Filed pursuant to Rule 424(b)(3)

Registration No. 333-228127

Prospectus

ALPS ELECTRIC CO., LTD.

Exchange of Shares of Common Stock of Alps Electric Co., Ltd.

for Shares of Alpine Electronics, Inc.

The boards of directors of Alps Electric Co., Ltd., or Alps Electric, and Alpine Electronics, Inc., or Alpine, have agreed to a statutory share exchange between Alps Electric and Alpine under the Companies Act of Japan, or the Companies Act, pursuant to which all of the shares of Alpine (other than those that Alps Electric Co., Ltd. directly owns) will be exchanged for shares of Alps Electric. Alps Electric and Alpine entered into a share exchange agreement on July 27, 2017, as amended by memoranda of understanding dated February 27 and July 27, 2018, setting forth the share exchange ratio and other terms of the transaction. The agreement as amended is referred to in this prospectus as the Share Exchange Agreement. In the share exchange, each shareholder of Alpine other than Alps Electric Co., Ltd. will receive 0.68 shares of Alps Electric common stock for each share of Alpine common stock that such shareholder holds. In addition, Alpine has announced its intention to pay a dividend of 100 yen per share of Alpine common stock, subject to any withholding of taxes required by law. The dividend will be payable to holders of Alpine common stock as of October 15, 2018, which is the record date for the dividend, on the condition that the Share Exchange Agreement is approved by Alpine’s shareholders at the extraordinary general meeting of shareholders referenced below. This dividend is referred to in this prospectus as the special dividend.

The share exchange may only be completed upon the approval of the Share Exchange Agreement by shareholders of Alpine at the extraordinary general meeting of shareholders and certain other conditions being satisfied. The special dividend is also subject to approval by shareholders of Alpine at the extraordinary general meeting of shareholders. The additional conditions and other terms of the share exchange are more fully described in this prospectus in the section entitled “The Share Exchange.” Under the current schedule, if the shareholders of Alpine approve the Share Exchange Agreement and the other conditions are satisfied, the share exchange is expected to become effective on January 1, 2019. Alps Electric is expected to be renamed ALPS ALPINE CO., LTD., or ALPS ALPINE, following the consummation of the share exchange.

This prospectus has been prepared for holders of Alpine common stock who are resident in the United States to provide them with detailed information about the share exchange and the shares of Alps Electric common stock to be issued and delivered in connection with the share exchange. You are encouraged to read this prospectus in its entirety.

The date, time and place of the extraordinary general meeting of Alpine shareholders, at which Alpine shareholders will vote on the Share Exchange Agreement and the special dividend, are as follows:

December 5, 2018 at 10 a.m. (Japan time)

First Floor Hall

Head Office Building, Alps Electric Co., Ltd.

1-7 Yukigaya-otsukamachi

Ota-ku, Tokyo

Japan

Shareholders of record of Alpine as of October 15, 2018 will be entitled to vote at Alpine’s extraordinary general meeting of shareholders. To attend and vote at the extraordinary general meeting of shareholders, shareholders of Alpine must follow the procedures outlined in the convocation notice, the letter of proxy or themail-in voting card and other proxy/voting and reference materials which will be distributed by Alpine. The affirmative vote of the holders of at leasttwo-thirds of the voting rights present or represented at its extraordinary general meeting of shareholders, at which shareholders holding at leastone-third of the total voting rights are present or represented, is required to approve the Share Exchange Agreement. The affirmative vote of the holders of at least a majority of the voting rights present or represented at the extraordinary general meeting of shareholders is required to approve the special dividend.

Shares of Alps Electric common stock are traded in yen on the Tokyo Stock Exchange. On November 8, 2018, the last reported official sale price of shares of Alps Electric common stock on the Tokyo Stock Exchange was 2,669 yen per share.

Alpine shareholders are entitled to exercise dissenters’ appraisal rights in connection with the share exchange by complying with applicable procedures under the Companies Act. See “The Share Exchange—Dissenters’ Appraisal Rights” beginning on page 79 of this prospectus.

You should carefully consider the risk factors beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities to be issued in connection with the share exchange or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus is dated November 9 , 2018, and is expected to first be mailed to the shareholders of Alpine on or after November 13, 2018.

REFERENCE TO ADDITIONAL INFORMATION

This prospectus is part of a registration statement on FormF-4, which includes additional important business and financial information about Alps Electric and Alpine that is not included in or delivered with this prospectus. This information is available to you without charge upon written or oral request. If you would like to receive any of the additional information, please contact:

Alps Electric Co., Ltd.

Corporate Planning Office

1-7, Yukigaya-otsukamachi

Ota-ku, Tokyo145-8501

Japan

Telephone: +81-3-3726-1211

Please note that copies of documents provided to you will not include exhibits, unless the exhibits are specifically incorporated by reference into the documents or this prospectus.

In order to receive timely delivery of requested documents in advance of the extraordinary general meeting of shareholders of Alpine, you should make your request no later thanNovember 28, 2018, which is five business days before you must make a decision regarding the share exchange.

See “Where You Can Find More Information” on page 164.

Upon the consummation of the share exchange, Alpine Electronics, Inc. will become a wholly owned subsidiary of Alps Electric Co., Ltd. On the same day as the consummation of the share exchange, Alps Electric expects to rename itself ALPS ALPINE CO., LTD. As used in this prospectus, references to “Alps Electric” are to Alps Electric Co., Ltd., references to “Alpine” are to Alpine Electronics, Inc. and references to “ALPS ALPINE” are to the post-share exchange ALPS ALPINE CO., LTD., in each case on a consolidated basis, except where the context otherwise requires. References to the “share exchange” are to the proposed share exchange between Alps Electric and Alpine, the terms of which are set forth in the Share Exchange Agreement. Unless the context otherwise requires, references in this prospectus to the financial results or business of “Alps Electric” refer to those of Alps Electric and its consolidated subsidiaries, including Alpine, of “Alpine” refer to those of Alpine and its consolidated subsidiaries and of “ALPS ALPINE” refer to those of ALPS ALPINE and its consolidated subsidiaries, including Alpine. References to the “Original Share Exchange Agreement” refer to the share exchange agreement relating to the share exchange as originally executed on July 27, 2017 (and thus before the amendments made to the agreement after such date).

As used in this prospectus, “U.S. dollar” or “$” means the lawful currency of the United States of America, and “Japanese yen,” “yen” or “¥” means the lawful currency of Japan.

As used in this prospectus, “IFRS” means International Financial Reporting Standards as issued by the International Accounting Standards Board, or IASB, and “Japanese GAAP” means accounting principles generally accepted in Japan. The consolidated financial information contained in this prospectus has been presented in accordance with IFRS, except for certain specifically identified information that was prepared in accordance with Japanese GAAP. Unless otherwise stated or the context otherwise requires, all amounts in the financial statements contained in this prospectus are expressed in Japanese yen.

For the fiscal years ended March 31, 2017 and 2018, which are the fiscal years for which Alps Electric has included IFRS consolidated financial statements in this prospectus, Alpine was a consolidated subsidiary of Alps Electric. Thus, the financial conditions, results of operations and cash flows of Alpine as of and for the fiscal years ended March 31, 2017 and 2018, as well as the financial condition of Alpine as of April 1, 2016, have been consolidated into those of Alps Electric for the same time periods.

Table of Contents

| | | | | | | | |

| | | |

Appendix D | | — | | Table of Proposed Amendments to the Articles of Incorporation of Alps Electric | | | App. D-1 | |

| | | |

Appendix E | | — | | English Translation of the Fairness Opinion dated July 26, 2017 Delivered by SMBC Nikko Securities Inc. to the Alpine Board of Directors | | | App. E-1 | |

| | | |

Appendix F | | — | | English Translation of the July 26, 2017 Committee Report of the OriginalThird-Party Committee | | | App. F-1 | |

| | | |

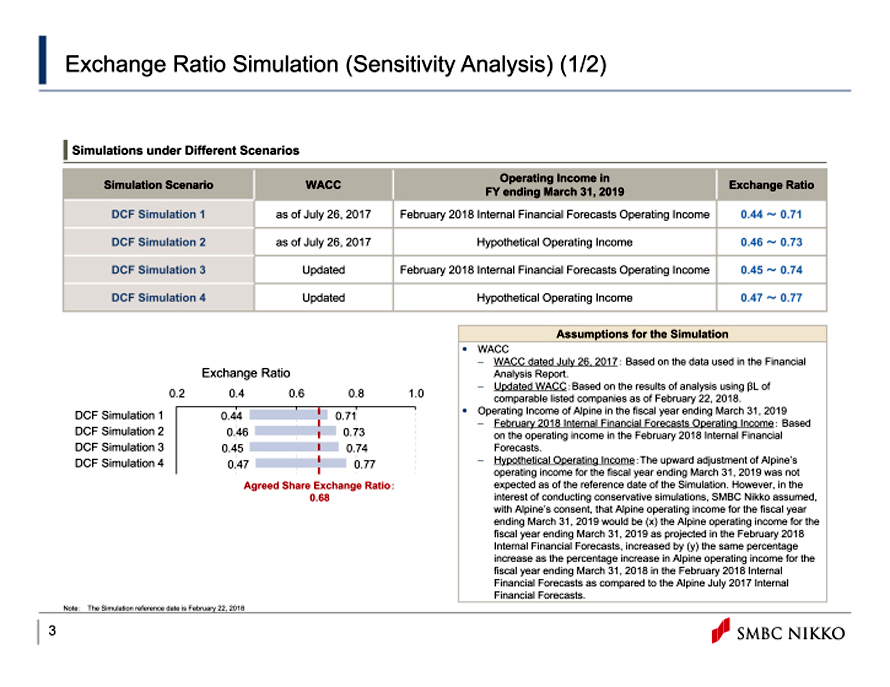

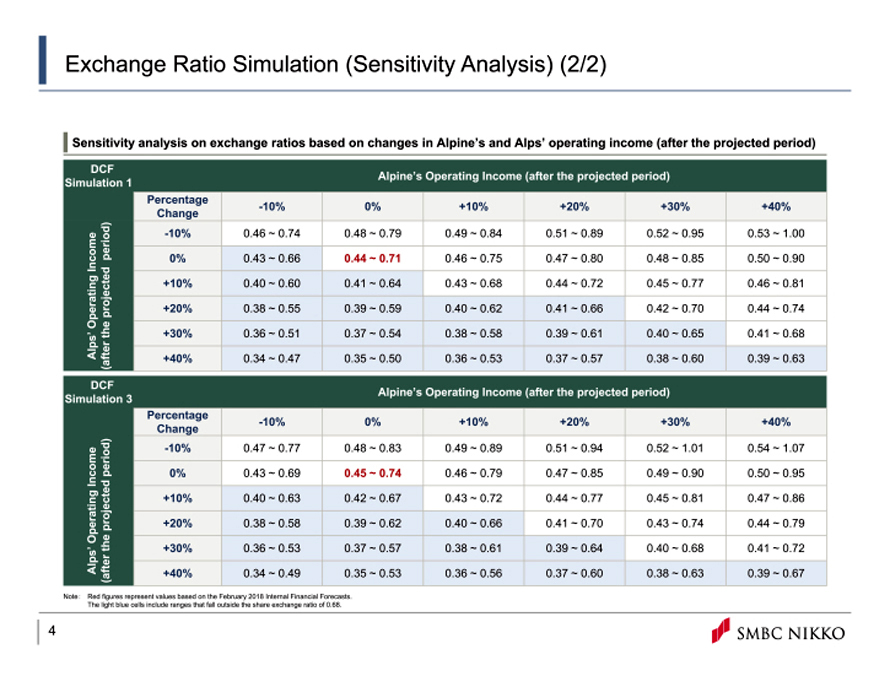

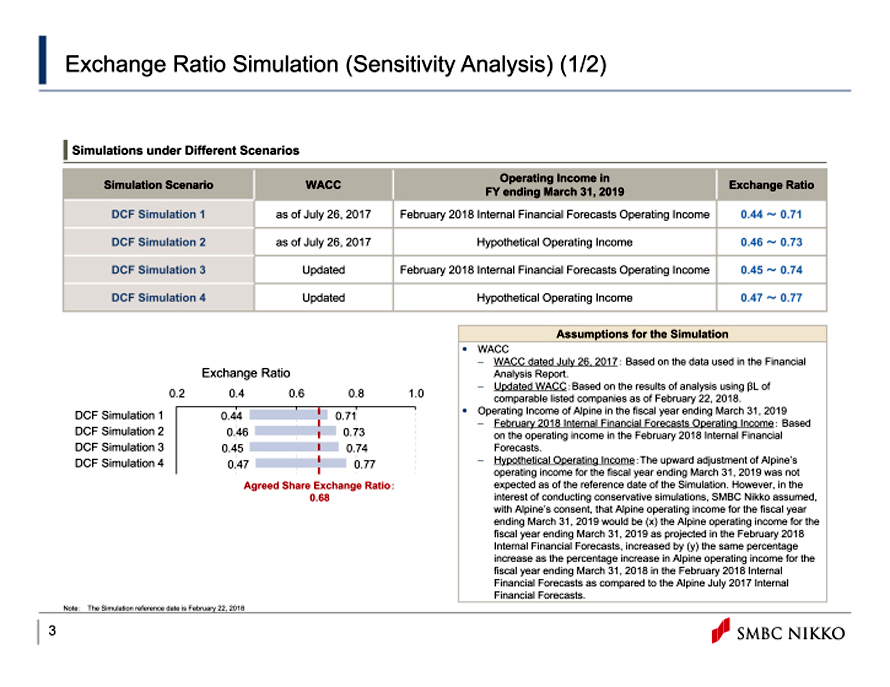

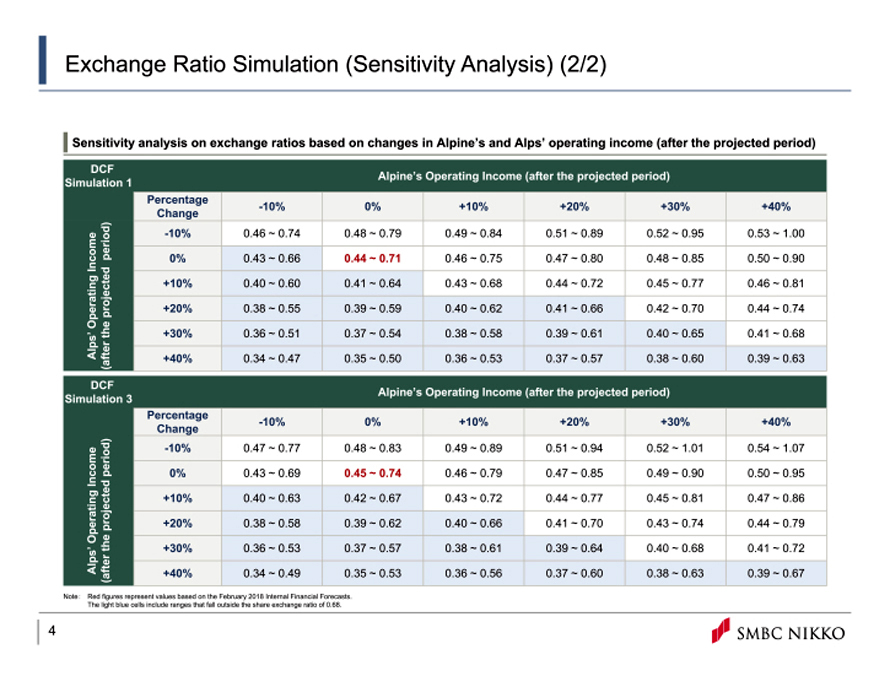

Appendix G | | — | | English Translation of the Supplementary Simulation (Sensitivity Analysis) Presentation dated February 26, 2018 Delivered by SMBC Nikko Securities Inc. to the Alpine Board of Directors | | | App. G-1 | |

| | | |

Appendix H | | — | | English Translation of the February 26, 2018 Committee Report of the Original Third-Party Committee Regarding the Amendment to the Share Exchange Agreement | | | App. H-1 | |

| | | |

Appendix I | | — | | English Translation of the February 26, 2018 Committee Report of the Original Third-Party Committee Regarding the Impact of the January 2018 Revised Alpine Forecasts on the Share Exchange Ratio | | | App. I-1 | |

| | | |

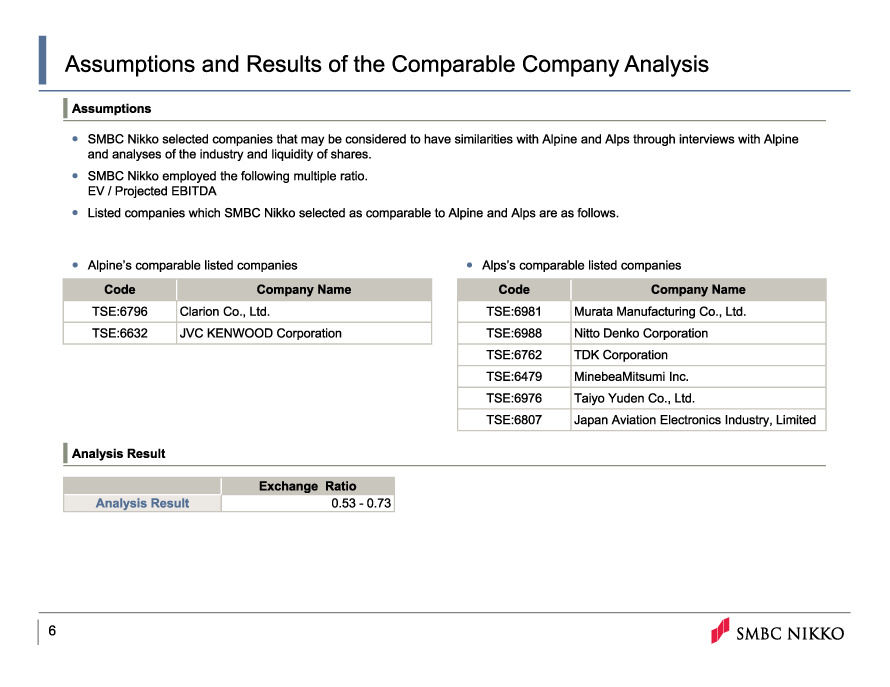

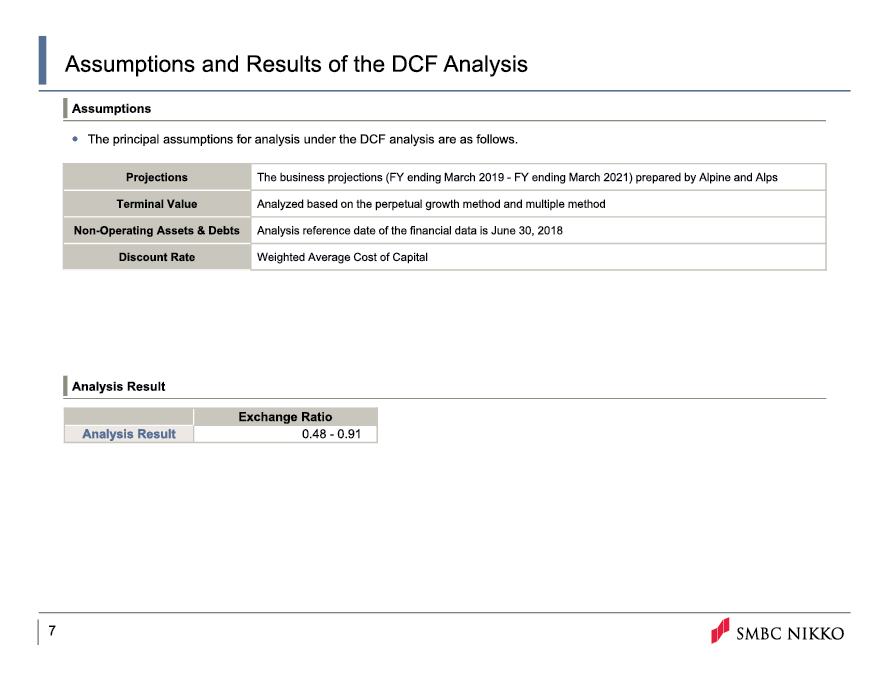

Appendix J | | — | | English Translation of the Financial Analysis Report dated September 26, 2018 Delivered by SMBC Nikko Securities Inc. to the Alpine Board of Directors | | | App. J-1 | |

| | | |

Appendix K | | — | | English Translation of the Fairness Opinion dated September 26, 2018 Delivered by YAMADA Consulting Group Co., Ltd. to the Third-Party Committee | | | App. K-1 | |

| | | |

Appendix L | | — | | English Translation of the September 26, 2018 Committee Report of the Third-Party Committee | | | App. L-1 | |

| | | |

Appendix M | | — | | English Translation of Selected Articles of the Companies Act of Japan | | | App. M-1 | |

| | | |

Appendix N | | — | | Unaudited Japanese GAAP Summary Financial Information of Alps Electric as of and for the Six Months Ended September 30, 2018 | | | App. N-1 | |

| | | |

Appendix O | | — | | Unaudited Japanese GAAP Summary Financial Information of Alpine as of and for the Six Months Ended September 30, 2018 | | | App. O-1 | |

QUESTIONS AND ANSWERS ABOUT THE SHARE EXCHANGE AND

VOTING PROCEDURES FOR THE EXTRAORDINARY

GENERAL MEETING OF SHAREHOLDERS

Q. What are Alps Electric and Alpine proposing?

A. Alps Electric and Alpine, a consolidated subsidiary of Alps Electric, are proposing to integrate their businesses through a statutory share exchange under the Companies Act of Japan, or the Companies Act. As of October 10, 2018, Alps Electric Co., Ltd. directly owns approximately 41% of the outstanding common stock of Alpine. Through the share exchange, Alps Electric Co., Ltd. will acquire all remaining shares of Alpine common stock that are not held by it immediately prior to January 1, 2019, which is the effective date of the share exchange, upon which shareholders of Alpine will become shareholders of Alps Electric, and Alpine will become a wholly owned subsidiary of Alps Electric. Alps Electric is expected to be renamed ALPS ALPINE CO., LTD. following the consummation of the share exchange. As part of the business integration, Alps Electric and Alpine plan to adopt an operating holding company structure. Through the adoption of an operating holding company structure, Alps Electric will serve as a holding company while also continuing to operate businesses itself after the Share Exchange, unlike a pure holding company that would engage solely in administrative operations. Alps Electric and Alpine also plan to establish within the operating holding company two divisions that primarily and separately operate Alps Electric and Alpine’s existing businesses; these two divisions are referred to as the“in-house companies” in this prospectus. For the synergies that the companies seek to achieve through the share exchange, see “The Share Exchange—Strategies of ALPS ALPINE.”

In addition, Alpine has announced its intention to pay a special dividend of 100 yen per share of Alpine common stock, subject to any withholding of taxes required by law, on the condition that the Share Exchange Agreement is approved by Alpine’s shareholders at the extraordinary general meeting of the shareholders referenced below.

Q. Why are Alps Electric and Alpine proposing the share exchange?

A. While Alpine is already a subsidiary of Alps Electric, Alps Electric and Alpine plan to conduct the share exchange so that they can together exercise more efficient management of the Alps group as a whole. Upon completing the transaction, the parties will work on full-scale cooperation, such as strengthening of their ability as a group to propose solutions to and conduct salesvis-a-vis their customers, development of employees through personnel exchanges across businesses, and joint use of Alps Electric’s fund-raising capabilities, network and production capability. Through these measures, coupled with others, such as enhanced mutual use of production bases, streamlining of back-office departments through shared infrastructures, strengthening of the group’s procurement capacity, and reinforcement of global operations, Alps Electric and Alpine will strive to maximize the synergies of the entire Alps group.

Q. What will I receive if the share exchange is approved?

A. Alpine shareholders as of the time immediately preceding the effective date of the share exchange (other than Alps Electric Co., Ltd.) will receive 0.68 shares of Alps Electric common stock for each share of Alpine common stock which they hold. Holders of Alpine common stock who have duly exercised their dissenters’ appraisal rights will not receive shares of Alps Electric common stock for shares of Alpine common stock they hold. In addition, if the special dividend is also approved by Alpine’s shareholders, holders of record of outstanding shares of Alpine common stock as of October 15, 2018, the record date for the special dividend, will each be entitled to receive a special dividend of 100 yen per share, to be paid on December 27, 2018, in respect of such shares of Alpine common stock that they hold, subject to any withholding of taxes required by law. See “The Share Exchange—Special Dividend.”

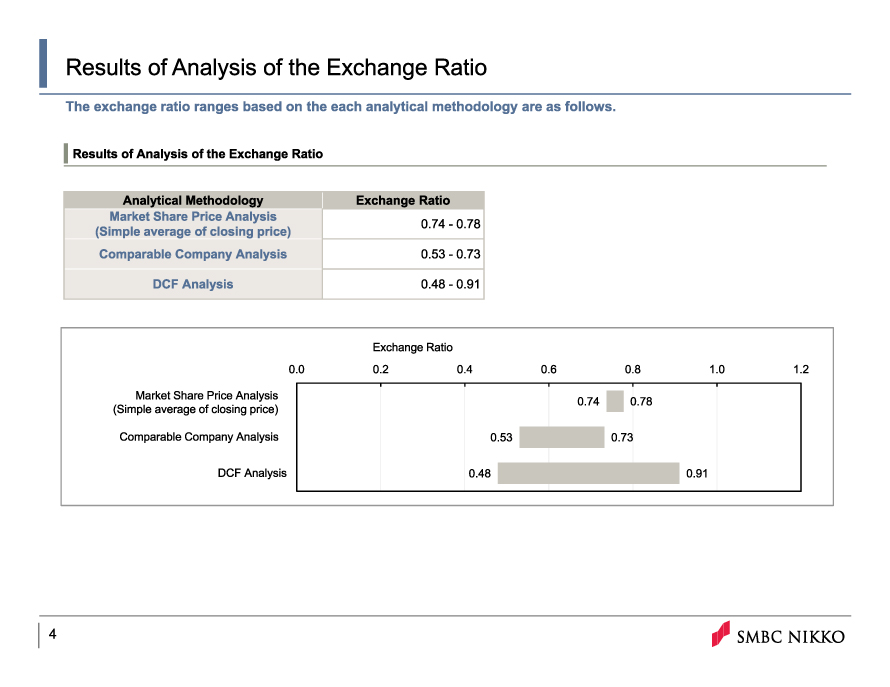

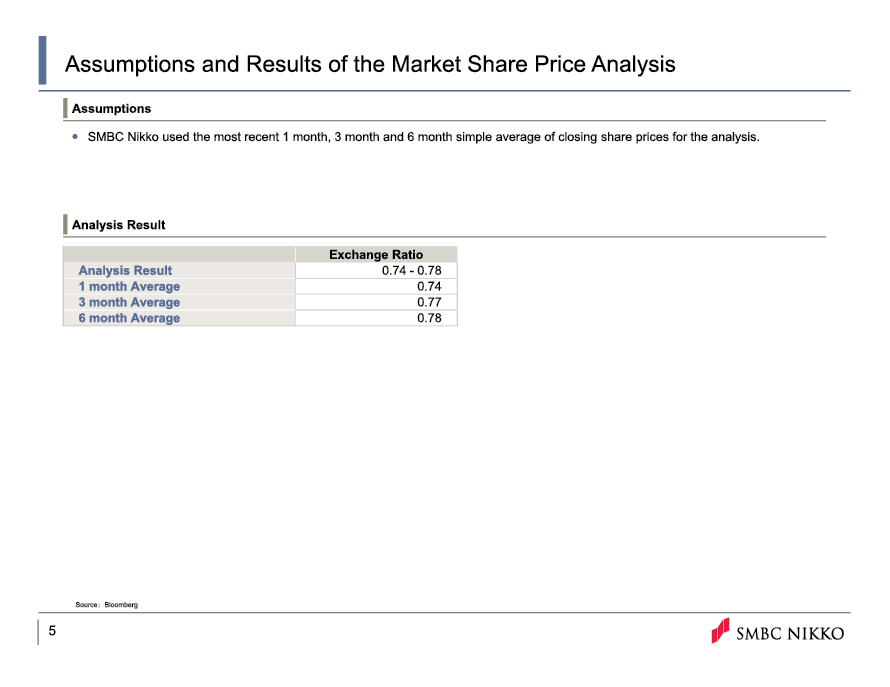

Q. How did Alps Electric and Alpine determine the share exchange ratio?

A. Alps Electric and Alpine conducted thorough negotiations and discussions regarding the share exchange ratio, each taking into consideration the results of its due diligence on the other party, the analyses of its financial

i

advisor, each party’s financial condition, assets, prospects and other factors. As a result of these negotiations and discussions concerning the share exchange ratio, Alps Electric and Alpine each reached the conclusion that the share exchange ratio was appropriate and on July 27, 2017 agreed upon the share exchange ratio for the share exchange.

Q. How does Alpine’s board of directors recommend that its shareholders vote regarding the share exchange?

A. Alpine’s board of directors (except for two directors who did not attend the meeting in order to avoid possible conflicts of interest) unanimously determined that the share exchange is advisable and serves the interests of Alpine and its shareholders.

Q. What vote of Alpine’s shareholders is required to approve the Share Exchange Agreement?

A. The affirmative vote of the holders of at leasttwo-thirds of the voting rights of Alpine present or represented at the extraordinary general meeting of shareholders, at which shareholders holding at leastone-third of the total voting rights are present or represented, is required to approve the Share Exchange Agreement. Shareholders of Alpine will have one voting right per one unit of shares of Alpine common stock, which consists of 100 shares.

Q. What vote of Alpine’s shareholders is required to approve the special dividend?

A. The affirmative vote of the holders of at least a majority of the voting rights of Alpine present or represented at the extraordinary general meeting of shareholders is required to approve the special dividend. Shareholders of Alpine will have one voting right per one unit of shares of Alpine common stock, which consists of 100 shares.

Q. After the share exchange, how much of ALPS ALPINE’s shares will Alpine’s shareholders own?

A. Based on the share exchange ratio and the number of common shares outstanding of Alps Electric as of September 30, 2018 and of Alpine as of October 15, 2018, both dates being the most recent date as of which shareholder information is available with respect to the relevant company, former shareholders of Alpine other than Alps Electric will hold approximately 12.39% of the outstanding common stock of ALPS ALPINE immediately after the share exchange.

Q. How will fractional shares be treated in the share exchange?

A. Shareholders of Alpine will not receive any fractional shares of common stock of Alps Electric in the share exchange. Instead, the shares representing the aggregate of all such fractions (in cases where such aggregated shares include any fractional shares, such fraction will be rounded down) will be sold in the Japanese market or sold to Alps Electric at the market price and the net cash proceeds from the sale will be distributed to the former holders of Alpine shares on a proportionate basis in accordance with their respective fractions.

Q. How will shareholders with less than a unit of shares of ALPS ALPINE shares be treated after the share exchange?

A. The articles of incorporation of Alps Electric, which will be renamed ALPS ALPINE after the consummation of the share exchange, provide that 100 shares of its common stock constitute one unit, which will have one voting right. If the share exchange is consummated, holders of 148 shares of Alpine common stock will receive in exchange for their shares 100 shares of ALPS ALPINE common stock, which constitute one unit, as well as cash in lieu of fractional shares. Holders of Alpine common stock who hold 147 shares or less will receive less than one unit of ALPS ALPINE shares through the share exchange, as well as cash in lieu of fractional shares if the number of shares they hold multiplied by 0.68, the share exchange ratio, would result in a fraction. Holders of Alpine common stock who hold more than 148 shares may receive ALPS ALPINE shares that constitute at least one unit and shares that constitute less than one unit, as well as cash in lieu of fractional shares if the number of their shares multiplied by 0.68 would result in a fraction. Shares constituting less than one unit will not carry voting rights, although holders of less than one unit of shares will be registered in ALPS ALPINE’s register of

ii

shareholders. A holder of shares constituting less than one unit of ALPS ALPINE shares may request ALPS ALPINE to purchase those shares at their market value in accordance with the Companies Act. Moreover, ALPS ALPINE’s articles of incorporation provide that a holder of less than a unit of ALPS ALPINE shares may request that ALPS ALPINE sell to the holder from any available treasury shares an amount of shares that will, when added to the number of shares held by such holder, constitute one unit of shares.

Q. Can the number of shares of Alps Electric common stock issued in exchange for shares of Alpine common stock change between now and the time when the share exchange is consummated?

A. No. The share exchange ratio has been fixed and, unless the Share Exchange Agreement is amended, will not change regardless of any changes in the trading prices of either Alps Electric or Alpine common stock between now and the effectiveness of the share exchange. For a more detailed discussion of the fixed share exchange ratio, see the first risk factor under “Risk Factors—Risks Related to the Share Exchange.”

Q. When is the share exchange expected to become effective?

A. The share exchange, if approved by Alpine’s shareholders, is expected to become effective on January 1, 2019 unless the Share Exchange Agreement is terminated or amended in accordance with its terms.

Q. Will Alpine shareholders receive dividends on Alpine common stock they hold for the fiscal year ending March 31, 2019?

A. ALPS ALPINE currently expects to pay dividends in late June 2019 to holders of record of its common stock, including those who were formerly holders of Alpine common stock but who became holders of ALPS ALPINE common stock in the share exchange, as of March 31, 2019. That payment of dividends will be subject to the approval of ALPS ALPINE’s board of directors, as well as ALPS ALPINE’s shareholders at its annual general shareholders’ meeting to be held in late June 2019. For a more detailed discussion of dividends generally, see “Description of Alps Electric Common Stock—Dividends.”

Q. How will trading in shares of Alpine common stock be affected in connection with the consummation of the share exchange?

A. Alpine expects that the last day of trading in its shares on the Tokyo Stock Exchange will be December 25, 2018, four trading days prior to the effective date of the share exchange, and that its shares will be delisted the following day.

Q. How will the legal rights of Alps Electric shares differ from the legal rights of Alpine shares?

A. There is no material difference between the legal rights of holders of Alps Electric shares and the legal rights of holders of Alpine shares.

Q. What are the Japanese tax consequences of the share exchange?

A.Non-resident holders of shares of Alpine common stock will generally not be subject to Japanese taxation with respect to the share exchange, except with respect to cash payments of the sale price from Alpine as a result of their exercise of dissenters’ appraisal rights. See “Taxation—Japanese Tax Consequences,” which is the opinion of Mori Hamada & Matsumoto, Japanese counsel to Alps Electric, for further discussion regarding the anticipated Japanese tax consequences tonon-resident holders of the share exchange.

Q. What are the U.S. tax consequences of the share exchange?

A. The share exchange has not been structured to achieve a particular treatment for U.S. federal income tax purposes, and Alps Electric and Alpine have no obligation to structure the share exchange in a manner that is

iii

tax-free to U.S. Holders (as defined under “Taxation”). It is the opinion of Shearman & Sterling LLP, U.S. tax counsel to Alps Electric, that as the share exchange is structured, it is more likely than not that the share exchange will qualify astax-deferred reorganization under the provisions of Section 368(a) of the U.S. Internal Revenue Code of 1986, as amended, or the Code. However, qualification of the share exchange as a reorganization depends on the resolution of issues and facts that will not be known until or after the date of the share exchange. If the share exchange qualifies as a reorganization, no gain or loss generally will be recognized by a U.S. Holder on the exchange of shares of Alpine common stock for shares of Alps Electric common stock pursuant to the share exchange, except with respect to any cash received in lieu of a fractional share of Alps Electric common stock and unless Alpine has been a passive foreign investment company, or PFIC, at any time during the holding period of the U.S. Holder. If the share exchange does not qualify as a reorganization, a U.S. Holder that exchanges its shares of Alpine common stock for shares of Alps Electric common stock will recognize gain or loss equal to the difference between (i) the sum of (a) the fair market value of the shares of Alps Electric common stock received and (b) any cash received in lieu of fractional shares of Alps Electric common stock and (ii) the U.S. Holder’s adjusted tax basis in the shares of Alpine common stock exchanged. See “Taxation—U.S. Federal Income Tax Consequences,” which is the opinion of Shearman & Sterling LLP, U.S. tax counsel to Alps Electric, for further discussion of the anticipated U.S. federal income tax consequences to U.S. Holders of the share exchange.

Q. How will the special dividend be treated for Japanese income tax purposes?

A. For Japanese income tax purposes, in the case of shareholders of Alpine who are non-residents of Japan, the special dividend will be treated in the same way as dividends on shares of Japanese companies generally, as described in “Taxation—Japanese Tax Consequences—Ownership and Disposition of ALPS ALPINE Shares.”

Q. How will the special dividend be treated for U.S. federal income tax purposes?

A. For U.S. federal income tax purposes, the special dividend is expected to be characterized as a distribution pursuant to Section 301(a) of the Code. Under such characterization, the gross amount of distributions paid to a U.S. Holder (as defined under “Taxation”) with respect to shares of Alpine common stock, including any Japanese tax withheld, will be treated as dividend income to the extent paid out of Alpine’s current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Alpine does not expect to maintain calculations of its earnings and profits under U.S. federal income tax principles; therefore, U.S. Holders should expect that the entire amount of any distribution, including the distribution of special dividend, generally will be reported as dividend income. Dividend income will be includible in gross income on the day it is actually or constructively received by the U.S. Holder. A corporate U.S. Holder will not be eligible for the dividends received deduction allowed to corporations under the Code in respect of dividends received from other U.S. corporations. Certain non-corporate recipients (including individuals) will be subject to tax at preferential tax rates, provided that certain conditions are satisfied.

However, if Alpine has been a PFIC at any time during a U.S. Holder’s holding period, special, unfavorable, U.S. federal income tax rules will apply to the U.S. Holder and may change the treatment of distributions on the Alpine common stock described above, including the availability of the preferential tax rates with respect to distributions to certain non-corporate recipients.

See “Taxation—U.S. Federal Income Tax Consequences,” which is the opinion of Shearman & Sterling LLP, U.S. tax counsel to Alps Electric, for further discussion of the anticipated U.S. federal income tax consequences to U.S. Holders of the receipt of special dividends with respect to Alpine stock.

Q. What else will be voted on at the extraordinary general meeting of shareholders of Alpine?

A. A proposal that one of Alpine’s shareholders has made will also be voted on at the extraordinary general meeting of shareholders of Alpine. The proposal, referred to herein as the shareholder proposal, is that Alpine

iv

pay, on December 27, 2018, a dividend of 300 yen per share of Alpine common stock to holders of record of outstanding shares of Alpine common stock as of October 15, 2018, subject to the condition that the Share Exchange Agreement is disapproved at the meeting.

Q. How does Alpine’s board of directors recommend that its shareholders vote regarding the shareholder proposal?

A. Alpine’s board of directors (except for the directors who did not attend the meeting in order to avoid possible conflicts of interest) unanimously opposes the shareholder proposal.

Q. What vote of Alpine’s shareholders is required to approve the shareholder proposal?

A. The affirmative vote of the holders of at least a majority of the voting rights of Alpine present or represented at the extraordinary general meeting of shareholders is required to approve the shareholder proposal.Shareholders of Alpine will have one voting right per one unit of shares of Alpine common stock, which consists of 100 shares.

Q. What is the record date for voting at the extraordinary general meeting of shareholders of Alpine?

A. The record date is October 15, 2018. Accordingly, holders of record of at least one unit of Alpine common stock as of that date will be eligible to vote at the extraordinary general meeting of shareholders of Alpine scheduled to be held on December 5, 2018. Shareholders of Alpine whose shares were issued or obtained after the record date will not be entitled to vote at the extraordinary general meeting of shareholders.

Q. How do I vote at the extraordinary general meeting of shareholders of Alpine?

You may exercise voting rights by voting via the Internet, submitting a letter of proxy or mail-in voting card, or attending the meeting in person or through another shareholder with voting rights whom you have appointed as yourattorney-in-fact or through a standing proxy, in the case of shareholders who arenon-residents of Japan. Alpine will distribute a letter of proxy, mail-in voting card, notice of convocation of Alpine’s extraordinary general meeting of shareholders and other proxy/voting materials to shareholders eligible to vote who are residents of Japan that will enable them to exercise their voting rights. Voting via the Internet must be done, and completed voting cards must be received by Alpine, by 5 p.m. (Japan time) one business day prior to the extraordinary general shareholders’ meeting. Completed letters of proxy must be received by Alpine no later than the starting time of the extraordinary general shareholders’ meeting to ensure that such letters of proxy are counted for the purpose of the vote.

For shareholders eligible to vote who arenon-residents of Japan and who have appointed a standing proxy in Japan, Alpine will distribute proxy/voting materials to their standing proxy in Japan, who may then transmit those materials to the shareholders according to the terms of the respective proxy agreements. For shareholders eligible to vote who arenon-residents of Japan and who have purchased shares of Alpine through a securities broker located outside of Japan, Alpine will distribute proxy/voting materials to the broker’s standing proxy in Japan, who is expected to transmit those materials according to the terms of the arrangement with the broker. Alpine shareholders who arenon-residents of Japan are encouraged to contact their standing proxy in Japan, or their broker, to obtain the proxy/voting materials and confirm the necessary procedures to exercise their voting rights. For shareholders eligible to vote who arenon-residents of Japan and who have designated a mailing address in Japan, Alpine will send proxy/voting materials to that mailing address.

In addition to the exercise of voting rights as described above, institutional investors may use the “Electronic Voting Platform for Institutional Investors,” which is operated by ICJ, Inc. to exercise their voting rights at the extraordinary general meeting of shareholders.

v

The articles of incorporation of Alps Electric, which will be renamed ALPS ALPINE after the consummation of the share exchange, provide that 100 shares of its common stock constitute one unit, which will have one voting

right. Therefore, if the share exchange is consummated, current holders of Alpine common stock who vote at the extraordinary general meeting of shareholders of Alpine but who will hold less than 100 shares of ALPS

ALPINE common stock after the share exchange will not have, unless they buy additional shares of ALPS ALPINE common stock, voting rights at general meetings of shareholders of ALPS ALPINE after the consummation of the share exchange.

Q. How will shares represented by letters of proxy be treated at the extraordinary general meeting of shareholders?

A. The letters of proxy that Alpine is providing to its shareholders for the extraordinary general meeting of Alpine shareholders will list the proposals to be voted on by shareholders at the meeting, namely the approval of the Share Exchange Agreement, the special dividend and the dividend proposed in the shareholder proposal. Such letters of proxy will allow shareholders to indicate their approval or disapproval with respect to each proposal. Any such letters of proxy that are returned to Alpine without indicating whether the shareholder approves or disapproves of any of the proposals will be handled in the manner Alpine chooses. It is expected that Alpine will choose to handle them as follows:

| | • | | to count towards the quorum for its extraordinary general meeting of shareholders any shares represented by such letters of proxy; |

| | • | | to count such letters of proxy as voting FOR the Share Exchange Agreement; |

| | • | | to count such letters of proxy as voting FOR the special dividend; and |

| | • | | to count such letters of proxy as voting AGAINST the dividend proposed in the shareholder proposal. |

Q. How will shares represented bymail-in voting cards be treated at the extraordinary general meeting of shareholders?

A. Themail-in voting cards used for the extraordinary general meeting of Alpine shareholders will list the proposals to be voted on by shareholders at the meeting, namely the approval of the Share Exchange Agreement, the special dividend and the dividend proposed in the shareholder proposal. Amail-in voting card will allow a shareholder to indicate his or her approval or disapproval with respect to each proposal. In accordance with Japanese law and practice, and as specified on the mail-in voting cards, Alpine intends to:

| | • | | count towards the quorum for its extraordinary general meeting of shareholders any shares represented by mail-in voting cards that are returned, regardless of whether or not they indicate the approval or disapproval of any of the proposals; |

| | • | | count mail-in voting cards that do not indicate the approval or disapproval of the Share Exchange Agreement as voting FOR the Share Exchange Agreement; |

| | • | | count mail-in voting cards that do not indicate the approval or disapproval of the special dividend as voting FOR the special dividend; and |

| | • | | count mail-in voting cards that do not indicate the approval or disapproval of the dividend proposed in the shareholder proposal as voting AGAINST such dividend. |

Amail-in voting card will become void if the shareholder who sent the mail-in voting card votes via Internet or votes in person, or through another shareholder entitled to vote and appointed as such person’s attorney-in-fact, or through a standing proxy in the case of shareholders who are non-residents of Japan, at the extraordinary general meeting of shareholders of Alpine.

vi

Q. May I revoke my vote after I submit a letter of proxy?

A. Yes. Any person who votes by a letter of proxy may revoke his or her vote any time before it is voted by clearly expressing his or her intention to revoke his or her proxy (for example, by providing a new letter of proxy).

Q. May I revoke my vote after I submit a mail-in voting card or vote via Internet?

A. Yes. Any person who votes by a mail-in voting card or votes via the Internet may revoke his or vote any time before it is voted:

| | • | | by voting via Internet (in the case of a vote via Internet, via Internet at a later time); or |

| | • | | by voting in person, or through another shareholder entitled to vote and appointed as such person’s attorney-in-fact, or through a standing proxy in the case of shareholders who are non-residents of Japan, at the extraordinary general meeting of shareholders of Alpine. |

Q. If my shares are held in “street name” by my broker, will my broker vote them for me without instructions?

A. Whether your broker will vote your shares without your instructions depends on the terms of the agreement entered into by you and your broker. Therefore, you are encouraged to contact your broker directly to confirm the applicable voting procedure.

Q. Do I have dissenters’ appraisal rights in connection with the share exchange?

A. Under the Companies Act, you are entitled to dissenters’ appraisal rights in connection with the share exchange in accordance with the procedures set forth in the Companies Act and related laws and regulations and share handling regulations of Alpine. Any Alpine shareholder (i) who notifies Alpine prior to the extraordinary general meeting of shareholders of his or her intention to oppose the share exchange, and who votes against the approval of the Share Exchange Agreement at the shareholders’ meeting; or (ii) who is not entitled to vote at such extraordinary general meeting of shareholders, and complies with the other relevant procedures set forth in the Companies Act and related laws and regulations and share handling regulations of Alpine, may demand that Alpine purchase his or her shares of Alpine common stock at fair value. If you vote against the Share Exchange Agreement via the Internet or by submitting a mail-in voting card, such submission will satisfy all requirements mentioned in (i) above. Such demand must be made within the period from the day 20 days prior to the effective date of the share exchange to the day immediately preceding the effective date of the share exchange.

The failure of an Alpine shareholder who is entitled to vote at the extraordinary general meeting of shareholders to provide such notice prior to the shareholders’ meeting or to vote against the approval of the Share Exchange Agreement at the shareholders’ meeting will in effect constitute a waiver of the shareholder’s right to demand that Alpine purchase his or her shares of Alpine common stock at fair value.

There are other procedural issues that you may wish to consider when deciding whether to exercise your dissenters’ appraisal rights. See “The Share Exchange—Dissenters’ Appraisal Rights” for a more detailed discussion of dissenters’ appraisal rights. The dissenters’ appraisal rights for shareholders of Alpine, as a company becoming a wholly owned subsidiary through a share exchange are set forth in Articles 785 and 786 of the Companies Act. An English translation of these articles is included in this prospectus as Appendix M.

Q. Who is soliciting my proxy?

A. Proxies are being solicited by Alpine. Alpine has also retained J-Eurus IR Co., Ltd. to assist it in soliciting proxies in Alpine’s name by telephone from shareholders resident in Japan.

Q. Who is paying for the cost of this proxy solicitation?

A. Alpine will bear the costs of soliciting proxies.

vii

Letters of proxy, proxy reference materials, the notice of convocation of Alpine’s extraordinary general meeting of shareholders and other materials will be mailed on Alpine’s behalf by Alpine’s transfer agent. Alpine will not incur significant additional costs in connection with the mailing of letters of proxy and proxy reference materials, as such materials will be mailed together with the notice of convocation and other voting materials. In addition, some of Alpine’s directors, officers and employees may solicit proxies on Alpine’s behalf by telephone from shareholders resident in Japan. Further, Alpine has retained J-Eurus IR Co., Ltd. to assist it in soliciting proxies in Alpine’s name by telephone from shareholders resident in Japan. Alpine expects the fees of J-Eurus IR Co., Ltd. for such services to be approximately ¥3 million.

Q. Whom can I call with questions?

A. If you have more questions about the share exchange, you should contact:

Alps Electric Co., Ltd.

Corporate Planning Office

1-7, Yukigaya-otsukamachi

Ota-ku, Tokyo145-8501 Japan

Telephone:+81-3-5499-8026 (IR Direct)

Alpine Electronics Inc.

Finance and Public Relations Department

1-7, Yukigaya-otsukamachi

Ota-ku, Tokyo145-0067 Japan

Telephone:+81-3-5499-4391 (IR Direct)

viii

SUMMARY

This summary highlights selected information from this prospectus. It does not contain all of the information that may be important to you. You should carefully read this entire prospectus for a more complete understanding of the share exchange being considered at the extraordinary general meeting of Alpine shareholders.

As used in this prospectus, references to “Alps Electric” are to Alps Electric Co., Ltd., references to “Alpine” are to Alpine Electronics Inc. and references to “ALPS ALPINE” are to ALPS ALPINE CO., LTD., to which Alps Electric will be renamed after the consummation of the share exchange. References to the “share exchange” are to the proposed share exchange between Alps Electric and Alpine, the terms of which are set forth in the Share Exchange Agreement between Alps Electric and Alpine. Unless the context otherwise requires, references in this prospectus to the financial results or business of “Alps Electric” refer to those of Alps Electric and its consolidated subsidiaries, including Alpine, of “Alpine” refer to those of Alpine and its consolidated subsidiaries and of “ALPS ALPINE” refer to those of ALPS ALPINE and its consolidated subsidiaries, including Alpine. References to the “Original Share Exchange Agreement” refer to the share exchange agreement relating to the share exchange as originally executed on July 27, 2017 (and thus before the amendments made to the agreement after such date).

The Companies

| | |

Alps Electric Co., Ltd. 1-7, Yukigaya-otsukamachi Ota-ku, Tokyo145-8501 Japan Telephone:+81-3-3726-1211 | | Alpine Electronics Inc. 1-7, Yukigaya-otsukamachi Ota-ku, Tokyo145-0067 Japan Telephone:+81-3-5499-8111 |

Alps Electric

(page 83)

Alps Electric, the parent company of Alpine, engages in the manufacturing and sale of various electronic components for the automotive, mobile and EHII (energy, healthcare, industry and Internet of Things, or IoT) markets, as well as car navigation systems, car information display products,in-car sound systems andin-car audio products. Alps Electric also engages in the integrated logistics services, primarily with respect to electronic components. As of March 31, 2018, Alps Electric had total assets of 701 billion yen. For the year ended March 31, 2018, it had net profit attributable to owners of Alps Electric of 38 billion yen.

Alpine

(page 95)

Alpine, a consolidated subsidiary of Alps Electric, engages in the manufacture and sale ofin-car information and communication products and audio products. Its primary products in the information and communication products segment include car navigation systems andin-car communication products. Its products in the audio products segment includein-car CD players, amplifiers and speakers. As of March 31, 2018, Alpine had total assets of 234 billion yen. For the year ended March 31, 2018, it had net profit attributable to owners of Alpine of 8 billion yen.

The Share Exchange

(page 36)

The boards of directors of Alps Electric and Alpine have agreed to a statutory share exchange under the Companies Act, pursuant to which shares of Alpine (other than those that Alps Electric Co., Ltd. directly owns)

1

will be exchanged for shares of Alps Electric, and Alpine will become a wholly owned subsidiary of Alps Electric. Alps Electric will serve as the operating holding company for the combined group and is expected to be renamed ALPS ALPINE following the consummation of the share exchange. On July 27, 2017, Alps Electric and Alpine entered into a share exchange agreement setting forth the terms of the share exchange. The agreement was amended by a memorandum of understanding executed on February 27, 2018, providing to the effect that Alps Electric and Alpine would adopt an operating holding company structure with anin-house company system. The agreement was further amended by a memorandum of understanding executed on July 27, 2018, in order that a series of stock acquisition rights newly issued by Alpine would be treated in the share exchange in a manner similar to pre-existing stock acquisition rights of Alpine.

Upon the share exchange, each shareholder of Alpine (other than Alps Electric Co., Ltd.) who is recorded or registered on the register of shareholders as of the time immediately preceding the effective date of the share exchange will receive 0.68 shares of Alps Electric common stock in exchange for each share of Alpine common stock that such shareholder holds. The resulting number of shares of Alps Electric common stock to which Alpine shareholders are entitled will be recorded in Alps Electric’s register of shareholders. The shares representing the aggregate of all fractional shares (in cases where such aggregated shares include any fractional shares, such fraction will be rounded down) will be sold in the Japanese market or sold to Alps Electric at the market price, and the net cash proceeds from the sale will be distributed to the former holders of Alpine shares on a proportionate basis in accordance with their respective fractions.

The share exchange can only be completed if the Share Exchange Agreement is approved by the shareholders of Alpine and certain other conditions are satisfied. If the Share Exchange Agreement is approved by the shareholders of Alpine and the other conditions for completing the share exchange are satisfied, the share exchange is expected to become effective on January 1, 2019.

Reasons for the Share Exchange

(page 45)

Alps Electric and Alpine entered into the Share Exchange Agreement so that they can together exercise more efficient management of the Alps group as a whole. Upon completing the transaction, the parties will work on full-scale cooperation, such as strengthening of their ability as a group to propose solutions to and conduct salesvis-a-vis their customers, development of employees through personnel exchanges across businesses, and joint use of Alps Electric’s fund-raising capabilities, network and production capability. Through these measures, coupled with others, such as enhanced mutual use of production bases, streamlining of back-office departments through shared infrastructures, strengthening of the group’s procurement capacity, and reinforcement of global operations, Alps Electric and Alpine will strive to maximize the synergies of the entire Alps group.

Special Dividend

(page 45)

Alpine has announced its intention to pay a special dividend of 100 yen per share of Alpine common stock, subject to any withholding of taxes required by law. The dividend will be payable to holders of Alpine common stock as of October 15, 2018, which is the record date for the special dividend, on the condition that the Share Exchange Agreement is approved by Alpine’s shareholders at the extraordinary general meeting of shareholders.

The Extraordinary General Meeting of Shareholders

(page 32)

To seek shareholders’ approval of the Share Exchange Agreement and special dividend, the board of directors of Alpine will convene an extraordinary general meeting of shareholders. Under Japanese law and the articles of incorporation of Alpine, the notice of an extraordinary general meeting of shareholders must be

2

dispatched at least two weeks in advance to all shareholders of record who have voting rights. Alpine will distribute materials to shareholders that will enable them to exercise their voting rights.

The date, time and place of the meeting is expected to be December 5, 2018, at 10 a.m. (Japan time), at the hall on the first floor of the head office building of Alps Electric Co., Ltd., at 1-7 Yukigaya-otsukamachi, Ota-ku, Tokyo, Japan.

Shareholders may exercise voting rights by voting via the Internet, submitting a letter of proxy ormail-in voting card, or attending the meeting in person or through another shareholder with voting rights whom you have appointed as yourattorney-in-fact or through a standing proxy in the case of shareholders who arenon-residents of Japan. Alpine will distribute a letter of proxy, mail-in voting card, notice of convocation of Alpine’s extraordinary general meeting of shareholders and other proxy/voting materials to shareholders eligible to vote who are residents of Japan that will enable them to exercise their voting rights. For shareholders eligible to vote who arenon-residents of Japan and who have appointed a standing proxy in Japan, Alpine will distribute proxy/voting materials to their standing proxy in Japan, who may then transmit those materials to the shareholders according to the terms of the respective proxy agreements. For shareholders eligible to vote who arenon-residents of Japan and who have purchased shares of Alpine through a securities broker located outside of Japan, Alpine will distribute proxy/voting materials to the broker’s standing proxy in Japan, who is expected to transmit those materials according to the terms of the arrangement with the broker. Alpine shareholders who arenon-residents of Japan are encouraged to contact their standing proxy in Japan, or their broker, to obtain the proxy/voting materials and confirm the necessary procedures to exercise their voting rights. For shareholders eligible to vote who arenon-residents of Japan and who have designated a mailing address in Japan, Alpine will send proxy/voting materials to that mailing address. In addition to the exercise of voting rights as described above, institutional investors may use the “Electronic Voting Platform for Institutional Investors,” which is operated by ICJ, Inc. to exercise their voting rights at the extraordinary general meeting of shareholders.

In addition to the Share Exchange Agreement and the special dividend, Alpine shareholders will also vote at the extraordinary general meeting of shareholders of Alpine on the shareholder proposal. The shareholder proposal is that Alpine pay, on December 27, 2018, a dividend of 300 yen per share of Alpine common stock to holders of record of outstanding shares of Alpine common stock as of October 15, 2018, subject to the condition that the Share Exchange Agreement is disapproved at the meeting.

The affirmative vote of the holders of at leasttwo-thirds of the voting rights of Alpine present or represented at its extraordinary general meeting of shareholders, at which shareholders holding at leastone-third of the total voting rights of Alpine who are entitled to exercise their voting rights are present or represented, is required to approve the Share Exchange Agreement. The affirmative vote of the holders of at least a majority of the voting rights of Alpine present or represented at the extraordinary general meeting of shareholders is required to approve the special dividend The affirmative vote of the holders of at least a majority of the voting rights of Alpine present or represented at the extraordinary general meeting of shareholders is also required to approve the shareholder proposal. Shareholders of Alpine will have one voting right per one unit of shares of Alpine common stock, which consists of 100 shares.

As of October 15, 2018, the directors and executive officers of Alpine owned approximately 0.13% of the voting rights of Alpine common stock. As of September 30, 2018, directors and executive officers of Alps Electric owned approximately 0.07% of voting rights of Alpine common stock.

Determinations of Alpine’s Board of Directors with Respect to the Share Exchange

(page 47)

On July 27, 2017, the board of directors of Alpine (except for two directors who did not attend the meeting in order to avoid conflicts of interest) unanimously approved the share exchange. On February 27, 2018, the

3

board of directors of Alpine (except for two directors who did not attend the meeting in order to avoid conflicts of interest and another director who did not attend due to business reasons) unanimously resolved that it is not necessary for Alpine to propose to Alps Electric a revision of the share exchange ratio even after taking into account the upward revisions to the full-year consolidated earnings forecasts of Alps Electric and Alpine for the fiscal year ended March 31, 2018. On September 27, 2018, the board of directors of Alpine (except for seven directors who did not attend the meeting in order to avoid conflicts of interest) unanimously resolved to set October 15, 2018 as the record date for the extraordinary general meeting of shareholders at which the Share Exchange Agreement will be submitted for approval. The board of directors of Alpine (except for seven directors who did not attend the meeting in order to avoid conflicts of interest) also unanimously approved the submission of a proposal for the payment of special dividends to the extraordinary general meeting of shareholders.

In its deliberation of the share exchange at each of the above occasions, the board of directors of Alpine considered a number of factors referred to under “The Share Exchange—Reasons for the Share Exchange—Determinations of Alpine’s Board of Directors” beginning on page 47.

Material Japanese Income Tax Consequences of the Share Exchange

(page 77)

Non-resident holders of shares of Alpine common stock will generally not be subject to Japanese taxation with respect to the share exchange, except with respect to cash payments of the sale price from Alpine as a result of their exercise of dissenters’ appraisal rights. See “Taxation—Japanese Tax Consequences,” which is the opinion of Mori Hamada & Matsumoto, Japanese counsel to Alps Electric, for further discussion regarding the anticipated Japanese tax consequences tonon-resident holders of the share exchange.

Material U.S. Federal Income Tax Consequences of the Share Exchange

(page 77)

The share exchange has not been structured to achieve a particular treatment for U.S. federal income tax purposes, and Alps Electric and Alpine have no obligation to structure the share exchange in a manner that istax-free to U.S. Holders (as defined under “Taxation”). It is the opinion of Shearman & Sterling LLP, U.S. tax counsel to Alps Electric, that as the share exchange is structured, it is more likely than not that the share exchange will qualify as atax-deferred reorganization under the provisions of Section 368(a) of the Code. However, qualification of the share exchange as a reorganization depends on the resolution of issues and facts that will not be known until or after the date of the share exchange. If the share exchange qualifies as a reorganization, no gain or loss generally will be recognized by a U.S. Holder on the exchange of shares of Alpine common stock for shares of Alps Electric common stock pursuant to the share exchange, except with respect to any cash received in lieu of a fractional share of Alps Electric common stock and unless Alpine has been a PFIC at any time during the holding period of the U.S. Holder. If the share exchange does not qualify as a reorganization, a U.S. Holder that exchanges its shares of Alpine common stock for shares of Alps Electric common stock will recognize gain or loss equal to the difference between (i) the sum of (a) the fair market value of the shares of Alps Electric common stock received and (b) any cash received in lieu of fractional shares of Alps Electric common stock and (ii) the U.S. Holder’s adjusted tax basis in the shares of Alpine common stock exchanged. See “Taxation—U.S. Federal Income Tax Consequences,” which is the opinion of Shearman & Sterling LLP, U.S. tax counsel to Alps Electric, for further discussion of the anticipated U.S. federal income tax consequences to U.S. Holders of the share exchange.

4

Material Japanese Income Tax Consequences of the Special Dividend

(page 77)

For Japanese income tax purposes, in the case of the shareholders of Alpine who are non-residents of Japan, the special dividend will be treated in the same way as dividends on shares of Japanese companies generally, as described in “Taxation—Japanese Tax Consequences—Ownership and Disposition of ALPS ALPINE Shares.”

Material U.S. Federal Income Tax Consequences of the Special Dividend

(page 77)

For U.S. federal income tax purposes, the special dividend is expected to be characterized as a distribution pursuant to Section 301(a) of the Code. Under such characterization, the gross amount of distributions paid to a U.S. Holder (as defined under “Taxation”) with respect to shares of Alpine common stock, including any Japanese tax withheld, will be treated as dividend income to the extent paid out of Alpine’s current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Alpine does not expect to maintain calculations of its earnings and profits under U.S. federal income tax principles; therefore, U.S. Holders should expect that the entire amount of any distribution, including the distribution of special dividend, generally will be reported as dividend income. Dividend income will be includible in gross income on the day it is actually or constructively received by the U.S. Holder. A corporate U.S. Holder will not be eligible for the dividends received deduction allowed to corporations under the Code in respect of dividends received from other U.S. corporations. Certainnon-corporate recipients (including individuals) will be subject to tax at preferential tax rates, provided that certain conditions are satisfied.

However, if Alpine has been a PFIC at any time during a U.S. Holder’s holding period, special, unfavorable, U.S. federal income tax rules will apply to the U.S. Holder and may change the treatment of distributions on the Alpine common stock described above, including the availability of the preferential tax rates with respect to distributions to certain non-corporate recipients.

See “Taxation—U.S. Federal Income Tax Consequences,” which is the opinion of Shearman & Sterling LLP, U.S. tax counsel to Alps Electric, for further discussion of the anticipated U.S. federal income tax consequences to U.S. Holders of the receipt of special dividends with respect to Alpine stock.

Anticipated Accounting Treatment

(page 78)

The share exchange will be accounted for by ALPS ALPINE as an equity transaction, not a business combination, since Alps Electric controls Alpine before and after the business integration. Accordingly, no profit or loss will be recognized in the consolidated statements of profit or loss or comprehensive income of ALPS ALPINE aside from any tax considerations, and the carrying amount ofnon-controlling interest will be adjusted to reflect the change in ALPS ALPINE’s ownership interest in Alpine. Any difference between the fair value of the consideration paid by ALPS ALPINE and the amount by which thenon-controlling interest is adjusted will be recognized in ALPS ALPINE’s equity attributable to owners of the company. Refer to “Unaudited Pro Forma Condensed Consolidated Financial Information” beginning on page 23.

Regulatory Matters

(page 78)

Alps Electric and Alpine have filed notifications and reports regarding the share exchange with the antitrust authorities whose approvals are necessary to conduct the share exchange. All such authorities have approved the share exchange. Specifically, on January 31, 2018, the Japan Fair Trade Commission, or JFTC, granted early

5

clearance of the transaction. On February 2, 2018, the United States granted early clearance of the transaction. On May 24, 2018, the European Commission granted clearance of the transaction. On May 28, 2018, China granted clearance of the transaction. On June 14, 2018, Taiwan granted clearance of the transaction. For a more detailed discussion of the regulatory approvals required for the share exchange, see “The Share Exchange—Regulatory Matters.”

Dissenters’ Appraisal Rights

(page 79)

Under the Companies Act, you may have dissenters’ appraisal rights in connection with the share exchange. For a more detailed discussion of these rights, see “The Share Exchange—Dissenters’ Appraisal Rights.”

Conditions to the Share Exchange

(page 81)

The obligations of each of Alps Electric and Alpine to carry out the share exchange are subject to the satisfaction of, among other things, conditions such as the following:

| | • | | Alpine having obtained shareholder approval of the Share Exchange Agreement on or before the day preceding the effective date of the share exchange; and |

| | • | | approvals of relevant government agencies and other authorities necessary to conduct the share exchange being obtained. |

Termination and Amendment

(page 82)

Each of Alps Electric and Alpine may terminate upon consultation between the parties, or amend upon agreement between the parties, the Share Exchange Agreement if any of the following occurs:

| | • | | a material change in the financial condition or operating condition of the other party; |

| | • | | a material interference with the execution of the share exchange occurs or is found to exist; or |

| | • | | any significant difficulty in achieving the purpose of the Share Exchange Agreement. |

The Share Exchange Agreement also may be terminated or amended by agreement of the parties.

Risk Factors

(page 8)

In determining whether to vote to approve the Share Exchange Agreement, you should carefully consider the risk factors beginning on page 8 of this prospectus.

Solicitation of Proxies

(page 34)

Alpine is soliciting your proxy. See “Extraordinary General Meeting of Shareholders of Alpine—Voting—Solicitation of Proxies.”

Interests of Certain Alpine Persons in the Share Exchange

(page 76)

Members of the Alpine board of directors and Alpine’s executive officers may have interests in the share exchange. These interests may create potential conflicts of interests.

6

Comparative Per Share Market Price Data

(page 29)

Both the shares of Alps Electric common stock and the shares of Alpine common stock are listed on the First Sections of the Tokyo Stock Exchange. The following table sets forth the closing sale prices of Alps Electric and Alpine common stock as reported on the First Section of the Tokyo Stock Exchange on July 26, 2017, the last trading day before the public announcement of the share exchange as well as the day the Share Exchange Agreement was originally signed, and November 8, 2018, the last practicable trading day before the distribution of this prospectus. The table also sets forth the implied equivalent value of Alpine’s common stock on these dates, as determined by multiplying the applicable reported sales price of Alps Electric’s common stock by the share exchange ratio of 0.68. Alps Electric urges you to obtain current market quotations for both Alps Electric’s common stock and Alpine’s common stock.

| | | | | | | | | | | | |

| | | Alps Electric

common stock | | | Alpine common stock | |

| | | Historical | | | Historical | | | Implied

equivalent value | |

| | | (Yen) | | | (Yen) | | | (Yen) | |

July 26, 2017 | | | 3,190 | | | | 1,708 | | | | 2,169 | |

November 8, 2018 | | | 2,669 | | | | 1,936 | | | | 1,815 | |

7

RISK FACTORS

In addition to the other information included into this prospectus, including the matters addressed under the caption “Cautionary Statement Concerning Forward-Looking Statements,” you should carefully consider the matters described below in evaluating the matters described in this prospectus with respect to the share exchange.

Risks Related to the Share Exchange

The share exchange ratio is fixed and will not be adjusted to reflect changes in the market values of Alps Electric and Alpine common stock. As a result, the value of Alps Electric common stock you receive in the share exchange may be less than the value of your shares when you vote on the Share Exchange Agreement.

Upon the effectiveness of the share exchange, each share of Alpine common stock (other than those that Alps Electric Co., Ltd. directly owns) will be exchanged for 0.68 shares of Alps Electric common stock. The ratio at which Alpine common stock will be exchanged for Alps Electric common stock is fixed and, unless the Share Exchange Agreement is amended, will not be adjusted for changes in the market prices of either company’s common stock. Therefore, even if the relative market values of Alps Electric or Alpine common stock change, there will be no change in the number of shares of Alps Electric common stock that shareholders of Alpine will receive in the share exchange.

The value that holders of Alpine common stock will receive in the share exchange depends on the market price of Alps Electric common stock at the effective date of the share exchange. As a result, any change in the price of Alps Electric’s common stock prior to the effective date of the share exchange will affect the value that holders of Alpine common stock will receive in the share exchange. The value of the Alps Electric common stock to be received in the share exchange (which will occur approximately four weeks after the extraordinary general meeting of shareholders) may be higher or lower than the indicative value as of the date of this prospectus or as of the date of the extraordinary general meeting of shareholders, depending on the then prevailing market prices of Alps Electric common stock.

The share prices of Alps Electric and Alpine common stock are subject to general price fluctuations in the market for publicly traded equity securities and have experienced volatility in the past. Stock price changes may result from a variety of factors that are beyond the control of Alps Electric and Alpine, including actual changes in, or investor perception of, Alps Electric’s and Alpine’s businesses, operations and prospects. Regulatory developments, as well as current or potential legal proceedings, and changes in general market and economic conditions may also affect the prices of Alps Electric and Alpine common stock.

The share exchange is subject to regulatory approvals and various conditions set forth in the Share Exchange Agreement and, even though it may be approved by the shareholders of Alpine, the share exchange nonetheless may not be completed as scheduled, or at all.

Under the Share Exchange Agreement, the effectuation of the share exchange is conditioned upon, among other things, obtaining or satisfying all regulatory approvals, permits, consents and requirements necessary for the effectiveness of the share exchange. Regulatory authorities in Japan or elsewhere may seek to block or delay the share exchange, or may impose conditions that reduce the anticipated benefits of the share exchange or make it difficult to complete as planned and shareholder approval of the Share Exchange Agreement will be subject to fulfillment of such conditions, if any. If all necessary regulatory approvals, permits, consents and requirements are not satisfied, even if the Share Exchange Agreement is approved at Alpine’s extraordinary general meeting of shareholders, there is no assurance that the share exchange will ultimately be completed as scheduled, or at all.

8

Furthermore, each of Alps Electric and Alpine may terminate upon consultation between the parties, or amend upon agreement between the parties, the Share Exchange Agreement if any of the following occurs:

| | • | | a material change in the financial condition or operating condition of the other party; |

| | • | | a material interference with the execution of the share exchange occurs or is found to exist; or |

| | • | | any significant difficulty in achieving the purpose of the Share Exchange Agreement. |

The Share Exchange Agreement also may be terminated or amended otherwise by agreement of the parties. Accordingly, even if all regulatory approvals, permits, consents and requirements are obtained, the share exchange may not be completed as scheduled or at all, regardless of whether the Share Exchange Agreement is approved at Alpine’s extraordinary general meeting of shareholders.

ALPS ALPINE may fail to realize the anticipated benefits of the share exchange due to the challenges of integrating the operations of Alps Electric and Alpine.

The success of the share exchange will depend, in part, on ALPS ALPINE’s ability to realize the anticipated growth opportunities and cost savings from combining the businesses of Alps Electric and Alpine. ALPS ALPINE’s ability to realize these anticipated benefits will depend in part on the extent to which ALPS ALPINE can successfully implement and manage the business integration of Alps Electric and Alpine, including the following:

| | • | | identifying areas and activities that present substantial potential synergies as a result of the share exchange, and allocating resources effectively to those and other promising areas and activities; |

| | • | | effectively integrating their respective organizations, business cultures, procedures and operations; |

| | • | | smoothly transitioning relevant operations and facilities to a common information technology system; and |

| | • | | developing and implementing uniform accounting policies, internal controls and procedures, disclosure controls and procedures and other governance policies and standards. |

If ALPS ALPINE is not able to successfully manage the integration process, take advantage of the anticipated synergies and create an integrated business, the anticipated benefits of the share exchange and subsequent integration may not be realized fully, or at all, or may take longer to realize than expected.

Significant costs will be incurred in the course of the share exchange and in the subsequent integration of the business operations of Alps Electric and Alpine.

Alps Electric and Alpine expect to record significant expenses related to the share exchange and in the subsequent integration of the business operations of Alps Electric and Alpine. These transaction-related expenses include financial advisory, consulting, legal and accounting fees and expenses, filing fees, printing expenses and other related charges. Some or all of these costs are payable by Alps Electric and Alpine, whether or not the share exchange is completed.

In addition to transaction-related expenses, ALPS ALPINE may also incur significant indirect costs while integrating and combining the businesses of Alps Electric and Alpine, including reallocating and integrating resources and operations. Moreover, ALPS ALPINE may also incur significant opportunity costs in the form of substantial disruption to its business and distraction of its management and employees fromday-to-day operations.

Additional significant costs may be incurred in connection with any shareholder litigation or appraisal claims in compensating dissenting shareholders of Alps Electric or Alpine who exercise their appraisal rights.

9

Uncertainties associated with the share exchange may damage ALPS ALPINE’s relationships with customers, suppliers and business partners of Alps Electric and Alpine.

Current customers, suppliers and business partners of Alps Electric or Alpine may, in response to the announcement of the share exchange or to subsequent steps taken to integrate the businesses of Alps Electric and Alpine, delay or defer decisions concerning their relationships with Alps Electric or Alpine because of uncertainties related to the share exchange, including the absence of certainty that the share exchange will be completed. The loss of such customers, suppliers and business partners may have a material adverse effect on ALPS ALPINE’s business and results of operations.

Negative media coverage of the share exchange, as well as statements by parties with competing interests, could have a materially adverse effect on ALPS ALPINE’s reputation, business and results of operations.

The share exchange of Alps Electric and Alpine is being covered by both Japanese and foreign media. Some of this coverage may be negative and pertains to a wide range of matters relating to the share exchange. Negative media coverage about the share exchange, regardless of its veracity, may affect investor sentiment and could have a material adverse effect on the stock price of ALPS ALPINE. The resulting reputational harm from such negative media coverage relating to the share exchange may also affect consumer perception, negatively affecting the business and results of operations of ALPS ALPINE. ALPS ALPINE, as well as Alps Electric and Alpine, may also be forced to devote considerable resources to address the impact of such media coverage relating to the share exchange.

In connection with the effectiveness of the share exchange, it will not be possible to trade shares of Alpine common stock during certain periods.

In connection with the share exchange, Alpine shares will be delisted from the Tokyo Stock Exchange. Under the current schedule and assuming the share exchange is completed, the last day of trading in shares of Alpine is expected to be four trading days prior to the effective date of the share exchange, and the delisting of those shares is expected to be three trading days prior to the effective date of the share exchange. Holders of Alpine shares who will receive shares in the share exchange are expected to be able to sell them beginning on January 4, 2019. As a result, holders of Alpine shares will not be able to trade their shares, or the Alps Electric shares they will be entitled to receive when the share exchange is completed, during the period between the delisting of Alpine shares and the effective date of the share exchange. Accordingly, these holders will be subject to the risk of not being able to liquidate their shares, including during a falling market.

Alpine shareholders will have a reduced ownership and voting interest in ALPS ALPINE and will therefore have less influence over the management of ALPS ALPINE.

After the effectiveness of the share exchange, Alpine’s shareholders will own a significantly smaller percentage of Alps Electric, which will be renamed ALPS ALPINE after the consummation of the share exchange, than they currently own in Alpine. Immediately following effectiveness of the share exchange, former shareholders of Alpine other than Alps Electric will own approximately 12.39% of the outstanding common stock of ALPS ALPINE. Consequently, Alpine’s shareholders will have less influence over the management and policies of ALPS ALPINE than they currently have in Alpine.

The fairness opinion, supplementary simulation (sensitivity analysis) presentation and financial analysis report as of September 26, 2018 that Alpine has obtained from its financial advisor, and the fairness opinion that the Third-Party Committee has obtained from its financial advisor, are based on assumptions as of a certain date, and may not be valid as of a later date.

Alpine has not obtained from its financial advisor, SMBC Nikko Securities Inc., or SMBC Nikko, an updated fairness opinion, supplementary simulation (sensitivity analysis) presentation or financial analysis report as of the date of this prospectus. SMBC Nikko provided a fairness opinion as of July 26, 2017, a supplementary

10

simulation (sensitivity analysis) presentation as of February 26, 2018, and a financial analysis report as of September 26, 2018. Similarly, the third-party committee established by Alpine’s board of directors has not obtained from its financial advisor, YAMADA Consulting Group Co., Ltd., or Yamada, an updated fairness opinion as of the date of this prospectus; Yamada provided a fairness opinion as of September 26, 2018. None of those documents provided by SMBC Nikko or Yamada to Alpine or to the third-party committee, respectively, speaks as of any date other than the respective dates thereof, and each is subject to various assumptions and qualifications. Changes in the operations and prospects of Alps Electric and Alpine, general market and economic conditions and other factors that may be beyond the control of Alps Electric and Alpine, and on which the fairness opinions, supplementary simulation (sensitivity analysis) presentation and the financial analysis report as of September 26, 2018 were based, may have altered the value of Alps Electric and Alpine, or the market price of Alps Electric and Alpine common stock as of the date of this prospectus, or may alter such values and prices by the time the share exchange is completed. You are encouraged to read the fairness opinions, supplementary simulation (sensitivity analysis) presentation and the financial analysis report as of September 26, 2018, which are included elsewhere in this prospectus, in their entirety.

A successful legal challenge to the validity of the share exchange following its completion may invalidate the shares of Alps Electric issued in the share exchange.

Until six months after the effective date of the share exchange, any of Alps Electric’s or Alpine’s shareholders and directors or liquidators as of the effective date of the share exchange may bring a court action to nullify the share exchange. ALPS ALPINE’s or Alps Electric’s shareholders, directors, liquidators, bankruptcy trustees or creditors who did not approve the share exchange may also bring a court action to nullify the share exchange until six months after the effective date of the share exchange. A court may nullify the share exchange if it finds that a material procedural defect occurred in connection with the share exchange. If any court action challenging the validity of the share exchange is brought, the price or liquidity of ALPS ALPINE’s shares may be adversely affected, regardless of the merits of the claim. Moreover, if such a court action is successful and a court enters a final and binding judgment, the share exchange would be nullified, and the Alps Electric shares issued in the exchange would be invalidated.