2022 First Quarter Results Gentherm, Inc. May 4, 2022 Exhibit 99.2

Forward-Looking Statement Except for historical information contained herein, statements in this presentation are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent Gentherm Incorporated's goals, beliefs, plans and expectations about its prospects for the future and other future events. The forward-looking statements included in this presentation are made as of the date hereof or as of the date specified herein and are based on management's reasonable expectations and beliefs. Such statements are subject to a number of important assumptions, risks, uncertainties and other factors that may cause actual results or performance to differ materially from that described in or indicated by the forward-looking statements. Those risks include, but are not limited to, risks that: the COVID-19 pandemic and its direct and indirect adverse impacts on the automobile and medical industries and global economy, which had and are likely to continue to have, an adverse effect on, among other things, the Company’s results of operations, financial condition, cash flows, liquidity, business operations and stock price; the current supply-constrained environment we are facing involving component shortages, manufacturing disruptions, logistics challenges and inflationary pressures, and any future material delays or inflationary pressures in the supply chain of the Company or the automotive original equipment manufacturers (“OEMs”) or first tier suppliers (“Tier 1s”) supplied by the Company; the period of sustained price increases for various material components and shipping costs currently experienced in the automotive industry, which may continue for longer than we expect; risks relating to the Company’s proposed acquisition of Alfmeier (the “Acquisition”), including: that the closing conditions to the proposed Acquisition may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant required antitrust approval; the occurrence of any event that could give rise to termination of the Acquisition agreement, including due to factors outside of the Company’s control; delay in closing the Acquisition or the possibility of non-consummation of the Acquisition; risks that the pendency and efforts to consummate the Acquisition may be disruptive to the Company or Alfmeier or their respective management teams; the effect of announcing the transaction on Alfmeier’s ability to retain and hire key personnel and maintain relationships with customers, suppliers and other third parties for the post-transaction benefit of the Company; the Company’s increased debt leverage following the closing of the Acquisition; risks inherent in the achievement of expected financial results, growth prospects and cost synergies for the Acquisition and the timing thereof; unexpected costs associated with or relating to the proposed Acquisition; and integration risks; the impact of industry or consumer behaviors on future automotive vehicle production and the Company’s strategy to develop and sell products tailored to evolving market demands, including the development and use of autonomous and electric vehicles and increasing use of car- and ride-sharing and on-demand transportation as a service, as well as related regulations; borrowing availability under the Company’s revolving credit facility; the Company’s failure to be in compliance with covenants under its debt agreements, which could result in the amounts outstanding thereunder being accelerated and becoming immediately due and payable; the Company’s ability to obtain additional financing by accessing the capital markets, which may not be available on acceptable terms or at all; the macroeconomic environment, including its impact on the automotive industry, which is cyclical; any significant declines in automobile production; market acceptance of the Company’s existing or new products, and new or improved competing products developed by competitors with greater resources; shifting customer preferences, including shifts due to the evolving use of automobiles and technology; the Company’s ability to project future sales volumes, based on which the Company manages its business; reductions in new business awards due to the macroeconomic environment, COVID-19 and related uncertainties; the Company’s ability to convert new business awards into product revenues; the loss, material reduction in sales from or insolvency of any of the Company’s key customers, including due to M&A or other market consolidation of OEMs and Tier 1s; the loss of any key suppliers; the impact of price downs in the ordinary course, or additional increased pricing pressures from the Company’s customers; the feasibility of Company’s development of new products on a timely, cost effective basis, or at all; security breaches and other disruptions to the Company’s IT systems; labor shortages, wage inflation and work stoppages impacting the Company, its suppliers or customers; changes in free trade agreements or the implementation of additional tariffs, and the Company’s ability to pass-through tariff costs; unfavorable changes to currency exchange rates; the Company’s ability to protect its intellectual property in certain jurisdictions; the Company’s ability to effectively implement ongoing restructuring and other cost-savings measures or realize the full amount of estimated savings; compliance with, and increased costs related to, domestic and international regulations, including potential climate change regulations; the Ukraine-Russia conflict, which has led to and could lead to further challenges in our manufacturing operations in our Ukraine facility and further global economic sanctions and market disruptions, including significant volatility in commodity prices, credit and capital markets, as well as supply chain interruptions; changes in government leadership and laws, political instability and economic tensions between governments; and severe weather conditions and natural disasters and any resultant disruptions on the supply or production of goods or services or customer demands. The foregoing risks should be read in conjunction with the Company's filings with the Securities and Exchange Commission (the “SEC”), including “Risk Factors”, in its most recent Annual Report on Form 10-K and subsequent SEC filings, for a discussion of these and other risks and uncertainties. In addition, the business outlook discussed in this presentation does not include the potential impact of the announced Alfmeier acquisition or any other business combinations, acquisitions, divestitures, strategic investments and other significant transactions that may be completed after the date hereof, each of which may present material risks to the Company’s future business and financial results. Except as required by law, the Company expressly disclaims any obligation or undertaking to update any forward-looking statements to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. 2

Use of Non-GAAP Financial Measures* In addition to the results reported herein in accordance with GAAP, the Company has provided here or elsewhere Adjusted Operating Expense, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EPS, Free Cash Flow, Net Debt and Revenue excluding the impact of foreign currency translation, each a non-GAAP financial measure. See the Company’s earnings release dated May 4, 2022 for the definitions of each non-GAAP financial measure, information regarding why the Company utilizes such non-GAAP measures as supplemental measures of performance or liquidity, and their limitations. * See Appendix for certain reconciliations of GAAP to non-GAAP historical financial measures. 3

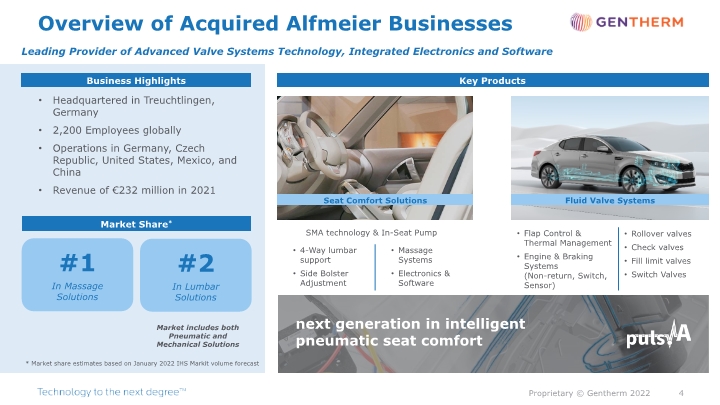

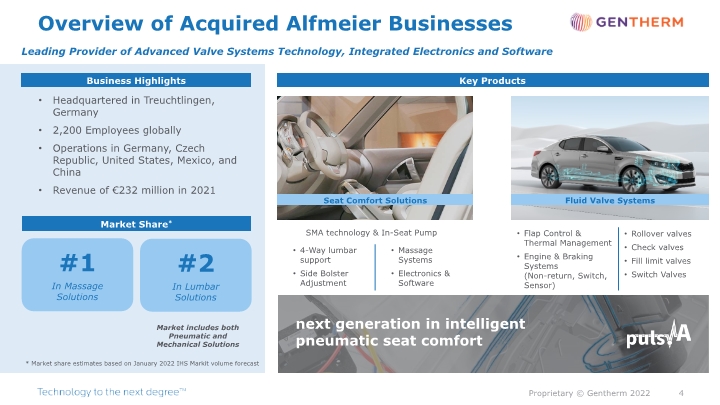

Overview of Acquired Alfmeier Businesses Business Highlights Headquartered in Treuchtlingen, Germany 2,200 Employees globally Operations in Germany, Czech Republic, United States, Mexico, and China Revenue of €232 million in 2021 * Market share estimates based on January 2022 IHS Markit volume forecast Leading Provider of Advanced Valve Systems Technology, Integrated Electronics and Software Key Products Fluid Valve Systems Market Share* #1 In Massage Solutions #2 In Lumbar Solutions Market includes both Pneumatic and Mechanical Solutions Seat Comfort Solutions Flap Control & Thermal Management Engine & Braking Systems (Non-return, Switch, Sensor) Rollover valves Check valves Fill limit valves Switch Valves next generation in intelligent pneumatic seat comfort 4-Way lumbar support Side Bolster Adjustment SMA technology & In-Seat Pump Massage Systems Electronics & Software 4

Alfmeier Acquisition Creates the largest global supplier of thermal and pneumatic comfort for Automotive Transaction: Innovative market leader of Automotive Lumbar and Massage Global leader in high complexity, high reliability valves for automotive fluid systems €177.5 Million* funded from cash balances and revolving credit facility Third quarter 2022 anticipated close Investment Thesis: Expands Gentherm’s value proposition beyond thermal in comfort, health, wellness, and energy efficiency Enables more compelling and high-value solutions across complementary customer relationships Expands Alfmeier market share with Gentherm’s industry leading customer base particularly in North America and Asia Expects to achieve approximately $10 million in annual run-rate cost savings * The amount may be adjusted at or post closing as set forth in the definitive purchase agreement 5

Automotive 1Q 2022 Highlights 6 Continued momentum in Automotive 12 Vehicle launches with 9 OEMs Multiple CCS® product launches Cadillac Lyriq EV Honda NP1 and NS1 Electric SUVs Maserati Levantino Mazda CX-50 Mercedes-Benz SL-Class Began new ClimateSense™ development project with a fourth OEM in Europe

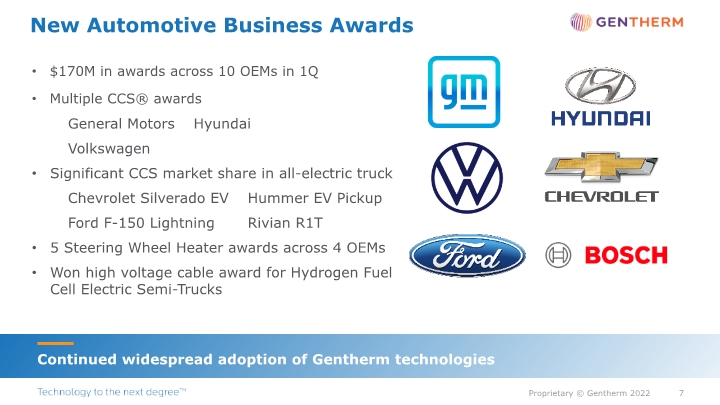

New Automotive Business Awards 7 Continued widespread adoption of Gentherm technologies $170M in awards across 10 OEMs in 1Q Multiple CCS® awards General Motors Hyundai Volkswagen Significant CCS market share in all-electric truck Chevrolet Silverado EV Hummer EV Pickup Ford F-150 Lightning Rivian R1T 5 Steering Wheel Heater awards across 4 OEMs Won high voltage cable award for Hydrogen Fuel Cell Electric Semi-Trucks

Medical 1Q 2022 Highlights 8 Challenging conditions still affecting the hospital market Revenue up 9% year over year, excluding the impact of foreign currency translation Won large fluid warming award, fulfilling competitor supply gap University of California San Diego Scripps Health Won multiple Blanketrol® III awards The Cleveland Clinic Seattle Children’s Hospital Norton Healthcare in Louisville, KY

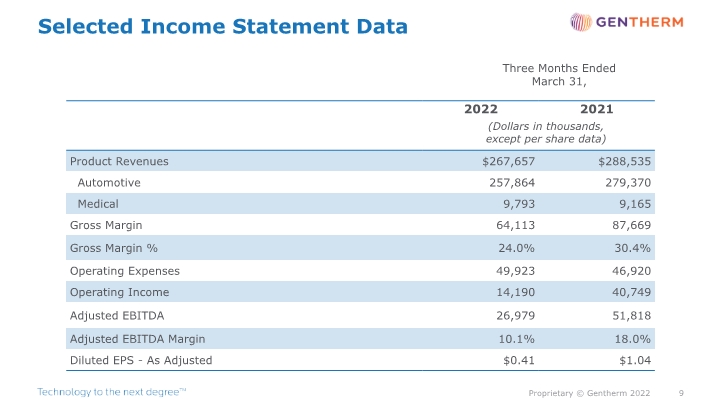

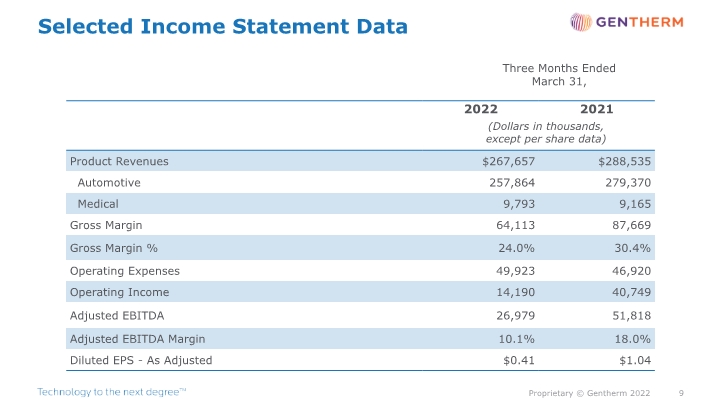

Selected Income Statement Data 9 Three Months Ended March 31, (Dollars in thousands, except per share data)

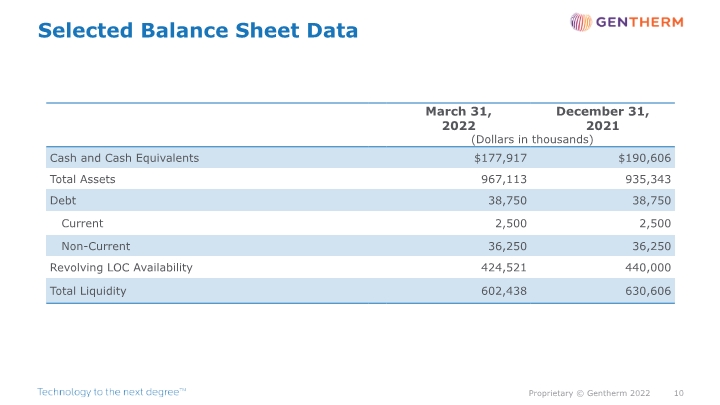

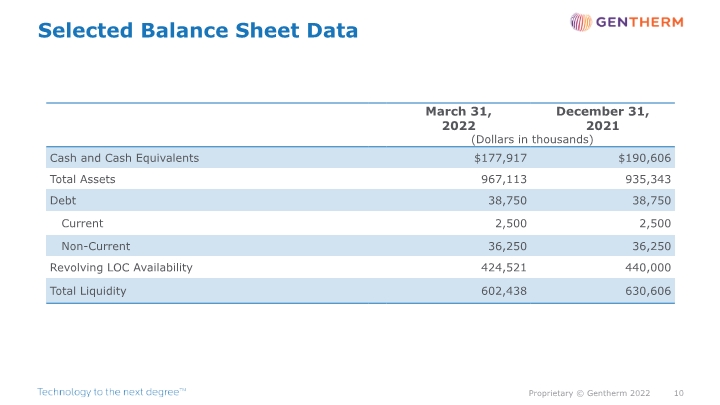

Selected Balance Sheet Data 10 (Dollars in thousands)

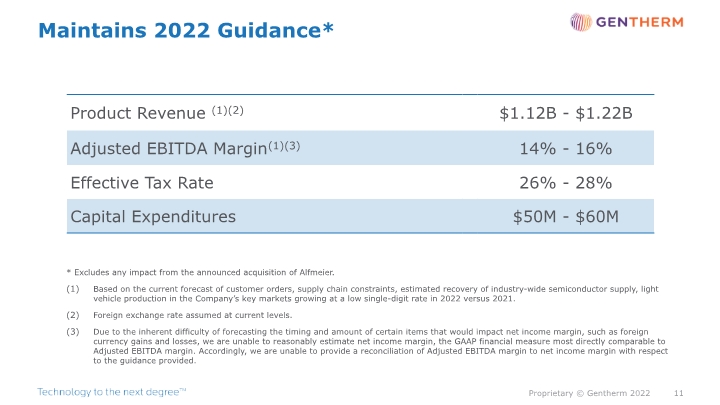

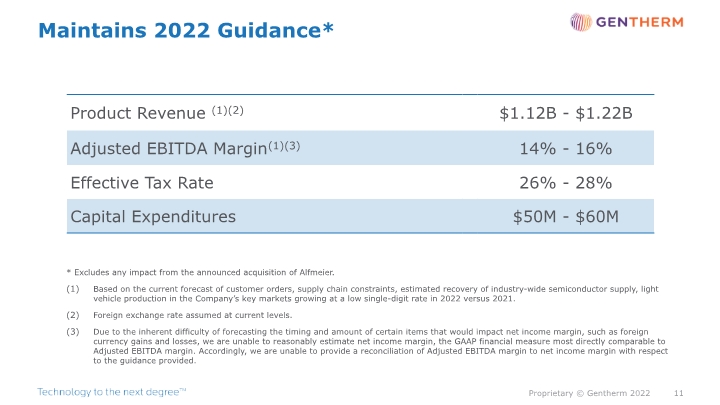

Maintains 2022 Guidance* 11 * Excludes any impact from the announced acquisition of Alfmeier. Based on the current forecast of customer orders, supply chain constraints, estimated recovery of industry-wide semiconductor supply, light vehicle production in the Company’s key markets growing at a low single-digit rate in 2022 versus 2021. Foreign exchange rate assumed at current levels. Due to the inherent difficulty of forecasting the timing and amount of certain items that would impact net income margin, such as foreign currency gains and losses, we are unable to reasonably estimate net income margin, the GAAP financial measure most directly comparable to Adjusted EBITDA margin. Accordingly, we are unable to provide a reconciliation of Adjusted EBITDA margin to net income margin with respect to the guidance provided.

Appendix 12

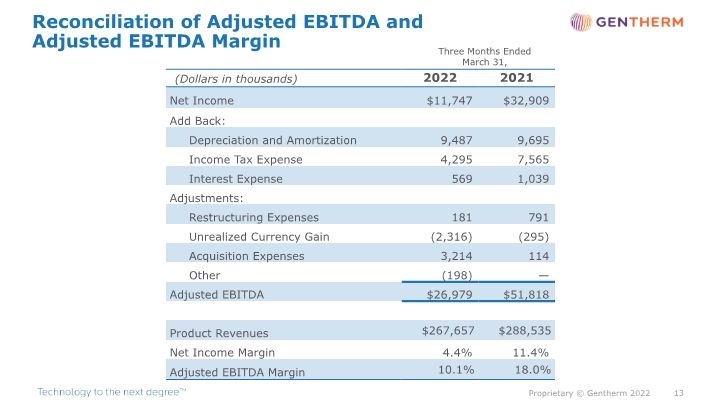

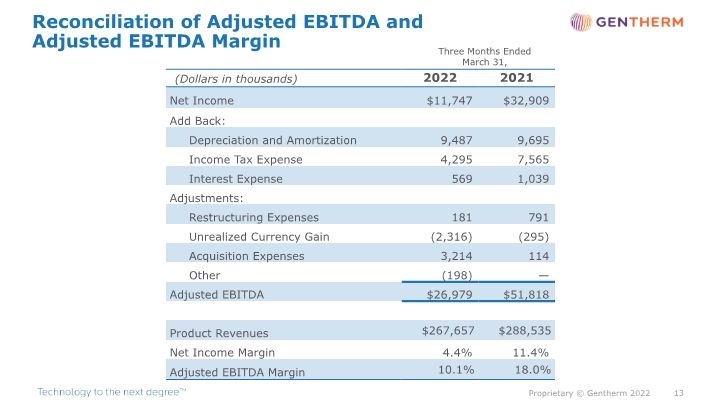

Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin 13 Three Months Ended March 31, (Dollars in thousands)

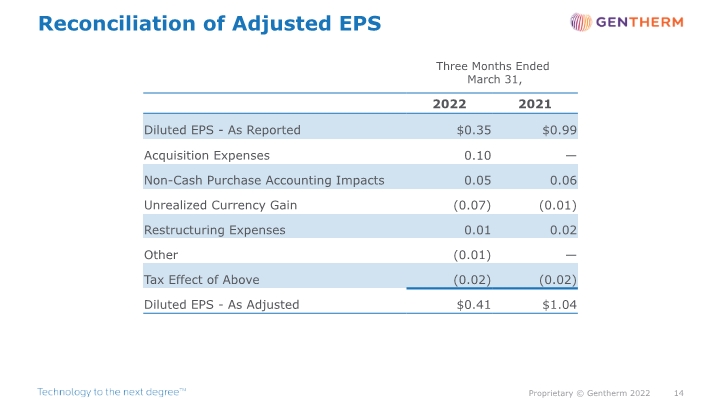

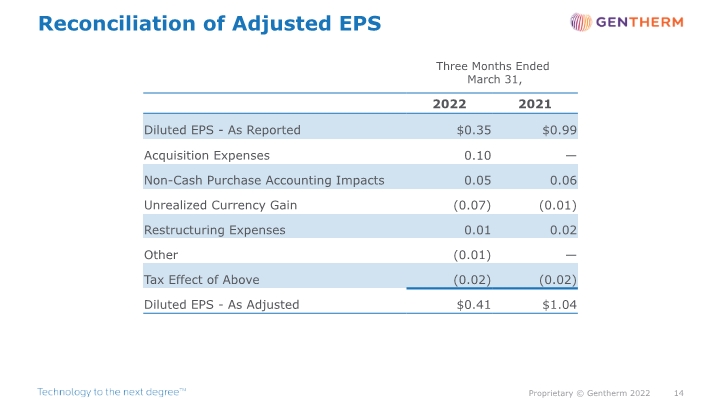

Reconciliation of Adjusted EPS 14 Three Months Ended March 31,