January 25, 2024

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

Attention: Jeff Gordon and Jean Yu

| | | | | | | | |

| | Re: | Titan International, Inc. |

Form 10-K for fiscal year ended December 31, 2022

File No. 001-12936

Dear Mr. Gordon and Ms. Yu:

This letter is being submitted in response to the comment letter dated December 27, 2023 (the “Comment Letter”) from the staff of the Securities and Exchange Commission (the “Staff”) addressed to David A. Martin, SVP and Chief Financial Officer of Titan International, Inc. (the “Company”) related to the Staff’s review of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”). This letter contains the Company’s responses to the Comment Letter. For your convenience, each comment is reproduced in bold-face type below, followed by the Company’s response.

Form 10-K for the Fiscal Year Ended December 31, 2022

Notes to the Consolidated Financial Statements

Description of Business and Significant Accounting Policies

Revenue Recognition, page F-12

1.We note your revenue recognition policy on page F-12; however, we do not consider the information sufficient in meeting the disclosure objective of the ASC 606-10-50. The objective of the disclosure requirements is for an entity to disclose sufficient information to enable users of financial statements to understand the nature, amount, timing, and uncertainty of revenue and cash flows arising from your contracts with customers. Consideration should be given to the level of detail necessary to satisfy the disclosure objective. In this regard, the information should be specific to the company and avoid the use of boilerplate language. Please revise accordingly.

Response: The Company primarily sells wheels, tires, wheel/tire assemblies, and undercarriage systems and components on a purchase order basis with its end customers. There are no significant judgments associated with customer contracts given they are ultimately supported by applicable purchase orders and transfer of control of our products to our customers generally occurs upon shipment as this is the point at which title and risk of loss of the product transfers to the customer. There are no material assets recognized from the costs to obtain or fulfill a contract with a customer.

In accordance with the staff’s request, in future filings, the Company will replace the revenue recognition policy footnote in full as follows to satisfy the objectives established within ASC 606-10-50:

Revenue Recognition

The Company derives revenues primarily from the sale of wheels, tires, tires/wheels assemblies, and undercarriage systems and components. he Company follows the five-step model to determine when to recognize revenue: (1) identify the contract(s) with the customer; (2) identify the performance obligations in the contract; (3) determine the transaction price; (4) allocate the transaction price to the performance obligations in the contract; (5) recognize revenue when the entity satisfies a performance obligation. In most arrangements within the Company, contracts with the

Titan International, Inc. 1525 Kautz Road, Suite 600, West Chicago, IL 60185 (630) 377-0486 www.titan-intl.com

customer are identified through the receipt of a purchase order, which also define the terms of the contract including the performance obligations or products to be sold, and specific transaction prices associated with the products. In some other arrangements, a master agreement exists that defines pertinent contract terms such as products and price. Purchase orders are then issued under the master agreement for specific quantities of products, which are fulfilled at the specified price at a given point in time. Generally, the Company’s performance obligations under the contracts are satisfied when there is transfer of control of the products to our customers, which is primarily upon shipment or, in certain instances, upon delivery of the products to the named customer location. The payment terms and conditions in our contracts vary and are customary within the geographies that we serve. As the Company’s standard payment terms are less than one year, the Company has elected the practical expedient under ASC 606-10-32-18 to not assess whether a contract has a significant financing component.

Revenues are stated net of returns, discounts and allowances, which are determined based on historical experience. Customer discounts and allowances, consisting primarily of volume discounts and other short-term incentive programs, are recorded as a reduction of revenue at the time of sale because these allowances reflect a reduction in the transaction price.

Costs to obtain or fulfill a contract with a customer, such as sales commissions to agents and internal sales employees, are recognized as an expense when incurred since the amortization period would be one year or less.

Shipping and handling costs are included as a component of cost of sales. Revenue derived from shipping and handling costs billed to customers is included in sales.

2.We note from your disclosures throughout the filing the company designs, manufactures and sells products to OEMs and aftermarket customers. In this regard, please tell us how you considered the guidance outlined in ASC 606-10-50-5 and paragraphs ASC 606-10-55-89 to 91 in determining the categories to use for disaggregating revenues that depict how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors such as, but not limited to, OEMs and aftermarket customers.

Response: As mentioned previously, the Company primarily sells wheels, tires, wheel/tire assemblies, and undercarriage systems and components on a purchase order basis with its end customers.

The Company determined that the nature, amount, timing and uncertainty of revenue in accordance with ASC 606-10-50-5 is primarily driven by our end customers which are appropriately classified within the agricultural, earthmoving/construction and consumer segments. The Company discloses the disaggregated revenue information based on its reportable segments due to the similarities across reportable segments in how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors, which are explained in the amended revenue recognition policy footnote discussed previously and within Item 1 of the 2022 Form 10-K. The nature, amount and timing of revenues and cash flows are similar between OEM and Aftermarket customers. The product type, geographical regions, end markets, contract duration, timing of transfer of control of products, and sales channels are all similar between OEM and Aftermarket, and therefore we believe disclosing OEM and Aftermarket sales does not provide additional information to the end users of the financial statements.

28. Segment and Geographical Information, page F-32

3.Please revise your segment footnote to comply with the disclosures requirements in ASC 280-10-50-29 and 40.

Response: In accordance with the staff’s request, in future filings, the Company will disclose external revenues by product and reportable segment. An example of such disclosure is set forth below, showing how such changes would have applied to the applicable disclosure in the Form 10-K. In future filings, disclosure similar to the below will be included immediately following the existing disclosures in Note 28:

Titan International, Inc. 1525 Kautz Road, Suite 600, West Chicago, IL 60185 (630) 377-0486 www.titan-intl.com

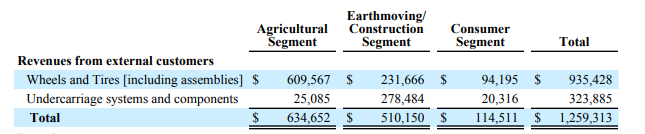

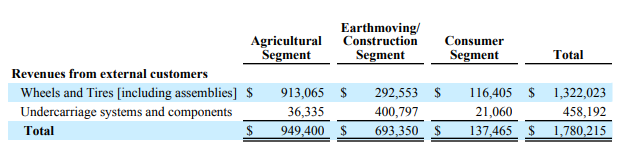

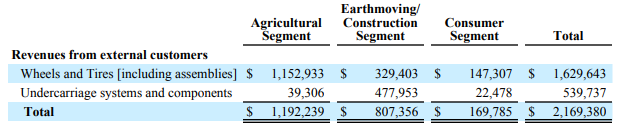

The table below presents information by products and reportable segments as of and for the years ended December 31, 2022, 2021 and 2020 (amounts in thousands):

For the year ended December 31, 2020

For the year ended December 31, 2021

For the year ended December 31, 2022

Further, in accordance with ASC 280-10-50-29 (b), the Company will disclose in future filings the following additional disclosure associated with the preparation of the segment disclosures in the second paragraph of Note 28 (added text underlined):

Titan is organized primarily on the basis of products being included in three marketing segments, with each reportable segment including wheels and tires and undercarriage systems and components. Given the integrated manufacturing operations and common administrative and marketing support, a substantial number of allocations primarily based on segment sales data must be made to determine operating segment data.

The Company does not believe additional disclosure is required for ASC 280-10-50-29 (items a - e) based on the following considerations in relation to the disclosures reported in the 2022 Form 10-K:

Titan International, Inc. 1525 Kautz Road, Suite 600, West Chicago, IL 60185 (630) 377-0486 www.titan-intl.com

a.There are no basis of accounting differences between the preparation of the Company’s consolidated financial statements and the segment footnote disclosure in the Company’s Form 10-K. There are no significant intersegment revenue transactions. Refer to Footnote 1 “Description of Business and Significant Accounting Policies” for further information.

b.There are no differences in measurements of the reportable segments’ profits or losses and the public entity’s income before income taxes. The primary common administrative and marketing support costs allocated include professional service fees, research and development costs and information technology expenses. Refer to the additional disclosure in future filings above to address allocations used to prepare the segment information.

c.There are no differences in measurements of the reportable segments’ assets and the public entity’s consolidated assets. As described in Footnote 28 of the 2022 Form 10-K, certain operating units’ property, plant, and equipment balances are carried at the corporate level. These are included within Corporate & Unallocated within the break-out of total assets by segment.

d.There are no changes from prior periods in terms of measurement methods used to determine reported segment profit or loss.

e.There are no asymmetrical allocations to segments. Allocations are primarily based on relative segment sales data.

If you have any questions or comments regarding this response, please call the undersigned at 217-228-6877. Thank you very much for your attention to this matter.

| | |

|

| Very truly yours, |

|

| /s/ David A. Martin |

| David A. Martin |

| Senior Vice President – |

| Chief Financial Officer |

Titan International, Inc. 1525 Kautz Road, Suite 600, West Chicago, IL 60185 (630) 377-0486 www.titan-intl.com