EXHIBIT 10.8

AMENDMENT NO. 1 TO LOAN AND SECURITY AGREEMENT

AMENDMENT NO. 1 TO LOAN AND SECURITY AGREEMENT, dated June 19, 2003, entered into by and among Congress Financial Corporation (Florida), a Florida corporation, in its capacity as agent acting for and on behalf of the parties to the Loan Agreement (as hereinafter defined) as lenders (in such capacity, “Agent”), the parties to the Loan Agreement as lenders (individually a “Lender” and collectively, “Lenders”), Supreme International, Inc., a Delaware corporation (“Supreme”) and Jantzen, Inc., a Delaware corporation (“Jantzen”, and together with Supreme, each individually an “Existing Borrower” and collectively, “Existing Borrowers”), Salant Corporation, a Delaware corporation (“Salant”), Salant Holding Corporation, a Delaware corporation (“Salant Holding”, and together with Salant, each individually a “New Borrower” and collectively, “New Borrowers”), Perry Ellis International, Inc., a Florida corporation (“Parent”), PEI Licensing, Inc., a Delaware corporation (“PEI Licensing”), Jantzen Apparel Corp., a Delaware corporation (“Jantzen Apparel”), BBI Retail, L.L.C., a Florida limited liability company (“BBI”), Supreme I Real Estate, LLC, a Florida limited liability company (“Supreme I”), Supreme II Real Estate, LLC, Florida limited liability company (“Supreme II”), Supreme Realty, LLC, a Florida limited liability company (“Supreme Realty”), Supreme Munsingwear Canada Inc., a Canada corporation (“Supreme Canada”), and Perry Ellis Real Estate Corporation, a Delaware corporation (“PE Real Estate”, and together with Parent, PEI Licensing, Jantzen Apparel, BBI, Supreme I, Supreme II, Supreme Realty and Supreme Canada, each individually a “Guarantor” and collectively, “Guarantors”).

W I T N E S S E T H :

WHEREAS, Agent, Lenders, Existing Borrowers and Guarantors have entered into financing arrangements pursuant to which Lenders (or Agent on behalf of Lenders) have made and may make loans and advances and provide other financial accommodations to Existing Borrowers as set forth in the Loan and Security Agreement, dated October 1, 2002, by and among Agent, Lenders, Existing Borrowers and Guarantors (as amended hereby and as the same may hereafter be further amended, modified, supplemented, extended, renewed, restated or replaced, the “Loan Agreement”, and together with all agreements, documents and instruments at any time executed and/or delivered in connection therewith or related thereto, as from time to time amended, modified, supplemented, extended, renewed, restated, or replaced, collectively, the “Financing Agreements”);

WHEREAS, Parent has created a newly formed wholly owned subsidiary, Connor Acquisition Corp. (“Connor” as hereinafter further defined), which is to merge with and into Salant with Salant as the surviving corporation, with the shares of capital stock of Connor converted into the shares of the surviving corporation (so that the surviving corporation shall be a wholly owned subsidiary of Parent) and the shares of Salant as the surviving corporation converted into the right to receive certain merger consideration consisting of cash and shares of capital stock of Parent, all as set forth in, and pursuant to, the Merger Agreements (as hereinafter defined);

WHEREAS, Existing Borrowers, New Borrowers and Guarantors have requested that Agent and Lenders amend the Loan Agreement to provide for Agent and Lenders to make loans and advances and provide other financial accommodations to each New Borrower under the terms and conditions of the Loan Agreement and that each New Borrower becomes an additional Borrower under the Loan Agreement, as amended hereby, and in connection therewith have requested that the Loan Agreement be amended in order to (1) consent to the formation by Parent of Connor, (2) consent to the merger of Connor with and into Salant, (3) add each New Borrower as an additional Borrower, subject to the provisions set forth herein and in the Loan Agreement, (4) add the grant by New Borrower and New Guarantor to Agent, for itself and the benefit of Lenders, of a security interest in and lien upon the assets and properties of such New Borrower to secure the payment and performance of all obligations of each of them to Agent and Lenders, and (5) make certain other amendments to the Loan Agreement; and

WHEREAS, by this Amendment No. 1, Agent, Lenders, Existing Borrowers, New Borrowers and Guarantors desire and intend to evidence such consent and amendments.

NOW, THEREFORE, In consideration of the foregoing, the mutual agreements and covenants contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1.Definitions.

1.1Additional Definitions. As used herein, the following terms shall have the meanings given to them below, and the Loan Agreement and the other Financing Agreements are hereby amended to include, in addition and not in limitation, the following definitions:

(a) “Amendment No. 1” shall mean Amendment No. 1 to Loan and Security Agreement as the same now exists or may hereafter be amended, modified, supplemented, extended, renewed, restated or replaced.

(b) “Commercial Letter of Credit” shall mean any Letter of Credit Accommodation consisting of a letter of credit issued for the purpose of providing the primary manner of payment for the purchase price of goods or services by a Borrower in the ordinary course of the business of such Borrower.

(c) “Connor” shall mean Connor Acquisition Corp., a Delaware corporation, and its successors and assigns.

(d) “Existing Salant Lenders” shall mean the lenders to a New Borrower listed on Exhibit A hereto (and including The CIT Group/Commercial Services, Inc. in its capacity as agent acting for such lenders) and their respective predecessors, successors and assigns; sometimes referred to herein individually as an “Existing Salant Lender”.

(e) “Existing Salant Letters of Credit” shall mean, collectively, the letters of credit issued for the account of a New Borrower or for which such New Borrower is otherwise liable, as listed on Exhibit B hereto, as the same now exist or may hereafter be amended, modified,

2

supplemented, extended, renewed, restated or replaced; sometimes referred to herein individually as an “Existing Salant Letter of Credit”.

(f) “LC Indemnification Agreement” shall mean the Letter of Credit Indemnification Agreement, dated of even date herewith, between Agent and The CIT Group/ Commercial Services, Inc. in its capacity as agent for the Existing Salant Lenders with respect to certain of the Existing Salant Letters of Credit, as the same now exists or may hereafter be amended, modified, supplemented, extended, renewed, restated or replaced.

(g) “Merger” shall mean the merger of Connor with and into Salant, with Salant as the surviving corporation, pursuant to and in accordance with the terms of the Merger Agreements.

(h) “Merger Agreements” shall mean, collectively, the following (as the same now exist or may hereafter be amended, modified, supplemented, extended, renewed, restated, or replaced): (i) the Agreement and Plan of Merger dated February 3, 2003, by and among Connor, Salant and Parent and (ii) all other agreements, documents or instruments executed or delivered in connection therewith.

(i) “Salant” shall mean Salant Corporation, a Delaware corporation, and its successors and assigns.

(j) “Salant Holding” shall mean Salant Holding Corporation, a Delaware corporation, and its successors and assigns.

(k) “Salant Supplemental Financing Agreements” shall mean, collectively, the following (as the same now exist or may hereafter be amended, modified, supplemented, extended, renewed, restated, or replaced): (i) the Guarantee by Existing Borrowers, Salant Holding and Guarantors in favor of Agent, for itself and the benefit of Lenders, with respect to the Obligations of Salant, (ii) the Guarantee by Existing Borrowers, Salant and Guarantors in favor of Agent, for itself and the benefit of Lenders, with respect to the Obligations of Salant Holding, (iii) the Pledge and Security Agreement by Parent in favor of Agent with respect to all of the issued and outstanding shares of Salant, (iv) the Pledge and Security Agreement by Salant in favor of Agent with respect to all of the issued and outstanding shares of Salant Holding, (v) the Trademark Collateral Assignment and Security Agreement by Salant in favor of Agent, (vi) the Trademark Collateral Assignment and Security Agreement by Salant Holding in favor of Agent, (vii) the Deposit Account Control Agreements by and among Agent, each New Borrower and the depository bank at which the deposit accounts of such New Borrower are maintained, and (viii) all other agreements, documents and instruments executed and/or delivered in connection with this Amendment No.1 and any of the foregoing.

(l) “Special Reserve” shall mean a Reserve in the amount of $1,000,000 established by Agent as of the date hereof.

1.2Amendments to Definitions.

3

(a) All references to the term “Applicable Margin” in the Loan Agreement and each such reference is hereby amended to mean, at any time, as to the Interest Rate for Prime Rate Loans and the Interest Rate for Eurodollar Rate Loans the applicable percentage (on a per annum basis) set forth below if either (i) the sum of: (A) the Quarterly Average Excess Availability for the immediately preceding fiscal quarter plus (B) the Excess Cash as of the last day of the immediately preceding fiscal quarter is at or within the amounts indicated for such percentage or (ii) the Leverage Ratio as of the last day of the immediately preceding fiscal quarter (which ratio for this purpose shall be calculated based on the four (4) immediately preceding fiscal quarters) is at or within the levels indicated for such percentage:

| | | | | | | | | | | | |

Tier | | Quarterly Average Excess Availability plus Excess Cash | | Leverage Ratio | | Applicable

Prime

Rate Margin | | | Applicable

Eurodollar

Rate Margin | |

| 1 | | $45,000,000 or more | | 2.00 to 1.00 or less | | | 0 | % | | | 2 | % |

| 2 | | Greater than or equal to $35,000,000 and less than $45,000,000 | | Greater than 2.00 to 1.00 but equal to or less than 3.00 to 1.00 | | | 0 | % | | | 2 1/4 | % |

| 3 | | Greater than or equal to $25,000,000 and less than $35,000,000 | | Greater than 3.00 to 1.00 but equal to or less than 4.00 to 1.00 | | | 1/4 | % | | | 2 1/2 | % |

| 4 | | Less than $25,000,000 | | Greater than 4.00 to 1.00 | | | 1/2 | % | | | 2 3/4 | % |

provided,that, (A) the Applicable Margin shall be calculated and established once each fiscal quarter (commencing with the fiscal quarter ending on October 31, 2003) and shall remain in effect until adjusted thereafter at the end of the next quarter and (B) the Applicable Margin shall be the lower percentage set forth above based on (1) the sum of the Quarterly Average Excess Availability and the Excess Cash as provided above or (2) the Leverage Ratio.

(b) All references to the term “Borrower” or “Borrowers” in the Loan Agreement or any of the other Financing Agreements and each such reference is hereby amended to include, in addition and not in limitation, each New Borrower.

(c) All references to the term “Collateral” in the Loan Agreement and each such reference is hereby amended to include, in addition and not in limitation, the assets and properties of New Borrowers at any time subject to the security interest or lien of Agent for itself and the benefit of Lenders, including the assets and properties described in Section 9 of this Amendment No. 1.

(d) The reference to the amount of “$5,000,000” in the definition of the term “Eligible Factor Receivables” in the Loan Agreement is hereby deleted and the amount of “$20,000,000” substituted therefor.

4

(e) All references to the term “Factoring Agreements” in the Loan Agreement and any of the other Financing Agreements and each such reference is hereby amended to include, in addition and not in limitation, the following in each case as the same now exist or may hereafter be amended, modified, supplemented, extended, renewed, restated or replaced: (i) the Non-Notification Factoring Agreement, dated on or about the date hereof, between The CIT Group/Commercial Services, Inc. and Salant, and all agreements, documents and instruments at any time executed and/or delivered by any Borrower or Guarantor in connection therewith; and (ii) the Non-Notification Factoring Agreement, dated on or about the date hereof, between The CIT Group/Commercial Services, Inc. and Salant Holding, and all agreements, documents and instruments at any time executed and/or delivered by any Borrower or Guarantor in connection therewith.

(f) All references to the term “Fee Letter” in the Loan Agreement and any of the other Financing Agreements and each such reference is hereby amended to include, in addition and not in limitation, the letter agreement, dated January 17, 2003, by and among Existing Borrowers, Guarantors and Agent, setting forth certain fees payable by Borrowers to Agent for the benefit of itself and Lenders, as the same now exists or may hereafter be amended, modified, supplemented, extended, renewed, restated or replaced.

(g) All references to the term “Financing Agreements” in the Loan Agreement and any of the other Financing Agreements and each such reference is hereby amended to include, in addition and not in limitation, collectively, this Amendment No. 1 and the Salant Supplemental Financing Agreements.

(h) All references to the term “Information Certificate” in the Loan Agreement or any of the other Financing Agreements and each such reference is hereby amended to mean the Amended and Restated Information Certificate with respect to Borrowers (including New Borrowers) and Guarantors included with this Amendment No. 1 as Exhibit C hereto.

(i) All references to the term “Interest Rate” in the Loan Agreement or any of the other Financing Agreements and each such reference is hereby amended to mean:

(i) Prior to June 19, 2003, subject to clauses (ii) and (iii) below:

(A) as to Prime Rate Loans, a rate equal to one-quarter ( 1/4%) percent in excess of the Prime Rate;

(B) as to Eurodollar Rate Loans, a rate equal to two and one-half (2 1/2%) percent per annum in excess of the Adjusted Eurodollar Rate (in each case, based on the Eurodollar Rate applicable for the relevant Interest Period, whether such rate is higher or lower than any rate previously quoted to a Borrower).

(ii) Subject to clause (iii) below, effective as of the first (1st) day of the second month of each fiscal quarter (commencing with the fiscal quarter ending on October 31, 2003), the Interest Rate payable by each Borrower shall be increased or decreased, as the case may be, (A) as to Prime Rate Loans, to the rate equal to the Applicable Margin for Prime Rate Loans on a

5

per annum basis in excess of the Prime Rate, and (B) as to Eurodollar Rate Loans, to the rate equal to the Applicable Margin for Eurodollar Rate Loans on a per annum basis in excess of the Adjusted Eurodollar Rate.

(iii) Notwithstanding anything to the contrary contained in clauses (i) or (ii) above, the Applicable Margin otherwise used to calculate the Interest Rate for Prime Rate Loans and Eurodollar Rate Loans shall be the highest percentage set forth in the definition of the term Applicable Margin for each category of Loans (without regard to the amount of Quarterly Average Excess Availability or the Leverage Ratio) plus two (2%) percent per annum, at Agent’ s option, (A) for the period (1) from and after the effective date of termination or non-renewal of the Loan Agreement until Agent and Lenders have received full and final payment of all outstanding and unpaid Obligations which are not contingent and cash collateral or letter of credit, as Agent may specify, in the amounts and on the terms required under Section 13.1 of the Loan Agreement for contingent Obligations (notwithstanding entry of a judgment against any Borrower or Guarantor) and (2) from and after the date of the occurrence of an Event of Default and for so long as such Event of Default is continuing and (B) on Loans to a Borrower at any time outstanding in excess of the Borrowing Base of such Borrower (whether or not such excess(es) arise or are made with or without the knowledge or consent of Agent or any Lender and whether made before or after an Event of Default).

(j) All references to the term “Inventory Loan Limit” in the Loan Agreement or any of the other Financing Agreements and each such reference is hereby amended to mean $60,000,000.

(k) All references to the term “Letter of Credit Facility Agreements” in the Loan Agreement and any of the other Financing Agreements and each such reference is hereby amended to include, in addition and not in limitation, the following in each case as the same now exist or may hereafter be amended, modified, supplemented, extended, renewed, restated or replaced: (i) the Letter of Credit and Security Agreement, dated on or about the date hereof, by New Borrowers and Israel Discount Bank of New York and the General Security Agreement, dated on or about the date hereof, between New Borrowers and Israel Discount Bank of New York; (ii) the Commitment Letter, dated on or about the date hereof, by and among New Borrowers and CommerceBank, N.A. and the Commercial Security Agreement, dated on or about the date hereof, by New Borrowers in favor of CommerceBank, N.A.; and (iii) the Continuing Letter of Credit Agreement, dated on or about the date hereof, by and among New Borrowers and HSBC Bank USA and the General Security Agreement, dated on or about the date hereof, by and among New Borrowers and HSBC Bank USA.

(l) All references to the term “Maximum Credit” in the Loan Agreement or any of the other Financing Agreements and each such reference is hereby amended to mean $110,000,000.

(m) All references to the term “Reserves” in the Loan Agreement or any of the other Financing Agreements and each such reference is hereby amended to include, in addition and not in limitation, the Special Reserve, except that for purposes of calculating the Excess Availability

6

as such term is used in the Loan Agreement, the Special Reserve shall not be considered in such calculation.

(n) All references to the term “The CIT Group/Commercial Services, Inc. (as successor to Congress Talcott Corporation)” in the Loan Agreement or any of the other Financing Agreements and each such reference is hereby amended to mean The CIT Group/Commercial Services, Inc. and its successors and assigns.

1.3Interpretation. For purposes of this Amendment No. 1, unless otherwise defined herein, all capitalized terms used herein which are defined in the Loan Agreement shall have the meanings given to such terms in the Loan Agreement.

2.Consent. Subject to the terms and conditions contained herein, to the extent such consent is or may be required under the Loan Agreement, Agent and Lenders hereby consent to: (a) the formation by Parent of Connor as a wholly-owned Subsidiary of Parent formed solely for the purpose of merging with Salant pursuant to the Merger and (b) the Merger.

3.Assumption of Obligations; Amendments to Guarantees and Financing Agreements.

3.1 Each New Borrower hereby expressly (a) assumes and agrees to be directly liable to Agent and Lenders, jointly and severally with Existing Borrowers, for all Obligations under, contained in, or arising pursuant to the Loan Agreement or any of the other Financing Agreements applicable to Existing Borrowers and as applied to such New Borrower as a Borrower, (b) agrees to perform, comply with and be bound by all terms, conditions and covenants of the Loan Agreement and the other Financing Agreements applicable to Existing Borrowers as applied to such New Borrower, with the same force and effect as if such New Borrower had originally executed and been an original Borrower signatory to the Loan Agreement and the other Financing Agreements, (c) each New Borrower is deemed to make as to itself and the Existing Borrowers, and is, in all respects, bound by all representations and warranties made by Existing Borrowers to Agent and Lenders set forth in the Loan Agreement or in any of the other Financing Agreements, and (d) agrees that Agent, for itself and the benefit of Lenders, shall have all rights, remedies and interests, including security interests in and liens upon the Collateral granted to Agent pursuant to Section 9 hereof, under and pursuant to the Loan Agreement and the other Financing Agreements, with respect to such New Borrower and its properties and assets with the same force and effect as Agent, for itself and the benefit of Lenders, has with respect to Existing Borrowers and their respective assets and properties, as if such New Borrower had originally executed and had been an original Borrower signatory, as the case may be, to the Loan Agreement and the other Financing Agreements.

3.2 Each Existing Borrower, in its capacity as a Guarantor of the payment and performance of the Obligations of the other Existing Borrowers, and each Guarantor hereby agrees that each of the Guarantees, dated October 1, 2002, by the Existing Borrowers and Guarantors in favor of Agent (collectively, the “Existing Guarantees”) is hereby amended to include New Borrowers as additional guarantor party signatories thereto, and each New Borrower hereby agrees that the Existing Guarantees are hereby amended to include such New Borrower as additional guarantor party signatories thereto. Each New Borrower hereby expressly (a) assumes and agrees to be

7

directly liable to Agent and Lenders, jointly and severally with Guarantors and Existing Borrowers signatories thereto, for payment and performance of all Obligations (as defined in the Existing Guarantees), (b) agrees to perform, comply with and be bound by all terms, conditions and covenants of the Existing Guarantees with the same force and effect as if such New Borrower had originally executed and been an original party signatory to each of the Existing Guarantees as a Guarantor, and (c) agrees that Agent and Lenders shall have all rights, remedies and interests with respect to such New Borrower and its property under the Existing Guarantees with the same force and effect as if such New Borrower had originally executed and been an original party signatory as a Guarantor to each of the Existing Guarantees.

4.Loans. Section 2.1(b)(iii) of the Loan Agreement is hereby amended by deleting the reference therein to “$40,000,000” and substituting the amount of “$60,000,000” therefor.

5.Letter of Credit Accommodations.

5.1 Section 2.2(b) of the Loan Agreement is hereby deleted in its entirety and the following substituted therefor:

“(b) In addition to any charges, fees or expenses charged by any bank or issuer in connection with the Letter of Credit Accommodations, Borrowers shall pay to Agent, for the benefit of Lenders, (i) a letter of credit fee at a rate equal to one (1%) percent per annum on the daily outstanding balance of the Letter of Credit Accommodations consisting of Commercial Letters of Credit for the immediately preceding month (or part thereof), payable in arrears as of the first day of each succeeding month and (ii) a letter of credit fee at a rate equal to two (2%) percent per annum on the daily outstanding balance of all other Letter of Credit Accommodations for the immediately preceding month (or part thereof), payable in arrears as of the first day of each succeeding month,except that Agent may, and upon the written direction of Required Lenders shall, require Borrowers to pay to Agent for the benefit of Lenders such letter of credit fee at a rate equal to three (3%) percent per annum on the daily outstanding balance of the Letter of Credit Accommodations consisting of Commercial Letters of Credit and at a rate equal to four (4%) percent per annum on the daily outstanding balance of all other Letter of Credit Accommodations for: (A) the period from and after the date of termination hereof until Agent and Lenders have received full and final payment of all Obligations (notwithstanding entry of a judgment against any Borrower) and (B) the period from and after the date of the occurrence of an Event of Default for so long as such Event of Default is continuing as determined by Agent. Such letter of credit fee shall be calculated on the basis of a three hundred sixty (360) day year and actual days elapsed and the obligation of Borrowers to pay such fee shall survive the termination of this Agreement.”

5.2 Section 2.2(e) of the Loan Agreement is hereby amended to delete the reference to the amount of “$30,000,000” therein and substitute the amount of “$60,000,000” therefor.

8

6.Fees. Section 3.2(a) of the Loan Agreement is hereby deleted in its entirety and the following substituted therefor:

“(a) Borrowers shall pay to Agent for the benefit of Lenders monthly an unused line fee at a rate equal to the percentage (on a per annum basis) set forth below calculated upon the amount by which $45,000,000 prior to June 19, 2003 and $80,000,000 on and after June 19, 2003 exceeds the average daily principal balance of the outstanding Loans and Letter of Credit Accommodations during the immediately preceding month (or part thereof) while this Agreement is in effect and for so long thereafter as any Obligations are outstanding. Such fee shall be payable on the first day of each month in arrears. The percentage used for determining the unused line fee shall be one-quarter ( 1/4%) percent until April 30, 2003 and three-eighths ( 3/8%) percent thereafter,provided,that, effective as of the first (1st) day of the second month of each fiscal quarter (commencing with the fiscal quarter ending on October 31, 2003), the percentage used for determining the unused line fee shall be as set forth below if either (i) the sum of the Quarterly Average Excess Availability for the immediately preceding fiscal quarter plus the Excess Cash as of the last day of the immediately preceding fiscal quarter is at or within the amounts indicated for such percentage or (ii) the Leverage Ratio as of the last day of the immediately preceding fiscal quarter (which ratio for this purpose shall be calculated based on the four (4) immediately preceding fiscal quarters) is at or within the levels indicated for such percentage:

| | | | | | |

Quarterly Average Excess Availability plus Excess Cash | | Leverage Ratio | | Unused Line

Fee Percentage | |

$45,000,000 or more | | 2.00 to 1.00 or less | | | 1/4 | % |

Greater than or equal to $35,000,000 and less than $45,000,000 | | Greater than 2.00 to 1.00 but equal to or less than 3.00 to 1.00 | | | 1/4 | % |

Greater than or equal to $25,000,000 and less than $35,000,000 | | Greater than 3.00 to 1.00 but equal to or less than 4.00 to 1.00 | | | 3/8 | % |

Less than $25,000,000 | | Greater than 4.00 to 1.00 | | | 3/8 | % |

provided,that, (A) the unused line fee percentage shall be calculated and established once each fiscal quarter (commencing with the fiscal quarter ending on or after October 31, 2003) and (B) the unused line fee percentage shall be the lower percentage set forth above based on (1) the sum of the Quarterly Average Excess Availability plus the Excess Cash as provided above or (2) the Leverage Ratio.”

9

7.Collection of Accounts. Section 6.3(a)(ii) of the Loan Agreement is hereby amended to delete the amount of “$20,000,0000” referred to therein and substitute “$35,000,000” therefor.

8.Sharing of Payments, Etc. Section 6.9 of the Loan Agreement is hereby amended to add a new Section 6.9(e) at the end thereof as follows:

“(e) Nothing contained in this Section 6.9 shall be construed to require that a Lender acting in its capacity as a Factor to the extent permitted hereunder who has purchased any accounts receivable owing by a Borrower or Guarantor to a third party share any payments received by it as a Factor in respect of such accounts receivable with any other Lender pursuant to the terms of this Section 6.9.”

9.Grant of Security Interest by New Borrowers.

9.1 Without limiting the provisions of Section 3 hereof, the Loan Agreement and the other Financing Agreements, to secure payment and performance of all of its Obligations, each New Borrower hereby grants to Agent, for itself and the benefit of Lenders, a continuing security interest in, a lien upon, and a right of set off against, and each New Borrower hereby assigns to Agent, for itself and the benefit of Lenders, as security all personal property and interests in personal property of such New Borrower, whether now owned or hereafter acquired or existing, and wherever located, including:

(a) all Accounts;

(b) all general intangibles, including, without limitation, all Intellectual Property;

(c) all goods, including, without limitation, Inventory and Equipment;

(d) all chattel paper, including, without limitation, all tangible and electronic chattel paper;

(e) all instruments, including, without limitation, all promissory notes;

(f) all documents;

(g) all deposit accounts;

(h) all letters of credit, banker’s acceptances and similar instruments for which such New Borrower is a beneficiary or otherwise entitled to any payment (contingent or otherwise), and including all letter-of-credit rights;

(i) all supporting obligations and all present and future liens, security interests, rights, remedies, title and interest in, to and in respect of Receivables and other Collateral, including (i) rights and remedies under or relating to guaranties, contracts of suretyship, letters of credit and credit and other insurance related to the Collateral, (ii) rights of stoppage in transit, replevin, repossession, reclamation and other rights and remedies of an unpaid vendor, lienor or secured

10

party, (iii) goods described in invoices, documents, contracts or instruments with respect to, or otherwise representing or evidencing, Receivables or other Collateral, including returned, repossessed and reclaimed goods, and (iv) deposits by and property of account debtors or other persons securing the obligations of account debtors;

(j) all (i) investment property (including securities, whether certificated or uncertificated, securities accounts, security entitlements, commodity contracts or commodity accounts) and (ii) monies, credit balances, deposits and other property of such New Borrower now or hereafter held or received by or in transit to Agent, any Lender or its Affiliates or at any other depository or other institution from or for the account of such New Borrower, whether for safekeeping, pledge, custody, transmission, collection or otherwise;

(k) all commercial tort claims, including, without limitation, those identified in the Information Certificate;

(l) to the extent not otherwise described above, all Receivables;

(m) all Records; and

(n) all products and proceeds of the foregoing, in any form, including insurance proceeds and all claims against third parties for loss or damage to or destruction of or other involuntary conversion of any kind or nature of any or all of the other Collateral.

9.2 Notwithstanding anything to the contrary contained in this Section 9 above, the types or items of Collateral described in this Section 9 shall not include any rights or interest in any contract, license or license agreement covering personal property of New Borrowers, if under the terms of such contract, license or license agreement, or applicable law with respect thereto, the grant of a security interest or lien therein to Agent is prohibited and such prohibition has not been or is not waived or the consent of the other party to such contract, license or license agreement has not been or is not otherwise obtained;provided,that, the foregoing exclusion shall in no way be construed (a) to apply if any such prohibition is unenforceable under the UCC or other applicable law or (b) so as to limit, impair or otherwise affect Agent’s unconditional continuing security interests in and liens upon any rights or interests of such New Borrower in or to monies due or to become due under any such contract, license or license agreement (including any Receivables).

9.3 In the event that Agent has not received evidence in form and substance satisfactory to Agent that each of the Subsidiaries of Salant set forth on Exhibit D hereto have been liquidated and dissolved to the extent permitted hereunder and the assets thereof validly transferred and assigned to a Borrower or Guarantor by October 31, 2003, promptly upon the request of Agent, as to any such Subsidiary which shall not have been so liquidated and dissolved and assets transferred and assigned: (a) Borrowers and Guarantors shall cause each of such Subsidiaries of Salant to execute and deliver to Agent, in form and substance satisfactory to Agent, (i) an absolute and unconditional guarantee of payment of any and all Obligations, (ii) a security agreement granting to Agent a first priority security interest and lien upon all of the assets of such Subsidiary (except as otherwise consented to in writing by Agent), (iii) related Uniform

11

Commercial Code Financing Statements and the authorization to file the same, and (b) the Borrowers and Guarantors that are the owner or holder of the Capital Stock of such Subsidiaries of Salant shall execute and deliver to Agent, in form and substance satisfactory to Agent, (i) a pledge and security agreement granting to Agent a first priority pledge of, security interest in and lien upon, all of the issued and outstanding shares of Capital Stock of such Subsidiary, and (ii) the original stock certificates or other instruments evidencing the Capital Stock of such Subsidiary, together with such stock powers with respect to such Capital Stock as Agent may request, and (c) Borrowers and Guarantors shall execute and deliver, or shall cause to be executed and delivered, such other agreements, documents and instruments as Agent may require, including, but not limited to, supplements and amendments hereto and other loan agreements or instruments evidencing indebtedness of such Subsidiary to Agent, including such opinion letters of counsel with respect to such guarantee, security agreements and related matters as Agent may request.

9.4 In the event that Agent does not receive evidence, in form and substance satisfactory to Agent, that all of the deposit accounts of New Borrower maintained at SunTrust Bank have been closed and are no longer receiving any checks or other items, by October 31, 2003, promptly upon Agent’s request, Borrowers and Guarantors shall cause to be executed and delivered Deposit Account Control Agreements with respect to any such deposit accounts, duly authorized, executed and delivered by SunTrust Bank and such New Borrower.

9.5 In the event that Agent does not receive evidence, in form and substance satisfactory to Agent, that all of the deposit accounts of each New Borrower maintained at JPMorgan Chase Bank as set forth in the Information Certificate or otherwise have been closed and are no longer receiving any checks or other items, by October 31, 2003, promptly upon Agent’s request, Borrowers and Guarantors shall cause to be executed and delivered Deposit Account Control Agreements with respect to any such deposit accounts, duly authorized, executed and delivered by JPMorgan Chase Bank and such New Borrower.

10.Use of Proceeds. Notwithstanding anything to the contrary contained in the Loan Agreement, Borrowers shall use a portion of the proceeds of the Loans for payments of the merger consideration required to be paid to the shareholders of Salant pursuant to and in accordance with the terms of the Merger Agreements as in effect on the date hereof and cost, expenses and fees in connection with the preparation, negotiation, execution and delivery of this Amendment No. 1.

11.Priority of Liens. Notwithstanding anything to the contrary contained in Section 5.2 or Section 8.4 of the Loan Agreement, the security interests and liens granted to Agent under this Amendment No. 1 or any of the other Financing Agreements in the deposit accounts of Salant and Salant Holding used for retail store locations, the deposit accounts at SunTrust Bank, N.A. and JPMorgan Chase Bank of Salant and the deposit accounts of the Subsidiaries of Salant organized under the laws of a jurisdiction outside of the United States of America, in each case as listed on the Information Certificate shall be valid but not perfected security interests in and liens upon such deposit accounts.

12.Sale of Assets, Consolidation, Merger, Dissolution, Etc.

12

12.1 Section 9.7(c) of the Loan Agreement is hereby deleted in its entirety and the following substituted therefor:

“(c) wind up, liquidate or dissolveexceptthat any Guarantor (other than Parent) or any Subsidiary of Salant (other than Salant Holding) may wind up, liquidate and dissolve,provided,that, each of the following conditions is satisfied, (i) the winding up, liquidation and dissolution of such Guarantor or Subsidiary shall not violate any law or any order or decree of any court or other Governmental Authority in any material respect and shall not conflict with or result in the breach of, or constitute a default under, any indenture, mortgage, deed of trust, or any other agreement or instrument to which any Borrower, Guarantor or Subsidiary is a party or may be bound, (ii) such winding up, liquidation or dissolution shall be done in accordance with the requirements of all applicable laws and regulations, (iii) effective upon such winding up, liquidation or dissolution, all of the assets and properties of such Guarantor or Subsidiary shall be duly and validly transferred and assigned to a Borrower or another Guarantor, free and clear of any liens, restrictions or encumbrances other than the security interest and liens of Agent (and Agent shall have received such evidence thereof as Agent may reasonably require) and Agent shall have received copies of such deeds, assignments or other agreements as Agent may request to evidence and confirm the transfer of such assets of such Guarantor or Subsidiary to a Borrower or Guarantor, (iv) Agent shall have received all documents and agreements that any Borrower, Guarantor or Subsidiary has filed with any Governmental Authority or as are otherwise required to effectuate such winding up, liquidation or dissolution, (v) no Borrower or Guarantor shall assume any Indebtedness, obligations or liabilities as a result of such winding up, liquidation or dissolution, or otherwise become liable in respect of any obligations or liabilities of the entity that is winding up, liquidating or dissolving, unless such Indebtedness is otherwise expressly permitted hereunder, (vi) Agent shall have received not less than ten (10) Business Days prior written notice of the intention of such Guarantor or Subsidiary (other than any Subsidiary of Salant except Salant Holding) to wind up, liquidate or dissolve, and (vii) as of the date of such winding up, liquidation or dissolution and after giving effect thereto, no Default or Event of Default shall exist or have occurred; or”

13.Minimum EBITDA. Section 9.17 of the Loan Agreement is hereby deleted in its entirety and the following substituted therefor:

“9.17Minimum EBITDA. At any time that the aggregate amount of the Excess Availability is less than $20,000,000, (a) the EBITDA of Parent and its Subsidiaries (on a consolidated basis) for the preceding twelve (12) consecutive months (treated as a single accounting period) as of the end of the most recent fiscal month for which Agent or any Lender has received financial statements of Borrowers or Guarantors, shall be not less than $40,000,000 (after giving effect to the EBITDA of Salant and its Subsidiaries on a pro forma basis in a manner satisfactory to Agent) and (b) the EBITDA of Parent and its Subsidiaries (on a consolidated basis) as of

13

the end of the most recent two (2) fiscal months, on a combined basis, for which Agent or any Lender has received financial statements of Borrowers or Guarantors shall be positive.”

14.Assignments; Participations. Agent hereby confirms that its consent to the assignment by a Lender of a portion of such Lender’s rights and obligations under the Loan Agreement to one or more Eligible Transferees as required under Section 13.7(a) of the Loan Agreement shall not be unreasonably withheld.

15.Existing Salant Letters of Credit.

15.1 Borrowers and Guarantors confirm and acknowledge that Agent, on behalf of Lenders, and for the account of Borrowers and Guarantors, has agreed to indemnify and reimburse the Existing Salant Lenders for certain liabilities of the Existing Salant Lenders in connection with or related to certain of the Existing Salant Letters of Credit as set forth in the LC Indemnification Agreement. Without limiting any other rights of Agent and Lenders or other obligations and liabilities of Borrowers and Guarantors, each Borrower shall reimburse Agent on demand (or, at its option, Agent may charge the loan account of any Borrower or Guarantor) for all liability, loss, costs, damage or expense (including, but not limited to, attorneys’ fees and expenses) which Agent or any Lender may suffer or incur by reason of any reimbursement or payment to any Existing Salant Lender in connection with the Existing Salant Letters of Credit or any other cause or matter arising out of or relating to the LC Indemnification Agreement. The Existing Salant Letters of Credit that are subject to the LC Indemnification Agreement shall constitute Letter of Credit Accommodations and shall be subject to a Reserve in the full amount of the liability of Agent to the Existing Salant Lenders (contingent or otherwise) pursuant to the LC Indemnification Agreement. The Reserve shall be reduced to the extent of any payment by Agent to an Existing Salant Lender in respect of or in connection with an Existing Salant Letter of Credit and, except as Agent may otherwise determine, shall not terminate as to any undrawn amounts under an Existing Salant Letter of Credit (and interest and fees related thereto) until Agent shall receive the written agreement of Existing Salant Lenders (or the agent on their behalf), in form and substance satisfactory to Agent, that Agent and Lenders have no further liability to Existing Salant Lenders in respect thereof.

15.2 Agent is irrevocably authorized to pay any Existing Salant Lender any amounts demanded by such Existing Salant Lender under the LC Indemnification Agreement without regard to any dispute or claim that any Borrrower or Guarantor may have or assert against any Existing Salant Lender or any issuer of any Existing Salant Letter of Credit, Agent or any party to any Existing Salant Letter of Credit and Borrowers and Guarantors shall indemnify and pay to Agent as set forth above, without offset, defense or counterclaim of any kind, nature or description.

15.3 In addition, Agent is transferring the liability to the issuer of certain of the Existing Salant Letters of Credit from the Existing Salant Lenders to Agent (on behalf of Lenders and for the account of Salant) as set forth in the letter agreement, dated of even date herewith, by and among such issuer, The CIT Group/Commercial Services, Inc. as agent for the other Existing Salant Lenders, Agent, Salant and Salant Holding. The Existing Salant Letters of Credit that are

14

so transferred shall constitute Letter of Credit Accommodations and shall be subject to a Reserve in the full amount of the liability of Agent to the issuer thereof (contingent or otherwise).

16.Representations, Warranties and Covenants. Borrowers (including New Borrowers) and Guarantors jointly and severally, represent, warrant and covenant with and to Agent and Lenders as follows, which representations, warranties and covenants shall survive the execution and delivery hereof:

16.1 This Amendment No. 1 and the Salant Supplemental Financing Agreements have been duly authorized, executed and delivered by all necessary action on the part of each Borrower and Guarantor which is a party hereto and thereto and, if necessary, their respective stockholders, and is in full force and effect as of the date hereof, as the case may be, and the agreements and obligations of Borrowers and Guarantors contained herein and therein constitute legal, valid and binding obligations of Borrowers and Guarantors enforceable against them in accordance with their terms except as such enforceability may be limited by (i) bankruptcy, insolvency, reorganization, moratorium or similar laws of general applicability affecting the enforcement of creditors’ rights and (ii) the application of general principles of equity (regardless of whether such enforceability is considered in a proceeding in equity or at law).

16.2 No action of, or filing with, or consent of any Governmental Authority, other than the filing of UCC financing statements, and no approval or consent of any other party, is required to authorize, or is otherwise required in connection with, the execution, delivery and performance of this Amendment No. 1 and the Salant Supplemental Financing Agreements.

16.3 None of the transactions contemplated by this Amendment No. 1 or the Salant Supplemental Financing Agreements are in contravention of any applicable law, or the terms of any agreement to which any Borrower or Guarantor is a party or by which any property of any Borrower or Guarantor is bound.

16.4 As of the date hereof, except as otherwise provided in Section 11 above, Agent has and will have a valid and perfected first priority security interest in the assets of New Borrowers, subject only to the liens indicated on Schedule 8.4 to the Information Certificate and the other liens permitted under Section 9.8 of the Loan Agreement.

16.5 After giving effect to the amendments provided for herein, including the new Information Certificate included with this Amendment No. 1, all of the representations and warranties set forth in the Loan Agreement and the other Financing Agreements, each as amended hereby, are true and correct in all material respects on and as of the date hereof as if made on the date hereof, except to the extent any such representation or warranty is made as of an earlier specified date, in which case such representation or warranty shall have been true and correct as of such date.

16.6 After giving effect to the amendments provided for herein and the Merger and other transactions contemplated hereby and in the Merger Agreements, each Borrower (including each New Borrower) is not insolvent (as such term is defined in the US Bankruptcy Code and any applicable state law) or will not become insolvent, and does not have unreasonably small

15

capital after the consummation of the transactions contemplated hereby and thereby to continue to engage in its business and has not incurred liabilities as a result of the transactions contemplated hereby and thereby that are beyond its ability to pay as such liabilities mature.

16.7 The Merger Agreements and the transactions contemplated thereby have been duly executed, delivered and performed in accordance with their terms, including the fulfillment (not the waiver, except as disclosed and consented to by Agent) of all conditions precedent set forth therein. Pursuant to the Merger Agreements and the transactions contemplated thereby, Parent has acquired and has good and marketable title to all of the issued and outstanding shares of Capital Stock of Salant and Salant has good and marketable title to all of the issued and outstanding shares of Capital Stock of Salant Holding and each of Salant Caribbean, S.A., Birdhill Limited and Salant Far East Limited (except for 5 shares in the case of Salant Caribbean, S.A., which are issued to Erick Sterkel Caal and one share in the case of each of Birdhill Limited and Salant Far East Limited, which are issued to Descona Ltd., a solicitor for the trustee of Salant), free and clear of all claims, liens, pledges and encumbrances of any kind, except as permitted under Section 9.8 of the Loan Agreement. The total amount of the purchase price and other consideration required to be paid by Parent for all of the issued and outstanding shares of Capital Stock of Salant does not exceed $92,000,000.

16.8 All actions and proceedings required by the Merger Agreements, applicable law or regulation (including, but not limited to, compliance with the Hart-Scott-Rodino Anti-Trust Improvements Act of 1976, as amended and all applicable securities laws) have been taken and the transactions contemplated thereby have been duly and validly taken and consummated.

16.9 Agent has, on or before the date hereof, received from Borrowers, true, complete and correct copies of the Merger Agreements, and all notices, instruments, documents and agreements related thereto, including all exhibits and schedules thereto.

16.10 Borrowers and Guarantors shall take such steps and execute and deliver, and cause to be executed and delivered, to Agent, such additional UCC financing statements and termination statements, and other and further agreements, documents and instruments as Agent may require in order to more fully evidence, perfect and protect Agent’s first priority security interest in the Collateral (including the Collateral of New Borrowers).

16.11 Each of the Subsidiaries of Salant set forth on Exhibit D hereto, other than Salant Caribbean, S.A., Birdhill Limited and Salant Far East Ltd., are and shall continue to be inactive and are not engaged in, and shall not engage in, any business or commercial activity or hold or own any assets or properties.

16.12 On or before the date hereof, Ocean Bank has ceased to be a Letter of Credit Issuer. On or before July 31, 2003, (a) all Letter of Credit Facility Agreements with Ocean Bank shall be terminated and of no further force and effect and Ocean Bank shall not have any security interest in or lien upon any of the assets or properties of any Borrower or Guarantor and (b) all UCC financing statements between Ocean Bank as secured party and any Borrower or Guarantor, as debtor filed with any Governmental Authority prior to the date hereof shall have been

16

terminated of record pursuant to termination statements the filing of which were duly authorized by Ocean Bank.

16.13 As of the date hereof, no Default or Event of Default exists or has occurred and is continuing.

17.Conditions Precedent. The effectiveness of the consent and amendments contained herein shall only be effective upon the satisfaction of each of the following conditions precedent in a manner satisfactory to Agent:

17.1 Agent shall have received an executed original or executed original counterparts of this Amendment No. 1 (including all schedules and exhibits hereto) and the Salant Supplemental Financing Agreements, duly authorized, executed and delivered by the respective party or parties hereto;

17.2 Agent shall have received, in form and substance satisfactory to Agent, (a) amendments to the Letter of Credit Intercreditor Agreements providing for the addition of the New Borrowers thereto, and related matters, duly authorized, executed and delivered by the Letter of Credit Issuers and (b) amendments to the Factor Assignment Agreements providing for the addition of the New Borrowers thereto (to the extent that the New Borrowers have been added to or are included in the arrangements with a Factor), and related matters, duly authorized, executed and delivered by the Factors and Borrowers and Guarantors;

17.3 each of the Merger Agreements and the transactions contemplated thereby shall have been or shall be duly authorized, executed and delivered by the respective parties thereto prior to or contemporaneously with the effectiveness thereof;

17.4 all conditions precedent to the obligations of the parties to the Merger Agreements shall have been fulfilled (and not merely waived, except if approved in writing by Agent), at or before the consummation of the Merger;

17.5 all actions and proceedings required by the Merger Agreements, applicable law or regulation and the transactions contemplated thereby shall have been duly and validly taken in accordance with the terms thereof, and all required consents thereto under any agreement, document or instrument to which Borrowers, Salant, Salant Holdings or any of their affiliates is a party or by which any of its or their properties are bound, and all applicable consents or approvals of each Governmental Authority, shall have been obtained and be in full force and effect;

17.6 no court of competent jurisdiction shall have issued any injunction, restraining order or other order which prohibits the consummation of the transactions described in the Merger Agreements or the Financing Agreements or modifies such transactions, and no governmental or other action or proceeding shall have been commenced, seeking any injunction, restraining order or other order which seeks to void or otherwise modify the transactions described in the Merger Agreements or the Financing Agreements;

17

17.7 Agent shall have received UCC, Federal and State tax lien and judgment searches with respect to New Borrowers in all relevant jurisdictions, as determined by Agent;

17.8 Agent shall have received evidence of insurance and loss payee endorsements required under the Loan Agreement and under the other Financing Agreements with respect to New Borrowers, in form and substance satisfactory to Agent, and certificates of insurance policies and/or endorse-ments naming Agent as loss payee;

17.9 the aggregate amount of the Excess Availability of Borrowers as determined by Agent, as of the date hereof, shall be not less than $40,000,000 after giving effect to the Loans made or to be made and Letter of Credit Accommodations issued or to be issued in connection with the Merger and the other transactions contemplated hereunder and the amount of any fees and expenses payable in connection therewith (exceptthat for purposes of this Section 17.9, the calculation of Excess Availability shall be without regard to the limitations of the Maximum Credit and the Loan Limits as to any Borrower for up to the aggregate amount of $10,000,000);

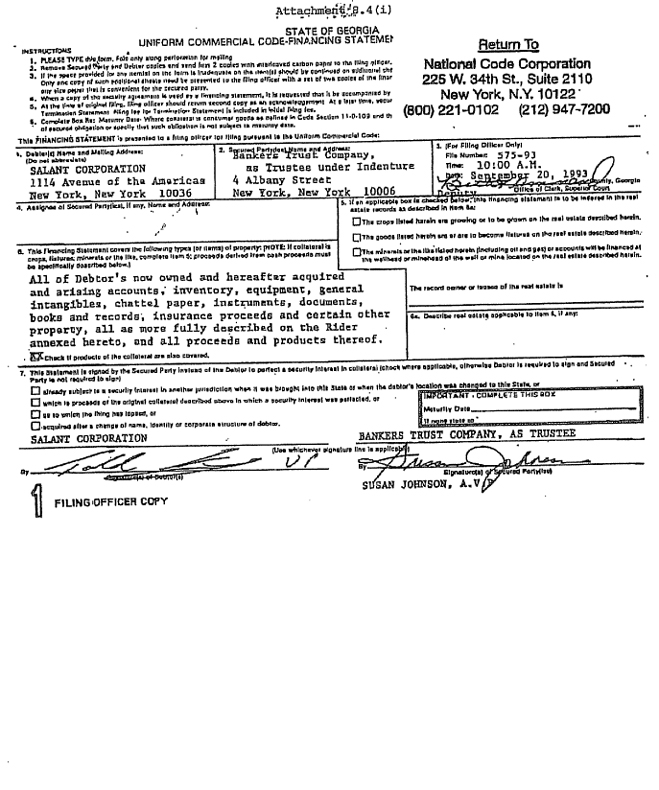

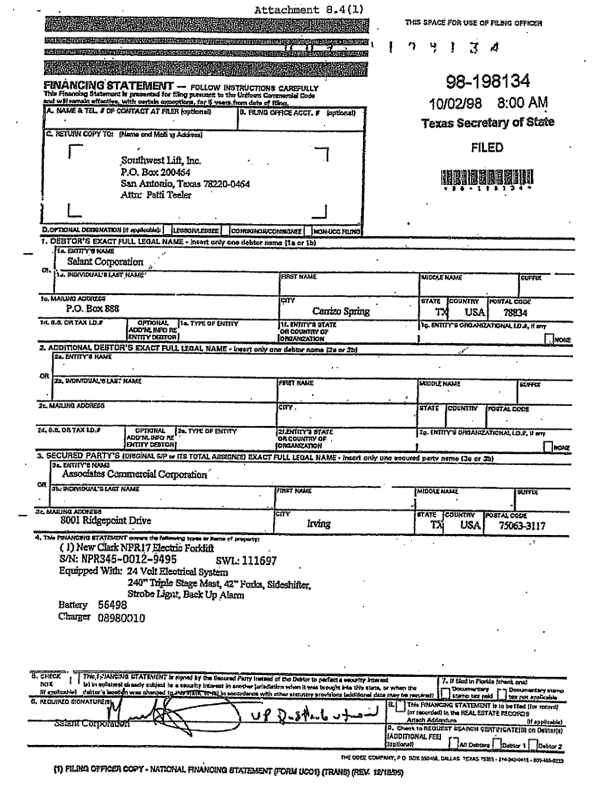

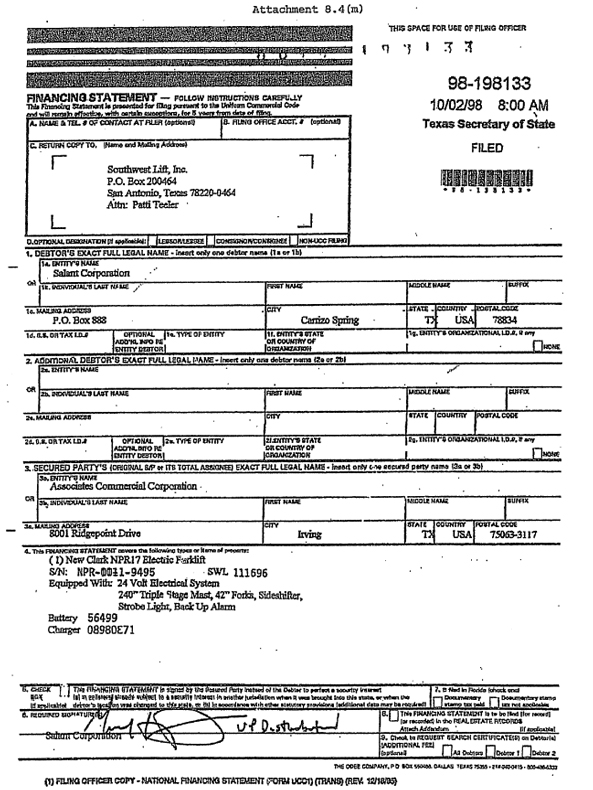

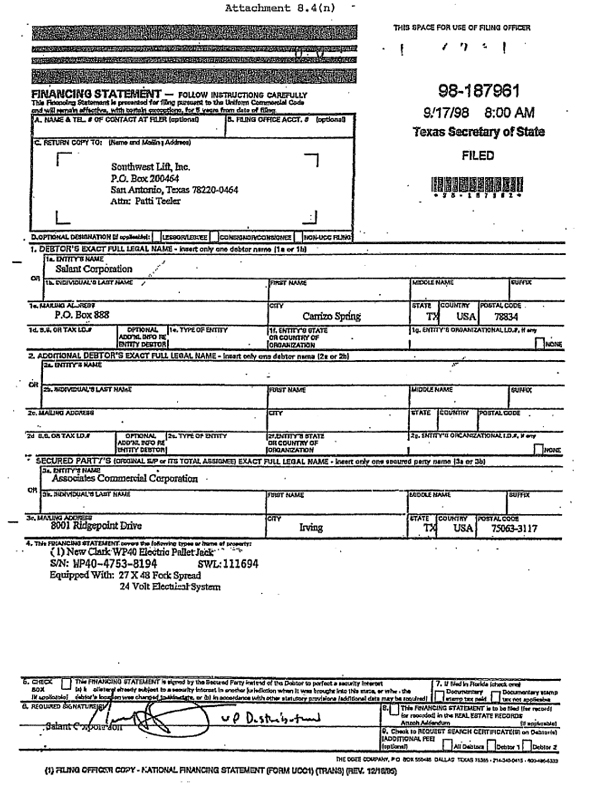

17.10 Agent shall have received, in form and substance satisfactory to Agent, all releases, terminations and such other documents as Agent may request to evidence and effectuate the termination by the Existing Salant Lenders of their respective financing arrangements with Salant and its Subsidiaries and the termination and release by it or them, as the case may be, of any interest in and to any assets and properties of Salant and its Subsidiaries, duly authorized, executed and delivered by it or each of them, including, but not limited to, UCC termination statements for all UCC financing statements previously filed by it or any of them or their predecessors, as secured party and Salant or any of its Subsidiaries, as debtor;

17.11 no material adverse change shall have occurred in the assets, business or prospects of Borrowers and Guarantors since the date of Agent’s latest field examination (not including for this purpose the field review referred to in Section 17.12 below) and no change or event shall have occurred which would impair the ability of any Borrower or Guarantor to perform its obligations hereunder or under any of the other Financing Agreements to which it is a party or of Agent or any Lender to enforce the Obligations or realize upon the Collateral;

17.12 Agent shall have completed a field review of the Records and such other information with respect to the Collateral of Salant and its Subsidiaries as Agent may require to determine the amount of Loans available to Salant and Salant Holding (including, without limitation, current perpetual inventory records and/or roll-forwards of Accounts and Inventory through the date of closing and test counts of the Inventory in a manner satisfactory to Agent, together with such supporting documentation as may be necessary or appropriate, and other documents and information that will enable Agent to accurately identify and verify the Collateral), the results of which in each case shall be satisfactory to Agent, not more than three (3) Business Days prior to the date hereof;

17.13 Agent shall have received evidence, in form and substance satisfactory to Agent, that Agent has a valid perfected first priority security interest in all of the Collateral (other than the Senior Note Priority Collateral, the Letter of Credit Issuer Priority Collateral and certain deposit accounts to the extent set forth in Section 11 hereof) and a valid perfected second priority

18

security interest in all other Collateral (other than certain deposit accounts to the extent set forth in Section 11 hereof);

17.14 Agent shall have received Borrowers’ projected financial statements for the period from the date hereof through January 31, 2004, which shall be prepared on a monthly basis, together with a certificate, dated the date hereof, of the chief financial officer or chief executive officer of Parent stating that such projected financial statements were prepared by such officer of Parent in good faith and are based on assumptions that are believed by such officer in good faith to be reasonable in light of all facts and circumstances known to Parent at such time, all of which shall be reasonably satisfactory to Agent;

17.15 Agent shall have received, in form and substance satisfactory to Agent, all consents, waivers, acknowledgments and other agreements from third persons which Agent may deem necessary or desirable in order to permit, protect and perfect its security interests in and liens upon the Collateral (including the Collateral of New Borrowers) or to effectuate the provisions of this Amendment No.1 and the other Financing Agreements;

17.16 Agent shall have received, in form and substance satisfactory to Agent, the Information Certificate duly authorized, executed and delivered by Borrowers and Guarantors;

17.17 New Borrowers shall have authorized Agent to prepare and file such Uniform Commercial Code financing statements and other documents and instruments which Agent has determined are necessary to perfect or continue perfecting the security interests of Agent in all of the assets now or hereafter owned by New Borrowers;

17.18 Agent shall have received originals of the shares of the stock certificates representing one hundred percent (100%) of the issued and outstanding shares of the Capital Stock of the direct and indirect Subsidiaries of a Borrower or Guarantor which are organized under the laws of a jurisdiction within the United States of America (in each case together with stock powers duly executed in blank with respect thereto);

17.19 Agent shall have received, in form and substance satisfactory to Agent, Deposit Account Control Agreements by and among Agent, each New Borrower and each bank where such New Borrower has a deposit account (other than deposit accounts used exclusively in connection with an individual retail store location and for the deposit accounts of New Borrower currently maintained at SunTrust Bank and JPMorgan Chase Bank), in each case, duly authorized, executed and delivered by such bank and New Borrower;

17.20 Agent shall have received, in form and substance satisfactory to Agent, true, correct and complete copies of the Merger Agreements, duly executed, authorized and delivered by each of the parties thereto;

17.21 Agent shall have received (i) a copy of the Certificate of Incorporation (or comparable document), and all amendments thereto, for each New Borrower certified by the Secretary of State of its jurisdiction of incorporation as of a recent date certifying that each of the foregoing documents remains in full force and effect and has not been modified or amended,

19

except as described therein and (ii) a certificate from an officer of each Borrower and Guarantor dated the date hereof certifying that its Certificate of Incorporation (or comparable document) and all amendments thereto for it remains in full force and effect and has not been modified or amended as to Existing Borrowers and Guarantors since the date of the certified copy thereof previously delivered to Agent prior to the date hereof and as to New Borrowers except as described therein;

17.22 Agent shall have received, in form and substance satisfactory to Agent, the Officer’s Certificate of Directors’ Resolutions, Corporate By-Laws, Incumbency and Shareholder’s Consent of each Borrower and each Guarantor (except as to Parent, without the Shareholder’s Consent) evidencing the adoption and subsistence of resolutions approving the execution, delivery and performance by each Borrower and Guarantor of this Amendment No. 1 and the Salant Supplemental Financing Agreements to which it is a party;

17.23 Agent shall have received original good standing certificates (or its equivalent) from the Secretary of State (or comparable official) from each jurisdiction where each Borrower and Guarantor conducts business;

17.24 Agent shall have received, in form and substance satisfactory to Agent, a legal opinion of counsel to Borrowers and Guarantors with respect to the matters contemplated by this Amendment No. 1, the Salant Supplemental Financing Agreements and the Merger Agreements, and including opinions of counsel qualified in such jurisdictions as Agent may specify; and

17.25 No Default or Event of Default shall exist or have occurred and be continuing.

18.Effect of this Amendment. This Amendment No.1 and the instruments and agreements delivered pursuant hereto constitute the entire agreement of the parties with respect to the subject matter hereof and thereof, and supersede all prior oral or written communications, memoranda, proposals, negotiations, discussions, term sheets and commitments with respect to the subject matter hereof and thereof. Except as expressly amended pursuant hereto and except for the consent expressly granted herein, no other changes or modifications or waivers to the Financing Agreements are intended or implied, and in all other respects the Financing Agreements are hereby specifically ratified, restated and confirmed by all parties hereto as of the effective date hereof. To the extent that any provision of the Loan Agreement or any of the other Financing Agreements are inconsistent with the provisions of this Amendment No.1, the provisions of this Amendment No.1 shall control.

19.Further Assurances. Each Borrower and Guarantor shall execute and deliver such additional documents and take such additional action as may be reasonably requested by Agent or Lenders to effectuate the provisions and purposes of this Amendment No.1.

20.Governing Law. The rights and obligations hereunder of each of the parties hereto shall be governed by and interpreted and determined in accordance with the internal laws of the State of Florida (but excluding any principles of conflicts of law or other rule of law that would cause the application of the law of any jurisdiction other than the laws of the State of Florida).

20

21.Binding Effect. This Amendment No.1 shall be binding upon and inure to the benefit of each of the parties hereto and their respective successors and assigns.

22.Counterparts. This Amendment No.1 may be executed in any number of counterparts, but all of such counterparts shall together constitute but one and the same agreement. In making proof of this Amendment No.1, it shall not be necessary to produce or account for more than one counterpart thereof signed by each of the parties hereto. Delivery of an executed counterpart of this Amendment No.1 by telecopier shall have the same force and effect as delivery of an original executed counterpart of this Amendment No.1. Any party delivering an executed counterpart of this Amendment No.1 by telecopier also shall deliver an original executed counterpart of this Amendment No.1, but the failure to deliver an original executed counterpart shall not affect the validity, enforceability, and binding effect of this Amendment No.1 as to such party or any other party.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

21

IN WITNESS WHEREOF, the parties hereto have caused this Amendment No. 1 to be duly executed and delivered by their authorized officers as of the day and year first above written.

| | |

| SUPREME INTERNATIONAL, INC |

| |

| By: | | Rosemary B. Trudeau |

| |

| Title: | | Treasurer |

|

| JANTZEN, INC. |

| |

| By: | | Rosemary B. Trudeau |

| |

| Title: | | Treasurer |

|

| SALANT CORPORATION |

| |

| By: | | Rosemary B. Trudeau |

| |

| Title: | | Treasurer |

|

| SALANT HOLDING CORPORATION |

| |

| By: | | Rosemary B. Trudeau |

| |

| Title: | | Treasurer |

|

| PERRY ELLIS INTERNATIONAL, INC. |

| PEI LICENSING, INC. |

| JANTZEN APPAREL CORP. |

| SUPREME REAL ESTATE I, LLC |

| SUPREME REAL ESTATE II, LLC |

| SUPREME REALTY, LLC |

| BBI RETAIL, L.L.C. |

| PERRY ELLIS REAL ESTATE CORPORATION |

| |

| By: | | Rosemary B. Trudeau |

| |

| Title: | | Secretary, Treasurer, V.P. or Manager, as applicable |

[SIGNATURES CONTINUE ON FOLLOWING PAGE]

[SIGNATURES CONTINUED FROM PRECEDING PAGE]

| | |

| SUPREME MUNSINGWEAR CANADA INC. |

| |

| By: | | Rosemary B. Trudeau |

| |

| Title: | | Treasurer |

| | |

| AGREED: |

|

CONGRESS FINANCIAL CORPORATION (FLORIDA), as Agent |

| |

| By: | | [ILLEGIBLE] |

| |

| Title: | | A.V.P |

EXHIBIT A

TO

AMENDMENT NO. 1

Existing Salant Lenders

The CIT Group/Commercial Services, Inc.

A-1

EXHIBIT B

TO

AMENDMENT NO. 1

Existing Letters of Credit

See Attached

B-1

THE CIT GROUP//COMMERCIAL SERVICES, INC

Detail Position Report

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L/C | | Beneficiary | | Type | | Issue

Date | | | Expiration

Date | | | Tol. | | | Opening

Balance | | Unused

Balance | | Outstanding

Acceptances | | | Guarantee

Balance | |

| | | | | | | | | |

| S222222 | | FOREIGN EXCHANGE | | SIGHT | | | 01/31/01 | | | | 02/01/01 | | | | 0.00 | | | 0.01 | | 0.01 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2789449 | | AMW H.K. LTD. | | SIGHT | | | 04/30/03 | | | | 07/05/03 | | | | 3.00 | | | 352,677.77 | | 931,814.22 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 3749464 | | * | | SIGHT | | | 12/04/02 | | | | 06/09/03 | | | | 5.00 | | | * | | * | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 3789673 | | * | | SIGHT | | | 05/02/03 | | | | 06/30/03 | | | | 5.00 | | | * | | * | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A790680 | | CELEBRITY DESIGNS, LTD. | | SIGHT | | | 06/04/03 | | | | 08/09/03 | | | | 5.00 | | | 22,157.33 | | 22,157.33 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986762 | | DAKAR S.A. | | SIGHT | | | 03/05/03 | | | | 09/14/03 | | | | 5.00 | | | 60,213.51 | | 83,190.98 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986781 | | ORIENT INTL ENTERPRISE LTD. | | SIGHT | | | 04/01/03 | | | | 06/30/03 | | | | 3.00 | | | 42,183.33 | | 55,427.36 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A749452 | | TAIWAN YAMAN | | SIGHT | | | 11/22/02 | | | | 07/15/03 | | | | 5.00 | | | 379,976.10 | | 1,771,704.00 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A749532 | | ASIAN AMERICAN | | SIGHT | | | 02/05/03 | | | | 07/21/03 | | | | 3.00 | | | 35,708.03 | | 98,128.48 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2986806 | | COMPASS TEXTILES LIMITED | | SIGHT | | | 04/22/03 | | | | 06/10/30 | | | | 3.00 | | | 23,783.42 | | 23,783.42 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A749462 | | YAGI TSUSHO LTD. | | SIGHT | | | 12/04/02 | | | | 06/30/03 | | | | 0.00 | | | 246,308.00 | | 571,189.89 | | | 0.00 | | | | | |

| | | | | | | | | |

| A789479 | | PENFABRIC SDN BERHAD | | SIGHT | | | 05/12/03 | | | | 07/05/03 | | | | 3.00 | | | 83,082.27 | | 83,082.27 | | | 0.00 | | | | 0.00 | |

| * | Portions of this document omitted pursuant to an application for an order for confidential treatment pursuant to Rule 24b-2 under the Exchange Act. Confidential portions of this document have been filed separately with the Securities and Exchange Commission. |

B-2

THE CIT GROUP//COMMERCIAL SERVICES, INC

Detail Position Report

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L/C | | Beneficiary | | Type | | Issue

Date | | | Expiration

Date | | | Tol. | | | Opening

Balance | | Unused

Balance | | Outstanding

Acceptances | | | Guarantee

Balance | |

| | | | | | | | | |

| A790000 | | MILIOR S.P.A. | | SIGHT | | | 05/12/03 | | | | 06/14/03 | | | | 5.00 | | | 19,529.90 | | 19,529.90 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A790520 | | ASHIMA DYECOT LTD. | | SIGHT | | | 05/30/03 | | | | 07/11/03 | | | | 3.00 | | | 18,169.20 | | 18,169.20 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986756 | | PENFABRIC SDN BERHAD | | SIGHT | | | 03/04/03 | | | | 06/10/03 | | | | 0.00 | | | 17,340.00 | | 5,776.26 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A926447 | | KOGGALA GARMENTS LTD. | | SIGHT | | | 01/06/99 | | | | 02/09/00 | | | | 0.00 | | | 123,123.00 | | 58,032.45 | | | 0.00 | | | | 58,032.45 | |

| | | | | | | | | |

| A926450 | | MANHATTAN INDUSTRIES | | SIGHT | | | 01/07/99 | | | | 12/30/99 | | | | 0.00 | | | 58,079.80 | | 105,300.94 | | | 0.00 | | | | 105,300.94 | |

| | | | | | | | | |

| A926488 | | MANHATTAN INDUSTRIES | | SIGHT | | | 03/11/99 | | | | 03/30/00 | | | | 0.00 | | | 325,325.00 | | 149,676.20 | | | 0.00 | | | | 149,676.20 | |

| | | | | | | | | |

| 2789617 | | SHANGHAI GAZAL TEXTILE/G | | SIGHT | | | 05/01/03 | | | | 05/30/03 | | | | 3.00 | | | 10,535.87 | | 10,535.87 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2790084 | | TRIL CREATIONS LTD. | | SIGHT | | | 05/19/03 | | | | 08/14/03 | | | | 3.00 | | | 24,478.15 | | 24,476.15 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2790170 | | * | | SIGHT | | | 05/16/03 | | | | 06/25/03 | | | | 3.00 | | | * | | * | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2790171 | | AMW H.K. LTD. | | SIGHT | | | 05/16/03 | | | | 06/30/03 | | | | 3.00 | | | 88,023.15 | | 93,532.72 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2790316 | | * | | SIGHT | | | 05/20/03 | | | | 07/05/03 | | | | 3.00 | | | * | | * | | | 0.00 | | | | 0.00 | |

| * | Portions of this document omitted pursuant to an application for an order for confidential treatment pursuant to Rule 24b-2 under the Exchange Act. Confidential portions of this document have been filed separately with the Securities and Exchange Commission. |

B-3

THE CIT GROUP//COMMERCIAL SERVICES, INC

Detail Position Report

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L/C | | Beneficiary | | Type | | Issue

Date | | | Expiration

Date | | | Tol. | | | Opening

Balance | | | Unused

Balance | | | Outstanding

Acceptances | | | Guarantee

Balance | |

| | | | | | | | | |

| 2790792 | | SHIRTEX INTERNATIONAL LTD. | | SIGHT | | | 06/11/03 | | | | 07/19/03 | | | | 3.00 | | | | 118,099.80 | | | | 118,099.80 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2986793 | | FOCUS HK CO. LTD. | | SIGHT | | | 04/09/03 | | | | 06/14/03 | | | | 3.00 | | | | 133,232.66 | | | | 135,044.30 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2986797 | | * | | SIGHT | | | 04/09/03 | | | | 06/14/03 | | | | 3.00 | | | | * | | | | * | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2986801 | | TRIL CREATIONS LTD. | | SIGHT | | | 04/17/03 | | | | 08/02/03 | | | | 3.00 | | | | 102,706.45 | | | | 102,706.45 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 3789803 | | SAE-A TRADING CO. LTD. | | SIGHT | | | 05/08/03 | | | | 07/15/03 | | | | 5.00 | | | | 573,039.81 | | | | 742,587.72 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 3789880 | | NASIGN CO. LTD. | | SIGHT | | | 05/08/03 | | | | 06/20/03 | | | | 3.00 | | | | 326,796.86 | | | | 9,518.35 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2749455 | | C.P.I. APPAREL LTD. | | SIGHT | | | 11/26/02 | | | | 03/20/03 | | | | 5.00 | | | | 94,122.00 | | | | 36,412.78 | | | | 0.00 | | | | 16,954.39 | |

| | | | | | | | | |

| 2789549 | | WING LEI WAH TAI KNITTING | | SIGHT | | | 04/30/03 | | | | 06/14/03 | | | | 3.00 | | | | 9,795.30 | | | | 9,795.30 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2789551 | | BRIGHTON INDUSTRIES LTD. | | SIGHT | | | 05/06/03 | | | | 06/30/03 | | | | 3.00 | | | | 132,000.00 | | | | 154,520.60 | | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2789619 | | TRIPPEL A APPAREL LTD. | | SIGHT | | | 05/07/03 | | | | 07/05/03 | | | | 3.00 | | | | 133,142.95 | | | | 224,112.55 | | | | 0.00 | | | | 0.00 | |

| * | Portions of this document omitted pursuant to an application for an order for confidential treatment pursuant to Rule 24b-2 under the Exchange Act. Confidential portions of this document have been filed separately with the Securities and Exchange Commission. |

B-4

THE CIT GROUP//COMMERCIAL SERVICES, INC

Detail Position Report

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L/C | | Beneficiary | | Type | | Issue

Date | | | Expiration

Date | | | Tol. | | | Opening

Balance | | Unused

Balance | | Outstanding

Acceptances | | | Guarantee

Balance | |

| | | | | | | | | |

| 2789620 | | KA FUNG KNITTING FACTORY | | SIGHT | | | 04/30/03 | | | | 07/30/03 | | | | 3.00 | | | 87,362.00 | | 193,683.78 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2789621 | | C.P.I. APPARELS LTD. | | SIGHT | | | 04/30/03 | | | | 06/30/03 | | | | 3.00 | | | 44,109.75 | | 17,835.99 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2789861 | | BINGER MARKETING WORK CO. | | SIGHT | | | 05/15/03 | | | | 08/04/03 | | | | 3.00 | | | 73,310.25 | | 153,548.64 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2789862 | | LEVER SHIRT G.W.B. AND D. FI | | SIGHT | | | 08/09/03 | | | | 07/10/03 | | | | 3.00 | | | 7,210.00 | | 7,210.00 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2986780 | | CARSON GARMENTS FTY LTD. | | SIGHT | | | 04/09/03 | | | | 06/30/03 | | | | 3.00 | | | 51,545.32 | | 64,545.96 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 2986802 | | FOCUS H.K. CO., LTD. | | SIGHT | | | 04/17/03 | | | | 06/30/03 | | | | 3.00 | | | 114,262.75 | | 80,685.31 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 3986777 | | KISUNG TEXTILES CO. | | SIGHT | | | 04/01/03 | | | | 07/30/03 | | | | 3.00 | | | 107,508.25 | | 416,009.79 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 3986778 | | WOOSEONG TEXTILE CO. LTD. | | SIGHT | | | 04/01/03 | | | | 06/30/03 | | | | 5.00 | | | 81,001.75 | | 92,970.64 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| 3986803 | | BONMAX INTL CO., LTD. | | SIGHT | | | 04/17/03 | | | | 08/14/03 | | | | 3.00 | | | 91,546.40 | | 273,691.80 | | | 0.00 | | | | 0.00 | |

B-5

THE CIT GROUP//COMMERCIAL SERVICES, INC

Detail Position Report

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L/C | | Beneficiary | | Type | | Issue

Date | | | Expiration

Date | | | Tol. | | | Opening

Balance | | Unused

Balance | | Outstanding

Acceptances | | | Guarantee

Balance | |

| | | | | | | | | |

| A749457 | | RIVIERA CREATIONS | | SIGHT | | | 12/03/02 | | | | 03/12/03 | | | | 5.00 | | | 470,806.35 | | 104,045.08 | | | 0.00 | | | | 187,737.60 | |

| | | | | | | | | |

| A789552 | | SHIRTEX INTERNATIONAL LTD. | | SIGHT | | | 05/15/03 | | | | 07/15/03 | | | | 3.00 | | | 89,173.80 | | 228,595.99 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A789618 | | ZHSJIANG FUKODA LEATHER | | SIGHT | | | 06/15/03 | | | | 06/30/03 | | | | 3.00 | | | 93,290.71 | | 93,290.71 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A789623 | | ONBEST TRADING LIMITED | | SIGHT | | | 05/16/03 | | | | 07/10/03 | | | | 3.00 | | | 28,024.03 | | 43,637.54 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A789860 | | GUPTA EXIM (INDIA) PVT LTD. | | SIGHT | | | 05/12/03 | | | | 07/05/03 | | | | 3.00 | | | 158,007.10 | | 158,007.10 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A789998 | | UNIQUE BODY FASHION CO., | | SIGHT | | | 05/15/03 | | | | 06/30/03 | | | | 3.00 | | | 48,193.70 | | 49,401.99 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986764 | | ARVIND ENTERPRISES | | SIGHT | | | 03/11/03 | | | | 07/15/03 | | | | 3.00 | | | 130,413.24 | | 527,155.98 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986770 | | HUZHOU HENGYU GARMENT | | SIGHT | | | 03/25/03 | | | | 07/30/03 | | | | 3.00 | | | 279,396.56 | | 349,874.37 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986784 | | SHANGHAI KNITWEAR IMP/EXP | | SIGHT | | | 04/23/03 | | | | 08/14/03 | | | | 3.00 | | | 183,298.29 | | 581,641.21 | | | 0.00 | | | | 0.00 | |

B-6

THE CIT GROUP//COMMERCIAL SERVICES, INC

Detail Position Report

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L/C | | Beneficiary | | Type | | Issue

Date | | | Expiration

Date | | | Tol. | | | Opening

Balance | | Unused

Balance | | Outstanding

Acceptances | | | Guarantee

Balance | |

| | | | | | | | | |

| A986785 | | SHANGHAI INTL TRADE DEV CO. | | SIGHT | | | 04/09/03 | | | | 06/14/03 | | | | 3.00 | | | 123,600.00 | | 152,403.95 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986800 | | JIANGSU OVERSEAS GRP GMT | | SIGHT | | | 04/14/03 | | | | 07/15/03 | | | | 3.00 | | | 36,373.42 | | 9,222.50 | | | 0.00 | | | | 0.00 | |

| | | | | | | | | |

| A986804 | | M/S PUNIHANI INTL | | SIGHT | | | 04/17/03 | | | | 06/30/03 | | | | 3.00 | | | 90,136.30 | | 107,810.10 | | | 0.00 | | | | 0.00 | |

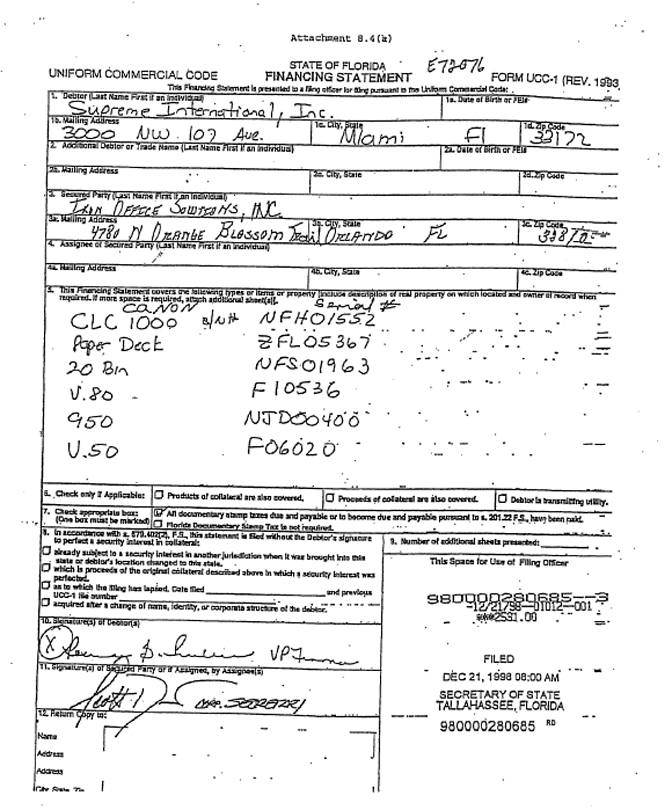

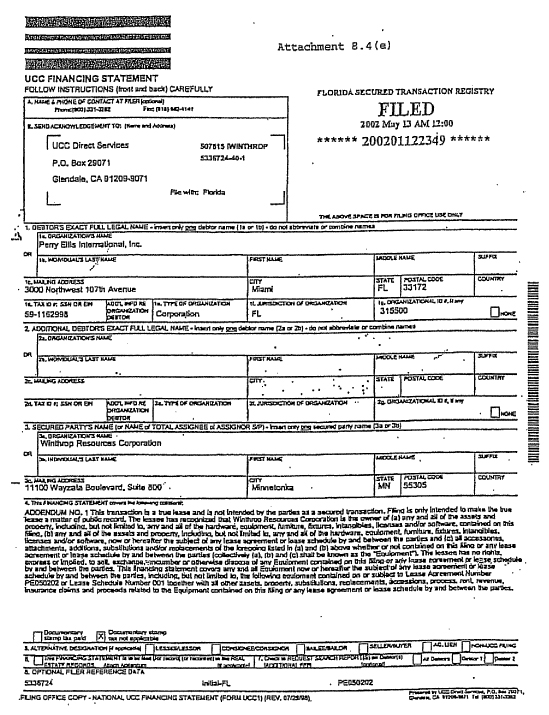

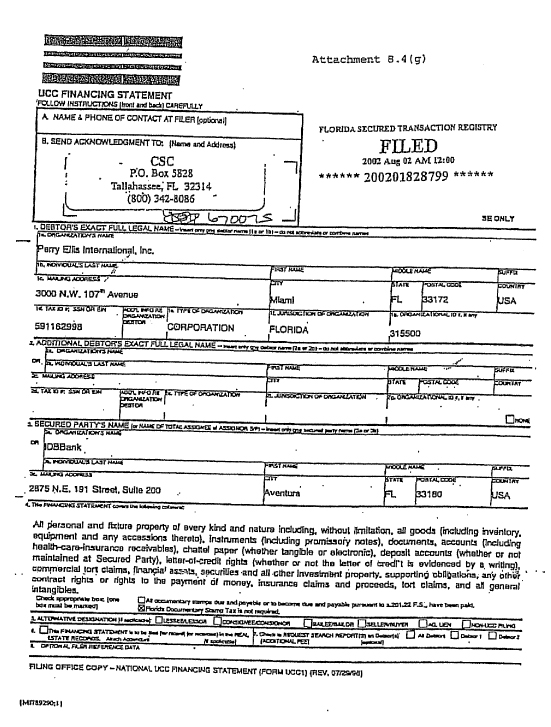

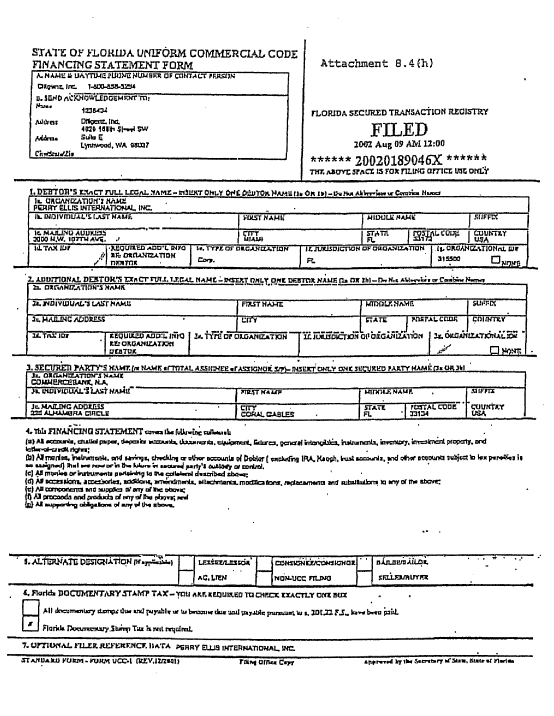

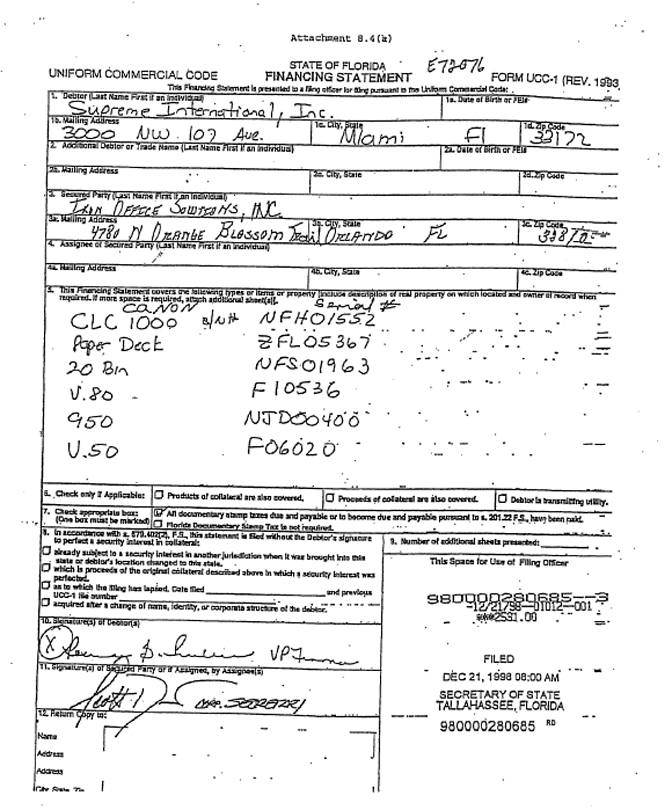

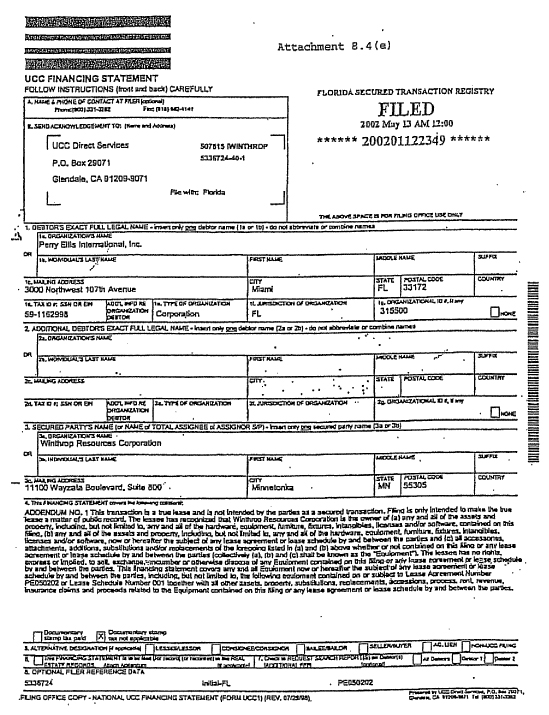

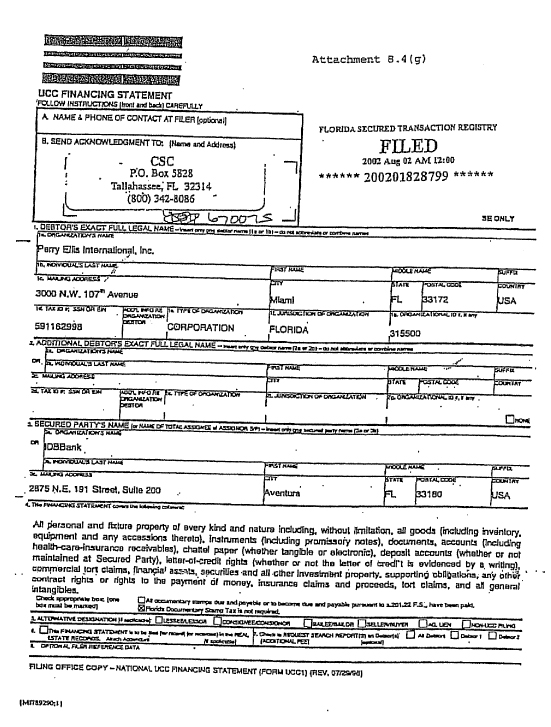

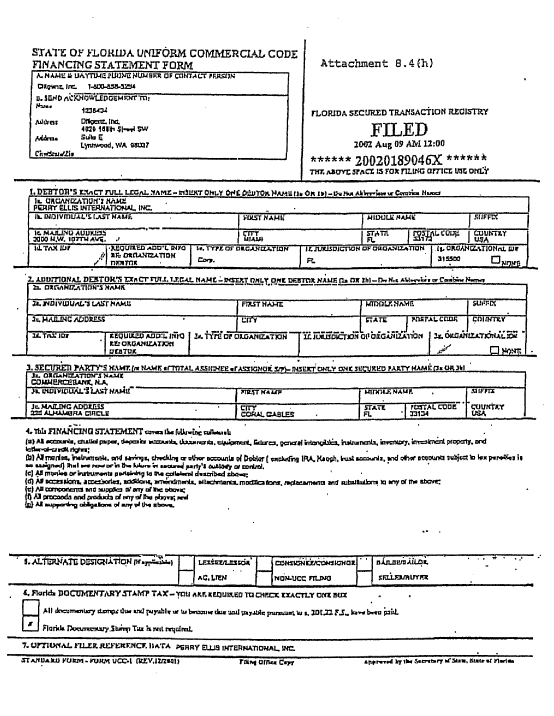

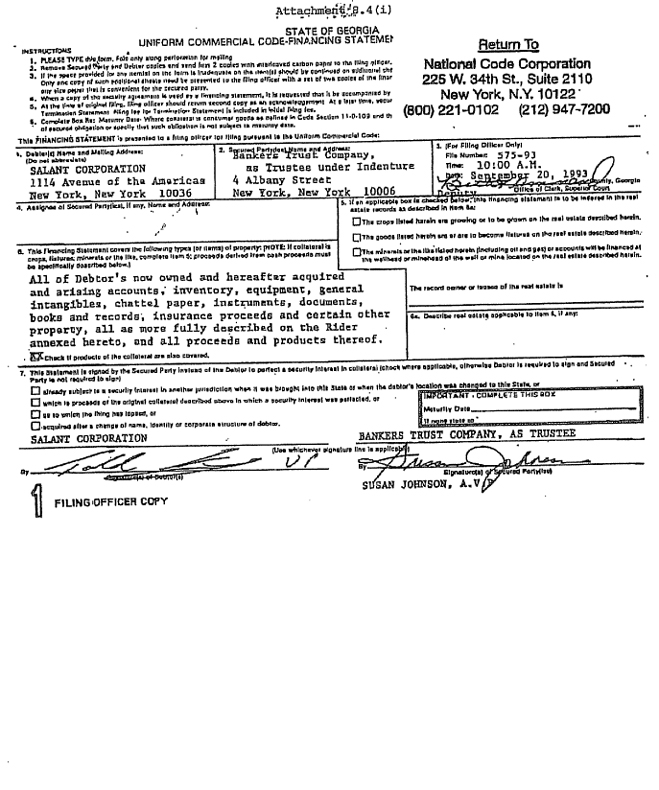

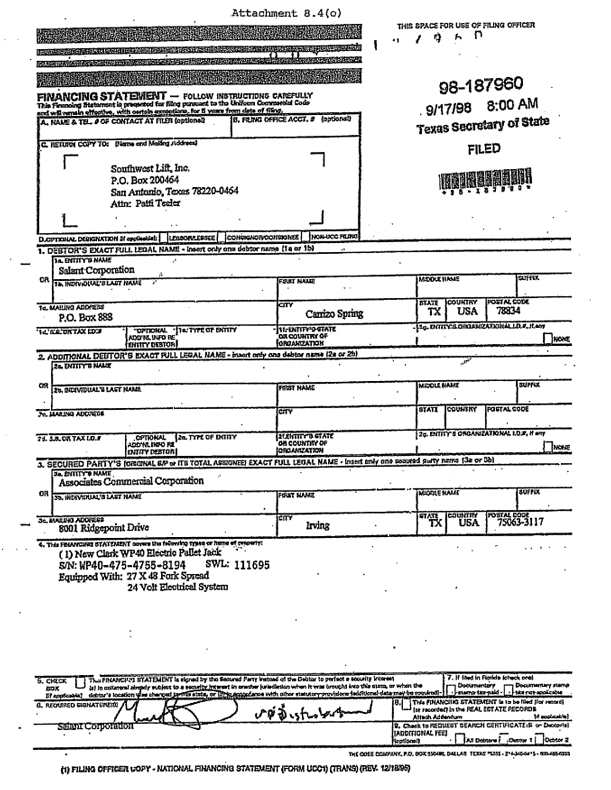

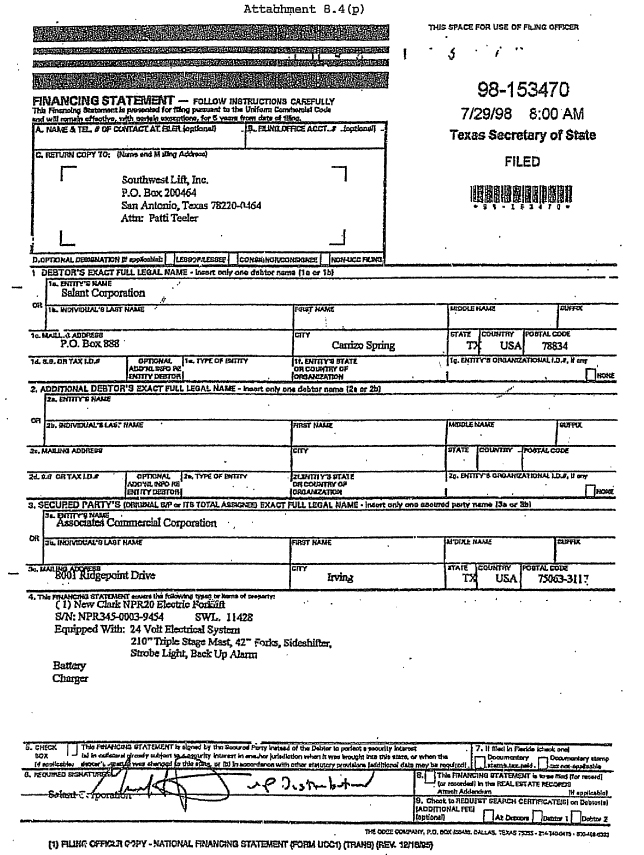

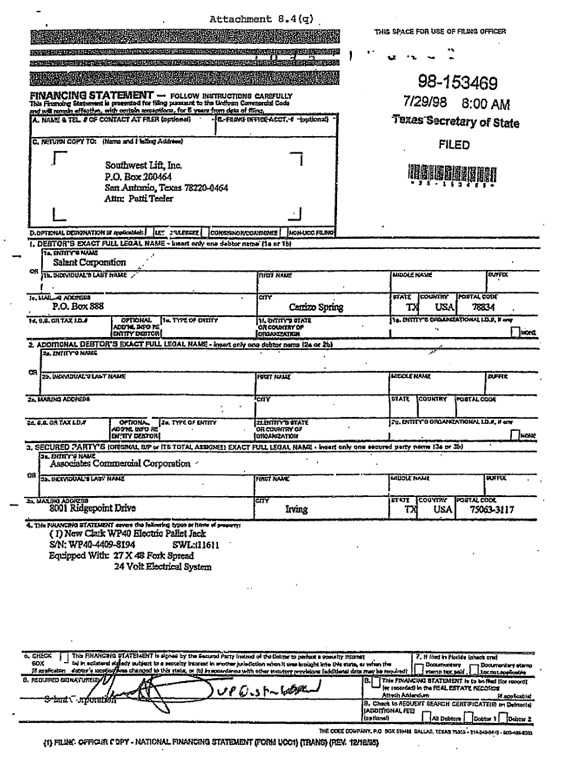

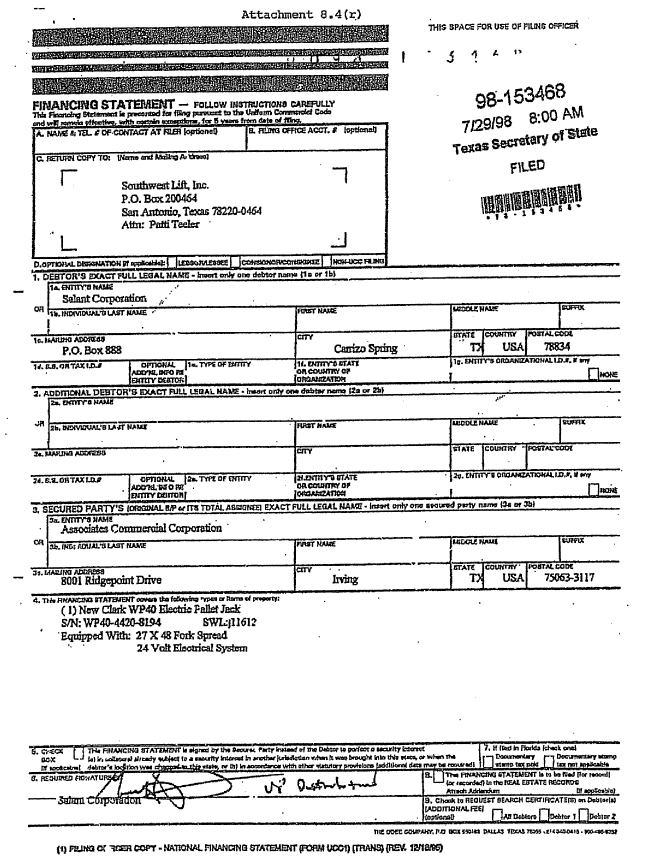

| | | | | | | | | |