UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

or

|

| |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12936

TITAN INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

|

| | |

| Delaware | | 36-3228472 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

2701 Spruce Street, Quincy, IL 62301

(Address of principal executive offices)

(217) 228-6011

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: |

| |

| Title of each class | Name of each exchange on which registered |

| Common stock, $0.0001 par value | New York Stock Exchange (Symbol: TWI) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| |

Large accelerated filer o | Accelerated filer þ |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o |

| | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the shares of common stock of the registrant held by non-affiliates was approximately $513 million based upon the last reported sale price of the common stock on the New York Stock Exchange on June 30, 2017.

Indicate the number of shares of Titan International, Inc. outstanding: 59,810,770 shares of common stock, $0.0001 par value, as of February 15, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for the annual meeting of stockholders, to be held on June 12, 2018, are incorporated by reference into Part III of this Form 10-K.

TITAN INTERNATIONAL, INC.

Index to Annual Report on Form 10-K

FORWARD-LOOKING STATEMENTS

This Form 10-K contains forward-looking statements, which are covered by the "Safe Harbor for Forward-Looking Statements" provided by the Private Securities Litigation Reform Act of 1995. You can identify these statements by the fact that they do not relate strictly to historical or current facts. We have tried to identify forward-looking statements in this report by using words such as “anticipates,” “estimates,” “expects,” “intends,” “plans,” and “believes,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may,” and “could.” These forward-looking statements include, among other items, statements relating to the following:

| |

| • | The Company's financial performance; |

| |

| • | Anticipated trends in the Company’s business; |

| |

| • | Expectations with respect to the end-user markets into which the Company sells its products (including agricultural equipment, earthmoving/construction equipment, and consumer products); |

| |

| • | Future expenditures for capital projects; |

| |

| • | The Company’s ability to continue to control costs and maintain quality; |

| |

| • | The Company's ability to meet conditions of loan agreements; |

| |

| • | The Company’s business strategies, including its intention to introduce new products; |

| |

| • | Expectations concerning the performance and success of the Company’s existing and new products; and |

| |

| • | The Company’s intention to consider and pursue acquisition and divestiture opportunities. |

Readers of this Form 10-K should understand that these forward-looking statements are based on the Company’s current expectations and assumptions about future events and are subject to a number of risks, uncertainties, and changes in circumstances that are difficult to predict, including those in Item 1A, Part I of this report, “Risk Factors,” certain of which are beyond the Company’s control.

Actual results could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various factors, including:

| |

| • | The effect of a recession on the Company and its customers and suppliers; |

| |

| • | Changes in the Company’s end-user markets into which the Company sells its products as a result of world economic or regulatory influences or otherwise; |

| |

| • | Changes in the marketplace, including new products and pricing changes by the Company’s competitors; |

| |

| • | Ability to maintain satisfactory labor relations; |

| |

| • | Unfavorable outcomes of legal proceedings; |

| |

| • | The Company's ability to comply with current or future regulations applicable to the Company's business and the industry in which it competes or any actions taken or orders issued by regulatory authorities; |

| |

| • | Availability and price of raw materials; |

| |

| • | Levels of operating efficiencies; |

| |

| • | The effects of the Company's indebtedness and its compliance with the terms thereof; |

| |

| • | Changes in the interest rate environment and their effects on the Company's outstanding indebtedness; |

| |

| • | Unfavorable product liability and warranty claims; |

| |

| • | Actions of domestic and foreign governments; |

| |

| • | Geopolitical and economic uncertainties relating to the countries in which the Company operates or does business; |

| |

| • | Risks associated with acquisitions, including difficulty in integrating operations and personnel, disruption of ongoing business, and increased expenses; |

| |

| • | The effects of potential processes to explore various strategic transactions, including dispositions; |

| |

| • | Fluctuations in currency translations; |

| |

| • | Climate change and related laws and regulations; |

| |

| • | Risks associated with environmental laws and regulations; |

| |

| • | Risks relating to our manufacturing facilities, including that any of our material facilities may become inoperable; and |

| |

| • | Risks related to financial reporting, internal controls, tax accounting, and information systems. |

Any changes in such factors could lead to significantly different results. Any assumptions that are inaccurate or do not prove to be correct could have a material adverse effect on the Company’s ability to achieve the results as indicated in forward-looking statements. Forward-looking statements speak only as of the date of this report. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. In light of these risks and uncertainties, there can be no assurance that the forward-looking information and assumptions contained in this document will in fact transpire. You should not place undue reliance on the forward-looking statements included in this report or that may be made elsewhere from time to time by the Company, or on its behalf. All forward-looking statements attributable to Titan are expressly qualified by these cautionary statements.

PART I

ITEM 1 – BUSINESS

INTRODUCTION

Titan International, Inc., together with its subsidiaries (Titan or the Company), is a global wheel, tire, and undercarriage industrial manufacturer and supplier servicing customers across its target markets. As a leading manufacturer in the off-highway industry, Titan produces a broad range of products to meet the specifications of original equipment manufacturers (OEMs) and aftermarket customers in the agricultural, earthmoving/construction, and consumer markets. As a manufacturer of both wheels and tires, the Company is uniquely positioned to offer customers added value through complete wheel and tire assemblies. Titan's agricultural products include rims, wheels, tires, and undercarriage systems and components manufactured for use on various agricultural equipment. Titan’s earthmoving/construction products include rims, wheels, tires, and undercarriage systems and components for various types of off-the-road (OTR) earthmoving, mining, military, construction, and forestry equipment. The Company's consumer products include, but are not limited to, bias truck tires in Latin America and light truck tires in Russia, as well as products for all-terrain vehicles (ATVs), turf, and golf cart applications.

As one of the few companies dedicated to off-highway wheels, tires, and assemblies, Titan’s engineering and manufacturing resources are focused on designing quality products that address the needs of our customers and end-users across the markets that Titan serves. Titan’s team of experienced engineers continuously work on new and improved engineered solutions that evolve with today’s applications for the off-highway wheel, tire, and assembly markets.

The Company traces its roots to the Electric Wheel Company in Quincy, Illinois, which was founded in 1890. Titan was incorporated in 1983. The Company has grown through six major acquisitions. In 2005, Titan Tire Corporation, a subsidiary of the Company, acquired The Goodyear Tire & Rubber Company’s North American farm tire assets. In 2006, Titan Tire Corporation of Bryan, another subsidiary of the Company, acquired the OTR tire assets of Continental Tire North America, Inc. In 2011, the Company acquired The Goodyear Tire & Rubber Company's Latin American farm tire business. In 2012, the Company purchased a 56% controlling interest in Planet Corporation Group, now known as Titan Australia. Also in 2012, the Company completed its acquisition of Titan Europe. Through separate acquisitions in 2013 and 2014, the Company, in partnership with One Equity Partners (OEP) and the Russian Direct Investment Fund (RDIF), acquired all of the equity interests in Voltyre-Prom, a leading producer of agricultural and industrial tires in Volgograd, Russia. These acquisitions have allowed Titan to expand its global footprint and enhance product offerings in the Company’s target markets.

COMPETITIVE STRENGTHS

Titan’s strong market position in the off-highway wheel, tire, and undercarriage market and its long-term core customer relationships contribute to the Company’s competitive strengths. Titan produces both wheels and tires which allows the Company to provide a one-stop solution for its customers' wheel and tire assembly needs. These strengths, along with Titan’s dedication to the off-highway equipment market, continue to drive the Company forward.

As a result of Titan’s offering of a broad range of specialized wheels, tires, assemblies, and undercarriage systems and components, Titan is a leader in the global off-highway market. Through an extensive dealer network and sales force, the Company is able to reach an increasing number of aftermarket and OEM customers and build Titan’s image and brand recognition. The Company’s acquisition of the Goodyear Farm Tire brand in North America and Latin America contributes to overall visibility and customer confidence. Through the 2012 acquisition of Titan Europe and the expansion of the Goodyear Farm Tire brand into Europe, Middle East and Africa (EMEA) in 2015, Titan has strengthened the Company's presence in Europe. Additionally, the 2013 acquisition of Voltyre-Prom expanded Titan's footprint into the Commonwealth of Independent States (CIS) region. Years of product design and engineering experience have enabled Titan to improve existing products and develop new ones, such as Low Sidewall (LSW®), that have been well received in the marketplace. Titan believes it has benefited from significant barriers to entry, such as the substantial investment necessary to replicate the Company’s manufacturing equipment and numerous tools, dies and molds, many of which are used in custom processes.

| |

| • | Wheel and Tire Manufacturing Capabilities |

The Company’s position as a manufacturer of both wheels and tires allows Titan to mount and deliver one of the largest selections of off-highway assemblies in North America. Titan offers this value-added service of one-stop solution for wheel and tire assemblies for the agricultural, earthmoving/construction, and consumer segments. Both standard and LSW assemblies are delivered as a single, complete unit based on each customer’s specific requirements.

| |

| • | Long-Term Core Customer Relationships |

The Company’s top customers, including global leaders in agricultural and construction equipment manufacturing, have been purchasing products from Titan or its predecessors for numerous years. Customers including AGCO Corporation, Caterpillar Inc., CNH Global N.V., Deere & Company, Hitachi, Ltd., Kubota Corporation, Liebherr, and AB Volvo have helped sustain Titan’s market leading position in wheel, tire, assembly, and undercarriage products.

BUSINESS STRATEGY

Titan’s business strategy is to increase its presence in the segments it serves through its one-stop solutions, including LSW technology. The Company continues to seek global expansion of complete wheel and tire assembly and undercarriage product offerings within the geographies it competes. This may be through strategic worldwide acquisitions or through expanded manufacturing capabilities in regions where the Company lacks either wheel, tire, or undercarriage production. In addition, Titan continues to improve operating efficiencies and gain additional synergies.

The Company has developed an LSW tire technology, featuring a larger rim diameter and a smaller sidewall than standard tires. With LSW tire technology, which has been widely adopted within the automotive industry, users experience reduced power hop, road lope, soil compaction, and fuel consumption as well as improved safety and performance. Both power hop and road lope can disturb ride quality and impede equipment performance. The benefits correspond to Titan’s markets through superior comfort, ride and fuel economy. Titan continues to enhance the LSW technology and expand its LSW product offering in both the agricultural and construction segments. Titan’s capabilities as both a wheel and tire manufacturer allow the Company to drive further adoption within these markets. Titan seeks to be at the forefront of off-road equipment advancement through the innovation of its LSW solution with the goal that it will become the industry standard.

| |

| • | Increase Aftermarket Tire Business |

The Company has concentrated on increasing Titan's presence in the tire aftermarket, which historically has been somewhat less cyclical than the OEM market. The aftermarket also offers the potential for higher profit margins and is a larger market. Titan’s strategy to enhance the Company's aftermarket platform, which began in mid-2016, focuses on improving the customer experience and product positioning in key sales markets. To support this strategy, the Company has maintained and supported Titan's salesforce for the tire aftermarket throughout the recent industry downturn.

| |

| • | Improve Operating Efficiencies |

The Company regularly works to improve the operating efficiency of assets and manufacturing facilities. Titan integrates each facility’s strengths through, among others, transfer of equipment and business to the facilities that are best equipped to handle the work, which enables Titan to increase utilization and spread operating costs over a greater volume of products. Titan continues to implement a comprehensive program to refurbish, modernize, and enhance the technology of its manufacturing equipment. Titan has also made investments to streamline processes, increase productivity, and lower costs in the selling, general and administrative areas.

| |

| • | Enhance Design Capabilities and New Product Development |

Equipment manufacturers constantly face changing industry dynamics. Titan directs its business and marketing strategy to understand and address the needs of customers and demonstrate the advantages of products. In particular, the Company often collaborates with customers in the design of new and enhanced products and recommends modified products to customers based on the Company's own market information. These value-added services enhance Titan’s relationships with customers. The Company tests new designs and technologies and develops manufacturing methods to improve product quality, performance, and cost.

| |

| • | Explore Additional Strategic Acquisitions |

The Company’s expertise in the manufacture of off-highway wheels, tires, and undercarriage systems and components has permitted it to take advantage of opportunities to acquire businesses that complement this product line. In the future, Titan may make additional strategic acquisitions of businesses that have an off-highway focus. The Company continually explores worldwide opportunities to expand its manufacturing and distribution capabilities in order to serve new and existing geographies.

BUSINESS SEGMENTS

Titan designs and manufactures products for OEMs and aftermarket customers in the agricultural, earthmoving/construction, and consumer markets. For additional information concerning the revenues, expenses, income from operations, and assets attributable to each of the segments in which the Company operates, see Note 29 to the Company's consolidated financial statements, included in Item 8 of this annual report.

AGRICULTURAL SEGMENT

Titan’s agricultural rims, wheels, tires, and undercarriage systems and components are manufactured for use on various agricultural equipment, including tractors, combines, skidders, plows, planters, and irrigation equipment, and are sold directly to OEMs and to the aftermarket through independent distributors, equipment dealers, and Titan’s distribution centers. The wheels and rims range in diameter from nine inches to 54 inches, with the 54-inch diameter being the largest agricultural wheel manufactured in North America. Basic configurations are combined with distinct variations (such as different centers and a wide range of material thickness) allowing the Company to offer a broad line of products to meet customer specifications. Titan’s agricultural tires range from approximately one foot to approximately seven feet in outside diameter and from five inches to 55 inches in width. The Company offers the added value of delivering a complete wheel and tire assembly to OEM and aftermarket customers.

EARTHMOVING/CONSTRUCTION SEGMENT

The Company manufactures rims, wheels, tires, and undercarriage systems and components for various types of OTR earthmoving, mining, military, construction, and forestry equipment, including skid steers, aerial lifts, cranes, graders and levelers, scrapers, self-propelled shovel loaders, articulated dump trucks, load transporters, haul trucks, backhoe loaders, crawler tractors, lattice cranes, shovels, and hydraulic excavators. The earthmoving/construction market is often referred to as OTR, an acronym for off-the-road. The Company provides OEM and aftermarket customers with a broad range of earthmoving/construction wheels ranging in diameter from 15 inches to 63 inches and in weight from 125 pounds to 7,000 pounds. The 63-inch diameter wheel is the largest manufactured in North America for the earthmoving/construction market. Titan’s earthmoving/construction tires range from approximately three feet to approximately 13 feet in outside diameter and in weight from 50 pounds to 12,500 pounds. The Company offers the added value of wheel and tire assembly for certain applications in the earthmoving/construction segment.

CONSUMER SEGMENT

Titan manufactures bias truck tires in Latin America and light truck tires in Russia. Titan also offers select products for ATVs, turf, and golf cart applications. This segment also includes sales that do not readily fall into the Company's other segments.

SEGMENT SALES |

| | | | | | | | | | | | | | | | | |

| | Year ended December 31, |

| (Dollars in thousands) | 2017 | | 2016 | | 2015 |

| | Net Sales | | % of Total Net Sales | | Net Sales | | % of Total Net Sales | | Net Sales | | % of Total Net Sales |

| Agricultural | $ | 690,238 |

| | 47% | | $ | 583,324 |

| | 46% | | $ | 651,804 |

| | 47% |

| Earthmoving/construction | 608,894 |

| | 41% | | 524,289 |

| | 41% | | 566,988 |

| | 41% |

| Consumer | 169,790 |

| | 12% | | 157,884 |

| | 13% | | 175,979 |

| | 12% |

| | $ | 1,468,922 |

| | | | $ | 1,265,497 |

| | | | $ | 1,394,771 |

| | |

OPERATIONS

Titan’s operations include manufacturing wheels, manufacturing tires, combining these wheels and tires into assemblies, and manufacturing undercarriage systems and components for use in the agricultural, earthmoving/construction, and consumer markets. These operations entail many manufacturing processes in order to complete the finished products.

| |

| • | Wheel Manufacturing Process |

Most agricultural wheels are produced using a rim and a center disc. A rim is produced by first cutting large steel sheets to required width and length specifications. These steel sections are rolled and welded to form a circular rim, which is flared and formed in the rollform operation. The majority of discs are manufactured using presses that both blank and form the center to specifications in multiple stage operations. The Company e-coats wheels using a multi-step process prior to the final paint top coating.

Large earthmoving/construction steel wheels are manufactured from hot and cold-rolled steel sections. Hot-rolled sections are generally used to increase cross section thickness in high stress areas of large diameter wheels. A special cold forming process for certain wheels is used to increase cross section thickness while reducing the number of wheel components. Rims are built from a series of hoops that are welded together to form a rim base. The complete rim base is made from either three or five separate parts that lock together after the rubber tire has been fitted to the wheel, the parts have been fully assembled, and the assembly inflated.

For most wheels in our consumer segment, the Company manufactures rims and center discs from rolled and flat steel. Rims are rolled and welded, and discs are stamped and formed from the sheets. The manufacturing process then entails welding the rims to the centers and painting the assembled product.

| |

| • | Tire Manufacturing Process |

The first stage in tire production is the mixing of rubber, carbon black, and chemicals to form various rubber compounds. These rubber compounds are then extruded and processed with textile or steel materials to make specific components. These components – beads (wire bundles that anchor the tire with the wheel), plies (layers of fabric that give the tire strength), belts (fabric or steel fabric wrapped under the tread in some tires), tread, and sidewall – are then assembled into an uncured tire carcass. The uncured carcass is placed into a press that molds and vulcanizes the carcass under set time, temperature, and pressure into a finished tire.

| |

| • | Wheel and Tire Assemblies |

The Company’s position as a manufacturer of both wheels and tires allows Titan to mount and deliver one of the largest selections of off-highway assemblies in North America. Titan offers this value-added service of one-stop solution for wheel and tire assemblies for the agricultural, earthmoving/construction, and consumer segments. Both standard and LSW assemblies are delivered as a single, complete unit based on each customer’s unique requirements.

| |

| • | Undercarriage Manufacturing Process |

The undercarriage components (track groups, track and carrier rollers, idler assemblies, and sprockets) are all manufactured from steel and produced according to customer specifications.

All of the track groups produced by the Company are built from four major parts: shoes, right and left hand links, pins, and bushings. Shoes are manufactured from steel cast in the Company foundry or obtained from different shapes of hot rolled profiles (depending on application), sheared to length, and then heat treated for high wear bending and breaking resistance. Right and left hand links are hot forged, trimmed, mass heat treated, machined, and finally induction hardened on rail surface for optimal wear and fatigue resistance. Pins are made from round bars that are cut, machined, heat treated, and surface finished. Bushings are generally cold extruded, machined, mass heat treated, and finally carburized or induction hardened for wear resistance and optimal toughness.

The lifetime lubricated and maintenance-free track and carrier rollers are assembled with two major components: single or double flange roller shells (typically hot forged in halves, deep hardened, friction or arc welded, and finish machined with metallurgical characteristics depending upon size and application) and shafts (generally cut from bars or forged, mass heat treated, rough machined, induction hardened, and ground).

The idler assemblies are also lifetime lubricated, for virtually no maintenance. They are offered with cast (single web or hollow design) or fabricated shells, depending on size and application, and feature induction-hardened tread surfaces for optimal wear resistance.

The sprockets, designed to transfer the machine driving loads from the final drive to the track, are produced cast or forged in several geometric options, depending upon size and application. They are also heat treated for wear resistance and cracking resistance.

The undercarriage systems, custom designed and produced by the Company, consist of a structured steel fabricated frame, all the undercarriage components mentioned above (track groups, track and carrier rollers, idler assemblies, and sprockets) and a final drive. They are completely assembled in house, for consistent quality.

The Company is ISO certified at all four main domestic manufacturing facilities located in Bryan, Ohio; Des Moines, Iowa; Freeport, Illinois; and Quincy, Illinois, as well as the majority of the foreign manufacturing facilities. The ISO series is a set of related and internationally recognized standards of management and quality assurance. The standards specify guidelines for establishing, documenting, and maintaining a system to ensure quality. The ISO certifications are a testament to Titan’s dedication to providing quality products for its customers.

RAW MATERIALS

Steel and rubber are the primary raw materials used by the Company in all segments. To ensure a consistent steel supply, Titan purchases raw steel from key steel mills and maintains relationships with steel processors for steel preparation. The Company is not dependent on any single producer for its steel supply; however, some components do have limited suppliers. Rubber and other raw materials for tire manufacture represent some of the Company’s largest commodity expenses. Titan has developed a procurement strategy and practice designed to mitigate price risk and lower cost. Titan buys rubber in markets where there are usually several sources of supply. In addition to the development of key domestic suppliers, the Company’s strategic procurement plan includes international steel and rubber suppliers to assure competitive price and quality in the global marketplace. As is customary in the industry, the Company does not have long-term contracts for the purchase of steel or rubber and, therefore, purchases are subject to price fluctuations.

CAPITAL EXPENDITURES

Capital expenditures for 2017, 2016, and 2015 were $32.6 million, $41.9 million, and $48.4 million, respectively. The capital expenditures in each year were used primarily for expanding capabilities, updating manufacturing equipment, and for further automation at the Company’s facilities.

PATENTS, TRADEMARKS, AND ROYALTIES

The Company owns various patents and trademarks and continues to apply for patent protection for new products. Due to the difficult nature of predicting the interpretation of patent laws, the Company cannot anticipate or predict any material adverse effect on its operations, cash flows, or financial condition to the extent the Company is unable to protect its patents or should the Company be found to be infringing others' patents.

The Company has trademark license agreements with The Goodyear Tire & Rubber Company to manufacture and sell certain farm tires under the Goodyear name. These agreements cover sales in North America, Latin America, Europe, the Middle East, Africa, Russia, and other Commonwealth of Independent States countries. Each of these agreements expire in 2025. The North American and Latin American farm tire royalties were prepaid through March 2018 as a part of the 2011 Goodyear Latin American farm tire acquisition. The Company also has a trademark license agreement with Goodyear to manufacture and sell certain non-farm tire products in Latin America under the Goodyear name.

MARKETING AND DISTRIBUTION

The Company employs an internal sales force and utilizes several manufacturing representative firms for sales in North America, Europe, Latin America, the CIS region, and other worldwide locations. Sales representatives are primarily organized within geographic regions.

Titan distributes wheels, tires, assemblies, and undercarriage systems directly to OEMs. The distribution of aftermarket tires occurs primarily through a network of independent and OEM-affiliated dealers.

SEASONALITY

Agricultural equipment sales are seasonal by nature. Farmers generally order equipment to be delivered before the growing season. Shipments to OEMs in the agricultural industry in the U.S. and Europe usually peak during the Company’s first and second quarters for the spring planting period, while shipments in Latin America usually peak during the Company's second and third quarters for the fall planting period. Earthmoving/construction and consumer segments have historically experienced higher demand in the first and second quarters. These segments are affected by mining, building, and economic conditions.

RESEARCH, DEVELOPMENT, AND ENGINEERING

The Company’s research, development, and engineering staff tests original designs and technologies and develops new manufacturing methods to improve product performance. These services enhance the Company’s relationships with its customers. Titan's advantage as both a wheel and tire manufacturer allows the Company to design, test, and bring to market innovative solutions to meet the specific needs of its customers. For example, Titan has developed the LSW technology, featuring a larger rim diameter and a smaller sidewall than standard tires, which helps reduce power hop, road lope, soil compaction, and provides improved safety and performance. Research and development (R&D) expenses are expensed as incurred. R&D costs were $10.3 million, $10.0 million, and $11.2 million for the years ending December 31, 2017, 2016, and 2015, respectively.

CUSTOMERS

Titan’s 10 largest customers accounted for 32% of net sales for the year ended December 31, 2017, and 34% for the year ended December 31, 2016. Net sales to Deere & Company in Titan’s agricultural, earthmoving/construction, and consumer segments combined represented 9% of the Company’s consolidated revenues for each of the years ended December 31, 2017 and 2016. No other customer accounted for more than 7% of the Company’s net sales in 2017 or 2016. Management believes the Company is not dependent on any single customer; however, certain products are dependent on a few customers. While the loss of any substantial customer could impact Titan’s business, the Company believes that its diverse product mix and customer base should minimize a longer-term impact caused by any such loss.

ORDER BACKLOG

Titan estimates that, at January 31, 2018, it had $391 million in orders believed to be firm compared to $240 million at January 31, 2017. The January 31, 2018, order amount included $109 million in the agricultural segment, $273 million in the earthmoving/construction segment, and $9 million in the consumer segment. The January 31, 2017, order amount included $81 million in the agricultural segment, $152 million in the earthmoving/construction segment, and $7 million in the consumer segment. The Company believes the above orders at January 31, 2018, will be filled during the current year. The Company does not believe that its backlog is material to, or a significant factor in, evaluating and understanding any of its business segments or its businesses considered as a whole.

INTERNATIONAL OPERATIONS

The Company operates manufacturing facilities in Latin America. The Latin American operations accounted for 19% of the Company's net sales for each of the years ended December 31, 2017 and 2016.

The Company operates facilities throughout Europe, which sell to OEM and aftermarket customers. The European operations accounted for 28% of the Company's net sales for each of the years ended December 31, 2017 and 2016.

The Company operates a manufacturing facility in Volgograd, Russia. The Russian operations accounted for 7% of the Company's net sales for each of the years ended December 31, 2017 and 2016.

EMPLOYEES

At December 31, 2017, the Company employed approximately 6,300 people worldwide, including approximately 4,300 located outside the United States.

At December 31, 2017, the employees at each of the Company's Bryan, Ohio; Freeport, Illinois; and Des Moines, Iowa facilities, which collectively account for approximately 41% of the Company’s U.S. employees, were covered by collective bargaining agreements which expire in November 2021.

Outside the United States, the Company enters into employment agreements in those countries in which such relationships are mandatory or customary. The provisions of these agreements correspond in each case with the required or customary terms in the subject jurisdiction.

The Company believes it has a good relationship with the members of its workforce.

ENVIRONMENTAL LAWS AND REGULATIONS

In the ordinary course of business, similar to other industrial companies, Titan is subject to extensive and evolving federal, state, and local environmental laws and regulations, and has made provisions for the estimated financial impact of potential environmental cleanup. The Company’s policy is to accrue environmental cleanup-related costs of a non-capital nature when those costs are believed to be probable and can be reasonably estimated. Expenditures that extend the life of the related property, or mitigate or prevent future environmental contamination, are capitalized. The Company does not currently anticipate any material capital expenditures for environmental control facilities. The quantification of environmental exposures requires an assessment of many factors, including changing laws and regulations, advances in environmental technologies, the quality of information available related to specific sites, the assessment stage of the site investigation, preliminary findings, and the length of time involved in remediation or settlement. Due to the difficult nature of predicting future environmental costs, the Company cannot anticipate or predict the material adverse effect on its operations, cash flows, or financial condition as a result of efforts to comply with, or its liabilities under, environmental laws.

As of December 31, 2017, two of Titan’s subsidiaries were involved in litigation concerning environmental laws and regulations:

In October 2010, the United States of America, on behalf of the Environmental Protection Agency (EPA), filed a complaint against Dico, Inc. (Dico) and Titan Tire Corporation (Titan Tire) in the U.S. District Court for the Southern District of Iowa, wherein the EPA sought civil penalties, punitive damages, and response costs against Dico and Titan Tire pursuant to the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (CERCLA).

In June 2015, Titan Tire and Dico appealed the U.S. District Court’s order granting the EPA’s motion for summary judgment that found Dico and Titan Tire liable for civil penalties and response costs for violating CERCLA and Dico liable for civil penalties and punitive damages for violating an EPA Administrative Order.

In December 2015, the United States Court of Appeals reversed the District Court’s summary judgment order with respect to “arranger” liability for Titan Tire and Dico under CERCLA and the imposition of punitive damages against Dico for violating the EPA Administrative Order, but affirmed the summary judgment order imposing civil penalties in the amount of $1.62 million against Dico for violating the EPA Administrative Order violation. The case was remanded to the District Court for a new trial on the remaining issues.

The trial occurred in April 2017. On September 5, 2017, the District Court issued an order: (a) concluding Titan Tire and Dico arranged for the disposal of a hazardous substance in violation of 42 U.S.C. § 9607(a); (b) holding Titan Tire and Dico jointly and severally liable for $5.45 million in response costs previously incurred and reported by the United States relating to the alleged violation, including enforcement costs and attorney’s fees; and (c) awarding a declaratory judgment holding Titan Tire and Dico jointly and severally liable for all additional response costs previously incurred but not yet reported or to be incurred in the future, including enforcement costs and attorney’s fees. The District Court also held Dico liable for $5.45 million in punitive damages under 42 U.S.C. § 9607(c)(3) for violating a unilateral administrative order. The punitive damages award does not apply to Titan Tire. The Company accrued a contingent liability of $6.5 million, representing $5.45 million in costs incurred by the United States and $1.05 million of additional response costs, for this order.

Titan Tire and Dico are appealing the case to the United States Court of Appeals for the Eighth Circuit. The Notice of Appeal was filed on November 2, 2017, and an appeal bond was secured to stay the execution of any collection actions on the underlying judgment pending the outcome of the appeal.

COMPETITION

The Company competes with several domestic and international companies, some of which are larger and have greater financial and marketing resources than Titan. The Company believes it is a primary source of steel wheels and rims to the majority of its North American customers. Major competitors in the off-highway wheel market include GKN Wheels, Ltd., Trelleborg Group, and Topy Industries, Ltd. Significant competitors in the off-highway tire market include Alliance Tire Company Ltd., Balkrishna Industries Limited (BKT), Bridgestone/Firestone, Michelin, Mitas a.s., and Pirelli. Significant competitors in the undercarriage market include Berco and Caterpillar.

The Company competes on the basis of price, quality, sales support, customer service, design capability, and delivery time. The Company's position of manufacturing both the wheel and the tire allows us to provide innovative assembly solutions for our customers, creating a competitive advantage in the marketplace. The Company’s ability to compete with international competitors may be adversely affected by currency fluctuations. Titan owns the molds and dies used to produce its wheels and tires. However, certain of the Company’s OEM customers could elect to manufacture their own products to meet their requirements or to otherwise compete with the Company. There can be no assurance that the Company will not be adversely affected by increased competition in the markets in which it operates, or that competitors will not develop products that are more effective, less expensive, or otherwise render certain of Titan’s products less competitive. From time to time, certain of the Company’s competitors have reduced their prices in particular product categories, which has prompted Titan to reduce prices as well. There can be no assurance that competitors of the Company will not further reduce prices in the future or that any such reductions would not have a material adverse effect on the Company.

NEW YORK STOCK EXCHANGE CERTIFICATION

The Company submitted to the New York Stock Exchange during fiscal 2017 the Annual CEO Certification required by Section 303A.12(a) of the New York Stock Exchange Listed Company Manual.

AVAILABLE INFORMATION

The Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and any amendments to those reports are made available, without charge, through the Company’s website located at www.titan-intl.com as soon as reasonably practicable after they are filed with the Securities and Exchange Commission (SEC). You can also obtain copies of these materials by visiting the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549, by calling the SEC at 800-SEC-0330, or by accessing the SEC’s website at www.SEC.gov. The following documents are also posted on the Company’s website:

| |

| • | Corporate Governance Policy |

| |

| • | Compensation Committee Charter |

| |

| • | Nominating Committee Charter |

| |

| • | Corporate Governance Committee Charter |

Printed copies of these documents are available, without charge, by writing to: Titan International, Inc.,

c/o Corporate Secretary, 2701 Spruce Street, Quincy, IL 62301.

The information on, or that may be accessed through, the aforementioned websites is not incorporated into this filing and should not be considered a part of this filing.

ITEM 1A – RISK FACTORS

The Company is subject to various risks and uncertainties, including those described below, relating to or arising out of the nature of its business and general business, economic, financing, legal, and other factors or conditions that may affect the Company. Realization of any of the following risks could have a material adverse effect on Titan’s business, financial condition, cash flows, and results of operations and, in turn, the value of Titan securities. In addition, other risks not presently known or that the Company currently believes to be immaterial may also adversely affect Titan's business, financial condition, and results of operations, perhaps materially. The risks discussed below also include forward-looking statements, and actual results and events may differ substantially from those discussed or highlighted in these forward-looking statements. Before making an investment decision with respect to any of Titan securities, you should carefully consider the following risks and uncertainties described below and elsewhere in this annual report.

| |

| • | The Company is exposed to price fluctuations of key commodities. |

The Company uses various raw materials, most significantly steel and rubber, in manufacturing its products across all of its market segments. The Company does not generally enter into long-term commodity contracts and does not use derivative commodity instruments to hedge exposures to commodity market price fluctuations. Therefore, the Company is exposed to price fluctuations of key commodities. Although the Company attempts to pass on certain material price increases to its customers, there is no assurance that the Company will be able to do so in the future. Any increase in the price of steel and rubber that is not passed on to customers could result in declining margins and have a material adverse effect on Titan’s financial condition and results of operations.

| |

| • | The Company relies on a limited number of suppliers. |

The Company currently relies on a limited number of suppliers for certain key commodities, which consist primarily of steel and rubber, in the manufacturing of Titan products. If the Company’s suppliers are unable to provide raw materials to Titan in a timely manner, or are unable to meet our quality, quantity or cost requirements, the Company may not in all cases be able to promptly obtain substitute sources. Any extended delay in receiving critical materials could impair Titan’s ability to deliver products to its customers. The loss of key suppliers, the inability to establish relationships with replacement suppliers, or the inability of Titan's suppliers to meet price, quality, quantity, and delivery requirements could have a significant adverse impact on the Company’s results of operations.

| |

| • | The Company���s revolving credit facility and other debt obligations contain covenants that could limit how the Company conducts its business. |

The Company’s revolving credit facility and other debt obligations contain covenants and restrictions. These covenants and restrictions could limit Titan’s ability to respond to market conditions, to provide for unanticipated capital investments, to raise additional debt or equity capital, to pay dividends, or to take advantage of business opportunities, including future acquisitions. The failure to meet or otherwise comply with these items could result in the Company ultimately being in default. Titan’s ability to comply with the covenants may be affected by events beyond its control, including prevailing economic, financial, and industry conditions.

| |

| • | The Company operates in cyclical industries and is subject to numerous changes in the economy. |

The Company's sales are substantially dependent on three major industries: agricultural equipment, earthmoving/construction equipment, and consumer products. The business activity levels in these industries are subject to specific industry and general economic cycles. Any downturn in these industries or the general economy could have a material adverse effect on Titan’s business.

The agricultural equipment industry is affected by crop prices, farm income and farmland values, weather, export markets, and government policies. The earthmoving/construction industry is affected by the levels of government and private construction spending and replacement demand. The mining industry, which is within the earthmoving/construction industry, is affected by raw material commodity prices. The consumer products industry is affected by consumer disposable income, weather, competitive pricing, energy prices, and consumer attitudes. In addition, the performance of these industries is sensitive to interest rate and foreign exchange rate changes and varies with the overall level of economic activity.

| |

| • | The Company’s revenues are seasonal in nature due to Titan’s dependence on seasonal industries. |

The agricultural, earthmoving/construction, and recreational industries are seasonal, with typically lower sales during the second half of the year. This seasonality in demand has resulted in fluctuations in the Company’s revenues and operating results. Because much of Titan’s overhead expenses are fixed, seasonal trends can cause volatility in profit margins and Titan's financial condition, especially during slower periods.

| |

| • | The Company’s customer base is relatively concentrated. |

The Company’s ten largest customers, which are primarily original equipment manufacturers (OEMs), accounted for 32% of Titan’s net sales for 2017. Net sales to Deere & Company represented 9% of total 2017 net sales. No other customer accounted for more than 7% of Titan's net sales in 2017. As a result, Titan’s business could be adversely affected if one of its larger customers reduces, or otherwise eliminates in full, its purchases from Titan due to work stoppages or slow-downs, financial difficulties, as a result of termination provisions, competitive pricing, or other reasons. There is also continuing pressure from OEMs to reduce costs, including the cost of products and services purchased from outside suppliers such as Titan, and in that regard OEMs may develop in-house tire and wheel capabilities. There can be no assurance that Titan will be able to maintain its long-term relationships with its major customers. Any failure to maintain the Company’s relationship with a leading customer could have an adverse effect on results of operations.

| |

| • | The Company may be adversely affected by changes in government regulations and policies. |

Domestic and foreign political developments and government regulations and policies directly affect the agricultural, earthmoving/construction, and consumer products industries in the United States and abroad. Regulations and policies in the agricultural industry include those encouraging farm acreage reduction in the United States and granting ethanol subsidies. Regulations and policies relating to the earthmoving/construction industry include those relating to the construction of roads, bridges, and other items of infrastructure. The modification of existing laws, regulations, or policies, or the adoption of new laws, regulations, or policies could have an adverse effect on any one or more of these industries and, therefore, on Titan’s business.

| |

| • | The Company is subject to corporate governance requirements, and costs related to compliance with, or failure to comply with, existing and future requirements could adversely affect Titan’s business. |

The Company is subject to corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as rules and regulations of the Securities and Exchange Commission (SEC), the Public Company Accounting Oversight Board (PCAOB), and the New York Stock Exchange (NYSE). These laws, rules, and regulations continue to evolve and may become increasingly restrictive in the future. Failure to comply with these laws, rules, and regulations may have a material adverse effect on Titan’s reputation, financial condition, and the value of the Company’s securities.

| |

| • | The Company is subject to risks associated with maintaining adequate disclosure controls and internal controls over financial reporting. |

Failure to maintain adequate financial and management processes and controls could affect the accuracy and timing of the Company's financial reporting. Testing and maintaining internal control over financial reporting involves significant costs and could divert management's attention from other matters that are important to Titan's business. If the Company does not maintain adequate financial and management personnel, processes, and controls, it may not be able to accurately report its financial performance on a timely basis, which could have a material adverse effect on the confidence in its financial reporting, its credibility in the marketplace, and the trading price of Titan's common stock.

| |

| • | The Company faces substantial competition from domestic and international companies. |

The Company competes with several domestic and international competitors, some of which are larger and have greater financial and marketing resources than Titan. Titan competes on the basis of price, quality, sales support, customer service, design capability, and delivery time. The Company’s ability to compete with international competitors may be adversely affected by currency fluctuations. In addition, certain OEM customers could elect to manufacture certain products to meet their own requirements or to otherwise compete with Titan. The success of the Company's business depends in large part on its ability to provide comprehensive wheel and tire assemblies to its customers. The development or enhancement by Titan's competitors of similar capabilities could adversely affect its business.

There can be no assurance that Titan’s businesses will not be adversely affected by increased competition in the Company’s markets, or that competitors will not develop products that are more effective or less expensive than Titan products or which could render certain products less competitive. From time to time certain competitors have reduced prices in particular product categories, which has caused Titan to reduce prices. There can be no assurance that in the future Titan’s competitors will not further reduce prices or that any such reductions would not have a material adverse effect on Titan’s business.

| |

| • | The Company may be affected by unfair trade. |

Titan faces intense competition from producers both in the United States and around the world, some of which may engage in unfair trade practices. For example, in early January 2016, Titan, along with the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Worker International Union, AFL-CIO, CLC of Pittsburgh, Pennsylvania, filed petitions with the U.S. Department of Commerce (DOC) and the U.S. International Trade Commission (ITC) alleging that imported off-the-road tires from India and Sri Lanka and wheel and tire assemblies from China were being dumped and/or subsidized and were a cause of material injury to the domestic industry. Unfair trade may have a material adverse effect on Titan's business.

| |

| • | The Company could be negatively impacted if Titan fails to maintain satisfactory labor relations. |

Titan is party to collective bargaining agreements covering a portion of the Company's workforce. If Titan is unable to maintain satisfactory labor relations with its employees covered by collective bargaining agreements, these employees could engage in strikes, or the Company may otherwise experience work slowdowns or be subject to other labor actions. Any such actions, and any other labor disputes with the Company’s employees domestically or internationally, could materially disrupt its operations. Future collective bargaining agreements may impose significant additional costs on Titan, which could adversely affect its financial condition and results of operations.

| |

| • | Unfavorable outcomes of legal proceedings could adversely affect results of operations. |

On September 5, 2017, the United States District Court for the Southern District of Iowa issued an order in an action brought by the United States of America on behalf of the EPA: (a) concluding Titan Tire and Dico arranged for the disposal of a hazardous substance; (b) holding Titan Tire and Dico jointly and severally liable for $5.45 million in response costs previously incurred and reported by the United States relating to the alleged violation; and (c) awarding a declaratory judgment holding Titan Tire and Dico jointly and severally liable for all additional response costs previously incurred but not yet reported or to be incurred in the future. The District Court also held Dico liable for $5.45 million in punitive damages for violating a unilateral administrative order. The punitive damages award does not apply to Titan Tire. The Company accrued a contingent liability of $6.5 million for this order in the quarter ended September 30, 2017. Titan Tire and Dico are appealing the case to the United States Court of Appeals for the Eighth Circuit. The Notice of Appeal was filed on November 2, 2017, and an appeal bond was secured to stay the execution of any collections actions on the underlying judgment pending the outcome of the appeal.

In addition, the Company is a party to routine legal proceedings arising out of the normal course of business. Due to the difficult nature of predicting unresolved and future legal claims, the Company cannot anticipate or predict any material adverse effect on its consolidated financial condition, results of operations, or cash flows as a result of efforts to comply with, or its liabilities pertaining to, legal judgments. Any adverse outcome in any litigation involving Titan or any of its subsidiaries could negatively affect the Company's business, reputation, and financial condition.

| |

| • | Acquisitions/divestitures may require significant resources and/or result in significant losses, costs, or liabilities. |

Any future acquisitions or divestitures will depend on the Company’s ability to identify suitable opportunities, to negotiate acceptable terms, and to finance acquisitions. Titan will also face competition for suitable acquisition candidates, which may increase costs. In addition, acquisitions and divestitures require significant managerial attention, which may be diverted from current operations. Furthermore, acquisitions and divestitures of businesses or facilities entail a number of additional risks, including:

- problems with effective integration or separation of operations, including challenges in implementing uniform standards, controls, procedures, and policies throughout an acquired business;

- potential disruption of the Company's ongoing business and the distraction of management from its day-to-day operations;

- the inability to maintain key customer, supplier, and employee relationships;

- the potential that expected benefits or synergies are not realized to the extent anticipated, or at all, and operating costs increase; and

- exposure to unanticipated liabilities.

International acquisitions or divestitures may be more complex and time consuming. Also, international acquisitions and divestitures may include a number of additional risks, including the integration of acquisitions or separation of divestitures in compliance with foreign laws and regulations and business and accounting systems.

Subject to the terms of its existing indebtedness, the Company may finance future acquisitions with cash from operations, additional indebtedness, and/or by issuing additional equity securities. These commitments may impair the operation of Titan’s businesses. In addition, the Company could face financial risks associated with incurring additional indebtedness, such as reducing liquidity and access to financing markets and increasing the amount of cash flow required to service such indebtedness.

| |

| • | The Company has international operations and purchases raw material from foreign suppliers. |

The Company had total aggregate net sales outside the United States of approximately $826.2 million, $707.2 million, and $750.2 million for the years ended December 31, 2017, 2016, and 2015, respectively. Net sales outside the United States have become a significant proportion of total net sales, accounting for 56%, 56%, and 54% for the years ending December 31, 2017, 2016, and 2015, respectively. Net sales from these international operations are expected to continue to represent a similar portion of total net sales for the foreseeable future.

International Operations and Sales – International operations and sales are subject to a number of special risks, including, but not limited to, risks with respect to currency exchange rates, economic and political destabilization, other disruption of markets, and restrictive actions by foreign governments (such as restrictions on transfer of funds, export duties, and quotas and foreign customs). Other risks include changes in foreign laws regarding trade and investment; difficulties in obtaining distribution and support; nationalization; reforms of United States laws and policies affecting trade, foreign investment, and loans; and changes in foreign tax and other laws. There may also be restrictions on the Company's ability to repatriate earnings and investments from international operations. There can be no assurance that one or a combination of these factors will not have a material adverse effect on the Company’s ability to increase or maintain its international sales.

Foreign Suppliers – The Company purchases raw materials from foreign suppliers. The production costs, profit margins, and competitive position of the Company are affected by the strength of the currencies in countries where Titan purchases goods, relative to the strength of the currencies in countries where the products are sold. The Company’s results of operations, cash flows, and financial position may be affected by fluctuations in foreign currencies.

| |

• | The Company is subject to anti-corruption laws and regulations. |

The Company has international operations and must comply with anti-corruption laws and regulations including the U.S. Foreign Corrupt Practices Act (FCPA). These anti-bribery laws generally prohibit companies and their intermediaries from making improper payments or providing anything of value for the purpose of obtaining or retaining business. The FCPA prohibits these payments regardless of local customs and practices. Safeguards that Titan may implement to discourage these practices could prove to be ineffective, and violations of these laws may result in criminal or civil sanctions or other liabilities or proceedings against Titan and could adversely affect the Company's business and reputation.

| |

| • | The Company may be subject to product liability and warranty claims. |

The Company warrants its products to be free of certain defects and, accordingly, may be subject, in the ordinary course of business, to product liability or product warranty claims. Losses may result or be alleged to result from defects in Titan products, which could subject the Company to claims for damages, including consequential damages. There can be no assurance that the Company's insurance coverage will be adequate for liabilities actually incurred or that adequate insurance will be available on terms acceptable to the Company. Any claims relating to defective products that result in liability exceeding Titan’s insurance coverage could have a material adverse effect on Titan's financial condition and results of operations. Further, claims of defects could result in negative publicity against Titan, which could adversely affect the Company’s business and reputation.

| |

| • | The Company has incurred, and may incur in the future, net losses. |

The Company reported a loss before income taxes of $52.9 million, $36.5 million, and $55.1 million for the years ended December 31, 2017, 2016, and 2015, respectively, and may incur losses in the future. There is no guarantee the Company will be profitable in the future.

| |

| • | The Company may be adversely affected by a disruption in, or failure of, information technology systems. |

The Company relies upon information technology systems, some of which are managed by third parties, to process, transmit, and store electronic information. Technology systems are used in a variety of business processes and activities, including purchasing, manufacturing, distribution, invoicing, and financial reporting. The Company utilizes security measures and business continuity plans to prevent, detect, and remediate damage from computer viruses, natural disasters, unauthorized access (whether through cybersecurity attacks or otherwise), utility failures, and other similar disruptions. Despite Titan's security measures and plans, a security breach or information technology system failure may disrupt and adversely affect the Company's operations and there can be no assurance that any such security measures or plans will be sufficient to mitigate all potential risks to Titan's systems, networks, and information. A significant theft, loss, or fraudulent use of customer or employee information could adversely impact the Company's reputation and could result in unauthorized release of confidential or otherwise protected information, significant costs, fines, and litigation, including with respect to enhanced cybersecurity protection and remediation costs.

| |

| • | The Company is subject to risks associated with climate change regulations. |

Governmental regulatory bodies in the United States and other countries have adopted, or are contemplating introducing regulatory changes in response to the potential impacts of climate change. Laws and regulations regarding climate change and energy usage may impact the Company directly through higher costs for energy and raw materials. The Company’s customers may also be affected by climate change regulations that may impact future purchases of the Company's products. Physical climate change may potentially have a large impact on the Company’s two largest industry segments, agriculture and earthmoving/construction. The potential impacts of climate change and climate change regulations are highly uncertain at this time, and the Company cannot anticipate or predict any material adverse effect on its consolidated financial condition, results of operations, or cash flows as a result of climate change and climate change regulations.

| |

| • | The Company is subject to risks associated with environmental laws and regulations. |

The Company’s operations are subject to federal, state, local, and foreign laws and regulations governing, among other things, emissions to air, discharge to waters, and the generation, handling, storage, transportation, treatment, and disposal of waste and other materials. The Company’s operations entail risks in these areas, and there can be no assurance that Titan will not incur material costs or liabilities. In addition, potentially significant expenditures could be required in order to comply with evolving environmental and health and safety laws, regulations, or requirements that may be adopted or imposed in the future. Titan’s customers may also be affected by environmental laws and regulations that may impact future purchases of the Company's products.

| |

| • | The Company is subject to foreign currency translation risk. |

The Company continues to expand globally and now operates in many worldwide locations and transacts business in many foreign currencies. Titan's financial statements are reported in U.S. dollars with financial statements of international subsidiaries being initially recorded in foreign currencies and translated into U.S. dollars. Large fluctuations in currency exchange rates between the U.S. dollar and other world currencies may materially adversely affect the Company's financial condition, results of operations, and liquidity.

| |

| • | The Company may incur additional tax expense or tax exposure. |

The Company is subject to income taxes in the United States and numerous foreign jurisdictions, and has domestic and international tax liabilities which are dependent upon the distribution of income among these different jurisdictions. Titan's income tax provision and cash tax liability in the future could be adversely affected by numerous factors, including income before taxes being lower than anticipated in countries with lower statutory tax rates and higher than anticipated in countries with higher statutory tax rates, changes in the valuation of deferred tax assets and liabilities, and changes in tax laws and regulations.

| |

| • | The Company is subject to risks associated with uncertainties related to social, political, and economic conditions in Russia and Brazil. |

Geopolitical and economic uncertainties relating to Russia and Brazil have and could continue to have a negative impact on the Company's sales and results of operations at the Company's Russian and Brazilian operations.

| |

| • | The Company is not insured against all potential losses and could be harmed by natural disasters, catastrophes, or sabotage. |

The Company's business activities involve substantial investments in manufacturing facilities and products are produced at a limited number of locations. These facilities could be materially damaged, including as a result of natural disasters, such as fires, floods, tornadoes, hurricanes, and earthquakes, or by sabotage. The Company could incur uninsured losses and liabilities arising from such events, as well as damage to its reputation, and/or suffer material losses in operational capacity and efficiency, which could have a material adverse impact on Titan's business, financial condition, and results of operations.

| |

| • | The Company's redeemable noncontrolling interest includes a settlement put option which may be settled with cash or Titan common stock. |

The Company's redeemable noncontrolling interest in Voltyre-Prom includes a settlement put option which is exercisable during a six-month period beginning July 9, 2018. The redeemable noncontrolling interest may be purchased, with cash or Titan common stock, at an amount set by the Shareholder's Agreement, which is estimated to be approximately $117 million to $122 million, if exercised in full.

ITEM 1B – UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2 – PROPERTIES

The Company’s properties with total square footage above one million are detailed by the location, size, and focus of each facility as provided in the table below (amounts in thousands):

|

| | | | | | | | | |

| | | Approximate square footage | | | | |

| Location | | Owned | | Leased | | Use | | Segment |

| Volzhsky, Russia | | 2,153 |

| | | | Manufacturing, distribution | | All segments |

| Union City, Tennessee | | 2,149 |

| | | | Manufacturing, distribution | | All segments |

| Des Moines, Iowa | | 1,930 |

| | | | Manufacturing, distribution | | All segments |

| Sao Paulo, Brazil | | 1,282 |

| | | | Manufacturing, distribution | | All segments |

| Quincy, Illinois | | 1,209 |

| | | | Manufacturing, distribution | | All segments |

| Freeport, Illinois | | 1,202 |

| | | | Manufacturing, distribution | | All segments |

The Company’s total properties by continent are detailed by the location, size, and focus as provided in the table below (amounts in thousands):

|

| | | | | | | | | | |

| | | Approximate square footage | | | | |

| Location | | Owned | | Leased | | Use | | Segment |

| North America | | 8,704 |

| | 535 |

| | Manufacturing, distribution | | All segments |

| Europe | | 3,918 |

| | 16 |

| | Manufacturing, distribution | | All segments |

| South America | | 1,434 |

| | 74 |

| | Manufacturing, distribution | | All segments |

| Australia | | | | 1,453 |

| | Manufacturing, distribution | | All segments |

| Asia | | 646 |

| | 269 |

| | Manufacturing, distribution | | All segments |

The Company considers each of its facilities to be in good condition and adequate for present use. Management believes that the Company has sufficient capacity to meet current market demand with the active facilities.

ITEM 3 – LEGAL PROCEEDINGS

The Company is a party to routine legal proceedings arising out of the normal course of business. Although it is not possible to predict with certainty the outcome of these unresolved legal actions or the range of possible loss, the Company believes at this time that none of these actions, individually or in the aggregate, will have a material adverse effect on the consolidated financial condition, results of operations, or cash flows of the Company. However, due to the difficult nature of predicting unresolved and future legal claims, the Company cannot anticipate or predict the material adverse effect on its consolidated financial condition, results of operations, or cash flows as a result of efforts to comply with, or its liabilities pertaining to, legal judgments.

Presently, Titan is engaged in the following material legal proceeding:

In early January 2016, Titan, along with the United Steel, Paper and Forestry, Rubber, Manufacturing, Energy, Allied Industrial and Service Worker International Union, AFL-CIO, CLC of Pittsburgh, Pennsylvania, filed petitions with the DOC and the ITC alleging that imported off-the-road tires from India and Sri Lanka and wheel and tire assemblies from China were being dumped and/or subsidized and were a cause of material injury to the domestic industry. Both the DOC and the ITC initiated investigations against India and Sri Lanka, but the ITC did not recommend pursuing the investigation into wheel and tire assemblies from China. On January 4, 2017, the DOC made a final affirmative determination in both the Indian and Sri Lankan countervailing duty cases, and subsequently made an amended affirmative final determination of dumping on imports from India for all but one company. Also on January 4, 2017, the ITC conducted the final injury hearing on Titan and the United Steel Workers’ petitions. In February 2017, the ITC determined, by unanimous vote, that the domestic industry producing certain off-the-road tires was materially injured by reason of subsidized imports from India and Sri Lanka and "dumped" imports from India. On March 9, 2017, countervailing duty orders on imports of off-the-road tires from India and Sri Lanka and an anti-dumping duty order on such tires from India (with the exception of imports from one company) were published in the Federal Register by the DOC. Following the ITC's February 28, 2017, determination, importers of products covered by the DOC's countervailing duty orders and antidumping order are required to post cash deposits equal to the countervailing duty amounts identified in the orders.

Two of Titan’s subsidiaries, Dico, Inc. and Titan Tire Corporation, are currently involved in litigation concerning environmental laws and regulations. See "Environmental Laws and Regulations" in Item 1 for additional information.

ITEM 4 – MINE SAFETY DISCLOSURES

Not applicable.

PART II

| |

| ITEM 5 | – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s common stock is traded on the New York Stock Exchange (NYSE) under the symbol TWI. As of February 15, 2018, there were approximately 350 holders of record of Titan common stock. The following table sets forth the high and low sales prices per share of common stock as reported on the NYSE, as well as information concerning per share dividends declared for the periods indicated.

|

| | | | | | | | | | | | |

| 2017 | | High | | Low | | Dividends Declared |

| First quarter | | $ | 14.23 |

| | $ | 9.21 |

| | $ | 0.005 |

|

| Second quarter | | 12.23 |

| | 8.52 |

| | 0.005 |

|

| Third quarter | | 13.00 |

| | 7.97 |

| | 0.005 |

|

| Fourth quarter | | 13.35 |

| | 9.33 |

| | 0.005 |

|

| 2016 | | |

| | |

| | |

|

| First quarter | | $ | 6.32 |

| | $ | 2.50 |

| | $ | 0.005 |

|

| Second quarter | | 7.50 |

| | 4.80 |

| | 0.005 |

|

| Third quarter | | 10.19 |

| | 5.97 |

| | 0.005 |

|

| Fourth quarter | | 12.14 |

| | 8.82 |

| | 0.005 |

|

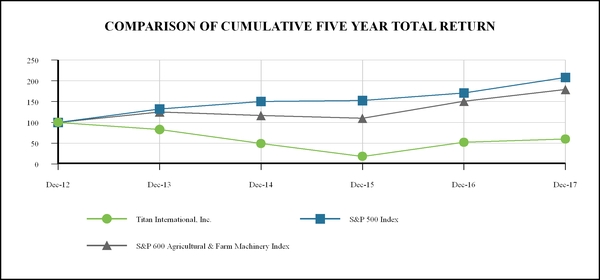

PERFORMANCE COMPARISON GRAPH

The performance graph below compares cumulative total return on the Company’s common stock over the past five years against the cumulative total return of the Standard & Poor’s 600 Agricultural & Farm Machinery Index, and against the Standard & Poor’s 500 Stock Index. The graph depicts the value on December 31, 2017, of a $100 investment made on December 31, 2012, in Company common stock and each of the other two indices, with all dividends reinvested. The stock price performance reflected below is based on historical results and is not necessarily indicative of future stock price performance.

The performance graph is not deemed to be “soliciting material” or to be “filed” with the SEC for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act) or otherwise subject to the liabilities under that Section, and shall not be deemed to be incorporated by reference into any filing of Titan under the Securities Act of 1933 or the Exchange Act.

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Fiscal Year Ended December 31, |

| | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

| Titan International, Inc. | $ | 100.00 |

| | $ | 82.88 |

| | $ | 49.07 |

| | $ | 18.24 |

| | $ | 52.04 |

| | $ | 59.90 |

|

| S&P 500 Index | 100.00 |

| | 132.39 |

| | 150.51 |

| | 152.59 |

| | 170.84 |

| | 208.14 |

|

| S&P 600 Agricultural & Farm Machinery Index (a) | 100.00 |

| | 125.10 |

| | 116.41 |

| | 109.87 |

| | 150.56 |

| | 178.93 |

|

(a) The S&P 600 Agricultural & Farm Machinery index was created March 2014. The index data above reflects the old S&P 600 Construction & Farm Machinery & Heavy Trucks index from 12/31/12 - 2/28/14 and the new S&P 600 Agricultural & Farm Machinery index from 3/31/14 - forward.