment. Should unforeseen events occur or operating trends change significantly, impairment losses could occur.

Valuation of Investment Accounted for as Available-for-Sale Security

The Company has an investment in Titan Europe Plc of $65.9 million as of December 31, 2006, representing a 17.3% ownership position. Titan Europe Plc is publicly traded on the AIM market in London, England. This investment is recorded as “Investment in Titan Europe Plc” on the consolidated balance sheet. In accordance with SFAS No. 115, the Company records the Titan Europe Plc investment as an available-for-sale security and reports this investment at fair value, with unrealized gains and losses excluded from earnings and reported in a separate component of stockholders’ equity. Should the fair value decline below the cost basis, the Company would be required to determine if this decline is other than temporary. If the decline in fair value were judged to be other than temporary, an impairment charge would be recorded. Should unforeseen events occur or investment trends change significantly, impairment losses could occur. Declared dividends on this investment are recorded in income as a component of other income.

Income taxes

Deferred income tax provisions are determined using the liability method whereby deferred tax assets and liabilities are recognized based upon temporary differences between the financial statement and income tax basis of assets and liabilities. The Company assesses the realizability of its deferred tax asset positions to determine if a valuation allowance is necessary.

Asset and Business Acquisitions

The allocation of purchase price for asset and business acquisitions requires management estimates and judgment as to expectations for future cash flows of the acquired assets and business and the allocation of those cash flows to identifiable intangible assets in determining the estimated fair value for purchase price allocations. If the actual results differ from the estimates and judgments used in determining the purchase price allocations, impairment losses could occur relating to any intangibles recorded in the acquisition. To aid in establishing the value of any intangible assets at the time of acquisition, the Company typically engages a professional appraisal firm.

Retirement Benefit Obligations

Pension benefit obligations are based on various assumptions used by third-party actuaries in calculating these amounts. These assumptions include discount rates, expected return on plan assets, mortality rates and other factors. Revisions in assumptions and actual results that differ from the assumptions affect future expenses, cash funding requirements and obligations. The Company has two frozen defined benefit pension plans and one defined benefit plan that purchased a final annuity settlement in 2002. The Company expects to contribute approximately $5 million to these frozen defined benefit pension plans in 2007. For more information concerning these costs and obligations, see the discussion of the “Pensions” and Note 21 to the Company’s financial statements.

The effect of hypothetical changes to selected assumptions on the Company’s frozen pension benefit obligations would be as follows (in thousands):

| | | December 31, 2006 | | 2007 |

| | | Increase | Increase | | Increase |

| | Percentage | (Decrease) | (Decrease) | | (Decrease) |

| Assumptions | Change | PBO (a) | Equity (b) | | Expense |

| Pension | | | | | |

| Discount rate (c) | +/-.5 | $(2,876)/$3,113 | $2,876/$(3,113) | | $(74)/$76 |

| Expected return on assets | +/-.5 | | | | $(296)/$296 |

| (a) | Projected benefit obligation (PBO) for pension plans. |

| (b) | Pretax minimum pension liability adjustment. |

| (c) | Pretax impact on service cost, interest cost and amortization of gains or losses. |

FISCAL YEAR ENDED DECEMBER 31, 2006, COMPARED TO FISCAL YEAR ENDED

DECEMBER 31, 2005

RESULTS OF OPERATIONS

The following tables and discussions provide highlights for the year ended December 31, 2006, compared to 2005 (amounts in thousands):

| | | 2006 | | 2005 | | % Increase | |

| Net sales | | $ | 679,454 | | $ | 470,133 | | | 45 | % |

| Gross profit | | | 72,778 | | | 64,210 | | | 13 | % |

Gross profit percentage | | | 10.7 | % | | 13.7 | % | | | |

Net Sales

Net sales for the year ended December 31, 2006, were $679.5 million compared to $470.1 million for the year ended December 31, 2005. The large sales improvement of $209.4 million, or 45%, for the year ended December 31, 2006, was attributed to the expanded agricultural product offering of Goodyear branded farm tires and the expanded earthmoving, construction and mining product offering of Continental & General branded off-the-road (OTR) tires. These product offerings came with the added manufacturing capacity from the Freeport, Illinois, facility, which was approximately $186 million in 2006, and the Bryan, Ohio, OTR facility, which was approximately $41 million since the acquisition date of July 31, 2006.

Cost of Sales and Gross Profit

Cost of sales was $606.7 million for the year ended December 31, 2006, as compared to $405.9 million in 2005. Gross profit for the year 2006 was $72.8 million or 10.7% of net sales, compared to $64.2 million, or 13.7% of net sales for 2005. Due to capacity constraints at Titan’s Bryan, Ohio, OTR tire facility, the Company is adding OTR tire capacity at its Freeport, Illinois, and Des Moines, Iowa, tire facilities. Titan is aligning synergies, which includes retooling, retraining personnel and movement of equipment at the Bryan, Freeport and Des Moines facilities. These realignment costs of approximately $9 million to $11 million lowered the Company’s gross profit for the fourth quarter of 2006, as labor costs that are normally dedicated to making products were instead used for retooling, retraining and movement of equipment. These costs resulted in an approximate 2% reduction in the annual gross profit percentage.

Administrative Expenses

Selling, general and administrative expenses were as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase | |

| Selling, general and administrative | | $ | 42,142 | | $ | 32,270 | | | 31 | % |

Percentage of net sales | | | 6.2 | % | | 6.9 | % | | | |

Selling, general and administrative (SG&A) expenses were $42.1 million or 6.2% of net sales for the year ended December 31, 2006, as compared to $32.3 million or 6.9% of net sales for 2005. Research and development (R&D) expenses, which were previously shown separately, have been combined with the SG&A expenses due to the reduced level of R&D expenditures. R&D expenses were $1.3 million and $0.8 million for the years ended December 31, 2006 and 2005, respectively. SG&A expenses for the year ended December 31, 2006, were approximately $5 million higher as a result of the Freeport and Bryan acquisitions and their associated selling expenses. However, as a result of the higher sales levels, SG&A expenses decreased by approximately 1% when expressed as a percentage of net sales.

Royalty Expense

Royalty expense was as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase | |

| Royalty expense | | $ | 5,001 | | $ | 0 | | | n/a | |

The December 2005 Goodyear North American farm tire asset acquisition included a license agreement with The Goodyear Tire & Rubber Company to manufacture and sell certain off-highway tires in North America. Royalty expenses for the year ended December 31, 2006, were $5.0 million. No royalty expense was recorded in the year ended December 31, 2005, as this license agreement was not yet in place.

Idled Assets Marketed for Sale

Idled asset marketed for sale depreciation was as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Decrease | |

| Idled assets depreciation | | $ | 3,624 | | $ | 4,736 | | | (23 | %) |

The Company’s profit margins have been negatively affected by the depreciation associated with the idled assets marketed for sale. The Company incurred $3.6 million and $4.7 million in depreciation related to the idled assets for the years ended December 31, 2006 and 2005, respectively. As a result of the Goodyear North American farm tire asset acquisition and the Continental OTR asset acquisition, the Company is placing these assets back into service primarily at the Des Moines, Iowa, Freeport, Illinois, and Bryan, Ohio facilities. Therefore, in December 2006, the idled assets balance of approximately $14 million was reclassified to property, plant and equipment, leaving no balance at December 31, 2006.

Dyneer Legal Charge

The State Court of California in 2005 allowed the disbursement of restricted cash funds held in the Vehicular Technologies case. In 2005, Titan recognized the Dyneer legal charge of approximately $15.2 million for the judgment related to this case, which is now closed.

Income from Operations

Income from operations was as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase | |

| Income from operations | | $ | 22,011 | | $ | 11,999 | | | 83 | % |

Percentage of net sales | | | 3.2 | % | | 2.6 | % | | | |

Income from operations for the year ended December 31, 2006, was $22.0 million or 3.2% of net sales, compared to $12.0 million or 2.6% in 2005. Income from operations was affected by the items previously discussed in the cost of sales, administrative, royalty, idled assets, and legal charge line items.

Interest Expense

Interest expense was as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase | |

| Interest expense | | $ | 17,001 | | $ | 8,617 | | | 97 | % |

Net interest expense for the year 2006 was $17.0 million compared to $8.6 million in 2005. The Company’s average debt balances in 2006 were substantially higher when compared to 2005. The average 2006 debt balances were higher with the Goodyear farm asset acquisition of approximately $100 million and the Continental OTR asset acquisition of approximately $53 million. These higher average debt balances in 2006 resulted in an increase in interest expense of approximately $5 million when compared to 2005. The Company’s average interest rates were 7.7% in 2006, compared to 6.2% in 2005, resulting in an increase in interest expense of approximately $3 million.

Noncash Convertible Debt Conversion Charge

In June 2005, Titan finalized a private transaction in which the Company issued 3,022,275 shares of common stock in exchange for the cancellation of $33.8 million principal amount of the Company’s outstanding 5.25% senior convertible notes due 2009, as proposed to the Company by certain note holders. The Company recognized a noncash charge of $7.2 million in connection with this exchange in accordance with SFAS No. 84, “Induced Conversions of Convertible Debt.”

Other Income

Other income was as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase | |

| Other income | | $ | 3,564 | | $ | 958 | | | 272 | % |

Other income of $3.6 million in 2006 included (i) interest income of $1.7 million, (ii) dividend income from the Titan Europe Plc investment of $1.3 million, (iii) currency exchange gain of $1.0 million and (iv) other expense of $0.4 million. The $3.6 million of other income in 2006 compares to $1.0 million in 2005.

Income Tax Expense

The Company recorded an income tax expense of $3.4 million in 2006 as compared to an income tax benefit of $13.9 million in 2005. As a result of several years of previous losses, the Company recorded a valuation allowance against its net deferred tax asset, consistent with the Company’s accounting policies. As a result of anticipated utilization of net operating loss carryforward in connection with its future Federal income tax filings, the Company recorded a tax benefit of $13.9 million in 2005 as a result of the reversal of the Company’s valuation allowance in accordance with SFAS 109. The Company’s net operating loss carryforward of approximately $32 million expires in 2023.

Net Income

Net income was as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Decrease | |

| Net income | | $ | 5,144 | | $ | 11,042 | | | (53 | %) |

Net income for the year ended December 31, 2006, was $5.1 million, compared to $11.0 million in 2005. Basic earnings per share were $.26 for the year ended December 31, 2006, as compared to $.61 in 2005. Diluted earnings per share were $.26 for the year ended December 31, 2006, as compared to $.60 in 2005.

Agricultural Segment Results

Agricultural segment results were as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase (Decrease) | |

| Net sales | | $ | 421,096 | | $ | 310,361 | | | 36 | % |

| Income from operations | | | 27,351 | | | 31,750 | | | (14 | %) |

Net sales in the agricultural market were $421.1 million for the year ended December 31, 2006, as compared to $310.4 million in 2005. The expanded product offering of Goodyear branded farm tires, along with the added manufacturing capacity from the Freeport, Illinois, facility accounted for the agricultural market higher sales levels.

Income from operations in the agricultural market was $27.4 million for the year 2006 as compared to $31.8 million in 2005. The decrease in income from operations in the agricultural market was attributed to higher sales volumes in relation to higher fixed overhead costs including fourth quarter of 2006 costs normally dedicated to making products were instead used for retooling, retraining and movement of equipment.

Earthmoving/Construction Segment Results

Earthmoving/construction segment results were as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase | |

| Net sales | | $ | 183,357 | | $ | 131,982 | | | 39 | % |

| Income from operations | | | 21,837 | | | 17,664 | | | 24 | % |

The Company’s earthmoving/construction market net sales were $183.4 million for the year ended December 31, 2006, as compared to $132.0 million in 2005. The expanded product offering of the Continental and General brands for OTR tires, along with added manufacturing capacity from the Bryan, Ohio, facility accounted for the earthmoving/construction market higher sales levels in 2006. These sales increases were offset by a decrease in sales to the United States government, which were approximately $21 million lower in 2006 as compared to 2005. Sales to the United States government are dependent on government appropriations and have a tendency for significant fluctuations.

The Company’s earthmoving/construction market income from operations was $21.8 million for the year 2006, up from $17.7 million in 2005. The Bryan, Ohio, facility produces tires for earthmoving, construction, and mining machinery in sizes larger than the Company was able to produce before this facility was acquired on July 31, 2006. The increase in income from operations in the earthmoving/construction segment is the result of margins realized on these larger earthmoving, construction and mining tires.

Consumer Segment Results

Consumer segment results were as follows (amounts in thousands):

| | | 2006 | | 2005 | | % Increase (Decrease) | |

| Net sales | | $ | 75,001 | | $ | 27,790 | | | 170 | % |

| Income from operations | | | 1,655 | | | 1,825 | | | (9 | %) |