UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2019

Commission File Number 333-228127

ALPS ALPINE CO., LTD.

(Translation of registrant’s name into English)

1-7, Yukigaya-otsukamachi

Ota-ku, Tokyo, 145-8501

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | ALPS ALPINE CO., LTD. |

| | |

| | |

| | By: | |

| | Name: | Junji Kobayashi |

| | Title: | Senior Manager |

Date: April 26, 2019

Security code: 6770 1st Mid-Term Business Plan (“MTP”) [Innovative T-shaped Company “ ITC101 ”] (Mid-term business plan for the three-year period from FY2019 to FY2021, excluding Logistics and other) Friday, April 26, 2019 ALPS ALPINE CO., LTD. ALPS ALPINE

Contents ALPSALPINE 1. Business environment P 3 2. Mid-Term Business Plan P 4-5 3. Synergy arising from business integration P 6-9 4. To achieve ITC101 P 10-12 5. Investments for future growth P 13 6. To achieve ITC101 (Consolidated) P 14 7. Capitalization policy and shareholder return policy P 15 ITC101: Innovative T-shaped Company with 10% operating income margin and 1 trillion yen sales (Innovative T-shaped Company, mid- and long-term goal: 10% operating income margin, 1 trillion yen sales on consolidated basis)

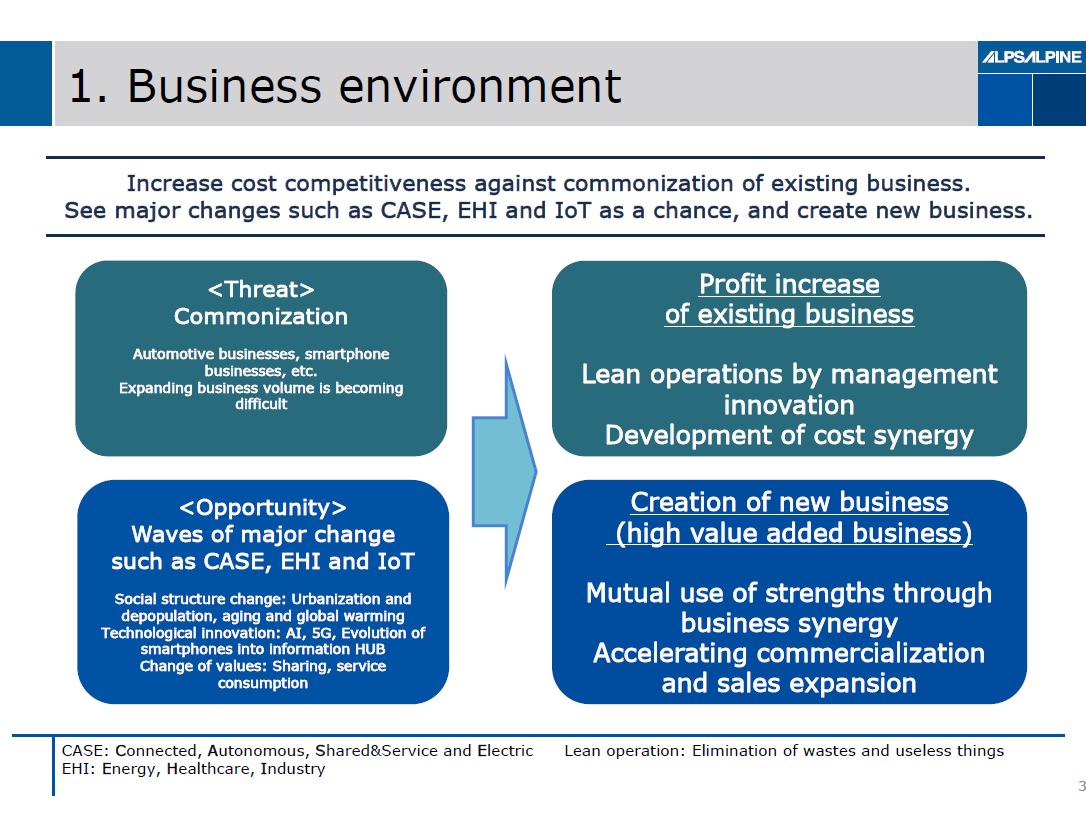

1. Business environment ALPSALPINE Increase cost competitiveness against commonization of existing business. See major changes such as CASE, EHI and IoT as a chance, and create new business. <Threat> Commonization Automotive businesses, smartphone businesses, etc. Expanding business volume is becoming difficult <Opportunity> Waves of major change such as CASE, EHI and IoT Social structure change: Urbanization and depopulation, aging and global warming Technological innovation: AI, 5G, Evolution of smartphones into information HUB Change of values: Sharing, service consumption Profit increase of existing business Lean operations by management innovation Development of cost synergy Creation of new business (high value added business) Mutual use of strengths through business synergy Accelerating commercialization and sales expansion CASE: Connected, Autonomous, Shared&Service and Electric Lean operation: Elimination of wastes and useless things EHI: Energy, Healthcare, Industry

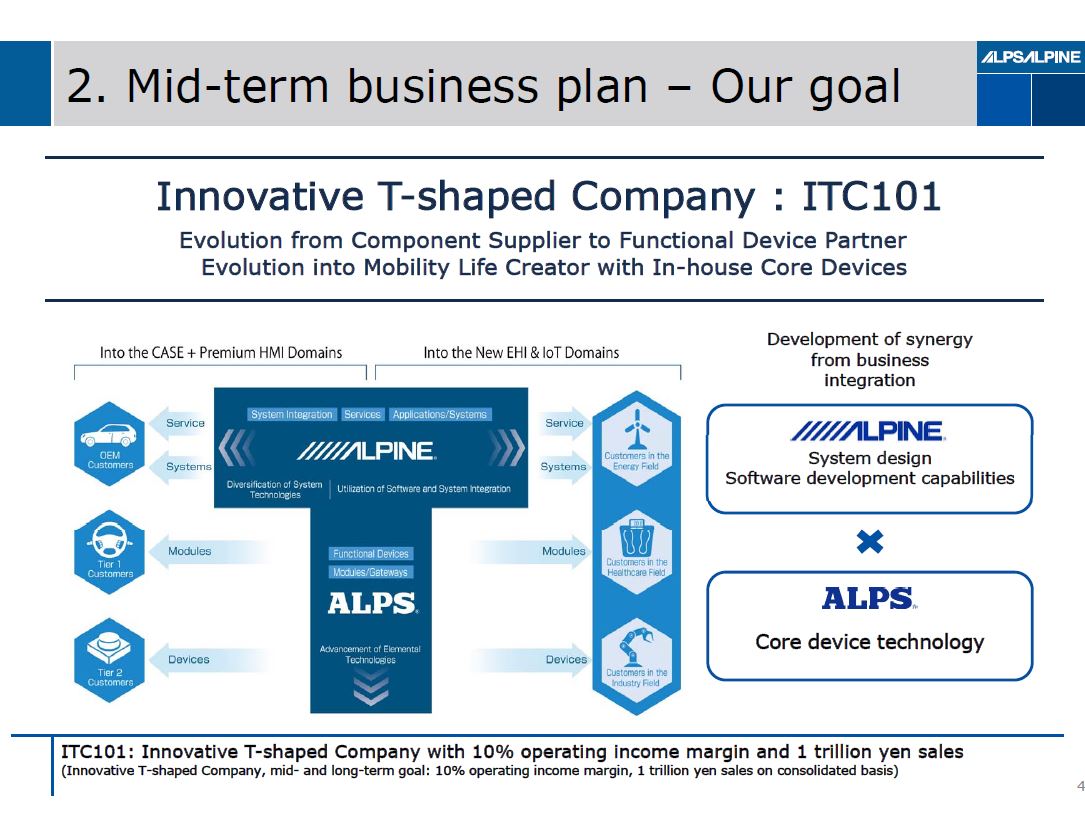

2. Mid-term business plan – Our goal ALPSALPINE Innovative T-shaped Company : ITC101 Evolution from Component Supplier to Functional Device Partner Evolution into Mobility Life Creator with In-house Core Devices Into the CASE + Premium HMI Domains Into the New EHI & IoT Domains OEM Customers Tier 1 Customers Tier 2 Customers Service Systems Modules Devices System Integration Services Applications/Systems Alpine Diversification of System Technologies Utilization of Software and System Integration Functional Devices Modules/Gateways ALPS Advancement of Elemental Technologies Service Systems Modules Devices Customers in the Energy Field Customers in the Healthcare Field Customers in the Industry Field Development of synergy from business integration Alpine System design Software development capabilities X ALPS Core device technology ITC101: Innovative T-shaped Company with 10% operating income margin and 1 trillion yen sales (Innovative T-shaped Company, mid- and long-term goal: 10% operating income margin, 1 trillion yen sales on consolidated basis)

2. Mid-term business plan Milestones of management innovation ALPSALPINE 1st MTP : Management innovation/lean operation of existing business, reduce fixed cost New business Shikomi, accelerate commercialization 2nd MTP : Increase net sales from new business 1st MTP FY2019 FY2020 FY2021 Synergy creation by business integration Management innovation for driving One ALPS ALPINE Reorganize domestic business/Reorganize overseas business Lean operation of existing business Resource shift Acceleration of Shikomi and commercialization for new business Synergy arising from business integration (FY2019~2021) Cost reduction TTL 20 bil. yen 2nd MTP FY2022-2024 Net sales expansion ITC101 10% consolidated operating income margin Consolidated net sales 1 trillion yen Annual net sales from new business 150 bil. yen Lean operation: Elimination of wastes and useless things Shikomi: Business proposal and certain activities to win orders

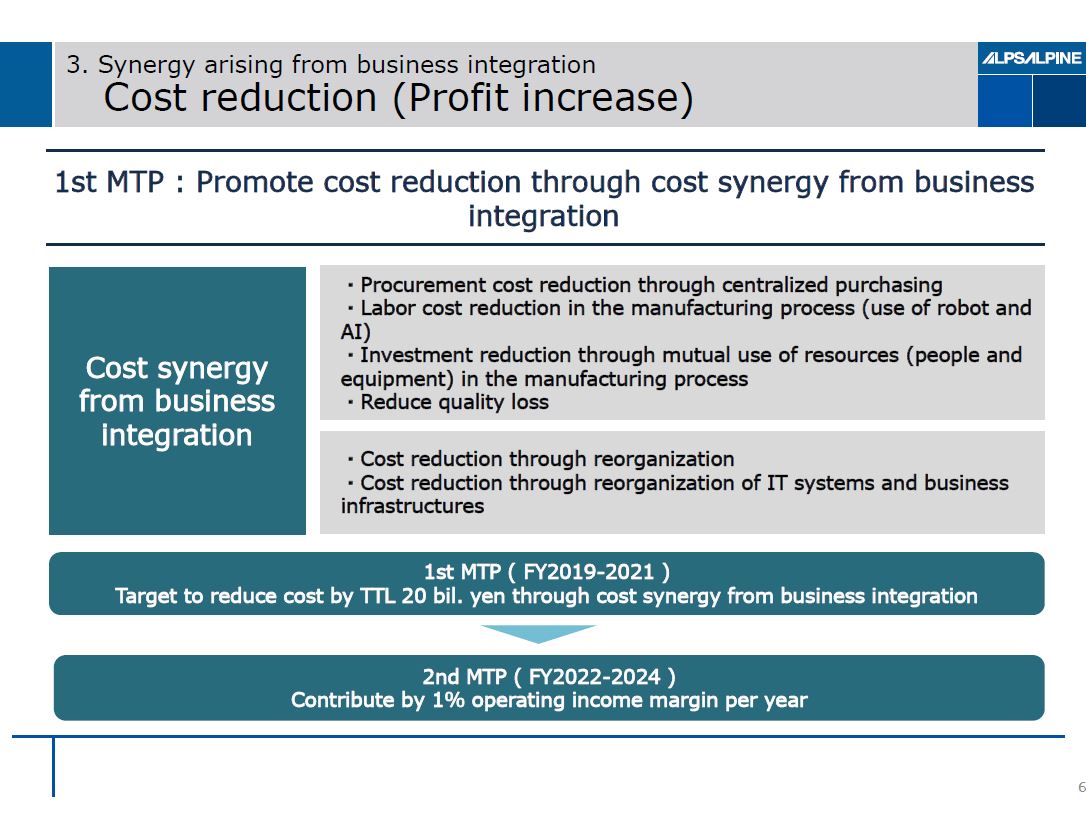

3. Synergy arising from business integration Cost reduction (Profit increase) ALPSALPINE 1st MTP : Promote cost reduction through cost synergy from business integration Cost synergy from business integration Procurement cost reduction through centralized purchasing Labor cost reduction in the manufacturing process (use of robot and AI) Investment reduction through mutual use of resources (people and equipment) in the manufacturing process Reduce quality loss Cost reduction through reorganization Cost reduction through reorganization of IT systems and business infrastructures 1st MTP ( FY2019-2021 ) Target to reduce cost by TTL 20 bil. yen through cost synergy from business integration 2nd MTP ( FY2022-2024 ) Contribute by 1% operating income margin per year

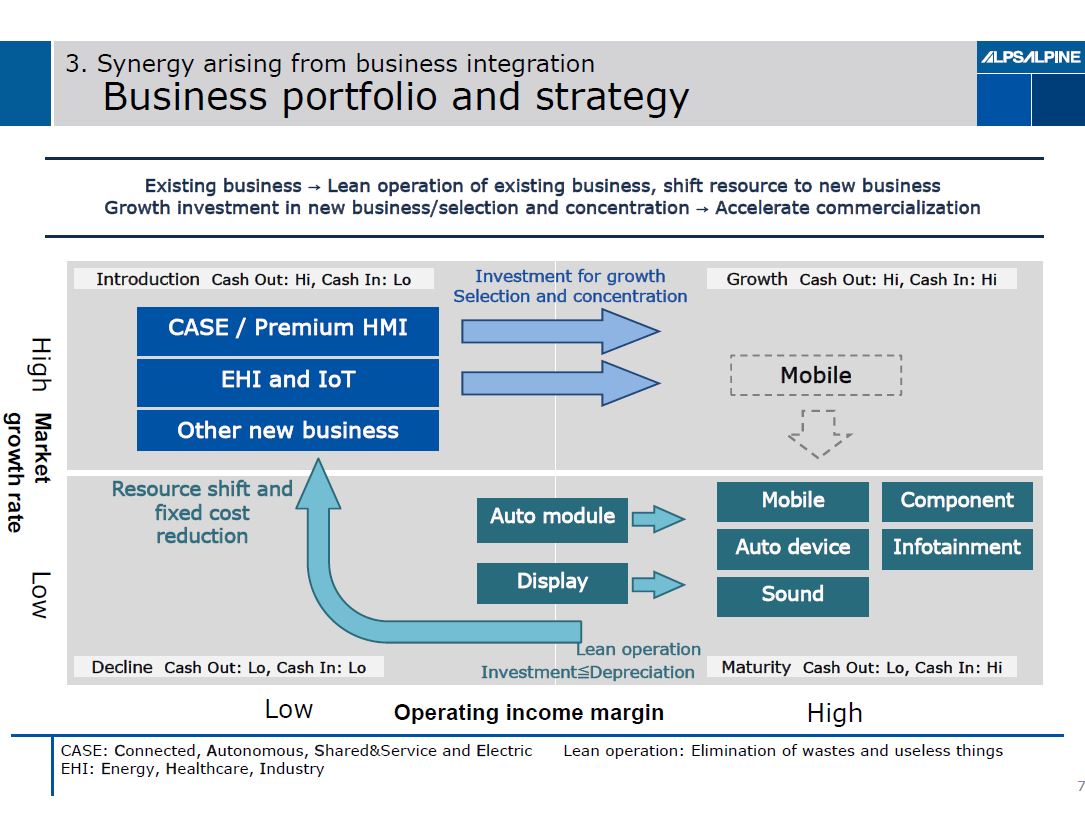

3. Synergy arising from business integration Business portfolio and strategy ALPSALPINE Existing business Lean operation of existing business, shift resource to new business Growth investment in new business/selection and concentration Accelerate commercialization High Market Low growth rate Introduction Cash Out: Hi, Cash In: Lo CASE / Premium HMI EHI and IoT Other new business Investment for growth Selection and concentration Growth Cash Out: Hi, Cash In: Hi Mobile Resource shift and fixed cost reduction Auto module Display Mobile Auto device Sound Component Infotainmnet Decline Cash Out: Lo, Cash In: Lo Lean Operation Investment = Depreciation Maturity Cash Out: Lo, Cash In: Hi Low Operating income margin High CASE: Connected, Autonomous, Shared&Service and Electric Lean operation: Elimination of wastes and useless things EHI: Energy, Healthcare, Industry

3. Synergy arising from business integration New business “CASE and Premium HMI” ALPSALPINE Integrate HMI, Connectivity and Sensors with system design and software development Develop products that integrate device and system, and accelerate commercialization Connected Communication network for module for 5G Cellular V2X module for in-car device-infrastructure Smart access - Smartphone keyless entry system = Remote parking system * Digital key system for car sharing TCU (Telematics control unit) Electric control unit for smart access 5G Contribution to car sharing service Premium HMI Autonomous Passenger monitoring system E-Mirror/image integration system Battery management system Steering monitoring system Short to middle distance high resolution mmW radar Tire sensing E-Mirror Current sensor Shared & Service Electric CASE: Connected, Autonomous, Shared&Service and Electric HMI: Human Machine Interface Cellular V2X: V2X (Vehicle-to-Everything) communication technology using mobile communication network such as LTE and 5G. C-V2X.

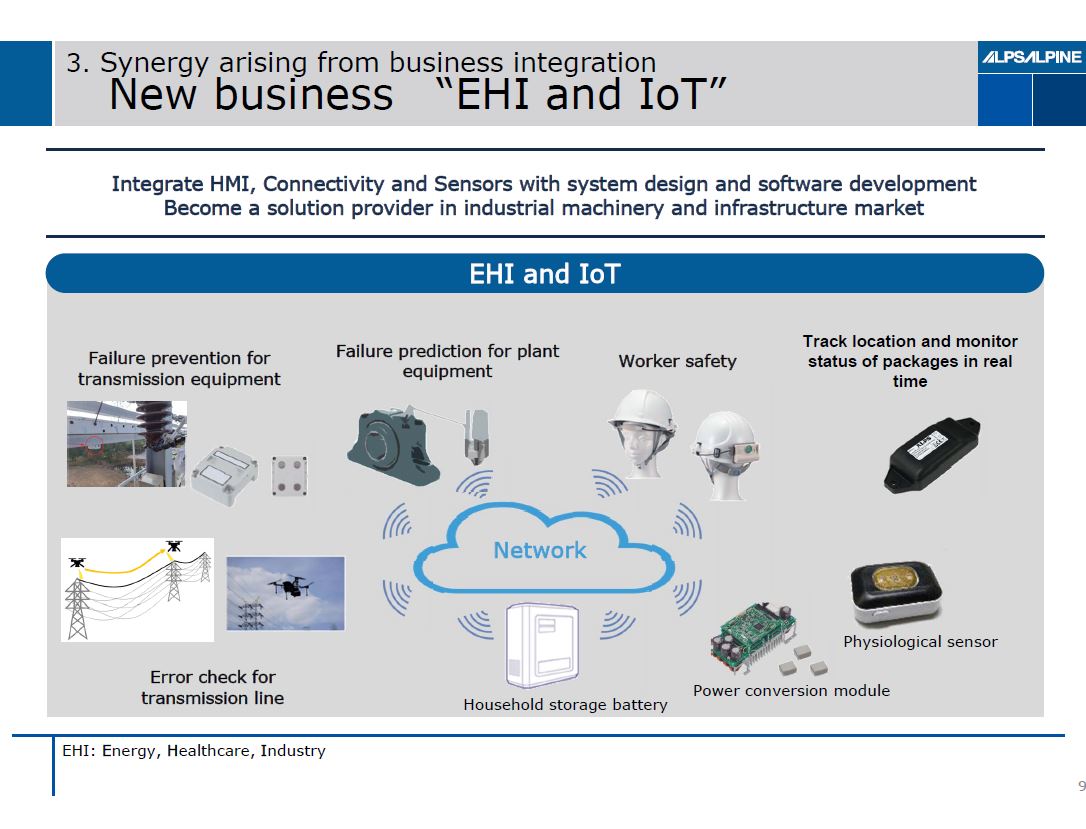

3. Synergy arising from business integration New business “EHI and IoT” ALPSALPINE Integrate HMI, Connectivity and Sensors with system design and software development Become a solution provider in industrial machinery and infrastructure market EHI and IoT Failure preventation for transmission equipment Error check for transmission line Failure prediction for plant equipment Network Household storage battery Worker safety Power conversion module Track location and monitor status of packages in real time Physiological sensor EHI: Energy, Healthcare, Industry

4. To achieve ITC101 ALPSALPINE (unit: billion yen) 1st MTP : 200 bil. yen new business Shikomi 2nd MTP : 150 bil. yen net sales NET SALES 1000 900 800 700 600 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 620.9 678.9 701.6 679.9 781.6 779.2 780.6 New business Shikomi 200 bil. yen for the 2nd MTP Annual net sales 150 bil. yean New business CASE and Premium HMI EHI & IoT, etc. 1st MTP 2nd MTP FY13-18: Combined sales of former Alps Electric and Alpine disclosed in the past by former Alps Electric Shikomi: Business proposal and certain activities to win orders

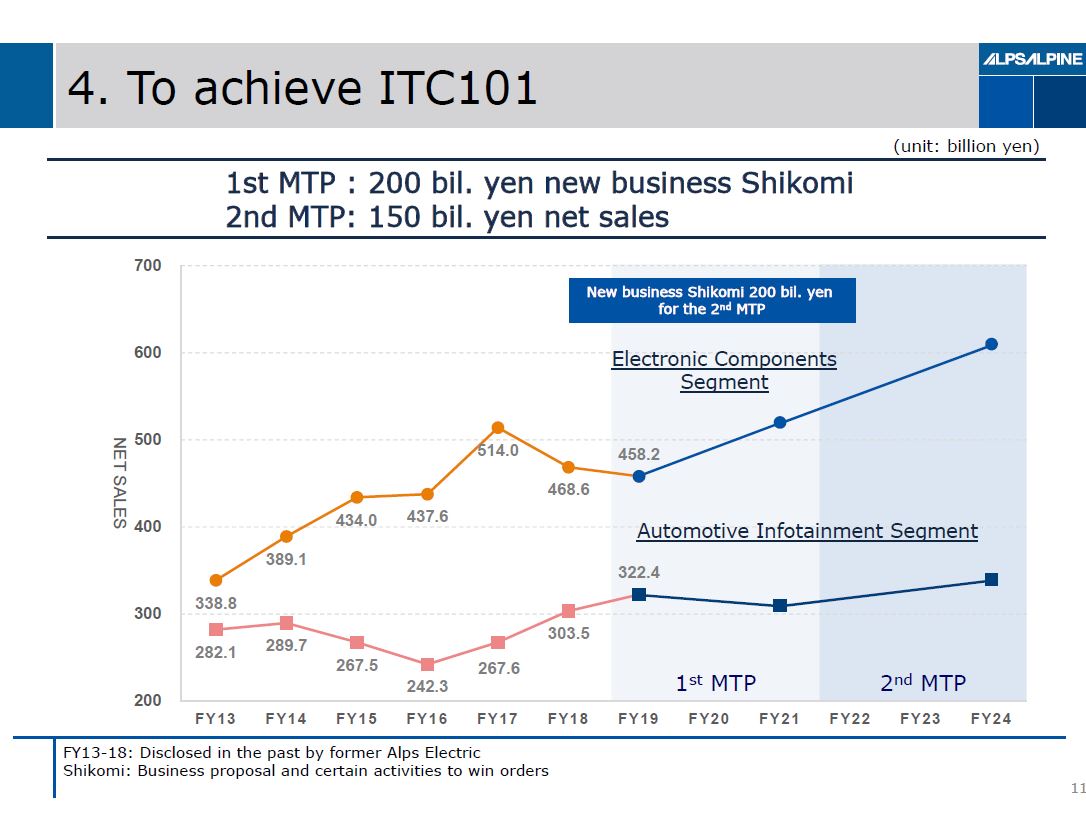

4. To achieve ITC101 ALPSALPINE (unit: billion yen) 1st MTP : 200 bil. yen new business Shikomi 2nd MTP: 150 bil. yen net sales NET SALES 700 600 500 400 300 200 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 338.8 389.1 434.0 437.6 514.0 468.6 458.2 282.1 289.7 267.5 242.3 267.6 303.5 322.4 New business Shikomi 200 bil. yen Electronic Components Segment Automotive Infotainment Segment 1st MTP 2nd MTP FY13-18: Disclosed in the past by former Alps Electric Shikomi: Business proposal and certain activities to win orders

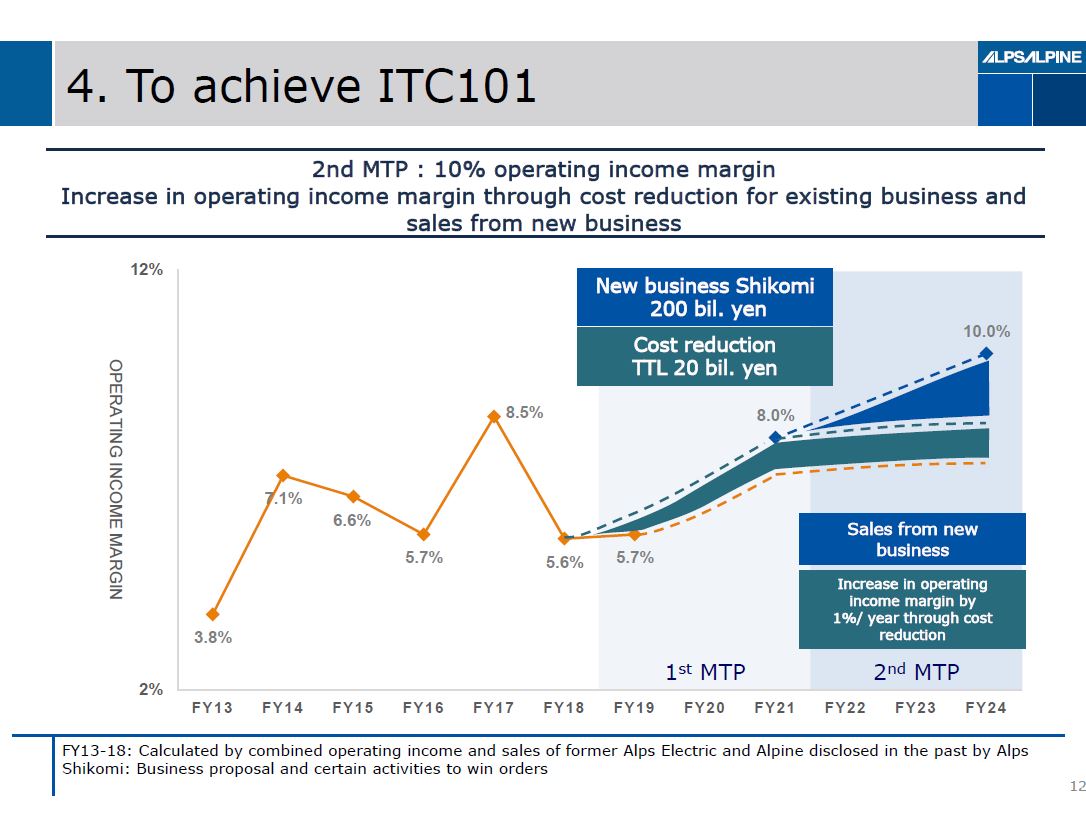

4. To achieve ITC101 ALPSALPINE 2nd MTP : 10% operating income margin Increase in operating income margin through cost reduction for existing business and sales from new business OPERATING INCOME MARGIN 12% 2% FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 FY24 3.8% 7.1% 6.6% 5.7% 8.5% 5.6% 5.7% 8.0% 10.0% New business Shikomi 200 bil. yen Cost reduction TTL 20 bil. yean Sales from new business Increase in operating income margin by 1%/year throughout cost reduction 1st MTP 2nd MTP FY13-18: Calculated by combined operating income and sales of former Alps Electric and Alpine disclosed in the past by Alps Shikomi: Business proposal and certain activities to win orders

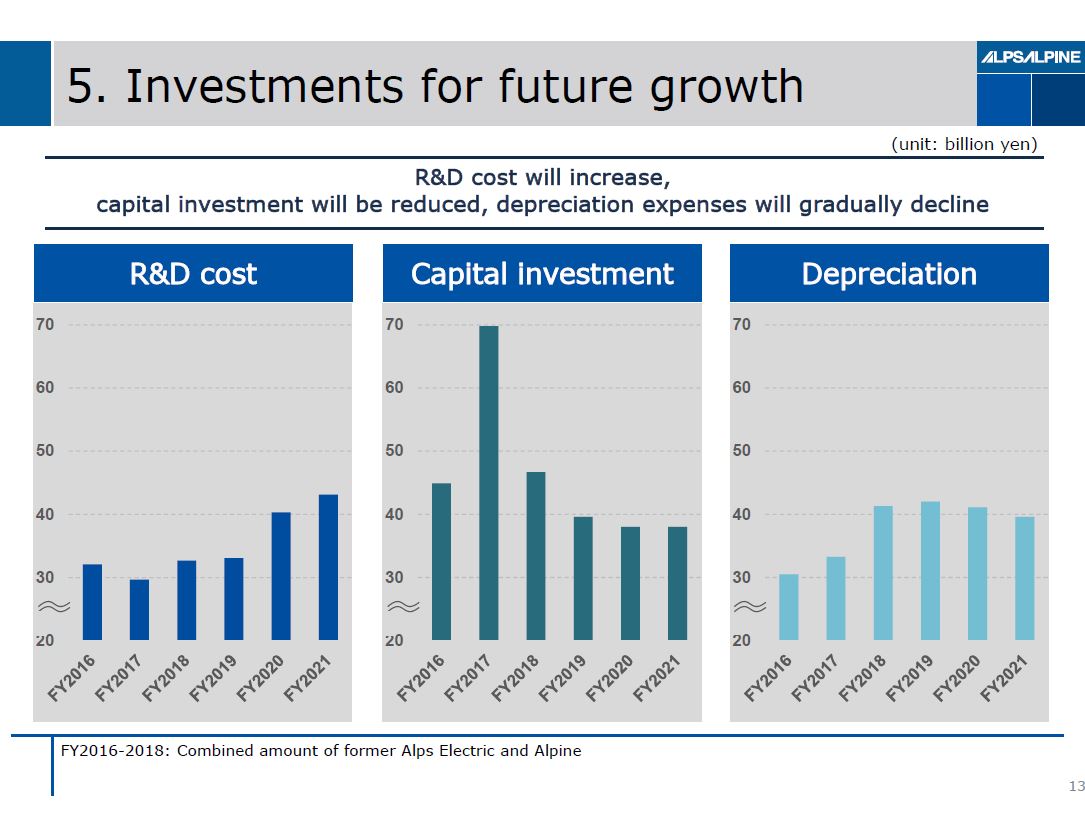

5. Investments for future growth ALPSALPINE (unit: billion yen) R&D cost will increase, capital investment will be reduced, depreciation expenses will gradually decline R&D cost FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 70 60 50 40 30 20 Capital investment 70 60 50 40 30 20 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 Depreciation 70 60 50 40 30 20 FY2016 FY2017 FY2018 FY2019 FY2020 FY2021 FY2016-2018: Combined amount of former Alps Electric and Alpine

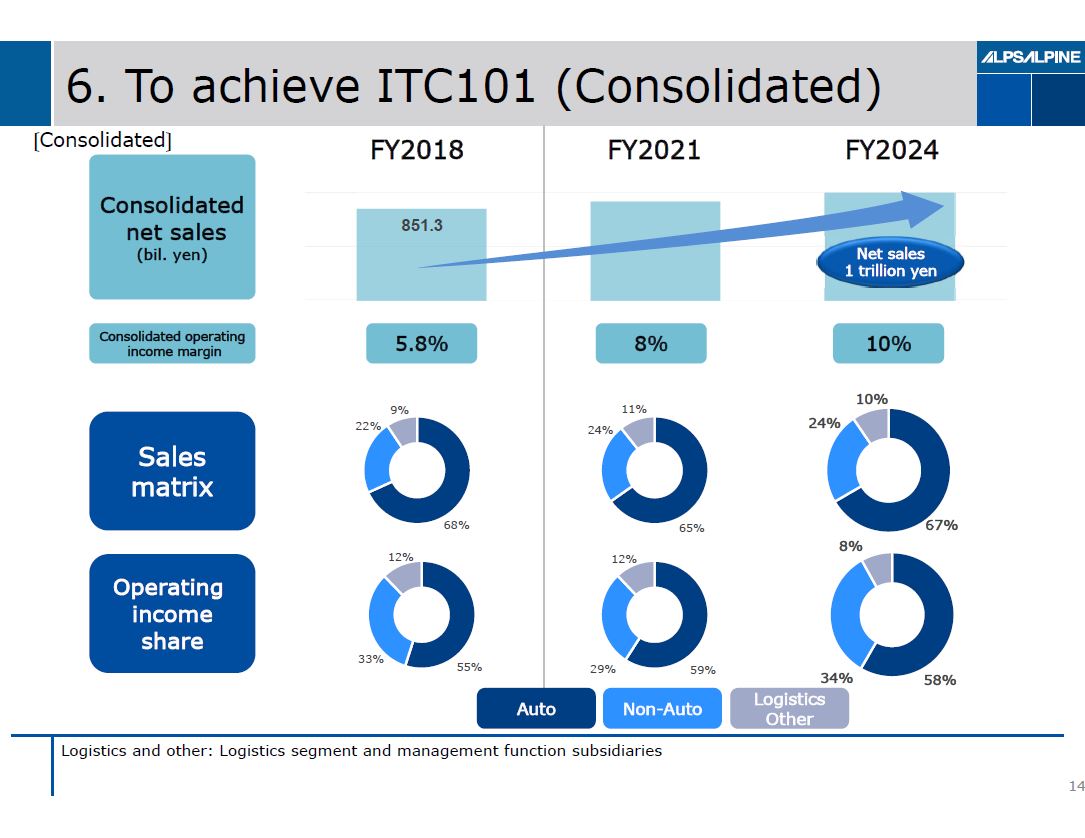

6. To achieve ITC101 (Consolidated) ALPSALPINE [Consolidated] Consolidated net sales (bil. yen) Consolidated operating income margin Sales matrix Operating income share FY2018 851.3 5.8% 9% 22% 68% 12% 33% 55% FY2021 8% 11% 24% 65% 12% 29% 59% FY2024 Net sales 1 trillion yen 10% 10% 24% 67% 8% 34% 58% Auto Non-Auto Logistics Other Logistics and other: Logistics segment and management function subsidiaries

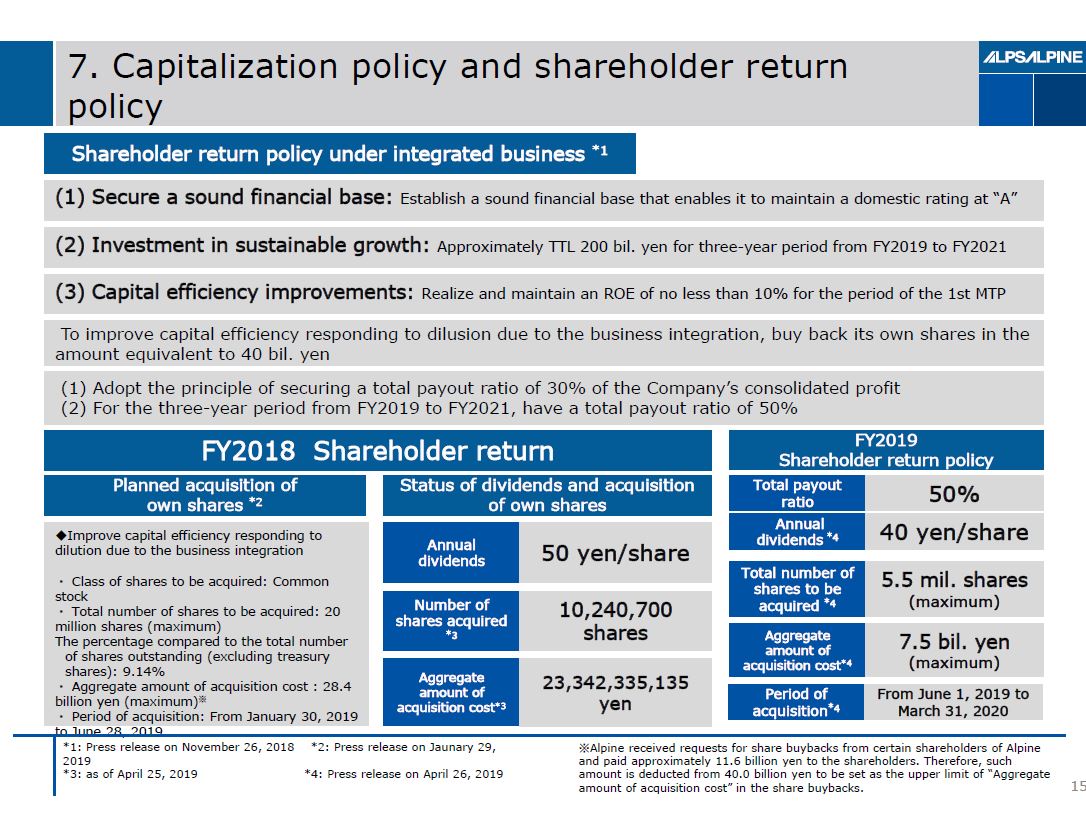

7. Capitalization policy and shareholder return policy ALPSALPINE Shareholder return policy under integrated business *1 (1) Secure a sound financial base: Establish a sound financial base that enables it to maintain a domestic rating at “A” (2) Investment in sustainable growth: Approximately TTL 200 bil. yen for three-year period from FY2019 to FY2021 (3) Capital efficiency improvements: Realize and maintain an ROE of no less than 10% for the period of the 1st MTP To improve capital efficiency responding to dilusion due to the business integration, buy back its own shares in the amount equivalent to 40 bil. yen (1) Adopt the principle of securing a total payout ratio of 30% of the Company’s consolidated profit (2) For the three-year period from FY2019 to FY2021, have a total payout ratio of 50% FY2018 Shareholder return Planned acquisition of own shares *2 Improve capital efficiency responding to dilution due to the business integration Class of shares to be acquired: Common stock Total number of shares to be acquired: 20 million shares (maximum) The percentage compared to the total number of shares outstanding (excluding treasury shares): 9.14% Aggregate amount of acquisition cost : 28.4 billion yen (maximum)* Period of acquisition: From January 30, 2019 to June 28, 2019 Status of dividends and acquisition of own shares Annual dividends Number of shares acquired*3 Aggregate amount of acquisition cost*3 50 yen/share 10,240,700 shares 23,342,335,135 yen FY2019 Shareholder return policy Total payout ratio Annual dividends *4 Total number of shares to be acquired *4 Aggregate amount of acquisition cost*4 Period of acquisition*4 50% 40 yen/share 5.5 mil. Shares (maximum) 7.5 bil. yen (maximum) From June 1, 2019 to March 31, 2020 *1: Press release on November 26, 2018 *2: Press release on Jaunary 29, 2019 *3: as of April 25, 2019 *4: Press release on April 26, 2019 *Alpine received requests for share buybacks from certain shareholders of Alpine and paid approximately 11.6 billion yen to the shareholders. Therefore, such amount is deducted from 40.0 billion yen to be set as the upper limit of “Aggregate amount of acquisition cost” in the share buybacks.

This document includes “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. To the extent that statements in this document do not relate to historical or current facts, they constitute forward-looking statements. These forward-looking statements are based on the current assumptions and beliefs of the Company in light of the information currently available, and involve known and unknown risks, uncertainties and other factors. Such risks, uncertainties and other factors may cause the actual results, performance, achievements or financial position of the Company to be materially different from any future results, performance, achievements or financial position expressed or implied by these forward-looking statements.

The Company undertakes no obligation to publicly update any forward-looking statements after the date of this document. Investors are advised to consult any further disclosures by the Company in its subsequent domestic filings in Japan and filings with the U.S. Securities and Exchange Commission.

The risks, uncertainties and other factors referred to above include, but are not limited to:

| (1) | onomic and business conditions in and outside Japan; |

| (2) | changes in demand for and material prices of automobiles, smart phones and consumer electrical equipment and machines, which are the main markets of the Company’s products, and changes in exchange rates; |

| (3) | changes in the competitive landscape, including the changes in the competition environment and the relationship with major customers; |

| (4) | further intensified competition in the electronic components business, automotive infotainment business and logistics business; |

| (5) | increased instability of the supply system of certain important components; |

| (6) | change in the product strategies or other similar matters, cancellation of a large-quantity order, or bankruptcy, of the major customers; |

| (7) | costs and expenses, as well as adverse impact to the group’s reputation, resulting from any product defects; |

| (8) | suspension of licenses provided by other companies of material intellectual property rights; |

| (9) | changes in interest rates on loans and other indebtedness of the Company, as well as changes in financial markets; |

| (10) | adverse impact to liquidity due to acceleration of indebtedness; |

| (11) | changes in the value of assets (including pension assets) such as securities and investment securities; |

| (12) | changes in laws and regulations (including environmental regulations) relating to the Company’s business activities; |

| (13) | increases in tariffs, imposition of import controls and other developments in the Company’s main overseas markets; |

| (14) | unfavorable political factors, terrorism, war and other social disorder; |

| (15) | interruptions in or restrictions on business activities due to natural disasters, accidents and other causes; |

| (16) | environmental pollution countermeasures costs; |

| (17) | violation of laws or regulations, or the filing of a lawsuit; and |

| (18) | inability or difficulty of realizing synergies or added value by the Business Integration by the integrated group. |

ALPSALPINE The business results forecasts and future predictions included in these materials are based on the judgment of the Company at the time of preparation of the materials, and are inherently subject to risks and uncertainties. As a result, actual business results and outcomes may differ significantly due to a variety of factors.