UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07059

| T. Rowe Price Blue Chip Growth Fund, Inc. |

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (410) 345-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2012

Item 1. Report to Shareholders

|

| Blue Chip Growth Fund | December 31, 2012 |

The views and opinions in this report were current as of December 31, 2012. They are not guarantees of performance or investment results and should not be taken as investment advice. Investment decisions reflect a variety of factors, and the managers reserve the right to change their views about individual stocks, sectors, and the markets at any time. As a result, the views expressed should not be relied upon as a forecast of the fund’s future investment intent. The report is certified under the Sarbanes-Oxley Act, which requires mutual funds and other public companies to affirm that, to the best of their knowledge, the information in their financial reports is fairly and accurately stated in all material respects.

REPORTS ON THE WEB

Sign up for our E-mail Program, and you can begin to receive updated fund reports and prospectuses online rather than through the mail. Log in to your account at troweprice.com for more information.

Manager’s Letter

Fellow Shareholders

After generating very strong first-half performance, stocks produced more subdued gains in the second half of 2012. The markets’ volatile and inconsistent performance was not surprising given the ongoing uncertainties confronting investors. High levels of unemployment and slower-than-optimal economic growth present challenges. Substantial deficits at various levels of government continue to vex policymakers. Sovereign debt issues and the resultant slowing in many European economies have not been resolved.

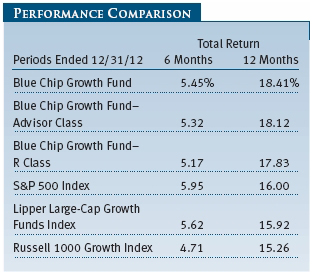

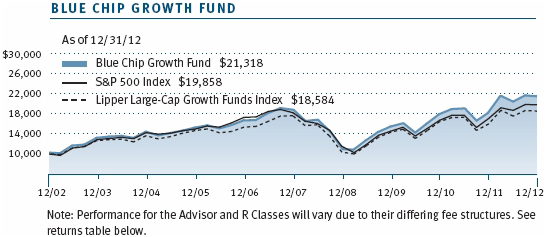

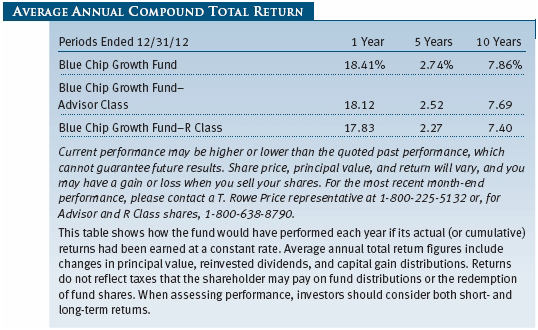

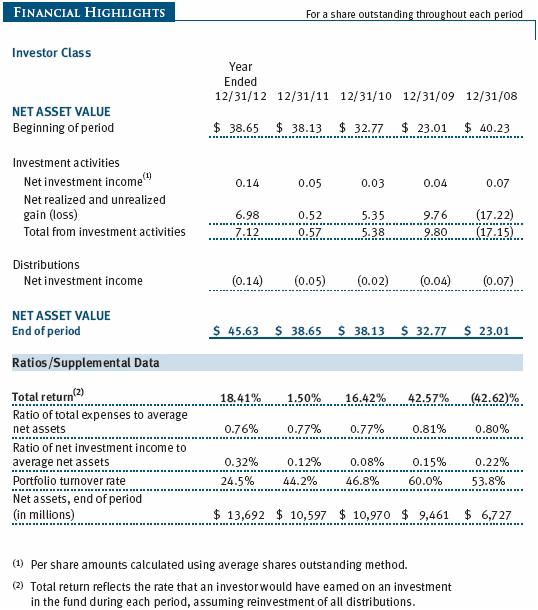

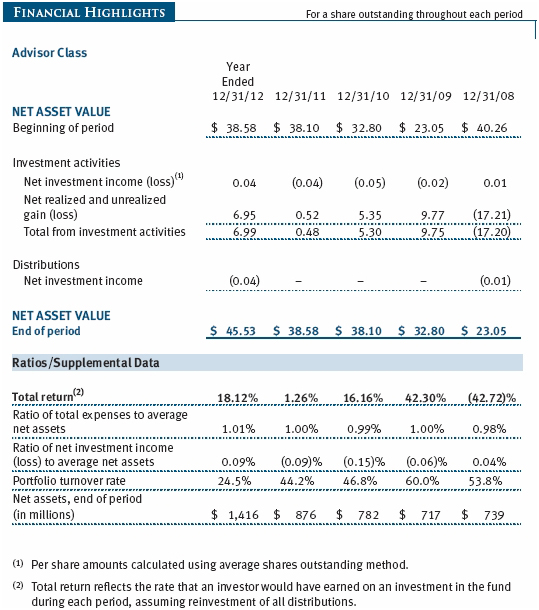

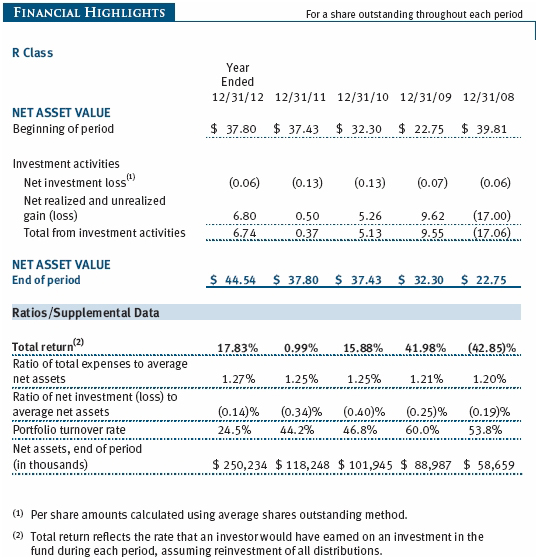

The Blue Chip Growth Fund returned 18.41% for the year ended December 31, 2012, outperforming the benchmark S&P 500 Index, the Lipper peer group average, and the Russell 1000 growth-specific index. As shown in the Growth of $10,000 chart on page 15, the fund’s 10-year return has outpaced the S&P 500 and its Lipper benchmark by a significant margin. (Returns for the Advisor and R Class shares were slightly lower, reflecting their higher fee structures.)

Your fund continued to compare favorably with its competitors. Lipper ranked the Blue Chip Growth Fund in the top 10% of its large-cap growth funds universe for the three-year period ended December 31, 2012. (Based on cumulative total return, Lipper ranked the Blue Chip Growth Fund 123 of 713, 46 of 640, 120 of 563, and 70 of 379 funds in the Lipper Large-Cap Growth Funds Index for the 1-, 3-, 5-, and 10-year periods ended December 31, 2012, respectively. Past performance cannot guarantee future results.)

The reelection of President Obama and unchanged majorities in Congress provide a more certain political backdrop. However, the fiscal cliff negotiations led only to substantial tax increases and minimal spending reductions. Upcoming debt ceiling and deficit negotiations could lead to a government shutdown and still not yield important spending and deficit reduction. The lack of a bipartisan solution to large U.S. structural deficits represents a major potential stumbling block for economic progress and investor confidence.

However, there are reasons to be constructive and even optimistic. Job growth has improved, and retail sales, auto sales, and housing starts paint a picture of a slowly improving, or at least resilient, U.S. economy. Progress has been made on the European debt crisis, but growth remains lackluster with northern Europe faring much better than the Mediterranean countries. An important potential bright spot is early signs of recovery in China, which alone could be quite helpful to global growth and the earnings prospects for many multinational companies.

Ultimately, investors may wait to see the effects of major tax increases in the U.S. as well as the policy actions taken over the next few months in conjunction with the deficit negotiations. Unfortunately, this uncertainty and disruptions stemming from rancorous debate and the cost of painful policy actions are part of the burden of substantial and growing deficits. If progress is made on structural deficits and other policy issues, the combination of reasonable valuations, rising but still favorable interest rates, and improving profit growth could drive solid gains in selected stocks. We want to be clear that there is an unusual amount of uncertainty in the current environment, and even if the proper policy choices are pursued, it may take considerable time for meaningful improvement in budget deficits and economic growth.

MARKET ENVIRONMENT

Over the nearly 20 years that we have managed your fund, we have generally been reluctant to place too much emphasis on politics or government policy. However, large structural deficits could have a profound effect on U.S. and global economic prosperity. President Obama was effective in raising taxes, especially on high earners, but FICA increases will be levied on all taxpayers. The Social Security tax will rise to 6.2% from 4.2%, where it had been for several years as part of a fiscal stimulus package.

Certainly, tax increases and tax simplification can play some part in reducing deficits over time. However, we hope that policymakers fully appreciate that the tax increases typically dampen growth and often do not yield as much revenue as anticipated. More importantly, they cannot yield enough revenue to significantly reduce projected deficits. This can only be accomplished by a substantial slowing in the growth (or reductions) of government spending. The strong differences in philosophy on how spending should be modified are perhaps understandable. However, the reality that government must better control spending should be embraced by all policymakers.

The rating agencies have taken note of the lack of progress in restraining spending and reducing deficits. If there is not more bipartisan cooperation on this issue, the U.S. could face painful debt ratings downgrades. If interest rates were to increase significantly, interest payments would become quite burdensome and could damage U.S. creditworthiness and economic growth. With the passage of time, the probability of entering a period of rising rates increases. We do not want to place inordinate emphasis on more general policy or macroeconomic issues, but we must convey the gravity of this issue.

In Europe, the decision to allow the European Central Bank to inject capital directly into the banking system in Spain and other countries appears to have achieved some greater level of stability. However, growth continues to be generally disappointing in most areas of Europe. China’s economy seems to be slowly improving in conjunction with a recent change in leadership. Given that a substantial portion of the revenue and earnings growth for many companies is generated from Asian economies, in particular China, the growth trajectory for the region warrants careful monitoring. Hurricane Sandy, which hit the eastern U.S. in late October with tragic loss of human life, also could hamper economic growth.

While recognizing the many challenges facing investors, we want to be clear that there are several powerful positives and also potential rewards in selected stocks. Solid revenue growth; improved efficiency and margins; and, ultimately, robust corporate earnings are being generated despite high levels of unemployment and capital expenditures that remain subdued. As overall demand improves, corporate earnings could be quite vibrant. Many companies have free cash flow yields approaching 10%, which is favorable relative to the approximate 1.8% yield on 10-year Treasury notes. While some stocks have performed well, many stocks are reasonably valued and reflect the opportunity we believe still exists in this market.

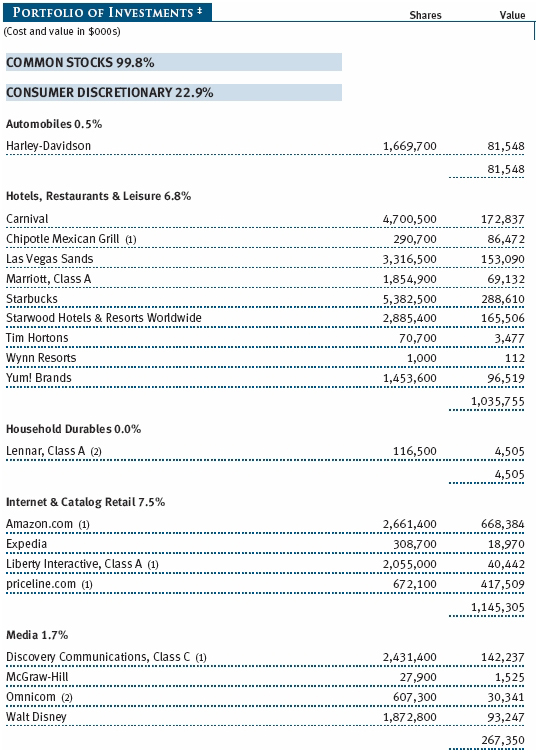

PORTFOLIO REVIEW

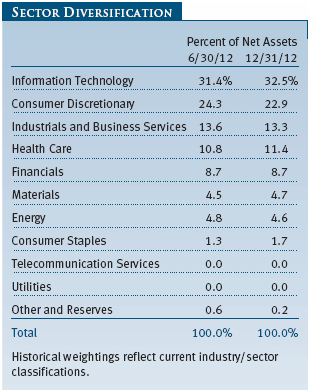

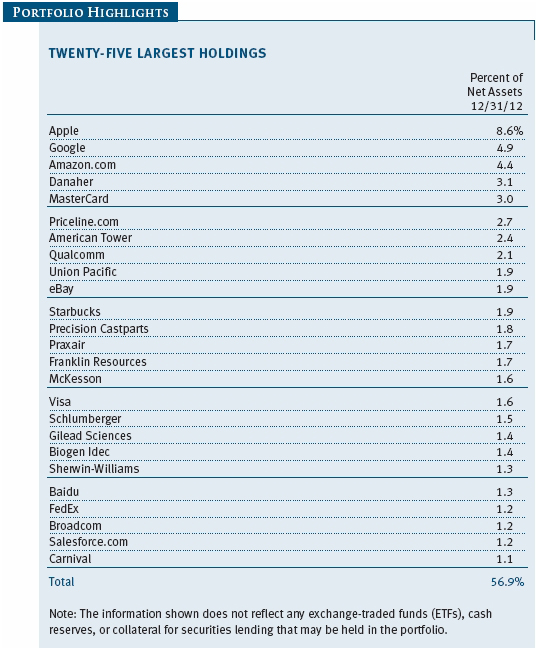

Our information technology, industrials and business services, consumer discretionary, and financial stocks performed well as investors slowly became more confident that the global economy was improving. However, performance of many of these same stocks suffered when deficit negotiations or concerns regarding growth in China caused anxiety. We expect that this pattern of inconsistent stock price behavior could continue for some time until these concerns are resolved to a greater degree.

In the technology area, Google was our largest contributor over the past six months. Investors worry that the company will not be able to integrate Motorola Mobility or compete with Apple effectively. However, the vast majority of all smartphones employ the Android operating system devised by Google, and its open platform continues to flourish. On balance, we are also very impressed with the company’s Google+ initiative in social networking as well as its continued efforts in mobile, video, and display and in its Chrome search engine and software products. While the company’s growth is moderating, we think that the stock’s current valuation more than reflects this. (Please refer to the fund’s portfolio of investments for a complete list of holdings and the amount each represents in the portfolio.)

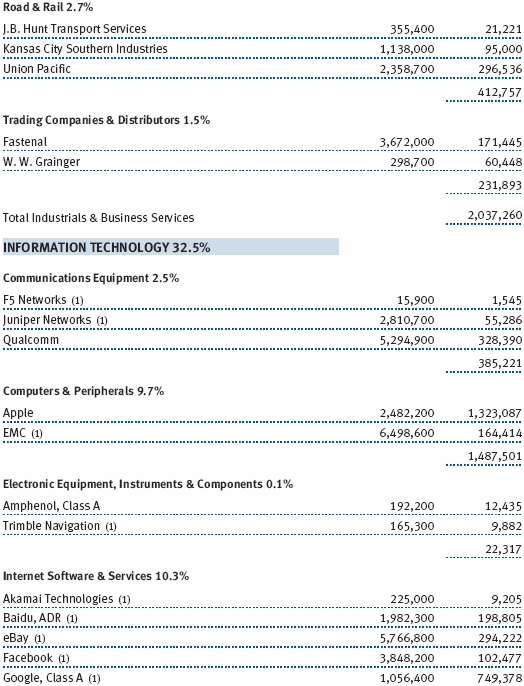

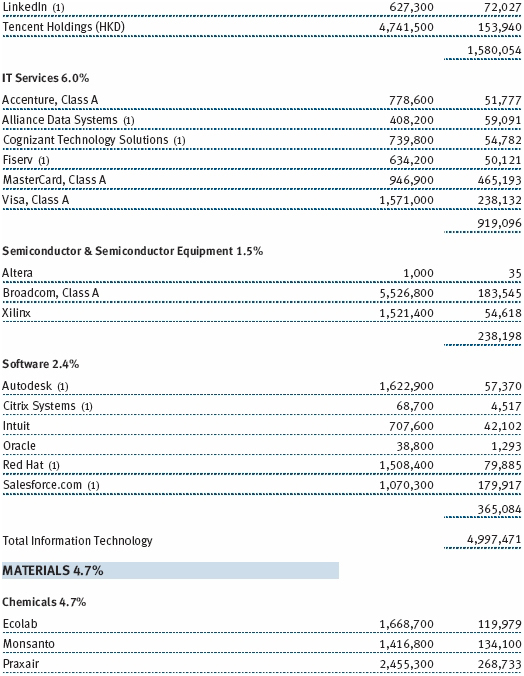

MasterCard and Visa were top contributors to performance after declining in response to the Durbin legislation passed to regulate the level of debit card transaction fees. While revenue growth has slowed modestly due to lackluster retail activity, both companies continue to generate consistent growth in earnings and free cash flow driven by their strong global franchises. EBay was also a top-five contributor for your fund in the second half of 2012. It has been a solid performer, benefiting from improvements in its Marketplace business and continued expansion of its PayPal segment into point-of-sale locations.

Our patience with longtime holding Qualcomm began to yield results. The company’s semiconductor solutions and chipsets are used in many of the leading smartphones and tablets. It is particularly well positioned for the next standard in wireless communication, dubbed LTE (short for long-term evolution). Salesforce.com contributed significantly to performance and is also an industry leader with important intellectual property. It has used its dominant position in cloud-based sales force automation software to expand into marketing, services, and social applications.

Facebook appeared as though it might be an extremely disappointing stock. It was not priced appropriately in its initial public offering, in our view, especially given the challenges it faced in transitioning its offerings to a growing number of mobile users. However, we sold a significant portion of our holdings at favorable prices shortly after the initial offering. We then added back to the investment at a much lower price when we saw evidence that the company’s efforts to sell and deploy advertising to mobile users were gaining traction. The stock was a strong performer late in 2012. Our longtime investment in Tencent again generated solid gains. This leading Chinese company is expanding its dominant position in online gaming and instant messaging into social, mobile, and commerce offerings.

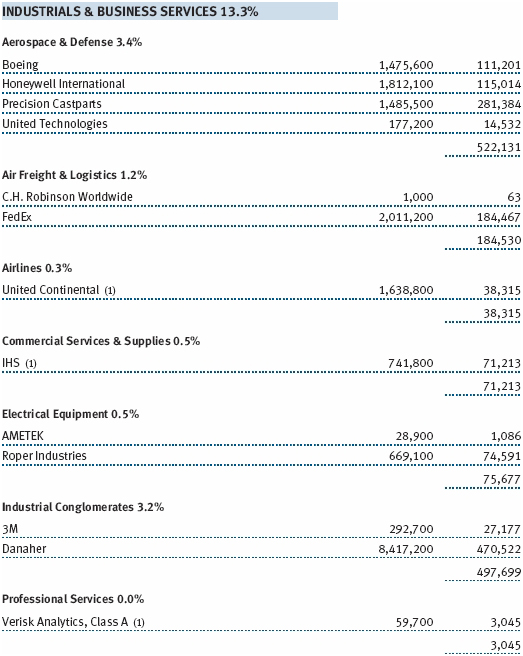

Industrials and business services produced a variety of winners during the second half. Precision Castparts, a global leader in the forging and casting of precision parts used in the aerospace and energy industries, continued to produce solid gains. It is an extraordinarily well-managed company with superior profitability. Our longtime holding in Danaher generated solid gains late in the year, and the company recently reported improved internal growth. Fastenal, a leading industrial products distributor, which we’ve held for several years, also performed well. It is a high-quality company known for consistent growth, strong profitability, and innovative solutions such as its vending machines, which are being adopted by industrial users at a rapid pace. Rail giant Union Pacific and aerospace and industrial leader Honeywell warrant mention. Both are led by outstanding managements that have produced consistently strong performance through improvements in efficiency and profitability.

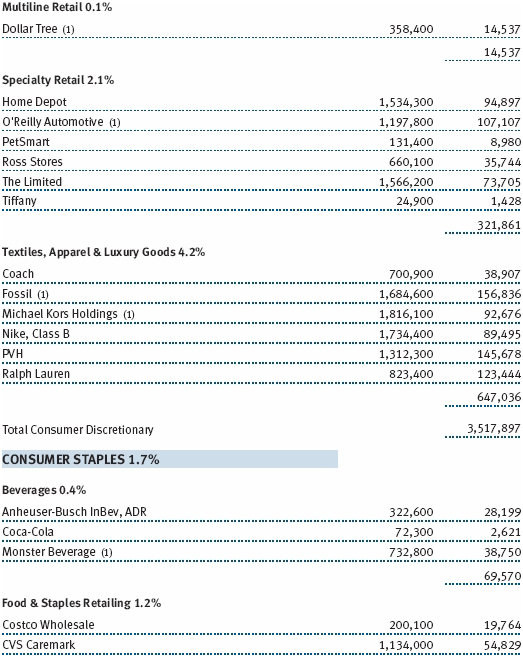

In consumer discretionary, we derived benefit from a variety of companies in this large and varied sector. Our large position in Amazon.com was a top contributor to second-half performance. Fortunately, third-party sales and Amazon Web Services (the company provides cloud-processing services for other companies) possess margins above the company average. As these businesses grew rapidly, they propelled a meaningful recovery in operating margin and stock performance for the company. Major contributor PVH’s iconic men’s shirt business was augmented by growing positions as a licensed seller of major brands such as Tommy Hilfiger and Calvin Klein. Its recent purchase of Warnaco should solidify its Calvin Klein global presence and result in substantial expense synergies. Fossil has been a volatile and sometimes disappointing holding, but it performed well in the second half of the year. The company’s leading portfolio of watches and accessories has generated strong sales and earnings growth for decades. Manufacturing for brands including Burberry, Armani, Diesel, Michael Kors, Marc Jacobs, and others powered strong results, particularly in Asian markets. Our longtime holding in Ralph Lauren also helped performance. It has a substantial presence in Asian markets and should benefit from distribution streamlining in certain markets, which is now largely completed. In the apparel area, Nike chipped in with solid gains from strong global footwear sales.

Other major winners in the consumer discretionary area included Discovery Communications. The company produced solid gains as its original programming on Discovery Channel, The Learning Channel, Animal Planet, and Investigation Discovery continued to drive strong profitability. Lodging and gaming companies made important performance contributions. Las Vegas Sands has been an inconsistent performer, but improving results at its large operations in Macau drove strong results. Macau’s $38 billion overall gaming revenues in 2012 are now many times the size of those produced in Las Vegas and larger than the entire U.S. gaming industry. Lodging giant Starwood Hotels & Resorts also generated solid gains. Its brands include leading hotels such as Sheraton, Westin, Le Meridien, and St. Regis, and it is well positioned in faster-growing international markets.

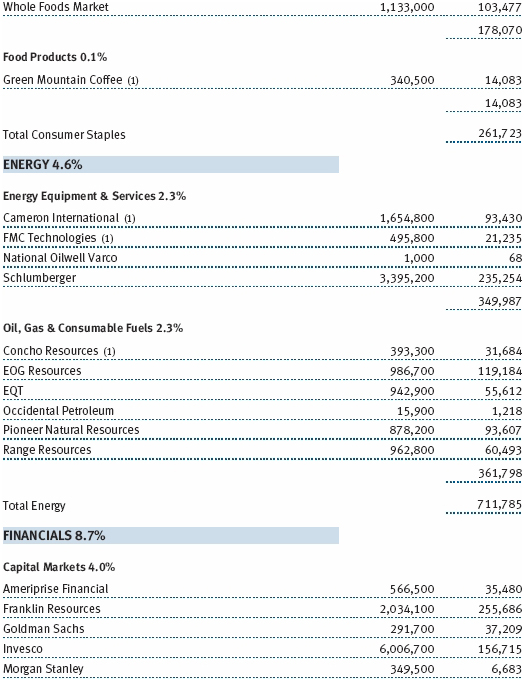

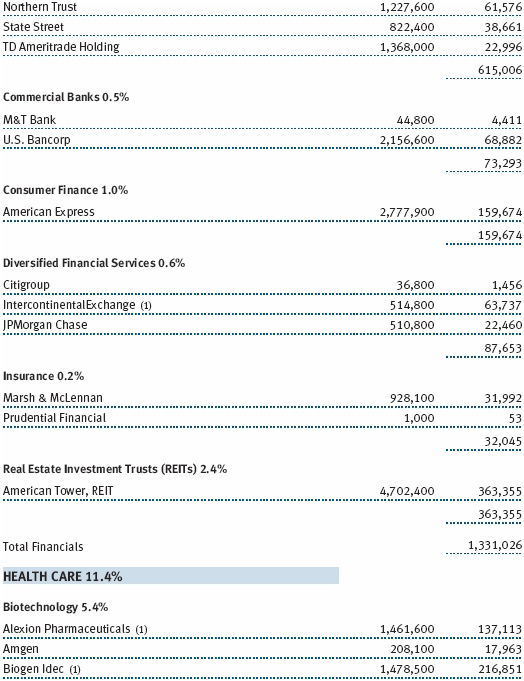

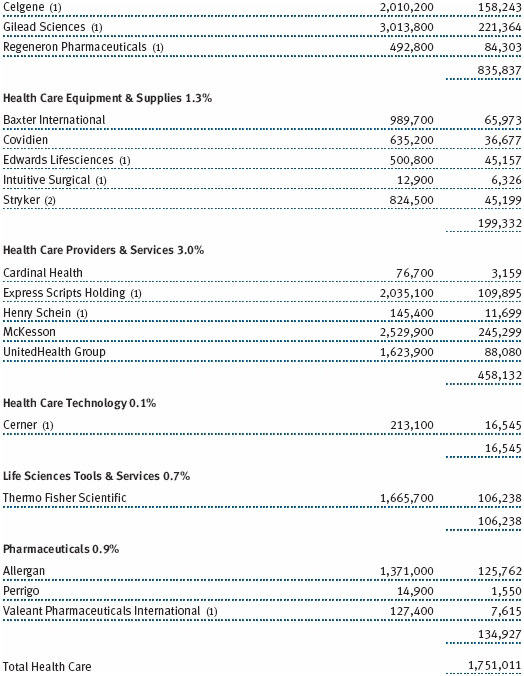

Several contributors in the financial services, health care, and materials industries are worthy of mention. Investment management leaders Franklin Resources and Invesco each generated strong growth in profitability and stock performance. Our longtime holding in American Tower has successfully made the conversion to a real estate investment trust (REIT) and is now classified as a financial company. This leading operator of towers used for wireless communication has a growing global presence with nearly 30,000 tower sites, and it has continued to perform well. Biotech leader Gilead Sciences was a top-five second-half performer, and Celgene also generated solid gains. Both companies have developed new products—Gilead to treat hepatitis C and Celgene to treat psoriasis and psoriatic arthritis and cancer—and have generated solid clinical trial data. Sherwin-Williams benefited from the sharp decline in oil prices (oil is a major raw material in paint) and a recovery in housing and home improvement. The company has increased its dividend for over 30 consecutive years and has high-quality products and retail stores. Our patience with Monsanto was rewarded as the company continues to introduce genomic-based seed solutions and just reported strong earnings growth.

Our largest loser for the second half was Apple, and the trend has continued in January. It is always disappointing when a company that has been a major positive contributor lags and hurts results. We try not to forget that each situation is different, and some of our underperformers recover and perform well while others experience a protracted period of underperformance. In the case of Apple, its tremendous success to date, and the fact that it generates most of its profits from the sale of devices that probably have shortening life cycles and lower margins over time, creates special challenges. Investors are rightly concerned that Apple operates essentially on a closed system, which has disadvantages versus the more open Android-based system used by most smartphone makers. In addition, there are concerns that competing products from other well-managed companies, such as Samsung, will take market share in certain areas. It is also true that the iPad mini is cannibalizing iPad revenues and that Apple will probably launch a new lower-cost iPhone to compete at a lower price point. These developments will probably be detrimental to gross margins and profitability. Even absent that potential trend, we knew that Apple could not continue to grow as fast as it had for the past several years. It is also possible that telecom carriers will not continue to subsidize Apple products if others produce devices that are considered equivalent or superior. This is an important threat that we are evaluating carefully.

However, most of the evidence we can gather indicates that Apple could continue to prosper. Its cloud-based ecosystem, which uses the IOS operating system to synchronize all Apple devices, has a well-earned reputation for quality and innovation and tends to produce repeat purchases and a willingness to own multiple Apple devices. Although the competition is improving, we don’t foresee a major change in those strengths. In the shorter term, Apple will probably experience continued margin pressure, and device sales may not be as robust in early 2013 if it is positioning to launch new products. Apple’s valuation appears to be attractive at less than 10 times 2014 estimated earnings, even before we give any credit for its substantial cash balances.

Baidu, the leading Chinese Internet search services provider, was another major detractor in the 6- and 12-month periods. Advertising constitutes a large portion of its revenues, and general economic slowing in China has dampened revenue growth. As users transition to mobile devices in greater numbers, the company faces certain challenges and costs to make its services fully relevant. While Baidu has a dominant share of searches, there are several competitors that have taken a small amount of market share. The situation warrants careful monitoring, and we have reduced our position size. However, recent developments, including improving growth in China and efforts to expand the company’s presence in e-commerce and social networking, support the view that Baidu will continue to experience solid growth.

Priceline.com had been a significant contributor in the past, but it was a major detractor in the past six months. The company still holds a dominant position in domestic and overseas travel markets. Its Agoda booking engine in Asia and Booking.com in Europe continue to drive strong growth, but the company experienced some slowing in recent quarters. However, Priceline’s business appears to be picking up, the company continues to generate solid free cash flow, and its valuation appears attractive relative to its substantial earnings growth.

STRATEGY

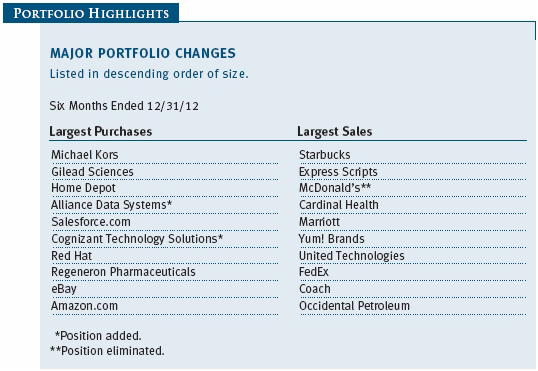

Additions to existing holdings, such as Michael Kors, Gilead Sciences, Home Depot, Salesforce.com, Regeneron, Red Hat, eBay, and Amazon.com, were significant enough to be included in the 10 largest purchases for the past six months. New positions included Alliance Data Services, a leading data services company that provides integrated credit services, loyalty marketing programs, and Internet-based marketing services. The company manages nearly 90 branded credit card and marketing programs for companies including Victoria’s Secret, Ann Taylor, Eddie Bauer, and Pottery Barn. Its LoyaltyOne program is the largest loyalty marketing program in Canada, and over 65% of Canadian households participate in its Air Miles Reward Program. The stock has been a solid performer since our purchase. Cognizant Technology is a leading global provider of consulting and outsourcing services. It has important operations in India and other countries that provide skilled workers, and we think the company is well positioned for continued growth. Cognizant complements our Accenture holding—both companies have produced strong earnings gains and share price appreciation.

We eliminated several positions in the second half of 2012. We sold McDonald’s at a solid profit after several years of ownership because it experienced a series of disappointing sales results in both domestic and international markets. While the shortfalls were not dramatic, they reinforced our analyst’s view that the company’s execution was not as strong as it had been over the past several years. Subsequent to our sale, the company made major changes to the senior management team of its restaurant operations. We would consider reestablishing a position in this high-quality company, but we currently think several other consumer discretionary stocks are more attractive.

Dollar General was eliminated after less than a year of ownership. We had accumulated only a moderate-sized position but began to trim our holdings due to concerns regarding increased competition from Wal-Mart and other stores with similar formats and the difficult overall retailing environment. Our fears were validated by recent subpar quarterly results, and we eliminated the relatively small remaining position.

OUTLOOK

We had hoped that the November elections and the ensuing resolution of the “fiscal cliff” negotiations at year-end would bring much greater clarity in several key areas. Some matters (such as the passage of a tax package) have been resolved. Unfortunately, the larger concerns surrounding spending and deficit reduction remain, and formidable challenges also persist. The sovereign debt crisis and severe weakness in many European economies have not been resolved. Lackluster economic growth and job creation in the U.S. and several major developed countries also represent a key concern. This slow growth could contribute to structural deficits that could imperil prospects for full recovery or even stability, particularly if interest rates rise significantly. Unfortunately, bipartisan solutions to reduce spending and address large deficits have not been enacted. We would also be quick to acknowledge that policymaking to address all of these situations is complex, risky, and unlikely to yield results that are unequivocally favorable. Said another way, all of the solutions have costs and also, perhaps, unintended consequences.

One unintended and undesirable side effect of the accommodative monetary policy pursued by global monetary authorities could be a sharp or persistent rise in inflation. There are other complicating factors that may weigh on markets for some time. Unrest in the Middle East could affect general global stability. Moderation in energy prices had represented an overall positive, but energy prices have begun to rebound. Major spending cuts or other policy actions could dampen rather than enhance growth in the short run. Confidence among business managers and investors and growth in employment may continue to improve quite slowly. Also, unemployment statistics underestimate the number of unemployed as many discouraged workers have left the workforce. A potential downgrade of U.S. debt, dollar instability, and a sharp increase in interest rates constitute threats that must be carefully evaluated. For these reasons and several others, we regard the current environment as having more complexity and risk than is typical—an unfortunate situation that could persist.

On balance, we continue to be constructive on the performance of stocks. While the challenges we have enumerated will certainly require time to resolve and will test the patience of policymakers and investors, corporate earnings at select companies could continue to impress, interest rates and inflation should remain at acceptable levels, and the valuations of many high-quality companies are quite reasonable.

Despite the uncertainty surrounding how effective fiscal and monetary actions will be in healing the economy, there are several things working in our favor:

1. Stocks historically have performed quite well following a lack-luster period of performance. Essentially, we have experienced two major bear markets since 2000.

2. Recent market strength does temper the amount of potential appreciation, but stock valuations are compelling in relation to the very low level of interest rates. The spread between the earnings yield on stocks and the 10-year Treasury rate is very attractive in any historical context. The free cash flow yield of many companies exceeds 10% and implies attractive valuation, especially in the context of 10-year Treasury note yields near 1.8%.

3. We believe that the high-quality, consistent-growth companies we seek to purchase could perform well even if the economy only experiences a modest recovery. Stringent expense management could also support rapid earnings growth if revenues begin to accelerate.

4. Many large-cap growth companies have solid balance sheets with record amounts of cash and strong capitalization. This should allow them to opportunistically invest in new products or businesses or make acquisitions as change creates dislocation.

5. Many of our holdings generate significant free cash flow. Shareholder-oriented management can use this cash to pay dividends, repurchase shares, or make value-added acquisitions.

We continue to strive to enhance returns in a challenging environment by investing in quality companies with durable, sustainable earnings and cash flow growth. We appreciate your continued confidence in this endeavor.

Respectfully submitted,

Larry J. Puglia

President and chairman of the Investment Advisory Committee

January 14, 2013

The committee chairman has day-to-day responsibility for managing the portfolio and works with committee members in developing and executing the fund’s investment program.

RISKS OF STOCK INVESTING

The fund’s share price can fall because of weakness in the stock markets, a particular industry, or specific holdings. Stock markets can decline for many reasons, including adverse political or economic developments, changes in investor psychology, or heavy institutional selling. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the investment manager’s assessment of companies held in a fund may prove incorrect, resulting in losses or poor performance even in rising markets. Growth stocks can be volatile because these companies usually invest a high portion of earnings in their businesses, and earnings disappointments often lead to sharply falling prices. The value approach carries the risk that a security’s intrinsic value may not be recognized for a long time or that the stock may actually be appropriately priced.

GLOSSARY

Dividend yield: The annual dividend of a stock divided by the stock’s price.

Free cash flow: The excess cash a company is generating from its operations that can be taken out of the business for the benefit of shareholders, such as dividends, share repurchases, investments, and acquisitions.

Lipper indexes: Fund benchmarks that consist of a small number (10 to 30) of the largest mutual funds in a particular category as tracked by Lipper Inc.

Price/book ratio: A valuation measure that compares a stock’s market price with its book value, i.e., the company’s net worth divided by the number of outstanding shares.

Price/earnings (P/E) ratio: A valuation measure calculated by dividing the price of a stock by its current or projected earnings per share. This ratio gives investors an idea of how much they are paying for current or future earnings power.

Russell 1000 Growth Index: A market capitalization-weighted index of those firms in the Russell 1000 Index with higher price-to-book ratios and higher forcast growth values.

Russell 1000 Index: A market capitalization-weighted index that tracks the performance of the 1,000 largest U.S. companies.

S&P 500 Index: An unmanaged index that tracks the stocks of 500 primarily large-cap U.S. companies.

Note: Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell indexes. Russell® is a trademark of Russell Investment Group.

Performance and Expenses

| Growth of $10,000 |

This chart shows the value of a hypothetical $10,000 investment in the fund over the past 10 fiscal year periods or since inception (for funds lacking 10-year records). The result is compared with benchmarks, which may include a broad-based market index and a peer group average or index. Market indexes do not include expenses, which are deducted from fund returns as well as mutual fund averages and indexes.

| Fund Expense Example |

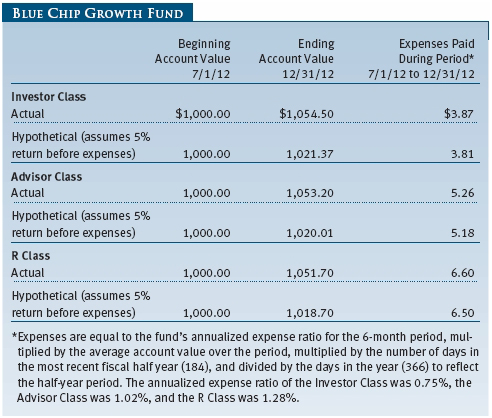

As a mutual fund shareholder, you may incur two types of costs: (1) transaction costs, such as redemption fees or sales loads, and (2) ongoing costs, including management fees, distribution and service (12b-1) fees, and other fund expenses. The following example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the most recent six-month period and held for the entire period.

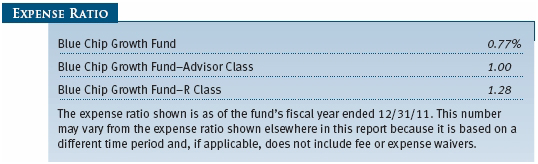

Please note that the fund has three share classes: The original share class (Investor Class) charges no distribution and service (12b-1) fee, Advisor Class shares are offered only through unaffiliated brokers and other financial intermediaries and charge a 0.25% 12b-1 fee, and R Class shares are available to retirement plans serviced by intermediaries and charge a 0.50% 12b-1 fee. Each share class is presented separately in the table.

Actual Expenses

The first line of the following table (Actual) provides information about actual account values and expenses based on the fund’s actual returns. You may use the information on this line, together with your account balance, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number on the first line under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information on the second line of the table (Hypothetical) is based on hypothetical account values and expenses derived from the fund’s actual expense ratio and an assumed 5% per year rate of return before expenses (not the fund’s actual return). You may compare the ongoing costs of investing in the fund with other funds by contrasting this 5% hypothetical example and the 5% hypothetical examples that appear in the shareholder reports of the other funds. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

Note: T. Rowe Price charges an annual account service fee of $20, generally for accounts with less than $10,000. The fee is waived for any investor whose T. Rowe Price mutual fund accounts total $50,000 or more; accounts electing to receive electronic delivery of account statements, transaction confirmations, prospectuses, and shareholder reports; or accounts of an investor who is a T. Rowe Price Preferred Services, Personal Services, or Enhanced Personal Services client (enrollment in these programs generally requires T. Rowe Price assets of at least $100,000). This fee is not included in the accompanying table. If you are subject to the fee, keep it in mind when you are estimating the ongoing expenses of investing in the fund and when comparing the expenses of this fund with other funds.

You should also be aware that the expenses shown in the table highlight only your ongoing costs and do not reflect any transaction costs, such as redemption fees or sales loads. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. To the extent a fund charges transaction costs, however, the total cost of owning that fund is higher.

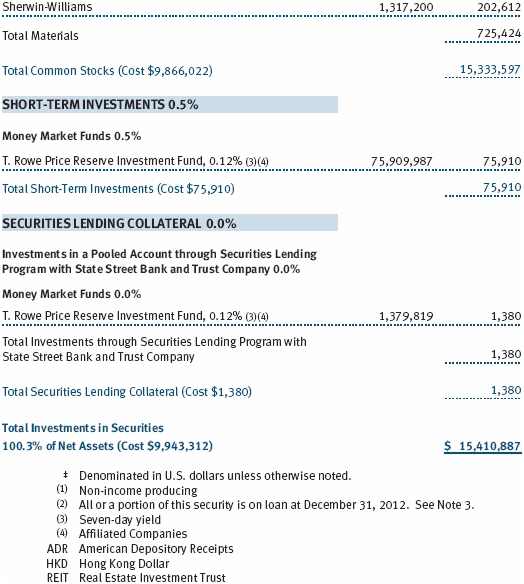

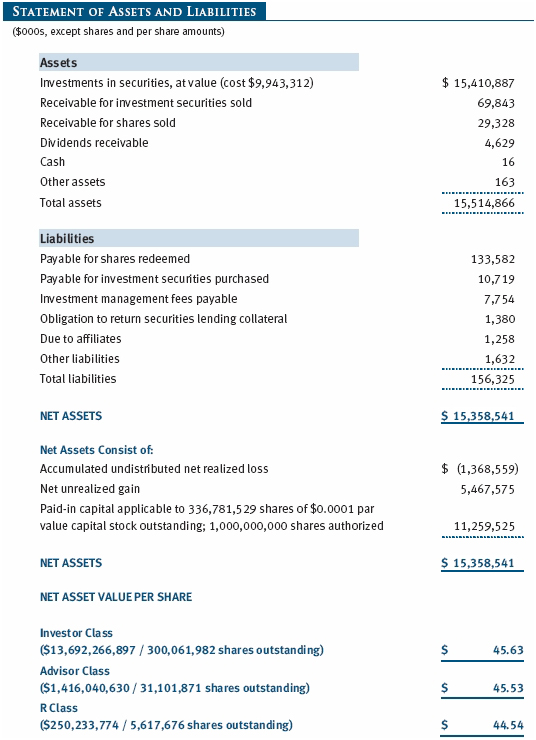

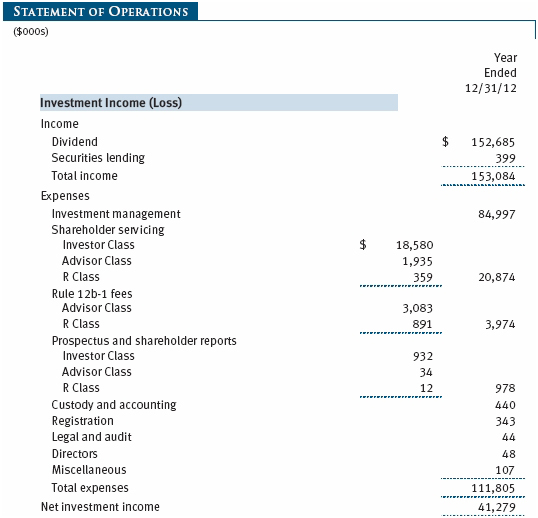

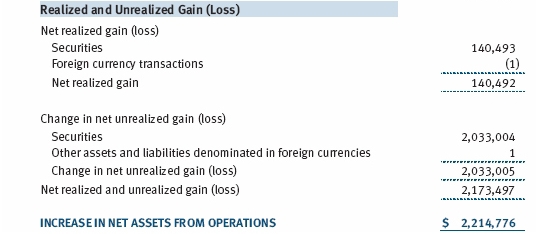

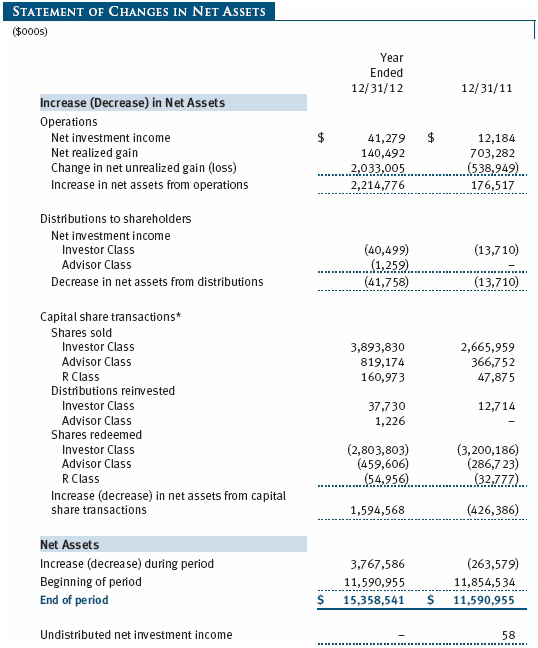

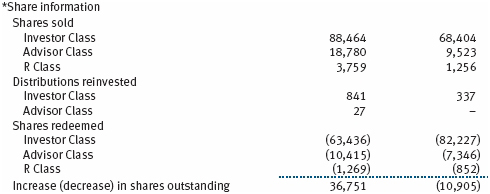

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

The accompanying notes are an integral part of these financial statements.

| Notes to Financial Statements |

T. Rowe Price Blue Chip Growth Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund seeks to provide long-term capital growth. Income is a secondary objective. The fund has three classes of shares: the Blue Chip Growth Fund original share class, referred to in this report as the Investor Class, offered since June 30, 1993; the Blue Chip Growth Fund–Advisor Class (Advisor Class), offered since March 31, 2000; and the Blue Chip Growth Fund–R Class (R Class), offered since September 30, 2002. Advisor Class shares are sold only through unaffiliated brokers and other unaffiliated financial intermediaries, and R Class shares are available to retirement plans serviced by intermediaries. The Advisor Class and R Class each operate under separate Board-approved Rule 12b-1 plans, pursuant to which each class compensates financial intermediaries for distribution, shareholder servicing, and/or certain administrative services. Each class has exclusive voting rights on matters related solely to that class; separate voting rights on matters that relate to all classes; and, in all other respects, the same rights and obligations as the other classes.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Preparation The accompanying financial statements were prepared in accordance with accounting principles generally accepted in the United States of America (GAAP), which require the use of estimates made by management. Management believes that estimates and valuations are appropriate; however, actual results may differ from those estimates, and the valuations reflected in the accompanying financial statements may differ from the value ultimately realized upon sale or maturity.

Investment Transactions, Investment Income, and Distributions Income and expenses are recorded on the accrual basis. Dividends received from mutual fund investments are reflected as dividend income; capital gain distributions are reflected as realized gain/loss. Dividend income and capital gain distributions are recorded on the ex-dividend date. Income tax-related interest and penalties, if incurred, would be recorded as income tax expense. Investment transactions are accounted for on the trade date. Realized gains and losses are reported on the identified cost basis. Distributions to shareholders are recorded on the ex-dividend date. Income distributions are declared and paid by each class annually. Capital gain distributions, if any, are generally declared and paid by the fund annually.

Currency Translation Assets, including investments, and liabilities denominated in foreign currencies are translated into U.S. dollar values each day at the prevailing exchange rate, using the mean of the bid and asked prices of such currencies against U.S. dollars as quoted by a major bank. Purchases and sales of securities, income, and expenses are translated into U.S. dollars at the prevailing exchange rate on the date of the transaction. The effect of changes in foreign currency exchange rates on realized and unrealized security gains and losses is reflected as a component of security gains and losses.

Class Accounting The Advisor Class and R Class each pay distribution, shareholder servicing, and/or certain administrative expenses in the form of Rule 12b-1 fees, in an amount not exceeding 0.25% and 0.50%, respectively, of the class’s average daily net assets. Shareholder servicing, prospectus, and shareholder report expenses incurred by each class are charged directly to the class to which they relate. Expenses common to all classes, investment income, and realized and unrealized gains and losses are allocated to the classes based upon the relative daily net assets of each class.

Rebates and Credits Subject to best execution, the fund may direct certain security trades to brokers who have agreed to rebate a portion of the related brokerage commission to the fund in cash. Commission rebates are reflected as realized gain on securities in the accompanying financial statements and totaled $154,000 for the year ended December 31, 2012. Additionally, the fund earns credits on temporarily uninvested cash balances held at the custodian, which reduce the fund’s custody charges. Custody expense in the accompanying financial statements is presented before reduction for credits.

In-Kind Redemptions In accordance with guidelines described in the fund’s prospectus, the fund may distribute portfolio securities rather than cash as payment for a redemption of fund shares (in-kind redemption). For financial reporting purposes, the fund recognizes a gain on in-kind redemptions to the extent the value of the distributed securities on the date of redemption exceeds the cost of those securities. Gains and losses realized on in-kind redemptions are not recognized for tax purposes and are reclassified from undistributed realized gain (loss) to paid-in capital. During the year ended December 31, 2012, the fund realized $78,373,000 of net gain on $144,163,000 of in-kind redemptions.

New Accounting Pronouncements In December 2011, the FASB issued amended guidance to enhance disclosure for offsetting assets and liabilities. The guidance is effective for fiscal years and interim periods beginning on or after January 1, 2013. Adoption will have no effect on the fund’s net assets or results of operations.

NOTE 2 - VALUATION

The fund’s financial instruments are reported at fair value as defined by GAAP. The fund determines the values of its assets and liabilities and computes each class’s net asset value per share at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day that the NYSE is open for business.

Valuation Methods Equity securities listed or regularly traded on a securities exchange or in the over-the-counter (OTC) market are valued at the last quoted sale price or, for certain markets, the official closing price at the time the valuations are made, except for OTC Bulletin Board securities, which are valued at the mean of the latest bid and asked prices. A security that is listed or traded on more than one exchange is valued at the quotation on the exchange determined to be the primary market for such security. Listed securities not traded on a particular day are valued at the mean of the latest bid and asked prices for domestic securities and the last quoted sale price for international securities.

Investments in mutual funds are valued at the mutual fund’s closing net asset value per share on the day of valuation.

Other investments, including restricted securities and private placements, and those financial instruments for which the above valuation procedures are inappropriate or are deemed not to reflect fair value, are stated at fair value as determined in good faith by the T. Rowe Price Valuation Committee, established by the fund’s Board of Directors (the Board). Subject to oversight by the Board, the Valuation Committee develops pricing-related policies and procedures and approves all fair-value determinations. The Valuation Committee regularly makes good faith judgments, using a wide variety of sources and information, to establish and adjust valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of private-equity instruments, the Valuation Committee considers a variety of factors, including the company’s business prospects, its financial performance, strategic events impacting the company, relevant valuations of similar companies, new rounds of financing, and any negotiated transactions of significant size between other investors in the company. Because any fair-value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted under the circumstances described below. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. A fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with closing prices and information to evaluate and/or adjust those prices. The fund cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares closing prices, the next day’s opening prices in the same markets, and adjusted prices. Additionally, trading in the underlying securities of the fund may take place in various foreign markets on certain days when the fund is not open for business and does not calculate a net asset value. As a result, net asset values may be significantly affected on days when shareholders cannot make transactions.

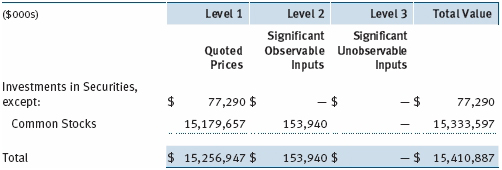

Valuation Inputs Various inputs are used to determine the value of the fund’s financial instruments. These inputs are summarized in the three broad levels listed below:

Level 1 – quoted prices in active markets for identical financial instruments

Level 2 – observable inputs other than Level 1 quoted prices (including, but not limited to, quoted prices for similar financial instruments, interest rates, prepayment speeds, and credit risk)

Level 3 – unobservable inputs

Observable inputs are those based on market data obtained from sources independent of the fund, and unobservable inputs reflect the fund’s own assumptions based on the best information available. The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level. For example, non-U.S. equity securities actively traded in foreign markets generally are reflected in Level 2 despite the availability of closing prices because the fund evaluates and determines whether those closing prices reflect fair value at the close of the NYSE or require adjustment, as described above. The following table summarizes the fund’s financial instruments, based on the inputs used to determine their values on December 31, 2012:

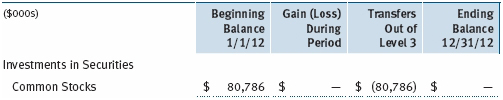

Following is a reconciliation of the fund’s Level 3 holdings for the year ended December 31, 2012. Transfers into and out of Level 3 are reflected at the value of the financial instrument at the beginning of the period. Gain (loss) reflects both realized and change in unrealized gain (loss) on Level 3 holdings during the period, if any, and is included on the accompanying Statement of Operations. The change in unrealized gain (loss) on Level 3 instruments held at December 31, 2012, totaled $0 for the year ended December 31, 2012.

NOTE 3 - OTHER INVESTMENT TRANSACTIONS

Consistent with its investment objective, the fund engages in the following practices to manage exposure to certain risks and/or to enhance performance. The investment objective, policies, program, and risk factors of the fund are described more fully in the fund’s prospectus and Statement of Additional Information.

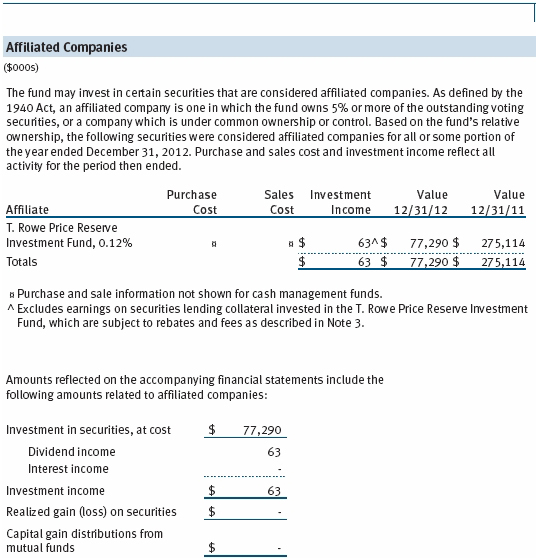

Securities Lending The fund lends its securities to approved brokers to earn additional income. It receives as collateral cash and U.S. government securities valued at 102% to 105% of the value of the securities on loan. Collateral is maintained over the life of the loan in an amount not less than the value of loaned securities as determined at the close of fund business each day; any additional collateral required due to changes in security values is delivered to the fund the next business day. Cash collateral is invested by the fund’s lending agent(s) in accordance with investment guidelines approved by management. Although risk is mitigated by the collateral, the fund could experience a delay in recovering its securities and a possible loss of income or value if the borrower fails to return the securities or if collateral investments decline in value. Securities lending revenue recognized by the fund consists of earnings on invested collateral and borrowing fees, net of any rebates to the borrower and compensation to the lending agent. In accordance with GAAP, investments made with cash collateral are reflected in the accompanying financial statements, but collateral received in the form of securities is not. At December 31, 2012, the value of loaned securities was $1,386,000; the value of cash collateral investments was $1,380,000.

Other Purchases and sales of portfolio securities other than short-term securities aggregated $5,048,122,000 and $3,464,613,000, respectively, for the year ended December 31, 2012.

NOTE 4 - FEDERAL INCOME TAXES

No provision for federal income taxes is required since the fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code and distribute to shareholders all of its taxable income and gains. Distributions determined in accordance with federal income tax regulations may differ in amount or character from net investment income and realized gains for financial reporting purposes. Financial reporting records are adjusted for permanent book/tax differences to reflect tax character but are not adjusted for temporary differences.

The fund files U.S. federal, state, and local tax returns as required. The fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

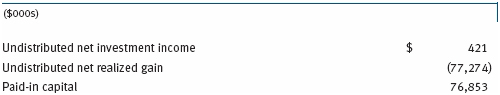

Reclassifications to paid-in capital relate primarily to redemptions in kind. Reclassifications between income and gain relate primarily to per-share rounding of distributions. For the year ended December 31, 2012, the following reclassifications were recorded to reflect tax character (there was no impact on results of operations or net assets):

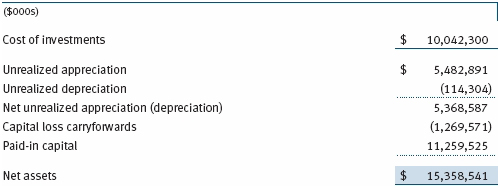

Distributions during the years ended December 31, 2012 and December 31, 2011, totaled $41,758,000 and $13,710,000, respectively, and were characterized as ordinary income for tax purposes. At December 31, 2012, the tax-basis cost of investments and components of net assets were as follows:

The difference between book-basis and tax-basis net unrealized appreciation (depreciation) is attributable to the deferral of losses from wash sales for tax purposes. The fund intends to retain realized gains to the extent of available capital loss carryforwards. As a result of the Regulated Investment Company Modernization Act of 2010, net capital losses realized on or after January 1, 2011 (effective date) may be carried forward indefinitely to offset future realized capital gains; however, post-effective losses must be used before pre-effective capital loss carryforwards with expiration dates. Accordingly, it is possible that all or a portion of the fund’s pre-effective capital loss carryforwards could expire unused. Additionally, all or a portion of the fund’s capital loss carryforwards may be from losses realized between November 1 and the fund’s fiscal year-end, which are deferred for tax purposes until the subsequent year but recognized for financial reporting purposes in the year realized. During the year ended December 31, 2012, the fund utilized $87,257,000 of capital loss carryforwards. The fund’s available capital loss carryforwards as of December 31, 2012, expire as follows: $1,241,700,000 in fiscal 2017; $27,871,000 have no expiration.

NOTE 5 - RELATED PARTY TRANSACTIONS

The fund is managed by T. Rowe Price Associates, Inc. (Price Associates), a wholly owned subsidiary of T. Rowe Price Group, Inc. (Price Group). The investment management agreement between the fund and Price Associates provides for an annual investment management fee, which is computed daily and paid monthly. The fee consists of an individual fund fee and a group fee. The individual fund fee is equal to 0.30% of the fund’s average daily net assets up to $15 billion and 0.255% of the fund’s average daily net assets in excess of $15 billion. The group fee rate is calculated based on the combined net assets of certain mutual funds sponsored by Price Associates (the group) applied to a graduated fee schedule, with rates ranging from 0.48% for the first $1 billion of assets to 0.28% for assets in excess of $300 billion. The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. At December 31, 2012, the effective annual group fee rate was 0.30%.

In addition, the fund has entered into service agreements with Price Associates and two wholly owned subsidiaries of Price Associates (collectively, Price). Price Associates computes the daily share prices and provides certain other administrative services to the fund. T. Rowe Price Services, Inc., provides shareholder and administrative services in its capacity as the fund’s transfer and dividend disbursing agent. T. Rowe Price Retirement Plan Services, Inc., provides sub-accounting and recordkeeping services for certain retirement accounts invested in the Investor Class and R Class. For the year ended December 31, 2012, expenses incurred pursuant to these service agreements were $140,000 for Price Associates; $2,810,000 for T. Rowe Price Services, Inc.; and $4,355,000 for T. Rowe Price Retirement Plan Services, Inc. The total amount payable at period-end pursuant to these service agreements is reflected as Due to Affiliates in the accompanying financial statements.

Additionally, the fund is one of several mutual funds in which certain college savings plans managed by Price Associates may invest. As approved by the fund’s Board of Directors, shareholder servicing costs associated with each college savings plan are borne by the fund in proportion to the average daily value of its shares owned by the college savings plan. For the year ended December 31, 2012, the fund was charged $1,093,000 for shareholder servicing costs related to the college savings plans, of which $828,000 was for services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2012, approximately 4% of the outstanding shares of the Investor Class were held by college savings plans.

The fund is also one of several mutual funds sponsored by Price Associates (underlying Price funds) in which the T. Rowe Price Spectrum Funds (Spectrum Funds) may invest. The Spectrum Funds do not invest in the underlying Price funds for the purpose of exercising management or control. Pursuant to a special servicing agreement, expenses associated with the operation of the Spectrum Funds are borne by each underlying Price fund to the extent of estimated savings to it and in proportion to the average daily value of its shares owned by the Spectrum Funds. Expenses allocated under this agreement are reflected as shareholder servicing expense in the accompanying financial statements. For the year ended December 31, 2012, the fund was allocated $603,000 of Spectrum Funds’ expenses, of which $371,000 related to services provided by Price. The amount payable at period-end pursuant to this agreement is reflected as Due to Affiliates in the accompanying financial statements. At December 31, 2012, approximately 4% of the outstanding shares of the Investor Class were held by the Spectrum Funds.

The fund may invest in the T. Rowe Price Reserve Investment Fund and the T. Rowe Price Government Reserve Investment Fund (collectively, the T. Rowe Price Reserve Investment Funds), open-end management investment companies managed by Price Associates and considered affiliates of the fund. The T. Rowe Price Reserve Investment Funds are offered as cash management options to mutual funds, trusts, and other accounts managed by Price Associates and/ or its affiliates and are not available for direct purchase by members of the public. The T. Rowe Price Reserve Investment Funds pay no investment management fees.

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of

T. Rowe Price Blue Chip Growth Fund, Inc.

In our opinion, the accompanying statement of assets and liabilities, including the portfolio of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of T. Rowe Price Blue Chip Growth Fund, Inc. (the “Fund”) at December 31, 2012, and the results of its operations, the changes in its net assets and the financial highlights for each of the periods indicated therein, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at December 31, 2012 by correspondence with the custodian and brokers, and confirmation of the underlying funds by correspondence with the transfer agent, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Baltimore, Maryland

February 15, 2013

| Tax Information (Unaudited) for the Tax Year Ended 12/31/12 |

We are providing this information as required by the Internal Revenue Code. The amounts shown may differ from those elsewhere in this report because of differences between tax and financial reporting requirements.

The fund’s distributions to shareholders included $296,000 from short-term capital gains.

For taxable non-corporate shareholders, $41,278,000 of the fund’s income represents qualified dividend income subject to the 15% rate category.

For corporate shareholders, $41,278,000 of the fund’s income qualifies for the dividends-received deduction.

| Information on Proxy Voting Policies, Procedures, and Records |

A description of the policies and procedures used by T. Rowe Price funds and portfolios to determine how to vote proxies relating to portfolio securities is available in each fund’s Statement of Additional Information, which you may request by calling 1-800-225-5132 or by accessing the SEC’s website, sec.gov. The description of our proxy voting policies and procedures is also available on our website, troweprice.com. To access it, click on the words “Our Company” at the top of our corporate homepage. Then, when the next page appears, click on the words “Proxy Voting Policies” on the left side of the page.

Each fund’s most recent annual proxy voting record is available on our website and through the SEC’s website. To access it through our website, follow the directions above, then click on the words “Proxy Voting Records” on the right side of the Proxy Voting Policies page.

| How to Obtain Quarterly Portfolio Holdings |

The fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available electronically on the SEC’s website (sec.gov); hard copies may be reviewed and copied at the SEC’s Public Reference Room, 100 F St. N.E., Washington, DC 20549. For more information on the Public Reference Room, call 1-800-SEC-0330.

| About the Fund’s Directors and Officers |

Your fund is overseen by a Board of Directors (Board) that meets regularly to review a wide variety of matters affecting the fund, including performance, investment programs, compliance matters, advisory fees and expenses, service providers, and other business affairs. The Board elects the fund’s officers, who are listed in the final table. At least 75% of the Board’s members are independent of T. Rowe Price Associates, Inc. (T. Rowe Price), and its affiliates; “inside” or “interested” directors are employees or officers of T. Rowe Price. The business address of each director and officer is 100 East Pratt Street, Baltimore, Maryland 21202. The Statement of Additional Information includes additional information about the fund directors and is available without charge by calling a T. Rowe Price representative at 1-800-638-5660.

Independent Directors

| Name | ||

| (Year of Birth) | ||

| Year Elected* | ||

| [Number of T. Rowe Price | Principal Occupation(s) and Directorships of Public Companies and | |

| Portfolios Overseen] | Other Investment Companies During the Past Five Years | |

| William R. Brody, M.D., | President and Trustee, Salk Institute for Biological Studies (2009 | |

| Ph.D. | to present); Director, Novartis, Inc. (2009 to present); Director, IBM | |

| (1944) | (2007 to present); President and Trustee, Johns Hopkins University | |

| 2009 | (1996 to 2009); Chairman of Executive Committee and Trustee, | |

| [142] | Johns Hopkins Health System (1996 to 2009) | |

| Anthony W. Deering | Chairman, Exeter Capital, LLC, a private investment firm (2004 | |

| (1945) | to present); Director, Under Armour (2008 to present); Director, | |

| 2001 | Vornado Real Estate Investment Trust (2004 to present); Director | |

| [142] | and Member of the Advisory Board, Deutsche Bank North America | |

| (2004 to present); Director, Mercantile Bankshares (2002 to 2007) | ||

| Donald W. Dick, Jr. | Principal, EuroCapital Partners, LLC, an acquisition and management | |

| (1943) | advisory firm (1995 to present) | |

| 1993 | ||

| [142] | ||

| Robert J. Gerrard, Jr. | Chairman of Compensation Committee and Director, Syniverse | |

| (1952) | Holdings, Inc. (2008 to 2011); Executive Vice President and General | |

| 2012 | Counsel, Scripps Networks, LLC (1997 to 2009); Advisory Board | |

| [90] | Member, Pipeline Crisis/Winning Strategies (1997 to present) | |

| Karen N. Horn | Senior Managing Director, Brock Capital Group, an advisory and | |

| (1943) | investment banking firm (2004 to present); Director, Eli Lilly and | |

| 2003 | Company (1987 to present); Director, Simon Property Group (2004 | |

| [142] | to present); Director, Norfolk Southern (2008 to present); Director, | |

| Fannie Mae (2006 to 2008) | ||

| Theo C. Rodgers | President, A&R Development Corporation (1977 to present) | |

| (1941) | ||

| 2005 | ||

| [142] | ||

| Cecilia E. Rouse, Ph.D. | Professor and Researcher, Princeton University (1992 to present); | |

| (1963) | Director, MDRC (2011 to present); Member, National Academy of | |

| 2012 | Education (2010 to present); Research Associate, National Bureau | |

| [90] | of Economic Research’s Labor Studies Program (1998 to 2009 | |

| and 2011 to present); Member, President’s Council of Economic | ||

| Advisors (2009 to 2011); Member, The MacArthur Foundation | ||

| Network on the Transition to Adulthood and Public Policy (2000 to | ||

| 2008); Member, National Advisory Committee for the Robert Wood | ||

| Johnson Foundation’s Scholars in Health Policy Research Program | ||

| (2008); Director and Member, National Economic Association | ||

| (2006 to 2008); Member, Association of Public Policy Analysis and | ||

| Management Policy Council (2006 to 2008); Member, Hamilton | ||

| Project’s Advisory Board at The Brookings Institute (2006 to 2008); | ||

| Chair of Committee on the Status of Minority Groups in the Economic | ||

| Profession, American Economic Association (2006 to 2008) | ||

| John G. Schreiber | Owner/President, Centaur Capital Partners, Inc., a real estate | |

| (1946) | investment company (1991 to present); Cofounder and Partner, | |

| 2001 | Blackstone Real Estate Advisors, L.P. (1992 to present); Director, | |

| [142] | General Growth Properties, Inc. (2010 to present) | |

| Mark R. Tercek | President and Chief Executive Officer, The Nature Conservancy (2008 | |

| (1957) | to present); Managing Director, The Goldman Sachs Group, Inc. | |

| 2009 | (1984 to 2008) | |

| [142] |

*Each independent director serves until retirement, resignation, or election of a successor.

Inside Directors

| Name | ||

| (Year of Birth) | ||

| Year Elected* | ||

| [Number of T. Rowe Price | Principal Occupation(s) and Directorships of Public Companies and | |

| Portfolios Overseen] | Other Investment Companies During the Past Five Years | |

| Edward C. Bernard | Director and Vice President, T. Rowe Price; Vice Chairman of the | |

| (1956) | Board, Director, and Vice President, T. Rowe Price Group, Inc.; | |

| 2006 | Chairman of the Board, Director, and President, T. Rowe Price | |

| [142] | Investment Services, Inc.; Chairman of the Board and Director, | |

| T. Rowe Price Retirement Plan Services, Inc., T. Rowe Price Savings | ||

| Bank, and T. Rowe Price Services, Inc.; Chairman of the Board, Chief | ||

| Executive Officer, and Director, T. Rowe Price International; Chief | ||

| Executive Officer, Chairman of the Board, Director, and President, | ||

| T. Rowe Price Trust Company; Chairman of the Board, all funds | ||

| Brian C. Rogers, CFA, CIC | Chief Investment Officer, Director, and Vice President, T. Rowe Price; | |

| (1955) | Chairman of the Board, Chief Investment Officer, Director, and Vice | |

| 2006 | President, T. Rowe Price Group, Inc.; Vice President, T. Rowe Price | |

| [75] | Trust Company |

*Each inside director serves until retirement, resignation, or election of a successor.

Officers

| Name (Year of Birth) | ||

| Position Held With Blue Chip Growth Fund | Principal Occupation(s) | |

| P. Robert Bartolo, CFA, CPA (1972) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price Trust Company | |

| Peter J. Bates, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Ryan N. Burgess CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| G. Mark Bussard (1972) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Jonathan Chou (1980) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc.; formerly student, Darden Graduate | |

| School of Business Administration, University | ||

| of Virginia (to 2008) | ||

| Shawn T. Driscoll (1975) | Vice President, T. Rowe Price Group, Inc. | |

| Vice President | ||

| David J. Eiswert, CFA (1972) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price International | |

| Roger L. Fiery III, CPA (1959) | Vice President, Price Hong Kong, Price | |

| Vice President | Singapore, T. Rowe Price, T. Rowe Price Group, | |

| Inc., T. Rowe Price International, and T. Rowe | ||

| Price Trust Company | ||

| John R. Gilner (1961) | Chief Compliance Officer and Vice President, | |

| Chief Compliance Officer | T. Rowe Price; Vice President, T. Rowe Price | |

| Group, Inc., and T. Rowe Price Investment | ||

| Services, Inc. | ||

| Gregory S. Golczewski (1966) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Trust Company | |

| Paul D. Greene II (1978) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Gregory K. Hinkle, CPA (1958) | Vice President, T. Rowe Price, T. Rowe Price | |

| Treasurer | Group, Inc., and T. Rowe Price Trust Company | |

| Thomas J. Huber, CFA (1966) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price Trust Company | |

| Michael M. Lasota (1982) | Vice President, T. Rowe Price and T. Rowe | |

| Vice President | Price Group, Inc.; formerly student, University | |

| of Chicago, Graduate School of Business | ||

| (to 2008) | ||

| Patricia B. Lippert (1953) | Assistant Vice President, T. Rowe Price and | |

| Secretary | T. Rowe Price Investment Services, Inc. | |

| George A. Marzano (1980) | Vice President, T. Rowe Price | |

| Vice President | ||

| David Oestreicher (1967) | Director, Vice President, and Secretary, T. Rowe | |

| Vice President | Price Investment Services, Inc., T. Rowe | |

| Price Retirement Plan Services, Inc., T. Rowe | ||

| Price Services, Inc., and T. Rowe Price Trust | ||

| Company; Vice President and Secretary, | ||

| T. Rowe Price, T. Rowe Price Group, Inc., and | ||

| T. Rowe Price International; Vice President, | ||

| Price Hong Kong and Price Singapore | ||

| Timothy E. Parker, CFA (1974) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Larry J. Puglia, CFA, CPA (1960) | Vice President, T. Rowe Price, T. Rowe Price | |

| President | Group, Inc., and T. Rowe Price Trust Company | |

| Deborah D. Seidel (1962) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., T. Rowe Price Investment Services, | |

| Inc., and T. Rowe Price Services, Inc. | ||

| Robert W. Sharps, CFA, CPA (1971) | Vice President, T. Rowe Price, T. Rowe Price | |

| Vice President | Group, Inc., and T. Rowe Price Trust Company | |

| Taymour R. Tamaddon, CFA (1976) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. | |

| Julie L. Waples (1970) | Vice President, T. Rowe Price | |

| Vice President | ||

| Ashley R. Woodruff, CFA (1979) | Vice President, T. Rowe Price and T. Rowe Price | |

| Vice President | Group, Inc. |

Unless otherwise noted, officers have been employees of T. Rowe Price or T. Rowe Price International for at least 5 years.

Item 2. Code of Ethics.

The registrant has adopted a code of ethics, as defined in Item 2 of Form N-CSR, applicable to its principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of this code of ethics is filed as an exhibit to this Form N-CSR. No substantive amendments were approved or waivers were granted to this code of ethics during the period covered by this report.

Item 3. Audit Committee Financial Expert.

The registrant’s Board of Directors/Trustees has determined that Mr. Anthony W. Deering qualifies as an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Deering is considered independent for purposes of Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

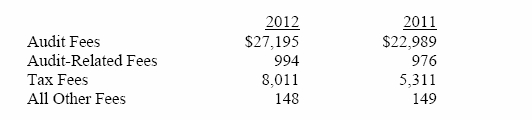

(a) – (d) Aggregate fees billed for the last two fiscal years for professional services rendered to, or on behalf of, the registrant by the registrant’s principal accountant were as follows:

Audit fees include amounts related to the audit of the registrant’s annual financial statements and services normally provided by the accountant in connection with statutory and regulatory filings. Audit-related fees include amounts reasonably related to the performance of the audit of the registrant’s financial statements and specifically include the issuance of a report on internal controls and, if applicable, agreed-upon procedures related to fund acquisitions. Tax fees include amounts related to services for tax compliance, tax planning, and tax advice. The nature of these services specifically includes the review of distribution calculations and the preparation of Federal, state, and excise tax returns. All other fees include the registrant’s pro-rata share of amounts for agreed-upon procedures in conjunction with service contract approvals by the registrant’s Board of Directors/Trustees.

(e)(1) The registrant’s audit committee has adopted a policy whereby audit and non-audit services performed by the registrant’s principal accountant for the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant require pre-approval in advance at regularly scheduled audit committee meetings. If such a service is required between regularly scheduled audit committee meetings, pre-approval may be authorized by one audit committee member with ratification at the next scheduled audit committee meeting. Waiver of pre-approval for audit or non-audit services requiring fees of a de minimis amount is not permitted.

(2) No services included in (b) – (d) above were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) Less than 50 percent of the hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) The aggregate fees billed for the most recent fiscal year and the preceding fiscal year by the registrant’s principal accountant for non-audit services rendered to the registrant, its investment adviser, and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant were $1,802,000 and $1,764,000, respectively.

(h) All non-audit services rendered in (g) above were pre-approved by the registrant’s audit committee. Accordingly, these services were considered by the registrant’s audit committee in maintaining the principal accountant’s independence.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable. The complete schedule of investments is included in Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-CSR was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s second fiscal quarter covered by this report that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) The registrant’s code of ethics pursuant to Item 2 of Form N-CSR is attached.

(2) Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

(3) Written solicitation to repurchase securities issued by closed-end companies: not applicable.

(b) A certification by the registrant's principal executive officer and principal financial officer, pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(b) under the Investment Company Act of 1940, is attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Blue Chip Growth Fund, Inc.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date February 15, 2013 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date February 15, 2013 | ||

| By | /s/ Gregory K. Hinkle | |

| Gregory K. Hinkle | ||

| Principal Financial Officer | ||

| Date February 15, 2013 | ||