Exhibit 99.1

Exhibit 99.1

PERRY ELLIS INTERNATIONAL

2

SAFE HARBOR

STATEMENT

We caution readers that the forward-looking statements (statements which are not historical facts) in this release are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements are based on current expectations rather than historical facts and they are indicated by words or phrases such as

“anticipate,” “believe,” “budget,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “guidance,” “indicate,” “intend,” “may,” “might,” “plan,” “possibly,” “potential,” “predict,”

“probably,” “proforma,” “project,” “seek,” “should” or “target” or the negative thereof or other variations thereon and similar words or phrases or comparable terminology. Such

forward-looking statements include, but are not limited to, statements regarding Perry Ellis’ strategic operating review, growth initiatives and internal operating improvements

intended to drive revenues and enhance profitability, the implementation of Perry Ellis’ profitability improvement plan and Perry Ellis’ plans to exit underperforming, low growth

brands and businesses. We have based such forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations,

assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, and other factors

that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-

looking statements, many of which are beyond our control. These factors include: general economic conditions, a significant decrease in business from or loss of any of our major

customers or programs, anticipated and unanticipated trends and conditions in our industry, including the impact of recent or future retail and wholesale consolidation, recent and

future economic conditions, including turmoil in the financial and credit markets, the effectiveness of our planned advertising, marketing and promotional campaigns, our ability to

contain costs, disruptions in the supply chain, our future capital needs and our ability to obtain financing, our ability to protect our trademarks, our ability to integrate acquired

businesses, trademarks, trade names and licenses, our ability to predict consumer preferences and changes in fashion trends and consumer acceptance of both new designs and newly

introduced products, the termination or non-renewal of any material license agreements to which we are a party, changes in the costs of raw materials, labor and advertising, our

ability to carry out growth strategies including expansion in international and direct-to-consumer retail markets, the effectiveness of our plans, strategies, objectives, expectations

and intentions which are subject to change at any time at our discretion, potential cyber risk and technology failures which could disrupt operations or result in a data breach, the

level of consumer spending for apparel and other merchandise, our ability to compete, exposure to foreign currency risk and interest rate risk, possible disruption in commercial

activities due to terrorist activity and armed conflict, actions of activist investors and the cost and disruption of responding to those actions, and other factors set forth in Perry Ellis’

filings with the Securities and Exchange Commission (SEC). Investors are cautioned that all forward-looking statements involve risks and uncertainties, including those risks and

uncertainties detailed in Perry Ellis’ filings with the SEC. You are cautioned not to place undue reliance on these forward-looking statements, which are valid only as of the date they

were made. We undertake no obligation to update or revise any forward-looking statements to reflect new information or the occurrence of unanticipated events or otherwise, except

as otherwise required by the federal securities laws.

3

AGENDA SCHEDULE

I. Introduction

II. Product Review—A Glimpse into PEI III. Perry Ellis IV. Original Penguin V. PEI Golf VI. Corporate Financial Overview VII. Lunch

4

Oscar

Feldenkreis

Vice Chairman of the Board,

President and Chief Operating Officer

KEY PILLARS OF GROWTH AND PROFITABILITY 5

1 2 3 4 5

Portfolio Retail Expand Direct-to- Operating Optimization Brand International Consumer Efficiencies Enhancement And Licensing Expansion Distribution

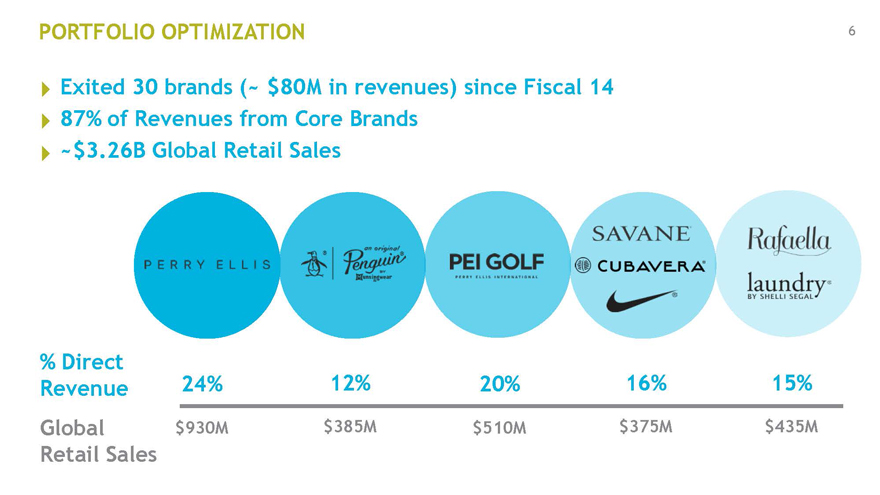

PORTFOLIO OPTIMIZATION 6

Exited 30 brands (~ $80M in revenues) since Fiscal 14

87% of Revenues from Core Brands

~$3.26B Global Retail Sales

% Direct

Revenue 24% 12% 20% 16% 15%

Global $930M $385M $510M $375M $435M

Retail Sales

PERRY ELLIS BRAND OVERVIEW 7

$930M Global Retail Sales

16%

14% DTC

32% Intl. Wholesale 52% 86% Licensing Domestic

Perry Ellis is one of the world’s leading designer lifestyle brands

Recent initiatives across the Collection business, have achieved significant improvement in profitability The brand generates nearly $1B in annual retail sales globally, spanning dozens of product categories

ORIGINAL PENGUIN BRAND OVERVIEW 8

$385M Global Retail Sales

20%

40%

DTC

36% Intl.

Wholesale

44% 60%

Licensing Domestic

Iconic Contemporary Sportswear Brand with strong American heritage

Strong global fashion appeal, with 40% of revenue from International

Has grown +13% on average over past three years

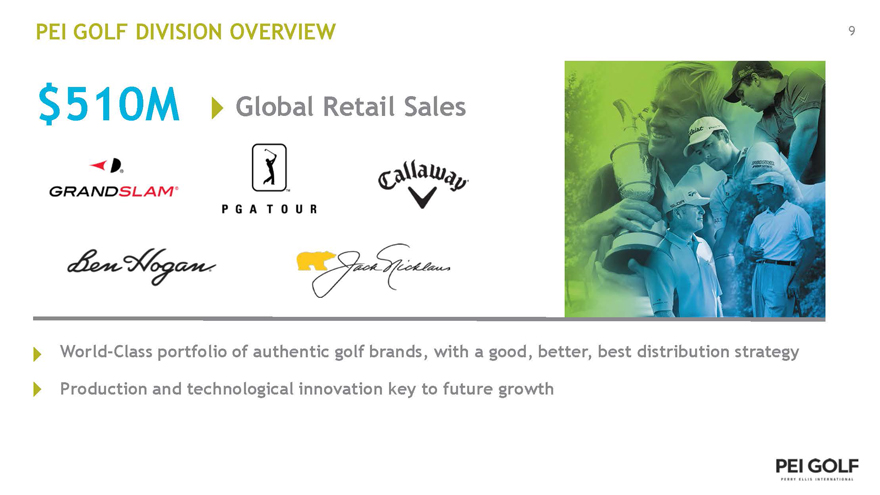

PEI GOLF DIVISION OVERVIEW 9

$510M Global Retail Sales

World-Class portfolio of authentic golf brands, with a good, better, best distribution strategy Production and technological innovation key to future growth

VERY PERRY ELLIS

14

BRAND PORTFOLIO 11

Perry Ellis Perry Ellis Perry Ellis Signature Perry Ellis Portfolio Perry Ellis 360 America

The pinnacle of A full lifestyle, Focused on the Perry Ellis 360 is This line is a more our product lines ‘Very Perry’ dressed-up side an exciting casual lifestyle has forward-thinking assortment of of Perry Ellis, athleisure product collection. Your designs that include mix-and-match Portfolio consists of extension. All 360 favorite go-to pieces, shirts, trousers, shirts, trousers, suits, dress shirts, items have reinvigorated with suiting, outerwear knits & sweaters, ties, footwear and performance modern details. and accessories. suit separates accessories. attributes such as and outerwear. moisture wicking and water resistance.

Building upon the Perry Ellis legacy with design excellence

WHOLESALE STRATEGIES 12

Key North American Retail Partners

Increase profitability with retail partners to deepen penetration in existing doors

Reduce inventory levels to control closeouts

Control markdowns at retail by increasing sell-throughs and reducing carryover

+41% &

+13% -45% +350 bps +400 bps

Revenues Inventory Gross Margin margin

Fiscal 2016 Direct EBITDA

1H Update (Collection)

WHOLESALE STRATEGIES 13

E-Commerce

Creating Strategies with leading online retailers and brick-and-mortar partners

WHOLESALE STRATEGIES 14

Shop-in-Shop Investments

Premium floor space at key doors, with enhanced visuals and stronger brand presentations

Since 2014 have rolled out 62 Shop-in-Shops. Sales topping retail average by +14 points

Macy’s Herald Square Concept Store opens in October featuring top-notch technology and

updated product

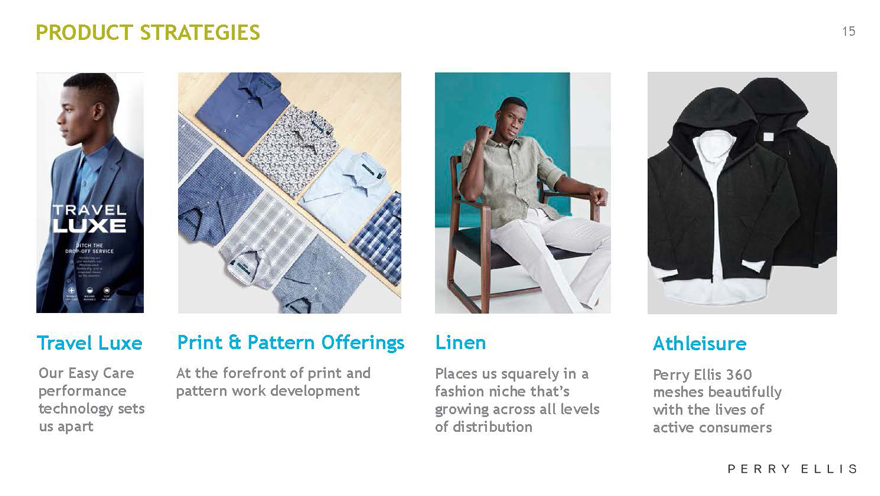

PRODUCT STRATEGIES 15

Travel Luxe Print & Pattern Offerings Linen Athleisure

Our Easy Care At the forefront of print and Places us squarely in a Perry Ellis 360 performance pattern work development fashion niche that’s meshes beautifully technology sets growing across all levels with the lives of us apart of distribution active consumers

OMNICHANNEL GLOBAL MARKETING & COMMUNICATION 16

Investing in market-leading digital innovation

Digital Partnerships

HypeBeast.com, Refinery29.com and mashable.com

Online influencers and bloggers such as Adam Gallagher (@iamgalla),Kat Irlin (@kat_in nyc) and Patrick Janelle (@guynamedpatrick) to maximize coverage within social media Amplify Fashion Show Coverage in Digital Space Facebook (750% higher); Twitter (500% higher); Instagram (320% higher) Digital Advertising Buys Deliver 14 million online impressions annually Weekly Twitter chat—#GentsChat

Online discussion around men’s fashion, the first of its kind. Resulted in 360% increase in engagement

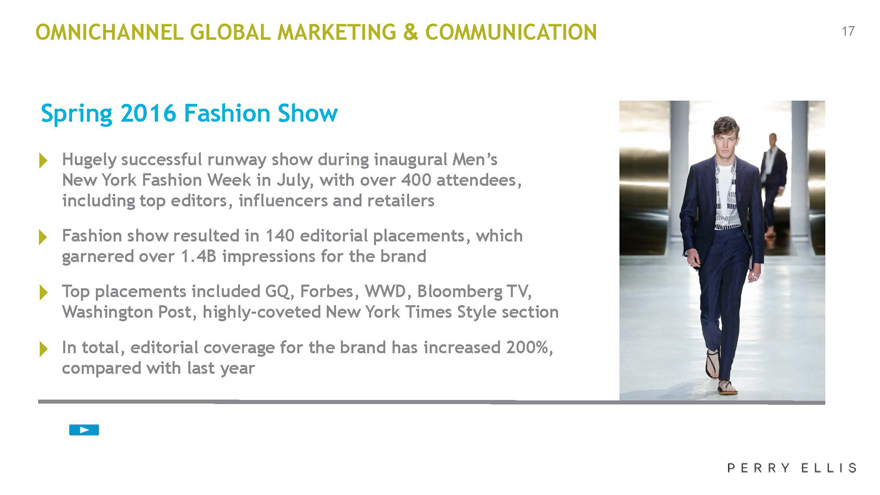

OMNICHANNEL GLOBAL MARKETING & COMMUNICATION 17

Spring 2016 Fashion Show

Hugely successful runway show during inaugural Men’s

New York Fashion Week in July, with over 400 attendees,

including top editors, influencers and retailers

Fashion show resulted in 140 editorial placements, which

garnered over 1.4B impressions for the brand

Top placements included GQ, Forbes, WWD, Bloomberg TV,

Washington Post, highly-coveted New York Times Style section

In total, editorial coverage for the brand has increased 200%,

compared with last year

DIRECT-TO-CONSUMER 18

Directly-Operated

Retail Stores

45

E-com website

perryellis.com

DIRECT-TO-CONSUMER 19

Strategic Initiatives

Execute localized and climate-right assortment strategies

Maximize Omnichannel experience and stores’ fulfillment of online orders Execute improved inventory management, driving faster turns and higher margins Retail excellence via superior systems and customer shopping experience Expand high-margin businesses, including luggage, footwear, accessories Intensify key-item ownership

FY 2016 YTD Performance Through 1H

Perry Ellis E-Commerce comps +46% Perry Ellis Retail comps up single digits

LICENSING 20

22 Domestic and 19 International Agreements

account for 59% of PEI’s Licensing Sales

Projecting 6.7% growth for the year: H1 FY2016

royalty revenue +9.2%

U.S./Canada +7.1% YTD

82.5% of brand’s total royalty revenue

Growth driven by footwear, luggage, tailored

clothing and a new dress-shirt agreement

3 new agreements in the last 10 months

International +20.2% YTD

17.5% of brand’s total revenue

Organic growth in Latin America

INTERNATIONAL DEVELOPMENT GROWTH OPPORTUNITIES 21

EMEA

Launch Perry Ellis America in the UK and Europe; springboard for new licensing revenues

Confirmed launch for SS 2016 in House of Fraser, Galeries Lafayette and Coin Collection to be available in London, Paris and Milan; expand distribution in AW2016

Target Perry Ellis America launch in Middle East and South Africa in FY-18; brand extensions in FY-19

Canada / Latin America

Opportunistically convert licensed Perry Ellis businesses to direct, to capture market share and increase profitability

Asia

Implement a hybrid licensing and distribution structure to launch Perry Ellis and Perry Ellis America in Greater China, Japan, India and then Asia/Pacific Expand distribution in Korea and store footprint in Southeast Asia

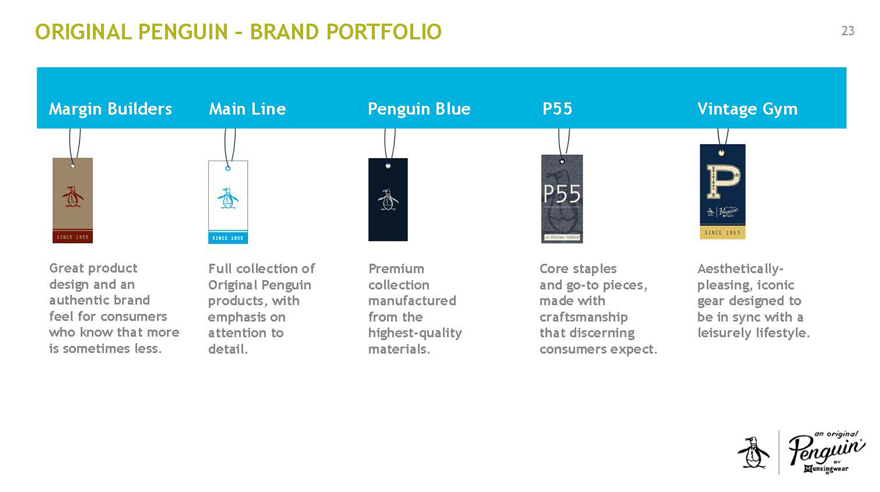

ORIGINAL PENGUIN – BRAND PORTFOLIO 23

Margin Builders Main Line Penguin Blue P55 Vintage Gym

Great product Full collection of Premium Core staples Aesthetically- design and an Original Penguin collection and go-to pieces, pleasing, iconic authentic brand products, with manufactured made with gear designed to feel for consumers emphasis on from the craftsmanship be in sync with a who know that more attention to highest-quality that discerning leisurely lifestyle. is sometimes less. detail. materials. consumers expect.

ORIGINAL PENGUIN – U.S. WHOLESALE STRATEGIES 24

Strengthened Channels of Distribution Key Partners

2012 10 20 53 & ECOM 25 0 0

2015 24 & ECOM 32 116 & ECOM 50 & ECOM 11 11 & ECOM

(ALL DOORS) (ALL DOORS)

Doubled door count with key retail partners

Expanded U.S. partnerships into Canada (Fall 15: 5 doors fixtured including Bloor Street)

Increased SKU profitability

ORIGINAL PENGUIN – A FULL LIFESTYLE COLLECTION 25

ORIGINAL PENGUIN—PRODUCT STRATEGIES 27

appears, you may have to delete the

Anchors Denim Jackets & Accessories Original Penguin

Outerwear Blue

Strengthening Re-introducing Continuing to Heightening Elevated label whose

our collection denim into our build momentum focus on bags, foundation is based

of swim, knits product mix, with seasonally- luggage and on premium fabrics.

and wovens. under the P55 relevant apparel. belts.

umbrella.

ORIGINAL PENGUIN – PRODUCT STRATEGY 28

60th Anniversary Capsule Collection

Women’s Wear Daily Editorial

8.26.2015

ORIGINAL PENGUIN GLOBAL MARKETING & COMMUNICATIONS STRATEGY 29

Original Penguin has developed a unique,

multi-platform omnichannel approach that

utilizes traditional and non-traditional

mediums, including print, digital, mobile,

social media and grassroots marketing.

We’re focused on reaching today’s

consumers, whether they happen to

be shopping online or in a retail setting.

ORIGINAL PENGUIN SENSORY MARKETING MUSIC STRATEGY 30

Partnership with Virgin/EMI

Two iconic brands leveraging assets, creating a unique alliance to reach consumers Stunt event will launch campaign, creating buzz and newsworthy PR Video content will include interviews with key artists talking about their music, and what’s influenced their fashion, over the last six decades Social-media support from all artists, to promote content and events Consumer Activation, to include Gold Penguin Treasure Hunt for tickets in key cities Grand Finale, featuring performances from high-profile artists to close the campaign

ORIGINAL PENGUIN—DIRECT TO CONSUMER 32

Directly-Operated Retail Stores

28

E-com websites

originalpenguin.com originalpenguin.co.uk

ORIGINAL PENGUIN – U.S. DIRECT TO CONSUMER 33

Strategic Initiatives

Optimize Full-Price/Outlet operating model Expand and intensify outerwear and accessories Develop leather bags, footwear, fragrances Balance outlet assortments, develop dress-up collection Maximize Omnichannel experience

FY 2016 YTD Performance Through 1H

U.S. E-com comps +12%

OPG U.S. Retail revenues up single digits

ORIGINAL PENGUIN – EUROPEAN WHOLESALE OVERVIEW 34

Key Partners

2012 15 30 0 0 0 3

2015 45 35 27 25 67 8

Wholesale Revenue growth of 88% from FY-12 (18% CAGR) Significant expansion in Europe (France, Italy and Spain), which now accounts for 15% of FY-16 European Revenues Strategic capital investments, including recent addition of office and showrooms in Germany and Shop-in-Shop installations in all markets

ORIGINAL PENGUIN—EUROPEAN DIRECT-TO-CONSUMER OVERVIEW 35

7 directly-operated OPG stores in Europe; growth of 212% from FY-12 Relocated lead Covent Garden store to Long Acre Street, London’s top boulevard for retail in May 2015 Two new stores (Ashford and York) opening in October

28X growth in e-commerce since FY-12

New Euro denominated site launching in Sep 2015

35

ORIGINAL PENGUIN—LICENSING 36

17 Domestic and 22 International Agreements Account for 22% of PEI’s Licensing Sales

22% of PEI’s licensing revenue

Projecting 18% growth for the year: HI FY2016 royalty revenue +25% U.S./Canada +24%YTD

64% of brand’s total royalty revenue Growth driven by footwear, kids, eyewear and new tailored-clothing license 5 new agreements in last 18 months International +27% YTD

36% of brand’s total royalty revenue Growth driven by business development in Europe and Latin America 9 new agreements in last 18 mo

INTERNATIONAL DEVELOPMENT GROWTH OPPORTUNITIES 37

EMEA

Expand brand footprint outside UK and Western Europe to Eastern Europe, Middle East and Africa

Leverage key retail partnerships (House of Fraser, Galeries Lafayette, El Corte Ingles, Coin) to

expand door count and penetration across all Original Penguin product categories

Balance business model between wholesale and DTC disciplined full price development, solid

outlet store penetration as well as GBP and Euro denominated e-commerce

Latin America

Explore a joint venture structure to launch OPG e-commerce in Mexico to maximize in-

country development

Asia (PEI Owns Brand In Philippines and India Only)

Expand rights and development beyond the Philippines and India to Australia / NZ

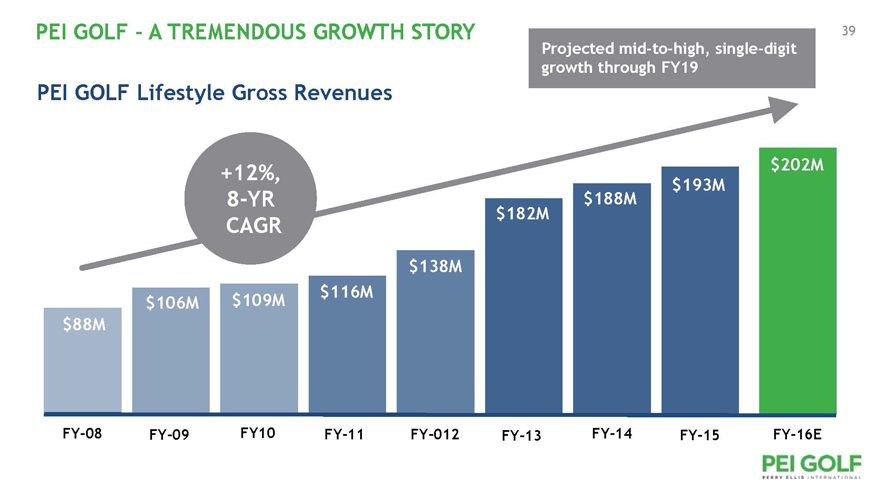

PEI GOLF – A TREMENDOUS GROWTH STORY 39

Projected mid-to-high, single-digit

growth through FY19

PEI GOLF Lifestyle Gross Revenues

+12%, $202M

$193M

8-YR $188M

$182M

CAGR

$138M

$109M $116M

$106M

$88M

FY-08 FY-09 FY10 FY-11 FY-012 FY-13 FY-14 FY-15 FY-16E

GLOBAL PORTFOLIO OF GOLF LIFESTYLE BRANDS 40

Each brand has its own identity, style and DNA

GOOD BETTER BEST

Walmart Kohl’s Department Stores International International

International Sporting Goods Department Stores Green Grass

Off Course Green Grass Sporting Goods

International Off Course

Better Department Stores

Corporate

Direct-to-Consumer

��

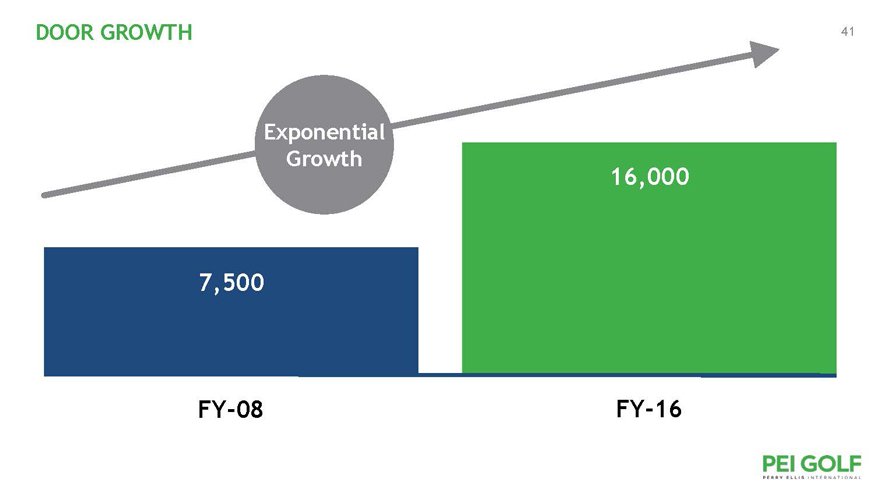

DOOR GROWTH 41

Exponential

Growth

16,000

7,500

FY-08 FY-16

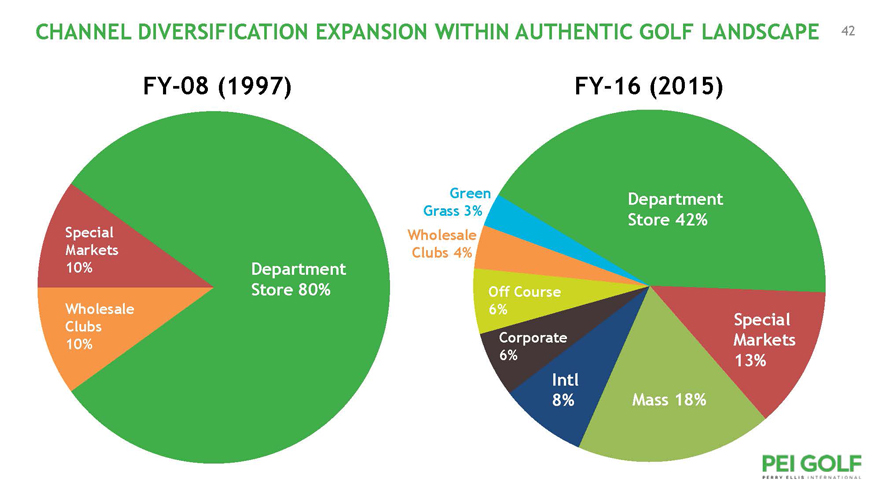

CHANNEL DIVERSIFICATION EXPANSION WITHIN AUTHENTIC GOLF LANDSCAPE 42

FY-08 (1997) FY-16 (2015)

eComm XX

Green Department Grass 3% Store 42%

Special Wholesale Markets Clubs 4%

10% Department

Store 80% Off Course Wholesale 6%

Clubs Special

10% Corporate Markets

6% 13% Intl

8% Mass 18%

PEI GOLF, LEADING THE EVOLUTION OF GOLF LIFESTYLE APPAREL 43

Golf Lifestyle Performance Gear

On Course Off Course Training

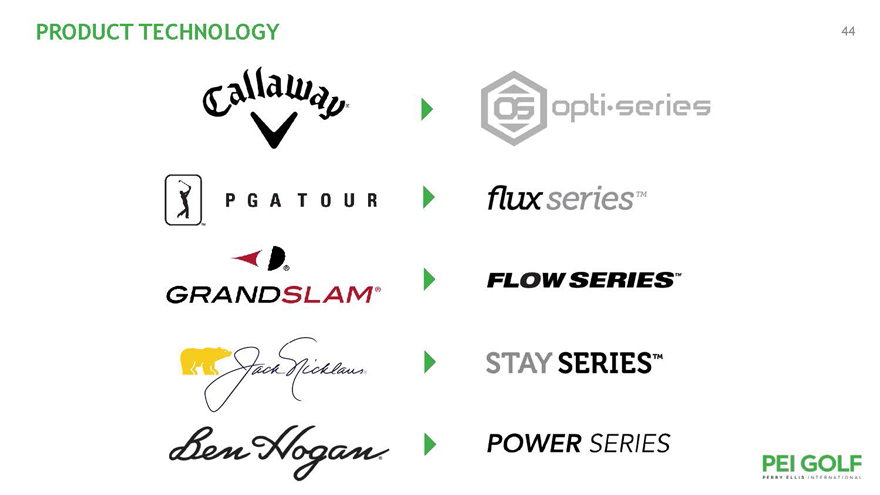

PRODUCT TECHNOLOGY 44

PERFORMANCE GEAR 45

Targeting the athleisure opportunity

WOMEN’S LIFESTYLE: GOLF, ACTIVE, LEISURE (GAL) 46

Function, Fit and Versatility

GOLF ACTIVE LEISURE

MARKETING STRATEGY 47

Key Initiatives

TOUR Player Activation with over 30 high-profile players

PGA TOUR, Web.com TOUR, Champions TOUR,

European TOUR, LPGA TOUR

National and Regional media and blogger outreach

Editorial coverage garnering 6.5M impressions

Social media fan engagement

Promotions have generated a 30% rise in

social media engagement year-over-year

Enhanced in-store visual experience

Localized retail partner initiatives

TOUR PLAYER ACTIVATION

49

Patrick Reed

2015 FedEx Cup Rank: 9

2015 Official World Golf Rank: 18

CAREER ACCOMPLISHMENTS

Winner 2015 Hyundai Tournament of Champions

Winner 2014 Humana Challenge

Winner 2014 WGC – Cadillac Championship

Winner 2013 Wyndham Championship

2014 Ryder Cup Team USA Member

2013 Presidents Cup Team USA Member

50

Danny Willett

2015 Race to Dubai Rank: 2 2015 Official World Golf Rank: 25

CAREER ACCOMPLISHMENTS

Winner 2015 Omega European Championship Winner 2015 Nedbank Golf Challenge Winner 2012 BMW International Open

51

Lee Janzen

2015 Charles Schwab Cup Rank: 7 2015 Official World Golf Rank: 1,125

CAREER ACCOMPLISHMENTS

Winner 2015 ACE Group Classic (Champions TOUR) Winner 1998 U.S. Open Championship Winner 1995 THE PLAYERS Championship Winner 1995 Kemper Open Winner 1995 Sprint International Winner 1994 Buick Classic Winner 1993 Phoenix Open Winner 1993 U.S. Open Championship Winner 1992 Northern Telecom Open

52

Tommy Gainey

2015 The 25 Money List Ranking: 65th 2015 Official World Golf Ranking: 577th

CAREER ACCOMPLISHMENTS

Winner 2012 The McGladery Classic

Winner 2010 Melwood Prince George’s County Open (Web.com TOUR) Winner 2010 Chiquita Classic (Web.com TOUR)

53

Sandra Gal

2015 Rolex Rank: 39 2015 CME Rank: 24

CAREER ACCOMPLISHMENTS

Winner 2011 Kia Classic

Member of the 2011 European Solheim Cup team 2007 First Team All-American at the University of Florida Winner of two World Amateur Team Championships

– 2004 and 2006

54

Robert Streb

2015 FedEx Cup Rank: 6

2015 Official World Golf Rank: 40

CAREER ACCOMPLISHMENTS

Winner at the 2015 McGladrey Classic

Winner at the 2012 Mylan Classic (Web.com TOUR)

55

Marc Leishman

2015 FedEx Cup Rank: 75

2015 Official World Golf Rank: 57

CAREER ACCOMPLISHMENTS

Winner 2012 Travelers Championship 2010 – Runner-up Farmers Insurance Open 2009—PGA TOUR Rookie of the Year 2009—Runner-up at BMW Championship Winner of the 2008 WNB Golf Classic 2008 – Runner-up at the Utah Championship

56

D.A. Points

2015 FedEx Cup Rank: 168

2015 Official World Golf Rank: 475

CAREER ACCOMPLISHMENTS

Winner 2013 Shell Houston Open

Winner 2011 AT&T Pebble Beach National Pro Am Winner 2008 Miccosukee Championship (Web.com TOUR) Winner 2004 Northeast Pennsylvania Classic (Web.com TOUR) Winner 2004 Pete Dye West Virginia Classic (Web.com TOUR) Winner 2001 BUY.com Inland Empire Open (Web.com TOUR)

IN-STORE VISUAL EXPERIENCE

JCPenney

FINANCIAL HIGHLIGHTS 62

Anita Britt

Chief Financial Officer

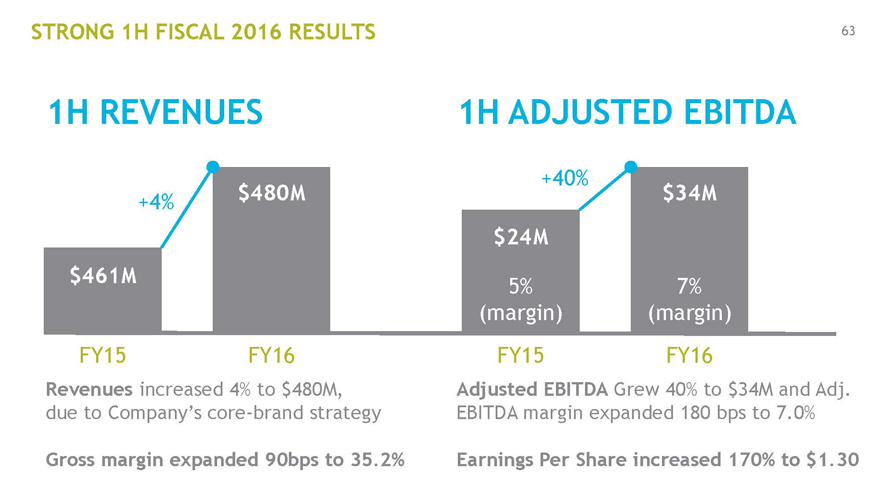

STRONG 1H FISCAL 2016 RESULTS 63

1H REVENUES 1H ADJUSTED EBITDA

+40%

+4% $480M $34M

$24M

$461M 5% 7%

(margin) (margin)

FY15 FY16 FY15 FY16

Revenues increased 4% to $480M, Adjusted EBITDA Grew 40% to $34M and Adj.

due to Company’s core-brand strategy EBITDA margin expanded 180 bps to 7.0%

Gross margin expanded 90bps to 35.2% Earnings Per Share increased 170% to $1.30

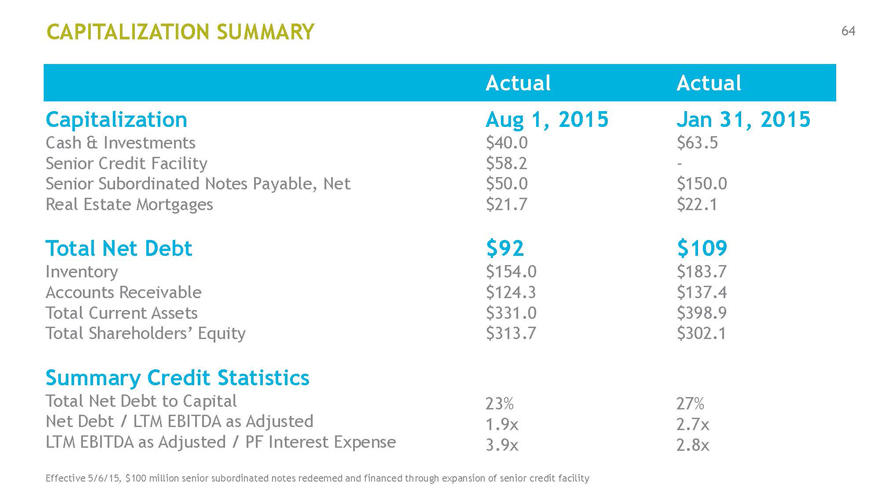

CAPITALIZATION SUMMARY 64

Actual Actual

Capitalization Aug 1, 2015 Jan 31, 2015

Cash & Investments $ 40.0 $63.5

Senior Credit Facility $ 58.2 —

Senior Subordinated Notes Payable, Net $ 50.0 $150.0

Real Estate Mortgages $ 21.7 $22.1

Total Net Debt $92 $109

Inventory $ 154.0 $183.7

Accounts Receivable $ 124.3 $137.4

Total Current Assets $ 331.0 $398.9

Total Shareholders’ Equity $ 313.7 $302.1

Summary Credit Statistics

Total Net Debt to Capital 23% 27%

Net Debt / LTM EBITDA as Adjusted 1.9x 2.7x

LTM EBITDA as Adjusted / PF Interest Expense 3.9x 2.8x

Effective 5/6/15, $100 million senior subordinated notes redeemed and financed through expansion of senior credit facility

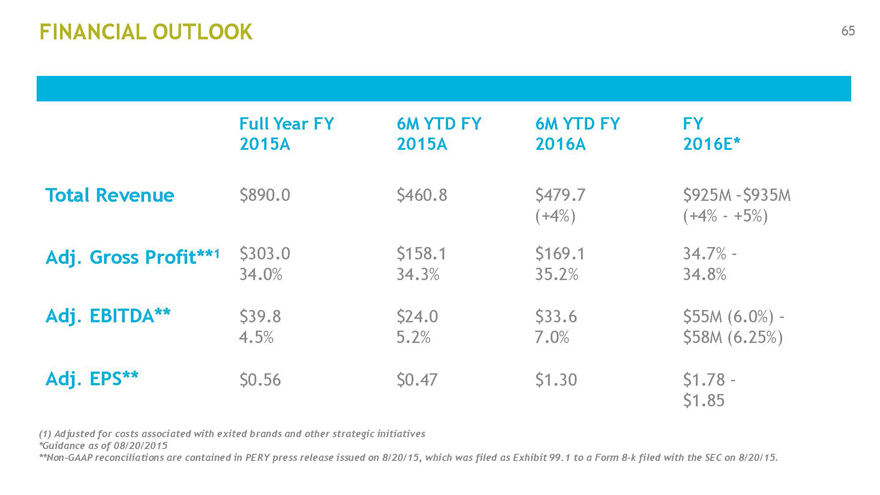

FINANCIAL OUTLOOK 65

Full Year FY 6M YTD FY 6M YTD FY FY

2015A 2015A 2016A 2016E*

Total Revenue $890.0 $460.8 $479.7 $925M –$935M

(+4%) (+4%—+5%)

Adj. Gross Profit**1 $303.0 $158.1 $169.1 34.7% –

34.0% 34.3% 35.2% 34.8%

Adj. EBITDA** $39.8 $24.0 $33.6 $55M (6.0%) –

4.5% 5.2% 7.0% $58M (6.25%)

Adj. EPS** $0.56 $0.47 $1.30 $1.78 –

$1.85

(1) | | Adjusted for costs associated with exited brands and other strategic initiatives |

*Guidance as of 08/20/2015

**Non-GAAP reconciliations are contained in PERY press release issued on 8/20/15, which was filed as Exhibit 99.1 to a Form 8-k filed with the SEC on 8/20/15.

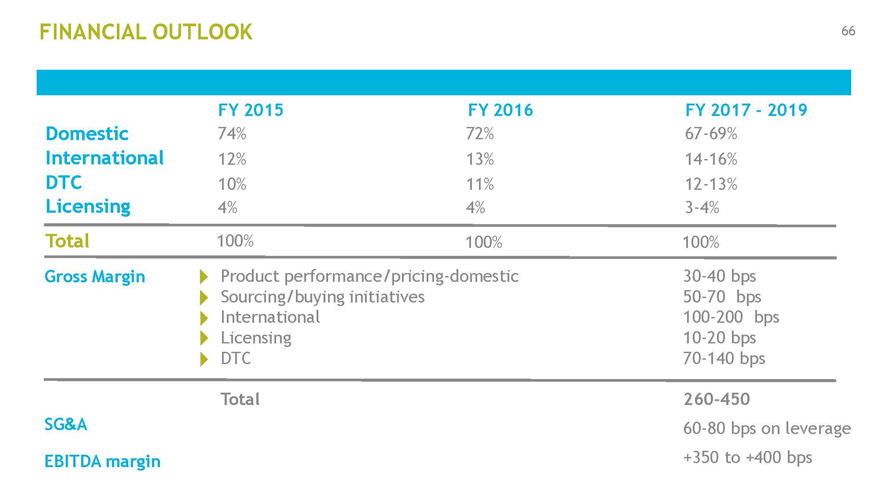

FINANCIAL OUTLOOK 66

FY 2015 FY 2016 FY 2017—2019

Domestic 74% 72% 67-69%

International 12% 13% 14-16%

DTC 10% 11% 12-13%

Licensing 4% 4% 3-4%

Total 100% 100% 100%

Gross Margin Product performance/pricing-domestic 30-40 bps

Sourcing/buying initiatives 50-70 bps

International 100-200 bps

Licensing 10-20 bps

DTC 70-140 bps

Total 260-450

SG&A 60-80 bps on leverage

EBITDA margin +350 to +400 bps

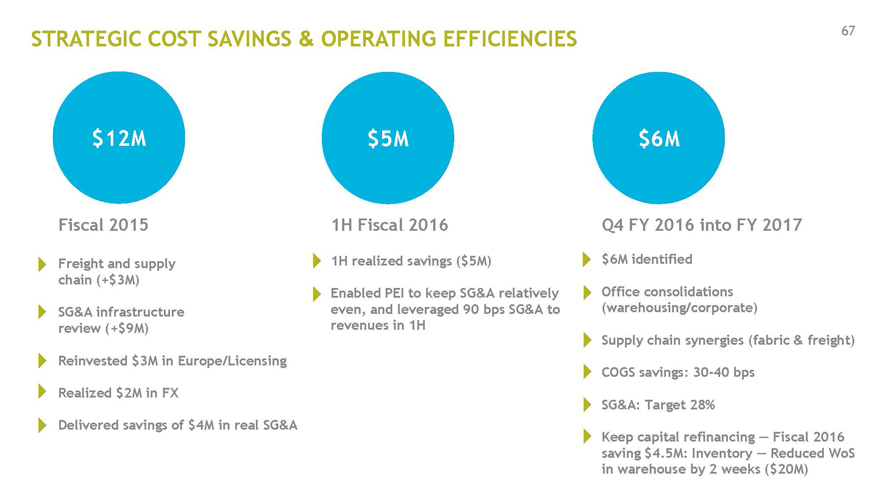

STRATEGIC COST SAVINGS & OPERATING EFFICIENCIES 67

$12M $5M $6M

Fiscal 2015 1H Fiscal 2016 Q4 FY 2016 into FY 2017

Freight and supply 1H realized savings ($5M) $6M identified chain (+$3M) Enabled PEI to keep SG&A relatively Office consolidations SG&A infrastructure even, and leveraged 90 bps SG&A to (warehousing/corporate) review (+$9M) revenues in 1H

Supply chain synergies (fabric & freight) Reinvested $3M in Europe/Licensing COGS savings: 30-40 bps Realized $2M in FX

SG&A: Target 28% Delivered savings of $4M in real SG&A

Keep capital refinancing — Fiscal 2016 saving $4.5M: Inventory — Reduced WoS in warehouse by 2 weeks ($20M)

Performing Elevating Reaping Yielding

to energize core products, revenue and shareholder value, brands and global marketing and strong financial via cost savings and expansion talent results operational efficiencies