| | |

| SCHEDULE 14A INFORMATION |

| |

| PROXY STATEMENT PURSUANT TO SECTION 14(a) |

| OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| Filed by the Registrant / X / |

| | |

| Filed by a party other than the Registrant / / |

| Check the appropriate box: | |

| | |

| / / | Preliminary Proxy Statement | |

| | |

| / / | Confidential, for Use of the Commission Only (as permitted by Rule | |

| | 14a-6(e) (2)) | |

| | |

| / / | Definitive Proxy Statement | |

| | |

| / X / | Definitive Additional Materials | |

| |

| / / | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

| |

| | PUTNAM MUNICIPAL OPPORTUNITIES TRUST |

| |

| | (Name of Registrant as Specified In Its Charter) |

| |

| | (Name of Person(s) Filing Proxy Statement, |

| | if other than Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| | |

| / X / | No fee required |

| | |

| / / | Fee computed on table below per Exchange Act Rule 14a 6(i)(1) and 0-11 |

| |

| | (1) Title of each class of securities to which transaction applies: |

| |

| (2) Aggregate number of securities to which transaction applies: |

| |

| | (3) Per unit price or other underlying value of transaction |

| | computed pursuant to Exchange Act Rule 0-11 (set forth the |

| | amount on which the filing fee is calculated and state how it |

| | was determined): |

| |

| | (4) Proposed maximum aggregate value of transaction: |

| |

| | (5) Total fee paid: |

| |

| / / | Fee paid previously with preliminary materials. |

| |

| / / | Check box if any part of the fee is offset as provided by Exchange Act Rule |

| | 0-11(a)(2) and identify the filing for which the offsetting fee was paid |

| | previously. Identify the previous filing by registration statement |

| | number, or the Form or Schedule and the date of its filing. |

| |

| | (1) Amount Previously Paid: |

| |

| | (2) Form, Schedule or Registration Statement No.: |

| |

| | (3) Filing Party: |

| |

| | (4) Date Filed: |

Putnam Municipal

OpportunitiesTrust(PMO)

Presentationto ISS

May 3, 2011

John A. Hill

Chairmanof the Board ofTrustees,

ThePutnamFunds

JamesonA.Baxter

ViceChairmanof the Board ofTrustees,

ThePutnamFunds

Paul D.Scanlon,CFA

Co-Head of FixedIncome, Putnam Investments

|

| Agenda [Mr. Hill] |

|

| 1.Overview: |

| |

| 1.PMO’s shareholders are well-served, and Karpus cannot be trusted to effect positive change for all shareholders |

| in any event. |

| |

| 2.Discussion: |

| |

| 1.PMO’s Trustees have acted as responsible, independent fiduciaries. |

| |

| 2.PMO’s preferred share leverage is highly advantageous to common shareholders and consistent with the legal |

| rights and legitimate expectations of preferred shareholders. |

| |

| 3.PMO’s performance and trading price do not warrant a change in management. |

| |

| 4.Karpus’s agenda for PMO discredits Karpus’s Trustee nominees as potential fund fiduciaries. |

| |

| 3.Conclusion: |

| |

| 1.Vote PMO’s Management Proxy (White Card): |

| |

| 1.FOR PMO’s 10 Trustee nominees voted upon by the common and preferred shareholders voting together. |

| �� |

| 2.FOR PMO’s 2 Trustee nominees voted upon by the preferred shareholders voting as a separate class. |

|

| 3.AGAINST Karpus’s Proposal 2 recommending that PMO’s management contract with Putnam Investment |

| Management, LLC (Putnam) be terminated. |

| |

| 4.AGAINST Karpus’s Proposal 3 recommending that PMO’s Trustees consider taking all steps to cause PMO |

| to redeem all preferred shares at par and to utilize alternative sources of leverage. |

| |

| 2.DO NOT VOTE Karpus’s Dissident Proxy (Green Card). |

| |

| 3.ISS shouldnotprovide separate recommendations for each class of stock. |

| |

|

|

| 2 |

|

| 1. Overview |

| PMO’s shareholders are well-served, and Karpus cannot be trusted to effect positive |

| change for all shareholders in any event. [Mr. Hill] |

|

| |

| •PMO’s shareholders are well-served. No management change is warranted. |

| |

| –PMO’s common shareholders continue to benefit from the fund’s closed-end, leveraged structure and |

| currently enjoy liquidity in the secondary market at prices close to NAV. |

| |

| –PMO’s common shareholders have benefited from the fund’s solid performance record and can have |

| continued confidence in Putnam, a leading money manager with substantial fixed income expertise. |

| |

| –PMO’s preferred shareholders have had their rights fully honored and have no legitimate basis to demand a |

| redemption or a change in the terms of the securities they purchased when such actions would be contrary to |

| the interests of the common shareholders. |

|

| –PMO’s current Trustees have a demonstrated record of independence and of actively seeking to promote the |

| interests of all shareholders. |

| |

| •Karpus cannot be trusted to effect positive change for all shareholders in any event. |

| |

| –Karpus’s primary interest is in forcing PMO to provide a liquidity event allowing it to exit its large common |

| share position (~ 16%, or $75M) and modest preferred share position (~ 4%, or $7M) at a profit and |

| irrespective of the impact of such a liquidity event on other shareholders. |

| |

| –Karpus’s interests are not aligned with those of other common shareholders who invested in the fund in order |

| to benefit from its closed-end, leveraged structure over the longer term. |

| |

| –Karpus’s interests are not aligned with those of other preferred shareholders since it purchased its preferred |

| shares at a substantial discount. |

| |

| –Karpus’s Trustee nominees cannot be trusted to fairly represent the interests of all shareholders, as they |

| would be obliged to do if elected. |

| |

|

|

| 3 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •The fiduciary obligations of PMO’s Trustees are clear. |

| |

| –The economic rights of preferred and common shareholders are clearly defined (slide 5). |

| |

| –All Trustees owe the same duties to PMO (slide 6). |

| |

| –As a legal matter, PMO’s Trustees owe their primary duty to common shareholders where the |

| interests of common and preferred shareholders diverge (slides 7 and 8). |

|

| –PMO has satisfied its obligations to preferred shareholders (slide 9). |

| |

| –Preferred shareholders have no inherent right to liquidity (slide 10). |

|

| •PMO’s Trustees have a demonstrated record of taking actions that have benefited |

| preferred shareholders. |

| |

| –Although under no fiduciary duty or legal obligation to do so, PMO’s Trustees have in fact taken a |

| number of actions over the past 3 years that have provided additional liquidity to preferred |

| shareholders (slide 11). |

| |

| •As a general matter, the Putnam Funds’ Trustees and Putnam have a demonstrated record |

| of actively addressing the particular concerns of closed-end fund shareholders (slide 12). |

| |

| •PMO’s Trustees are independent, experienced, and highly qualified fiduciaries with strong |

| fund governance practices (slide 13). |

| |

| |

|

| 4 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •The economic rights of preferred and common shareholders are clearly defined. |

| |

| –Under PMO’s organizational documents, PMO’spreferredshareholders are legally entitled to aportionof |

| PMO’s assets and earnings. |

|

| –In contrast, PMO’scommonshareholders are entitled toall remainingassets and earnings of PMO after |

| the rights of the preferred shareholders have been satisfied. |

| |

| |

| |

| |

|

| 5 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

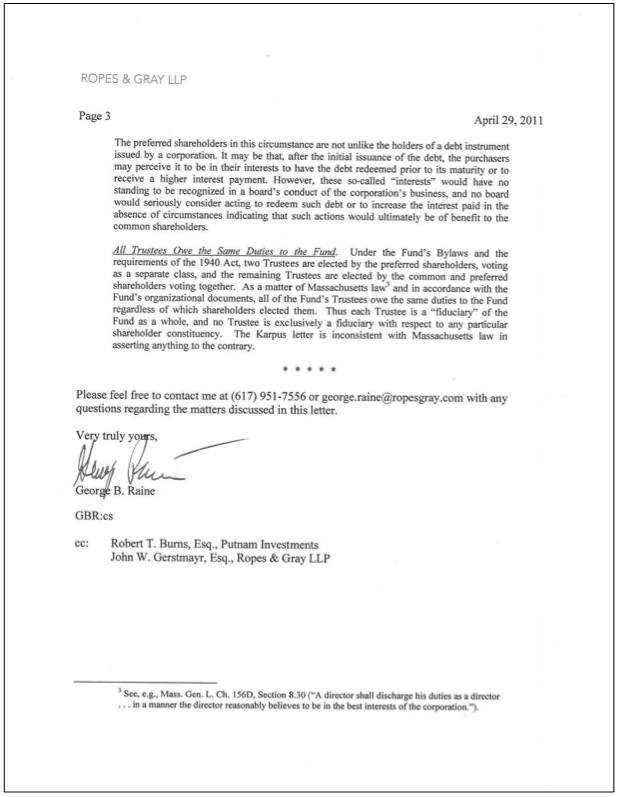

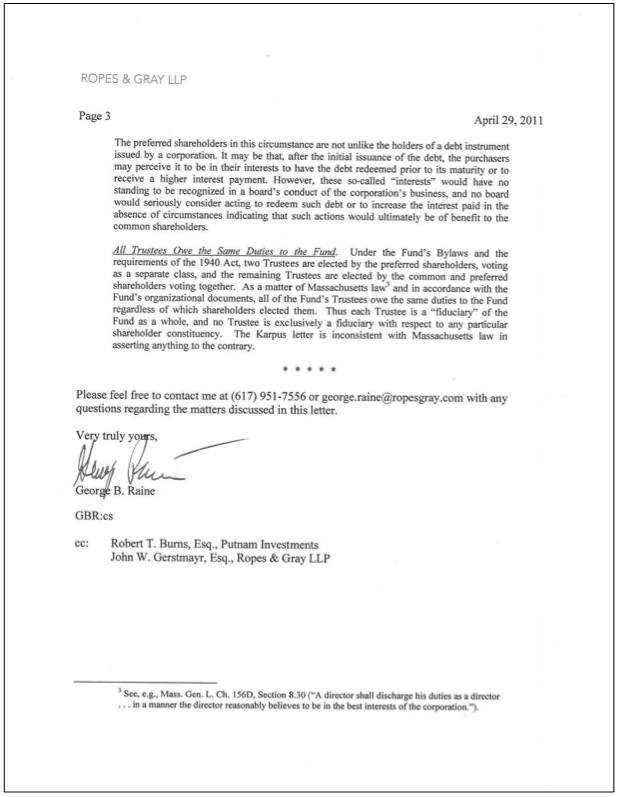

| •All Trustees owe the same duties to PMO. |

| |

| –Under the Investment Company Act of 1940 (1940 Act), 2 Trustees are elected exclusively by the preferred |

| shareholders. |

|

| –1940 Act provides exclusive voting rights to preferred shareholders to ensure that their economic entitlements |

(e.g., dividends and liquidation preference) are appropriately honored. |

|

| –1940 Act doesnotaccord any other fiduciary priority to preferred shareholders or otherwise suggest a |

| “balancing” of interests between preferred and common shareholders. |

|

| –The fiduciary duties of corporate directors/Trustees are defined by state law. |

|

| –Under state law and PMO’s organizational documents, all of PMO’s Trustees owe the same duties to PMO |

| regardless of which shareholders elected them. |

|

| •Mass. Business Corporation Act, Ch. 156D, Sec. 8.30: “[A] director shall discharge his duties as a director... |

| in a manner the director reasonably believes to be in the best interests of thecorporation.” |

|

| •PMO’s Declaration of Trust: The Trustees will hold assets “in trust...for the benefit of the holders...of |

| shares.” Trustees are entitled to indemnification when acting in “in good faith in the reasonable belief that |

| [their actions are] in the best interests of [PMO],” subject to certain 1940 Act limitations. |

|

| –Each Trustee thus is a “fiduciary” of PMO as a whole, and no Trustee is exclusively a fiduciary with respect to |

| only common or preferred shareholders. |

| |

| |

| |

| |

|

| 6 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •As a legal matter, PMO’s Trustees owe their primary duty to common shareholders where |

| the interests of common and preferred shareholders diverge. |

| |

| –The Delaware Chancery Court, to which state courts frequently look for guidance on corporate governance |

| issues, has stated, “[G]enerally it will be the duty of the board, where discretionary judgment is to be |

| exercised, to prefer the interests of the common stock — as the good faith judgment of the board sees them |

| to be — to the interests created by the special rights, preferences, etc., of preferred stock, where there is a |

| conflict.”In re Trados Inc. Shareholder Litigation, 2009 WL 2225958, *7 (Del. Ch. 2009);Equity-Linked |

| Investors v. Adams, 705 A.2d 1040, 1042 (Del. Ch. 1997). |

| |

| –Thus, PMO’s Trustees arenotrequired or permitted to engage in a “balancing” of interests as between |

| common and preferred shareholders in matters where these interests diverge. |

| |

| |

| |

| |

|

| 7 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •As a legal matter, PMO’s Trustees owe their primary duty to common shareholders where |

| the interests of common and preferred shareholders diverge. |

|

| –A common example from corporate finance is instructive: |

|

| •After the initial issuance of debt, the debt holders may wish to have the debt redeemed prior to its maturity |

| or to receive a higher interest payment. |

|

| •No responsible corporate board would seriously consider acting to redeem such debt or to increase the |

| interest paid in the absence of circumstances indicating that such actions would benefit the common |

| stock holders. |

|

| •Similarly, PMO’s preferred shareholders may wish to be redeemed or to change the terms of the securities |

| they purchased, but, in the absence of circumstances indicating that such actions would benefit PMO’s |

| common shareholders, PMO’s preferred shareholders have no legitimate basis to expect such actions. |

| |

| |

| |

| |

|

| 8 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •PMO has satisfied its obligations to preferred shareholders. |

| |

| –Since the collapse of preferred share remarketings/auctions across the industry in February 2008, PMO has |

| continued to satisfy all of its obligations under both the Bylaws and the 1940 Act: |

|

| •PMO has paid dividends at the default interest rate set in accordance with the Bylaws. |

| |

| •PMO has continued to engage and pay a remarketing agent for the conduct of the remarketings/auctions. |

| |

| •PMO has assured that the preferred shares continue to be entitled to all voting rights and privileges. |

| |

| •PMO has continued to meet its asset coverage tests and other maintenance requirements. |

| |

| |

| |

| |

|

| 9 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •Preferred shareholders have no inherent right to liquidity. |

|

| –The terms of PMO’s preferred shares do not guarantee that there will be liquidity for the shares, through the |

| remarketing/auction process or otherwise. |

|

| •The offering documents for PMO’s preferred shares specifically disclosed the possibility of illiquidity as a |

| result of failed remarketings/auctions. |

|

| •PMO’s Bylaws specifically contemplate the possibility of failed remarketings/auctions by requiring PMO to |

| pay dividends to preferred shareholders at a default interest rate for periods following failed |

| remarketings/auctions. |

|

| –The terms of PMO’s preferred shares do not require PMO or its Trustees to provide liquidity except in those |

| specific cases where mandatory redemption provisions in the Bylaws are triggered (e.g., if PMO fails to satisfy |

| asset coverage requirements). |

| |

| |

| |

| |

|

| 10 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •PMO’s Trustees have a demonstrated record of taking actions that have benefited |

| preferred shareholders. |

|

| –Although under no fiduciary duty or legal obligation to do so, PMO’s Trustees have in fact taken a number of |

| actions over the past 3 years that have provided additional liquidity to preferred shareholders. |

| |

| •June 2008 – August 2008: PMO redeemed $59.1M, or 15%, of then-outstanding preferred shares, |

| substituting tender option bonds (TOBs) as an alternative form of leverage. |

|

| •September 2008: Putnam recommended, and the Trustees approved, the merger of PMO into a |

| comparable open-end Putnam fund, subject to a number of conditions. The merger would have resulted in |

| the complete redemption of all preferred shares. |

|

| •November 2008 – January 2009: PMO redeemed $156.05M, or approximately 47%, of the remaining |

| preferred shares in preparation for the merger. |

|

| •While efforts to complete the merger were suspended in January 2009 due to unprecedented market |

| conditions, the foregoing actions resulted in the aggregate redemption of 54.61% ($215.15M out of $394M |

| in liquidation preference) of the preferred shares originally outstanding. |

| |

| |

| |

| |

|

| 11 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| |

| •As a general matter, the Putnam Funds’ Trustees and Putnam have a demonstrated record |

| of actively addressing the particular concerns of closed-end fund shareholders. |

|

| –The Trustees meet regularly with Putnam regarding closed-end funds, and they carefully monitor the funds’ |

| performance, the trading prices (including any discounts or premiums) of fund shares, and the expressed |

| views of shareholders in the funds. |

|

| –Putnam and the Trustees have taken significant actions when circumstances indicate that such actions would |

| benefit the long-term best interests of shareholders: |

|

•They have merged closed-end funds. |

|

| •They have merged closed-end funds together, twice in 2005 and twice in 2008. |

|

| •They have merged closed-end funds into open-end funds, once in 2006 and twice in 2007. |

|

| •They have initiated tender offers.In 2007, tender offers were conducted to purchase up to 10% of the |

| outstanding common shares of each of 8 closed-end funds (including PMO) at a price per share equal to |

| 98% of NAV. In 2008, a tender offer for another fund was conducted to purchase up to 15% of its |

| outstanding common shares at a price per share equal to 99% of NAV. |

| |

| •They have instituted a share repurchase program.In 2005, the Trustees approved a share repurchase |

| plan and have renewed it ever since. To date, the program has made a meaningful contribution to |

| investment return. |

| |

| •They reduced management fees for the closed-end funds, effective January 1, 2006.PMO’s |

| management fee decreased by 15%, from 65 basis points to 55 basis points. |

| |

| •They have monitored the incremental earnings associated with preferred share leverageby |

| requiring Putnam to forego a management fee on assets attributable to preferred shares should the |

| incremental earnings become negative. |

| |

|

| 12 |

|

| 2.1. Discussion |

| |

| PMO’s Trustees have acted as responsible, independent fiduciaries. [Ms. Baxter] |

|

| •PMO’s Trustees are independent, experienced, and highly qualified fiduciaries with strong fund |

| governance practices. |

| |

| –Independent |

|

| •The Trustees have an independent Chairman, John Hill. |

| |

| •Jameson Baxter, the Vice Chairman of the Board and Chairman of its Contract Committee, is the Chairman of the Mutual |

| Fund Directors Forum, which promotes vigilant, dedicated, and well-informed independent directors and serves as their |

| voice and advocate on important policy matters. |

| |

| •11 of 12 Trustees are Independent Trustees, not “interested persons” of PMO or of Putnam. |

|

| •The Independent Trustees are assisted by an independent administrative staff and by auditors and legal counsel selected by |

| the Independent Trustees and independent of Putnam. |

|

| –Highly qualified, with significant current and past experience(for complete biographies, see Appendix A) |

|

| •The Trustees are highly accomplished business and investment professionals with extensive leadership experience and |

| deep backgrounds in mutual fund governance. |

|

| •See how Karpus’s Trustee nominees compare with the current Trustees: |

| | | | |

| PMO’s Current 12 Trustees | | Karpus’s Proposed 12 Trustees | |

|

| |

| 4 have experience as a founder or Chief Executive Officer of a major investment firm | | 0 with equivalent experience | |

|

| |

| 7 serve on Boards of Directors of public operating companies | | 1 with equivalent positions | |

|

| |

| A former Chief Financial Officer of a Fortune 100 company | | 0 with equivalent experience | |

|

| |

| The Chairman of the Mutual Fund Directors Forum | | 0 with equivalent experience | |

|

| |

| A former Director of the Investment Company Institute | | 0 with equivalent experience | |

|

| |

| 12 have experience supervising mutual funds | | 3 with equivalent experience | |

|

| |

|

| –Strong fund governance practices |

| |

| •A combination of long-tenured and newer members, bringing diverse perspectives to fund oversight |

| |

| •No staggered board or other takeover defenses; every PMO board member stands for election each fiscal year |

|

| 2.2. Discussion |

| |

| PMO’s preferred share leverage is highly advantageous to common shareholders and consistent |

| with the legal rights and legitimate expectations of preferred shareholders. [Mr. Scanlon] |

|

| |

| •The cost and terms of PMO’s preferred share leverage are highly advantageous to PMO’s common |

| shareholders (slide 15). |

| |

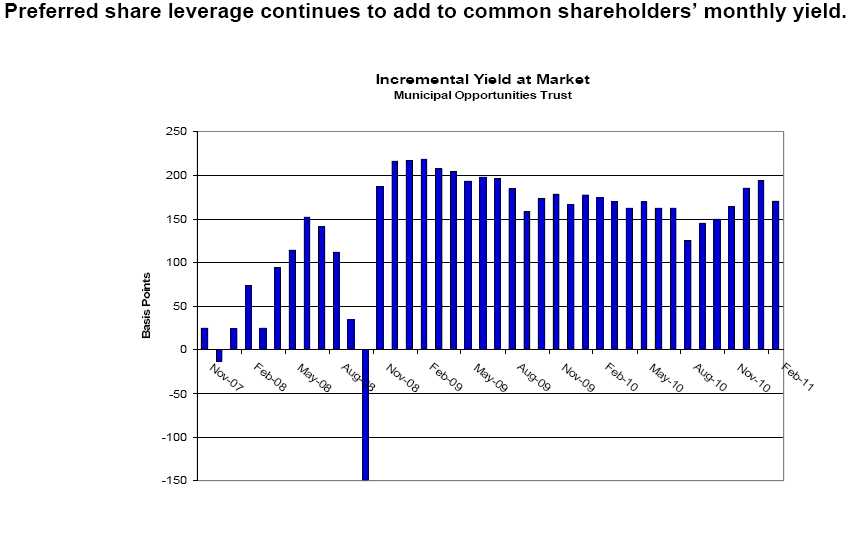

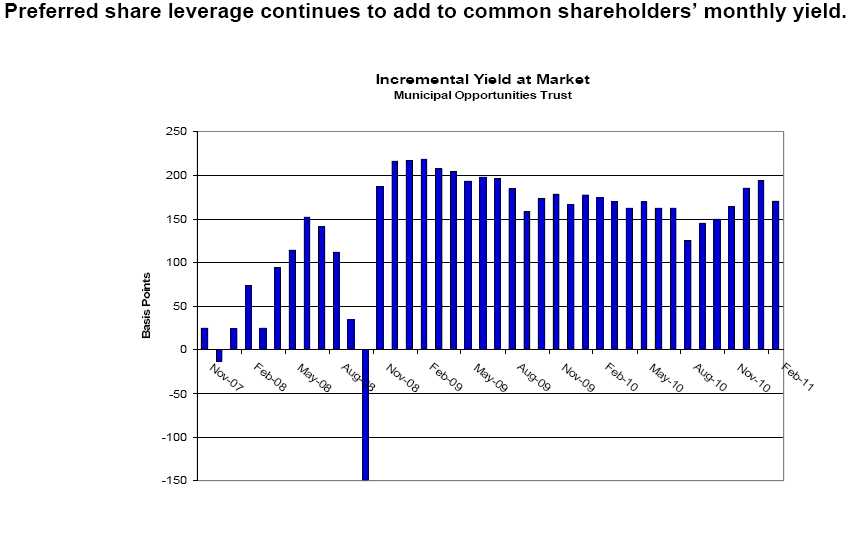

| •Preferred share leverage continues to add to common shareholders’ monthly yield |

| (slide 16). |

| |

| •Putnam actively monitors the marketplace for alternative financing solutions that would result in |

| additional liquidity for preferred shareholders without being contrary to the interests of PMO’s common |

| shareholders and regularly reports to PMO’s Trustees on these matters (slide 17). |

| |

| •PMO’s actions in redeeming preferred shares place it in the mainstream of industry practice (slide 18). |

| |

| •Anyone evaluating a board’s actions relating to ARPS redemptions should be mindful of the many |

| considerations that can influence a fund’s redemption rate and should exercise caution in relying on any |

| single measure (slide 19). |

| |

| |

| |

| |

|

| 14 |

|

| 2.2. Discussion |

| |

| PMO’s preferred share leverage is highly advantageous to common shareholders and consistent |

| with the legal rights and legitimate expectations of preferred shareholders. [Mr. Scanlon] |

|

| |

| •The cost and terms of PMO’s preferred share leverage are highly advantageous to PMO’s |

| common shareholders. |

|

| –As a result of the Federal Reserve Board’s decisions to maintain interest rates at historically low levels, the |

| currentcostof maintaining PMO’s preferred share leverage is highly favorable to PMO’s common |

| shareholders. |

|

| –Thetermsof PMO’s preferred shares are also highly favorable to PMO’s common shareholders and cannot |

| be replaced with any alternative form of leverage cited by Karpus. |

|

| •Maturity – Preferred shares are perpetual in nature, with no stated maturity date. |

| |

| •Callability – Preferred shares are callable at any time at the option of PMO. |

| |

| •Puttability – Preferred shareholders have no ability to “put” the shares back to PMO. |

| |

| •Financing rate – Recent dividend rates for PMO’s Series B and Series C preferred shares were, |

| respectively, 0.396% (4/25 failed remarketing) and 0.411% (4/28 failed remarketing). |

| |

| •As an example, if a homeowner today had a mortgage whose terms featured: |

| |

| •No due date, |

| |

| •Pre-payment at the homeowner’s option at any time without penalty, |

| |

| •No possibility of the homeowner being forced to pre-pay the mortgage, and |

| |

| •An interest rate hovering between 0% and 1%, |

| |

| •Would it be in the best interest of that homeowner to pay off the mortgage or refinance at this time? |

| |

| |

| |

| |

|

| 15 |

|

| 2.2. Discussion |

| |

| PMO’s preferred share leverage is highly advantageous to common shareholders and consistent |

| with the legal rights and legitimate expectations of preferred shareholders. [Mr. Scanlon] |

|

| |

|

|

| 2.2. Discussion |

| |

| PMO’s preferred share leverage is highly advantageous to common shareholders and consistent |

| with the legal rights and legitimate expectations of preferred shareholders. [Mr. Scanlon] |

|

| |

| •Putnam actively monitors the marketplace for alternative financing solutions that would |

| result in additional liquidity for preferred shareholders without being contrary to the |

| interests of PMO’s common shareholders and regularly reports to PMO’s Trustees on |

| these matters. |

|

| –Tax-exempt closed-end funds have fewer options for alternative leverage than taxable funds. |

|

| –Karpus’s suggested alternative sources of leverage, including municipal term preferred securities |

| (MTPS) and variable rate demand preferred securities (VRDPs), aremore costlyand haveless |

| favorable termsat this time. |

|

| •Fixed dividend rates on a recent issuance of MTPS were 2.90%, with the shares having a |

| mandatory call 5 years from the issue date. |

|

| •VRDPs pay dividends at variable rates, but a third party, commonly referred to as a liquidity |

| provider, purchases the VRDPs in the event of a failed remarketing/auction. |

|

| •These rates are typically subject to escalation in the event of an extended period of failed |

| remarketings/auctions, and closed-end funds are typically required to redeem VRDPs still owned |

| by the liquidity provider if there are 6 months of continuous, unsuccessful remarketings/auctions. |

|

| •Tender options bonds (TOBs), another financing source cited by Karpus, represent only a partial, |

| rather than complete, form of alternative leverage, and PMO has already taken advantage of this |

| opportunity to the extent deemed prudent. |

| |

| |

|

| 17 |

|

| 2.2. Discussion |

| |

| PMO’s preferred share leverage is highly advantageous to common shareholders and consistent |

| with the legal rights and legitimate expectations of preferred shareholders. [Mr. Scanlon] |

|

| |

| •PMO’s actions in redeeming preferred shares place it in the mainstream of industry practice. |

| |

| –Since the failure of the auction-rate preferred securities (ARPS) market through 3/31/11, PMO has redeemed |

| 54.61% of its originally outstanding ARPS. |

| |

| –Analysis of the actual redemption actions of other tax-exempt closed-end funds during this same period |

| reveals the following: |

| |

| •The average tax-exempt closed-end fund has redeemed 48.72% of its outstanding ARPS. |

|

| •The median tax-exempt closed-end fund has redeemed 35.00% of its outstanding ARPS. |

| |

| •Excluding the Nuveen funds, which as an organization made a unique and highly speculative investment |

| judgment by refinancing ARPS using fixed-rate preferred shares, the average for the remaining funds was |

| 29.95% and the median was 25.24%. |

| |

| •Of the 158 tax-exempt closed-end funds that still have ARPS outstanding, PMO has redeemed a higher |

percentage of its preferred shares since 2008 than any other fund, with the exception of 4 Nuveen funds. |

| |

| •Excluding the Nuveen funds, industry data show that PMO has redeemed a higher percentage than every |

| single one of the 135 other tax-exempt closed-end funds with ARPS outstanding; the only non-Nuveen |

| funds to have redeemed more than PMO are the 16 funds that have redeemed 100% of their ARPS (5 of |

| which redeemed in connection with a merger or liquidation). |

| |

| •A chart showing distribution of redemptions by percentage is included as Appendix D. |

| |

–Source of ARPS redemption data as of 3/31/11 is Cecilia L. Gondor, Thomas J. Herzfeld Advisors, Inc. |

| |

| |

| |

|

| 18 |

|

| 2.2. Discussion |

| |

| PMO’s preferred share leverage is highly advantageous to common shareholders and consistent |

| with the legal rights and legitimate expectations of preferred shareholders. [Mr. Scanlon] |

|

| |

| •Anyone evaluating a board’s actions relating to ARPS redemptions should be mindful of the |

| many considerations that can influence a fund’s redemption rate and should exercise |

| caution in relying on any single measure. |

| |

| –Redemption decisions across the industry reflect many factors, including: |

| |

| •The relatively limited options available for refinancing ARPS, |

| |

| •The highly variable cost structures of ARPS issued through different underwriters at different points |

| in time, |

| |

| •The significant issuance costs for any new financing, |

| |

| •Fundamental investment decisions regarding the appropriate leverage structure, and |

| |

| •General business decisions such as the determination to merge or liquidate a fund. |

| |

| –ISS should not apply a single bright-line standard for purposes of evaluating a board’s actions relating |

| to ARPS redemptions. |

|

| –Any quantitative assessment should take into account the limitations of simple averages or medians, |

especially where a concentration of 100%-redemption data points can distort the results. |

| |

| |

| |

| |

|

| 19 |

|

| 2.3. Discussion |

| |

| PMO’s performance and trading price do not warrant a change in management. [Mr. Hill] |

|

| •In Putnam’s hands, PMO’s performance compares favorably with its Lipper peer group |

| (slide 21). |

| |

| •PMO’s expenses also compare favorably with its Lipper peer group (slide 21). |

| |

| •PMO’s common shareholders currently enjoy liquidity in the secondary market at prices |

| close to NAV, due to the continued narrowing of the trading discount (slide 22). |

| |

| •PMO’s Trustees have taken proactive steps in periods of common share trading discounts |

| to provide liquidity and enhance fund returns, while maintaining the fund’s closed-end |

| structure (slide 23). |

| |

| •PMO has skilled portfolio management (slide 24). |

|

| •Putnam’s fixed income investment organization is one of the largest in the industry |

| (slide 24). |

| |

| •Putnam’s fixed income funds have a strong track record (slide 24). |

| |

| •Putnam is a leading money manager (slide 25). |

| |

|

| 20 |

|

| 2.3. Discussion |

|

| PMO’s performance and trading price do not warrant a change in management. [Mr. Hill] |

|

| •In Putnam’s hands, PMO’s performance compares favorably with its Lipper peer group. |

|

| Annualized total returns as of March 31, 2011: |

| | | | | |

| | 1 year | 3 years | 5 years | |

|

| |

| PMO at NAV | 0.19% | 3.52% | 3.02% | |

|

| |

| PMO at market price | 1.03% | 6.68% | 4.61% | |

|

| |

| Lipper General Municipal Debt Funds | -0.55% | 3.68% | 2.43% | |

| (leveraged closed-end) Average | | | | |

|

| •PMO’s expenses also compare favorably with its Lipper peer group. |

| | | |

| | Expense ratio | |

|

| |

| PMO as of FYE April 30, 2010 (most recent fiscal year) | 1.08% | |

|

| |

| Lipper General Municipal Debt Funds | 1.23% | |

| (leveraged closed-end) Average | | |

|

| 2.3. Discussion |

| PMO’s performance and trading price do not warrant a change in management. [Mr. Hill] |

|

| |

| •PMO’s common shareholders currently enjoy liquidity in the secondary market at prices |

| close to NAV, due to the continued narrowing of the trading discount. |

|

| –PMO’s market price relative to NAV has fluctuated over time; in no period has PMO experienced a deep, |

| persistent discount. |

| | | | | |

| | Tightest discount | Widest discount | Average discount/ | |

| | (or highest premium) | (or lowest premium) | premium | |

|

| | YTD through | -1.00% | -5.32% | -3.18% | |

| 4/28/2011 | | | | |

|

| |

| 2010 | -1.05% | -6.93% | -3.70% | |

|

| |

| 2009 | -4.01% | -11.77% | -6.72% | |

|

| |

| 2008 | -4.16% | -13.93% | -9.98% | |

|

| |

| 2007 | -5.85% | -13.95% | -9.16% | |

|

| |

| 2006 | -8.66% | -13.86% | -11.24% | |

|

| |

| 2005 | -4.80% | -14.14% | -10.03% | |

|

| |

| 2004 | +4.38% | -7.00% | -1.67% | |

|

| |

| 2003 | +2.49% | -8.06% | -2.81% | |

|

| |

| 2002 | +1.68% | -8.49% | -2.26% | |

|

| |

| 2001 | +7.05% | -5.24% | +2.34% | |

|

| |

| 2000 | +2.70% | -12.42% | -4.31% | |

|

| |

| 1999 | +8.83% | -12.57% | +1.46% | |

|

| |

| 1998 | +10.99% | -1.72% | +3.07% | |

|

| |

| 1997 | +6.01% | +0.47% | +3.22% | |

|

| |

| 1996 | +4.17% | -3.71% | +0.70% | |

|

| |

| 1995 | +1.25% | -8.22% | -2.98% | |

| | |

| 2.3. Discussion | | |

| |

| PMO’s performance and trading price do not warrant a change in management. [Mr. Hill] |

|

| |

| •PMO’s Trustees have taken proactive steps in periods of common share trading discounts |

| to provide liquidity and enhance fund returns, while maintaining the fund’s closed-end |

| structure. | | |

| | | |

| –The tender offer:In 2007, PMO conducted a tender offer to purchase 10% of the fund’s |

| outstanding common shares at a price per share equal to 98% of the NAV per share. |

| |

| –The repurchase program:Recognizing the benefit of share repurchases for less than NAV, |

| since 2005 Putnam and the Trustees have authorized a program to conduct open-market |

| repurchases of outstanding common shares for PMO and all Putnam closed-end funds. |

| |

| –The benefit:From October 2005 to March 2011, share repurchases under both the share |

| repurchase program and the 2007 tender offer contributed approximately 1.27% to PMO’s |

| cumulative returns during a low-interest-rate environment for fixed income investing. |

| |

| |

| Benefit to PMO through | Contribution to PMO’s cumulative | PMO’s cumulative returns |

| repurchase, in $ | returns at NAV, 10/25/05-3/31/11 | at NAV, 10/25/05-3/31/11 |

|

| $3,286,245 | 1.27% | 18.53% |

| |

| |

| |

| |

|

| | | 23 |

| | | |

| 2.3. Discussion | | | |

| |

| PMO’s performance and trading price do not warrant a change in management. [Mr. Hill] |

|

| |

| •PMO has skilled portfolio management(for complete biographies, see Appendix B). |

|

| PMO portfolio managers | Investment experience (years) | Responsibilities |

|

| Thalia Meehan, CFA | 28 | Team Leader, Tax Exempt Group |

| Paul M. Drury, CFA | 22 | Tax Exempt Specialist |

| Susan A. McCormack, CFA | 25 | Tax Exempt Specialist |

| | | |

| •Putnam’s fixed income investment organization is one of the largest in the industry. |

| |

| –Over 60 investment professionals averaging 15 years of experience, and with $55 billion in assets under |

| management | | | |

| | | |

| Co-heads of fixed income | Investment experience (years) | Responsibilities |

|

| D. William Kohli | 24 | Portfolio Construction and Global Strategies |

| Michael V. Salm | 20 | Liquid Markets |

| Paul D. Scanlon, CFA | 25 | Corporate Credit and Tax Exempt |

| | | |

| –Research coverage of every global fixed income sector | |

| |

| •Putnam’s fixed income funds have a strong track record. | |

| |

| –% of Putnam fixed income funds that ranked above average in their Lipper groups as of March 31, 2011: |

| |

| 1 year | 3 years | 5 years | 10 years |

|

| 72% (21 of 29 funds) | 85% (23 of 27 funds) | 93% (25 of 27 funds) | 92% (24 of 26 funds) |

| |

| –% of Putnam tax-exempt fixed income funds that ranked above average in their Lipper groups as of |

| March 31, 2011: | | | |

| | | | |

| 1 year | 3 years | 5 years | 10 years |

|

| 87% (13 of 15 funds) | 87% (13 of 15 funds) | 100% (15 of 15 funds) | 93% (14 of 15 funds) |

| |

|

| 24 |

|

| 2.3. Discussion |

| |

| PMO’s performance and trading price do not warrant a change in management. [Mr. Hill] |

|

| |

| •Putnam is a leading money manager. |

|

| –For its 2010 investment performance, Putnam ranked in the top quartile of the Barron’s/Lipper survey of |

| mutual fund families. |

| |

| –Putnam ranked #1 for the same survey for 2009. |

| |

| –Putnam has over 70 years of investment experience, managing money for individuals and institutions |

| since 1937. |

|

| –Over $127 billion in assets under management. |

|

| –81 mutual funds across asset classes, and six investment categories – growth, blend, value, income, absolute |

| return, and global sector. |

| |

| –23 variable annuity and variable life product choices, with subaccounts for The Hartford Financial Services |

| Group and Allstate Life Insurance Company. |

| |

| –311 401(k) plans including a range of Putnam funds. |

| |

| –141 investment professionals with a balance of skill and backgrounds. |

| |

| –Offices in Boston, London, Frankfurt, Amsterdam, Tokyo, Sydney, and Singapore. |

| |

| –Led by experienced investment managers who seek superior results over time backed by original, |

| fundamental research. |

| |

| |

| |

| |

|

| 25 |

|

| 2.4. Discussion |

| |

| Karpus’s agenda for PMO discredits Karpus’s Trustee nominees as potential fund |

| fiduciaries. [Ms. Baxter] |

|

| |

| •Karpus’s goal is to dismantle PMO’s closed-end structure for its own profit, irrespective of |

| the costs imposed on other shareholders. |

| |

| •PMO’s shareholders consciously chose a closed-end fund, and the closed-end structure |

| continues to offer benefits. |

|

| –Investments in higher-yielding securities.Because a closed-end fund’s shares are not redeemable, PMO |

| is not required to maintain short-term, lower-yielding investments in anticipation of possible redemptions. |

| |

| –No sales and redemption costs.PMO does not experience the cash flows associated with sales and |

| redemptions of open-end fund shares, which create transaction costs that are borne by long-term |

| shareholders. |

| |

| –Ability to use leverage.Unlike open-end funds, closed-end funds are permitted to engage in investment |

| leverage by issuing preferred shares. |

|

| •Leverage is a viable investment tool to adjust duration, take advantage of relative value along the yield |

| curve, increase yield, and increase exposure to attractive securities and/or sectors. |

| |

| •In April 2010, PMO shareholders wisely defeated Karpus in its efforts to open-end PMO. |

|

| –For the 2 years ended December 31, 2010, PMO achieved a total return of 37.6% at NAV, compared with |

| the 20.9% return of the class A shares of Putnam’s comparable open-end fund, Putnam Tax Exempt |

| Income Fund. |

| |

| |

| |

|

| 26 |

|

| 2.4. Discussion |

| |

| Karpus’s agenda for PMO discredits Karpus’s Trustee nominees as potential fund |

| fiduciaries. [Mr. Scanlon] |

|

| |

| •Karpus’s stated agenda “to receive the intrinsic value of [its] shares” can harm other |

| shareholders by imposing significant transaction costs and a higher operating expense |

| ratio. |

| |

| –A liquidity event (i.e., a merger, open-ending, or liquidation) would require redemption of all remaining |

| preferred shares and could impose costs on shareholders.PMO would need to sell a significant portion |

| of its portfolio in order to redeem its outstanding preferred shares prior to a liquidity event, which could cause |

| the fund to incur significant transaction costs under certain market conditions as well as the risk of potential |

| market losses associated with liquidating large positions in a short time frame. |

| |

| –A merger or open-ending would result in additional asset liquidation to meet redemptions.PMO would |

| likely need to liquidate additional assets in order to meet redemption requests from investors who do not wish |

| to remain open-end fund shareholders. |

| |

| –Other costs associated with a merger or open-ending.PMO would likely incur legal, accounting, proxy |

| solicitation, and other costs in connection with soliciting a shareholder vote for a merger or open-ending and |

| effecting the transaction. |

| |

| –Increased expense ratio.Significant shareholder redemptions would reduce the size of PMO, which could |

| result in an increased expense ratio for remaining shareholders. |

| |

| •Karpus’s stated agenda, if implemented, would deprive PMO’s other shareholders of the |

| leveraged, closed-end investment that they consciously selected from among a broad array |

| of options available in the marketplace. |

| |

| |

|

| 27 |

| | | | |

| 3. Conclusions | | |

| |

| Recommendations for PMO’s 2011 shareholder meeting [Mr. Hill] |

|

| |

| |

| • | PMO’s shareholders are well-served; no management change is warranted. Karpus cannot be trusted to |

| | effect positive change for all shareholders in any event. | |

| |

| • | Vote PMO’s Management Proxy (White Card). | |

| |

| • | DO NOT VOTE Karpus’s Dissident Proxy (Green Card). | |

| |

| | PMO White Card Proposal | Proposed ISS Recommendation | Rationale |

| |

|

| |

| | 1a: Fixing the number of Trustees at 12 | VoteFOR fixing the number of Trustees at 12. | Recommendation of the Trustees’ Board Policy and |

| | | | | Nominating Committee |

| |

|

| |

| | 1b: Electing Trustees | VoteFOR PMO’s 10 Trustee nominees voted | PMO’s Trustees are independent, highly qualified, and |

| | | | upon by the common and preferred | active fiduciaries with a demonstrated record of |

| | | | shareholders voting together. | advancing the interests of all shareholders. Karpus’s |

| | | | | nominees lack equivalent qualifications and experience, |

| | | | VoteFOR PMO’s 2 Trustee nominees voted | and cannot be trusted to protect the interests of all |

| | | | upon by the preferred shareholders voting | shareholders. |

| | | | separately. | |

| |

|

| |

| |

| | 2: | [Karpus Proposal] Terminating PMO’s | VoteAGAINST Karpus’s proposal to | Putnam is a leading money manager and has delivered |

| | | management contract with Putnam | terminate PMO’s management contract with | solid performance for PMO’s common shareholders. |

| | | | Putnam. | Shareholders can have continued confidence in Putnam. |

| |

|

| |

| | 3: | [Karpus Proposal] Recommending Trustees | VoteAGAINST Karpus’s proposal to redeem | Karpus’s proposal is not appropriate for a shareholder |

| | | consider taking all steps to cause PMO to | preferred shares at par and utilize alternate | referendum. PMO’s Trustees regularly consider |

| | | redeem preferred shares at par and to utilize | sources of leverage. | alternative sources of leverage that would result in |

| | | alternate sources of leverage* | | additional liquidity for preferred shareholders without |

| | | | | harming PMO’s common shareholders. In their business |

| | | | | judgment, the Trustees have determined that such |

| | | | | alternatives would be contrary to the interests of |

| | | | | common shareholders. |

| |

| |

| |

| * As no purpose would be served by permitting a shareholder vote on this proposal, the Trustees do not intend to permit a vote on Proposal 3 at the meeting. |

| |

|

| | | | | 28 |

|

| 3. Conclusions |

| |

| Recommendations for PMO’s 2011 shareholder meeting [Ms. Baxter] |

|

| |

| •ISS should not issue separate recommendations for each class of stock. |

| |

| –Karpus’s 2 nominees for election by the preferred shareholders do not deserve seats on PMO’s board. |

| |

| •PMO’s nominees for election by the preferred shareholders consist of the independent Chairman of the |

| Board of Trustees and the independent Chairman of the Audit and Compliance Committee. Each has |

| served on the Board of Trustees of the Putnam Funds for over 25 years. During that time they have |

| demonstrated an outstanding record of independence and diligence in promoting the interests of |

| shareholders. |

| |

| •Karpus’s nominees for election by the preferred shareholders are (i) a person who has regularly engaged |

| in the business of attacking closed-end funds and (ii) a person who has regularly served as an advisor to |

| persons engaged in such activities. Both nominees have a history of serving as allies of Karpus in its |

| attacks on closed-end funds. They cannot be trusted to independently and fairly represent the interests of |

| all shareholders. |

| |

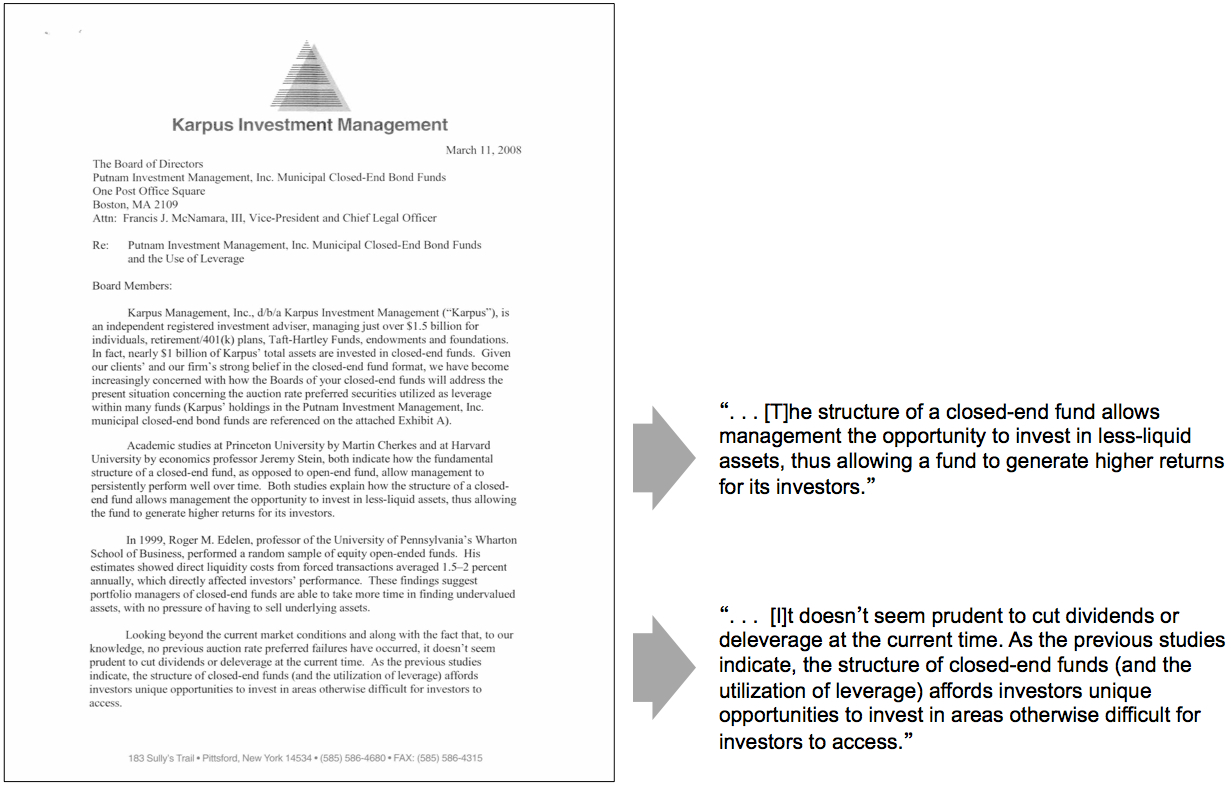

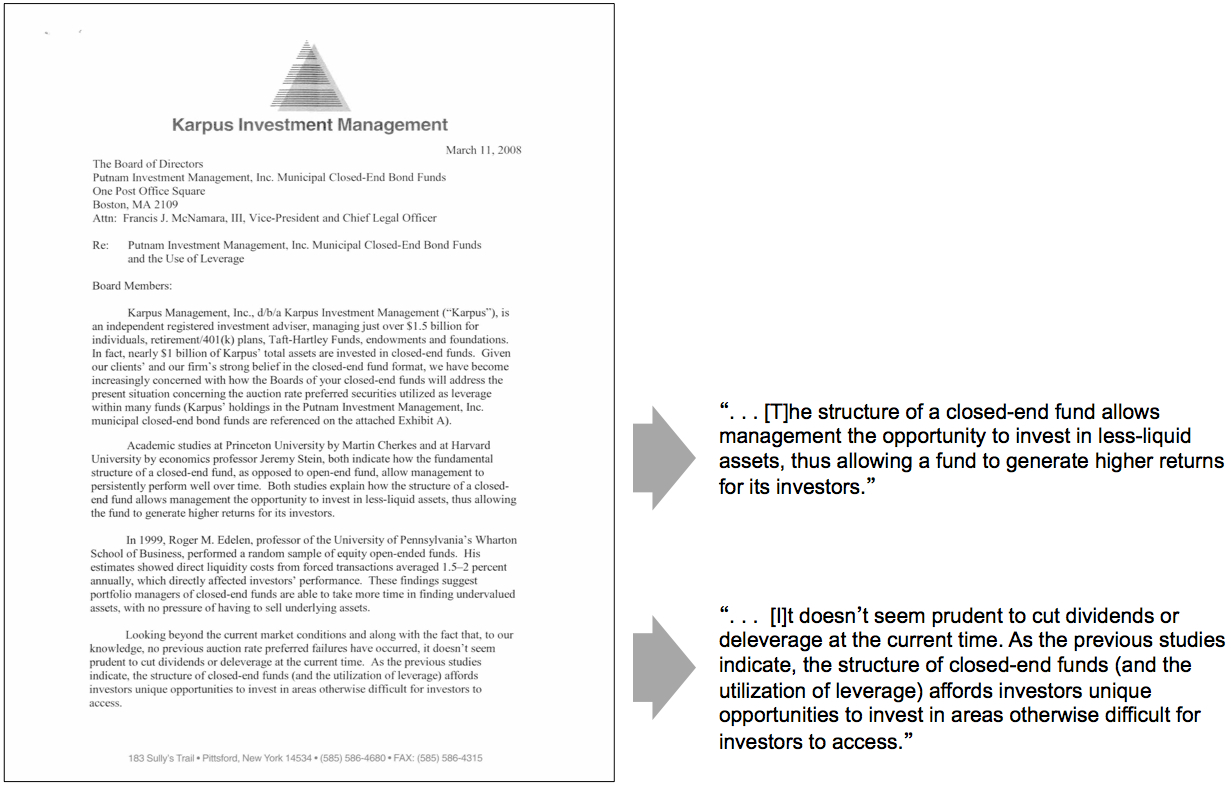

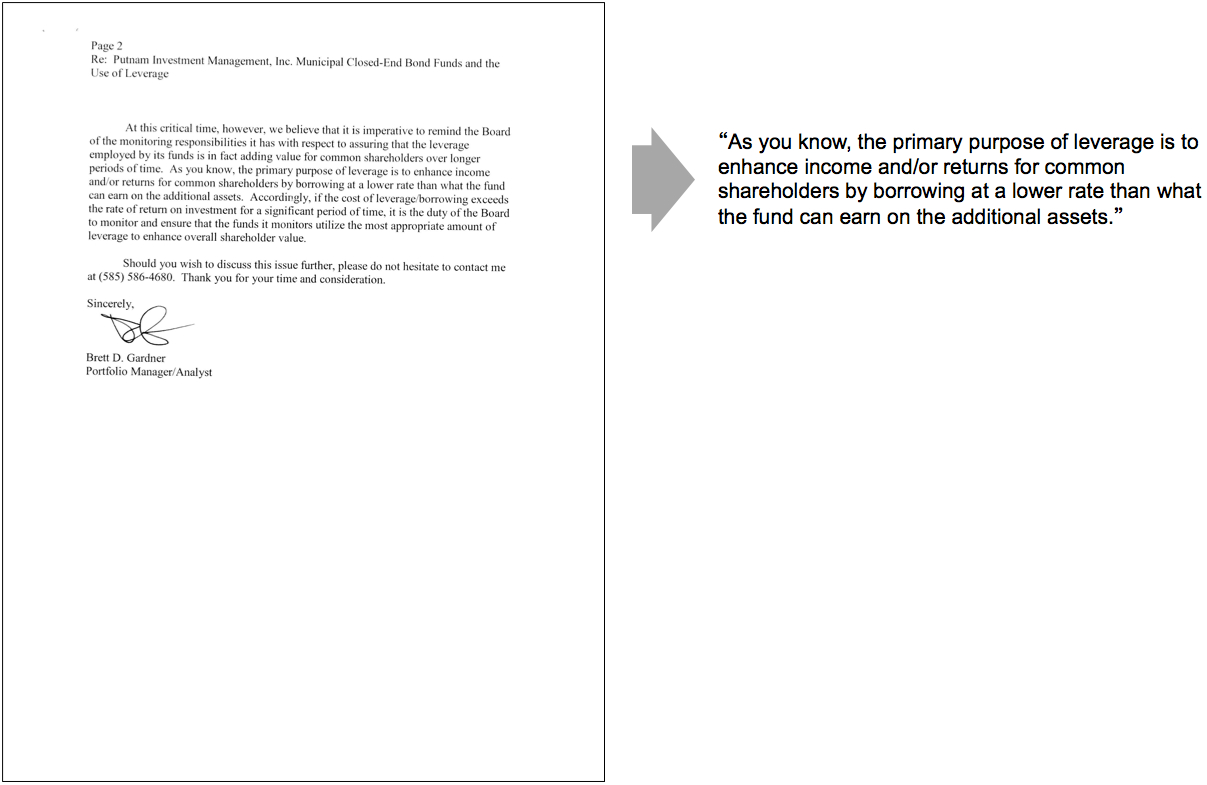

| •Mr. Goldstein has publicly criticized closed-end funds for redeeming preferred shares at par, stating, “I’m |

| suspicious of some of the managers that are redeeming preferred shares, whether they are acting in the |

| interest of the funds or the management company to salvage their reputations.” Similarly, his sponsor |

| Karpus has vigorously opposed such redemptions in the past (including in a letter to PMO in 2008, which is |

| attached as Appendix E) as being contrary to the interests of common shareholders. These positions |

| significantly undercut their claims to champion the particular interests of the preferred shareholders. |

| |

| |

| |

| |

|

| 29 |

|

| 3. Conclusions |

| |

| Recommendations for PMO’s 2011 shareholder meeting [Mr. Hill] |

|

| |

| •ISS should not issue separate recommendations for each class of stock. |

| |

| –An ISS recommendation supporting Karpus’s 2 nominees for election by the preferred shareholders |

| would only be harmful to the fund. |

|

| •The election of 2 Karpus nominees would disrupt the orderly governance of PMO by likely resulting in the |

| holding of separate meetings for PMO’s board. (Currently, PMO’s board meets nine times a year in |

| combined meetings for all of the Putnam Funds.) As a result, PMO would incur additional legal and |

| administrative costs due to the loss of efficiencies associated with the combined meetings. |

|

| •If elected, the 2 Karpus nominees would have no power to force PMO’s board to take any particular action |

| relating to the preferred and, consistent with their obligations to protect the interests of all shareholders, |

| could not advocate for any action that would benefit the preferred shareholders at the expense of the |

| common shareholders in any event. |

| |

| –Because there is one fund and one fiduciary obligation to PMO as a whole, there should be one ISS |

| recommendation to both classes of stock. |

| |

| •It would be illogical for ISS to endorse the election of 2 Karpus nominees who would likely take positions |

| and promote actions that are fundamentally inconsistent with the strategic direction of those 10 current |

| Trustee nominees that ISS may simultaneously endorse for election by the common shareholders. |

| |

| |

| |

| |

|

| 30 |

|

| Appendices |

|

| |

| •Appendix A: Trustees’ biographies |

| |

| •Appendix B: Investment managers’ biographies |

| |

| •Appendix C: Ropes & Gray LLP legal memorandum on Trustees’ fiduciary duties |

| |

| •Appendix D: Table of distribution of ARPS redemptions among tax-exempt closed-end funds, from |

| failure of ARPS in 2008 through 3/31/11 |

| |

| •Appendix E: Karpus’s letter to PMO in 2008 cautioning against ARPS redemptions |

| |

| |

| |

| |

|

| 31 |

AppendixA

John A. Hill(Chair)

(Born 1942),Trusteesince 1985 andChairmansince 2000

Mr. Hill isfounderand Vice-Chairmanof FirstReserve Corporation,theleadingprivate equity buyout firmspecializingin theworldwide energy industry,with offices inGreenwich, Connecticut; Houston,Texas;London, England;andShanghai,China. The firm'sinvestmentson behalf of some of thenation'slargestpensionandendowmentfunds arecurrently concentratedin 31companieswith annualrevenuesinexcessof $15 billion, whichemployover100,000people in 23countries.

Mr. Hill is aDirectorof DevonEnergy Corporation(aleading independent naturalgas an oilexplorationandproduction company)andvariousprivatecompaniesowned by FirstReserve,and serves as aTrusteeof SarahLawrence Collegewhere he serves aschairmanand also chairs theInvestment Committee.He is also amemberof theAdvisoryBoard of theMillsteinCenter forCorporate GovernanceandPerformanceat the YaleSchoolofManagement.

Prior toformingFirstReservein 1983, Mr. Hill served asPresidentof F.EberstadtandCompany,aninvestment bankingandinvestment managementfirm.Between1969 and 1976, Mr. Hill heldvariousseniorpositionsinWashington,D.C. with thefederal government, including Deputy Associate Directorof the Office ofManagementandBudgetandDeputy Administratorof theFederal Energy Administrationduring the FordAdministration.

Mr. Hill was born and raised inMidland,Texas, Mr. Hillreceivedhis B.A. inEconomicsfromSouthern Methodist Universityandpursued graduate studiesas aWoodrowWilsonFellow.

JamesonA.Baxter(Vice Chair)

(Born 1943),Trusteesince 1994 and ViceChairmansince 2005

Ms. Baxter serves asChairmanof the Mutual FundDirectors Forum.Until 2011, Ms. Baxter served as adirectorofASHTA Chemical,Inc. Until 2007, she was aDirectorof BantaCorporation(aprintingand supply chainmanagement company), Ryerson,Inc. (a metalsservice corporation),andAdvocateHealth Care. Until 2004, she was aDirectorofBoardSource (formerlytheNationalCenter forNonprofit Boards),and until 2002, she was aDirectorofIntermatic Corporation(amanufacturerofenergycontrolproducts). She isChairman Emeritusof the Board ofTrusteesof MountHolyoke College,having served asChairmanfor 5 years.

Ms. Baxter has heldvarious positionsininvestment bankingandcorporate finance, includingVicePresidentof andConsultantto FirstBoston Corporationand VicePresidentandPrincipalof theRegency Group.She is agraduateof MountHolyoke College.

RaviAkhoury

(Born 1947),Trusteesince 2009

Mr.Akhouryserves asAdvisorto New York LifeInsurance Company.He is also aDirectorof Jacob BallasCapitalIndia (a non-banking finance company focusedon private equityadvisory services)and is amemberof itsCompensation Committee.He also serves as aTrusteeof the RubinMuseum, servingon theInvestment Committee,and of theAmericanIndiaFoundation.Mr.Akhouryis also aDirectorof RAGEFrameworks,Inc. (a privatesoftware company).

Previously,Mr.Akhourywas aDirectorand on theCompensation CommitteeofMaxIndia/NewYork LifeInsurance Companyin India. He was also VicePresidentandInvestmentPolicyCommittee memberofFischer, Francis,Trees and Watts (a fixed-income portfolio managementfirm). He has also served on the Board of BhartiTelecom(an Indiantelecommunications company), servingas amemberof its Audit andCompensation Committees,and as aDirectorandmemberof the AuditCommitteeon the Board ofThompsonPress (apublishing company). From 1992 to 2007, he wasChairmanand CEO ofMacKay Shields,a multi-product investment managementfirm with over $40 billion in assets undermanagement.

Mr.Akhoury graduatedfrom the IndianInstituteofTechnologywith a B.S. inEngineeringandobtainedan M.S. inQuantitative Methodsfrom SUNY atStonybrook.

AppendixA

BarbaraM.Baumann

(Born 1955)Trusteesince 2010

Ms.BaumannisPresidentand Owner of Cross CreekEnergy Corporation,astrategic consultanttodomestic energyfi rms and directinvestorinenergy assets.Ms.Baumann currentlyserves as aDirectorof SMEnergy Company(apubliclyheld U.S.explorationandproduction company)andUnisource Energy Corporation(apubliclyheldelectricutility inArizona),as well as CodyResources Management,LLP (aprivatelyheldenergy, ranching,andcommercialreal estatecompany). Ms.Baumannis aTrusteeof MountHolyoke Collegeand serves on theInvestment Committeefor thecollege’s endowment.She is the former Chair of the Board and acurrentBoardmemberof Girls Inc. of MetroDenver,and serves on theFinance Committeeof TheChildren’s HospitalofDenver.

Prior toformingCross CreekEnergy Corporationin 2003, Ms.BaumannwasExecutiveVicePresidentofAssociated Energy Managers,adomesticprivate equity fi rm. From 1981 until 2000, she held a variety offinancialandoperational management positionswith the globalenergy company Amoco Corporationand itssuccessor,BP, mostrecently servingasCommercial Operations Managerof itsWestern BusinessUnit.

Ms.Baumannholds an M.B.A. from TheWharton Schoolof theUniversityofPennsylvaniaand a B.A. from MountHolyoke College.

CharlesB. Curtis

(Born 1940),Trusteesince 2001

Mr. Curtis isPresident Emeritusof theNuclearThreatInitiative(a privatefoundation dealingwithnational security issues),serves as SeniorAdvisorto the UnitedNations Foundation,and as SeniorAdvisorto the Center forStrategicandInternational Studies.

Mr. Curtis is amemberof theCouncilonForeign Relationsand theNational Petroleum Council.He also serves asDirectorofEdison InternationalandSouthern California Edison.Until 2006, Mr. Curtis served as amemberof theTrustee Advisory Councilof theApplied Physics Laboratory,JohnsHopkins University.

Mr. Curtis is anattorneywith over 15 years in privatepracticeand 19 years invarious positionsin publicservice, including serviceat theDepartmentofTreasury,the U.S. House ofRepresentatives,theSecuritiesandExchange Commission,theFederal Energy Regulatory Commissionand theDepartmentofEnergy.

RobertJ.Darretta

(Born 1946),Trusteesince 2007

Mr.Darrettaserves asDirectorofUnitedHealth Group,adiversifiedhealth-carecompany,and as the Health CareIndustry AdvisortoPermira,a global private equity firm.

Until April 2007, Mr.Darrettawas ViceChairmanof the Board ofDirectorsofJohnson&Johnson,one of theworld'slargest and mostbroadlybased health-carecompanies.Prior to 2007, he hadresponsibilityforJohnson&Johnson's finance, investor relations, information technology,andprocurement functions.He served asJohnson&JohnsonChiefFinancialOfficer for adecade,prior to which he spent two years asTreasurerof thecorporationand over 10 yearsleading various Johnson&Johnson operating companies.

Mr.Darretta receiveda B.S. inEconomicsfromVillanova University.

AppendixA

Paul L.Joskow

(Born 1947),Trusteesince 1997

Dr.Joskowis aneconomistandPresidentof the Alfred P. SloanFoundation(aphilanthropic institution focused primarilyonresearchandeducationon issuesrelatedtoscience, technology,andeconomic performance). He is theElizabethand James KillianProfessorofEconomicsandManagement, Emeritusat theMassachusetts InstituteofTechnology(MIT), where he joined the faculty in 1972. Dr.Joskowwas theDirectorof the Center forEnergyandEnvironmentalPolicyResearchat MIT from 1999through2007.

Dr.Joskowserves as aTrusteeof YaleUniversity,as aDirectorofTransCanada Corporation(anenergy company focusedonnaturalgastransmissionand powerservices)and ofExelon Corporation(anenergy company focusedon powerservices),and as amemberof the Board ofOverseersof theBoston Symphony Orchestra.Prior toAugust2007, he served as aDirectorofNationalGrid (a UK-basedholding companywithinterestsinelectricand gastransmissionanddistributionandtelecommunications infrastructure). Prior to July 2006, he served asPresidentof the YaleUniversity Council.Prior toFebruary2005, he served on the board of theWhitehead InstituteforBiomedical Research(a non-profitresearch institution). Prior toFebruary2002, he was aDirectorof State FarmIndemnity Company(anautomobile insurance company),and prior to March 2000, he was aDirectorof NewEngland Electric System(a public utilityholding company).

Dr.Joskowhaspublishedseven books andnumerous articlesonindustrial organization, government regulationofindustry,andcompetitionpolicy. He is active inindustry restructuring, environmental, energy, competition,andprivatization policies— having served as anadvisortogovernmentsandcorporations worldwide.Dr.Joskowholds a Ph.D. and MPhil from YaleUniversityand a B.A. fromCornell University.

KennethR.Leibler

(Born 1949),Trusteesince 2006

Mr. Leibler is afounderand formerChairmanof theBoston Options Exchange,anelectronic marketplacefor thetradingofderivative securities.

Mr. Leiblercurrentlyserves as ViceChairmanof the Board ofTrusteesof Beth IsraelDeaconess HospitalinBoston.He is also aDirectorofNortheast Utilities,whichoperatesNewEngland’slargestenergy delivery system,and, untilNovember2010, was aDirectorof Ruder FinnGroup,a globalcommunicationsandadvertisingfirm.

Prior toDecember2006, he served as aDirectorof theOptimumFunds group. Prior toOctober2006, he served as aDirectorof ISO NewEngland,theorganization responsiblefor theoperationof theelectric generation systemin the NewEnglandstates. Prior to 2000, Mr. Leibler was aDirectorof theInvestment Company InstituteinWashington,D.C.

Prior toJanuary2005, Mr. Leibler served asChairmanand ChiefExecutiveOfficer of theBostonStockExchange.Prior toJanuary2000, he served asPresidentand ChiefExecutiveOfficer of LibertyFinancial Companies,apubliclytradeddiversifiedassetmanagement organization.Prior to June 1990, Mr. Leibler served asPresidentand ChiefOperatingOfficer of theAmericanStockExchange (AMEX),and at the time was theyoungest personin AMEX history to hold the title ofPresident.Prior toservingas AMEXPresident,he held thepositionof ChiefFinancial Officer,andheadeditsmanagementandmarketing operations.

Mr. Leiblergraduatedwith adegreeinEconomicsfromSyracuse University.

RobertE.Patterson

(Born 1945),Trusteesince 1984

Mr.Pattersonis SeniorPartnerof CabotProperties,LP and Co-Chairmanof CabotProperties,Inc. (a private equity firminvestingincommercialrealestate).

Mr.Pattersonis pastChairmanand served as aTrusteeof the JoslinDiabetes Center.Hepreviouslywas aTrusteeof SeaEducation Association.Prior toDecember2001, Mr.PattersonwasPresidentandTrusteeof CabotIndustrialTrust (apubliclytraded real estateinvestmenttrust). Prior toFebruary1998, he wasExecutiveVicePresidentandDirectorofAcquisitionsof CabotPartners Limited Partnership(aregistered investment adviser involvedininstitutionalreal estateinvestments). Prior to 1990, he served asExecutiveVicePresidentof Cabot, Cabot &ForbesRealtyAdvisors,Inc. (thepredecessor companyof CabotPartners).

Mr.Patterson practicedlaw and heldvarious positionsin stategovernment,and was thefounding Executive Directorof theMassachusetts Industrial Finance Agency.Mr.Pattersonis agraduateofHarvard CollegeandHarvardLawSchool.

AppendixA

George Putnam,III

(Born 1951),Trusteesince 1984

Mr.PutnamisChairmanof NewGeneration Research,Inc. (apublisheroffinancial advisoryand otherresearch services),andPresidentof NewGeneration Advisors,LLC (aregistered investment adviserto private funds). Mr.Putnam foundedthe NewGeneration companiesin 1986.

Mr.Putnamis aDirectorof TheBostonFamily Office, LLC (aregistered investment adviser). He is aTrusteeofEpiphany Schooland aTrusteeof theMarine Biological

LaboratoryinWoodsHole,Massachusetts.Prior to June 2007, Mr.PutnamwasPresidentof thePutnam Funds.Until 2010, he was aTrusteeof St. Mark’sSchool,until 2006, he was aTrusteeof ShoreCountryDaySchool,and until 2002, was aTrusteeof the SeaEducation Association.

Mr.Putnam previously workedas anattorneywith the law firm ofDechertLLP(formerlyknown asDechertPrice &Rhoads)inPhiladelphia.He is agraduateofHarvard College, Harvard Business School,andHarvardLawSchool.

RobertL.Reynolds

(Born 1952),Trusteesince 2008 andPresidentof the Funds since July 2009

Mr.ReynoldsisPresidentand ChiefExecutiveOfficer ofPutnam Investments,amemberofPutnam Investments' ExecutiveBoard ofDirectors,andPresidentof thePutnam Funds.He has more than 30 years ofinvestmentandfinancial services experience.

Prior to joiningPutnam Investmentsin 2008, Mr.Reynoldswas ViceChairmanand ChiefOperatingOfficer ofFidelity Investmentsfrom 2000 to 2007. During this time, he served on the Board ofDirectorsfor FMRCorporation, Fidelity Investments InsuranceLtd.,Fidelity Investments CanadaLtd., andFidelity ManagementTrustCompany.He was also aTrusteeof theFidelityFamily ofFunds.From 1984 to 2000, Mr.Reynoldsserved in anumberofincreasingly responsible leadershiproles atFidelity.

Mr.Reynoldsserves onseveralnot-for-profitboards, includingthose of the WestVirginia University Foundation, Concord Museum,Dana-FarberCancer Institute,Lahey Clinic, andInitiativefor aCompetitiveInner City inBoston.He is amemberof the ChiefExecutivesClub ofBoston,theNational Innovation Initiative,and theCouncilonCompetitiveness,and he is a formerPresidentof theCommercialClub ofBoston.

Mr.Reynolds receiveda B.S. inBusiness Administration/Financefrom WestVirginia University.

W.Thomas Stephens

(Born 1942),Trusteesince 2009

Mr.Stephensretired asChairmanand ChiefExecutiveOfficer of BoiseCascade,L.L.C. (a paper, forestproducts,andtimberlandassetscompany)inDecember2008.

Mr.Stephensis aDirectorofTransCanada Pipelines,Ltd. (anenergy infrastructure company). Until 2004, Mr.Stephenswas aDirectorof XcelEnergy Incorporated(a public utilitycompany),QwestCommunications,andNorske Canada,Inc. (a papermanufacturer). Until 2003, Mr.Stephenswas aDirectorof Mail-Well, Inc. (adiversified printing company). He served asChairmanof Mail-Well until 2001 and as CEO ofMacMillan Bloedel,Ltd. (a forestproducts company)until 1999.

Prior to 1996, Mr.StephenswasChairmanand ChiefExecutiveOfficer of JohnsManville Corporation.Mr.Stephensholds B.S. and M.S.degreesfrom theUniversityofArkansas.

AppendixB

|

| Investment managers’ biographies |

|

Paul D.Scanlon,CFA

Mr.Scanlonis Co-Head of FixedIncomeand TeamLeaderofCorporateCredit and TaxExemptatPutnam.He is aPortfolio ManagerofPutnam AbsoluteReturn 100 Fund,Putnam AbsoluteReturn 300 Fund,Putnam Diversified IncomeTrust,Putnam FloatingRateIncomeFund,PutnamHigh YieldAdvantageFund,PutnamHigh Yield Trust,Putnam Master Intermediate IncomeTrust, andPutnam Premier IncomeTrust. Mr.Scanlon,a CFAcharterholder,joinedPutnamin 1999, and has been in theinvestment industrysince 1986.

Education: UniversityofChicago,M.B.A.;Colgate University,B.A.

ThaliaMeehan,CFA

Ms.Meehanis a TeamLeaderof the TaxExempt Group.Inadditiontomanaging Putnam’sTaxExempt Group,she is aPortfolio ManagerofPutnam’stax-exemptfixedincomefunds. Ms.Meehanhas served on theNational FederationofMunicipal Analysts’Board ofGovernorsand is amemberofPutnam’s Diversity Advisory Council,theBoston Municipal Analyst Forum,and theBoston Security Analysts Society,as well as theSocietyofMunicipal Analysts.In 2002, shereceivedtheMeritorious ServiceAward from theNFMA.Ms.Meehan,who joinedPutnam’sTaxExemptBond Group in 1989, is a CFAcharterholderand has been in theinvestment industrysince 1983.

Education: Williams College,B.A.

Paul M. Drury, CFA

Mr. Drury is a TaxExempt Specialiston the TaxExemptFixedIncometeam. He isresponsibleformanaging several sectorswithin themunicipal market.He is aPortfolio ManagerofPutnam’stax-exemptfixedincomefunds. Mr. Drury joinedPutnamin 1989 as a Mutual FundAccountantin the TaxExempt Accounting Department.A CFAcharterholder,he has over 21 years ofinvestment industry experience.

Education: Suffolk University,B.A.

Susan A.McCormack,CFA

Ms.McCormackis a TaxExempt Specialiston the TaxExemptFixedIncome Group.She is aPortfolio ManagerofPutnam’stax-exemptfixedincomefunds. Ms.McCormackjoinedPutnamin 1994 as ananalystand moved into the role ofPortfolio Managerin 1999. She is a CFAcharterholderand has been in theinvestment industrysince 1986.

Education: Stanford University,M.B.A.;Dartmouth College,A.B.

AppendixC

|

| Ropes & Gray LLP legal memorandum on Trustees’ fiduciary duties |

|

AppendixC

|

| Ropes & Gray LLP legal memorandum on Trustees’ fiduciary duties |

|

|

| Appendix D |

| |

| Table of distribution of ARPS redemptions among tax-exempt closed-end funds, |

| from failure of ARPS in 2008 through 3/31/11 |

|

| | |

| Range of ARPS Redemptions (% Redeemed) | Including Nuveen | Excluding Nuveen |

| Among Tax-Exempt Closed-End Funds | Funds | Funds |

|

| 0% | 20 | 19 |

|

| 0.01% – 9.99% | 24 | 18 |

|

| 10% – 19.99% | 29 | 24 |

|

| 20% – 29.99% | 28 | 25 |

|

| 30% – 39.99% | 35 | 33 |

|

| 40% – 49.99% | 17 | 16 |

|

| 50% – 59.99% | 2 | 1 |

|

| 60% – 69.99% | 3 | 0 |

|

| 70% – 79.99% | 0 | 0 |

|

| 80% – 89.99% | 0 | 0 |

|

| 90% – 99.99% | 0 | 0 |

|

| 100% | 82 | 16 |

|

| Number of Tax-Exempt Closed-End Funds | 240 | 152 |

|

| |

| |

| Source of ARPS redemption data as of 3/31/11 is Cecilia L. Gondor, Thomas J. Herzfeld Advisors, Inc. | |

|

| 39 |

|

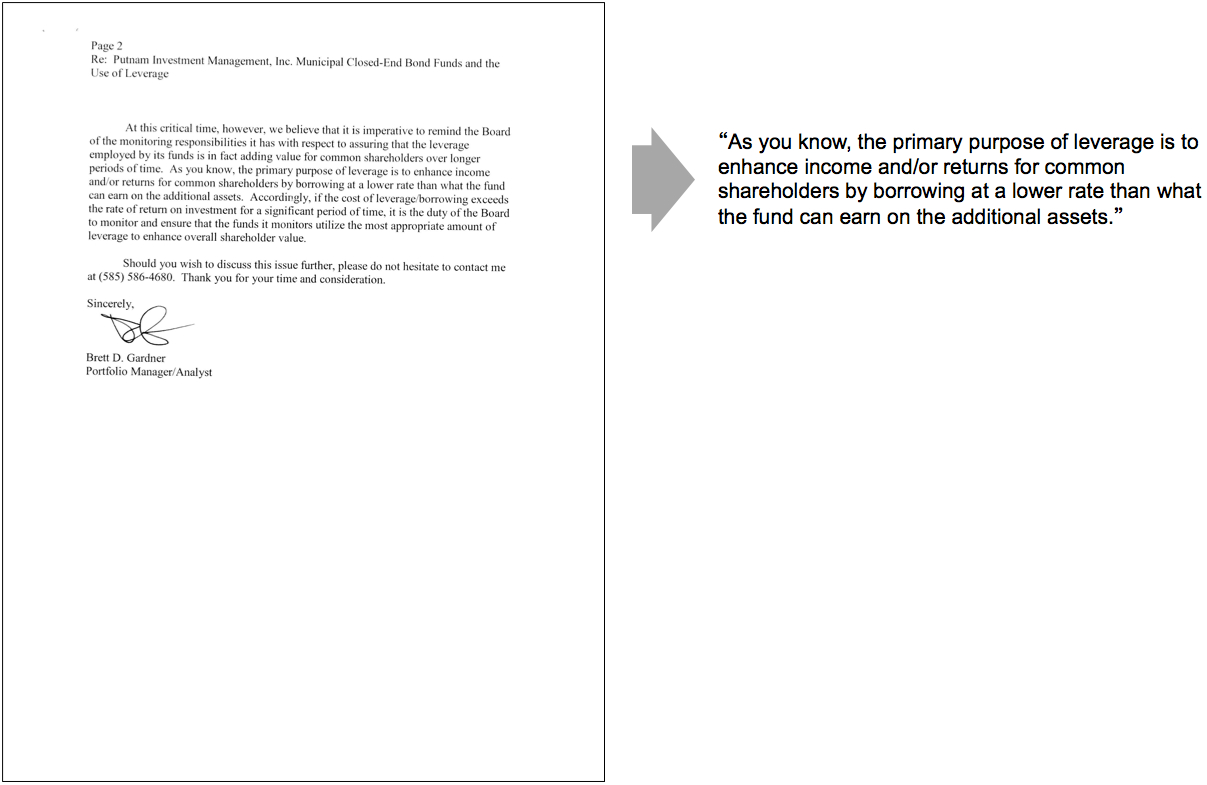

| Appendix E |

| |

| Karpus’s letter to PMO in 2008 cautioning against ARPS redemptions |

|

|

| Appendix E |

| |

| Karpus’s letter to PMO in 2008 cautioning against ARPS redemptions |

|

Putnam Municipal

OpportunitiesTrust(PMO)

Presentationto ISS

May 3, 2011