UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended December 31, 2010 |

or

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Commission file number 1-12936 |

TITAN INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Illinois | | 36-3228472 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2701 Spruce Street, Quincy, IL 62301

(Address of principal executive offices)

(217) 228-6011

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common stock, no par value | New York Stock Exchange (Symbol: TWI) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer þ |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the shares of common stock of the registrant held by non-affiliates was approximately $321 million based upon the closing price of the common stock on the New York Stock Exchange on June 30, 2010.

As of February 15, 2011, a total of 41,995,832 shares of common stock of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the annual meeting of stockholders to be held on May 12, 2011, are incorporated by reference into Part III of this Form 10-K.

TITAN INTERNATIONAL, INC.

Index to Annual Report on Form 10-K

| | | |

| Part I. | | Page |

| | | |

Item 1. | Business | 3-10 |

| | | |

Item 1A. | Risk Factors | 11-14 |

| | | |

Item 1B. | Unresolved Staff Comments | 15 |

| | | |

Item 2. | Properties | 15 |

| | | |

Item 3. | Legal Proceedings | 15 |

| | | |

| Part II. | | |

| | | |

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 16 |

| | | |

Item 6. | Selected Financial Data | 17 |

| | | |

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18-38 |

| | | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 39 |

| | | |

Item 8. | Financial Statements and Supplementary Data | 39 |

| | | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 39 |

| | | |

Item 9A. | Controls and Procedures | 39 |

| | | |

Item 9B. | Other Information | 39 |

| | | |

| Part III. | | |

| | | |

Item 10. | Directors, Executive Officers and Corporate Governance | 40 |

| | | |

Item 11. | Executive Compensation | 40 |

| | | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 41 |

| | | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | 41 |

| | | |

Item 14. | Principal Accounting Fees and Services | 41 |

| | | |

| Part IV. | | |

| | | |

Item 15. | Exhibits, Financial Statement Schedules | 42 |

| | | |

| | Signatures | 43 |

| | | |

| | Exhibit Index | 44 |

PART I

ITEM 1 – BUSINESS

INTRODUCTION

Titan International, Inc. and its subsidiaries (Titan or the Company) hold the unique position in North America of manufacturing both wheels and tires for its target markets. As a leading manufacturer in the off-highway industry, Titan produces a broad range of specialty products to meet the specifications of original equipment manufacturers (OEMs) and aftermarket customers in the agricultural, earthmoving/construction and consumer markets. Titan’s earthmoving/construction market includes wheels and tires supplied to the mining industry, while the consumer market includes products for all-terrain vehicles (ATVs) and recreational/utility trailers.

As one of the few companies dedicated to off-highway wheel and tire products, Titan’s engineering and manufacturing resources are focused on designing quality products that address the real-life concerns of our end-users. Titan’s team of experienced engineers continually works on new and improved engineered products that evolve with today’s applications for the off-highway wheel and tire markets.

Titan traces its roots to the Electric Wheel Company in Quincy, Illinois, which was founded in 1890. The Company was incorporated in 1983. The Company has grown through two major asset acquisitions in recent years. In 2005, Titan Tire Corporation, a subsidiary of the Company, acquired The Goodyear Tire & Rubber Company’s North American farm tire assets. In 2006, Titan Tire Corporation of Bryan, a subsidiary of the Company, acquired the off-the-road (OTR) tire assets of Continental Tire North America, Inc. These asset acquisitions have allowed Titan to achieve higher sales levels and enhance product offering in the Company’s target markets.

In 2010, Titan’s agricultural market sales represented 76% of net sales, the earthmoving/construction market represented 22% and the consumer market represented 2% of net sales. For information concerning the revenues, certain expenses, income from operations and assets attributable to each of the segments in which the Company operates, see Note 26 to the consolidated financial statements of Titan, included in Item 8 herein.

COMPETITIVE STRENGTHS

Titan’s strong market position in the off-highway wheel and tire market and its long-term core customer relationships contribute to the Company’s competitive strengths. These strengths, along with Titan’s dedication to the off-highway wheel and tire market, continue to drive the Company forward.

Titan’s ability to offer a broad range of specialized wheels, tires and assemblies has resulted in the Company’s strong position in the domestic off-highway market. Through a diverse dealer network, the Company is able to reach an increasing number of customers in the aftermarket and build Titan’s image and brand recognition. The Company’s acquisition of the Goodyear Farm Tire brand in North America contributes to overall visibility and customer confidence. Years of product design and engineering experience have enabled Titan to improve existing products and develop new ones that have been well received in the marketplace. In addition, Titan believes it has benefited from significant barriers to entry, such as the substantial investment necessary to replicate the Compa ny’s manufacturing equipment and numerous tools, dies and molds, many of which are used in custom processes.

| · | Long-Term Core Customer Relationships |

The Company’s top customers, including global leaders in agricultural and construction equipment manufacturing, have been purchasing products from Titan or its predecessors for numerous years. Customers including AGCO Corporation, CNH Global N.V., Deere & Company and Kubota Corporation have helped sustain Titan’s leadership in wheel, tire and assembly innovation.

BUSINESS STRATEGY

Titan’s business strategy is to continue its growth into the giant OTR market, increase its presence in the tire aftermarket, continue to improve operating efficiencies, maintain emphasis on new product development and explore additional strategic acquisitions.

| · | Giant Mining Tire Product |

The Company’s 2006 acquisition of the OTR tire assets of Continental Tire North America, Inc. in Bryan, Ohio, expanded Titan’s product offering into larger earthmoving, construction and mining tires. The Company subsequently expanded the Bryan facility production capacity to include giant mining tires. These giant tires offer continuing opportunity in the earthmoving marketplace. The “Big Daddy” giant tire is approximately 13 feet tall and weighs in at approximately 12,500 pounds.

| · | Increase Aftermarket Tire Business |

The Company has concentrated on increasing its presence in the tire aftermarket, which historically has tended to be somewhat less cyclical than the OEM market. The aftermarket also offers the potential for higher profit margins and is larger in most cases.

| · | Improve Operating Efficiencies |

The Company continually works to improve the operating efficiency of its assets and manufacturing facilities. Titan integrates each facility’s strength, which may include transferring equipment and business to the facilities that are best equipped to handle the work. This provides capacity to increase utilization and spread operating costs over a greater volume of products. Titan is also continuing a comprehensive program to refurbish, modernize and enhance the computer technology of its manufacturing equipment.

| · | Enhance Design Capacity and New Product Development |

Equipment manufacturers constantly face changing industry dynamics. Titan directs its business and marketing strategy to understand and address the needs of its customers and demonstrate the advantages of its products. In particular, the Company often collaborates with customers in the design of new and enhanced products. Titan recommends modified products to its customers based on its own market information. These value-added services enhance Titan’s relationships with its customers. The Company tests new designs and technologies and develops methods of manufacturing to improve product quality and performance. Titan’s engineers introduced designs for giant mining wheels and tires, which went into start-up production in third quarter 2008. These gi ant tires employ an innovative steel radial construction technology, new to the OTR tire industry, to enhance performance and durability. Titan’s engineers are also working on a new 15-degree tire and wheel design for OTR and farm radial assemblies to improve tire and wheel life.

| · | Explore Additional Strategic Acquisitions |

The Company’s expertise in the manufacture of off-highway wheels and tires has permitted it to take advantage of opportunities to acquire businesses in the United States that complement this product line, including companies engaged in the tire market and companies that have wheel and tire assembly capabilities. In the future, Titan may make additional strategic acquisitions of businesses that have an off-highway focus.

In December 2010, Titan announced that it had entered into agreements with the Goodyear Tire & Rubber Company to buy their European and Latin American farm tire businesses, including a licensing agreement that will allow Titan to manufacture and sell Goodyear-brand farm tires in Europe, Africa, Eastern Europe, Russia, Latin America and North America, for approximately $130 million U.S. dollars, subject to post-closing adjustments.

The Latin American portion of the transaction includes Goodyear’s Sao Paulo, Brazil manufacturing plant, property, equipment and inventories. Subject to customary closing conditions and regulatory approvals, it is expected to close in the first half of 2011.

The European portion of the transaction is subject to the exercise of a put option by Goodyear following completion of a social plan related to the previously announced discontinuation of consumer tire production at its Amiens North, France manufacturing plant and required consultation with the local Works Council. Upon completion of this action, as well as customary closing conditions and regulatory approvals, the transaction will include the Amiens North plant, property, equipment and inventories.

AGRICULTURAL MARKET

Titan’s agricultural rims, wheels and tires are manufactured for use on various agricultural and forestry equipment, including tractors, combines, skidders, plows, planters and irrigation equipment, and are sold directly to OEMs and to the aftermarket through independent distributors, equipment dealers and Titan’s own distribution centers. The wheels and rims range in diameter from 9 to 54 inches, with the 54-inch diameter being the largest agricultural wheel manufactured in North America. Basic configurations are combined with distinct variations (such as different centers and a wide range of material thickness) allowing the Company to offer a broad line of products to meet customer specifications. Titan’s agricultural tires range from approximately 1 foot to approximately 7 foot in o utside diameter and from 5 to 44 inches in width. The Company offers the added value of delivering a complete wheel and tire assembly to customers.

EARTHMOVING/CONSTRUCTION MARKET

The Company manufactures rims, wheels and tires for various types of OTR earthmoving, mining, military and construction equipment, including skid steers, aerial lifts, cranes, graders and levelers, scrapers, self-propelled shovel loaders, articulated dump trucks, load transporters, haul trucks and backhoe loaders. The earthmoving/construction market is often referred to as OTR, an acronym for off-the-road. The Company provides OEM and aftermarket customers with a broad range of earthmoving/construction wheels ranging in diameter from 20 to 63 inches and in weight from 125 pounds to 7,000 pounds. The 63-inch diameter wheel is the largest manufactured in North America for the earthmoving/construction market. Titan’s earthmoving/construction tires range from approximately 3 feet to approximately 13 f eet in outside diameter and in weight from 50 pounds to 12,500 pounds. The Company offers the added value of wheel and tire assembly for certain applications in the earthmoving/construction market.

CONSUMER MARKET

Titan provides wheels and tires and assembles brakes, actuators and components for the domestic boat, recreational and utility trailer markets. Titan also offers select products for ATVs, turf, and golf car applications. Likewise, Titan produces a variety of tires for the consumer market.

| MARKET SALES | | | | | | | | | | | | | | | |

| | | Year ended December 31, | |

| (Amounts in thousands) | | 2010 | | | 2009 | | | 2008 | |

| | | | | | % of Total | | | | | | % of Total | | | | | | % of Total | |

| | | Net Sales | | | Net Sales | | | Net Sales | | | Net Sales | | | Net Sales | | | Net Sales | |

| Agricultural | | $ | 675,178 | | | | 76 | % | | $ | 563,528 | | | | 77 | % | | $ | 729,895 | | | | 70 | % |

| Earthmoving/construction | | | 191,042 | | | | 22 | % | | | 144,589 | | | | 20 | % | | | 281,008 | | | | 27 | % |

| Consumer | | | 15,371 | | | | 2 | % | | | 19,482 | | | | 3 | % | | | 25,797 | | | | 3 | % |

| | | $ | 881,591 | | | | | | | $ | 727,599 | | | | | | | $ | 1,036,700 | | | | | |

MARKET CONDITIONS OUTLOOK

In 2010, Titan experienced higher sales when compared to the depressed sales levels in the second half of 2009. During the second half of 2009, Titan implemented extended shutdowns in conjunction with many of the Company’s major customers, which resulted in a steep drop in sales. The Company did not implement any extended shutdowns in the second half of 2010. The Company continues to see signs that the market for Titan’s products experienced the bottom of a cycle in late 2009 and early 2010. The Company is currently pursuing opportunities to increase sales of certain products related to the super giant tire project. If the Company is unsuccessful with these sales efforts, Titan may record additional reserves for this product inventory, adversely affecting Titan’s fin ancial results.

Energy, raw material and petroleum-based product costs have been exceptionally volatile and may negatively impact the Company’s margins. Many of Titan’s overhead expenses are fixed; therefore, lower seasonal trends may cause negative fluctuations in quarterly profit margins and affect the financial condition of the Company.

OPERATIONS

Titan’s operations include manufacturing wheels, manufacturing tires, and combining these wheels and tires into assemblies for use in the agricultural, earthmoving/construction and consumer markets. These operations entail many manufacturing processes in order to complete the finished products.

| · | Wheel Manufacturing Process |

Most agricultural wheels are produced using a rim and a center disc. A rim is produced by first cutting large steel sheets to required width and length specifications. These steel sections are rolled and welded to form a circular rim, which is flared and formed in the rollform operation. The majority of discs are manufactured using presses that both blank and form the center to specifications in multiple stage operations. The Company e-coats wheels using a multi-step process prior to the final paint top coating.

Large earthmoving/construction steel wheels are manufactured from hot and cold-rolled steel sections. Hot-rolled sections are generally used to increase cross section thickness in high stress areas of large diameter wheels. A special cold forming process for certain wheels is used to increase cross section thickness while reducing the number of wheel components. Rims are built from a series of hoops that are welded together to form a rim base. The complete rim base is made from either three or five separate parts that lock together after the rubber tire has been fitted to the wheel and inflated.

For most consumer market wheels, the Company manufactures rims and center discs from steel sheets. Rims are rolled and welded, and discs are stamped and formed from the sheets. The manufacturing process then entails welding the rims to the centers and painting the assembled product.

| · | Tire Manufacturing Process |

The first stage in tire production is the mixing of rubber, carbon black and chemicals to form various rubber compounds. These rubber compounds are then extruded and processed with textile or steel materials to make specific components. These components – beads (wire bundles that anchor the tire with the wheel), plies (layers of fabric that give the tire strength), belts (fabric or steel fabric wrapped under the tread in some tires), tread and sidewall – are then assembled into an uncured tire carcass. The uncured carcass is placed into a press that molds and vulcanizes the carcass under set time, temperature and pressure into a finished tire.

| · | Wheel and Tire Assemblies |

The Company’s position as a manufacturer of both wheels and tires allows Titan to mount and deliver one of the largest selections of off-highway assemblies in North America. Titan offers this value-added service of one-stop shopping for wheel and tire assemblies for the agricultural, earthmoving/construction and consumer markets. Customer orders are entered into the Company’s system either through electronic data interchange or manually. The appropriate wheel-tire assembly delivery schedule is established based on each customer’s requirements and products are received by the customer on a just-in-time basis.

The Company is ISO certified at all five main manufacturing facilities located in Bryan, Ohio; Des Moines, Iowa; Freeport, Illinois; Quincy, Illinois; and Saltville, Virginia. The ISO series is a set of related and internationally recognized standards of management and quality assurance. The standards specify guidelines for establishing, documenting and maintaining a system to ensure quality. The ISO certifications are a testament to Titan’s dedication to providing quality products for its customers.

RAW MATERIALS

Steel and rubber are the primary raw materials used by the Company in all segments. To ensure a consistent steel supply, Titan purchases raw steel from key steel mills and maintains relationships with steel processors for steel preparation. The Company is not dependent on any single producer for its steel supply. Rubber and other raw materials for tire manufacture represent some of the Company’s largest commodity expenses. Titan buys rubber in markets where there are usually several sources of supply. In addition to the development of key domestic suppliers, the Company’s strategic procurement plan includes international steel and rubber suppliers to assure competitive price and quality in the global marketplace. As is customary in the industry, the Company d oes not have long-term contracts for the purchase of steel or rubber and, therefore, purchases are subject to price fluctuations.

CAPITAL EXPENDITURES

Capital expenditures for 2010, 2009 and 2008 were $28.9 million, $39.5 million and $80.0 million, respectively. Included in capital expenditures were amounts for the giant OTR project of approximately $23 million in 2009 and approximately $60 million in 2008. The remaining capital expenditures in each year were used primarily for updating manufacturing equipment, expanding manufacturing capacity and for further automation at the Company’s facilities. Capital expenditures for 2011 are forecasted to be approximately $15 million to $20 million. These capital expenditures are anticipated to be used to enhance the Company’s existing facilities and manufacturing capabilities.

PATENTS, TRADEMARKS AND ROYALTIES

The Company owns various patents and trademarks and continues to apply for patent protection for new products. While patents are considered significant to the operations of the business, at this time Titan does not consider any one of them to be of such importance that the patent’s expiration or invalidity could materially affect the Company’s business. However, due to the difficult nature of predicting the interpretation of patent laws, the Company cannot anticipate or predict the material adverse effect on its operations, cash flows or financial condition as a result of associated liabilities created under such patent interpretations.

The Company pays a royalty relating to a license agreement with The Goodyear Tire & Rubber Company to manufacture and sell certain off-highway tires in North America. Titan currently plans to continue using the Goodyear trademark until circumstances require a change. The current term of the agreement with Goodyear is for the next two years.

MARKETING AND DISTRIBUTION

The Company employs an internal sales force and utilizes several manufacturing representative firms for sales in North America. Sales representatives are primarily organized within geographic regions.

Titan distributes wheels and tires directly to OEMs. The distribution of aftermarket tires occurs primarily through a network of independent and OEM-affiliated dealers. The Company distributes wheel and tire assemblies directly to OEMs and aftermarket customers through its distribution network consisting of eight facilities in the United States.

SEASONALITY

Agricultural equipment sales are seasonal by nature. Farmers generally order equipment to be delivered before the growing season. Shipments to OEMs usually peak during the Company’s first and second quarters for the spring planting period. Earthmoving/construction and consumer markets also historically tend to experience higher demand in the first and second quarters. These markets are affected by mining, building and economic conditions.

RESEARCH, DEVELOPMENT AND ENGINEERING

The Company’s research, development and engineering staff tests original designs and technologies and develops new manufacturing methods to improve product performance. These services enhance the Company’s relationships with its customers. Titan’s engineers have introduced designs for giant OTR tires. These giant tires employ an innovative steel radial construction technology, new to the OTR tire industry, to enhance performance and durability. Titan’s engineers are also working on a new 15-degree tire and wheel design for OTR and farm radial assemblies. This revolutionary technology will simplify maintenance to minimize downtime, provide better air retention, simplify mounting and increase service life. Research and development (R&D) expenses are expens ed as incurred. R&D costs were $6.3 million, $8.9 million and $3.5 million for the years of 2010, 2009 and 2008, respectively.

CUSTOMERS

Titan’s 10 largest customers accounted for approximately 58% of net sales for the year ended December 31, 2010, compared to approximately 54% for the year ended December 31, 2009. Net sales to Deere & Company in Titan’s agricultural, earthmoving/construction and consumer markets combined represented approximately 26% and 24% of the Company’s consolidated revenues for the years ended December 31, 2010 and 2009, respectively. Net sales to CNH Global N.V. in Titan’s three markets represented approximately 15% and 13% of the Company’s consolidated revenues for the years ended December 31, 2010 and 2009, respectively. No other customer accounted for more than 10% of the Company’s net sales in 2010 or 2009. Management believes the Company is not totally depen dent on any single customer; however, certain products are dependent on a few customers. While the loss of any substantial customer could impact Titan’s business, the Company believes that its diverse product mix and customer base may minimize a longer-term impact caused by any such loss.

ORDER BACKLOG

As of January 31, 2011, Titan estimates $227 million in firm orders compared to $134 million at January 31, 2010, for the Company’s operations. Orders are considered firm if the customer would be obligated to accept the product if manufactured and delivered pursuant to the terms of such orders. The Company believes that the majority of the current order backlog will be filled during the present year.

INTERNATIONAL OPERATIONS

In accordance with Accounting Standards Codification (ASC) 320 Investments – Debt and Equity Securities, the Company records the Titan Europe Plc investment as an available-for-sale security and reports the investment at fair value, with unrealized gains and losses excluded from earnings and reported as a separate component of comprehensive income in stockholders’ equity. Should the fair value decline below the cost basis, the Company would be required to determine if this decline is other than temporary. If the decline in fair value were judged to be other than temporary, an impairment charge would be recorded. The Company’s stock ownership interest in Titan Europe Plc was 22.9% at both December 31, 2010 and 2009. The fair value of the Company’s investment in Titan Eu rope Plc was $22.7 million and $6.5 million at December 31, 2010 and 2009, respectively. Titan Europe Plc is publicly traded on the AIM market in London, England.

EMPLOYEES

At December 31, 2010, the Company employed approximately 2,400 people in the United States. Approximately 18% of the Company’s employees in the United States were covered by a collective bargaining agreement. This 18% is comprised of employees at the Des Moines, Iowa facility, who in December 2010 ratified a collective bargaining agreement which expires in November 2012. The labor agreements for the Company’s Bryan, Ohio and Freeport, Illinois, facilities expired on November 19, 2010, for the employees covered by their respective collective bargaining agreements, which account for approximately 29% of the Company’s employees in the United States. As of December 31, 2010, the employees of these two facilities were working without a contract under the terms of the Company̵ 7;s latest offer.

ENVIRONMENTAL LAWS AND REGULATIONS

In the ordinary course of business, like other industrial companies, Titan is subject to extensive and evolving federal, state and local environmental laws and regulations, and has made provisions for the estimated financial impact of environmental cleanup. The Company’s policy is to accrue environmental cleanup-related costs of a non-capital nature when those costs are believed to be probable and can be reasonably estimated. Expenditures that extend the life of the related property, or mitigate or prevent future environmental contamination, are capitalized. The Company does not currently anticipate any material capital expenditures for environmental control facilities. The quantification of environmental exposures requires an assessment of many factors, including changing laws and regulations, ad vances in environmental technologies, the quality of information available related to specific sites, the assessment stage of the site investigation, preliminary findings and the length of time involved in remediation or settlement. Due to the difficult nature of predicting future environmental costs, the Company cannot anticipate or predict the material adverse effect on its operations, cash flows or financial condition as a result of efforts to comply with, or its liabilities under, environmental laws.

EXPORT SALES

The Company had total aggregate export sales of approximately $80.2 million, $82.7 million and $128.8 million, for the years ended December 31, 2010, 2009 and 2008, respectively.

COMPETITION

The Company competes with several domestic and international companies, some of which are larger and have greater financial and marketing resources than Titan. The Company believes it is a primary source of steel wheels and rims to the majority of its North American customers. Major competitors in the off-highway wheel market include Carlisle Companies Incorporated, GKN Wheels, Ltd., Topy Industries, Ltd. and certain other foreign competitors. Significant competitors in the off-highway tire market include Bridgestone/Firestone, Carlisle Companies Incorporated, Michelin and certain other foreign competitors.

The Company competes primarily on the basis of price, quality, customer service, design capability and delivery time. The Company’s ability to compete with international competitors may be adversely affected by currency fluctuations. In addition, certain of the Company’s OEM customers could, under individual circumstances, elect to manufacture the Company’s products to meet their requirements or to otherwise compete with the Company. There can be no assurance that the Company will not be adversely affected by increased competition in the markets in which it operates, or that competitors will not develop products that are more effective, less expensive or otherwise render certain of Titan’s products less competitive. From time to time, certain of the Company’s compet itors have reduced their prices in particular product categories, which has prompted Titan to reduce prices as well. There can be no assurance that competitors of the Company will not further reduce prices in the future or that any such reductions would not have a material adverse effect on the Company.

7.875% SENIOR SECURED NOTES DUE 2017

In October 2010, the Company closed on an offering of $200 million 7.875% senior secured notes due 2017. Titan used a portion of the net proceeds from the offering to finance the repurchase of $138.9 million of its 8% senior unsecured notes due January 2012 and to pay all consent payments, accrued interest and costs and expenses associated therewith. The Company intends to use the remaining net proceeds from this offering of approximately $44 million for general corporate purposes, which may include potential future acquisitions.

8% SENIOR UNSECURED NOTES DUE JANUARY 2012 REPURCHASE

In June 2010, the Company closed on a tender transaction to purchase $47.4 million of its outstanding 8% senior unsecured notes due January 2012 (senior unsecured notes). In October 2010, the Company closed on another tender transaction to purchase $138.9 million of its outstanding senior unsecured notes. In connection with these tender offers and an additional note repurchase of $6.5 million in July 2010, the Company recorded expenses of $14.6 million. These expenses were related to: (i) early tender premium of $13.0 million, (ii) unamortized deferred financing fees of $1.2 million and (iii) other fees of $0.4 million.

GOODYEAR EUROPEAN AND LATIN AMERICAN FARM TIRE BUSINESS

In December 2010, Titan announced that it had entered into agreements with the Goodyear Tire & Rubber Company to buy their European and Latin American farm tire businesses, including a licensing agreement that will allow Titan to manufacture and sell Goodyear-brand farm tires in Europe, Africa, Eastern Europe, Russia, Latin America and North America, for approximately $130 million U.S. dollars, subject to post-closing adjustments.

The Latin American portion of the transaction includes Goodyear’s Sao Paulo, Brazil manufacturing plant, property, equipment and inventories. Subject to customary closing conditions and regulatory approvals, it is expected to close in the first half of 2011.

The European portion of the transaction is subject to the exercise of a put option by Goodyear following completion of a social plan related to the previously announced discontinuation of consumer tire production at its Amiens North, France manufacturing plant and required consultation with the local Works Council. Upon completion of this action, as well as customary closing conditions and regulatory approvals, the transaction will include the Amiens North plant, property, equipment and inventories.

NEW YORK STOCK EXCHANGE CERTIFICATION

The Company submitted to the New York Stock Exchange during fiscal 2010 the Annual CEO Certification required by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual.

AVAILABLE INFORMATION

The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are made available, without charge, through the Company’s website located at www.titan-intl.com as soon as reasonably practicable after they are filed with the Securities and Exchange Commission (SEC). The SEC maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The following documents are also posted on the Company’s website:

| · | Corporate Governance Policy |

| · | Business Conduct Policy |

| · | Audit Committee Charter |

| · | Compensation Committee Charter |

| · | Nominating/Corporate Governance Committee Charter |

Printed copies of these documents are available, without charge, by writing to: Titan International, Inc.,

c/o Corporate Secretary, 2701 Spruce Street, Quincy, IL 62301.

ITEM 1A – RISK FACTORS

The Company is subject to various risks and uncertainties relating to or arising out of the nature of its business and general business, economic, financing, legal and other factors or conditions that may affect the Company. Realization of any of the following risks could have a material adverse effect on Titan’s business, financial condition, cash flows and results of operations.

| · | The Company is exposed to price fluctuations of key commodities. |

The Company does not generally enter into long-term commodity contracts and does not use derivative commodity instruments to hedge exposures to commodity market price fluctuations. Therefore, the Company is exposed to price fluctuations of key commodities, which consist primarily of steel and rubber. Although the Company attempts to pass on certain material price increases to its customers, there is no assurance that the Company will be able to do so in the future. Any increase in the price of steel and rubber that is not passed on to customers could have an adverse material effect on Titan’s results of operations.

| · | The Company relies on a limited number of suppliers. |

The Company currently relies on a limited number of suppliers for certain key commodities, which consist primarily of steel and rubber, in the manufacturing of Titan products. The loss of key suppliers or their inability to meet price, quality, quantity and delivery requirements could have a significant adverse impact on the Company’s results of operations.

| · | The Company’s revolving credit facility and debt obligation contain covenants. |

The Company’s revolving credit facility and debt obligations contain covenants and restrictions. These covenants and restrictions could limit Titan’s ability to respond to market conditions, to provide for unanticipated capital investments, to raise additional debt or equity capital, to pay dividends or to take advantage of business opportunities, including future acquisitions. The failure to meet these items could result in the Company ultimately being in default. Titan’s ability to comply with the covenants may be affected by events beyond its control, including prevailing economic, financial and industry conditions.

| · | The Company operates in cyclical industries and is subject to numerous changes in the economy. |

The Company sales are substantially dependent on three major industries: agricultural equipment, earthmoving/construction equipment and consumer products. The business activity levels in these industries are subject to specific industry and general economic cycles. Any downturn in these industries or the general economy could have an adverse material effect on Titan’s business.

The agricultural equipment industry is affected by crop prices, farm income and farmland values, weather, export markets and government policies. The earthmoving/construction industry is affected by the levels of government and private construction spending and replacement demand. The consumer products industry is affected by consumer disposable income, weather, competitive pricing, energy prices and consumer attitudes. In addition, the performance of these industries is sensitive to interest rate and foreign exchange rate changes and varies with the overall level of economic activity.

| · | The Company’s customer base is relatively concentrated. |

The Company’s ten largest customers, which are primarily original equipment manufacturers (OEMs), accounted for approximately 58% of Titan’s net sales for 2010. Net sales to Deere & Company and CNH Global N.V. represented 26% and 15% , respectively, of total 2010 net sales. No other customer accounted for more than 10% of net sales in 2010. As a result, Titan’s business could be adversely affected if one of its larger customers reduces its purchases from Titan due to work stoppages or slow-downs, financial difficulties, as a result of termination provisions, competitive pricing or other reasons. There is also continuing pressure from the OEMs to reduce costs, including the cost of products and services purchased from outside suppliers such as Titan. � 0;The Company has had long-term relationships with major customers and expects to continue these relationships. There can be no assurance that Titan will be able to maintain such ongoing relationships. Any failure to maintain the Company’s relationship with a leading customer could have an adverse effect on results of operations.

| · | The Company’s revenues are seasonal in nature due to Titan’s dependence on seasonal industries. |

The agricultural, earthmoving/construction and recreational industries are seasonal, with typically lower sales during the second half of the year. This seasonality in demand has resulted in fluctuations in the Company’s revenues and operating results. Because much of Titan’s overhead expenses are fixed, seasonal trends can cause reductions in quarterly profit margins and financial condition, especially during slower periods.

| · | The Company may be adversely affected by changes in government regulations and policies. |

Domestic and foreign political developments and government regulations and policies directly affect the agricultural, earthmoving/construction and consumer products industries in the United States and abroad. Regulations and policies in the agricultural industry include those encouraging farm acreage reduction in the United States and granting ethanol subsidies. Regulations and policies relating to the earthmoving/construction industry include the construction of roads, bridges and other items of infrastructure. The modification of existing laws, regulations or policies or the adoption of new laws, regulations or policies could have an adverse effect on any one or more of these industries and therefore on Titan’s business.

| · | The Company is subject to corporate governance requirements, and costs related to compliance with, or failure to comply with, existing and future requirements could adversely affect Titan’s business. |

The Company is subject to corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as new rules and regulations subsequently adopted by the Securities and Exchange Commission (SEC), the Public Company Accounting Oversight Board (PCAOB) and the New York Stock Exchange (NYSE). These laws, rules and regulations continue to evolve and may become increasingly restrictive in the future. Failure to comply with these laws, rules and regulations may have an adverse material effect on Titan’s reputation, financial condition and the value of the Company’s securities.

| · | The Company faces substantial competition from domestic and international companies. |

The Company competes with several domestic and international competitors, some of which are larger and have greater financial and marketing resources than Titan. Titan competes primarily on the basis of price, quality, customer service, design capability and delivery time. The Company’s ability to compete with international competitors may be adversely affected by currency fluctuations. In addition, certain OEM customers could, under certain circumstances, elect to manufacture certain products to meet their own requirements or to otherwise compete with Titan.

There can be no assurance that Titan’s businesses will not be adversely affected by increased competition in the Company’s markets or that competitors will not develop products that are more effective or less expensive than Titan products or which could render certain products less competitive. From time to time certain competitors have reduced prices in particular product categories, which has caused Titan to reduce prices. There can be no assurance that in the future Titan’s competitors will not further reduce prices or that any such reductions would not have a material adverse effect on Titan’s business.

| · | The Company could be negatively impacted if Titan fails to maintain satisfactory labor relations. |

At December 31, 2010, approximately 18% of Titan employees in the United States were covered by a collective bargaining agreement. This 18% is comprised of employees at the Des Moines, Iowa facility, who in December 2010 ratified a collective bargaining agreement which expires in November 2012. Upon the expiration of any of the collective bargaining agreements, however, Titan may be unable to negotiate new collective bargaining agreements on terms that are cost effective to the Company. The business operations may be affected as a result of labor disputes or difficulties and delays in the process of renegotiating collective bargaining agreements.

The labor agreements for the Company’s Bryan, Ohio and Freeport, Illinois, facilities expired on November 19, 2010, for the employees covered by their respective collective bargaining agreements, which account for approximately 29% of Titan employees in the United States. As of December 31, 2010, the employees of these two facilities were working without a contract under the terms of the Company’s latest offer. The respective unions have retained their rights to challenge the Company’s actions.

| · | Unfavorable outcomes of legal proceedings could adversely affect results of operations. |

The Company is a party to routine legal proceedings arising out of the normal course of business. Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss, the Company believes at this time that none of these actions, individually or in the aggregate, will have a material adverse effect on the consolidated financial condition, results of operations or cash flows of the Company. However, due to the difficult nature of predicting unresolved and future legal claims, the Company cannot anticipate or predict the material adverse effect on its consolidated financial condition, results of operations or cash flows as a result of efforts to comply with or its liabilities pertaining to legal judgments.

| · | Acquisitions may require significant resources and/or result in significant losses, costs or liabilities. |

Any future acquisitions will depend on the ability to identify suitable acquisition candidates, to negotiate acceptable terms for their acquisition and to finance those acquisitions. Titan will also face competition for suitable acquisition candidates that may increase costs. In addition, acquisitions require significant managerial attention, which may be diverted from current operations. Furthermore, acquisitions of businesses or facilities entail a number of additional risks, including:

- problems with effective integration of operations

- the inability to maintain key pre-acquisition customer, supplier and employee relationships

- the potential that expected benefits or synergies are not realized and operating costs increase

- exposure to unanticipated liabilities

In December 2010, Titan announced that it had entered into agreements with the Goodyear Tire & Rubber Company to buy their European and Latin American farm tire businesses, including a licensing agreement that will allow Titan to manufacture and sell Goodyear-brand farm tires in Europe, Africa, Eastern Europe, Russia, Latin America and North America, for approximately $130 million U.S. dollars, subject to post-closing adjustments.

The Latin American portion of the transaction includes Goodyear’s Sao Paulo, Brazil manufacturing plant, property, equipment and inventories. Subject to customary closing conditions and regulatory approvals, it is expected to close in the first half of 2011.

The European portion of the transaction is subject to the exercise of a put option by Goodyear following completion of a social plan related to the previously announced discontinuation of consumer tire production at its Amiens North, France manufacturing plant and required consultation with the local Works Council. Upon completion of this action, as well as customary closing conditions and regulatory approvals, the transaction will include the Amiens North plant, property, equipment and inventories.

Subject to the terms of indebtedness, the Company may finance future acquisitions with cash from operations, additional indebtedness and/or by issuing additional equity securities. These commitments may impair the operation of Titan’s businesses. In addition, the Company could face financial risks associated with incurring additional indebtedness such as reducing liquidity and access to financing markets and increasing the amount of cash flow required to service such indebtedness.

| · | The Company has export sales and purchases raw material from foreign suppliers. |

The Company had total aggregate export sales of approximately $80.2 million, $82.7 million and $128.8 million, for the years ended December 31, 2010, 2009 and 2008, respectively.

Export Sales – Exports to foreign markets are subject to a number of special risks, including but not limited to risks with respect to currency exchange rates, economic and political destabilization, other disruption of markets and restrictive actions by foreign governments (such as restrictions on transfer of funds, export duties and quotas and foreign customs). Other risks include changes in foreign laws regarding trade and investment; difficulties in obtaining distribution and support; nationalization; reforms of United States laws and policies affecting trade, foreign investment and loans; and foreign tax laws. There can be no assurance that one, or a combination of these factors will not have a material adverse effect on the Company’s ability to increase or maintain its export sales.

Foreign Suppliers – The Company purchases raw materials from foreign suppliers. The production costs, profit margins and competitive position of the Company are affected by the strength of the currencies in countries where Titan purchases goods, relative to the strength of the currencies in countries where the products are sold. The Company’s results of operations, cash flows and financial position may be affected by fluctuations in foreign currencies.

| · | The Company may be subject to product liability and warranty claims. |

The Company warrants its products to be free of certain defects and accordingly may be subject in the ordinary course of business to product liability or product warranty claims. Losses may result or be alleged to result from defects in Titan products, which could subject the Company to claims for damages, including consequential damages. There can be no assurance that Company insurance will be adequate for liabilities actually incurred or that adequate insurance will be available on terms acceptable to the Company. Any claims relating to defective products that result in liability exceeding Titan’s insurance coverage could have a material adverse effect on financial condition and results of operations. Further, claims of defects could result in negative publicity against Titan, which could adversely affect the Company’s business.

| · | The Company has incurred, and may incur in the future, net losses. |

The Company reported net loss of $(24.6) million for the year ended December 31, 2009. As a result of the 2009 net loss, the Company has a net operating loss carryforward for income tax purposes. If Titan would continue to incur net losses, the Company may not be able to realize the full tax benefit of these net operating losses.

| · | The Company is subject to risks associated with climate change and climate change regulations. |

Governmental regulatory bodies in the United States and other countries have, or are, contemplating introducing regulatory changes in response to the potential impacts of climate change. Laws and regulations regarding climate change and energy usage may impact the Company directly through higher costs for energy and raw materials. The Company’s customers may also be affected by climate change regulations that may impact future purchases. Physical climate change may potentially have a large impact on the Company’s two largest industry segments, agriculture and earthmoving/construction. The potential impacts of climate change and climate change regulations are highly uncertain at this time, and the Company cannot anticipate or predict the material adverse effect on its consolidated fi nancial condition, results of operations or cash flows as a result of climate change and climate change regulations.

| · | The Company is subject to risks associated with environmental laws and regulations. |

The Company’s operations are subject to federal, state, local and foreign laws and regulations governing, among other things, emissions to air, discharge to waters and the generation, handling, storage, transportation, treatment and disposal of waste and other materials. The Company’s operations entail risks in these areas, and there can be no assurance that Titan will not incur material costs or liabilities. In addition, potentially significant expenditures could be required in order to comply with evolving environmental and health and safety laws, regulations or requirements that may be adopted or imposed in the future.

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

ITEM 2 – PROPERTIES

The Company’s properties are detailed by the location, size and focus of each facility as provided in the table below:

| | | Approximate square footage | | | |

| Location | | Owned | | | Leased | | Use | Segment |

| Des Moines, Iowa | | | 2,047,000 | | | | | Manufacturing, distribution | All segments |

| Freeport, Illinois | | | 1,202,000 | | | | | Manufacturing, distribution | All segments |

| Quincy, Illinois | | | 1,134,000 | | | | | Manufacturing, distribution | All segments |

| Brownsville, Texas | | | 993,000 | | | | | Storage | See note (a) |

| Bryan, Ohio | | | 714,000 | | | | | Manufacturing, distribution | All segments |

| Greenwood, S. Carolina | | | 110,000 | | | | | Storage | See note (a) |

| Dublin, Georgia | | | 20,000 | | | | | Distribution | All segments |

| Saltville, Virginia | | | 14,000 | | | | 245,000 | | Manufacturing, distribution | Earthmoving/Construction |

| Natchez, Mississippi | | | | | | | 1,203,000 | | Storage | See note (a) |

| Pendergrass, Georgia | | | | | | | 120,000 | | Distribution | All segments |

| Elko, Nevada | | | | | | | 4,000 | | Distribution | Earthmoving/Construction |

| (a) | The Brownsville, Greenwood and Natchez facilities are currently being used for storage. The Company’s facilities in Brownsville, Texas; Greenwood, South Carolina, and Natchez, Mississippi, are not in operation. |

The Company considers each of its facilities to be in good condition and adequate for present use. Management believes that the Company has sufficient capacity to meet current market demand with the active facilities. The Company has no current plans to restart manufacturing at the storage facilities described in note (a) above.

ITEM 3 – LEGAL PROCEEDINGS

The Company is a party to routine legal proceedings arising out of the normal course of business. Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss, the Company believes at this time that none of these actions, individually or in the aggregate, will have a material adverse effect on the consolidated financial condition, results of operations or cash flows of the Company. However, due to the difficult nature of predicting unresolved and future legal claims, the Company cannot anticipate or predict the material adverse effect on its consolidated financial condition, results of operations or cash flows as a result of efforts to comply with or its liabilities pertaining to legal judgments.

PART II

| ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s common stock is traded on the New York Stock Exchange (NYSE) under the symbol TWI. On February 15, 2011, there were approximately 500 holders of record of Titan common stock and an estimated 8,800 beneficial stockholders. The following table sets forth the high and low sales prices per share of common stock as reported on the NYSE, as well as information concerning per share dividends declared for the periods indicated.

| 2010 | | High | | | Low | | | Dividends Declared | |

| First quarter | | $ | 9.84 | | | $ | 7.15 | | | $ | 0.005 | |

| Second quarter | | | 13.10 | | | | 8.81 | | | | 0.005 | |

| Third quarter | | | 14.27 | | | | 9.37 | | | | 0.005 | |

| Fourth quarter | | | 19.86 | | | | 12.85 | | | | 0.005 | |

| | | | | | | | | | | | | |

| 2009 | | | | | | | | | | | | |

| First quarter | | $ | 11.44 | | | $ | 3.05 | | | $ | 0.005 | |

| Second quarter | | | 10.45 | | | | 4.82 | | | | 0.005 | |

| Third quarter | | | 9.87 | | | | 5.79 | | | | 0.005 | |

| Fourth quarter | | | 10.35 | | | | 7.55 | | | | 0.005 | |

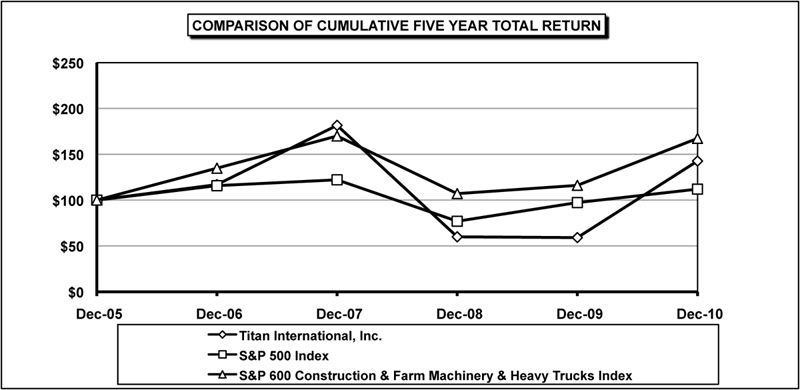

PERFORMANCE COMPARISON GRAPH

The performance graph compares cumulative total return for the Company’s common stockholders over the past five years against the cumulative total return of the Standard & Poor’s 600 Construction and Farm Machinery and Heavy Trucks Index, and against the Standard & Poor’s 500 Stock Index. The graph depicts the value on December 31, 2010, of a $100 investment made on December 31, 2005, in Company common stock and each of the other two indices, with all dividends reinvested. Titan’s common stock is traded on the NYSE under the symbol TWI.

| | | Fiscal Year Ended December 31, | |

| | | 2005 | | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | |

| Titan International, Inc. | | $ | 100.00 | | | $ | 116.94 | | | $ | 181.54 | | | $ | 59.96 | | | $ | 59.11 | | | $ | 142.65 | |

| S&P 500 Index | | | 100.00 | | | | 115.79 | | | | 122.16 | | | | 76.96 | | | | 97.33 | | | | 111.99 | |

| S&P 600 Construction. & Farm Machinery & Heavy Trucks Index | | | 100.00 | | | | 134.85 | | | | 169.95 | | | | 107.07 | | | | 116.09 | | | | 167.36 | |

ITEM 6 – SELECTED FINANCIAL DATA

The selected financial data presented below, as of and for the years ended December 31, 2010, 2009, 2008, 2007, and 2006, are derived from the Company’s consolidated financial statements, as audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, and should be read in conjunction with the Company’s Management’s Discussion and Analysis of Financial Condition and Results of Operations and our audited consolidated financial statements and notes thereto.

(All amounts in thousands, except per share data)

| | | Year Ended December 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Net sales | | $ | 881,591 | | | $ | 727,599 | | | $ | 1,036,700 | | | $ | 837,021 | | | $ | 679,454 | |

| Gross profit | | | 113,929 | | | | 55,965 | | | | 139,714 | | | | 84,131 | | | | 72,778 | |

| Noncash goodwill impairment charge | | | 0 | | | | 11,702 | | | | 0 | | | | 0 | | | | 0 | |

| Income (loss) from operations | | | 40,784 | | | | (18,894 | ) | | | 73,321 | | | | 24,838 | | | | 22,011 | |

| Noncash Titan Europe Plc charge | | | 0 | | | | 0 | | | | (37,698 | ) | | | 0 | | | | 0 | |

| Noncash debt conversion charge | | | 0 | | | | 0 | | | | 0 | | | | (13,376 | ) | | | 0 | |

| Income (loss) before income taxes | | | 649 | | | | (32,002 | ) | | | 23,010 | | | | (3,884 | ) | | | 8,574 | |

| Net income (loss) | | | 358 | | | | (24,645 | ) | | | 13,337 | | | | (7,247 | ) | | | 5,144 | |

| Net income (loss) per share – basic * | | | .01 | | | | (.71 | ) | | | .39 | | | | (.23 | ) | | | .21 | |

| Net income (loss) per share – diluted * | | | .01 | | | | (.71 | ) | | | .38 | | | | (.23 | ) | | | .21 | |

| Dividends declared per common share * | | | .020 | | | | .020 | | | | .018 | | | | .016 | | | | .016 | |

* Adjusted to reflect the five-for-four stock split that took place in 2008. | |

| | | | |

| (All amounts in thousands) | | As of December 31, | |

| | | 2010 | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| Working capital | | $ | 395,587 | | | $ | 375,144 | | | $ | 232,564 | | | $ | 239,985 | | | $ | 247,009 | |

| Current assets | | | 487,940 | | | | 445,216 | | | | 369,199 | | | | 327,765 | | | | 309,933 | |

| Total assets | | | 787,470 | | | | 736,463 | | | | 654,782 | | | | 590,495 | | | | 585,126 | |

Long-term debt (a) | | | 373,564 | | | | 366,300 | | | | 200,000 | | | | 200,000 | | | | 291,266 | |

| Stockholders’ equity | | | 278,315 | | | | 261,953 | | | | 279,188 | | | | 272,522 | | | | 187,177 | |

(a) Excludes amounts due within one year and classified as a current liability. | |

| ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s discussion and analysis of financial condition and results of operations (MD&A) is designed to provide readers of these financial statements with a narrative from the perspective of the management of Titan International, Inc. (Titan or the Company) on Titan’s financial condition, results of operations, liquidity and other factors which may affect the Company’s future results.

FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements, including statements regarding, among other items:

| · | Anticipated trends in the Company’s business |

| · | Future expenditures for capital projects |

| · | The Company’s ability to continue to control costs and maintain quality |

| · | Ability to meet financial covenants and conditions of loan agreements |

| · | The Company’s business strategies, including its intention to introduce new products |

| · | Expectations concerning the performance and success of the Company’s existing and new products |

| · | The Company’s intention to consider and pursue acquisition and divestiture opportunities |

Readers of this Form 10-K should understand that these forward-looking statements are based on the Company’s expectations and are subject to a number of risks and uncertainties, including those in Item 1A, Part I of this report, “Risk Factors,” certain of which are beyond the Company’s control.

Actual results could differ materially from these forward-looking statements as a result of certain factors, including:

| · | The effect of a recession on the Company and its customers and suppliers |

| · | Changes in the Company’s end-user markets as a result of world economic or regulatory influences |

| · | Changes in the marketplace, including new products and pricing changes by the Company’s competitors |

| · | Ability to maintain satisfactory labor relations, which may be affected by the closing of some facilities |

| · | Unfavorable outcomes of legal proceedings |

| · | Availability and price of raw materials |

| · | Levels of operating efficiencies |

| · | Unfavorable product liability and warranty claims |

| · | Actions of domestic and foreign governments |

| · | Fluctuations in currency translations |

| · | Ability to secure financing at reasonable terms |

| · | Laws and regulations related to climate change |

| · | Risks associated with environmental laws and regulations |

Any changes in such factors could lead to significantly different results. The Company cannot provide any assurance that the assumptions referred to in the forward-looking statements or otherwise are accurate or will prove to transpire. Any assumptions that are inaccurate or do not prove to be correct could have a material adverse effect on the Company’s ability to achieve the results as indicated in forward-looking statements. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks and uncertainties, there can be no assurance that the forward-looking information contained in this document will in fact transpire.

OVERVIEW

Titan International, Inc. and its subsidiaries are leading manufacturers of wheels, tires and assemblies for off-highway vehicles used in the agricultural, earthmoving/construction and consumer markets. Titan manufactures both wheels and tires for the majority of these market applications, allowing the Company to provide the value-added service of delivering complete wheel and tire assemblies. The Company offers a broad range of products that are manufactured in relatively short production runs to meet the specifications of original equipment manufacturers (OEMs) and/or the requirements of aftermarket customers.

The Company’s major OEM customers include large manufacturers of off-highway equipment such as AGCO Corporation, CNH Global N.V., Deere & Company and Kubota Corporation, in addition to many other off-highway equipment manufacturers. The Company distributes products to OEMs, independent and OEM-affiliated dealers, and through a network of distribution facilities.

The following table provides highlights for the year ended December 31, 2010, compared to 2009 (amounts in thousands):

| | | 2010 | | | 2009 | |

| Net sales | | $ | 881,591 | | | $ | 727,599 | |

| Income (loss) from operations | | | 40,784 | | | | (18,894 | ) |

| Net income (loss) | | | 358 | | | | (24,645 | ) |

The Company recorded sales of $881.6 million for 2010, which were approximately 21% higher than the 2009 sales of $727.6 million. The higher sales levels resulted from increased demand in the Company’s agricultural segment, up approximately 20%; and earthmoving/construction segment, up approximately 32%. Sales in the second half of 2009 were affected by reduced demand for the Company’s products, as many of the Company’s major customers implemented extended shutdowns during the period as a consequence of the recession. Titan in turn implemented extended shutdowns at its production facilities in response to lower demand during this time period. Extended shutdowns were not required during the second half of 2010 as Titan’s customers were aided by the stabilization of the overall economy and increased demand for their products.

The Company’s income from operations was $40.8 million for 2010 compared to loss from operations of $(18.9) million for 2009. Titan’s net income was $0.4 million for 2010 compared to net loss of $(24.6) million in 2009. Diluted income per share was $.01 in 2010, compared to diluted loss per share of $(.71) in 2009. The operating gains were primarily the result of the significant increase in second half 2010 results as compared to the extended shutdowns that influenced the second half 2009 results.

SUBSEQUENT EVENTS

Exchange Agreement for 5.625% Convertible Senior Subordinated Notes due 2017

In January 2011, Titan was approached by a note holder of the Company’s 5.625% convertible senior subordinated notes due 2017 (convertible notes), with an offer to exchange the note holder’s convertible notes for the Company’s common stock. The two parties privately negotiated an agreement to exchange approximately $59.6 million in aggregate principal amount of the Convertible Notes for approximately 6.6 million shares of the Company’s common stock, plus a payment for the accrued and unpaid interest. The exchange was closed on January 19, 2011. The convertible notes exchanged represented approximately 35% of the total outstanding convertible notes. In the first quarter of 2011, the Company will recognize a noncash charge of approximately $16 million in connection with thi s exchange in accordance with ASC 470-20 Debt – Debt with Conversion and Other Options.

Cash Deposit for 8% Senior Unsecured Notes due 2012

In February 2011, Titan satisfied and discharged the indenture relating to the 8% senior unsecured notes due January 2012 by depositing with the trustee $1.1 million cash representing the outstanding principal of such notes and the interest payments due on July 15, 2011, and at maturity on January 15, 2012. Titan irrevocably instructed the trustee to apply the deposited money toward the interest and principal of the notes.

RESULTS OF OPERATIONS

The following table sets forth the Company’s statement of operations expressed as a percentage of net sales for the periods indicated. This table and subsequent discussions should be read in conjunction with the Company’s audited consolidated financial statements and notes thereto.

| | | As a Percentage of Net Sales | |

| | | Year ended December 31, | |

| | | 2010 | | | 2009 | | | 2008 | |

| Net sales | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

| Cost of sales | | | 87.1 | | | | 92.3 | | | | 86.5 | |

| Gross profit | | | 12.9 | | | | 7.7 | | | | 13.5 | |

| | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 6.5 | | | | 6.4 | | | | 5.2 | |

| Research and development | | | 0.7 | | | | 1.2 | | | | 0.3 | |

| Royalty expense | | | 1.1 | | | | 1.1 | | | | 0.9 | |

| Noncash goodwill impairment charge | | | 0.0 | | | | 1.6 | | | | 0.0 | |

| Income (loss) from operations | | | 4.6 | | | | (2.6 | ) | | | 7.1 | |

| | | | | | | | | | | | | |

| Interest expense | | | (3.0 | ) | | | (2.2 | ) | | | (1.5 | ) |

| Gain (loss) on note repurchase | | | (1.6 | ) | | | 0.2 | | | | 0.0 | |

| Noncash Titan Europe Plc charge | | | 0.0 | | | | 0.0 | | | | (3.6 | ) |

| Other income, net | | | 0.1 | | | | 0.2 | | | | 0.2 | |

| Income (loss) before income taxes | | | 0.1 | | | | (4.4 | ) | | | 2.2 | |

| Income tax provision (benefit) | | | 0.0 | | | | (1.0 | ) | | | 0.9 | |

| Net income (loss) | | | 0.1 | % | | | (3.4 | )% | | | 1.3 | % |

In addition, the following table sets forth components of the Company’s net sales classified by segment for the years ended December 31, (amounts in thousands):

| | | 2010 | | | 2009 | | | 2008 | |

| Agricultural | | $ | 675,178 | | | $ | 563,528 | | | $ | 729,895 | |

| Earthmoving/Construction | | | 191,042 | | | | 144,589 | | | | 281,008 | |

| Consumer | | | 15,371 | | | | 19,482 | | | | 25,797 | |

| Total | | $ | 881,591 | | | $ | 727,599 | | | $ | 1,036,700 | |

STOCK SPLIT

In June 2008, Titan’s Board of Directors approved a five-for-four stock split with a record date of July 31, 2008, and a payable date of August 15, 2008. The Company gave five shares for every four shares held as of the record date. Stockholders received one additional share for every four shares owned as of the record date and received cash in lieu of fractional shares. All share and per share data, except shares authorized, have been adjusted to reflect the effect of the stock split for all periods presented.

CRITICAL ACCOUNTING ESTIMATES

Preparation of the financial statements and related disclosures in compliance with accounting principles generally accepted in the United States of America requires the application of appropriate technical accounting rules and guidance, as well as the use of estimates. The Company’s application of these policies involves assumptions that require difficult subjective judgments regarding many factors, which, in and of themselves, could materially impact the financial statements and disclosures. A future change in the estimates, assumptions or judgments applied in determining the following matters, among others, could have a material impact on future financial statements and disclosures.

Inventories

Inventories are valued at the lower of cost or market. Cost is determined using the first-in, first-out (FIFO) method in 2010 for approximately 64% of inventories and the last-in, first-out (LIFO) method for approximately 36% of inventories. The major rubber material inventory and related work-in-process and their finished goods are accounted for under the FIFO method. The major steel material inventory and related work-in-process and their finished goods are accounted for under the LIFO method. Market value is estimated based on current selling prices. Estimated provisions are established for excess and obsolete inventory, as well as inventory carried above market price based on historical experience. Should experience change, adjustments to the estimated provisions would be necessary.

Income Taxes

Deferred income tax provisions are determined using the liability method whereby deferred tax assets and liabilities are recognized based upon temporary differences between the financial statement and income tax basis of assets and liabilities. The Company assesses the realizability of its deferred tax asset positions and recognizes and measures uncertain tax positions in accordance with ASC 740 Income Taxes.

As a result of the 2009 net loss, the Company has a net operating loss carryforward for income tax purposes. If Titan would continue to incur net losses, the Company may not be able to realize the full tax benefit of these net operating losses.

Retirement Benefit Obligations

Pension benefit obligations are based on various assumptions used by third-party actuaries in calculating these amounts. These assumptions include discount rates, expected return on plan assets, mortality rates and other factors. Revisions in assumptions and actual results that differ from the assumptions affect future expenses, cash funding requirements and obligations. The Company has three frozen defined benefit pension plans and one defined benefit plan that previously purchased a final annuity settlement. Titan expects to contribute approximately $3 million to these frozen defined pension plans in 2011. For more information concerning these costs and obligations, see the discussion of the “Pensions” and Note 20 to the Company’s financial statements.

The effect of hypothetical changes to selected assumptions on the Company’s frozen pension benefit obligations would be as follows (amounts in thousands):

| | | | | | December 31, 2010 | | | 2011 | |

| | | | | | Increase | | | Increase | | | Increase | |

| | | Percentage | | | (Decrease) | | | (Decrease) | | | (Decrease) | |

| Assumptions | | Change | | | PBO (a) | | | Equity | | | Expense | |

| Pension | | | | | | | | | | | | |

Discount rate | | | +/-.5 | | | $ | (4,747)/$5,170 | | | $ | 4,747/$(5,170) | | | $ | (481)/$156 | |

Expected return on assets | | | +/-.5 | | | | | | | | | | | $ | (351)/$351 | |

| (a) | Projected benefit obligation (PBO) for pension plans. |

FISCAL YEAR ENDED DECEMBER 31, 2010, COMPARED TO FISCAL YEAR ENDED DECEMBER 31, 2009

RESULTS OF OPERATIONS

Highlights for the year ended December 31, 2010, compared to 2009 (amounts in thousands):

| | | 2010 | | | 2009 | | | % Increase | |

| Net sales | | $ | 881,591 | | | $ | 727,599 | | | | 21 | % |

| Cost of sales | | | 767,662 | | | | 671,634 | | | | 14 | % |

| Gross profit | | | 113,929 | | | | 55,965 | | | | 104 | % |

| Gross profit percentage | | | 12.9 | % | | | 7.7 | % | | | | |

Net Sales

Net sales for the year ended December 31, 2010, were $881.6 million compared to $727.6 million for the year ended December 31, 2009. The higher sales were primarily the result of a substantial increase in demand in the Company’s agricultural segment, up approximately 20%; and earthmoving/construction segment, up approximately 32%. Second half sales in 2009 were affected by reduced demand for the Company’s products, as many of the Company’s major customers implemented extended shutdowns during the period as a consequence of the recession. Titan in turn implemented extended shutdowns at its production facilities to manage lower demand during this time period. Extended shutdowns were not required during the second half of 2010 as Titan’s customers were aided by the stabiliza tion of the overall economy and an increase in demand for their products.

Cost of Sales and Gross Profit

Cost of sales was $767.7 million for the year ended December 31, 2010, as compared to $671.6 million in 2009. The cost of sales increased 14% as a result of higher sales levels of 21%.

Gross profit for the year 2010 was $113.9 million, or 12.9% of net sales, compared to $56.0 million, or 7.7% of net sales for 2009. The gross profit margin for 2010 was higher than 2009 primarily due to the negative margins in the second half of 2009 resulting from extended production facility shutdowns and improved plant utilization resulting from the higher sales levels.

Selling, General and Administrative Expenses

Selling, general and administrative expenses were as follows (amounts in thousands):

| | | 2010 | | | 2009 | | | % Increase | |

| Selling, general and administrative | | $ | 57,565 | | | $ | 46,734 | | | | 23 | % |

| Percentage of net sales | | | 6.5 | % | | | 6.4 | % | | | | |

Selling, general and administrative (SG&A) expenses were $57.6 million, or 6.5% of net sales, for the year ended December 31, 2010, as compared to $46.7 million, or 6.4% of net sales, for 2009. The higher SG&A expenses for 2010 were primarily the result of an increase in CEO and management incentive compensation, higher selling and marketing expenses related to sales levels, and higher legal and professional fees. Expenses recorded for CEO and management incentive compensation were approximately $6 million higher in 2010, when compared to 2009. Selling and marketing expenses for 2010 were approximately $2 million higher than 2009 primarily due to the higher sales levels. Legal and professional fees for 2010 were approximately $2 million higher than 2009 due primarily to fees associated w ith potential acquisitions.

Research and Development Expenses

Research and development expenses were as follows (amounts in thousands):

| | | 2010 | | | 2009 | | | % Decrease | |

| Research and development | | $ | 6,317 | | | $ | 8,850 | | | | (29 | )% |

| Percentage of net sales | | | 0.7 | % | | | 1.2 | % | | | | |

Research and development (R&D) expenses were $6.3 million, or 0.7% of net sales, for the year ended December 31, 2010, as compared to $8.9 million, or 1.2% of net sales, for 2009. The Company R&D costs related to the Giant OTR products were less in 2010 than 2009.

Royalty Expense