UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240.14a-12

Titan International, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

| 1) | Title of each class of securities to which transaction applies: |

______________________________________________________________________________________

| |

| 2) | Aggregate number of securities to which transaction applies: |

______________________________________________________________________________________

| |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

______________________________________________________________________________________

| |

| 4) | Proposed maximum aggregate value of transaction. |

______________________________________________________________________________________

______________________________________________________________________________________

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration number, or the Form or Schedule and the date of its filing.

| |

| 1) | Amount Previously Paid: |

______________________________________________________________________________________

| |

| 2) | Form, Schedule or Registration Statement No.: |

______________________________________________________________________________________

______________________________________________________________________________________

______________________________________________________________________________________

Titan International, Inc.

2701 Spruce Street Quincy, Illinois 62301

______________________ ______________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Meeting Date: June 11, 2020

To Titan Stockholders:

The Annual Meeting of Stockholders (the Annual Meeting) of Titan International, Inc., a Delaware corporation (Titan or the Company), is to be held on Thursday, June 11, 2020, at 10:00 a.m. Central Daylight Time, at Titan Tire Corporation, 2345 East Market Street, Des Moines, IA 50317*, to consider and act upon the following matters:

| |

| 1) | Election of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, and Maurice M. Taylor Jr. as directors to serve for one-year terms and until their successors are elected and qualified; |

| |

| 2) | Ratification of the selection of Grant Thornton LLP by the Board of Directors as the independent registered public accounting firm to audit the Company's financial statements for the year ending December 31, 2020; |

| |

| 3) | Approval, in a non-binding advisory vote, of the 2019 compensation paid to the Company's named executive officers; and |

To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Titan's Board of Directors has fixed the close of business on April 14, 2020, as the "record date." Only those stockholders whose names appear as holders of record of Titan common stock at the Company's close of business on April 14, 2020, are entitled to receive notice of, and to vote at, the Annual Meeting or any adjournments or postponements thereof. A copy of Titan's Annual Report, including Form 10-K, for the year ended December 31, 2019, is being made available concurrently with this Proxy Statement to all stockholders entitled to notice of and to vote at the Annual Meeting.

Every stockholder's vote is important. All stockholders are encouraged to attend the Annual Meeting in person* or by proxy. Stockholders can help the Company avoid unnecessary costs and delay by voting your shares as soon as possible. In addition to voting in person, stockholders of record may vote over the internet or by telephone, following the instructions in the Notice of Internet Availability of Proxy Materials (the Notice) that you received in the mail and this Proxy Statement, or, if you requested to receive printed proxy materials by mail, by completing, signing, dating and promptly returning your proxy card in the return envelope, which requires no postage if mailed in the United States. If you vote by telephone or Internet, you do not need to mail back a proxy card. Please review the instructions on each of your voting options described in this Proxy Statement, as well as in the Notice you received in the mail. Please note that if your shares are held by a broker or other intermediary and you wish to vote at the Annual Meeting, you must obtain a legal proxy from that record holder. The presence, in person or by properly executed proxy, of the majority of common stock outstanding on the record date is necessary to constitute a quorum for the transaction of business at the Annual Meeting.

Meeting Attendance: Please note that if you are attending the Annual Meeting in person*, proof of Titan common stock ownership as of the record date must be presented, in addition to valid photo identification.

|

| | | |

| | | By Order of the Board of Directors, | |

| | | | |

| | | /s/ MICHAEL G. TROYANOVICH | |

| Quincy, Illinois | | Michael G. Troyanovich | |

| April 28, 2020 | | Secretary and General Counsel | |

* We currently intend to hold the Annual Meeting in person. The health and well-being of our various stakeholders is our top priority. Accordingly, as part of our precautions regarding the coronavirus (or COVID-19) outbreak, we are monitoring the situation regarding COVID-19 and are preparing for the possibility that the Annual Meeting may be held solely by means of remote communication. If we take this step, we will announce the decision to do so in advance and make details on how to participate in the Annual Meeting available at https://ir.titan-intl.com/home/default.aspx. Please monitor the website for updated information. As always, we encourage you to vote your shares prior to the Annual Meeting.

TABLE OF CONTENTS

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TITAN INTERNATIONAL, INC.

Meeting Date: June 11, 2020

GENERAL MATTERS

This Proxy Statement is being furnished to the stockholders of Titan International, Inc. (Titan or the Company) in connection with the solicitation of proxies by the Board of Directors of the Company (the Board of Directors) for use at the Annual Meeting of Stockholders (the Annual Meeting) to be held on June 11, 2020, at the time and place and for the purposes set forth in the accompanying Notice of Annual Meeting, and at any adjournment or postponement of that meeting. The Company is commencing mailing of the Notice of Internet Availability of Proxy Materials (the Notice), in lieu of a paper copy of this Proxy Statement, to its stockholders on or about April 28, 2020. In accordance with rules adopted by the Securities and Exchange Commission (the SEC), the Company may furnish proxy materials, including this Proxy Statement and its Annual Report, to its stockholders by providing access to such documents on the Internet instead of mailing printed copies. The Company has elected to provide its stockholders access to the Company’s proxy materials over the Internet; accordingly, most stockholders will not receive printed copies of these proxy materials unless they request them. Instead, the Notice, which was previously mailed to the Company’s stockholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs you as to how you may submit your proxy, including by telephone or over the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in the Notice. Although the Company's Annual Report to Stockholders, including Form 10-K, for the year ended December 31, 2019, has been made available to Titan stockholders in connection with the solicitation of proxies by the Board of Directors, it is not incorporated by reference into this Proxy Statement and shall not be deemed to be proxy soliciting material. In this Proxy Statement, unless the context requires otherwise, references to “we,” “our,” or “us” refer to Titan.

VOTING PROCEDURES

Qualifications to Vote

Only holders of shares of common stock of the Company (Common Stock) at the close of business on April 14, 2020 (the Record Date) will be entitled to receive notice of, and vote at, the Annual Meeting or any adjournment or postponement thereof. Shares of Common Stock held on the Record Date include shares that are held directly in the name of a holder of Common Stock (the Common Stockholders) as the registered stockholder of record on the Record Date and those shares of which the Common Stockholder is the beneficial owner on the Record Date and which are held through a broker, bank, or other institution, as nominee, on the Common Stockholder’s behalf (sometimes referred to as being held in “street name”), that is considered the stockholder of record of those shares.

Shares Entitled to Vote

On the Record Date, there were 60,602,294 shares of Common Stock outstanding, and there were no other outstanding classes of stock that will be entitled to vote at the Annual Meeting.

Votes per Share

Common Stockholders are entitled to one vote per share of Common Stock they held of record on the Record Date on each matter that may properly come before the Annual Meeting.

Proposals Requiring Vote; Board Recommendation

Common Stockholders are being asked to consider and vote upon the following matters:

Proposal #1: Election of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, and Maurice M. Taylor Jr., as directors to serve for one-year terms and until their successors are elected and qualified;

Proposal #2: Ratification of the selection of Grant Thornton LLP by the Board of Directors as the independent registered public accounting firm to audit the Company's financial statements for the year ending December 31, 2020;

Proposal #3: Approval, in a non-binding advisory vote, of the 2019 compensation paid to the Company's named executive officers;

and such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. The Board of Directors unanimously recommends that you vote FOR each of the nominees named in Proposal #1 and FOR each of Proposals #2 and #3.

Time and Place; Directions; Attending the Annual Meeting

The Annual Meeting of Stockholders of Titan will be held on Thursday, June 11, 2020, at 10:00 a.m. Central Daylight Time, at Titan Tire Corporation, 2345 East Market Street, Des Moines, IA 50317. You may call Titan Tire Corporation at (515) 265-9404 for directions to the location of the Annual Meeting.

Please note that if you are attending the Annual Meeting in person, proof of Common Stock ownership as of the Record Date must be presented, in addition to valid photo identification. As part of our precautions regarding the coronavirus (or COVID-19) outbreak, the Company is monitoring the situation regarding COVID-19 and is preparing for the possibility that the Annual Meeting may be held solely by means of remote communication. If the Company takes this step, an announcement will be made in advance by the Company of its decision to do so, and the Company will make details on how to participate in the Annual Meeting available at https://ir.titan-intl.com/home/default.aspx. Common Stockholders are encouraged to monitor the website for updated information.

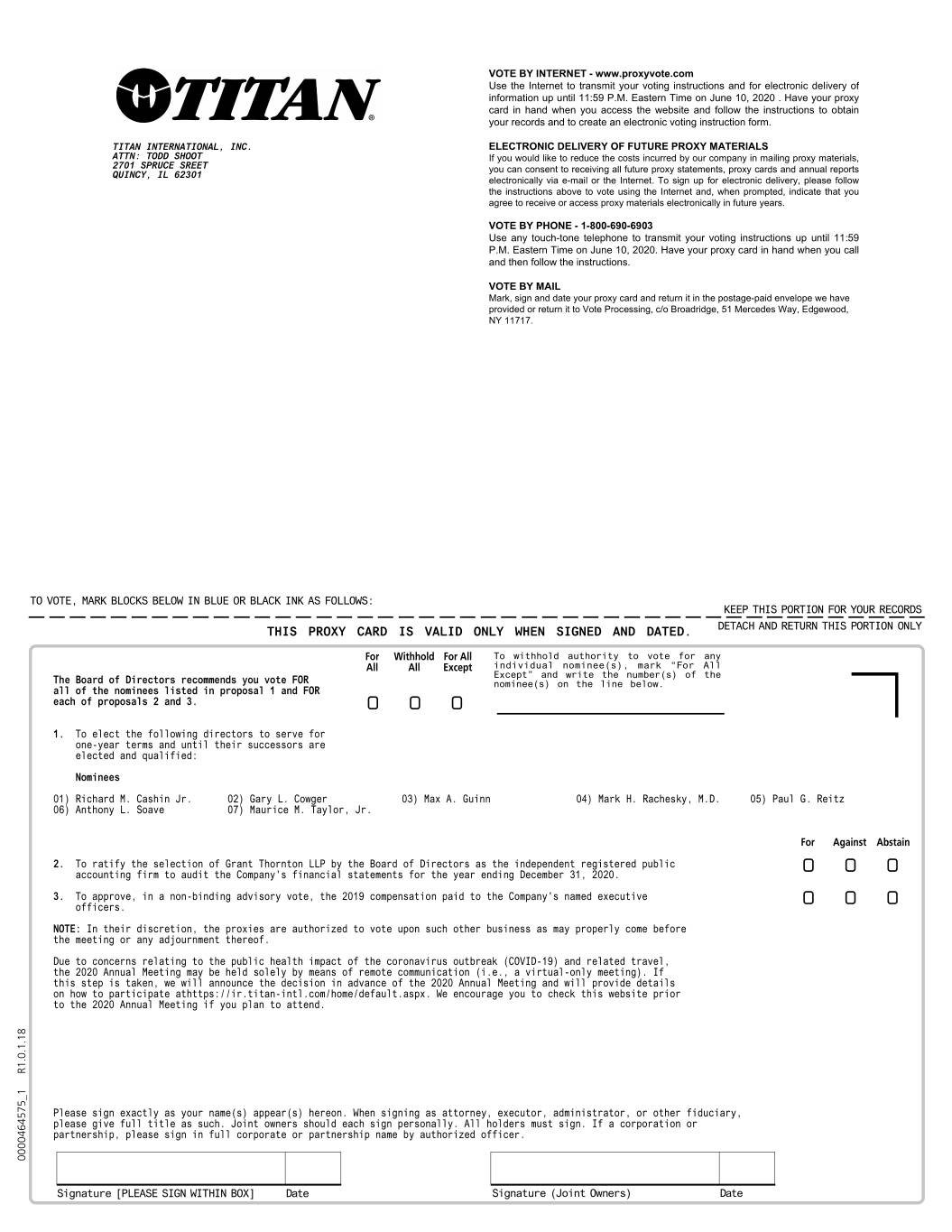

Voting by Stockholders of Record; Submitting Your Proxy

Common Stockholders are asked to vote their shares as promptly as possible. Common Stockholders of record on the Record Date are entitled to cast their votes in person at the Annual Meeting, by telephone or over the Internet, as described in the instructions in the Notice and these materials. If you requested to receive printed proxy materials by mail, you may also vote by completing, signing, dating and promptly returning your proxy card in the return envelope according to the instructions on the proxy card. If you submit your vote by telephone or Internet, you do not need to mail back a proxy card.

All shares of Common Stock represented at the Annual Meeting by properly executed proxies received prior to or at the Annual Meeting and not properly revoked will be voted at the Annual Meeting in accordance with the instructions indicated in the proxy. If no instructions are indicated, such proxies will be voted FOR each of the nominees named in Proposal #1 and FOR each of Proposals #2 and #3 and persons designated as proxies will vote with their best judgment on such other business as may properly come before the Annual Meeting. The Board of Directors does not know of any matters that will come before the Annual Meeting other than those described in the Notice of Annual Meeting attached to this Proxy Statement.

Voting by Beneficial Owners of Common Stock

If your shares are held in “street name,” your broker or other institution serving as nominee will send you a request for directions for voting those shares. Many brokers, banks, and other institutions serving as nominees (but not all) participate in a program that offers internet voting options and may provide you with a Notice of Internet Availability of Proxy Materials. Follow the instructions on the Notice of Internet Availability of Proxy Materials to access our proxy materials online or to request a paper or email copy of our proxy materials. If you received these proxy materials in paper form, the materials included a voting instruction card so you can instruct your broker or other nominee how to vote your shares. Because you are not the stockholder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a legal proxy from the organization that holds your shares giving you the right to vote your shares at the Annual Meeting.

For a discussion of rules regarding the voting of shares held by beneficial owners when you do not give voting instructions to your broker, please see “Broker Non-Votes” below.

Broker Non-Votes

Under the rules of the New York Stock Exchange (NYSE), member brokers that hold shares in “street name” for their customers that are the beneficial owners of those shares only have the authority to vote on certain “routine” items in the event that they have not received instructions from beneficial owners. Under NYSE rules, when a proposal is not a “routine” matter and a member broker has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm may not vote the shares on that proposal because it does not have discretionary authority to vote those shares on that matter. A “broker non-vote” is submitted when a broker returns a proxy card and indicates that, with respect to particular matters, it is not voting a specified number of shares on those matters, as it has not received voting instructions with respect to those shares from the beneficial owner and does not have discretionary authority to vote those shares on such matters. The shares of Common Stock as to which “broker non-votes” are submitted are not entitled to vote at the Annual Meeting with respect to the matters to which the “broker non-votes” apply. However, such shares will be included for purposes of determining whether a quorum is present at the Annual Meeting.

Quorum for Annual Meeting

There must be a quorum for the Annual Meeting to be held. The presence, in person or by properly executed proxy, of Common Stockholders holding a majority of the Common Stock outstanding on the Record Date is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and “broker non-votes” are counted as present in determining whether or not there is a quorum. If a quorum is not present at the time the Annual Meeting is convened, Common Stockholders representing a majority of the shares of Common Stock present, in person or represented by properly executed proxy, may adjourn the Annual Meeting.

Vote Required to Approve Proposals

Proposal #1: Election of each of Mr. Cashin, Mr. Cowger, Mr. Guinn, Dr. Rachesky, Mr. Reitz, Mr. Soave and Mr. Taylor as directors requires the affirmative vote of Common Stockholders holding a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting.

Proposal #2: Ratification of the selection of the independent registered public accounting firm of Grant Thornton LLP requires the affirmative vote of the Common Stockholders holding a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting.

| |

| Proposal #3: | Approval, in a non-binding advisory vote, of the 2019 executive compensation requires the affirmative vote of the Common Stockholders holding a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting. Although the advisory vote on 2019 compensation paid to the Company's named executive officers is non-binding, the Board of Directors will review the result of the vote and will take it into account in making a determination concerning executive compensation in the future. |

Abstentions are counted in the number of shares present in person or represented by proxy for purposes of determining whether a proposal has been approved and, as a result, are equivalent to votes against Proposal #2 and Proposal #3. There will be no abstentions on Proposal #1. Brokers that do not receive instructions with respect to Proposal #1 and Proposal #3 from their customers will not be entitled to vote on that proposal as each of such proposals is considered a “non-routine” matter; any such broker non-votes will not have any impact on the outcome of Proposal #1 and Proposal #3. However, such shares representing the broker non-votes will be treated as shares present for purposes of determining whether a quorum is present. Because Proposal #2 is considered a “routine” matter, brokers have discretionary authority to vote on Proposal #2 in the absence of timely instructions from their customers. As a result, there will be no broker non-votes with respect to Proposal #2.

Revoking a Proxy

Any proxy given pursuant to this solicitation may be revoked at any time before it is voted. Common Stockholders may revoke a proxy at any time prior to its exercise by filing with the Secretary of the Company a duly executed revocation (which must be received before the start of the Annual Meeting), submitting a new proxy bearing a later date by following the instructions provided in the Notice or the proxy card (which must be received before the start of the Annual Meeting) or voting in person by written ballot at the Annual Meeting. Attendance at the Annual Meeting will not of itself constitute revocation of a proxy. Any written notice revoking a proxy should be sent to: Michael G. Troyanovich, Secretary and General Counsel of Titan International, Inc., 2701 Spruce Street, Quincy, Illinois 62301. If you are a beneficial owner, you may revoke your proxy and change your vote at any time before the Annual Meeting by: (i) submitting new voting instructions to your broker or other intermediary; or (ii) if you have obtained a legal proxy from your broker or other intermediary, by attending the Annual Meeting and voting in person by written ballot.

Company's Transfer Agent

Computershare Trust Company, N.A.

Mailing address: Physical address:

P.O. Box 505000 462 South 4th Street, Suite 1600

Louisville, KY 40233 Louisville, KY 40202

Stockholder Information: (877) 237-6882 Agent website: www.computershare.com/investor

Common Stock Data

The Common Stock is listed and traded on the New York Stock Exchange under the symbol TWI.

Vote Tabulation

Broadridge Investor Communication Services will be responsible for determining whether or not a quorum is present and tabulate votes cast by proxy or in person at the Annual Meeting.

Voting Results

Titan will announce preliminary voting results at the Annual Meeting and publish final results by filing a Current Report on Form 8-K with the SEC.

Please Vote

Every stockholder's vote is important. Whether or not you intend to be present at the Annual Meeting, please vote your shares as promptly as possible in accordance with the instructions in the Notice and these materials. Common Stockholders of record on the record date are entitled to cast their votes in person at the Annual Meeting, by telephone or over the Internet, as described in the instructions in the Notice and these materials. If you requested to receive printed proxy materials by mail, you may also vote by completing, signing, dating and promptly returning your proxy card in the return envelope provided to you, which requires no postage if mailed in the United States.

Proxy Notice

Important Notice Regarding the Availability of Proxy Materials for Annual Meeting of Stockholders to be held on June 11, 2020.

The Notice of Internet Availability of Proxy Materials, the Proxy Statement and the Company's Annual Report to Stockholders, including Form 10-K, for the year ended December 31, 2019, are available at the Company's website, www.titan-intl.investorroom.com/sec-filings, and at www.proxyvote.com.

PROPOSAL #1 - Election of Directors

The Board of Directors recommends that stockholders vote FOR the election of each of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, and Maurice M. Taylor Jr. as Directors to serve until the 2021 Annual Meeting.

The Board of Directors currently consists of eight directors with each of the directors elected annually to serve until the next annual meeting of stockholders, and until such director's successor is elected and qualified. As previously disclosed and discussed further below, however, Albert J. Febbo notified the Board of Directors of his decision to retire from the Board of Directors and not to stand for re-election at the Annual Meeting. The Board of Directors has determined that, with the exception of the Chairman of the Board (Mr. Taylor) and Paul G. Reitz, each of Richard M. Cashin Jr., Gary L. Cowger, Albert J. Febbo, Max A. Guinn, Mark H. Rachesky, MD, and Anthony L. Soave meets the independence requirements for directors set forth in the NYSE listing standards.

The Nominating Committee of the Board of Directors (the Nominating Committee) recommended to the Board of Directors the nomination of, and the Board of Directors is nominating, each of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, and Maurice M. Taylor Jr. at the Annual Meeting for election as a director to serve until the 2021 Annual Meeting of Stockholders and until his successor is elected and qualified. Each of the nominees is currently a director serving on the Board of Directors and has consented to serve as a director if elected. Albert J. Febbo notified the Board of Directors of his retirement from the Board of Directors and is not standing for re-election to the Board of Directors at the Annual Meeting. Mr. Febbo is a valuable, long-term Board member serving even before Titan first became a public company in 1993. During his thirty years of total service, he provided significant contributions and insights to the Board and the Company throughout his tenure. In connection with Mr. Febbo's departure, the Board of Directors reduced the size of the Board of Directors to seven directors, effective following the Annual Meeting.

In the unexpected event that any nominee for director becomes unable or declines to serve before the Annual Meeting, it is intended that shares represented by proxies that are properly submitted will be voted for such substitute nominee as may be appointed by the Company's existing Board of Directors, as recommended by the Nominating Committee. The following is a brief description of the business experience of each of the nominees for at least the past five years.

Nominees

Richard M. Cashin Jr.

Richard (Dick) Cashin is President of OEP Capital Advisors LP (OEP), which manages $5 billion of investments and commitments on behalf of over 100 individual and institutional investors. OEP is an independent investment advisor, the former private equity investment arm of JP Morgan Chase (JPM), having completed a spin-out from JPM in January 2015. OEP and its predecessors have invested nearly $12 billion in over 80 investments.

During his fourteen-year tenure with JPM, Mr. Cashin was the Managing Partner of OEP. Prior to that, Mr. Cashin was Managing Partner of Cashin Capital Partners (April 2000-April 2001) and President of Citigroup Venture Capital, Ltd. (1980-2000, became President in 1994). Mr. Cashin serves on the Board of Tenax Aerospace. He is a Trustee of the American University in Cairo, Boys Club of New York, Brooklyn Museum, Central Park Conservancy, Jazz at Lincoln Center, National Rowing Foundation, and Newport Festivals Foundation. He is active in inner-city educational initiatives, Harvard fundraising and has served as Co-Chairman of his Harvard class for over 40 years.

Mr. Cashin, who is 67 years old, became a director of the Company in 1994. Mr. Cashin possesses particular knowledge and experience in finance, strategic planning, acquisitions and leadership of organizations that enhances the Board of Directors' overall qualifications. Mr. Cashin's experience with large mergers and acquisitions especially contributes to Titan's overall long-range plan.

Gary L. Cowger

Mr. Cowger has served as the chairman and CEO of GLC Ventures, LLC, a management consultancy on business, manufacturing and technology strategy, and global organizational structures and implementation since 2009. He serves on the board of directors of Delphi Technologies PLC, College for Creative Studies, and Kettering University (formerly known as General Motors Institute), where he was a past Chairman. Mr. Cowger has served as a board member of Tecumseh Products, Saturn Corporation, OnStar, Saab, Adam Opel, AG, GM of Canada, NUMMI, GMAC, and Delphi Automotive. He has also served on the board of the United Negro College Fund, the MIT North America Executive Board, the board of the Detroit Symphony, the governing board for the Leaders for Manufacturing at MIT, and the board of Focus Hope, and was the Co-Chair of the Martin Luther King Memorial Foundation Executive Leadership Cabinet with the Honorable Andrew Young. Mr. Cowger enjoyed a long-term career with General Motors from 1965 until his retirement in December 2009. He held senior positions at General Motors including President

and Managing Director of GM de Mexico (1994-1997), Chairman of Adam Opel, AG (1998), Group Vice President of Manufacturing and Labor Relations (1999-2001), and President of GM North America (2001-2005). Mr. Cowger, who is 73 years old, became a director of the Company in January 2014. Mr. Cowger's global manufacturing background provides an informed perspective to the Company's global operations.

Max A. Guinn

Mr. Guinn served in various roles with Deere & Company for 38 years, from 1980 through his retirement in November 2018. Mr. Guinn served as President of the Worldwide Construction & Forestry Division of Deere & Company from October 2014 through his retirement and as Senior Vice President, Human Resources, Communications, Public Affairs, and Labor Relations from 2012 to 2014. Prior to 2012, he held positions of increasing responsibility in quality services, supply management, and manufacturing in the agricultural, construction and forestry businesses. From 2014 to 2018, Mr. Guinn also served as a Director of John Deere Capital Corporation, which provides and administers financing for retail purchases of new equipment manufactured by John Deere’s agriculture and turf and construction and forestry operations and used equipment taken in trade for this equipment. Mr. Guinn received a BS degree in Mechanical Engineering from the University of Missouri-Rolla (now Missouri University of Science & Technology) and an MBA from the University of Dubuque. Mr. Guinn, who is 61 years old, became a director of the Company in June 2019. Mr. Guinn's global manufacturing background and experience bring unique insights into the Company's global operations.

Mark H. Rachesky, MD

Dr. Rachesky is the Founder and Chief Investment Officer of MHR Fund Management LLC, a New York-based investment firm that takes a private equity approach to investing that was founded in 1996. MHR manages approximately $5 billion of capital and has holdings in public and private companies in a variety of industries. Dr. Rachesky is Chairman of the Board of Directors of Lions Gate Entertainment Corp., Loral Space & Communications Inc., and Telesat Canada, and serves on the Board of Directors of Emisphere Technologies, Inc. and Navistar International Corporation. He has also previously served as a director of Leap Wireless International, Inc. Dr. Rachesky holds an MBA from the Stanford University School of Business, an MD from the Stanford University School of Medicine and a BA in Molecular Aspects of Cancer from the University of Pennsylvania. Dr. Rachesky, who is 61 years old, became a director of the Company in June 2014. Dr. Rachesky has demonstrated leadership skills as well as extensive financial expertise and broad-based business knowledge and relationships. In addition, Dr. Rachesky has significant expertise and perspective as a member of the board of directors of private and public companies engaged in a wide range of businesses.

Paul G. Reitz

Mr. Reitz joined the Company in 2010 as Chief Financial Officer, became President in February 2014, and was named Chief Executive Officer (CEO) effective in January 2017. Prior to joining Titan, he was the Chief Accounting Officer for Carmike Cinemas based in Columbus, Georgia. He has also held leadership positions with McLeodUSA Publishing, Yellow Book USA Inc., and Deloitte and Touche LLP. He has a Master's of Business Administration Degree from the University of Iowa and a Bachelor of Business Administration Degree from Northwood University. He is on the Board of Directors of Wheels India Limited and Culver-Stockton College. Mr. Reitz, who is 47 years old, was appointed to the Board of Directors in December 2017. Mr. Reitz has held leadership roles on both the financial and operational sides of Titan. This experience has provided Mr. Reitz with an extensive knowledge of the opportunities available to and challenges involved in Titan's business.

Anthony L. Soave

Mr. Soave is President, Chief Executive Officer and founder of Soave Enterprises LLC, a privately held, Detroit-headquartered company comprised of numerous holdings in the real estate development, environmental and industrial services, metals recycling, agriculture, and automotive retailing industries, among others. Mr. Soave has held this position since 1998. From 1974 to 1998, he served as President and Chief Executive Officer of Detroit-based City Management Corporation, which he founded. Mr. Soave, who is 80 years old, became a director of the Company in 1994. Mr. Soave possesses particular knowledge and experience in sales, distribution, and leadership in diversified businesses that enhances the Board of Directors' overall qualifications. Mr. Soave's experiences in building businesses from the ground up contribute to the dynamic of Titan's entrepreneurial spirit. Mr. Soave's operational and distribution background further assist with the Company's direction.

Maurice M. Taylor Jr.

Mr. Taylor is Chairman of the Company's Board of Directors. Mr. Taylor retired as Chief Executive Officer of the Company in December 2016, a position that he held since 1990. Mr. Taylor has served as a director of Titan International, Inc. since 1990, when Titan was acquired in a leveraged buyout by Mr. Taylor and other investors. Mr. Taylor, who owned 53% of Titan at the time, took the Company public in 1992 on NASDAQ and, in 1993, moved Titan to the NYSE. Mr. Taylor, who is 75 years old,

has been in the manufacturing business for more than 50 years and has a bachelor's degree in engineering. He is also a journeyman tool and die maker as well as a certified welder. Mr. Taylor's work experiences provide in-depth knowledge and experience in sales, manufacturing, engineering, and innovation that enhances the Board of Directors' overall qualifications. Mr. Taylor's extensive background with the Company has given him a breadth of insight into Titan's markets and the requirements of end users. With Mr. Taylor's knowledge and a management style that constantly re-evaluates short-term goals, Titan is able to adapt quickly to changing conditions. Mr. Taylor picked up the nickname of "The Grizz," so the mascot of Titan International is a version of a friendly Grizz bear. In 1996, Mr. Taylor ran as a Republican candidate for President of the United States, campaigning to bring sound fiscal management and business know-how to Washington.

PROPOSAL #2 - Ratification of Independent Registered Public Accounting Firm of

Grant Thornton LLP

The Board of Directors recommends that stockholders vote FOR the ratification of the selection of the independent registered public accounting firm, Grant Thornton LLP, to audit the consolidated financial statements of the Company and its subsidiaries for the year ending December 31, 2020.

Grant Thornton LLP served the Company as the independent registered public accounting firm during the year ended December 31, 2019, and has been selected by the Audit Committee of the Board of Directors (the Audit Committee) to serve as the independent registered public accounting firm for the present year ending December 31, 2020. Grant Thornton LLP has served the Company in this capacity since 2012.

If stockholders fail to ratify the selection of Grant Thornton LLP, the Audit Committee will consider this fact when selecting an independent registered public accounting firm for the audit year ending December 31, 2021.

A representative from Grant Thornton LLP is expected to be present at the Annual Meeting and will have an opportunity to make a statement if such representative desires to do so and will be available to respond to appropriate questions of stockholders in attendance.

PROPOSAL #3 - Approval, in a Non-Binding Advisory Vote, of the 2019 Compensation Paid to the Named Executive Officers

As required by Section 14A of the Securities Exchange Act of 1934 (the Exchange Act) the Company is providing stockholders with the opportunity to vote, on a non-binding advisory basis, on a resolution approving the 2019 compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the rules of the SEC, included in the “Compensation Discussion and Analysis” section and the compensation tables and narrative discussion contained in the “Compensation of Executive Officers” section of this Proxy Statement.

As described in the "Compensation Discussion and Analysis" section, the objectives of the Company's compensation program are to attract and retain individuals with the necessary skills that are vital to the long-term success of Titan. The compensation program is designed to be fair and just to both the Company and the individual. The overall goal of the Company's compensation policy is to maximize stockholder value by attracting, retaining and motivating the executive officers that are critical to the long-term success of the Company. Stockholders are encouraged to review the “Compensation Discussion and Analysis” and “Compensation of Executive Officers” sections of this Proxy Statement for additional information regarding the Company's executive compensation.

The Board of Directors is requesting the support of Titan's stockholders for the executive compensation as disclosed in the “Compensation Discussion and Analysis” and “Compensation of Executive Officers” sections of this Proxy Statement. This proposal gives the Company's stockholders the opportunity to express their views on the executive officers' compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our executive officers and the overall compensation objectives and philosophy described in this Proxy Statement.

The Board of Directors recommends that stockholders vote FOR the approval, in a non-binding advisory vote, of the 2019 compensation paid to the named executive officers and the following resolution:

“RESOLVED, that the compensation of the Company's Named Executive Officers as described in the Company's definitive Proxy Statement for the Company's 2020 Annual Meeting of Stockholders pursuant to Item 402 of Regulation S-K, including the sections entitled 'Compensation Discussion and Analysis' and 'Compensation of Executive Officers,' is hereby APPROVED.”

The vote on the compensation of our executive officers, commonly referred to as "say-on-pay," is advisory and not binding on the Company, the Board of Directors, or the Compensation Committee of the Board of Directors (the Compensation Committee). The final decision on the compensation and benefits of our executive officers and on whether, and, if so, how, to address any stockholder approval or disapproval of executive compensation remains with the Board of Directors and the Compensation Committee. However, the Board of Directors and the Compensation Committee value the opinions of the Company’s stockholders as expressed through their votes and other communications, and will consider the outcome of this vote, together with other relevant factors, when making future compensation decisions for the named executive officers.

The Board of Directors previously determined that the Company will hold an advisory vote on executive compensation annually.

OTHER BUSINESS

The Board of Directors does not intend to present at the Annual Meeting any business other than the items stated in the “Notice of Annual Meeting of Stockholders” and does not know of any matters to be brought before the Annual Meeting other than those referred to above. If, however, any other matters properly come before the Annual Meeting requiring a stockholder vote, the persons designated as proxies will vote on each such matter in accordance with their best judgment.

AUDIT AND OTHER FEES

The Audit Committee of the Board of Directors engaged the independent registered public accounting firm of Grant Thornton LLP as independent accountants to audit the Company's consolidated financial statements for the fiscal year ended December 31, 2019. Fees paid to the independent registered public accounting firm of Grant Thornton LLP included the following:

Audit Fees: For the years ended December 31, 2019 and 2018, Grant Thornton LLP billed the Company $2,261,075 and $2,359,087, respectively, for professional services rendered for the audit of the Company's annual consolidated financial statements included in the Company's Form 10-K, including fees related to the audit of internal controls in connection with the Sarbanes-Oxley Act of 2002, reviews of the quarterly financial statements included in the Company's Form 10-Q reports, statutory audits of foreign subsidiaries and related administrative fees and out-of-pocket expenses incurred by Grant Thornton LLP. For 2018, approximately $269,024 of administrative fees and out-of-pocket expenses incurred by Grant Thornton LLP in connection with the audit of the Company’s annual consolidated financial statements that were classified as “All Other Fees” in our 2018 proxy statement have been reclassified as “Audit Fees”.

Audit-Related Fees: For the year ended December 31, 2019, Grant Thornton LLP did not provide to the Company any audit-related services and did not bill the Company for any related fees. For the year ended December 31, 2018, Grant Thornton LLP billed the Company $40,000 for professional services rendered related to the Company's Form S-4 filing.

Tax and All Other Fees: For the years ended December 31, 2019 and 2018, Grant Thornton LLP did not provide to the Company any tax or all other fees and did not bill the Company for any related fees.

|

| | | | | | | |

| | 2019 | | 2018 |

| Audit Fees | $ | 2,261,075 |

| | $ | 2,359,087 |

|

| Audit-Related Fees: Senior secured notes offering | — |

| | 40,000 |

|

| Tax Fees | — |

| | — |

|

| All Other Fees | — |

| | — |

|

| Total | $ | 2,261,075 |

| | $ | 2,399,087 |

|

Audit Committee Pre-Approval: All of the services provided by Grant Thornton LLP for each of 2019 and 2018 were pre-approved by the Audit Committee as required by and described in the Audit Committee's Charter.

AUDIT COMMITTEE REPORT

In connection with the filing and preparation of the Company’s Annual Report on Form 10-K for the year ended December 31, 2019, the Audit Committee reviewed and discussed the audited financial statements with the Company’s management and its independent auditors, including meetings where the Company’s management was not present.

The Audit Committee selected Grant Thornton LLP (GT) to serve as the independent registered public accounting firm for the Company for 2019 with stockholders' approval. The Audit Committee has discussed the issue of independence with GT and is satisfied that they have met the independence requirement including receipt of the written disclosures and the letter from GT as required by PCAOB Rule 3526 (Public Company Accounting Oversight Board Rule 3526, Communications with Audit Committees Concerning Independence). The Audit Committee has discussed with GT the applicable requirements of the PCAOB and SEC.

The Audit Committee periodically meets independently with GT to discuss the accounting principles applied by management and to discuss the quality of the Company's internal audit function. GT reported to the Audit Committee that there were no unresolved matters with management to report. The Audit Committee has established procedures for the receipt, retention and treatment of complaints relating to the Company. The members of the Audit Committee are not professionally engaged in the practice of auditing or accounting and are not experts in those fields, but make every effort to test the veracity of facts and accounting principles applied by management.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2019.

|

| |

| | Members of the Audit Committee: |

| | |

| | Albert J. Febbo, Chairman |

| | Richard M. Cashin, Jr. |

| | Gary L. Cowger |

| | Max A. Guinn |

COMPENSATION OF DIRECTORS

The Company can use the combination of cash and stock-based incentive compensation to attract and retain qualified directors to serve on the Board of Directors. In setting director compensation, the Company considers the amount of time and skill level required by the directors in fulfilling their duties to the Company. The Compensation Committee engaged Pay Governance beginning in 2018, as its outside compensation consultant, to analyze its then-current non-employee director compensation practices. Based on Pay Governance’s analysis, the Compensation Committee adopted the recommendation to allow a non-employee director to elect such director’s annual director fee in restricted stock units instead of cash and eliminate meeting fees for meetings attended after September 1, 2019.

Each non-employee director of the Company receives an annual director fee of $90,000 in cash. Beginning in 2019, each non-employee director of the Company may elect to receive all or a portion of the annual director fee in restricted stock units, granted pursuant to a restricted stock unit award, under the Titan International, Inc. 2005 Equity Incentive Plan, as amended (the Incentive Plan), in lieu of cash. To the extent a non-employee director made such an election for 2019, the restricted stock units are scheduled to vest on September 13, 2020, the one year anniversary of the grant date, provided that the non-employee director remains in continuous service through such vesting date or upon his earlier death, disability, retirement or not standing for re-election, and the number of restricted stock units was calculated based on the closing price of Common Stock on September 12, 2019.

In 2019, in addition to the annual director fee, the Company approved a grant of restricted stock units under the Incentive Plan to each non-employee director that became effective on September 13, 2019 equivalent to $90,000 in value, calculated based on the closing price of Common Stock on September 12, 2019. These additional restricted stock units are scheduled to vest on September 13, 2020, the one year anniversary of the grant date, provided that the non-employee director remains in continuous service through such vesting date or upon the earlier of death, disability, retirement or not standing or re-election.

The Chairman of the Board receives an additional $90,000 fee, payable in cash or, upon the Chairman of the Board’s election, in restricted stock units granted in lieu of cash. For 2019, the Chairman of the Board elected to repay the Company for his personal use of the Company’s aircraft by electing to forgo receiving his annual Chairman fee. The Audit Committee Chairman receives an additional $22,500 annual cash payment while each Chairman of the Compensation Committee, the Corporate Governance Committee of the Board of Directors (the Corporate Governance Committee), and the Nominating Committee receives an additional $15,000 annual cash payment for such person's service in those positions. The “audit committee financial expert” serving on the Audit Committee receives an additional $7,500 annual cash payment for this role. For meetings attended prior to September 1, 2019, the Company also paid each director a fee of $500 for each Board of Directors or committee meeting attended. Titan also reimburses directors for out-of-pocket expenses related to their attendance at such meetings.

|

| | | | |

Annual Director Fee | Chairman of the Board Fee | Audit Committee Chairman Fee | Other Committee Chairman Fee | Audit Committee Financial Expert Fee |

| $90,000 | $90,000 | $22,500 | $15,000 | $7,500 |

The Company does not have any consulting contracts or arrangements with any of its directors. At December 31, 2019, the directors beneficially owned, in the aggregate, approximately 18.5% of the outstanding shares of Common Stock.

DIRECTOR COMPENSATION TABLE FOR 2019

The table below summarizes the compensation earned by each member of the Board of Directors (other than Paul G. Reitz, Titan's President and Chief Executive Officer) for service on the Board of Directors for 2019. For a summary of the compensation earned by Mr. Reitz, see "Compensation of Executive Officers" below.

|

| | | | | | | | | | | | |

| Name of Director | Fees Earned or Paid in Cash | | Stock Awards (a) | All Other Compensation | | Total |

| Richard M. Cashin Jr. | $ | 116,000 |

| | 90,000 |

| 98,423 |

| (b) | $ | 304,423 |

|

| Gary L. Cowger | 111,000 |

| | 90,000 |

| — |

| | 201,000 |

|

| Albert J. Febbo | 117,000 |

| | 90,000 |

| — |

| | 207,000 |

|

| Max A. Guinn | 16,500 |

| | 180,000 |

| — |

| | 196,500 |

|

| Peter B. McNitt (c) | 3,500 |

| | — |

| — |

| | 3,500 |

|

| Mark H. Rachesky, MD | 3,500 |

| | 180,000 |

| — |

| | 183,500 |

|

| Anthony L. Soave | 4,500 |

| | 180,000 |

| — |

| | 184,500 |

|

| Maurice M. Taylor Jr. | 94,000 |

| (d) | 180,000 |

| — |

| | 274,000 |

|

| |

| (a) | The amounts included in the “Stock Awards” column reflect the aggregate grant date fair value of (i) 30,927 restricted stock units granted to all non-employee directors in September 2019 and (ii) an additional 30,928 restricted stock units granted to each of Messrs. Taylor, Guinn, Rachesky and Soave upon their respective elections to receive their annual $90,000 board retainer fee in restricted stock units in lieu of cash, in each case, computed in accordance with Accounting Standards Codification (ASC) 718 Compensation - Stock Compensation. The restricted stock units for each non-employee director on the Company's Board of Directors were granted on September 13, 2019 and are scheduled to vest on September 13, 2020, the one year anniversary of their grant date, or, if earlier, upon the non-employee director’s death, disability, retirement or not standing for re-election. As previously disclosed, each member of the Company's Board of Directors (other than Mr. Reitz, Titan's President and Chief Executive Officer) may elect to receive all or a portion of his annual $90,000 board retainer fee in restricted stock units in lieu of cash. |

| |

| (b) | This amount consists of the aggregate incremental cost for personal use of Company aircraft. The method used to calculate this cost is set forth in a footnote to the Summary Compensation Table. |

| |

| (c) | On May 3, 2019, Peter B. McNitt informed the Board of Directors of his decision to not stand for re-election at the 2019 annual meeting of stockholders and thereby retired, effective on June 12, 2019, from his board positions. |

| |

| (d) | The amount included in the “Fees Earned or Paid in Cash” column consists of the $90,000 annual fee Mr. Taylor earned for his service as Chairman of the Board and $4,000 related to fees for each Board of Directors or committee meeting attended prior to September 1, 2019. With respect to 2019, Mr. Taylor (i) repaid the Company $80,918 for his personal use of the Company aircraft, which amount was calculated as described in a footnote to the Summary Compensation Table and (ii) elected to forgo receiving the remaining $9,088 of his annual Chairman fee. |

DIRECTORS OUTSTANDING STOCK OPTIONS AND RESTRICTED STOCK AWARDS

The following table shows the outstanding stock options and restricted stock units as of December 31, 2019 for each member of the Board of Directors (other than Mr. Reitz, Titan's President and Chief Executive Officer):

|

| | | | |

| Name of Director | Number of Stock Options | Number of Restricted Stock Units |

| Richard M. Cashin Jr. | 145,000 |

| 30,927 |

|

| Gary L. Cowger | — |

| 30,927 |

|

| Albert J. Febbo | — |

| 30,927 |

|

| Max A. Guinn | — |

| 61,855 |

|

| Mark H. Rachesky, MD | 99,000 |

| 61,855 |

|

| Anthony L. Soave | 145,000 |

| 61,855 |

|

| Maurice M. Taylor Jr. | 49,200 |

| 61,855 |

|

DIRECTOR STOCK OWNERSHIP GUIDELINES

The Board of Directors believes that each director should develop a meaningful ownership position in the Company. Therefore, in 2019 the Board of Directors adopted stock ownership guidelines for non-employee directors of the Company. Pursuant to these guidelines, each non-employee director is expected to achieve stock ownership of at least five times their annual cash retainer within five years of the later to occur of the adoption of the guidelines or first becoming a non-employee director.

COMMITTEES OF THE BOARD OF DIRECTORS; MEETINGS

The following table provides (i) the membership of each committee of the Board of Directors as of the date of the filing of this proxy statement and (ii) the number of meetings held by each committee during 2019:

|

| | | | | |

| Name of Director (a) | Board of Directors | Audit Committee | Compensation Committee | Nominating Committee | Corporate Governance Committee |

| Richard M. Cashin Jr. | X | X | Chair | X | X |

| Gary L. Cowger | X | X | X | Chair | X |

| Albert J. Febbo (b) | X | Chair | X | X | X |

| Max A. Guinn (c) | X | X | — | — | Chair |

| Mark H. Rachesky, MD | X | — | X | X | X |

| Paul G. Reitz | X | — | — | — | — |

| Anthony L. Soave | X | — | X | X | X |

| Maurice M. Taylor Jr. | Chair | — | — | — | — |

| | | | | | |

| 2019 Meetings | 11 | 5 | 2 | 2 | 4 |

|

| |

| X | Member of the Board of Directors or applicable Committee |

Chair | Chairman of the Board of Directors or applicable Committee |

| — | Not a member of applicable Committee |

| (a) | On May 3, 2019, Peter B. McNitt informed the Board of Directors of his decision to not stand for re-election at the 2019 annual meeting of stockholders and thereby retired, effective on June 12, 2019, from his board positions. |

| (b) | On April 7, 2020, Albert J. Febbo informed the Board of Directors of his decision to not stand for re-election and thereby retire from his board positions with an effective date of June 11, 2020, the date of the Annual Meeting. |

| (c) | On June 12, 2019, at a meeting of the Board of Directors of the Company, the Board upon recommendation of the Nominating Committee of the Board, appointed Max A. Guinn as a member of the Board, effective June 12, 2019. Mr. Guinn's term on the Board is consistent with other members of the Board. |

Board of Directors

The Board of Directors approves nominees for election as directors. Each current director who served on the Board of Directors during 2019 attended 75% or more of (i) the aggregate number of meetings of the Board of Directors during the period in which such individual was a director and (ii) the aggregate number of meetings of committees on which such director served during 2019 with the exception of Mr. Cashin who attended seven of the 11 applicable Board of Directors meetings. The Board of Directors and committee meetings are presided over by the applicable Chairman. If the Chairman is unavailable, the directors present appoint a temporary Chairman to preside at the meeting.

Audit Committee

The Audit Committee was composed of four independent non-employee directors during 2019. The Board of Directors has determined that each of the members of the Audit Committee satisfies the requirements of the NYSE with respect to independence, accounting or financial-related expertise, and financial literacy. Mr. Cashin qualifies as an "audit committee financial expert" as defined in the SEC rules under the Sarbanes-Oxley Act of 2002.

The Audit Committee retains the independent registered public accounting firm to perform audit and non-audit services, reviews the scope and results of such services, consults with the internal audit staff, reviews with management and the independent registered public accounting firm any recommendations of the auditors regarding changes and improvements in the Company's accounting procedures and controls and management's response thereto, and reports to the Board of Directors. The Audit Committee meets quarterly with members of management, internal audit, and the independent registered public accounting firm, individually and together, to review and approve the financial press releases and periodic reports on Form 10-Q and Form 10-K prior to their filing and release. The Audit Committee operates under a written charter, which was amended and restated on June 2, 2016, and is available on the Company's website: www.titan-intl.com. In September 2016, Titan entered into an Audit Committee Observer Agreement (the Observer Agreement) with, among others, MHR Institutional Partners III LP, MHR Capital Partners Master Account LP, MHR Capital Partners (100) LP, MHR Institutional Advisors III LLC, MHR Advisors LLC, MHRC LLC, MHR Fund Management LLC, MHR Holdings LLC, and Mark H. Rachesky (collectively, the MHR Entities) that permits the MHR Entities to designate an observer of the Audit Committee. Mr. David Gutterman was designated to serve effective as of March 14, 2018, and as of the date of this Proxy Statement serves as the observer pursuant to the Observer Agreement.

Compensation Committee

The Compensation Committee provides oversight of all of Titan's executive compensation and benefit programs. The Compensation Committee reviews and approves and makes recommendations accordingly to the Board of Directors regarding, the salaries and all other forms of compensation of the Company's executive officers, including reviewing and approving corporate goals and objectives with respect to executive officer compensation. The Compensation Committee is responsible for the adoption of, the administration of, and making awards under, the Company’s equity compensation plans, to the extent provided for by any such plan. The Compensation Committee is also primarily responsible for reviewing the non-employee director compensation program and recommending any changes to the program to the Board of Directors.

Nominating Committee

The Nominating Committee recommended to the Board of Directors that each of Richard M. Cashin Jr., Gary L. Cowger, Max A. Guinn, Mark H. Rachesky, MD, Paul G. Reitz, Anthony L. Soave, and Maurice M. Taylor Jr. stand for re-election as directors based on approved criteria. See Proposal #1 for further information regarding these director nominees.

Pursuant to its charter, the Nominating Committee is responsible for the following: (i) identification of individuals qualified to become Directors of the Company; (ii) seeking to address vacancies on the Board of Directors by actively considering candidates that bring a diversity of background and opinion; (iii) considering director candidates on merit and considering the benefits of all aspects of diversity when recommending such candidates to serve as new directors; (iv) developing a process for annual evaluation of the Board of Directors and its committees; and (v) reviewing the Board of Directors' committee structure and composition to make annual recommendations to the Board of Directors regarding the appointment of directors to serve as members of each committee and as committee chairpersons.

Corporate Governance Committee

Pursuant to its charter, the Corporate Governance Committee is responsible for the following: (i) development and recommendation of a set of corporate governance guidelines; (ii) oversight of the Company's corporate governance practices and procedures; (iii) evaluation of the Corporate Governance Committee and its success in meeting the requirements of its charter; (iv) development and oversight of a Company orientation program for new directors and continuing education program for current directors; (v) review and discussion with management of disclosure of the Company's corporate governance practices; (vi) monitoring compliance with the Company's Code of Business Conduct; and (vii) reviewing transactions between the Company and any related persons.

BOARD LEADERSHIP STRUCTURE

The Company's Board of Directors is currently comprised of seven non-employee directors and Mr. Reitz, Titan's President and CEO, who was appointed to the Board of Directors in December 2017. Mr. Taylor, the Chairman of the Board, served as Chief Executive Officer until his retirement in 2016. Mr. Taylor has served as Chairman of the Board since 2005, and has been a member of the Board of Directors since 1993, when Titan first became a public company. As previously disclosed and discussed in this proxy statement, Albert J. Febbo notified the Board of Directors of his retirement from the Board of Directors and is not standing for re-election to the Board of Directors at the Annual Meeting. In connection with Mr. Febbo's departure, the Board of Directors reduced the size of the Board of Directors to seven directors, effective following the Annual Meeting. The Company believes that the composition of the Board of Directors, including the independent, experienced directors, benefits Titan and its stockholders.

While the Board of Directors does not have a formal policy requiring the separation of the positions of Chairman of the Board and Chief Executive Officer, the roles of the Chairman of the Board and the Chief Executive Officer are currently separated. The Company believes that this structure is the best governance model for the Company at this time as the Chairman of the Board, Mr. Taylor, is able to focus on Board matters with the insight and experience gained from years of being the Company's Chief Executive Officer, allowing the current President and Chief Executive Officer, Mr. Reitz, to focus on the Company's operations. The Board of Directors believes Titan is well-served by the current leadership structure.

The Board of Directors conducts an annual evaluation in order to determine whether it and its committees are functioning effectively. As part of this annual self-evaluation, the Board of Directors evaluates whether the current leadership structure continues to be advantageous for Titan and its stockholders.

Risk Oversight

The Board of Directors is responsible for overseeing Titan's Enterprise Risk Management (ERM) process. The Board of Directors focuses on Titan's ERM strategy and the most significant risks facing Titan from strategic, financial, operational and legal perspectives considering impact, likelihood and velocity. The Board of Directors evaluates whether appropriate risk mitigation strategies are implemented by management and are effective. The Board of Directors is also apprised of particular risk management matters in connection with its general oversight and approval of corporate matters. The Board of Directors works with the Audit Committee in its oversight of Titan's ERM process. The Audit Committee Chairman reviews with management (i) policies with respect to risk assessment and management of risks that may be material to the Company, (ii) Titan's system of disclosure controls and system of internal controls over financial reporting, and (iii) Titan's compliance with legal and regulatory requirements. The Company's other Board committees also consider and address risk as they perform their respective committee responsibilities, including evaluation of risks relating to the Company's compensation programs and corporate governance standards. Each of the committees reports to the full Board of Directors as appropriate, including when a matter rises to the level of a material risk.

Titan's management is responsible for day-to-day risk management. The Company's Internal Audit team reports functionally to the Audit Committee and administratively to the Chief Financial Officer and serves as the primary monitoring and testing function for company-wide policies and procedures. The Chief Financial Officer and the Internal Audit team manage the day-to-day oversight of the ERM strategy for ongoing business described above.

The Board of Directors believes the risk management responsibilities detailed above are an effective approach for addressing the risks facing the Company at this time.

Risks Relating to Employee Compensation Policies and Practices

The Board of Directors does not believe that the Company's compensation policies and practices are reasonably likely to have a material adverse effect on the Company at this time or that any portion of its compensation policies and practices encourage excessive risk taking. In examining risks relating to employee compensation policies and practices, the Company considered the following factors:

| |

| • | The Company is an industrial manufacturer; in the Company's opinion, this business does not lend itself to or incentivize significant risk-taking by Company employees. |

| |

| • | A portion of the compensation for our named executive officers consists of a fixed base salary established by their respective employment agreements, which creates little, if any, risk to the Company. |

| |

| • | Discretionary bonuses are determined by the Compensation Committee based upon a variety of measures, including business objectives and performance metrics. In making determinations with respect to such bonuses, the Compensation Committee considers the Company’s strategic objectives and near-term and long-term interests, as well as those of the Company’s stockholders. In that regard, the Compensation Committee believes that the Company’s compensation program for its executives has an appropriate balance of risk and reward in relation to the Company’s business plan, and does not encourage excessive or unnecessary risk-taking behavior. |

| |

| • | The compensation practices for the Company's non-bargaining employees and management have been established over several decades; in the Company's opinion, based on its experience, these practices have not promoted significant risk-taking. |

| |

| • | The Company does not have a history of material changes in compensation that would have a material adverse effect on the Company related to risk management practices and risk-taking incentives. |

DIRECTOR NOMINATION PROCESS

The Nominating Committee and other members of the Board of Directors identify candidates for consideration by the Nominating Committee for election to the Board of Directors. An executive search firm may also be utilized to identify qualified director candidates for consideration.

The Nominating Committee evaluates candidates from any reasonable source, including stockholder recommendations and recommendations from current directors and executive officers, based on the qualifications for a director described in its charter. These considerations include, among other things, merit, expected contributions to the Board of Directors, whether the candidate meets the independence standards of the SEC and the NYSE, and a diversity of background and opinion, with diversity being broadly considered by the Board of Directors to mean a variety of opinions, perspectives, personal and professional experiences and backgrounds, including gender, race and ethnicity differences, as well as other differentiating characteristics such as organizational experience, professional experience, education, cultural and other background, viewpoint, skills and other personal qualities. The Nominating Committee then presents qualified candidates to the full Board of Directors for consideration and selection. In connection with the next search by the board for a new director, the Company is committed to incorporating procedures by which women and diverse racial and ethnic backgrounds are identified for consideration.

The Nominating Committee will consider nominees for election to the Board of Directors that are recommended by stockholders, applying the same criteria for candidates as discussed above. Under Rule 14a-8 under the Exchange Act, any stockholder nominations for election as directors at the 2021 Annual Meeting must be delivered to the Nominating Committee, c/o Corporate Secretary, Titan International, Inc., 2701 Spruce Street, Quincy, Illinois, 62301, not later than December 26, 2020 to be eligible for inclusion in Titan’s proxy statement and form of proxy related to the 2021 Annual Meeting of Stockholders.

Involvement in Legal Proceedings

The Company is not aware of any events with respect to any director or executive officer of the Company requiring disclosure under Item 401(f) of Regulation S-K that are material to an evaluation of the ability or integrity of any director or executive officer.

COMPENSATION DISCUSSION AND ANALYSIS

Overview

This Compensation Discussion and Analysis describes the compensation policies and determinations that apply to the Company's named executive officers. The Compensation Committee is empowered to review and approve the annual compensation package for the Company's named executive officers. The named executive officers for 2019 were as follows:

|

| |

| Position | Name |

| President and Chief Executive Officer | Paul G. Reitz |

| Senior Vice President and Chief Financial Officer | David A. Martin |

| Secretary & General Counsel | Michael G. Troyanovich |

Objective

The objectives of the Company's compensation program are to attract and retain individuals with the necessary skills that are vital to the long-term success of the Company. To achieve these objectives, the compensation program is designed to be fair to both the Company and the individual. Consideration is given to the individual's overall responsibilities, qualifications, experience, and job performance.

Philosophy

The overall goal of the Company's compensation policy is to maximize stockholder value by attracting, retaining and motivating the executive officers that are critical to its long-term success. The Compensation Committee believes that executive compensation should be designed to promote the long-term economic goals of the Company. The philosophy of the Compensation Committee as it relates to executive compensation is that the CEO and other executive officers should be compensated at competitive levels sufficient to attract, motivate, and retain talented executives who are capable of leading the Company in achieving its business objectives in an industry facing increasing competition and change. To that end, the Compensation Committee has determined that the compensation package for executive officers shall consist of the following components reflecting a mix of fixed and variable compensation, as well as cash and equity compensation, with the amount and mix of compensation for named executive officers established pursuant to the terms of applicable employment agreements and otherwise determined by the Compensation Committee, as described below:

| |

| • | Base salaries to reflect responsibility, experience, tenure, and performance of executive officers; |

| |

| • | Cash bonus awards, when applicable, to reward performance for strategic business objectives and individual objectives; |

| |

| • | Long-term incentive compensation, when applicable, to emphasize business and individual objectives; and |

| |

| • | Other benefits as deemed appropriate to be competitive in the marketplace. |

See “Employment Agreements” below for a description of the employment agreements to which the named executive officers are party. In addition to reviewing the compensation of executive officers against competitive market data that is publicly available, the Compensation Committee also considers recommendations from its independent compensation consultant, if any, as well as recommendations from the Company's CEO regarding the total compensation for the other named executive officers. The Compensation Committee also considered the historical compensation of each named executive officer, from both a base salary and total compensation package perspective, in setting the 2019 compensation for the executives.

Compensation Committee Charter

The Compensation Committee has a charter to assist in carrying out its responsibilities. The Compensation Committee reviews the charter and the guidelines contained therein on an annual basis and makes any modifications as it deems necessary. The Compensation Committee Charter is available on our website at www.titan-intl.com.

Executive Compensation Decision-Making

The Compensation Committee analyzes individual and Company performance in relation to considering changes to compensation programs. The Compensation Committee also relies on data and studies prepared by Pay Governance to assist it in benchmarking compensation and developing pay practices that reflect the Company’s and shareholder goals. The Company's management and members of the Board of Directors also provide the Compensation Committee with historical compensation information relating to the executive officers to assist the Compensation Committee in formulating the named executive officer’s compensation. The Compensation Committee considers competitors, markets, and individual performance, as well as the Company’s performance when making salary adjustments and bonus awards. With the assistance of Pay Governance, the Compensation Committee benchmarks the named executive officer’s compensation and pay mix against the Company’s peer group. The information provided to the Compensation Committee includes items such as base salary, bonuses (both annual and long-term incentives), and equity-based awards. The Compensation Committee takes into account the historical trend of each element of compensation, the analysis prepared by Pay Governance, and the total compensation for each year in connection with its decision about proposed compensation amounts. The Compensation Committee sets all compensation with regard to the CEO of the Company. For the other named executive officers of the Company, the Compensation Committee receives recommendations from the CEO which it considers when setting compensation for these individuals. The Compensation Committee members communicate with others in their own marketplaces to compare salaries and compensation packages.

The Compensation Committee has the authority to engage compensation consultants to assist with designing compensation for the named executive officers. Beginning in 2018, the Compensation Committee consulted with Pay Governance, which analyzed and made recommendations with respect to the Company’s compensation of its named executive officers for 2019. As the Company is a manufacturer in the off-highway industry, the selected group includes twenty public companies in the manufacturing and industrial business. The size of the company is also considered when selecting the benchmarking group. For 2019, the benchmarking group included one new company that was not in the previous year's group due to a previous peer group company being acquired during the year. The companies chosen for comparison include the following:

|

| | | |

| Alamo Group, Inc. | Commercial Vehicle Group, Inc. | Graco Inc. | Park-Ohio Holdings Corp. |

| Applied Industrial Technologies, Inc. | DXP Enterprises, Inc. | ITT Inc. | Stoneridge, Inc. |

| Barnes Group Inc. | Enerpac Tool Group Corp. | Lindsay Corporation | Valmont Industries, Inc. |

| Briggs & Stratton Corporation | EnPro Industries, Inc. | Materion Corporation | Wabash National Corporation |

| Chart Industries, Inc. | Federal Signal Corporation | Modine Manufacturing Company | Watts Water Technologies, Inc. |

The Compensation Committee recognizes other companies may use different types of calculations and matrices to decide what a compensation package should contain. However, the Compensation Committee believes any package that uses only such formulas and matrices may not be a complete representation of the Company’s performance. The Compensation Committee's members use their extensive business experience and judgment, including reviewing competitive compensation information obtained from public information to evaluate and determine the Company's executive compensation packages in addition to performance measures. While the Compensation Committee considers the executive compensation information for the group obtained through Pay Governance, the Compensation Committee does not focus on aligning the compensation for the Company’s executives to any specified percentage or level of the executive compensation for companies in the group. The Compensation Committee's philosophy of evaluating the overall Company performance, not just using numeric measurement criteria, allows the Compensation Committee greater flexibility in carrying out its duties.

The Compensation Committee may grant performance awards as part of an executive officer’s compensation package. Generally, performance awards require satisfaction of pre-established performance goals, consisting of one or more business criteria and a targeted performance level with respect to such criteria as a condition of awards being granted, becoming exercisable or settled, or as a condition to accelerating the timing of such events. Performance may be measured over a period of any length specified by the Compensation Committee. Additional detail regarding 2019 performance measures used by the Compensation Committee in connection with establishing named executive officer compensation for 2019 can be found under “Incentive Compensation” below.

In setting compensation packages, including performance-based incentives, the Compensation Committee considers the provisions of its incentive programs. The Compensation Committee takes into account whether or not stock-based compensation is given as part of the executives' compensation package. The performance goals under the Company’s incentive programs are designed using recommendations from the Company’s compensation consultant and the Compensation Committee's business experience and judgment to best align executive compensation with the Company's actual performance. The Compensation Committee also considers the deductibility limitations imposed by Section 162(m) of the Internal Revenue Code.