Life is Complex.

Nuveen makes things e-simple.

It only takes a minute to sign up for e-Reports. Once enrolled, you’ll receive an e-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within the e-mail to see the report and save it on your computer if you wish.

Free e-Reports

right to your e-mail!

www.investordelivery.com

If you receive your Nuveen Fund

dividends and statements from your

financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund

dividends and statements directly from

Nuveen.

NOT FDIC INSURED MAY LOSE

VALUE NO BANK GUARANTEE

Table of Contents

| | |

| Chairman’s Letter to Shareholders | 4 |

| | |

| Portfolio Manager’s Comments | 5 |

| | |

| Fund Leverage | 10 |

| | |

| Common Share Information | 11 |

| | |

| Risk Considerations | 13 |

| | |

| Performance Overview and Holding Summaries | 14 |

| | |

| Shareholder Meeting Report | 18 |

| | |

| Report of Independent Registered Public Accounting Firm | 19 |

| | |

| Portfolios of Investments | 20 |

| | |

| Statement of Assets and Liabilities | 33 |

| | |

| Statement of Operations | 34 |

| | |

| Statement of Changes in Net Assets | 35 |

| | |

| Statement of Cash Flows | 36 |

| | |

| Financial Highlights | 38 |

| | |

| Notes to Financial Statements | 41 |

| | |

| Additional Fund Information | 54 |

| | |

| Glossary of Terms Used in this Report | 55 |

| | |

| Reinvest Automatically, Easily and Conveniently | 57 |

| | |

| Annual Investment Management Agreement Approval Process | 58 |

| | |

| Board Members & Officers | 66 |

3

Chairman’s Letter

to Shareholders

Dear Shareholders,

The worries weighing on markets at the end of 2018 appeared to dissipate in early 2019 as positive economic and corporate earnings news, more dovish signals from central banks and trade progress boosted investor confidence. However, political noise and trade disputes continue to drive short-term market volatility and weigh on longer-term outlooks. Investors are concerned that increased tariffs and a protracted stalemate between the U.S. and its trading partners could dampen business and consumer sentiment, weakening spending and potentially impacting the global economy. Additionally, political uncertainty and the risk of policy error appear elevated. In the U.S. in particular, low interest rate levels and the widening federal deficit have constrained the available policy tools for countering recessionary pressures. As the current U.S. economic expansion has reached the 10-year mark this summer, it’s important to note that economic expansions don’t die of old age, but mature economic cycles can be more vulnerable to an exogenous shock.

Until a clearer picture on trade emerges, more bouts of market turbulence are likely in the meantime. While the downside risks warrant careful monitoring, we believe the likelihood of a near-term recession remains low. Global economic growth is moderating, with demand driven by the historically low unemployment in the U.S., Japan and across Europe. Central banks across the developed world continue to emphasize their readiness to adjust policy, and China’s authorities remain committed to keeping economic growth rates steady with fiscal and monetary policy.

The opportunity set may be narrower, but we believe there is still scope for gains in this environment. Patience and maintaining perspective can help you weather periodic market volatility. We encourage you to work with your financial advisor to assess short-term market movements in the context of your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chairman of the Board

July 23, 2019

4

Portfolio Manager’s Comments

Nuveen Connecticut Quality Municipal Income Fund (NTC)

Nuveen Massachusetts Quality Municipal Income Fund (NMT)

These Funds feature portfolio management by Nuveen Asset Management, LLC (NAM), an affiliate of Nuveen, LLC. Portfolio manager Michael S. Hamilton discusses U.S. economic and municipal market conditions, key investment strategies and the twelve-month performance of the Nuveen Connecticut and Massachusetts Funds. Michael assumed portfolio management responsibility for these Funds in 2011.

During May 2019, the Board of Trustees approved the merger of the Nuveen Connecticut Quality Municipal Income Fund (NTC) into the acquiring Fund, the Nuveen AMT-Free Municipal Credit Income Fund (NVG). In order for the reorganization to occur, it must be approved by shareholders. If shareholders approve the reorganization, Nuveen Connecticut Quality Municipal Income Fund shareholders will receive a cash distribution prior to the closing of the reorganization of approximately 10% of net asset value per share.

What factors affected the U.S. economy and the national municipal market during the twelve-month reporting period ended May 31, 2019?

The U.S. economy continued its solid expansion, with economic activity rebounding in early 2019 after a slump at the end of 2018. In the first quarter of 2019, gross domestic product (GDP), which measures the value of goods and services produced by the nation’s economy less the value of the goods and services used up in production, adjusted for price changes, grew at an annualized rate of 3.1%, according to the Bureau of Economic Analysis “second” estimate. A jump in exports and a buildup of inventories helped offset slower consumer and business spending in the first three months of 2019. For the full year 2018, U.S. GDP growth came in at 2.9%, as economic activity cooled over the second half of 2018 after peaking at 4.2% (annualized) in the second quarter of 2018.

Consumer spending, the largest driver of the economy, remained well supported by low unemployment, wage gains and tax cuts. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 3.6% in May 2019 from 3.8% in May 2018 and job gains averaged around 196,000 per month for the past twelve months. As the jobs market has tightened, average hourly earnings grew at an annualized rate of 3.1% in May 2019. However, falling energy prices led to a slower rate of inflation over the past twelve months.

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio manager as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements, and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Bond insurance guarantees only the payment of principal and interest on the bond when due, and not the value of the bonds themselves, which will fluctuate with the bond market and the financial success of the issuer and the insurer. Insurance relates specifically to the bonds in the portfolio and not to the share prices of a Fund. No representation is made as to the insurers’ ability to meet their commitments.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Manager’s Comments (continued)

The Consumer Price Index (CPI) increased 1.8% over the twelve-month reporting period ended May 31, 2019 before seasonal adjustment, as reported by the Bureau of Labor Statistics.

Low mortgage rates and low inventory drove home prices higher during this economic cycle. But the pace of price increases has slowed along with declining new home sales and housing starts. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, was up 3.5% year-over-year in April 2019 (most recent data available at the time this report was prepared). The 10-City and 20-City Composites reported year-over-year increases of 2.3% and 2.5%, respectively.

As some data began pointing to slower momentum in the overall economy, the Federal Reserve (Fed) notably shifted its stance. From December 2015 through December 2018, the Fed had gradually lifted its main policy interest rate to prevent the economy from overheating. In its final meeting of 2018, the Fed indicated that two more rate hikes might be forthcoming in 2019, roiling the markets, which had expected a more dovish tone. However, as more recent data revealed a mixed picture of the economy, the Fed said it would adopt a more “patient” approach, signaling the possibility of no rate hikes in 2019. Markets began to speculate that the Fed’s next move would be a rate cut, rather than a rate increase, particularly after trade tensions intensified between the U.S. and China. However, the minutes from the Fed’s April 30-May 1 meeting showed that the Fed was in no hurry to make any policy adjustment. The Fed kept rates unchanged in its first three policy meetings of 2019, as expected, and in March announced its plan to discontinue rolling assets off its balance sheet.

During the twelve-month reporting period, geopolitical news remained a prominent market driver. Tariff and trade policy topped the list of concerns. Hope for a China-U.S. trade deal dimmed after the latest round of negotiations ended with an impasse and both countries levied tariff increases. Additionally, the U.S. blacklisted Chinese company Huawei, banning companies from doing business with the telecom giant without U.S. government approval. In response, China announced its own “Unreliable Entity” list. Further roiling markets was President Trump’s surprise announcement that he would impose tariffs on Mexico if the country didn’t take more action to curb illegal immigration. (Subsequent to the end of the reporting period, the two countries announced a joint agreement and the U.S. administration suspended its tariff plan.) Meanwhile, as agreed in July 2018, the U.S. and the European Union continued to withhold further tariffs. Later in 2018, the U.S., Mexico and Canada agreed to a new trade deal to replace the North American Free Trade Agreement, but it has not yet been ratified by the countries’ legislatures. With no clear path forward on U.S.-China trade policy, markets grew increasingly worried that trade conflicts would dampen global growth, as negative sentiment could inhibit business, consumer and investor confidence and spending.

In the U.K., Prime Minister Theresa May was unable to secure a Brexit deal before the original March 29, 2019 deadline. The European Union extended the deadline to October 31, 2019, and Prime Minister May announced she would resign effective June 7, 2019, raising the possibility that her successor could favor a no-deal Brexit. Europe also contended with Italy’s euroskeptic coalition government and its challenging fiscal condition, the “yellow vest” protests in France, immigration policy concerns, Russian sanctions and political risk in Turkey.

Elections around the world also remained a source of uncertainty. Investors grew more skeptical that Brazil’s newly elected president could deliver reforms, while some of the market’s initial fears about Mexico’s new president subsided. Europe’s traditional centrist parties lost seats in the Parliamentary elections and populist parties saw marginal gains. The ruling parties in India and South Africa maintained their majorities, where slower economic growth could complicate their respective reform mandates.

6

The twelve-month reporting period began on a weak note for municipal bonds but turned strongly positive in the second half of the period. With the economy strengthening and the labor market tightening throughout the second half of 2018, the Fed continued to increase its main policy interest rate. The prevailing economic outlook was generally positive, driving the 10-year U.S. Treasury yield to a high of 3.24% in November 2018. However, interest rates declined significantly over the remainder of the reporting period on signs of a weaker macroeconomic environment, more dovish central bank policy, geopolitical tensions (especially regarding trade) and bouts of equity market volatility. The U.S. Treasury yield curve flattened overall, with a portion of the curve inverting. However, the municipal yield curve “twisted” by flattening at the short end and steepening at the long end of the curve.

Along with the falling interest rate environment, favorable supply-demand conditions were supportive of municipal bond performance. Issuance has been subdued since the passage of the Tax Cuts and Jobs Act of 2017. Because new issue advance refunding bonds are no longer tax exempt under the new tax law, the total supply of municipal bonds has decreased, boosting the scarcity value of existing municipal bonds. Municipal bond gross issuance nationwide totaled $338.6 billion in this reporting period, a 19.2% decrease from the issuance for the twelve-month reporting period ended May 31, 2018. Nevertheless, the overall low level of interest rates encouraged issuers to continue to actively refund their outstanding debt. In these transactions the issuers are issuing new bonds and taking the bond proceeds and redeeming (calling) old bonds. These refunding transactions have ranged from 40% to 60% of total issuance over the past few years. Thus, the net issuance (all bonds issued less bonds redeemed) is actually much lower than the gross issuance. So, while gross issuance volume has been strong, the net has not, and this was an overall positive technical factor on municipal bond investment performance in recent years. Although the pace of refundings is slowing, net negative issuance is expected to continue.

Low global interest rates have continued to drive investors toward higher after-tax yielding assets, including U.S. municipal bonds. The Fed’s pivot to a more dovish stance in early 2019 also brought investors back to fixed income markets, including municipal bonds, driving large inflows into the asset class in the early months of 2019. Additionally, as tax payers have begun to assess the impact of the 2017 tax law, which caps the state and local tax (SALT) deduction for individuals, there has been increased demand for tax-exempt municipal bonds in 2019 to date, especially in states with high income and/or property taxes.

What were the economic and market conditions in Connecticut and Massachusetts during the twelve-month reporting period ended May 31, 2019?

Though showing steady growth, Connecticut’s economy continues to lag the national recovery. Total non-farm employment is still below the 2008 peak. Weakness in the financial services and government sectors are undermining growth. As of May 2019, Connecticut’s unemployment rate was 3.8%, marginally higher than the national rate of 3.6%. Connecticut has a high number of defense-related industries that make it more sensitive to both cuts and increases in federal defense spending. On October 31, 2017, the Governor signed the $41.3 billion 2018-2019 biennium budget, 123 days late. It is 2.5% larger than the adopted 2016-2017 biennium budget. It contains no increases in broad-based taxes but does rely on a complex maneuver designed to increase federal Medicaid reimbursement to the State. Legislation adopted with the biennium budget imposed stricter budget controls, which helped Connecticut post a sizeable General Fund surplus in Fiscal Year 2018 and make a significant deposit to the State’s rainy day reserve fund. Connecticut’s pensions remain among the worst funded in the nation, which are likely to be a source of future financial strain at the state level. According to Moody’s Investors Service, Inc. (Moody’s), Connecticut’s per-capita debt burden was the highest in the nation at $6,544 in 2017, in contrast to the national median of $987. Connecticut enjoys the highest per-capita income of the 50 states, at 139% of the national average in 2017. At the end of the reporting period, Moody’s rated Connecticut “A1” with a

7

Portfolio Manager’s Comments (continued)

stable outlook. Moody’s had downgraded its rating to A1 from Aa3 on May 15, 2017, citing the State’s weakening demographics and high fixed costs. S&P rates Connecticut “A” with a positive outlook. Though S&P downgraded its rating to A from A+ on April 13, 2018, citing the State’s high fixed costs and heavy debt load, it has since shifted its outlook to positive. On April 19, 2019, S&P formally changed its outlook to positive, citing the State’s replenished reserves and increased financial controls. Approximately $6.0 billion in Connecticut municipal bonds were issued during the twelve months ending May 31, 2019, a gross issuance decrease of 5.7% year-over-year.

Massachusetts continues to benefit from a highly diverse economy. Biotechnology, pharmaceuticals, finance and software development are increasingly driving the Massachusetts economy, aided by the Commonwealth’s extensive education and health care sectors. Among the 50 states, Massachusetts has the highest percentage of population over 25 with a bachelor's degree, at approximately 43%. This compares with the national average of 31%. Job growth in Massachusetts is strong and exceeds the national average. Unemployment in the Commonwealth was 3.0% in May 2019, below the national average of 3.6% for the same period. According to the U.S. Department of Commerce, Bureau of Economic Analysis, Massachusetts’ per capita income is second highest among the 50 states. At $65,890 for calendar year 2017, it is 131% of the national average. The Commonwealth’s $41.2 billion Fiscal Year 2019 budget represents a 2.3% increase over the adopted Fiscal 2018 budget. The 2019 budget calls for no hikes in sales or income taxes. It calls for a $96 million deposit into the Commonwealth’s rainy day fund and a reduction in onetime revenue solutions. According to Moody's, Massachusetts' debt burden is second highest in the nation (after Connecticut) on a per capita basis ($6,085 versus the median of $987) and third highest as a percentage of the state GDP (8.3% versus the median of 2.1%). As of May 2019, Moody’s rated Massachusetts Aa1 with a stable outlook, and S&P rated the Commonwealth AA with a stable outlook. S&P had downgraded its rating from AA+ to AA on June 9, 2017, citing a reduction in the Commonwealth’s reserve levels. For the twelve months ended May 31, 2019, Massachusetts’ tax-exempt bond supply totaled $9.3 billion, a 21.5% decrease over the prior twelve months.

What key strategies were used to manage these Funds during the twelve-month reporting period ended May 31, 2019?

Municipal bonds benefited from fundamental and technical tailwinds in this reporting period. Falling interest rates, favorable credit conditions, strong municipal bond demand and low supply propelled municipal bond returns higher in the reporting period. Connecticut’s municipal bond market outperformed the national municipal market, while the Massachusetts municipal market lagged the national market. During this time, we continued to take a bottom-up approach to discovering sectors that appeared undervalued as well as individual credits that we believed had the potential to perform well over the long term.

Our trading activity continued to focus on pursuing the Funds’ investment objectives. The Funds’ positioning emphasized longer maturities, lower rated credits and/or sectors offering higher yields. For NTC, we bought maturities 12 years and longer across a diverse group of sectors including local general obligations (GOs), state of Connecticut GOs, water and sewer, higher education and student loans. NMT added bonds mainly in the 12- to 25-year maturity range from the health care, higher education, water and sewer, ports and state of Massachusetts GO sectors.

Most of the new purchases were funded from the proceeds of called and maturing bonds. We also sold some shorter-dated bonds, which we considered placeholders that could be sold and reinvested in more attractive long-term opportunities as they arise. Additionally, higher prevailing interest rates in the third and fourth quarters of 2018 presented favorable conditions to sell some depreciated bonds and buy similarly structured, higher yielding bonds. These bond exchanges helped boost tax efficiencies, as the

8

loss on the depreciated bonds we sold can be used to offset capital gains in the future, and helped increase the Fund’s income distribution capabilities. Both NTC and NMT were active with this trading strategy during the reporting period.

As of May 31, 2019, the Funds continued to use inverse floating rate securities. We employ inverse floaters for a variety of reasons, including duration management, income enhancement and total return enhancement.

How did the Funds perform during the twelve-month reporting period ended May 31, 2019?

The tables in each Fund's Performance Overview and Holding Summaries section of this report provide the Funds’ total returns for the one-year, five-year and ten-year periods ended May 31, 2019. Each Fund's total returns at common share net asset value (NAV) are compared with the performance of a corresponding market index.

For the twelve months ended May 31, 2019, the total returns at common share NAV for NTC and NMT outperformed the returns for the national S&P Municipal Bond Index and their respective state’s S&P Municipal Bond Index.

The Funds’ performance was affected by duration and yield curve positioning, credit ratings allocations, sector allocations and individual credit selection. In addition, the use of regulatory leverage was a factor affecting performance of the Funds. Leverage is discussed in more detail later in the Fund Leverage section of this report.

Duration and yield curve positioning was the largest positive contributor to relative performance. In this reporting period, long duration bonds outperformed and short duration bonds underperformed. The Funds’ underweights in shorter durations, especially six years and shorter for NTC and eight years and shorter for NMT, and overweights in longer durations, particularly durations longer than six years in NTC and eight years in NMT, aided performance.

Credit ratings allocation was a small positive contributor to the Funds’ performance. In Connecticut, the highest grade credits under-performed the broad market, while lower rated bonds beat the overall market. NTC’s underweight allocations to AAA and AA rated paper and overweight to single A and lower rated credits boosted relative performance. For the Massachusetts Fund, an underweight to AAA rated bonds, which lagged the broad market, and an overweight to credits rated AA and lower, which outperformed the broad market, were advantageous. Especially beneficial were NMT’s overweight allocations to single A and BBB rated bonds.

Sector positioning added value to NTC’s performance but slightly detracted from NMT’s performance. NTC was most helped by the tax-supported sector, where positions in state GO bonds rebounded as the state’s government took steps to improve its financial situation, helping credit spreads narrow during this reporting period. For NMT, an underweight to the tax-supported sector, and particularly an underweight to state and local GOs, dampened relative performance. NMT’s positioning in higher education bonds was also unfavorable, as the Fund held higher education credits with shorter effective durations that underperformed the market.

Individual credits that contributed the most to performance tended to be lower rated, higher effective duration structures. Standout performers in NTC included state of Connecticut GOs held in a tender option bond (TOB) trust, Sacred Heart University revenue bonds and local GOs issued for Bridgeport, Connecticut. NMT benefited from positions in Emerson College revenue bonds and WGBH Educational Foundation revenue bonds.

9

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through their issuance of preferred shares and/or investments in inverse floating rate securities, which represent leveraged investments in underlying bonds. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments in recent years have been much lower than the interest the Fund has been earning on its portfolio of long-term bonds that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund common shares will experience a greater increase in their net asset value if the municipal bonds acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the bonds acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. Over the last few quarters, short-term interest rates have indeed increased from their extended lows after the 2007-09 financial crisis. This increase has reduced common share net income, and also reduced potential for long-term total returns. Nevertheless, the ability to effectively borrow at current short-term rates is still resulting in enhanced common share income, and management believes that the advantages of continuation of leverage outweigh the associated increase in risk and volatility described above.

Leverage from issuance of preferred shares had a positive impact on the total return performance of the Funds over the reporting period. The use of leverage through inverse floating rate securities had a negligible impact on the total return performance of the Funds over the reporting period.

As of May 31, 2019, the Funds’ percentages of leverage are as shown in the accompanying table.

| | | |

| | NTC | NMT |

| Effective Leverage* | 37.74% | 37.20% |

| Regulatory Leverage* | 35.48% | 35.02% |

| | |

| * | Effective Leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of certain derivative and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Currently, the leverage effects of Tender Option Bond (TOB) inverse floater holdings are included in effective leverage values, in addition to any regulatory leverage. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

THE FUNDS’ REGULATORY LEVERAGE

As of May 31, 2019, the Funds have issued and outstanding preferred shares as shown in the accompanying table.

| | | | | | | |

| | | Variable Rate Preferred* | | | Variable Rate Remarketed Preferred** | |

| | | Shares Issued at Liquidation Preference | | | Shares Issued at Liquidation Preference | |

| NTC | | $ | 112,000,000 | | | $ | — | |

| NMT | | $ | 74,000,000 | | | $ | — | |

| | |

| * | Preferred shares of the Fund featuring a floating rate dividend based on a predetermined formula or spread to an index rate. Includes the following preferred shares AMTP, iMTP, VMTP, MFP-VRM and VRDP in Special Rate Mode, where applicable. See Notes to Financial Statements, Note 4 – Fund Shares, Preferred Shares for further details. |

| ** | Preferred shares of the Fund featuring floating rate dividends set by a remarketing agent via a regular remarketing. Includes the following preferred shares VRDP not in Special Rate Mode, MFP-VRRM and MFP-VRDM, where applicable. See Notes to Financial Statements, Note 4 – Fund Shares, Preferred Shares for further details. |

Refer to Notes to Financial Statements, Note 4 — Fund Shares, Preferred Shares for further details on preferred shares and each Fund’s respective transactions.

10

Common Share Information

COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding the Funds’ distributions is current as of May 31, 2019. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investments value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| | | | | | | |

| | | Per Common | |

| | | Share Amounts | |

| Monthly Distributions (Ex-Dividend Date) | | NTC | | | NMT | |

| June 2018 | | $ | 0.0410 | | | $ | 0.0445 | |

| July | | | 0.0410 | | | | 0.0445 | |

| August | | | 0.0410 | | | | 0.0445 | |

| September | | | 0.0410 | | | | 0.0410 | |

| October | | | 0.0410 | | | | 0.0410 | |

| November | | | 0.0410 | | | | 0.0410 | |

| December | | | 0.0410 | | | | 0.0410 | |

| January | | | 0.0410 | | | | 0.0410 | |

| February | | | 0.0410 | | | | 0.0410 | |

| March | | | 0.0410 | | | | 0.0410 | |

| April | | | 0.0410 | | | | 0.0410 | |

| May 2019 | | | 0.0410 | | | | 0.0410 | |

| Total Distributions from Net Investment Income | | $ | 0.4920 | | | $ | 0.5025 | |

| Yields | | | | | | | | |

| Market Yield* | | | 3.75 | % | | | 3.83 | % |

| Taxable-Equivalent Yield* | | | 5.33 | % | | | 5.40 | % |

| | |

| * | Market Yield is based on the Fund’s current annualized monthly dividend divided by the Fund’s current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a combined federal and state income tax rate of 29.7% and 29.1% for NTC and NMT, respectively. Your actual combined federal and state income tax rate may differ from the assumed rate. The Taxable-Equivalent Yield also takes into account the percentage of the Fund’s income generated and paid by the Fund (based on payments made during the previous calendar year) that was either exempt from federal income tax but not from state income tax (e.g., income from an out-of-state municipal bond), or was exempt from neither federal nor state income tax. Separately, if the comparison were instead to investments that generate qualified dividend income, which is taxable at a rate lower than an individual’s ordinary graduated tax rate, the fund’s Taxable- Equivalent Yield would be lower. |

Each Fund seeks to pay regular monthly dividends out of its net investment income at a rate that reflects its past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

11

Common Share Information (continued)

All monthly dividends paid by each Fund during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

COMMON SHARE REPURCHASES

During August 2018, the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of May 31, 2019, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

| | | | | | | |

| | | NTC | | | NMT | |

| Common shares cumulatively repurchased and retired | | | 360,000 | | | | 26,148 | |

| Common shares authorized for repurchase | | | 1,445,000 | | | | 935,000 | |

During the current reporting period, the Funds repurchased and retired their common shares at a weighted average price per share and a weighted average discount per share as shown in the accompanying table.

| | | | | | | |

| | | NTC | | | NMT | |

| Common shares repurchased and retired | | | 99,200 | | | | 26,148 | |

| Weighted average price per common share repurchased and retired | | $ | 11.23 | | | $ | 11.67 | |

| Weighted average discount per common share repurchased and retired | | | 15.96 | % | | | 15.20 | % |

Each Fund may repurchase its common shares on a dynamic basis with the goal of providing liquidity in circumstances when sufficient natural demand may not otherwise exist. This typically occurs in adverse market environments when a Fund’s common shares are trading at a significant discount to their current net asset value. By providing liquidity in such circumstances, a Fund seeks over time to enable common shareholders to sell their shares more efficiently, and thereby enable its common shares to trade at a narrower discount to their then-current net asset value.

By repurchasing its common shares below net asset value, and retiring those shares at net asset value, a Fund also generates immediate benefits for common shareholders through accretion to net assets as well as common net earnings. As reflected under “Discount Per Share Repurchased and Retired” in the Financial Highlights section of the financial statements, such net asset value accretion during the fiscal year was $0.01 per common share for NTC and NMT.

OTHER COMMON SHARE INFORMATION

As of May 31, 2019, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs as shown in the accompanying table.

| | | | | | | |

| | | NTC | | | NMT | |

| Common share NAV | | $ | 14.21 | | | $ | 14.73 | |

| Common share price | | $ | 13.13 | | | $ | 12.84 | |

| Premium/(Discount) to NAV | | | (7.60 | )% | | | (12.83 | )% |

| 12-month average premium/(discount) to NAV | | | (14.03 | )% | | | (12.84 | )% |

12

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Connecticut Quality Municipal Income Fund (NTC)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political, or regulatory changes affecting municipal bond issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NTC.

Nuveen Massachusetts Quality Municipal Income Fund (NMT)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value. Debt or fixed income securities such as those held by the Fund, are subject to market risk, credit risk, interest rate risk, derivatives risk, liquidity risk, and income risk. As interest rates rise, bond prices fall. Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. State concentration makes the Fund more susceptible to local adverse economic, political, or regulatory changes affecting municipal bond issuers. These and other risk considerations such as inverse floater risk and tax risk are described in more detail on the Fund’s web page at www.nuveen.com/NMT.

13

| | |

NTC | Nuveen Connecticut Quality Municipal |

| | Income Fund |

| | Performance Overview and Holding Summaries as of May 31, 2019 |

| | | | |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

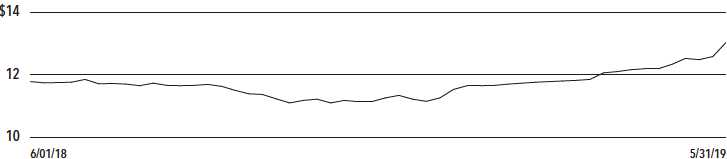

Average Annual Total Returns as of May 31, 2019 |

| |

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NTC at Common Share NAV | 7.92% | 4.14% | 5.12% |

| NTC at Common Share Price | 16.51% | 5.65% | 4.96% |

| S&P Municipal Bond Connecticut Index | 6.72% | 2.91% | 3.48% |

| S&P Municipal Bond Index | 6.06% | 3.55% | 4.73% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Common Share Price Performance — Weekly Closing Price

14

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 154.9% |

| Other Assets Less Liabilities | 3.1% |

Net Assets Plus Floating Rate Obligations | |

and AMTP Shares, net of deferred | |

offering costs | 158.0% |

| Floating Rate Obligations | (3.1)% |

| AMTP Shares, net of deferred | |

| offering costs | (54.9)% |

Net Assets | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| Connecticut | 90.2% |

| Guam | 4.6% |

| New York | 2.5% |

| Oregon | 1.3% |

| Puerto Rico | 0.8% |

| Virgin Islands | 0.6% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| Tax Obligation/General | 27.2% |

| Health Care | 20.4% |

| Water and Sewer | 13.8% |

| Tax Obligation/Limited | 13.6% |

| Education and Civic Organizations | 11.0% |

| U.S. Guaranteed | 10.1% |

| Other | 3.9% |

Total | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 9.9% |

| AAA | 2.2% |

| AA | 32.7% |

| A | 45.9% |

| BBB | 6.5% |

| BB or Lower | 2.0% |

| N/R (not rated) | 0.8% |

Total | 100% |

15

| | |

NMT | Nuveen Massachusetts Quality Municipal |

| | Income Fund |

| | Performance Overview and Holding Summaries as of May 31, 2019 |

| | | | |

| Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section. |

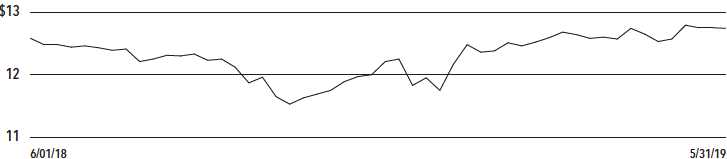

Average Annual Total Returns as of May 31, 2019 |

| |

| | Average Annual |

| | 1-Year | 5-Year | 10-Year |

| NMT at Common Share NAV | 6.87% | 4.56% | 6.01% |

| NMT at Common Share Price | 5.80% | 4.03% | 4.85% |

| S&P Municipal Bond Massachusetts Index | 5.93% | 3.24% | 4.23% |

| S&P Municipal Bond Index | 6.06% | 3.55% | 4.73% |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Common Share Price Performance — Weekly Closing Price

16

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

| | |

Fund Allocation | |

(% of net assets) | |

| Long-Term Municipal Bonds | 152.3% |

| Other Assets Less Liabilities | 1.4% |

Net Assets Plus VRDP Shares, | |

net of deferred offering costs | 153.7% |

| VRDP Shares, net of deferred | |

| offering costs | (53.7)% |

Net Assets | 100% |

| | |

States and Territories | |

(% of total municipal bonds) | |

| Massachusetts | 93.8% |

| Guam | 4.9% |

| Virgin Islands | 0.8% |

| Puerto Rico | 0.5% |

Total | 100% |

| | |

Portfolio Composition | |

(% of total investments) | |

| Education and Civic Organizations | 29.7% |

| Health Care | 21.0% |

| U.S. Guaranteed | 12.0% |

| Tax Obligation/Limited | 11.5% |

| Tax Obligation/General | 10.9% |

| Transportation | 6.5% |

| Water and Sewer | 5.3% |

| Other | 3.1% |

Total | 100% |

| | |

Portfolio Credit Quality | |

(% of total investment exposure) | |

| U.S. Guaranteed | 11.6% |

| AAA | 4.1% |

| AA | 49.4% |

| A | 23.0% |

| BBB | 7.7% |

| BB or Lower | 4.2% |

Total | 100% |

17

Shareholder Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen on April 10, 2019 for NTC; at this meeting the shareholders were asked to elect Board Members.

| | | | |

| | | NTC | |

| | Common and | | |

| | Preferred | | |

| | shares voting | | |

| | together | | Preferred |

| | as a class | | Shares |

Approval of the Board Members was reached as follows: | | | |

| Judith M. Stockdale | | | |

| For | 11,045,423 | | — |

| Withhold | 2,026,081 | | — |

| Total | 13,071,504 | | — |

| Carole E. Stone | | | |

| For | 11,032,363 | | — |

| Withhold | 2,039,141 | | — |

| Total | 13,071,504 | | — |

| Margaret L. Wolff | | | |

| For | 11,039,650 | | — |

| Withhold | 2,031,854 | | — |

| Total | 13,071,504 | | — |

| William C. Hunter | | | |

| For | — | | 1,120 |

| Withhold | — | | — |

| Total | — | | 1,120 |

| Albin F. Moschner | | | |

| For | — | | 1,120 |

| Withhold | — | | — |

| Total | — | | 1,120 |

18

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Nuveen Connecticut Quality Municipal Income Fund

Nuveen Massachusetts Quality Municipal Income Fund:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Nuveen Connecticut Quality Municipal Income Fund and Nuveen Massachusetts Quality Municipal Income Fund (the “Funds”), including the portfolios of investments, as of May 31, 2019, the related statements of operations for the year then ended, the statements of changes in net assets for each of the years in the two-year period then ended, the statements of cash flows for the year then ended, and the related notes (collectively, the “financial statements”) and the financial highlights for each of the years in the five-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of May 31, 2019, the results of their operations and their cash flows for the year then ended, the changes in their net assets for each of the years in the two-year period then ended, and the financial highlights for each of the years in the five-year period then ended, in conformity with U.S. generally accepted accounting principles.

Fund Reorganization

As discussed in note 1 to the financial statements, during May 2019, the Funds’ Board of Trustees approved the reorganization of Nuveen Connecticut Quality Municipal Income Fund into Nuveen AMT-Free Municipal Credit Income Fund. The reorganization requires shareholder approval; therefore, the reorganization date is yet to be determined.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements and financial highlights, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements and financial highlights. Such procedures also included confirmation of securities owned as of May 31, 2019, by correspondence with custodians and brokers or other appropriate auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements and financial highlights. We believe that our audits provide a reasonable basis for our opinion.

/s/ KPMG LLP

We have served as the auditor of one or more Nuveen investment companies since 2014.

Chicago, Illinois

July 26, 2019

19

| | |

NTC | Nuveen Connecticut Quality Municipal |

| | Income Fund |

| | Portfolio of Investments |

| | May 31, 2019 |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | LONG-TERM INVESTMENTS – 154.9% (100.0% of Total Investments) | | | |

| | | MUNICIPAL BONDS – 154.9% (100.0% of Total Investments) | | | |

| | | Education and Civic Organizations – 17.0% (11.0% of Total Investments) | | | |

| $ 4,250 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Connecticut | 7/26 at 100.00 | A2 | $ 4,540,870 |

| | | College, Refunding Series 2016L-1, 4.000%, 7/01/46 | | | |

| 1,150 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Connecticut | 7/21 at 100.00 | A2 | 1,210,639 |

| | | College, Series 2011H, 5.000%, 7/01/41 | | | |

| 5,565 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Fairfield | 7/26 at 100.00 | A– | 6,402,811 |

| | | University, Series 2016Q-1, 5.000%, 7/01/46 | | | |

| 1,125 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Norwich Free | 7/23 at 100.00 | A1 | 1,183,208 |

| | | Academy, Series 2013B, 4.000%, 7/01/34 | | | |

| 7,030 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Quinnipiac | 7/25 at 100.00 | A– | 7,901,017 |

| | | University, Refunding Series 2015L, 5.000%, 7/01/45 | | | |

| | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Quinnipiac | | | |

| | | University, Series 2016M: | | | |

| 500 | | 5.000%, 7/01/34 | 7/26 at 100.00 | A– | 581,590 |

| 1,500 | | 5.000%, 7/01/36 | 7/26 at 100.00 | A– | 1,736,535 |

| 6,145 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Sacred Heart | 7/27 at 100.00 | A | 7,153,087 |

| | | University, Series 2017I-1, 5.000%, 7/01/42 | | | |

| | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, The Loomis | | | |

| | | Chaffee School Issue, Series 2011-I: | | | |

| 560 | | 5.000%, 7/01/23 – AGM Insured | 7/21 at 100.00 | A1 | 596,809 |

| 225 | | 5.000%, 7/01/24 – AGM Insured | 7/21 at 100.00 | A1 | 239,551 |

| 2,250 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, University of | 7/28 at 100.00 | BBB | 2,589,457 |

| | | New Haven, Series 2018K-1, 5.000%, 7/01/38 | | | |

| 515 | | University of Connecticut, Student Fee Revenue Bonds, Refunding Series 2010A, | 11/19 at 100.00 | Aa3 | 522,694 |

| | | 5.000%, 11/15/27 | | | |

| 30,815 | | Total Education and Civic Organizations | | | 34,658,268 |

| | | Health Care – 31.6% (20.4% of Total Investments) | | | |

| 5,500 | | Connecticut Health and Educational Facilities Authority Revenue Bonds, Hartford | 7/25 at 100.00 | A | 6,004,570 |

| | | HealthCare, Series 2015F, 5.000%, 7/01/45 | | | |

| 7,025 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Hartford | 7/21 at 100.00 | A | 7,393,953 |

| | | HealthCare, Series 2011A, 5.000%, 7/01/41 | | | |

| 500 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Hartford | 7/24 at 100.00 | A | 555,625 |

| | | HealthCare, Series 2014E, 5.000%, 7/01/42 | | | |

| 1,915 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Middlesex | 7/25 at 100.00 | A3 | 2,125,133 |

| | | Hospital, Series 2015O, 5.000%, 7/01/36 | | | |

| 1,275 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Stamford | 7/20 at 100.00 | BBB+ | 1,312,409 |

| | | Hospital, Series 2010-I, 5.000%, 7/01/30 | | | |

| | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Stamford | | | |

| | | Hospital, Series 2012J: | | | |

| 1,000 | | 5.000%, 7/01/37 | 7/22 at 100.00 | BBB+ | 1,069,480 |

| 7,155 | | 5.000%, 7/01/42 | 7/22 at 100.00 | BBB+ | 7,636,818 |

| 4,000 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Stamford | 7/26 at 100.00 | BBB+ | 4,167,120 |

| | | Hospital, Series 2016K, 4.000%, 7/01/46 | | | |

20

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Health Care (continued) | | | |

| | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Trinity Health | | | |

| | | Credit Group, Series 2016CT: | | | |

| $ 2,650 | | 5.000%, 12/01/41 | 6/26 at 100.00 | AA– | $ 3,066,606 |

| 770 | | 5.000%, 12/01/45 | 6/26 at 100.00 | AA– | 888,796 |

| 5,915 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Western | 7/21 at 100.00 | A | 6,264,103 |

| | | Connecticut Health, Series 2011M, 5.375%, 7/01/41 | | | |

| 4,000 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Western | 7/21 at 100.00 | A | 4,225,920 |

| | | Connecticut Health, Series 2011N, 5.000%, 7/01/29 | | | |

| | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Yale-New Haven | | | |

| | | Health Issue, Series 2014E: | | | |

| 2,610 | | 5.000%, 7/01/32 | 7/24 at 100.00 | AA– | 2,974,017 |

| 2,740 | | 5.000%, 7/01/33 | 7/24 at 100.00 | AA– | 3,112,147 |

| 900 | | 5.000%, 7/01/34 | 7/24 at 100.00 | AA– | 1,018,449 |

| 4,540 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Ascension Health | 11/19 at 100.00 | AA+ | 4,604,967 |

| | | Series 2010A, 5.000%, 11/15/40 | | | |

| 7,475 | | Monroe County Industrial Development Corporation, New York, FHA Insured Mortgage Revenue | 2/21 at 100.00 | AA | 7,948,541 |

| | | Bonds, Unity Hospital of Rochestor Project, Series 2010, 5.500%, 8/15/40 | | | |

| 59,970 | | Total Health Care | | | 64,368,654 |

| | | Long-Term Care – 1.5% (1.0% of Total Investments) | | | |

| 1,100 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Duncaster, Inc, | 8/24 at 100.00 | BBB | 1,169,135 |

| | | Series 2014A, 5.000%, 8/01/44 | | | |

| 630 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Healthcare | 9/26 at 100.00 | BB | 666,389 |

| | | Facility Expansion Church Home of Hartford Inc Project, Series 2016A, 5.000%, 9/01/46, 144A | | | |

| 1,260 | | Connecticut Housing Finance Authority, State Supported Special Obligation Bonds, | 6/20 at 100.00 | A1 | 1,300,710 |

| | | Refunding Series 2010-16, 5.000%, 6/15/30 | | | |

| 2,990 | | Total Long-Term Care | | | 3,136,234 |

| | | Tax Obligation/General – 42.1% (27.2% of Total Investments) | | | |

| | | Bridgeport, Connecticut, General Obligation Bonds, Series 2014A: | | | |

| 2,345 | | 5.000%, 7/01/32 – AGM Insured | 7/24 at 100.00 | AA | 2,625,251 |

| 1,600 | | 5.000%, 7/01/34 – AGM Insured | 7/24 at 100.00 | AA | 1,782,912 |

| 2,800 | | Bridgeport, Connecticut, General Obligation Bonds, Series 2016D, 5.000%, 8/15/41 – | 8/26 at 100.00 | AA | 3,178,056 |

| | | AGM Insured | | | |

| | | Bridgeport, Connecticut, General Obligation Bonds, Series 2017A: | | | |

| 1,470 | | 5.000%, 11/01/36 | 11/27 at 100.00 | A | 1,704,112 |

| 750 | | 5.000%, 11/01/37 | 11/27 at 100.00 | A | 866,873 |

| | | City of New Haven, Connecticut, General Obligation Bonds, Series 2017A: | | | |

| 1,000 | | 5.000%, 8/01/35 | 8/27 at 100.00 | BBB+ | 1,135,150 |

| 1,425 | | 5.000%, 8/01/36 | 8/27 at 100.00 | BBB+ | 1,612,900 |

| 5,580 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Connecticut | 11/23 at 100.00 | A1 | 6,224,602 |

| | | State University System, Series 2013N, 5.000%, 11/01/31 | | | |

| 3,075 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Connecticut | 11/26 at 100.00 | A1 | 3,687,571 |

| | | State University System, Series 2016P-1, 5.000%, 11/01/29 | | | |

| 1,000 | | Connecticut State, General Obligation Bonds, Series 2011D, 5.000%, 11/01/31 | 11/21 at 100.00 | AA | 1,069,490 |

| 2,600 | | Connecticut State, General Obligation Bonds, Series 2014A, 5.000%, 3/01/31 | 3/24 at 100.00 | A1 | 2,933,788 |

| 3,500 | | Connecticut State, General Obligation Bonds, Series 2014F, 5.000%, 11/15/34 | 11/24 at 100.00 | A1 | 3,977,540 |

| 4,580 | | Connecticut State, General Obligation Bonds, Series 2015A, 4.500%, 3/15/33 | 3/25 at 100.00 | A1 | 5,086,411 |

| 2,630 | | Connecticut State, General Obligation Bonds, Series 2015F, 5.000%, 11/15/34 | 11/25 at 100.00 | A1 | 3,046,539 |

| | | Connecticut State, General Obligation Bonds, Series 2017A: | | | |

| 4,000 | | 5.000%, 4/15/34 | 4/27 at 100.00 | A1 | 4,725,080 |

| 3,730 | | 5.000%, 4/15/35 | 4/27 at 100.00 | A1 | 4,392,373 |

21

| | |

NTC | Nuveen Connecticut Quality Municipal Income Fund |

| | Portfolio of Investments (continued) |

| | May 31, 2019 |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Tax Obligation/General (continued) | | | |

| | | Connecticut State, General Obligation Bonds, Series 2018A: | | | |

| $ 3,500 | | 5.000%, 4/15/35 (UB) (4) | 4/28 at 100.00 | A1 | $ 4,189,150 |

| 5,000 | | 5.000%, 4/15/38 (UB) (4) | 4/28 at 100.00 | A1 | 5,929,550 |

| 2,300 | | Connecticut State, General Obligation Bonds, Series 2019A, 5.000%, 4/15/36 | 4/29 at 100.00 | A1 | 2,784,058 |

| 225 | | Hamden, Connecticut, General Obligation Bonds, Series 2016, 5.000%, 8/15/32 – | 8/24 at 100.00 | AA | 256,084 |

| | | BAM Insured | | | |

| 870 | | Hartford, Connecticut, General Obligation Bonds, Series 2009A, 5.000%, 8/15/28 – | 8/19 at 100.00 | AA | 875,638 |

| | | AGC Insured | | | |

| | | Milford, Connecticut, General Obligation Bonds, Series 2018: | | | |

| 1,055 | | 4.000%, 11/01/36 | 11/24 at 100.00 | AAA | 1,123,807 |

| 1,055 | | 4.000%, 11/01/37 | 11/24 at 100.00 | AAA | 1,119,302 |

| | | New Haven, Connecticut, General Obligation Bonds, Refunding Series 2016A: | | | |

| 1,000 | | 5.000%, 8/15/32 – AGM Insured | 8/26 at 100.00 | AA | 1,159,150 |

| 1,550 | | 5.000%, 8/15/35 – AGM Insured | 8/26 at 100.00 | AA | 1,784,701 |

| 985 | | New Haven, Connecticut, General Obligation Bonds, Series 2014A, 5.000%, 8/01/33 – | 8/24 at 100.00 | AA | 1,096,679 |

| | | AGM Insured | | | |

| | | New Haven, Connecticut, General Obligation Bonds, Series 2015: | | | |

| 790 | | 5.000%, 9/01/32 – AGM Insured | 9/25 at 100.00 | AA | 897,803 |

| 1,620 | | 5.000%, 9/01/33 – AGM Insured | 9/25 at 100.00 | AA | 1,838,765 |

| 500 | | 5.000%, 9/01/35 – AGM Insured | 9/25 at 100.00 | AA | 567,335 |

| 900 | | North Haven, Connecticut, General Obligation Bonds, Series 2006, 5.000%, 7/15/24 | No Opt. Call | Aa1 | 1,054,935 |

| 1,670 | | Oregon State, General Obligation Bonds, Oregon University System Projects, Series 2011G, | 8/21 at 100.00 | AA+ | 1,784,028 |

| | | 5.000%, 8/01/36 | | | |

| 600 | | Stratford, Connecticut, General Obligation Bonds, Series 2014, 5.000%, 12/15/32 | 12/22 at 100.00 | AA– | 662,202 |

| 1,500 | | Stratford, Connecticut, General Obligation Bonds, Series 2017, 4.000%, 1/01/39 – | 1/27 at 100.00 | AA | 1,628,715 |

| | | BAM Insured | | | |

| | | Suffield, Connecticut, General Obligation Bonds, Refunding Series 2005: | | | |

| 820 | | 5.000%, 6/15/19 | No Opt. Call | AA+ | 820,943 |

| 1,400 | | 5.000%, 6/15/21 | No Opt. Call | AA+ | 1,505,224 |

| 2,285 | | The Metropolitan District Hartford County, Connecticut General Obligation Bonds, Series | 7/28 at 100.00 | AA | 2,760,029 |

| | | 2018, 5.000%, 7/15/36 | | | |

| 1,000 | | Town of Hamden, Connecticut, General Obligation Bonds, Refunding Series 2018A, 5.000%, | 8/28 at 100.00 | AA | 1,198,510 |

| | | 8/15/30 – BAM Insured | | | |

| | | Waterbury, Connecticut, General Obligation Bonds, Lot A Series 2015: | | | |

| 445 | | 5.000%, 8/01/30 – BAM Insured | 8/25 at 100.00 | AA | 523,115 |

| 390 | | 5.000%, 8/01/31 – BAM Insured | 8/25 at 100.00 | AA | 457,805 |

| 610 | | 5.000%, 8/01/32 – BAM Insured | 8/25 at 100.00 | AA | 714,280 |

| 445 | | 5.000%, 8/01/33 – BAM Insured | 8/25 at 100.00 | AA | 520,178 |

| 445 | | 5.000%, 8/01/34 – BAM Insured | 8/25 at 100.00 | AA | 519,021 |

| 75,045 | | Total Tax Obligation/General | | | 85,819,655 |

| | | Tax Obligation/Limited – 21.2% (13.6% of Total Investments) | | | |

| 1,000 | | Connecticut State Higher Education Supplement Loan Authority, Revenue Bonds, Series 2019B, | 11/27 at 100.00 | A1 | 1,002,500 |

| | | 3.250%, 11/15/35 (AMT) | | | |

| 3,855 | | Connecticut State, Special Tax Obligation Bonds, Transportation Infrastructure Purposes | 10/23 at 100.00 | A+ | 4,304,146 |

| | | Series 2013A, 5.000%, 10/01/33 | | | |

| 1,380 | | Connecticut State, Special Tax Obligation Bonds, Transportation Infrastructure Purposes | 8/25 at 100.00 | A+ | 1,592,423 |

| | | Series 2015A, 5.000%, 8/01/33 | | | |

| | | Connecticut State, Special Tax Obligation Bonds, Transportation Infrastructure Purposes | | | |

| | | Series 2016A: | | | |

| 5,300 | | 5.000%, 9/01/33 | 9/26 at 100.00 | A+ | 6,234,496 |

| 1,075 | | 5.000%, 9/01/34 | 9/26 at 100.00 | A+ | 1,260,567 |

22

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Tax Obligation/Limited (continued) | | | |

| | | Connecticut State, Special Tax Obligation Bonds, Transportation Infrastructure Purposes, | | | |

| | | Series 2014A: | | | |

| $ 3,500 | | 5.000%, 9/01/33 | 9/24 at 100.00 | A+ | $ 3,984,715 |

| 1,000 | | 5.000%, 9/01/34 | 9/24 at 100.00 | A+ | 1,135,790 |

| 1,500 | | Government of Guam, Business Privilege Tax Bonds, Refunding Series 2015D, | 11/25 at 100.00 | BB | 1,640,085 |

| | | 5.000%, 11/15/39 | | | |

| | | Government of Guam, Business Privilege Tax Bonds, Series 2011A: | | | |

| 840 | | 5.250%, 1/01/36 | 1/22 at 100.00 | BB | 882,680 |

| 3,200 | | 5.125%, 1/01/42 | 1/22 at 100.00 | BB | 3,336,992 |

| 2,315 | | Harbor Point Infrastructure Improvement District, Connecticut, Special Obligation | 4/27 at 100.00 | N/R | 2,578,771 |

| | | Revenue Bonds, Harbor Point Project, Refunding Series 2017, 5.000%, 4/01/39, 144A | | | |

| 1,500 | | Puerto Rico Municipal Finance Agency, Series 2002A, 5.250%, 8/01/21 – AGM Insured | 7/19 at 100.00 | AA | 1,521,030 |

| 1,010 | | Puerto Rico Public Finance Corporation, Commonwealth Appropriation Bonds, Series 1998A, | No Opt. Call | Aaa | 1,110,051 |

| | | 5.125%, 6/01/24 – AMBAC Insured | | | |

| 2,600 | | University of Connecticut, General Obligation Bonds, Series 2010A, 5.000%, 2/15/28 | 2/20 at 100.00 | A+ | 2,656,030 |

| 2,500 | | University of Connecticut, General Obligation Bonds, Series 2013A, 5.000%, 8/15/32 | 8/23 at 100.00 | A+ | 2,771,550 |

| 760 | | University of Connecticut, General Obligation Bonds, Series 2014A, 5.000%, 2/15/31 | 2/24 at 100.00 | A+ | 855,365 |

| | | University of Connecticut, General Obligation Bonds, Series 2015A: | | | |

| 2,250 | | 5.000%, 3/15/31 | 3/26 at 100.00 | A+ | 2,647,687 |

| 1,415 | | 5.000%, 2/15/34 | 2/25 at 100.00 | A+ | 1,616,836 |

| 1,790 | | Virgin Islands Public Finance Authority, Gross Receipts Taxes Loan Note, Refunding | 10/22 at 100.00 | AA | 1,946,267 |

| | | Series 2012A, 5.000%, 10/01/32 – AGM Insured | | | |

| 38,790 | | Total Tax Obligation/Limited | | | 43,077,981 |

| | | Transportation – 0.8% (0.5% of Total Investments) | | | |

| 1,500 | | Connecticut Airport Authority, Connecticut, Customer Facility Charge Revenue Bonds, | 7/29 at 100.00 | A– | 1,599,915 |

| | | Ground Transportation Center Project, Series 2019A, 4.000%, 7/01/49 (AMT) | | | |

| | | U.S. Guaranteed ��� 15.6% (10.1% of Total Investments) (5) | | | |

| 2,500 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Fairfield | 7/20 at 100.00 | A– | 2,596,225 |

| | | University, Series 2010-O, 5.000%, 7/01/40 (Pre-refunded 7/01/20) | | | |

| 2,000 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Lawrence and | 7/21 at 100.00 | N/R | 2,138,640 |

| | | Memorial Hospitals, Series 2011F, 5.000%, 7/01/36 (Pre-refunded 7/01/21) | | | |

| | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Middlesex | | | |

| | | Hospital, Series 2011N: | | | |

| 1,105 | | 5.000%, 7/01/25 (Pre-refunded 7/01/21) | 7/21 at 100.00 | A3 | 1,185,124 |

| 400 | | 5.000%, 7/01/26 (Pre-refunded 7/01/21) | 7/21 at 100.00 | A3 | 429,004 |

| 500 | | 5.000%, 7/01/27 (Pre-refunded 7/01/21) | 7/21 at 100.00 | A3 | 536,255 |

| | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Sacred Heart | | | |

| | | University, Series 2011G: | | | |

| 250 | | 5.125%, 7/01/26 (Pre-refunded 7/01/21) | 7/21 at 100.00 | A | 268,765 |

| 3,260 | | 5.625%, 7/01/41 (Pre-refunded 7/01/21) | 7/21 at 100.00 | A | 3,537,882 |

| 3,000 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Wesleyan | 7/20 at 100.00 | AA | 3,115,470 |

| | | University, Series 2010G, 5.000%, 7/01/35 (Pre-refunded 7/01/20) | | | |

| 1,240 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Yale-New Haven | 7/20 at 100.00 | Aa3 | 1,292,948 |

| | | Hospital, Series 2010M, 5.500%, 7/01/40 (Pre-refunded 7/01/20) | | | |

| 1,010 | | Connecticut Health and Educational Facilities Authority, Revenue Bonds, Catholic Health | 11/20 at 100.00 | AA– | 1,057,106 |

| | | East Series 2010, 4.750%, 11/15/29 (Pre-refunded 11/15/20) | | | |

| 2,050 | | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series | 7/20 at 100.00 | A– | 2,140,938 |

| | | 2010, 5.625%, 7/01/40 (Pre-refunded 7/01/20) | | | |

| 3,000 | | Harbor Point Infrastructure Improvement District, Connecticut, Special Obligation | 4/20 at 100.00 | N/R | 3,156,900 |

| | | Revenue Bonds, Harbor Point Project, Series 2010A, 7.875%, 4/01/39 (Pre-refunded 4/01/20) | | | |

23

| | |

NTC | Nuveen Connecticut Quality Municipal Income Fund |

| | Portfolio of Investments (continued) |

| | May 31, 2019 |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | U.S. Guaranteed (5) (continued) | | | |

| $ 870 | | Hartford, Connecticut, General Obligation Bonds, Series 2009A, 5.000%, 8/15/28 | 8/19 at 100.00 | AA | $ 876,038 |

| | | (Pre-refunded 8/15/19) – AGC Insured | | | |

| 2,220 | | Oregon State, General Obligation Bonds, Oregon University System Projects, Series 2011G, | 8/21 at 100.00 | N/R | 2,385,057 |

| | | 5.000%, 8/01/36 (Pre-refunded 8/02/21) | | | |

| 4,870 | | South Central Connecticut Regional Water Authority, Water System Revenue Bonds, | 8/21 at 100.00 | AA– | 5,242,458 |

| | | Twentieth-Sixth Series, 2011, 5.000%, 8/01/41 (Pre-refunded 8/01/21) | | | |

| 1,725 | | Stamford, Connecticut, Special Obligation Revenue Bonds, Mill River Corridor Project, | 4/21 at 100.00 | N/R | 1,893,808 |

| | | Series 2011A, 7.000%, 4/01/41 (Pre-refunded 4/01/21) | | | |

| 30,000 | | Total U.S. Guaranteed | | | 31,852,618 |

| | | Utilities – 3.7% (2.4% of Total Investments) | | | |

| | | Connecticut Municipal Electric Energy Cooperative, Power Supply System Revenue Bonds, | | | |

| | | Tender Option Bond Trust 2016-XG0059: | | | |

| 1,295 | | 13.351%, 1/01/32, 144A (IF) (4) | 1/23 at 100.00 | Aa3 | 1,846,579 |

| 410 | | 13.241%, 1/01/38, 144A (IF) (4) | 1/23 at 100.00 | Aa3 | 575,976 |

| | | Connecticut Transmission Municipal Electric Energy Cooperative, Transmission System | | | |

| | | Revenue Bonds, Series 2012A: | | | |

| 655 | | 5.000%, 1/01/31 | 1/22 at 100.00 | Aa3 | 707,577 |

| 500 | | 5.000%, 1/01/32 | 1/22 at 100.00 | Aa3 | 539,475 |

| 2,830 | | 5.000%, 1/01/42 | 1/22 at 100.00 | Aa3 | 3,050,599 |

| 500 | | Eastern Connecticut Resource Recovery Authority, Solid Waste Revenue Bonds, Wheelabrator | 7/19 at 100.00 | A– | 507,550 |

| | | Lisbon Project, Series 1993A, 5.500%, 1/01/20 (AMT) | | | |

| 250 | | Guam Power Authority, Revenue Bonds, Series 2012A, 5.000%, 10/01/34 – AGM Insured | 10/22 at 100.00 | AA | 274,145 |

| 6,440 | | Total Utilities | | | 7,501,901 |

| | | Water and Sewer – 21.4% (13.8% of Total Investments) | | | |

| | | Connecticut, State Revolving Fund General Revenue Bonds, Green Bonds, Series 2017A: | | | |

| 1,500 | | 5.000%, 5/01/36 | 5/27 at 100.00 | AAA | 1,810,290 |

| 1,500 | | 5.000%, 5/01/37 | 5/27 at 100.00 | AAA | 1,804,560 |

| | | Greater New Haven Water Pollution Control Authority, Connecticut, Regional Wastewater | | | |

| | | System Revenue Bonds, Refunding Series 2014B: | | | |

| 500 | | 5.000%, 8/15/30 | 8/24 at 100.00 | AA | 575,730 |

| 1,000 | | 5.000%, 8/15/31 | 8/24 at 100.00 | AA | 1,149,060 |

| 500 | | 5.000%, 8/15/32 | 8/24 at 100.00 | AA | 573,845 |

| 55 | | Greater New Haven Water Pollution Control Authority, Connecticut, Regional Wastewater | 7/19 at 100.00 | AA | 55,154 |

| | | System Revenue Bonds, Series 2005A, 5.000%, 8/15/35 – NPFG Insured | | | |

| | | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, | | | |

| | | Refunding Series 2017: | | | |

| 1,335 | | 5.000%, 7/01/36 | 7/27 at 100.00 | A– | 1,513,957 |

| 890 | | 5.000%, 7/01/40 | 7/27 at 100.00 | A– | 999,532 |

| 3,045 | | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series | 7/23 at 100.00 | A– | 3,327,332 |

| | | 2013, 5.500%, 7/01/43 | | �� | |

| 235 | | Guam Government Waterworks Authority, Water and Wastewater System Revenue Bonds, Series | 7/26 at 100.00 | A– | 260,086 |

| | | 2016, 5.000%, 1/01/46 | | | |

| 10,015 | | Hartford County Metropolitan District, Connecticut, Clean Water Project Revenue Bonds, | 11/24 at 100.00 | Aa2 | 11,314,146 |

| | | Refunding Green Bond Series 2014A, 5.000%, 11/01/42 | | | |

| | | Hartford County Metropolitan District, Connecticut, Clean Water Project Revenue Bonds, | | | |

| | | Series 2013A: | | | |

| 4,100 | | 5.000%, 4/01/36 | 4/22 at 100.00 | Aa2 | 4,437,430 |

| 2,500 | | 5.000%, 4/01/39 | 4/22 at 100.00 | Aa2 | 2,702,350 |

| 795 | | South Central Connecticut Regional Water Authority Water System Revenue Bonds, Thirtieth | 8/24 at 100.00 | AA– | 898,358 |

| | | Series 2014A, 5.000%, 8/01/44 | | | |

24

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | Water and Sewer (continued) | | | |

| | | South Central Connecticut Regional Water Authority, Water System Revenue Bonds, | | | |

| | | Refunding Thirty-Second Series 2016B: | | | |

| $ 2,715 | | 4.000%, 8/01/36 | 8/26 at 100.00 | AA– | $ 2,985,278 |

| 2,220 | | 5.000%, 8/01/37 | 8/26 at 100.00 | AA– | 2,602,373 |

| 1,270 | | South Central Connecticut Regional Water Authority, Water System Revenue Bonds, | 8/28 at 100.00 | AA– | 1,528,001 |

| | | Thirty-third Series 2018A, 5.000%, 8/01/42 | | | |

| 4,000 | | South Central Connecticut Regional Water Authority, Water System Revenue Bonds, | 8/22 at 100.00 | AA– | 4,380,320 |

| | | Twenty-Seventh Series 2012, 5.000%, 8/01/33 | | | |

| 500 | | Stamford, Connecticut, Water Pollution Control System and Facility Revenue Bonds, Series | 8/23 at 100.00 | AA+ | 568,745 |

| | | 2013A, 5.250%, 8/15/43 | | | |

| 38,675 | | Total Water and Sewer | | | 43,486,547 |

| $ 284,225 | | Total Long-Term Investments (cost $300,123,527) | | | 315,501,773 |

| | | Floating Rate Obligations – (3.1)% | | | (6,375,000) |

| | | Adjustable Rate MuniFund Term Preferred Shares, net of deferred offering costs – (54.9)% (6) | | | (111,837,892) |

| | | Other Assets Less Liabilities – 3.1% | | | 6,385,232 |

| | | Net Assets Applicable to Common Shares – 100% | | | $ 203,674,113 |

| | |

| (1) | All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted. |

| (2) | Optional Call Provisions: Dates (month and year) and prices of the earliest optional call or redemption. There may be other call provisions at varying prices at later dates. Certain mortgage-backed securities may be subject to periodic principal paydowns. Optional Call Provisions are not covered by the report of independent registered public accounting firm. |

| (3) | For financial reporting purposes, the ratings disclosed are the highest of Standard & Poor’s Group (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch, Inc. (“Fitch”) rating. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Ratings below BBB by Standard & Poor’s, Baa by Moody’s or BBB by Fitch are considered to be below investment grade. Holdings designated N/R are not rated by any of these national rating agencies. Ratings are not covered by the report of independent registered public accounting firm. |

| (4) | Investment, or portion of investment, has been pledged to collateralize the net payment obligations for investments in inverse floating rate transactions. |

| (5) | Backed by an escrow or trust containing sufficient U.S. Government or U.S. Government agency securities, which ensure the timely payment of principal and interest. |

| (6) | Adjustable Rate MuniFund Term Preferred Shares, net of deferred offering costs as a percentage of Total Investments is 35.4%. |

| 144A | Investment is exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These investments may only be resold in transactions exempt from registration, which are normally those transactions with qualified institutional buyers. |

| AMT | Alternative Minimum Tax. |

| IF | Inverse floating rate security issued by a tender option bond (“TOB”) trust, the interest rate on which varies inversely with the Securities Industry Financial Markets Association (SIFMA) short-term rate, which resets weekly, or a similar short-term rate, and is reduced by the expenses related to the TOB trust. |

| UB | Underlying bond of an inverse floating rate trust reflected as a financing transaction. See Notes to Financial Statements, Note 3 – Portfolio Securities and Investments in Derivatives, Inverse Floating Rate Securities for more information. |

| | See accompanying notes to financial statements. |

25

| | |

NMT | Nuveen Massachusetts Quality Municipal |

| | Income Fund |

| | Portfolio of Investments |

| | May 31, 2019 |

| | | | | | |

Principal | | | Optional Call | | |

Amount (000) | | Description (1) | Provisions (2) | Ratings (3) | Value |

| | | LONG-TERM INVESTMENTS – 152.3% (100.0% of Total Investments) | | | |

| | | MUNICIPAL BONDS – 152.3% (100.0% of Total Investments) | | | |

| | | Education and Civic Organizations – 45.2% (29.7% of Total Investments) | | | |

| $ 3,515 | | Massachusetts Development Finance Agency, Revenue Bonds, Berklee College of Music, | 10/26 at 100.00 | A | $ 4,135,292 |

| | | Series 2016, 5.000%, 10/01/39 | | | |