Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

POST PROPERTIES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

| ONE RIVERSIDE 4401 NORTHSIDE PARKWAY, SUITE 800 ATLANTA, GEORGIA 30327-3057 404.846.5000 FAX 404.504.9388 WWW.POSTPROPERTIES.COM |

April 5, 2012

Dear Shareholder:

We cordially invite you to attend the 2012 Annual Meeting of Shareholders of Post Properties, Inc. to be held on Wednesday, May 30, 2012, at 9:00 a.m. local time at our offices, One Riverside, 4401 Northside Parkway, Suite 800, Atlanta, GA 30327.

The items of business are listed in the following Notice of Annual Meeting of Shareholders and are more fully addressed in the Proxy Statement.

We are pleased to take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to shareholders over the Internet. We believe that this e-proxy process expedites shareholders’ receipt of proxy materials, while also lowering the costs and reducing the environmental impact of our Annual Meeting. On April 5, 2012, we began mailing a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and annual report and how to vote over the Internet or how to request and return a proxy card by mail. Shareholders who previously made a request to receive a paper copy of the proxy materials were mailed the Proxy Statement, an annual report and proxy card, and shareholders who previously made a request to receive email delivery of the proxy materials were sent a proxy materials email with instructions on how to access our Proxy Statement and annual report and how to vote over the Internet. For information on how to vote your shares, please refer to the Notice of Internet Availability of Proxy Materials, proxy materials email or proxy card you received to assure that your shares will be represented and voted at the Annual Meeting even if you cannot attend.

On behalf of your board of directors, thank you for your continued support of and interest in Post Properties, Inc.

Sincerely,

Robert C. Goddard, III

Chairman of the Board

Table of Contents

| ONE RIVERSIDE 4401 NORTHSIDE PARKWAY, SUITE 800 ATLANTA, GEORGIA 30327-3057 404.846.5000 FAX 404.504.9388 WWW.POSTPROPERTIES.COM |

POST PROPERTIES, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 30, 2012

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Post Properties, Inc. will be held at our offices, One Riverside, 4401 Northside Parkway, Suite 800, Atlanta, GA 30327 on Wednesday, May 30, 2012, at 9:00 a.m. local time, for the following purposes:

(1) to elect the nine directors nominated by the board of directors and listed in this Proxy Statement for a one-year term,

(2) to approve, on an advisory basis, executive compensation, often referred to as “say on pay,”

(3) to ratify the appointment of Deloitte & Touche LLP as our independent registered public accountants for 2012, and

(4) to transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

Only the holders of record of common stock of Post Properties, Inc. at the close of business on March 28, 2012 are entitled to notice of and to vote at the Annual Meeting of Shareholders and any adjournment or postponement of the Annual Meeting. A list of shareholders as of the close of business on March 28, 2012 will be available at the Annual Meeting for examination by any shareholder, his agent or his attorney.

Your attention is directed to the Proxy Statement provided with this Notice.

By Order of the Board of Directors,

Sherry W. Cohen

Executive Vice President

and Corporate Secretary

Atlanta, Georgia

April 5, 2012

Table of Contents

Your vote is important. Whether or not you expect to attend the Annual Meeting, please vote your shares over the Internet or, if you requested and received a paper copy of the proxy card by mail, vote your shares over the Internet or by telephone or sign and date the proxy card and return it in the envelope enclosed therewith, which does not require any postage if mailed in the United States. If you are a shareholder of record and you attend the Annual Meeting, you may revoke the proxy and vote your shares in person. If you are a beneficial owner and you have a legal proxy to vote your shares, you may vote in person at the Annual Meeting.

If you hold shares of common stock through a bank, broker or other nominee, your bank, broker or other nominee will vote your shares for you if you provide instructions on how to vote the shares. In the absence of instructions, your bank, broker or other nominee can only vote your shares on certain limited matters, but will not be able to vote your shares on other matters. It is important that you provide voting instructions because banks, brokers and other nominees do not have the authority to vote your shares for the election of directors or for the “say on pay” advisory vote without instructions from you.

Important Notice regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 30, 2012.

The Proxy Statement and Annual Report to security holders are available at www.edocumentview.com/ PPS2012.

Table of Contents

| 1 | ||||

| 8 | ||||

| 8 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

Common Stock Ownership by Management and Principal Shareholders | 22 | |||

| 26 | ||||

| 26 | ||||

Executive Compensation and Management Development Committee Report | 45 | |||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| 54 | ||||

| 58 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| 61 | ||||

| 61 | ||||

Proposal 3 — Ratification of the Appointment of the Independent Registered Public Accountants | 62 | |||

| 63 | ||||

| 64 | ||||

| 64 | ||||

| 64 | ||||

| 65 | ||||

| 66 |

i

Table of Contents

POST PROPERTIES, INC.

One Riverside

4401 Northside Parkway, Suite 800

Atlanta, Georgia 30327-3057

PROXY STATEMENT

FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 30, 2012

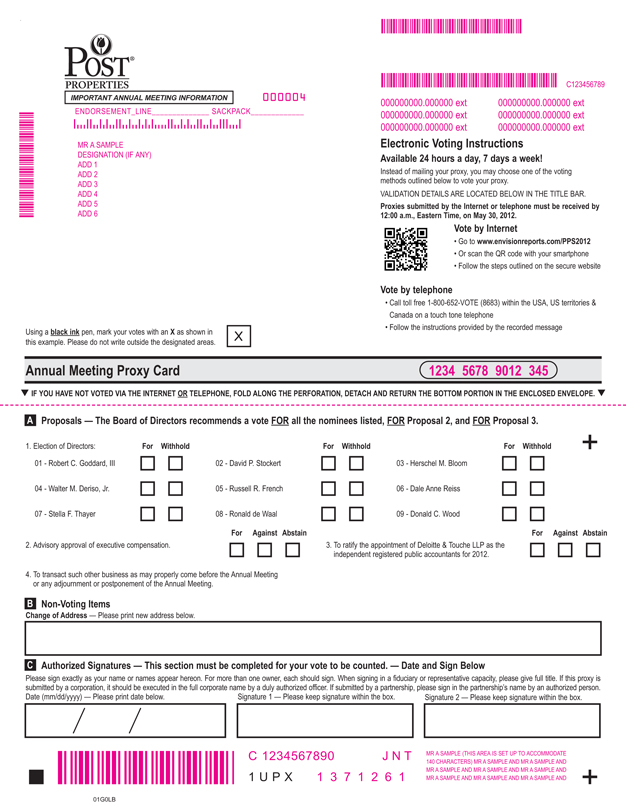

The 2012 Annual Meeting of Shareholders (Annual Meeting) of Post Properties, Inc. (Post Properties or the Company) will be held on Wednesday, May 30, 2012, at the Company’s offices, One Riverside, 4401 Northside Parkway, Suite 800, Atlanta, GA 30327, beginning promptly at 9:00 a.m. local time. The form of proxy provided herewith is solicited by our board of directors. We anticipate that a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and annual report and how to vote over the Internet or how to request and return a proxy card by mail will first be mailed to our shareholders on or about April 5, 2012. We anticipate that, for shareholders who previously made a request to receive a paper copy of the proxy materials, a paper copy of the Proxy Statement, annual report and proxy card will first be mailed on or about April 5, 2012. We anticipate that, for shareholders who previously made a request to receive email delivery of the proxy materials, a proxy materials email with instructions on how to access our Proxy Statement and annual report and how to vote over the Internet, will first be emailed on or about April 5, 2012.

Why is this Proxy Statement being made available?

Our board of directors has made this Proxy Statement available to you because you own shares of our common stock. This Proxy Statement describes issues on which we would like you, as a shareholder, to vote. It also gives you information on these issues so that you can make an informed decision.

When you vote over the Internet or (if you received a proxy card by mail) by telephone or by signing, dating and returning a proxy card, you appoint David P. Stockert and Sherry W. Cohen as your representatives at the Annual Meeting. Mr. Stockert and Ms. Cohen will vote your shares at the Annual Meeting as you have instructed them. This way, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, it is a good idea to vote over the Internet or (if you received a proxy card by mail) by telephone or by signing, dating and returning your proxy card in advance of the Annual Meeting just in case your plans change.

If an issue comes up for vote at the Annual Meeting other than the proposals described in this Proxy Statement, Mr. Stockert and Ms. Cohen will vote your shares, under your proxy, at their discretion.

Why did I receive a Notice of Internet Availability of Proxy Materials in the mail instead of a printed set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (SEC), we are permitted to furnish our proxy materials over the Internet to our shareholders by delivering a Notice of Internet Availability of Proxy Materials in the mail. Unless requested, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice of Internet Availability of Proxy Materials instructs you on how to access and review the Proxy Statement and 2011 Annual Report to Shareholders over the Internet atwww.edocumentview.com/PPS2012. The Notice of Internet Availability of Proxy Materials

Table of Contents

also instructs you on how you may submit your proxy over the Internet, or how you can request a full set of proxy materials, including a proxy card to return by mail. If you received a Notice of Internet Availability of Proxy Materials in the mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting these materials provided in the Notice of Internet Availability of Proxy Materials.

What is the record date?

The record date is March 28, 2012. Only shareholders of record of common stock as of the close of business on this date will be entitled to notice of and to vote at the Annual Meeting.

How many shares are outstanding?

As of the record date, we had 53,641,106 shares of common stock outstanding in addition to 151,228 outstanding partnership units in Post Apartment Homes, L.P. (Post Apartment Homes), which are exchangeable for shares of common stock on a one-for-one basis. Only shares of common stock outstanding as of the record date will be eligible to vote at the Annual Meeting. Each holder of common stock on the record date is entitled to one vote for each share of common stock held.

What am I voting on?

You are being asked to vote on the following:

| • | to elect the nine directors nominated by the board and listed in this Proxy Statement for a one-year term, |

| • | to approve, on an advisory basis, the executive compensation of the Named Executive Officers as disclosed in this Proxy Statement, and |

| • | to ratify the appointment of Deloitte & Touche LLP as our independent registered public accountants for 2012. |

No cumulative voting rights are authorized, and dissenters’ rights are not applicable to the matters being voted upon.

How do I vote?

If you are a registered shareholder, meaning that your shares are registered in your name, you have four voting options. You may vote:

| • | over the Internet at the web address noted in the Notice of Internet Availability of Proxy Materials, proxy materials email or proxy card you received (if you have access to the Internet, we encourage you to vote in this manner), |

| • | by telephone through the number noted in the proxy card you received (if you received a proxy card), |

| • | by signing and dating your proxy card (if you received a proxy card) and mailing it in the prepaid and addressed envelope enclosed therewith, or |

2

Table of Contents

| • | by attending the Annual Meeting and voting in person. |

Please follow the directions in the Notice of Internet Availability of Proxy Materials, proxy materials email or proxy card you received carefully.

Are voting procedures different if I hold my shares in the name of a broker, bank or other nominee?

If your shares are held in “street name” through a broker, bank or other nominee, please refer to the instructions they provide regarding how to vote your shares or to revoke your voting instructions. The availability of telephone and Internet voting depends on the voting processes of the broker, bank or other nominee. Street name holders may vote in person only if they have a legal proxy to vote their shares as described below.

In addition, if you hold shares through the Company’s 401(k) plan, your voting instructions (or any change to your voting instructions) must be received by 12:00 a.m., Eastern Time, on May 28, 2012 in order to allow the plan administrator to tabulate the vote for shares held in the 401(k) plan in accordance with the plan’s stock fund operating procedures.

What if I return my proxy card but do not provide voting instructions?

If you return a signed proxy card but do not provide voting instructions, your shares will be votedforthe nine directors nominated by the board and listed in this Proxy Statement,for the approval, on an advisory basis, of executive compensation, andforthe ratification of the appointment of the independent registered public accountants.

Can all shareholders vote in person at the Annual Meeting?

We will pass out written ballots to anyone who wants to vote at the Annual Meeting. If you hold your shares through a broker, bank or other nominee, you must bring with you a legal proxy from your broker, bank or other nominee authorizing you to vote such shares in order to vote in person at the Annual Meeting. Please note that if you request a legal proxy, any previously submitted proxy will be revoked and your shares will not be voted unless you attend the Annual Meeting and vote in person or appoint another proxy to vote on your behalf.

What does it mean if I receive more than one Notice of Internet Availability of Proxy Materials, proxy materials email or proxy card?

It means that you have multiple accounts with the transfer agent and/or with a broker, bank or other nominee. You will need to vote separately with respect to each Notice of Internet Availability of Proxy Materials, proxy materials email or proxy card you received. Please vote all of the shares you own.

What if I change my mind after I vote my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

| • | voting again over the Internet or by telephone prior to 12:00 a.m., Eastern Time, on May 30, 2012, |

3

Table of Contents

| • | signing and returning another proxy card with a later date, |

| • | voting in person at the Annual Meeting, or |

| • | giving written notice to the Corporate Secretary of Post Properties. |

Please note that street name holders cannot vote in person at the Annual Meeting unless they have a legal proxy.

How many votes do you need to hold the Annual Meeting?

In order for us to conduct the Annual Meeting, we must have a quorum, which means that a majority of our outstanding shares of common stock as of the record date must be present at the Annual Meeting. Your shares will be counted as present at the Annual Meeting if you:

| • | vote over the Internet or by telephone, |

| • | properly submit a proxy card (even if you do not provide voting instructions), or |

| • | attend the Annual Meeting and vote in person. |

Will my shares be voted if I do not vote over the Internet, vote by telephone, sign and return my proxy card or vote in person at the Annual Meeting?

If you are a registered shareholder, meaning that your shares are registered in your name, and you do not vote over the Internet, by telephone, by signing and returning your proxy card or by voting in person at the Annual Meeting, then your shares will not be voted and will not count in deciding the matters presented for consideration in this Proxy Statement.

If your shares are held in street name and you do not vote your shares, your broker, bank or other nominee may vote your shares on your behalf under certain circumstances.

On “routine” matters, including the ratification of the appointment of the independent registered public accountants described in this Proxy Statement, brokerage firms have authority under New York Stock Exchange (or NYSE) rules to vote their customers’ shares if their customers do not provide voting instructions. When a brokerage firm votes its customers’ shares on a routine matter without receiving voting instructions, these shares are counted both for establishing a quorum to conduct business at the Annual Meeting and in determining the number of shares votedfororagainstthe routine matter.

On “non-routine” matters, including the election of directors and the “say on pay” advisory vote described in this Proxy Statement, if the brokerage firm has not received instructions from the shareholder, the brokerage firm cannot vote the shares on that proposal. Accordingly, it is particularly important that you provide voting instructions to your brokerage firm, so that your shares may be voted in the election of directors and the “say on pay” advisory vote.

When a brokerage firm does not have the authority to vote its customers’ shares or does not exercise its authority, these are referred to as “broker non-votes.” Broker non-votes are only counted for establishing a quorum and will have no effect on the outcome of the vote.

4

Table of Contents

We encourage you to provide instructions to your brokerage firm by voting your proxy. This action ensures your shares will be voted at the Annual Meeting.

How may I vote for each proposal?

| • | For “Proposal 1 — Election of Directors,” you may voteforall nominees,withholdfrom all nominees orwithholdfrom individual nominees. |

| • | For “Proposal 2 — Advisory Approval of Executive Compensation,” you may votefor, against or abstain from voting. |

| • | For “Proposal 3 — Ratification of the Appointment of the Independent Registered Public Accountants,” you may votefor, againstorabstainfrom voting. |

How many votes are needed to elect directors?

Directors are elected by a plurality vote. As a result, the nine director nominees receiving the highest number offorvotes will be elected as directors. If you abstain from voting on the proposal and a quorum is present, abstentions will have no effect on the outcome of the vote on the proposal.

In 2006, we adopted a Policy on Majority Voting. The policy sets forth our procedures if a nominee is elected but receives a majority ofwithheldvotes. In an uncontested election, any nominee for director who receives a greater number of voteswithheldfrom his or her election than votesforsuch election is required, within five days, to tender his or her resignation. Our Nominating and Corporate Governance Committee is required to make a recommendation to the board of directors with respect to the resignation. The board of directors is required to take action with respect to this recommendation and to disclose its decision-making process. The policy is more fully described under the caption “Corporate Governance — Policy on Majority Voting.”

How many votes are needed to approve executive compensation on an advisory basis?

With respect to the “say on pay” vote, in order to pass, thefor votes cast at the Annual Meeting must exceed theagainstvotes cast at the Annual Meeting. If you abstain from voting on the proposal and a quorum is present, abstentions will have no effect on the outcome of the vote on the proposal.

How many votes are needed to approve the proposal to ratify the appointment of the independent registered public accountants?

For the proposal to pass, theforvotes cast at the Annual Meeting must exceed theagainstvotes cast at the Annual Meeting. If you abstain from voting on the proposal and a quorum is present, abstentions will have no effect on the outcome of the vote on the proposal.

What happens if a director nominee is unable to stand for election?

The board of directors may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter event, shares represented by proxies will be votedfor the substitute nominee designated by the board of directors. Proxies cannot be voted for more than nine director nominees at the Annual Meeting.

5

Table of Contents

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will publish the final results in a current report on Form 8-K within four business days of the Annual Meeting. We will file that report with the SEC, and you can get a copy from:

| • | our website atwww.postproperties.comby clicking on the For Investors link, followed by the SEC Filings tab, |

| • | the SEC’s website atwww.sec.gov, |

| • | the SEC at (800) SEC-0330, or |

| • | our Corporate Secretary at Post Properties, Inc., One Riverside, 4401 Northside Parkway, Suite 800, Atlanta, Georgia 30327-3057. |

Who will pay for the costs of soliciting proxies?

We will bear the costs of soliciting proxies. In an effort to have as large a representation at the Annual Meeting as possible, one or more of our employees, in certain instances, may personally make special solicitations of proxies either by telephone or mail. We also will reimburse brokers, banks, nominees and other fiduciaries for postage and reasonable clerical expenses of forwarding the proxy materials or sending a Notice of Internet Availability of Proxy Materials to the beneficial owners of our common stock. In addition, we have retained Innisfree M&A Incorporated to assist in the solicitation of proxies with respect to shares of our common stock held of record by brokers, nominees and institutions and, in certain cases, by other holders. Such solicitation may be made through the use of mail, by telephone or by personal calls. The anticipated cost of the services of Innisfree M&A Incorporated is $9,500 plus expenses.

How can I obtain a copy of the 2011 Annual Report to Shareholders and the Annual Report on Form 10-K for the year ended December 31, 2011?

Our Annual Report to Shareholders for the year ended December 31, 2011, which includes our Annual Report on Form 10-K for the year ended December 31, 2011, is available atwww.edocumentview.com/PPS2012, and if you received a printed copy of this Proxy Statement, accompanies this Proxy Statement. However, the annual report forms no part of the material for the solicitation of proxies.

6

Table of Contents

This report may also be accessed through our website atwww.postproperties.comby clicking on the For Investors link, followed by the Financial Reports tab. In addition, our Annual Report on Form 10-K for the year ended December 31, 2011, is available from the SEC’s website atwww.sec.gov.At the written request of any shareholder who owns common stock as of the close of business on the record date, we will provide, without charge, paper copies of our Annual Report on Form 10-K, including the financial statements and financial statement schedule, as filed with the SEC, except exhibits thereto. If requested by eligible shareholders, we will provide copies of the exhibits for a reasonable fee. You can request copies of our Annual Report on Form 10-K by following the instructions on the Notice of Internet Availability of Proxy Materials or by mailing a written request to:

Post Properties, Inc.

One Riverside

4401 Northside Parkway, Suite 800

Atlanta, Georgia 30327-3057

Attention: Corporate Secretary

How do I obtain directions to attend the Annual Meeting and vote in person?

Directions to the Annual Meeting are located atwww.edocumentview.com/PPS2012.

7

Table of Contents

PROPOSAL 1 — ELECTION OF DIRECTORS

Our bylaws provide that at least three and no more than 15 directors shall constitute the full board of directors. Currently, our board of directors consists of ten members. The term of each of Robert C. Goddard, III, Douglas Crocker II, David P. Stockert, Herschel M. Bloom, Walter M. Deriso, Jr., Russell R. French, Dale Anne Reiss, Stella F. Thayer, Ronald de Waal and Donald C. Wood expires at the 2012 Annual Meeting and when his or her respective successor is elected and qualified.

Upon the recommendation of our independent Nominating and Corporate Governance Committee, the board of directors has nominated incumbent directors Robert C. Goddard, III, David P. Stockert, Herschel M. Bloom, Walter M. Deriso, Jr., Russell R. French, Dale Anne Reiss, Stella F. Thayer, Ronald de Waal and Donald C. Wood to stand for re-election at the Annual Meeting and to hold office until our 2013 Annual Meeting of Shareholders and when his or her respective successor is elected and qualified.

In accordance with the mandatory retirement policy for directors in our Corporate Governance Guidelines, Mr. Crocker is not eligible to stand for reelection at the Annual Meeting since his 72nd birthday occurs in April 2012. We thank Mr. Crocker for his eight years of service on our board. The size of our board of directors will be reduced to nine members immediately following the Annual Meeting.

Biographical information about our nominees for director and the experience, qualifications, attributes and skills considered by our Nominating and Corporate Governance Committee and the board of directors in determining that the nominee should serve as a director appears below. For additional information about how we identify and evaluate nominees for director, see “Selection of Director Nominees” below.

Robert C. Goddard, IIIhas been a director of Post Properties since May 2002 and Chairman of the Board since February 2003. Since July 2000, Mr. Goddard has been Chairman and Chief Executive Officer of Goddard Investment Group, LLC, a commercial real estate investment firm focusing in the Atlanta, Dallas, Houston, Denver and Miami markets. From 1988 to December 2000, Mr. Goddard served as Chairman and Chief Executive Officer of the NAI/Brannen Goddard Company, a real estate firm. He is currently a member of the Board of Trustees of Emory University. Mr. Goddard is 57 years old.

We believe that Mr. Goddard’s experience of over 30 years in the real estate industry, knowledge of our core markets, and experience as Chairman and Chief Executive Officer of other significant real estate businesses qualify him to serve as a director and Chairman of our Board.

David P. Stockerthas been a director of Post Properties since May 2002. Since July 2002, Mr. Stockert has been President and Chief Executive Officer of Post Properties. From January 2001 to June 2002, Mr. Stockert served as Post Properties’ President and Chief Operating Officer. From July 1999 to October 2000, Mr. Stockert was Executive Vice President of Duke Realty Corporation, a publicly traded real estate company. From June 1995 to July 1999, Mr. Stockert was Senior Vice President and Chief Financial Officer of Weeks Corporation, also a publicly traded real estate company that was a predecessor by merger to Duke Realty Corporation. Prior to joining Weeks Corporation, Mr. Stockert worked as an investment banker and as a certified public accountant. Mr. Stockert is 49 years old.

8

Table of Contents

We believe that Mr. Stockert’s 20 year real estate career, including his experience as a senior officer with public real estate companies and his service as our Chief Executive Officer, qualifies him to serve as a director.

Herschel M. Bloomhas been a director of Post Properties since May 1994. Mr. Bloom is a retired partner from the law firm of King & Spalding LLP. Mr. Bloom’s practice was focused on corporate, partnership and real estate tax matters. Mr. Bloom was a partner with King & Spalding LLP for over 33 years until his retirement in April 2008. From 1986 to 2006, Mr. Bloom also served as a director of Russell Corporation. Mr. Bloom is 69 years old.

We believe Mr. Bloom’s extensive experience as a practicing tax lawyer counseling real estate concerns and public REITs and service on another public company board qualify him to serve as a director.

Walter M. Deriso, Jr. has been a director of Post Properties since May 2004. Mr. Deriso currently serves as Chairman of the Board of Atlantic Capital Bancshares, Inc. and of its subsidiary, Atlantic Capital Bank, a commercial banking and financial services company, and has held these positions since August 2006. From 1997 to February 2005, Mr. Deriso served as Vice Chairman of Synovus Financial Corp., a diversified financial services company. Mr. Deriso held various offices with Security Bank and Trust Company of Albany, a subsidiary of Synovus, beginning in 1991 and served as Chairman of the Board from 1997 to 2006. Mr. Deriso was a practicing attorney with the firm of Divine, Wilkin, Deriso, Raulerson & Fields from 1972 to 1991. In addition, Mr. Deriso has served on the boards of numerous organizations, including as Chairman of the Georgia Bankers Association, Chairman of the Program Management Team of the Georgia Rail Passenger Program and a member of the Board of Visitors of Emory University. He is currently a member of the Board of Trustees of Emory University, Chairman of the Board of the Georgia Regional Transportation Authority and a member of the board of directors of the Georgia Chamber of Commerce. Mr. Deriso is 65 years old.

We believe Mr. Deriso’s leadership background, roles with companies in the financial services sector, including his service on a public company board, his experience in finance, business operations and in evaluating real estate assets, and his experience as a practicing attorney, qualify him to serve as a director.

Russell R. Frenchhas been a director of Post Properties since July 1993. He is currently a special limited partner of Moseley & Co. VI, LLC and has held this position since 2007. Mr. French is a retired venture capitalist and was previously a member of Moseley & Co. III and a partner of Moseley & Co. II, positions he had held for more than the past five years. In addition, Mr. French has been a member of MKFJ-IV, LLC since 1998 and a member of Moseley & Co. V, LLC since 2000. Each of Moseley & Co. III, MKFJ-IV, LLC and Moseley & Co. V, LLC is the general partner of a venture capital fund. In addition, Mr. French is a member of the Board of Trustees of Emory University and a former member of the board of directors of the Georgia Tech/Emory Biomedical Engineering Department. Mr. French is also a former director of the Georgia Research Alliance. Mr. French is 66 years old.

We believe Mr. French’s experience in evaluating and understanding businesses across a range of industries and his financial background qualify him to serve as a director. We also value Mr. French’s contributions as one of the audit committee financial experts on our board.

Dale Anne Reiss has been a director of Post Properties since October 2008. Ms. Reiss is currently the Managing Director of Artemis Advisors LLC, Chairman of Brock Real Estate LLC and Senior Managing Director of Brock Capital Group, LLC. Ms. Reiss retired in 2008 as the Global Director of

9

Table of Contents

Real Estate, Hospitality and Construction Services for Ernst & Young LLP. From 1995 through 2008, Ms. Reiss was a senior partner at Ernst & Young LLP. She also held the position of managing partner at its predecessor, Kenneth Leventhal & Company, from 1985 through its merger with Ernst & Young in 1995. Previously, she was Senior Financial Officer for Urban Investment and Development Company, a real estate investment and development company, from 1980 to 1985. Ms. Reiss is a trustee of the Urban Land Institute. Ms. Reiss is also a director of iStar Financial Incorporated, a commercial real estate finance company. Ms. Reiss is 64 years old.

We believe that Ms. Reiss’ many years of experience in the real estate industry, significant public company finance and accounting background, and service as a director of another public real estate company qualify her to serve as a director. We also value Ms. Reiss’ contributions as one of the audit committee financial experts on our board.

Stella F. Thayerhas been a director of Post Properties since September 2005. Ms. Thayer is currently, and has been for more than the past five years, an attorney and shareholder of the law firm of Macfarlane Ferguson & McMullen. She is also the President, Treasurer and a director of Tampa Bay Downs, Inc., an American thoroughbred horse racing facility. From June 1992 through May 1997, Ms. Thayer served as the Chairman of the Board of Reflectone, Inc., a public company that focused on flight simulators and training applications for the U.S. Government, commercial and international customers and the entertainment industry prior to the company’s sale to British Aerospace. In addition, among Ms. Thayer’s many civic and governmental activities, she is the past Chairman of the Board of Trustees of the Tampa General Hospital Foundation, a Trustee Emerita of the Board of Trustees of the University of South Florida Foundation, a member of the Board of Advisors of Columbia Law School, former Chairman of the Hillsborough County Aviation Authority, former Chairman of the Hillsborough County Hospital Authority and a current or former trustee of the Ferguson Foundation, Inc., the Florida House, the LeRoy Collins Institute and the National Museum of Racing and Hall of Fame. Ms. Thayer is 71 years old.

We believe Ms. Thayer’s experience as a practicing lawyer, her business background (including service as the Chairman of the Board of a public company and as President of a business enterprise), and her longstanding involvement in civic and charitable leadership roles in the community qualify her to serve as a director.

Ronald de Waalhas been a director of Post Properties since May 2000. Mr. de Waal is Chairman of the Board of WE International b.v., a Netherlands corporation that operates fashion specialty stores in Belgium, the Netherlands, Switzerland, Germany and France, and has held this position since 1983. Mr. de Waal is also Chairman of Ronus Inc., an Atlanta-based real estate company which develops and manages mixed-use real estate properties. Mr. de Waal was a director of Saks Incorporated and The Body Shop International plc (England) within the last five years. Mr. de Waal is 60 years old.

We believe Mr. de Waal’s experience as Chairman of the Board of a large, global business enterprise, knowledge of the real estate industry, including as Chairman of an Atlanta-based real estate company, and prior service on other public company boards qualify him to serve as a director.

Donald C. Wood has been a director of Post Properties since May 2011. Mr. Wood has been the President and Chief Executive Officer of Federal Realty Investment Trust, a publicly traded real estate investment trust, since January 2003, and prior to that time, served in various officer positions with Federal, including President and Chief Operating Officer (from 2001 to 2003), Senior Vice President and Chief Operating Officer (from 2000 to 2001), Senior Vice President-Chief Operating Officer and

10

Table of Contents

Chief Financial Officer (from 1999 to 2000) and Senior Vice President-Treasurer and Chief Financial Officer (from 1998 to 1999). Mr. Wood is also a member of the Board of Trustees of Federal Realty Investment Trust, Chairman of the Board of the National Association of Real Estate Investment Trusts and a director of the Real Estate Roundtable. Mr. Wood is 51 years old.

We believe Mr. Wood’s extensive experience in the real estate industry, knowledge of our markets and leadership experience as chief executive officer of a publicly traded real estate investment trust qualify him to serve as a director.

The board of directors recommends a voteFOR the nine directors

nominated by the board and listed in this Proxy Statement.

11

Table of Contents

Committees of the Board of Directors

Audit Committee. The Audit Committee currently consists of Messrs. Deriso and French and Mss. Reiss and Thayer. The board of directors has determined that Mr. French, the current committee chair, and Ms. Reiss qualify as “audit committee financial experts” within the meaning of SEC rules and regulations. All committee members are independent as defined in applicable SEC and NYSE rules and under the director independence standards specified in our Corporate Governance Guidelines. During 2011, the committee held 13 meetings.

The Audit Committee is responsible for, among other things:

| • | directly appointing, retaining, evaluating, compensating and terminating our independent registered public accounting firm, |

| • | discussing with our independent registered public accounting firm their independence from management, |

| • | reviewing with our independent registered public accounting firm the scope and results of their audit, |

| • | pre-approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm, |

| • | overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC, |

| • | reviewing and monitoring our accounting principles, accounting policies and financial and accounting controls, |

| • | overseeing our internal auditors and coordinating their audit efforts with our independent registered public accounting firm, and |

| • | reviewing policies with respect to risk and fraud assessment and risk and fraud management. |

Executive Compensation and Management Development Committee. The Executive Compensation and Management Development Committee currently consists of Messrs. Bloom, Deriso and French and Ms. Thayer. Ms. Thayer currently serves as chair. All committee members are independent as defined in applicable SEC and NYSE rules and under the director independence standards specified in our Corporate Governance Guidelines. During 2011, the committee held six meetings.

The Executive Compensation and Management Development Committee is responsible for, among other things:

| • | annually reviewing and approving our goals and objectives for executive compensation, |

| • | annually reviewing and approving for the Chief Executive Officer and the other senior executives (1) the annual base salary level, (2) the annual cash incentive opportunity level, (3) the long-term incentive opportunity level, and (4) special or supplemental benefits or perquisites (if any), |

12

Table of Contents

| • | annually approving actual annual cash incentive plan payouts and long-term equity incentive grants, |

| • | reviewing and approving employment agreements, severance arrangements and change of control agreements for the senior executive officers, as appropriate, |

| • | making recommendations and reports to the board of directors concerning matters of executive compensation, |

| • | administering our executive incentive plans, |

| • | making recommendations to the board of directors concerning matters of director compensation, |

| • | reviewing compensation plans, programs and policies, and |

| • | reviewing incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk taking. |

See Compensation Discussion and Analysis for a description of the processes and procedures of the Executive Compensation and Management Development Committee and for additional information regarding the Executive Compensation and Management Development Committee’s role and management’s role in determining compensation for executive officers and directors.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee currently consists of Messrs. Crocker, Deriso and Goddard and Ms. Reiss. Mr. Deriso currently serves as chair. All committee members are independent as defined in applicable SEC and NYSE rules and under the director independence standards specified in our Corporate Governance Guidelines. During 2011, the committee held three meetings.

The Nominating and Corporate Governance Committee is responsible for, among other things:

| • | seeking potential candidates to be considered for election to the board of directors, |

| • | recommending potential candidates for election to the board of directors, |

| • | reviewing corporate governance matters, and |

| • | making recommendations to the board of directors concerning the structure and membership of board committees. |

Strategic Planning and Investment Committee. The Strategic Planning and Investment Committee currently consists of Messrs. Bloom, Crocker, Goddard, de Waal, and Wood. Mr. Crocker currently serves as chair. During 2011, the committee held five meetings.

The Strategic Planning and Investment Committee is responsible for, among other things:

| • | developing a multi-year strategic business plan with our Chief Executive Officer and other executive officers and reviewing such plan annually, |

| • | evaluating and overseeing financial strategy, development, dispositions, acquisitions and certain investments on behalf of the Company, |

13

Table of Contents

| • | considering the risks that may result from changes in the Company’s corporate strategy and the risks associated with specific transactions, and |

| • | reviewing and recommending to the board of directors approval of certain types of transactions on behalf of the Company and its subsidiaries. |

In accordance with our Corporate Governance Guidelines, our Chairman annually reviews committee chairs and membership and recommends any changes to the Nominating and Corporate Governance Committee, which will in turn conduct its own review and recommend any changes to the full board of directors.

Committee Charters and Corporate Governance Guidelines

The charters of each of the Audit Committee, the Executive Compensation and Management Development Committee, the Nominating and Corporate Governance Committee and the Strategic Planning and Investment Committee and our Corporate Governance Guidelines may be accessed on our website atwww.postproperties.comby clicking on the For Investors link, followed by the Corporate Governance tab, and are available in print upon request from our Corporate Secretary.

Codes of Business Conduct and Ethics

We have a Code of Business Conduct, which is applicable to all directors and employees, including our executive and financial officers. There is a separate Code of Ethics for Senior Executive and Financial Officers that applies to our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and persons performing similar functions. The Code of Business Conduct and the Code of Ethics are available on our website atwww.postproperties.comby clicking on the For Investors link, followed by the Corporate Governance tab, and are available in print upon request from our Corporate Secretary. Any amendments to, or waivers of, the Code of Business Conduct or the Code of Ethics will be disclosed on our website promptly following the date of such amendment or waiver.

Selection of Director Nominees

General Criteria and Process

It is the Nominating and Corporate Governance Committee’s responsibility to review and recommend to the board of directors nominees for director and to identify one or more candidates to fill any vacancies that may occur on the board of directors. However, the board of directors expects the Nominating and Corporate Governance Committee will consider the views of the Chairman and Chief Executive Officer in making appointments to the board of directors. As expressed in our Corporate Governance Guidelines, we do not set specific criteria for directors, but we believe that candidates should show evidence of leadership in their particular field, have broad experience and the ability to exercise sound business judgment, possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the shareholders. In light of our focus in the multifamily real estate industry, when evaluating each candidate’s experience, the Nominating and Corporate Governance Committee considers real estate industry expertise. Although we have not adopted a formal policy with respect to diversity, our Corporate Governance Guidelines also provide that the membership of the board of directors should reflect a diversity of experiences, gender, ethnicity and age. Under the charter of the Nominating and Corporate Governance Committee, the Nominating and Corporate Governance Committee is responsible for determining desired board skills and attributes, including those described in the Corporate Governance Guidelines.

14

Table of Contents

For each of the nominees to the board of directors, the biographies included in this Proxy Statement highlight the experiences and qualifications that were among the most important to the Nominating and Corporate Governance Committee in concluding that the nominee should serve as a director.

The Nominating and Corporate Governance Committee also believes that directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serve on the board of directors for an extended period of time. Our Corporate Governance Guidelines prohibit a director from serving on more than a total of six public company boards (including the board of the Company) at any one time.

The Nominating and Corporate Governance Committee may use a variety of sources to identify new candidates. New candidates may be identified through recommendations from independent directors or management, third-party search firms, discussions with others in the real estate industry who may know of suitable candidates, and shareholder recommendations. For example, Mr. Wood, was initially identified as a director candidate by our Chief Executive Officer when the Nominating and Corporate Governance Committee and the board began evaluating potential candidates with significant real estate and REIT chief executive officer experience in light of Mr. Crocker not being eligible to stand for reelection at the 2012 Annual Meeting due to our mandatory retirement policy. Our Chief Executive Officer was familiar with Mr. Wood and Federal Realty as a result of real estate transactions that Post and Federal Realty had participated in together over the last decade.

The Nominating and Corporate Governance Committee typically evaluates each prospective candidate’s background and qualifications. In addition, one or more committee members or the other board members interviews each prospective candidate. After completing the evaluation, prospective candidates are recommended to the full board by the Nominating and Corporate Governance Committee, with the full board selecting the candidates to be nominated for election by the shareholders or to be elected by the board to fill a vacancy.

Shareholder Recommendation of Candidates for Director

We have not adopted a specific policy regarding the consideration of director candidates recommended to our Nominating and Corporate Governance Committee by shareholders. Shareholders who wish to recommend candidates for consideration by the committee may submit their recommendations in writing to our Corporate Secretary at the address provided in this Proxy Statement. The committee may consider these shareholder recommendations when it evaluates and recommends nominees to the board of directors for submission to the shareholders at each annual meeting. For information regarding shareholder nominations of directors and shareholder proposals, please see the “Other Matters” section of this Proxy Statement.

In 2006, we adopted a policy on majority voting in the election of directors. Pursuant to this policy, in an uncontested election of directors, any nominee who receives a greater number of voteswithheldfrom his or her election than votesfor his or her election will, within five days following the certification of the shareholder vote, tender his or her written resignation to the Chairman of the Board for consideration by the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee will consider the resignation and, within 45 days following the date of the shareholders’ meeting at which the election occurred, will make a recommendation to the board of directors concerning the acceptance or rejection of the resignation.

15

Table of Contents

In determining its recommendation to the board of directors, the Nominating and Corporate Governance Committee will consider all factors deemed relevant, including:

| • | the stated reason or reasons why shareholders who castwithholdvotes for the director did so, |

| • | the qualifications of the director (including, for example, whether the director serves on the Audit Committee of the board of directors as an “audit committee financial expert” and whether there are one or more other directors qualified, eligible and available to serve on the Audit Committee in such capacity), and |

| • | whether the director’s resignation from the board of directors would be in the Company’s best interests and the best interests of our shareholders. |

The Nominating and Corporate Governance Committee also will consider a range of possible alternatives concerning the director’s tendered resignation as the members of the Nominating and Corporate Governance Committee deem appropriate, including:

| • | acceptance of the resignation, |

| • | rejection of the resignation, or |

| • | rejection of the resignation coupled with a commitment to seek to address and cure the underlying reasons reasonably believed by the Nominating and Corporate Governance Committee to have substantially resulted in thewithheldvotes. |

Under the policy, the board of directors will take formal action on the recommendation no later than 75 days following the date of the shareholders’ meeting. In considering the recommendation, the board of directors will consider the information, factors and alternatives considered by the Nominating and Corporate Governance Committee and any additional information, factors and alternatives as the board of directors deems relevant. We will publicly disclose, in a Form 8-K filed with the SEC, the board of directors’ decision within four business days after the decision is made. The board of directors will also provide a full explanation of the process by which the decision was made and, if applicable, the board of directors’ reason or reasons for rejecting the tendered resignation.

As part of our Corporate Governance Guidelines, we have established director independence standards which are set forth in our Corporate Governance Guidelines, which may be accessed on our website atwww.postproperties.comby clicking on the For Investors link, followed by the Corporate Governance tab. Our director independence standards meet or exceed the requirements of SEC rules and regulations and the NYSE listing standards.

As required by the Corporate Governance Guidelines, the board of directors reviewed and analyzed the independence of each director and director nominee. The purpose of the review was to determine whether any particular relationships or transactions involving directors or their affiliates or immediate family members were inconsistent with a determination that the director is independent for purposes of serving on the board of directors and its committees. During this review, the board of directors examined whether there were any transactions and/or relationships between directors or their affiliates or immediate family members and the Company and the substance of any such transactions or relationships.

16

Table of Contents

As a result of this review, the board of directors affirmatively determined that the following directors and nominees are independent for purposes of serving on the board of directors and meet the requirements set forth in our director independence standards: Messrs. Goddard, Crocker, Bloom, Deriso, French, de Waal and Wood and Mss. Reiss and Thayer. The board of directors further determined that all current members of the Audit Committee, Executive Compensation and Management Development Committee and Nominating and Corporate Governance Committee are independent and previously determined that all members of these committees during 2011 were independent. Mr. Stockert is not considered independent because he is an executive officer of the Company.

Board Leadership Structure and Role in Risk Oversight

Mr. Goddard has served as the Chairman of our board of directors since May 2002. Our Corporate Governance Guidelines provide that the Chairman will be an independent director under our director independence standards and NYSE listing standards. The Chairman is elected by the other members of the board. Our Chairman provides leadership to ensure that the board functions in an independent, cohesive fashion.

We believe it is beneficial to have a non-executive Chairman who is responsible for leading the board. We also believe our President and Chief Executive Officer should be principally responsible for running the Company. Under our Corporate Governance Guidelines and our bylaws, our non-executive Chairman:

| • | provides leadership to the board and facilitates communication between, and information flow to, the directors; |

| • | presides at board meetings, executive sessions and shareholder meetings; |

| • | sees that all orders, resolutions and policies adopted or established by the board are carried into effect; |

| • | reviews and recommends any changes to committee chairs and membership to the Nominating and Corporate Governance Committee; and |

| • | meets with shareholders and other constituencies from time-to-time. |

Our Chairman also has access to management and financial and other information as he deems appropriate from time-to-time to assist him and the board in discharging their responsibilities. Under our Corporate Governance Guidelines, our Chairman and Chief Executive Officer set agendas for meetings of the board and jointly recommend new director candidates or changes in board membership to the Nominating and Corporate Governance Committee.

Mr. Crocker has served as our Vice Chairman since August 2008, and having reached our mandatory retirement age, is not eligible to stand for re-election at the Annual Meeting. Because the board believes our non-executive Chairman provides effective independent leadership for our board and our company, the board of directors has determined to eliminate the role of Vice Chairman following the Annual Meeting. The board of directors has amended our Corporate Governance Guidelines, effective as of the Annual Meeting, consistent with this determination.

17

Table of Contents

Our board has nine independent members (eight following the retirement of Mr. Crocker) and only one non-independent member, our Chief Executive Officer. We have four standing board committees, including our Strategic Planning and Investment Committee, comprised solely of independent directors, each with a different independent director serving as chair of the committee. We believe that the number of independent, experienced directors that make up our board, along with the independent oversight of the board by our non-executive Chairman, benefits our Company and our shareholders.

Under our Corporate Governance Guidelines, our board of directors provides oversight of the Company’s risk management processes. Pursuant to the Corporate Governance Guidelines and the charter of our Audit Committee, the Audit Committee is primarily responsible for reviewing policies with respect to risk and fraud assessment and risk and fraud management and meeting periodically with management to review the results of risk and fraud assessments conducted by management. The Audit Committee receives reports from management periodically regarding the Company’s assessment of risks. In addition, our director of internal audit periodically provides an enterprise risk management assessment to our Audit Committee. The Audit Committee also reports regularly on these matters to the full board of directors, which the board considers in assessing the Company’s risk profile. Each of our board committees also considers the risks within its area of responsibilities. For example, in accordance with its charter, our Executive Compensation and Management Development Committee reviews the Company’s incentive compensation arrangements to confirm that incentive pay does not encourage unnecessary risk taking and periodically considers the relationship between risk management and incentive compensation. Further, our Strategic Planning and Investment Committee is charged with considering the risks that may result from changes in our corporate strategy and considering the risks associated with specific transactions in determining whether to recommend a particular transaction to the full board of directors. We believe that the leadership structure of our board supports its effective oversight of the Company’s risk management.

Meetings of the Board of Directors

During 2011, our board of directors held five meetings. Each of our directors attended at least 75% of the aggregate of all meetings of the board of directors and committees on which he or she served occurring in the time period during which such director served in 2011. Directors are encouraged, but not required, to attend the annual shareholders meeting. All of our directors who were directors at the time of the 2011 annual shareholders meeting attended the meeting.

Executive Sessions of Non-Management Directors

Pursuant to the Corporate Governance Guidelines, Robert C. Goddard, III, our non-executive Chairman of the board, presides at regularly scheduled executive sessions of our non-management directors.

We pay our non-employee directors fees for their services as directors. For the year ended December 31, 2011, our non-employee directors were entitled to receive:

| • | an annual retainer of $25,000, |

| • | a board of directors meeting attendance fee of $1,500 per meeting, |

18

Table of Contents

| • | a committee meeting attendance fee of $1,000 per meeting (other than “chair-only” meetings), |

| • | an additional annual retainer for the Audit Committee chair of $20,000, |

| • | an additional annual retainer of $7,500 for the chairs of the Executive Compensation and Management Development Committee, the Nominating and Corporate Governance Committee and the Strategic Planning and Investment Committee, and |

| • | an annual grant of the number of shares of restricted stock equal to $60,000 divided by the closing price of the common stock on the NYSE on December 31 to each non-employee director who is serving on the board of directors on December 31 of such year, with the shares vesting one-third each year over a three-year period beginning on the first anniversary of the grant date. |

Our non-executive Chairman has waived his receipt of the cash and stock compensation paid to our other outside directors for the year ended December 31, 2011. The Company made an aggregate of $100,000 of cash donations to charitable organizations and educational institutions in the non-executive Chairman’s honor. The charitable organizations and educational institutions that received these donations from us were selected by us in consultation with our non-executive Chairman.

In general, equity awards to non-employee directors vest in connection with a change of control or upon reaching the mandatory retirement age of 72.

2011 Director Compensation Table

The following table sets forth information concerning the fiscal 2011 compensation of our non-employee directors:

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total ($) | |||||||||

Herschel M. Bloom | 43,500 | 59,984 | 103,484 | |||||||||

Douglas Crocker II | 48,000 | 59,984 | 107,984 | |||||||||

Walter M. Deriso, Jr. | 60,000 | 59,984 | 119,984 | |||||||||

Russell R. French | 70,500 | 59,984 | 130,484 | |||||||||

Robert C. Goddard, III(3) | — | — | — | |||||||||

Dale Anne Reiss | 47,500 | 59,984 | 107,484 | |||||||||

Stella F. Thayer | 58,000 | 59,984 | 117,984 | |||||||||

Ronald de Waal | 37,500 | 59,984 | 97,484 | |||||||||

Donald C. Wood | 22,541 | 59,984 | 82,525 | |||||||||

| (1) | Non-employee directors may elect to defer all or a part of their retainer and meeting fees under our Deferred Compensation Plan. Under the plan, we issue a number of shares equal in value to the fees deferred by the non-employee directors into a rabbi trust organized in connection with the plan. Directors have the right to vote the shares held in the rabbi trust. Ms. Thayer and Mr. de |

19

Table of Contents

| Waal were the only directors that elected to defer a part of their retainer and meeting fees under our Deferred Compensation Plan in 2011. The fees of Ms. Thayer and Mr. de Waal were deferred in the following number of shares for each director: |

Name | Number of Shares | |||

Stella F. Thayer | 1,495 | |||

Ronald de Waal | 970 | |||

| (2) | On December 31, 2011, we granted each non-employee director (other than Mr. Goddard) 1,372 shares of restricted stock. The amount shown in the table represents the grant date fair value of the restricted stock granted in 2011, computed in accordance with FASB ASC Topic 718. See Note 10 to the consolidated financial statements in the Form 10-K filed on February 28, 2012 for information about the assumptions used to value these awards. These shares of restricted stock will vest one-third each year over a three year period, commencing December 31, 2012. Dividends are paid on all shares of restricted stock. |

The number of outstanding stock options and shares of restricted stock held as of December 31, 2011 by each individual who served as one of our non-employee directors during 2011 is summarized in the table below.

Name | Number of Securities Underlying Unexercised Options Exercisable (#) | Number of Securities Underlying Unexercised Options Unexercisable (#) | Number of Outstanding Shares of Restricted Stock (#) | |||||||||

Herschel M. Bloom | 13,000 | — | 3,495 | |||||||||

Douglas Crocker II | 10,000 | — | 3,495 | |||||||||

Walter M. Deriso, Jr. | 10,000 | — | 3,495 | |||||||||

Russell R. French | 13,000 | — | 3,495 | |||||||||

Robert C. Goddard, III | 278,013 | — | — | |||||||||

Dale Anne Reiss | — | — | 3,495 | |||||||||

Stella F. Thayer | 7,500 | — | 3,495 | |||||||||

Ronald de Waal | 13,000 | — | 3,495 | |||||||||

Donald C. Wood | — | — | 1,372 | |||||||||

| (3) | Mr. Goddard, our non-executive Chairman, has waived his receipt of the cash and stock compensation paid to our other outside directors for the year ended December 31, 2011. The Company made an aggregate of $100,000 of cash donations to charitable organizations and educational institutions in Mr. Goddard’s honor. |

All directors may make contributions and purchase shares under our employee stock purchase plan. Messrs. Bloom, Crocker, Deriso, French, Goddard and Wood and Mss. Reiss and Thayer participated in our employee stock purchase plan in 2011.

Our non-employee directors are reimbursed for all reasonable out-of-pocket expenses incurred in attending board meetings and director education programs.

Mandatory Retirement for Directors

In accordance with our Corporate Governance Guidelines, no director may stand for election or re-election after the director’s 72nd birthday.

20

Table of Contents

Communications with the Board of Directors

The board of directors has adopted a policy and process to facilitate communications with the board of directors as a group, our non-executive Chairman of the Board and our non-management directors as a group. Shareholders and interested parties who wish to communicate directly with the members of the board of directors may do so by writing to Post Properties, Inc., One Riverside, 4401 Northside Parkway, Suite 800, Atlanta, Georgia 30327-3057, Attn: Corporate Secretary, or by sending electronic mail todirectors@postproperties.com.The Corporate Secretary will forward all such communications to directors.

21

Table of Contents

COMMON STOCK OWNERSHIP BY MANAGEMENT

AND PRINCIPAL SHAREHOLDERS

Except as otherwise indicated, the following table sets forth the beneficial ownership of shares of common stock as of February 29, 2012 for:

| • | our directors, |

| • | our Chief Executive Officer, Chief Financial Officer and the three other most highly compensated executive officers calculated in accordance with SEC rules and regulations (collectively the Named Executive Officers), and |

| • | our directors and executive officers as a group. |

The table below also sets forth the beneficial ownership of shares of common stock for each shareholder that holds more than a 5% interest in our outstanding common stock.

Unless otherwise indicated in the footnotes, all of such interests are owned directly and the indicated person or entity has sole voting and dispositive power.

Name of Beneficial Owner(1) | Number of Shares Owned | Number of Exercisable Options(2) | Total | Percent of Class(3) | ||||||||||||

Directors and Executive Officers: | ||||||||||||||||

Herschel M. Bloom | 36,615 | (4) | 13,000 | 49,615 | * | |||||||||||

Douglas Crocker II | 42,870 | (5) | 10,000 | 52,870 | * | |||||||||||

Walter M. Deriso, Jr. | 38,486 | (6) | 10,000 | 48,486 | * | |||||||||||

Russell R. French | 60,881 | (7) | 13,000 | 73,881 | * | |||||||||||

Robert C. Goddard, III | 332,289 | (8) | 278,013 | 610,302 | 1.1% | |||||||||||

Dale Anne Reiss | 13,791 | — | 13,791 | * | ||||||||||||

Stella F. Thayer | 54,243 | (9) | 7,500 | 61,743 | * | |||||||||||

Ronald de Waal | 171,960 | (10) | 13,000 | 184,960 | * | |||||||||||

Donald C. Wood | 1,939 | — | 1,939 | * | ||||||||||||

David P. Stockert | 136,387 | (11) | 493,460 | 629,847 | 1.2% | |||||||||||

Christopher J. Papa | 37,512 | (12) | 59,713 | 97,225 | * | |||||||||||

Sherry W. Cohen | 25,666 | (13) | 84,463 | 110,129 | * | |||||||||||

S. Jamie Teabo | 17,783 | (14) | 10,233 | 28,016 | * | |||||||||||

Charles A. Konas | 15,199 | (15) | 11,347 | 26,546 | * | |||||||||||

All directors and executive officers as a group (15 persons) | 995,053 | 1,015,826 | 2,010,879 | 3.7% | ||||||||||||

22

Table of Contents

Name of Beneficial Owner(1) | Number of Shares Owned | Number of Exercisable Options(2) | Total | Percent of Class(3) | ||||||||||||

Five Percent Shareholders: | ||||||||||||||||

FMR LLC(16) | 7,101,317 | — | 7,101,317 | 13.3% | ||||||||||||

The Vanguard Group, Inc.(17) | 5,683,923 | — | 5,683,923 | 10.7% | ||||||||||||

BlackRock, Inc.(18) | 4,885,088 | — | 4,885,088 | 9.2% | ||||||||||||

CBRE Clarion Securities, LLC(19) | 3,447,313 | — | 3,447,313 | 6.5% | ||||||||||||

Vanguard Specialized Funds—Vanguard REIT Index Fund (20) | 2,797,217 | — | 2,797,217 | 5.3% | ||||||||||||

| * | Less than 1% |

| (1) | Under SEC rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of such security, or “investment power,” which includes the power to dispose of or to direct the disposition of such security. A person also is deemed to be a beneficial owner of any securities which that person has the right to acquire within 60 days. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which he or she has no economic or pecuniary interest. |

| (2) | Includes options that become exercisable on or before April 29, 2012. |

| (3) | Based on an aggregate of 53,276,385 shares issued and outstanding as of February 29, 2012. Assumes that all options beneficially owned by the person are exercised for shares of common stock. The total number of shares outstanding used in calculating this percentage assumes that none of the options beneficially owned by other persons are exercised for shares of common stock. |

| (4) | Includes 4,687 shares held in the Deferred Compensation Plan. |

| (5) | Includes 7,982 shares held in the Deferred Compensation Plan. Also includes 650 shares beneficially owned indirectly through a supplemental retirement plan. |

| (6) | Includes 8,536 shares held in the Deferred Compensation Plan. Of shares reported, 6,683 are held in a margin account. |

| (7) | Includes 22,434 shares held in the Deferred Compensation Plan. |

| (8) | Includes 23,889 shares held in the Deferred Compensation Plan. Of shares reported, 7,000 are held through GIG REIT Fund #1 and 12,000 are held through the Goddard Foundation, in which Mr. Goddard has no pecuniary interest. |

| (9) | Includes 13,259 shares held in the Deferred Compensation Plan. |

| (10) | Includes 17,560 shares held in the Deferred Compensation Plan. Also includes 116,300 shares deemed beneficially owned by Mr. de Waal through his control of certain corporations. |

| (11) | Includes 1,640 shares held in the Company’s 401(k) plan. |

| (12) | Includes 1,114 shares held in the Company’s 401(k) plan. |

| (13) | Includes 2,152 shares held in the Company’s 401(k) plan. Also includes 400 shares held by Ms. Cohen’s spouse. |

| (14) | Includes 1,100 shares held in the Company’s 401(k) plan. |

| (15) | Includes 942 shares held in the Company’s 401(k) plan. |

23

Table of Contents

| (16) | As of December 31, 2011. Based solely upon information provided in a Schedule 13G/A filed with the SEC on February 14, 2012. Includes 5,096,759 shares of common stock beneficially owned by Fidelity Management & Research Company (Fidelity), 82 Devonshire Street, Boston, Massachusetts 02109, a wholly-owned subsidiary of FMR LLC and an investment advisor to various investment companies; 317,360 shares of common stock beneficially owned by Pyramis Global Advisors, LLC (PGALLC), 900 Salem Street, Smithfield, Rhode Island, 02917, an indirect wholly-owned subsidiary of FMR LLC and an investment advisor to institutional accounts, non-U.S. mutual funds or investment companies; 1,677,798 shares of common stock beneficially owned by Pyramis Global Advisors Trust Company (PGATC), 900 Salem Street, Smithfield, Rhode Island, 02917, as a result of its serving as investment manager of institutional accounts owning such shares; 9,400 shares of common stock beneficially owned by FIL Limited (FIL), Pembroke Hall, 42 Crow Lane, Hamilton, Bermuda, and various foreign-based subsidiaries which provide investment advisory and management services to a number of non-U.S. investment companies and certain institutional investors. Each of Edward C. Johnson 3d and FMR LLC, through its control of Fidelity, has sole dispositive power over the 5,096,759 shares owned by funds advised by Fidelity. Members of the family of Edward C. Johnson 3d, Chairman of FMR LLC, are the predominant owners of shares representing 49% of the voting power of FMR LLC and have entered into a shareholders’ voting agreement with respect to their shares. As such, members of the Johnson family may be deemed to form a controlling group with respect to FMR LLC. The power to vote or direct the voting of the shares owned directly by the Fidelity funds resides with the funds’ boards of trustees. Each of Edward C. Johnson 3d and FMR LLC, through its control of PGALLC, has sole dispositive power over 317,360 shares and sole power to vote or to direct the voting of 316,260 shares owned by the institutional accounts or funds advised by PGALLC. Each of Edward C. Johnson 3d and FMR LLC, through its control of PGATC, has sole dispositive power over 1,677,798 shares and power to vote or to direct the voting of 1,600,618 shares owned by the institutional accounts managed by PGATC. Partnerships controlled predominately by members of the family of Edward C. Johnson 3d, Chairman of FMR LCC and FIL, or trusts for their benefit, own shares of FIL voting stock with the right to cast between 25% and 50% of the total votes which may be cast by all holders of FIL voting stock. |

| (17) | As of December 31, 2011. Based solely upon information provided in a Schedule 13G/A filed with the SEC on February 9, 2012. The Vanguard Group, Inc. beneficially owns 5,683,923 shares of common stock, of which it has sole voting power with respect to 76,886 shares, sole dispositive power with respect to 5,607,037 shares and shared dispositive power with respect to 76,886 shares. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc. is the beneficial owner of 76,886 shares of common stock as a result of its serving as investment manager of collective trusts. The business address for The Vanguard Group, Inc. is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (18) | As of December 30, 2011. Based solely upon information provided in a Schedule 13G/A filed with the SEC on February 9, 2012. BlackRock, Inc. beneficially owns 4,885,088 shares, all of which it has sole voting power and sole dispositive power with respect thereto. The business address for BlackRock, Inc. is 40 East 52nd Street, New York, New York 10022. |

| (19) | As of December 31, 2011. Based solely upon information provided in a Schedule 13G filed with the SEC on February 13, 2012. CBRE Clarion Securities, LLC beneficially owns 3,447,313 shares of common stock, of which it has sole voting power with respect to 1,945,913 shares and sole dispositive power with respect to 3,447,313 shares. The business address for CBRE Clarion Securities, LLC is 201 King of Prussia Road, Suite 600, Radnor, Pennsylvania 19087. |

24

Table of Contents

| (20) | As of December 31, 2011. Based solely upon information provided in a Schedule 13G filed with the SEC on January 27, 2012. The Vanguard Specialized Funds — Vanguard REIT Index Fund beneficially owns 2,797,217 shares of common stock, all of which it has sole voting power with respect thereto. The business address for The Vanguard Specialized Funds — Vanguard REIT Index Fund is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

25

Table of Contents

Compensation Discussion and Analysis

Executive Summary

Business Environment

A gradually improving economy in the United States, favorable demographics and modest new supply of multi-family units in the near term contributed to improving apartment fundamentals in our markets starting in 2010 and continuing throughout 2011. Our Funds from Operations (FFO)1 improved significantly in 2011 as compared to 2010, and exceeded our internal budgets. Our stock price also improved during 2011, producing a total return to shareholders, including reinvested dividends, of approximately 23.04%. Operating results for our core apartment business, including same-store rents, property revenues, occupancy and net operating income, improved over the course of 2011. We also continued to strengthen our balance sheet, refinancing debt at lower rates, and ending the year with ample liquidity, both in cash and in borrowing capacity under our unsecured lines of credit. We commenced four new apartment developments in Austin, Texas, Houston, Texas, Orlando, Florida and Raleigh, North Carolina in 2011, taking advantage of favorable multifamily operating fundamentals and our expectation of gradually rising rents.

Key Compensation Decisions