| OMB APPROVAL |

| OMB Number: 3235-0570 |

| Expires: November 30, 2005 |

| Estimated average burden |

| hours per response... 5.0 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07678

American Municipal Income Portfolio Inc.

(Exact name of registrant as specified in charter)

800 Nicollet Mall, Minneapolis, MN | | 55402 |

(Address of principal executive offices) | | (Zip code) |

Joseph M. Ulrey III 800 Nicollet Mall, Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-677-3863

Date of fiscal year end: January 31, 2004

Date of reporting period: July 31, 2004

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Item 1. Report to Shareholders

American Municipal

Income

Portfolio

XAA

July 31, 2004 |

Semiannual Report |

American Municipal Income Portfolio

Our Image – George Washington

His rich legacy as patriot and leader is widely recognized as embodying the sound judgment, reliability, and strategic vision that are central to our brand. Fashioned in a style reminiscent of an 18th century engraving, the illustration conveys the symbolic strength and vitality of Washington, which are attributes that we value at First American.

| | Table of Contents |

| | |

| | Financial Statements |

| | |

| | Notes to Financial Statements |

| | |

| | Schedule of Investments |

| | |

| | Shareholder Update |

NOT FDIC INSURED NO BANK GUARANTEE MAY LOSE VALUE

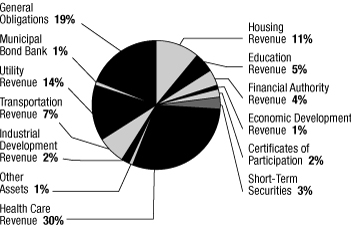

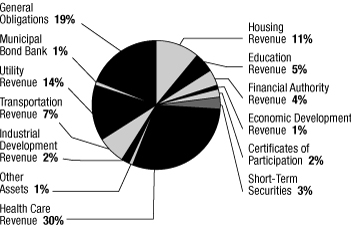

Portfolio Composition

As a percentage of total assets on July 31, 2004

Credit Quality Breakdown

As a percentage of total assets on July 31, 2004; ratings are the higher of Standard & Poor's or Moody's Investors Service

| AAA/Aaa | | | 51 | % | |

| AA/Aa | | | 7 | % | |

| A | | | 14 | % | |

| BBB/Baa | | | 17 | % | |

| Nonrated | | | 11 | % | |

| | | | 100 | % | |

2004 Semiannual Report

American Municipal Income Portfolio

1

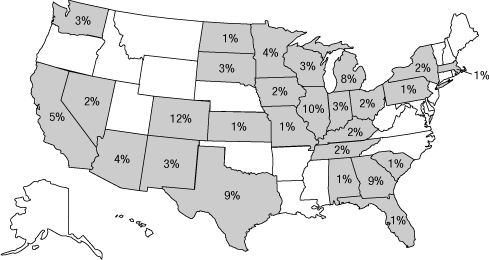

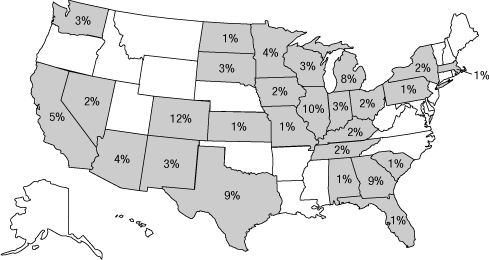

Geographical Distribution

As a percentage of total assets on July 31, 2004

2004 Semiannual Report

American Municipal Income Portfolio

2

Financial STATEMENTS (Unaudited)

Statement of Assets and Liabilities July 31, 2004

| Assets: | | | |

| Investments in unaffiliated securities, at market value* (note 2) | | $ | 124,987,568 | | |

Investment in affiliated money market fund, at

market value** (note 5) | | | 4,492,408 | | |

| Receivable for investment securities sold | | | 2,494,025 | | |

| Receivable for accrued interest | | | 1,507,941 | | |

| Other assets | | | 18,368 | | |

| Total assets | | | 133,500,310 | | |

| Liabilities: | | | |

| Payable for preferred share distributions (note 3) | | | 3,611 | | |

| Payable for investment securities purchased | | | 2,514,275 | | |

| Payable for investment management fees (note 5) | | | 38,705 | | |

| Payable for administrative fees (note 5) | | | 22,117 | | |

| Payable for remarketing agent fees (note 5) | | | 12,634 | | |

| Payable for other expenses | | | 63,290 | | |

| Total liabilities | | | 2,654,632 | | |

| Preferred shares, at liquidation value | | | 43,500,000 | | |

| Net assets applicable to outstanding common shares | | $ | 87,345,678 | | |

Net assets applicable to outstanding common shares

consist of: | | | |

| Common shares and additional paid-in capital | | $ | 80,009,100 | | |

| Undistributed net investment income | | | 1,370,852 | | |

| Accumulated net realized loss on investments | | | (168,700 | ) | |

| Unrealized appreciation of investments | | | 6,134,426 | | |

| Net assets applicable to outstanding common shares | | $ | 87,345,678 | | |

| *Investments in unaffiliated securities, at cost | | $ | 118,853,142 | | |

| **Investment in affiliated money market fund, at cost | | $ | 4,492,408 | | |

| Net asset value and market price of common shares: | | | |

| Net assets applicable to outstanding common shares | | $ | 87,345,678 | | |

Common shares outstanding (authorized 200 million shares of

$0.01 par value) | | | 5,756,267 | | |

| Net asset value per share | | $ | 15.17 | | |

| Market price per share | | $ | 14.15 | | |

| Liquidation preference of preferred shares (note 3): | | | |

| Preferred shares outstanding (authorized one million shares) | | | 1,740 | | |

| Liquidation preference per share | | $ | 25,000 | | |

See accompanying Notes to Financial Statements.

2004 Semiannual Report

American Municipal Income Portfolio

3

Financial STATEMENTS (Unaudited) continued

Statement of Operations For the Six Months Ended July 31, 2004

| Investment income: | | | |

| Interest from unaffiliated securities | | $ | 3,342,698 | | |

| Dividends from affiliated money market fund | | | 21,862 | | |

| Total investment income | | | 3,364,560 | | |

| Expenses (note 5): | | | |

| Investment management fees | | | 229,537 | | |

| Administrative fees | | | 131,164 | | |

| Remarketing agent fees | | | 54,063 | | |

| Custodian fees | | | 9,837 | | |

| Transfer agent fees | | | 33,933 | | |

| Registration fees | | | 16,828 | | |

| Reports to shareholders | | | 27,571 | | |

| Directors' fees | | | 3,757 | | |

| Audit and legal fees | | | 23,205 | | |

| Other expenses | | | 20,743 | | |

| Total expenses | | | 550,638 | | |

| Net investment income | | | 2,813,922 | | |

| Net realized and unrealized gains (losses) on investments: | | | |

| Net realized gain on investments (note 4) | | | 393,728 | | |

| Net change in unrealized depreciation of investments | | | (3,102,546 | ) | |

| Net loss on investments | | | (2,708,818 | ) | |

| Distributions to preferred shareholders (note 2): | | | |

| From net investment income | | | (209,173 | ) | |

Net decrease in net assets applicable to common shares

resulting from operations | | $ | (104,069 | ) | |

See accompanying Notes to Financial Statements.

2004 Semiannual Report

American Municipal Income Portfolio

4

Statements of Changes in Net Assets

| | | Six Months

Ended

7/31/04

(Unaudited) | | Year Ended

1/31/04 | |

| Operations: | | | |

| Net investment income | | $ | 2,813,922 | | | $ | 5,876,556 | | |

| Net realized gain on investments | | | 393,728 | | | | 955,092 | | |

| Net change in unrealized appreciation or depreciation of investments | | | (3,102,546 | ) | | | 2,018,611 | | |

| Distributions to preferred shareholders (note 2): | |

| From net investment income | | | (209,173 | ) | | | (419,577 | ) | |

Net increase (decrease) in net assets applicable to common

shares resulting from operations | | | (104,069 | ) | | | 8,430,682 | | |

| Distributions to common shareholders (note 2): | | | |

| From net investment income | | | (2,693,934 | ) | | | (5,387,866 | ) | |

| Total increase (decrease) in net assets applicable to common shares | | | (2,798,003 | ) | | | 3,042,816 | | |

| Net assets applicable to common shares at beginning of period | | | 90,143,681 | | | | 87,100,865 | | |

| Net assets applicable to common shares at end of period | | $ | 87,345,678 | | | $ | 90,143,681 | | |

| Undistributed net investment income | | $ | 1,370,852 | | | $ | 1,460,037 | | |

See accompanying Notes to Financial Statements.

2004 Semiannual Report

American Municipal Income Portfolio

5

Notes to Financial STATEMENTS (Unaudited)

| | (1 | ) Organization | | American Municipal Income Portfolio Inc. (the "Fund") is registered under the Investment Company Act of 1940 (as amended) as a diversified, closed-end management investment company. The Fund invests primarily in a diverse range of municipal securities that, at the time of purchase, are rated investment grade or are unrated and deemed to be of comparable quality by U.S. Bancorp Asset Management, Inc. ("USBAM"). The Fund may invest up to 5% of its total assets in municipal securities that, at the time of purchase, are rated lower than investment grade or are unrated and deemed to be of comparable quality by USBAM. The Fund will not invest in municipal securities that, at the time of purchase, are rated lower than B or are unrated and deemed to be of comparable quality by USBAM. Additional information regarding recent investment policy changes can be found in the shareholder update section of the report. Municipal sec urities in which the Fund invests may include municipal derivative securities, such as inverse floating rate and inverse interest-only municipal securities. The Fund's investments also may include futures contracts, options on futures contracts, options, and interest rate swaps, caps, and floors. Although the Fund is authorized to invest in the financial instruments mentioned in the preceding sentence, and may do so in the future, the Fund did not make any such investments during the six months ended July 31, 2004. Fund shares are listed on the New York Stock Exchange under the symbol XAA. | |

|

| | (2 | ) Summary of Significant Accounting Policies | | Security Valuations | |

|

| | | | | Security valuations for the Fund's investments are furnished by one or more independent pricing services that have been approved by the Fund's board of directors. Investments in equity securities that are traded on a national securities exchange are stated at the last quoted sales price if readily available for such securities on each business day. For | |

|

2004 Semiannual Report

American Municipal Income Portfolio

6

| securities traded on NASDAQ national market system, the Fund utilizes the NASDAQ Official Closing Price which compares the last trade to the bid/ask price of a security. If the last trade is within the bid/ask range, then that price will be the closing price. If the last trade is outside the bid/ask range, and falls above the ask, the ask price will be the closing price. If the last trade is below the bid, the bid will be the closing price. Other equity securities traded in the over-the-counter market and listed equity securities for which no sale was reported on that date are stated at the last quoted bid price. Debt obligations exceeding 60 days to maturity are valued by an independent pricing service. The pricing service may employ methodologies that utilize actual market transactions, broker-dealer supplied valuations, or other formula-driven valuation techniques. These techniques generally consider such factors as yields or prices of bonds of comparable quality, type of issue, coupon, maturity, ratings, and general market conditions. Securities for which prices are not available from an independent pricing service but where an active market exists are valued using market quotations obtained from one or more dealers that make markets in the securities or from a widely-used quotation system. When market quotations are not readily available, securities are valued at fair value as determined in good faith by procedures established and approved by the Fund's board of directors. Some of the factors which may be considered by the board of directors in determining fair value are fundamental analytical data relating to the investment; the nature and duration of any restrictions on disposition; trading in similar securities of the same issuer or comparable companies; information from broker-dealers; and an evaluation of the forces that influence the market in which the securities are purchased and sold. If events occur that mat erially affect the value of securities (including non-U.S. securities) between the close of trading in those securities and the close of regular trading on the New York Stock Exchange, the securities will be valued at fair value. As of | |

|

2004 Semiannual Report

American Municipal Income Portfolio

7

Notes to Financial STATEMENTS (Unaudited) continued

| July 31, 2004, the Fund had no fair valued securities. Debt obligations with 60 days or less remaining until maturity may be valued at their amortized cost, which approximates market value. Security valuations are performed once a week and at the end of each month. | |

|

| Security Transactions and Investment Income | |

|

| The Fund records security transactions on the trade date of the security purchase or sale. Dividend income is recorded on the ex-dividend date. Interest income, including accretion of bond discounts and amortization of premiums, is recorded on an accrual basis. Security gains and losses are determined on the basis of identified cost, which is the same basis used for federal income tax purposes. | |

|

| Inverse Floaters | |

|

| As part of its investment strategy, the Fund may invest in certain securities for which the potential income return is inversely related to changes in a floating interest rate (inverse floaters). In general, income on inverse floaters will decrease when short-term interest rates increase and increase when short-term interest rates decrease. Inverse floaters may be characterized as derivative securities and investments in these securities may subject the Fund to the risks of reduced or eliminated interest payments and losses of invested principal. In addition, inverse floaters have the effect of providing investment leverage and, as a result, the market values of such securities will generally be more volatile than those of fixed-rate, tax-exempt securities. To the extent the Fund invests in inverse floaters, the net asset value of the Fund's shares may be more volatile than if the Fund did not invest in such securi ties. As of July 31, 2004, the Fund had no outstanding investments in inverse floaters. | |

|

| Futures Transactions | |

|

| To gain exposure to or protect itself from changes in the market, the Fund may buy and sell interest rate futures | |

|

2004 Semiannual Report

American Municipal Income Portfolio

8

| contracts. Risks of entering into futures contracts and related options include the possibility there may be an illiquid market and that a change in the value of the contract or option may not correlate with changes in the value of the underlying securities. | |

|

| Upon entering into a futures contract, the Fund is required to deposit, in segregated accounts with its custodian, either cash or securities in an amount (initial margin) equal to a certain percentage of the contract value. Subsequent payments (variation margin) are made or received by the Fund each day. The variation margin payments are equal to the daily changes in the contract value and are recorded as unrealized gains and losses. The Fund recognizes a realized gain or loss when the contract is closed or expires. As of July 31, 2004, the Fund had no outstanding futures contracts. | |

|

| Securities Purchased on a When-Issued Basis | |

|

| Delivery and payment for securities that have been purchased by the Fund on a when-issued or forward-commitment basis can take place a month or more after the transaction date. During this period, such securities do not earn interest, are subject to market fluctuation, and may increase or decrease in value prior to their delivery. The Fund segregates, with its custodian, assets with a market value equal to the amount of its purchase commitments. The purchase of securities on a when-issued or forward-commitment basis may increase the volatility of the Fund's net asset value if the Fund makes such purchases while remaining substantially fully invested. As of July 31, 2004, the Fund had entered into outstanding when-issued or forward-commitment securities of $2,514,275. | |

|

| Federal Taxes | |

|

| The Fund intends to comply with the requirements of the Internal Revenue Code applicable to regulated investment | |

|

2004 Semiannual Report

American Municipal Income Portfolio

9

Notes to Financial STATEMENTS (Unaudited) continued

| companies and not be subject to federal income tax. Therefore, no income tax provision is required. The Fund also intends to distribute its taxable net investment income and realized gains, if any, to avoid the payment of any federal excise taxes. | |

|

| Net investment income and net realized gains and losses may differ for financial statement and tax purposes primarily because of market discount amortization. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. In addition, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the year that the income or realized gains or losses were recorded by the Fund. | |

|

| The tax character of common and preferred share distributions paid during the six months ended July 31, 2004 (estimated) and the fiscal year ended January 31, 2004, were characterized as follows: | |

|

| | | 7/31/04 | | 1/31/04 | |

| Distributions paid from: | |

| Tax-exempt income | | $ | 2,903,107 | | | $ | 5,745,748 | | |

| Ordinary income | | | - | | | | 60,896 | | |

| | | $ | 2,903,107 | | | $ | 5,806,644 | | |

| At January 31, 2004, the Fund's most recently completed fiscal year-end, the components of accumulated earnings on a tax basis were as follows: | |

|

| Undistributed tax-exempt income | | | | $ | 1,336,185 | | |

| Undistributed ordinary income | | | | | 8,853 | | |

| Accumulated capital losses | | | | | (562,428 | ) | |

| Unrealized appreciation | | | | | 9,351,971 | | |

| Accumulated earnings | | | | $ | 10,134,581 | | |

2004 Semiannual Report

American Municipal Income Portfolio

10

| Distributions to Shareholders | |

|

| Distributions from net investment income are made monthly for common shareholders and weekly for preferred shareholders. Common share distributions are recorded as of the close of business on the ex-dividend date and preferred share dividends are accrued daily. Net realized gains distributions, if any, will be made at least annually. Distributions are payable in cash or, for common shareholders pursuant to the Fund's dividend reinvestment plan, reinvested in additional common shares of the Fund. Under the dividend reinvestment plan, common shares will be purchased in the open market. | |

|

| Repurchase Agreements | |

|

| For repurchase agreements entered into with certain broker-dealers, the Fund, along with other affiliated registered investment companies, may transfer uninvested cash balances into a joint trading account, the daily aggregate balance of which is invested in repurchase agreements secured by U.S. government or agency obligations. Securities pledged as collateral for all individual and joint repurchase agreements are held by the Fund's custodian bank until maturity of the repurchase agreement. Provisions for all agreements ensure that the daily market value of the collateral is in excess of the repurchase amount, including accrued interest, to protect the Fund in the event of a default. | |

|

| Use of Estimates in the Preparation of Financial Statements | |

|

| The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts in the financial statements. Actual results could differ from these estimates. | |

|

2004 Semiannual Report

American Municipal Income Portfolio

11

Notes to Financial STATEMENTS (Unaudited) continued

| | (3 | ) Remarketed Preferred Shares | | As of July 31, 2004, the Fund had 1,740 remarketed preferred shares (870 shares in class "T" and 870 shares in class "TH") (RP®) outstanding with a liquidation preference of $25,000 per share. The dividend rate on the RP® is adjusted every seven days (on Tuesdays for class "T" and on Thursdays for class "TH"), as determined by the remarketing agent. On July 31, 2004, the dividend rates were 1.00% and 1.03% for class "T" and "TH", respectively. | |

|

| | | | | RP® is a registered trademark of Merrill Lynch & Company ("Merrill Lynch"). | |

|

| | (4 | ) Investment Security Transactions | | Cost of purchases and proceeds from sales of securities, other than temporary investments in short-term securities, for the six months ended July 31, 2004, aggregated $26,528,159 and $29,378,421, respectively. | |

|

| | (5 | ) Expenses | | Investment Management and Administrative Fees | |

|

| | | | | Pursuant to an investment advisory agreement (the "Agreement"), USBAM, a subsidiary of U.S. Bank National Association ("U.S. Bank"), manages the Fund's assets and furnishes related office facilities, equipment, research, and personnel. The Agreement provides USBAM with a monthly investment management fee in an amount equal to an annualized rate of 0.35% of the Fund's average weekly net assets (computed by subtracting liabilities, which exclude preferred shares, from the value of the total assets of the Fund). For its fee, USBAM provides investment advice and, in general, conducts the management and investment activities of the Fund. | |

|

| | | | | Pursuant to a co-administration agreement (the "Co-Administration Agreement"), USBAM serves as co-administrator for the Fund (U.S. Bancorp Fund Services, LLC, a subsidiary of U.S. Bancorp is also co-administrator but currently has no functional responsibilities related the Fund) and provides | |

|

2004 Semiannual Report

American Municipal Income Portfolio

12

| administrative services, including legal and shareholder services, to the Fund. Under this Co-Administration Agreement, USBAM receives a monthly administrative fee in an amount equal to an annualized rate of 0.20% of the Fund's average weekly net assets (computed by subtracting liabilities, which exclude preferred shares, from the value of the total assets of the Fund). For its fee, USBAM provides numerous services to the Fund including, but not limited to, handling the general business affairs, financial and regulatory reporting, and various other services. Separate from the Co-Administration Agreement, USBAM (from its own resources) has retained SEI Investments, Inc. as a sub-administrator to perform, among other services, net asset value calculations. | |

|

| The Fund may invest in money market funds that are series of First American Funds, Inc. ("FAF"), subject to certain limitations. In order to avoid the payment of duplicative investment advisory fees to USBAM, which acts as the investment adviser to both the Fund and the related money market funds, USBAM will reimburse the Fund an amount equal to that portion of the investment advisory fee received from the related money market funds that is attributable to the assets of the Fund. For financial statement purposes, this reimbursement is recorded as investment income. | |

|

| Remarketing Agent Fees | |

|

| The Fund has entered into a remarketing agreement with Merrill Lynch (the "Remarketing Agent"). The remarketing agreement provides the Remarketing Agent with a monthly fee in an amount equal to an annual rate of 0.25% of the Fund's average amount of RP® outstanding. For its fee, the Remarketing Agent will remarket shares of RP® tendered to it on behalf of | |

|

2004 Semiannual Report

American Municipal Income Portfolio

13

Notes to Financial STATEMENTS (Unaudited) continued

| | | | | shareholders and will determine the applicable dividend rate for each seven-day dividend period. | |

|

| | | | | Custodian Fees | |

|

| | | | | U.S. Bank serves as the Fund's custodian pursuant to a custodian agreement with the Fund. The fee for the Fund is equal to an annual rate of 0.015% of average weekly net assets. These fees are computed weekly and paid monthly. | |

|

| | | | | Other Fees and Expenses | |

|

| | | | | In addition to the investment management, administrative, custodian, and remarketing agent fees, the Fund is responsible for paying most other operating expenses including: outside directors' fees and expenses, registration fees, printing and shareholder reports, transfer agent fees and expenses, legal, auditing, and accounting services, insurance, interest, taxes, and other miscellaneous expenses. | |

|

| | (6 | ) Capital Loss Carryover | | For federal income tax purposes, the Fund had capital loss carryovers at January 31, 2004, the Fund's most recently completed fiscal year-end, which, if not offset by subsequent capital gains, will expire on the Fund's fiscal year-ends as indicated below. | |

|

Capital Loss

Carryover | | Expiration | |

| $ | 216,201 | | | | 2008 | | |

| | 346,227 | | | | 2009 | | |

| $ | 562,428 | | | | | | |

| | (7 | ) Indemnifications | | The Fund enters into contracts that contain a variety of indemnifications. The Fund's maximum exposure under these arrangements is unknown. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote. | |

|

2004 Semiannual Report

American Municipal Income Portfolio

14

| | (8 | ) Financial Highlights | | Per-share data for an outstanding common share throughout each period and selected information for each period are as follows: | |

|

| | | Six Months

Ended

7/31/04 | | Year Ended January 31, | |

| | | (Unaudited) | | 2004 | | 2003 | | 2002 | | 2001 | | 2000 | |

| Per-Share Data | |

Net asset value, common shares,

beginning of period | | $ | 15.66 | | | $ | 15.13 | | | $ | 14.67 | | | $ | 14.50 | | | $ | 13.17 | | | $ | 15.43 | | |

| Operations: | |

| Net investment income | | | 0.49 | | | | 1.02 | | | | 1.07 | | | | 1.04 | | | | 1.15 | | | | 1.03 | | |

Net realized and unrealized

gains (losses) on investments | | | (0.47 | ) | | | 0.52 | | | | 0.40 | | | | 0.12 | | | | 1.27 | | | | (2.27 | ) | |

| Distributions to preferred shareholders: | |

| From net investment income | | | (0.04 | ) | | | (0.07 | ) | | | (0.10 | ) | | | (0.18 | ) | | | (0.30 | ) | | | (0.25 | ) | |

| Total from operations | | | (0.02 | ) | | | 1.47 | | | | 1.37 | | | | 0.98 | | | | 2.12 | | | | (1.49 | ) | |

| Distributions to common shareholders: | |

| From net investment income | | | (0.47 | ) | | | (0.94 | ) | | | (0.91 | ) | | | (0.81 | ) | | | (0.79 | ) | | | (0.77 | ) | |

Net asset value, common shares,

end of period | | $ | 15.17 | | | $ | 15.66 | | | $ | 15.13 | | | $ | 14.67 | | | $ | 14.50 | | | $ | 13.17 | | |

Market value, common shares,

end of period | | $ | 14.15 | | | $ | 14.90 | | | $ | 14.60 | | | $ | 14.02 | | | $ | 13.80 | | | $ | 11.75 | | |

| Selected Information | |

Total return, common shares,

net asset value (a) | | | (0.14 | )% | | | 9.98 | % | | | 9.58 | % | | | 6.92 | % | | | 16.58 | % | | | (9.88 | )% | |

Total return, common shares,

market value (b) | | | (1.89 | )% | | | 8.77 | % | | | 11.06 | % | | | 7.77 | % | | | 25.44 | % | | | (10.81 | )% | |

Net assets applicable to common

shares at end of period (in millions) | | $ | 87 | | | $ | 90 | | | $ | 87 | | | $ | 84 | | | $ | 83 | | | $ | 75 | | |

Ratio of expenses to average weekly

net assets applicable to

common shares (c) | | | 1.25 | % (e) | | | 1.18 | % | | | 1.23 | % | | | 1.17 | % | | | 1.23 | % | | | 1.20 | % | |

Ratio of net investment income

to average weekly net assets

applicable to common shares (c) | | | 5.91 | % (e) | | | 6.65 | % | | | 7.19 | % | | | 7.11 | % | | | 8.00 | % | | | 7.82 | % | |

Portfolio turnover rate

(excluding short-term securities) | | | 21 | % | | | 34 | % | | | 18 | % | | | 9 | % | | | 35 | % | | | 10 | % | |

Remarketed preferred shares

outstanding, end of period

(in millions) | | $ | 44 | | | $ | 44 | | | $ | 44 | | | $ | 44 | | | $ | 44 | | | $ | 44 | | |

Asset coverage per remarketed

preferred share (in thousands) (d) | | $ | 75 | | | $ | 77 | | | $ | 75 | | | $ | 74 | | | $ | 73 | | | $ | 69 | | |

Liquidation preference and

market value per remarketed

preferred share (in thousands) | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | | |

(a) Assumes reinvestment of distributions at net asset value.

(b) Assumes reinvestment of distributions at actual prices pursuant to the Fund's dividend reinvestment plan.

(c) Ratios do not reflect the effect of dividend payments to preferred shareholders; income ratios reflect income earned on assets attributable to preferred shares, where applicable.

(d) Represents net assets applicable to common shares plus preferred shares at liquidation value divided by preferred shares outstanding.

(e) Annualized.

2004 Semiannual Report

American Municipal Income Portfolio

15

Schedule of INVESTMENTS (Unaudited)

American Municipal Income Portfolio July 31, 2004

| Description of Security | | Principal

Amount | | Market

Value (a) | |

| (Percentages of each investment category relate to net assets applicable to outstanding common shares) | | | |

| Municipal Long-Term Securities - 140.2% | | | |

| Alabama - 0.8% | | | |

Camden Industrial Development Board, AMT

(Callable 12/1/13 at 100),

6.38%, 12/1/24 | | $ | 650,000 (f) | | | $ | 680,641 | | |

| Arizona - 7.4% | | | |

Douglas Community Housing Revenue,

Rancho La Perilla

(Callable 1/20/10 at 102),

6.13%, 7/20/41 | | | 990,000 | | | | 1,026,620 | | |

Gilbert Industrial Development Authority,

S.W. Student Services

(Callable 2/1/09 at 102),

5.85%, 2/1/19 | | | 1,300,000 | | | | 1,457,937 | | |

Pima County United School District (FGIC),

8.38%, 7/1/13 | | | 2,450,000 (b) | | | | 3,280,109 | | |

University Medical Center

(Callable 7/1/14 at 100),

5.00%, 7/1/24 | | | 750,000 | | | | 726,975 | | |

| | | | 6,491,641 | | |

| California - 13.4% | | | |

Alameda Corridor Transportation Authority,

Zero-Coupon Bond (AMBAC),

5.72%, 10/1/30 | | | 13,375,000 (b) (g) | | | | 3,057,257 | | |

California Statewide Communities Development Authority

(Callable 11/1/13 at 100),

5.25%, 11/15/23 | | | 2,000,000 | | | | 2,027,740 | | |

Golden State Tobacco Settlement

(Callable 6/1/13 at 100),

5.50%, 6/1/33 | | | 1,500,000 | | | | 1,506,120 | | |

State General Obligation

(Callable 2/1/13 at 100),

5.00%, 2/1/21 | | | 1,500,000 | | | | 1,532,400 | | |

State General Obligation

(Callable 2/1/14 at 100),

5.00%, 2/1/33 | | | 1,000,000 | | | | 969,000 | | |

State Public Works, Department of Mental Health

(Callable 6/1/14 at 100),

5.50%, 6/1/19 | | | 2,000,000 | | | | 2,131,220 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

16

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

Vernon California Electrical System

(Callable 4/1/08 at 100),

5.50%, 4/1/23 | | $ | 500,000 | | | $ | 506,080 | | |

| | | | 11,729,817 | | |

| Colorado - 11.0% | | | |

Educational and Cultural Facilities Authority, The

Classical Academy

(Prerefunded 12/1/11 at 100),

7.25%, 12/1/30 | | | 2,000,000 (e) | | | | 2,468,880 | | |

Northwest Parkway Public Highway Authority,

Zero-Coupon Bond (AMBAC)

(Callable 6/15/11 at 33.46),

6.29%, 6/15/29 | | | 5,000,000 (b) (g) | | | | 1,124,300 | | |

State Health Facilities Authority, Evangelical Lutheran

(Callable 10/1/12 at 100),

5.90%, 10/1/27 | | | 650,000 | | | | 658,847 | | |

State Health Facilities Authority, Covenant

Retirement Community

(Callable 12/1/12 at 101),

6.13%, 12/1/33 | | | 1,000,000 | | | | 1,011,590 | | |

State Housing and Financial Authority, Solid Waste

Revenue, AMT,

5.70%, 7/1/18 | | | 1,000,000 (f) | | | | 1,013,390 | | |

State Multifamily Housing and Financial Authority

(Callable 4/1/12 at 100),

5.70%, 10/1/42 | | | 2,750,000 | | | | 2,820,978 | | |

Water Reserve and Power Development

(Callable 9/1/06 at 101),

5.90%, 9/1/16 | | | 500,000 | | | | 538,900 | | |

| | | | 9,636,885 | | |

| Florida - 1.3% | | | |

Palm Beach County Facilities Authority, Abbey

Delray South

(Callable 10/1/13 at 100),

5.45%, 10/1/15 | | | 1,100,000 | | | | 1,095,545 | | |

| Georgia - 10.5% | |

Municipal Electrical Authority (FGIC)

(Escrowed to maturity),

6.50%, 1/1/12 | | | 8,000,000 (b) (c) | | | | 9,192,880 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

17

Schedule of INVESTMENTS (Unaudited) continued

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

| Illinois - 17.2% | | | |

Chicago Illinois Metro Water Reclamation Dist.

(Escrowed to maturity),

5.50%, 12/1/10 | | $ | 3,000,000 (c) | | | $ | 3,373,710 | | |

Chicago Illinois O'Hare International

Airport Revenue, AMT

(Callable 1/1/12 at 100),

5.38%, 1/1/32 | | | 2,500,000 (f) (h) | | | | 2,514,275 | | |

Chicago State University Revenue (MBIA)

(Prerefunded to 12/1/04 at 102),

6.00%, 12/1/12 | | | 1,000,000 (b) (e) | | | | 1,035,490 | | |

Health Facility Authority, Lutheran General Hospital,

7.00%, 4/1/08 | | | 1,000,000 | | | | 1,093,640 | | |

Health Facility Authority, Lutheran General Hospital,

7.00%, 4/1/14 | | | 500,000 | | | | 603,555 | | |

Health Facility Authority, Villa St. Benedict

(Callable 11/15/13 at 101),

6.90%, 11/15/33 | | | 600,000 | | | | 591,018 | | |

Kane County School District (FGIC)

(Prerefunded to 2/1/05 at 100),

5.75%, 2/1/15 | | | 1,000,000 (b) (e) | | | | 1,021,730 | | |

Metropolitan Pier and Exposition Authority,

Convertible, Zero-Coupon Bond (MBIA),

5.32%, 6/15/23 | | | 6,115,000 (b) (g) | | | | 3,283,938 | | |

Rockford Multifamily Housing Revenue, Rivers

Edge Apts., AMT

(Callable 1/20/08 at 102),

5.88%, 1/20/38 | | | 1,000,000 (f) | | | | 1,017,020 | | |

State Health Facilities Authority, Condell

Medical Center

(Callable 5/15/12 at 100),

5.50%, 5/15/32 | | | 500,000 | | | | 489,500 | | |

| | | | 15,023,876 | | |

| Indiana - 4.9% | | | |

Health Facility Authority, Columbus Hospital (FSA),

7.00%, 8/15/15 | | | 2,670,000 (b) | | | | 3,245,358 | | |

Indianapolis Indiana Airport Authority, AMT,

5.10%, 1/15/17 | | | 1,000,000 (f) | | | | 1,008,430 | | |

| | | | 4,253,788 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

18

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

| Iowa - 3.6% | | | |

Hospital Facilities Authority

(Callable 2/15/10 at 101),

6.75%, 2/15/15 | | $ | 1,000,000 | | | $ | 1,107,160 | | |

Sheldon Health Care Facilities

(Callable 3/1/05 at 100),

6.15%, 3/1/16 | | | 1,000,000 | | | | 1,013,140 | | |

State Higher Education Loan Authority, Wartburg

College (ACA)

(Callable 10/1/12 at 100),

5.50%, 10/1/33 | | | 1,000,000 (b) | | | | 1,014,370 | | |

| | | | 3,134,670 | | |

| Kansas - 1.2% | | | |

Kansas City Utility Systems (FGIC)

(Callable 9/1/04 at 102),

6.25%, 9/1/14 | | | 1,000,000 (b) | | | | 1,024,040 | | |

| Kentucky - 2.2% | | | |

State Housing Authority, Series H, AMT,

(Callable 11/1/09 at 100),

6.08%, 1/1/30 | | | 1,905,000 (f) | | | | 1,971,027 | | |

| Massachusetts - 0.5% | | | |

Boston Industrial Development Financing Authority,

Crosstown Center Project, AMT

(Callable 9/1/12 at 102),

6.50%, 9/1/35 | | | 500,000 (f) | | | | 486,640 | | |

| Michigan - 11.8% | | | |

Comstock Park Public Schools (FGIC),

7.88%, 5/1/11 | | | 3,145,000 (b) | | | | 3,951,221 | | |

Hospital Financing Authority, Daughters of Charity

(Escrowed to maturity, callable 11/1/05 at 101),

5.25%, 11/1/15 | | | 1,500,000 (c) | | | | 1,571,700 | | |

Kent Hospital Financial Authority, Butterworth

Hospital (MBIA),

7.25%, 1/15/13 | | | 4,000,000 (b) | | | | 4,779,640 | | |

| | | | 10,302,561 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

19

Schedule of INVESTMENTS (Unaudited) continued

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

| Minnesota - 6.7% | | | |

Agriculture and Economic Development Board,

Fairview Health Care System

(Callable 11/15/10 at 101),

6.38%, 11/15/29 | | $ | 1,000,000 | | | $ | 1,070,620 | | |

Glencoe Health Care Facilities,

Glencoe Regional Health Services

(Callable 4/1/11 at 101),

7.50%, 4/1/31 | | | 900,000 | | | | 963,099 | | |

Maplewood Multifamily Revenue,

Carefree Cottages II, AMT (FNMA)

(Callable 4/15/14 at 100),

4.80%, 4/15/34 | | | 1,000,000 (b) (f) | | | | 991,600 | | |

Marshall Health Care Facility, Weiner Medical Center

(Callable 11/1/13 at 100),

6.00%, 11/1/28 | | | 500,000 | | | | 512,785 | | |

Minneapolis Health Care System, Allina Health System,

6.00%, 11/15/23 | | | 565,000 | | | | 598,199 | | |

State Agricultural and Economic Development

Board Revenue, Fairview Health System,

Convertible, Zero-Coupon Bond

(Callable 11/15/10 at 101),

5.06%, 11/15/22 | | | 2,400,000 (g) | | | | 1,722,672 | | |

| | | | 5,858,975 | | |

| Missouri - 0.6% | | | |

Cape Girardeau County Industrial Development Authority,

Southeast Hospital Association

(Callable 6/1/12 at 100),

5.75%, 6/1/32 | | | 500,000 | | | | 502,145 | | |

| New Mexico - 4.1% | | | |

Mortgage Finance Authority,

6.88%, 1/1/25 | | | 1,465,000 | | | | 1,532,932 | | |

Mortgage Finance Authority,

6.50%, 7/1/25 | | | 1,155,000 | | | | 1,173,965 | | |

Mortgage Finance Authority,

6.75%, 7/1/25 | | | 920,000 | | | | 923,091 | | |

| | | | 3,629,988 | | |

| New York - 3.1% | | | |

New York City, Series B,

5.75%, 8/1/16 | | | 1,400,000 | | | | 1,530,284 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

20

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

New York Water and Sewer System

(Crossover refunded to 6/15/10 at 101),

6.00%, 6/15/33 | | $ | 380,000 (e) | | | $ | 431,509 | | |

New York Water and Sewer System

(Prerefunded to 6/15/10 at 101),

6.00%, 6/15/33 | | | 620,000 (e) | | | | 717,929 | | |

| | | | 2,679,722 | | |

| North Dakota - 2.1% | | | |

Fargo Health Systems, Meritcare

(Callable 6/1/10 at 101),

5.63%, 6/1/31 | | | 1,750,000 | | | | 1,825,670 | | |

| Ohio - 4.2% | | | |

Akron Bath Copley Hospital Revenue,

Summa Health Systems (RAAI)

(Callable 11/15/14 at 100),

5.25%, 11/15/16 | | | 1,000,000 (b) | | | | 1,057,790 | | |

Richland County Hospital Facilities, Medcentral

Health System

(Callable 11/15/10 at 101),

6.13%, 11/15/16 | | | 1,000,000 | | | | 1,067,330 | | |

Richland County Hospital Facilities, Medcentral

Health System

(Callable 11/15/10 at 101),

6.38%, 11/15/30 | | | 1,000,000 | | | | 1,048,120 | | |

Toledo - Lucas County Port Authority, Crocker Park

Public Improvement Project

(Callable 12/1/13 at 102),

5.25%, 12/1/23 | | | 500,000 | | | | 496,365 | | |

| | | | 3,669,605 | | |

| Pennsylvania - 1.1% | | | |

Chartiers Valley Industrial and Commercial

Development Authority, Friendship Village South

(Callable 8/15/10 at 100),

5.75%, 8/15/20 | | | 1,000,000 | | | | 970,440 | | |

| Puerto Rico - 1.3% | | | |

Puerto Rico Public Finance Corp.

(Callable 2/1/12 at 100),

5.75%, 8/1/27 | | | 1,000,000 | | | | 1,104,760 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

21

Schedule of INVESTMENTS (Unaudited) continued

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

| South Carolina - 0.7% | |

State Jobs Economic Development Authority, Hospital

Facility, Palmetto Health

(Callable 8/1/13 at 100),

6.13%, 8/1/23 | | $ | 250,000 | | | $ | 257,048 | | |

State Jobs Economic Development Authority, Hospital

Facility, Palmetto Health

(Callable 8/1/13 at 100),

6.38%, 8/1/34 | | | 375,000 | | | | 389,078 | | |

| | | | 646,126 | | |

| South Dakota - 4.2% | | | |

Souix Falls Health Facilities, Dow Rummel

Village Project

(Callable 11/15/12 at 100),

6.63%, 11/15/23 | | | 620,000 | | | | 622,232 | | |

State Economic Development Finance Authority, Pooled

Loan Pg., McEleeg S.D., AMT

(Callable 4/1/14 at 100),

5.95%, 4/1/24 | | | 2,000,000 (f) | | | | 2,006,660 | | |

State Economic Development Finance Authority, Pooled

Loan Pg., Davis Family, AMT

(Callable 4/1/14 at 100),

6.00%, 4/1/29 | | | 1,000,000 (f) | | | | 996,070 | | |

| | | | 3,624,962 | | |

| Tennessee - 3.0% | | | |

Johnson City Health and Education Facilities, Mountain

States Health

(Callable 7/1/12 at 103),

7.50%, 7/1/33 | | | 1,000,000 | | | | 1,154,890 | | |

Shelby County Health, Education and Housing Facilities,

Methodist Health Care

(Callable 9/1/12 at 100),

6.50%, 9/1/21 | | | 650,000 | | | | 715,663 | | |

Sullivan County Health, Education and Housing Facilities,

Wellmont Health System

(Callable 9/1/12 at 101),

6.25%, 9/1/32 | | | 750,000 | | | | 747,000 | | |

| | | | 2,617,553 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

22

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

| Texas - 17.1% | | | |

Abilene Health Facility Development Revenue, Sears

Methodist Retirement

(Callable 5/15/09 at 101),

6.00%, 11/15/29 | | $ | 500,000 | | | $ | 461,615 | | |

Abilene Health Facility Development Revenue, Sears

Methodist Retirement

(Callable 8/15/08 at 101),

5.88%, 11/15/18 | | | 1,150,000 | | | | 1,117,432 | | |

Arlington Independent School District

(Callable 2/15/05 at 100),

6.00%, 2/15/15 | | | 670,000 | | | | 684,358 | | |

Brazoria County Environmental Authority, Dow

Chemical Project, AMT

(Callable 5/15/12 at 100),

5.70%, 5/15/33 | | | 500,000 (f) | | | | 537,330 | | |

Brazos River Pollution Control Authority, TXU

Energy, AMT

(Callable 10/1/13 at 101),

6.75%, 10/1/38 | | | 1,000,000 (f) | | | | 1,038,320 | | |

Brazos River Pollution Control Authority, Texas

Utilities, AMT

(Callable 4/1/13 at 101),

7.70%, 4/1/33 | | | 500,000 (f) | | | | 578,485 | | |

Fort Bend Independent School District

(Escrowed to maturity),

5.00%, 2/15/14 | | | 1,000,000 (c) | | | | 1,086,100 | | |

Grand Prairie Independent School District (PSF)

(Callable 8/15/11 at 100),

5.85%, 2/15/26 | | | 40,000 (b) | | | | 43,420 | | |

Grand Prairie Independent School District (PSF)

(Prerefunded to 8/15/11 at 100),

5.85%, 2/15/26 | | | 2,960,000 (b) (e) | | | | 3,392,545 | | |

Houston Health Facilities Development Revenue,

Retirement Facility, Buckingham Senior Living

(Callable 2/15/14 at 101),

7.00%, 2/15/26 | | | 1,500,000 | | | | 1,518,750 | | |

Richardson Hospital Authority, Richardson

Regional Hospital

(Callable 12/1/13 at 100),

6.00%, 12/1/34 | | | 2,500,000 | | | | 2,525,550 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

23

Schedule of INVESTMENTS (Unaudited) continued

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount | | Market

Value (a) | |

Sam Rayburn Municipal Power Agency (RAAI)

(Callable 10/1/12 at 100),

5.75%, 10/1/21 | | $ | 1,000,000 (b) | | | $ | 1,068,380 | | |

Tarrant County Housing and Finance Authority,

Fair Oaks

(Callable 7/1/10 at 102),

6.88%, 7/1/30 | | | 585,000 | | | | 351,000 | | |

Tyler Health Facility, Mother Frances Hospital

(Callable 7/1/13 at 100),

5.75%, 7/1/27 | | | 500,000 | | | | 493,705 | | |

| | | | 14,896,990 | | |

| Washington - 2.2% | | | |

Douglas County Public Utility District (MBIA)

(Callable 1/1/05 at 102),

6.00%, 1/1/15 | | | 1,000,000 (b) | | | | 1,039,170 | | |

Skagit County Public Hospital District

(Callable 12/1/13 at 101),

6.00%, 12/1/23 | | | 900,000 | | | | 890,784 | | |

| | | | 1,929,954 | | |

| Wisconsin - 4.0% | | | |

State Health and Education Facility, Beloit Hospital

(Callable 7/1/03 at 102),

5.90%, 7/1/11 | | | 625,000 | | | | 631,981 | | |

State Health and Educational Facility Authority, Attic

Angel Obligated Group

(Callable 11/15/08 at 102),

5.75%, 11/15/27 | | | 1,800,000 | | | | 1,599,948 | | |

State Health and Educational Facility Authority,

Wheaton Fransiscan Services

(Callable 2/15/12 at 101),

5.75%, 8/15/30 | | | 750,000 | | | | 765,698 | | |

State Health and Educational Facility Authority,

Synergyhealth Inc.

(Callable 8/15/13 at 100),

6.00%, 11/15/23 | | | 500,000 | | | | 509,040 | | |

| | | | 3,506,667 | | |

Total Municipal Long-Term Securities

(cost: $116,353,142) | | | | | | | 122,487,568 | | |

See accompanying Notes to Schedule of Investments.

2004 Semiannual Report

American Municipal Income Portfolio

24

American Municipal Income Portfolio

(Continued)

| Description of Security | | Principal

Amount/

Shares | | Market

Value (a) | |

| Municipal Short-Term Security (d) - 2.9% | | | |

| South Dakota - 2.9% | | | |

South Dakota State Health and Educational Facility

Authority, Avera Health (AMBAC),

1.16%, 7/1/24

(cost: $2,500,000) | | $ | 2,500,000 (b) | | | $ | 2,500,000 | | |

Total Investments in Unaffiliated Securities - 143.1%

(cost: $118,853,142) | | | | | | | 124,987,568 | | |

| Affiliated Money Market Fund (i) - 5.1% | | | |

| First American Tax Free Obligations Fund, Class Z | | | 4,492,408 | | | | 4,492,408 | | |

Total Affiliated Money Market Fund

(cost: $4,492,408) | | | | | | | 4,492,408 | | |

Total Investments in Securities (j) - 148.2%

(cost: $123,345,550) | | | | | | $ | 129,479,976 | | |

Notes to Schedule of Investments:

(a) Securities are valued in accordance with procedures described in note 2 in Notes to Financial Statements.

(b) Portfolio abbreviations and definitions:

ACA–American Capital Access

AMBAC–American Municipal Bond Assurance Company

FGIC–Financial Guaranty Insurance Corporation

FNMA–Federal National Mortgage Association

FSA–Financial Security Assurance

MBIA–Municipal Bond Insurance Association

PSF–Permanent School Fund

RAAI–Radian Asset Assurance Inc.

(c) Escrowed to maturity issues are typically backed by U.S. government obligations. If call date is available, these bonds may still be subject to call at the call date and price indicated.

(d) Floating or variable rate obligation maturing in more than one year. The interest rate, which is based on specific, or an index of, market interest rates, is subject to change periodically and is the effective rate on July 31, 2004. This instrument may also have a demand feature which allows the recovery of principal at any time, or at specified intervals not exceeding one year, on up to 30 days' notice. Maturity date shown represents final maturity.

(e) Prerefunded issues are backed by U.S. government obligations. Crossover refunded issues are backed by the credit of the refunding issuer. In both cases, the bonds mature at the date and price indicated.

(f) AMT–Alternative Minimum Tax. As of July 31, 2004, the aggregate market value of securities subject to the Alternative Minimum Tax is $14,839,888, which represents 17.0% of net assets applicable to common shares.

(g) For zero-coupon investments, the interest rate shown is the effective yield on the date of purchase.

(h) On July 31, 2004, the total cost of investments purchased on a when-issued basis was $2,514,275.

2004 Semiannual Report

American Municipal Income Portfolio

25

Schedule of INVESTMENTS (Unaudited) continued

(i) Investment in affiliated security. This money market fund is advised by U.S. Bancorp Asset Management, Inc., which also serves as advisor for the Fund. See note 5 in Notes to Financial Statements.

(j) On July 31, 2004, the cost of investments in securities for federal income tax purposes was $123,170,626. The difference between federal tax cost and book cost is due to the tax deferral of market discount accretion. The aggregate gross unrealized appreciation and depreciation of investments in securities, based on this cost were as follows:

| Gross unrealized appreciation | | $ | 6,869,015 | | |

| Gross unrealized depreciation | | | (559,665 | ) | |

| Net unrealized appreciation | | $ | 6,309,350 | | |

2004 Semiannual Report

American Municipal Income Portfolio

26

SHAREHOLDER UPDATE

| Investment Policy Change | |

|

| To date, all of the Fund's municipal security investments have been, at the time of purchase, either rated investment grade or, if unrated, determined to be of comparable quality. Effective immediately, the Fund may invest up to 5% of its total assets in municipal securities that are, at the time of purchase, either rated lower than investment grade or, if unrated, determined to be of comparable quality. These securities are commonly referred to as "high yield" securities or "junk bonds." The Fund will not invest in municipal securities that, at the time of purchase, are rated lower than B or are unrated and determined to be of comparable quality. If the rating of a security is reduced or discontinued after purchase, the Fund is not required to sell the security, but it may consider doing so. The Fund's investments in high yield securities (rated and unrated) and investment-grade quality unrated securities will not exceed, in the aggregate, 25% of the Fund's total assets (not including unrated securities that have been pre-refunded with U.S. Government securities and U.S. Government agency securities). All determinations regarding the credit quality of unrated securities are made by USBAM. | |

|

| High yield securities generally have more volatile prices, carry more risk to principal and may be more susceptible to real or perceived adverse economic conditions than investment grade securities. In addition, the secondary market for high yield securities may be less liquid than for investment grade securities. When the Fund purchases unrated securities, it will depend on USBAM's analysis of credit risk without the assessment of an independent rating organization, such as Moody's Investors Service or Standard & Poor's. | |

|

2004 Semiannual Report

American Municipal Income Portfolio

27

SHAREHOLDER UPDATE

| How to Obtain a Copy of the Fund's Proxy Voting Policies and Proxy Voting Record | |

|

| A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities, as well as information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month period ended June 30, is available (1) without charge upon request by calling 800.677.FUND; (2) at firstamericanfunds.com; and (3) on the U.S. Securities and Exchange Commission's website at http://www.sec.gov. | |

|

| Quarterly Portfolio Holdings Information | |

|

| Beginning with the quarter ending October 31, 2004, the Fund will file its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the Securities and Exchange Commission on Form N-Q. The Fund's Forms N-Q will be available (1) without charge upon request by calling 800.677.FUND; (2) at firstamericanfunds.com; and (3) on the U.S. Securities and Exchange Commission's website at http://www.sec.gov. In addition, you may review and copy the Fund's Forms N-Q at the Commission's Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling 1-800-SEC-0330. | |

|

2004 Semiannual Report

American Municipal Income Portfolio

28

Board of DIRECTORS

VIRGINIA STRINGER

Chairperson of American Municipal Income Portfolio

Owner and President of Strategic Management Resources, Inc.

BENJAMIN FIELD III

Director of American Municipal Income Portfolio

Retired; former Senior Financial Advisor, Senior Vice President, Chief Financial Officer, and Treasurer of Bemis Company, Inc.

MICKEY FORET

Director of American Municipal Income Portfolio

Consultant to, and formerly Executive Vice President and Chief Financial Officer of, Northwest Airlines, Inc.

ROGER GIBSON

Director of American Municipal Income Portfolio

Retired; former Vice President of Cargo-United Airlines

VICTORIA HERGET

Director of American Municipal Income Portfolio

Investment Consultant; former Managing Director of Zurich Scudder Investments

LEONARD KEDROWSKI

Director of American Municipal Income Portfolio

Owner and President of Executive and Management Consulting, Inc.

RICHARD RIEDERER

Director of American Municipal Income Portfolio

Retired; former President and Chief Executive Officer of Weirton Steel

JOSEPH STRAUSS

Director of American Municipal Income Portfolio

Owner and President of Strauss Management Company

JAMES WADE

Director of American Municipal Income Portfolio

Owner and President of Jim Wade Homes

American Municipal Income Portfolio’s Board of Directors is comprised entirely of independent directors.

AMERICAN MUNICIPAL INCOME PORTFOLIO

2004 Semiannual Report

U.S. Bancorp Asset Management, Inc., is a wholly owned subsidiary of U.S. Bank National Association, which is a wholly owned subsidiary of U.S. Bancorp.

| | This document is printed on paper containing 10% postconsumer waste. |

| | | | |

| | 9/2004 0309-04 XAA-SAR | | |

Item 2—Code of Ethics - Did registrant adopt a code of ethics, as of the end of the period covered by this report, that applies to the registrant’s principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, regardless of whether these individuals are employed by the registrant or a third party? If not, why not? Briefly describe any amendments or waivers that occurred during the period. State here if code of ethics/amendments/waivers are on website and give website address. State here if fund will send code of ethics to shareholders without charge upon request.

Response: Not applicable to semi-annual report.

Item 3—Audit Committee Financial Expert - - Did the registrant’s board of directors determine that the registrant either: (i) has at least one audit committee financial expert serving on its audit committee; or (ii) does not have an audit committee financial expert serving on its audit committee? If yes, disclose name of financial expert and whether he/she is “independent,” (fund may, but is not required, to disclose name/independence of more than one financial expert) If no, explain why not.

Response: Not applicable to semi-annual report.

Item 4—Principal Accountant Fees and Services

(a) Audit Fees - Disclose aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years.

(b) Audit-Related Fees - Disclose aggregate fees billed in each of the last two fiscal years for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

(c) Tax Fees - Disclose aggregate fees billed in each of the last two fiscal years for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

(d) All Other Fees - Disclose aggregate fees billed in each of the last two fiscal years for products and services provided by the principal accountant, other than the services reported in paragraphs (a) through (c) of this Item. Registrants shall describe the nature of the services comprising the fees disclosed under this category.

(e)(1) Disclose the audit committee’s pre-approval policies and procedures pursuant to paragraph (c)(7) of Rule 2-01 of Regulation

S-X.

(e)(2) Disclose the percentage of services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) If greater than 50%, disclose the percentage of hours expended on the principal accountant’s engagement to audit the registrant’s financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant’s full-time, permanent employees.

(g) Disclose the aggregate non-audit fees billed by the registrant’s accountant for services rendered to the registrant, and rendered to the registrant’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the adviser that provides ongoing services to the registrant for each of the last two fiscal years of the registrant.

(h) Disclose whether the registrant’s audit committee has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser (not including any subadviser whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling, controlled by, or under common control with the investment adviser that provides ongoing services to the registrant that were not pre-approved pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X is compatible with maintaining the principal accountant’s independence.

Response: Not applicable to semi-annual report.

Item 5—Audit Committee of Listed Registrants

(a) If the registrant is a listed issuer as defined in Rule 10A-3 under the Exchange Act (17 CFR 240.10A-3), state whether or not the registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act (15 U.S.C. 78c(a)(58)(A)). If the registrant has such a committee, however designated, identify each committee member. If the entire board of directors is acting as the registrant’s audit committee as specified in Section 3(a)(58)(B) of the Exchange Act (15 U.S.C. 78c(a)(58)(B)), so state.

(b) If applicable, provide the disclosure required by Rule 10A-3(d) under the Exchange Act (17 CFR 240.10A-3(d)) regarding an exemption from the listing standards for audit committees.

Response: Not applicable to semi-annual report.

Item 6—Schedule of Investments – File Schedule I – Investments in securities of unaffiliated issuers as of the close of the reporting period as set forth in Section 210.12-12 of Regulation S-X [17 CFR 210.12-12], unless the schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Response: The schedule is included as part of the report to shareholders filed under Item 1 of this Form.

Item 7—Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies - - For closed-end funds that contain voting securities in their portfolio, describe the policies and procedures that it uses to determine how to vote proxies relating to those portfolio securities.

Response: Not applicable to semi-annual report.

Item 8—Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers

(a) If the registrant is a closed-end management investment company, in the following tabular format, provide the information specified in paragraph (b) of this Item with respect to any purchase made by or on behalf of the registrant or any “affiliated purchaser,” as defined in Rule 10b-18(a)(3) under the Exchange Act (17 CFR 240.10b-18(a)(3)), of shares or other units of any class of the registrant’s equity securities that is registered pursuant to Section 12 of the Exchange Act (15 U.S.C. 781).

Registrant Purchases of Equity Securities

Period (identify

beginning and

ending dates for

each Month) | | (a) Total Number

of Shares (or

Units) Purchased | | (b) Average Price

Paid per Share

(or Unit) | | (c) Total Number

of Shares (or

Units) Purchased

as Part of Publicly

Announced Plans

or Programs | | (d) Maximum Number

(or Approximate

Dollar Value) of

Shares (or Units) that

May Yet Be Purchased

Under the Plans or

Programs |

Month #1 | | | | | | | | |

Month #2 | | | | | | | | |

Month #3 | | | | | | | | |

Month #4 | | | | | | | | |

Month #5 | | | | | | | | |

Month #6 | | | | | | | | |

Total | | | | | | | | |

(b) The table shall include the following information for each class of securities for each month included in the period covered by the report:

(1) The total number of shares (or units) purchased (column (a));

(2) The average price paid per share (or unit) (column (b));

(3) The number of shares (or units) purchased as part of publicly announced repurchase plans or programs (column (c)); and

(4) The maximum number (or approximate dollar value) of shares (or units) that may yet be purchased under the plans or programs (column (d)).

Response: The registrant did not purchase any shares of its equity securities during the period covered by the report.

Item 9—Submission of Matters to a Vote of Security Holders – Describe any material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors, where those changes were implemented after the registrant last provided disclosure in response to the requirements of Item 7(d)(2)(ii)(G) of Schedule 14A (17 CFR 240.14a-101), or this Item.

Response: There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of directors, that were implemented after the registrant last provided disclosure in response to the requirements of Item 7(d)(2)(ii)(G) of Schedule 14A (17 CFR 240.14a-101), or this item.

Item 10—Controls and Procedures

(a) Disclose the conclusions of the registrant’s principal executive and principal financial officers, or persons performing similar functions, regarding the effectiveness of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c))) as of a date within 90 days of the filing date of the report that includes the disclosure required by this paragraph, based on the evaluation of these controls and procedures required by Rule 30a-3(b) under the Act (17 CFR

270.30a-3(b)) and Rules 13a-15(b) under the Exchange Act (17 CFR 240.13a-15(b) or 240.15d-15(b)).

Response: The registrant’s Principal Executive Officer and Principal Financial Officer have evaluated the registrant’s disclosure controls and procedures within 90 days of the date of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form

N-CSR was recorded, processed, summarized and reported timely.

(b) Disclose any change in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(c) under the Act (17 CFR 270.30a-3(c))) that occurred during the registrant’s last fiscal half-year (the registrant’s second fiscal half-year in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Response: There were no changes in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal half-year that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 11 – Exhibits

11(a) - Attach code of ethics or amendments/waivers, unless code of ethics or amendments/waivers is on website or offered to shareholders upon request without charge.

Response: Not applicable to semi-annual report.

11(b) - Attach certifications (4 in total pursuant to Sections 302 and 906 for PEO/PFO).

Response: Attached hereto.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

American Municipal Income Portfolio Inc. |

|

By: | /s/ Thomas S. Schreier, Jr. | |

| Thomas S. Schreier, Jr. |

| President |

|

Date: October 8, 2004 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: | /s/ Thomas S. Schreier, Jr. | |

| Thomas S. Schreier, Jr. |

| President |

|

Date: October 8, 2004 |

|

By: | /s/ Joseph M. Ulrey III | |

| Joseph M. Ulrey III |

| Treasurer |

|

Date: October 8, 2004 |