Use these links to rapidly review the document

ALDILA, INC. Report on Form 10-K For the Fiscal Year Ended December 31, 2009 INDEX

FINANCIAL TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

| (Mark One) | | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2009 |

Or |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 0-21872

ALDILA, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 13-3645590

(I.R.S. Employer Identification Number) |

14145 Danielson Street, Suite B, Poway, CA, 92064

(Address of principal executive offices)

858-513-1801

Registrant's telephone number, including area code

Securities Registered Pursuant to Section 12(b) of the Act:

| | |

| Title of each class | | Names of each exchange on which registered |

|---|

| None | | None |

Securities registered pursuant to section 12(g) of the Act:

| | | | |

| | | (Title of Class) | | |

| | | Common Stock, par value $0.01 per share | | |

Indicate by check mark if the registrant is well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this form 10-K. o

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer o | | Accelerated filer o | | Non-accelerated filer o

(Do not check if a

smaller reporting company) | | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

Aggregate market value of voting stock held by non-affiliates as of June 30, 2009 was—$14.1 million.

Common shares outstanding as of March 26, 2010 was—5,202,156

Table of Contents

ALDILA, INC.

Report on Form 10-K

For the Fiscal Year Ended December 31, 2009

INDEX

| | | | | | |

Part I | | |

| | Item 1. | | Business | | 3 |

| | Item 1A. | | Risk Factors | | 10 |

| | Item 2. | | Properties | | 13 |

| | Item 3. | | Legal Proceedings | | 13 |

| | Item 4. | | (Removed and Reserved) | | 13 |

Part II | | |

| | Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 14 |

| | Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 16 |

| | Item 8. | | Financial Statements and Supplementary Data | | 26 |

| | Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 26 |

| | Item 9A. | | Controls and Procedures | | 26 |

| | Item 9B. | | Other Information | | 27 |

Part III | | |

| | Item 10. | | Directors and Executive Officers and Corporate Governance | | 28 |

| | Item 11. | | Executive Compensation | | 32 |

| | Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 41 |

| | Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 43 |

| | Item 14. | | Principal and Accounting Fees and Services | | 44 |

Part IV | | |

| | Item 15. | | Exhibits, Financial Statement Schedules | | 45 |

Signatures | | 69 |

Exhibit Index | | 70 |

2

Table of Contents

PART I

This Form 10-K contains forward-looking statements within the meaning of the federal securities laws. These forward-looking statements are necessarily based on certain assumptions and are subject to significant risks and uncertainties. These forward-looking statements are based on management's expectations as of the date hereof, and the Company does not undertake any responsibility to update any of these statements in the future. Actual future performance and results could differ from that contained in or suggested by these forward-looking statements as a result of factors set forth in this Form 10-K (including those sections hereof incorporated by reference from other filings with the Securities and Exchange Commission), in particular as set forth in "Business Risks" under Item 1 and set forth in the "Management's Discussion and Analysis of Financial Condition and Results of Operations" under Item 7.

Item 1. Business

General

Aldila, Inc. ("Aldila" or the "Company") is a leading designer and manufacturer of high-quality innovative graphite (carbon fiber-based composite) golf shafts in the United States today. Aldila conducts its operations through its subsidiaries, Aldila Golf Corp. ("Aldila Golf") and Aldila Materials Technology Corp ("AMTC"). Aldila enjoys strong relationships with most major domestic and many foreign golf club manufacturers including Callaway Golf, TaylorMade-adidas Golf, Ping and Acushnet Company. Aldila believes that it is one of the few independent shaft manufacturers with the technical and production expertise required to produce high-quality graphite shafts in quantities sufficient to meet demand. The Company's current golf shaft product lines consist of Aldila branded and co-branded products designed for its major customers and custom club makers, as well as custom shafts developed in conjunction with its major customers. These product lines are designed to improve the performance of any level of golfer from novice to tour professional.

In 1994, the Company started production of its principal raw material for golf shafts, graphite prepreg, which consists of carbon fibers combined with epoxy resin in sheet form. See "Manufacturing—Composite Materials." The Company now produces substantially all of its graphite prepreg requirements internally and also sells prepreg externally to third parties.

In 1998, the Company established a manufacturing facility in Evanston, Wyoming for the production of carbon fiber, in an effort to further vertically integrate its manufacturing operations. On October 29, 1999, SGL Carbon Fibers and Composites, Inc. ("SGL") purchased a 50% interest in the Company's carbon fiber manufacturing operation. The Company and SGL entered into an agreement to operate the facility through a limited liability company with equal ownership interests between the joint venture members. The Company and SGL also entered into supply agreements with the new entity, Carbon Fiber Technology LLC ("CFT"), for the purchase of carbon fiber at cost plus an agreed-upon mark-up. Profits and losses of CFT were shared equally by the partners. The Company sold its remaining 50% interest in CFT to SGL on November 30, 2007. The Company secured a five year supply agreement with CFT. The agreement allows, but does not require, the Company to purchase up to 900,000 pounds of carbon fiber during the first year and up to approximately 996,000 pounds of carbon fiber in years two through five.

Graphite Golf Shafts

The Company was founded in San Diego, California in 1972 and was an early leader in the design and production of graphite golf shafts. The Company believes it is well positioned to remain a leader in the market for graphite shafts due to its innovative and high-quality products, strong customer relationships, design and composite expertise and significant manufacturing capabilities.

3

Table of Contents

Most golf clubs being sold today have shafts constructed from steel or graphite, although limited numbers are also manufactured from other materials. Graphite shafts were introduced in the early 1970's as the first major improvement in golf shaft technology since steel replaced wood in the 1930's. The first graphite shafts had significant torque (twisting force) and appealed primarily to weaker-swinging players desiring greater distance. Graphite shaft technology has subsequently improved so that shafts can now be designed for golfers at all skill levels.

Unlike steel shafts, the design of graphite shafts is easier to alter with respect to weight, flex, flex location, balance point and torque to produce greater distance, increased accuracy and reduced club vibration resulting in improved "feel" to the golfer. The improvements in the design and manufacture of graphite shafts and the growing recognition of their superior performance characteristics for many golfers compared to steel have resulted in increased demand for graphite shafts by golfers of all skill levels. The initial acceptance of graphite shafts was primarily for use in woods. According to the 2009 U.S. National Consumer Survey ("2009 Survey"), conducted by The Darrell Survey Company, graphite continues to dominate the professional and consumer wood club market. The 2009 Survey found that over 99% of new drivers purchased contained graphite shafts. In hybrid clubs, (also known as utility clubs and driving irons), 98% of the new clubs purchased had graphite shafts, up from 87% the previous year. The acceptance of graphite shafts in irons has not achieved the same success as in metal woods and hybrids. The 2009 Survey found that irons with graphite shafts accounted for 23% of new club purchases.

Products

Golf Shafts—

Aldila offers a broad range of innovative and high-quality graphite golf shafts designed to maximize the performance of golfers of every skill level. The Company manufactures hundreds of unique graphite shafts featuring various combinations of performance characteristics such as weight, flex, flex point, balance point and torque. All of the Company's shafts are composite structures consisting principally of carbon fiber and epoxy resins. The Company's shafts may also include boron (added to increase shaft strength) or fiberglass. The Company regularly evaluates new composite materials for inclusion in the Company's golf shafts and new refinements on designs using current materials.

The Company's shafts, which constituted approximately 85% of net sales in the year ended December 31, 2009, are designed in partnership with its customers (principally golf club manufacturers) to accommodate specific golf club designs. In addition, the Company researches new and innovative shaft designs on an independent basis, which has enabled the Company to produce a variety of new branded shafts and co-branded shafts as well as generate design ideas for customized shafts. The Company's branded and co-branded models are typically sold to golf club manufacturers, distributors and golf pro and repair shops and are used either to assemble a new custom club from selected components or as an after-market re-shaft of existing clubs. The Company also helps develop cosmetic designs to give the customer's golf clubs a distinctive look, even when the customer does not require a shaft with customized performance characteristics. The prices of Aldila shafts typically range from $5 to $300.

The Company introduced the NV Prototype at the January 2003 PGA Merchandise Show and subsequently renamed it to the NV®. The NV® went on to become the most successful new product launch in the Company's history and returned Aldila to the forefront of the composite shaft industry. The NV® features the Company's exclusive Micro Laminate Technology® ("MLT"). The Company followed up the NV® with the introduction of the NVS™, NV ProtoPype®, NV® Hybrid, NVS™ Hybrid and the Gamer® shafts in 2004. All of these product line extensions and new product lines target specific objectives, whether it is for a higher initial launch angle, more controlled launch angle or

4

Table of Contents

reduced torque to target various golf enthusiasts. Hybrid clubs are still currently an important segment of the golf industry for graphite shaft companies, as they are predominantly shafted with graphite shafts. They are designed to replace long irons, usually shafted with steel shafts, by providing a club that is easier to hit and much more forgiving for the average as well as very skilled players. The Company offers a full range of shafts to fit hybrid clubs, including the DVS® Hybrid, VS Proto™ Hybrid, NV® Hybrid, NVS™ Hybrid and Gamer®. In the spring of 2006, Aldila began shipments of VS Proto™ and the VS Proto™ Hybrid. Both are high-end, high performance shafts featuring carbon nanotubes as well as aerospace carbon fibers and Aldila's exclusive high performance resin system. In 2007, Aldila began shipping the Aldila DVS® wood and hybrid shaft. The DVS® features a new responsive tip design combined with very low torque to maximize kick at impact while still maintaining accuracy. The DVS® is also constructed with Aldila's Micro Laminate Technology® and features carbon nanotubes for optimal feel and performance. The Company introduced the VooDoo® shaft in June of 2008 featuring our S-core Technology™. We began offering it on Tour with the VooDoo® name and colors in February of 2008. What sets the VooDoo® apart from other shafts is its patent pending S-core, or stabilized core, technology designed to increase distance and provide outstanding accuracy with each swing. The shaft utilizes a high modulus carbon fiber stabilizing rib running the length of the shaft. This internal structure greatly stabilizes the shaft's cross-section. The internal rib system increases hoop strength and cross sectional stiffness by approximately 80% greater than conventional graphite shafts, and up to 60% greater than competitors' attempts at cross sectional stabilization. This increased stability allows the VooDoo® to better resist shaft ovaling and deformation during the swing, which maximizes energy transfer to the ball and because the shaft's symmetry is maintained throughout the swing, it loads and unloads more consistently, enabling you to more reliably deliver the club head to the ball with every swing. With this shaft more energy is stored in pure bending and released to the ball at impact, which leads to greater ball speed. The VooDoo® was quickly embraced on the PGA, Nationwide and European Tours. The Company believes that it will continue to be successful in the branded segment for the foreseeable future and has focused its engineering, marketing and advertising effort in support of this business.

Composite Materials—

Since 1994, the Company has manufactured prepreg material for its production of golf shafts. The Company manufactures almost all of the prepreg that it uses in its golf shaft operations. In 1998, the Company began selling prepreg manufactured in its Poway, California manufacturing facility to third parties. Net sales of prepreg represented approximately 14% of the Company's aggregate net sales in 2009. The Company expanded its prepreg operations beginning in 2005 and now has six, twenty four inch tape lines and one, fifty inch wide tape line. In addition, the Company has two resin filmers which provide film sets for its prepreg operations and accommodates sales of adhesive film to external third parties.

Other Products—

The Company also manufactures other tube products for various applications, all of which use manufacturing operations similar to graphite shafts. The Company does not expect these applications to have a material affect on its operations.

Product Design and Development

Aldila is committed to maintaining its reputation as a leader in innovative shaft design and composite materials technology. The Company believes that the enhancement and expansion of its existing product lines and the development of new products are necessary for the Company's growth and success. The Company's research and development efforts are done in-house. The Company spent

5

Table of Contents

approximately $2.7 million and $2.9 million for the years ended December 31, 2009 and 2008, respectively. Such costs were included in cost of sales.

Graphite Shafts

Graphite shaft designs and modifications are frequently the direct result of the combined efforts and expertise of the Company and its customers to develop an exclusive shaft for each customer's clubs. New golf shaft designs are developed and tested using a CAD/CAE golf shaft analysis program, which evaluates a new shaft design with respect to weight, torque, flex point, tip and butt flexibility, swing weight and other critical shaft design criteria. In addition, the Company researches new and innovative shaft designs on an independent basis, which has enabled the Company to produce a variety of new branded shafts as well as to generate design ideas for customized shafts. To improve and advance product designs as they relate to composite technology and the shaft manufacturing process, the Company's engineers utilize existing materials, such as boron, kevlar, fiberglass, ceramic, thermoplastic and carbon fiber. The Company's engineers also look to newer, more advanced materials such as carbon nanotubes. Nanotechnology is a fast growing field of research that has good potential for structures such as composite golf shafts. The Company believes it is one of the first major shaft companies to employ carbon nanotubes in shaft design, and is at the forefront of utilizing this emerging technology in golf shaft development. The Company's design research also focuses on improvements in graphite shaft aesthetics since cosmetic appearance has become increasingly important to customers. The Company's research and development efforts have resulted in the Aldila "One," Aldila NV®, NVS™, NV ProtoPype®, NV® Hybrid, NVS™ Hybrid, Gamer®, VS Proto™, VS Proto™ Hybrid, DVS® and VooDoo® shafts. All of the NV® family of shafts features the Company's exclusive MLT. Although the Company emphasizes these research and development activities, there can be no assurance that Aldila will continue to develop competitive products or otherwise respond successfully to emerging market trends.

The Company has applied its composite materials expertise on a limited basis to other products in recent years, graphite tubing and other molded parts on a special order basis.

Composite Materials

Composite material products are developed and manufactured to support the Company's golf shaft manufacturing requirements and outside sales demand. The Company is focused on developing and providing world class quality composite materials for a variety of applications other than golf. These products are developed based upon a variety of requests and include variations in thickness, fiber types, combinations of fibers and fabrics, processing cure cycles and alternative resin matrices. The Company provides a wide range of unidirectional prepregs, prepreg fabrics, and film adhesives with high performance resins that can be cured from 180°F to 400°F available in widths from 4 to 50 inches wide. The Company utilizes a flexible manufacturing model that enables it to provide short lead times and accommodate customer change order requests. The Company's focus on continuous process improvement and technological research enables the Company to be competitive in the world market as a materials supplier.

Customers and Customer Relations

The Company believes that its close customer relationships and responsive service have been significant elements of its success to date, establishing itself as a premier graphite shaft company and expanding composite materials company. The Company has two distinct customer service departments, one for graphite shaft customers and one for composite material customers. Each department is specialized in order to accommodate their specific customer base. The Company's graphite shaft customers often work together with the Company's graphite shaft engineers when developing a new golf club in order to design a club that maximizes the performance features of the principal component

6

Table of Contents

parts: the grip, the clubhead and the Aldila shaft. The Company's partnership relationship with all its customers' continues after the products have been developed. Following the design process, the Company continues to provide high levels of customer support and service in areas such as quality control and assurance, timely and responsive manufacturing, delivery schedules and education. The Company believes the physical proximity of it's headquarter facilities to many of its graphite shaft customers has facilitated a high degree of customer interaction and responsiveness to their specific customer needs. While the Company has had long-established relationships with most of its graphite shaft customers, it is not the exclusive supplier of graphite shafts to most of them and generally does not have long-term supply agreements with its customers.

For fiscal year 2009, the Company had 621 golf shaft customers and 115 composite materials customers. The golf shaft customers included 104 golf club manufacturers and 199 distributors, with the balance principally consisting of custom club assemblers, pro shops and repair shops. However, the majority of the Company's sales have been and may continue to be concentrated among a relatively small number of customers. Sales to the Company's top five customers represented approximately 56% and 59% of net sales in 2009 and 2008, respectively.

Historically, Aldila's principal customers have varied as a result of general market trends in the golf industry, in particular, the prevailing popularity of the various clubs that contain Aldila's shafts. As a result, there typically are changes in the composition of the list of the Company's ten most significant customers from year to year. Due to the substantial marketplace success of their clubs in recent periods, for the last several years the Company's largest customers have been Acushnet Company, Callaway Golf, and Ping. While the Company believes its relationship with each of these major customers is good, the Company is not the exclusive supplier to any of them. The Company's sales to its principal customers have varied substantially from year to year.

| | | | | | | |

Customer | | 2009 | | 2008 | |

|---|

Ping | | | 20 | % | | 21 | % |

Acushnet Company | | | 10 | % | | 16 | % |

Callaway Golf | | | 11 | % | | 15 | % |

Because of the historic volatility of consumer demand for specific clubs, as well as continued competition from alternative shaft suppliers, sales to a given customer in a prior period may not necessarily be indicative of future sales and it is often difficult to project the Company's sales to a given customer in advance.

Marketing, Advertising and Promotion

The Company's marketing efforts are geared towards its graphite shaft business. Its strategy is designed to encourage golf club manufacturers to select and promote Aldila shafts and to increase overall market acceptance and use of graphite golf shafts. The Company utilizes a variety of marketing and promotional channels to increase sales of Aldila brand name shafts through its network of distributors and to support Aldila's brand name recognition and reputation among consumers for offering consistently high quality products designed for a wide range of golfers. Although the Company has very limited sales directly to the end users of its products, the Company believes that its brand name recognition contributes to the marketability of its customers' products. In addition, Nick Price serves on the Company's advisory staff and assist in its marketing efforts. Aldila's marketing and promotion expenditures were approximately $1.9 million and $4.0 million in 2009 and 2008, respectively. The Company does not currently incur significant marketing expenses for its products other than golf shafts.

7

Table of Contents

Sales and Distribution

Within the golf club industry, most companies do not manufacture the three principal components of the golf club—the grip, the shaft and the clubhead—but rather source these components from independent suppliers that design and manufacture components to the club manufacturers' specifications. As a result, Aldila sells its graphite shafts primarily to golf club manufacturers and to a lesser extent, distributors, custom club shops, pro shops and repair shops. Distributors typically resell the Company's products to custom club assemblers, pro and custom club shops, and individuals. The Company uses its internal sales force in the marketing and sale of its shafts to golf club manufacturers and distributors. Sales to golf club manufacturers and assemblers accounted for approximately 80% of net sales for the year ended December 31, 2009 as compared to 80% for the previous year.

Composite materials sales, which represented 14% of the Company's 2009 net sales, are made primarily to manufacturers of composite products. The Company predominantly has utilized its internal sales force in the marketing and sale of these products to its customers in the past and will continue to utilize its internal sales force for the sales of prepreg in the future.

International sales represented 46% and 39% of net sales for the years ended December 31, 2009 and 2008, respectively. The Company's international sales have increased from 18% in 2004 to 46% in 2009. A significant portion of the increase is attributed to increased sales to customers in China. The majority of these customers are assemblers in China, with the end product usually being shipped back to the United States or Europe. See Note 12 in the Notes to Consolidated Financial Statements for further breakdown of our international sales and long-lived assets.

Manufacturing

The Company believes that its manufacturing expertise and production capacity differentiate it from many of its competitors and enable Aldila to respond quickly to its customers' orders and provide sufficient quantities on a timely basis. The Company today operates two golf shaft manufacturing facilities and one prepreg manufacturing facility. During its 37 years of operation, the Company has improved its manufacturing processes and believes it has established a reputation as the industry's leading volume manufacturer of high performance graphite shafts.

Shaft Manufacturing Process.

The process of manufacturing a graphite shaft has several distinct phases. Different designs of Aldila shafts require variations in both the manufacturing process and the materials used. In traditional shaft designs, treated graphite known as "prepreg" (See Composite Materials Manufacturing Process) is rolled onto metal rods known as mandrels. The graphite is then baked at high temperatures to harden the material into a golf shaft. At the end of the manufacturing process, the shafts are painted and stylized using a variety of colors, patterns and designs, including logos and other custom identification. Through each phase of this process, the Company performs quality control reviews to ensure continuing high standards of quality and uniformity to meet exacting customer specifications. The Company's shaft manufacturing facilities are located in Zhuhai, China and Ho Chi Minh City, Vietnam. Over the past several years the majority of the Company's shafts have been manufactured in China. The primary materials currently used in the Company's graphite shafts are prepreg, paints, inks and heat transfer decals.

Composite Materials (Prepreg) Manufacturing Process.

The Company now produces substantially all of its prepreg requirements internally and is dependent on its own prepreg production operation to support its shaft manufacturing requirements and for its outside sales of composite materials. The Company is, however, somewhat dependent upon certain prepreg suppliers for types of prepreg that it does not produce and, therefore, the Company

8

Table of Contents

expects to occasionally purchase some prepreg products from outside suppliers in the future for its graphite shaft business. The manufacturing of prepreg is usually a three step process: first, resin components are mixed with catalyst to form a resin system, second, the mixed resin is applied to paper utilizing one of the Company's state of the art resin filmers, and lastly the completed film set is combined with carbon fiber and heated through various stages at various temperatures to allow the resin to release into carbon fiber and complete a roll of prepreg.

Environmental Matters

The Company is subject to various federal, state, local and foreign environmental laws and regulations, including those governing the use, discharge and disposal of hazardous materials as the Company uses hazardous substances and generates hazardous waste in the ordinary course of its manufacturing of graphite golf shafts, other composites, graphite prepreg and carbon fiber. The Company believes it is in substantial compliance with applicable laws and regulations and has not, to date, incurred any material liabilities under environmental laws and regulations; however, there can be no assurance that environmental liabilities will not arise in the future, which may affect the Company's business.

Competition

Aldila operates in a highly competitive environment in both the United States and international markets for the sale of its graphite golf club shafts. The Company believes that it is the largest supplier of graphite shafts to the United States club market, which results from its ability to establish a premium brand image and reputation among golf club companies as a value-added supplier with competitive prices. The Company believes that it competes in the premium branded and co-branded segment of the graphite golf shaft industry with several companies. The Company believes that its major competitors in this segment of the graphite shaft market include but are not limited to, Fujikura, Mitsubishi, UST, GDI and Grafalloy (a True Temper Company). This market is a highly competitive market and a recognized brand name with PGA Tour acceptance is required to compete in this market. The largest and most competitive segment of the graphite golf shaft market is the OEM shaft market for OEM stock shafts. To compete in this market a Company must meet strict shaft specifications, have a large production capacity able to meet tight lead times, and deliver quality products. The Company competes with the aforementioned competitors in this market along with golf club assemblers. Golf club assemblers are one stop shops that assemble the clubs and often manufacture golf club heads and shafts. The Company believes it has more shaft capacity, with its multiple manufacturing locations, than its competitors, which allows the Company some flexibility in where to produce the shafts and compete on its ability to meet tight lead times and deliver quality product. Presently, the industry has substantial excess graphite shaft manufacturing capacity both in the United States and in other countries.

The Company also competes for sales of prepreg with other producers of prepreg, many of whom have substantially greater research and development, managerial and financial resources than the Company. Some producers have been producing prepreg for substantially longer periods of time than the Company, and represent significant competition to the Company. The Company's ability to compete in the sale of prepreg is dependent to some extent on the demand from manufacturers and consumers of prepreg products utilizing the types of products the Company produces. In addition, the ability to purchase specific fiber when required, could limit the Company's ability to compete in prepreg sales.

Intellectual Property

Aldila utilizes a number of trademarks and logos in connection with the sale and advertising of its products. The Company takes all reasonable measures to ensure that any product bearing an Aldila trademark reflects the consistency and quality associated with the Company's products and intends to

9

Table of Contents

continue to protect them to the fullest extent practicable. As of December 31, 2009, the Company had approximately 24 domestic trademarks.

Employees

As of December 31, 2009, Aldila employed 1,186 persons on a full-time basis, including 10 in sales and marketing, 22 in research, development and engineering and 981 in production. The balance of employees are administrative and support staff. The number of full-time employees includes 695 persons who are employed in the Company's China facility, 311 persons who are employed in the Company's Vietnam facility and 180 persons who are employed in the Company's Poway, California locations in prepreg manufacturing and headquarters' facilities. As of December 31, 2009, the Company also employed 178 temporary employees. Aldila considers its employee relations to be good.

Seasonality

Because the Company's customers have historically built inventory in anticipation of purchases by golfers in the spring and summer, the principal selling season for golf equipment, the Company's operating results have been affected by seasonal demand for golf clubs, which has generally resulted in highest sales occurring in the first and second quarter. The timing of customers' new product introductions has frequently mitigated the impact of seasonality in recent years.

Backlog

As of December 31, 2009, the Company had a sales backlog of approximately $10.6 million compared to approximately $8.6 million as of December 31, 2008. Historically, the majority of the dollar volume of the Company's backlog at the end of a quarter has been shipped during the following quarter. Orders can typically be cancelled without penalty up to 30 days prior to shipment. Historically, the Company's backlog generally has been highest at the beginning of the first and second quarters, due in large part to seasonal factors. Due to the timing and receipt of customer orders, backlog is not necessarily indicative of future operating results.

Item 1A. Risk Factors

Dependence on Discretionary Consumer Spending

Sales of golf equipment have historically been dependent on discretionary spending by consumers, which may be adversely affected by general economic conditions. The country has just come out of the worst recession in years, coupled with the collapse of the world's financial industry and the U.S. housing markets. Consumers drastically reduced their spending in the back half of 2008 and throughout 2009. With this recent and significant deterioration of economic conditions in the U.S. and elsewhere, there has been considerable pressure on consumer demand, and the resulting impact on consumer spending has had and may continue to have a material adverse effect on the demand for the Company's products as well as its financial condition and results of operations. Consumer demand and the condition of the golf retail industry may also be impacted by other external factors such as war, terrorism, geopolitical uncertainties, public health issues, natural disasters and other business interruptions. The impact of these external factors is difficult to predict, and one or more of the factors could adversely impact the Company's business. The golf industry has historically been a recession proof industry, in which equipment sales ranging plus or minus one to two percent. A continued decrease in consumer demand and spending on golf equipment or, in particular, a decrease in demand for golf clubs with graphite shafts could have an adverse effect on the Company's business and operating results and its ability to service its credit facility.

10

Table of Contents

Customer Concentration

The Company's sales have been, and very likely will continue to be, concentrated among a small number of customers. In 2009, sales to the Company's top five customers represented approximately 56% of net sales. Aldila's principal customers have historically varied depending largely on the prevailing popularity of the various clubs that contain Aldila shafts. In 2009, Ping accounted for 20% of net sales, Acushnet Company accounted for 11% of net sales and Callaway Golf accounted for 10% of net sales. The Company cannot predict the impact that general market trends in the golf industry, including the fluctuation in popularity of specific clubs manufactured by customers, will have on its future business or operating results.

While the Company has had long-established relationships with most of its customers, it is not the exclusive supplier of graphite shafts to most of them, and consistent with the industry practice, generally does not have long-term contracts with its customers. We believe that Ping, Acushnet Company and Callaway Golf, who collectively represent approximately 41% of the Company's net sales in 2009, each purchased from at least two other graphite shaft suppliers. In the event Ping, Acushnet Company and Callaway Golf, or any other significant customer, increases purchases from its other suppliers or adds additional suppliers, the Company could be adversely affected. Although the Company believes that its relationships with its customers are good, the loss of a significant customer, or a substantial decrease in sales to a significant customer, could have a material adverse effect on the Company's business and operating results. In addition, sales by the Company's major customers are likely to vary dramatically from time to time due to fluctuating consumer demand for golf equipment generally and for their specific products.

Competition

Aldila operates in a highly competitive environment for golf equipment sales. The Company believes that it competes principally on the basis of its ability to provide a broad range of high quality, performance graphite shafts, its ability to deliver customized products in large quantities and on a timely basis, the acceptance of graphite shafts in general, and Aldila branded shafts, in particular, by professionals and other golfers whose preferences are to some extent subjective, and finally, price.

Aldila competes against both domestic and foreign shaft manufacturers. Some of the Company's current and potential competitors may have greater resources than Aldila. The Company also faces potential competition from those golf club manufacturers that currently purchase golf shaft components from outside suppliers but that may have, develop or acquire, the ability to manufacture shafts internally.

As the Company further enters into the manufacture and sale of prepreg products, it competes with other producers of prepregs, many of whom have substantially greater research and development, managerial and financial resources than the Company and represent significant competition for the Company.

Shaft Manufacturing by Club Companies and One-Stop Shops

Another factor that could have a negative impact in the future on the Company's sales to golf club manufacturers would be a decision by one of its customers to manufacture all or a portion of their graphite shaft requirements, or to have an increased amount of their requirements filled from one-stop shops (where main components, shaft or head, of the golf club could be produced or purchased and assembled). While the Company has not, to date, experienced any material decline in its sales for these reasons, should any of the Company's major customers decide to meet any significant portion of their shaft needs either internally or through one-stop shops, it could have a material adverse impact on the Company and its financial results.

11

Table of Contents

New Product Introduction

The Company believes that the introduction of new, innovative golf shafts using graphite or other composite materials will be critical to its future success. While the Company emphasizes research and development activities in connection with carbon fiber and other composite material technology, there can be no assurance that the Company will continue to develop competitive products or that the Company will be able to develop or utilize new composite material technology on a timely or competitive basis or otherwise respond to emerging market trends.

Although the Company believes that it has generally achieved success in the introduction of its customized graphite golf shafts, specifically, the Aldila NV® line of golf shafts, no assurance can be given that the Company will be able to continue to design and manufacture products that meet with market acceptance, either on the part of club manufacturers or golfers. The design of new graphite golf shafts is also influenced by rules and interpretations of the United States Golf Association ("USGA"). There can be no assurance that any new products will receive USGA approval or that existing USGA standards will not be altered in ways that adversely affect the sales of the Company's products.

Reliance on Offshore Manufacturing Facilities

The Company operates manufacturing facilities in Zhuhai, People's Republic of China and Ho Chi Minh City, Vietnam. The Company pays certain expenses of these facilities in Chinese renminbis and Vietnam dong, respectively, which are subject to fluctuations in currency value and exchange rates. The Company operates in the People's Republic of China in a special economic zone, which affords special advantages to companies with regards to income taxes. The operation in Vietnam also enjoys advantages in regards to income taxes. There can be no assurance that the governments of the People's Republic of China or Vietnam will continue the programs currently in place or that the Company will continue to be able to benefit from these programs. The loss of these benefits could have an adverse effect on the Company's business. The Company is also subject to other customary risks of doing business outside the United States, including political instability, other import/export regulations and cultural differences.

Raw Material Cost/Availability

The Company's gross profit margin, in part, is dependant on the price paid for carbon fiber purchased from vendors. Historically, the carbon fiber market has been cyclical and experienced periods of excess capacity and low prices followed by periods of little excess capacity and high prices. In the past, when there was excess capacity, carbon fiber suppliers sold carbon fiber at reduced prices, which had the effect of increasing competition, as carbon fiber was less expensive and material was available in the graphite shaft and composite materials businesses. During tight supply times, the Company may have difficulty in obtaining certain types of carbon fibers, which are used in the Company's graphite shafts and composite prepreg materials.

Since 2003, the trend has been toward less excess capacity and higher prices, although beginning in 2006 prices of carbon fiber leveled somewhat. Management cannot predict the timing or extent of future price changes for carbon fiber, but higher prices may negatively impact the Company if the Company is not able to pass along these increases to its customers.

The Company has relationships with vendors for its carbon fiber needs through 2010 and beyond. In the world carbon fiber market, there are a limited amount of carbon fiber manufacturers. The Company currently purchases carbon fiber from most of these carbon fiber manufacturers.

The Company is dependent on its internal production of graphite prepreg to support its shaft manufacturing operations and composite materials business. If the Company's prepreg production is interrupted for any reason and the Company is unable to secure an alternative supply of prepreg, it

12

Table of Contents

could have a material impact to the Company's business. The exposure to the Company resulting from its reliance on its own internal production of the raw materials for its golf shaft business is enhanced because the Company currently operates only one prepreg facility. As noted above, the carbon fiber and composite prepreg industries have encountered various capacity issues in the past, and either situation can have an adverse effect on the Company's business.

Utilization of Certain Hazardous Materials

In the ordinary course of its manufacturing processes, the Company uses hazardous substances and generates hazardous waste. The Company has not, to date, incurred any material liabilities under environmental laws and regulations and believes that it is in substantial compliance with applicable laws and regulations. Nevertheless, no assurance can be given that the Company will not encounter environmental problems or incur environmental liabilities in the future, which could adversely affect its business.

Reliance on Key Personnel

The success of the Company is dependent upon its senior management team, as well as its ability to attract and retain qualified personnel. There is competition for qualified personnel in the golf shaft industry as well as the carbon fiber business. Further, in the past, we have used equity incentive programs as part of our overall employee compensation arrangements to both attract and retain qualified personnel. The recent decline in our stock price has negatively impacted, and may continue to negatively impact, the value of these equity incentive and related compensation programs as retention and recruiting tools. We may need to create new or additional equity incentive programs and/or compensation packages to remain competitive, which could be dilutive to our existing stockholders and/or adversely affect our results of operations. There is no assurance that the Company will be able to retain its existing senior management personnel or to attract additional qualified personnel.

Item 2. Properties

The Company's principal executive offices are located in Poway, California (in the San Diego metropolitan area). The Company's golf shafts are manufactured at two separate facilities; one in the Zhuhai economic development zone of the People's Republic of China and one that is in Ho Chi Minh City, Vietnam. The Company leases a 73,000 square foot facility in Poway, California for graphite prepreg production. The Company also leases an additional 52,000 square foot facility in Poway, California for the Company's executive offices and warehouse. The China facility is also leased and comprises approximately 88,000 square feet. The Vietnam facility was built by the Company and operates under a 54 year land lease. The land is approximately 10,000 square meters and the building is comprised of approximately 64,000 square feet. The Company also may lease warehousing space when needed.

Item 3. Legal Proceedings

The Company is not currently subject or a party to any material legal proceedings.

Item 4. (Removed and Reserved)

13

Table of Contents

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

COMMON STOCK PERFORMANCE

| | | | | | | | | | | | | | | | | | | |

| | 2009 | | 2008 | |

|---|

| | Dividends

Declared | | High | | Low | | Dividends

Declared | | High | | Low | |

|---|

First Quarter | | $ | 0.00 | | $ | 5.92 | | $ | 2.27 | | $ | 5.15 | | $ | 11.79 | | $ | 9.49 | |

Second Quarter | | $ | 0.00 | | $ | 5.67 | | $ | 2.52 | | $ | 0.15 | | $ | 11.25 | | $ | 5.76 | |

Third Quarter | | $ | 0.00 | | $ | 4.56 | | $ | 2.57 | | $ | 0.00 | | $ | 5.58 | | $ | 3.66 | |

Fourth Quarter | | $ | 0.00 | | $ | 4.29 | | $ | 2.83 | | $ | 0.00 | | $ | 7.99 | | $ | 2.21 | |

On March 26, 2010, the closing common stock price was $5.11. There were 232 common stockholders of record. The company believes a significant number of beneficial owners also own Aldila stock in "street name".

Aldila, Inc. common stock was traded on The NASDAQ Stock Market, LLC under the symbol, ALDA, until February 8, 2010 when the Company moved the listing to the OTCQX Premier.

The Company intends to retain earnings for use in operations and payments of cash dividends on its common stock. Cash dividends are discussed by the Company's Board of Directors and management at each quarterly Board Meeting, and if approved, cash dividends are announced. On February 11, 2008 the Company declared a $5.00 special cash dividend per share to be paid on March 10, 2008 to shareholders of record as of February 25, 2008. The Company announced on August 21, 2008, that its Board of Directors decided to suspend its quarterly cash dividend.

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information regarding securities authorized for issuance under the Company's equity compensation plans as of December 31, 2009:

| | | | | | | | | | | | | |

Plan Category | | Number of

securities to be

issued upon

exercise of

outstanding

options | | Weighted-

average exercise

price of

outstanding

options | | Number of

securities to

be issued

upon

vesting

of restricted

stock | | Number of securities

remaining available for

future issuance under

equity compensation

plans(2) | |

|---|

Equity compensation plans approved by security holders—1994 Stock Incentive Plan(1) | | | 154,085 | | $ | 10.78 | | | 28,163 | | | — | |

Equity compensation plans approved by security holders—2009 Outside Director Equity Plan | | | 13,336 | | $ | 3.79 | | | — | | | 86,664 | |

Equity compensation plans approved by security holders—2009 Equity Incentive Plan | | | | | | | | | 42,680 | | | 817,320 | |

| | | | | | | | | | | |

Total | | | 167,421 | | | | | | 70,843 | | | 903,984 | |

| | | | | | | | | | | |

- (1)

- On October 7, 2008, the Compensation Committee ("Committee") of Aldila Inc.'s Board of Directors modified all outstanding stock options issued prior to May 30, 2008 under the Aldila Inc. 1994 Stock Incentive Plan. The modifications adjusted the exercise price to reflect the

14

Table of Contents

aforementioned $5.00 special cash dividend paid during the first quarter of 2008. The modifications were made by the Committee, acting as Administrator of the Plan, pursuant to Section 12 of the Plan which governs "Changes upon Recapitalization." The modifications are intended to comply with applicable IRS regulations regarding modifications to incentive stock options. The weighted average share prices reflect the impact of the modification.

- (2)

- The 1994 Stock Incentive Plan was terminated for future issuances when the 2009 plans were adopted.

15

Table of Contents

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A")

The Company's MD&A is comprised of significant accounting estimates made in the normal course of its operations, overview of the Company's business conditions, results of operations, liquidity and capital resources and contractual obligations. The Company did not have any off balance sheet arrangements as of December 31, 2009 or 2008. The Company's significant accounting estimates identified are; revenue recognition, accounts receivables, inventory valuation and income taxes. The Company is disclosing segment information for two operating segments, Composite Products and Composite Materials. Composite Products is comprised of sales of golf shafts, and other composite products. Composite Materials is comprised of external sales of prepreg products in the forms of uni-tapes, fabrics and film adhesives.

Critical Accounting Policies and Significant Accounting Estimates

The consolidated financial statements of the Company are prepared in conformity with accounting principles generally accepted in the United States of America. As such, the Company is required to make certain estimates, judgments and assumptions that we believe are reasonable based upon the information available. These estimates and assumptions affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the periods presented. The significant accounting policies, which the Company believes are the most critical to aid in fully understanding and evaluating our reported financial results, include the following:

Revenue Recognition

The Company recognizes revenue from product sales at the time of shipment and passage of title. We also offer certain of our customers the right to return shafts for breakage within a limited time after delivery. We track such shaft breakage returns, and we record a provision for the estimated amount of such future returns, based on historical experience and any notification we receive of pending returns at the time sales are made. The Company believes that any shafts returned for breakage will be returned within three years of the initial sale of the shaft. The Company estimates in regards to total actual returns, that 50% will be returned in the first year after sale, 30% in the second year after sale and the remaining 20% in the third year after sale, assuming a mid-year convention. The Company's breakage return rate has been between 0.17% and 0.50% (breakage returns divided by sales dollars) for the past ten years. The Company has historically utilized a four-year moving average of the breakage return rate to record its estimated liability. The four-year average utilized in the accrual estimate as of December 31, 2009 is 0.27%. The Company's breakage return rate has declined over the past years. The highest four-year average over the past ten years has been 0.47%. If the Company were to use 0.47% in estimating its liability as of December 31, 2009, it would have the effect of increasing the liability by approximately $238,000, which would be recorded in cost of goods sold. While breakage returns have historically been within our expectations and the provisions established, we cannot guarantee that we will continue to experience the same return rates that we have in the past. Any significant increase in product failure rates and the resulting returns could have a material adverse impact on our operating results for the period or periods in which such returns materialize.

Accounts Receivable

We perform ongoing credit evaluations of our customers and adjust credit limits based upon payment history and the customer's current credit worthiness, as determined by our review of their current credit information. We continuously monitor collections and payments from our customers and maintain a provision for estimated credit losses based upon our historical experience and any specific customer collection issues that we have identified. While such credit losses have historically been within

16

Table of Contents

our expectations and the provisions established, we cannot guarantee that we will continue to experience the same credit loss rates that we have in the past. In addition, the current economic environment has changed the landscape of credit worthiness worldwide, with more and more companies forced to stretch their resources. The Company believes that its focus in this area should help to identify and prevent problem accounts before they become significant. However, since our accounts receivable are concentrated in a relatively few number of customers, a significant change in the liquidity or financial position of any one of these customers could have a material adverse impact on the ability to collect our accounts receivable and our future operating results. The Company estimates its allowance for doubtful accounts on a monthly basis, by reviewing all amounts owed to the Company and focusing on those amounts that are greater than 60 days past due. The Company reviews the customers that have amounts greater than 60 days past due and where appropriate, establishes a reserve for the receivable amount that Company deems to be at risk in collecting. As of December 31, 2009, the Company estimated this amount to be approximately $36,000. If the Company were to reserve for the total amount greater than 60 days past due, it would increase the allowance by approximately $69,000, which would be recorded in selling, general and administrative expense.

Inventories

We value our inventory at the lower of the actual cost to purchase and/or manufacture the inventory or the current estimated market value of the inventory. We regularly review inventory quantities on hand and record a provision for excess and obsolete inventory based primarily on our estimated forecast of product demand and production requirements for the next twelve months. A significant increase in the demand for our products could result in a short-term increase in the cost of inventory purchases while a significant decrease in demand could result in an increase in the amount of excess inventory quantities on hand. Management of the Company, including but not limited to, representatives from manufacturing, sales, accounting and officers review the inventory reserve methodology quarterly and when appropriate, establish additional reserves or reduce existing reserves.

The Company's reserve methodology consists of the following: reviewing on hand inventories of all of its finished goods shafts and comparing inventories to historical sales trends and anticipated sales forecasts. A 100% reserve is established for all shafts that are deemed to be obsolete. In some cases a reserve of 50% or 25% may be established to discount the product to its estimated realizable value. Raw materials are reviewed based upon estimated future production and when appropriate, reserves are established. Shafts that are designated for rework (parts that need additional work) are reviewed and when appropriate reserves are established. The final analysis is to review inactive inventory, and apply reserves to parts that were not included in the other analyses and have been inactive in the system for a period of twelve months. The Company's average reserve percentage compared to gross inventory has been approximately 9% for the past five years. In the past five years, the highest reserve percentage was approximately 10% and the lowest reserve percentage was approximately 8%. The Company's reserve percentage as of December 31, 2009 is 10%. See the estimated impact below to cost of goods sold, utilizing the different reserve rates above:

| | | | | | | | | | |

(Amounts below in thousands) | | Highest | | Average | | Lowest | |

|---|

Gross inventory as of 12/31/09 | | $ | 10,279 | | $ | 10.279 | | $ | 10,279 | |

Reserve rate | | | 9.7 | % | | 8.7 | % | | 7.7 | % |

| | | | | | | | |

Estimated reserve | | | 999 | | | 895 | | | 793 | |

Recorded Reserve as of 12/31/09 | | | 999 | | | 999 | | | 999 | |

| | | | | | | | |

Impact to costs of goods sold | | $ | — | | $ | (104 | ) | $ | (206 | ) |

| | | | | | | | |

In the future, if our inventory were determined to be overvalued, we would be required to recognize such costs in our cost of goods sold at the time of such determination. Likewise, if our

17

Table of Contents

inventory is determined to be undervalued, we may have over-reported our costs of goods sold in previous periods and would be required to recognize such additional operating income at the time of sale. Therefore, although we make every effort to ensure that our forecasts of future product demands are reasonable, any significant unanticipated changes in demand could have a significant impact on the value of our inventory and our reported operating results. The Company continues to look at ways of minimizing its inventory levels and to be more efficient. As the Company continues to try to reduce its carrying levels of its work-in-process and finished goods inventory, it should have the effect of further reducing the amount of its inventory reserves.

Income Taxes

The Company has analyzed filing positions in all of the federal, state, and foreign jurisdictions where it is required to file income tax returns, as well as all open tax years in these jurisdictions. For the period ended December 31, 2009, the Company recorded a net unrecognized tax benefit of $392,000 including interest. The Company attempts to identify these positions at the end of each year based upon the more than likely or not threshold. The Company files its income taxes for the previous year in October of the following year. At times the estimates made at the end of the year may change when the Company files its income tax return. The Company attempts to mitigate this; however, there can be no certainty that there will not be adjustments to the Company's estimates that have previously been made. The Company has $1.8 million and $1.6 million in unrecognized tax benefits and interest as of December 31, 2009 and 2008, respectively.

Overview—Business Conditions

Composite Products

The Composite Products segment is mainly comprised of graphite golf shafts. The graphite shaft market consists of customized OEM production shafts, both premium and value and Aldila branded and co-branded shafts. The Company sells customized OEM production and co-branded shafts directly to its OEM customers and sells Aldila branded shafts through the OEM custom stock and custom fit programs and to distributors. The Company's recent branded shaft offerings are as follows:

Branded Shaft Offerings

- •

- Aldila NV® and NV® Line extensions

- •

- Introduced in 2003, featuring the Company's exclusive Micro Laminate Technology®.

- •

- Has had numerous Tour victories.

- •

- The Company introduced NV® line extensions in 2004, including the NVS™, NV ProtoPype®, Pink NV®, NV® Irons and NV® Hybrid shafts.

- •

- The Aldila NV® can be considered one of the most successful shaft introductions ever.

- •

- VS ProtoTM and the VS ProtoTM Hybrid

- •

- Introduced and began shipping in 2006.

- •

- High performance shaft featuring carbon nanotubes as well as aerospace carbon fibers and the Company's exclusive high performance resin systems.

- •

- Used by the winner of the 2006 U.S. Open.

- •

- DVS® and DVS® Hybrid

- •

- Introduced late in the fourth quarter 2007.

- •

- Features carbon nanotubes and an innovative tip design for extra kick at impact—with optimum launch.

- •

- Used by former Aldila advisory staff member, Paula Creamer, for 4 LPGA victories in 2008.

18

Table of Contents

- •

- VooDoo®

- •

- Initially introduced on Tour only during the first quarter of 2008.

- •

- One of the most popular shafts on the PGA Tour.

- •

- Used to win 8 events in 2008 and 10 events in 2009.

- •

- En FuegoTM

- •

- 3 different shafts—Wasabi™, Habanero™ and Serrano™, each promotes a different ball launch.

- •

- Introduced on Tour during 2009.

Hybrid shafts are included in branded shafts. The Company's branded hybrid shafts have been the most popular hybrid shafts on Tour for the last several years, often times outpacing the nearest competitor at a two to one margin. The Company's success in Branded Shafts has led to tremendous success on Tour over the past several years.

Tour Play

- •

- 2007 Tour Play

- •

- Tour professionals using Aldila shafts won 19 events on the PGA Tour and nearly fifty percent of all the events on the Nationwide Tour.

- •

- Aldila shafts were also the most popular shafts for woods and hybrid clubs at every major championship on the PGA Tour.

- •

- Aldila shafts were used by the winner of The Masters and the U.S. Open as well as the winner of the World Golf Championship-Accenture Match Play Championship.

- •

- Former Aldila advisory staff member, Paula Creamer, won the SBS Open and led the U.S. Women's team to victory in the Solheim Cup playing her Pink NV® woods.

- •

- Aldila was also the shaft of choice for the majority of players in both woods and hybrids at the 2007 PGA Club Professional Championship.

- •

- At the 2007 U.S. Men's Amateur, Aldila was the leading shaft choice for hybrids.

- •

- During the U.S. Public Links Championship, Aldila was the most popular wood and hybrid shaft.

- •

- Aldila was also the leading shaft at the NCAA Division 1 Men's Championship in both woods and hybrids and the leading driver shaft at the NCAA Women's Championship.

- •

- Aldila shafts were included on the Golf Digest Hot List and won Golf Tips Magazine's Technology Award.

- •

- 2008 Tour Play

- •

- Aldila enjoyed a great 2008 Tour season.

- •

- On the PGA Tour, players using Aldila shafts won 13, events including the World Golf Championship-CA Championship and the Verizon Heritage by former Aldila advisory staff member, Boo Weekley.

- •

- Players using Aldila shafts won 13 events on the Nationwide Tour and 15 events on the Champions Tour.

- •

- On the LPGA Tour we won 20 events, and Paula Creamer, a former Aldila advisory staff member, has won four events.

- •

- 2009 Tour Play

- •

- Aldila enjoyed a great 2009 Tour season.

- •

- On the PGA Tour, players using Aldila shafts won 15 events including the Mercedes-Benz Championship, WGC-Accenture Match Play Championship and The Masters.

- •

- Players using Aldila shafts won 16 events on the Nationwide Tour.

19

Table of Contents

- •

- Aldila was the most popular wood and hybrid shaft at The Masters, U.S. Open, The PGA Championship, The Open Championship and every World Golf Championship. For the second year in a row, Aldila was also the most popular shaft at every FedEx Cup event.

- •

- Aldila was the most popular wood and hybrid shaft at the majority of all other PGA and Nationwide Tour events.

Our entire high performance line has done well with Tour players winning using our NV®, VS Proto™, DVS® and VooDoo® shafts.

The Company tries to maintain a broad customer base in both the OEM production shaft and branded shaft market segments and competes aggressively with foreign-based shaft manufacturers for OEM production shafts and branded shafts. However, the Company's sales have tended to be concentrated among a limited number of major club companies, thus making the Company's results of operations dependent on those customers, their continued willingness to purchase a significant portion of their shafts from the Company, and their success in selling clubs containing the Company's shafts to their customers. In 2009, net sales to Ping, Acushnet Company and Callaway Golf, represented 20%, 11% and 10% of the Company's net sales, respectively, and the Company anticipates that these companies will continue, collectively, to represent the largest portion of its sales in 2010.

Although it is generally difficult to predict in advance the success of any particular club or of any particular manufacturer, the Company believes that it is protected to some extent from normal periodic fluctuations in sales among the various golf club companies by virtue of the broad depth and range of its customer base. Golf club companies regularly introduce new clubs, frequently containing innovations in design. Sometimes these new clubs achieve dramatic success in the marketplace, thus increasing the overall volatility of club sales among the major companies. While the Company seeks to have its shafts represented on as many major product introductions as possible, it can provide no assurance that its shafts will be included in any particular "hot" club or that sales of a "hot" club that does not include the Company's shafts will not have a negative impact on the sales of those clubs that do. The Company's sales could also suffer a significant drop-off from period to period to the extent that they may be dependent in any period on sales of one or more "hot" clubs, which then tail off in subsequent periods and at the same time, new offerings fail to achieve a high level of new sales sufficient to exceed or replace the previous sales levels of "hot" clubs. This is especially true in the premium branded driver programs. If the Company does not participate in these programs, it could have an adverse effect on the Company's revenues and average selling prices. Average selling prices of the Company's shafts have varied greatly over the years based upon programs it participates in, mix of shafts, wood vs. irons, competition, retail inventory situations or a shortage of raw materials available. The Company's average

20

Table of Contents

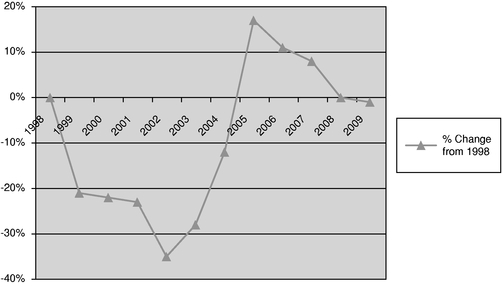

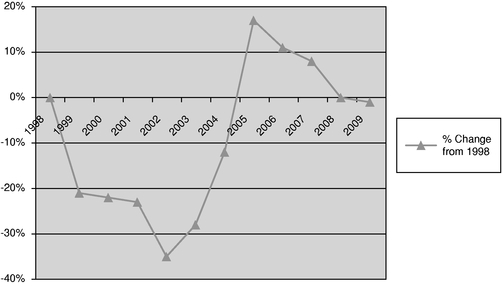

selling price decreased in 2009 by 2% as compared to 2008. See the graph of the Company's average selling price changes below.

Average Selling Price Change from 1998

The Company believes that some of the success it enjoyed in 2005 and 2006 was attributed to a shortage of carbon fiber. The Company believes that some of its competitors are negatively impacted when there is a shortage of carbon fiber, which can create a shortage of prepreg. Although, the Company does not have ownership in a carbon fiber plant any longer, it still produces the majority of its carbon fiber prepreg, which the Company believes is a competitive advantage. In the midst of this pricing pressure that the Company has faced over the years, the Company has attempted to reduce its cost structure in order to be competitive. In order to do so, the Company continues to look at ways to do this, which in the past has prompted the Company to move its shaft manufacturing operations offshore, first to Mexico, then China and more recently, Vietnam in 2006. The Company closed its Mexico facility during 2009 and shifted that production to Asia.

Composite Materials

The Composite Materials segment is comprised of external sales of prepreg, film adhesives, fabrics and other materials. The Company historically has not tracked inter-segment sales and has always looked at the contribution provided by Composite Materials based upon the external sales of materials. The Company records all shared costs to Composite Products and allocates certain costs for segment reporting, such as shipping, purchasing and other administrative costs based upon the net revenues of each segment. Costs that are specific to one segment are charged directly to the respective segment.

The Company began to manufacture composite materials in 1994. Initially, the prepreg produced was mainly consumed by the Composite Products segment. Sales of prepreg, as a percentage of net sales, were 14% for the periods ended December 31, 2009 and 2008. The Company has spent a significant amount of money over the past several years to increase the capacity of its prepreg operations in support of its external sales of prepreg and Composite Products operations. Over the last several years, the Company has put in place two prepreg production lines, a second resin filmer and completed the installation of a wide prepreg tape line during the first quarter of 2008. The prepreg lines add to the Company's capacity of prepreg to support both the Composite Materials and Composite Products segments. The additional resin filmer supports the Company's wide tape line and

21

Table of Contents

provide backup film capacity as the Company had previously only one resin filmer. In addition, the wide tape line allows the Company to enter some markets it has previously not been able to access.

The Company continues to look for opportunities to sell its prepreg and film adhesive products to other fabricators of products manufactured from composite materials. The Company has achieved some success in these areas and management believes that growth opportunities in these areas will continue to exist. In addition, management believes that vertical integration through its prepreg operation has been successful, to date, and is allowing the Company to maintain, or in some cases enhance, its competitive position with respect to the major United States golf club companies that are its principal customers.

2009 Compared to 2008

Net Sales

| | | | | | | | | | | | | | |

| | 2009 | | 2008 | | Chg | | % Chg | |

|---|

Composite Products | | $ | 42,618 | | $ | 46,023 | | $ | (3,405 | ) | | (7 | )% |

Composite Materials | | | 7,156 | | | 7,583 | | | (427 | ) | | (6 | )% |

| | | | | | | | | | |

| | Total Net Sales | | $ | 49,774 | | $ | 53,606 | | $ | (3,832 | ) | | (7 | )% |

| | | | | | | | | | |

Composite Products—

Composite Products net sales decreased by $3.4 million for 2009 as compared to 2008. The Company's average selling price of golf shafts decreased by 2% and overall units declined by 6% for 2009 as compared to 2008. The decrease in units is mainly attributed to the overall state of the golf industry, which suffered through the recession as did other industries. The golf industry was historically thought to be recession proof, with equipment sales that typically did not fluctuate by more than 1%-2% a year. Although the fourth quarter of 2008 and almost all of 2009 was weak for the golf industry it appears that the golf industry is ready to rebound. The Company believes that it is positioned well with its customers when the economic conditions improve and has seen improvement during the fourth quarter of 2009. The Company had a 21% increase in sales for the fourth quarter ended December 31, 2009 as compared to December 31, 2008. The decrease in Composite Products sales were attributed to a decrease in OEM shaft sales, which were partially offset by increases in sales of branded and co-branded shafts. Branded golf shaft sales increased by 8% and co-branded golf shaft sales increased by 22%. Branded and co-branded golf shaft sales increased to 39% of Composite Products sales in 2009 from 32% in 2008. The Company has seen increased competition in this segment of the golf shaft market.

Composite Materials—

Composite Materials net sales decreased by $427,000 for 2009 as compared to 2008 and represent approximately 14% of the Company's consolidated net revenues. The majority of our Composite Materials business is to customers in the recreational products industry. Our customers' businesses have been impacted by the weak economy similar to what impacted the Composite Products segment at the end of 2008 and throughout 2009. The Composite Materials sales also had a strong fourth quarter of 2009 with sales up 76% as compared to the fourth quarter of 2008, which hopefully signals a return to some normal pre-recession ordering patterns. The Company has added capacity in this segment over the past several years to support the Composite Products segment and for outside sales of Composite Materials. The Company continues to attempt to diversify its customer base in this segment. The Company sales are highly concentrated in the recreational products industry.

22

Table of Contents

Gross Profit

| | | | | | | | | | | | | | |

| | 2009 | | 2008 | | Chg | | % Chg | |

|---|

Composite Products | | $ | 8,678 | | $ | 7,771 | | $ | 907 | | | 12 | % |

Composite Materials | | | 2,002 | | | 1,795 | | | 207 | | | 12 | % |

| | | | | | | | | | |

| | Total Gross Profit | | $ | 10,680 | | $ | 9,566 | | $ | 1,114 | | | 12 | % |

| | | | | | | | | | |

Composite Products—

Composite Products gross profit increased by approximately $907,000 or 12% in 2009 as compared to 2008. The increase in Composite Products gross profit was attributed to lower manufacturing cost during the year. The Company maintained strict cost controls and was able to reduce its raw material costs and cost to manufacture during the year. During the fourth quarter of 2008, the Company began to shift more of its manufacturing from Mexico to Asia, which led to the eventual closing of the Mexico manufacturing facility during 2009. The Company manufactured 27% of its product in Mexico during 2008 as compared to only 9% in 2009. Composite Products gross margin increased to 20% for 2009 as compared to 17% for 2008. The Company's gross profit was negatively affected by additional inventory reserves of $568,000 in 2009 as compared to $619,000 in 2008. The increase in reserves in 2009 and 2008 were offset by the sales of product that was fully reserved for of $185,000 in 2009 and $128,000 in 2008. The net effect of the inventory reserve adjustments was a decrease in gross profit of $383,000 in 2009 and a decrease in gross profit of $491,000 in 2008.

Composite Materials—

The Composite Materials gross profit increased by approximately $207,000, or 12%, in 2009 as compared to 2008. The increase was mainly attributed to lower raw material costs and a better mix of product being sold.

Operating Income (Loss)

| | | | | | | | | | | | | | |

| | 2009 | | 2008 | | Chg | | % Chg | |

|---|

Gross profit | | $ | 10,680 | | $ | 9,566 | | $ | 1,114 | | | 12 | % |

Selling, General & Administrative ("SG&A) Expense | | | | | | | | | | | | | |

Composite Products | | | 9,584 | | | 12,182 | | | (2,598 | ) | | (21 | )% |

Composite Materials | | | 973 | | | 991 | | | (18 | ) | | (2 | )% |

| | | | | | | | | | |

| | Total SG&A | | | 10,557 | | | 13,173 | | | (2,616 | ) | | (20 | )% |

| | | | | | | | | | |

Operating Income (Loss) | | | | | | | | | | | | | |

Composite Products | | | (906 | ) | | (4,411 | ) | | 3,505 | | | 79 | % |