UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07618

AB MUNICIPAL INCOME FUND II, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: May 31, 2017

Date of reporting period: November 30, 2016

ITEM 1. REPORTS TO STOCKHOLDERS.

NOV 11.30.16

SEMI-ANNUAL REPORT

AB MUNICIPAL INCOME FUND II

| + | | AB MASSACHUSETTS PORTFOLIO |

| + | | AB NEW JERSEY PORTFOLIO |

| + | | AB PENNSYLVANIA PORTFOLIO |

Investment Products Offered

|

•Are Not FDIC Insured •May Lose Value •Are Not Bank Guaranteed |

Investors should consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at www.abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

This shareholder report must be preceded or accompanied by the Fund’s prospectus for individuals who are not current shareholders of the Fund.

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227-4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Forms N-Q are available on the Commission’s website at www.sec.gov. The Fund’s Forms N-Q may also be reviewed and copied at the Commission’s Public Reference Room in Washington, DC; information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330. AB publishes full portfolio holdings for the Fund monthly at www.abfunds.com.

AllianceBernstein Investments, Inc. (ABI) is the distributor of the AB family of mutual funds. ABI is a member of FINRA and is an affiliate of AllianceBernstein L.P., the Adviser of the funds.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

January 25, 2017

Semi-Annual Report

This report provides management’s discussion of fund performance for the portfolios of AB Municipal Income Fund II (the “Fund”) for the semi-annual reporting period ended November 30, 2016. The Fund has eight portfolios: AB Arizona Portfolio, AB Massachusetts Portfolio, AB Michigan Portfolio, AB Minnesota Portfolio, AB New Jersey Portfolio, AB Ohio Portfolio, AB Pennsylvania Portfolio and AB Virginia Portfolio (individually, a “Portfolio”, collectively, the “Portfolios”).

At a Special Meeting of Shareholders of the Fund held on November 22, 2016, shareholders, at the recommendation of the Board of Trustees of the Fund (the “Board”), approved a proposal to liquidate and terminate the AB Michigan Portfolio (the “Liquidation”). The Portfolio was liquidated on January 23, 2017.

Investment Objectives and Policies

The eight Portfolios, by investing principally in high-yielding, predominantly investment-grade municipal securities, seek to provide their shareholders with the highest level of current income exempt from federal taxation and state taxation of the respective state that is available without assuming what AllianceBernstein L.P. (the “Adviser”) considers to be undue risk. Each of the Portfolios invests, under normal circumstances, at least 80% of its net assets in

municipal securities that pay interest that is exempt from federal income tax. Each of the Portfolios pursues its objective by investing at least 80% of its net assets in municipal securities issued by the named state or municipal securities with interest that is otherwise exempt from the named state’s income tax.

The Portfolios may also invest in forward commitments; zero-coupon municipal securities and variable, floating and inverse floating-rate municipal securities; and derivatives, such as options, futures contracts, forwards and swaps.

Investment Results

The tables on pages 9–10 show performance for each Portfolio compared to its benchmark, the Bloomberg Barclays Municipal Bond Index, for the six- and 12-month periods ended November 30, 2016. All performance comparisons are before sales charges. The inception date for Advisor Class shares for the Massachusetts and Virginia Portfolios was July 25, 2016; due to limited performance history, there is no discussion of comparison to the benchmark for this share class.

AB Arizona Portfolio – All share classes of the Portfolio outperformed the benchmark for both periods. Security selection in the special tax and transportation sectors contributed most to performance, followed by selection within the health care, local general obligation and education sectors, relative to the benchmark. For the

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 1 | |

12-month period, security selection in the special tax sector was the largest contributor to performance, followed by security selection in the transportation, health care, education and local general obligation sectors. Yield-curve positioning detracted during both periods.

AB Massachusetts Portfolio – All share classes of the Portfolio outperformed the benchmark for the six-month period, while all share classes of the Portfolio, except Class A, underperformed for the 12-month period. For both periods, security selection in the education sector contributed most to performance, followed by the health care, transportation and special tax sectors, relative to the benchmark. For the six-month period, security selection in the industrials sector had a negative impact on performance, while during the 12-month period, security selection in the insured sector detracted.

AB Michigan Portfolio – For both periods, all share classes of the Portfolio outperformed the benchmark. For the six-month period, security selection within the education, water, local general obligation and housing sectors contributed to performance, while security selection in the leasing sector detracted, relative to the benchmark. For the 12-month period, security selection in the education sector contributed most to returns, followed by the water, housing, health care and local general obligation sectors. Security

selection in the leasing and insured sectors detracted.

AB Minnesota Portfolio – All share classes of the Portfolio outperformed the benchmark for the six-month period. Security selection in the education, power, health care and local general obligation sectors contributed to performance, relative to the benchmark. Security selection in the leasing and insured sectors detracted. During the 12-month period, Class A shares outperformed the benchmark, while Class B and C shares underperformed. Security selection in the education and power sectors contributed most to performance, followed by the health care, local general obligation and housing sectors. Security selection in the insured and leasing sectors detracted.

AB New Jersey Portfolio – All share classes of the Portfolio outperformed the benchmark for both periods. Security selection in the education, power, health care and local general obligation sectors contributed to performance, relative to the benchmark. Security selection in the leasing and insured sectors detracted. During the 12-month period, security selection in the education and power sectors contributed most to performance, followed by the health care, local general obligation and housing sectors. Security selection in the insured and leasing sectors detracted.

AB Ohio Portfolio – All share classes of the Portfolio outperformed

| | |

| 2 | | • AB MUNICIPAL INCOME FUND II |

the benchmark for both periods. For the six-month period, security selection within the local general obligation sector contributed most to performance, followed by the education, transportation, water and special tax sectors, relative to the benchmark. Security selection in the industrials and leasing sectors detracted from performance. For the 12-month period, security selection in the education and local general obligation sectors contributed most to performance. Security selection in the special tax, water and transportation sectors also contributed, while the leasing and power sectors detracted.

AB Pennsylvania Portfolio – All share classes of the Portfolio outperformed the benchmark for the six-month period. Security selection within the local general obligation sector contributed most to performance, followed by the education and transportation sectors, relative to the benchmark. For the 12-month period, Class A shares of the Portfolio outperformed the benchmark, while Class B and C shares underperformed. Security selection in the local general obligation sector was the largest contributor to performance, followed by the education, transportation, water and industrials sectors. Yield-curve positioning detracted during both periods.

AB Virginia Portfolio – All share classes of the Portfolio outperformed the benchmark for the six-month period. Security selection in the

pre-refunded sector contributed most to relative performance, followed by the transportation, local general obligation, health care and education sectors. Security selection within the leasing and housing sectors detracted. For the 12-month period, Class A and C shares outperformed the benchmark, while Class B shares underperformed. Security selection in the prerefunded, industrials, transportation, education and health care sectors contributed to performance, while security selection in the leasing sector detracted.

All Portfolios used derivatives in the form of interest rate swaps and inflation swaps for the six- and 12-month periods for hedging purposes. For both periods, interest rate swaps added to absolute performance for all Portfolios, with the exception of the Pennsylvania Portfolio, where interest rate swaps had no material impact. Inflation swaps had no material impact on absolute performance for both periods.

Market Review and Investment Strategy

After generally declining for the first half of the 12-month period, municipal bond yields for maturities beyond five years rose over the latter half. In large part, the increase in yields happened in November as the bond market quickly reflected higher market expectations of inflation following President-elect Trump’s win. Given the large increases in November, longer-maturity bonds

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 3 | |

rose the most over the six-month period. Prior to November, yields for shorter-maturity bonds had already moved higher to reflect a higher probability of the US Federal Reserve raising its target for the federal funds rate, and as a change in regulations for money market funds led to a reduced demand for very short-term instruments. As a result, over the course of the 12-month period, yields were higher by 0.30% to 0.60%, depending on the maturity. Municipal credit fundamentals remained consistent with continued slow economic growth as tax revenues continued to increase, though in some cases at a slower rate, and default rates remain low across the broad municipal market.

The Portfolios may purchase municipal securities that are insured under policies issued by certain insurance companies. Historically, insured municipal securities typically received a higher credit rating, which meant that the issuer of the securities paid a lower interest rate. As a result of declines in the credit

quality and associated downgrades of most fund insurers, insurance has less value than it did in the past. The market now values insured municipal securities primarily based on the credit quality of the issuer of the security with little value given to the insurance feature. In purchasing such insured securities, the Adviser evaluates the risk and return of municipal securities through its own research. If an insurance company’s rating is downgraded or the company becomes insolvent, the prices of municipal securities insured by the insurance company may decline.

| | | | | | | | |

| Portfolio | | Insured

Bonds* | | | Pre-refunded/ ETM†/Insured

Bonds* | |

Arizona | | | 18.80 | % | | | 3.28 | % |

Massachusetts | | | 5.76 | % | | | 2.17 | % |

Michigan | | | 5.36 | % | | | 0.00 | % |

Minnesota | | | 8.37 | % | | | 2.68 | % |

New Jersey | | | 24.96 | % | | | 8.87 | % |

Ohio | | | 6.96 | % | | | 0.00 | % |

Pennsylvania | | | 9.40 | % | | | 0.00 | % |

Virginia | | | 4.59 | % | | | 1.86 | % |

| * | | Breakdowns expressed as a percentage of investments in municipal bonds. |

| | |

| 4 | | • AB MUNICIPAL INCOME FUND II |

DISCLOSURES AND RISKS

Benchmark Disclosure

The Bloomberg Barclays Municipal Bond Index is unmanaged and does not reflect fees and expenses associated with the active management of a mutual fund portfolio. The Bloomberg Barclays Municipal Bond Index is a total return performance benchmark for the long-term investment grade, tax-exempt bond market. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Portfolios.

A Word About Risk

Market Risk: The value of the Portfolios’ assets will fluctuate as the bond market fluctuates. The value of the Portfolios’ investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events that affect large portions of the market.

Credit Risk: An issuer or guarantor of a fixed-income security, or the counterparty to a derivatives or other contract, may be unable or unwilling to make timely payments of interest or principal, or to otherwise honor its obligations. The issuer or guarantor may default, causing a loss of the full principal amount of a security. The degree of risk for a particular security may be reflected in its credit rating. There is the possibility that the credit rating of a fixed-income security may be downgraded after purchase, which may adversely affect the value of the security. Investments in fixed-income securities with lower ratings tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Municipal Market Risk: This is the risk that special factors may adversely affect the value of municipal securities and have a significant effect on the yield or value of the Portfolios’ investments in municipal securities. These factors include economic conditions, political or legislative changes, uncertainties related to the tax status of municipal securities, or the rights of investors in these securities. To the extent that the Portfolios invest more of their assets in a particular state’s municipal securities, the Portfolios may be vulnerable to events adversely affecting that state, including economic, political and regulatory occurrences, court decisions, terrorism and catastrophic natural disasters, such as hurricanes or earthquakes. The Portfolios’ investments in certain municipal securities with principal and interest payments that are made from the revenues of a specific project or facility, and not general tax revenues, may have increased risks. Factors affecting the project or facility, such as local business or economic conditions, could have a significant effect on the project’s ability to make payments of principal and interest on these securities.

The Portfolios may invest in the municipal securities of Puerto Rico and other US territories and their governmental agencies and municipalities, which are exempt from federal, state, and, where applicable, local income

(Disclosures, Risks and Note about Historical Performance continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 5 | |

Disclosures and Risks

DISCLOSURES AND RISKS

(continued from previous page)

taxes. These municipal securities may have more risks than those of other US issuers of municipal securities. Like many US states and municipalities, Puerto Rico experienced a significant downturn during the recent recession. Puerto Rico’s downturn was particularly severe, and Puerto Rico continues to face a very challenging economic and fiscal environment. Municipal securities issued by Puerto Rico issuers have extremely low credit ratings and are on “negative watch” by credit rating organizations. Some Puerto Rico issuers are in default on principal and interest payments. The Government Development Bank, which provides liquidity to Puerto Rico’s government agencies, recently defaulted on a $400 million debt payment. This default casts doubts on the ability of Puerto Rico and its government agencies to make future payments. If this and the general economic situation in Puerto Rico persist or worsen, the volatility and credit quality of Puerto Rican municipal securities could be adversely affected, and the market for such securities may experience continued volatility. In addition, Puerto Rico’s difficulties have resulted in increased volatility in portions of the broader municipal securities market from time to time, and this may recur in the future.

Tax Risk: There is no guarantee that all of the Portfolios’ income will remain exempt from federal or state income taxes. From time to time, the US government and the US Congress consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the income received by shareholders from the Portfolios by increasing taxes on that income. In such event, the Portfolios’ net asset values (“NAVs”) could also decline as yields on municipal bonds, which are typically lower than those on taxable bonds, would be expected to increase to approximately the yield of comparable taxable bonds. Actions or anticipated actions affecting the tax exempt status of municipal bonds could also result in significant shareholder redemptions of shares of the Portfolios as investors anticipate adverse effects on the Portfolios or seek higher yields to offset the potential loss of the tax deduction. As a result, the Portfolios would be required to maintain higher levels of cash to meet the redemptions, which would negatively affect the Portfolios’ yield.

Interest Rate Risk: Changes in interest rates will affect the value of investments in fixed-income securities. When interest rates rise, the value of investments in fixed-income securities tends to fall and this decrease in value may not be offset by higher income from new investments. The Portfolios may be subject to a heightened risk of rising rates as the current period of historically low interest rates may be ending. Interest rate risk is generally greater for fixed-income securities with longer maturities or durations.

Duration Risk: Duration is a measure that relates the expected price volatility of a fixed-income security to changes in interest rates. The duration of

(Disclosures, Risks and Note about Historical Performance continued on next page)

| | |

| 6 | | • AB MUNICIPAL INCOME FUND II |

Disclosures and Risks

DISCLOSURES AND RISKS

(continued from previous page)

a fixed-income security may be shorter than or equal to full maturity of a fixed-income security. Fixed-income securities with longer durations have more risk and will decrease in price as interest rates rise. For example, a fixed-income security with a duration of three years will decrease in value by approximately 3% if interest rates increase by 1%.

Inflation Risk: This is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money. As inflation increases, the value of the Portfolios’ assets can decline as can the value of the Portfolios’ distributions. This risk is significantly greater for fixed-income securities with longer maturities.

Liquidity Risk: Liquidity risk occurs when certain investments become difficult to purchase or sell. Difficulty in selling less liquid securities may result in sales at disadvantageous prices affecting the value of your investment in the Portfolios. Causes of liquidity risk may include low trading volumes, large positions and heavy redemptions of the Portfolios’ shares. Over recent years liquidity risk has also increased because the capacity of dealers in the secondary market for fixed-income securities to make markets in these securities has decreased, even as the overall bond market has grown significantly, due to, among other things, structural changes, additional regulatory requirements and capital and risk restraints that have led to reduced inventories. Liquidity risk may be higher in a rising interest rate environment, when the value and liquidity of fixed-income securities generally decline. Municipal securities may have more liquidity risk than other fixed-income securities because they trade less frequently and the market for municipal securities is generally smaller than many other markets.

Derivatives Risk: Investments in derivatives may be illiquid, difficult to price, and leveraged so that small changes may produce disproportionate losses for the Portfolios, and may be subject to counterparty risk to a greater degree than more traditional investments.

Management Risk: The Portfolios are subject to management risk because they are actively managed investment funds. The Adviser will apply its investment techniques and risk analyses in making investment decisions, but there is no guarantee that its techniques will produce the intended results.

These risks are fully discussed in the Portfolios’ prospectus. As with all investments, you may lose money by investing in the Portfolios.

An Important Note About Historical Performance

The investment return and principal value of an investment in the Portfolios will fluctuate, so that shares, when redeemed, may be worth more or less than their original cost. Performance shown on the following pages represents past performance and does not

(Disclosures, Risks and Note about Historical Performance continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 7 | |

Disclosures and Risks

DISCLOSURES AND RISKS

(continued from previous page)

guarantee future results. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting www.abfunds.com.

All fees and expenses related to the operation of the Portfolios have been deducted. Net asset value returns do not reflect sales charges; if sales charges were reflected, the Portfolios’ quoted performance would be lower. SEC returns reflect the applicable sales charges for each share class: a 3.00% maximum front-end sales charge for Class A shares; the applicable contingent deferred sales charge for Class B shares (3% year 1, 2% year 2, 1% year 3); a 1% 1-year contingent deferred sales charge for Class C shares. Returns for the different share classes will vary due to different expenses associated with each class. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| 8 | | • AB MUNICIPAL INCOME FUND II |

Disclosures and Risks

HISTORICAL PERFORMANCE

THE PORTFOLIOS VS THEIR BENCHMARK

PERIODS ENDED NOVEMBER 30, 2016 (unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | NAV Returns | | | | |

| AB ARIZONA PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -2.86% | | | | 0.85% | | | | | |

| |

Class B* | | | -3.31% | | | | 0.10% | | | | | |

| |

Class C | | | -3.31% | | | | 0.10% | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| AB MASSACHUSETTS PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -2.86% | | | | 0.13% | | | | | |

| |

Class B* | | | -3.22% | | | | -0.61% | | | | | |

| |

Class C | | | -3.23% | | | | -0.62% | | | | | |

| |

Advisor Class | | | -4.20% | † | | | — | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| AB MICHIGAN PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -2.67% | | | | 1.32% | | | | | |

| |

Class B* | | | -3.03% | | | | 0.57% | | | | | |

| |

Class C | | | -3.04% | | | | 0.66% | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| AB MINNESOTA PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -2.74% | | | | 0.17% | | | | | |

| |

Class B* | | | -3.11% | | | | -0.39% | | | | | |

| |

Class C | | | -3.11% | | | | -0.59% | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| * | | Effective January 31, 2009, Class B shares are no longer available for purchase to new investors. Please see Note A for more information. |

| † | | Since inception on: 7/25/2016. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 9 | |

Historical Performance

HISTORICAL PERFORMANCE

(continued from previous page)

THE PORTFOLIOS VS THEIR BENCHMARK

PERIODS ENDED NOVEMBER 30, 2016 (unaudited)

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | NAV Returns | | | | |

| AB NEW JERSEY PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -2.94% | | | | 0.84% | | | | | |

| |

Class B* | | | -3.31% | | | | 0.09% | | | | | |

| |

Class C | | | -3.21% | | | | 0.09% | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| AB OHIO PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -3.18% | | | | 0.51% | | | | | |

| |

Class B* | | | -3.45% | | | | -0.14% | | | | | |

| |

Class C | | | -3.45% | | | | -0.14% | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| AB PENNSYLVANIA PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -2.82% | | | | 0.50% | | | | | |

| |

Class B* | | | -3.19% | | | | -0.25% | | | | | |

| |

Class C | | | -3.18% | | | | -0.25% | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| AB VIRGINIA PORTFOLIO | | 6 Months | | | 12 Months | | | | |

Class A | | | -2.80% | | | | 0.55% | | | | | |

| |

Class B* | | | -3.18% | | | | -0.29% | | | | | |

| |

Class C | | | -3.18% | | | | -0.20% | | | | | |

| |

Advisor Class | | | -3.98% | † | | | — | | | | | |

| |

| Bloomberg Barclays Municipal Bond Index | | | -3.52% | | | | -0.22% | | | | | |

| |

| | | | | | | | | | | | |

| * | | Effective January 31, 2009, Class B shares are no longer available for purchase to new investors. Please see Note A for more information. |

| † | | Since inception on: 7/25/2016. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 10 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB ARIZONA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent

Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.86 | % | | | 3.00 | % |

1 Year | | | 0.85 | % | | | -2.14 | % | | | | | | | | |

5 Years | | | 3.39 | % | | | 2.76 | % | | | | | | | | |

10 Years | | | 3.69 | % | | | 3.38 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 1.15 | % | | | 1.85 | % |

1 Year | | | 0.10 | % | | | -2.84 | % | | | | | | | | |

5 Years | | | 2.66 | % | | | 2.66 | % | | | | | | | | |

10 Years(a) | | | 3.27 | % | | | 3.27 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 1.16 | % | | | 1.87 | % |

1 Year | | | 0.10 | % | | | -0.88 | % | | | | | | | | |

5 Years | | | 2.66 | % | | | 2.66 | % | | | | | | | | |

10 Years | | | 2.97 | % | | | 2.97 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -2.21 | % |

5 Years | | | 2.64 | % |

10 Years | | | 3.49 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -2.83 | % |

5 Years | | | 2.53 | % |

10 Years(a) | | | 3.38 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -0.88 | % |

5 Years | | | 2.53 | % |

10 Years | | | 3.08 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 11 | |

Historical Performance

AB ARIZONA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.96%, 1.71% and 1.71% for Class A, Class B and Class C shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.78%, 1.53% and 1.53% for Class A, Class B and Class C shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 12 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB MASSACHUSETTS PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent

Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.35 | % | | | 2.19 | % |

1 Year | | | 0.13 | % | | | -2.84 | % | | | | | | | | |

5 Years | | | 3.24 | % | | | 2.61 | % | | | | | | | | |

10 Years | | | 3.82 | % | | | 3.50 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 0.64 | % | | | 1.04 | % |

1 Year | | | -0.61 | % | | | -3.53 | % | | | | | | | | |

5 Years | | | 2.52 | % | | | 2.52 | % | | | | | | | | |

10 Years(a) | | | 3.39 | % | | | 3.39 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 0.64 | % | | | 1.04 | % |

1 Year | | | -0.62 | % | | | -1.59 | % | | | | | | | | |

5 Years | | | 2.52 | % | | | 2.52 | % | | | | | | | | |

10 Years | | | 3.09 | % | | | 3.09 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Advisor Class Shares | | | | | | | | | | | 1.75 | % | | | 2.84 | % |

Since Inception‡ | | | -4.20 | % | | | -4.20 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -2.99 | % |

5 Years | | | 2.29 | % |

10 Years | | | 3.60 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -3.61 | % |

5 Years | | | 2.20 | % |

10 Years(a) | | | 3.49 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -1.67 | % |

5 Years | | | 2.18 | % |

10 Years | | | 3.19 | % |

| | | | |

| Advisor Class Shares | | | | |

Since Inception‡ | | | -3.58 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 13 | |

Historical Performance

AB MASSACHUSETTS PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.87%, 1.64%, 1.63% and 0.62% for Class A, Class B, Class C and Advisor Class shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.77%, 1.52%, 1.52% and 0.52% for Class A, Class B, Class C and Advisor Class shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

| ‡ | | Inception date: 7/25/2016. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 14 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB MICHIGAN PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent

Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.33 | % | | | 2.14 | % |

1 Year | | | 1.32 | % | | | -1.70 | % | | | | | | | | |

5 Years | | | 2.75 | % | | | 2.13 | % | | | | | | | | |

10 Years | | | 3.18 | % | | | 2.87 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 0.64 | % | | | 1.03 | % |

1 Year | | | 0.57 | % | | | -2.37 | % | | | | | | | | |

5 Years | | | 2.03 | % | | | 2.03 | % | | | | | | | | |

10 Years(a) | | | 2.76 | % | | | 2.76 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 0.82 | % | | | 1.32 | % |

1 Year | | | 0.66 | % | | | -0.32 | % | | | | | | | | |

5 Years | | | 2.03 | % | | | 2.03 | % | | | | | | | | |

10 Years | | | 2.46 | % | | | 2.46 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -2.85 | % |

5 Years | | | 1.85 | % |

10 Years | | | 2.89 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -3.55 | % |

5 Years | | | 1.73 | % |

10 Years(a) | | | 2.79 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -1.52 | % |

5 Years | | | 1.72 | % |

10 Years | | | 2.48 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 15 | |

Historical Performance

AB MICHIGAN PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.24%, 2.00% and 1.99% for Class A, Class B and Class C shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.85%, 1.60% and 1.60% for Class A, Class B and Class C shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 16 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB MINNESOTA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.14 | % | | | 1.95 | % |

1 Year | | | 0.17 | % | | | -2.83 | % | | | | | | | | |

5 Years | | | 2.91 | % | | | 2.28 | % | | | | | | | | |

10 Years | | | 3.42 | % | | | 3.10 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 0.36 | % | | | 0.61 | % |

1 Year | | | -0.39 | % | | | -3.32 | % | | | | | | | | |

5 Years | | | 2.19 | % | | | 2.19 | % | | | | | | | | |

10 Years(a) | | | 2.99 | % | | | 2.99 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 0.42 | % | | | 0.72 | % |

1 Year | | | -0.59 | % | | | -1.56 | % | | | | | | | | |

5 Years | | | 2.17 | % | | | 2.17 | % | | | | | | | | |

10 Years | | | 2.69 | % | | | 2.69 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -2.54 | % |

5 Years | | | 2.09 | % |

10 Years | | | 3.21 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -3.12 | % |

5 Years | | | 1.99 | % |

10 Years(a) | | | 3.10 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -1.27 | % |

5 Years | | | 1.96 | % |

10 Years | | | 2.80 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 17 | |

Historical Performance

AB MINNESOTA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.08%, 1.84% and 1.84% for Class A, Class B and Class C shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios exclusive for interest expense to 0.85%, 1.60% and 1.60% for Class A, Class B and Class C shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 18 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB NEW JERSEY PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.82 | % | | | 3.08 | % |

1 Year | | | 0.84 | % | | | -2.18 | % | | | | | | | | |

5 Years | | | 3.20 | % | | | 2.57 | % | | | | | | | | |

10 Years | | | 3.40 | % | | | 3.08 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 1.11 | % | | | 1.88 | % |

1 Year | | | 0.09 | % | | | -2.84 | % | | | | | | | | |

5 Years | | | 2.44 | % | | | 2.44 | % | | | | | | | | |

10 Years(a) | | | 2.98 | % | | | 2.98 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 1.11 | % | | | 1.88 | % |

1 Year | | | 0.09 | % | | | -0.89 | % | | | | | | | | |

5 Years | | | 2.46 | % | | | 2.46 | % | | | | | | | | |

10 Years | | | 2.67 | % | | | 2.67 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| Class A Shares | | | | |

1 Year | | | -2.25 | % |

5 Years | | | 2.30 | % |

10 Years | | | 3.19 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -2.93 | % |

5 Years | | | 2.18 | % |

10 Years(a) | | | 3.07 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -0.98 | % |

5 Years | | | 2.18 | % |

10 Years | | | 2.77 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 19 | |

Historical Performance

AB NEW JERSEY PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.99%, 1.78% and 1.74% for Class A, Class B and Class C shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.82%, 1.57% and 1.57% for Class A, Class B and Class C shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 20 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB OHIO PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent

Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.49 | % | | | 2.41 | % |

1 Year | | | 0.51 | % | | | -2.52 | % | | | | | | | | |

5 Years | | | 2.54 | % | | | 1.93 | % | | | | | | | | |

10 Years | | | 3.21 | % | | | 2.89 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 0.67 | % | | | 1.08 | % |

1 Year | | | -0.14 | % | | | -3.07 | % | | | | | | | | |

5 Years | | | 1.81 | % | | | 1.81 | % | | | | | | | | |

10 Years(a) | | | 2.78 | % | | | 2.78 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 0.77 | % | | | 1.25 | % |

1 Year | | | -0.14 | % | | | -1.12 | % | | | | | | | | |

5 Years | | | 1.81 | % | | | 1.81 | % | | | | | | | | |

10 Years | | | 2.49 | % | | | 2.49 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -2.50 | % |

5 Years | | | 1.78 | % |

10 Years | | | 3.01 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -3.27 | % |

5 Years | | | 1.66 | % |

10 Years(a) | | | 2.90 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -1.32 | % |

5 Years | | | 1.66 | % |

10 Years | | | 2.60 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 21 | |

Historical Performance

AB OHIO PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.99%, 1.75% and 1.74% for Class A, Class B and Class C shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.80%, 1.55% and 1.55% for Class A, Class B and Class C shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 22 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB PENNSYLVANIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent

Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.42 | % | | | 2.25 | % |

1 Year | | | 0.50 | % | | | -2.47 | % | | | | | | | | |

5 Years | | | 3.16 | % | | | 2.54 | % | | | | | | | | |

10 Years | | | 3.45 | % | | | 3.14 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 0.70 | % | | | 1.11 | % |

1 Year | | | -0.25 | % | | | -3.18 | % | | | | | | | | |

5 Years | | | 2.42 | % | | | 2.42 | % | | | | | | | | |

10 Years(a) | | | 3.02 | % | | | 3.02 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 0.70 | % | | | 1.11 | % |

1 Year | | | -0.25 | % | | | -1.23 | % | | | | | | | | |

5 Years | | | 2.42 | % | | | 2.42 | % | | | | | | | | |

10 Years | | | 2.73 | % | | | 2.73 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -2.63 | % |

5 Years | | | 2.27 | % |

10 Years | | | 3.24 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -3.35 | % |

5 Years | | | 2.16 | % |

10 Years(a) | | | 3.12 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -1.40 | % |

5 Years | | | 2.16 | % |

10 Years | | | 2.82 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 23 | |

Historical Performance

AB PENNSYLVANIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 1.03%, 1.88% and 1.78% for Class A, Class B and Class C shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.85%, 1.60% and 1.60% for Class A, Class B and Class C shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance continued on next page)

| | |

| 24 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

AB VIRGINIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

| | | | | | | | | | | | | | | | |

| AVERAGE ANNUAL RETURNS AS OF NOVEMBER 30, 2016 (unaudited) | |

| | | NAV Returns | | | SEC Returns (reflects applicable

sales charges) | | | SEC Yields* | | | Taxable

Equivalent

Yields† | |

| | | | | | | | | | | | | | | | |

| Class A Shares | | | | | | | | | | | 1.57 | % | | | 2.56 | % |

1 Year | | | 0.55 | % | | | -2.50 | % | | | | | | | | |

5 Years | | | 3.22 | % | | | 2.60 | % | | | | | | | | |

10 Years | | | 3.84 | % | | | 3.52 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class B Shares | | | | | | | | | | | 0.86 | % | | | 1.40 | % |

1 Year | | | -0.29 | % | | | -3.21 | % | | | | | | | | |

5 Years | | | 2.49 | % | | | 2.49 | % | | | | | | | | |

10 Years(a) | | | 3.42 | % | | | 3.42 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Class C Shares | | | | | | | | | | | 0.87 | % | | | 1.42 | % |

1 Year | | | -0.20 | % | | | -1.17 | % | | | | | | | | |

5 Years | | | 2.49 | % | | | 2.49 | % | | | | | | | | |

10 Years | | | 3.12 | % | | | 3.12 | % | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Advisor Class Shares | | | | | | | | | | | 1.95 | % | | | 3.18 | % |

Since Inception‡ | | | -3.98 | % | | | -3.98 | % | | | | | | | | |

| | | | |

SEC AVERAGE ANNUAL RETURNS AS OF THE MOST RECENT CALENDAR QUARTER-END DECEMBER 31, 2016 (unaudited) | |

| | | SEC Returns (reflects applicable

sales charges) | |

| | | | |

| Class A Shares | | | | |

1 Year | | | -2.40 | % |

5 Years | | | 2.33 | % |

10 Years | | | 3.64 | % |

| | | | |

| Class B Shares | | | | |

1 Year | | | -3.12 | % |

5 Years | | | 2.23 | % |

10 Years(a) | | | 3.51 | % |

| | | | |

| Class C Shares | | | | |

1 Year | | | -1.07 | % |

5 Years | | | 2.23 | % |

10 Years | | | 3.22 | % |

| | | | |

| Advisor Class Shares | | | | |

Since Inception‡ | | | -3.35 | % |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

(Historical Performance and footnotes continued on next page)

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 25 | |

Historical Performance

AB VIRGINIA PORTFOLIO

HISTORICAL PERFORMANCE

(continued from previous page)

The Portfolio’s current prospectus fee table shows the Portfolio’s total annual operating expense ratios as 0.87%, 1.65%, 1.62% and 0.62% for Class A, Class B, Class C and Advisor Class shares, respectively, gross of any fee waivers or expense reimbursements. Contractual fee waivers and/or expense reimbursements limit the Portfolio’s annual operating expense ratios to 0.80%, 1.55%, 1.55% and 0.55% for Class A, Class B, Class C and Advisor Class shares, respectively. These waivers/reimbursements may not be terminated before September 30, 2017 and may be extended by the Adviser for additional one-year terms. Absent reimbursements or waivers, performance would have been lower. The Financial Highlights section of this report sets forth expense ratio data for the current reporting period; the expense ratios shown above may differ from the expense ratios in the Financial Highlights section since they are based on different time periods.

| * | | SEC yields are calculated based on SEC guidelines for the 30-day period ended November 30, 2016. |

| † | | Taxable equivalent yields are based on SEC yields and a 35% marginal federal income tax rate and maximum state taxes where applicable. |

| (a) | | Assumes conversion of Class B shares into Class A shares after six years. |

| ‡ | | Inception date: 7/25/2016. |

See Disclosures, Risks and Note about Historical Performance on pages 5-8.

| | |

| 26 | | • AB MUNICIPAL INCOME FUND II |

Historical Performance

FUND EXPENSES

(unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments, contingent deferred sales charges on redemptions and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), or contingent deferred sales charges on redemptions. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 27 | |

Fund Expenses

FUND EXPENSES

(unaudited)

(continued from previous page)

AB Arizona Portfolio

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2016 | | | Ending

Account Value

November 30, 2016 | | | Expenses

Paid During

Period* | | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 971.40 | | | $ | 3.85 | | | | 0.78 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.16 | | | $ | 3.95 | | | | 0.78 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 966.90 | | | $ | 7.54 | | | | 1.53 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.40 | | | $ | 7.74 | | | | 1.53 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 966.90 | | | $ | 7.54 | | | | 1.53 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.40 | | | $ | 7.74 | | | | 1.53 | % |

| | | |

| AB Massachusetts Portfolio | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2016 | | | Ending

Account Value

November 30, 2016 | | | Expenses

Paid During

Period* | | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 971.40 | | | $ | 3.81 | | | | 0.77 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.21 | | | $ | 3.90 | | | | 0.77 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 967.80 | | | $ | 7.50 | | | | 1.52 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.45 | | | $ | 7.69 | | | | 1.52 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 967.70 | | | $ | 7.50 | | | | 1.52 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.45 | | | $ | 7.69 | | | | 1.52 | % |

| Advisor Class | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 958.00 | | | $ | 1.79 | | | | 0.52 | %*** |

Hypothetical** | | $ | 1,000 | | | $ | 1,015.71 | | | $ | 1.84 | | | | 0.52 | %*** |

| | | |

| AB Michigan Portfolio | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2016 | | | Ending

Account Value

November 30, 2016 | | | Expenses

Paid During

Period* | | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 973.30 | | | $ | 4.20 | | | | 0.85 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.81 | | | $ | 4.31 | | | | 0.85 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 969.70 | | | $ | 7.90 | | | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.05 | | | $ | 8.09 | | | | 1.60 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 969.60 | | | $ | 7.90 | | | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.05 | | | $ | 8.09 | | | | 1.60 | % |

| | |

| 28 | | • AB MUNICIPAL INCOME FUND II |

Fund Expenses

FUND EXPENSES

(unaudited)

(continued from previous page)

AB Minnesota Portfolio

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

June 1,

2016 | | | Ending

Account

Value

November 30,

2016 | | | Expenses

Paid

During

Period* | | | Annualized

Expense

Ratio* | | | Effective

Expenses

Paid

During

Period+ | | | Effective

Annualized

Expense

Ratio+ | |

| Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 972.60 | | | $ | 4.15 | | | | 0.84 | % | | $ | 4.20 | | | | 0.85 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.86 | | | $ | 4.26 | | | | 0.84 | % | | $ | 4.31 | | | | 0.85 | % |

| Class B | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.90 | | | $ | 7.85 | | | | 1.59 | % | | $ | 7.90 | | | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.10 | | | $ | 8.04 | | | | 1.59 | % | | $ | 8.09 | | | | 1.60 | % |

| Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.90 | | | $ | 7.85 | | | | 1.59 | % | | $ | 7.90 | | | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.10 | | | $ | 8.04 | | | | 1.59 | % | | $ | 8.09 | | | | 1.60 | % |

AB New Jersey Portfolio

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2016 | | | Ending

Account Value

November 30, 2016 | | | Expenses

Paid During

Period* | | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 970.60 | | | $ | 4.05 | | | | 0.82 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.96 | | | $ | 4.15 | | | | 0.82 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 966.90 | | | $ | 7.74 | | | | 1.57 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.20 | | | $ | 7.94 | | | | 1.57 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 967.90 | | | $ | 7.75 | | | | 1.57 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.20 | | | $ | 7.94 | | | | 1.57 | % |

AB Ohio Portfolio

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2016 | | | Ending

Account Value

November 30, 2016 | | | Expenses

Paid During

Period* | | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.20 | | | $ | 3.95 | | | | 0.80 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.06 | | | $ | 4.05 | | | | 0.80 | % |

| Class B | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 965.50 | | | $ | 7.64 | | | | 1.55 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.30 | | | $ | 7.84 | | | | 1.55 | % |

| Class C | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 965.50 | | | $ | 7.64 | | | | 1.55 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.30 | | | $ | 7.84 | | | | 1.55 | % |

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 29 | |

Fund Expenses

FUND EXPENSES

(unaudited)

(continued from previous page)

AB Pennsylvania Portfolio

| | | | | | | | | | | | | | | | |

| | | Beginning

Account Value

June 1, 2016 | | | Ending

Account Value

November 30, 2016 | | | Expenses

Paid During

Period* | | | Annualized

Expense

Ratio* | |

| Class A | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 971.80 | | | $ | 4.20 | | | | 0.85 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,020.81 | | | $ | 4.31 | | | | 0.85 | % |

| Class B | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.10 | | | $ | 7.89 | | | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.05 | | | $ | 8.09 | | | | 1.60 | % |

| Class C | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.20 | | | $ | 7.89 | | | | 1.60 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.05 | | | $ | 8.09 | | | | 1.60 | % |

AB Virginia Portfolio

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Beginning

Account

Value

June 1,

2016 | | | Ending

Account

Value

November 30,

2016 | | | Expenses

Paid

During

Period* | | | Annualized

Expense

Ratio* | | | Effective

Expenses

Paid

During

Period+ | | | Effective

Annualized

Expense

Ratio+ | |

| Class A | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 972.00 | | | $ | 3.91 | | | | 0.79 | % | | $ | 3.95 | | | | 0.80 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,021.11 | | | $ | 4.00 | | | | 0.79 | % | | $ | 4.05 | | | | 0.80 | % |

| Class B | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.20 | | | $ | 7.65 | | | | 1.55 | % | | $ | 7.65 | | | | 1.55 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.30 | | | $ | 7.84 | | | | 1.55 | % | | $ | 7.84 | | | | 1.55 | % |

| Class C | | | | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 968.20 | | | $ | 7.60 | | | | 1.54 | % | | $ | 7.65 | | | | 1.55 | % |

Hypothetical** | | $ | 1,000 | | | $ | 1,017.35 | | | $ | 7.79 | | | | 1.54 | % | | $ | 7.84 | | | | 1.55 | % |

| Advisor Class | | | | | | | | | | | | | | | | | |

Actual | | $ | 1,000 | | | $ | 960.20 | | | $ | 1.89 | | | | 0.55 | % | | $ | 1.89 | | | | 0.55 | %*** |

Hypothetical** | | $ | 1,000 | | | $ | 1,015.61 | | | $ | 1.94 | | | | 0.55 | % | | $ | 1.94 | | | | 0.55 | %*** |

| * | | Expenses are equal to the classes’ annualized expense ratios multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one half-year period). |

| ** | | Assumes 5% annual return before expenses. |

| *** | | Expenses are equal to the classes’ annualized expense ratios multiplied by the average account value over the period, multiplied by 128/365 (to reflect the since inception period). |

| + | | The Portfolio’s investments in affiliated/unaffiliated underlying portfolios incur no direct expenses, but bear proportionate shares of the acquired fund fees (i.e., operating, administrative and investment advisory fee) of the affiliated/unaffiliated underlying portfolios. Currently the Adviser has voluntarily agreed to waive its investment advisory fee from the Portfolio in an amount equal to the Portfolio’s share of the advisory fees of the affiliated underlying portfolios, as borne indirectly by the Fund as an acquired fund fee and expense. The Portfolio’s effective expenses are equal to the classes’ annualized expense ratio plus the Portfolio’s pro-rata share of the weighted average expense ratio of the affiliated/unaffiliated underlying portfolios in which it invests, multiplied by the average account value over the period, multiplied by 183/365 (to reflect the one-half year period). |

| | |

| 30 | | • AB MUNICIPAL INCOME FUND II |

Fund Expenses

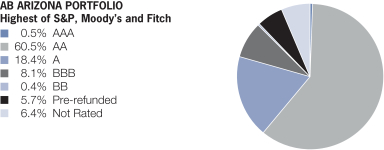

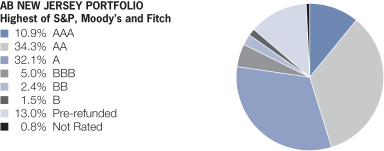

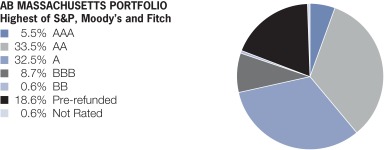

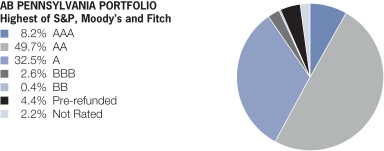

BOND RATING SUMMARY*

November 30, 2016 (unaudited)

| * | | All data are as of November 30, 2016. The Portfolio’s quality rating breakdowns are expressed as a percentage of the Portfolio’s total investments in municipal securities and may vary over time. The Portfolio also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). The quality ratings are determined by using the ratings of Standard & Poor’s Ratings Services (“S&P”), Moody’s Investors Services, Inc. (“Moody’s”) and Fitch Ratings, Ltd. (“Fitch”). The Portfolio considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies, including when there is a split rating. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by US government securities and therefore are deemed high-quality investment grade by the Adviser. If applicable, Not Applicable (N/A) includes non-creditworthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 31 | |

Bond Rating Summary

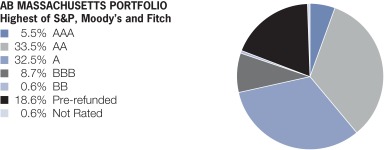

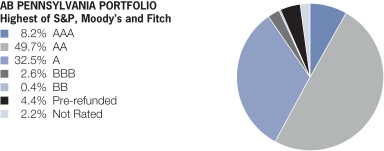

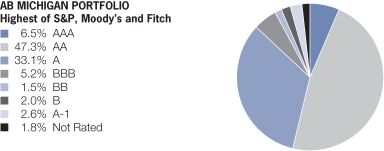

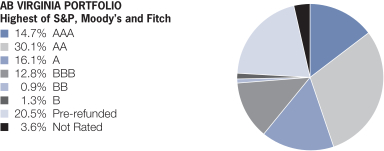

BOND RATING SUMMARY*

November 30, 2016 (unaudited)

| * | | All data are as of November 30, 2016. The Portfolio’s quality rating breakdowns are expressed as a percentage of the Portfolio’s total investments in municipal securities and may vary over time. The Portfolio also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). The quality ratings are determined by using the ratings of S&P, Moody’s and Fitch. The Portfolio considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies, including when there is a split rating. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by US government securities and therefore are deemed high-quality investment grade by the Adviser. If applicable, Not Applicable (N/A) includes non-creditworthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| | |

| 32 | | • AB MUNICIPAL INCOME FUND II |

Bond Rating Summary

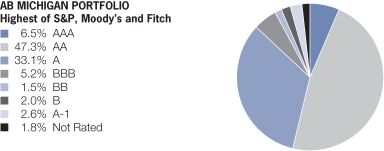

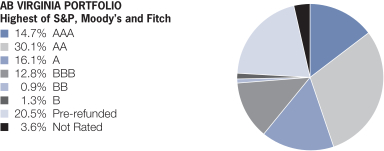

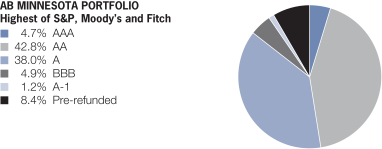

BOND RATING SUMMARY*

November 30, 2016 (unaudited)

| * | | All data are as of November 30, 2016. The Portfolio’s quality rating breakdowns are expressed as a percentage of the Portfolio’s total investments in municipal securities and may vary over time. The Portfolio also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). The quality ratings are determined by using the ratings of S&P, Moody’s and Fitch. The Portfolio considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies, including when there is a split rating. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by US government securities and therefore are deemed high-quality investment grade by the Adviser. If applicable, Not Applicable (N/A) includes non-creditworthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| | | | |

| AB MUNICIPAL INCOME FUND II • | | | 33 | |

Bond Rating Summary

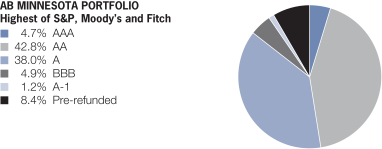

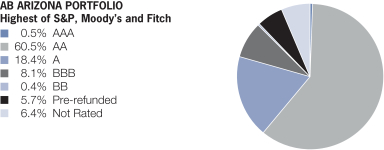

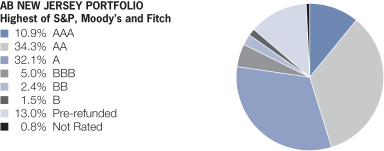

BOND RATING SUMMARY*

November 30, 2016 (unaudited)

| * | | All data are as of November 30, 2016. The Portfolio’s quality rating breakdowns are expressed as a percentage of the Portfolio’s total investments in municipal securities and may vary over time. The Portfolio also enters into derivative transactions, which may be used for hedging or investment purposes (see “Portfolio of Investments” section of the report for additional details). The quality ratings are determined by using the ratings of S&P, Moody’s and Fitch. The Portfolio considers the credit ratings issued by S&P, Moody’s and Fitch and uses the highest rating issued by the agencies, including when there is a split rating. These ratings are a measure of the quality and safety of a bond or portfolio, based on the issuer’s financial condition. AAA is the highest (best) and D is the lowest (worst). If applicable, the pre-refunded category includes bonds which are secured by US government securities and therefore are deemed high-quality investment grade by the Adviser. If applicable, Not Applicable (N/A) includes non-creditworthy investments; such as, equities, currency contracts, futures and options. If applicable, the Not Rated category includes bonds that are not rated by a nationally recognized statistical rating organization. The Adviser evaluates the creditworthiness of non-rated securities based on a number of factors including, but not limited to, cash flows, enterprise value and economic environment. |

| | |

| 34 | | • AB MUNICIPAL INCOME FUND II |

Bond Rating Summary

AB ARIZONA PORTFOLIO

PORTFOLIO OF INVESTMENTS

November 30, 2016 (unaudited)

| | | | | | | | |

| | | Principal

Amount

(000) | | | U.S. $ Value | |

| |

| | | | | | | | |

MUNICIPAL OBLIGATIONS – 99.3% | | | | | | | | |

Long-Term Municipal Bonds – 99.3% | | | | | | | | |

Arizona – 81.2% | | | | | | | | |

Arizona Department of Transportation State

Highway Fund Revenue

Series 2011A

5.25%, 7/01/29 (Pre-refunded/ETM) | | $ | 1,500 | | | $ | 1,714,095 | |

Series 2013A

5.00%, 7/01/37 | | | 3,000 | | | | 3,343,170 | |

Arizona Game & Fish Department & Commission

(Arizona Game & Fish Department &

Commission State Lease)

Series 2006

5.00%, 7/01/26 | | | 1,000 | | | | 1,018,300 | |