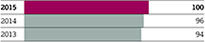

Exhibit 15.1

What science can do

AstraZenecaAnnual Report and Form 20-F Information 2015

| | | | | | |

| | | | | | | |

| | | | | | |

| | |

Welcome to the AstraZeneca Annual Report and Form 20-F Information 2015. | | Learn about our main therapy areas: |

| |

We are a global, science-led

biopharmaceutical business and in

this Annual Report we report on

the progress we made in 2015 in

pushing the boundaries of science

to deliver life-changing medicines. AstraZeneca. What science can do. | |  |

From page 4, Pascal Soriot, our Chief Executive Officer, reviews the progress we made during the year in delivering our strategy. Our Chief Financial Officer, Marc Dunoyer, reviews our financial performance from page 62. From page 82, Leif Johansson, our Chairman, reviews how our governance and approach to remuneration support delivery of the strategy. | | | | | |

|

|

| | | |

Front cover: New approaches in the treatment of asthma AstraZeneca is developing a therapy aimed at producing long-term benefit in asthma by addressing imbalances in the immune system that may be an underlying cause of the disease. Rather than simply treating symptoms by relaxing airway constriction and dampening inflammation in the lung, this therapy aims to target toll-like receptor 9 in dendritic cells in the lung. This could potentially change the way immune cells communicate with each other and restore a healthy balance to the immune system. | | | | Important information for readers of this Annual Report For more information in relation to the inclusion of reported performance, Core financial measures and constant exchange rate (CER) growth rates as used in this Annual Report, please see the Financial Review on page 64. Throughout this Annual Report, growth rates are expressed at CER unless otherwise stated. Definitions The Glossary and the Market definitions table from page 247 are intended to provide a useful guide to terms and AstraZeneca’s definitions of markets, as well as to acronyms and abbreviations, used in this Annual Report. Use of terms In this Annual Report, unless the context otherwise requires, ‘AstraZeneca’, ‘the Group’, ‘we’, ‘us’ and ‘our’ refer to AstraZeneca PLC and its consolidated entities. Cautionary statement regarding forward-looking statements A cautionary statement regarding forward-looking statements and other essential information relating to this Annual Report can be found on page 251. | | Directors’ Report The following sections make up the Directors’ Report, which has been prepared in accordance with the requirements of the Companies Act 2006: > Business Review: Research and Development > Resources Review: Employees > Corporate Governance: including the Audit Committee Report and Corporate Governance Report > Directors’ Responsibility Statement > Development Pipeline > Sustainability: supplementary information > Shareholder Information > Corporate Information Strategic Report The following sections make up the Strategic Report, which has been prepared in accordance with the requirements of the Companies Act 2006: > AstraZeneca at a glance > Chief Executive Officer’s Review > Strategy > Therapy Area Review > Business Review > Resources Review > Financial Review |

Financial highlights

| | |

| | |

| |

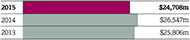

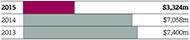

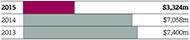

| Total Revenue* | | Net cash flow from operating activities |

| up 1% at CER to $24,708 million (down 7% at actual rate of exchange) | | down 53% (at actual rate of exchange) to $3,324 million |

| |

| |  |

| |

| $24.7bn | | $3.3bn |

| | |

| | |

| | |

| |

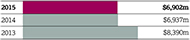

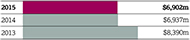

| Core operating profit | | Reported operating profit |

| up 6% at CER to $6,902 million (down 1% at actual rate of exchange) | | up 100% at CER to $4,114 million (up 93% at actual rate of exchange) |

| |

| |  |

| |

| $6.9bn | | $4.1bn |

| | |

| | |

| |

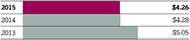

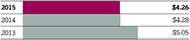

| Core EPS | | Reported EPS |

| for the full year up 7% at CER to $4.26 | | for the full year up 137% at CER to $2.23 |

| (unchanged at actual rate of exchange) | | (up 128% at actual rate of exchange) |

| |

| |  |

| |

| $4.26 | | $2.23 |

Financial Review from page 62

Financial Review from page 62

| * | As detailed on page 144, Total Revenue consists |

| | of Product Sales and Externalisation Revenue. |

| | | | | | |

| | For more information within this Annual Report | |  | | For more information see

www.astrazeneca.com |

This Annual Report is also available on our website,

www.astrazeneca.com/annualreport2015

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 1 |

Strategic Report

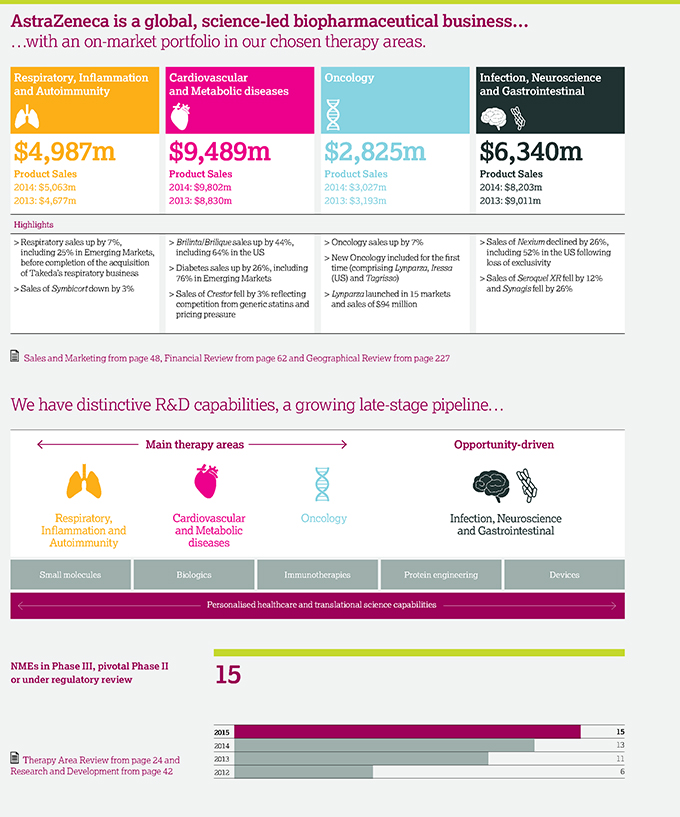

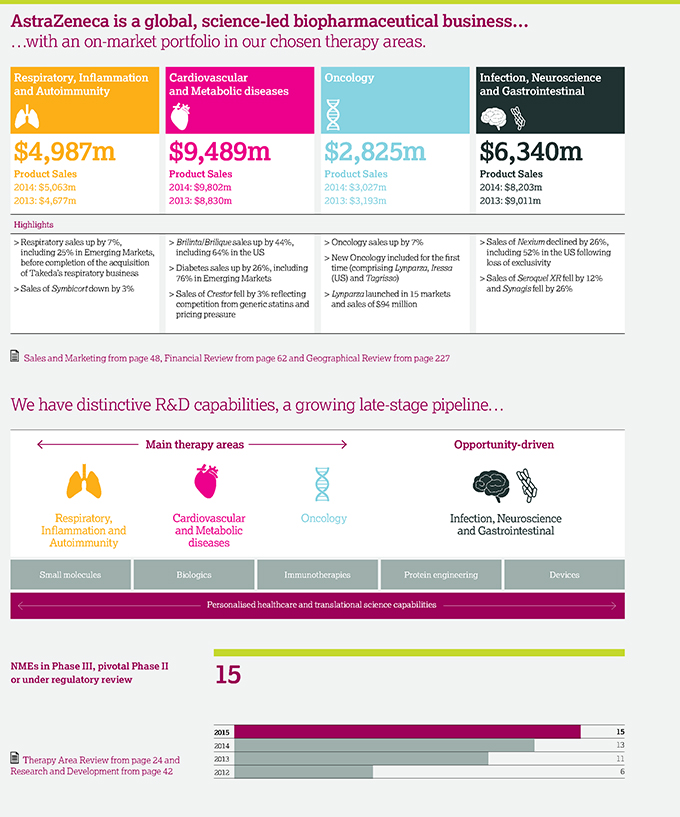

AstraZeneca at a glance

| | |

| 2 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 3 |

Strategic Report

Chief Executive Officer’s Review

| | | | |

| | |

2015 was an exceptional year for AstraZeneca as we made significant progress in meeting both our near- and longer-term strategic goals. Building on the solid foundations of the previous two years, our success during 2015 was based on a strong commitment to our values. It was this focus that made the year a great one for science and patients. | | importantly, offer patients a new treatment option in a disease where very few solutions exist. Another significant development in Oncology came with our agreement in December to invest in a majority equity stake in Acerta Pharma, a company focused on haematology which represents a natural fit with our existing Oncology pipeline. The acquisition provides us with access to acalabrutinib (ACP-196), a potential best-in-class small molecule oral BTK inhibitor, which is expected to transform the treatment landscape for B-cell malignancies, the most common forms of blood cancers, and has potential in solid tumours and autoimmune diseases. The acquisition of Acerta Pharma will also reinforce our growing position in haematology – building on our agreement with Celgene, in April, to develop durvalumab across a range of blood cancers. Innovation in Cardiovascular and Metabolic diseases Also in December, we completed our acquisition of ZS Pharma. This transaction provides access to the potassium-binding compound ZS-9, a potential best-in-class treatment for hyperkalaemia (high potassium levels in the bloodstream). The acquisition represents a good fit with our pipeline and portfolio in Cardiovascular and Metabolic diseases (CVMD), which focuses on reducing morbidity, mortality and organ damage by addressing multiple risk factors across cardiovascular disease, diabetes and chronic kidney disease. |

It was this focus that made the year a great one for science and patients.” It was this focus that made the year a great one for science and patients.”

| | The first stage of our strategic journey involved strengthening our product pipeline and building our Growth Platforms. We are now well into the second stage of that journey, as we manage a transitional period of patent expiries, and are on track to continue driving our Growth Platforms and launch our new products. The increased momentum we built in 2015 was exemplified by a number of developments towards the end of the year in each of our main therapy areas that will help deliver our strategy. Leadership in Oncology The first of those events was the approval in November ofTagrisso in the US. This approval marks a significant milestone in AstraZeneca’s journey, and in our leadership in Oncology.Tagrisso is the first treatment approved for patients with a very specific form of non-small cell lung cancer who present with a genetic mutation in the epidermal growth factor receptor but also have a secondary mutation, T790M. Its story is remarkable and, as shown over, it demonstrates our ability to successfully deliver our pipeline and, even more | |

| | |

| 4 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | | | |

AstraZeneca:Values in action Tagrisso (osimertinib) highlights how living our values can ensure we achieve our goals. It started with inspiration and effort of our scientists to design a compound precisely targeting the biological dysfunction associated with a specific form of non-small cell lung cancer. And, by putting patients first, working collaboratively and following the science, we delivered the fastest development journey in our history: less than three years from first patient dosed to approval. It was then shipped to patients in less than six hours. | |  | | Artistic impression of

osimertinib binding to mutant EGFR. |

| | | | | | | | |

Transforming Respiratory treatment Another development in December, was our agreement to acquire Takeda’s core respiratory business. When completed, this agreement will expand our ownership of rights to roflumilast(Daliresp/Daxas), the only approved oral PDE4 inhibitor for the treatment of COPD. The agreement builds on our acquisition from Actavis, in March, of the rights to marketDaliresp in the US. This important agreement will also provide us with access to other marketed medicines that complement our growing portfolio. Importantly, it will support our return to growth after 2017 and our goal to transform the way respiratory disease is treated. Achieve scientific leadership In addition to these developments, in the week before Christmas, we received our sixth approval for the year from the FDA. Subsequently, in February 2016, we received approval from the EU forTagrisso for lung cancer. However, in what was a very busy and successful year, my Review can only give a flavour of what we achieved. The 2015 Strategic priorities overview, shown on the right, lists some of our other achievements, as well as the challenges we faced. All these are explored in more detail throughout our Strategic Report. So far as achieving scientific leadership is concerned, one measure of the distance we have come is in the recognition we have received through ‘high-impact’ publications in major relevant scientific journals. AstraZeneca people had 58 such articles published in 2015 compared with seven in 2010 – a more than eightfold increase. | | 2015 Strategic priorities overview | | |

| | Achieve scientific leadership > 6 approvals of NMEs or major LCM projects in major markets | |  | | Return to growth > 1% increase in Total Revenue to $24,708 million at CER; comprising | |  |

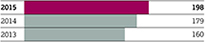

| | – Oncology:Iressa(US);Tagrisso (AZD9291/osimertinib) (US); Faslodex500mg (China) – CVMD:BydureonDual Pen (Japan); Brilinta(US for treatment of history of heart attack) – RIA:Zurampic(US) > 2 Phase III NME starts: – anifrolumab for lupus – PT010 for COPD > 12 NME or major LCM regulatory submissions in major markets > Accelerated reviews included – BrilintaFDA granted Priority Review for PEGASUS – TagrissoFDA and PMDA granted Priority Review. EMA accelerated assessment – FDA granted Fast Track status for anifrolumab for systemic lupus erythematosus; durvalumab for head and neck cancer; and tremelimumab for mesothelioma > 20 projects discontinued | | Product Sales of $23,641 million (down 1%) and Externalisation Revenue of $1,067 million (up 140%) – Based on actual exchange rates, Total Revenue declined by 7%, reflecting the particular weakness of key trading currencies against the US dollar > 11% increase in Growth Platforms revenue contributing 57% of Total Revenue – Respiratory: up 7%, before completion of the acquisition of Takeda’s respiratory business – Brilinta/Brilique: up 44% underpinned by a recently-extended US label and positive CHMP opinion – Diabetes: up 26%, including 76% in Emerging Markets; globalFarxiga/Forxiga growth of 137% – Emerging Markets: up 12%, including China and Latin America each growing by 15% – Japan revenue: up 4% – New Oncology: contributed $119 million, comprisingLynparza,Iressa(US) and Tagrisso > US revenue was down 6% to $9,474 million; Europe down 6% to $5,323 million; and Established ROW was stable at $3,022 million (at CER) |

| | Great place to work > Our quarterly employee survey (pulse) showed belief in our strategy stood at 89% (compared with 86% in our 2014 all-employee survey) > Exceeded our targets for senior leaders: women (42% versus 41%) and country of origin from an Emerging Market or Japan (15.6% versus 13%) > Exceeded our target by screening more than one million people in Kenya for hypertension as part of our Healthy Heart Africa programme | |

|

| | | | | | | | |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 5 |

Strategic Report

Chief Executive Officer’s Reviewcontinued

|

Strategic Report In this Strategic Report, we outline our business model, the marketplace in which we operate and the strategic priorities we decided upon in response to those conditions. We define our measures of success (our key performance indicators) and the risks we have identified to achieving our strategy. Subsequent sections explore our therapy areas as well as our business units and the resources we are able to deploy in their support. We also highlight how commitment to our values contributes to our success. |

Great people are central to our success and being a great place to work is at the heart of our efforts to release the talents of our employees.

A pipeline ahead of plan

Our pipeline is also a measure of our progress and 2015 was a year of considerable success. Of our six approvals for the year, the approval, in September, ofBrilinta in the US for the treatment of patients with a history of heart attack beyond the first year was particularly impressive: it took just nine months to move from the presentation of top-line PEGASUS TIMI-54 data to launch.

During the year we also made 12 major regulatory submissions. After our partner Amgen decided to terminate our collaboration on brodalumab in May, our subsequent collaboration with Valeant, with their specific expertise in dermatology, enabled submissions to be made in the US and EU by the end of the year. In July, results of a Phase III study for selumetinib did not meet its primary endpoint for uveal melanoma. As for saxagliptin/dapagliflozin, its submission in the EU and elsewhere remains on track despite a Complete Response Letter being received from the FDA in October.

External recognition of the strength of our pipeline was provided by the number of accelerated reviews received by our candidate drugs during the year, including those for cancer, respiratory diseases and lupus. Internally, six Phase III investment decisions and 11 Phase II starts stand testament to the quality of the projects in development which will help deliver sustainable growth.

Even after the approvals we received during the year, and the 18 approvals of the last two years, we ended 2015 with 15 projects in late-stage development, including recently

acquired compounds. This exceeds the target set in 2013 of nine to 10 NMEs in Phase III/pivotal Phase II studies or under regulatory review by 2016.

Collaboration as a way of life

2015 was also a good year for collaborations which are an integral part of our business model and culture. They improve the productivity of our R&D and help maximise the value of our pipeline. With 10 deals we considerably exceeded our target. Some of these, such as our agreement with Celgene, are examples of strategic collaborations to broaden and accelerate the development of key pipeline assets. This is explained in more detail in the Business model on page 8.

As well as externalising some of our early development projects outside our main therapy areas, we also divest medicines that can be better deployed by a partner with a primary focus in that area. Examples in 2015 included the divestment ofEntocort, our gastrointestinal medicine. Both routes allow us to leverage the capabilities and expertise of others, focus our own resources and deliver the greatest benefit to patients and shareholders.

Scientific collaborations also help us push the boundaries of science. For example, during the year we announced four collaborations aimed at harnessing the power of CRISPR (clustered regularly-interspaced short palindromic repeats), including one with The Wellcome Trust Sanger Institute in Cambridge, UK – see over.

| | |

| 6 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | | | |

Values in action:We follow the science Genetic engineering is not new. The Human Genome Project produced a complete genetic blueprint for building a human in 2003 but, until now, scientists have been unable to manipulate genes simply and effectively. A new technology called CRISPR is changing that by allowing the genome of several different species to be edited precisely. We are using CRISPR to identify new targets for medicines and develop new models to test compounds which align more closely with human disease. | |  |

| | |

Return to growth We delivered a strong pipeline and financial performance in 2015 as we began the next phase in our strategic journey. As the 2015 Strategic priorities overview shows, Total Revenue in 2015 was up 1% at CER. The overview also shows the success we have had with our Growth Platforms where Product Sales grew by 11% and represented 57% of Total Revenue. Our top-line and gross-margin growth underpinned continued investment in R&D. Core R&D costs were up by 21% in the year which reflected the investment in the pipeline. Investing in China for the long term The extent of our ambition was demonstrated by our strategic investments, announced in December, to accelerate the delivery of innovative medicines to patients in China, the world’s second largest economy and our second largest market, and to support the delivery of our strategy. These initiatives will see AstraZeneca become the first multinational pharmaceutical company operating in China to commit to local development of its innovative global portfolio from research to commercialisation. Just as importantly, these initiatives will allow us to better integrate Chinese requirements into our global portfolio decisions. Great place to work Great people are central to our success and being a great place to work is at the heart of our efforts to release the talents of our employees. So, for example, during 2015, we held over 70 People Development Week | | events to help our staff take ownership of their personal development. A talented workforce is also diverse and I am pleased that we managed to exceed our targets for women and country of origin among our senior leaders. I take pride in the fact that our efforts are being increasingly recognised in external awards for the work environment we have instilled. That environment is nurtured by our investment in strategic R&D centres, such as Cambridge, UK where we now have more than 1,600 employees and where the construction of our R&D centre and global headquarters is progressing rapidly. These investments help create an environment of innovation and a focus on science and patients. They also attract a lot of talent from academia and other companies. A great place to work also has to be one where we do the right thing – for the patients who take our medicines, as well as the planet and society as a whole. If we are to deliver business success over the longer term, then sustainability has to be in our DNA. As the Chairman outlines in more detail in his Statement, the steps we are taking in this regard reflect a determination to do our fair share. Looking ahead The investments we made in 2015 were designed to ensure we achieved a balance between meeting our short-term goal of returning to growth and then delivering sustainable growth over the longer term as we build a sustainable, durable and more profitable business. | | As we face the transitional period of patent expiry forCrestor in the US, we’re confident that our strong execution on strategy, combined with the benefits of focused investments and new launches, keeps us on track to return to sustainable growth in line with our targets. The weakness of key trading currencies against the US dollar has continued. Based on average exchange rates in January 2016 and our published currency sensitivities, an adverse impact of around 3% from currency movements on Total Revenue and Core EPS in 2016 would be anticipated. Appreciation I am confident that in AstraZeneca we have the people who can overcome our short-term challenges and deliver longer-term sustainable growth. In that regard I would particularly like to welcome Pam Cheng and Sean Bohen who joined us during the year. In doing so, I would like to thank David Smith and Briggs Morrison whom Pam and Sean replaced, for the contributions they made to our strategic journey. In closing, I would like to pay tribute to everyone in AstraZeneca for making 2015 a tremendous year. I have every confidence in their ability to continue that success in the years ahead.

Pascal Soriot Chief Executive Officer |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 7 |

Strategic Report | Strategy

Business model

Our Purpose and Values drive what we do – and how we do it. This includes our

business model and our determination to create sustainable value across every

medicine’s life-cycle.

| | |

| AstraZeneca’s investor proposition | | How it works |

| | |

Externalisation Our business model includes externalisation as part of our portfolio management strategy and is a result of increasing R&D productivity and a focus on three main therapy areas. Externalisation activities relate to specific risk- and reward-sharing strategic collaborations that provide greater access to strong science and broaden, accelerate and maximise the development and commercialisation potential for some of our medicines and help bring those medicines to patients faster. Milestone payments and royalties arising from externalisation activities are included in the income statement as Externalisation Revenue. Externalisation allows us to leverage the capabilities and expertise of others, focus on our main therapy areas and deliver the greatest benefit to patients and shareholders. Externalisation activities in 2015 included our collaboration with Celgene, leveraging the expertise of AstraZeneca in immuno-oncology along with the experience of Celgene in the study and treatment of blood cancers, for the development and commercialisation of durvalumab across a range of haematological malignancies. Similarly, our collaboration with Lilly, entered into in 2014, combines the scientific expertise from our two organisations and, by sharing the risks and cost of late-stage development, aims to accelerate the advancement of AZD3293 and progress a new approach to support the treatment of Alzheimer’s disease patients around the world. AstraZeneca retains significant interest, and continued participation, in the key decision making undertaken within these strategic collaborations. | |  |

Financial Review on page 62 Financial Review on page 62

| | |

| | |

| | |

| 8 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 9 |

Strategic Report | Strategy

Life-cycle of a medicine

| | |

| As a global science-led biopharmaceutical company, our activities span the entire life-cycle of a medicine from Research and Development to Manufacturing and Supply to the global Sales and Marketing of primary care and specialty care medicines that transform lives. | | |

|

Research and development phases 10–15 years |

1

Find potential medicine

| > | | Identify unmet medical need aligned with our three therapy areas and undertake scientific research to identify potential new medicines |

| > | | Initiate process of seeking patent protection |

2

Pre-clinical studies

| > | | Conduct laboratory and animal studies to understand if the potential medicine is safe to introduce into humans and in what quantities |

| > | | Determine likely efficacy, side effect profile and maximum dose estimates |

3

Phase I studies

| > | | Begin clinical studies with small groups of healthy human volunteers (small molecules) or patients (biologics) to understand how the potential medicine is absorbed into the body, distributed around it and excreted |

| > | | Determine approximate dosage and identify side effects |

4

Phase II studies

| > | | Conduct studies on small- to medium-sized groups of patients to test effectiveness and tolerability of the medicine and determine optimal dose |

| > | | Design Phase III studies to generate data needed for regulatory approvals and pricing/reimbursement globally |

5

Phase III studies

| > | | Engage in studies in a larger group of patients to gather information about effectiveness and safety of the medicine and evaluate the overall benefit/risk profile |

| > | | Initiate branding for the new medicine in preparation for its launch |

6

Regulatory submission and pricing

| > | | Seek regulatory approvals for manufacturing, marketing and selling the medicine |

| > | | Submit clinical data to regulatory authorities (and, if requested, generate further data increasingly in real-world settings) to demonstrate the safety and efficacy of the medicine to enable them to decide on whether to grant regulatory approvals |

| | | | | | |

Launch phase 5–10 years | | | | Post-exclusivity 20+ years |

7

Launch new medicine

| > | | Raise awareness of patient benefit and appropriate use, market and sell medicine |

| > | | Clinicians begin to prescribe medicines and patients begin to benefit |

| > | | Continuously monitor, record and analyse reported side effects. Review need to update the side effect warnings to ensure that patients’ wellbeing is maintained |

| > | | Assess real-world effectiveness, and opportunities to support patients and prescribers, to achieve maximum benefit from the medicine |

8

Post-launch research and development

| > | | Conduct studies to further understand the benefit/risk profile of the medicine in larger and/or additional patient populations |

| > | | Life-cycle management activities to broaden understanding of a medicine’s full potential |

| > | | Consider additional diseases or aspects of disease to be treated by or better ways of administering the medicine |

| > | | Submit data packages with requests for life-cycle management to regulatory authorities for review and approval |

9

Post-exclusivity

| > | | Patent expiry and generic entry |

| > | | Reinvestment of returns |

Primary care and specialty care

Primary care is general healthcare provided by doctors who ordinarily have first contact with patients and who may have continuing care for them. Specialty care is specific healthcare provided by medical specialists who do not generally have first contact with patients. Specialty care medicines generally treat more severe diseases and an increasing number of specialty care medicines require a diagnostic test for patient eligibility or to achieve the best outcomes.

Small molecule drugs

| > | | Typically composed of 20 to 100 atoms with a well-defined chemical structure |

| > | | Potential for off target activity |

| > | | Manufactured through chemical synthesis. Identical copies can be made |

| > | | Wide variety of administration routes, such as oral, inhaled, injected or topical delivery |

Large molecule drugs (biologics)

| > | | Small biologics (eg peptides) typically 200 to 3,000 atoms. Large biologics (eg antibodies), typically 5,000 to 50,000 atoms |

| > | | High selectivity and specificity; potentially immunogenic |

| > | | Manufactured in a living system such as a microorganism, or plant or animal cells |

| > | | Administration route often intravenous, intramuscular or other parenteral route |

| | |

| 10 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | | | |

Research and Development from page 42 Research and Development from page 42

Manufacturing and Supply from page 46 Manufacturing and Supply from page 46

Sales and Marketing from page 48 Sales and Marketing from page 48

| | | | Note: This is a high-level overview of a medicine’s life-cycle and is illustrative only. It is neither intended to, nor does it, represent the life-cycle of any particular medicine or of every medicine discovered and/or developed by AstraZeneca, or the probability of success or approval of any AstraZeneca medicine. |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 11 |

Strategic Report | Strategy

Marketplace

| | | | | | |

| | |

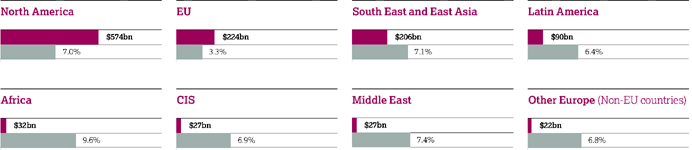

Despite global economic, political and social challenges, the pharmaceutical industry is expected to enjoy long-term growth. This is due to favourable demographic trends and significant unmet medical need. | | The global context According to the International Monetary Fund (IMF), a return to robust and synchronised global expansion remains elusive six years after the world economy emerged from its broadest and deepest post-war recession. Moreover, downside risks to the world economy appear more pronounced, particularly for emerging market and developing economies, and including renewed concerns about China’s growth potential. |

| | |

Overview > Global pharmaceutical sales grew by 9.5% in 2015 > The sector remains highly competitive > Patient populations are expanding and ageing > Non-communicable diseases kill 38 million people each year > The costs of developing a new medicine continue to rise > Priority Reviews and Breakthrough Therapies are becoming more prevalent > A highly regulated sector reflects the demand for safe, effective and high-quality medicines > Pricing and reimbursement continue to be challenging > Patents are expiring on some of the biggest-selling drugs ever produced > The sector faces challenges in building and maintaining trust | | The demand for healthcare, however, continues to increase. While this is a favourable trend for long-term industry growth, challenges remain. These include expiring patents, competition from and growing use of generic medicines, obtaining regulatory approval, securing reimbursement for new medicines, improving R&D productivity and attaining pricing and sales sufficient to generate revenue and sustain the cycle of innovation. Expanding patient populations The number of people accessing healthcare is increasing, as is healthcare spending, particularly by the elderly. For example, WHO estimates that, by 2050, the world’s population aged 60 years and older is expected to total two billion, up from 900 million in 2015 and that, by then, 80% of all older people will live in low- and middle-income countries. As the diagram on pages 14 and 15 shows, we expect developing markets to continue to boost pharmaceutical growth. Unmet medical need The prevalence of non-communicable diseases (NCDs), such as cancer and cardiovascular, metabolic and respiratory diseases, is increasing worldwide. NCDs are |

| | | |

84.0% Generics constituted 84.0% of prescriptions dispensed in the US. | |

| | $140bn Global investment in pharmaceutical R&D expected to reach an estimated $140 billion in 2015, a 30% increase from $108 billion in 2006. | |

| | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | |

| | |

| 12 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

often associated with ageing populations and lifestyle choices, including smoking, diet and lack of exercise. Many NCDs require long-term management. WHO estimates that NCDs kill 38 million people each year and disproportionately affect low- and middle-income countries where nearly three-quarters of these deaths occur. For example, more than 60% of the world’s total new annual cancer cases occur in Africa, Asia and Central and South America. These regions account for 70% of the world’s cancer deaths.

The pharmaceutical sector: opportunities and challenges

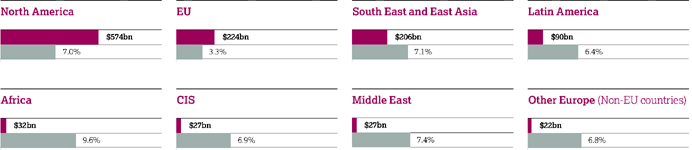

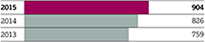

As shown in the table on the right, global pharmaceutical sales grew by 9.5% in 2015. Established Markets saw average revenue growth of 9.3% and Emerging Markets revenue growth at 10.3%. The US, China, Japan, Germany and France are the world’s top five pharmaceutical markets. In 2015, the US had 45.7% of global sales (2014: 44.6%; 2013: 43.2%).

Science and technology

Innovation is critical to addressing unmet medical need. The delivery of new medicines will rely on a more advanced understanding of disease and the use of new technology and approaches, including personalised healthcare (PHC) and predictive science.

Technological breakthroughs in the design and testing of novel compounds present fresh opportunities for using small molecules as the basis for new medicines. The use of large molecules, or biologics, has also become an important source of innovation. Biologics are among the most commercially successful new products. By 2020, biologics are expected to account for 46% of the total sales revenue of the world’s top 100 pharmaceutical products, having risen from 21% in 2006. As such, most pharmaceutical companies now pursue R&D in both small molecules and biologics.

Priority Reviews and Breakthrough Therapies are becoming more prevalent with more than half the Center for Drug Evaluation and Research NME approvals in 2015 receiving a Priority Review and, almost a quarter having a Breakthrough Therapy designation. Between the inception of the Breakthrough Therapy designation programme in October 2012 and the end of 2015, the FDA has granted more than 100

such requests, and one-third of these have already resulted in product approvals.

The cost of developing new medicines continues to rise. Global R&D investment is expected to reach $140 billion in 2015. While the growth rate of R&D spend has slowed in recent years, pharmaceutical companies continue to deliver new medicines. In 2015 the FDA approved 45 NMEs compared with 41 in 2014 and 27 in 2013. The number of approvals in 2015 is the largest since 1996 when 59 NMEs were approved.

To ensure sustainable returns on R&D investment, the industry is working to increase its success rate in developing commercially viable new drugs while achieving a lower, more flexible cost base. Regulators and payers, however, are demanding greater evidence of comparative effectiveness of medicines. This increases development times and costs.

Fortunately, innovative technology is helping accelerate product approvals. A greater emphasis on Proof of Concept is also helping to improve productivity and reduce costs by showing the potential efficacy of drugs earlier in the development process.

Regulatory requirements

A highly regulated biopharmaceutical industry reflects the public’s expectation of safe, effective and high-quality medicines. Meeting this expectation requires responsible testing, manufacturing and marketing. It also relies on maintaining effective working relationships with health authorities worldwide, including the FDA in the US, the EMA in the EU, the PMDA in Japan, and the CFDA in China. Increasingly, regulation and governmental policy are being introduced to stimulate innovation in drug development. In the US, for example, the 21st Century Cures Act, passed by the House of Representatives in July 2015, and the related Senate Innovation for Healthier Americans Legislative Initiative, are focused on accelerating the discovery, development and delivery of promising new treatments for patients. Similarly, the PDUFA reauthorisation legislation considered by the US Congress in 2017 is anticipated to contain proposals aimed at accelerating innovation and modernising the regulatory environment. Additionally, the growing complexity and globalisation of clinical studies have led to an increase in public-private consortia. Such consortia, which include industry, academia

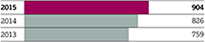

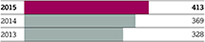

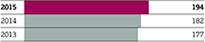

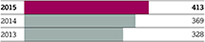

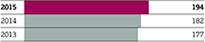

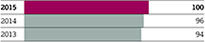

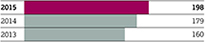

Global pharmaceutical sales

World $bn

$904bn(9.5%)

US $bn

$413bn(12.0%)

Europe $bn

$194bn(6.3%)

Established ROW $bn

$100bn(4.3%)

Emerging Markets $bn

$198bn(10.3%)

Data based on world market sales using AstraZeneca market definitions as set out in the Market definitions on page 247. Source: IMS Health, IMS Midas Quantum Q3 2015 (including US data). Reported values and growth are based at CER. Value figures are rounded to the nearest billion and growth percentages are rounded to the nearest tenth.

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 13 |

Strategic Report | Strategy

Marketplacecontinued

Estimated pharmaceutical sales and market growth – 2019

and government bodies, aim to drive innovation, streamline regulatory processes, and define and clarify approval requirements for innovative drug and biologic products.

Regulatory health authorities continue to implement programmes intended to address unmet medical need and to speed up patient access to transformative medicines. This is demonstrated by the Breakthrough Therapy programme employed by the FDA and the EMA’s piloting of a programme to implement ‘adaptive pathways’, or ‘staggered approval’, to improve timely patient access to new medicines. In Japan, the SAKIGAKE strategy is fostering a more favourable environment for drug development and accelerating the availability of currently unapproved medicines for serious and life-threatening diseases. The lengthy review process in China extends new medicine approval periods to as long as five years. This challenges the ability of pharmaceutical companies to deliver innovative medicines and treat unmet medical need in China. However, proposed revisions to China’s Drug Administration Law, which are under review, may help address this issue.

Greater transparency and public access to regulatory submissions that support approval of new medicines continues to be an area of interest. A recent example involves the EMA policy on publication of clinical data for medicinal products for human use, which provides guidance for the publication of clinical reports that underpin the EMA’s decision making. These clinical reports include the overviews, summaries and clinical study reports submitted by the applicant, together with documentation of statistical methods.

The study of paediatric populations continues to present challenges to the industry as differences between study requirements and timeframes may vary significantly among health authorities. However, there have been efforts to provide incentives to stimulate paediatric research. An example is EMA’s initiative offering free-of-charge meetings early in drug development. Increased interest in the availability of the paediatric rare disease voucher programme in the US is another noteworthy development.

Regulatory requirements for the registration of biosimilar products continue to be developed and become better defined. This includes the publication of a new pathway for China and the first biosimilar product approval in the US. However, significant areas of regulatory policy are still evolving. Among these are transparency of data to support approval of claims for biosimilarity in labelling, standards for interchangeability and pharmaceutical substitution, and traceability of pharmacovigilance reports through naming conventions that permit differentiation of products. For more information about biosimilars, please see Patent expiries and genericisation below.

Pricing of medicines

Pricing and reimbursement remain challenging in many markets. Most pharmaceutical sales are generated in highly regulated markets where governments, insurers and other private payers exert various controls on pricing and reimbursement. These include limitations on pharmaceutical spending and the cost of readmitting patients to hospital. Implementation of certain reforms and shifting market dynamics are further

constraining healthcare providers, while difficult economic conditions burden patients who pay out-of-pocket for medicines. Pharmaceutical companies are now expending significant resources to demonstrate the economic as well as therapeutic value of their medicines.

In the US, the Affordable Care Act (ACA) has had a direct impact on healthcare activities. It continues to reshape the market through various provisions designed to reduce cost and improve healthcare and patient outcomes. We, along with other pharmaceutical companies, are working with policymakers and regulators to help contain costs, improve outcomes and promote an environment that fosters medical and scientific innovation.

In Europe, governments continue to implement price control measures for medicines, including mandatory discounts, clawbacks and price referencing rules. These measures are decreasing drug prices, particularly in the challenged economies of Greece, Romania and Italy. In France, price negotiations are particularly challenging due to budget pressures. In Germany, Europe’s largest pharmaceutical market, manufacturers must now prove the added benefit of their drug over existing alternatives if they are to avoid relegation to a single reimbursement level (or reference) for each drug group.

In China, pricing practices remain a priority for regulators. Though free pricing has been introduced, provincial and hospital tenders continue to put increasing pricing pressures on pharmaceutical companies. In Russia and selected Middle East markets, governments are encouraging local manufacturing by offering more favourable

| | |

| 14 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | | | |

| |

· Estimated pharmaceutical sales – 2019. Ex-manufacturer prices at CER. Source: IMS Health. · Estimated pharmaceutical market growth – 2014 to 2019. Compound annual growth rate. Source: IMS Health. | | |

pricing legislation. In Japan, mandated biennial cuts are likely to continue. In Latin America, pricing is increasingly controlled by governments as, for example, in Colombia.

For more information about price controls, reductions and US healthcare reform, and price regulation in our major markets, please see Geographical Review from page 227 and Risk from page 212

For more information about price controls, reductions and US healthcare reform, and price regulation in our major markets, please see Geographical Review from page 227 and Risk from page 212

Patent expiries and genericisation

Patent protection for pharmaceutical products is finite. Patents are expiring on some of the biggest-selling drugs ever produced and payers, physicians and patients have greater access to generic alternatives (both substitutable and analogue) in many important drug classes. These generic alternatives are primarily lower priced because generic manufacturers are largely spared the costs of R&D and market development. As a result, demand for generics is high. For prescriptions dispensed in the US in 2015, generics constituted 84.0% of the market by volume (2014: 83.4%).

Generic competition can also result from patent disputes or challenges before patent expiry. Increasingly, generics companies are launching products ‘at risk’, for example, before resolution of the relevant patent litigation. This trend, which is likely to continue, creates significant market presence for the generic version while the litigation remains unresolved. Given the unpredictable nature of patent litigation, some companies have settled such challenges on terms acceptable to the innovator and generic manufacturer. While competition authorities generally accept such agreements as a legitimate way to settle these disputes, they have questioned some settlements as being anti-competitive.

Biologics typically retain exclusivity for longer than traditional small molecule pharmaceuticals, with less generic competition. With limited experience to date, the substitution of biosimilars for the original branded product has not followed the same pattern as generic substitution in small molecule products and, as a result, erosion of the original biologic’s branded market share has not been as rapid. This is due to biologics’ complex manufacturing processes and the inherent difficulties in producing a biosimilar, which could require additional clinical trials. However, with regulatory authorities in Europe and the US continuing to implement abbreviated approval pathways for biosimilar versions, innovative biologics are likely to face increased competition. Similar to biologics, some small molecule pharmaceutical products are in complex formulations and/or require technically challenging manufacturing and thus may not follow the pattern of generic market erosion seen with traditional, tabletted pharmaceuticals. For those products, the introduction of generic alternatives (both substitutable and analogue) can be slower.

Building trust

The pharmaceutical industry faces challenges in building and maintaining trust, particularly with governments and regulators. This reflects the past decade’s legal disputes between pharmaceutical companies and governmental and regulatory authorities. To address this challenge, companies are strengthening a culture of ethics and integrity, adopting higher governance standards and improving relationships with employees, shareholders and other stakeholders.

Numerous companies, including those in the pharmaceutical industry, have been investigated by the China Public Security Bureau following allegations of bribery, and criminal and financial penalties have been imposed. Investigations by the DOJ and SEC under the Foreign Corrupt Practices Act are continuing as are investigations by the UK Serious Fraud Office under the UK Bribery Act. Information about material legal proceedings can be found in Note 27 to the Financial Statements from page 186.

Strategic responses

Our industry remains highly competitive. It includes large, research-based pharmaceutical companies (such as AstraZeneca) that discover, develop and sell innovative, patent-protected prescription medicines and vaccines, smaller biotechnology and vaccine businesses, and companies that produce generic medicines. While many of our peers face similar challenges, they tackle them in different ways. Some companies have pursued a strategy focused on branded prescription pharmaceuticals. Others have diversified by acquiring or building branded generics businesses or consumer portfolios. A number of companies are focused on improving R&D productivity and operational efficiency. Other companies have looked to geographic expansion, especially in Emerging Markets and Japan. Across the industry, business development deals (including licensing and collaborations), and competition for business development opportunities continued in 2015. It is estimated that the value of mergers announced in the healthcare sector during the year amounted to more than $650 billion, accounting for 14% of all merger and acquisition activity.

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 15 |

Strategic Report | Strategy

Strategic priorities

| | | | | | |

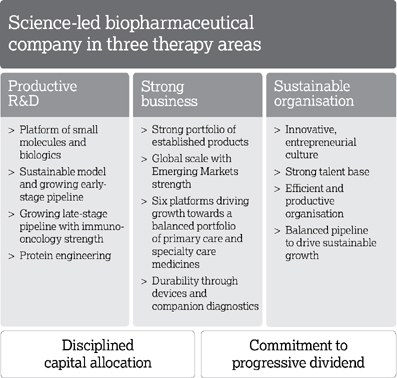

| We are focused on returning to growth in our chosen therapy areas through a science-led innovation strategy. This strategy is based on investing in three therapy areas, building a strong and balanced portfolio of primary care and specialty care medicines, and accelerating key R&D programmes. It also involves engaging in targeted business development and leveraging our strong global commercial presence, particularly in Emerging Markets. | | | | What do we need to do? | | |

| | Achieve scientific leadership

| | Focus on innovative science in three therapy areas | | |

| | | Prioritise and accelerate our pipeline | | |

| | | Transform our innovation and culture model | | |

| | | Accelerate through business development | | |

| | Return to growth

| | Focus on Growth Platforms | | |

| | | Transform through specialty care, devices and biologics | | |

| | Be a great place to work

| | Evolve our culture | | |

| | | Simplify our business | | |

| | | Attract and retain the best talent | | |

| | | Deliver business success over the long term | | |

| | Achieve our Group financial targets

| | Drive on-market value | | |

| | | Maintain a progressive dividend | | |

| | | Maintain a strong balance sheet | | |

| | |

| 16 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | | | |

| | | How are we implementing this? | | For more information |

| | | |

| | | Our focus is on Respiratory, Inflammation and Autoimmunity; Cardiovascular and Metabolic diseases; and Oncology. We are also taking an opportunity-driven approach to Infection, Neuroscience and Gastrointestinal disorders. We are working across small molecules, biologics, immunotherapies, protein engineering and devices. | | Therapy Area Review from page 24 |

| | | |

| | | We are accelerating and investing in key R&D programmes. 15 new molecular entities (NMEs) are in Phase III/pivotal Phase II or under regulatory review compared with our March 2013 target of nine to 10 by the end of 2016. | | Pipeline and Therapy Area Introduction from page 24 |

| | | |

| | | Between 2013 and the end of 2016, we have the potential for 12 to 16 Phase II starts; 14 to 16 NME and major line extension regulatory submissions; and eight to 10 NME and major line extension regulatory approvals. We are strengthening our early-stage pipeline through novel science and technology. | | Development Pipeline from page 205 |

| | | |

| | | Our two autonomous biotech units, MedImmune and IMED, drive science and innovation, and GMD drives our late-stage development unit. | | Research and Development from page 42 |

| | | |

| | | We are focusing on novel science, such as immune-mediated therapy combinations and personalised healthcare (PHC). | | |

| | | |

| | | To increase our proximity to bioscience clusters, we are co-locating around three strategic centres in Cambridge, UK; Gaithersburg, Maryland US; and Gothenburg, Sweden. These moves will leverage our capabilities and foster collaboration with leading scientists and research organisations. | | |

| | | |

| | | We are working to reinforce our therapy areas and are strengthening our portfolio and pipeline through targeted business development, including collaborations, in-licensing and acquisitions. | | In the wider world from page 55 |

| | | |

| | | We are collaborating strategically to broaden and accelerate the development of key pipeline assets (externalisation) and divesting non-core assets to realise value. | | |

| | | |

| | | Brilinta/Brilique– We are working to deliverBrilinta/Brilique’s potential to reduce cardiovascular deaths through ongoing clinical studies and plans for market leadership. | | Cardiovascular and Metabolic diseases from page 30 |

| | | |

| | | Diabetes – We are working to maximise the potential of our broad and innovative non-insulin, anti-diabetic portfolio to transform patient care. | | Cardiovascular and Metabolic diseases from page 30 |

| | | |

| | | Emerging Markets – We are focused on delivering innovative medicines by accelerating our investment in Emerging Markets capabilities, with a focus on China and other leading markets, such as Russia and Brazil. We are also expanding our commercial reach through multi-channel marketing and sales force excellence and building strong local medical and scientific affairs teams. Transformation of our capabilities is supporting new products and improving access and affordability. | | Sales and Marketing from page 48 |

| | | |

| | | Respiratory – We are working to maximise pipeline value, devices and medicines to fulfil unmet medical need and improve patient outcomes in asthma, chronic obstructive pulmonary disease (COPD) and idiopathic pulmonary fibrosis (IPF). | | Respiratory, Inflammation and Autoimmunity from page 26 |

| | | |

| | | Japan – We are strengthening our Oncology franchise and working to maximise the success of our Diabetes medicines and established brands:Symbicort,NexiumandCrestor. | | Sales and Marketing from page 48 |

| | | |

| | | New Oncology – Became our sixth Growth Platform in January 2015 and includesLynparza,Iressa(US) andTagrisso. We are aiming to deliver six new cancer medicines to patients by 2020. | | Oncology from page 34 |

| | | |

| | | We are transforming our business to become more sustainable, durable and profitable. This involves focusing on specialty care medicines, devices and biologics. Biologics now account for half of the NMEs in development, potentially enhancing asset longevity. A greater focus on innovative and differentiated delivery devices affords patient choice while ensuring product durability. Our new specialty care portfolio is expected to balance our strength in primary care medicines. | | Therapy Area Review from page 24 |

| | | |

| | | We are working to improve our employees’ identification with our Purpose and Values and to promote greater understanding of and belief in our strategy. We are investing in and implementing tailored leadership development programmes. | | Employees from page 52 |

| | | |

| | | We are developing simpler, more efficient processes and flattening our organisational structure to encourage accountability and improve decision making and communication. | | |

| | | |

| | | We are accelerating efforts to attract diverse, top talent with new capabilities. | | |

| | | |

| | | We are supporting the sustainable delivery of our business strategy while delivering wider benefits to society and the environment. | | In the wider world from page 55 |

| | | |

| | | We invest in R&D and on-market Growth Platforms to return to growth. Our aim is to deliver industry-leading productivity by restructuring to create scope for investment and a flexible cost base. | | Financial Review from page 62 |

| | | |

| | | Our policy is to maintain or grow dividend per share. | | |

| | | |

| | | Target a strong, investment-grade credit rating, operational cash balance and periodic share repurchases. | | |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 17 |

Strategic Report | Strategy

Key performance indicators

How we performed against the indicators by which we measure our success.

| | |

| 18 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 19 |

Strategic Report | Strategy

Key performance indicatorscontinued

| | |

| 20 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

Risk overview

What may challenge the delivery of our strategic priorities.

|

Oversight and monitoring Board: defines the Group’s risk appetite, which enables the Group, in both quantitative and qualitative terms, to judge the level of risk it is prepared to take in achieving its overall objectives. SET:responsible for overseeing and monitoring the effectiveness of the risk management processes implemented by management. Management: Global Compliance, Finance and Internal Audit Services support SET by advising on policy and standard setting, monitoring and auditing, communication and training, as well as reporting on the adequacy of line management processes as they apply to risk management. |

Managing risk

As a global, science-led biopharmaceutical business, we face a diverse range of risks and uncertainties. These could adversely affect our business. Our approach to risk management is therefore designed to encourage clear decision making on which risks we take and how we manage these risks. Fundamental to this process is a sound understanding of every risk’s potential strategic, commercial, financial, compliance, legal and reputational implications.

We work to ensure that we have effective risk management processes in place to support the delivery of our strategic priorities. This enables us to meet the expectations of our stakeholders and upholds our Values. We monitor our business activities and external and internal environments for new, emerging and changing risks to ensure that these are managed appropriately.

The Board believes that existing robust processes and clear accountabilities, as described below, provide it with adequate information on the Principal Risks and uncertainties we face.

Risk management embedded in business processes

We strive to embed sound risk management in our strategy, planning, budgeting and performance management processes.

The Board has defined the Group’s risk appetite, expressing the acceptable levels of risk for the Group using three key dimensions. These are: (i) earnings and cash flow; (ii) return on investment; and (iii) ethics. Annually, the Group develops a long-term business plan to support the delivery of its strategy. The Board reviews this to ensure that the plan conforms to its risk appetite. Our risk management approach is aligned to our strategy and business planning processes. We cross-check financial risks and opportunities identified through the business planning process and integrate our findings into the overall risk management reporting. Line managers are accountable for identifying and managing risks and for delivering business objectives in accordance with the Group’s risk appetite.

Within each SET function, leadership teams discuss the risks the business faces. Every year, we map these risks to AstraZeneca’s risk ‘taxonomy’. This process provides a Group-wide assessment that is shared with the Board, Audit Committee and SET. Quarterly, each SET function identifies any changes to these risks, its mitigation plans and new and emerging risks. The quarterly updates are assimilated into a Group Risk Report for the Board, Audit Committee and SET. Supporting tools are in place to assist risk leaders and managers in managing, monitoring and planning for risk and we continue to work on developing our risk management standards and guidelines.

We also develop business continuity plans to address situations in which specific risks have the potential to severely impact our business. These plans include training and crisis simulation activities for business managers.

More information about our Global Compliance function and the Code of Conduct can be found in the Corporate Governance Report from page 90

More information about our Global Compliance function and the Code of Conduct can be found in the Corporate Governance Report from page 90

Viability statement

In accordance with provision C.2.2 of the 2014 UK Corporate Governance Code, the Board has determined that a three-year period to 31 December 2018 constitutes an appropriate period over which to provide its viability statement.

The Board considers annually and on a rolling basis, a three-year bottom-up detailed business plan. The Board also considers a 10-year long-term strategic plan but, given the inherent uncertainty involved, believes that the three-year statement presents readers of the Annual Report with a reasonable degree of assurance while still providing a longer-term perspective.

The three-year detailed business plan captures risks to the sales and cost forecasts at a market and SET function level and is used to perform central net debt and headroom profile analysis. This analysis considers a severe but plausible downside scenario incorporating the Principal Risks such as market pricing and access, delivery of pipeline and loss of IP. The resilience of the Group to absorb further Principal Risk events such as regulatory/litigious fines has also been analysed. The Group has adequate resilience against these and the other Principal Risks due to our diversified product portfolio; our global footprint; our robust supply infrastructure; our access to external financing, which includes committed facilities; and our ability to manage our cost base.

Based on the results of this analysis, the Directors have a reasonable expectation that the Company will be able to continue in operation and meet its liabilities as they fall due over the three-year period of their assessment.

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 21 |

Strategic Report | Strategy

Risk overviewcontinued

| | | | | | | | |

Principal Risks This table provides insight into the Principal Risks that could have a materially adverse effect on the business or results of operations. We outline why effective management of these risks is important and relevant to the business, how we are managing them and which risks are rising, falling or have remained static during the past 12 months. Trend key  Increasing risk Increasing risk

Decreasing risk Decreasing risk

Unchanged Unchanged

Strategy key  Achieve scientific leadership Achieve scientific leadership

Return to growth Return to growth

Be a great place to work Be a great place to work

Achieve Group financial targets Achieve Group financial targets

Further information on our key risk management and assurance processes can be found in Risk from pages 212 to 226 which also includes a description of circumstances under which principal and other risks and uncertainties might arise in the course of our business and their potential impact Further information on our key risk management and assurance processes can be found in Risk from pages 212 to 226 which also includes a description of circumstances under which principal and other risks and uncertainties might arise in the course of our business and their potential impact

| | | | Risk category and Principal Risks | | Context/potential impact | | |

| | | | Product pipeline and intellectual property | | |

| | | | Delivery of pipeline and new products | | The development of any pharmaceutical product candidate is a complex, risky and lengthy process involving significant financial, R&D and other resources. A project may fail or be delayed at any stage of the process due to a number of factors, which could reduce our long-term growth, revenue and profit | | |

| | | | Meet quality, regulatory and ethical drug approval and disclosure requirements | | Delays in regulatory reviews and approvals impact patients and market access, and can materially affect our business or financial results | | |

| | | | Secure and protect product IP | | Discovering and developing medicines requires a significant investment of resources. For this to be a viable investment, through generation of sufficient revenues, new medicines must be safeguarded from being copied with a reasonable amount of certainty for a reasonable amount of time | | |

| | | | Commercialisation | | |

| | | | Externally driven demand, pricing, access and competitive pressures | | Operating in over 100 countries, we are subject to political, socio-economic and financial factors both globally and in individual countries. There can be additional pressure from governments and other healthcare payers on medicine prices and sales in response to recessionary pressures, reducing our revenue, profits and cash flow | | |

| | | | Quality and execution of commercial strategies | | If commercialisation of a product does not succeed as anticipated, or its rate of sales growth is slower than anticipated, there is a risk that we may not be able to fully recoup the costs in launching it | | |

| | | | Supply chain and business execution | | |

| | | | Maintain supply of compliant, quality product | | Delays or interruptions in supply can lead to recalls, product shortages, regulatory action, reputational harm and lost sales | | |

| | | | Information technology and data security and privacy | | Significant disruption to our IT systems, including breaches of data security or failure to integrate new systems, could harm our reputation and materially affect our financial condition or results of operations. This could lead to regulatory penalties or non-compliance with laws and regulations | | |

| | | | Delivery of gains from productivity initiatives | | Inappropriately managed initiatives could lead to low employee engagement and reduced productivity; increased absence and attrition levels; or even industrial action. All could adversely impact the value of the initiative | | |

| | | | Attract, develop, engage and retain talented and capable employees at all levels | | Failure to attract and retain highly skilled personnel may weaken our succession plans for critical positions in the medium term. Failure to engage our employees could impact productivity and turnover. Both could adversely affect the achievement of our strategic objectives | | |

| | | | Legal, regulatory and compliance | | |

| | | | Safety and efficacy of marketed products | | Patient safety is very important to us and we strive to minimise the risks and maximise the benefits of our medicines. Failure to do this could adversely impact our reputation, our business and the results of operations, and could lead to product liability claims | | |

| | | | Defence of product, pricing and practices litigation | | Investigations or legal proceedings could be costly, divert management attention or damage our reputation and demand for our products. Unfavourable resolutions could subject us to criminal liability, fines or penalties, adversely affecting our financial results | | |

| | | | Meet regulatory and ethical expectations on commercial practices and scientific exchanges | | Any failure to comply with applicable laws, rules and regulations may result in civil and/or criminal legal proceedings and/or regulatory sanctions, fines or penalties, impacting financial results | | |

| | | | Economic and financial | | |

| | | | Achieve strategic plans and meet targets and expectations | | Failure to successfully implement our business strategy may frustrate the achievement of our financial or other targets or expectations. This failure could, in turn, damage our reputation and materially affect our business, financial position or results of operations | | |

| | |

| 22 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

| | | | | | | | |

| | | Management actions | | Trend versus prior year | | Link to strategy |

| | | | | |

| | | | | | | | | |

| | | | | |

| | | > Prioritise and accelerate our pipeline > Strengthen pipeline through acquisitions, licensing and collaborations > Focus on innovative science in three therapy areas | |  | | Increasing importance of pipeline contribution given loss of exclusivity on key brands | |  |

| | | | | |

| | | > Quality management systems incorporating monitoring, training and assurance activities > Collaborating with regulatory bodies and advocacy groups to monitor and respond to changes in the regulatory environment including revised process, timelines and guidance | |  | | | |  |

| | | | | |

| | | > Active management of IP rights | |  | | | |  |

| | | | | |

| | | | | | | | | |

| | | | | |

| | | > Focus on Growth Platforms > Demonstrating value of medicines/health economics > Global footprint > Diversified portfolio | |  | | Global economic conditions placing downwards pressure on healthcare spending and therefore revenue | |  |

| | | | | |

| | | > Focus on Growth Platforms > Accelerate through business development and strategic collaborations

and alliances | |  | | Loss of exclusivity on key brands increases challenge to achieve our short- to medium-term targets | |  |

| | | | | |

| | | | | | | | | |

| | | | | |

| | | > Business continuity and resilience initiatives, disaster and data recovery

and emergency response plans > Contingency plans including dual sourcing, multiple suppliers and stock levels > Quality management systems | |  | | Supply chain evolving to incorporate new supply chains and to support product launches | |  |

| | | | | |

| | | > Disaster and data recovery plans > Strategies to secure critical systems and processes | |  | | Several key transformational programmes involving large IT-related aspects | |  |

| | | | | |

| | | > Appropriate project governance structure and oversight > Regular review of strategic initiatives by appropriate senior executive and Board level committees | |  | | Ongoing restructuring and footprint projects including Cambridge relocation in the UK | |  |

| | | | | |

| | | > Evolve our culture > Focus on simplification > Development of our employees | |  | | Ongoing restructuring and footprint projects including Cambridge relocation in the UK | |  |

| | | | | |

| | | | | | | | | |

| | | | | |

| | | > Robust processes and systems in place to manage patient safety and efficacy trends as well as externally reported risks through regulatory agencies and other parties. This includes a comprehensive pharmacovigilance programme supplemented by close monitoring and review of adverse events | |  | | | |  |

| | | | | |

| | | > Combined internal and external counsel management | |  | | | |  |

| | | | | |

| | | > Strong ethical and compliance culture > Established compliance framework in place including annual Code of Conduct training for all employees | |  | | Increasing government and regulatory scrutiny and evolving compliance challenges as complexity of business relationships increases | |  |

| | | | | |

| | | | | | | | | |

| | | | | |

| | | > Focus on Growth Platforms > Focus on innovative science in three therapy areas > Strengthen pipeline through acquisitions, licensing and collaborations > Appropriate capital structure and balance sheet > Portfolio-driven decision making process governed by committees | |  | | Increasing requirement to balancelong-and short-term investments as we navigate a period of loss of exclusivity on key brands | |  |

| | |

| AstraZenecaAnnual Report and Form 20-F Information 2015 | | 23 |

Strategic Report|Therapy Area Review

Pipeline and Therapy Area Introduction

Our business model describes how we create and sustain value over the life-cycle of a medicine across our therapy areas. In this section, we review our therapy areas, including our portfolio of marketed products, pipeline projects, strategic priorities, capabilities, resources and business development activities.

Overview

As outlined in Strategic priorities from page 16, a key element of our drive to achieve scientific leadership is our focus on innovative science in three therapy areas: Respiratory, Inflammation and Autoimmunity (RIA); Cardiovascular and Metabolic diseases (CVMD); and Oncology. We apply our distinctive capabilities to small molecules, biologics, immunotherapies,

protein engineering technologies and delivery devices across these therapy areas. Our goal is to deliver life-changing medicines to patients while creating value for shareholders. Our approach to Infection, Neuroscience and Gastrointestinal (ING) is opportunity-driven.

Our Global Product and Portfolio Strategy group (GPPS) leads our therapy area

| | | | |

Key pipeline progressions | | Product | | Achievement |

Phase III NME starts | | anifrolumab | | Phase III programme commenced for systemic lupus erythematosus |

| | | PT010 | | Phase III programme commenced for COPD |

Expedited review | | Brilinta | | FDA granted Priority Review for PEGASUS |

| | Tagrisso (AZD9291) | | FDA and PMDA granted Priority Review. EMA accelerated assessment |

| | anifrolumab | | FDA granted Fast Track status for systemic lupus erythematosus |

| | durvalumab | | FDA granted Fast Track status for head and neck cancer |

| | | tremelimumab | | FDA granted Fast Track status for mesothelioma |

Regulatory filings | | Brilinta | | Regulatory submissions accepted in US, EU and Japan forBrilintato reduce the rate of cardiovascular death, myocardial infarction (MI) and stroke in patients with acute coronary syndrome or a history of MI |

| | cediranib | | MAA accepted by EMA for treatment of recurrent platinum- sensitive ovarian cancer |

| | PT003 | | NDA accepted by FDA for treatment of COPD |

| | Tagrisso (AZD9291) | | Regulatory submission accepted by the FDA, EMA and PMDA for treatment of 2nd line or greater EGFRm T790M NSCLC |

| | CAZ AVI | | MAA accepted by EMA for treatment of serious bacterial infection, including complicated intra-abdominal infection and complicated urinary tract infection |

| | saxagliptin/ dapagliflozin FDC | | MAA accepted by EMA for treatment of Type 2 diabetes |

| | | brodalumab | | Regulatory submission accepted by EMA and FDA for psoriasis |

Regional approvals | | BydureonPen | | Japanese regulatory approval for treatment of Type 2 diabetes |

| | Iressa | | US regulatory approval for treatment of EGFRm NSCLC |

| | Brilinta | | Regulatory approval in US forBrilintato reduce the rate of cardiovascular death, MI and stroke in patients with acute coronary syndrome or a history of MI |

| | Tagrisso (AZD9291) | | Regulatory approval in US for treatment of 2nd line or greater EGFRm T790M NSCLC; CHMP issues Positive Opinion to EMA and EU approval received in February 2016 |

| | Zurampic(lesinurad) | | Regulatory approval in US; CHMP issues Positive Opinion to EMA |

| | | Faslodex 500mg | | Regulatory approval in China for breast cancer |

Discontinued projects | | | | 20 projects discontinued |

activities. GPPS also serves as the bridge between our R&D and Sales and Marketing functions and works to provide strategic direction from early-stage research to commercialisation. It also helps us to integrate our corporate, portfolio, therapy area and product strategies. This, in turn, drives scientific innovation, prioritises investment, supports the growth of our therapy areas, and accelerates business development. GPPS also works closely with healthcare providers, regulatory authorities and payers to ensure our medicines help to fulfil unmet medical need and provide economic as well as therapeutic benefits.

Putting patients first

In keeping with our value of putting patients first, we formed a Patient Centricity team in 2015 to better connect patients with our science and to help ensure we deliver medicines they value. In 2015, we connected with more than 30,000 patients through our new alliance with PatientsLikeMe, a virtual patient community, and are exploring similar partnerships with other organisations to ensure we understand our patients’ requirements better.

Our products

While this Therapy Area Review concentrates on our key marketed products, many of our other products are crucial to our business in certain countries in Emerging Markets.

For more information on our potential new products and product life-cycle developments, please see the therapy area pipeline tables on pages 26, 30, 34 to 35, and 39 and the Development Pipeline table from page 205. For information on patent expiries of our key marketed products, please see Patent Expiries from page 210.

Indications for each product described in this Therapy Area Review may vary among countries. Please see local prescribing information for country-specific indications for any particular product.

| | |

| 24 | | AstraZenecaAnnual Report and Form 20-F Information 2015 |

|

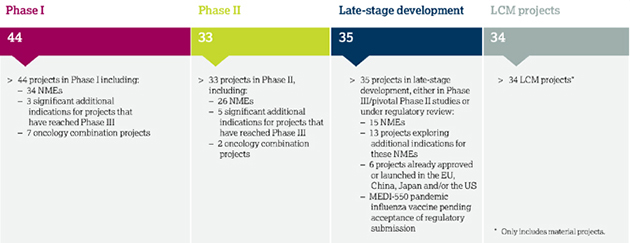

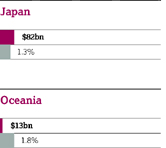

Development pipeline overview Our pipeline includes 146 projects of which 125 are in the clinical phase of development.

|

For those of our products subject to litigation, information about material legal proceedings can be found in Note 27 to the Financial Statements from page 186.

Details of relevant risks are set out in Risk from page 212

Details of relevant risks are set out in Risk from page 212

Development pipeline

The Development pipeline overview above summarises our development pipeline as at 31 December 2015.

We continue to maintain a clinical portfolio of more than 100 projects, and are making significant progress in advancing our late-stage programmes through regulatory approval. The portfolio has reached a steady state, with new project starts and progressions netted out against project

termination and rationalisation decisions. Twenty projects were discontinued in 2015, 11 for poorer than anticipated safety and efficacy results, eight as a result of strategic shift in the environment or portfolio prioritisation, and one because of a change in regulatory requirements.

During 2015, 18 NMEs progressed to their next phase of development. We also started a number of oncology trials during the course of the year, of which 12 were oncology combination trials. Importantly, many of our late-stage programmes achieved key milestones, with 12 NME or major LCM regulatory submissions within the year, and six major approvals. Expedited regulatory reviews indicate the degree of medical need that many of these programmes aim to address.

Progress against targets

We remain on track to meet the pipeline aspirations that we have previously communicated for the period from 2013 to the end of 2016: 12 to 16 Phase II starts; 14 to 16 NME and line extension regulatory submissions; and eight to 10 NME and line extension regulatory approvals. Moreover, we had 15 NME projects in pivotal studies or under regulatory review at the end of 2015, versus 13 at the end of 2014. This demonstrates the sustainability of our pipeline and our ability to deliver new medicines to patients.

For more information on the risks associated with biologics and our products, please see Risk from page 212

For more information on the risks associated with biologics and our products, please see Risk from page 212

Global Product Sales by therapy area

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | 2015 | | | | | | | | | | | 2014 | | | | | | | | | | | 2013 | |

| | | Sales $m | | | Actual growth % | | | CER growth % | | | | | Sales $m | | | Actual growth % | | | CER growth % | | | | | Sales $m | | | Actual growth % | | | CER growth % | |