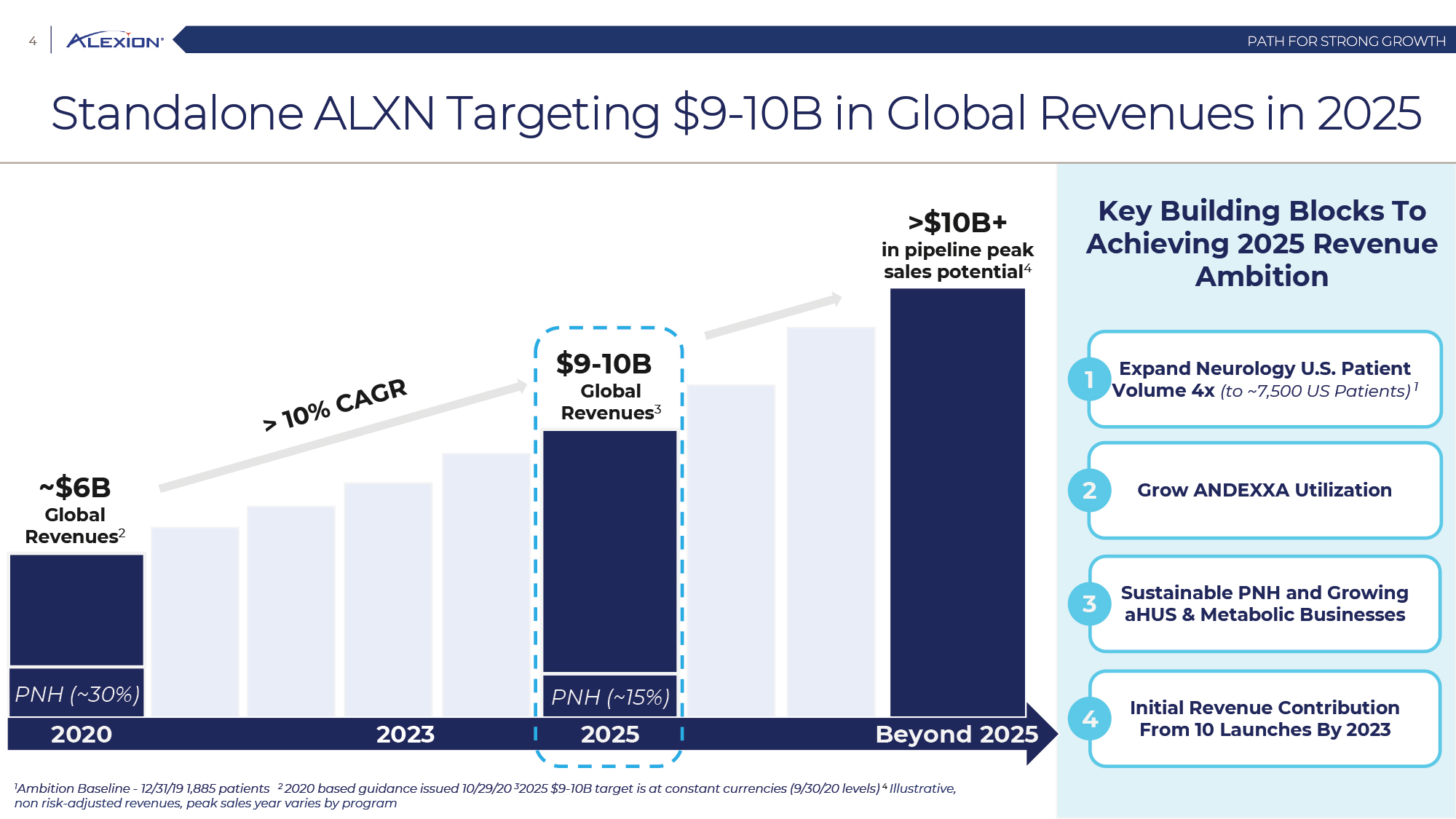

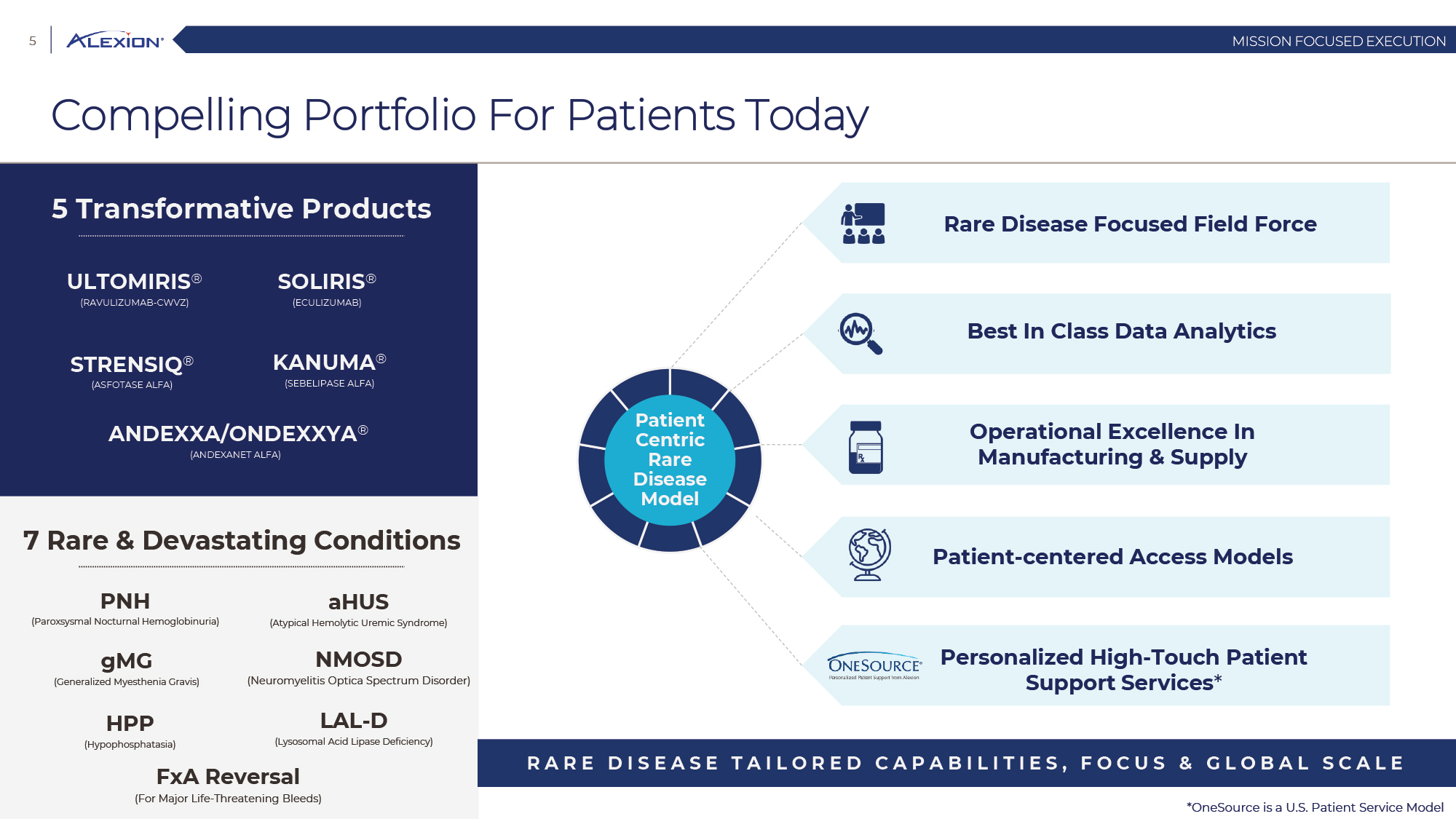

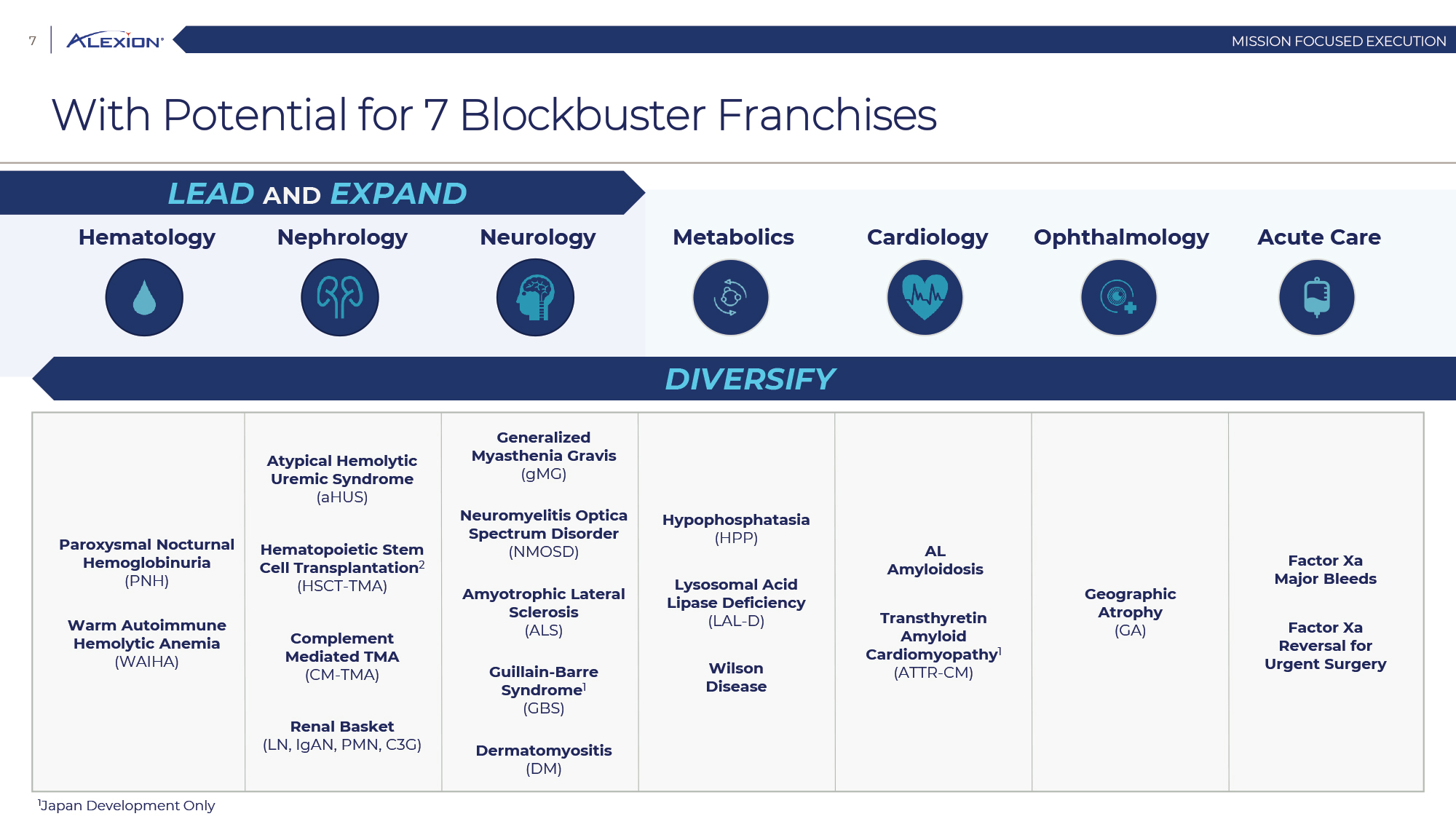

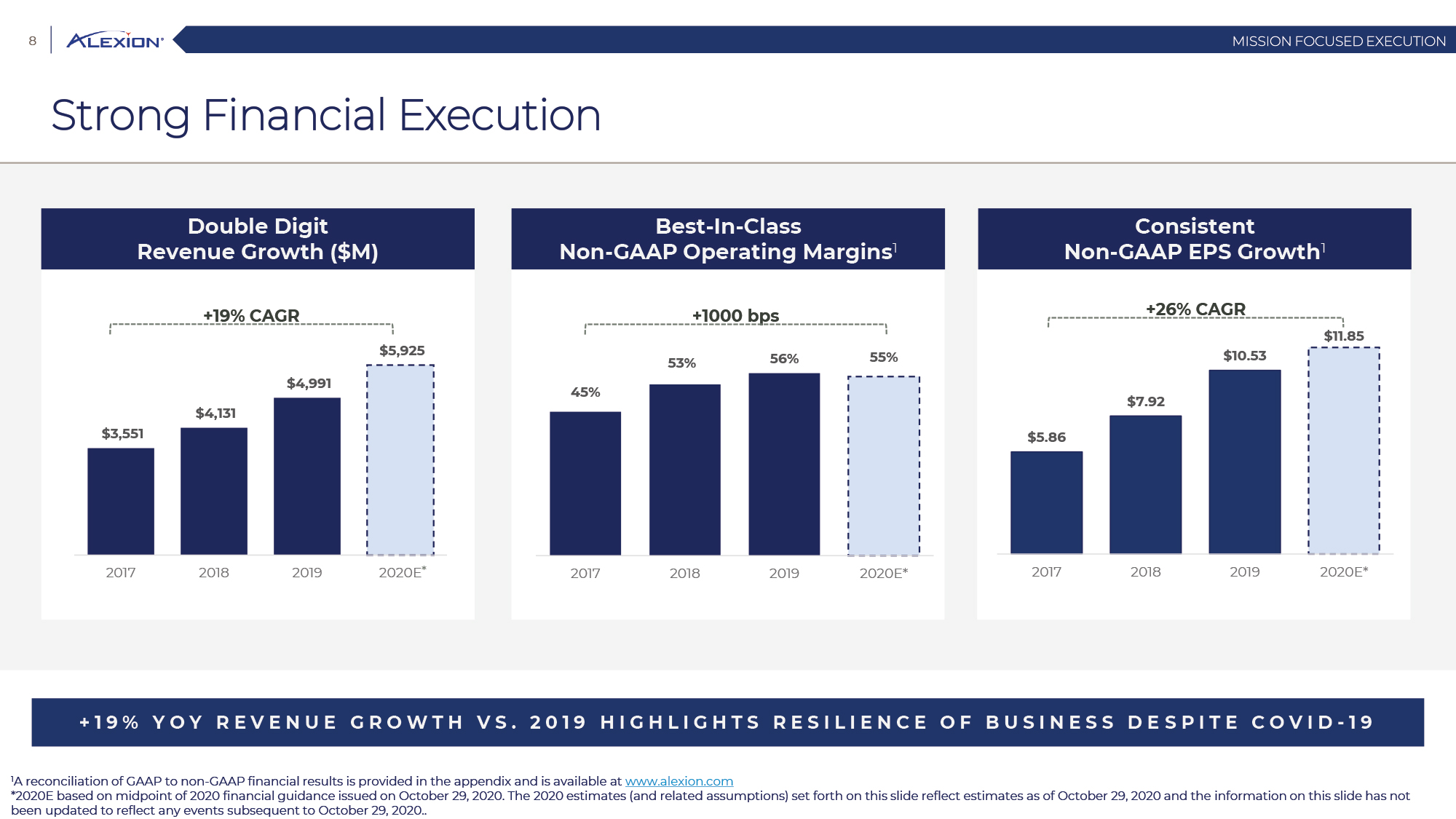

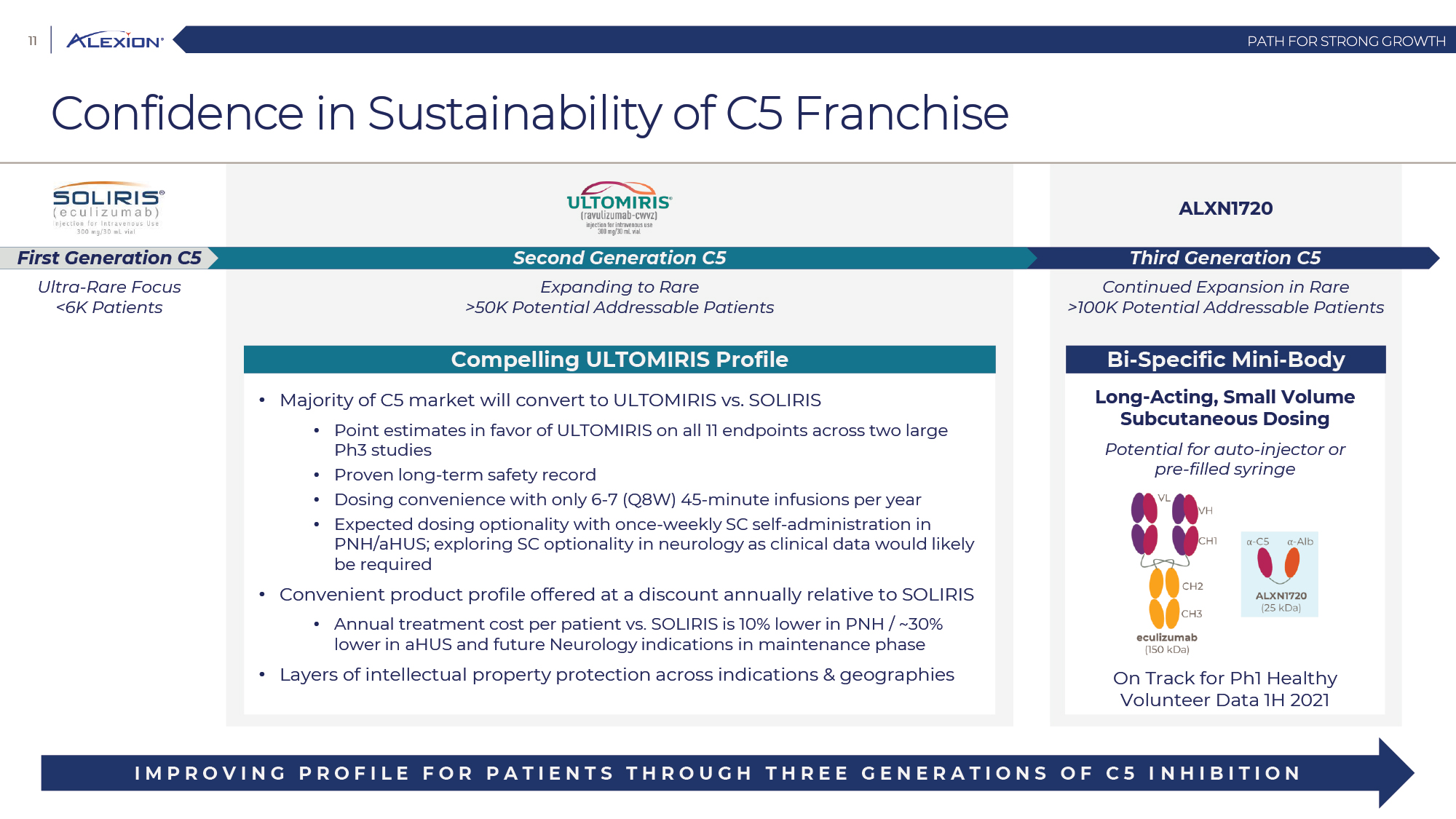

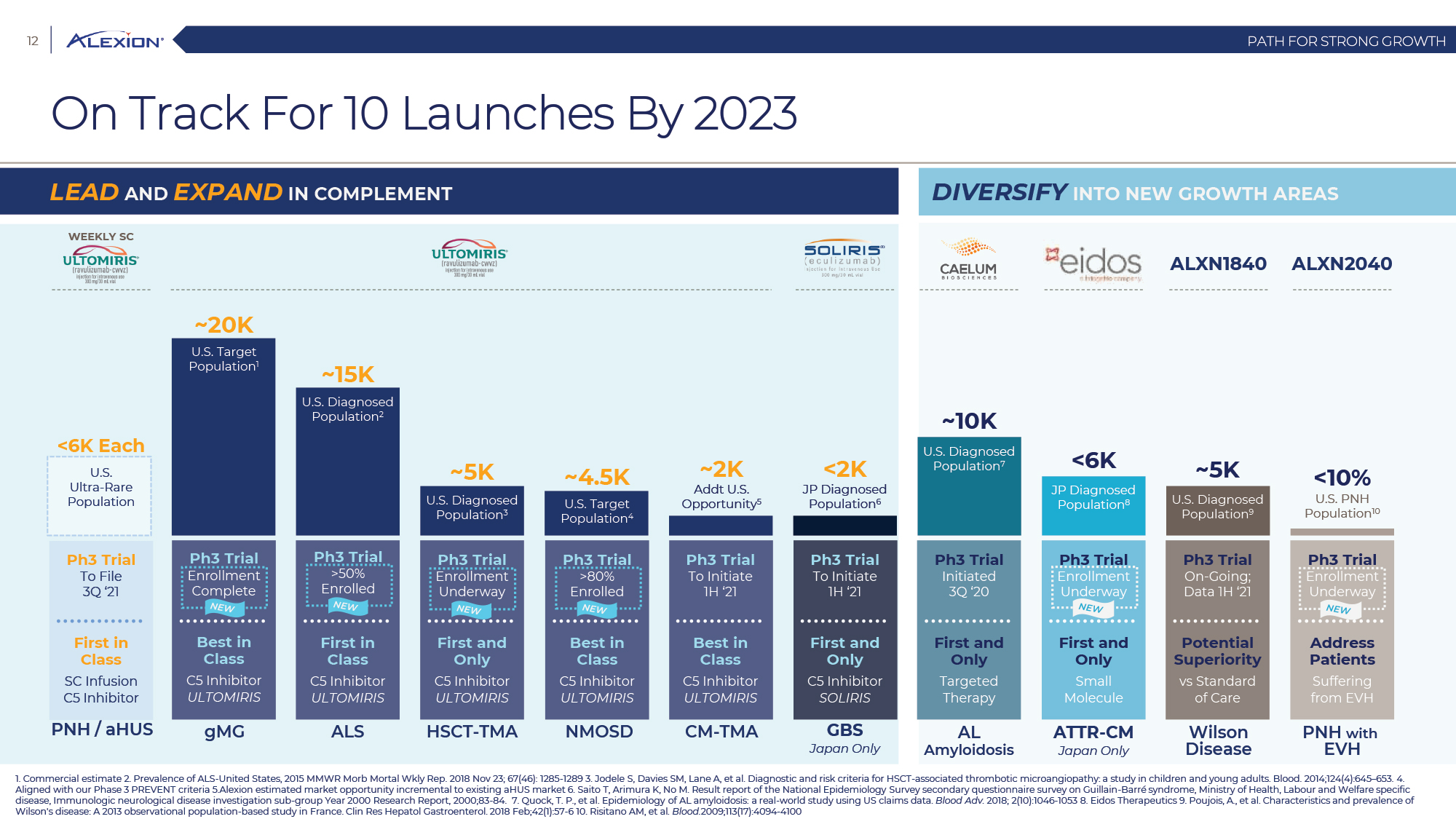

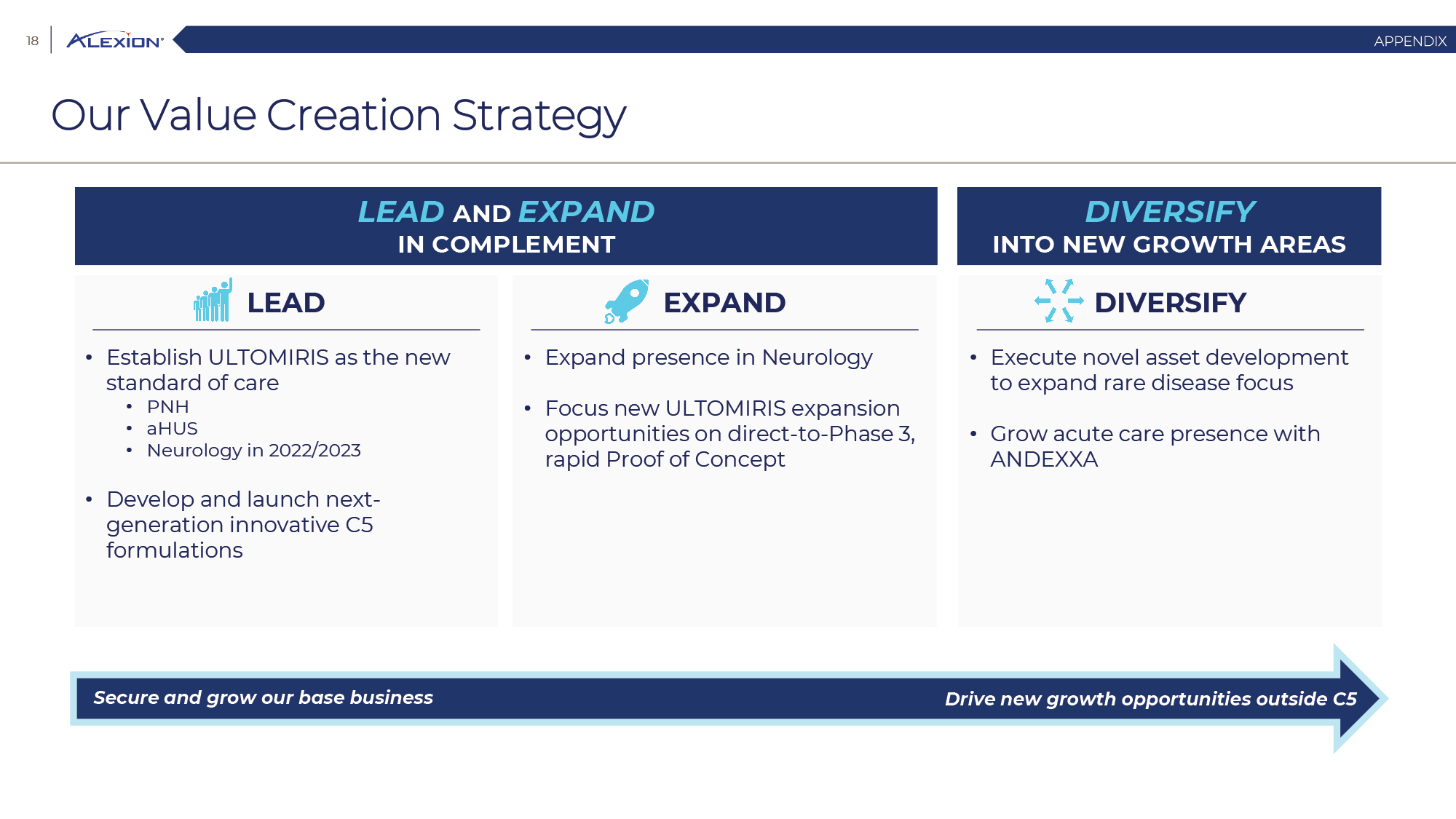

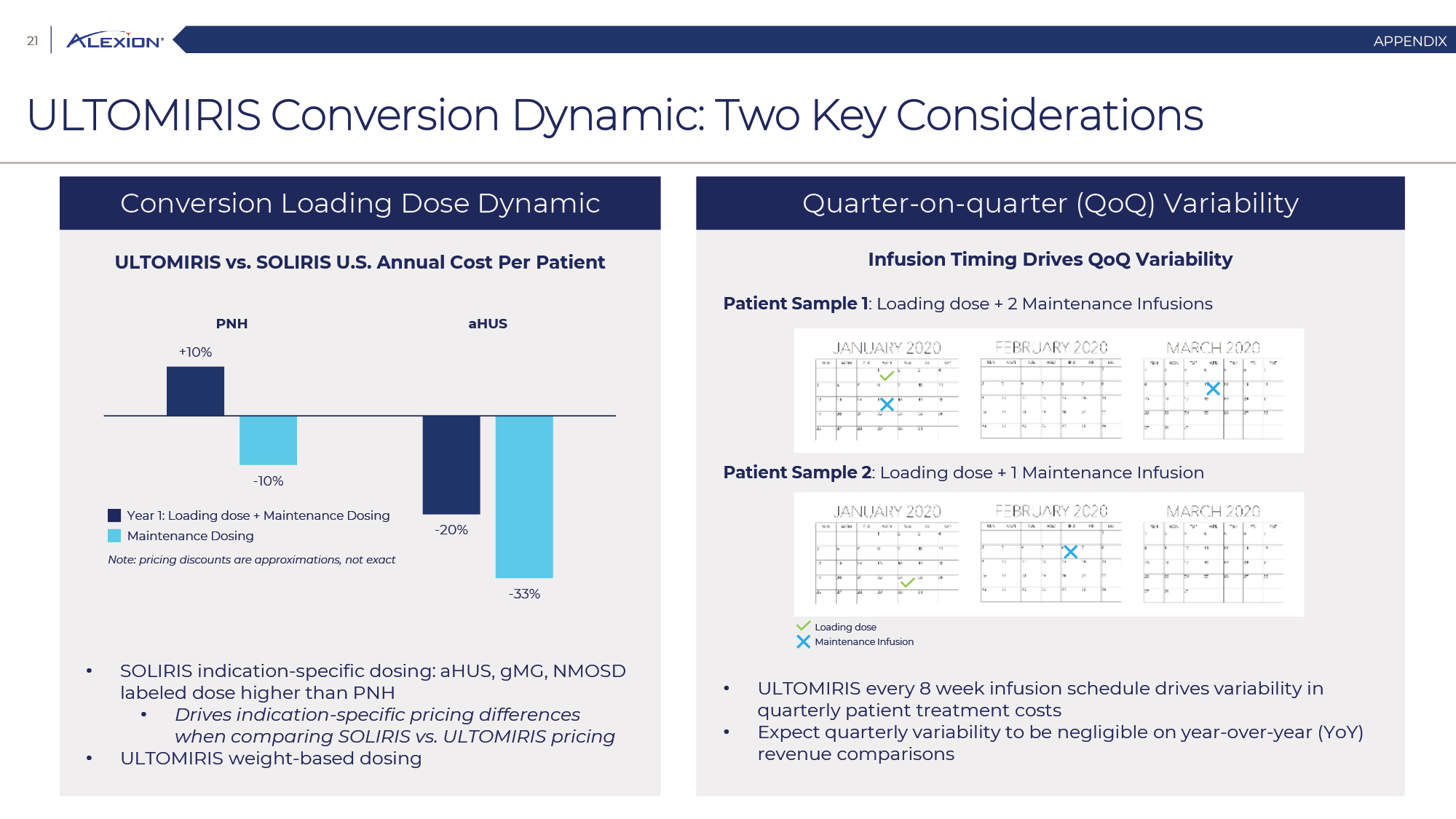

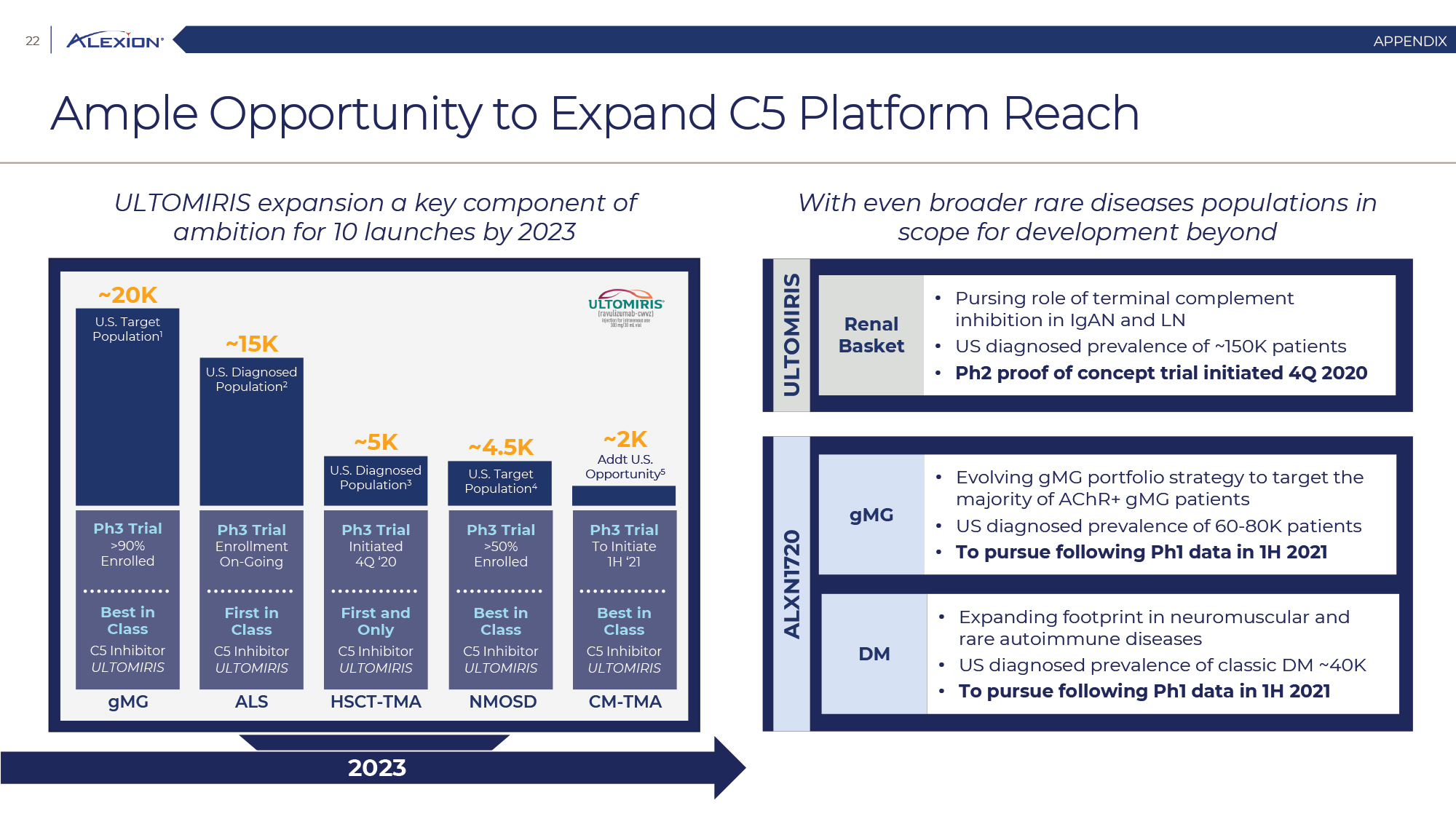

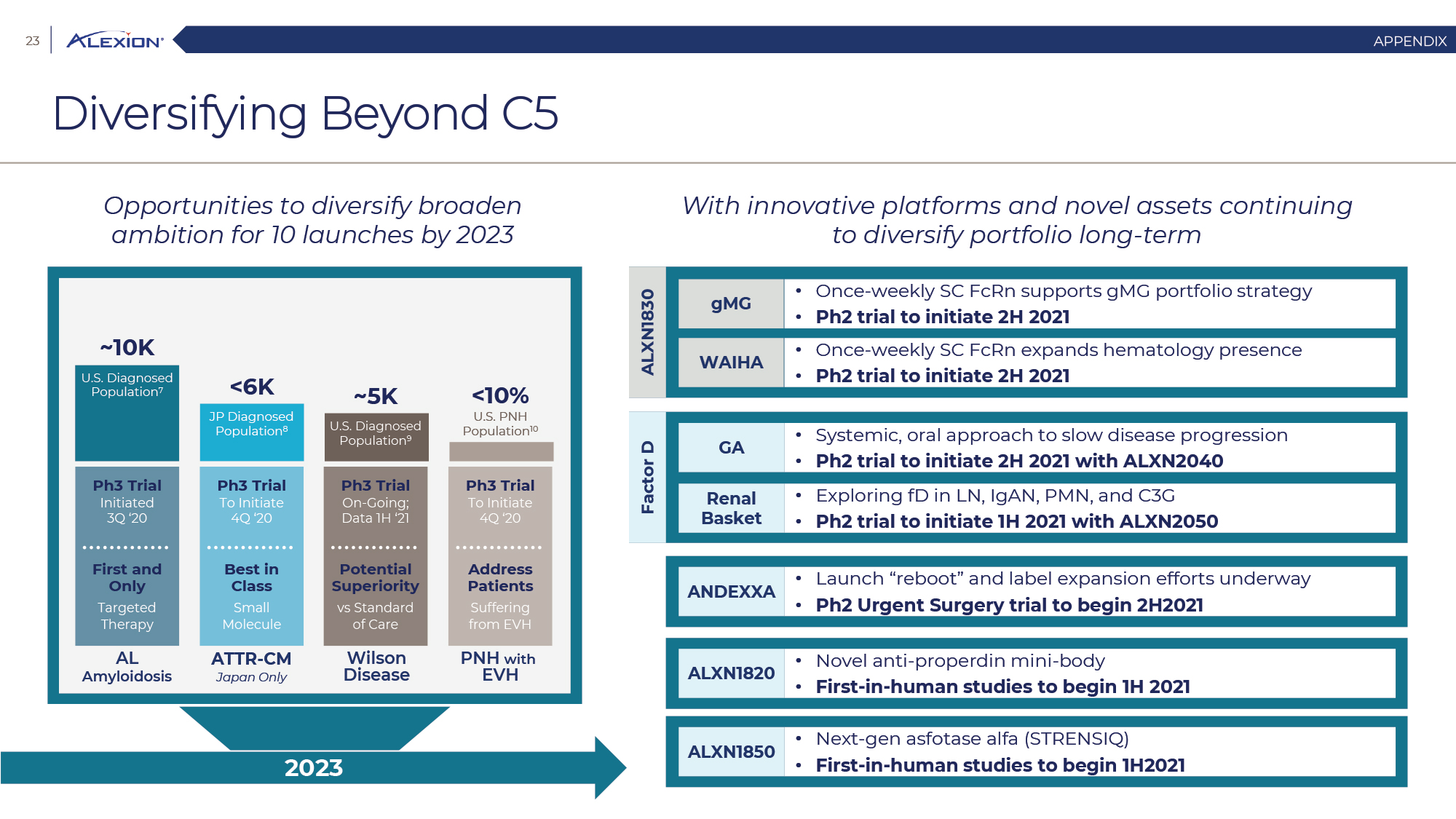

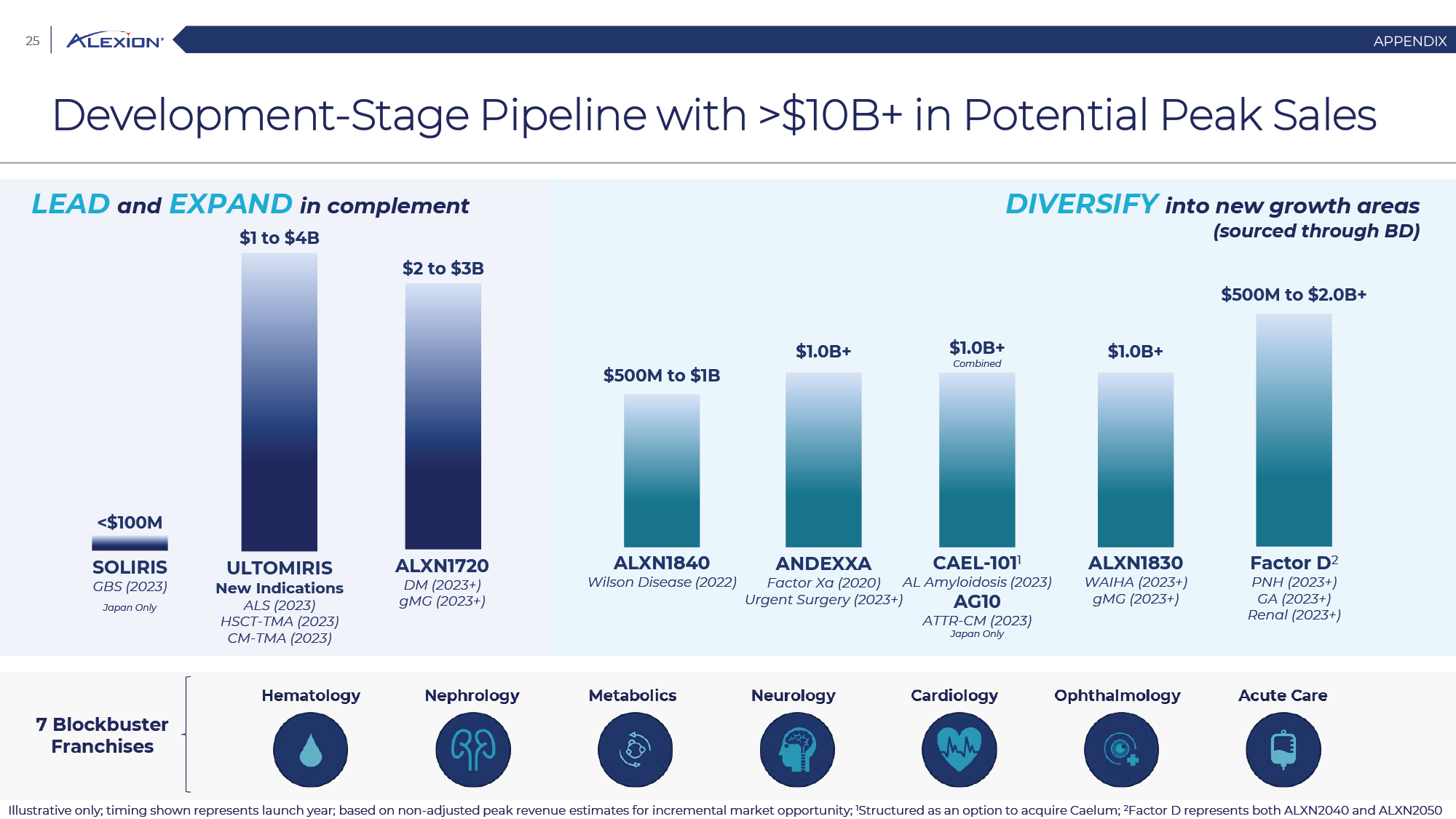

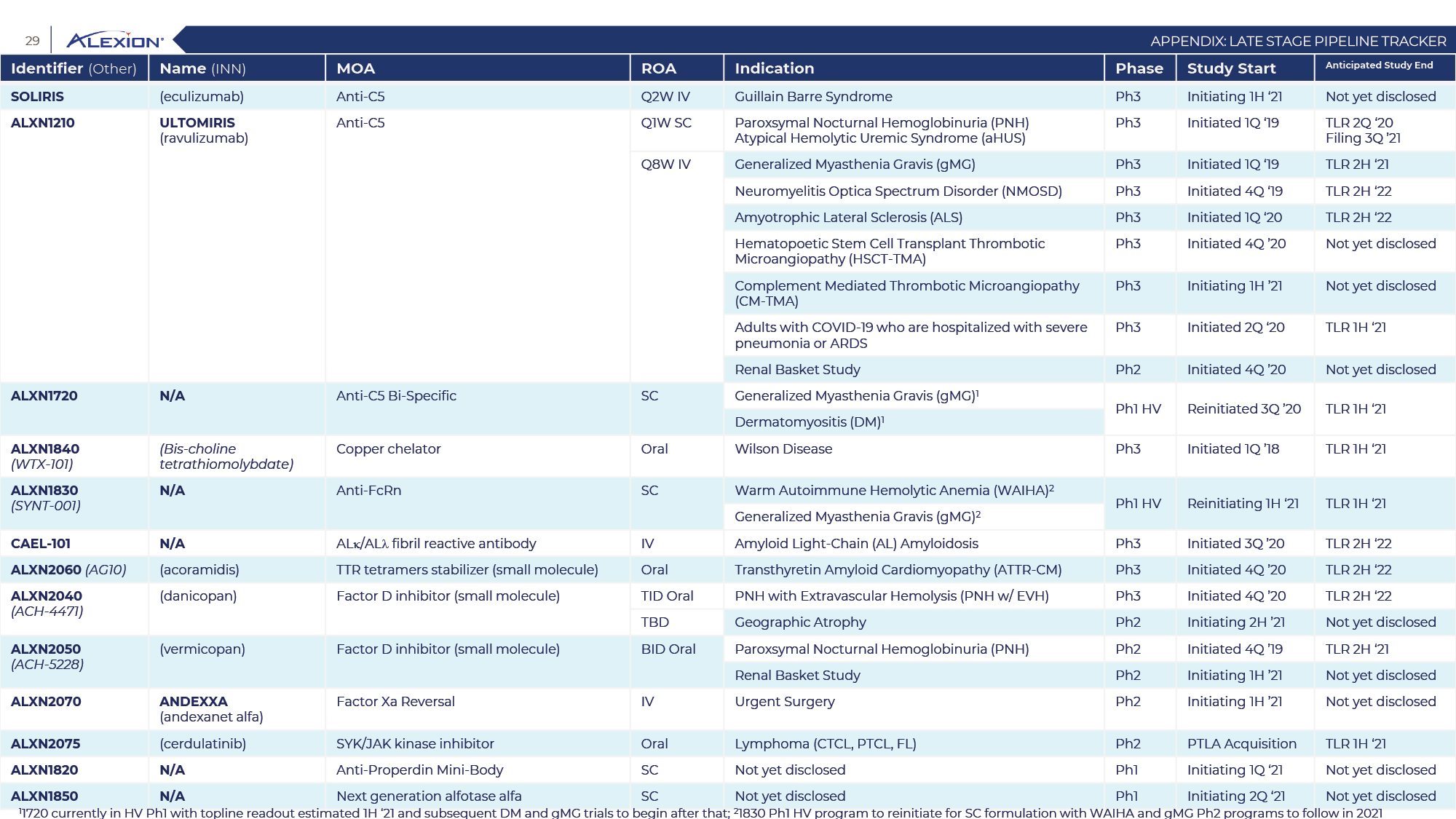

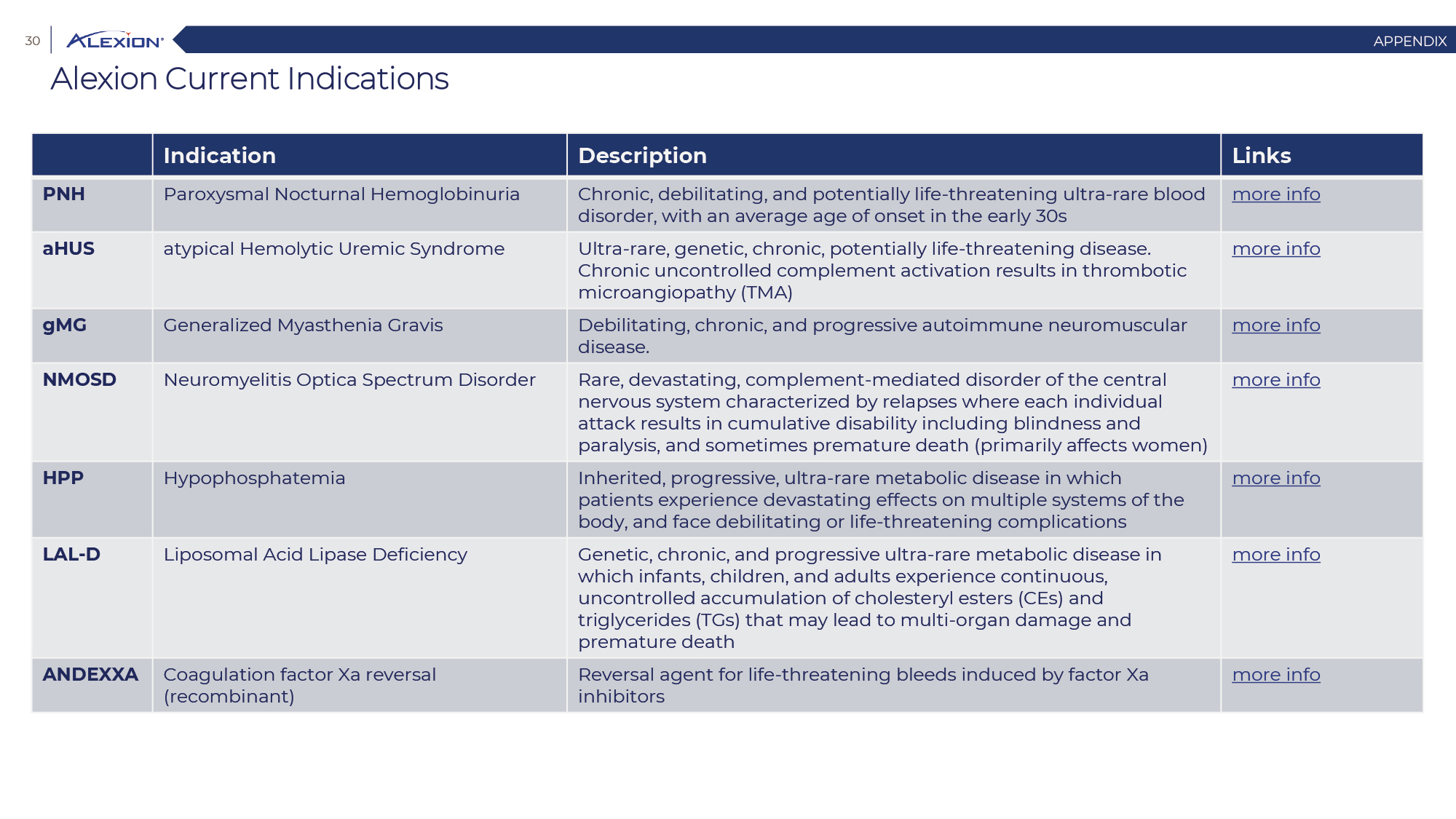

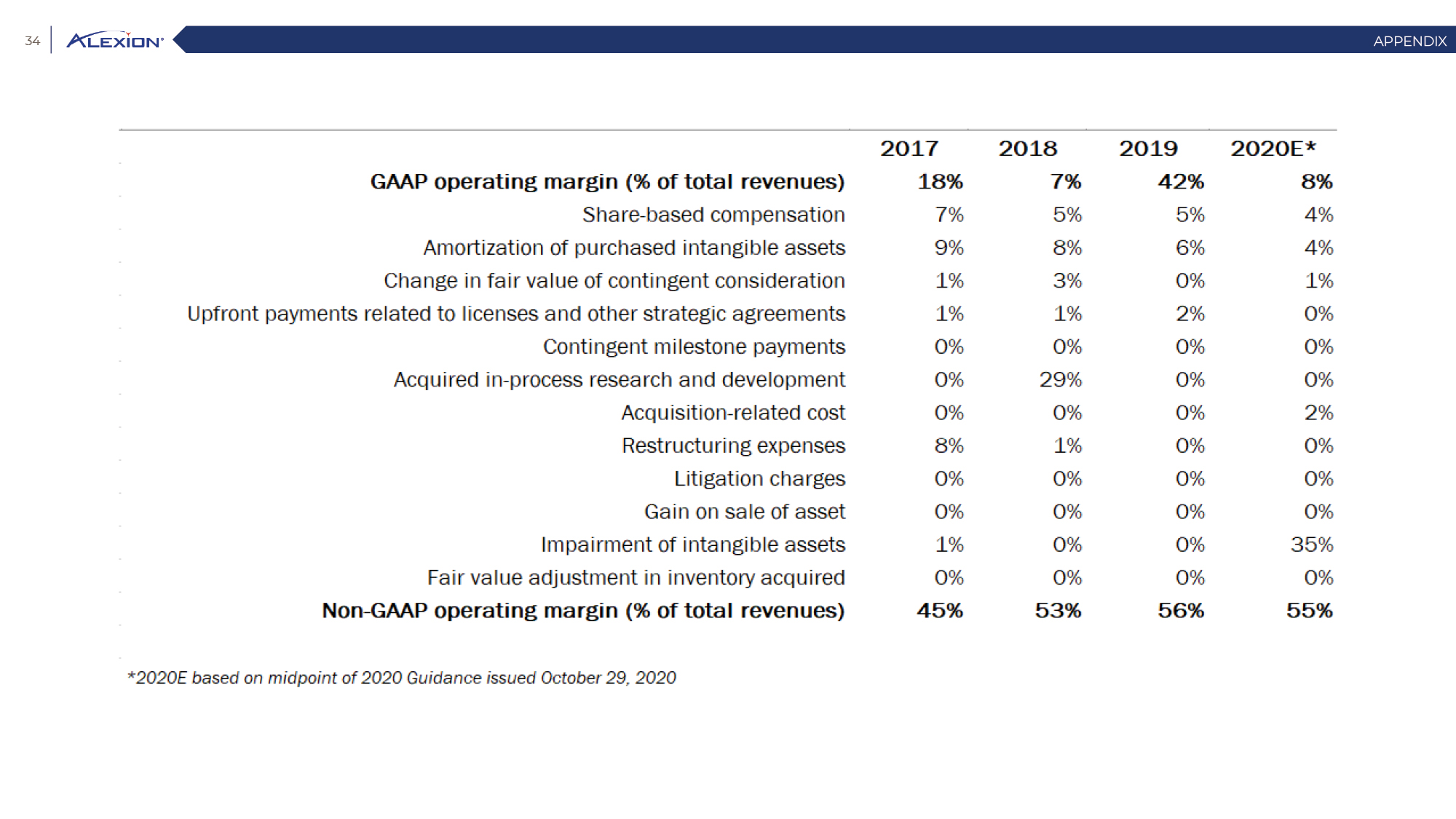

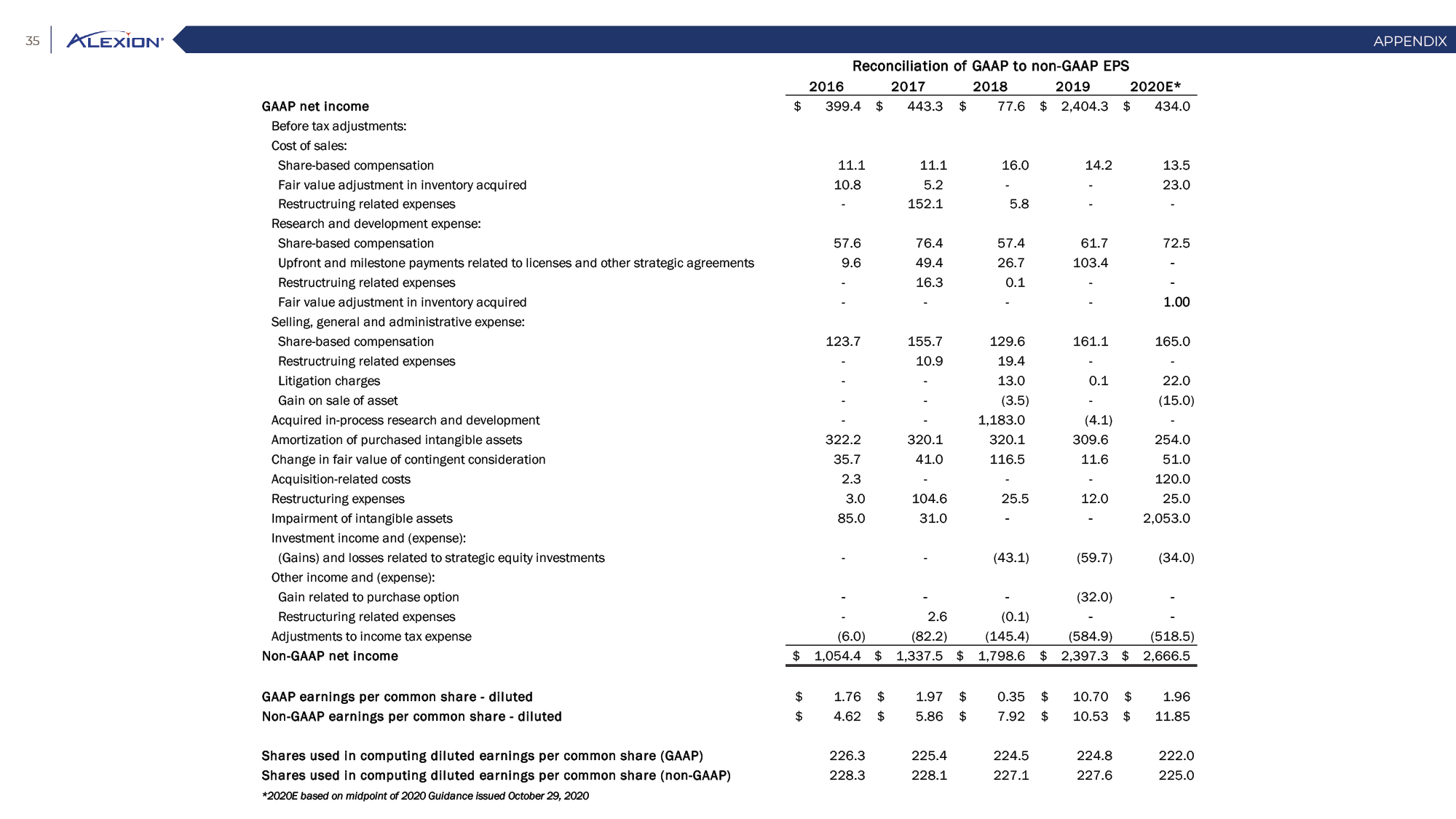

Forward Looking Statements This presentation contains forward-looking statements, including statements related to: the proposed acquisition by AstraZeneca and the anticipated timing of such acquisition; the benefits of the acquisition and the ability of the acquisition to deliver value to shareholders; the ability of AstraZeneca to successfully integrate Alexion's operations, and the ability of AstraZeneca to implement its plans, forecasts and other expectations with respect to Alexion's business after the completion of the proposed acquisition and realize expected synergies; Alexion’s anticipated financial results (including short-term guidance and long-range financial guidance), anticipated 2020 revenue, operating margin and non-GAAP EPS, revenue by 2025, our cumulative average growth rate through 2025, and peak revenue from our pipeline beyond 2025 (and all of the assumptions, judgments and estimates related to such anticipated future results); ambition to quadruple the number of neurology patients in the US by 2025; ambition for 10 product launches by 2023; anticipated future product launches (and the timing of those launches); plans to establish 7 blockbuster franchises and the targeted indications in each franchise; plans to make regulatory filings for approval of certain products and product candidates, the expected timing of such filings as well as the expected timing of the receipt of certain regulatory approvals to market a product; our ambition to treat 7,500 neurology patients by 2025; our strategy and ability to grow the ANDEXXA business both in indication and geography; ability to realize continued and sustainable growth in our aHUS franchise and metabolic business; the ability of our pipeline and existing products to provide long-term sustainable growth for shareholders; Company’s plans for future clinical trials and studies, the timing for the commencement and conclusion of future clinical trials and the expected timing of the receipt of results of clinical trials and studies; the anticipated number of patients that may be treated with the Company’s products both currently approved and in our pipeline; the Company’s goals for 2021 and near term events to support value creation for shareholders; the Company’s strategy for long-term value creation (including the following: establishing ULTOMIRIS as the new standard of care in PNH, aHUS and Neurology, plans to launch our next generation C5 formulations, plans to expand our presence in Neurology, focus expansion of ULTOMIRIS on direct-to-phase 3 rapid proof of concept trials, plans to further diversify our assets and establish novel platforms and the benefits of those plans); plans for additional formulations of ULTOMIRIS (high concentration and subcutaneous) and the timing for regulatory approval and potential benefits of such formulations; Alexion’s ambitions for its portfolio of assets; the anticipated pricing of ULTOMIRIS in PNH and aHUS; ambitions to increase aHUS program; the affected patient populations in the indications we are pursuing; plans to develop and launch ALXN1720; plans for our CSR program; the growth potential and plans for our FcRn program; and continued diversification of the pipeline. Forward-looking statements are subject to factors that may cause Alexion's results and plans to differ materially from those forward-looking statements, including for example: the risk that the proposed acquisition of Alexion by Astra Zeneca may not be completed and such failure could negatively affect our stock price and future business and financial results and if the Astra Zeneca merger agreement is terminated, we may be forced to pay a termination fee to Astra Zeneca; the severity of the impact of the COVID-19 pandemic on Alexion’s business, including on commercial and clinical development programs; our dependence on sales from our C5 products (SOLIRIS and ULTOMIRIS); delays (expected or unexpected) in the time it takes regulatory agencies to review and make determinations on applications for the marketing approval of our products; Alexion’s inability to timely submit (or failure to submit) future applications for regulatory approval for our products and product candidates; payer, physician and patient acceptance of ULTOMIRIS as an alternative to SOLIRIS; appropriate pricing for ULTOMIRIS; future competition from biosimilars and novel products; inability to timely initiate (or failure to initiate) and complete future clinical trials due to safety issues, IRB decisions, CMC-related issues, expense or unfavorable results from earlier trials (among other reasons); the number of patients that will use our products and product candidates in the future; decisions of regulatory authorities regarding the adequacy of our research, marketing approval or material limitations on the marketing of our products; delays or failure of product candidates to obtain regulatory approval; delays or the inability to launch product candidates due to regulatory restrictions, anticipated expense or other matters; interruptions or failures in the manufacture and supply of our products and our product candidates; failure to satisfactorily address matters raised by the FDA and other regulatory agencies; results in early stage clinical trials may not be indicative of full results or results from later stage or larger clinical trials (or broader patient populations) and do not ensure regulatory approval; the possibility that results of clinical trials are not predictive of safety and efficacy and potency of our products (or we fail to adequately operate or manage our clinical trials) which could cause us to halt trials, delay or prevent us from making regulatory approval filings or result in denial of regulatory approval of our product candidates; unexpected delays in clinical trials; unexpected concerns that may arise from additional data or analysis obtained during clinical trials; future product improvements may not be realized due to expense or feasibility or other factors; uncertainty of long-term success in developing, licensing or acquiring other product candidates or additional indications for existing products; inability to complete acquisitions due to failure of regulatory approval or material changes in target or otherwise; inability to complete acquisitions and investments due to increased competition for technology; the possibility that current rates of adoption of our products are not sustained (or anticipated adoption rates are not realized); internal development efforts do not result in commercialization of additional products; the adequacy of our pharmacovigilance and drug safety reporting processes; failure to protect and enforce our data, intellectual property and proprietary rights and the risks and uncertainties relating to intellectual property claims, lawsuits and challenges against us (including intellectual property lawsuits relating to products brought by third parties against Alexion); the risk that third party payors (including governmental agencies) will not reimburse or continue to reimburse for the use of our products at acceptable rates or at all; failure to realize the benefits and potential of investments, collaborations, licenses and acquisitions; failure by regulatory authorities to approve transactions; the possibility that expected tax benefits will not be realized or that tax liabilities exceed current expectations; assessment of impact of recent accounting pronouncements; potential declines in sovereign credit ratings or sovereign defaults in countries where we sell our products; delay of collection or reduction in reimbursement due to adverse economic conditions or changes in government and private insurer regulations and approaches to reimbursement; uncertainties surrounding legal proceedings, company investigations and government investigations; the risk that estimates regarding the number of patients with PNH, aHUS, gMG, NMOSD, HPP and LAL-D and other future indications we are pursuing are inaccurate; the risks of changing foreign exchange rates; risks relating to the potential effects of the Company's restructuring; risks related to the acquisition of companies and co-development and collaboration efforts; and a variety of other risks set forth from time to time in Alexion's filings with the SEC, including but not limited to the risks discussed in Alexion's Quarterly Report on Form 10-Q for the period ended September 30, 2020 and in our other filings with the SEC. Alexion disclaims any obligation to update any of these forward-looking statements to reflect events or circumstances after the date hereof, except when a duty arises under law.In addition to financial information prepared in accordance with GAAP, this press release also contains non-GAAP financial measures that Alexion believes, when considered together with the GAAP information, provide investors and management with supplemental information relating to performance, trends and prospects that promote a more complete understanding of our operating results and financial position during different periods. Alexion also uses these non-GAAP financial measures to establish budgets, set operational goals and to evaluate the performance of the business. The non-GAAP results, determined in accordance with our internal policies, exclude the impact of the following GAAP items (see reconciliation tables below for additional information): share-based compensation expense, fair value adjustment of inventory acquired, amortization of purchased intangible assets, changes in fair value of contingent consideration, restructuring and related expenses, upfront payments related to licenses and other strategic agreements, acquired in-process research and development, impairment of purchased intangible assets, gains and losses related to strategic equity investments, litigation charges, gain or loss on sale of a business or asset, gain or loss related to purchase options, contingent milestone payments associated with acquisitions of legal entities accounted for as asset acquisitions, acquisition related costs and certain adjustments to income tax expense. These non-GAAP financial measures are not intended to be considered in isolation or as a substitute for, or superior to, the financial measures prepared and presented in accordance with GAAP, and should be reviewed in conjunction with the relevant GAAP financial measures. Please refer to the attached Reconciliations of GAAP to non-GAAP Financial Results and GAAP to non-GAAP Financial Guidance for explanations of the amounts adjusted to arrive at non-GAAP net income, non-GAAP and non-GAAP earnings per share amounts for the three and nine month periods ended September 30, 2020 and 2019 and for the projected twelve months ending December 31, 2020.Amounts may not foot due to rounding.