| | |

| | SCHEDULE 14A INFORMATION | |

| | |

| | PROXY STATEMENT PURSUANT TO SECTION 14(a) | |

| | OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| | |

| | Filed by the Registrant / X / | |

| | |

| | Filed by a party other than the Registrant | / / |

| Check the appropriate box: | |

| / / | Preliminary Proxy Statement | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule | |

| | 14a-6(e) (2)) | |

| / / | Definitive Proxy Statement | |

| / X/ | Definitive Additional Materials | |

| / / | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 | |

| |

| | PUTNAM MUNICIPAL OPPORTUNITIES TRUST |

| | (Name of Registrant as Specified In Its Charter) |

| | (Name of Person(s) Filing Proxy Statement, |

| | if other than Registrant) | |

| | |

| Payment of Filing Fee (Check the appropriate box): | |

| | |

| / X / | No fee required | |

| | |

| / / | Fee computed on table below per Exchange Act Rule 14a 6(i)(1) and 0-11 | |

| | |

| | (1) Title of each class of securities to which transaction applies: | |

| | |

| (2) Aggregate number of securities to which transaction applies: | |

| | |

| | (3) Per unit price or other underlying value of transaction | |

| | computed pursuant to Exchange Act Rule 0-11 (set forth the | |

| | amount on which the filing fee is calculated and state how it | |

| | was determined): | |

| | |

| | (4) Proposed maximum aggregate value of transaction: | |

| | |

| | (5) Total fee paid: | |

| | |

| / / | Fee paid previously with preliminary materials. | |

| | |

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule | |

| | 0-11(a)(2) and identify the filing for which the offsetting fee was paid | |

| | previously. Identify the previous filing by registration statement | |

| | number, or the Form or Schedule and the date of its filing. | |

| | |

| | (1) Amount Previously Paid: | |

| | |

| | (2) Form, Schedule or Registration Statement No.: | |

| | |

| | (3) Filing Party: | |

| | |

| | (4) Date Filed: | |

Putnam

Municipal Opportunities

Trust

Investor Presentation

John A. Hill

Chairmanof the Board ofTrustees,

ThePutnamFunds

JamesonA.Baxter

ViceChairmanof the Board ofTrustees,

ThePutnamFunds

Rob A.Bloemker

Head of FixedIncome,

Putnam Investments

1.AboutPutnam Municipal OpportunitiesTrust (PMO)

2.PMO’sIndependent Trusteeshaveactively advancedtheinterestsofshareholders

3.PMO’s closed-endstructureat this timecontinuestoprovide benefitstoshareholdersthat are notavailableunder an open-endstructure

4.Karpusseeks aliquidityevent that serves its owninterestsat theexpenseof othershareholders,andKarpuswould not be anappropriate fiduciary

5.Vote to re-elect theIndependent Trusteesandmaintaintheirapproachto PMO’s closed-endstructurein thismarket environment

|

| 1. About Putnam Municipal |

| Opportunities Trust (PMO) |

|

| 1. About Putnam Municipal Opportunities Trust |

|

A solidperformance historyin line withclosed-end fundpeers

•PMO’s peer group is the LipperGeneral MunicipalDebt Funds(Leveraged Closed-End)category

–PMO at market price hasoutperformedits Lipper peer groupaverageover 1, 3, and 5 years

–PMO at net asset value hasoutperformedits Lipper peer groupaverageover 3 and 5 years

•PMO was rated 3 stars out of 5 byMorningstaras of12/31/09in the Muni Nat Long-Term Bondcategory

| | | |

| Putnam Municipal Opportunities Trust, annualized total returns as of December 31, 2009 |

| | | | |

| | 1 year | 3 years | 5 years |

|

| Net asset value | 33.88% | 1.92% | 3.78% |

|

| Market price | 37.06% | 3.47% | 4.03% |

|

| Lipper General Municipal Debt Funds | 35.07% | 1.30% | 3.43% |

| (Leveraged Closed-End) category average | | | |

|

| Barclays Capital Municipal Bond Index | 12.91% | 4.41% | 4.32% |

| |

| PMO’s expenses are competitive with its Lipper peer group | |

|

| | Expense ratio |

|

| |

| PMO as of FYE April 30, 2009 | 1.38% |

|

| |

| Lipper General Municipal Debt Funds | |

| (Leveraged Closed-End) category average as of March 10, 2010 | 1.38% |

|

|

| 1. About Putnam Municipal Opportunities Trust |

|

PMO hasskilled managers

Fundobjective:

Putnam Municipal OpportunitiesTrust seeks toprovideas high a level ofcurrent incomefree fromfederal incometax asPutnam Management believesisconsistentwith thepreservationof capital

| | | | |

| Portfolio managers | | Investment experience (years) | | Titles / Responsibilities* |

|

| |

| Thalia Meehan, CFA | | 27 | | Managing Director |

| | | | | Team Leader, Tax Exempt Group |

|

| |

| Paul M. Drury, CFA | | 21 | | Senior Vice President |

| | | | | Tax Exempt Specialist |

|

| |

| Susan A. McCormack, CFA | | 24 | | Senior Vice President |

| | | | | Tax Exempt Specialist |

Theportfolio managersarebackedbyPutnam Investments’fixed-income resources

•Nearly 70investment professionalsand $50 billion in assets undermanagement

•Research coverageof every global fixed-incomesector

Putnam’sfixed-income fundshave astrongtrackrecord

•More than 74% ofPutnamfixed-incomefunds — closed-end and open-end —rankedaboveaveragein their Lippergroups

•% ofPutnamfixed-incomefunds thatrankedaboveaveragein their Lippergroupsas ofDecember31, 2009:

| | | |

| 1 year | 3 years | 5 years | 10 years |

|

| 77% (17 of 22 funds) | 91% (20 of 22 funds) | 86% (19 of 22 funds) | 90% (19 of 21 funds) |

| |

| * See Appendix A for investment manager biographies. | |

|

| | 4 |

|

| 1. About Putnam Municipal Opportunities Trust |

|

The fund ismanagedbyPutnam Investments,aleading money manager

•Over 70 years ofinvestment experience, managingmoney forindividualsandinstitutionssince 1937

•Nearly $114 billion in assets undermanagement,for nearly 6 millionshareholder accounts*

•190institutional clients, including pensionfunds ofseveralstates and many largecorporations†

•78 mutual funds across assetclasses,and sixinvestment categories—growth,blend, value,income, absolutereturn, and global sector

•24variable annuityandvariablelifeproduct choices,withsubaccountsfor TheHartford Financial ServicesGroup andAllstateLifeInsurance Company

•411 401(k) plansincludinga range ofPutnamfunds

•156investment professionalswith abalanceof skill andbackgrounds

•OfficesinBoston, London, Frankfurt, Amsterdam,Tokyo,Sydney,andSingapore

•Led byexperienced investment managerswho seeksuperiorresults over timebackedbyoriginal, fundamental research

* As ofFebruary28, 2010.

† As ofSeptember30, 2009.

All other data as ofDecember31, 2009.

|

| 1. About Putnam Municipal Opportunities Trust |

|

Twomattersfor theApril8, 2010shareholder meeting

•ElectionofTrustees

–TheTrusteesof thePutnamFunds areindependent,highlyqualified,and activefiduciarieswho haveproactively protectedthe long-terminterestsofshareholders.TheTrusteesmeetregularlywith the fund’sinvestment manager, Putnam

–Thedissidentslate ofTrustee nominees submittedbyKarpus Investment Managementdoes notappearto becomposedofindividualswithsignificant experienceinfiduciary responsibilityand closed-end fundgovernance

•Shareholder ProposaltoConsiderOpen-Endingthe Fund

–The merits ofmaintainingthe fund’s closed-end fundstructureat this time areespecially compellingwhen one takes intoaccountthecurrent market circumstances, narrow tradingpricediscount, advantageous preferredshareleverage,andsignificant outperformanceby the fundrelativeto acomparableopen-endPutnamfund

–TheIndependent Trusteeshave asignificantandlengthyhistory ofapprovingopen-endingmergersfor closed-end funds when they are in the bestinterestsof fundshareholders

|

| 2. PMO’s Independent Trustees have |

| actively advanced the interests |

| of shareholders |

|

| 2. PMO’s Independent Trustees have actively advanced the interests of shareholders |

|

TheTrusteesareindependent, experienced,andhighly qualified fiduciaries

•Independent

–TheTrusteeshave anindependent Chairman,John Hill

–Jameson Baxter,the ViceChairmanof the Board andChairmanof itsContract Committee,is theChairmanof the Mutual FundDirectors Forum,which servesinvestment company directors, promotes vigilant, dedicatedand well-informed independent directors,and serves as their voice andadvocateonimportantpolicymatters

–13 of 14Trusteesare, and would be ifelected, Independent Trustees.AsIndependent Trustees,they are not“interested persons”of PMO or ofPutnam

–TheIndependent Trusteesareassistedby anindependent administrativestaff and byauditorsand legalcounselwho areselectedby theIndependent Trusteesand areindependentofPutnam

•Highly qualified,withsignificant currentand pastexperience(forcomplete biographies,seeAppendixB)

–Six ChiefExecutive Officersofinvestmentfirms

–ChiefInvestmentOfficer of majorretirementplans

–ChiefFinancialOfficer ofJohnson&Johnson

–Presidentof MountHolyoke College

–ProfessorofEconomicsat MIT

•Strongfundgovernance practices

–Acombinationof long-tenuredand newermembers, bringing diverse perspectivesto fundoversight

–Nostaggeredboard or othertakeover defenses;every PMO boardmemberstands forelectioneach fiscal year

|

| 2. PMO’s Independent Trustees have actively advanced the interests of shareholders |

|

TheTrusteesandPutnam have actively addressedthespecific concerns

ofclosed-end fundshareholders

•TheIndependent Trusteeshave heldregularly scheduled monthly meetingsand haveconducted additional meetingsasnecessary

•TheIndependent TrusteesmeetregularlywithPutnam regarding closed-endfunds,and theycarefully monitorthefunds’ performance,thetrading prices (includinganydiscountsorpremiums)of fundshares,and theexpressedviews ofshareholdersin the funds

•Putnamand theIndependent Trusteeshave takenactionsthatbenefitthe bestinterestsof fundshareholders:

–They havemergedfunds.

•They havemergedclosed-end fundstogether,twice in 2005 and twice in 2008

•They havemergedclosed-end funds into open-end funds, once in 2006 and twice in 2007

–They haveinitiated tender offers.In 2007, tender offers wereconductedtopurchaseup to 10% of theoutstanding commonshares of each of eight closed-end funds(includingPMO) at a price per share equal to 98% of NAV. In 2008, a tender offer foranotherfund wasconductedtopurchaseup to 15% of itsoutstanding commonshares at a price per share equal to 99% of NAV

–They haveinstituteda sharerepurchase program.In 2005, theTrustees approveda sharerepurchaseplan and haverenewedit ever since. To date, theprogramhas made ameaningful contributiontoinvestmentreturn

–Theyreduced managementfees for theclosed-end funds,effective January1, 2006.PMO’smanagementfeedecreasedby 15%, from 65 basis points to 55 basis points

|

| 2. PMO’s Independent Trustees have actively advanced the interests of shareholders |

|

Putnamand theIndependent Trustees have actedinshareholders’ best interests sincetheauction-ratesecurities market collapsed

•Putnamand theIndependent TrusteestookactionwhenPMO’s preferred shareholdersfacedsignificant liquidity issues,andPMO’s common shareholdersfacedpotentially highercosts ofpreferredshareleverage

•Putnamand theIndependent Trustees devoted,andcontinuetodevote, considerable effortstoaddressingthesituationin amannerthat takes intoaccounttheinterestsof bothcommonandpreferred shareholders

•PMO todayremains leveragedin amanner comparableto itsindustry peers,whilehaving provided significant liquidityto thefund’s preferred shareholdersandhaving reducedthe risk to thefund’s common shareholders associatedwithpotentially increasing preferredshare“maximum dividend rates”

Chronology:

–Beginningin early 2008, theauction (remarketing) processfor PMO’spreferred shares,and similarpreferredshares across the closed-end fundindustry, ceasedtofunction

–From June 2008 toAugust2008, PMOredeemed15% ($59.1M)of itsoutstanding preferred shares, substitutingtender option bonds(TOBs)

–InSeptember2008,Putnam recommended,and theTrustees approved,themergerof PMO into asimilarly managedopen-endPutnamfund in light of thefollowing factors:(i)marketplace developmentsat that time forleveragedclosed-end funds; (ii) the risks and costs to PMO’ ;scommon shareholdersofmaintainingthe then-current preferredshareleverageover time; (iii) the cost andavailabilityofalternative leverage financing sourcesfor PMO; (iv) the level ofdiscountthenprevailingin thetradingprice of PMO’s shares ascomparedwith NAV; and (v)general conditionsin themunicipalbondmarket

–Theannouncementof the formalapprovalof themergerinOctober2008 noted thatcompletionof themergerwould besubjectto anumberofconditionsand thatcompletioncould bedelayedin light ofchanging market conditions

–FromNovember2008 toJanuary2009, anadditional47% ($156.05M)ofpreferredshares wereredeemedinpreparationfor themerger

–$215.15Mof $394M ofpreferredshareleveragewasredeemed.PMO’sleveragewasreducedfrom 42% to 26% (30%includingTOBleverage),to a levelreasonably comparableto other funds in its Lippercategory

|

| 2. PMO’s Independent Trustees have actively advanced the interests of shareholders |

|

Putnamand theIndependent Trustees have actedinshareholders’ best interests sincetheauction-ratesecurities market collapsed (cont.)

•TheIndependent Trustees determinedtosuspendtheproposed mergeras in theshareholders’bestinterests becauseoffundamental changesinmarket conditions

•Putnamand theIndependent Trusteeswillcontinuetomonitor market conditionsin light of theshareholders’bestinterests

–TheIndependent Trustees believethat theproposed mergermayultimately representthe best long-term option for PMO’scommon shareholdersifconditions emergeto make itadvisable(for both PMO and the open-end fund into which it wouldmerge)

–Putnamand theTrusteeswillcontinuetomonitorthemarketplaceforalternative financing solutionsthat would permitadditional redemptionofpreferredshareswithout material detrimentto PMO’scommon shareholders

•TheIndependent Trusteesowe afiduciaryduty to the fund to act in amannerthatprotectsitsinterests, takingintoaccounttheinterestsof allshareholders,bothcommonandpreferred

–Fiduciaryduties tocommon shareholderslimit the ability of PMO’s board —regardlessof itsmembers— toredeemtheremaining preferredshares

–TheIndependent Trustees electedby thepreferred shareholdersdo not havespecial responsibilitiesto thoseshareholders

–PMOcontinuestocomplywith all of the terms of thepreferredshares andcontinuesto pay the“maximum dividendrate”

Chronology:

•Thesignificant declineinliquidityacross majormarketsin the wake ofLehman Brothers’ September2008bankruptcy caused Putnamtorecommendto theTrusteesinJanuary2009 that furtherredemptionsofpr eferredshares would not beadvisableat that time

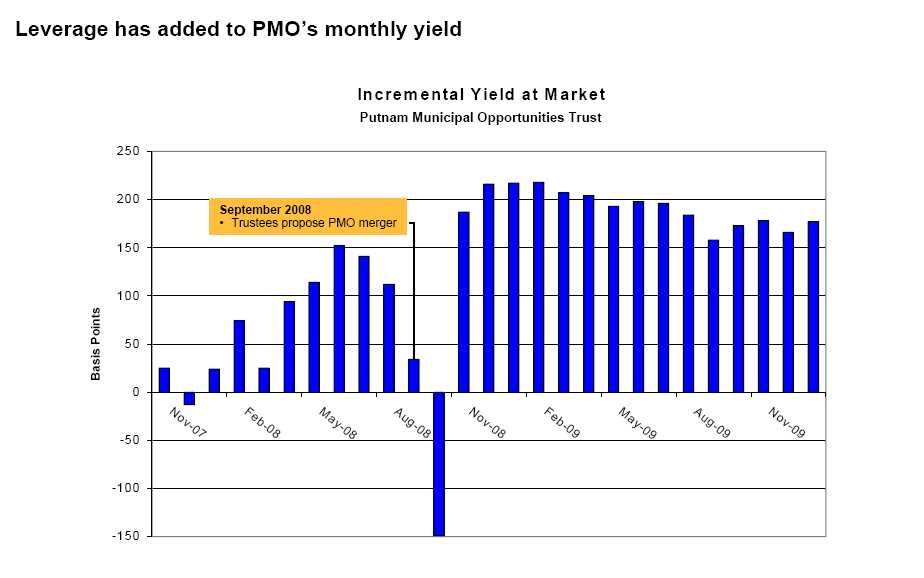

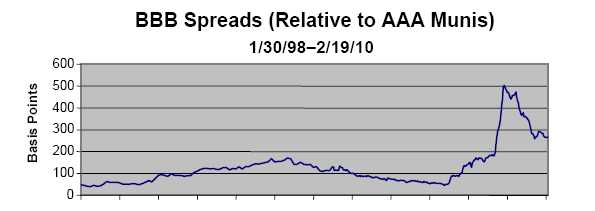

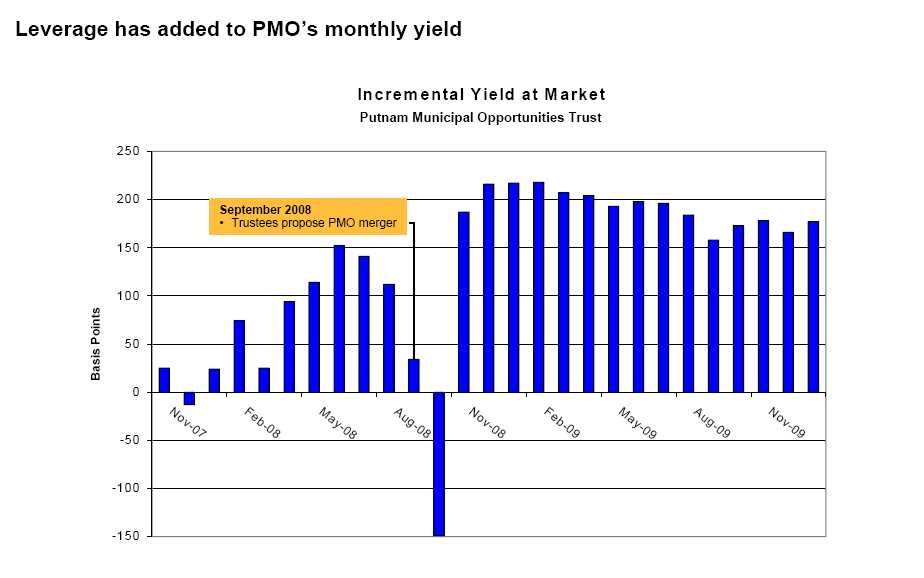

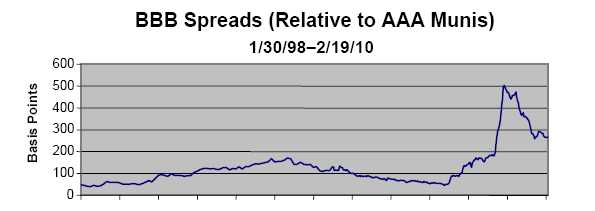

•By thesummerof 2009, whileliquidity conditionsin allmarketshadgenerally improved, liquidity challenges persistedin certain credit qualitysegmentsof themunicipalbondmarket, includingthe BBB-ratedsegments heavily representedin theportfolio(seeAppendixC). At the same time, due toFederal Reserve actionsthat hadreducedshort-termborrowingcosts tohistoricallows, thebenefitsofpreferredshareleverageto PMO’scommon shareholders increased significantly. Moreover, Putnam advisedtheTrusteesof itsexpectationthatpreferredshareleveragewouldcontinueto beadvantageousto PMO’scommon shareholdersfor theforeseeablefuture

•Consequently,in June 2009,Putnam advisedtheTrusteesthatmarket conditionsmade theproposedopen-endingmerger inadvisable,based on the costs offunding anticipated redemptionsand on thedisadvantagesofremoving preferredshareleverageat that time. On June 26, 2009, it wasannouncedthat theTrustees authorized Putnamtosuspendfurther efforts toimplementthemergerat that time

|

| 3. PMO’s closed-end structure at this time |

| continues to provide benefits to |

| shareholders that are not available |

| under an open-end structure |

|

| 3. PMO’s closed-end structure at this time continues to provide benefits to |

| shareholders that are not available under an open-end structure |

|

PMO’s closed-endstructure today offers advantagesover open-endfunds

•Investmentsinhigher-yielding securities.Becausea closed-end fund’s shares are notredeemable,PMO is notrequiredtomaintainshort-term, lower-yielding investmentsinanticipationofpossible redemptions

•No sales andredemptioncosts.PMO does notexperiencethe cash flowsassociatedwith sales andredemptionsof open-end fundshares,which createtransactioncosts that are borne by long-termshareholders

•Abilityto useleverage.Unlike open-end funds, closed-end funds arepermittedtoengageininvestment leveragebyissuing preferred shares. Leverageis a viableinvestmenttool to:

–Adjustduration

–Takeadvantageof relative value along the yield curve

–Increaseyield

–Increase exposuretoattractive securitiesand/or sectors

|

| 3. PMO’s closed-end structure at this time continues to provide benefits to |

| shareholders that are not available under an open-end structure |

|

|

| 3. PMO’s closed-end structure at this time continues to provide benefits to |

| shareholders that are not available under an open-end structure |

|

As aclosed-end fund, PMO hasoutperformed Putnam’s comparableopen-end fund,whichhas the sameinvestmentgoal andportfolio managers

•PMO’sreturnsat NAV over 1, 5, and 10 yearsexceedthose ofPutnamTaxExempt IncomeFund

•PMO’sreturnsatmarketpriceexceedthose ofPutnamTaxExempt IncomeFund for allperiods

•PMO’sshareholders benefitedfrom theTrustees’ decisiontosuspendthemerger becausein 2009 PMO nearlydoubledthe return ofPutnamTaxExempt IncomeFund, the fund into which it would havemerged

| | | | |

| PMO vs. Putnam Tax Exempt Income Fund, its open-end counterpart, as of December 31, 2009 |

| | | | |

| | 1 year | 3 years | 5 years | 10 years |

|

| PMO at net asset value | 33.88% | 1.92% | 3.78% | 6.03% |

|

| PMO at market price | 37.06% | 3.47% | 4.03% | 6.86% |

|

| Putnam Tax Exempt Income Fund | 17.94% | 3.01% | 3.31% | 4.85% |

|

| 3. PMO’s closed-end structure at this time continues to provide benefits to |

| shareholders that are not available under an open-end structure |

|

PMO’s discountis not areasonfor open-ending

•While PMO’scommonshares have traded at adiscountto their NAV over certainperiods,thediscounthasfluctuatedover time, and at times PMO’scommonshares have traded at apremiumto NAV

•In no period has PMOexperienceda deep,persistent discount

•Thenarrowingof PMO’sdiscount currentlygivescommon shareholders opportunitiestoliquidatetheirpositionsatmarketpricesrelativelyclose to NAV,withoutopen-ending the fund

•PMO’sdiscountlevels (-4.01%,-9.24%,and -5.97%)in the periodbetweenthemerger suspension (6/26/09)and theannouncementofKarpus’s proposals (12/24/09)were morefavorablethan PMO’sdiscountlevels forcalendaryear 2008 or 2009

| | | |

| | Narrowest discount | Widest discount | Average discount/ |

| | (or highest premium) | (or lowest premium) | Premium |

|

| YTD 2010 | -3.16% | -5.85% | -4.67% |

|

| 2009 | -4.01% | -11.77% | -6.70% |

|

| 2008 | -4.16% | -13.93% | -9.98% |

|

| 2007 | -5.85% | -13.95% | -9.16% |

|

| 2006 | -8.66% | -13.86% | -11.24% |

|

| 2005 | -4.80% | -14.14% | -10.03% |

|

| 2004 | +4.38% | -7.00% | -1.67% |

|

| 2003 | +2.49% | -8.06% | -2.81% |

|

| 2002 | +1.68% | -8.49% | -2.26% |

|

| 2001 | +7.05% | -5.24% | +2.34% |

|

| 2000 | +2.70% | -12.42% | -4.31% |

|

| 1999 | +8.83% | -12.57% | +1.46% |

|

| 1998 | +10.99% | -1.72% | +3.07% |

|

| 1997 | +6.01% | +0.47% | +3.22% |

|

| 1996 | +4.17% | -3.71% | +0.70% |

|

| 1995 | +1.25% | -8.22% | -2.98% |

|

|

| 3. PMO’s closed-end structure at this time continues to provide benefits to |

| shareholders that are not available under an open-end structure |

|

TheIndependent Trustees authorizedatenderoffer andrepurchase program

thatprovided liquidityandhelped PMO’s returns

•Thetenderoffer:In 2007, the fundconducteda tender offer topurchase10% of PMO’soutstanding commonshares at a price per share equal to 98% of the NAV per share

•Therepurchase program:Recognizingthe benefit of sharerepurchasesfor less than NAV,Putnamand theTrusteeshave, since 2005,authorizedfor PMO and allPutnamclosed-end funds aprogramtoconductopen-market repurchasesofoutstanding common shares.

•Thebenefit:FromOctober2005 toAugust2009, sharerepurchasesunder both the sharerepurchase programand the 2007 issuer tender offercontributed approximately1.27% to PMO’s total return during a low-interest-rateenvironmentfor fixedincome investing

| | |

| Benefit to fund through | Contribution to returns | Fund’s actual total returns |

| repurchase, in $ | at NAV, 10/25/05–8/31/09 | at NAV, 10/25/05–8/31/09 |

|

| $3,286,245 | 1.27% | 8.18% |

|

| 3. PMO’s closed-end structure at this time continues to provide benefits to |

| shareholders that are not available under an open-end structure |

|

| |

| Putnam and the Independent Trustees have a demonstrated history of advancing |

| the interests of PMO’s shareholders |

| |

| October 2005 | Trustees authorized repurchase of PMO shares |

|

| January 2006 | Trustees reduced PMO management fees 15% |

|

| March 2006 | Trustees doubled repurchase limit from 5% to 10% of outstanding shares |

|

| September 2006 | Trustees extended share repurchase program |

|

| February 2007 | Trustees made a tender offer to repurchase PMO shares |

|

| September 2007 | Trustees renewed share repurchase program |

|

| June 2008 | PMO distribution increased |

|

| June 2008 | Trustees authorized a plan to redeem preferred shares and substitute TOBs |

|

| September 2008 | Trustees renewed share repurchase program |

| |

| | Trustees proposed merging PMO into a similar open-end fund |

|

| Fourth quarter 2008 | Market liquidity crisis raised cost of merging funds |

| |

| | Lower interest rates improved returns on fund’s leverage |

|

| December 2008 | PMO distribution increased |

|

| January 2009 | Trustees delayed proposed merger |

|

| 2008–09 (continuous) | Significant preferred share redemptions |

|

| April 2009 | PMO distribution increased |

|

| June 2009 | Trustees suspended proposed merger |

|

| October 2009 | PMO distribution increased |

|

| December 2009 | PMO registered 33.88% return at NAV for 2009 |

|

| 4. Karpus seeks a liquidity event that |

| serves its own interests at the |

| expense of other shareholders, and |

| Karpus would not be an |

| appropriate fiduciary |

|

| 4. Karpus seeks a liquidity event that serves its own interests at the expense of other |

| shareholders, and Karpus would not be an appropriate fiduciary |

|

Karpus’s pursuitofshort-term profits would burden other shareholders with significant costs

•Karpus specializesintaking positionsinclosed-end funds whentradingpricediscountsare large and thenseekingshort-termprofitsbypressingforliquidity eventsthatextractvalue from othershareholders

•Thesignificant potentialcosts of an open-ending conversionis areasonto voteagainsttheshareholder proposal

–Costsassociatedwithredeeming preferred shares.PMO would need to sell asignificant portionof itsportfolioin order toredeemitsoutstanding preferredshares prior to aconversion

•This would cause the fund to incurtransactioncosts as well as the risk ofpotential marketlossesassociatedwithliquidatinglargepositionsin a short time frame

–Assetliquidationto meetredemptionsafter open-ending.Followingaconversion,PMO would likely need toliquidate additionalassets in order to meetredemption requestsfrominvestorswho do not wish toremain shareholdersof an open-end fund

• TheTrustees consideredthat suchmechanismsasredemptionfees and in-kindpaymentsmightmitigatethetransactioncostsassociatedwith suchadditional redemptions,but might not fullyinsulatetherema ining shareholdersfrombearingaportionof these costs

–Other costsassociatedwith open-ending.PMO would likely incur legal,accounting,proxysolicitation,and other costs inconnectionwithsolicitingashareholdervote forconversionandeffectingaconversion

–Increased expenseratio.Significant shareholder redemptionswouldreducethe size of PMO, which could result in anincreased expenseratio forremaining shareholders

•PMO’s shareholders wouldbeforcedto incur costs inlocatingandacquiringanalternativefund inwhichtoinvest followingany open-ending

|

| 4. Karpus seeks a liquidity event that serves its own interests at the expense of other |

| shareholders, and Karpus would not be an appropriate fiduciary |

|

Karpushas putforward trustee candidateslessqualifiedthan the

Trusteesof thePutnam Funds

•Limited financial market experience

•Limitedfundoversight experience

•Limited academic backgroundinfinance

Karpus’s proposalto open-end PMOwouldhurt long-termshareholders

•Karpus neglectstheinterestsofshareholderswhoconsciously selectedPMO for the

advantagesof its closed-endstructure

•Karpus’spursuit of short-term profitsthroughaliquidityevent with aninvestment vehicle

notstructuredtoprovide liquiditywouldimposecosts on PMO’sshareholders

|

| 5. Vote to re-elect the Independent Trustees and |

| maintain their approach to PMO’s closed-end |

| structure in this market environment |

|

| 5. Vote to re-elect the Independent Trustees and maintain their approach |

| to PMO’s closed-end structure in this market environment |

|

Re-electPMO’s Independent Trustees

•TheTrusteesareindependent, experienced,and highlyqualified fiduciaries

•PMO’sIndependent Trusteeshaveactively advancedtheinterestsofshareholders

•TheIndependent TrusteesandPutnamhave ademonstratedhistory ofactively pursuingtheinterestsof PMO’s

shareholders

Reject Karpus’s proposaltochange PMO’s closed-endstructure

•After carefulconsiderationofcurrent market conditions,theIndependent Trusteeshaveconcludedthat the

currentclosed-endstructure continuestoprovide benefitstoshareholdersthat are notavailableunder an open-end

structure

•Open-ending the fund would occur at theexpenseof long-termshareholdersbyextracting liquidityfrom an

investment vehicle intendedto beinsulatedfrom suchconcerns

•TheIndependent Trusteeswillperiodicallyreview PMO’s closed-endstructureasmarket

conditions change

Note:RecognizethatKarpus’s purported nomineesto beelected solelyby

preferredshareholdersareinvalid

•Karpus’sproxy cardrecommendstwopurported nomineesto beelectedsolely by PMO’spreferred shareholders

•Investorssuch asKarpuswho do not ownpreferredshares lack the power to vote inrespectof these twotrustee

positions,andthereforecannot makenominationsfor thesepositions

•Even ifKarpushad had the power to make thesenominations, Karpus’s nominee submissionfailed to meet the

provisionsof PMO’sadvancenoticebylaws

•AppendixA:Investment manager biographies

•AppendixB:Trustee biographies

•AppendixC:Current liquidityof BBB bondsincreasesthe cost of open-ending PMO

|

| Appendix A: Investment manager biographies |

|

Rob A.Bloemker

Mr.Bloemkeris aManaging Directorand Head of FixedIncomeatPutnam Investments.In this role, he isresponsiblefor themanagement, analysis,andtradingofPutnam’sfixed-income productsfor retail andinstitutionalclients in the Unite d States andinternationally.Mr.Bloemker’sdirectreports includethe teamleadersofInvestmentGrade and High Yield Credit, LiquidMarkets, StructuredCredit,Emerging MarketsDebt, MoneyMarkets, Portfolio Construction,and TaxExempt.His team of nearly 70investment professionals managesov er $50 billion inassets.

Inaddition,Mr.Bloemkeris the LeadPortfolio Manageronabsolute-return andbenchmark-focused portfolios, including Putnam AbsoluteReturn 100 Fund,Putnam AbsoluteReturn 300 Fund,Putnam American Government IncomeFund,Putnam IncomeFund, andPutnamU.S.Government IncomeTrust. He is also aportfolio managerofPutnam Diversified IncomeTrust,PutnamGlobalIncomeTrust,Putnam Master Intermediate IncomeTrust, andPutnam Premier IncomeTrust.

Mr.BloemkerjoinedPutnamin 1999 as aMortgage Specialist,and has served invariousroles ofincreasing responsibility.Mostrecently,he served as TeamLeaderofPutnam’sMBS, ABS, andGovernmentteams. Mr.Bloemkeralso serves onPutnam’s Executive CommitteeandOperating Committee,and has been in theinvestment industrysince 1988.

Education: Washington University,B.S., B.A.

ThaliaMeehan,CFA

Ms.Meehanis aManaging Directorand TeamLeaderof the TaxExempt Group.Inadditiontomanaging Putnam’sTaxExempt Group,she is aPortfolio ManagerofPutnam’stax-exemptfixed-incomefunds. Ms.Meehanhas served on theNational FederationofMunicipal Analysts’Board ofGovernorsand is amemberofPutnam’s Diversity Advisory Council,theBoston Municipal Analyst Forum,and theBoston Security Analysts Society,as well as theSocietyofMunicipal Analysts.In 2002, shereceivedtheMeritorious ServiceAward from theNFMA.Ms.Meehan,who joinedPutnam’sTaxExemptBond Group in 1989, is a CFAcharterholderand has been in theinvestment industrysince 1983.

Education: Williams College,B.A.

Paul M. Drury, CFA

Mr. Drury is a Senior VicePresidentand TaxExempt Specialiston the TaxExemptFixedIncometeam. He isresponsibleformanaging several sectorswithin themunicipal market.He is aPortfolio ManagerofPutnam’stax-exemptand fixed-incomefunds. Mr. Drury joinedPutnamin 1989 as a Mutual FundAccountantin the TaxExempt Accounting Department.A CFAcharterholder,he has over 21 years ofinvestment industry experience.

Education: Suffolk University,B.A.

Susan A.McCormack,CFA

Ms.McCormackis a Senior VicePresidentand TaxExempt Specialiston the TaxExemptFixedIncome Group.She is aPortfolio ManagerofPutnam’stax-exemptfixed-incomefunds. Ms.McCormackjoinedPutnamin 1994 as ananalystand moved into the role ofPortfolio Managerin 1999. She is a CFAcharterholderand has been in theinvestment industrysince 1986.

Education: Stanford University,M.B.A.;Dartmouth College,A.B.

|

| Appendix B: Trustee biographies |

|

John A. Hill(Chair)

(Born 1942),Trusteesince 1985 andChairmansince 2000

Mr. Hill isfounderand Vice-Chairmanof FirstReserve Corporation,theleadingprivate equity buyout firmspecializingin theworldwide energy industry,with offices inGreenwich, Connecticut; Houston,Texas;London, England;andShanghai,China. The firm’sinvestmentson behalf of some of thenation’slargestpensionandendowmentfunds arecurrently concentratedin 26companieswith annualrevenuesinexcessof $13 billion, whichemployover100,000people in 23countries.

Mr. Hill isChairmanof the Board ofTrusteesof thePutnamMutualFunds,aDirectorof DevonEnergy Corporationandvariousprivatecompaniesowned by FirstReserve,and serves as aTrusteeof SarahLawrence C ollegewhere he serves aschairmanand also chairs theInvestment Committee.He is also amemberof theAdvisoryBoard of theMillsteinCenter forCorporate GovernanceandPerformanceat the YaleSchoolofManagement.

Prior toformingFirstReservein 1983, Mr. Hill served asPresidentof F.EberstadtandCompany,aninvestment bankingandinvestment managementfirm.Between1969 and 1976, Mr. Hill heldvariousseniorpositionsinWashington,D.C. with thefederal government, including Deputy Associate Directorof the Office ofManagementandBudgetandDeputy Administratorof theFederal Energy Administrationduring the FordAdministration.

Mr. Hill was born and raised inMidland,Texas, Mr. Hillreceivedhis B.A. inEconomicsfromSouthern Methodist Universityandpursued graduate studiesas aWoodrowWilsonFellow.

JamesonA.Baxter(Vice Chair)

(Born 1943),Trusteesince 1994 and ViceChairmansince 2005

Ms. Baxter is thePresidentof BaxterAssociates,Inc., a privateinvestmentfirm. Ms. Baxter serves as aDirectorofASHTA Chemicals,Inc., and asChairmanof the Mutual FundDirectors Forum.Until 2007, she was aDirectorof BantaCorporation(aprintingand supply chainmanagement company), Ryerson,Inc. (a metalsservice corporation),andAdvocateHealth Care. Until 2004, she was aDirectorofBoardSource (formerlytheNationalCenter forNonprofit Boards);and until 2002, she was aDirectorofIntermatic Corporation(amanufacturerofenergycontrolproducts). She isChairman Emeritusof the Board ofTrustees,MountHolyoke College,having served asChairmanfor five years.

Ms. Baxter has heldvarious positionsininvestment bankingandcorporate finance, includingVicePresidentof andConsultantto FirstBoston Corporationand VicePresidentandPrincipalof theRegency Group.She is agraduateof MountHolyoke College.

RaviAkhoury

(Born 1947),Trusteesince 2009

Mr.Akhouryserves asAdvisorto New York LifeInsurance Company,andpreviouslywas aMemberof itsExecutive Management Committee.He is also aDirectorof Jacob BallasCapitalIndia (a non-banking finance company focusedon private equityadvisory services)and is amemberof itsCompensation Committee.Inaddition,he serves as aTrusteeofAmericanIndiaFoundationand of the RubinMuseum, servingon itsInvestment Committee.

Previously,Mr.Akhourywas aDirectorand on theCompensation CommitteeofMaxIndia/NewYork LifeInsurance Companyin India. He was also VicePresidentandInvestmentPolicyCommittee MemberofFischer, Francis,Trees and Watts (a fixed-income portfolio managementfirm). He has also served on the Board of BhartiTelecom(an Indiantelecommunications company), servingas amemberof its Audit andCompensation committees,and as amemberof the AuditCommitteeon the Board ofThompsonPress (apublishing company). From 1992 to 2007, he wasChairmanand CEO ofMacKay Shields,a multi-product investment managementfirm with over $40 billion in assets undermanagement.

Mr.Akhoury graduatedfrom the IndianInstituteofTechnologyand holds an M.S. from StateUniversityof New York atStonybrook.

|

| Appendix B: Trustee biographies |

|

CharlesB. Curtis

(Born 1940),Trusteesince 2001

Mr. Curtis isPresident Emeritusof theNuclearThreatInitiative(a privatefoundation dealingwithnational security issues),serves as SeniorAdvisorto the UnitedNations Foundation,and is SeniorAdvisorto the Center forStrategicandInternational Studies.

Mr. Curtis is amemberof theCouncilonForeign Relationsand theNational Petroleum Council.He also serves asDirectorofEdison InternationalandSouthern California Edison.Until 2006, Mr. Curtis served as amemberof theTrustee Advisory Councilof theApplied Physics Laborat ory,JohnsHopkins University.

FromAugust1997 toDecember1999, Mr. Curtis was aPartnerat Hogan &HartsonLLP, aninternationallaw firmheadquarteredinWashington,D.C. Prior to May 1997, Mr. Curtis wasDeputy SecretaryofEnergyand UnderSecretaryof the U.S.DepartmentofEnergy.Inaddition,he was afounding memberof the law firm of Van NessFeldman.Mr. Curtis served asChairmanof theFederal Energy Regulatory Commissionfrom 1977 to 1981 and has heldpositionson the staff of the U.S. House ofRepresentatives,the U.S.Treasury Department,and the SEC.

RobertJ.Darretta

(Born 1946),Trusteesince 2007

Mr.Darrettaserves asDirectorofUnitedHealth Group,adiversifiedhealth-carecompany.

Until April 2007, Mr.Darrettawas ViceChairmanof the Board ofDirectorsofJohnson&Johnson,one of theworld'slargest and mostbroadlybased health-carecompanies.Prior to 2007, he hadresponsibilityforJohnson&Johnson’s finance, investor relations, information technology,andprocurement function.He served asJohnson&JohnsonChiefFinancialOfficer for adecade,prior to which he spent two years asTreasurerof thecorporationand over ten yearsleading various Johnson&Johnson operating companies.

Mr.Darretta receiveda B.S. inEconomicsfromVillanova University.

Myra R.Drucker

(Born 1948),Trusteesince 2004

Ms.Druckeris Vice Chair of the Board ofTrusteesof SarahLawrence Collegeand amemberof theInvestment Committeeof theKresge Foundation(acharitabletrust). She is also aDirectorofInteractiveDataCorporation(aprovideroffinancial marketdata andanalyticstofinancial institutionsandinvestors)and former Chair of the Board ofTrusteesofCommonfund(a not-for-profit firmmanagingassets foreducational endowmentsandfoundations).

Ms.Druckeris an ex-officiomemberof the New York StockExchange Pension Managers Advisory Committee,having served as Chair for seven years. She serves as anadvisorto RCMCapital Management(aninvestment managementfirm) and to theEmployee Benefits Investment Committeeof TheBoeing Company(anaerospacefirm) .

FromNovember2001 untilAugust2004, Ms.DruckerwasManaging Directorand amemberof the Board ofDirectorsofGeneral MotorsAssetManagementand ChiefInvestmentOfficer ofGeneral MotorsTrust Bank. From December1992 toNovember2001, Ms.Druckerserved as ChiefInvestmentOfficer of XeroxCorporation(adocument company). Prior toDecember1992, Ms.Druckerwas Staff VicePresidentandDirectorof TrustInvestmentsforInternati onalPaper (a paper andpackaging company).

Ms.Drucker receiveda B.A. from SarahLawrence Collegeandpursued graduate studiesineconomics, statistics,andportfoliotheory atTemple University.

|

| Appendix B: Trustee biographies |

|

Paul L.Joskow

(Born 1947),Trusteesince 1997

Dr.Joskowis aneconomistandPresidentof the Alfred P. SloanFoundation(aphilanthropic institution focused primarilyonresearchandeducationon issuesrelatedtoscience, technology,andeconomic performance). He is on leave from hispositionas theElizabethand James KillianProfessorofEconomicsandManagementat theMassachusetts InstituteofTechnology(MIT), where he has been on the faculty since 1972. Dr.Joskowwas theDirectorof the Center forEnergyandEnvironmentalPolicyResearchat MIT from 1999through2007.

Dr.Joskowserves as aTrusteeof YaleUniversity,aDirectorofTransCanada Corporation(anenergy company focusedonnaturalgastransmissionand powerservices)and ofExelon Corporation(anenergy company f ocusedon powerservices),and as amemberof the Board ofOverseersof theBoston Symphony Orchestra.Prior toAugust2007, he served as aDirectorofNationalGrid (a UK-basedholding companywithinterestsinelectricand gastr ansmissionanddistributionandtelecommunications infrastructure). Prior to July 2006, he served asPresidentof the YaleUniversity Council.Prior toFebruary2005, he served on the board of theWhitehead InstituteforBiomedical Research(a non-profitresearch institution). Prior toFebruary2002, he was aDirectorof State FarmIndemnity Company(anautomobile insurance company),and prior to March 2000, he was aDirectorof NewEngland Electric System(a public utilityholding company).

Dr.Joskowhaspublishedsix books andnumerous articlesonindustrial organization, government regulationofindustry,andcompetitionpolicy. He is active inindustry restructuring, environmental, energy, competition,andprivatization policies—servingas anadvisortogovernmentsandcorporations worldwide.Dr.Joskowholds a Ph.D. and M. Phil from YaleUniversityand a B.A. fromCornell University.

ElizabethT.Kennan

(Born 1938),Trusteesince 1992

Dr.Kennanis aPartnerofCambus-KennethFarm(thoroughbredhorse and cattlebreeding). She isPresident Emeritusof MountHolyoke College.

Dr.Kennanserved asChairmanand is now LeadDirectorofNortheast Utilities.She is aTrusteeof theNationalTrust forHistoric Preservationand of CentreCollegeinDanville, Kentucky.Until 2006, she was amemberof TheTrusteesofReservations.Prior to 2001, Dr.Kennanserved on theoversight committeeof the FolgerShakespeare Library.Prior to June 2005, she was aDirectorofTalbots,Inc., and she has served asDirectoron anumberof otherboards, includingBellAtlantic, ChastainRealEstate, ShawmutBank,BerkshireLifeInsurance,andKentuckyHome LifeInsurance.Dr.Kennanhas also served asPresidentof FiveColleges Incorporatedand as aTrusteeof Notre DameUniversity,and is active invarious educationaland civicassociations.

As amemberof the faculty ofCatholic Universityfor twelve years, until 1978, Dr.Kennan directedthe post-doctoral programinPatristicandMedieval Studies,taughthistory,andpublished numerous articlesand two books. Dr.Kennanholds a Ph.D. from theUniversityofWashingtoninSeattle,an M.A. from OxfordUniversity,and an A.B. from MountHolyoke College.She holdsseveral honorary doctorates.

|

| Appendix B: Trustee biographies |

|

KennethR.Leibler

(Born 1949),Trusteesince 2006

Mr. Leibler is afounderand formerChairmanof theBoston Options Exchange,anelectronic marketplacefor thetradingofderivative securities.

Mr. Leiblercurrentlyserves as aTrusteeof Beth IsraelDeaconess HospitalinBoston.He is also LeadDirectorof Ruder FinnGroup,a globalcommunicationsandadvertisingfirm, and aDirectorofNortheast Utilities,whichoperatesNewEngland'slargestenergy delivery system.Prior toDecember2006, he served as aDirectorof theOptimumFunds group. Prior toOctober2006, he served as aDirectorof ISO NewEngland,theorganization responsiblefor theoperationof theelectric generation systemin the NewEnglandstates. Prior to 2000, Mr. Leibler was aDirectorof theInvestment Company InstituteinWashington,D.C.

Prior toJanuary2005, Mr. Leibler served asChairmanand ChiefExecutiveOfficer of theBostonStockExchange.Prior toJanuary2000, he served asPresidentand ChiefExecutiveOfficer of LibertyFinancial Companies,apubliclytradeddiversifiedassetmanagement organization.Prior to June 1990, Mr. Leibler served asPresidentand ChiefOperatingOfficer of theAmericanStockExchange (AMEX),and at the time was theyoungest personin AMEX history to hold the title ofPresident.Prior toservingas AMEXPresident,he held thepositionof ChiefFinancial Officer,andheadeditsmanagementandmarketing operations.

Mr. Leiblergraduated magnacum laude with adegreeinEconomicsfromSyracuse University,where he waselectedPhi BetaKappa.

RobertE.Patterson

(Born 1945),Trusteesince 1984

Mr.Pattersonis SeniorPartnerof CabotProperties,LP andChairmanof CabotProperties,Inc. (a private equity firminvestingincommercialrealestate).

Mr.Pattersonserves asChairman EmeritusandTrusteeof the JoslinDiabetes Center.Prior to June 2003, he was aTrusteeof SeaEducation Association.Prior toDecember2001, Mr.PattersonwasPresidentandTrusteeof CabotIndustrialTrust (apubliclytraded real estateinvestmenttrust). Prior toFebruary1998, he wasExecutiveVicePresidentandDirectorofAcquisitionsof CabotPartners Limited Partnership(aregistered investment adviser involvedininstitutionalrea l estateinvestments). Prior to 1990, he served asExecutiveVicePresidentof Cabot, Cabot &ForbesRealtyAdvisors,Inc. (thepredecessor companyof CabotPartners).

Mr.Patterson practicedlaw and heldvarious positionsin stategovernment,and was thefounding Executive Directorof theMassachusetts Industrial Finance Agency.Mr.Pattersonis agraduateofHarvard CollegeandHarvardLawSchool.

George Putnam,III

(Born 1951),Trusteesince 1984

Mr.PutnamisChairmanof NewGeneration Research,Inc. (apublisheroffinancial advisoryand otherresearch services),andPresidentof NewGeneration Advisors,Inc. (aregistered investment adviserto private funds). Mr.Putnam foundedthe NewGeneration companiesin 1986.

Mr.Putnamis aDirectorof TheBostonFamily Office, LLC (aregistered investment adviser). He is aTrusteeof St. Mark'sSchool,aTrusteeofEpiphany School,and aTrusteeof theMarine Biological LaboratoryinWoodsHole,Massachusetts.Until 2006, he was aTrusteeof ShoreCountryDaySchool,and until 2002, was aTrusteeof the SeaEducation Association.

Mr.Putnam previously workedas anattorneywith the law firm ofDechertLLP(formerlyknown asDechertPrice &Rhoads)inPhiladelphia.He is agraduateofHarvard College, Harvard Business School,andHarvardLawSchool.

|

| Appendix B: Trustee biographies |

|

RobertL.Reynolds

(Born 1952),Trusteesince 2008 andPresidentof the Funds since 2009

Mr.ReynoldsisPresidentand ChiefExecutiveOfficer ofPutnam Investments,amemberofPutnam Investments’ ExecutiveBoard ofDirectors,andPresidentof thePutnam Funds.He has more than 30 years ofinvestmentandfinancial services experience.

Prior to joiningPutnam Investmentsin 2008, Mr.Reynoldswas ViceChairmanand ChiefOperatingOfficer ofFidelity Investmentsfrom 2000 to 2007. During this time, he served on the Board ofDirectorsfor FMRCorporation, Fidelity Investments InsuranceLtd.,Fidelity Investments CanadaLtd., andFidelity ManagementT rustCompany.He was also aTrusteeof theFidelityFamily ofFunds.From 1984 to 2000, Mr.Reynoldsserved in anumberofincreasingly responsible leadershiproles atFidelity.

Mr.Reynoldsserves onseveralnot-for-profitboards, includingthose of the WestVirginia University Foundation, Concord Museum,Dana-FarberCancer Institute,Lahey Clinic, andInitiativefor aCompetitiveInner City inBoston.He is amemberof the ChiefExecutivesClub ofBoston,theNational Innovation Initiative,and theCouncilonCompetitiveness.

Mr.Reynolds receiveda B.S. inBusiness Administration/Financefrom WestVirginia University.

W.Thomas Stephens

(Born 1942),Trusteesince 2009

Mr.Stephensis aDirectorofTransCanada Pipelines,Ltd. (anenergy infrastructure company). From 1997 to 2008, Mr.Stephensserved as aTrusteeon the Board of thePutnam Funds,which herejoinedas aTrusteein 2009.

Mr.Stephensretired asChairmanand ChiefExecutiveOfficer of BoiseCascade,L.L.C. (a paper, forestproducts,andtimberlandassetscompany)inDecember2008. Until 2004, Mr.Stephenswas aDirectorof Xcel Energy Incorporated(a public utilitycompany),QwestCommunications,andNorske Canada,Inc. (a papermanufacturer). Until 2003, Mr.Stephenswas aDirectorof Mail-Well, Inc. (adiversified printing company). He served asChairmanof Mail-Well until 2001 and as CEO ofMacMillan Bloedel,Ltd. (a forestproducts company)until 1999. Prior to 1996, Mr.StephenswasChairmanand ChiefExecutiveOfficer of JohnsManville Corporation.

Mr.Stephensholds B.S. and M.S.degreesfrom theUniversityofArkansas.

RichardB.Worley

(Born 1945),Trusteesince 2004

Mr.WorleyisManaging Partnerof PermitCapitalLLC, aninvestment managementfirm.

Mr.Worleyserves as aTrusteeof theUniversityofPennsylvania Medical Center,The Robert WoodJohnson Foundation(aphilanthropic organization devotedto health-careissues),and theNational Constitution Center.He is also aDirectorof TheColonial Williamsburg Foundation(ahistorical preservation organization),and thePhiladelphia Orchestra Association.Mr.Worleyalso serves on theInvestment committeesof MountHolyoke Collegeand WorldWildlifeFund (a wildlifeconservation organization).

Prior to joining PermitCapitalLLC in 2002, Mr.Worleyserved asPresident,ChiefExecutive Officer,and ChiefInvestmentOfficer ofMorgan StanleyDean WitterInvestment Managementand as aManaging DirectorofMorgan Stanley,afinancial servicesfirm. Mr.Worleyalso was theChairmanof MillerAnderson&Sherrerd,aninvestment managementfirm that wasacquiredbyMorgan Stanleyin 1996.

Mr.Worleyholds a B.S. from theUniversityofTennesseeandpursued graduate studiesineconomicsat theUniversityof Texas.

|

| Appendix C: Current liquidity of BBB bonds increases the cost of open-ending PMO |

|

The costs of open-endingPMO wouldinclude selling portfolio assets, includingBBB-bonds with

hightradingcostscurrently,in order toredeemitsoutstanding preferred sharesprior to a

conversionand to meetsubsequent redemption requestsfrominvestorswho do not wish to

remain shareholdersof an open-end fund

•PMO has a largeallocationto BBBsecurities becausethemanagers believethatallocationoffers value

•Thecurrent spreadover AAAsecuritiesis 266 bps (as of2/19/09),which isnarrowerthan thespreadduring 2009, but still wider than it has been for most of the pastdecade, indicating reduced demandand highertradingcosts

Putnam

Municipal Opportunities

Trust

Investor Presentation