CONFERENCE CALL OCTOBER [X], 2019 Alexion to Acquire Achillion Conference Call October 16, 2019 Exhibit 99.2

Acquisition of achillion agenda Introduction Susan Altschuller, Ph.D., Vice President, Investor Relations Strategic Rationale Ludwig Hantson, Ph.D., Chief Executive Officer Overview of Factor D Portfolio John Orloff, M.D., Head of R&D Ludwig Hantson, Ph.D., Chief Executive Officer Closing Remarks Brian Goff, Chief Commercial Officer and Paul Clancy, CFO Available for Q&A Financial Overview & Lead Indications Aradhana Sarin, M.D., Chief Strategy and Business Officer

This presentation contains forward-looking statements including, statements related to: the proposed acquisition of Achillion by Alexion; Alexion’s ability to create value for patients and shareholders from the acquisition of Achillion and Alexion’s ability to advance Achillion’s pipeline; Achillion’s lead candidate danicopan’s ability to enhance treatment for PNH patients experiencing extravascular hemolysis (EVH) and, as a combination therapy, to establish a new standard of care for these patients; therapeutic benefits of Achillion products, including potential first-in-class C3 glomerulopathy (C3G) and Factor D inhibitors; development and regulatory timelines for ACH-4471 and ACH-5228 and Phase 2 C3G studies; Alexion’s ability to build and diversify in rare disease with the acquisition of Achillion; Alexion’s ability to leverage its leading rare disease development and commercialization capabilities to further develop a portfolio of oral Factor D inhibitors; Achillion’s platform will produce a platform for Factor D inhibition in additional alternative pathway complement-mediated rare diseases; Ahcillion’s pipeline includes several small molecules that have the potential to treat immune-related diseases associated with the alternative pathway of the complement system; there is significant opportunity for Factor D inhibition in the treatment of diseases; the potential benefits of Alexion’s transaction with Stealth BioThrepeutics (Stealth), the therapeutic benefits of Elamipretide to treat mitochondrial diseases and the anticipated clinical and regulatory timeline for the development of Elamipretide; and the anticipated closing date of the acquisition. A number of important factors could cause actual results to differ materially from those indicated by such forward-looking statements, including: the risk that the proposed acquisition of Achillion by Alexion may not be completed; the failure to receive the required stockholder approval necessary to complete the acquisition; the failure (or delay) to receive the required regulatory approvals of the proposed acquisition; the failure of the closing conditions set forth in the acquisition agreement to be satisfied (or waived); the anticipated benefits of the Achillion platform and therapies and Elamipretide may not be realized; future clinical trials of Achillion and Stealth products may not prove that the therapies are safe and effective to the level required by regulators; decisions of regulatory authorities regarding the adequacy of the research and clinical tests, marketing approval or material limitations on the marketing of Achillion and Stealth products; delays or failure of product candidates to obtain regulatory approval; delays or the inability to launch product candidates due to regulatory restrictions; anticipated expense or other matters; interruptions or failures in the manufacture and supply of products and product candidates; failure to satisfactorily address matters raised by the FDA and other regulatory agencies; the possibility that results of clinical trials are not predictive of safety and efficacy results of products in broader patient populations; the possibility that clinical trials of product candidates could be delayed or terminated prior to completion for a number of reasons; the adequacy of pharmacovigilance and drug safety reporting processes; and a variety of other risks set forth from time to time in Alexion's filings with the SEC, including but not limited to the risks discussed in Alexion's Quarterly Report on Form 10-Q for the period ended June 30, 2019 and in our other filings with the SEC. Alexion disclaims any obligation to update any of these forward-looking statements to reflect events or circumstances after the date hereof, except when a duty arises under law. FORWARD LOOKING STATEMENTS

Strategic Rationale Ludwig Hantson, Ph.D. Chief Executive Officer

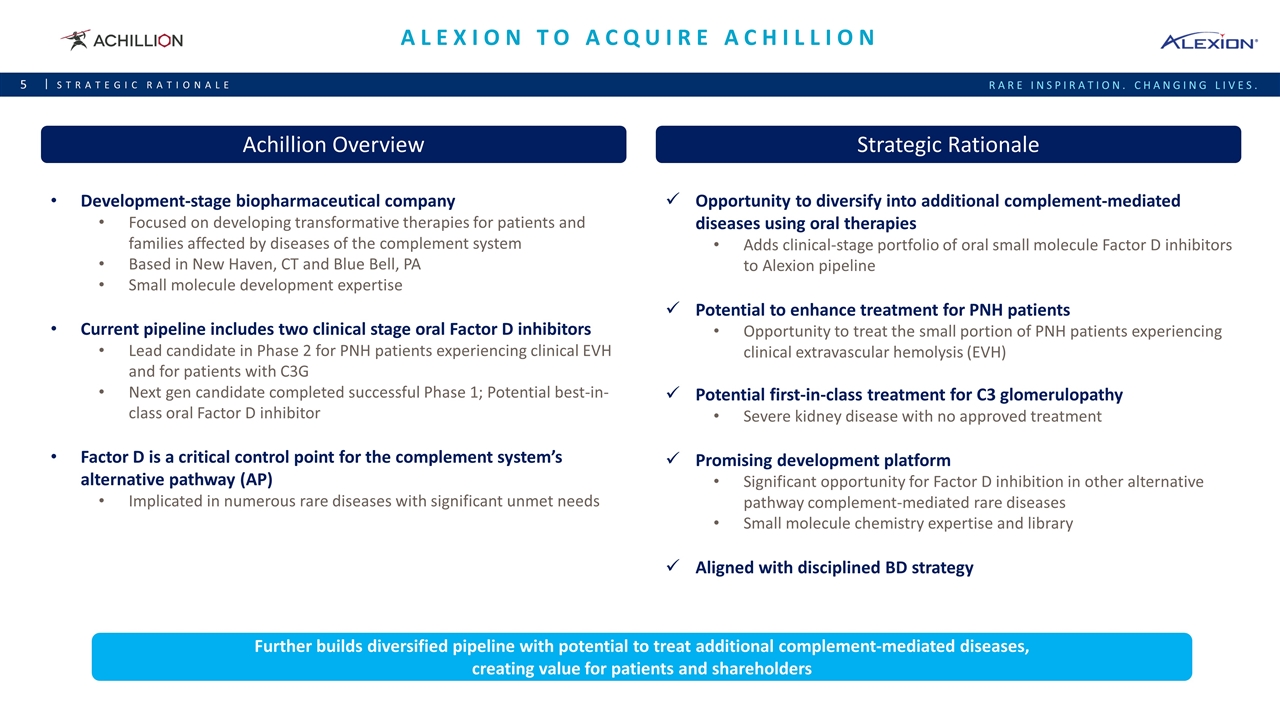

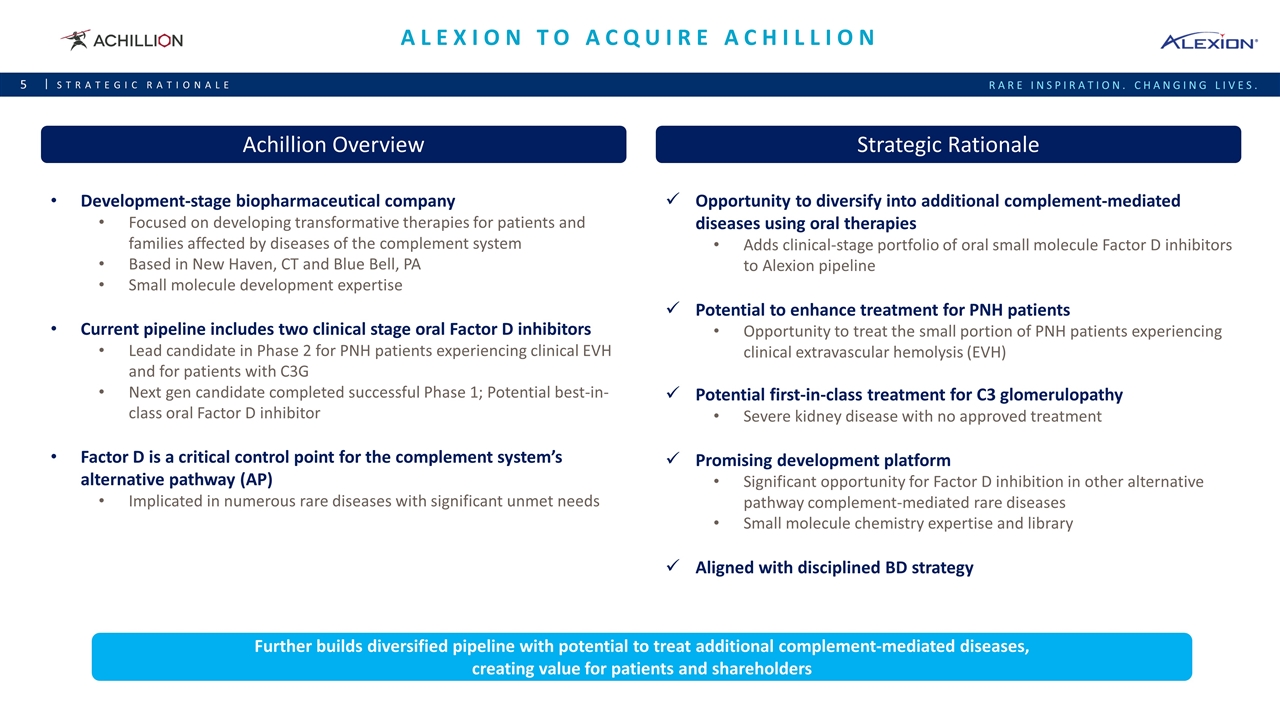

ALEXION TO ACQUIRE ACHILLION Strategic Rationale Further builds diversified pipeline with potential to treat additional complement-mediated diseases, creating value for patients and shareholders Strategic Rationale Development-stage biopharmaceutical company Focused on developing transformative therapies for patients and families affected by diseases of the complement system Based in New Haven, CT and Blue Bell, PA Small molecule development expertise Current pipeline includes two clinical stage oral Factor D inhibitors Lead candidate in Phase 2 for PNH patients experiencing clinical EVH and for patients with C3G Next gen candidate completed successful Phase 1; Potential best-in-class oral Factor D inhibitor Factor D is a critical control point for the complement system’s alternative pathway (AP) Implicated in numerous rare diseases with significant unmet needs Opportunity to diversify into additional complement-mediated diseases using oral therapies Adds clinical-stage portfolio of oral small molecule Factor D inhibitors to Alexion pipeline Potential to enhance treatment for PNH patients Opportunity to treat the small portion of PNH patients experiencing clinical extravascular hemolysis (EVH) Potential first-in-class treatment for C3 glomerulopathy Severe kidney disease with no approved treatment Promising development platform Significant opportunity for Factor D inhibition in other alternative pathway complement-mediated rare diseases Small molecule chemistry expertise and library Aligned with disciplined BD strategy Achillion Overview

Financial Overview & Lead Indications Aradhana Sarin, M.D. Chief Strategy and Business Officer

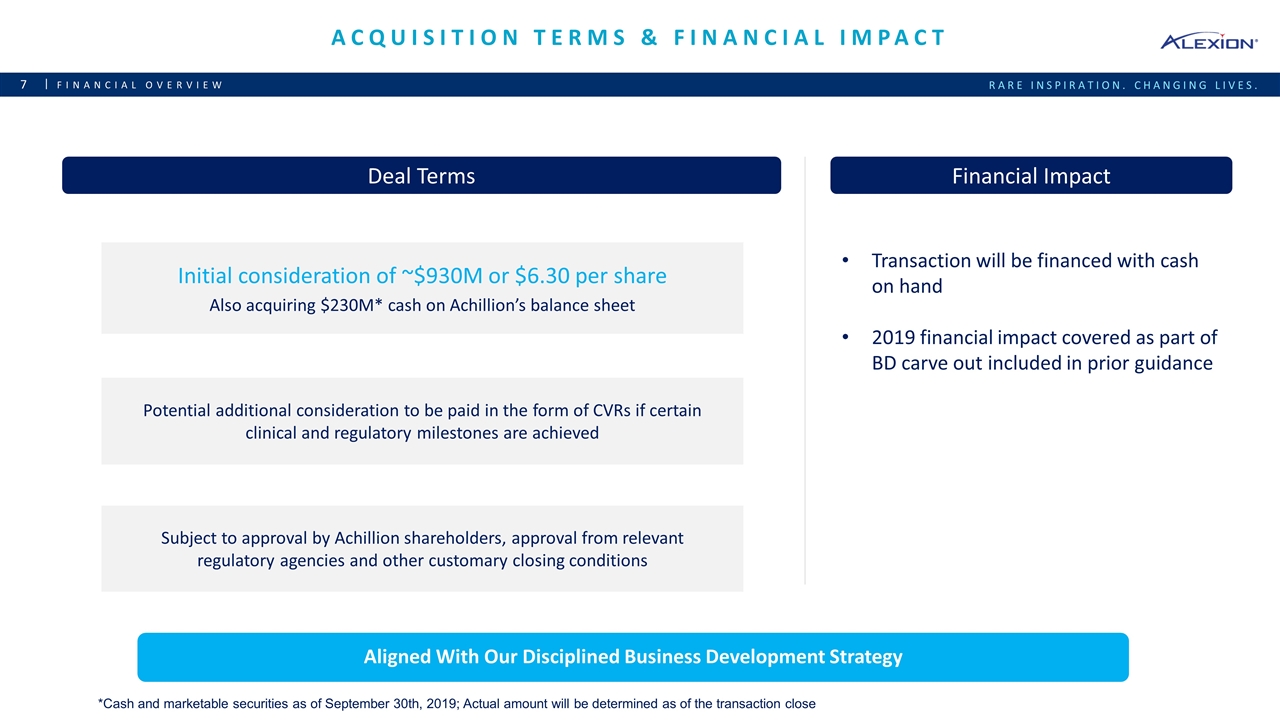

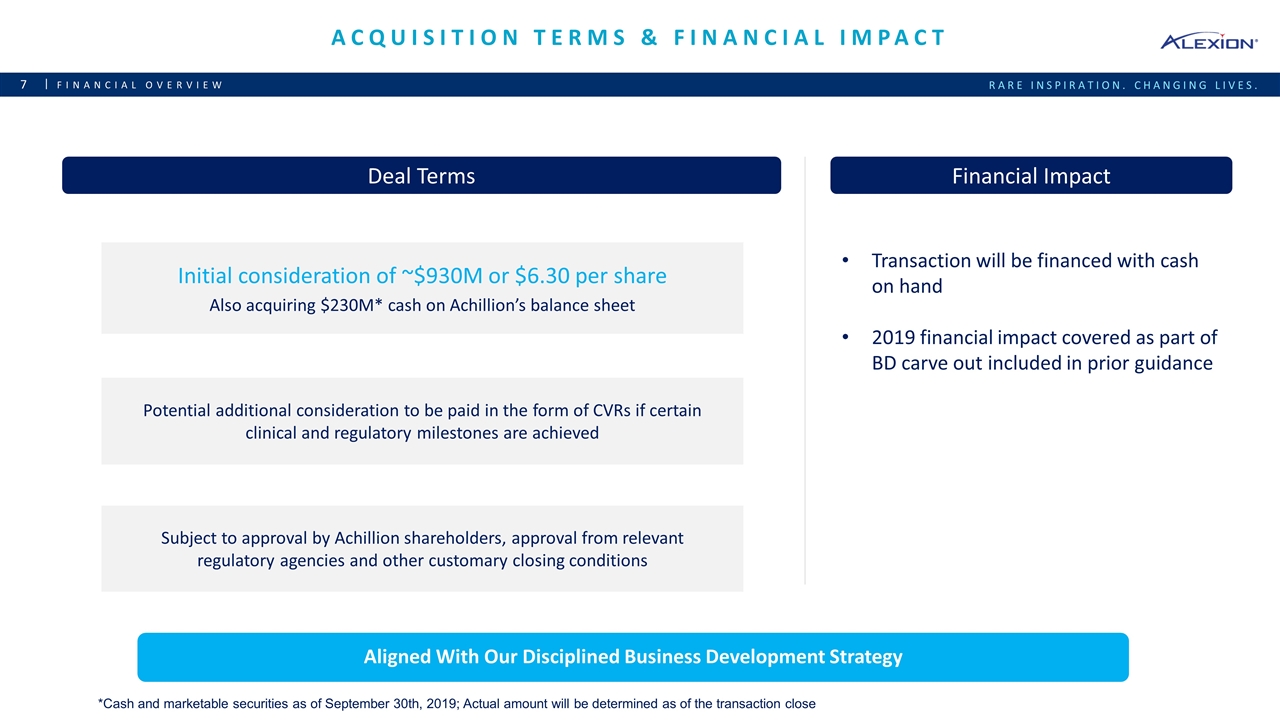

Acquisition Terms & Financial Impact Financial overview Aligned With Our Disciplined Business Development Strategy Deal Terms Initial consideration of ~$930M or $6.30 per share Also acquiring $230M* cash on Achillion’s balance sheet Potential additional consideration to be paid in the form of CVRs if certain clinical and regulatory milestones are achieved Financial Impact Transaction will be financed with cash on hand 2019 financial impact covered as part of BD carve out included in prior guidance Subject to approval by Achillion shareholders, approval from relevant regulatory agencies and other customary closing conditions *Cash and marketable securities as of September 30th, 2019; Actual amount will be determined as of the transaction close

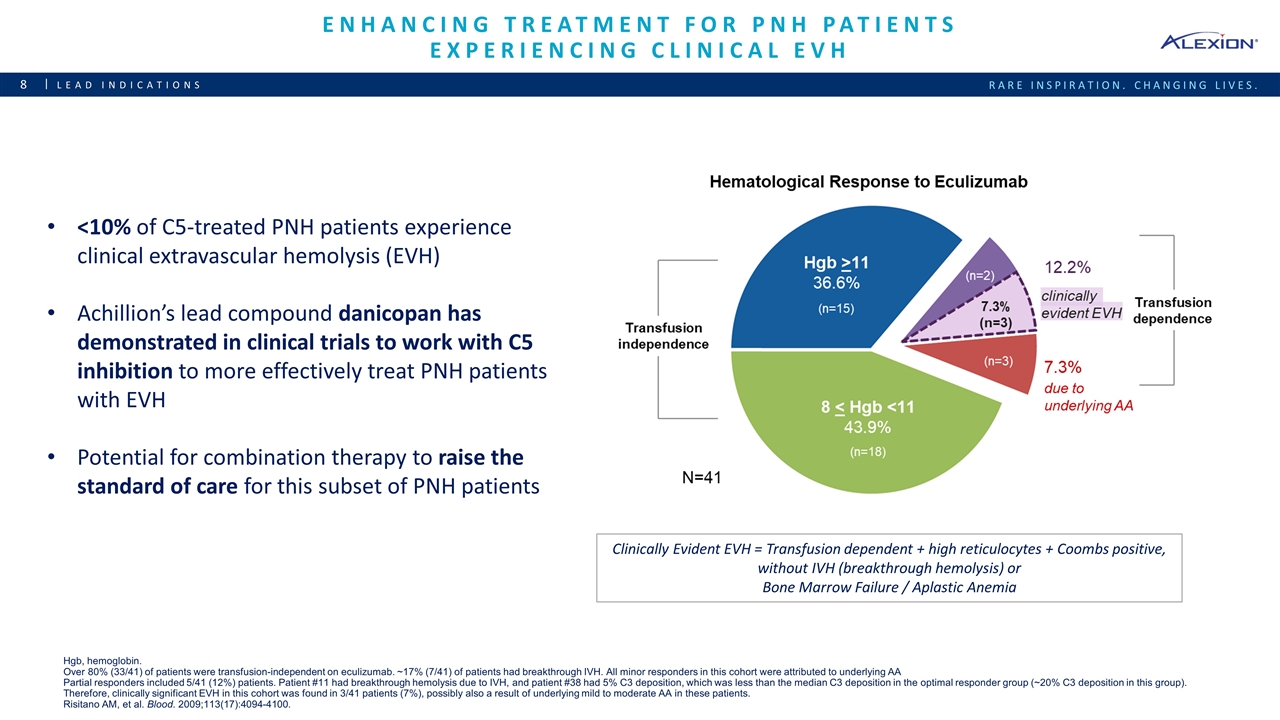

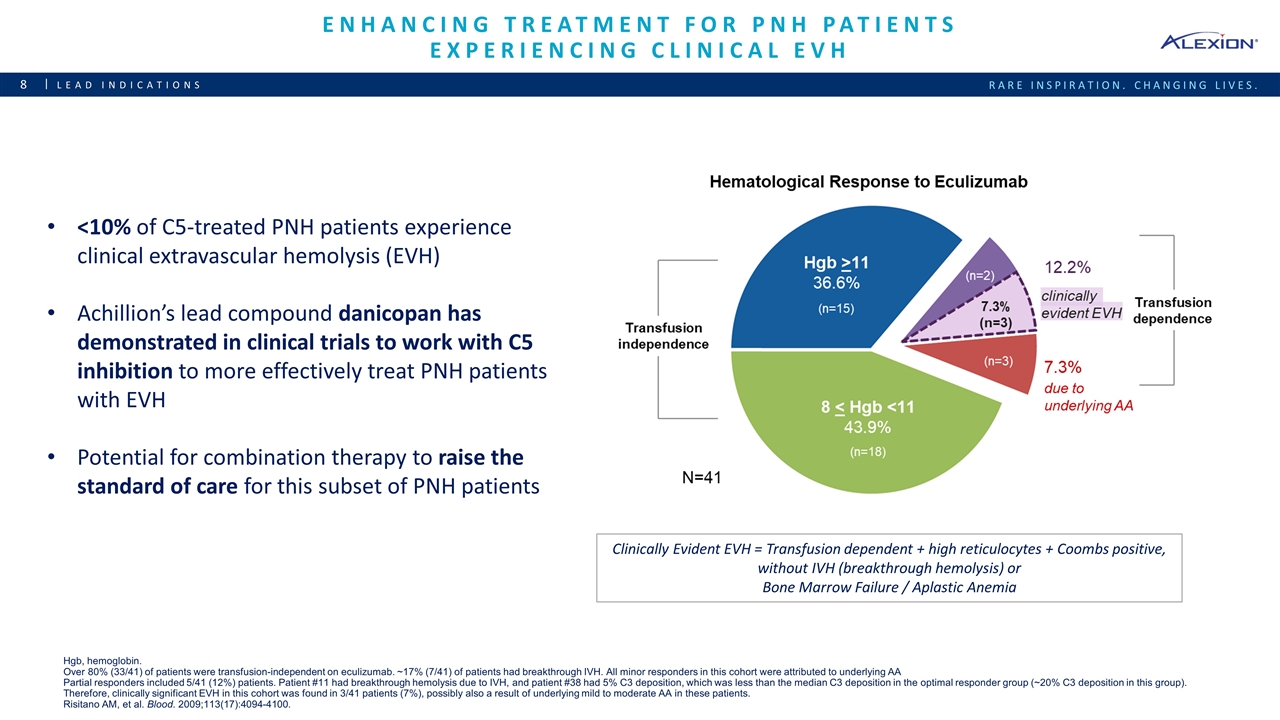

Enhancing Treatment for PNH Patients Experiencing Clinical EVH Lead indications <10% of C5-treated PNH patients experience clinical extravascular hemolysis (EVH) Achillion’s lead compound danicopan has demonstrated in clinical trials to work with C5 inhibition to more effectively treat PNH patients with EVH Potential for combination therapy to raise the standard of care for this subset of PNH patients Clinically Evident EVH = Transfusion dependent + high reticulocytes + Coombs positive, without IVH (breakthrough hemolysis) or Bone Marrow Failure / Aplastic Anemia Hgb, hemoglobin. Over 80% (33/41) of patients were transfusion-independent on eculizumab. ~17% (7/41) of patients had breakthrough IVH. All minor responders in this cohort were attributed to underlying AA Partial responders included 5/41 (12%) patients. Patient #11 had breakthrough hemolysis due to IVH, and patient #38 had 5% C3 deposition, which was less than the median C3 deposition in the optimal responder group (~20% C3 deposition in this group). Therefore, clinically significant EVH in this cohort was found in 3/41 patients (7%), possibly also a result of underlying mild to moderate AA in these patients. Risitano AM, et al. Blood. 2009;113(17):4094-4100.

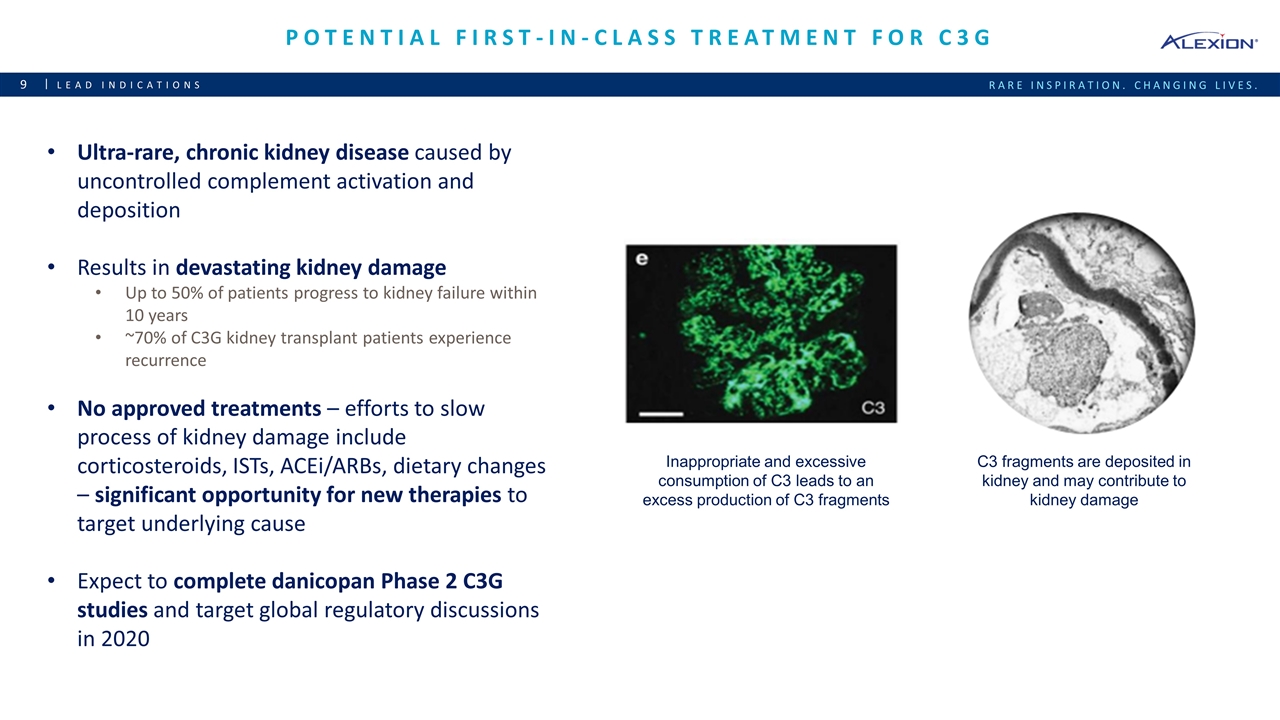

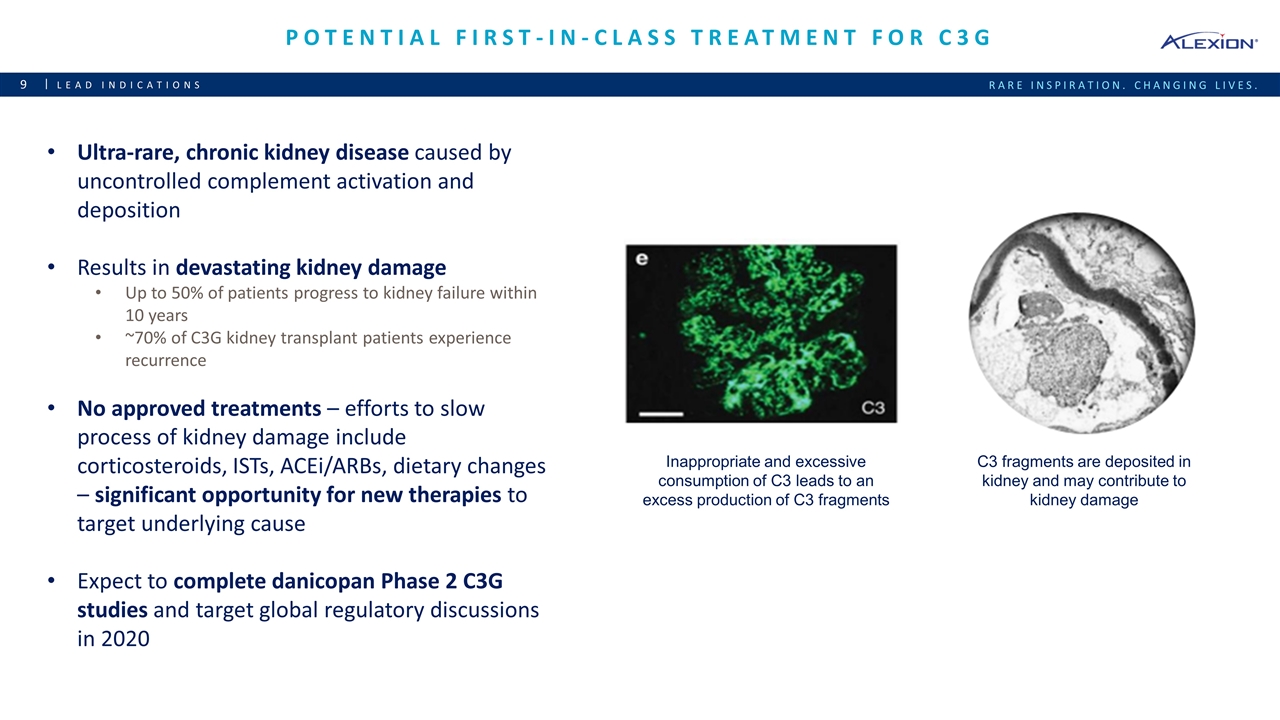

Potential first-in-class treatment for C3G Lead indications Ultra-rare, chronic kidney disease caused by uncontrolled complement activation and deposition Results in devastating kidney damage Up to 50% of patients progress to kidney failure within 10 years ~70% of C3G kidney transplant patients experience recurrence No approved treatments – efforts to slow process of kidney damage include corticosteroids, ISTs, ACEi/ARBs, dietary changes – significant opportunity for new therapies to target underlying cause Expect to complete danicopan Phase 2 C3G studies and target global regulatory discussions in 2020 Inappropriate and excessive consumption of C3 leads to an excess production of C3 fragments C3 fragments are deposited in kidney and may contribute to kidney damage

Overview of Factor D Portfolio John Orloff, M.D. Head of R&D

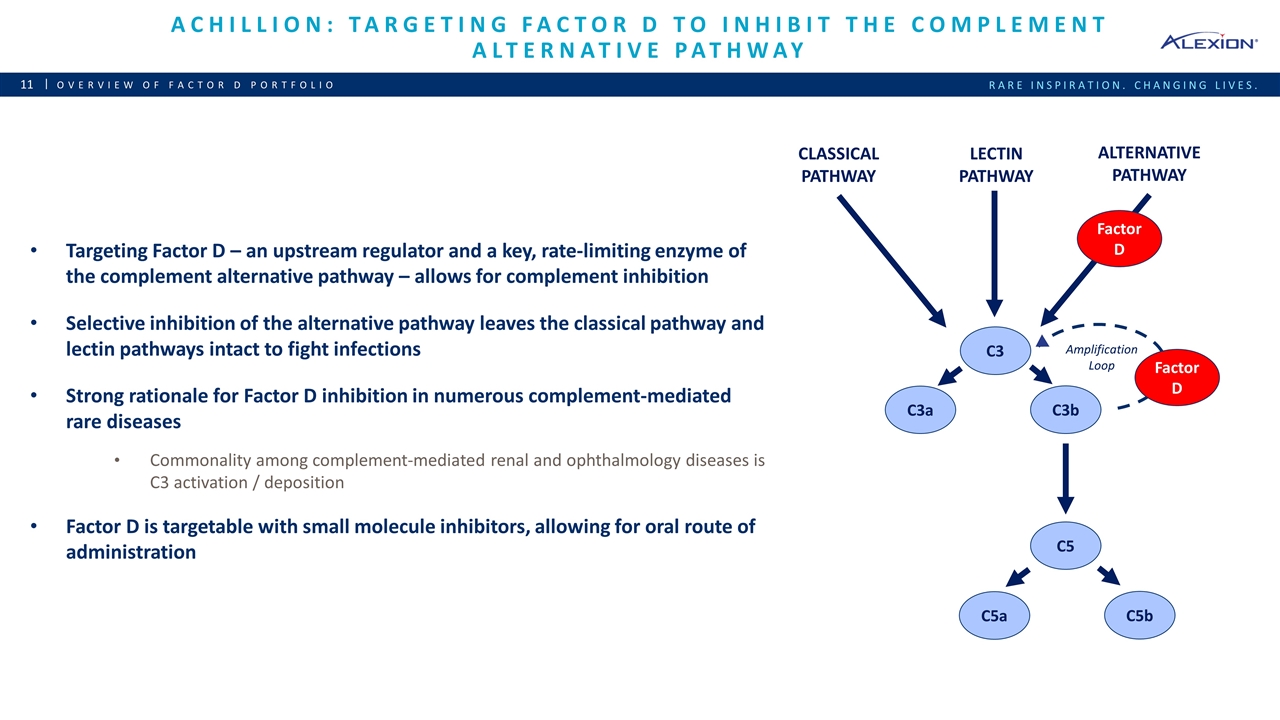

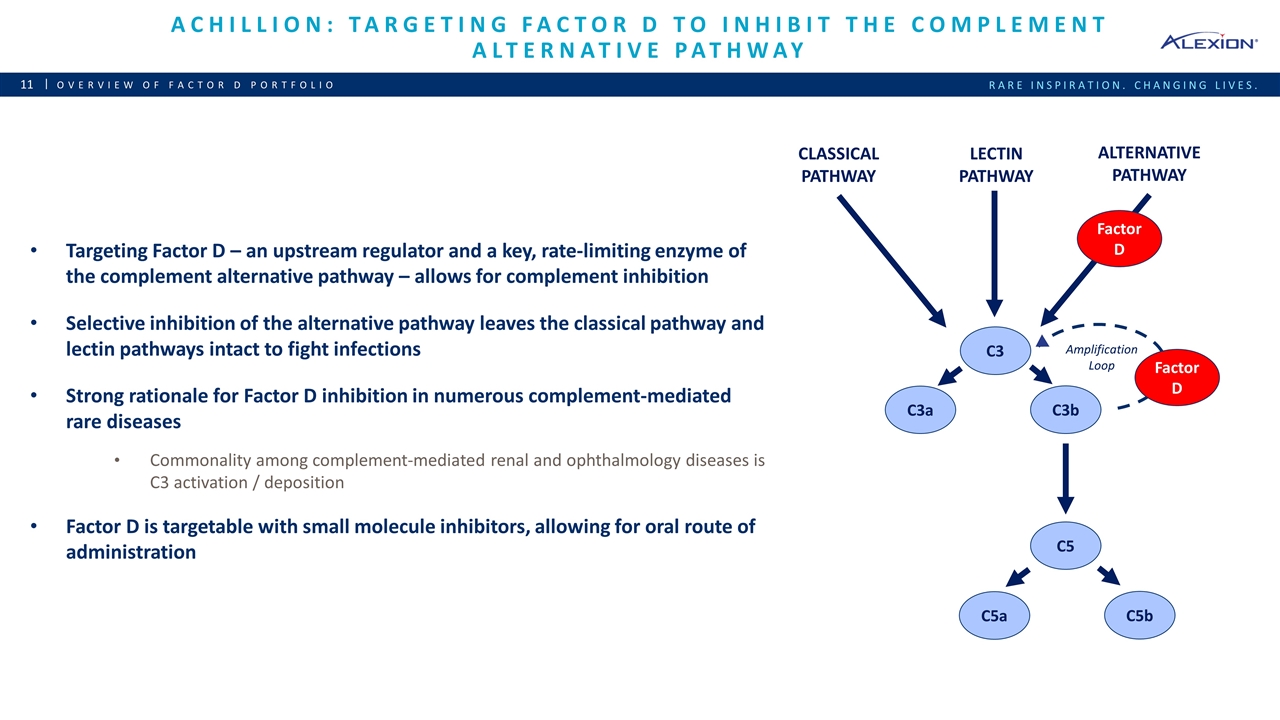

Achillion: targeting factor d to inhibit the complement alternative pathway Overview of Factor D Portfolio Targeting Factor D – an upstream regulator and a key, rate-limiting enzyme of the complement alternative pathway – allows for complement inhibition Selective inhibition of the alternative pathway leaves the classical pathway and lectin pathways intact to fight infections Strong rationale for Factor D inhibition in numerous complement-mediated rare diseases Commonality among complement-mediated renal and ophthalmology diseases is C3 activation / deposition Factor D is targetable with small molecule inhibitors, allowing for oral route of administration CLASSICAL PATHWAY LECTIN PATHWAY ALTERNATIVE PATHWAY C3 Factor D C3a C3b C5 C5a C5b Amplification Loop Factor D

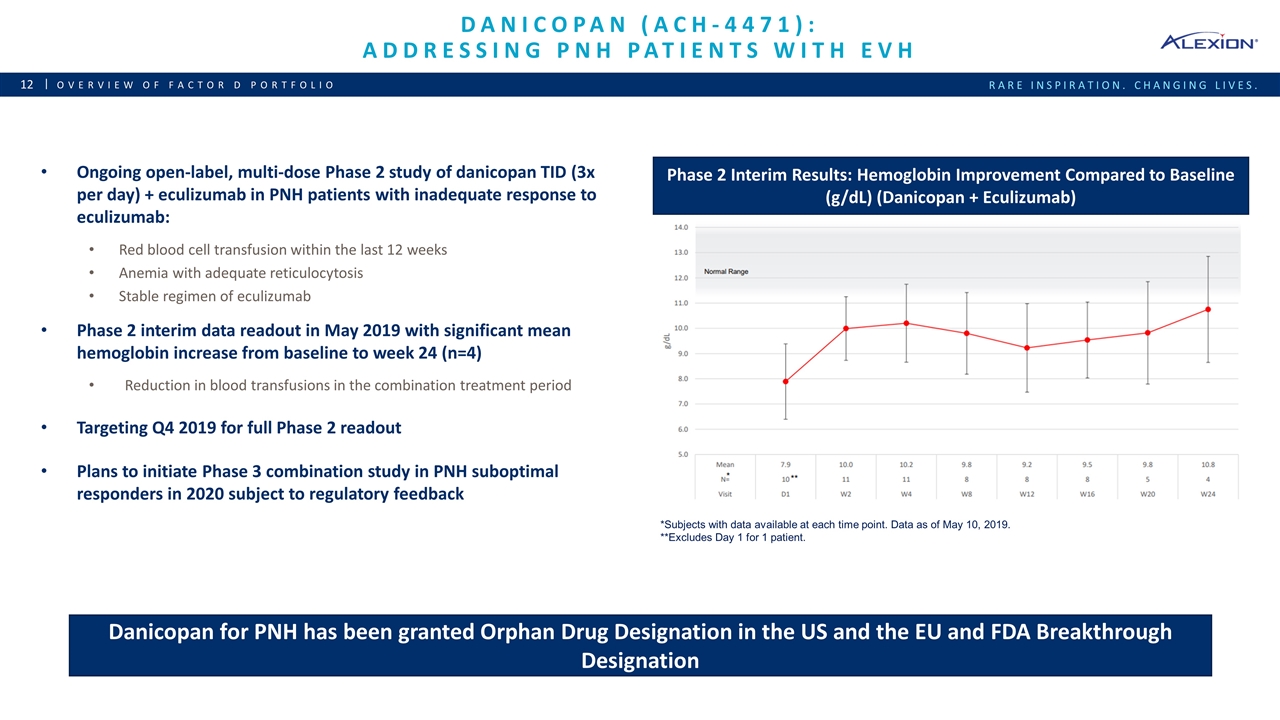

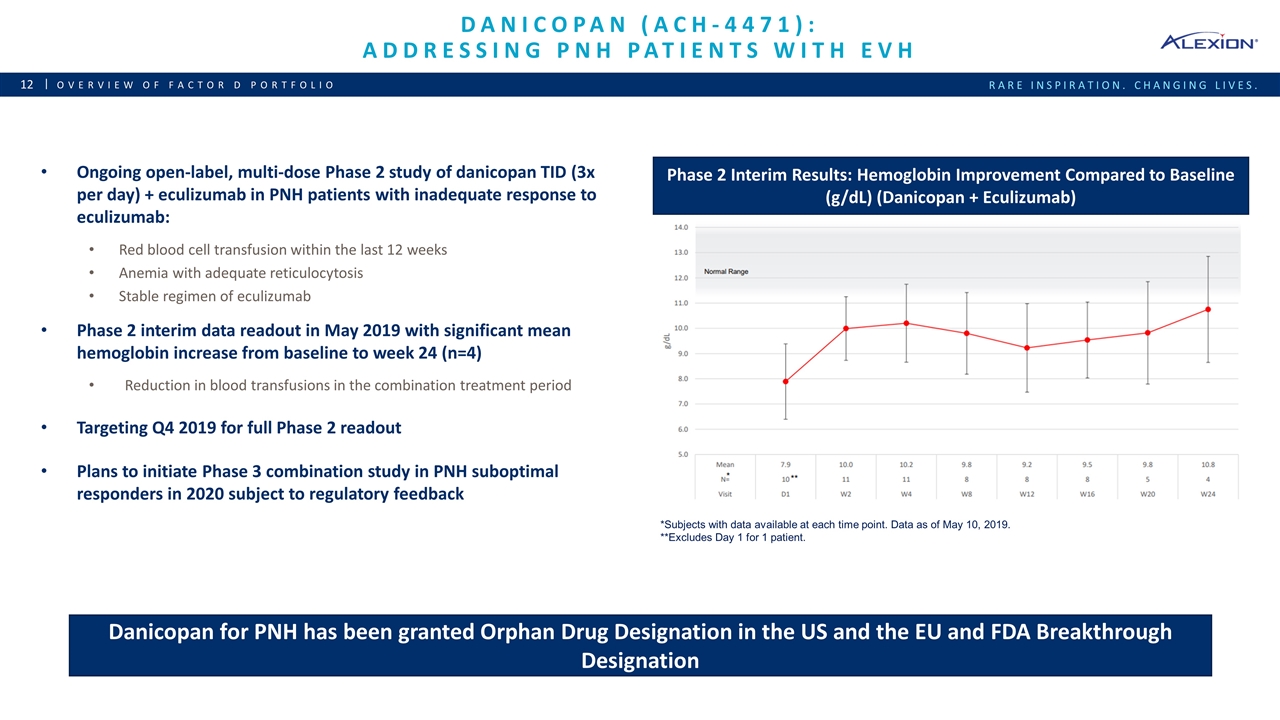

Danicopan (ACH-4471): Addressing PNH patients with EVH Overview of Factor D Portfolio Phase 2 Interim Results: Hemoglobin Improvement Compared to Baseline (g/dL) (Danicopan + Eculizumab) Ongoing open-label, multi-dose Phase 2 study of danicopan TID (3x per day) + eculizumab in PNH patients with inadequate response to eculizumab: Red blood cell transfusion within the last 12 weeks Anemia with adequate reticulocytosis Stable regimen of eculizumab Phase 2 interim data readout in May 2019 with significant mean hemoglobin increase from baseline to week 24 (n=4) Reduction in blood transfusions in the combination treatment period Targeting Q4 2019 for full Phase 2 readout Plans to initiate Phase 3 combination study in PNH suboptimal responders in 2020 subject to regulatory feedback Danicopan for PNH has been granted Orphan Drug Designation in the US and the EU and FDA Breakthrough Designation *Subjects with data available at each time point. Data as of May 10, 2019. **Excludes Day 1 for 1 patient.

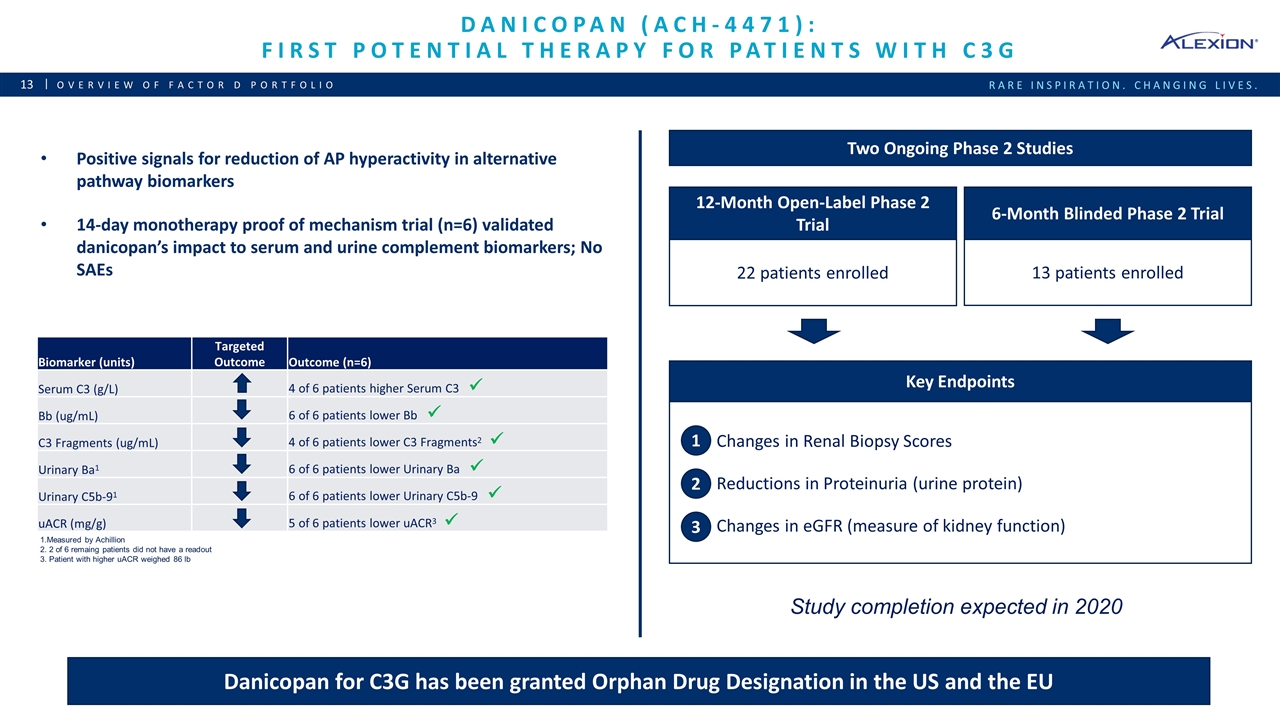

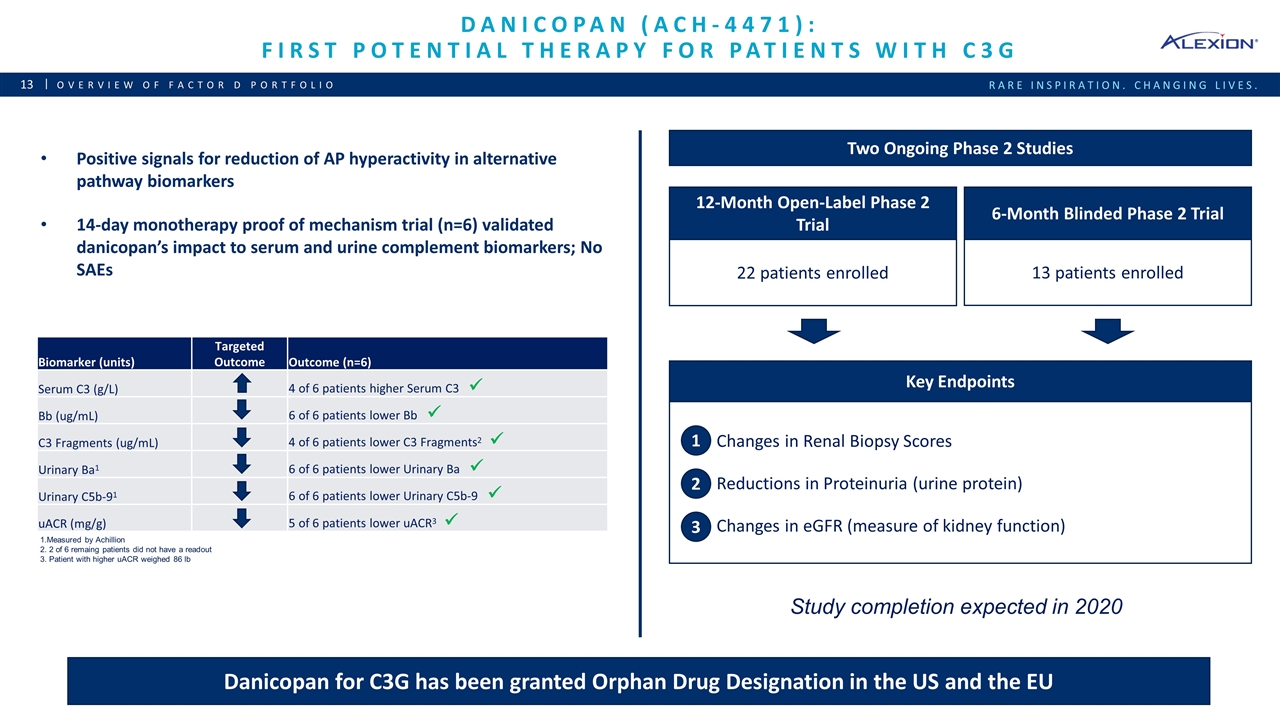

Danicopan (ACH-4471): First potential therapy for patients with c3g Overview of Factor D Portfolio Two Ongoing Phase 2 Studies 12-Month Open-Label Phase 2 Trial 6-Month Blinded Phase 2 Trial 22 patients enrolled 13 patients enrolled Changes in Renal Biopsy Scores Reductions in Proteinuria (urine protein) Changes in eGFR (measure of kidney function) 1 2 3 Key Endpoints Positive signals for reduction of AP hyperactivity in alternative pathway biomarkers 14-day monotherapy proof of mechanism trial (n=6) validated danicopan’s impact to serum and urine complement biomarkers; No SAEs Danicopan for C3G has been granted Orphan Drug Designation in the US and the EU Study completion expected in 2020 1.Measured by Achillion 2. 2 of 6 remaing patients did not have a readout 3. Patient with higher uACR weighed 86 lb Biomarker (units) Targeted Outcome Outcome (n=6) Serum C3 (g/L) 4 of 6 patients higher Serum C3 ü Bb (ug/mL) 6 of 6 patients lower Bb ü C3 Fragments (ug/mL) 4 of 6 patients lower C3 Fragments2 ü Urinary Ba1 6 of 6 patients lower Urinary Ba ü Urinary C5b-91 6 of 6 patients lower Urinary C5b-9 ü uACR (mg/g) 5 of 6 patients lower uACR3 ü

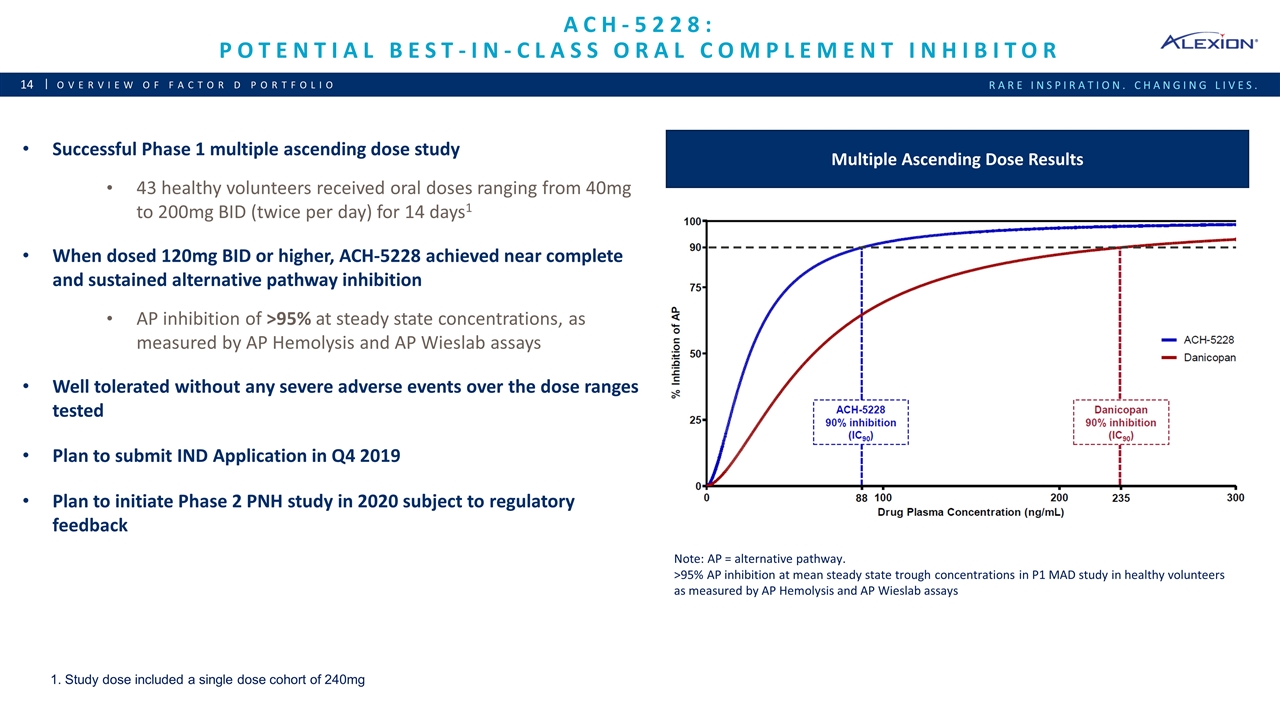

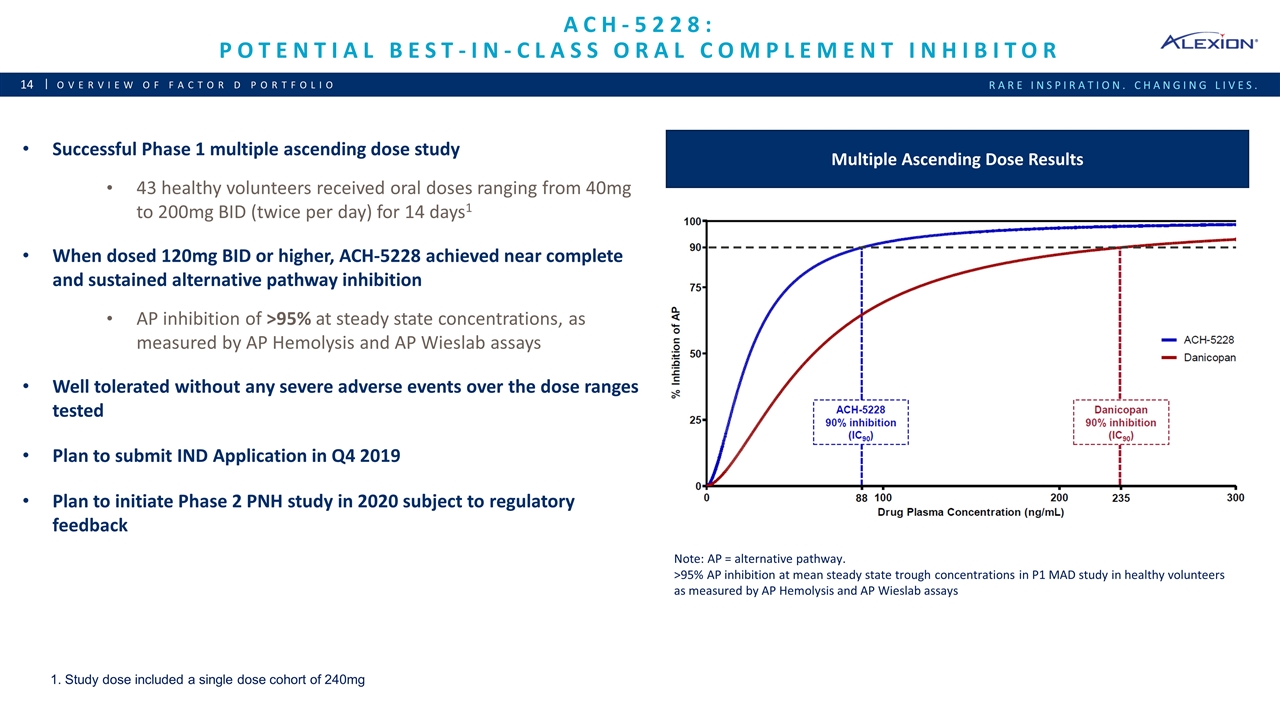

Ach-5228: potential best-in-class oral complement inhibitor Overview of Factor D Portfolio Successful Phase 1 multiple ascending dose study 43 healthy volunteers received oral doses ranging from 40mg to 200mg BID (twice per day) for 14 days1 When dosed 120mg BID or higher, ACH-5228 achieved near complete and sustained alternative pathway inhibition AP inhibition of >95% at steady state concentrations, as measured by AP Hemolysis and AP Wieslab assays Well tolerated without any severe adverse events over the dose ranges tested Plan to submit IND Application in Q4 2019 Plan to initiate Phase 2 PNH study in 2020 subject to regulatory feedback Multiple Ascending Dose Results Note: AP = alternative pathway. >95% AP inhibition at mean steady state trough concentrations in P1 MAD study in healthy volunteers as measured by AP Hemolysis and AP Wieslab assays 1. Study dose included a single dose cohort of 240mg

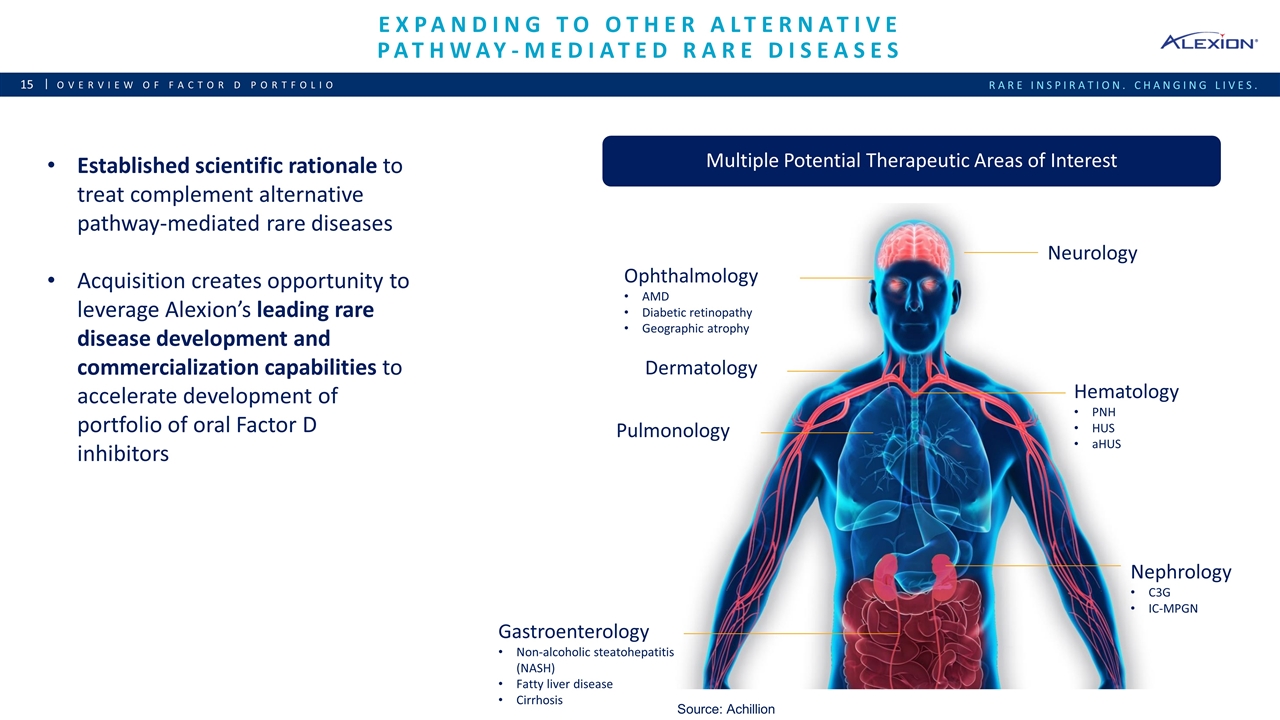

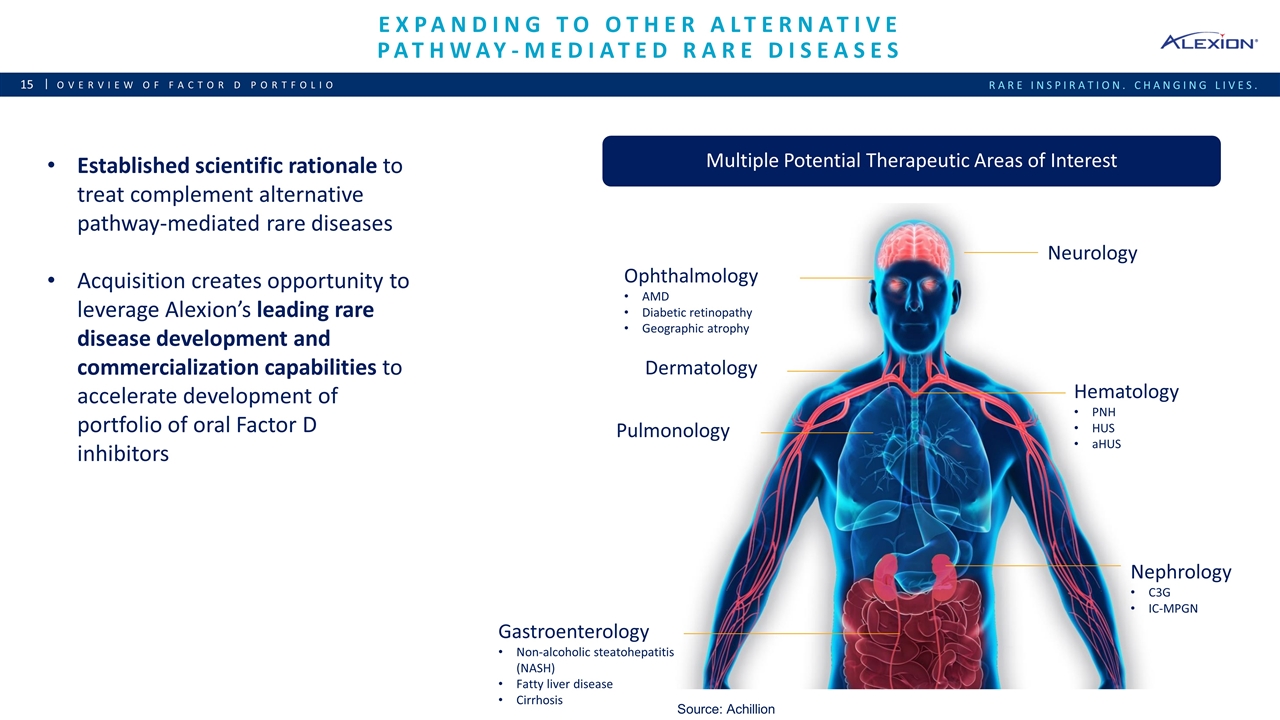

Expanding to Other Alternative Pathway-mediated Rare Diseases Overview of Factor D Portfolio Established scientific rationale to treat complement alternative pathway-mediated rare diseases Acquisition creates opportunity to leverage Alexion’s leading rare disease development and commercialization capabilities to accelerate development of portfolio of oral Factor D inhibitors Multiple Potential Therapeutic Areas of Interest Neurology Ophthalmology AMD Diabetic retinopathy Geographic atrophy Dermatology Pulmonology Nephrology C3G IC-MPGN Gastroenterology Non-alcoholic steatohepatitis (NASH) Fatty liver disease Cirrhosis Hematology PNH HUS aHUS Source: Achillion

Pipeline Update

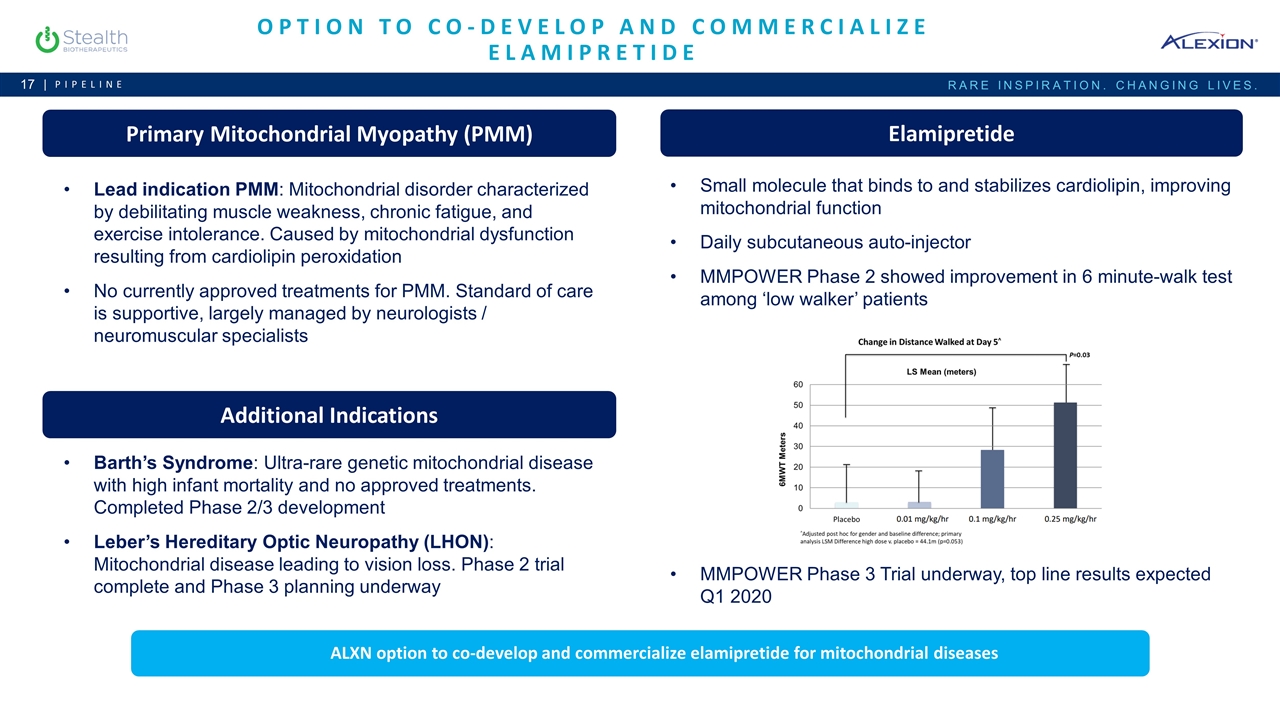

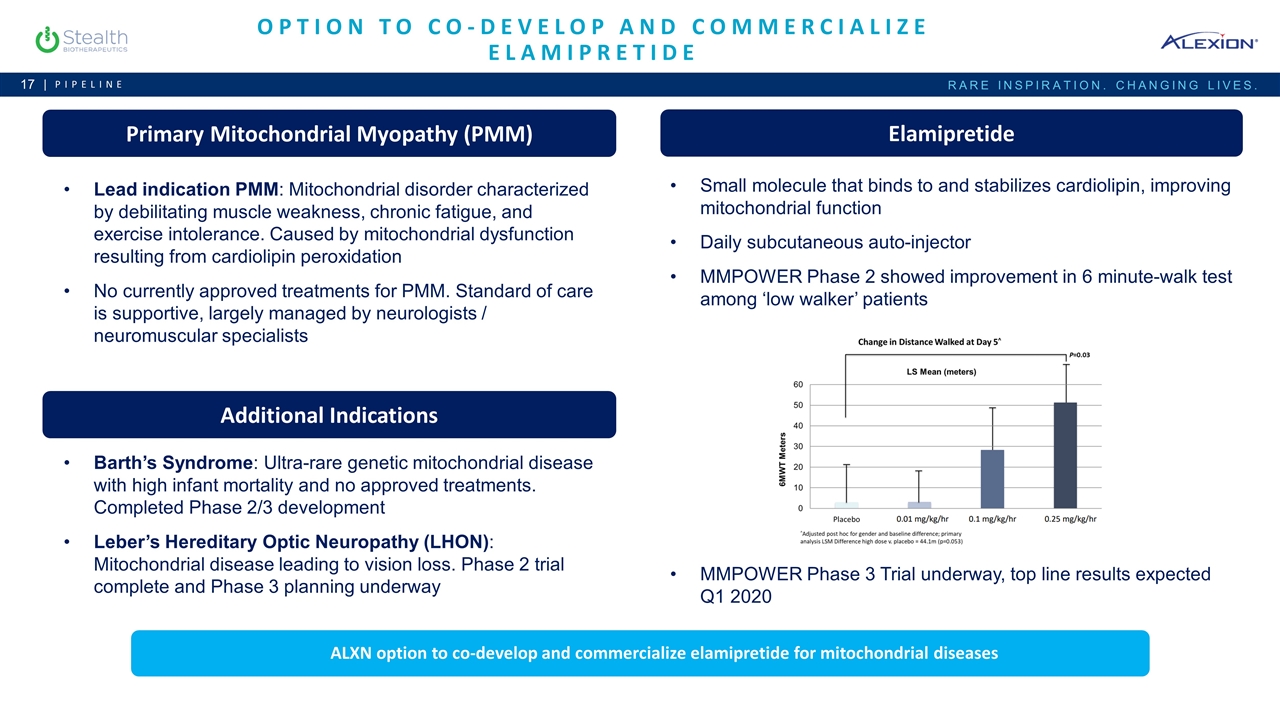

Option to Co-Develop and Commercialize Elamipretide Pipeline Primary Mitochondrial Myopathy (PMM) Lead indication PMM: Mitochondrial disorder characterized by debilitating muscle weakness, chronic fatigue, and exercise intolerance. Caused by mitochondrial dysfunction resulting from cardiolipin peroxidation No currently approved treatments for PMM. Standard of care is supportive, largely managed by neurologists / neuromuscular specialists Elamipretide Small molecule that binds to and stabilizes cardiolipin, improving mitochondrial function Daily subcutaneous auto-injector MMPOWER Phase 2 showed improvement in 6 minute-walk test among ‘low walker’ patients MMPOWER Phase 3 Trial underway, top line results expected Q1 2020 Additional Indications Barth’s Syndrome: Ultra-rare genetic mitochondrial disease with high infant mortality and no approved treatments. Completed Phase 2/3 development Leber’s Hereditary Optic Neuropathy (LHON): Mitochondrial disease leading to vision loss. Phase 2 trial complete and Phase 3 planning underway ALXN option to co-develop and commercialize elamipretide for mitochondrial diseases

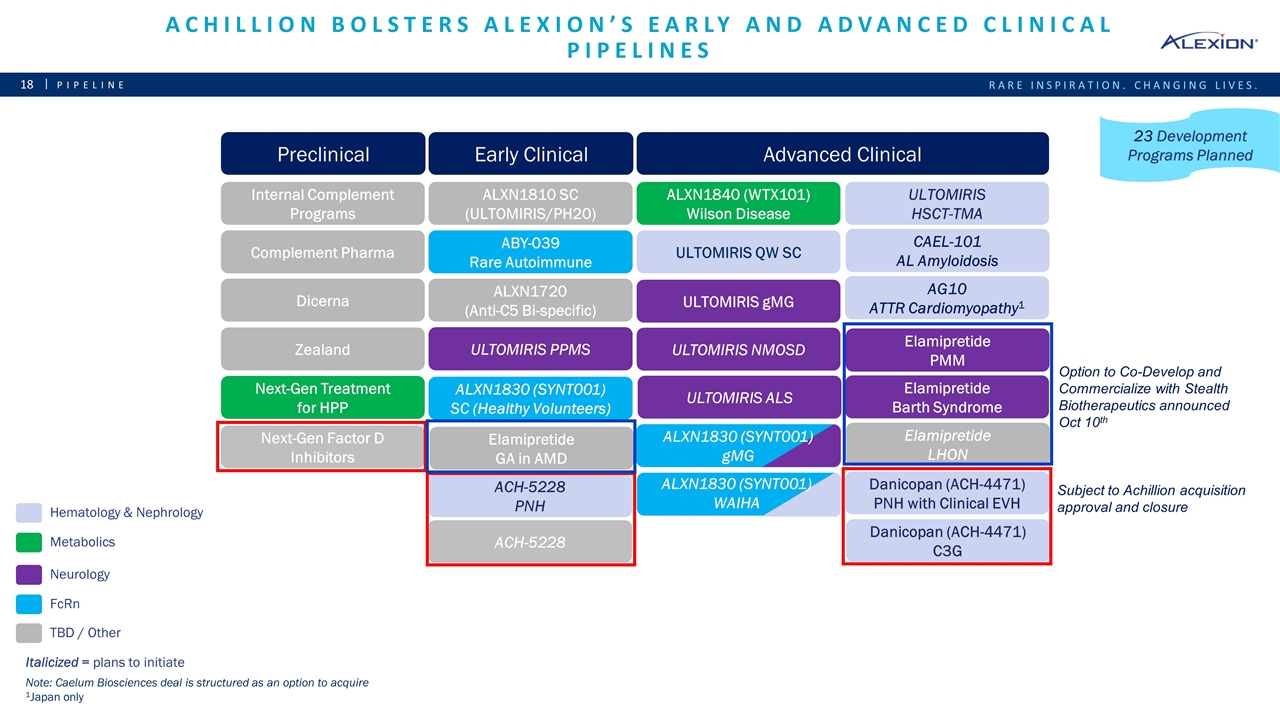

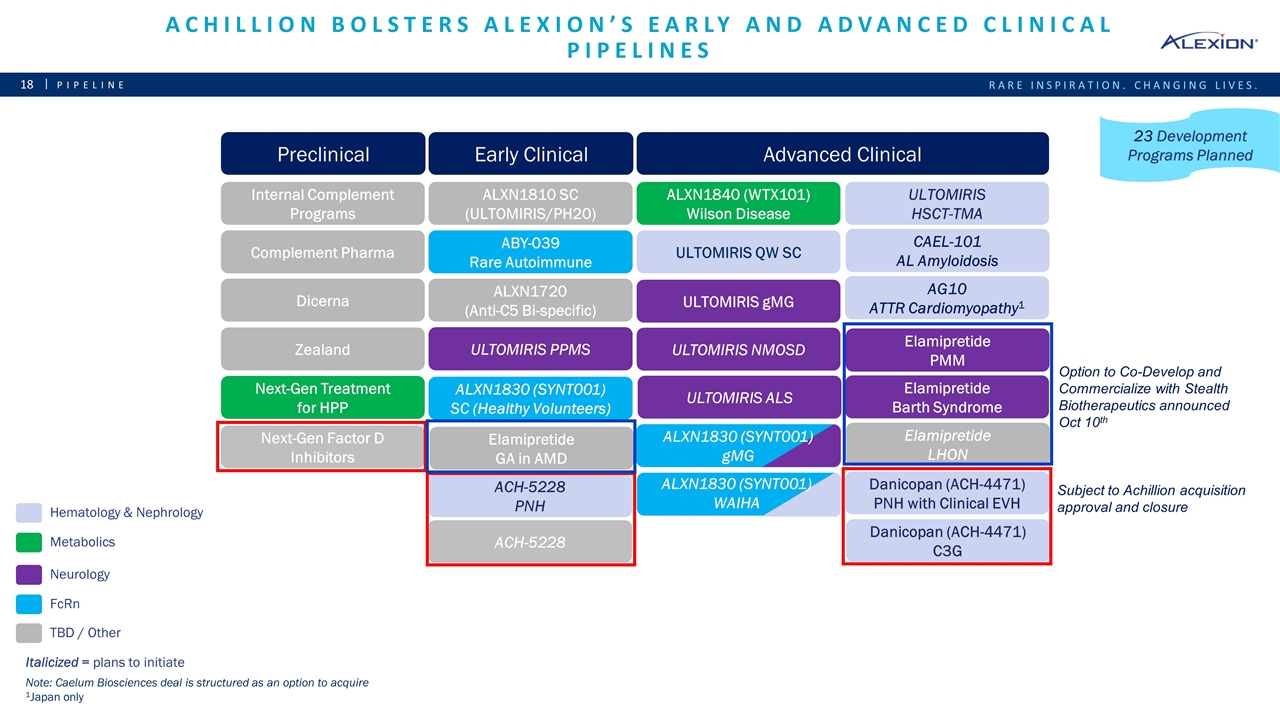

ACH-5228 PNH Achillion bolsters Alexion’s early and advanced clinical pipelines Pipeline Hematology & Nephrology Metabolics Neurology FcRn TBD / Other Italicized = plans to initiate Internal Complement Programs Preclinical Early Clinical Advanced Clinical ALXN1210 QW SubQ ALXN1210 IV PNH Complement Pharma Dicerna ALXN1810 SC (ULTOMIRIS/PH20) ULTOMIRIS PPMS ULTOMIRIS ALS CAEL-101 AL Amyloidosis ULTOMIRIS QW SC ULTOMIRIS gMG ULTOMIRIS NMOSD ALXN1840 (WTX101) Wilson Disease ALXN1720 (Anti-C5 Bi-specific) ABY-039 Rare Autoimmune Next-Gen Treatment for HPP Zealand ALXN1830 (SYNT001) WAIHA ALXN1830 (SYNT001) gMG ALXN1830 (SYNT001) SC (Healthy Volunteers) Note: Caelum Biosciences deal is structured as an option to acquire 1Japan only 23 Development Programs Planned ULTOMIRIS HSCT-TMA AG10 ATTR Cardiomyopathy1 Danicopan (ACH-4471) PNH with Clinical EVH Danicopan (ACH-4471) C3G ACH-5228 Elamipretide PMM Next-Gen Factor D Inhibitors Preclinical Early Clinical Elamipretide LHON Elamipretide Barth Syndrome Option to Co-Develop and Commercialize with Stealth Biotherapeutics announced Oct 10th Subject to Achillion acquisition approval and closure Elamipretide GA in AMD

Closing Remarks Ludwig Hantson, Ph.D. Chief Executive Officer

Aligned with our strategy to deliver long-term growth Closing Build and Diversify in Rare Diseases Broaden Alexion’s portfolio with the potential to serve more patients with rare complement-mediated diseases Disciplined Business Development Transaction maintains Alexion’s financial flexibility to continue to build the pipeline while adding new clinical stage assets Strong Strategic Fit Leverages Alexion’s complement and rare disease development and commercialization expertise

Q&A