UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

Icagen, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

ICAGEN, INC.

Notice of Annual Meeting of Stockholders

ICAGEN WILL HOLD ITS

ANNUAL MEETING OF STOCKHOLDERS:

on Monday, June 5, 2006

at 12:00 p.m., Eastern Time

at NC Biotechnology Center

15 T.W. Alexander Drive

Research Triangle Park, North Carolina 27709

AGENDA FOR THE ANNUAL MEETING:

| 1. | Elect one Class II director for a term of three years; |

| 2. | Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2006; and |

| 3. | Transact other business, if any, that may properly come before the annual meeting or any adjournment of the meeting. |

Stockholders of record at the close of business on Monday, April 10, 2006 are entitled to receive this notice of our annual meeting and to vote at the annual meeting and at any adjournments of the meeting.

Included with this Notice and Proxy Statement is a copy of our Annual Report to Stockholders for the year ended December 31, 2005, which contains our consolidated financial statements and other information of interest to our stockholders.

Your vote is important. Whether or not you plan to attend the annual meeting, please promptly complete, date and sign the enclosed proxy card and return it in the accompanying envelope. If you mail the proxy card in the United States, postage is prepaid.

|

By Order of the Board of Directors, |

|

|

P. Kay Wagoner, Ph.D. |

| President and Chief Executive Officer |

April 27, 2006

TABLE OF CONTENTS

ICAGEN, INC.

4222 Emperor Boulevard, Suite 350

Durham, North Carolina 27703

PROXY STATEMENT

For our Annual Meeting of Stockholders to be held on June 5, 2006

Icagen, Inc., a Delaware corporation, which is referred to as “we” or “us” in this document, is sending you this proxy statement in connection with the solicitation of proxies by our board of directors for use at our Annual Meeting of Stockholders, which will be held on Monday, June 5, 2006 at 12:00 p.m. at NC Biotechnology Center, 15 T.W. Alexander Drive, Research Triangle Park, North Carolina 27709. If the annual meeting is adjourned for any reason, then the proxies may be used at any adjournments of the annual meeting.

We are first sending the Notice of Annual Meeting, this proxy statement, the enclosed proxy card and our Annual Report to Stockholders for the year ended December 31, 2005 to our stockholders on or about May 2, 2006.

INFORMATION ABOUT THE ANNUAL MEETING, VOTING AND

COMMUNICATING WITH OUR BOARD OF DIRECTORS

What is the purpose of the annual meeting?

At the annual meeting, stockholders will consider and vote on the following matters:

| | 1. | The election of one Class II director for a term of three years; |

| | 2. | The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2006; and |

| | 3. | The transaction of other business, if any, that may properly come before the annual meeting or any adjournment of the meeting. |

Who can vote?

To be able to vote on the above matters, you must have been a stockholder of record at the close of business on April 10, 2006, the record date for the annual meeting. The number of shares entitled to vote at the meeting is 22,167,040 shares of our common stock, which is the number of shares that were issued and outstanding on the record date.

How many votes do I have?

Each share of our common stock that you owned on the record date entitles you to one vote on each matter that is voted on.

Is my vote important?

Your vote is important regardless of how many shares you own. Please take the time to read the instructions below and vote. Choose the method of voting that is easiest and most convenient for you and please cast your vote as soon as possible.

How can I vote?

Stockholder of record: Shares registered in your name. If you are a stockholder of record, that is, your shares are registered in your own name, not in “street name” by a bank or brokerage firm, then you can vote in any one of the following two ways:

| | 1. | You may vote by mail. To vote by mail, you need to complete, date and sign the proxy card that accompanies this proxy statement and promptly mail it in the enclosed postage-prepaid envelope. You |

| | do not need to put a stamp on the enclosed envelope if you mail it in the United States. The persons named in the proxy card will vote the shares you own in accordance with your instructions on the proxy card you mail. If you return the proxy card, but do not give any instructions on a particular matter described in this proxy statement, the persons named in the proxy card will vote the shares you own in accordance with the recommendations of our board of directors. Our board of directors recommends that you vote FOR both proposals. |

| | 2. | You may vote in person. If you attend the annual meeting, you may vote by delivering your completed proxy card in person or you may vote by completing a ballot at the meeting. Ballots will be available at the meeting. |

Beneficial owner: Shares held in “street name.” If the shares you own are held in “street name” by a bank or brokerage firm, then your bank or brokerage firm, as the record holder of your shares, is required to vote your shares according to your instructions. In order to vote your shares, you will need to follow the directions your bank or brokerage firm provides you. Many banks and brokerage firms also offer the option of voting over the Internet or by telephone, instructions for which would be provided by your bank or brokerage firm on your vote instruction form. Under the rules of The Nasdaq Stock Market, if you do not give instructions to your bank or brokerage firm, it will still be able to vote your shares with respect to certain “discretionary” items, but will not be allowed to vote your shares with respect to certain “non-discretionary” items. For example, the election of directors and ratification of the appointment of independent registered public accounting firms are considered to be discretionary items on which banks and brokerage firms may vote. In the case of non-discretionary items, the shares will be treated as “broker non-votes.” “Broker non-votes” are shares that are held in “street name” by a bank or brokerage firm that indicates on its proxy that it does not have discretionary authority to vote on a particular matter.

If you wish to come to the meeting to personally vote your shares held in street name, you will need to obtain a proxy card from the holder of record(i.e.,your brokerage firm or bank).

Can I change my vote after I have mailed my proxy card?

Yes. You can change your vote and revoke your proxy at any time before the polls close at the annual meeting by doing any one of the following things:

| | • | | signing and returning another proxy card with a later date; |

| | • | | giving our corporate secretary a written notice before or at the meeting that you want to revoke your proxy; or |

| | • | | voting in person at the meeting. |

Your attendance at the meeting alone will not revoke your proxy.

What constitutes a quorum?

In order for business to be conducted at the meeting, a quorum must be present. A quorum consists of the holders of a majority of the shares of common stock issued, outstanding and entitled to vote at the meeting, that is, at least 11,083,521 shares.

Shares of our common stock represented in person or by proxy (including broker non-votes and shares that abstain or do not vote with respect to one or more of the matters to be voted upon) will be counted for the purpose of determining whether a quorum exists.“Broker non-votes”are shares that are held in “street name” by a bank or brokerage firm that indicates on its proxy that it does not have discretionary authority to vote on a particular matter.

If a quorum is not present, the meeting will be adjourned until a quorum is obtained.

2

What vote is required for each item?

Election of directors (Proposal 1): The nominee receiving a plurality, or the highest number, of votes cast at the meeting, regardless of whether that number represents a majority of the votes cast, will be elected.

Ratification of the appointment of Ernst & Young LLP (Proposal 2): The affirmative vote of a majority of the total number of votes cast on this proposal at the meeting is needed to approve this matter.

How will votes be counted?

Each share of common stock will be counted as one vote, whether executed by you directly or on a ballot voted in person at the meeting. Shares will not be voted in favor of a matter, and will not be counted as voting on a particular matter, if either (1) the holder of the shares abstains from voting on the matter or (2) the shares are broker non-votes. As a result, abstentions and broker non-votes will have no effect on the outcome of voting at the meeting.

Who will count the votes?

Our transfer agent and registrar, American Stock Transfer & Trust Company, will count, tabulate and certify the votes. Edward P. Gray, our secretary, will serve as the inspector of elections at the meeting.

How does the board of directors recommend that I vote on the proposals?

Our board of directors recommends that you vote FOR both proposals.

Will any other business be conducted at the annual meeting or will other matters be voted on?

We are not aware of any other business to be conducted or matters to be voted upon at the meeting. Under our bylaws, the deadline for stockholders to notify us of any proposals or nominations for director to be presented for action at the annual meeting was the close of business on March 25, 2006, the 90th day prior to the first anniversary of the preceding year’s annual meeting. If any other matter properly comes before the meeting, the persons named in the proxy card that accompanies this proxy statement will exercise their judgment in deciding how to vote, or otherwise act, at the meeting with respect to that matter or proposal.

Does Icagen require members of its board of directors to attend the annual meeting?

Our bylaws require that the chairman of our board of directors attend the annual meeting, and if he cannot attend, then our president would attend in his stead. Our corporate governance guidelines provide that directors are responsible for attending the annual meeting. Three of our directors attended our 2005 annual meeting of stockholders.

Where can I find the voting results?

We will report the voting results from the annual meeting in our Quarterly Report on Form 10-Q for the second quarter of 2006, which we expect to file with the Securities and Exchange Commission, or the SEC, in August 2006.

Can I recommend a candidate for Icagen’s board of directors?

Yes. Stockholders may recommend director candidates for consideration by the Nominating/Corporate Governance Committee of our board of directors by submitting the stockholder’s name, address and number of shares of Icagen stock held and any other information required by our bylaws, the candidate’s name, age, address and number of shares of Icagen stock held and the candidate’s resume to our secretary at the address below. If a stockholder would like a candidate to be considered for inclusion in the proxy statement for our 2007 annual

3

meeting, then the stockholder must follow the procedures for stockholder proposals outlined immediately below under “How and when may I submit a stockholder proposal for the 2007 annual meeting?”. You can find more detailed information on our process for selecting board members and our criteria for board nominees in the section of this proxy statement entitled “Committees of our board of directors—Nominating/Corporate Governance Committee” and in the Corporate Governance Guidelines posted in the “Investors” section of our website, www.icagen.com.

How and when may I submit a stockholder proposal for the 2007 annual meeting?

If you are interested in submitting a proposal or information about a proposed director candidate for inclusion in the proxy statement for our 2007 annual meeting, you must follow the procedures outlined in Rule 14a-8 of the Securities Exchange Act of 1934. To be eligible for inclusion, we must receive your stockholder proposal or information about your proposed director candidate at the address noted below no later than December 28, 2006.

If you wish to present a proposal or a proposed director candidate at the 2007 annual meeting of stockholders, but do not wish to have the proposal or director candidate considered for inclusion in the proxy statement and proxy card, you must also give written notice to us at the address noted below. We must receive this required notice at least 90 days, but no more than 120 days, before the first anniversary of the 2006 annual meeting. However, if the date of the 2007 annual meeting is advanced by more than 20 days, or delayed by more than 60 days, from the first anniversary of the 2006 annual meeting, then we must receive the required notice of a proposal or proposed director candidate no earlier than the 120th day prior to the 2007 annual meeting and no later than the close of business on the later of (1) the 90th day prior to the 2007 annual meeting and (2) the 10th day following the date on which notice of the date of the meeting was mailed or public disclosure was made, whichever occurs first. If you do not provide timely notice of a proposal or proposed director candidate to be presented at the 2007 annual meeting of stockholders, then the persons named in the proxy card that accompanies the proxy statement for our 2007 annual meeting will decide, in their own discretion, whether or not, and how, to vote on that proposal or candidate.

Any proposals, notices or information about proposed director candidates should be sent to:

Icagen, Inc.

4222 Emperor Boulevard, Suite 350

Durham, North Carolina 27703

Attention: Secretary

How can I communicate with Icagen’s board of directors?

Our board of directors will give appropriate attention to written communications that are submitted by stockholders, and will respond if and as appropriate. The chairman of the Nominating/Corporate Governance Committee, with the assistance of our senior management, is primarily responsible for monitoring and responding to communications from stockholders and other interested parties and for providing copies or summaries of communications to the other directors, as he considers appropriate.

All communications are forwarded to the chairman of the Nominating/Corporate Governance Committee and to the chairman of another committee of the board of directors, if the communication was addressed to the attention of another committee of the board of directors. The chairman of the Nominating/Corporate Governance Committee, in consultation, in the case of communications to be addressed by another committee of the board of directors, with the chairman of that committee, shall decide in each case whether any particular communication should be forwarded to some or all other members of the board of directors.

Our stockholders may send communications to our board of directors by forwarding them to our secretary at the above address or by sending an email to corporatesecretary@icagen.com or our board of directors at board@icagen.com or, in addition, in the case of matters concerning accounting, internal accounting controls and auditing, our Audit Committee at auditchair@icagen.com.

4

Who bears the costs of soliciting these proxies?

We will bear the costs of soliciting proxies. We are soliciting proxies for the annual meeting by mailing this proxy statement and accompanying materials to our stockholders. We are also soliciting proxies in the following ways:

| | • | | Our directors, officers and regular employees may, without additional pay, solicit proxies by telephone, facsimile, e-mail and personal interviews. |

| | • | | We will request brokerage houses, custodians, nominees and fiduciaries to forward copies of the proxy materials to the persons for whom they hold shares and request instructions for voting the proxies. We will reimburse the brokerage houses and other persons for their reasonable expenses in connection with this distribution. |

How can I obtain a copy of Icagen’s Annual Report on Form 10-K?

Our Annual Report on Form 10-K is available in the “Investors” section of our website at www.icagen.com. Alternatively, if you would like us to send you a copy, without charge, please contact:

Icagen, Inc.

4222 Emperor Boulevard, Suite 350

Durham, North Carolina 27703

Attention: Investor Relations

(919) 941-5206

investorsandpress@icagen.com

If you would like us to send you a copy of the exhibits listed on the exhibit index of the Annual Report on Form 10-K, we will do so upon your payment of our reasonable expenses in furnishing a requested exhibit.

Whom should I contact if I have any questions?

If you have any questions about the annual meeting or your ownership of our common stock, please contact our investor relations department at the address, telephone number or e-mail address listed above.

Householding of annual meeting materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to stockholders may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you call or write our investor relations department at the address, telephone number or e-mail address listed above. If you want to receive separate copies of our proxy statement or annual report to stockholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder.

PROPOSAL 1—ELECTION OF DIRECTORS

Our board of directors is divided into three classes, with one class being elected each year and members of each class holding office for a three-year term. We have one Class II director, whose term expires at this annual meeting; three Class III directors, whose terms expire at our 2007 annual meeting of stockholders; and three Class I directors, whose terms expire at our 2008 annual meeting of stockholders. We also have a vacancy for a second Class II director that may be filled before the 2009 annual meeting by a majority vote of the remaining directors. Our board of directors is authorized to have eight members, and we currently have seven members. We are seeking an additional director to fill the vacancy left by the resignation of H. Jefferson Leighton, a Class II director, in October 2005.

5

At this annual meeting, our stockholders will have an opportunity to vote for one nominee for Class II directors: Charles A. Sanders. Dr. Sanders is currently a director of Icagen, and you can find more information about him in the section of this proxy statement entitled “INFORMATION ABOUT OUR DIRECTORS, OFFICERS AND 5% STOCKHOLDERS—Our Board of Directors.”

The persons named in the enclosed proxy card will vote to elect the one nominee as a Class II director, unless you withhold authority to vote for the election of the nominee by marking the proxy card to that effect. If elected, the nominee for Class II director will hold office until the 2009 annual meeting of stockholders and until his successor is elected and qualified. The nominee has indicated his willingness to serve if elected. However, if the nominee should be unable to serve, the persons named in the proxy card may vote the proxy for a substitute nominee nominated by our board of directors, or our board of directors may reduce the number of directors.

Our board of directors recommends a vote FOR the nominee.

PROPOSAL 2—RATIFICATION OF THE APPOINTMENT OF AUDITORS

The Audit Committee of our board of directors has selected Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2006. Although stockholder approval of our Audit Committee’s selection of Ernst & Young is not required by law, we believe that it is advisable to give stockholders an opportunity to ratify this selection. If our stockholders do not ratify this selection, then our Audit Committee will reconsider the selection. We expect that a representative of Ernst & Young, which served as our auditors for the year ended December 31, 2005, will be present at the annual meeting to respond to appropriate questions, and to make a statement if he or she wishes.

Our board of directors recommends a vote FOR this proposal.

We paid Ernst & Young LLP a total of $308,000 for professional services rendered for the year ended December 31, 2005 and $487,000 for professional services rendered for the year ended December 31, 2004. The following table provides information about these fees.

| | | | | | |

Fee Category | | Fiscal 2005 | | Fiscal 2004 |

Audit Fees(1) | | $ | 261,000 | | $ | 382,000 |

Audit-Related Fees(2) | | $ | 40,000 | | $ | 53,000 |

Tax Fees(3) | | $ | 7,000 | | $ | 52,000 |

Other Fees | | $ | — | | $ | — |

| | | | | | |

Total Fees | | $ | 308,000 | | $ | 487,000 |

| | | | | | |

| (1) | Audit fees consisted of fees for the audit of our annual financial statements, the review of our interim financial statements, the review of financial information included in our filings with the SEC, including those related to our initial public offering, and other professional services provided in connection with statutory and regulatory filings or engagements. |

| (2) | Audit-related fees consisted of fees for assurance and related services that are reasonably related to the performance of the audit and the review of our financial statements and which are not reported under “Audit Fees.” These services related to consultation with regard to various accounting issues. |

| (3) | Tax fees consisted of fees for tax compliance which relate to preparation of original and amended tax returns and tax consultation with regard to various tax matters. |

The Audit Committee of our board of directors believes that the non-audit services described above did not compromise Ernst & Young’s independence. The Audit Committee’s charter, which you can find in the “Investors” section of our website, www.icagen.com, requires that all proposals to engage Ernst & Young for services, and all proposed fees for these services, be submitted to the Audit Committee for approval before

6

Ernst & Young may provide the services. None of the above fees were approved using the “de minimus exception” under SEC rules.

The Audit Committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by the Company’s registered public accounting firm. This policy generally provides that the Company will not engage its registered public accounting firm to render audit or non-audit services unless the service is specifically approved in advance by the Audit Committee or the engagement is entered into pursuant to one of the pre-approval procedures described below.

From time to time, the Audit Committee may pre-approve specified types of services that are expected to be provided to the Company by its registered public accounting firm during the next 12 months. Any such pre-approval is detailed as to the particular service or type of services to be provided and is also generally subject to a maximum dollar amount.

The Audit Committee has also delegated to the chairman of the Audit Committee the authority to approve any audit or non-audit services to be provided to the Company by its registered public accounting firm. Any approval of services by the chairman of the Audit Committee pursuant to this delegated authority is reported on at the next regularly scheduled meeting of the Audit Committee.

INFORMATION ABOUT OUR DIRECTORS, OFFICERS AND 5% STOCKHOLDERS

Security Ownership of Certain Beneficial Owners and Management

The following table contains information as of January 31, 2006 about the beneficial ownership of shares of our common stock by:

| | (1) | each person of whom we are aware who beneficially owns more than 5% of the outstanding shares of our common stock; |

| | (2) | our directors and nominee for director; |

| | (3) | P. Kay Wagoner, Ph.D., our Chief Executive Officer; |

| | (4) | our three other most highly compensated executive officers who were serving as executive officers on December 31, 2005, which we refer to, along with Dr. Wagoner, as our named executive officers; and |

| | (5) | all of our directors and executive officers as a group. |

| | | | | | |

| | | Amount and Nature of Beneficial Ownership(1) | |

Name and Address of Beneficial Owner | | Number of Shares | | | Percent of Class | |

5% Stockholders | | | | | | |

| | |

Entities affiliated with Alta Partners One Embarcadero Center, Suite 4050 San Francisco, CA 94111 | | 2,135,001 | (2) | | 9.7 | % |

| | |

The Goldman Sachs Group, Inc. 85 Broad Street New York, NY 10004 | | 1,934,000 | (3) | | 8.8 | |

| | |

Entities affiliated with Venrock Associates 30 Rockefeller Plaza, Room 5508 New York, NY 10112 | | 1,719,706 | (4) | | 7.8 | |

| | |

Abbott Laboratories 100 Abbott Park Road, Dept. 032L, Bldg. AP6D-2 Abbott Park, IL 60064 | | 1,646,535 | (5) | | 7.5 | |

7

| | | | | | |

| | | Amount and Nature of Beneficial Ownership(1) | |

Name and Address of Beneficial Owner | | Number of Shares | | | Percent of Class | |

Directors and Named Executive Officers | | | | | | |

P. Kay Wagoner, Ph.D. | | 760,974 | (6) | | 3.4 | % |

Richard D. Katz, M.D. | | 345,694 | (7) | | 1.5 | |

Edward P. Gray, J.D. | | 143,021 | (8) | | * | |

J. Heyward Hull, III, Pharm.D., M.S. | | 268,099 | (9) | | 1.2 | |

André L. Lamotte, Sc.D. | | 155,018 | (10) | | * | |

Anthony B. Evnin, Ph.D. | | 1,719,706 | (11) | | 7.8 | |

Richard G. Morrison, Ph.D. | | 18,750 | (12) | | * | |

Charles A. Sanders, M.D. | | 103,750 | (13) | | * | |

Dennis B. Gillings, CBE, Ph.D. | | 968,751 | (14) | | 4.4 | |

Martin A. Simonetti | | 8,333 | (15) | | * | |

All executive officers and directors as a group (10 persons) | | 4,492,096 | (16) | | 19.2 | |

| (1) | As of January 31, 2006, we had 22,050,762 shares of our common stock outstanding. The number of shares that each stockholder, director and executive officer beneficially owns is determined under rules promulgated by the SEC. Under the SEC rules, a person is deemed to beneficially own (a) any shares that the person has sole or shared power to vote or invest and (b) any shares that the person has the right to acquire within 60 days after January 31, 2006(i.e., April 1, 2006) through the exercise of any stock option or warrant, the conversion of any convertible security or the exercise of any other right. However, the inclusion of shares in this table does not mean that the named stockholder is a direct or indirect beneficial owner of the shares for any other purpose. Unless otherwise noted in the footnotes to this table, each person or entity named in the table has sole voting and investment power (or shares this power with his or her spouse) over all shares listed as owned by the person or entity. |

| (2) | Includes 1,327,087 shares owned by Alta BioPharma Partners, L.P., 757,895 shares owned by ICAgen Chase Partners (Alta Bio), LLC, and 50,019 shares owned by Alta Embarcadero BioPharma Partners, LLC. Alta Partners provides investment advisory services to various venture capital funds, including Alta BioPharma Partners, L.P., ICAgen Chase Partners (Alta Bio), LLC and Alta Embarcadero BioPharma Partners, LLC. Jean Deleage, Guy Nohra, Garrett Gruener, Daniel Janney and Alix Marduel, collectively known as the principals, are managing members of Alta BioPharma Management, LLC, the general partner of Alta BioPharma Partners, L.P., and managing members of Alta/Chase BioPharma Management, LLC, the managing member of ICAgen Chase Partners (Alta Bio), LLC. Jean Deleage and Garrett Gruener, collectively known as the principals, are members of Alta Embarcadero BioPharma Partners, LLC. The respective general partner, managing member and members of Alta BioPharma Partners, L.P., ICAgen Chase Partners (Alta Bio) LLC and Alta Embarcadero BioPharma Partners, LLC exercise sole voting and investment power with respect to the shares owned by such funds. The principals of Alta Partners disclaim beneficial ownership of all such shares held by the foregoing funds, except to the extent of their proportionate pecuniary interests therein. |

| (3) | Consists of securities beneficially owned by the investment banking division of The Goldman, Sachs Group, Inc., as a parent holding company, which are owned, or may be deemed to be beneficially owned, by Goldman, Sachs & Co., a broker or dealer registered under Section 15 of the Securities Act of 1933, as amended, and an investment advisor registered under Section 203 of the Investment Advisors Act of 1940. Goldman, Sachs & Co. is a direct and indirect wholly-owned subsidiary of The Goldman Sachs Group, Inc. The securities do not reflect securities, if any, beneficially owned by any other operating unit of The Goldman Sachs Group, Inc. The investment banking division disclaims beneficial ownership of the securities beneficially owned by any client accounts with respect to which the investment banking division or its employees have voting or investment discretion, or both, and certain investment entities, of which the investment banking division is the general partner, managing general partner or other manager, to the extent interests in such entities are held by persons other than the investment banking division. |

8

| (4) | Includes 704,855 shares owned by Venrock Associates and 20,633 shares of common stock issuable upon exercise of stock options issued to Venrock Associates which are exercisable within 60 days of January 31, 2006; and 965,996 shares owned by Venrock Associates II, L.P. and 28,222 shares of common stock issuable upon exercise of stock options issued to Venrock Associates II, L.P. which are exercisable within 60 days of January 31, 2006. The general partners share voting and investment power of the shares held by Venrock Associates and Venrock Associates II, L.P. The general partners of each of Venrock Associates and Venrock Associates II, L.P. are Anthony B. Evnin, one of our directors, Michael C. Brooks, Eric S. Copeland, Bryan E. Roberts, Ray A. Rothrock, Michael F. Tyrrell and Anthony Sun. Messrs. Evnin, Brooks, Copeland, Roberts, Rothrock, Tyrrell and Sun may be deemed to beneficially own the shares held by Venrock Associates and Venrock Associates II, L.P.; however, each person disclaims beneficial ownership of these shares except to the extent of his proportionate pecuniary interest therein. |

| (5) | Abbott Laboratories holds our shares directly and does not share voting or investment power with respect to those shares with any other person. |

| (6) | Includes 400,726 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

| (7) | Consists of 345,694 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

| (8) | Consists of 143,021 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

| (9) | Includes 240,086 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

| (10) | Includes 28,750 shares of common stock issuable upon exercise of stock options issued to Dr. Lamotte exercisable within 60 days of January 31, 2006. Also includes 26,175 shares owned by Medical Science Partners, L.P.; 19,592 shares owned by Medical Science Partners II, L.P. and 41,597 shares owned by European Medical Ventures. Dr. Lamotte, a member of our board of directors, is a managing partner of Medical Science Partners, L.P. and Medical Science Partners II, L.P. and has voting and investment power of the shares held by Medical Science Partners, L.P. and Medical Science Partners II, L.P. Dr. Lamotte may be deemed to be a beneficial owner of these shares but disclaims beneficial ownership as to these shares except to the extent of his proportionate pecuniary interest therein. |

| (11) | Consists of the shares beneficially owned by entities affiliated with Venrock Associates as described in footnote four. Dr. Evnin disclaims beneficial ownership of these shares except to the extent of his proportionate pecuniary interest therein. |

| (12) | Consists of 18,750 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

| (13) | Includes 52,396 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

| (14) | Includes an aggregate of 11,112 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006 and 875,001 shares owned by PharmaBio Development Inc., a wholly-owned subsidiary of Quintiles Transnational Corp. of which Dr. Gillings, one of our directors, is chairman and chief executive officer, and may be deemed to be a beneficial owner of these shares. Dr. Gillings disclaims beneficial ownership of the shares owned by PharmaBio Development Inc. The board of directors of each of PharmaBio Development Inc. and Quintiles share voting and dispositive power over the shares held by PharmaBio Development Inc. The members of the board of directors of each of PharmaBio Development Inc. and Quintiles disclaim beneficial ownership of these shares, except to the extent of their pecuniary interest therein. Dr. Gillings is executive chairman and chief executive officer of, and a member of the board of directors of, Quintiles. |

| (15) | Consists of 8,333 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

| (16) | Includes 1,297,723 shares of common stock issuable upon exercise of stock options exercisable within 60 days of January 31, 2006. |

9

Our Board of Directors

Below is information about each member of our board of directors, including the nominee for election as a Class II director. This information includes each director’s age as of January 31, 2006 and length of service as a director of Icagen, his or her principal occupation and business experience for at least the past five years and the names of other publicly held companies of which he or she serves as a director. There are no family relationships among any of our directors, nominee for director and executive officers.

| | | | | | |

Name | | Age | | Director

Since | | Principal Occupation, Other Business Experience During Past Five Years and Other Directorships |

| Directors Whose Terms Expire in 2008 (Class I Directors) |

| | | |

Anthony B. Evnin, Ph.D. | | 64 | | 1997 | | Dr. Evnin has served as a director since May 1997. Dr. Evnin has been a general partner at Venrock Associates, a venture capital limited partnership, since 1974. Dr. Evnin also serves on the boards of directors of a number of companies, including Coley Pharmaceutical Group, Inc., Memory Pharmaceuticals Corp., Renovis, Inc. and Sunesis Pharmaceuticals Incorporated, biopharmaceutical companies which are public, and several private companies. Dr. Evnin received his Ph.D. in chemistry from the Massachusetts Institute of Technology and his A.B. from Princeton University. |

| | | |

| Dennis B. Gillings, CBE, Ph.D. | | 61 | | 1997 | | Dr. Gillings has served as a director since August 1997. Dr. Gillings is the executive chairman and chief executive officer of, and a member of the board of directors of, Quintiles Transnational Corp., a pharmaceutical services company. Dr. Gillings founded Quintiles in 1982. He served for more than 15 years as professor at the University of North Carolina at Chapel Hill and received the Honorary Degree of Doctor of Science from the University in May 2001. Dr. Gillings has served on several boards and councils, including Triangle Pharmaceuticals, Inc., a publicly traded biotechnology company, the University of North Carolina Health Care System, the Association for Contract Research Organizations, the North Carolina Institute of Medicine and the United Way. Dr. Gillings received a diploma in mathematical statistics from Cambridge University in 1967 and a Ph.D. in mathematics from the University of Exeter, England, in 1972. |

| | | |

Martin A. Simonetti | | 48 | | 2005 | | Mr. Simonetti has served as a director since March 2005. Mr. Simonetti has served as chief executive officer and as a director of VLST Corp., a biotechnology company, since December 2005. Mr. Simonetti was chief financial officer and treasurer of Dendreon Corporation, a biotechnology company, from January 1999 to July 2005 and senior vice president, finance of Dendreon from January 2001 to July 2005. Prior to joining Dendreon, Mr. Simonetti was employed at Amgen Inc., a |

10

| | | | | | |

Name | | Age | | Director

Since | | Principal Occupation, Other Business Experience During Past Five Years and Other Directorships |

| | | |

| | | | | | biotechnology company, most recently serving as vice president operations and finance of Amgen BioPharma and its director of Colorado operations. From 1984 to 1991, Mr. Simonetti worked at Genentech, Inc., a biotechnology company, first as a scientist in its medicinal and analytical chemistry department and later as a financial analyst and group controller. Mr. Simonetti serves on the board of directors of Alexandria Real Estate Equities, a publicly traded real estate investment trust, and is a member of the Dean’s executive advisory board for the Albers School of Business and Economics at Seattle University. Mr. Simonetti received an M.S. in Nutrition from the University of California, Davis and an M.B.A. from the University of Santa Clara. |

|

| Nominee Whose Term Expires at the Annual Meeting (Class II Director) |

| | | |

Charles A. Sanders, M.D. | | 73 | | 1997 | | Dr. Sanders has served as a director since May 1997 and as chairman of the board of directors since October 2005. Dr. Sanders retired in 1995. Dr. Sanders served as chairman and chief executive officer of Glaxo Inc., a pharmaceutical company, from 1989 to May 1995, and also served as a member of the board of directors of Glaxo plc. Previously, Dr. Sanders was general director of Massachusetts General Hospital and professor of medicine at Harvard Medical School. Dr. Sanders is a director of Vertex Pharmaceuticals Incorporated; Biopure Corporation; Genentech, Inc.; Fisher Scientific International; and Cephalon, Inc., all publicly traded biotechnology companies, and LipoScience Inc., a private medical technology company. He is currently a member of the Institute of Medicine of the National Academy of Sciences, a member of the CSIS Board of Trustees, chairman of Project HOPE and chairman of the Foundation for the National Institutes of Health. Dr. Sanders is also past chairman of the New York Academy of Sciences, past chairman of The Commonwealth Fund and past chairman of the Overseers Committee to Visit the Harvard Medical School. Dr. Sanders received his M.D. from Southwestern Medical College of the University of Texas. |

|

| Directors Whose Terms Expire in 2007 (Class III Directors) |

| | | |

André L. Lamotte, Sc.D. | | 57 | | 1992 | | Dr. Lamotte has served as a director since our inception. Dr. Lamotte is currently engaged in venture capital activities focused on the biotechnology sector in Europe and Asia. From 2003 through 2004, Dr. Lamotte served as a venture partner with HBM BioVentures, Ltd., a biotechnology investment fund. Dr. Lamotte is a founder of and has served as managing partner of Medical Science Partners, L.P., a venture capital limited partnership, since |

11

| | | | | | |

Name | | Age | | Director

Since | | Principal Occupation, Other Business Experience During Past Five Years and Other Directorships |

| | | | | | 1988. He also serves as the managing partner of Medical Science Partners, II, L.P. and Medical Science II Co-Investment, L.P. From April 1983 to April 1988, Dr. Lamotte served as vice president and a general partner of Pasteur Merieux Inc., a pharmaceutical company. Dr. Lamotte serves on the board of directors of several private companies as well as Agenix Limited, a biotechnology company listed in Australia, and Arpida Ltd., a biopharmaceutical company listed in Switzerland. Dr. Lamotte received his Sc.D. in chemistry from the Massachusetts Institute of Technology and an M.B.A. from Harvard University. |

| | | |

Richard G. Morrison, Ph.D. | | 69 | | 2004 | | Dr. Morrison has served as a director since January 2004. Dr. Morrison was an adjunct professor of business management and marketing, with a focus on international management, in the Cameron School of Business, University of North Carolina at Wilmington, from 1995 to May 2001. Dr. Morrison had a 30-year international career with Eli Lilly, a pharmaceutical company, holding a number of marketing and general management positions in Europe, the Middle East and in several South American countries. He was president of Lilly Brazil at the time of his retirement from Eli Lilly in December 1993. Dr. Morrison serves on the board of directors of BeaconMedaes, a private medical equipment company, and Diatron MI Ltd. and Diatron Messtechnik GmbH, private medical equipment companies. He is a past member of the board of directors of the Juvenile Diabetes Research Foundation and continues to serve on its nominating committee. Dr. Morrison received a Ph.D. and a Masters degree from Louisiana State University. |

| | | |

P. Kay Wagoner, Ph.D. | | 57 | | 1992 | | Dr. Wagoner is a co-founder of our company and has served as our president and a director since our inception and as chief executive officer since September 1996. Prior to founding Icagen, Dr. Wagoner served in research management positions at Glaxo Inc. where she initiated and led Glaxo’s U.S. ion channel discovery efforts in central nervous system, cardiovascular and metabolic disease. In 2001, Dr. Wagoner received the distinguished alumna award for science and business from the University of North Carolina, Chapel Hill. Dr. Wagoner also serves or has served on a variety of boards of directors, including the University of North Carolina’s Graduate School Advisory Board and the Governing Body of the Biotechnology Industry Organization’s (BIO) Emerging Companies Section. In 2004, Dr. Wagoner was awarded the Entrepreneurial Excellence Award by the Research Triangle-based Council for Entrepreneurial Development, the largest entrepreneurial support organization in the United States, and the Ernst & Young Entrepreneur of the Year Regional Award for Life Sciences and Healthcare. Dr. Wagoner received her Ph.D. in physiology from the University of North Carolina at Chapel Hill. |

12

Our Executive Officers

Below is information about each of our executive officers. This information includes each officer’s age, his or her position with Icagen, the length of time he or she has held each position and his or her business experience for at least the past five years. Our board of directors elects our officers annually, and officers serve until they resign or the board terminates their position. There are no family relationships among any of our directors, nominee for director and executive officers.

| | | | |

Name | | Age | | Position and Business Experience

During Past Five Years |

P. Kay Wagoner, Ph.D. | | 57 | | President and Chief Executive Officer. For more information, see “Our Board of Directors” above. |

| | |

Richard D. Katz, M.D. | | 42 | | Senior Vice President, Finance and Corporate Development, Chief Financial Officer and Treasurer. Dr. Katz has been our senior vice president, finance and corporate development, chief financial officer and treasurer since April 2001. From August 1996 to 2001, Dr. Katz worked in the Investment Banking Division of Goldman Sachs, an investment banking firm, most recently as a vice president in the Healthcare Group. Prior to joining Goldman Sachs, Dr. Katz earned a Masters in Business Administration from Harvard Business School where he graduated as a Baker Scholar. Dr. Katz earned his M.D. from the Stanford University School of Medicine and completed an internship in general surgery at the Hospital of the University of Pennsylvania. Dr. Katz received his A.B. in applied mathematics with high distinction from Harvard University. |

| | |

Edward P. Gray, J.D. | | 56 | | Senior Vice President, Intellectual Property, Chief Patent Counsel and Secretary. Mr. Gray has been our senior vice president, intellectual property, and chief patent counsel since August 2001 and our secretary since March 2004. Mr. Gray was retired from 1999 to 2001. From 1992 to 1999, Mr. Gray held several positions in the intellectual property department of Eli Lilly & Company, including most recently assistant general patent counsel and special patent counsel. Mr. Gray also served from 1989 to 1992 as general counsel for Cardiac Pacemakers, Inc., a medical device company and former subsidiary of Eli Lilly. Mr. Gray received his J.D. from the University of Toledo and a B.S. in pharmacy from Butler University. Mr. Gray is a member of several state and federal bars, including the United States Supreme Court and the U.S. Court of Appeals, Federal Circuit. Mr. Gray is a member of the American Intellectual Property Law Association and the Licensing Executives Society and a past member of the Food and Drug Law Institute. |

| | |

J. Heyward Hull, III, Pharm.D., M.S. | | 64 | | Senior Vice President, Development and Regulatory Affairs. Dr. Hull has been our senior vice president, development and regulatory affairs since March 2000. Dr. Hull will retire from this position on May 17, 2006. After his retirement as senior vice president, development and regulatory affairs, Dr. Hull will continue part-time employment with Icagen as its principal clinical research scientist. From 1995 to 2000, Dr. Hull held senior management positions at Quintiles Transnational Corp., including group vice president. From 1978 to 1995, Dr. Hull held positions of increasing responsibility at Burroughs Wellcome Co., a pharmaceutical company, including director of cardiovascular medicine. Dr. Hull currently serves as an adjunct clinical professor at the University of North Carolina School of Pharmacy. Dr. Hull received his doctorate in pharmacy from the University of North Carolina, Chapel Hill. |

13

CORPORATE GOVERNANCE

We are committed to strong and effective corporate governance because we believe that it leads to long-term value for our stockholders and, ultimately, makes us more competitive. We have taken the following steps, among others, to strengthen our governance practices:

| | • | | The majority of the members of our board of directors are independent, as defined by Nasdaq listing standards. Of our seven directors, only two (Dr. Wagoner and Dr. Gillings) do not meet the Nasdaq independence criteria. |

| | • | | Our Audit Committee, Compensation Committee and Nominating/Corporate Goverance Committee are all composed solely of independent directors. |

| | • | | Our board of directors and board committees are active in the execution of their duties. During 2005, our board met seven times, either in person or by teleconference, and acted by written consent on two occasions; our Audit Committee met nine times, either in person or by teleconference, and acted by written consent on one occasion; our Compensation Committee met four times, either in person or by teleconference, and acted by written consent on two occasions; and our Nominating/Corporate Governance Committee met two times, either in person or by teleconference, and acted by written consent on two occasions. Other than Dr. Gillings, all of our directors attended at least 75% of the meetings of our board and of the committees on which they served. |

| | • | | The independent members of our board of directors regularly meet in executive session without Dr. Wagoner or any other Icagen employees present. |

| | • | | We have adopted written Corporate Governance Guidelines and a written Code of Business Conduct and Ethics for all of our officers, employees and directors. |

| | • | | Our board of directors has adopted written charters for all of our board committees. The charters of our Audit Committee, Compensation Committee and Nominating/Corporate Governance Committee give each of these committees the authority to retain independent legal, accounting and other advisors. |

| | • | | We have a separate president and chief executive officer (Dr. Wagoner) and chairman of the board (Dr. Sanders), instead of combining these two offices under one person. Our chairman is an independent director. |

You can find our Corporate Governance Guidelines, Code of Business Conduct and Ethics and the charters for our Audit, Compensation and Nominating/Corporate Governance Committees in the “Investors” section of our website, www.icagen.com, or by contacting our investor relations department at the address, telephone number or e-mail set forth below. We will post any amendments to these documents on our website. If we grant a waiver of any part of our Code of Business Conduct and Ethics to any of our executive officers or directors, we will disclose the waiver that is required to be disclosed pursuant to the disclosure requirements of Item 5.05 of Form 8-K on our website.

Icagen, Inc.

4222 Emperor Boulevard, Suite 350

Durham, North Carolina 27703

Attention: Investor Relations

(919) 941-5206

investorsandpress@icagen.com

Under applicable Nasdaq rules, a director of Icagen will only qualify as an “independent director” if, in the opinion of our board of directors, that person does not have a relationship which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Our board of directors has determined that none of Dr. Evnin, Mr. Simonetti, Dr. Sanders, Dr. Lamotte or Dr. Morrison has a relationship which would

14

interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is an “independent director” as defined under Rule 4200(a)(15) of The Nasdaq Stock Market, Inc. marketplace rules.

Committees of our Board of Directors

Audit Committee:Our Audit Committee consists of Dr. Morrison (Chairman), Dr. Evnin and Mr. Simonetti, all of whom meet The Nasdaq Stock Market criteria for independence and are able to read and understand financial statements. In addition, our board has determined that Mr. Simonetti is an “audit committee financial expert” as defined by the SEC. The Audit Committee’s responsibilities are:

| | • | | appointing, approving the compensation of, and assessing the independence of our independent registered public accounting firm; |

| | • | | overseeing the work of our independent auditors, including through the receipt and consideration of certain reports from our independent registered public accounting firm; |

| | • | | reviewing and discussing with management and the independent registered public accounting firm our annual and quarterly financial statements and related disclosures; |

| | • | | coordinating our board of directors’ oversight of internal control over financial reporting, disclosure controls and procedures and code of business conduct and ethics; |

| | • | | establishing procedures for the receipt and retention of accounting-related complaints and concerns; |

| | • | | meeting independently with our independent registered public accounting firm and management; and |

| | • | | preparing the audit committee report required by SEC rules. |

Compensation Committee:Our Compensation Committee consists of Dr. Sanders (Chairman), Dr. Lamotte and Mr. Simonetti. Each of Dr. Sanders, Dr. Lamotte and Mr. Simonetti meet The Nasdaq Stock Market criteria for independence. The Compensation Committee’s responsibilities are:

| | • | | reviewing and approving, or making recommendations to the board of directors with respect to, the compensation of our chief executive officer and our other executive officers; |

| | • | | overseeing and administering, and making recommendations to the board of directors with respect to, our cash and equity incentive plans; |

| | • | | reviewing and making recommendations to the board of directors with respect to director compensation; and |

| | • | | preparing the compensation committee report required by SEC rules. |

Nominating/Corporate Governance Committee:Our Nominating/Corporate Governance Committee consists of Dr. Evnin (Chairman), Dr. Lamotte, Dr. Morrison and Dr. Sanders, all of whom meet The Nasdaq Stock Market criteria for independence. The Committee’s responsibilities include:

| | • | | recommending to the board of directors the persons to be nominated for election as directors or to fill vacancies on the board of directors, and to be appointed to each of the board’s committees; |

| | • | | overseeing an annual review by the board of directors with respect to management succession planning; |

| | • | | developing and recommending to the board of directors corporate governance principles and guidelines; and |

| | • | | overseeing periodic evaluations of the board of directors. |

The process followed by the Nominating/Corporate Governance Committee to identify and evaluate director candidates includes requests to members of our board of directors and others for recommendations, meetings

15

from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the committee and our board of directors. In addition, during the fiscal year ended December 31, 2005, we retained the services of an executive search firm to help identify and evaluate potential director candidates.

In considering whether to recommend any particular candidate for inclusion in the board of directors’ slate of recommended director nominees, the Nominating/Corporate Governance Committee applies the criteria attached to the Corporate Governance Guidelines. These criteria include:

| | • | | a reputation for integrity, honesty and adherence to high ethical standards; |

| | • | | business acumen and experience and the ability to exercise sound judgment with respect to Icagen’s objectives; |

| | • | | a commitment to understand Icagen and its industry and to regularly attend and participate in board and committee meetings; |

| | • | | the interest and ability to understand the sometimes conflicting interests of the various constituencies of Icagen, including stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders; and |

| | • | | an absence of actual or potential conflicts of interest, or the appearance of conflicts of interest, that would impair the candidate’s ability to represent the interests of all stockholders. |

The Nominating/Corporate Governance Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. We believe that the backgrounds and qualifications of our directors, considered as a group, should provide a composite mix of experience, knowledge and abilities that will allow our board of directors to fulfill its responsibilities.

The process for considering an incumbent director for reelection to the board of directors is that the Nominating/Corporate Governance Committee considers the composition of the entire board, the strengths and contributions of each member of the board, and the strengths and contributions of the particular director being considered. After discussion among the committee members, the committee decides whether to recommend to the full board that the director be nominated for reelection.

Stockholders may recommend individuals to the Nominating/Corporate Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials and a statement as to whether the stockholder or group of stockholders making the recommendation has beneficially owned more than 5% of the Company’s common stock for at least a year as of the date such recommendation is made, to Nominating/Corporate Governance Committee, c/o Corporate Secretary, Icagen, Inc., 4222 Emperor Boulevard, Suite 350, Durham, North Carolina 27703. Assuming that appropriate biographical and background material has been provided on a timely basis, the committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria as it follows for candidates submitted by others.

Stockholders also have the right under our bylaws to directly nominate directors candidates, without any action or recommendation on the part of the Nominating/Corporate Governance Committee or our board of directors, by following the procedures set forth under “Information About the Annual Meeting and Voting—Can I recommend a candidate for Icagen’s board of directors?”.

You can find more detailed information on our process for selecting board members and our criteria for board nominees in the Corporate Governance Guidelines posted in the “Investors” section of our website, www.icagen.com.

16

Audit Committee Report

The Audit Committee has reviewed and discussed with our management our audited financial statements for the year ended December 31, 2005. The Audit Committee has reviewed and discussed with Ernst & Young LLP, our independent registered public accounting firm, our audited financial statements and the matters required by Statement on Auditing Standards No. 61 (Communication with Audit Committees). SAS 61 requires our independent registered public accounting firm to discuss with the Audit Committee the following, among other things:

| | • | | methods to account for significant unusual transactions; |

| | • | | the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus; |

| | • | | the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors’ conclusions regarding the reasonableness of those estimates; and |

| | • | | disagreements with management, if any, over the application of accounting principles, the basis for management’s accounting estimates and the disclosures in the financial statements. |

The Audit Committee has also received from Ernst & Young the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee has discussed the matters disclosed in the letter and the independence of Ernst & Young with representatives of that firm. Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditors’ professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. The Audit Committee also considered whether the provision by Ernst & Young of the non-audit services discussed under “Proposal 2—Ratification of the Appointment of Auditors” is compatible with maintaining the auditors’ independence and determined that the non-audit services were indeed compatible with maintaining Ernst & Young’s independence.

Based on its discussions with management and Ernst & Young, and its review of the representations and information provided by management and Ernst & Young, the Audit Committee recommended to the board of directors that Icagen’s audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2005 for filing with the SEC.

This Audit Committee report is not incorporated by reference into any of our previous or future filings with the SEC, unless any such filing explicitly incorporates the report.

Richard G. Morrison, Chairman

Anthony B. Evnin

Martin A. Simonetti

17

COMPENSATION OF OUR DIRECTORS AND EXECUTIVE OFFICERS

Compensation of our Directors

We reimburse non-employee directors for out-of-pocket expenses they incur in attending board and committee meetings and pay each non-employee director an annual retainer fee of $25,000. The chairman of our Audit Committee receives an additional annual retainer of $10,000 and our other committee chairmen receive an additional annual retainer of $3,000. In addition, we pay each non-employee director $1,000 for attendance at each board meeting in which he or she participates in person or $500 if attendance is by telephone. Each non-employee director also receives $1,000 for each meeting of a committee of the board that he or she participates in person or $500 if attendance is by telephone that is held on a day other than the day of any meeting of the full board of directors. Directors who are also our employees do not receive any compensation in their capacities as directors.

Each of our non-employee directors receives options to purchase 25,000 shares of our common stock for his or her services as a director for each three-year term served. The options for our current directors are granted every three calendar years as of the first business day of the calendar year. The options for new directors will be granted as of the date of the election or appointment of the director to the board of directors. The options granted to the non-employee directors vest monthly over three years, subject to the director’s continued service as a director. In addition, our chairman of the board of directors receives options to purchase 20,000 additional shares of our common stock for his or her services as a director for each year served. The options for our chairman of the board of directors are granted every calendar year in January of each year. The options granted to the chairman of the board of directors vest monthly over one year commencing on January 1, subject to the director’s continued service as a director. Options granted to non-employee directors have exercise prices equal to the fair market value of common stock at the date of grant.

Compensation of our Executive Officers

Summary Compensation

The following table contains information about the compensation of each of our named executive officers for the three years ended December 31, 2005.

Summary Compensation Table

| | | | | | | | | | | | | | | | | |

Name and Principal Position | | | | | Long-Term

Compensation

Awards | | |

| | Annual Compensation | | | Number of

Shares

Underlying

Options(#) | | All Other

Compensation ($)(2) |

| | Year | | Salary($) | | Bonus($) | | Other Annual

Compensation | | | |

P. Kay Wagoner, Ph.D. President and Chief Executive Officer | | 2005

2004

2003 | | $

$

$ | 304,840

276,750

270,000 | | $

$ | 50,000

—

1,000 | |

| —

—

— |

| | 75,000

125,000

— | | $

$

$ | 1,800

1,400

1,283 |

| | | | | | |

Richard D. Katz, M.D. Senior Vice President, Finance and Corporate Development, Chief Financial Officer and Treasurer | | 2005

2004

2003 | | $

$

$ | 244,697

229,442

220,000 | | $

$

$ | 74,833

1,000

1,000 | | $

$

$ | 42,000

45,000

48,000 | (1)

(1)

(1) | | 40,000

72,221

10,000 | |

| —

—

— |

| | | | | | |

J. Heyward Hull, III, Pharm.D., M.S. Senior Vice President, Development and Regulatory Affairs | | 2005

2004

2003 | | $

$

$ | 231,592

216,784

208,464 | |

$

$ | —

71,000

1,000 | |

| —

—

— |

| | 18,000

25,000

55,695 | | $

$

$ | 1,800

1,600

1,400 |

| | | | | | |

Edward P. Gray, J.D. Senior Vice President, Intellectual Property, Chief Patent Counsel and Secretary | | 2005

2004

2003 | | $

$

$ | 201,652

189,430

180,710 | | $

$

$ | 21,252

1,000

1,000 | |

| —

—

— |

| | 50,000

15,000

15,000 | |

| —

—

— |

| (1) | Represents loan forgiveness including principal and accrued interest. |

| (2) | Represents the value of our contributions on behalf of the named executive officer to our 401(k) savings plan. |

18

Option Grants

The following table contains information about grants of stock options during the year ended December 31, 2005 to each named executive officer.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | Individual Grants | | |

| | | Number of

Shares

Underlying

Options

Granted(#)(1) | | Percent of

Total Options

Granted to

Employees in

Fiscal

Year(%) | | | Exercise

Price Per

Share ($) | | Expiration

Date | | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for

Option Term($)(2) |

Name | | | | | | 5% | | 10% |

P. Kay Wagoner, Ph.D. | | 75,000 | | 11.8 | % | | $ | 6.74 | | 5/11/15 | | $ | 317,906 | | $ | 805,637 |

Richard D. Katz, M.D. | | 40,000 | | 6.3 | % | | $ | 6.74 | | 5/11/15 | | $ | 169,550 | | $ | 429,673 |

J. Heyward Hull, III, Pharm.D., M.S. | | 18,000 | | 2.8 | % | | $ | 6.74 | | 5/11/15 | | $ | 76,297 | | $ | 193,353 |

Edward P. Gray, J.D. | | 50,000 | | 7.9 | % | | $ | 6.74 | | 5/11/15 | | $ | 211,937 | | $ | 537,091 |

| (1) | The stock options vest monthly over a four-year period. The stock options provide that all of the options that are unvested and unexercisable become immediately vested and exercisable if there is a change in control of Icagen and the optionholder loses his or her position with the acquiring or succeeding corporation or is offered a position of diminished responsibilities on or prior to the eighteen-month anniversary of the date of the reorganization event. |

| (2) | These amounts represent total hypothetical gains that each named executive officer could achieve if he or she were to exercise each of his or her stock options in full just before it expires. These amounts assume that our stock price will appreciate at a rate of 5% and 10% compounded annually from the date on which the options were granted until their expiration. The gains shown are net of the option exercise price, but do not include deductions for taxes or other expenses associated with the exercise of the option or the sale of the underlying shares. The gains shown are purely hypothetical; of course, we cannot predict how our stock price will perform in the future, nor can we predict how long an executive officer will actually remain an employee of Icagen. |

Aggregated Option Exercises and Year-End Option Table

The following table contains information about stock options exercised during the year ended December 31, 2005 and stock options held on December 31, 2005 by each of our named executive officers.

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year-End Option Values

| | | | | | | | | |

| | | Shares

Acquired on

Exercise(#) | | Value

Realized($) | | Number of Shares

Underlying

Unexercised Options at Fiscal Year-End(#) | | Value of Unexercised

In-the-Money Options at

Fiscal Year-End($)(1) |

Name | | | | Exercisable/ Unexercisable | | Exercisable/ Unexercisable |

P. Kay Wagoner, Ph.D. | | — | | — | | 385,099/157,294 | | $ | 1,945,756/$169,559 |

Richard D. Katz, M.D. | | — | | — | | 338,054/84,167 | | $ | 1,389,984/$ 60,627 |

J. Heyward Hull, III, Pharm.D., M.S. | | — | | — | | 232,665/53,017 | | $ | 1,196,760/$119,731 |

Edward P. Gray, J.D. | | — | | — | | 136,767/63,233 | | $ | 549,357/$ 43,393 |

| (1) | Value is based on $6.45, the last sales price per share of our common stock on December 31, 2005, as reported on The Nasdaq National Market, less the exercise price of the stock option. |

19

Employment Agreements

Dr. P. Kay Wagoner, Ph.D. Pursuant to an amended and restated executive employment agreement effective February 1, 2006, we agreed to continue to employ Dr. Wagoner as our president and chief executive officer for a term beginning February 1, 2006 and ending July 6, 2007. The agreement is renewable for consecutive additional one-year terms. Under this agreement, Dr. Wagoner is entitled to an annual base salary of at least $340,000. Annual increases, if any, will be made based on performance and in the sole discretion of our board of directors or our Compensation Committee. Dr. Wagoner is also eligible to participate in any management bonus plans established by our board from time to time. In addition, she is eligible to receive such grants of stock options or other stock based awards as may be awarded in the discretion of our board or our Compensation Committee. Upon the termination of her employment by us other than for cause or by Dr. Wagoner for good reason, including, under specified circumstances, a change in control of Icagen, Dr. Wagoner has the right to receive a severance payment in an amount equal to 24 times her monthly base salary and the average of the cash bonus awards made to Dr. Wagoner during the two-year period prior to her termination. In addition, Dr. Wagoner is entitled to the continuation of benefits for a comparable period of time as a result of any such termination. If we choose not to renew the employment agreement with Dr. Wagoner, she is entitled to receive a severance payment in an amount equal to 18 times her monthly base salary and the average of the cash bonus awards made to Dr. Wagoner during the two-year period prior to her termination. Dr. Wagoner is required to sign a general release of claims with us as a condition to her receipt of any severance payment under the agreement. If at any time any such payment to Dr. Wagoner constitutes an excess parachute payment within the meaning of Section 280G of the Internal Revenue Code, Dr. Wagoner is entitled to be reimbursed by us for any taxes owed, subject to certain limitations specified in the agreement, and any such tax gross-up payment must be paid in accordance with Section 409A of the Internal Revenue Code. Dr. Wagoner agrees that the severance benefit and continuing benefits to which she may become entitled under the agreement shall be paid in accordance with Section 409A of the Internal Revenue Code and agrees that, to the extent required in order to avoid the imposition on Dr. Wagoner of any excise tax under Section 409A of the Internal Revenue Code, the initial payment of the severance benefit or continuing benefits may be delayed for a period of six months following the date of termination of her employment. Pursuant to this agreement, Dr. Wagoner is bound by the terms of our standard non-disclosure, inventions and non-competition agreement, which prohibits her from competing with us during the term of her employment and for a period of two years after termination of employment.

Dr. Richard D. Katz, M.D. Pursuant to an amended and restated executive employment agreement effective February 1, 2006, we agreed to continue to employ Dr. Katz as our senior vice president of finance and corporate development, chief financial officer and treasurer for a term beginning February 1, 2006 and ending April 23, 2007. The agreement is renewable for consecutive additional one-year terms. Under this agreement, Dr. Katz is entitled to an annual base salary of at least $260,741. Annual increases, if any, will be made based on performance and in the sole discretion of our board of directors or our Compensation Committee. Dr. Katz is also eligible to participate in any management bonus plans established by our board from time to time. In addition, he is eligible to receive such grants of stock options or other stock based awards as may be awarded in the discretion of our board or our Compensation Committee. Upon the termination of his employment by us other than for cause or by Dr. Katz for good reason, including, under specified circumstances, a change in control of Icagen, Dr. Katz has the right to receive a severance payment in an amount equal to 18 times his monthly base salary. In addition, Dr. Katz is entitled to the continuation of benefits for a comparable period of time as a result of any such termination. If we choose not to renew the employment agreement with Dr. Katz, he is entitled to receive a severance payment in an amount equal to 12 times his monthly base salary. Dr. Katz is required to sign a general release of claims with us as a condition to his receipt of any severance payment under the agreement. If at any time any such payment to Dr. Katz constitutes an excess parachute payment within the meaning of Section 280G of the Internal Revenue Code, Dr. Katz is entitled to be reimbursed by us for any taxes owed, subject to certain limitations specified in the agreement, and any such tax gross-up payment must be paid in accordance with Section 409A of the Internal Revenue Code. Dr. Katz agrees that the severance benefit and continuing benefits to which he may become entitled under the agreement shall be paid in accordance with Section 409A of the Internal Revenue Code and agrees that, to the extent required in order to avoid the imposition on Dr. Katz of any excise

20

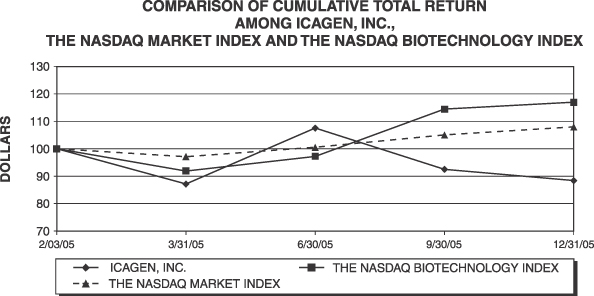

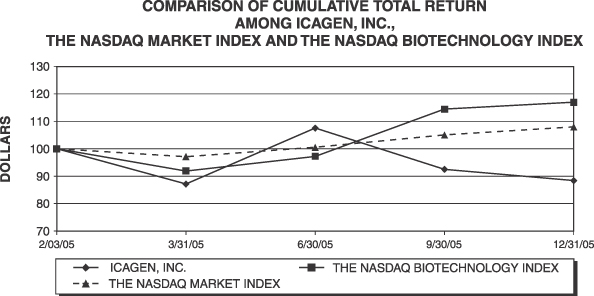

tax under Section 409A of the Internal Revenue Code, the initial payment of the severance benefit or continuing benefits may be delayed for a period of six months following the date of termination of his employment. Pursuant to this agreement, Dr. Katz is bound by the terms of our standard non-disclosure, inventions and non-competition agreement, which prohibits him from competing with us during the term of his employment and for a period of two years after termination of employment. In connection with his employment and relocation, on April 11, 2002, we provided a loan to Dr. Katz for the purchase of a new home that is evidenced by a promissory note in the aggregate principal amount of $200,000 with interest at a fixed annual rate of 4.65%. The note is payable in five annual installments of principal plus accrued interest commencing on April 23, 2002. So long as Dr. Katz remains our employee, $40,000 of the principal balance plus accrued interest is forgiven annually. As of December 31, 2005, the total principal amount outstanding under the loan was approximately $40,000.