Myriad Genetics Fiscal First-Quarter 2017 Earnings Call 11/01/2016 Exhibit 99.2

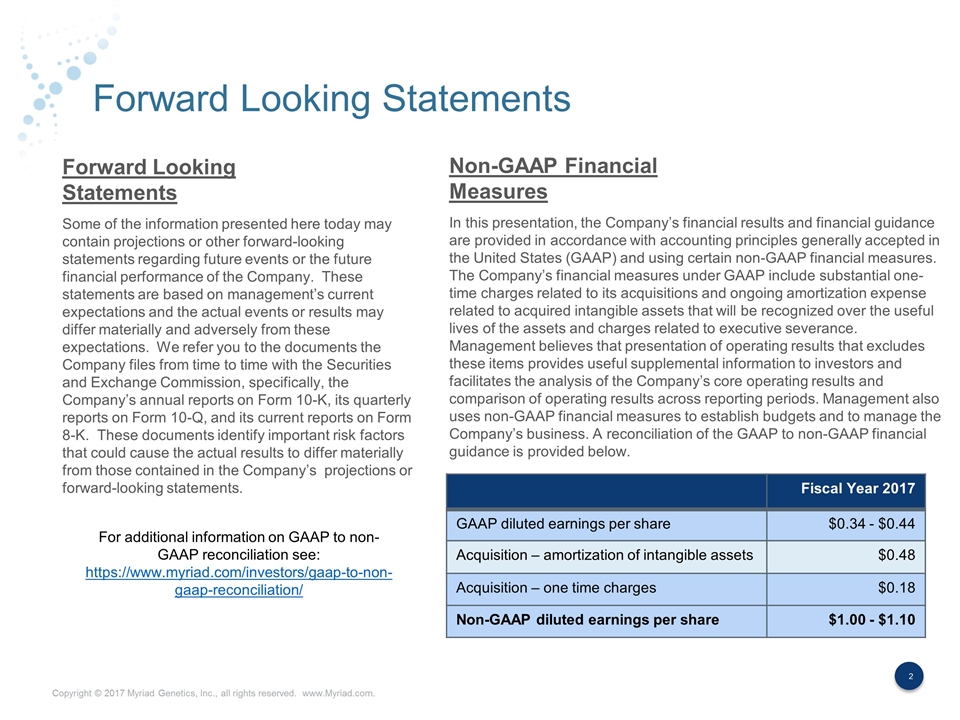

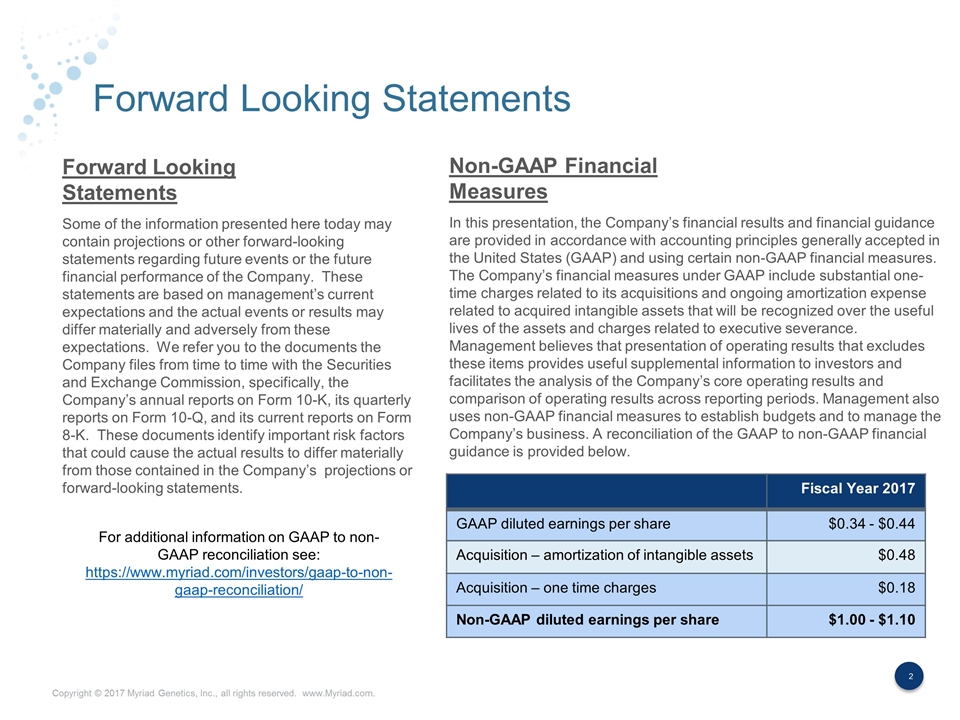

Forward Looking Statements Some of the information presented here today may contain projections or other forward-looking statements regarding future events or the future financial performance of the Company. These statements are based on management’s current expectations and the actual events or results may differ materially and adversely from these expectations. We refer you to the documents the Company files from time to time with the Securities and Exchange Commission, specifically, the Company’s annual reports on Form 10-K, its quarterly reports on Form 10-Q, and its current reports on Form 8-K. These documents identify important risk factors that could cause the actual results to differ materially from those contained in the Company’s projections or forward-looking statements. In this presentation, the Company’s financial results and financial guidance are provided in accordance with accounting principles generally accepted in the United States (GAAP) and using certain non-GAAP financial measures. The Company’s financial measures under GAAP include substantial one-time charges related to its acquisitions and ongoing amortization expense related to acquired intangible assets that will be recognized over the useful lives of the assets and charges related to executive severance. Management believes that presentation of operating results that excludes these items provides useful supplemental information to investors and facilitates the analysis of the Company’s core operating results and comparison of operating results across reporting periods. Management also uses non-GAAP financial measures to establish budgets and to manage the Company’s business. A reconciliation of the GAAP to non-GAAP financial guidance is provided below. Forward Looking Statements Non-GAAP Financial Measures Fiscal Year 2017 GAAP diluted earnings per share $0.34 - $0.44 Acquisition – amortization of intangible assets $0.48 Acquisition – one time charges $0.18 Non-GAAP diluted earnings per share $1.00 - $1.10 For additional information on GAAP to non-GAAP reconciliation see: https://www.myriad.com/investors/gaap-to-non-gaap-reconciliation/

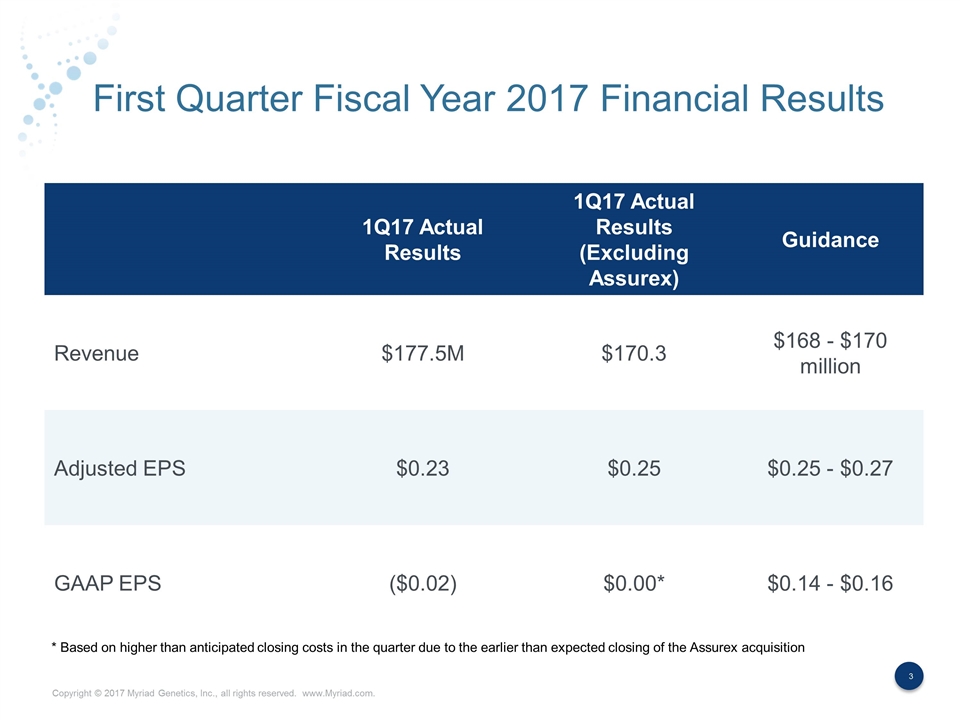

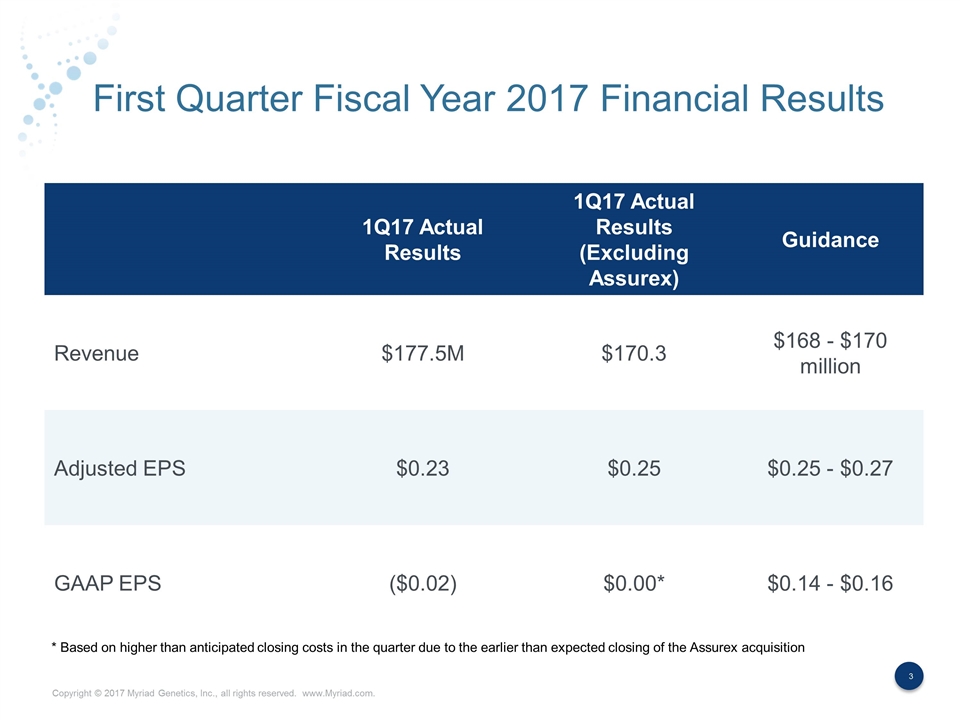

First Quarter Fiscal Year 2017 Financial Results 1Q17 Actual Results 1Q17 Actual Results (Excluding Assurex) Guidance Revenue $177.5M $170.3 $168 - $170 million Adjusted EPS $0.23 $0.25 $0.25 - $0.27 GAAP EPS ($0.02) $0.00* $0.14 - $0.16 * Based on higher than anticipated closing costs in the quarter due to the earlier than expected closing of the Assurex acquisition

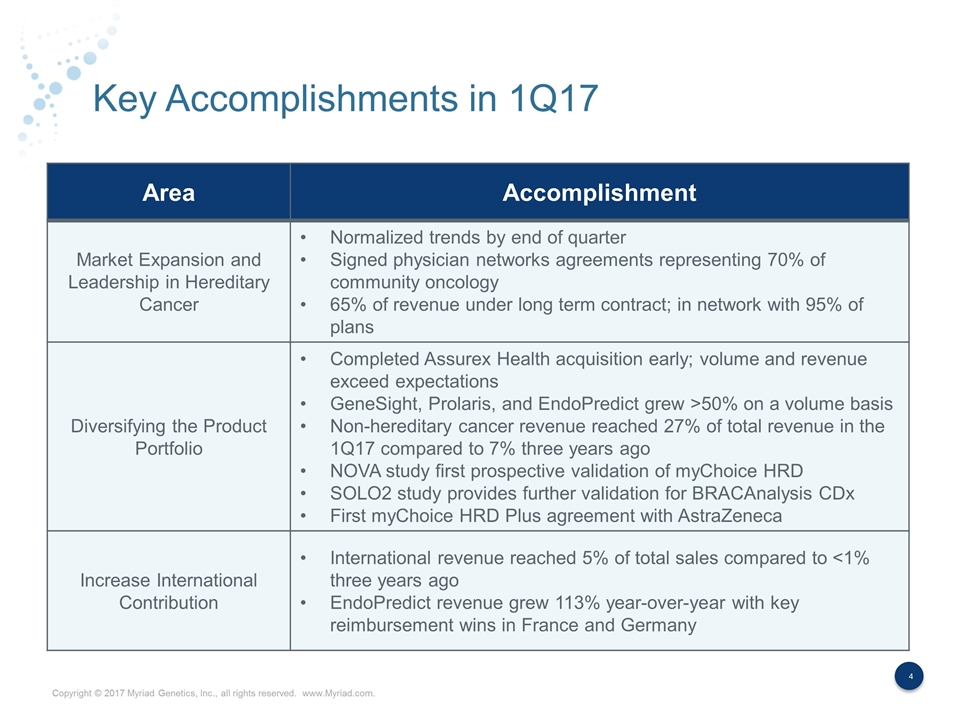

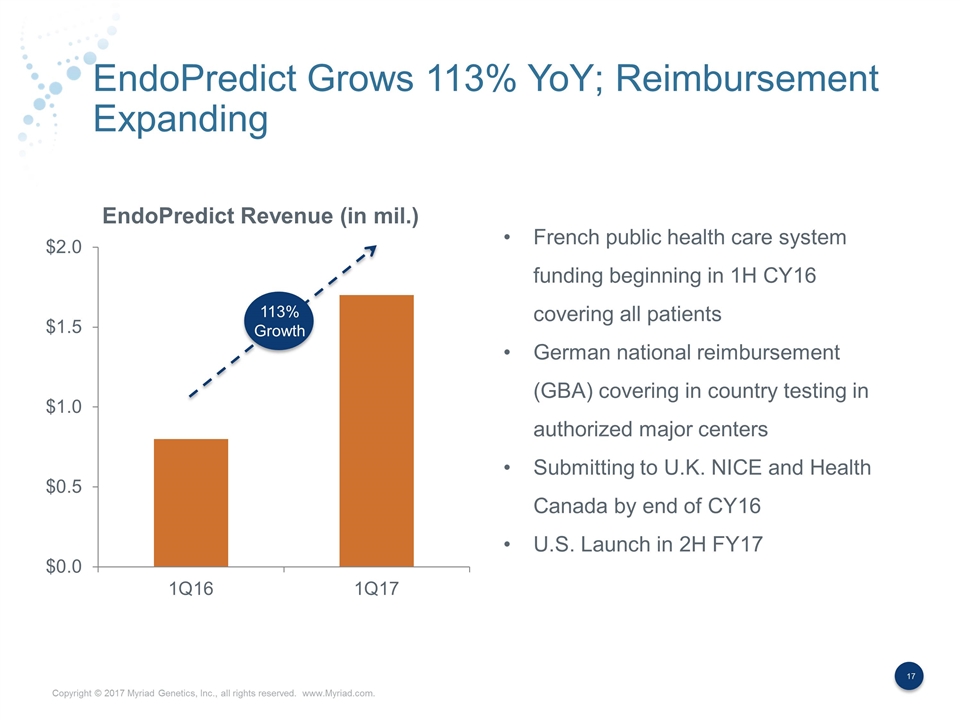

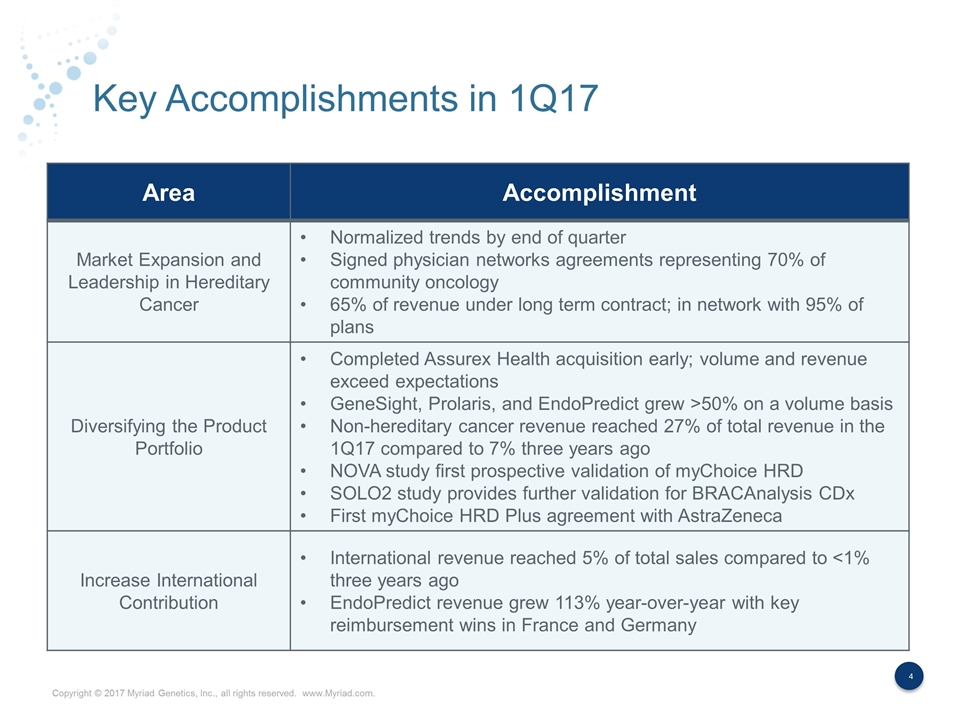

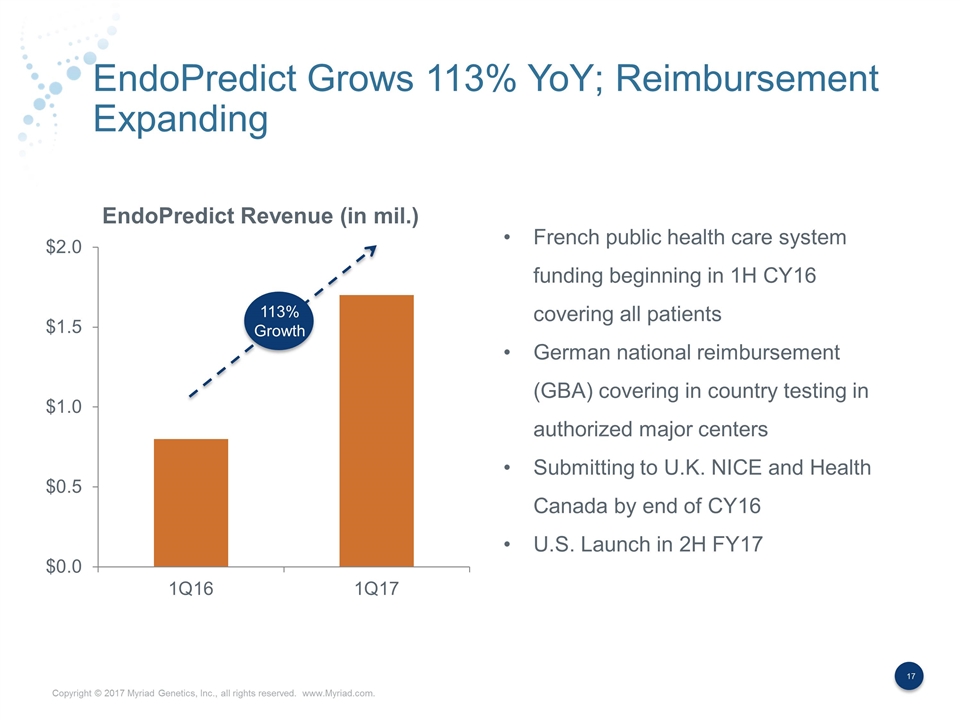

Key Accomplishments in 1Q17 Area Accomplishment Market Expansion and Leadership in Hereditary Cancer Normalized trends by end of quarter Signed physician networks agreements representing 70% of community oncology 65% of revenue under long term contract; in network with 95% of plans Diversifying the Product Portfolio Completed Assurex Health acquisition early; volume and revenue exceed expectations GeneSight, Prolaris, and EndoPredict grew >50% on a volume basis Non-hereditary cancer revenue reached 27% of total revenue in the 1Q17 compared to 7% three years ago NOVA study first prospective validation of myChoice HRD SOLO2 study provides further validation for BRACAnalysis CDx First myChoice HRD Plus agreement with AstraZeneca Increase International Contribution International revenue reached 5% of total sales compared to <1% three years ago EndoPredict revenue grew 113% year-over-year with key reimbursement wins in France and Germany

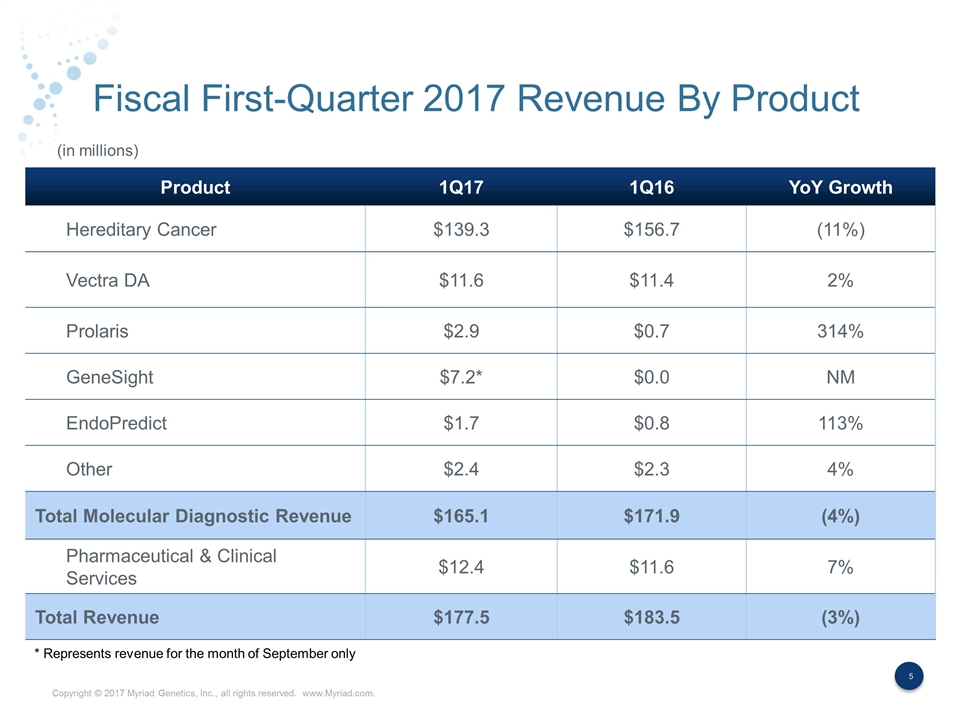

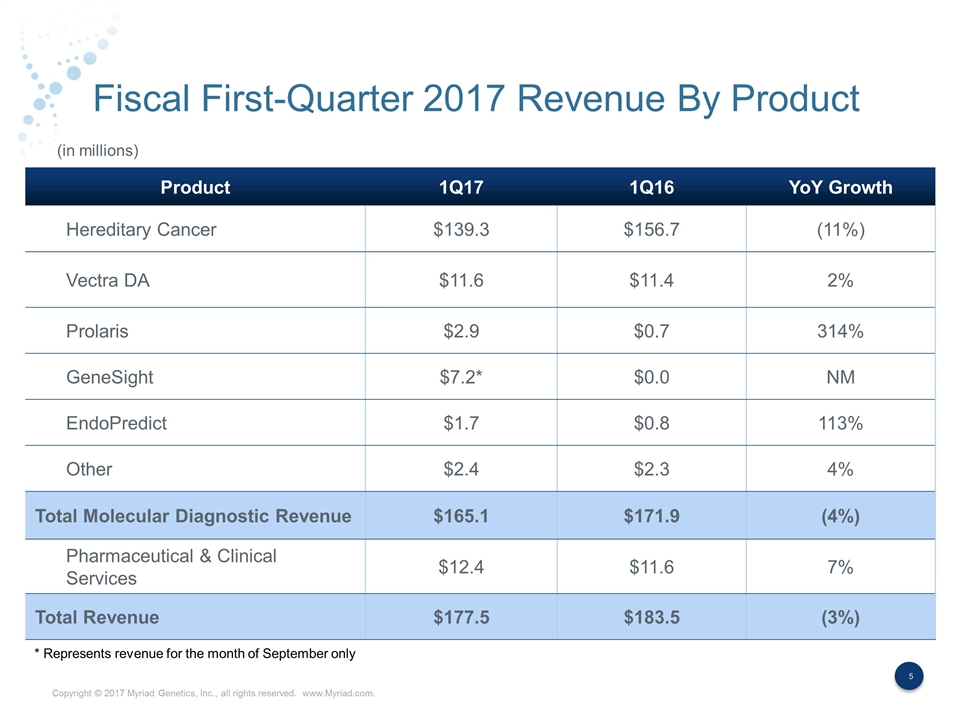

Fiscal First-Quarter 2017 Revenue By Product Product 1Q17 1Q16 YoY Growth Hereditary Cancer $139.3 $156.7 (11%) Vectra DA $11.6 $11.4 2% Prolaris $2.9 $0.7 314% GeneSight $7.2* $0.0 NM EndoPredict $1.7 $0.8 113% Other $2.4 $2.3 4% Total Molecular Diagnostic Revenue $165.1 $171.9 (4%) Pharmaceutical & Clinical Services $12.4 $11.6 7% Total Revenue $177.5 $183.5 (3%) (in millions) * Represents revenue for the month of September only

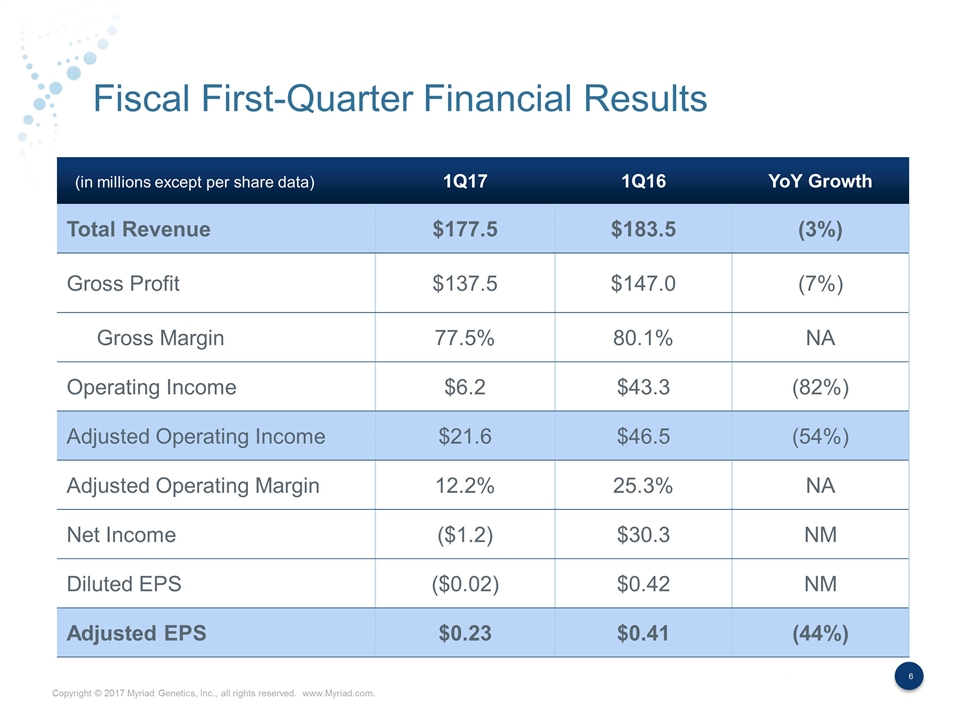

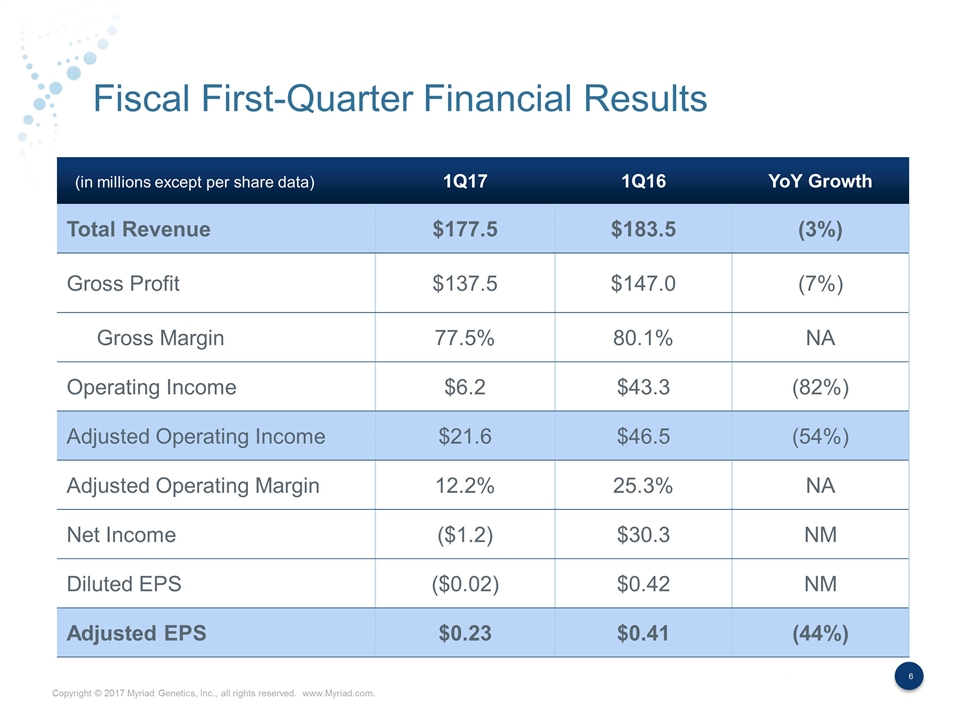

Fiscal First-Quarter Financial Results 1Q17 1Q16 YoY Growth Total Revenue $177.5 $183.5 (3%) Gross Profit $137.5 $147.0 (7%) Gross Margin 77.5% 80.1% NA Operating Income $6.2 $43.3 (82%) Adjusted Operating Income $21.6 $46.5 (54%) Adjusted Operating Margin 12.2% 25.3% NA Net Income ($1.2) $30.3 NM Diluted EPS ($0.02) $0.42 NM Adjusted EPS $0.23 $0.41 (44%) (in millions except per share data)

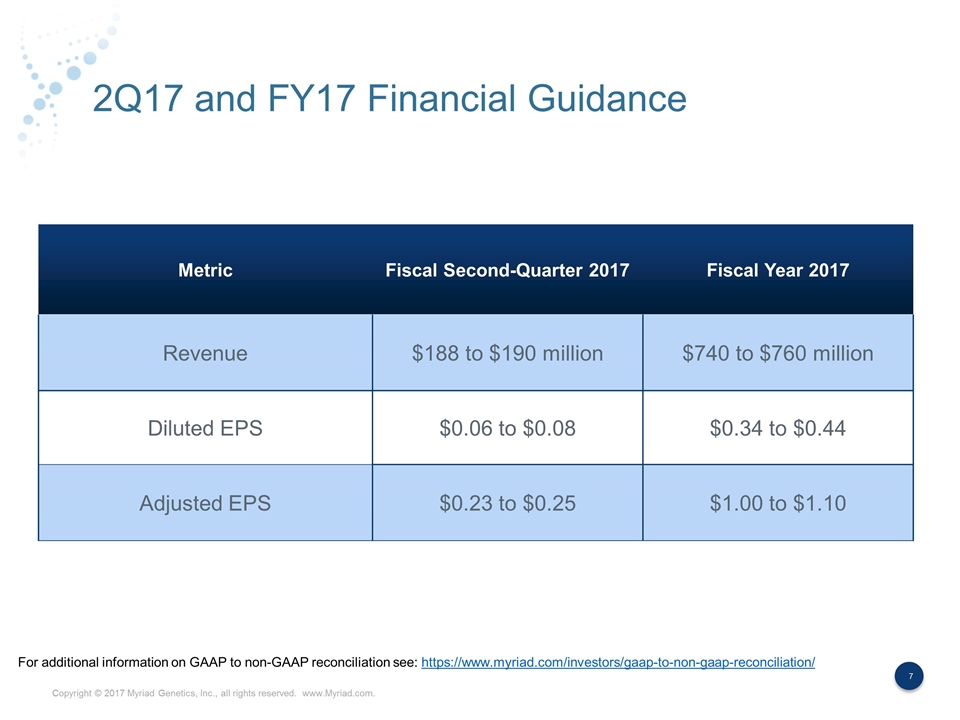

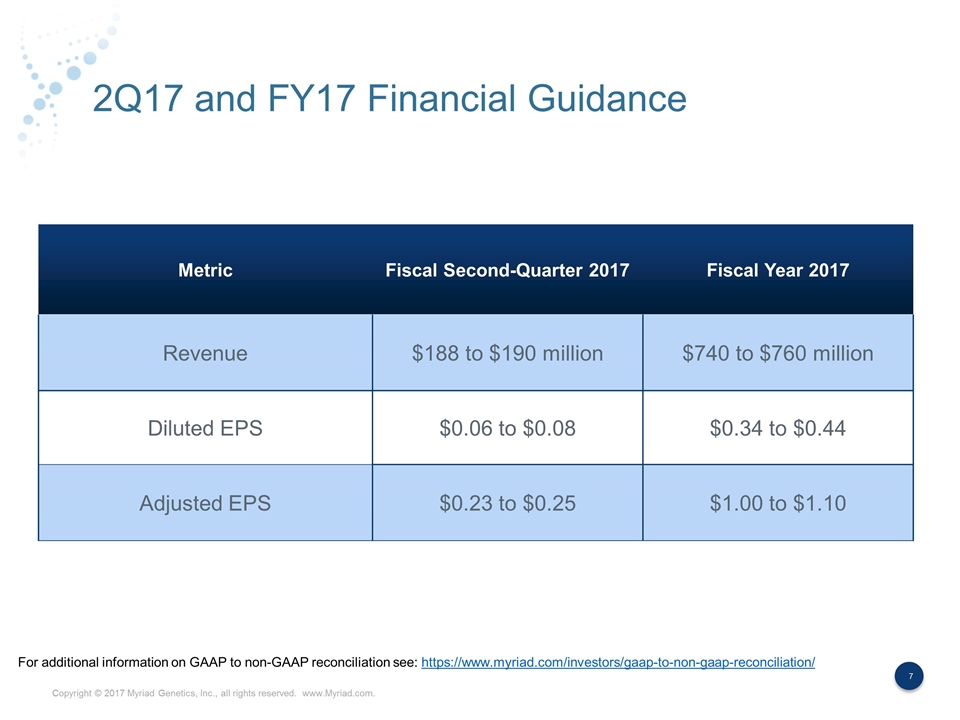

2Q17 and FY17 Financial Guidance Metric Fiscal Second-Quarter 2017 Fiscal Year 2017 Revenue $188 to $190 million $740 to $760 million Diluted EPS $0.06 to $0.08 $0.34 to $0.44 Adjusted EPS $0.23 to $0.25 $1.00 to $1.10 For additional information on GAAP to non-GAAP reconciliation see: https://www.myriad.com/investors/gaap-to-non-gaap-reconciliation/

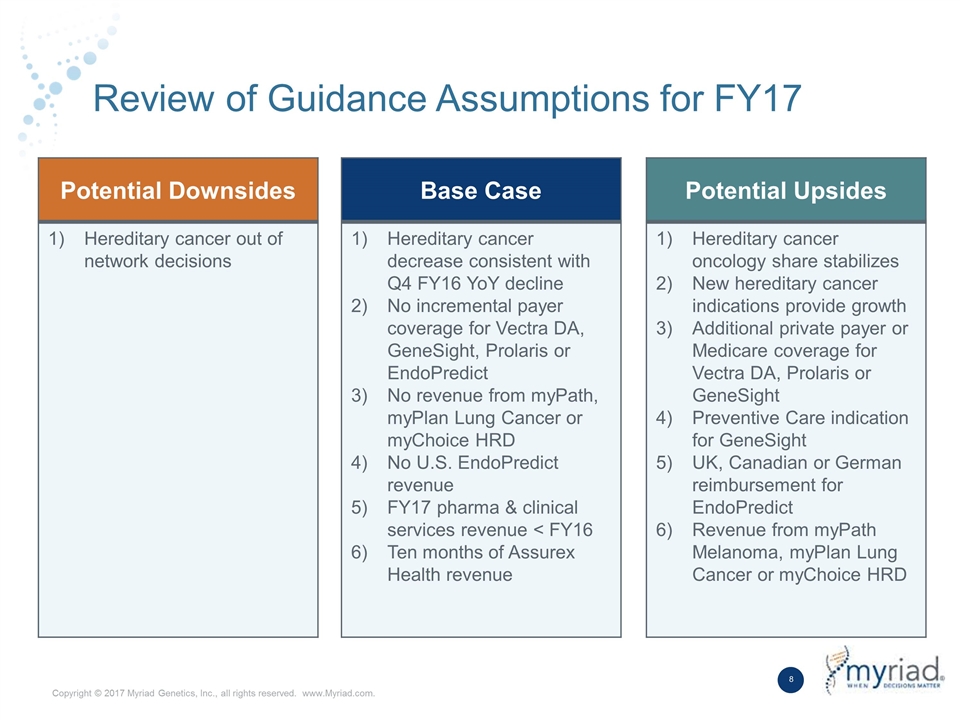

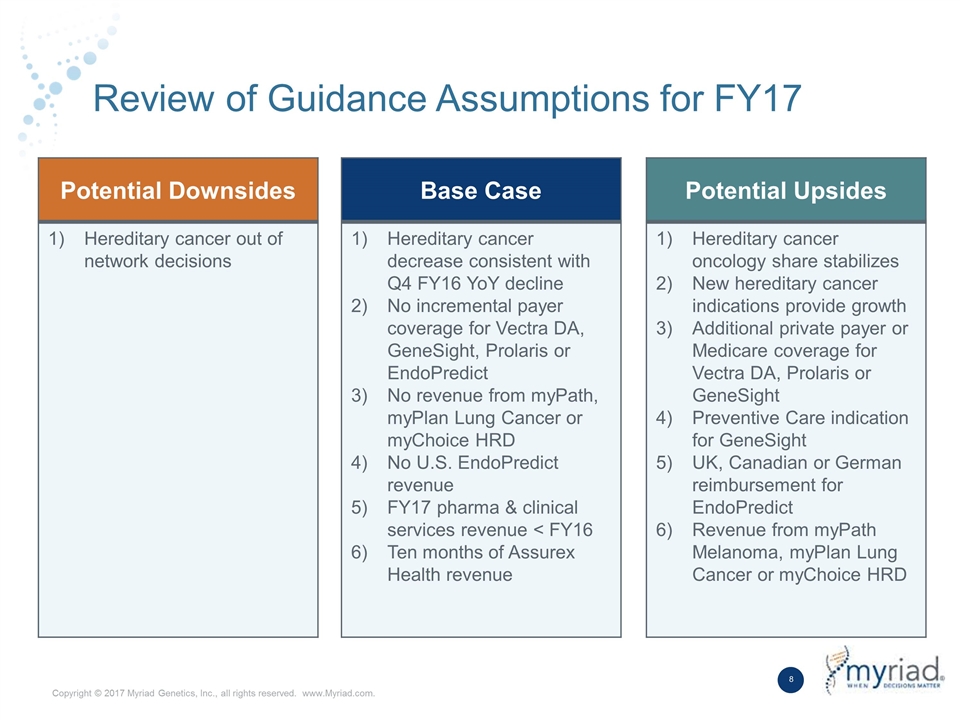

Review of Guidance Assumptions for FY17 Potential Downsides Hereditary cancer out of network decisions Base Case Hereditary cancer decrease consistent with Q4 FY16 YoY decline No incremental payer coverage for Vectra DA, GeneSight, Prolaris or EndoPredict No revenue from myPath, myPlan Lung Cancer or myChoice HRD No U.S. EndoPredict revenue FY17 pharma & clinical services revenue < FY16 Ten months of Assurex Health revenue Potential Upsides Hereditary cancer oncology share stabilizes New hereditary cancer indications provide growth Additional private payer or Medicare coverage for Vectra DA, Prolaris or GeneSight Preventive Care indication for GeneSight UK, Canadian or German reimbursement for EndoPredict Revenue from myPath Melanoma, myPlan Lung Cancer or myChoice HRD

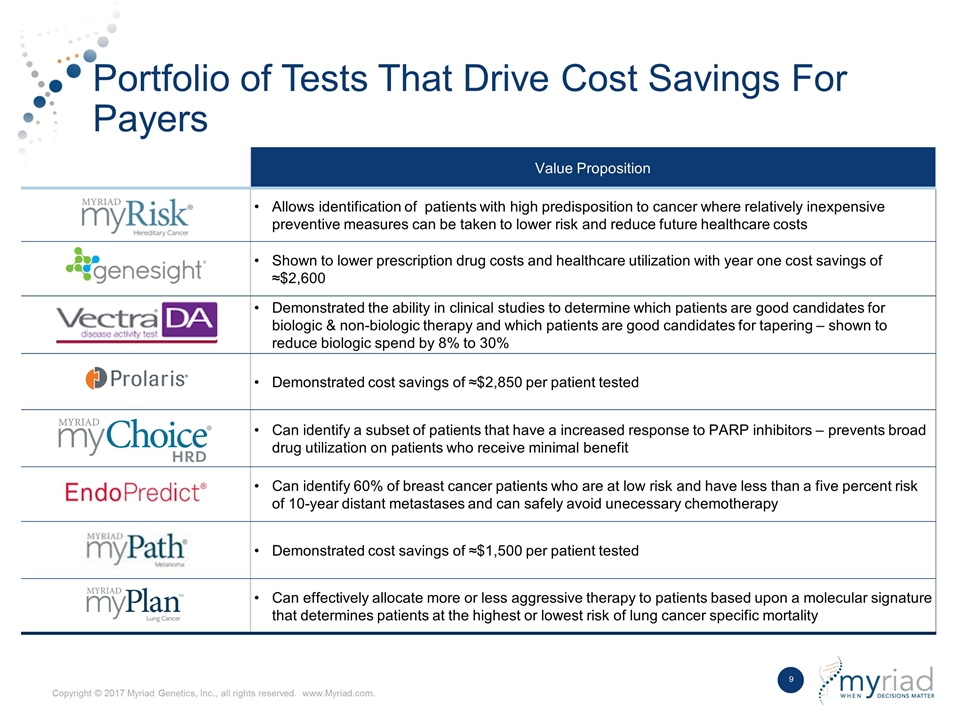

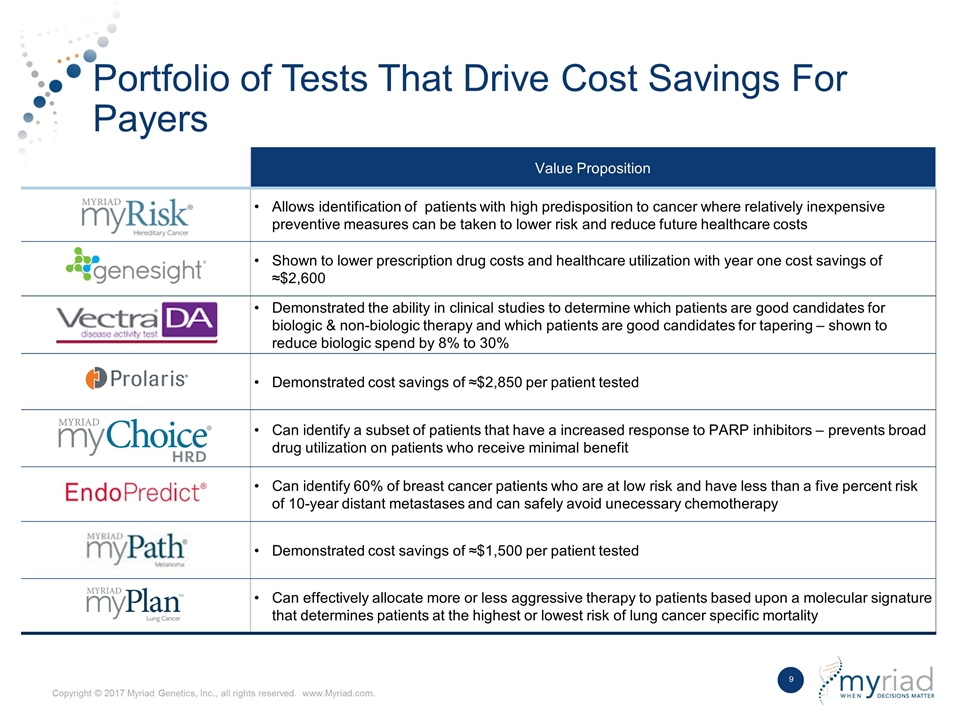

Value Proposition Allows identification of patients with high predisposition to cancer where relatively inexpensive preventive measures can be taken to lower risk and reduce future healthcare costs Shown to lower prescription drug costs and healthcare utilization with year one cost savings of ≈$2,600 Demonstrated the ability in clinical studies to determine which patients are good candidates for biologic & non-biologic therapy and which patients are good candidates for tapering – shown to reduce biologic spend by 8% to 30% Demonstrated cost savings of ≈$2,850 per patient tested Can identify a subset of patients that have a increased response to PARP inhibitors – prevents broad drug utilization on patients who receive minimal benefit Can identify 60% of breast cancer patients who are at low risk and have less than a five percent risk of 10-year distant metastases and can safely avoid unecessary chemotherapy Demonstrated cost savings of ≈$1,500 per patient tested Can effectively allocate more or less aggressive therapy to patients based upon a molecular signature that determines patients at the highest or lowest risk of lung cancer specific mortality Portfolio of Tests That Drive Cost Savings For Payers

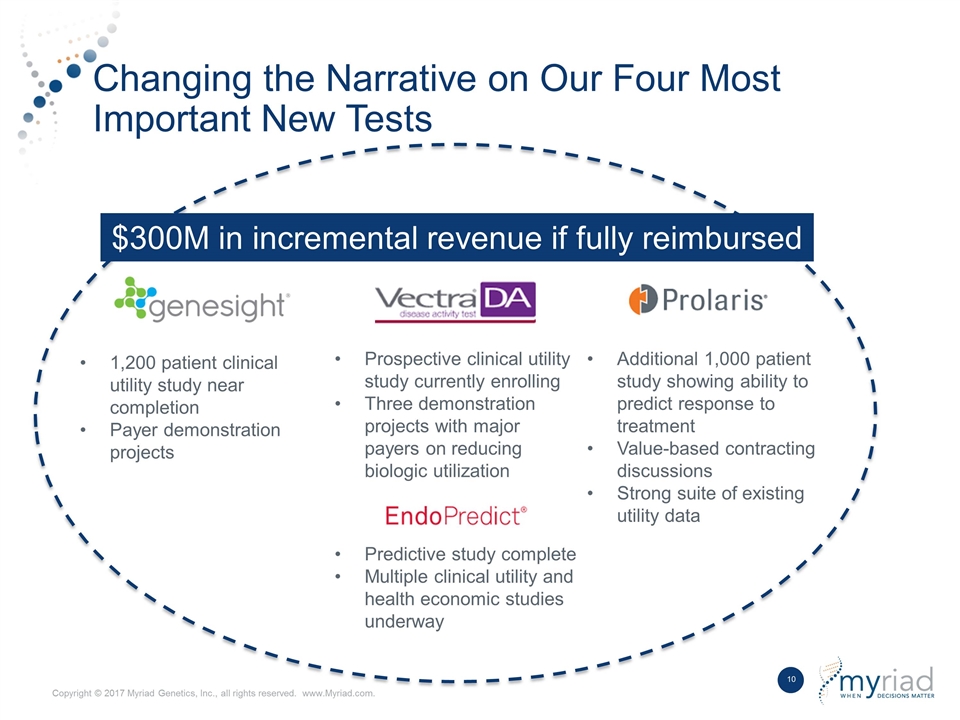

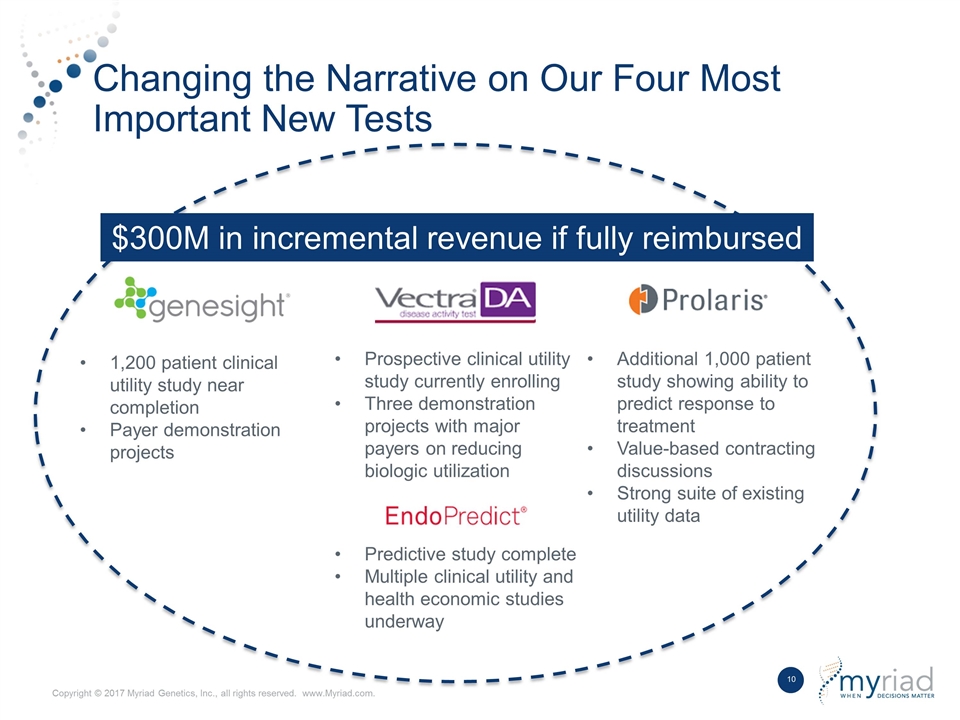

Changing the Narrative on Our Four Most Important New Tests $300M in incremental revenue if fully reimbursed 1,200 patient clinical utility study near completion Payer demonstration projects Prospective clinical utility study currently enrolling Three demonstration projects with major payers on reducing biologic utilization Additional 1,000 patient study showing ability to predict response to treatment Value-based contracting discussions Strong suite of existing utility data Predictive study complete Multiple clinical utility and health economic studies underway

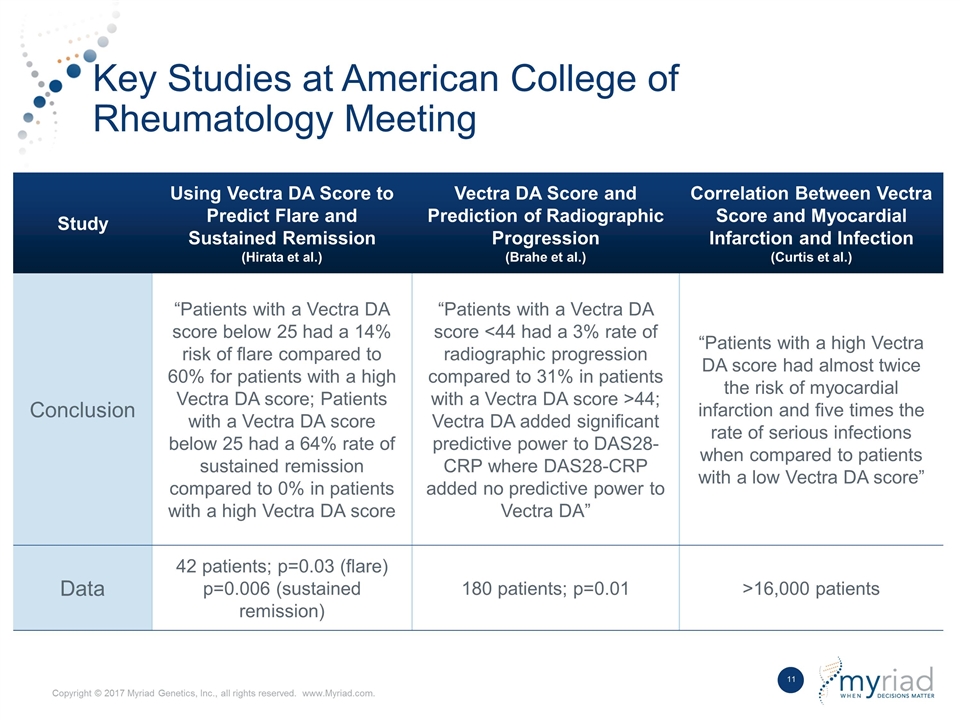

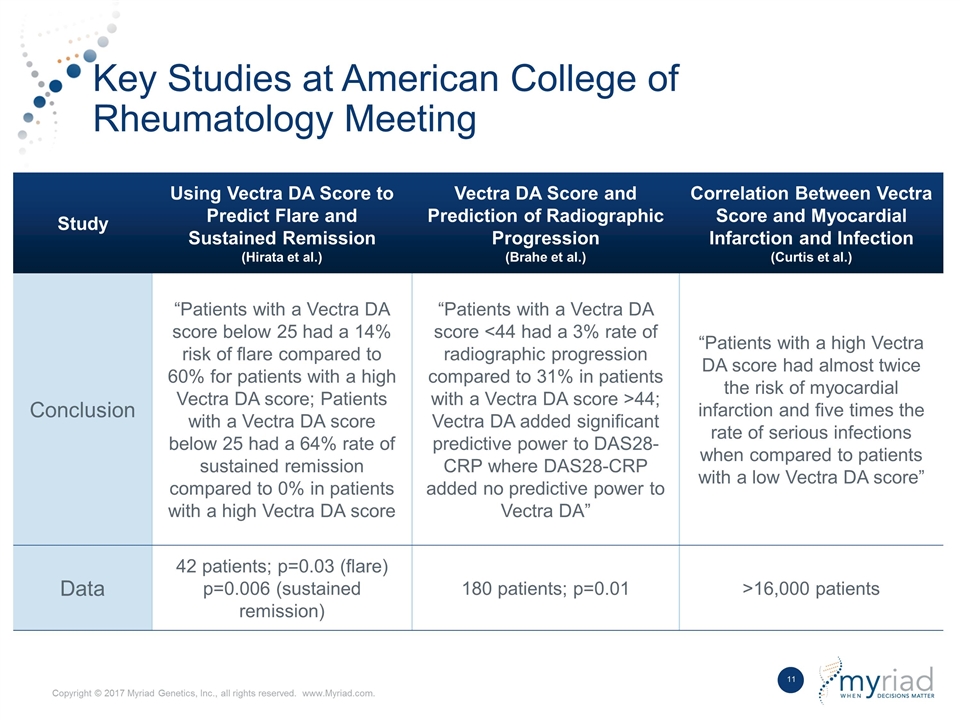

Key Studies at American College of Rheumatology Meeting Study Using Vectra DA Score to Predict Flare and Sustained Remission (Hirata et al.) Vectra DA Score and Prediction of Radiographic Progression (Brahe et al.) Correlation Between Vectra Score and Myocardial Infarction and Infection (Curtis et al.) Conclusion “Patients with a Vectra DA score below 25 had a 14% risk of flare compared to 60% for patients with a high Vectra DA score; Patients with a Vectra DA score below 25 had a 64% rate of sustained remission compared to 0% in patients with a high Vectra DA score “Patients with a Vectra DA score <44 had a 3% rate of radiographic progression compared to 31% in patients with a Vectra DA score >44; Vectra DA added significant predictive power to DAS28-CRP where DAS28-CRP added no predictive power to Vectra DA” “Patients with a high Vectra DA score had almost twice the risk of myocardial infarction and five times the rate of serious infections when compared to patients with a low Vectra DA score” Data 42 patients; p=0.03 (flare) p=0.006 (sustained remission) 180 patients; p=0.01 >16,000 patients

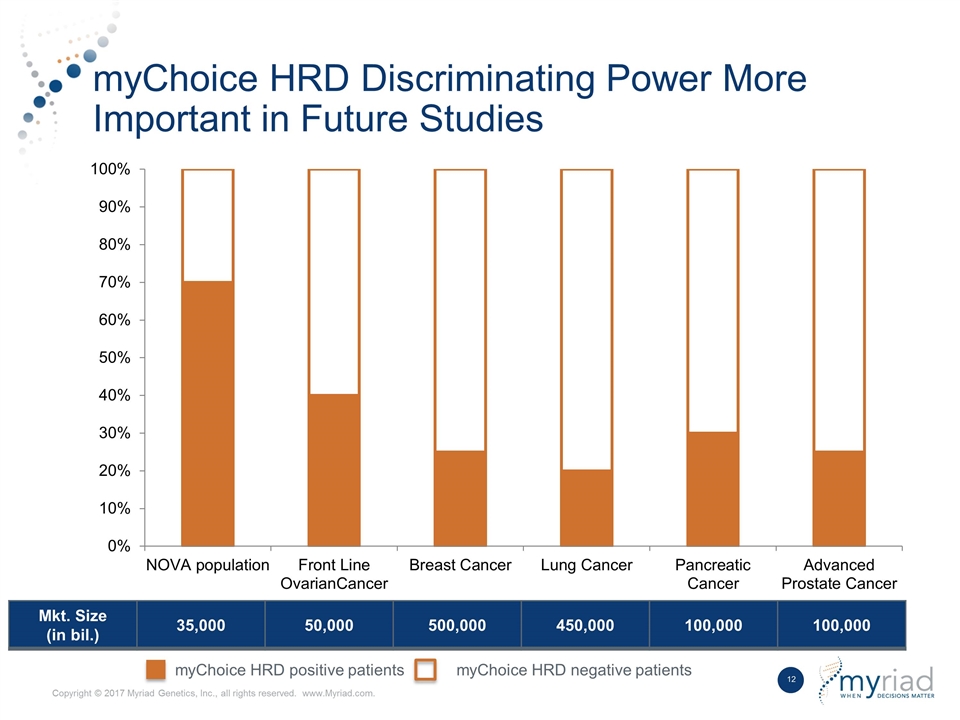

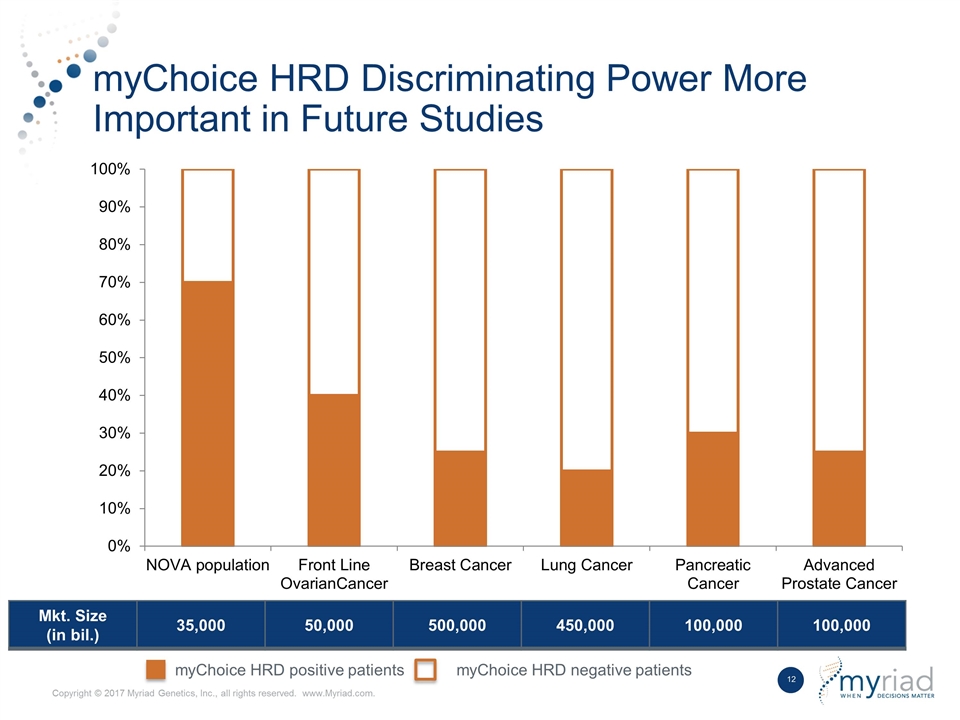

myChoice HRD Discriminating Power More Important in Future Studies Mkt. Size (in bil.) 35,000 50,000 500,000 450,000 100,000 100,000 myChoice HRD positive patients myChoice HRD negative patients

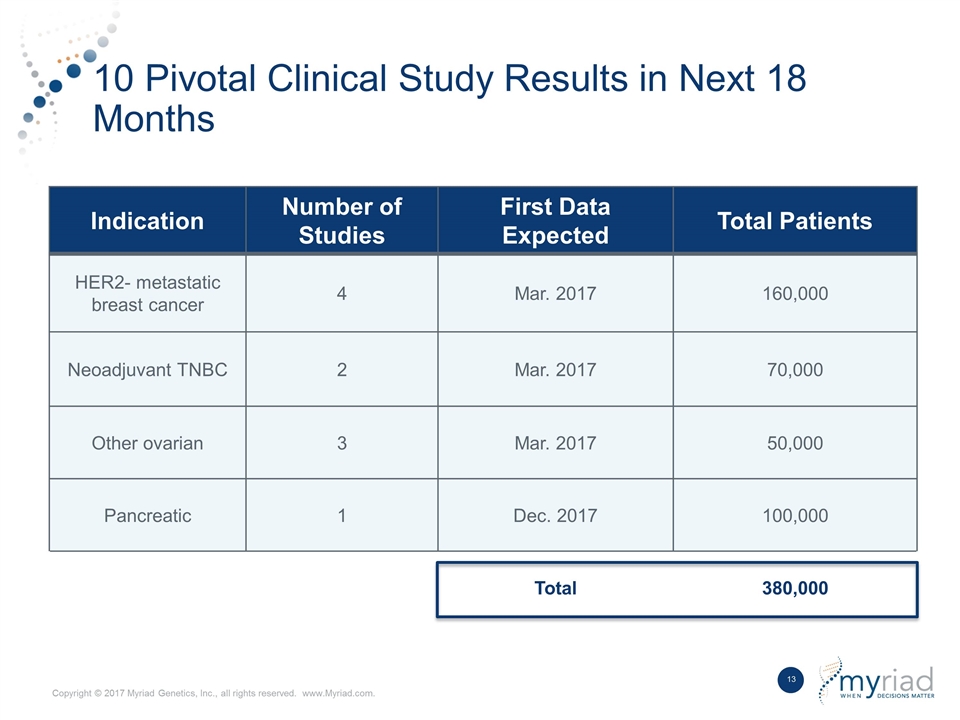

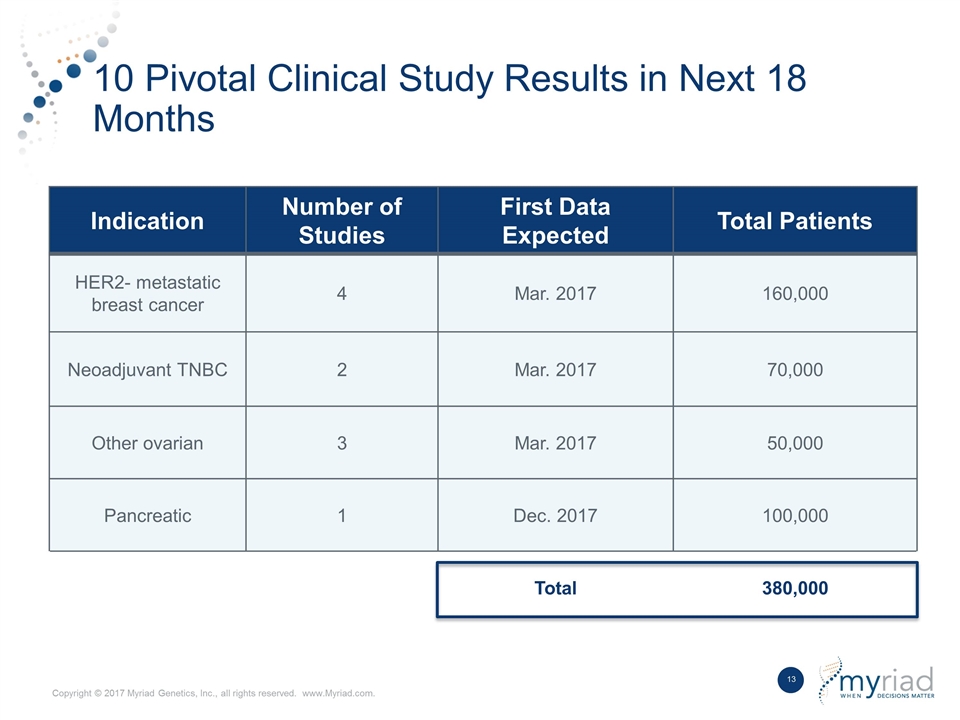

10 Pivotal Clinical Study Results in Next 18 Months Indication Number of Studies First Data Expected Total Patients HER2- metastatic breast cancer 4 Mar. 2017 160,000 Neoadjuvant TNBC 2 Mar. 2017 70,000 Other ovarian 3 Mar. 2017 50,000 Pancreatic 1 Dec. 2017 100,000 Total 380,000

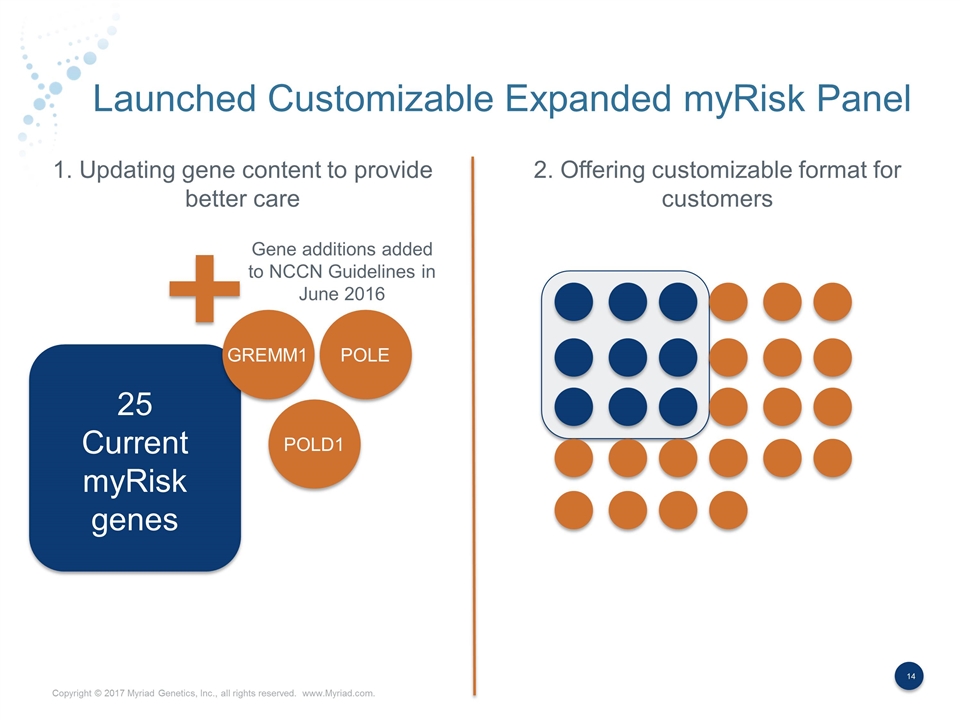

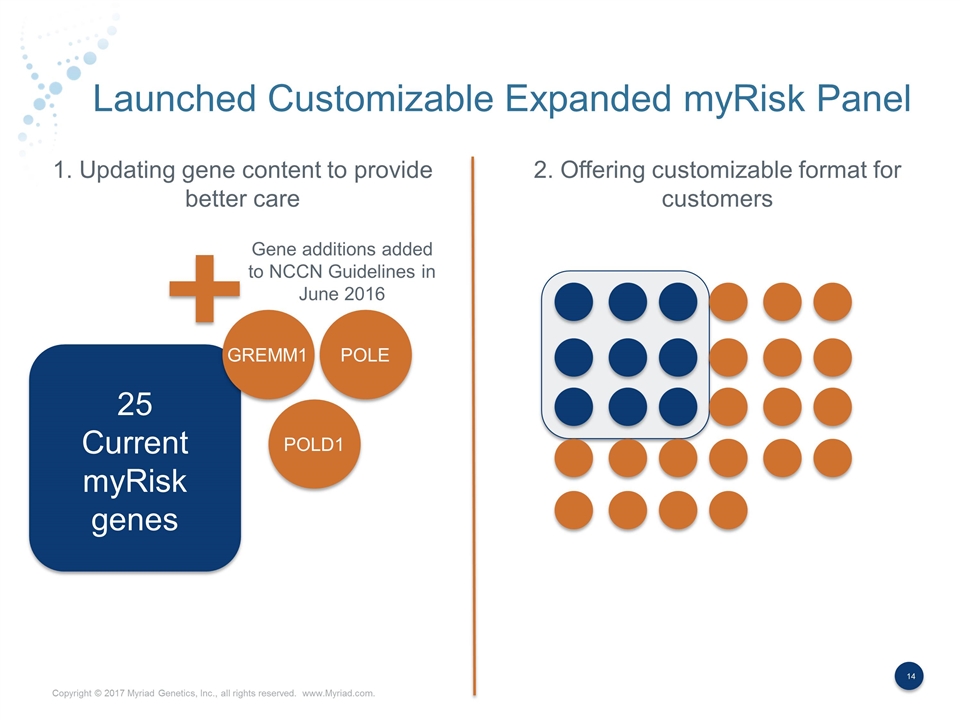

Launched Customizable Expanded myRisk Panel Gene additions added to NCCN Guidelines in June 2016 GREMM1 POLE POLD1 25 Current myRisk genes NBN 1. Updating gene content to provide better care 2. Offering customizable format for customers

Myriad Now Preferred Provider With Largest Oncology Physician Networks 70% of U.S. Community Oncology Practices Preferred Provider

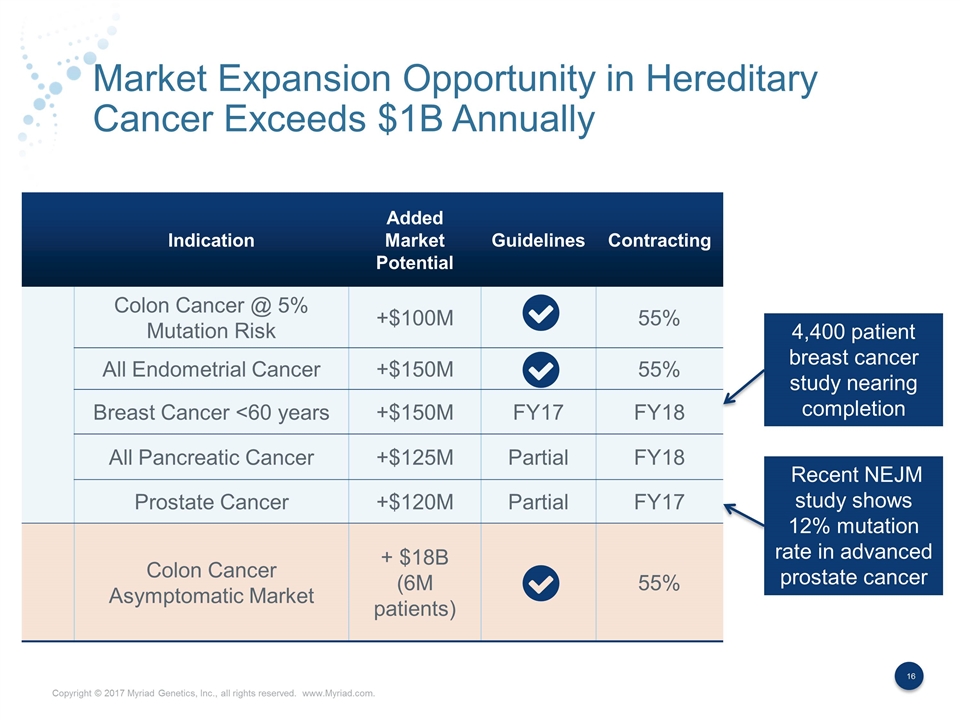

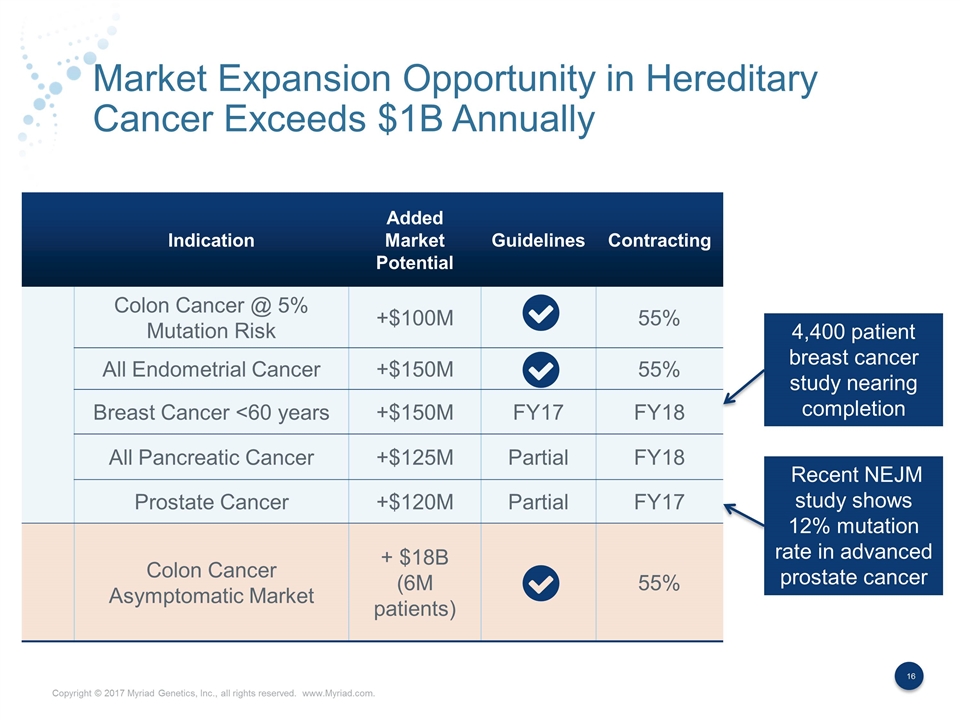

Market Expansion Opportunity in Hereditary Cancer Exceeds $1B Annually Indication Added Market Potential Guidelines Contracting Colon Cancer @ 5% Mutation Risk +$100M 55% All Endometrial Cancer +$150M 55% Breast Cancer <60 years +$150M FY17 FY18 All Pancreatic Cancer +$125M Partial FY18 Prostate Cancer +$120M Partial FY17 Colon Cancer Asymptomatic Market + $18B (6M patients) 55% 4,400 patient breast cancer study nearing completion Recent NEJM study shows 12% mutation rate in advanced prostate cancer

EndoPredict Grows 113% YoY; Reimbursement Expanding 113% Growth French public health care system funding beginning in 1H CY16 covering all patients German national reimbursement (GBA) covering in country testing in authorized major centers Submitting to U.K. NICE and Health Canada by end of CY16 U.S. Launch in 2H FY17

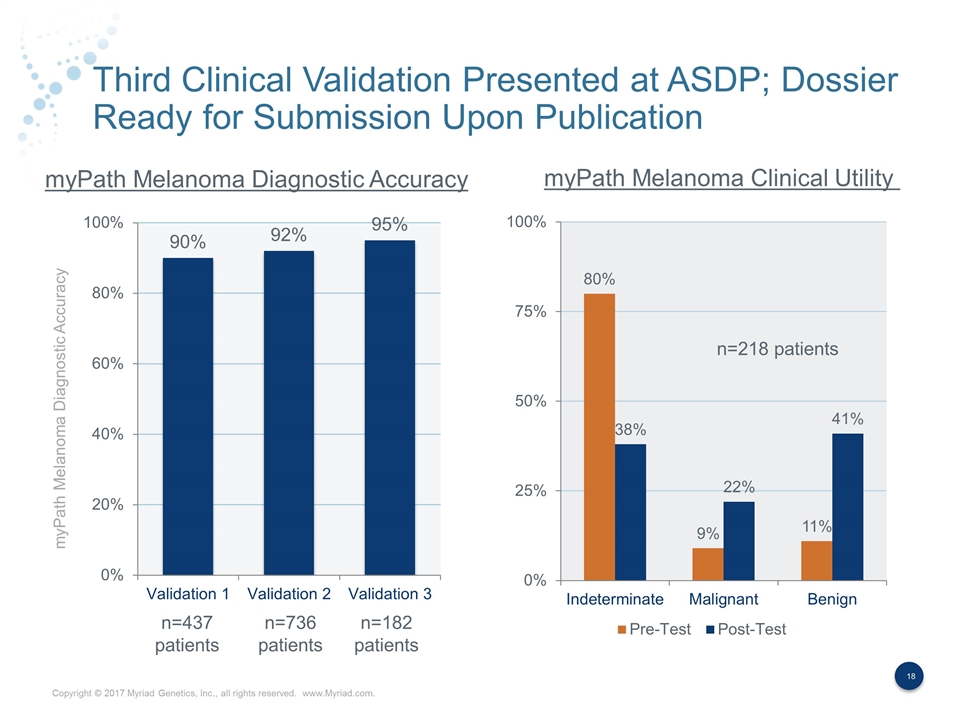

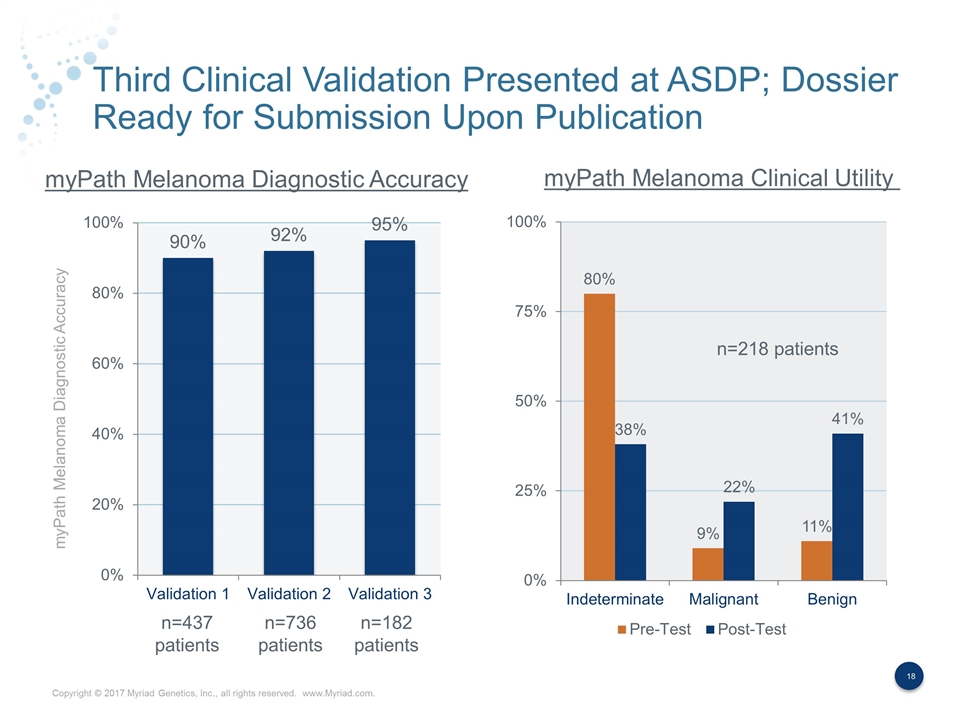

Third Clinical Validation Presented at ASDP; Dossier Ready for Submission Upon Publication myPath Melanoma Diagnostic Accuracy myPath Melanoma Diagnostic Accuracy myPath Melanoma Clinical Utility n=437 patients n=736 patients n=218 patients n=182 patients

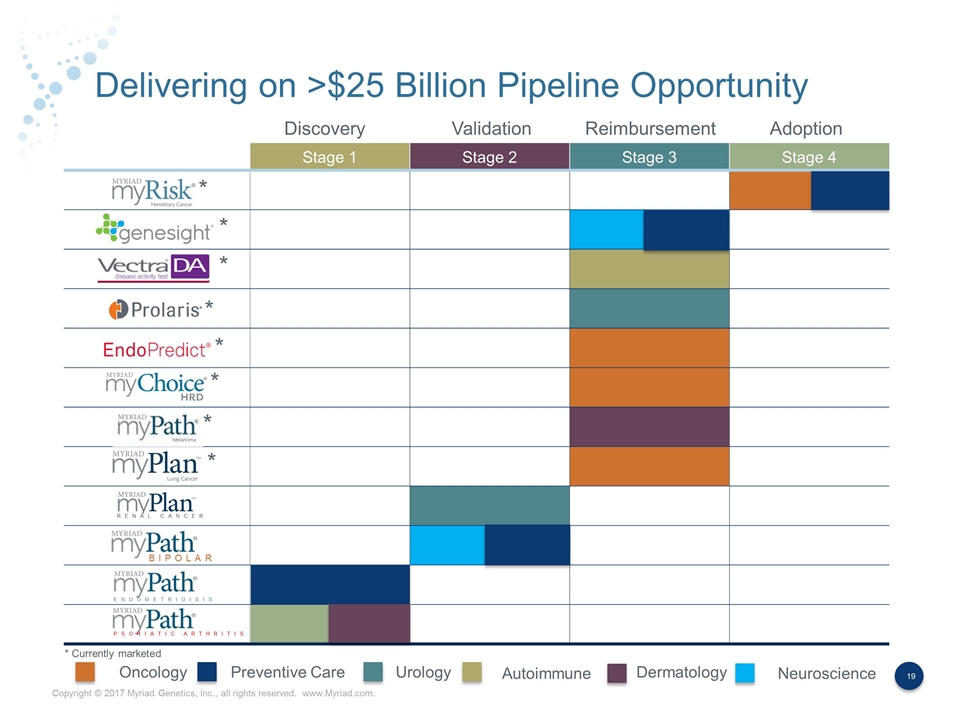

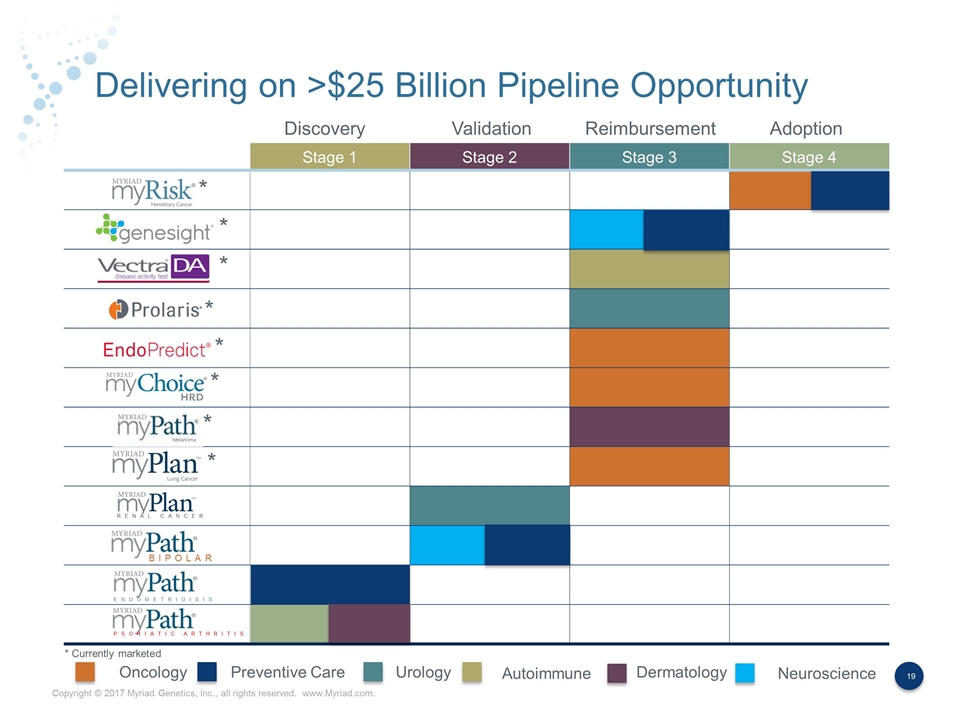

Delivering on >$25 Billion Pipeline Opportunity Stage 1 Stage 2 Stage 3 Stage 4 BIPOLAR ENDOMETRIOISIS PSORIATIC ARTHRITIS RENAL CANCER * * * * * * * * * Currently marketed Oncology Preventive Care Urology Autoimmune Dermatology Neuroscience Adoption Reimbursement Validation Discovery