Sigma-Aldrich Corporation Enabling Science to Improve the Quality of Life March 16, 2010 Exhibit 99.1 |

2 Cautionary Statement •Our presentation today will include forward looking statements relating to the Company’s future performance, goals, strategic actions and initiatives and similar intentions and beliefs, including expectations, goals, beliefs, intentions and the like regarding future sales, earnings, cash flow, share repurchases and other matters. These statements involve assumptions regarding Company operations, investments and acquisitions and conditions in the markets the Company serves. Although the Company believes its expectations are based on reasonable assumptions, such statements are subject to risks and uncertainties including, among others, certain economic, political and technological factors. Actual results could differ materially from those stated or implied during this review or contained in other Company communications due to, but not limited to, such factors as (1) declining global economic conditions, (2) changes in pricing and the competitive environment and the global demand for our products, (3) fluctuations in foreign currency exchange rates, (4) changes in research funding and the success of research and development activities, (5) dependence on uninterrupted manufacturing operations, (6) changes in the regulatory environment in which the Company operates, (7) changes in worldwide tax rates or tax benefits from domestic and international operations, including the matter described in Note 10 – Income Taxes – to the Consolidated Financial Statements in the Company’s Form 10-K report for the year ended December 31, 2009, (8) exposure to litigation, including product liability claims, (9) the ability to maintain adequate quality standards, (10) reliance on third party package delivery services, (11) failure to achieve planned cost reductions in global supply chain initiatives and restructuring actions, (12) an unanticipated increase in interest rates, (13) failure of planned sales initiatives in our Research and SAFC businesses, (14) other changes in the business environment in which the Company operates, and (15) the outcome of the matters described in Note 11-Contingent Liabilities and Commitments-in the Company’s Form 10-K report for the year ended December 31, 2009. The Company does not undertake any obligation to publicly update the matters covered in this presentation. •With over 60% of sales denominated in currencies other than the U.S. dollar, management uses currency-adjusted growth, and believes it is useful to investors, to judge the Company’s controllable, local currency performance. Organic sales growth data presented in this review is proforma data and excludes currency impacts. While we are able to report historical currency impacts after the fact, we are unable to estimate changes that may occur later in 2010 to applicable exchange rates and thus are unable to reconcile the projected non-GAAP currency adjusted internal growth rates to reported GAAP growth rates for 2010. Any significant changes in currency exchange rates would likely have a significant impact on our reported growth rates due to the volume of our sales denominated in foreign currencies. •Management reports both GAAP and adjusted sales and income comparisons to reflect what it believes are ongoing and/or comparable operating results excluding currency impacts. Management excludes this item in judging its historical performance and in assessing its expected future performance. Management also uses free cash flow, a non-GAAP measure, to judge its performance and ability to pursue opportunities that enhance shareholder value. Management believes this non-GAAP information is useful to investors as well. Reconciliations of GAAP to non-GAAP information are included in the Company’s February 10, 2010 earnings release posted on its website, www.sigma-aldrich.com |

Sigma-Aldrich Corporation Jai Nagarkatti Chairman, President and Chief Executive Officer |

4 Agenda Enabling science to improve the quality of life Summary Growth Drivers Portfolio Assessment and Financial Roadmap Our Overarching Objective / Plan Overview |

5 Our Overarching Objective To build on our core capabilities and leverage our financial strength to deliver sustainable above-market growth and create value for our Employees, Customers and Shareholders |

6 Overview How should you measure success? Plan to achieve our objective Our markets and global trends Who is Sigma-Aldrich? |

7 Who is Sigma-Aldrich? Delivering Value Through a Diversified Portfolio Sigma-Aldrich ($ Million) 2009 Revenue $2,148 2009 EBITDA $ 592 2009 Free Cash Flow $ 396 Delivering strong financial performance despite a challenging economy |

8 70% Research Consumables 30% Fine Chemicals & Services Who is Sigma-Aldrich? •Research Business • Customers – Academia – Pharma & Biotech – Industrial – Hospitals – Testing Labs • Products (170,000; 48,000 Manufactured) – Reagents – Chemicals – Biochemicals – Standards – Lab Supplies – Kits •Manufacturing (SAFC) • Customers – Pharma – Biotech – Hitech • Capabilities – Chemical Synthesis (API’s, Intermediates) – Isolation, Extraction, Purification – Fermentation – Assay Development – Media Formulation – Services A Life Science company enabling researchers and manufacturers to improve the quality of life |

9 Markets and Global Trends Markets Sigma-Aldrich participates in space with significant room for growth |

10 Markets and Global Trends Global Economy Shifting East *As determined by FTSE Global Equity Index; Source: Global Insight's World Overview Projected GDP Growth GDP in $ Trillions Sigma-Aldrich’s plan to capture opportunity: expand presence in emerging markets |

11 Market and Global Trends Shift Towards Biology Sigma-Aldrich’s plan to capture opportunity: build reputation through innovation in Biology Pharmaceutical R&D Increasingly Focused on Biologics |

12 Market and Global Trends Exponential Importance of the Internet Sigma-Aldrich’s plan to capture opportunity: Aggressive investment to enhance customer experience *World Internet Stats Internet Users Have Increased by Nearly 10 Times in the Past Decade* |

13 Market and Global Trends Focus on Energy, the Environment and Food Safety Sigma-Aldrich’s plan to capture opportunity: focused approach in Analytical, Chemistry and Materials Science to support research and manufacturing Global Renewable Energy Growth 2008-2018 ($ Billions) |

14 Plan to Achieve Objective Approach • Site Consolidation Revitalize or divest underperforming assets Redeploy ABC M = Focus on Analytical, Biology, Chemistry and Materials Science • Systems • E-Business • Sales Process Supply Chain and go-to-market approach Optimize • Innovation (ABC M ) • Global Reach • Unique Manufacturing To build and strengthen our core capabilities Invest • Analytical (A) • Biology (B) • Chemistry (C) • Materials Science ( M ) On opportunities where we have sustainable competitive advantage Focus above-market growth and create value for our employees, customers and shareholders To build on our core capabilities and leverage our financial strength to deliver sustainable |

15 Plan to Achieve Objective • Share repurchase Capital structure Financial strength • Competitive pricing strategy Pricing Sourcing knowledge • Optimize Supply Chain • Leverage Process Improvement Operations Operating excellence Earnings Expansion • Business development and inorganic growth Capital structure Financial strength • Support bench-to-bulk demand Fulfill demand Unique manufacturing • Expand in faster growth countries Geographic Global footprint ABC M focus Innovation Unrivalled scientific knowledge Top Line Growth Initiatives Leverage Competitive Advantage Leverage core competencies through targeted initiatives to create value |

16 Plan to Achieve Objective Impact of Top Line Growth Initiatives 4% Incremental contribution to top line growth 0.5% Expand Web and B2B capabilities Realign sales effort Optimize Go-to-Market 1.0% Apply our technologies to customers’ unique and evolving supply chains SAFC/Unique Mfg. Capabilities 1.0% Increase presence and assets in faster growth economies Geographic Expansion Leverage chemistry knowledge to offer products for materials research and manufacturing Chemistry Increase focus on biology Expand traditional product portfolio and build new targeted platform technologies Biology 1.5% Expand into attractive areas of detection and analysis Analytical Innovation ABC M Focus Incremental Impact Initiatives |

17 ABC M Targets High Growth Markets M&A activity will supplement organic growth Sigma-Aldrich Market Share |

18 How to Measure Success Strategic actions build sustainable value 200-300 bpts Expand cumulative operating margins by 2014 > $2 Billion Free cash flow (five years) 7-8% Top line organic growth (normal economic conditions) Incremental Impact Five-Year Financial Targets |

19 Management Team |

Portfolio Assessment and Financial Roadmap Rakesh Sachdev Sr. Vice President, Chief Financial Officer and Chief Administrative Officer |

21 Outline Capital Structure and Use of Cash Investment Thesis Looking Ahead – Sales Growth Drivers – Profitability Drivers Portfolio Assessment Historical Performance and Trends 2009 Results Recap and 2010 Guidance |

22 2009 – Key Business Highlights • Strong financial year, despite economic environment – Several records achieved – EPS & Free Cash Flow • Research Biotech growth driven by – Innovative new antibody products – Regenerative medicine – Epigenetic products • Fine Chemicals (SAFC) benefited from sale of components for H1N1 vaccine and Industrial media for biological drugs • Continued growth in CAPLA markets – Contribution of 21% of total sales • Strongest growth achieved in academic markets • Increased e-commerce sales to 45% of world-wide research-based products from 42% in 2008 • Knock-out rats recognized as a Top 5 Innovation in 2009 by The Scientist Magazine |

23 Full Year 2009 Financial Results 2009 Performance drove EPS and free cash flow to a new record. Free cash flow improvement driven by $70M reduction in inventory |

24 Pre-tax Margin Improved in 2009 2009 pre-tax margins improved 60 bpts despite currency headwinds and restructuring charges |

25 2010 Guidance |

Historical Trends – Profitable Sales Growth Continued a 35 year track record in EPS growth • Demonstrated historic performance • Robust business model – even in a downturn 26 |

27 Historical Performance – Shareholder Returns •Share Price Consistently achieving high ROE. Share price has outperformed the peer and broad market indices |

28 Sigma-Aldrich Portfolio Snapshot Mapping Old With New ~50% of research business comes from biology products and services Biology focus in Research Markets *Estimated |

29 Portfolio Snapshot Another Look |

30 Research Portfolio Well-positioned for Growth (~70% of Total Company) • Lower growth (~5%) • Stable profitable business $7.4B • Broad offering of 18,000 products • Basic tools for Biochemical research Traditional Biochemistry (Cell Culture Media, Enzymes, other Lab Essentials) • Chemistry growth ~3-4% Mat. Sci. growth >10% • Capital efficient • Stable, profitable business $3.5B • Applications span life and Materials Science • Established leadership position and recognized brand • Broadest offering of 50,000 products Chemistry/ Materials Science (Chemical Synthesis of Small Molecules, Isotopes, Materials for Electronics) • High growth (>10%) • Technology investments $2.3B • Help understand complex biological pathways and systems in living cells • Enhance research in Life Science workflow from “discovery to drug” Biology (Biomolecules, Functional Geonomics, Cell-based Assays, Transgenics) • Higher growth (>10%) $3.5B • Diverse end markets - Environmental, Biotech, Food & Beverage, Pharma, Testing and Analysis Analytical (Reagents, Standards, Separation Consumables) Financial Impact Addressable Market Characteristics Research Portfolio Significant opportunities in $17 billion addressable market |

31 SAFC Portfolio Positioned for Value Creation (~30% of Total Company) • Asia growth • Benefit from global recovery • Diverse applications – LED lights, LCDs, semiconductors, solar panels Hitech Materials (Organic Metals, Oxides) • Higher growth • Optimizing manufacturing footprint • Vertically integrated • Momentum in late clinical trial and commercialization projects Bioscience (Media for Manufacture of Large Molecules for Biopharma) • Capital intensive • High contribution margins • Products difficult to handle and produce – unique manufacturing Custom Pharma (High potency API’s, Viral Vaccines, Fermentation) • Capital efficient • Moderate growth • Larger quantities of research products • Quality systems Supply Solutions Financial Impact Characteristics SAFC Portfolio Significant opportunities in $60+ billion addressable market |

32 Sales Growth – Where? Above Average Market Growth |

33 Sales Growth – How? Initiatives to achieve above market growth rates |

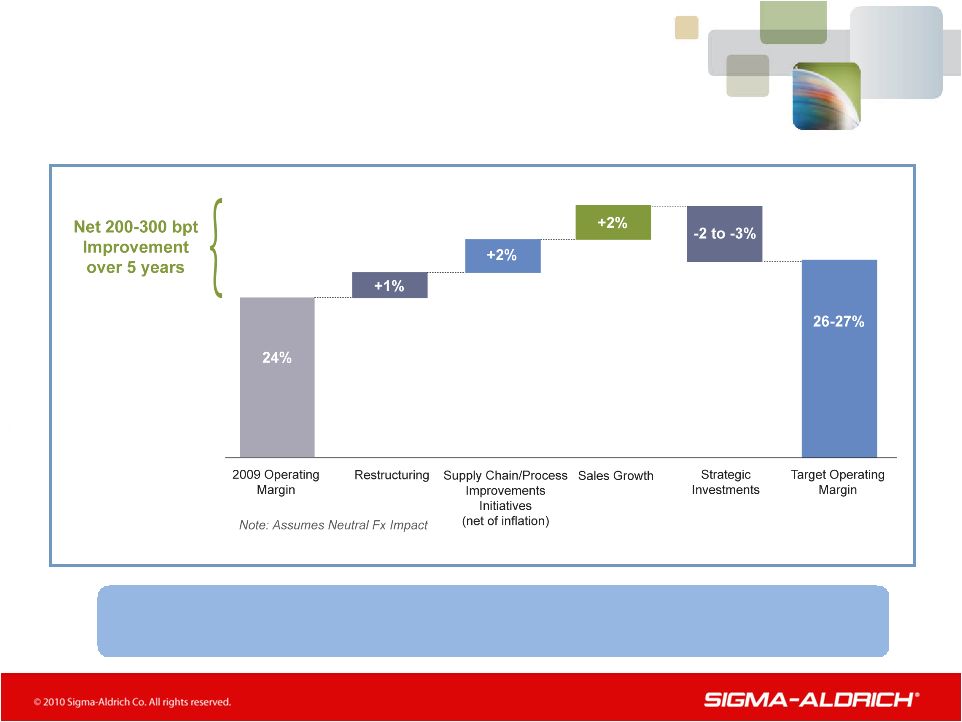

34 Profitability Drivers Net 200-300 basis point improvement in operating margin over 5 years |

35 Restructuring Activities Selective reduction in workforce Voluntary early retirement program Improve customer service levels Exiting five manufacturing sites in U.S. and Europe Recently Announced Actions Total one-time costs of actions estimated at $31 million, with annual savings of $15-20 million in 12-18 months Improve operating efficiency Lower overall fixed cost structure Align manufacturing and distribution footprint with demand Activities Will drive margin expansion |

36 Capital Structure (At December 31, 2009) Solid liquidity position to fund growth |

37 Historical Use of Cash (2005 to 2009) Uses $(0.3) Net 0.3 Dividends 0.9 Share buy-back $ 0.6 Acquisitions/Investments $ 1.5 Free cash flow 0.5 Capital expenditures $ 2.0 Operating cash flow $ Billions Funded with debt Over $1 billion returned to shareholders through share buy-back and dividends |

38 Future Uses of Cash 2010 and Beyond • Fund organic growth through technology, partnerships, licensing and go-to-market investments • Fund inorganic growth • Cash dividends • Share repurchases • Debt reduction Expect free cash flow to be in excess of $2 billion over next five years |

39 Inorganic Growth Criteria |

40 Investment Thesis Why Sigma-Aldrich Now? Value Creation Sigma-Aldrich Advantage • Manufacturing and distribution footprint optimization • Demonstrated ability to achieve earnings and cash flow savings from global supply chain and process improvement initiatives • Margin expansion from profitable sales growth • Solid liquidity position to fund both organic and inorganic growth • Increasing focus on eBusiness channel to market • Emerging Markets becoming a larger contributor • Uniquely positioned in high growth markets of Analytical, Biology, Materials Science and niche Fine Chemicals Over five years: 200 - 300 bpts margin expansion > $2 billion cumulative free cash flow Earnings Power Expansion 7 - 8% Organic Growth Plus Inorganic Growth Sales Growth |

Analytical Frank Wicks President, Research Essentials/ Research Specialties |

42 Analytical Chemistry Is: The study of the chemical/biochemical composition of matter It asks and answers three fundamental questions: • What is the material present? • How much is present? • What is the quality? Platform recognized for its innovation and breadth |

43 Typical Analytical Process Material to be Analyzed Analyzer System Sample Induction Sample Collection Sample Preparation (Separation) Detection Data Collection and Analysis Results |

44 Important Questions Answered by Analytical • How do the manufacturers of your multi-vitamin tablets know they contain the right amounts of the right vitamins? How do they know the tablets don’t degrade or spoil? – Analytical Chemistry • How do researchers know if they have synthesized the right chemical, prepared the right mixture or fabricated the right material? – Analytical Chemistry • How do we determine the safety of our food or the cleanliness of our environment? – Analytical Chemistry • How do pharmaceutical scientists determine the safety and efficacy of new drug candidates? – Analytical Chemistry |

45 How Analytical Fits Within Our Research Business Growth Strategy ABC M Our customers use analytical technology combined with chemistry, biology and/or materials science in all stages of their workflow from “Discover to Apply” |

46 Analytical Market Overview * Market growth of 5% Source: SDI, Analyst Reports, Team Analysis * Includes instruments (HPLC, GC, TLC, LPLC, IC, flash chromatography), consumables, standards and reagents Market by Product Type |

47 Global Analytical Market * Overview •Market by customer segment • Environmental – Testing pollutants in water, air and soil • Biotech – Sample prep and analysis of large bio-molecules, bio-markers, etc. • Food & Beverages – Testing nutrients, ingredients, additives and impurities • Pharmaceutical – Characterization, efficacy – Control of API’s, impurities and metabolites Source: SDI, Analyst Reports, Team Analysis * Includes instruments (HPLC, GC, TLC, LPLC, IC, flash chromatography), consumables, standards and reagents |

48 Analytical Innovative Solutions For Environmental, Food Safety and Pharmaceutical Testing •Hydranal ® • The “gold standard” for water content testing •SPME • Positively impacts environment by reducing chemicals required for analytical testing •dSPE • Facilitates accurate testing of pesticide residues for fruits/vegetables •Ascentis Express • Accelerates drug discovery and development with significant separation cycle time reduction Improving the quality of life |

49 Analytical Growth Strategy • Become the “Aldrich” of analytical standards and reagents • Chemical analysis – Increased emphasis in food safety and the environment • Additional capability for collaborative innovation with academia and industry – Increased R&D and business development • Bioanalytical – Leverage internal “Bio” capabilities to expand in this fast-growing segment • Material analysis – Build on synergies with Materials Science initiative to develop material analysis capabilities and products • Expand in high-growth emerging markets • Inorganic growth – Providing niche technologies as product areas Expanding analytical innovation |

50 Going Forward To achieve >10% top-line sales growth, we will become the leading provider of analytical consumables and know-how • Known as “the source” for the highest quality analytical consumables • The commercial partner-of-choice for analytical consumable innovators • A valued, sought-after problem- solving partner for chemical and biochemical analysis |

Chemistry Frank Wicks President, Research Essentials/ Research Specialties |

52 Chemistry Is: The science of matter and the changes it undergoes Sigma-Aldrich – “Organic molecules used in scientific research” |

53 Market Overview • $1B in size • The users are most often the buyers • Main segments are Pharma, Biopharma, Academia, Industrial • Pharma segment hard hit by consolidation of the industry, trend towards big molecules and general cost savings in R&D • Academia and governmental segments are growing • Main growth in Asian and South American markets Market growth 2 - 3% |

54 Chemistry • Chemical Synthesis – most comprehensive product range of simple molecules to enable creation of more complex molecules • Organic Building Blocks – basic molecules used especially in drug discovery • Stable Isotopes – isotopically labeled products used in pharmaceutical and research applications • Chemistry Services – sourcing and custom packaging to enable drug discovery • Materials Science – application of chemistry for molecules with properties of high technological value; e.g. materials used in electronic devices Materials Science is a fast growing market segment |

55 Chemistry Growth Strategy • Aldrich is the premier brand with 40% market share • Broadest selection of 50,000 products – add 1,000 new annually • Sales channels – mainly catalog and e-channels • One-half million catalogs distributed • Aldrichimica Acta – leading organic chemistry journal We will deliver 3 - 4% growth |

Materials Science Frank Wicks President, Research Essentials/ Research Specialties |

57 Materials Science Is: A field of study that focuses on specific groups of materials with particular properties of high technological value and their applications towards devices |

58 How Materials Science Fits Within Sigma-Aldrich’s Chemistry Growth Strategy • Chemical knowledge for Life Science applications carries over to high technology • Faster growing applications area – capturing flat panel displays, environmental • Over the past 6 years we have: – Positioned the Aldrich brand in the Materials Science market – Built R&D capacity – Implemented a strong marketing communication platform – Introduced 150 new products per year • We offer products across the materials spectrum from hard to soft materials (ie. inorganics to metal-organics to organics to polymers) |

59 Materials Science Market Overview Global Materials Science R&D Market • $0.5 billion • Competition is fragmented • Market growth – 9% – Big and growing in size and diversity – Funding intact – Our target markets are still in early phases of life cycle and new niches are popping up Development market twice the size of research market Key Drivers Macro Trends Electronics – green technology • Expanded materials spectrum – metals, ceramics, organics, electronics Alternative energy – government spending and green technology • Growing customer base Biomedical engineering – heavy R&D investment, innovation driven by healthcare • Well funded user industries investing in high-performance materials Materials Science Market ($B) |

60 Materials Science Growth Strategy Use innovation focused approach to fill the gaps: • Accelerate new product introduction on existing platforms • Create new offerings for development customers • Enhance analytical capabilities • Polymers • Metals • Ceramics Expand our market reach to non- traditional Sigma-Aldrich customers: • Only a third of the materials researchers are chemists • Target engineers and physicists engaged in materials research • PR campaign and branding Sell more proactively: • Intensify web marketing • Start custom project selling • Focus on Supply Solutions type sales • Build and train local sales force and technical service Reach non-traditional customers |

61 Going Forward •Objective: > 10% growth •Scope: • To supply high quality materials and services to scientists and engineers engaged in fundamental and applied materials science research worldwide and in the development of innovative products in select markets, such as alternative energy, biomedical devices and electronics •Key Growth Strategies • Expand customer, market and geographical reach to materials scientists and engineers worldwide, innovative product and service offerings and based on deep and dominant positions in focused materials chemistry technologies (ultra-high purity organics, ultra-high purity inorganic salts; polymers; metals & ceramics preparation and acquire bolt-on capabilities that further differentiate our position) Deliver > 10% growth |

Biology David Smoller President, Research Biotech |

63 Biology Is: •A natural science concerned with the study of life and living organisms •Challenge • Understanding the dynamics of the complex biological pathways and molecular interactions within living cells |

64 Biology Segments Comprehensive portfolio of life science products – $800 million |

65 How Biology Fits within our Research Business Growth Strategy • Biology is a complimentary technology to chemistry in the life science workflow from “Discovery to Drug” • Life science research moving towards understanding complex biological pathways and entire biological systems • R&D grants awarded to laboratories researching diseases and therapeutics, especially in areas relating to stem cell and epigenetic research • Uses same logistics, production, distribution network, global footprint • Same customers |

66 66 Biochemistry / Biology Market Business Unit Market Size ($ Millions) Market Growth Biomolecules RB $1,900 9% Functional Genomics RB 900 15 Cells & Cell Based Assays RB 600 18 Protein Assays RB 600 14 Transgenics & Services RB 2,000 13 Genomics RB 1,800 5 Cell Culture RE/RS 500 7 Specialty Biochem and Enzymes RE/RS 900 5 Lab Essentials RE/RS 800 3 $10,000 |

67 Sigma is “Where Bio Begins” for our Customers |

68 Biology Segments Comprehensive portfolio of life science products – $800 million |

69 Basic tools for Biochemical research Largest Breadth of Traditional Biochemistry Products • Offer over 18,000 products • Add 500 new products each year to support the latest cutting edge research • Largely sold through the catalog and e-channels – Over one-half million catalogs distributed • Over one-million names with up-to-date contact information • Target-market information to specified “communities” in niche product areas |

70 Largest Breadth of Traditional Biochemistry Products • Cell Culture – Complete range of media and components to grow a variety of cell types • Specialty Biochem and Enzymes – Industry leading offering of products for basic Biochemical research • Lab Essentials – Broad range of the most common biochemicals; such as buffers, carbohydrates and amino acids Will deliver 5% growth annually |

71 Biology Segments Comprehensive portfolio of life science products – $800 million |

72 Leading Biomolecule Provider Biological Rich Content • Leading biomolecule supplier with 4,000 bioactive small molecules and thousands of proteins and peptides used for life science research • Number one oligo synthesis world-wide with manufacturing in all regions of the world • More than 26,000 monoclonal and polycolonal antibodies, including the industry’s most highly-characterized, validated Prestige Antibodies ® , powered by Atlas Antibodies Biologically rich content products |

73 Leading the Industry Functional Genomics and Regenerative Medicine • Unparalleled gene editing technology – CompoZr™ Zinc Finger Nucleases (ZFN) • Cutting-edge gene silencing products – Mission ® siRNAs and the largest set of validated lentivirus based shRNA clones • Innovative set of reagents for regenerative medicine including – Stemgent ® reprogramming kit to develop induced pluripotent stem (iPS) – HyStem ™ , customizable synthetic extracellular matrix (ECM) |

New Paradigm in Animal Models • Most relevant model system for your research – Rat – Mouse – Other • Addresses currently unmet needs – ADME – CNS disease – CV disease – Hypertension – Immunodeficiency models – Increased productivity Sigma Publishes in Science on the First KO Rat 74 |

75 Sigma Acquires Ace Animals, Inc. • High quality research rodents to the biomedical industry since 1973 • Brings rodent breeding and distribution capabilities and marries them to our SAGE™ Labs animal creation business |

Leveraged ZFNs in Cell-based Assays ZFNs used to label organelles in a living cell 76 |

77 Power of ZFNs in Stem Cell Research YFP + Pluripotent Stem Cells |

78 Connecting with Scientist Information and Social Networking |

79 Going Forward • To achieve double-digit top line sales growth – become leader in specific market segments within the cell biology market and differentiated animal models market by: – Acquiring new biologically rich content products – Leverage portfolio of biologically rich content products, services and information – Enable customers to achieve an even deeper understanding of biology Sigma is the only company that is positioned to do this |

80 Biology Segments Overall growth >7% 5% Growth >10% Growth |

Go To Market Gerrit van den Dool Vice President, Sales |

82 Go To Market Customer Profiles • Biologists • Often very repetitive use and purchasing profile • Application and technology driven • Chemists • The quickest means to an end • Technology and product availability • Economic Buyers • Short-term product costs • Relationship • Procurement Organizations • Total costs of ownership, sourcing, services Different customer types “My reps should bring me new ideas; updated equipment and reagents - that is really helpful.” -Biologist “What I really like about my rep is the ability to call someone when I have problems and know that they will fight to get my problem resolved.” -Enterprise Researcher |

83 Go To Market Coverage Strategies Initiatives Varied customers require different approaches |

84 Go To Market Adjustments • Biologists require higher touch • Realign sales force to achieve more focused coverage • No substantial change in total sales force Biologists require higher touch Level of “Optimal” Rep Interaction 1 Contact preference of at least once every 1-6 months 2 Contact preference of at least once every 1 months 3 Excluding post purchase technical support Percent 3 |

85 Go To Market Strategic Accounts Customized approach for global customers Coordinate efforts across Research and SAFC for Biopharma customers at this level Coordinate efforts across all segments at this level Specialized management level personnel to cover Global accounts |

SAFC Gilles Cottier President, SAFC |

87 SAFC Is: Unique manufacturing capabilities for Life Science and High Technology commercial applications |

88 SAFC |

89 Leverages Our Research Business • Leverage research assets • Utilize our scientific knowledge • Leverage same customer base from research to commercial applications |

90 Fine Chemicals Market |

91 Enabling science to improve the quality of life Unique Manufacturing Capabilities Application Examples of Our Technologies • Late phase Antibody Drug Conjugates (ADCs) and viral products for various cancer treatments • Adjuvants and critical raw materials for vaccines • High purity compounds for Light Emitting Diode (LED) lights utilized in new generation light bulbs,TVs and mobile devices • Solid Form State Chemistry • High Potency Ingredients • SMB Chromatography • Extraction & Purification • Fermentation • Viral Vaccine • Zinc Finger Nuclease (ZFN) • Critical Cell Culture Components • High Potency Conjugation • New Materials for Silicon Semiconductors and Compound Semiconductors |

92 Pipeline getting stronger SAFC Project Pipeline Pharmaceuticals and Biopharmaceuticals |

93 SAFC Strategy • Pursue selective commercial opportunities utilizing distinctive technologies and competencies which leverage our scientific knowledge and allow us to maximize our return • Get closer to large life science customers with comprehensive capabilities offer • Leverage quality leadership position • Address unique and evolving supply chain needs of customers • Expand in faster growing, emerging markets • Improve profitability through plant process improvements, facility rationalization and manufacturing center of excellence |

94 $100 million additional sales within next three years SAFC Growth Initiatives and Unique Manufacturing Capabilities • Cell lines engineering with Zinc Finger Nuclease (ZFN) for commercial therapeutic protein production • High Potency Active Pharmaceutical Ingredient (HPAPI) and viral particles for cancer and vaccines • Compound semiconductors for Light Emitting Diode (LED) market |

95 Cell Line Engineering with ZFN Technology Market Dynamics Pharmaceutical Biologics • Has become an established production process in biological pharmaceutical production • >10% anticipated growth for the next 5 years Technology is maturing, but relative to Chemistry is: • Higher production cost by a factor of 10 • Modestly characterized • Less dependable Cell line engineering enable significant improvement in productivity and reliability of commercial therapeutic protein production Source: Evaluate Pharma |

96 Cell Line Engineering with ZFN Technology •Unique Capabilities and Benefits • ZFN versus traditional cell line engineering approach – Cut cell line development time by 50% (six months versus 12 months) – Ability to modify more than one gene simultaneously (trait stacking) – Enables cell line engineering for small to mid-sized biotech companies and emerging biopharma • Customer Benefits – Increased cell growth and productivity – Enhanced efficacy and protein quality (glycosylation) – Increased knowledge of production systems (= reduced regulatory hurdles) – More reproducible production systems (= speed to the clinic) – Reduced host and viral proteins for ease of purification and safety – Shift our customers’ constraints to the molecule, not the production system Acquired exclusive rights for ZFN technology for bioproduction systems in October 2009 |

97 Cell Line Engineering with ZFN Technology |

98 HPAPI and Viral Particles for Oncology/Vaccine Technology Trends • Increasing complexity and potency of drugs • Monoclonal antibodies to reach and react with cancer specific tissue • Blend technologies to achieve targeted and specified results • Vaccines for cancer prevention Oncology is becoming number one therapeutic area Source: World Pharma Frontiers |

99 HPAPI and Viral Particles for Oncology/Vaccine •Technology Investment Investment of over $90 million in the last three years, expanding ‘technology solutions’ throughout the drug development lifecycle |

100 HPAPI and Viral Particles for Oncology/Vaccine •Unique Manufacturing Capabilities • World leader for high potent active pharmaceutical ingredient production • Largest and leading CMO for production of viral vectors • Leading capability in antibody drug conjugation • One of the world’s largest-scale high-potency fermentation facilities Leadership position = Double digit growth for these technologies in 2009 |

101 Compound Semiconductors for LED Market Dynamics Source: Phillips Lighting 2009 Source: ‘LED LCD TV Roadmap and Market Forecast by Maker’ December 2009, Displaybank Global LED LCD TV Market Forecast General Illumination Market Lighting will undergo the same upheaval as the film and music business |

102 Well positioned to capture market explosive growth Compound Semiconductors for LED •Unique Capabilities • SAFC Hitech – leader in manufacturing and distributing key metal organics for the LED Market – Trimethyl Gallium, Trimethyl Indium, Triethyl Gallium, Trimetyl Aluminium • Global manufacturing footprint – Well positioned to supply growing markets in Asia, North America and Europe • Direct selling model to all major players for general lighting and backlighting in key U.S., European and Asian markets – Strong customer intimacy model |

103 Going Forward •Our Key Growth Initiatives • Well positioned to respond to fast growing end-markets • Balanced portfolio between innovative technologies and traditional capabilities • Aligned to mega-trends – Shift from chemistry towards biology – Increasing complexity and potency of drugs – Focus on environmentally friendly products SAFC objective > 7% growth |

Geographic Expansion Eric Green Vice President and Managing Director, International |

105 Market Drivers and Trends • Emerging markets will represent 43% 2 of global GDP by 2018 • Developing countries aggressively boosting R&D funding • Pharmaceutical companies increasingly rely on off-shoring and out-sourcing • Local companies are emerging Emerging markets have significant growth potential 1 As determined by FTSE Global Equity Index 2 Source: Global Insight’s World Overview |

106 International Markets (Asia Pacific and Latin America) Mexico Brazil Argentina Chile • 10% • 90% South Korea Japan China Taiwan Vietnam Malaysia India Singapore Australia New Zealand Direct presence in 14 International countries |

107 Emerging regions playing larger role Strong Performance In International Markets |

108 Current International Profile |

109 Key Growth Drivers |

110 Country specific modes of customer interaction remain essential Go-To-Market •Expand sales force coverage • Invest in technical selling to support ABC M strategy • Extend reach into new geographies •Optimize pricing strategy •Drive e-adoption • Invest in web localization • “Ease of Use” is our key enabler |

111 Infrastructure remains a key differentiator as we drive demand Infrastructure Expansion • Expand distribution capabilities • Existing geographies • New geographies • Continue to differentiate through service • Optimize inventory management • Adapt our logistics capabilities to support new product lines Bangalore DC & Packaging Planned Expansion |

112 Localization of Supply • Qualify and develop in-country sources for selected product categories • Invest in local QC and packaging infrastructure • Leverage in-country sources through global supply chain integration Increase share and margins through local sourcing * Sigma-Aldrich Estimate Laboratory and Research Market Size in China* |

113 Acquisitions and Partnerships • Increase emphasis on targeting inorganic growth opportunities in the region • Form strategic partnerships with local and global companies • Identify technologies and capabilities to support ABC M strategy Bolt-on acquisitions targeted to support ABC growth in international M |

114 To achieve 30% of corporate sales by 2014 Conclusion and Summary • We have a sustainable growth strategy • The growth trend for emerging markets remains strong • We are investing in strategic capabilities while focusing on selling and supply chain • We will seek to supplement our organic growth with acquisitions that fit |

eBusiness Amanda Halford Vice President, eBusiness |

116 Our Vision Transition from a “catalog” company with a website to a “web” enabled company with a catalog • Drive our ABC M strategy through Internet leadership • Use customer insight to create an on-line experience that is segmented, personalized and localized • Build for the future on our best in class technology platform • Accelerate access to unrivalled scientific knowledge “I firmly believe that companies that win the battle of e-commerce will win the war in our competitive environment.” Jai Nagarkatti, October 2009 |

117 Fastest Growing Channel to Market Will Accelerate Growth •Key Statistics – 2009 • 45% of global research sales vs. 4% in 2000 • 54% of U.S. research sales vs. 7% in 2000 • 3 million monthly visits vs. 600k in 2000 eBusiness is a key driver for overall growth $700 M through the web in 2009 |

118 Opportunities to Drive Revenue at Each Stage of the Online Customer Buying Cycle Learn Choose Use |

119 Largest Channel to Market Driving Strategy As our single largest channel to market, our website will drive our ABC M strategy Segmentation 119 |

120 Customer Insight Creating a Differentiated Customer Experience • Observes customers in their work environment • Watches how they actually work, not just listening to what they say they do • Translates observations into functionality that enhances customer’s experience Localization Personalization |

121 New Technologies Accelerated Access to Our Unrivalled Scientific Knowledge |

122 Did You Know? •Number of internet devices by year • 1984 – 1,000 • 1992 – 1,000,000 • 2008 – 1,000,000,000 |

123 Growing Online Market Accelerating Revenue Growth As a Web-enabled company, we will take full advantage of the growing online market to accelerate revenue growth |

Global Supply Chain Dave Julien President, Global Supply Chain |

125 Sigma-Aldrich Global Supply Chain 2010 and Beyond An integrated effort Manufacturing Distribution/Logistics Quality Control Centers of Excellence Product Portfolio Management Packaging Procurement Planning |

126 Global Supply Chain Project Goals – 2010 •Global Integration • Organization • Supply Chain governance • Metrics • Systems (SAP) •People • New capabilities and expertise •Processes • Complexity reduction • Flexibility • Risk reduction Faster, better and more cost-effective |

127 Global Supply Chain Progress – 2010 •Procurement and planning • Global organization •Manufacturing, QC and packaging • Harmonizing, global teams •Product portfolio • Eliminating overlaps •Logistics and distribution • Global management •Systems and harmonization • Projects moving along Teams formed and projects active |

128 Global Supply Chain •2009 Results • Inventory Reduction From 7.0 to 6.5 MOH ($75M) • Supply Chain Savings Net $22 Million • Process Improvement Savings $15 Million • Procurement 75% of Total Savings • Service > 90% Available Globally Pulled projects forward in 2009, beat targets |

129 Global Supply Chain •2010 Targets • Inventory Reduction < 6.5 MOH • Supply Chain Savings Net $15 Million • Process Improvement Savings $15 Million • Service Rates Maintained or improved from 2009 • Systems SAP installations to be completed at major sites 2010 targets similar to 2009 |

130 Global Supply Chain Procurement – 2010 Goals • Total spend greater than $1 Billion – 50% direct / 50% indirect • Almost a decade into initiative; increased focus 2007 – $110 Million plus saved • Sigma-Aldrich procurement controls 55%, target 80% • Continued focus on indirect spend • Improve regional and global communication, expand opportunities • Strengthen team in APLA • Vendor on-time delivery and risk mitigation Procurement still largest opportunity |

131 Global Supply Chain Procurement 2010 Procurement savings hitting peak Supply Chain Project |

132 Global Supply Chain Planning – 2010 Goals • Priority planning for new products • Special focus on fastest selling products • Implementing advanced planning system tools • Continued emphasis on reducing inventory write-offs • Reducing cycle time is key Decreased inventory by $100+ million while improving fill rates |

133 Global Supply Chain Manufacturing, QC and Packaging – 2010 • Active global teams developing 5-year strategies • Facilities optimization – centers of excellence – capacity utilization – regional requirements • Packaging component consolidation ($60M spend) • Process, testing and data harmonization • International expansion Global strategy developing |

134 Global Supply Chain Distribution Initiative – Customer Focus – 2010 • High stock availability – 96% for U.S. and Europe – 80% for China and India • 24-hour service to the key markets • Highly automated distributon center in Europe • Excellence in handling chemicals • Global solutions for global customer Customized solutions to drive sales 8 million lines shipped to customers in 2009 |

135 Global Supply Chain Distribution Initiative – Capacity SD Mke StL 8 million units in stock to support our customers |

136 Global Supply Chain Distribution Initiative – 2010 • Global harmonized processes to improve efficiency • Inventory optimization through global management • Continuous improvement to global network • Development of customized solutions • Optimize regional centers • Expand footprint in APLA Significant contribution to savings |

137 Ahead of plan, potential to beat targets Global Supply Chain Pre-tax Savings 2% pretax margin improvement by 2014 Supply Chain Expected Savings |

Summary Jai Nagarkatti Chairman, President and Chief Executive Officer |

139 Sigma-Aldrich Uniquely Positioned for Value Creation Compelling investment opportunity History of profitable growth Strong financial position and cash flow Plans to enhance growth rates and improve profitability Diversified portfolio: products, customers, geography Unrivaled scientific knowledge and unsurpassed service |

140 Summary Why Sigma-Aldrich Now? Value Creation Sigma-Aldrich Advantage • Manufacturing and distribution footprint optimization • Demonstrated ability to achieve earnings and cash flow savings from global supply chain and process improvement initiatives • Margin expansion from profitable sales growth • Solid liquidity position to fund both organic and inorganic growth • Increasing focus on eBusiness channel to market • Emerging Markets becoming a larger contributor • Uniquely positioned in high growth markets of Analytical, Biology, Materials Science and niche Fine Chemicals Over five years: 200 - 300 bpts margin expansion > $2 billion cumulative free cash flow Earnings Power Expansion 7 - 8% Organic Growth Plus Inorganic Growth Sales Growth |

141 Sigma-Aldrich Corporation Questions? Call the conference telephone number Toll free: 877-660-8922 Access code: 4999095 |